Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - VERDE RESOURCES, INC. | ex-31_1.htm |

| EX-31.2 - EX-31.2 - VERDE RESOURCES, INC. | ex-31_2.htm |

| EX-32.1 - EX-32.1 - VERDE RESOURCES, INC. | ex-32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10–Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ________________

Commission file number: 000-55276

|

Verde Resources, Inc.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

|

|

|

|

Nevada

|

|

32-0457838

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

Unit 701, 7/F, The Phoenix, 21-25 Luard Road, Wanchai, Hong Kong

|

||

|

(Address of principal executive offices)

|

||

|

|

||

|

(852) 21521223

|

||

|

(Registrant's telephone number, including area code)

|

||

|

|

||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No []

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes[X]No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one).

|

Large accelerated filer [ ]

|

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

|

Smaller reporting company [X]

|

|

(Do not check if a smaller reporting company)

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of November 23, 2015 there were 91,288,909 shares of the issuer's common stock, par value $0.001, outstanding.

VERDE RESOURCES, INC.

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2015

TABLE OF CONTENTS

|

|

|

PAGE

|

|

|

|

|

|

|

PART I - FINANCIAL INFORMATION

|

|

|

|

|

|

|

Item 1.

|

3

|

|

|

|

|

|

|

Item 2.

|

21

|

|

|

|

|

|

|

Item 3.

|

30

|

|

|

|

|

|

|

Item 4.

|

30

|

|

|

|

|

|

|

|

PART II - OTHER INFORMATION

|

|

|

|

|

|

|

Item 1.

|

31

|

|

|

|

|

|

|

Item 1A.

|

31

|

|

|

|

|

|

|

Item 2.

|

31

|

|

|

|

|

|

|

Item 3.

|

31

|

|

|

|

|

|

|

Item 4.

|

31

|

|

|

|

|

|

|

Item 5.

|

31

|

|

|

|

|

|

|

Item 6.

|

31

|

|

|

|

|

|

|

|

32

|

2

VERDE RESOURCES, INC.

INDEX TO INTERIMCONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD OF ENDED SEPTEMBER 30, 2015

|

|

Page

|

|

|

|

|

Condensed Consolidated Balance Sheets

|

4

|

|

|

|

|

Condensed Consolidated Statements of Operations

|

5

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows

|

6

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements

|

7

|

3

Verde Resources, Inc.

Condensed Consolidated Balance Sheets

|

|

As at

September 30,

|

As at

June 30,

|

||||||

|

|

2015

|

2015

|

||||||

|

ASSETS

|

(Unaudited)

|

(Audited)

|

||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$

|

70,216

|

$

|

36,927

|

||||

|

Amount due from related parties

|

2,583

|

3,017

|

||||||

|

Inventories

|

23,877

|

11,865

|

||||||

|

Deposit & prepayment

|

87,445

|

161,431

|

||||||

|

Total Current Assets

|

$

|

184,121

|

$

|

213,240

|

||||

|

Long Term Assets

|

||||||||

|

Property, plant and equipment

|

$

|

324,988

|

$

|

478,225

|

||||

|

Total Long Term Assets

|

$

|

324,988

|

$

|

478,225

|

||||

|

|

||||||||

|

TOTAL ASSETS

|

$

|

509,109

|

$

|

691,465

|

||||

|

|

||||||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable

|

$

|

1,506,738

|

$

|

1,729,304

|

||||

|

Advanced from related parties

|

594,132

|

524,522

|

||||||

|

Accrual

|

140,308

|

157,026

|

||||||

|

Taxation payable

|

3,235

|

1,495

|

||||||

|

Loans from banks

|

31,235

|

39,585

|

||||||

|

Total Current Liabilities

|

$

|

2,275,648

|

$

|

2,451,932

|

||||

|

Long term Liabilities

|

||||||||

|

Loans from banks (non-current)

|

$

|

24,683

|

$

|

37,207

|

||||

|

Total Long Term Liabilities

|

$

|

24,683

|

$

|

37,207

|

||||

|

|

||||||||

|

TOTAL LIABILITIES

|

$

|

2,300,331

|

$

|

2,489,139

|

||||

|

|

||||||||

|

STOCKHOLDERS' DEFICIT

|

||||||||

|

Preferred stock, par value $0.001, 50,000,000 shares authorized, none issued and outstanding

|

-

|

-

|

||||||

|

Common stock, par value $0.001, 250,000,000 shares authorized, 91,288,909

shares issued and outstanding as of September 30, 2015 & June 30, 2015

|

$

|

91,289

|

$

|

91,289

|

||||

|

Additional paid-in capital

|

1,869,993

|

1,869,993

|

||||||

|

Accumulated deficit

|

(4,016,456

|

)

|

(3,653,699

|

)

|

||||

|

Accumulated other comprehensive income (loss)

|

786,343

|

404,021

|

||||||

|

Non-controlled interest

|

(522,391

|

)

|

(509,278

|

)

|

||||

|

Total Stockholders' Deficit

|

$

|

(1,791,222

|

)

|

$

|

(1,797,674

|

)

|

||

|

|

||||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

$

|

509,109

|

$

|

691,465

|

||||

|

|

||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Verde Resources, Inc.

Condensed Consolidated Statements of Operations

|

|

Three Months Ended

September 30, |

|||||||

|

|

2015

|

2014

|

||||||

|

|

||||||||

|

REVENUES

|

||||||||

|

Revenue

|

$

|

324,449

|

$

|

563,775

|

||||

|

Cost of revenue

|

(389,576

|

)

|

(839,324

|

)

|

||||

|

Gross loss

|

(65,127

|

)

|

(275,549

|

)

|

||||

|

OPERATING EXPENSES:

|

||||||||

|

Selling, general & administrative expenses

|

(310,738

|

)

|

(176,030

|

)

|

||||

|

LOSS FROM OPERATIONS

|

$

|

(375,865

|

)

|

$

|

(451,579

|

)

|

||

|

|

||||||||

|

OTHER INCOME(EXPENSES)

|

(5

|

)

|

13,340

|

|||||

|

|

||||||||

|

NET LOSS BEFORE INCOME TAX

|

$

|

(375,870

|

)

|

$

|

(438,239

|

)

|

||

|

|

||||||||

|

Provision of Income Tax

|

-

|

-

|

||||||

|

NET LOSS

|

$

|

(375,870

|

)

|

$

|

(438,239

|

)

|

||

|

|

||||||||

|

Non-controlled interest

|

13,113

|

46,761

|

||||||

|

Net loss contributed to the group

|

(362,757

|

)

|

(391,478

|

)

|

||||

|

|

||||||||

Other comprehensive income(loss)

|

Foreign currency translation income(loss)

|

$

|

382,322

|

$

|

56,466

|

||||

|

|

||||||||

|

Comprehensive income(loss)

|

$

|

19,565

|

$

|

(335,012

|

)

|

|||

|

|

||||||||

|

Basic and Diluted Loss per Common Share

|

$

|

(0.004

|

)

|

$

|

(0.01

|

)

|

||

|

|

||||||||

|

Weighted Average Number of Common Shares Outstanding

|

91,288,909

|

85,388,909

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Verde Resources, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

September 30,

2015

|

September 30,

2014

|

||||||

|

Cash flows from operating activities:

|

||||||||

|

Net loss

|

$

|

(375,870

|

)

|

$

|

(438,239

|

)

|

||

|

Adjustments to reconcile loss to net cash used in operations

|

||||||||

|

Depreciation

|

90,291

|

176,218

|

||||||

|

Reorganization

|

-

|

-

|

||||||

|

Disposal of fixed assets

|

-

|

1,938

|

||||||

|

Issuance of common stock (non cash)

|

-

|

-

|

||||||

|

Changes in operating assets and liabilities

|

||||||||

|

(Increase) decrease in:

|

||||||||

|

Accounts receivable from related parties

|

160,732

|

(13,005

|

)

|

|||||

|

Deposits and prepayment

|

73,750

|

37,538

|

||||||

|

Inventory

|

(13,716

|

)

|

51,528

|

|||||

|

Other receivable

|

-

|

-

|

||||||

|

Increase (decrease) in:

|

||||||||

|

Accounts payable

|

25,972

|

(1,363

|

)

|

|||||

|

Accrued liabilities

|

(10,899

|

)

|

15,073

|

|||||

|

GST payable

|

1,955

|

-

|

||||||

|

Advanced from sub-contractor & related parties

|

96,350

|

40,438

|

||||||

|

Deposit received from customer

|

-

|

38,030

|

||||||

|

Net cash provided by (used in) operating activities

|

48,565

|

(91,844

|

)

|

|||||

|

|

||||||||

|

Cash flows from investing activities:

|

||||||||

|

Proceeds from disposal of plant and equipment

|

-

|

4,577

|

||||||

|

Addition of motor vehicle

|

-

|

(18,682

|

)

|

|||||

|

Net cash (used in) investing activities

|

-

|

(14,105

|

)

|

|||||

|

|

||||||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from bank loans

|

-

|

13,176

|

||||||

|

Repayments of bank loans

|

(10,597

|

)

|

(14,264

|

)

|

||||

|

Shareholders' loans waived

|

-

|

-

|

||||||

|

Proceeds from issuance of common stock

|

-

|

-

|

||||||

|

Net cash (used in) financing activities

|

(10,597

|

)

|

(1,088

|

)

|

||||

|

|

||||||||

|

Net increase(decrease) in cash and cash equivalent

|

37,968

|

(107,037

|

)

|

|||||

|

|

||||||||

|

Effect of exchange rate changes on cash

|

(4,679

|

)

|

23,397

|

|||||

|

|

||||||||

|

Net increase (decrease) in cash and cash equivalents

|

33,289

|

(83,640

|

)

|

|||||

|

Cash and cash equivalents at beginning of year

|

36,927

|

121,780

|

||||||

|

Cash and cash equivalents at end of year

|

$

|

70,216

|

$

|

38,140

|

||||

|

|

||||||||

|

Supplementary cash flow information

|

||||||||

|

Income taxes paid

|

$

|

-

|

$

|

-

|

||||

|

Interest paid

|

$

|

812

|

$

|

1,658

|

||||

|

Supplementary non-cash information

|

||||||||

|

Reorganization

|

-

|

-

|

||||||

|

Issuance of common stock

|

-

|

-

|

||||||

The accompanying notes are an integral part of these condensed financial statements.

6

Verde Resources, Inc.

Notes to Condensed Consolidated Financial Statements

September 30, 2015

(Unaudited)

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

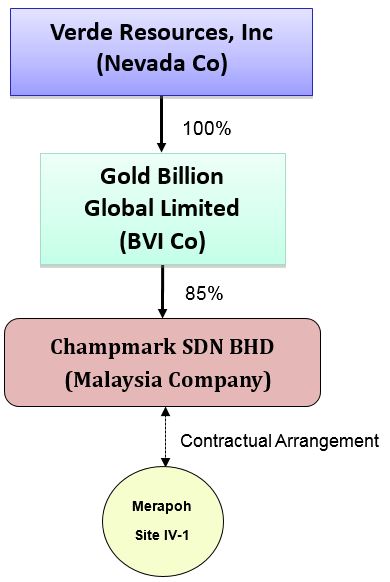

Verde Resources, Inc. (the "Company" or "VRDR") was incorporated on April 22, 2010, in the State of Nevada, U.S.A. The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America, and the Company's fiscal year end is June 30.

Gold Billion Global Limited ("Gold Billion" or "GBL") was incorporated in British Virgin Islands on February 7, 2013. GBL was setup by the Board of Director of Federal Mining Resources Limited ("FMR"). The major operation of GBL is to manage and monitor the mineral exploration and mining projects of FMR.

On July 1, 2013, FMR has assigned its rights and obligation on Champmark Sdn Bhd ("CSB") to GBL. Four of the five members of CSB Board of Directors were appointed by FMR, with two of the GBL Board of Directors currently sitting on the CSB Board. According to ASC 810-05-08 A, CSB is a deemed subsidiary of GBL where it has controlled the CSB Board of Directors, has assigned rights to receive future benefits and residual value, and obligation to absorb loss and finance for CSB by GBL. GBL has the power to direct the activities of CSB that most significantly impact CSB's economic performance and the obligation to absorb losses of CSB that could potentially be significant to the CSB or the right to receive benefits from CSB that could potentially be significant to CSB. GBL is the primary beneficiary of CSB because it has been assigned with all relevant rights and obligation and can direct the activities of CSB through the common directors and the 85% shareholder, FMR. Under 810-23-42, 43, it is determined that CSB is de-facto agent of GBL and GBL is the de-facto principal of CSB. GBL started to consolidate CSB from July 1, 2013 and the Company consolidated GBL and CSB from October 25, 2013 onwards.

On February 17, 2014, the Company entered into a Supplementary Agreement to the Assignment Agreement and completed an acquisition of GBL pursuant to the Supplementary Agreement. The acquisition was a reverse acquisition in accordance with ASC 805-40 "Reverse Acquisitions". The legal parent was VRDR which was the accounting acquiree while GBL was the accounting acquirer. There was a 15% non-controlling interest of Champmark SDN BHD ("CSB") after the acquisition. This transaction was accounted for as a recapitalization effected by a share exchange, wherein GBL with its 85% deemed subsidiary CSB was considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

As a result of the acquisition, the Company holds 100% equity interest in GBL and 85% variable interest in CSB. Our consolidated subsidiaries include GBL being our wholly-owned subsidiary and 85% of CSB being a variable interest entity (VIE) and deemed subsidiary of GBL.

On March 17, 2014, the Company through GBL and its deemed subsidiary CSB entered into a Sub-Contract Agreement with Borneo Oil & Gas Corporation Sdn Bhd ("BOG") for the engagement of its sub-contractor services to carry out exploration and exploitation works on alluvial and lode gold resources at Site IV-1 of the Merapoh Mine. The Sub-Contract Agreement is for a period of 5 years with a renewal for another 5 years subject to review by both parties. BOG is a wholly-owned subsidiary of Borneo Oil Berhad (BOB) which is listed on the main market of Kuala Lumpur Stock Exchange. BOG being a local company in Malaysia provides the Company with the advantage of local knowledge and well-established connection in dealing with the relevant local authorities in our mining operations.

On April 1, 2014, GBL purchased 85% equity interest of CSB, and CSB became indirect subsidiary of the Company.

Effective August 27, 2014, the Company's Articles of Incorporation have been amended to increase the authorized shares of the Company from 100,000,000 shares of common stock to 250,000,000 shares of common stock. A copy of the Certificate of Amendment was filed with the Nevada Secretary of State. The Form 8K announcing the increase of the authorized shares of the Company was filed with SEC on September 15, 2014.

7

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Condensed Consolidated Financial Statements

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted. The results of operations for the periods ended September 30, 2015 are not necessarily indicative of the operating results for the full years.

Basis of Presentation

The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America (GAAP). These condensed consolidated financial statements are expressed in United States dollars ($). Financial statements prepared in accordance with GAAP contemplate the realization of assets and the satisfaction of liabilities in the normal course of business. These condensed consolidated audited financial statements include all adjustments that, in the opinion of management, are necessary in order to make the financial statements not misleading.

Basis of Consolidation

The condensed consolidated financial statements include the financial statements of Verde Resources, Inc., its wholly owned subsidiary Gold Billion Global Limited ("GBL") and the 85% of the deemed subsidiary variable interest of Champmark SDN BHD ("CSB"). All inter-company balances and transactions between the Company and its subsidiary and variable interest entity (VIE) have been eliminated upon consolidation.

The Company has adopted ASC Topic 810-10-5-8, "Variable Interest Entities", which requires a variable interest entity or VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE's residual returns.

Variable Interest Entity

On July 1, 2013, the Company's subsidiary, GBL entered into a series of agreements ("VIE agreements") with FMR and details of the VIE agreements are as follows:

|

|

1.

|

Management Agreement, FMR entrusted the management rights of its subsidiary CSB to GBL that include:

|

|

||

|

|

i)

|

management and administrative rights over the day-to-day business affairs of CSB and the mining operation at Site IV-1 of the Merapoh Gold Mine;

|

|||

|

|

ii)

|

final right for the appointment of members to the Board of Directors and the management team of CSB;

|

|||

|

|

iii)

|

act as principal of CSB;

|

|

||

|

|

iv)

|

obligation to provide financial support to CSB;

|

|||

|

|

v)

|

option to purchase an equity interest in CSB;

|

|||

|

|

vi)

|

entitlement to future benefits and residual value of CSB;

|

|||

|

|

vii)

|

right to impose no dividend policy;

|

|

||

|

|

viii)

|

human resources management.

|

|

|

|

|

|

2.

|

Debt Assignment, FMR assigned to GBL the sum of money in the amount of US Dollars Three Hundred Nine Thousand Three Hundred Thirty One And Cents Ninety Two Only (US$ 309,331.92), now due to GBL from CSB under the financing obligation from the FMR to CSB.

|

With the above agreements, GBL demonstrates its ability to control CSB as the primary beneficiary and the operating results of the VIE was included in the condensed consolidated financial statements for the nine months ended December 31, 2014.

On April 1, 2014, the Board of Director of GBL notified FMR upon the decision to exercise the right of option to purchase 85% equity interest of CSB under Management Agreement Section 3.2.4 dated July 1, 2013 between GBL and FMR. This acquisition was completed on April 1, 2014 with consideration of US$1. GBL then became 85% shareholder of CSB and is required to consolidate CSB as a subsidiary.

8

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company's periodic filings with the Securities and Exchange Commission include, where applicable, disclosures of estimates, assumptions, uncertainties and markets that could affect the financial statements and future operations of the Company.

Cash and Cash Equivalents

Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with maturities of less than three months, which are readily convertible to known amounts of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value. The Company had $70,216 and $36,927 in cash and cash equivalents at September 30, 2015 and June 30, 2015, respectively.

Concentrations of Credit Risk

The Company's financial instruments that are exposed to concentrations of credit risk primarily consist of its cash and cash equivalents and related party payables it will likely incur in the near future. The Company places its cash and cash equivalents with financial institutions of high credit worthiness. At times, its cash and cash equivalents with a particular financial institution may exceed any applicable government insurance limits. The Company's management plans to assess the financial strength and credit worthiness of any parties to which it extends funds, and as such, it believes that any associated credit risk exposures are limited.

Risks and Uncertainties

The Company operates in the resource exploration industry that is subject to significant risks and uncertainties, including financial, operational, technological, and other risks associated with operating a resource exploration business, including the potential risk of business failure.

Accounts Receivable

Accounts receivable are recognized and carried at net realizable value. An allowance for doubtful accounts will be recorded in the period when a loss is probable based on an assessment of specific evidence indicating troubled collection, historical experience, accounts aging, ongoing business relation and other factors. Accounts are written off after exhaustive efforts at collection. If accounts receivable are to be provided for, or written off, they would be recognized in the consolidated statement of operations within operating expenses. At and, the Company has no allowance for doubtful accounts, as per management's judgment based on their best knowledge. As of September 30, 2015 and June 30, 2015, the longest credit term for certain customers are 60 days.

Provision for Doubtful Accounts

The Company maintains an allowance for doubtful accounts to reserve for potentially uncollectible receivables and reviews accounts receivable by amounts due by customers which are past due to identify specific customers with known disputes or collectability issues. In determining the amount of the reserve, the Company makes judgments about the creditworthiness of customers based on past collection experience and ongoing credit risk evaluations. At September 30, 2015 and June 30, 2015 there was no allowance for doubtful accounts.

9

Fair Value

ASC Topic 820 "Fair Value Measurement and Disclosures" establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market.

These tiers include:

|

|

●

|

Level 1—defined as observable inputs such as quoted prices in active markets;

|

|

|

●

|

Level 2—defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and

|

|

|

●

|

Level 3—defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

|

The Company's financial instruments consist of cash and cash equivalents, trade receivables, other receivables, payables, and short term and long term debt. The carrying values of cash and cash equivalents, trade receivables, other receivables, and payables approximate their fair value due to their short maturities. The carrying value of long term debt approximates the fair value of debt of similar terms and remaining maturities available to the company.

The Company's non-financial assets are measured on a recurring basis. These non-financial assets are measured for impairment annually on the Company's measurement date at the reporting unit level using Level 3 inputs. For most assets, ASC 820 requires that the impact of changes resulting from its application be applied prospectively in the year in which the statement is initially applied.

The Company's non-financial assets measured on a non-recurring basis include the Company's property, plant and equipment and finite-use intangible assets which are measured for recoverability when indicators for impairment are present. ASC 820 requires companies to disclose assets and liabilities measured on a non-recurring basis in the period in which the re-measurement at fair value is performed.

The Company did not have any convertible bonds as of September 30, 2015 and June 30, 2015.

Foreign Currency Translation

The Company's reporting currency is the United States dollar ("$") and the accompanying consolidated financial statements have been expressed in United States dollars. The Company's functional currency is the Malaysian Ringgit ( "MYR") which is a functional currency as being the primary currency of the economic environment in which their operations are conducted.

In accordance with ASC Topic 830 "Translation of Financial Statements" , capital accounts of the consolidated financial statements are translated into United States dollars from MYR at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the respective year. The resulting exchange differences are recorded in the consolidated statement of operations.

|

|

September 30,

2015

|

June 30,

2015

|

||||||

|

Period-end MYR : $1 exchange rate

|

0.2264

|

0.2644

|

||||||

|

Average MYR : $1 exchange rate

|

0.2419

|

0.2883

|

||||||

Comprehensive Income

Comprehensive income is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, all items that are required to be recognized under current accounting standards as components of comprehensive income are required to be reported in a financial statement that is presented with the same prominence as other financial statements. Comprehensive income includes net income and the foreign currency translation changes.

10

Segment Reporting

The Company currently engages in one operation segment: Gold Mining. The expenses incurred were consisting principally of management services. The Company's major operation is located in Malaysia.

Mineral Acquisition and Exploration Costs

The Company has been in the exploration stage since its formation on April 22, 2010 and has not yet realized any revenue from its planned operations. It has been primarily engaged in the acquisition, exploration, and development of mining properties. The Company will no longer in the exploration stage after the reverse take-over with its subsidiary GBL.

Mineral property acquisition and exploration costs are expensed as incurred. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserves.

Environmental Expenditures

The operations of the Company have been, and may in the future be, affected from time to time in varying degree by changes in environmental regulations, including those for future reclamation and site restoration costs. Both the likelihood of new regulations and their overall effect upon the Company vary greatly and are not predictable. The Company's policy is to meet or, if possible, surpass standards set by relevant legislation by application of technically proven and economically feasible measures.

Environmental expenditures that relate to ongoing environmental and reclamation programs are charged against earnings as incurred or capitalized and amortized depending on their future economic benefits. All of these types of expenditures incurred since inception have been charged against earnings due to the uncertainty of their future recoverability. Estimated future reclamation and site restoration costs, when the ultimate liability is reasonably determinable, are charged against earnings over the estimated remaining life of the related business operation, net of expected recoveries.

Revenue Recognition

In accordance with the ASC Topic 605, "Revenue Recognition", the Company recognizes revenue when persuasive evidence of an arrangement exists, transfer of title has occurred or services have been rendered, the selling price is fixed or determinable and collectibility is reasonably assured.

The Company derives revenues primarily from the sales of gold mineral to registered gold trading companies in Malaysia. The Company generally recognizes its revenues at the time of gold sales and its selling price is determined by the prevailing market value of gold bullion quoted by the leading registered gold trading company in Malaysia. Sales invoice will be duly presented to the trading companies when delivery is completed and revenue is then recognized.

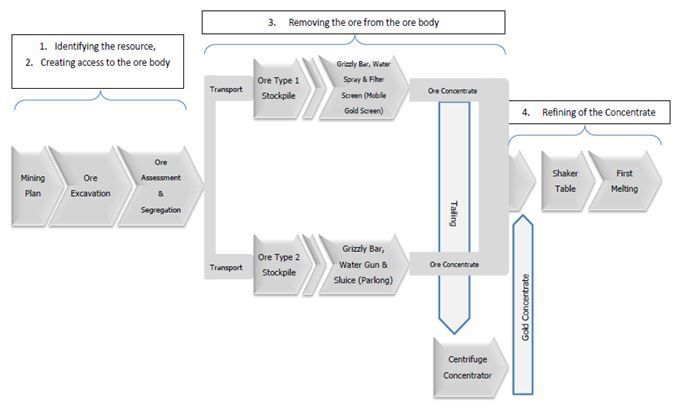

Cost of Revenue

The cost of revenue consists of exploration cost, mine equipment depreciation, production cost, mine site management cost, sub-contractor cost, and royalty and tribute payment which are levied on the gross revenue at the rate of 18% on the invoiced value of gold sales.

Advertising Expenses

Advertising costs are expensed as incurred under ASC Topic 720, "Advertising Costs" . Advertising expenses incurred for the periods ended September 30, 2015 and June 30, 2015 were $0.

11

Income Taxes

The provision for income taxes is determined in accordance with the provisions of ASC Topic 740, "Accounting for Income Taxes" ("ASC 740"). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclose in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts. As of September 30, 2015 and June 30, 2015, the Company did not have any significant unrecognized uncertain tax positions.

Recent Accounting Pronouncements

The FASB has issued Accounting Standards Update (ASU) No. 2014-06, Technical Corrections and Improvements Related to Glossary Terms. The amendments in this ASU relate to glossary terms and cover a wide range of Topics in the FASB's Accounting Standards Codification™ (Codification). These amendments are presented in four sections:

1. Deletion of Master Glossary Terms (Section A) arising because of terms that were carried forward from source literature (e.g., FASB Statements, EITF Issues, and so forth) to the Codification but were not utilized in the Codification.

2. Addition of Master Glossary Term Links (Section B) arising from Master Glossary terms whose links did not carry forward to the Codification.

3. Duplicate Master Glossary Terms (Section C) arising from Master Glossary terms that appear multiple times in the Master Glossary with similar, but not identical, definitions.

4. Other Technical Corrections Related to Glossary Terms (Section D) arising from miscellaneous changes to update Master Glossary terms. The amendments do not have transition guidance and are effective upon issuance for both public entities and nonpublic entities.

The FASB has issued Accounting Standards Update (ASU) No. 2014-08, Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity. The amendments in the ASU change the criteria for reporting discontinued operations while enhancing disclosures in this area. It also addresses sources of confusion and inconsistent application related to financial reporting of discontinued operations guidance in U.S. GAAP.

Under the new guidance, only disposals representing a strategic shift in operations should be presented as discontinued operations. Those strategic shifts should have a major effect on the organization's operations and financial results. Examples include a disposal of a major geographic area, a major line of business, or a major equity method investment.

In addition, the new guidance requires expanded disclosures about discontinued operations that will provide financial statement users with more information about the assets, liabilities, income, and expenses of discontinued operations.

The new guidance also requires disclosure of the pre-tax income attributable to a disposal of a significant part of an organization that does not qualify for discontinued operations reporting. This disclosure will provide users with information about the ongoing trends in a reporting organization's results from continuing operations.

The amendments in this ASU enhance convergence between U.S. GAAP and International Financial Reporting Standards (IFRS). Part of the new definition of discontinued operation is based on elements of the definition of discontinued operations in IFRS 5, Non-Current Assets Held for Sale and Discontinued Operations.

The amendments in the ASU are effective in the first quarter of 2015 for public organizations with calendar year ends. For most nonpublic organizations, it is effective for annual financial statements with fiscal years beginning on or after December 15, 2014. Early adoption is permitted.

12

The FASB has issued Accounting Standards Update (ASU) No. 2014-12, Compensation – Stock Compensation (Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period. The issue is the result of a consensus of the FASB Emerging Issues Task Force.

The amendments in the ASU require that a performance target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in Topic 718, Compensation – Stock Compensation, as it relates to awards with performance conditions that affect vesting to account for such awards. The performance target should not be reflected in estimating the grant-date fair value of the award. Compensation cost should be recognized in the period in which it becomes probable that the performance target will be achieved and should represent the compensation cost attributable to the period(s) for which the requisite service has already been rendered. If the performance target becomes probable of being achieved before the end of the requisite service period, the remaining unrecognized compensation cost should be recognized prospectively over the remaining requisite service period. The total amount of compensation cost recognized during and after the requisite service period should reflect the number of awards that are expected to vest and should be adjusted to reflect those awards that ultimately vest. The requisite service period ends when the employee can cease rendering service and still be eligible to vest in the award if the performance target is achieved.

The amendments in this ASU are effective for annual periods and interim periods within those annual periods beginning after December 15, 2015. Earlier adoption is permitted. The effective date is the same for both public business entities and all other entities.

Entities may apply the amendments in this ASU either: (a) prospectively to all awards granted or modified after the effective date; or (b) retrospectively to all awards with performance targets that are outstanding as of the beginning of the earliest annual period presented in the financial statements and to all new or modified awards thereafter. If retrospective transition is adopted, the cumulative effect of applying this ASU as of the beginning of the earliest annual period presented in the financial statements should be recognized as an adjustment to the opening retained earnings balance at that date. In addition, if retrospective transition is adopted, an entity may use hindsight in measuring and recognizing the compensation cost.

The amendments in the ASU require that a performance target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in Topic 718, Compensation – Stock Compensation, as it relates to awards with performance conditions that affect vesting to account for such awards. The performance target should not be reflected in estimating the grant-date fair value of the award. Compensation cost should be recognized in the period in which it becomes probable that the performance target will be achieved and should represent the compensation cost attributable to the period(s) for which the requisite service has already been rendered. If the performance target becomes probable of being achieved before the end of the requisite service period, the remaining unrecognized compensation cost should be recognized prospectively over the remaining requisite service period. The total amount of compensation cost recognized during and after the requisite service period should reflect the number of awards that are expected to vest and should be adjusted to reflect those awards that ultimately vest. The requisite service period ends when the employee can cease rendering service and still be eligible to vest in the award if the performance target is achieved.

The amendments in this ASU are effective for annual periods and interim periods within those annual periods beginning after December 15, 2015. Earlier adoption is permitted. The effective date is the same for both public business entities and all other entities.

Entities may apply the amendments in this ASU either: (a) prospectively to all awards granted or modified after the effective date; or (b) retrospectively to all awards with performance targets that are outstanding as of the beginning of the earliest annual period presented in the financial statements and to all new or modified awards thereafter. If retrospective transition is adopted, the cumulative effect of applying this ASU as of the beginning of the earliest annual period presented in the financial statements should be recognized as an adjustment to the opening retained earnings balance at that date. In addition, if retrospective transition is adopted, an entity may use hindsight in measuring and recognizing the compensation cost.

The FASB has issued Accounting Standards Update (ASU) No. 2014-13, Consolidation (Topic 810): Measuring the Financial Assets and the Financial Liabilities of a Consolidated Collateralized Financing Entity. The amendments in this ASU will apply to a reporting entity that is required to consolidate a collateralized financing entity under the Variable Interest Entities guidance when: (1) the reporting entity measures all of the financial assets and the financial liabilities of that consolidated collateralized financing entity at fair value in the consolidated financial statements based on other Codification Topics; and (2) the changes in the fair values of those financial assets and financial liabilities are reflected in earnings.

The amendments in this ASU are effective for public business entities for annual periods, and interim periods within those annual periods, beginning after December 15, 2015. For entities other than public business entities, the amendments are effective for annual periods ending after December 15, 2016, and interim periods beginning after December 15, 2016. Early adoption is permitted as of the beginning of an annual period.

The fair value of the financial assets of a collateralized financing entity, as determined under GAAP, may differ from the fair value of its financial liabilities even when the financial liabilities have recourse only to the financial assets. Before this ASU, there was no specific guidance in GAAP on how a reporting entity should account for that difference.

The amendments in this ASU provide an alternative to Topic 820 Fair Value Measurement for measuring the financial assets and the financial liabilities of a consolidated collateralized financing entity to eliminate that difference. When the measurement alternative is not elected for a consolidated collateralized financing entity within the scope of this ASU, the amendments clarify that: (1) the fair value of the financial assets and the fair value of the financial liabilities of the consolidated collateralized financing entity should be measured using the requirements of Topic 820; and (2) any differences in the fair value of the financial assets and the fair value of the financial liabilities of that consolidated collateralized financing entity should be reflected in earnings and attributed to the reporting entity in the consolidated statement of income (loss).

The Financial Accounting Standards Board (FASB) has issued Accounting Standards Update (ASU) No. 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern. ASU 2014-15 is intended to define management's responsibility to evaluate whether there is substantial doubt about an organization's ability to continue as a going concern and to provide related footnote disclosures.

Under Generally Accepted Accounting Principles (GAAP), financial statements are prepared under the presumption that the reporting organization will continue to operate as a going concern, except in limited circumstances. Financial reporting under this presumption is commonly referred to as the going concern basis of accounting. The going concern basis of accounting is critical to financial reporting because it establishes the fundamental basis for measuring and classifying assets and liabilities.

Currently, GAAP lacks guidance about management's responsibility to evaluate whether there is substantial doubt about the organization's ability to continue as a going concern or to provide related footnote disclosures.

Under Generally Accepted Accounting Principles (GAAP), financial statements are prepared under the presumption that the reporting organization will continue to operate as a going concern, except in limited circumstances. Financial reporting under this presumption is commonly referred to as the going concern basis of accounting. The going concern basis of accounting is critical to financial reporting because it establishes the fundamental basis for measuring and classifying assets and liabilities.

Currently, GAAP lacks guidance about management's responsibility to evaluate whether there is substantial doubt about the organization's ability to continue as a going concern or to provide related footnote disclosures.

13

This ASU provides guidance to an organization's management, with principles and definitions that are intended to reduce diversity in the timing and content of disclosures that are commonly provided by organizations today in the financial statement footnotes.

The amendments are effective for annual periods ending after December 15, 2016, and interim periods within annual periods beginning after December 15, 2016. Early application is permitted for annual or interim reporting periods for which the financial statements have not previously been issued.

The amendments are effective for annual periods ending after December 15, 2016, and interim periods within annual periods beginning after December 15, 2016. Early application is permitted for annual or interim reporting periods for which the financial statements have not previously been issued.

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

NOTE 3 - CASH AND CASH EQUIVALENT

The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. At September 30, 2015 and June 30, 2015 cash and cash equivalents consisted of bank deposits in Malaysia bank and petty cash on hands.

NOTE 4 - AMOUNT DUE FROM RELATED PARTIES

Amount due from related parties at September 30, 2015 and June 30, 2015 consist of the following items:

|

|

||||||||

|

|

September 30,

2015

|

June 30,

2015

|

||||||

|

Amount due from Stable Treasure Sdn. Bhd. (*)

|

$

|

2,583

|

$

|

3,017

|

||||

(*) One of the directors of Stable Treasure Sdn. Bhd., Mr. Balakrishnan B S Muthu is also the director of the Company. The advances related to ordinary business transactions and bear no interest or collateral, repayable and renewable under normal business advancement terms.

NOTE 5 - INVENTORIES

Inventories are valued at cost, not in excess of market. Inventories are determined at first in first out basis and comprised of production cost, mine site management cost and sub-contractor cost. Inventories, at September 30, 2015 and June 30, 2015 are summarized as follows:

|

|

September 30,

2015

|

June 30,

2015

|

||||||

|

Inventories

|

$

|

23,877

|

$

|

11,865

|

||||

The inventories represent the gold minerals as at September 30, 2015 and June 30, 2015, which were comprised of 8% share by the Company and 92% share by the sub-contractor and the other parties such as original mine assigner.

14

NOTE 6 - ACCOUNTS PAYABLE AND ADVANCED FROM RELATED PARITES

Accounts Payable

Accounts payable at September 30, 2015 and June 30, 2015 consist of the following items:

|

|

||||||||

|

|

September 30,

2015

|

June 30,

2015

|

||||||

|

Due to Changxin Wanlin Technology Co Ltd(*)

|

$

|

1,459,504

|

$

|

1,704,474

|

||||

|

Other accounts payable

|

47,234

|

24,830

|

||||||

|

|

$

|

1,506,738

|

$

|

1,729,304

|

||||

(*) Due to Changxin Wanlin Technology Co Ltd are accounts payable derived from ordinary business transactions. One of the directors of Changxin Wanlin Technology Co. Ltd., Mr. Wu Ming Ding, is also the director of VRDR, GBL and CSB. This accounts payable bears no interest or collateral, repayable and renewable under normal business accounts payable terms.

Advanced from related parties

Advanced from related parties at September 30, 2015 and June 30, 2015 consist of the following items:

|

|

September 30,

2015

|

June 30,

2015

|

||||||

|

Advanced from BOG (#1)

|

$

|

222,667

|

$

|

186,057

|

||||

|

Advanced from Federal Mining Resources Limited(#2)

|

$

|

173,465

|

$

|

173,465

|

||||

|

Advanced from Federal Capital Investment Limited (#3)

|

$

|

144,000

|

$

|

120,000

|

||||

|

Advanced from Yorkshire Capital Limited (#4)

|

$

|

54,000

|

$

|

45,000

|

||||

|

|

$

|

594,132

|

$

|

524,522

|

||||

(#1) BOG is one of the shareholders of the Company. The advances are related to ordinary business transactions and bear no interest or collateral, repayable and renewable under normal business advancement terms.

(#2) One of the directors of Federal Mining Resources Limited, Mr. Wu Ming Ding, is also the director of the Company. The advances are related to ordinary business transactions and bear no interest or collateral, repayable and renewable under normal business advancement terms.

(#3) One of the directors of Federal Capital Investment Limited, Mr. Wu Ming Ding, is also the director of the Company. The advances are related to ordinary business transactions and bear no interest or collateral, repayable and renewable under normal business advancement terms.

(#4) One of the directors of Yorkshire Capital Limited, Mr. Lai Kui Shing, Andy, is also a director of CSB. The advances are related to ordinary business transactions and bear no interest or collateral, repayable and renewable under normal business advancement terms.

15

NOTE 7 - PROPERTY, PLANT AND EQUIPMENT

Property and equipment at September 30, 2015 and June 30, 2015 are summarized as follows:

|

|

September 30,

2015

|

June 30,

2015

|

||||||

|

Land and Building

|

$

|

890,399

|

$

|

1,039,848

|

||||

|

Plant and Machinery

|

140,242

|

163,780

|

||||||

|

Office equipment

|

17,829

|

20,821

|

||||||

|

Project equipment

|

1,009,717

|

1,179,193

|

||||||

|

Computer

|

9,697

|

11,325

|

||||||

|

Motor Vehicle

|

104,384

|

121,904

|

||||||

|

Accumulated depreciation

|

(1,847,280

|

)

|

(2,058,646

|

)

|

||||

|

|

$

|

324,988

|

$

|

478,225

|

||||

The depreciation expenses charged for the period ended September 30, 2015 and 2014 was $90,291 and $172,487.

NOTE 8 – LOANS FROM BANKS (HIRE PURCHASE INSTALLMENT LOANS)

The loans from banks include long term and short term and are summarized as follow:

|

|

September 30,

2015

|

June 30,

2015

|

||||||

|

Loans from banks

|

$

|

31,235

|

$

|

39,585

|

||||

|

Loans from banks(non-current)

|

24,683

|

37,207

|

||||||

|

Total

|

$

|

55,918

|

$

|

76,792

|

||||

Hire purchase installment loans with total amount $58,614 and $80,828 as at September 30, 2015 and June 30, 2015 are $55,918 and $76,792 net of imprest charges equivalent to interest $2,696 and $4,036 are summarized as follows:

|

|

||||||||||||||||

|

|

September 30,

2015

|

June 30,

2015

|

||||||||||||||

|

|

Interest Rate

|

Monthly Due

|

||||||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

$

|

262

|

$

|

-

|

$

|

-

|

||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

564

|

-

|

655

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

249

|

3,481

|

5,085

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

249

|

3,481

|

5,085

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

889

|

3,556

|

7,387

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

1,418

|

31,188

|

43,105

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

246

|

6,157

|

8,461

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

175

|

8,055

|

11,050

|

|||||||||||

|

Hire purchase loans payable to banks

|

$

|

55,918

|

$

|

80,828

|

||||||||||||

(*) Hire purchase installment loans with Motor Vehicles as collateral. The financial institutions in Malaysia are Islamic banks and bear no interest in the installment agreement. However, there are certain imprest charges equivalent to interests which are being calculated at an average annual rate of approximate 6.11% for the entire loans life and periods.

16

The scheduled maturities of the CSL's hire purchase installment loans are as follows:

|

September 30,

|

||||

|

2015

|

32,918

|

|||

|

2016

|

21,202

|

|||

|

2017

|

2,572

|

|||

|

2018

|

1,922

|

|||

|

Later years

|

-

|

|||

|

Total minimum hire purchase installment payment

|

$

|

58,614

|

||

|

Less: Amount representing imprest charges equivalent to interest (current portion: $1,683 and non-current portion: $1,013)

|

2,696

|

|||

|

Present value of net minimum lease payments (#)

|

$

|

55,918

|

||

(#) Minimum payment reflected in the balance sheet as current and noncurrent obligations under hire purchases installment loans as at September 30, 2015.

NOTE 9 – INCOME TAX

The Company and its subsidiaries are subject to income taxes on an entity basis on income arising in, or derived from, the tax jurisdiction in which they operate. T he Company is a Nevada incorporated company and subject to United State Federal Income Tax. GBL is a British Virgin Islands incorporated company and not required to pay income tax on corporate income. CSB is a Malaysia incorporated company and required to pay corporate income tax at 25% of taxable income.

A reconciliation between the income tax computed at the relevant statutory rate and the Company's provision for income tax is as follows:

|

|

|

|

|

|

|

|

|

Period ended

|

||

|

|

|

September 30, 2015

|

|

June 30, 2015

|

|

US Federal Income Tax Rate.

|

|

34%

|

|

34%

|

|

Valuation allowance – US Rate

|

|

(34%)

|

|

(34%)

|

|

BVI Income Tax Rate

|

|

0%

|

|

0%

|

|

Valuation allowance – BVI Rate

|

|

(0%)

|

|

(0%)

|

|

Malaysia Income Tax Rate

|

|

25%

|

|

25%

|

|

Valuation allowance – Malaysia Rate

|

|

(25%)

|

|

(25%)

|

|

Provision for income tax

|

|

-

|

|

-

|

Summary of the Company's net deferred tax liabilities and assets are as follows:

|

|

||||||||

|

|

September 30, 2015

|

June 30, 2015

|

||||||

|

Deferred tax assets:

|

||||||||

|

Tax attribute carryforwards

|

$

|

127,795

|

509,223

|

|||||

|

Valuation allowances

|

(127,795

|

)

|

(509,223

|

)

|

||||

|

Total

|

$

|

-

|

-

|

|||||

The Company has recorded valuation allowances for certain tax attribute carry forwards and other deferred tax assets due to uncertainty that exists regarding future realizability. If in the future the Company believes that it is more likely than not that these deferred tax benefits will be realized, the majority of the valuation allowances will be recognized in the consolidated statement of operations. The Company did not have any interest and penalty provided or recognized in the income statements for period September 30, 2015 and June 30, 2015 or balance sheet as of September 30, 2015 and June 30, 2015. The Company did not have uncertainty tax positions or events leading to uncertainty tax position within the next 12 months.

17

NOTE 10 - COMMITMENTS AND CONTINGENCIES

The Company is committed under an operating lease for office premises expiring May 2015, with fixed monthly rental. As at September 30, 2015, the Company has future minimum rental payment of $3,871 due for the year ended June 30, 2016.

As at September 30, 2015, the Company's hire purchase installment agreements are disclosed in Note 8. See Note 8 for the commitments for minimum installment payments under these agreements.

NOTE 11 – EARNINGS/(LOSS) PER SHARE

The Company has adopted ASC Topic No. 260, "Earnings Per Share," ("EPS") which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures, and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic earnings (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period.

The following table sets forth the computation of basic and diluted earnings per share:

|

|

|

|

Three Months Ended

September 30,

|

|

|||||

|

|

|

|

2015

|

|

|

2014

|

|

||

|

Net loss applicable to common shares

|

|

$

|

(375,870

|

)

|

|

$

|

(438,239

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares

|

|

|

|

|

|

|

|

|

|

|

outstanding (Basic)

|

|

|

|

91,288,909

|

|

|

|

85,388,909

|

|

|

Options

|

`

|

|

|

-

|

|

|

|

-

|

|

|

Warrants

|

|

|

|

-

|

|

|

|

-

|

|

|

Weighted average common shares

|

|

|

|

|

|

|

|

|

|

|

outstanding (Diluted)

|

|

|

|

91,288,909

|

|

|

|

85,388,909

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share (Basic and Diluted)

|

|

$

|

(0.004

|

)

|

|

$

|

(0.005

|

)

|

|

The Company has no potentially dilutive securities, such as options or warrants, currently issued and outstanding.

18

NOTE 12 - CAPITAL STOCK

Authorized Stock

The Company has authorized 250,000,000 common shares and 50,000,000 preferred shares, both with a par value of $0.001 per share. Each common share entitles the holder to one vote, in person or proxy, on any matter on which action of the stockholders of the corporation is sought.

Share Issuance

On September 30, 2013, the Company issued 2,500,000 and 1,477,500 common shares at $0.01 and $0.04 per share, respectively, resulting in total cash proceeds of $84,100, being $3,978 for par value shares and $80,122 for capital in excess of par value.

On October 25, 2013, the Company issued 80,000,000 common shares at par value under the terms of the Assignment Agreement whereby FMR will assign its management rights of CSB's mining operation in the Mining Lease to VRDR, through its wholly-owned subsidiary GBL, in exchange for 80,000,000 shares of the Company's common stock.

On November 11, 2013, the Company issued 75,000 common shares at US$1.75 per share to Marketing Management International, LLC ("MMI"), a Florida Limited Liability Company, under the terms of the Consulting Agreement for the engagement of its consulting services.

On January 29, 2014, the Company issued a total of 643,229 common shares for $665,238, of which 288,288 common shares at US$1.25 per share, 183,661 common shares at US$0.83 per share and 171,280 common shares at US$0.89 per share, to Borneo Oil & Gas Corporation Sdn Bhd ("BOG"), a Malaysia Limited Liability Company, under the terms of the Sub-Contractor Agreement for the engagement of its sub-contractor services.

On March 10, 2014, the Company issued a total of 693,180 common shares for $609,756, of which 179,340 common shares at US$0.85 per share and 513,840 common shares at US$0.89 per share, to Borneo Oil & Gas Corporation Sdn Bhd ("BOG"), a Malaysia Limited Liability Company, under the terms of the Sub-Contractor Agreement for the engagement of its sub-contractor services.

On January 21, 2015, the Company issued 5,900,000 common shares at US$0.05 per share to Borneo Oil & Gas Corporation Sdn Bhd ("BOG"), a Malaysia Limited Liability Company, under the terms of the Consultant Agreement for the additional services of its sub-contractor.

There were 91,288,909 common shares issued and outstanding at September 30, 2015 and June 30, 2015.

There are no preferred shares outstanding. The Company has issued no authorized preferred shares. The Company has no stock option plan, warrants, or other dilutive securities.

NOTE 13 - RELATED PARTY TRANSACTIONS

As of September 30, 2015, advances were made by five companies of $2,053,636 related to ordinary business transactions. All advances related to ordinary business transactions, bear no interest or collateral, repayable and renewable under normal advancement terms. Details are disclosed in Note 6.

As of September 30, 2015, amounts due from one company of $2,583 related to ordinary business transactions. The receivable amounts related to ordinary business transactions bear no interest or collateral, repayable and renewable under normal advancement terms. Details are disclosed in Note 4.

During the period ended September 30, 2015, the Company sold $427 worth of gold to BOG.

During the period ended September 30, 2015, the Company incurred cost of revenue worth of $239,776 to BOG.

During the period ended September 30, 2015, the Company disposed a motor vehicle to BOG.

On January 21, 2015, the Company issued 5,900,000 common shares at US$0.05 per share to BOG, under the terms of the Consultant Agreement dated January 15, 2015.

19

NOTE 14 - GOING CONCERN AND LIQUIDITY CONSIDERATIONS

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. As of and for the period ended September 30, 2015, the Company has a loss from operations of $375,870 and working capital deficiency of $2,091,527. The Company intends to fund operations through debt and equity financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the period ending September 30, 2015 and subsequently.

The ability of the Company to survive is dependent upon, among other things, obtaining additional financing to continue operations, and development of its business plan.

In response to these problems, management intends to raise additional funds through public or private placement offerings, and related party loans.

These factors, among others, raise substantial doubt about the Company's ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 15 - CONCENTRATIONS

Suppliers

The Company's major suppliers for the period ended September 30, 2015 and 2014 are listed as following:

|

|

Subcontractors

|

|

|

Accounts Payable

|

|

|||||||||||

|

|

|

Three

|

|

|

Three

|

|

|

|

|

|

|

|

||||

|

|

|

Months

|

|

|

Months

|

|

|

|

|

|

|

|

||||

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

|

|

|

||||

|

Major Suppliers

|

|

September 30, 2015

|

|

|

September 30, 2014

|

|

|

September 30, 2015

|

|

|

September 30, 2014

|

|

||||

|

Company A

|

|

|

100

|

%

|

|

|

100

|

%

|

|

|

0

|

%

|

|

|

0

|

%

|

Customers

The Company's major customers for the period ended September 30, 2015 and 2014 are listed as following:

|

|

Sales

|

|

|

Accounts Receivable

|

|

|||||||||||

|

|

|

Three

|

|

|

Three

|

|

|

|

|

|

|

|

||||

|

|

|

Months

|

|

|

Months

|

|

|

|

|

|

|

|

||||

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

|

|

|

||||

|

Major Customers

|

|

September 30,

2015

|

|

|

September 30,

2014

|

|

|

September 30,

2015

|

|

|

September 30,

2014

|

|

||||

|

Company M

|

|

|

0

|

%

|

|

|

48

|

%

|

|

|

0

|

%

|

|

|

0

|

%

|

|

Company N

|

|

|

1

|

%

|

|

|

36

|

%

|

|

|

0

|

%

|

|

|

0

|

%

|

|

Company O

|

|

|

99

|

%

|

|

|

16

|

%

|

|

|

0

|

%

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE 16 -SUBSEQUENT EVENTS

The Company has evaluated subsequent events from the balance sheet date through the date the financial statements were issued and determined that there are no additional items to disclose.

20

Forward-Looking Statements

Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words "expects," "anticipates," "intends," "believes" and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed herein as well as in the "Description of Business – Risk Factors" section in our Annual Report on Form 10-K, as filed on September 30, 2013. You should carefully review the risks described in our Annual Report and in other documents we file from time to time with the Securities and Exchange Commission. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements.

All references in this Form 10-Q to the "Company," "Verde Resources," "we," "us," or "our" are to Verde Resources, Inc.

Business Overview