Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Rebel Group, Inc. | f10k2019ex32-2_rebel.htm |

| EX-32.1 - CERTIFICATION - Rebel Group, Inc. | f10k2019ex32-1_rebel.htm |

| EX-31.2 - CERTIFICATION - Rebel Group, Inc. | f10k2019ex31-2_rebel.htm |

| EX-31.1 - CERTIFICATION - Rebel Group, Inc. | f10k2019ex31-1_rebel.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

(Mark One)

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File No. 333-177786

REBEL GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

| Florida | 45-3360079 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| 7500A Beach Road, Unit 16-324, The Plaza Singapore 199591 |

+6562941531 | |

| (Address of Principal Executive Offices and Zip Code) | (Registrant’s Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting equity held by non-affiliates of the registrant is computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter. The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $145,931,828, based upon the closing price of the Company’s common stock of $2.9 per share as reported on the OTC Markets on such date. However, since there is no active trading market for the Company’s common stock, the Company does not believe that the quoted price of its common stock is indicative of the actual value of such stock.

As of April 24, 2020, the number of shares of the registrant’s common stock outstanding was 55,354,031.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. The Annual Report contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “will,” “could,” and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. You should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and the notes to those statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include, among others, the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The Company’s ability to devise and implement effective internal controls and procedures such that it can timely file reports required with the SEC; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This Annual Report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this Annual Report are made as of the date of this Annual Report and should be evaluated with consideration of any changes occurring after the date of this Annual Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context hereof, references in this Annual Report:

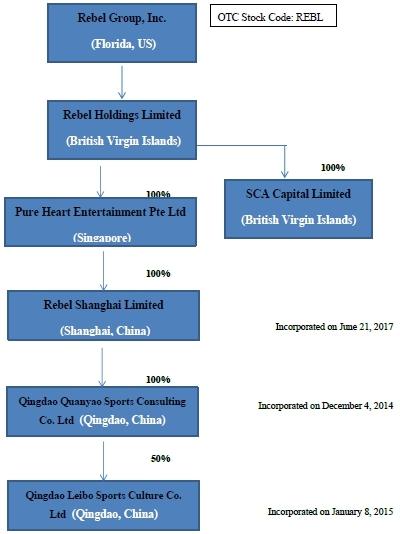

| ● | The “Company”, “Rebel”, “we”, “us” and “our” shall refer to Rebel Group, Inc., a Florida corporation, and its subsidiaries; |

| ● | “Rebel FC” refers to Rebel Holdings Limited, a British Virgin Islands company; |

| ● | “Pure Heart” refers to Pure Heart Entertainment Pte Ltd., a Singapore company; |

| ● | “SCA Capital” refers to SCA Capital Limited, a British Virgin Islands company; |

| ● | “Rebel Shanghai” refers Rebel Shanghai Limited, a PRC company; |

| ● | “Qingdao Quanyao” refers to Qingdao Quanyao Sports Consulting Co. Ltd., a PRC company; |

| ● | “Leibo” refers to Qingdao Leibo Sports Culture Co Ltd, a PRC company; |

| ● | “shares” and “Common Stock” refer to our Common Stock, $0.0001 par value per share; |

| ● | “China” and “PRC” refer to the People’s Republic of China, excluding, for the purposes of this prospectus only, Macau, Taiwan and Hong Kong; and |

| ● | all references to “RMB,” “yuan” and “Renminbi” are to the legal currency of China, and all references to “USD,” and “U.S. dollars” are to the legal currency of the United States. |

Certain market data and other statistical information contained in this Annual Report are based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of the MMA industry. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

ii

PART I

Overview

Rebel Group, Inc., through its subsidiaries, organizes, promotes and hosts mixed martial arts (“MMA”) events featuring MMA talents. It delivers MMA events centered on Chinese fighters and martial art fans. With assistance from contracted production crews, the Company produces and distributes videos of its MMA events through the Internet and social media. It also generates revenues from the exploitation of its film television rights.

Our operations focus on three business components:

| ● | Live MMA event promotion, which consists of generating revenue from ticket sales and providing a foundation for sponsorship and distribution for our live MMA events in China. |

| ● | MMA content distribution, which consists of paid distribution of original content on television, cable networks, pay-per-view broadcasts, and over the Internet, in China and through international distribution agreements. | |

| ● | Sponsorships and promotions, which consist of sponsorships for live MMA events and televised productions and related advertising and promotional opportunities. |

The Company seeks to promote MMA in China by hosting live high-profile matches that features talented fighters from around the world. MMA is a full contact sport that permits fighters to use techniques from various martial art disciplines such as Boxing, Wrestling, Taekwondo, Karate, Brazilian Jiu-jitsu, Muay Thai, and Judo. Unlike boxing, where athletes can only strike with their fists and target areas above the belt, the fighters in MMA can use punches, kicks, elbows, knee strikes, takedowns and submissions to win a contest.

Producing MMA events include various business operations such as securing event venues, signing up fighters and performers, obtaining sponsorships, producing event videos, marketing, and hosting pre-event shows which consist of music performances, fighters’ interviews and documentaries. The Company’s events are broadcast through top sporting entertainment stations such as Guangdong TV sports channel, Beijing TV Sports Channel and Qinghai satellite. We also utilize major Chinese internet platforms such as PP Sports, YY.com and Youku (Alisports) for online streaming in order to reach more audiences.

1

Our Events

The Company hosts live events in which highly skilled fighters from different martial arts backgrounds compete at different weight classes. We introduce fighters’ background information and training stories into the broadcasting of fighting events.

The Company selects fighters with track records of distinguished careers. After a careful selection process assessing each fighters’ amateur and professional records, age, experience and fame, we market our MMA events through social media such as Facebook, Twitter, Chinese Weibo and WeChat, TV channels such as Guangdong TV sports channel, Beijing TV Sports Channel and Qinghai Satellite TV, as well as video and interviews covered by major Chinese media outlets such as Guangzhou TV news channel, Guangzhou Daily and Pudong TV.

The Company has successfully hosted nine MMA events. The most recent MMA event, Return of the Champion, was held on September 7, 2019 at Hongkou Indoor Stadium, Shanghai, China, with its online digital viewership of 21.75 million exceeding the average viewership of Rebel FC’s two events in 2018 of 13 million (digital and broadcast viewership combined). In addition to the 21.75 million viewership from major online platforms such as Yizhibo, PP Sports, QiE Live, iQiyi, Gedoumi and Baidu Sports, the Company also garnered a viewership of 3.7 million on TV stations such as Qinghai Satellite TV and Shenzhen TV 5 (Sports Health Channel). In all, Return of the Champion gathered 25.45 million viewership from both TV and digital platforms, a 96% increase from the average viewership of its two events in 2018.

On January 11, 2020, the Company became the first Southeast Asian MMA promotion to host an event in Europe. Dubbed The New Order, it garnered the most number of views for the Company to date – 30.62 million on both TV and digital platforms such as Russia’s Boxing TV and ACB TV as well as China’s Yizhibo Live, PP Sports, QiE Live, iQiyi and Weibo Combat.

Aside from television and online broadcasting, the Company will venture into the Pay-Per-View (“PPV”) aspect of live sporting events in 2021 to leverage on its fanbase established from its fight events and projected reality show in 2020 as well as plan to market and monetize the media rights of its content by securing exclusive partnerships with digital broadcast partners such as iQiyi, PP Sports, Gedoumi and Baidu Sports starting from 2021 when it increases the number of live events and introduces the second season of its projected reality show.

Impact of the COVID-19 pandemic

Beginning in late 2019, there were reports of the COVID-19 (coronavirus) outbreak originating in China, prompting government-imposed quarantines, cessation of certain travel and business closures. Our business will be materially adversely affected by the recent coronavirus (COVID-19) outbreak. In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world, including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public Health Emergency of International Concern.” On January 31, 2020, a public health emergency for the United States was declared to aid the U.S. healthcare community in responding to COVID-19. The COVID-19 pandemic resulted in a widespread health crisis and have had adverse impact on the economies and financial markets worldwide, including our business. For instance, we may be unable to organize and/or host events, allow attendance at such events, or carry out other business expansion if continued concerns relating to COVID-19 restrict travel, limit the ability to have meetings with vendors and service providers and would be unavailable to negotiate and complete transactions in a timely manner. The extent to which COVID-19 impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. Any and all of the foregoing could have a material adverse impact on its business, operating results and financial condition.

Due to the COVID-19 situation, the Company has not been able to host any planned events. Our planned Australia event which was supposed to be hosted in April 2020 was cancelled. As long as any country is not able to allow for any hosting of an event in any scale, we will not be able to access such markets as planned. As a result, this may result in no ticket sales, sponsorship or any distribution revenues. Many countries have also implemented remote working measures. In Singapore, a circuit breaker measure was introduced on April 7, 2020, among all things, the government requires for all the Company to have their employees to stay and work from home. As most of our operational team is based in Singapore, this could adversely affect our event hosting abilities and thus our ability to generate revenues and operate our business. The lack of the ability to travel and conduct meetings with service providers and vendors to organize any events or planned events in the future will be affected, as a result, our business and operating results and financial condition may be largely affected by the introduced travel ban.

Corporate History and Background

Rebel Group, Inc. was incorporated in the State of Florida on September 13, 2011. Effective April 16, 2013, the Company changed its name from “First Social Networx Corp.” to “Moxian Group Holdings, Inc.” with “MOXG” as its trading symbol. Also, effective April 16, 2013, the Company increased the number of shares that it is authorized to issue to a total of 600,000,000 shares, including 500,000,000 shares of common stock, par value $.0001 per share (the “Common Stock”) and 100,000,000 shares of preferred stock, par value $.0001 per share. In addition, effective April 16, 2013, the Company effected a 20-for-1 forward stock split of its Common Stock, without changing the par value or the number of authorized shares of the Common Stock (the “Forward Split”).

On April 25, 2013, pursuant to a share exchange agreement, the Company completed a reverse acquisition of Moxian Group Limited (“Moxian BVI”) and its wholly-owned subsidiaries, including Moxian (Hong Kong) Limited (“Moxian HK”), Moxian Technologies (Shenzhen) Co., Ltd. (“Moxian Shenzhen”) and Moxian Malaysia SDN BHD (“Moxian Malaysia”) (the “Share Exchange Transaction”). The Company acquired the operating business of Moxian BVI and its subsidiaries and the Company ceased being a shell company as such term is defined under Rule 12b-2 under the Exchange Act. After the incorporation of the business of Moxian BVI, the Company changed its business to developing a social network platform that sought to integrate social media and business into one single platform.

2

On February 17, 2014, the Company incorporated a new wholly-owned subsidiary, Moxian Intellectual Property Limited, under the laws of Samoa (“Moxian IP”). On February 19, 2014, Moxian HK and Moxian Shenzhen entered into an assignment and assumption agreement with Moxian IP, where Moxian HK and Moxian Shenzhen assigned and transferred all of the intellectual property rights that they respectively owned in connection with the Moxian business (the “IP Rights”) to Moxian IP in consideration of $1,000,000. As a result, the Company then owned and controlled such IP Rights through Moxian IP.

On February 19, 2014, the shareholders then holding a majority of the outstanding shares of the Company approved and authorized the Company to enter into a License and Acquisition Agreement (the “License and Acquisition Agreement”) with MOXC, pursuant to which the Company sold 100% of the equity interests of Moxian BVI together with its subsidiaries to Moxian CN Group Limited, a wholly-owned subsidiary of MOXC (“Moxian CN Samoa”) for $1,000,000. The License and Acquisition Agreement closed on February 21, 2014. As a result, Moxian BVI, together with its subsidiaries, Moxian HK, Moxian Shenzhen, and Moxian Malaysia, became the subsidiaries of MOXC.

Under the License and Acquisition Agreement, the Company also agreed to grant MOXC the exclusive right to use the Company’s then held IP Rights in Mainland China, Hong Kong, Taiwan, Malaysia, and other countries and regions where the Company conduct business (the “Licensed Territory”) as well as the exclusive right to solicit, promote, distribute and sell Moxian products and services in the Licensed Territory for five years (the “License”). In exchange for such license, MOXC agreed to pay to the Company: (i) $1,000,000 as a license maintenance royalty each year commencing on the first anniversary of the date of the License and Acquisition Agreement and (ii) 3% of the gross profit resulting from distribution and sale of our products and services on behalf of the Company as an earned royalty. In addition, MOXC had the right to acquire the new IP Rights that are developed by the Company and sub-license such rights to a third party. MOXC was also under the obligation to develop the social media market of our products and services in the Licensed Territory. Immediately prior to the execution of the Equity Transfer Agreement, the Moxian BVI Transfer Price was not paid and no license maintenance royalty or earned royalty under the License and Acquisition Agreement had accrued.

Therefore, under the Equity Transfer Agreement, discussed below, the Company and MOXC agreed to terminate the License and Acquisition Agreement so that the liabilities of MOXC and the rights of the Company thereunder, other than the Moxian BVI Transfer Price, were terminated.

The Company sought to acquire a new business in the technology area and as a result, on July 23, 2014, the Company changed its name from “Moxian Group Holdings, Inc.” to “Inception Technology Group, Inc.” Also, effective July 23, 2014, the Company effected a 1-for-5 reverse split of its issued and outstanding Common Stock. However, no acquisition of a technology business was closed or consummated.

On December 5, 2014, the Company amended its Articles of Incorporation to change its corporate name from “Inception Technology Group, Inc.” to “Rebel Group, Inc.” and effectuated a 1-for-20 reverse stock split of its Common Stock, without changing the par value or the number of authorized shares of the Common Stock (the “Reverse Split”). The business plan of the Company was originally to utilize a social network platform that integrated social media and business into one single platform to promote businesses of merchants and assist the targeted clients to find consumers online and bring them into real-world stores.

On January 30, 2015, the Board of Directors of the Company approved and submitted for approval of the Company’s shareholders with a majority of voting rights, a Plan of Disposition (“Plan of Disposition”). Under the Plan of Disposition, the Company proposed to distribute the proceeds resulting from the Equity Transfer Transaction and Sale of Moxian BVI, within one year from the date of the Equity Transfer Transaction, to the shareholders as of January 29, 2015, on a pro-rata basis except for Rebel FC Stockholder, who agreed to waive such proceeds. On January 30, 2015, the Company’s shareholders with a majority of voting rights approved the Plan of Disposition. No additional vote of the Company’s shareholders was required or sought in connection with the Plan of Disposition, and the Company’s record shareholders had no appraisal rights in connection with the proposed transactions under the Plan of Disposition. The Plan of Disposition was not completed within the planned one-year period, and was delayed due to MOXC’s then proposed underwritten offering and exchange listing. On May 24, 2016, due to the MOXC Reverse Stock Split, effective on June 20, 2016, the Company’s shares in MOXC were reduced from 7,782,000 shares to 3,891,000 shares. The Company is in the process of preparing and approving a revised Plan of Disposition, which takes into account that the Company currently holds 3,891,000 shares of MOXC which are currently valued at $11,634,090 and pursuant to which the Company plans to distribute, as a dividend, the 3,891,000 MOXC shares to the Company’s shareholders as of January 29, 2015, on a pro-rata basis, that would have been entitled to share in the proceeds of the sale of the MOXC shares by the Company under the original Plan of Disposition, if the Company had consummated such sale.

3

Also on January 30, 2015, REBL, Rebel FC and the sole stockholder of Rebel FC (the “Rebel FC Stockholder”) entered into and consummated transactions pursuant to a Share Exchange Agreement (the “Share Exchange Agreement,” such transaction referred to as the “Share Exchange Transaction”), whereby the Company issued to the Rebel FC Stockholder 20,700,000 shares of its Common Stock, par value $0.0001 per share, in exchange for 100% of the equity interests of Rebel FC held by the Rebel FC Stockholder. The shares of our Common Stock received by the Rebel FC Stockholder in the Share Exchange Transaction then constituted approximately 90% of our issued and outstanding Common Stock. As a result of the Share Exchange Transaction, Rebel FC, together with its subsidiaries, Pure Heart and SCA Capital, became REBL’s wholly-owned subsidiaries.

The Share Exchange Agreement contained representations and warranties by us, Rebel FC and the Rebel FC Stockholder which are customary for transactions of this type such as, with respect to the Company: organization, good standing and qualification to do business; capitalization; subsidiaries; authorization and validity of the transaction and transaction documents; consents being obtained or not required to consummate the transaction; no conflict or violation of Articles of Incorporation; with respect to Rebel FC: authorization; capitalization; and title to Rebel FC’s shares of common stock being exchanged, and with respect to Rebel FC Stockholder: authorization; no conflict or violation of law; investment purpose; reliance on exemption on the Company’s Common Stock to be exchanged; and transfer or resale pursuant to the Securities Act.

Our acquisition of Rebel FC and its subsidiaries pursuant to the Share Exchange Agreement was accounted for as a reverse merger and recapitalization effected by a share exchange. Rebel FC was considered the acquirer for accounting and financial reporting purposes.

Simultaneously with the consummation of the Share Exchange Transaction, the Company entered into an Equity Transfer Agreement (the “Equity Transfer Agreement,” such transaction, the “Equity Transfer Transaction”) with MOXC, to sell, transfer, and convey 50,000 ordinary shares of Moxian IP, constituting 100% equity interests of Moxian IP for $6,782,000 (the “Moxian IP Transfer Price”). The Moxian IP Transfer Price for Moxian IP is based on an appraisal report, dated November 15, 2014, prepared by Grant Sherman Appraisal Limited, an independent appraiser.

Pursuant to the Equity Transfer Agreement, MOXC agreed to repay the Moxian IP Transfer Price and the Moxian BVI Transfer Price in the aggregate of $7,782,000 in the form of a convertible promissory note (the “Note”) issued by MOXC. The maturity date for the Note was October 30, 2015 with 1% interest per annum, and all sums due under this Note could be converted at the conversion price of $1.00 per share (“Conversion Price”) at the option of MOXC, if the volume weighted average price (“VWAP”) of MOXC’s common stock for a period of thirty (30) trading days immediately prior to the date of conversion was higher than the Conversion Price. Under the Note, MOXC had a right of first refusal to purchase the shares issuable upon conversion at the price of 80% of the VWAP for 30 trading days immediately prior to the date of the proposed repurchase by MOXC.

On August 14, 2015, due to the VWAP of the MOXC common stock for 30 trading day prior to August 14, 2015 was higher than $1.00, which triggered the clause of conversion under the MOXC Note, MOXC notified us that it elected to convert the amount of $3,891,000 under the MOXC Note into 3,891,000 shares of the MOXC common stock at the conversion price of $1.00 (the “August Conversion”). As a result of the August Conversion, the remainder amount of the MOXC Note was $3,891,000.

4

On September 30, 2015, MOXC notified us that it elected to convert the remainder of the MOXC Note, of $3,891,000 into 3,891,000 shares of the MOXC common stock (the “September Conversion”). After the August Conversion and the September Conversion, consequently, all of the MOXC Note was converted in to the total of 7,782,000 shares of the MOXC common stock with no amount of the MOXC Note outstanding. On May 24, 2016, MOXC’s board of directors approved a reverse stock split of MOXC’s issued and outstanding shares of common stock, at a ratio of 1-for-2 (the “MOXC Reverse Stock Split”). The MOXC Reverse Stock Split was effective on June 20, 2016, and pursuant to the MOXC Reverse Stock Split, the Company’s shares in MOXC were reduced from 7,782,000 shares to 3,891,000 shares.

Immediately after the completion of the Share Exchange Transaction and the Equity Transfer Transaction, the Company discontinued its social media business and changed its business to producing dynamic Mixed Martial Arts (“MMA”) fighting events and promoting MMA fighting in China and Singapore.

Rebel Holdings Limited (Rebel FC), which utilizes the trade name of Rebel Fighting Championship, was incorporated on October 28, 2014 in the British Virgin Islands and engages in the business of hosting and promoting MMA events. On January 30, 2015, we completed the acquisition of Rebel FC pursuant to the Share Exchange Agreement. The acquisition was accounted for as a reverse merger and recapitalization effected by a Share Exchange Transaction. Rebel FC was considered the acquirer for accounting and financial reporting purposes.

Pure Heart was incorporated under the laws of Singapore on August 24, 2000 under the name “Soo Kee Coffeeshop Pte. Ltd.” Effective November 27, 2002, it changed its name to “Asia Pacific Export International Pte Ltd.” It later changed its name from “Asia Pacific Export International Pte Ltd.” to “Pure Heart Entertainment Pte Ltd.” on June 7, 2013. As of October 30, 2014, it became a wholly owned subsidiary of Rebel FC. Pure Heart is an operating subsidiary of Rebel FC and is dedicated to hosting and promoting MMA events.

SCA Capital Limited, a British Virgin Islands company, was incorporated on January 7, 2011 and holds the intellectual property rights relating to the Rebel FC business. On October 28, 2014, SCA Capital became a wholly-owned subsidiary of Rebel FC.

On October 1, 2017, the Company and Pure Heart Entertainment Pte Ltd., a wholly owned subsidiary of the Company and a company incorporated under the laws of Singapore (“Pure Heart”) entered into a share transfer agreement (the “Share Transfer”) with Naixin Qi, an individual (the “Shareholder”), the sole shareholder of Qingdao Quanyao Sports Consulting Co. Ltd, a company organized under the laws of PRC (the “Quanyao”).

Pursuant to the Share Transfer, Pure Heart, through a wholly foreign owned entity (the “WOFE”) Rebel Shanghai Limited (“Rebel Shanghai”), incorporated under the laws of PRC on June 21, 2017, agreed to acquire 100% of the outstanding equity interests (the “Equity Stake”) of Quanyao from the Shareholder with the purchase price valued at approximately $7,000,000 consisting of the following: (i) the forgiveness of debt owed by Quanyao to Pure Heart as of October 1, 2017, in the amount of approximately $2,825,000 (the “Forgiven Debts”) and (ii) 12,000,000 shares (the “Shares”) of the common stock of the Company, par value $.0001 per share (the “Common Stock”) (together the “Purchase Price”). The purchase price was based on valuation report by an independent appraisal firm.

Quanyao is a company which was established under the laws of PRC on December 4, 2014. It organizes, promotes and hosts MMA events in China. Quanyao holds 50% equity of Qingdao Leibo Sports Culture Co. Ltd. (“Leibo”), a company incorporated under the laws of PRC on January 8, 2015 which also organizes, promotes and hosts MMA events. Quanyao and Leibo together held 4 events in China between 2015 to 2017 under the Rebel brand in accordance with Cooperation Agreement with Pure Heart. Quanyao held 2 events in China in 2018. One event, Rebel FC 7 - Fight for Honor, is held at Kerry Hotel Pudong in Shanghai on April 29, 2018. The other event, Rebel FC 8- A Warrior’s Return, is held at Tianhe Sports Stadium in Guangzhou on May 30, 2018. The most recent MMA event, Return of the Champion, was held on September 7, 2019 at Hongkou Indoor Stadium, Shanghai, China.

The Share Transfer was executed on November 21, 2017 and Quanyao officially became wholly-owned subsidiary of Rebel Shanghai.

5

As disclosed in the Form 8-K filed with the Securities and Exchange Commission on August 20, 2019, on June 20, 2019, the Board of Directors of the Company approved a distribution of 778,200 shares of Moxian Inc.’s common stock, $0.001 par value per share held by the Company. Moxian Inc.’s common stock will be distributed to the shareholders of the Company who were shareholders of the Company as of January 29, 2015.

The following diagram sets forth the structure of the Company as of the date of this Report:

Our Strategy

Our objective is to become the most recognized MMA sports and media brand in China. To achieve this objective, we intend to employ the following strategies:

| ● | Hosting Successful Events in China. We intend to leverage the success of our most recent events to increase our ticket sales, sponsorship deals, television distribution and media rights. | |

| ● | Identifying and Signing Top Chinese Prospects. Rebel will focus its tournament setting strategy on featuring competition between top professional Chinese athletes against highly ranked professional athletes from around the world. In order to achieve that, Rebel will implement a comprehensive scouting program throughout China to identify promising Chinese athletes to join Rebel in multi-fight agreements. This strategy will ensure Rebel to develop and retain top Chinese athletes, which will enhance our positioning in the MMA market and enable Rebel to host high quality tournaments. Rebel’s differential in understanding the Chinese martial arts tradition will enable Rebel to attract the best Chinese fighters to compete on our events. Currently, we have secured three exclusive engagement contract with Wenbo Liu, who is a Chinese middleweight champion of Legend Fighting Championship, a well-known Hong Kong-based MMA promoter. We plan to sign more exclusive engagement contracts with top professional Chinese athletes like Wenbo Liu. |

6

| ● | Distributing our Original Content. We intend to leverage our past successes to produce, distribute and monetize our original MMA contents through domestic and international distribution arrangements. We intend to establish live television arrangements with various distribution channels in China and Singapore such as Starhub TV, Guangdong Sports TV, Beijing Sports TV and Qinghai Satellite TV. In addition to television broadcasting, the Company plans to build pay-per-view (“PPV”) viewership model to attract more audiences. PPV is a type of live broadcast service by which a viewer can purchase events to view via private channel at the same time with everyone else ordering it. We plan to distribute our live MMA events through PPV viewership model in 2020 and charge between $5 to $10 for each PPV MMA event. | |

| ● | Securing Key Venues. We intend to produce MMA events at key venues in four major Chinese cities-- Shanghai, Shenzhen, Guangzhou and Beijing. This strategy will allow us to build up our brand name in China’s affluent coastal cities and grow our brand and fan base in mid-class Chinese families. | |

| ● | Securing Sponsorships. We intend to increase our revenues through expanding our sponsorships. Currently, we rely on local and regional sponsors for our live events, although we plan to establish sponsorship and advertising arrangements with larger organizations such as Venom and Thomas Cook. For every event moving forward, we target to obtain at least 10 sponsors. | |

| ● | Development of a Reality Television Show. We plan to produce a 12-episode reality show which will be distributed across major Chinese internet platforms. The show will feature Chinese professional MMA fighters training and competing against each other to win a prize of RMB1,000,000 (USD$144,773). We believe that the show will provide us with an independent revenue stream and a good marketing tool to establish a better brand name recognition in China. | |

| ● | Establishment of Adjacent Revenue Streams. The major companies in our industry have utilized their brand to derive revenue by establishing gyms and selling merchandise. For example, UFC derived $19,000,000 (3.5% of their total revenue) from the sale of merchandise in 2015. We intend to establish our Rebel brand name gyms and produce our own exclusive merchandise in the near future. |

Industry and Competition

In the past 20 years, modern day Mixed Martial Arts (“MMA”) has developed from a martial art style banned in most U.S. states to an international sports phenomenon that has reached a high level of recognition and popularity. MMA is a full contact sport that permits fighters to use techniques from various martial art disciplines and combat sports such as boxing, wrestling, taekwondo, karate, Brazilian jiu-jitsu, muay thai, and judo. The “MMA industry” generates revenues by promoting live MMA bouts, and through pay-per-view, video-on-demand and televised MMA event programming, merchandise sales, event and fighter sponsorships, and the monetization of MMA-related intellectual property royalties.

According to IBIS World’s Martial Arts Studios Market Research Report issued in August 2018, the total market value of MMA in the US is 4 billion USD (http://www.ibisworld.com/industry/martial-arts-studios.html). While no report online has precise figures of the growth of the MMA industry worldwide, UFC’s, the American-based MMA promotion whose standards all MMA promotions around the world are measured, latest valuation at 5 billion USD (https://www.forbes.com/sites/noahkirsch/2017/09/07/exclusive-billionaire-fertitta-brothers-sell-remaining-ufc-stakes-at-5-billion-valuation/#3f2875b74d69) demonstrate the potential MMA holds. UFC states on its website that its live MMA events are currently televised in over 129 countries and territories and watched by approximately 800 million households in 28 languages.

The market for live and televised MMA events content is extremely competitive. The main competitors in our industry, specifically in China, which include but are not limited to:

| ● | The Ultimate Fighting Championship (“UFC”); |

| ● | Bellator MMA (“Bellator”); |

| ● | ONE Fighting Championship (“OFC”), which is based in Singapore and targets the Asia market; and |

| ● | Kunlun Fight, a fighting club located in China which broadcasts its events over the Chinese television channel. |

7

The principal competitive factors in our industry include:

| ● | The ability to attract and retain successful professional fighters in order to promote events that are appealing to fans and sponsors; |

| ● | The ability to promote a large number of events and bouts so that fighters are willing to commit to multi-fight agreements; |

| ● | The ability to produce high-quality media content on a consistent basis to secure television and other media distribution arrangements; and |

| ● | The ability to generate brand awareness in China. |

Our Competitive Strengths

Despite the competition we face, we believe that our approach of delivering high quality content concentrating on the untapped combat sports market in China, centered around Chinese fighters and fans, where we believe we have the resources and experience to penetrate the market and grow our business, enables us to address the competitive factors more effectively and thrive in this competitive market. The major MMA promotors, UFC, Bellator, OFC, provide high quality content, however, they mainly focus on promotion in the United States, Latin America, Europe and South-East Asia, and not China. At the same time, the major Chinese promoters focus more on kickboxing and do not provide the same high quality MMA focuses content as Rebel.

Based upon Weibo followers, we have signed contracts with three of the nine most popular MMA fighters from China, Wenbo Liu, Ning Guangyou and Yao Honggang. We plan to utilize this local popularity to establish a prominent fan base in MMA crazed China by marketing these up and coming Chinese fighters to the Chinese market.

Government Regulation

In order to organize and host a live event in China, we need to obtain a license from the local Police Department. We also need to comply with the rules and regulations required by the State of Administration Radio Film and Television. Rebel counts with the services of a company specialized in handling the documentation and end-to-end process required by the various Chinese departments, such as the police and fire departments, in order to acquire the license to host the events.

Intellectual Property

The PRC has domestic laws for the protection of rights in copyrights, trademarks and trade secrets. The PRC is also a signatory to all of the world’s major intellectual property conventions, including:

| ● | Convention establishing the World Intellectual Property Organization (June 3, 1980); |

| ● | Paris Convention for the Protection of Industrial Property (March 19, 1985); |

| ● | Patent Cooperation Treaty (January 1, 1994); and |

| ● | Agreement on Trade-Related Aspects of Intellectual Property Rights (November 11, 2001). |

The PRC Trademark Law, adopted in 1982 and revised in 2013, with its implementation rules adopted in 2014, protects registered trademarks. The Trademark Office of the State Administration of Industry and Commerce of the PRC, handles trademark registrations and grants trademark registrations for a term of ten years.

Our primary trademark portfolio consists of 11 registered trademarks. Our trademarks are valuable assets that reinforce the brand and our consumers’ favorable perception of our products. The current registrations of these trademarks are effective for varying periods of time and may be renewed periodically, provided that we, as the registered owner, comply with all applicable renewal requirements including, where necessary, the continued use of the trademarks in connection with similar goods. In addition to trademark protection, we own the URL designation and domain name, www.rebelfightingchampionship.com.

8

We have registered the following trademarks:

| Trademark | Country of Registration | Application Number | Class | Duration | Current Owner | |||||

|

Singapore | T131264IZ | 41 | Set to expire in 2023 | SCA Capital Limited | |||||

|

China | 16036465 | 28 | Set to expire in 2026 | SCA Capital Limited | |||||

|

China | 16036464 | 32 | Set to expire in 2026 | SCA Capital Limited | |||||

|

China | 16036461 | 41 | Set to expire in 2026 | SCA Capital Limited | |||||

|

China | 16036463 | 35 | Set to expire in 2026 | SCA Capital Limited | |||||

|

China | 18720895 | 41 | Set to expire in 2027 | SCA Capital Limited | |||||

|

China | 18720894 | 41 | Set to expire in 2027 | SCA Capital Limited | |||||

|

China | 18951853 | 25 | Set to expire in 2027 | SCA Capital Limited | |||||

|

China | 18720893 | 28 | Set to expire in 2027 | SCA Capital Limited | |||||

|

China | 16036466 | 41 | Set to expire in 2026 | SCA Capital Limited | |||||

|

China | 16036467 | 41 | Set to expire in 2026 | SCA Capital Limited |

9

Employees

As of December 31, 2019, Rebel FC employed 14 employees based in China and Singapore, which teams are organized in the following departments:

| ● | Management |

| ● | HR |

| ● | IT |

| ● | Finance |

| ● | Project Management |

| ● | Communication, Public Relations and Marketing |

| ● | Sales & Sponsorships |

Additionally, Rebel contracts external companies to provide specialized services for the organization of the events. The typical services outsourced to external companies are, among others, venue production, video production, logistics, hospitality services, TV production and broadcasting, and event marketing and advertisement.

Facilities

We do not own any real property. Our principal executive and administrative offices are located in Singapore at 7500A Beach Road, Unit 16-324, The Plaza, Singapore. Our rent is approximately SGD 5,700 (USD $4,178) per month. We are renting the property on a month-to-month basis. The Company’s new headquarters are located in Shanghai at the Unit C02, 5/F (Mixpace), Building T2 (CES West Bund Center), NO. 277 Longlan Road, Xuhui District, Shanghai 200030 pursuant to a lease agreement with a monthly rent of RMB 13,500 (USD $1,954). The lease will expire on March 18, 2021.

Certain factors could have a material adverse effect on our business, financial condition, results of operations and prospects. You should consider carefully the risks and uncertainties described below, in addition to other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and related notes. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties of which we are unaware, or that we currently believe are not material, may also become important factors that adversely affect our business, financial condition, results of operations and prospects. If any of the following risks occurs, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline, and you could lose part or all of your investment.

10

Risks Related to Our Business

We have a history of net losses and we are uncertain about our future profitability.

We have incurred $19,201,492 and $8,370,529 of accumulated deficits for the years ended December 31,2019 and 2018 respectively. As of December 31, 2019, we had a stockholders’ deficit of $4,024,723. If our revenue grows more slowly than currently anticipated, or if operating expenses are higher than expected, we may be unable to consistently achieve profitability, our financial condition will suffer, and the value of our common stock could decline. We may incur losses in the foreseeable future as we continue to develop and market our portfolio. If revenue from any of our current or future portfolio offerings is insufficient, or if our product development is delayed, we may be unable to achieve profitability and, in the event we are unable to secure financing for prolonged periods of time, we may need to temporarily curtail operations.

There is substantial doubt as to our ability to continue as a going concern

The negative operating results of cash flow and working capital in 2019 raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result if we are unable to continue as a going concern. If we are unable to continue as a going concern, holders of our common stock might lose their entire investment. Our continued operations are highly dependent upon our ability to increase revenues, decrease operating costs, and if needed complete equity and/or debt financing. We believe if we are unable to obtain our resources to fund operations, we may be required to delay scale back or eliminate some or all of our planned operations, which may have a material adverse effect on our business, results of operations and ability to operate as a going concern.

Changes in public and consumer tastes and preferences and industry trends could reduce demand for our services and content offerings and adversely affect our business.

Our ability to generate revenues is highly sensitive to rapidly changing consumer preferences and industry trends, as well as the popularity of the talent we represent, and the assets we own. Our success depends on our ability to offer premium content through popular channels of distribution that meet the changing preferences of the broad consumer market and respond to competition from an expanding array of choices facilitated by technological developments in the delivery of content. Our operations and revenues are affected by consumer tastes and entertainment trends, including the market demand for the distribution rights to live sports events, which are unpredictable and subject to change and may be affected by changes in the social and political climate. Changes in consumers’ tastes or a change in the perceptions of our business partners, whether as a result of the social and political climate or otherwise, could adversely affect our operating results. Our failure to avoid a negative perception among consumers or anticipate and respond to changes in consumer preferences, including in the form of content creation or distribution, could result in reduced demand for our services and content offerings or those of our clients and owned assets across our platform, which could have an adverse effect on our business, financial condition and results of operations.

We may not be able to adapt to or manage new content distribution platforms or changes in consumer behavior resulting from new technologies.

We must successfully adapt to and manage technological advances in our industry, including the emergence of alternative distribution platforms. If we are unable to adopt or are late in adopting technological changes and innovations that other entertainment providers offer, it may lead to a loss of consumers viewing our content, a reduction in revenues from attendance at our live events, a loss of ticket sales or lower ticket fees. It may also lead to a reduction in our clients’ ability to monetize new platforms. Our ability to effectively generate revenue from new distribution platforms and viewing technologies will affect our ability to maintain and grow our business. If we fail to adapt our distribution methods and content to emerging technologies and new distribution platforms, while also effectively preventing digital piracy, our ability to generate revenue from our targeted audiences may decline and could result in an adverse effect on our business, financial condition and results of operations.

11

Because our success depends substantially on our ability to maintain a professional reputation, adverse publicity concerning us, one of our businesses, our clients or our key personnel could adversely affect our business.

Our professional reputation is essential to our continued success and any decrease in the quality of our reputation could impair our ability to, among other things, recruit and retain qualified and experienced agents, managers and other key personnel, retain or attract agency clients or customers or enter into multimedia, licensing and sponsorship engagements. Our overall reputation may be negatively impacted by a number of factors, including negative publicity concerning us, members of our management or our agents, managers and other key personnel. In addition, we are dependent for a portion of our revenues on the relationships between content providers and the clients and key brands, such as sports leagues and federations and collegiate sporting institutions, that we represent, many of whom are significant public personalities with large social media followings whose actions generate significant publicity and public interest. Any adverse publicity relating to such individuals or entities that we employ or represent, or to our company, including from reported or actual incidents or allegations of illegal or improper conduct, such as harassment, discrimination or other misconduct, could result in significant media attention, and could have a negative impact on our professional reputation, potentially resulting in termination of licensing or other contractual relationships, our or our employees’ inability to attract new customer or client relationships, or the loss or termination of such employees’ services, all of which could adversely affect our business, financial condition and results of operations.

The markets in which we operate are highly competitive.

We face competition from a variety of other companies. We face competition from alternative providers of the content, services and events we and our clients offer and from other forms of entertainment and leisure activities in a rapidly changing and increasingly fragmented marketplace. Any increased competition, which may not be foreseeable, or our failure to adequately address any competitive factors, could result in reduced demand for our content, live events, clients or key brands, which could have an adverse effect on our business, financial condition and results of operations.

We depend on the continued service of the members of our executive management and other key employees, as well as management of acquired businesses, the loss or diminished performance of whom could adversely affect our business.

Our performance is substantially dependent on the performance of the members of our executive management and other key employees, as well as management of acquired businesses. We seek to acquire businesses that have strong management teams and often rely on these individuals to conduct the day-to-day operations of and pursue the growth of these acquired businesses. Although we have entered into employment and severance protection agreements with certain members of our senior management team and we typically seek to sign employment agreements with the management of acquired businesses, we cannot be sure that any member of our senior management or management of the acquired businesses will remain with us or that they will not compete with us in the future. The loss of any member of our senior management team could impair our ability to execute our business plan and growth strategy, have a negative impact on our revenues and the effective working relationships that our executive management have developed and cause employee morale problems and the loss of additional key employees, agents, managers and clients.

We may be unsuccessful in our strategic acquisitions, investments and commercial agreements, and we may pursue acquisitions, investments or commercial agreements for their strategic value in spite of the risk of lack of profitability.

We face significant uncertainty in connection with acquisitions, investments and commercial agreements. To the extent we choose to pursue certain commercial, investment or acquisition strategies, we may be unable to identify suitable targets for acquisition, investment opportunities or commercial deals, or to make these acquisitions, investments or deals on favorable terms. If we identify suitable acquisition candidates, investments or deals, our ability to realize a return on the resources expended pursuing such candidates, investments or deals and to successfully implement or enter into them will depend on a variety of factors, including our ability to obtain financing on acceptable terms and requisite governmental approvals as well as the factors discussed below. Additionally, we may decide to make or enter into acquisitions, investments or commercial agreements with the understanding that such acquisitions, investments or commercial agreements will not be profitable, but may be of strategic value to us. We cannot provide assurances that the anticipated strategic benefits of these acquisitions, investments or commercial agreements will be realized in the long-term or at all.

12

Our compliance with regulations may limit our operations and future acquisitions.

We are also subject to laws and regulations that could significantly affect our ability to expand our business through acquisitions or enter into joint ventures. Our failure to comply with all applicable laws and regulations could result in, among other things, regulatory actions or legal proceedings against us, the imposition of fines, penalties or judgments against us or significant limitations on our activities. Multiple or repeated failures by us to comply with these laws and regulations could result in increased fines, actions or legal proceedings against us. In addition, the regulatory environment in which we operate is subject to change. New or revised requirements imposed by governmental regulatory authorities could have adverse effects on us, including increased costs of compliance. We also may be adversely affected by changes in the interpretation or enforcement of existing laws and regulations by these governmental authorities.

We rely on technology, such as our information systems, to conduct our business. Failure to protect our technology against breakdowns and security breaches could adversely affect our business.

We rely on technology, such as our information systems, content distribution systems, ticketing systems and payment processing systems, to conduct our business. This technology is vulnerable to service interruptions and security breaches from inadvertent or intentional actions by our employees, partners and vendors, or from attacks by malicious third parties. Such attacks are of ever-increasing levels of sophistication and are made by groups and individuals with a wide range of motives and expertise, including organized criminal groups, “hacktivists,” nation states and others. The techniques used to breach security safeguards evolve rapidly, and they may be difficult to detect for an extended period of time, and the measures we take to safeguard our technology may not adequately prevent such incidents.

We may be unable to protect our trademarks and other intellectual property rights, and others may allege that we infringe upon their intellectual property rights.

We have invested significant resources in brands associated with our business in an attempt to obtain and protect our public recognition. These brands are essential to our success and competitive position. We have also invested significant resources in the premium content that we produce. Our trademarks and other intellectual property rights are critical to our success and our competitive position. Our intellectual property rights may be challenged and invalidated by third parties and may not be strong enough to provide meaningful commercial competitive advantage. If we fail to maintain our intellectual property, our competitors might be able to enter the market, which would harm our business. Further, policing unauthorized use and other violations of our intellectual property is difficult, particularly given our global scope, so we are susceptible to others infringing, diluting or misappropriating our intellectual property rights. If we are unable to maintain and protect our intellectual property rights adequately, we may lose an important advantage in the markets in which we compete. While we believe we have taken, and take in the ordinary course of business, appropriate available legal steps to reasonably protect our intellectual property, we cannot predict whether these steps will be adequate to prevent infringement or misappropriation of these rights.

As a result of our operations in international markets, we are subject to risks associated with the legislative, judicial, accounting, regulatory, political and economic risks and conditions specific to such markets.

We provide services in various jurisdictions abroad through a number of brands and businesses that we own and operate, as well as through joint ventures, and we expect to continue to expand our international presence. We face, and expect to continue to face, additional risks in the case of our existing and future international operations, including:

| ● | political instability, adverse changes in diplomatic relations and unfavorable economic conditions in the markets in which we have international operations or into which we may expand; |

13

| ● | more restrictive or otherwise unfavorable government regulation of the entertainment and sports industry, which could result in increased compliance costs or otherwise restrict the manner in which we provide services and the amount of related fees charged for such services; |

| ● | limitations on the enforcement of intellectual property rights; |

| ● | enhanced difficulties of integrating any foreign acquisitions; |

| ● | limitations on the ability of foreign subsidiaries to repatriate profits or otherwise remit earnings; |

| ● | adverse tax consequences; |

| ● | less sophisticated legal systems in some foreign countries, which could impair our ability to enforce our contractual rights in those countries; |

| ● | limitations on technology infrastructure; |

| ● | variability in venue security standards and accepted practices; and |

| ● | difficulties in managing operations due to distance, language and cultural differences. |

Participants and spectators in connection with our live entertainment and sports events are subject to potential injuries and accidents, which could subject us to personal injury or other claims and increase our expenses, as well as reduce attendance at our live entertainment and sports events, causing a decrease in our revenue.

There are inherent risks to participants and spectators involved with producing, attending or participating in live entertainment and sports events. Injuries and accidents have occurred and may occur from time to time in the future, which could subject us to substantial claims and liabilities for injuries. Incidents in connection with our entertainment and sports events at any of our venues or venues that we rent could also result in claims, reducing operating income or reducing attendance at our events, causing a decrease in our revenues. There can be no assurance that the insurance we maintain will be adequate to cover any potential losses. The physical nature of many of our live sports events exposes the athletes that participate to the risk of serious injury or death. These injuries could include concussions, and many sports leagues and organizations have been sued by athletes over alleged long-term neurocognitive impairment arising from concussions. Although the participants in certain of our live sports events, as independent contractors, are responsible for maintaining their own health, disability and life insurance, we may seek coverage under our accident insurance policies, if available, or our general liability insurance policies, for injuries that our athletes incur while competing. To the extent such injuries are not covered by our policies, we may self-insure medical costs for our athletes for such injuries. Liability to us resulting from any death or serious injury, including concussions, sustained by athletes while competing, to the extent not covered by our insurance, could adversely affect our business, financial condition and operating results.

Costs associated with, and our ability to, obtain insurance could adversely affect our business.

Heightened concerns and challenges regarding property, casualty, liability, business interruption, cancellation and other insurance coverage have resulted from terrorist and related security incidents along with varying weather-related conditions and incidents. As a result, we may experience increased difficulty obtaining high policy limits of coverage at a reasonable cost and with reasonable deductibles, including coverage for acts of terrorism and weather-related property damage. We cannot assure you that future increases in insurance costs and difficulties obtaining high policy limits and reasonable deductibles will not adversely impact our profitability, thereby possibly impacting our operating results and growth. We have a significant investment in property and equipment at each of our venues, which are generally located near major cities and which hold events typically attended by a large number of people. We cannot assure you that our insurance policy coverage limits, including insurance coverage for property, casualty, liability and business interruption losses and acts of terrorism, would be adequate should one or multiple adverse events occur, or that our insurers would have adequate financial resources to sufficiently or fully pay our related claims or damages. We cannot assure you that adequate coverage limits will be available, offered at a reasonable cost, or offered by insurers with sufficient financial soundness. The occurrence of such an incident or incidents affecting any one or more of our venues could have an adverse effect on our financial position and future results of operations if asset damage or company liability were to exceed insurance coverage limits or if an insurer were unable to sufficiently or fully pay our related claims or damages.

14

Unfavorable outcomes in legal proceedings may adversely affect our business and operating results.

Our results may be affected by the outcome of pending and future litigation. Unfavorable rulings in our legal proceedings could result in material liability to us or have a negative impact on our reputation or relations with our employees or third parties. The outcome of litigation, including class action lawsuits, is difficult to assess or quantify. Plaintiffs in class action lawsuits may seek recovery of very large or indeterminate amounts and the magnitude of the potential loss relating to such lawsuits may remain unknown for substantial periods of time. In addition, we from time to time in the future may be subject to various other claims, investigations, legal and administrative cases and proceedings (whether civil or criminal) or lawsuits by governmental agencies or private parties. If the results of these investigations, proceedings or suits are unfavorable to us or if we are unable to successfully defend against third-party lawsuits, we may be required to pay monetary damages or may be subject to fines, penalties, injunctions or other censure that could have an adverse effect on our business, financial condition and results of operations. Even if we adequately address the issues raised by an investigation or proceeding or successfully defend a third-party lawsuit or counterclaim, we may have to devote significant financial and management resources to address these issues, which could have an adverse effect on our business, results of operations and financial condition.

We may not be able to attract and retain key professional MMA fighters.

Our business is dependent upon identifying, recruiting and retaining highly regarded professional MMA fighters for our promotions. Fans and sponsors are attracted to events featuring top fighters, and the value placed on a promotion’s television and other media rights is dependent to a great extent on the quality of the promotion’s fighter roster. We may not be able to attract and retain key professional MMA fighters due to competition with other regional promoters for the same fighters. Failing to put on events featuring top professional fighters could adversely affect our operating results and have a material adverse effect on our business.

We may not be able to attract sufficient sponsorship.

Our business strategy involves developing sponsorships for all of our live events. We cannot make any assurance that we will be able secure adequate sponsorship for each of our events. Ticket and PPV sales are only parts of our revenue model and sponsorships are critical to making an event profitable. Our inability to attract sufficient sponsorships for each event could adversely affect our results of operations.

We may not be able to secure contracts with video streaming sites for our Pay-per-view business.

Part of our growth strategy is to start delivering our shows by streaming them through Pay-Per-View (“PPV”) channels and over the internet. There can be no assurance that we will secure licensing contracts with PPV providers or televisions stations that offer PPV. Our inability to secure PPV would negatively impact our future profitability but not our growth prospect as our key strategy is focusing on the high digital online viewership growth to drive future revenue streams.

We may not be able to secure event venues.

We cannot provide any assurance that we will be able to book event venues at ideal locations to attract sufficient audience to attend our events. Our ability to book appropriate venues is subject to availability and our willingness and ability to pay. This could adversely affect our event hosting abilities and thus our ability to generate revenues and operate our business.

We may not be able to secure television stations to broadcast our shows.

In addition to hosting live events, part of our intended revenue stream is to come from TV distribution. However, we cannot guarantee that we will be able to find TV channels to broadcast our events. Our ability to secure the airtime of our events on TV is affected by various factors, among other things, whether a TV station requires payment from the Company for the broadcasting, whether there is an available slot for the Company’s event and whether there is any censorship on events with violent content. In addition, if no TV station is willing to broadcast our events, our events and our brand will not have sufficient publicity in the media; therefore, it may negatively impact the sale of our future events. Thus, the failure to sell the rights to broadcast our events to TV stations would negatively affect our future profitability. This same risk also applies to our planned reality show.

The economic uncertainty impacts our business and financial results which could materially affect us in the future.

Any significant decrease in consumer confidence, or periods of economic slowdown or recession, could lead to a curtailing of discretionary spending, which in turn could reduce our revenues and results of operations and adversely affect our financial position. Our business will be dependent upon consumer discretionary spending and therefore will be affected by consumer confidence as well as the future performance of the Chinese and the global economies. As a result, our results of operations will be susceptible to economic slowdowns and recessions. Increases in job losses, home foreclosures, investment losses in the financial markets, personal bankruptcies, credit card debt and home mortgage and other borrowing costs, declines in housing values and reduced access to credit, among other factors, may result in lower levels of ticket sales, sponsorship and distribution revenue.

15

The COVID-19 pandemic could have a material adverse effect on our business, financial condition and results of operations.

Our business will be materially adversely affected by the recent coronavirus (COVID-19) outbreak. In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world, including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public Health Emergency of International Concern.” On January 31, 2020, a public health emergency for the United States was declared to aid the U.S. healthcare community in responding to COVID-19. The COVID-19 pandemic resulted in a widespread health crisis and have had adverse impact on the economies and financial markets worldwide, including our business. For instance, we may be unable to organize and/or host events, allow attendance at such events, or carry out other business expansion if continued concerns relating to COVID-19 restrict travel, limit the ability to have meetings with vendors and service providers and would be unavailable to negotiate and complete transactions in a timely manner. The extent to which COVID-19 impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. Any and all of the foregoing could have a material adverse impact on its business, operating results and financial condition. Further, there can be no assurance that we would be able to secure commercial financing in the future in the event that we require additional capital.

Due to the COVID-19 situation, the Company has not been able to host any planned events. Our planned Australia event which was supposed to be hosted in April 2020 was cancelled. As long as any country is not able to allow for any hosting of an event in any scale, we will not be able to penetrate into the markets as planned. As a result, this may result in no ticket sales, sponsorship or any distribution revenues.

Many countries have also implemented a Work From Home (WFM) measures. In Singapore, a circuit breaker measure was introduced on April 7, 2020, amongst all things, the government requires for all the Company to have their employees to stay and work from home. As most of our operational team is based in Singapore. This could adversely affect our event hosting abilities and thus our ability to generate revenues and operate our business.

From January 2020, countries have begun to shut its borders to foreigners. The lack of the ability to travel and conduct meetings with service providers and vendors to organize any events or planned events in the future will be affected, as a result, our business and operating results and financial condition may be materially affected by the introduced travel ban.

We may face disruptions of the systems and equipment utilized in our live events.

We rely largely on outside contractors to supply us with the sound and lighting equipment for our live events. Although the Company inspects such equipment upon delivery from the contractors prior to an event, we cannot guarantee if such equipment may function without disruptions in the live event. In the event the provided equipment or system malfunctions at a live event, it will result in disruption of the progression of our event and may have a negative impact on the Company’s reputation. This would also affect our ability to retain audience and would affect our future events in the MMA market.

16

We may face pressure from parental, government, or other groups to stop our operations.

Due to the inherent violence involved in MMA, we may face pressure from nonprofit organizations or parental groups to prohibit events to be held, marketed or broadcast in countries which we currently operate in or plan to expand to. This could negatively impact our ability to market our brand, reduce the number of sponsorships that we may obtain and adversely affect our revenue from live event ticket sales and TV broadcasting.

The markets in which we operate are highly competitive, rapidly changing and increasingly fragmented, and we may not be able to compete effectively, especially against competitors with greater financial resources or marketplace presence.

For our live and television audiences, we will face competition from, in addition to other MMA promotions, professional and college sports, as well as from other forms of live and televised entertainment and other leisure activities that are offered in a rapidly changing and increasingly fragmented marketplace. Many of the companies with which we will compete have greater financial resources than will be available to us. Our failure to compete effectively could result in a significant loss of viewers, venues, distribution channels or athletes and fewer advertising dollars spent on our form of sporting events, any of which could adversely affect our operating results.

Our quarterly results of operations are subject to fluctuations due to the timing of our event hosting.

The timing of our events may result in significant fluctuations in our quarterly performance. We typically incur most cash costs for an event within the third month immediately preceding, and the month of the event. Due to these substantial up-front financial requirements to recruit fighters, rent venues, advertise as well as other costs to prepare for the events, the quarterly results of our financials may incur significant expense and vary from quarter to quarter.

We may not be able to attain profitability.

Attaining profitability depends upon numerous factors, including our ability to generate increased revenues and our ability to control expenses. We may incur significant losses in the future for a number of reasons, including the other risks described in this filing and our ongoing depreciation and amortization expense, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown events. Accordingly, we can make no assurances that we will be able to achieve, sustain or increase profitability in the future.

We have a limited history of operating as a promoter for MMA events.

We are a development stage company formed to carry out the MMA events and thus have a limited operating history. We started our business in June of 2013 and to date we have held nine MMA events in total with two in Singapore and seven in China. Thus, we have limited experience in promoting the MMA events. We expect that our results of operations may also fluctuate significantly in the future as a result of a variety of market factors, including, among others, the dominance of other companies which has long-term history and experience in the area of MMA, the entry of new competitors into the MMA business, our ability to attract, retain and motivate qualified personnel, the initiation, renewal or expiration of our customer base, pricing changes by the company or its competitors, specific economic conditions in the MMA business and general economic conditions. Accordingly, our future revenue and operating results are difficult to forecast.

We may need additional capital to support our operations or the growth of our business, and we cannot be certain that this capital will be available on reasonable terms when required, or at all.