Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Rebel Group, Inc. | Financial_Report.xls |

| EX-4.1 - SPECIMEN STOCK CERTIFICATE OF COMMON STOCK OF MOXIAN GROUP HOLDINGS, INC - Rebel Group, Inc. | f10k2013ex4i_moxiangroup.htm |

| EX-32.1 - CERTIFICATION - Rebel Group, Inc. | f10k2013ex32i_moxiangroup.htm |

| EX-21.1 - LIST OF SUBSIDIARIES. - Rebel Group, Inc. | f10k2013ex21i_moxiangroup.htm |

| EX-31.1 - CERTIFICATION - Rebel Group, Inc. | f10k2013ex31i_moxiangroup.htm |

| EX-10.3 - LOAN AGREEMENT - Rebel Group, Inc. | f10k2013ex10iii_moxiangroup.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended September 30, 2013

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

|

|

Commission File No. 333-177786

|

||

|

MOXIAN GROUP HOLDINGS, INC.

|

||

|

(Exact Name of Registrant as Specified in its Charter)

|

||

| Florida | 45-3360079 | |

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

Unit No. 304, New East Ocean Centre,

No 9 Science Museum Road, T.S.T.,

Kowloon, Hong Kong

|

(606) 928-1131 | |

|

(Address of Principal Executive Offices and Zip Code)

|

(Registrant’s Telephone Number, Including Area Code)

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

The aggregate market value of the voting common equity held by non-affiliates based upon the price at which Common Stock was last sold as of March 29, 2013, the last business day of the registrant’s most recently completed second fiscal quarter was approximately $37,500.

As of December 27, 2013, the number of shares of the registrant’s common stock outstanding was 230,000,000.

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2013

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

|

PART I

|

||

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

13

|

|

Item 1B.

|

Unresolved Staff Comments

|

13

|

|

Item 2.

|

Properties

|

13

|

|

Item 3.

|

Legal Proceedings

|

13

|

|

Item 4.

|

Mine Safety Disclosure

|

13

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

Item 6.

|

Selected Financial Data

|

14

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

16

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

16

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

17

|

|

Item 9A.

|

Controls and Procedures

|

17

|

|

Item 9B.

|

Other Information

|

18

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

18

|

|

Item 11.

|

Executive Compensation

|

20

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

21

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

21

|

|

Item 14.

|

Principal Accountant Fees and Services

|

22

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

22

|

|

SIGNATURES

|

24

|

|

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

|

●

|

The availability and adequacy of our cash flow to meet our requirements;

|

|

●

|

Economic, competitive, demographic, business and other conditions in our local and regional markets;

|

|

●

|

Changes or developments in laws, regulations or taxes in our industry;

|

|

●

|

Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities;

|

|

●

|

Competition in our industry;

|

|

●

|

The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business;

|

|

●

|

Changes in our business strategy, capital improvements or development plans;

|

|

●

|

The availability of additional capital to support capital improvements and development; and

|

|

●

|

Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC.

|

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

|

●

|

The “Company,” “we,” “us,” or “our,” are references to the combined business of the Company, Moxian BVI, Moxian HK, Moxian Shenzhen and Moxian Malaysia.

|

|

●

|

“Common Stock” refers to the common stock, par value $.0001, of the Company;

|

|

●

|

“HK” refers to the Hong Kong;

|

|

●

|

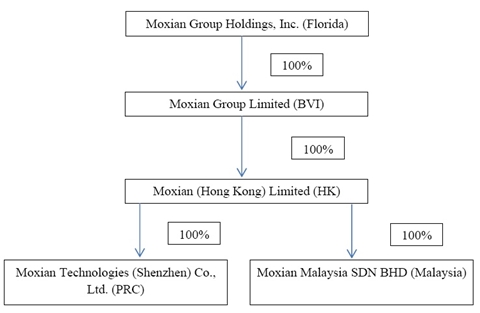

“Moxian” refers to, collectively, (i) Moxian Group Holdings, Inc., a Florida corporation, (ii) Moxian Group Limited, a company incorporated under the laws of British Virgin Islands (“Moxian BVI”), (iii) Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), (iv) Moxian Technologies (Shenzhen) Co., Ltd. (“Moxian Shenzhen”), and (v) Moxian Malaysia SDN BHD (“Moxian Malaysia”).

|

|

●

|

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States;

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

|

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the renminbi). References to “RM” are to the Malaysian Ringgit (also known as “MYR”). According to the currency exchange website www.xe.com, as of December 26, 2013, US$1.00 = 6.06256 yuan; 1 yuan= US$0.164947; US $1.00 = 3.2935RM; 1 RM = US $0.3036.

3

PART I

ITEM 1. BUSINESS

Introduction

Moxian Group Holdings, Inc. (“Moxian Holdings,” the “Company,” “we,” “our,” or “us”), formerly First Social Networx Corp., was incorporated under the laws of the State of Florida on September 13, 2011. Effective on April 16, 2013, the Company changed its name to “Moxian Group Holdings, Inc.” with its trading symbol being “MOXG.” Also effective on April 16, 2013, the Company increased the number of shares that it is authorized to issue to a total of 600,000,000 shares, including 500,000,000 shares of Common Stock and 100,000,000 shares of preferred stock, par value $.0001 per share. In addition, the Company effected a 20-for-1 forward stock split of the Common Stock, without changing the par value or the number of authorized shares of the Common Stock (the “Forward Split”).

On April 25, 2013, pursuant to a Share Exchange Agreement, the Company completed a reverse acquisition of Moxian BVI and its wholly-owned subsidiaries, including Moxian HK, Moxian Shenzhen and Moxian Malaysia (the “Share Exchange Transaction”). The Company acquired the operating business of Moxian BVI and its subsidiaries and the Company ceased being a shell company as such term is defined under Rule 12b-2 under the Exchange Act. The Company is currently in the business of IT Services and Media Advertising industry in various regions.

Moxian BVI was incorporated on July 3, 2012 under the laws of British Virgin Islands. Moxian HK was incorporated on January 18, 2013 and became Moxian BVI’s subsidiary since February 14, 2013. Moxian HK is currently engaged in the business of online social media and will launch its business in China and Malaysia.

Moxian Shenzhen was invested and wholly owned by Moxian HK. Moxian Shenzhen was incorporated on April 8, 2013 and will be engaged in the business of internet technology, computer software, commercial information consulting, etc.

Moxian Malaysia was incorporated on March 1, 2013 and became Moxian HK’s subsidiary since April 2, 2013. Moxian Malaysia is conducting its business in IT Services and Media Advertising industry.

The following diagram sets forth the structure of the Company as of the date of this Report:

Our web site address is www.moxian.com. Information contained on our web site is not part of this Annual Report on Form 10-K or our other filings with the Securities and Exchange Commission (“SEC”).

4

Our Business

General Development and Operation Plan

Moxian is a social network platform that integrates social media and business into one single platform. We utilize our website as a social media to promote our clients’ business and assist our clients to find consumers online and bring them into real-world stores. In Moxian, our registered consumer users can share photos, post messages in their timeline, and most importantly, interact with our merchant clients to receive up-to-date offers or deals through both the web and mobile applications. Through the Moxian Platform, the brand merchants and retailers will increase their in-store sales by attracting more consumers through their online advertisement and promotions.

Moxian Platform provides great opportunities for our merchant clients and consumer users. We offer different types of products for our merchant clients to advertise through our website, www.moxian.com, and enable them to leverage our unique combination of reach, social context and engagement. Therefore, our merchant clients are able to maximize the growth of their businesses. On the other hand, we build up most useful tools that enable consumer users to connect, share, discover, and communicate with each other and our consumer users can maximize the value of using our website through obtaining rewards and buying deals from our merchant clients.

Moxian intends to launch its business in Malaysia and China, and will mainly runs its operation and conducts marketing activities in Eastern and Southeastern Asian countries and districts, such as Singapore, Malaysia, Indonesia, Philippine, India, Thailand, Brunei, Vietnam, Taiwan during the first three years from the year of 2013.

Our Users

Users of Moxian consist of the following two categories:

|

●

|

Merchant clients – we provide our merchant clients with both free and paid accounts. For free accounts, merchant clients can obtain a Do It Yourself webpage for business promotion activities only. For paid accounts, after the merchant clients purchase one of our MO-Tube packages (as described below), they are allowed to issue MO-Points to our consumer users, post the contents of their products and services at MO-Promo e-catalog sites, promote their products and services on the mobile directory listing, display advertisements on Moxian main page and on the timeline of their web pages.

|

|

●

|

Consumer users, or MO-Pals in the language of Moxian website – Moxian offers free service for MO-Pals. MO-Pals can sign up a Moxian account for free, invite friends and family members, meet new groups, share stories, photos and videos, send micro-blog messages, play online games and earn MO-Points from Moxian and its affiliated merchants.

|

Our Products

MO-Promo Platform

Moxian designed and developed a social marketing platform, branded as “MO-Promo,” which serves as an online sale promotion website for our clients’ businesses. It is a social marketing platform consists of the following components: (a) Social Customer Relationship Management (SCRM) system, (b) MO-Points, (c) online games, (d) a social networking website known as MO-Zone and (d) Social Loyalty Program that is rewarding MO-Pals as users or customers who are using MO-Points. Moxian’s registered consumer users can access the online stores by visiting “MO-Promo” at www.moxian.com. In Mo-Promo, they will be rewarded with MO-Points for free through playing games and wining prizes that are sponsored by Moxian and merchant clients. Therefore, the registered consumer users are encouraged to visit our website and the online stores. Our merchant clients can also advertise, run marketing campaigns and learn about their customers through our MO-Promo Platform. Below are the detailed descriptions of Mo-Promo Platform.

SCRM System

The Social Customer Relationship Management (“SCRM”) system enables our merchant clients to interact with their consumers and better understand the needs of the consumer users. SCRM combines the work of people including market researchers, PR staff, marketing teams, and sales teams. It is a platform for the merchants to connect to their business partners and existing/prospective consumers (our subscribers). Our SCRM system allows merchant clients to find insights into a brand's overall visibility through interactions and communications of consumer users in Moxian so that they can identify opportunities for engagement, assess competitor’s activities, and be alerted to impending crises. Our SCRM monitoring tools can glean quantitative and qualitative responses to advertising campaigns for promotions, illuminate opportunities to improve one’s brand, uncover significant unmet customer needs, and identify people who may be highly predisposed to a brand or a product. Our SCRM system also provides valuable information about emerging trends and consumers’ opinions on specific topics, brands or products.

5

MO-Points

MO-Points are the electronic points in the Moxian Social Loyalty Program. The registered users can use MO-Points to (i) play games to win rewarding prizes at our Incentive Games Center because some games need to be activated with MO-Points, and (ii) claim rewards or gifts from Moxian or Moxian’s merchant clients. There are multiple ways of earning MO-Points. The registered users can receive MO-Points by: (i) playing our online games, (ii) making purchases at Moxian merchant clients’ stores, or (iii) referring their friends or family to Moxian’s merchant clients (including sharing photos, submitting comments, sending messages, etc.). MO-Points cannot be transferred, gifted, resold or exchanged for cash or products.

Moxian currently provides 500 MO-Points to its merchant clients with no charge (the “Trial MO-Points”) when they first sign up for Moxian’s service packages. The merchant clients may promote the sales of their own businesses by rewarding those users who purchase the products and services from such merchants’ offline stores with MO-Points. Because of the rewards of MO-Points, the customers of such Moxian merchants will have incentives to return for additional purchase or to disseminate the information regarding such Moxian merchants. If a Moxian’s merchant client gives out all the Trial MO-Points and it decides to continue marketing itself by utilizing the MO-Promo Platform, such merchant client will need to pay for the full Moxian’s service packages, which offer MO-Points ranging from 3,000 to 10,000 points.

Social Loyalty Program

Moxian Social Loyalty Program is a system which encourages registered consumer users to spend MO-Points and return to the MO-Promo Platform. We encourage our users to return to Moxian through rewarding users with reward prizes for ‘spending’ MO-Points in Incentive Game Center. The registered users, after spending MO-Points, will feel necessary to make additional purchases from our client merchants, to play more Moxian online games, and to use Moxian social media platform in order to obtain more MO-Points. This tactic creates the sought-after customer loyalty for our merchant clients, and provides a long-term financial benefit to our clients’ businesses by creating loyal returning customers. They can also promote specific products through providing reward points in such specific products. These promotion methods are at very low costs. Therefore, Social Loyalty Program is a great fit for small to medium business owners with limited resources to increase their revenue by rewarding their frequent customers for their purchases and thus increase their revenue.

Online Games

Our online games consist of two categories: (i) Incentive Game Center (“Incentive Game Center”) such as MO-Bid, MO-Grab, MO-Chess that encourages users to play and win give-away prizes, which are either sponsored by Moxian or its merchant clients; and (ii) other online games, known as MO-Puzzle games, enables the users to play for fun and earn MO-Points. The online games are part of the social media platform that attracts the consumer users to visit our website.

MO-Zone

MO-Zone permits Moxian consumer users to share photos, write diaries, exchange information, watch video clips, and communicate with each other. Every user can design MO-Zone to his or her own taste. It is also the social networking site where Moxian consumer users can share their shopping experiences.

Moxian Advertisement

The merchant clients can advertise their products or service through posting banners or different types of advertisements in Moxian. In addition, the clients can create their own Moxian page. In their page, they can specify a title, content, image, and to which a user is directed if he or she clicks on the page. They can present their products and service on the page, and post any discount information or any activities in the physical stores regarding their new products. The merchant clients can further engage their intended audiences by incorporating social context with their marketing messages. Social context includes actions a user’s friends have taken, such as visible history when the user’s friend has visited the merchants’ web page. With the social context, the merchants can highlight the interactions of a user’s friends with a brand or product.

Moxian Mobile Applications

Moxian mobile applications provide its consumer users another approach to experience our website. Moxian currently provides its platform on both Apple-based products (iOS) and Android-based products. They can be downloaded for free at official market place centers (App Store and Google Play). Our mobile application allows users to redeem points, use social media features such as checking in to the application, sharing photos, having a shortcut to the MO-Promo platform, and using our MO-Points to purchase or bid items at the MO-Promo platform.

Our Website Feature

The most significant feature of Moxian is that we develop insights into social conversations and behaviors, level of engagement, influence, and activities of our registered users, or MO-Pals. We analyze the profiles of MO-Pals. Each time a MO-Pal redeems MO-Points, a message will appear in the user’s timeline page. Therefore, we can record the occurrence and analyze the data, including age, gender, marital status, and race. The MO-Pals’ preference in buying different brands of products is also recorded in their social profile, as well as their direct communications with their contacts. Because we provide merchant clients with the valuable information from our analysis, our clients will be able to send the right messages to the right people; therefore, they can market their products or services more effectively.

6

MO-Tube Packages

We provide the basic features of MO-Promo Platform for all merchant clients for free. Such free packages include the basic SCRM features with 500 Trial MO-Points offered. In order to make use of all the MO-Promo features, merchant clients will have to purchase MO-Tube packages at various prices. Under our MO-Tube packages, the merchant clients can make use of the full SCRM features, advertise on our websites, and conduct online activities to their targeted customers and thus boost the offline sales.

After subscribing for the MO-Tube packages, the merchant clients will have access to more detailed data of the consumer users who have made a purchase at our merchant offline shop previously. In addition, MO-Points are allocated to our clients according to the different MO-Tube packages they subscribed. As an incentive to boost more subscription, Moxian will also bundle these packages with offline advertisement opportunities with our business partners in offline media such as roadside billboard and magazines.

Value for Our Merchant Clients

We dedicate to creating values for our merchant clients. By purchasing the MO-Tube service packages, our clients are able to leverage on our MO-Promo platform for their advertising and marketing needs targeted towards their current clients and potential clients. We offer our clients a unique combination of interaction with consumer users, figuring out the relevant users, learning the users’ preference in their consumption, and engaging the users with innovative promotion methods.

|

●

|

Interaction. We offer our consumer users a platform to interact with their friends and discover new things. In the midst of doing so, our merchant clients are able to communicate with these users through this platform, running promotions such as giving out prizes and discounts.

|

|

●

|

Targeted Consumer Users. Our merchants can target users on Moxian based on users’ interest and personal information which users have chosen to share with us on Moxian. Because the consumer users will be attracted by advertisements and promotion campaigns that are targeted to them, the promotion campaigns targeted at either first time customers or returned customers could generate more revenues for our merchant clients.

|

|

●

|

Preference in Consumption. We are a strong believer of the “word of mouth” concept in marketing and Moxian can assist our consumer users to express their preference in consumption. We create a function for the consumer users to show the history of visiting the merchants’ Moxian page in their own timeline. Thus, the messages would be communicated to their friends who may be potential customers to our merchant clients’ outlets or stores and promote their business. In addition, when a consumer user redeems MO-Points at our merchant’s outlet, the redemption of MO-Points would automatically subscribe him to the news feed of the merchant’s business site on the consumer user’s homepage (i.e. MO-Zone).

|

|

●

|

Engagement. We encourage constant interaction between merchants and their consumers. Moxian offers a platform for both merchants and consumers to be actively involved. Further, merchants not only could engage with existing customers, but also potential customers who would be introduced to the merchants in the process of such engagement. Our platform encourages innovative methods for our merchants, such as promotion campaigns, sharing of information, discovering new products/services, or pulling polls to understand the needs of customers. For example, by learning the results of polls, we believe that our merchant clients who owns Moxian page will increase awareness of and engagement with their Pages.

|

Because of the above values, the MO-Promo platform offers great opportunities and financial incentives for our merchant clients to sign up our website and purchase the MO-Tube Packages. Besides the above methods, we also create values for our merchant clients through MO-Zone. When a promotional campaign is started by a merchant, the news of such campaign would be published onto the subscribed users’ login/homepage on MO-Zone. Thus, the merchant clients will maximize their revenue through the interaction and engagement with consumer users, as well as the advertising and promotion through Moxian.

Social Media Marketing Services

In order to better serve our clients and subscribers, we, through MO-Promo and other Moxian applications, also provide various consulting and management services to small and medium-sized businesses, including:

|

●

|

We provide social media consulting services, where a consultant will be assigned to each client;

|

|

●

|

We publish interactive contents for the merchant clients in the social communities of their respective industries;

|

|

●

|

We design and customize social webpages for the merchant clients, including running feedback, adding coupons or promotions and embedding clients’ product videos and images into the social websites of the clients;

|

|

●

|

We manage marketing campaign on our clients’ social webpages; and

|

|

●

|

We provide analysis and statistics of visitors for clients’ social webpages and hold free strategy sessions to assist clients on generating more traffic on their social webpages.

|

7

Marketing Strategy

Referral marketing is an increasingly popular method for marketers to add new resources of revenue or to streamline sales processes with business partners. Moxian has two types of referral programs where different marketers assist us to broaden our client base. The first one is the referral by MO-Pals. MO-Pals (our subscribers) are allowed to refer other users to earn extra free MO-Points. Therefore, our subscribers will be motivated to patron our client merchants’ social webpages or online/offline stores, which will ultimately stimulate the sales of the products and services of our clients. In the meantime, such referral among MO-Pals will increase Moxian’s user database rapidly, which enables us to provide more accurate analysis and statistics of consumer behavior and preferences for our client merchants. Secondly, we would utilize the referral by sale representatives in specific region. This kind of business referral is to target those who are interested in building Moxian business in a region, such as Malaysia and Singapore, where they will be appointed by Moxian as Moxian’s sales agents in the region to represent Moxian for referring client merchants to us. Moxian usually pays 30% of the prices of the sold products or services as referral fees.

There are two advantages of our marketing strategy. Firstly, it is easy to identify prospective customers. Once the prospective customers are identified, Moxian’s internal sales teams can focus their efforts on those activities required to close the deal and/or fulfill the solution delivery, rather than devoting time to acquiring and developing the lead, as would typically be the case with other types of marketing programs. Secondly, there are no costs or fees associated with our referral programs, because rewards, which can be redeemed by exchanging MO-Points, are only given out to the holders of MO-Points after such holders have purchased the offers or deals from our merchant clients. As a result, referral programs can create higher number of returned customers than other types of marketing programs.

Other methods of promoting Moxian include online ads, event campaigns, and print media such as local-based booklet magazines, cross social media marketing, which is an integrated marketing strategy with digital channels, social media and website or blog touch points, with a role for e-mail marketing, and online forms.

Customers

Moxian’s customers include retail merchants, manufacturers, shopping mall operators, transportation, telecommunication providers, software developers, online e-commerce operators, payment providers, and news media. There are currently no paying customers yet. Most of our merchant clients are using our platform on a trial basis.

Industry

Moxian endeavors to build an “Online-to-Offline” O2O platform model. It is widely believed that O2O platform has been proven to substantially enhance marketing and commerce performance for brands and retailers compared to traditional digital marketing approaches. O2O refers to any and all activities that originate online yet eventually result in a shopper going to a physical store. Forrester Research predicts that by 2016, more than half of the $3.5 trillion spent in the US retail offline will be influenced by the web (Forrester’s US Cross-Channel Retail Forecast, 2011 To 2016.).

O2O platform model has been recognized as a trillion dollar opportunity (“http://techcrunch.com/2010/08/07/why-online2offline-commerce-is-a-trillion-dollar-opportunity/”). According to official statistics, China’s O2O market reached 98.7 billion yuan (approx. US$9 billion) in 2011. Industry analysts anticipate that the China O2O market will quadruple to 418 billion yuan (approx. US$67 billion) in 2016. Moxian is able to capture a share in this market by offering its unique platform to merchants. Our platform allows users to be aware of their interested merchants’ on-going promotion so as to attract them to purchase offline.

Because O2O is being perceived as a gold mine in the age of the mobile internet in China, we will face challenges coming from the pioneers of the industry both in Asia and overseas majors trying to expand into Asia. However, we are confident that our business model is capable in obtaining a good amount of market share in competing with our current competitors. Our market is not restricted to China as compared to other potential competitors. We will be targeting a variety of Asian countries which will grant us a bigger market share.

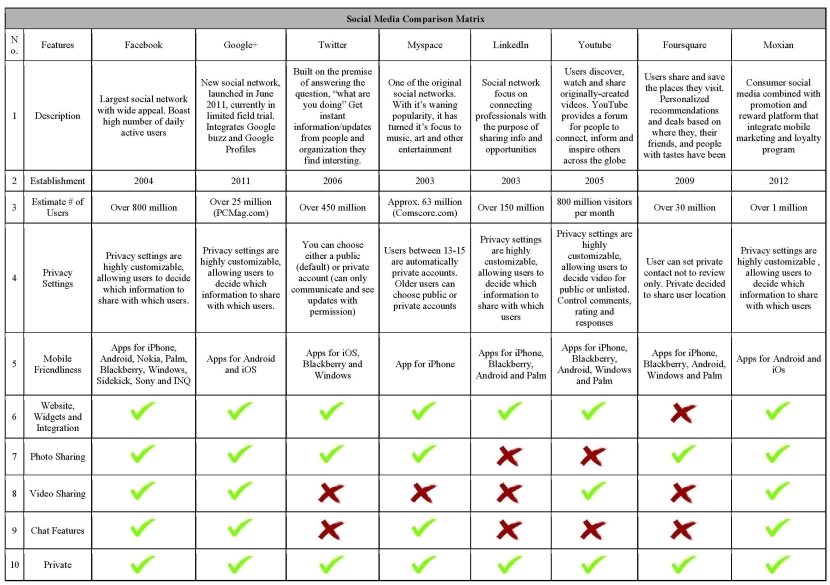

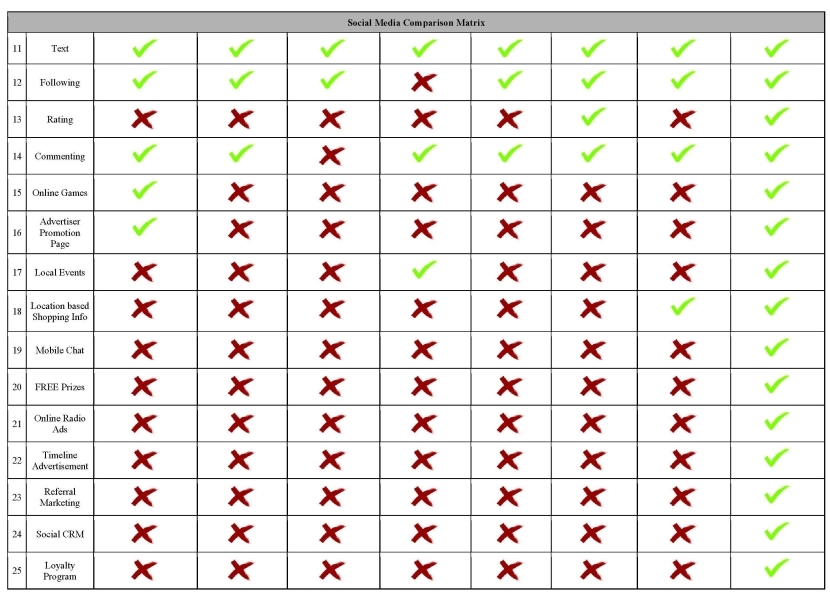

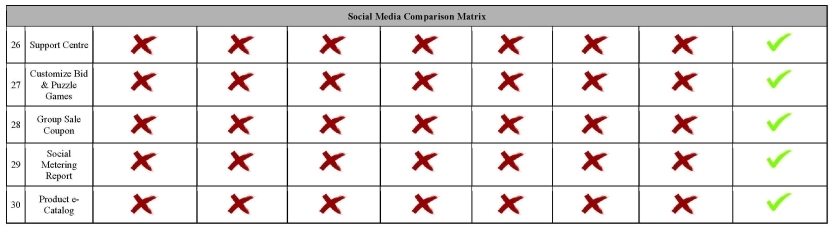

Competition

Although major global social network platform providers have the advantage of popularity, Moxian has a unique social business model and social media features that will enable us to stand out in the competition. Other major social network platforms usually focus on personal photo sharing, video sharing, chat feature, private grouping, micro-blog, following group, rating messages and commenting messages. What makes Moxian distinguishable is that our merchant clients have: (i) their own promotion webpages, (ii) local event programs for their customer users, (iii) location-based promotion information, (iv) mobile chat applications, (v) give-away free prizes for consumer users, (vi) timeline advertising on Moxian’s social webpage, (vii) social customer relationship management system for merchants, (viii) social loyalty program, and (ix) customized online games to promote merchants’ brand and group sales promotion.

8

Our competitors are the major players in the social networking industry such as Facebook, Google, Twitter, Myspace, Linkedin, YouTube, and Foursquare. Below is the table of comparison between Moxian’s services and its competitors’ services.

9

10

Our Strategy

In order for us to compete in the social media and the O2O market, our strategies include:

Expand our user base. We dedicate to attracting more users and our goal is to retain existing and acquire new subscribers by providing more real-time deals, delivering high quality customer service and expanding the number and categories of deals we offer. We continue to focus on growing our user base across Asia in large markets such as China, Singapore, Hong Kong, and Malaysia. We intend to grow our user base by continuing our marketing efforts and enhancing our products, including mobile apps, in order to make Moxian more accessible and useful. We continue to develop a variety of activities to attract more loyal users by give-away prizes, offline events sponsored by our partners, sales promotions and rewards programs. In addition, we adopt the word-of-mouth and referral marketing strategy to increase users’ sign-ups in Moxian.

Increase the number and variety of our products. We focus on product development that we believe will create engaging interactions between our consumer users and merchant clients, across the web, and on mobile devices. We continue to invest significantly in improving our core products such as MO-Promo, MO-Zone, and MO-Points and develop other new products to increase the varieties of our products.

Generate sticky contents. In order to attract more users, we intend to develop contents on a website with a purpose of attracting users’ attention for longer viewing time and for them to return to our website. We tailor the contents based on our analysis of the users and generate such contents that are favorable to our consumer users.

Cooperate with more branded businesses. In order to develop Moxian’s reputation, we will develop more merchant clients who have established their brand in local and global markets. Our merchant expansion efforts are focused on providing merchants with a positive experience by offering placement of their deals to our website at a lower cost, high quality customer service and tools to manage deals more effectively.

Regulations

Because we are launching in Malaysia and China first, the following discussions about regulations that govern Moxian’s operations will focus on Malaysia and China.

With respect to collecting information via user registration and consumption of MO-Points data, we will have to comply with The Personal Data Protection Act in Malaysia. Our Privacy Policy has been drafted to be in compliance with such rules.

In PRC, we will have to comply with the laws and regulations relating to the distribution of Internet content in China such as Application of the Appropriate ICP License and our data usage policy has to be in accordance with Regulations of The People’s Republic of China for Safety Protection of Computer Information System.

Our website is maintained through the server in Hong Kong. Therefore, the data usage policy and regular terms of service by both our users and merchants have to comply with the rules and regulations of Hong Kong SAR. As the information our merchants and consumer users are preserved in Hong Kong, We will need to comply with the Hong Kong Personal Data (Privacy) Ordinance (Cap 486).

Security Technologies

Social media offers important business advantages to companies and organizations. However, it has potential security risks. In order to mitigate these security risks, we established and enforced social media usage policies. We have deployed strategies such as multilayered security at the gateway and end point, content classification, content filtering, and data loss prevention (DLP).

Moxian believes that effective security for social networking must leverage both decentralized and centralized modes of IT security. In other words, Moxian must protect both the network and the users at the end point.

Our centralized security holds the key to safeguard enterprises’ data and network resources. As hackers become more aggressive in their attacks on social media, we continue to set up the use of traditional protection tools such as scanning to verify incoming content and traffic. In addition, we implemented a Web security tool and configured the Internet gateway to block malicious inbound traffic such as cross-site scripting exploits and phishing. Moxian also has inbound content filtering, which employs spam blockers and anti-virus applications to block or allow a communication based on analysis of its content.

For outgoing traffic, a DLP solution enables the business to screen content before it leaves the corporate network. It monitors outbound traffic to detect and potentially stop the communication of sensitive information by under protected means. DLP can identify sensitive data at rest, control its usage at user end points, and monitor or block its egress from network perimeters.

Whenever user personal data is processed, Moxian takes utmost care in keeping their data secured. We use a variety of industry-standard security technologies and procedures to help protect their personal data from unauthorized access or disclosure. We store data behind a firewall, a barrier designed to prevent outsiders from accessing our servers. Even though Moxian takes significant steps to ensure that the users and clients’ personal data is not intercepted, accessed, used or disclosed by unauthorized persons, we cannot eliminate security risks entirely particularly where the internet is concerned.

11

Employees

As of September 30, 2013, the Company had 50 employees, with 30 employees working on the software development, 10 in the sales and marketing and 10 in the administrative department.

Intellectual Property

The technique of Moxian Platform is developed in Shenzhen, China. The following are the intellectual property rights that the Company owns, the details of which are set forth in the following table:

|

Mark

|

Country of Registration

|

Application Number

|

Class

|

Description

|

Current Owner

|

|||||

|

Hong Kong

|

302534274

|

9,35,38,40,41,42

|

Class 9: Magnetic data carriers, recording discs, data processing equipment and computers

Class 35: Advertising, business management, business administration

Class 38: Telecommunications

Class 40: Treatment of materials

Class 41: Entertainment

Class 42: Design and development of computer hardware and software

|

Moxian (Hong Kong) Limited

|

|||||

|

China

|

10624435

(to be approved)

|

28

|

Data transmission; computer terminal communication; transmission of messages and images (computer aided); electronic mails; provision of connecting services of telecommunication to connect to the global computer network; long-distance teleconference services; provision of connecting services to users to global computer network, etc.

|

Shenzhen New Clouds Network Technology Co., Ltd.

|

|||||

|

China

|

10624504

(to be approved)

|

35

|

Billposting; advertisement promotion; mail-in advertisement; TV commercials; advertisement platform rental; computer online e-commercials; display products on mass media for retail purposes; advertisement design; auctions, etc.

|

Shenzhen New Clouds Network Technology Co., Ltd.

|

On January 15, 2013, Moxian (Hong Kong) Limited entered into an Intangible Asset Transfer Agreement with Shenzhen New Clouds Network Technology Co., Ltd. to transfer the two trademarks mentioned above to Moxian HK for no consideration. Moxian HK entered into an Intangible Asset Transfer Agreement with Fensheng Kuan to acquire the following domains: www.moxian.com, www.m41.com,www.spellthread.com without any consideration. We are still in the process of registering the transfer of the referenced trademarks and the domain names under the name of Moxian HK as of the date of this Current Report.

We are in the process of registering the above trademarks and the name “Moxian” in the following countries: Singapore, Indonesia, Malaysia, China, India, Thailand, Philippines and United States of America.

Available Information

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the U.S. Securities and Exchange Commission (the “SEC”). The Company is subject to the informational requirements of the Exchange Act and files or furnishes reports, proxy statements, and other information with the SEC. Such reports and other information filed by the Company with the SEC are available via the Company’s website at www.moxian.com when such reports are available on the SEC’s website. The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

12

Principal Executive Offices

Our principal executive office is located at Unit No. 304, New East Ocean Centre, No 9 Science Museum Road, T.S.T., Kowloon, Hong Kong. Our principal telephone number at such location is (852) 2723-8638.

ITEM 1A. RISK FACTORS

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 2. PROPERTIES

The Company currently does not own any properties. For our headquarter, we are renting the office from our corporate secretary, H.K.I.C Consultants Limited for an annual rent of HKD$10,000 (or approximately $1,290). For Moxian Shenzhen, we are currently renting an office in Shenzhen for IT development since April 2013. The monthly rent is RMB 60,000 (or approximately $9,703). For Moxian Malaysia, we are renting an office from MVC Centrepoint South Sdn Bhd for a monthly rent of $8,000. The Company believes that the aforementioned office space will be sufficient for its current needs.

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. There are currently no legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is currently trading on the OTC Market Group’s OTCQB. Our common stock was traded under the symbol “FSCN” until April 16, 2013 and is currently quoted on the OTCQB under the trading symbol “MOXG.” Our common stock did not trade prior to June 18, 2013. Trading in stocks quoted on the OTCQB is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little to do with a company’s operations or business prospects. We cannot assure you that there will be a market for our common stock in the future.

OTCQB securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTCQB securities transactions are conducted through a telephone and computer network connecting dealers in stocks.

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. The following quotations reflect the high and low bids for our shares of common stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. All prices are split-adjusted to reflect the 20-for-1 stock split in April 2013.

|

High

|

Low

|

|||||||

|

Fiscal Year 2012*

|

Bid

|

Bid

|

||||||

|

First Quarter

|

$

|

-

|

$

|

-

|

||||

|

Second Quarter

|

$

|

-

|

$

|

-

|

||||

|

Third Quarter

|

$

|

-

|

$

|

-

|

||||

|

Fourth Quarter

|

$

|

-

|

$

|

-

|

||||

|

High

|

Low

|

|||||||

|

Fiscal Year 2013

|

Bid

|

Bid

|

||||||

|

First Quarter*

|

$ | - | $ | - | ||||

|

Second Quarter*

|

$ | - | $ | - | ||||

|

Third Quarter*

|

$ | - | $ | - | ||||

|

Fourth Quarter

|

$ | 0.80 | $ | 0.28 | ||||

* The Company’s Common Stock did not trade until June 2013.

13

As of December 24, 2013, the last sale price reported on the OTCQB for the Company’s Common Stock was approximately $0.30 per share.

Holders

As of September 30, 2013, we had 230,000,000 shares of our common stock par value, $.0001 issued and outstanding. There were approximately 149 beneficial owners of our common stock.

Transfer Agent and Registrar

The Transfer Agent for our capital stock is Island Stock Transfer, located at 15500 Roosevelt Boulevard, Suite 301.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

Unregistered Sales of Equity Securities

On April 25, 2013, we issued 105,000,000 shares of our Common Stock to the former sole shareholder of Moxian BVI in exchange for all of the issued and outstanding capital stock of Moxian BVI pursuant to the Share Exchange Agreement. We did not receive any cash consideration in connection with the Share Exchange Transaction.

The above issuances of shares of our Common Stock were conducted in accordance with a safe harbor from the registration requirements of the Securities Act under Regulation S thereunder or an exemption from the registration requirements of the Securities Act under Section 4(2) by virtue of compliance with the provisions of Regulation D under the Securities Act.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended September 30, 2013.

ITEM 6. SELECTED FINANCIAL DATA

Disclosure in response to this item is not required of a smaller reporting company.

14

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The following discussion of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

Certain statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

The "Company", "we," "us," and "our," refer to (i) Moxian Group Holdings, Inc., a Florida corporation,(ii) Moxian Group Limited, a British Virgin Islands company (“Moxian BVI”),(iii) Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), (iii) Moxian Technologies (Shenzhen) Co., Ltd. (“Moxian Shenzhen”), and (iv) Moxian Malaysia SDN BHD (“Moxian Malaysia”)

Overview

The Company engages in the business of providing a social marketing and promotion platform to merchants who desire to promote their businesses through online social media. Our products and services aim to enhance the interaction between users and merchant clients by allowing merchant clients to study consumer behavior through data compiled from our database of users’ activities. We design our products and services to allow our merchant clients to run advertisement campaigns and promotions to target their customers. Our platform is also designed and built to entice users to return and to encourage new consumer users to subscribe our website.

We are currently at development stage. Our primary activities have been the designing and developing and development of our products and services, negotiating strategic alliances and other agreements, and raising capital. We have not commenced our principal operations, nor have we generated any significant revenues.

Since our inception, as of September 30, 2012 and September 30, 2013, our accumulated deficits were $31,162 and $790,343, respectively. Our stockholders’ equity (deficiency) was $15,338 and ($735,279), respectively. We have so far generated $96,933 in revenue. Our losses have principally been attributed to operating expenses, administrative and other operating expenses.

Results of Operations

For the year ended September 30, 2013 compared with the year ended September 30, 2012

Gross Revenues

The Company received sales revenues of $96,933 in the year ended September 30, 2013 compared to nil being generated in the year ended September 30, 2012.

The Company’s sales revenue of $96,933 in the year ended September 30, 2013 comes from two major customers who subscribed to acquire regional district agency in Malaysia to sign up merchants to use our MO-Promo platform as well as merchant clients who has subscribed to use the MO-Promo platform. In our efforts to acquire these subscribers, the costs of $3,811 consist of mainly domain name registration fees and acquiring window and car stickers for advertising purposes.

Operating Expenses

Operating expenses for the years ended September 30, 2013 and September 30, 2012, were $827,003 and $29,062, respectively. The expenses consisted of filing fees, professional fees, payroll and benefits and other general expenses.

We expect that our general and administrative expenses will continue to increase as we incur additional costs to support the growth of our business.

15

Net Loss

Net loss for the years ended September 30, 2013 and September 30, 2012, were $759,181 and $29,062, respectively. Basic and diluted net loss per share amounted to ($0.00) for the years ended September 30, 2013 and September 30, 2012.

Liquidity and Capital Resources

At September 30, 2013 we had working capital of $1,000,072 consisting of cash on hand of $753,098 as compared to working capital of $17,338 and our cash of $17,338 at September 30, 2012.

Net cash used in operating activities for the year ended September 30, 2013 was $766,887 as compared to $29,062 for the years ended September 30, 2012. The cash used in operating activities are mainly for filing fees, professional fees, payroll and benefits and general expenses.

Currently, we have limited operating capital. We expect that our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital, and the revenues, if any, generated from our business operations alone may not be sufficient to fund our operations or planned growth.

We will likely require additional capital to continue to operate our business, and to further expand our business. Sources of additional capital through various financing transactions or arrangements with third parties may include equity or debt financing, bank loans or revolving credit facilities. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. Our inability to raise additional funds when required may have a negative impact on our operations, business development and financial results.

Critical Accounting Policies and Estimates

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at dates of the financial statements and the reported amounts of revenue and expenses during the periods. Actual results could differ from these estimates. Our significant estimates and assumptions include depreciation and the fair value of our stock, stock-based compensation, debt discount and the valuation allowance relating to the Company’s deferred tax assets.

Recently Issued Accounting Pronouncements

Reference is made to the “Recent Accounting Pronouncements” in Note 2 to the Financial Statements included in this Report for information related to new accounting pronouncement, none of which had a material impact on our consolidated financial statements, and the future adoption of recently issued accounting pronouncements, which we do not expect will have a material impact on our consolidated financial statements.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive activities and business development. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

As of September 30, 2013, we did not have any off-balance sheet arrangements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company's consolidated financial statements, together with the report of the independent registered public accounting firm thereon and the notes thereto, are presented beginning at page F-1.The Company’s balance sheets as of September 30, 2013 and 2012 and the related statements of operations, changes in stockholders’ deficit and cash flows for the years then ended have been audited by Dominic K.F. Chan & Co. Dominic K.F. Chan & Co is an independent registered public accounting firm. These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and pursuant to Regulation S-K as promulgated by the Securities and Exchange Commission and are included herein pursuant to Part II, Item 8 of this Form 10-K. The financial statements have been prepared assuming the Company will continue as a going concern.

16

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Previous Independent Accountants

On May 7, 2013, in connection with the Company’s acquisition of the assets and operations of Moxian BVI and the related change in control of the Company, Board of Directors of the Company approved to terminate DKM Certified Public Accountants (“DKM”) as the Company’s independent registered public accounting firm.

The Company’s consolidated financial statements since through the fiscal year ended September 30, 2012 were audited by Peter Messineo, CPA (“PM”), prior to that firm’s merger into DKM. PM’s report on our financial statements for the most recent fiscal year did not contain an adverse opinion, a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles, except the inclusion of a paragraph indicating substantial doubt for continuance as a going concern.

During the fiscal years ended September 30, 2012 and 2011 and through May 7, 2013, (a) there were no disagreements with DKM or PM on any matter of accounting principles or practices, financial statement disclosure, auditing scope or procedure, which disagreements, if not resolved to the satisfaction of DKM/PM, would have caused it to make reference to the subject matter of the disagreement in connection with its report on the financial statements for such years and (b) there were no “reportable events” as described in Item 304(a)(1)(v) of Regulation S-K.

New Independent Registered Public Accounting Firm

On May 7, 2013, the Board of Directors of the Company ratified the appointment of Dominic K.F. Chan & Co, CPA (“K.F. Chan”) as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2013. K.F. Chan is located at Rooms 2105-06, 21/F., Office Tower, Langham Place, 8 Argyle Street, Mongkok, Kowloon, Hong Kong.

During the Company's previous fiscal years ended September 30, 2012 and 2011 and through May 7, 2013, neither the Company nor anyone on the Company's behalf consulted with K.F. Chan regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements or (ii) any matter that was either the subject of a disagreement or a reportable event as defined in Item 304(a)(1)(v) of Regulation S-K. Prior to the Share Exchange Transaction, Moxian BVI had been audited by K.F. Chan.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosures Control and Procedures

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the company’s principal executive and principal financial officers and effected by the company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

|

●

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company;

|

|

●

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and

|

|

●

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements.

|

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

As of September 30, 2013, management assessed the effectiveness of our internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control--Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) and SEC guidance on conducting such assessments. Based on that evaluation, they concluded that, during the period covered by this Report, such internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully described below. This was due to deficiencies that existed in the design or operation of our internal controls over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

The matters involving internal controls and procedures that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; and (3) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by our Chief Executive Officer in connection with the review of our financial statements as of September 30, 2013.

Management believes that the material weaknesses set forth in items (2) and (3) above did not have an effect on our financial results. However, management believes that the lack of a functioning audit committee and the lack of a majority of outside directors on our board of directors results in ineffective oversight in the establishment and monitoring of required internal controls and procedures, which could result in a material misstatement in our financial statements in future periods.

17

Management’s Remediation Initiatives

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we have initiated, or plan to initiate, the following series of measures:

We will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to us. And, we plan to appoint one or more outside directors to our board of directors who shall be appointed to an audit committee resulting in a fully functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures such as reviewing and approving estimates and assumptions made by management when funds are available to us.

Management believes that the appointment of one or more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on our Board.

We anticipate that these initiatives will be at least partially, if not fully, implemented by the end of fiscal year 2014. Additionally, we plan to test our updated controls and remediate our deficiencies in year 2014.

Changes in internal controls over financial reporting

Except the following, there was no change in our internal controls over financial reporting that occurred during the period covered by this Report, which has materially affected, or is reasonably likely to materially affect, our internal controls over financial reporting:

On February 27, 2013, Ms. Marilyn Stark our former President and sole director of the Board of Directors resigned from all her positions and Mr. Liew Kwong Yeow was appointed as the President, Chief Executive Officer and director of the Company, and Mr. Lin Kuan Liang Nicolas was elected as a director of the Board of the Company.

This annual report does not include an attestation report of the Company’s registered independent public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered independent public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report on Form 10-K.

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table sets forth the name and position of our current executive officers and directors.

|

Name

|

Age

|

Position

|

||

|

Liew Kwong Yeow

|

58

|

President, Chief Executive Officer and Director

|

||

|

Lin Kuan Liang Nicolas

|

25

|

Director

|

Mr. Liew Kwong Yeow, age 58, has more than 25 years of experience in several multi-national organizations, such as Matsushita Denki, General Motors, Intel as well as Urmet Telecoms Italy. He held senior positions and mainly responsible for quality, engineering and procurement of related products and services. In 2006, Mr. Liew was instrumental in setting up the first manufacturing plant of Urmet Telecommunications Torino Italy in China and fine-tuning its supply chains, and with Mr. Liew’s assistance, the entire operations of Urmet became significantly competitive in the China markets. Prior to that, Mr. Liew was the General Manager of Aztech Singapore’s plant in China from 2001 through 2005. During 1992 through 2001, he served as the head of QA Operations of the manufacturing facilities of Pheonix Mecano Switzerland in Singapore. Mr. Liew received his diploma in Electrical Engineering from Singapore Polytechnics University in 1974. He also completed the management study programs in: City and Guilds regarding Electrical and Electronics in 1974, Industrial Training Board at MOE Singapore in 1976, Matsushita DENKI Management Development Program in 1978, General Motors Institute in 1983 and Intel University in 1987. Mr. Liew is fluent in English and Chinese.

Mr. Lin Kuan Liang Nicolas, age 25, is currently working as an analyst at Chance Investment Inc., advising Chinese businesses on acquisition and fund- raising projects. During December 2010 through April 2011, he was the legal associate at FM Holdings Limited, where he was actively involved in the company’s restructuring and debt-financing. Prior to that and since June 2010, Mr. Lin worked as the junior associate at Global Fund Investment (UK) Limited in London. Mr. Lin graduated from Queen Mary, University of London with LLB in Law in June 2010.

All directors hold office until the next annual meeting of shareholders and until their successors have been duly elected and qualified. Directors are elected at the annual meetings to serve for one-year terms. Any non-employee director of the Company or its subsidiaries is reimbursed for expenses incurred for attendance at meetings of the Board and any committee of the board of directors although no such committee has been established.

18

Each officer is appointed by the board of directors and holds his office at the pleasure and discretion of the board of directors or until his earlier resignation, removal or death.

There are no material proceedings to which any director, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the Company or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Director Independence

Our securities are not listed on a national securities exchange or in an inter-dealer quotation system which has requirements that directors be independent. We do not have majority of independent directors.

Committees of the Company’s Board of Directors

Because our board of directors currently consists of two members, we do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. Also, we do not have a “financial expert” on our board of directors as that term is defined by Item 401(e)(2) of Regulation S-K. We do not believe it is necessary for our board of directors to appoint such committees because the volume of matters that come before our board of directors for consideration permits the Board of Directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees. In considering candidates for membership on the Board of Directors, the Board of Directors will take into consideration the needs of the Board of Directors and the candidate's qualifications. The Board of Directors will request such information as:

|

●

|

The name and address of the proposed candidate;

|

|

●

|

The proposed candidates resume or a listing of his or her qualifications to be a director of the Company;

|

|

●

|

A description of any relationship that could affect such person's qualifying as an independent director, including identifying all other public company board and committee memberships;

|

|

●

|

A confirmation of such person's willingness to serve as a director if selected by the Board of Directors; and

|

|

●

|

Any information about the proposed candidate that would, under the federal proxy rules, be required to be included in the Company's proxy statement if such person were a nominee.

|

Once a person has been identified by the Board of Directors as a potential candidate, the Board of Directors may collect and review publicly available information regarding the person to assess whether the person should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors and the Board of Directors believes that the candidate has the potential to be a good candidate, the Board of Directors would seek to gather information from or about the candidate, including through one or more interviews as appropriate and review his or her accomplishments and qualifications generally, including in light of any other candidates that the Board of Directors may be considering. The Board of Director's evaluation process does not vary based on whether the candidate is recommended by a shareholder.

The Board of Directors will, from time to time, seek to identify potential candidates for director nominees and will consider potential candidates proposed by the Board of Directors and by management of the Company.

Meetings of the Board of Directors

During its fiscal year ended September 30, 2013, the Board of Directors did not meet on any occasion, but rather transacted business by unanimous written consent.

Board Leadership Structure and Role in Risk Oversight