Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - NCS Multistage Holdings, Inc. | ncsm-20191231xex32_2.htm |

| EX-32.1 - EX-32.1 - NCS Multistage Holdings, Inc. | ncsm-20191231xex32_1.htm |

| EX-31.2 - EX-31.2 - NCS Multistage Holdings, Inc. | ncsm-20191231xex31_2.htm |

| EX-31.1 - EX-31.1 - NCS Multistage Holdings, Inc. | ncsm-20191231xex31_1.htm |

| EX-23.1 - EX-23.1 - NCS Multistage Holdings, Inc. | ncsm-20191231xex23_1.htm |

| EX-21.1 - EX-21.1 - NCS Multistage Holdings, Inc. | ncsm-20191231xex21_1.htm |

| EX-4.1 - EX-4.1 - NCS Multistage Holdings, Inc. | ncsm-20191231xex4_1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission file number: 001-38071

NCS Multistage Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware |

|

46-1527455 |

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification number) |

|

|

|

|

|

|

|

|

|

19350 State Highway 249, Suite 600 |

|

|

|

|

|

Houston, Texas |

|

77070 |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: (281) 453-2222

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, $0.01 par value |

NCSM |

NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

Non-accelerated filer |

☑ |

Smaller reporting company |

☑ |

|

|

|

|

|

Emerging growth company |

☑ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of June 30, 2019, the aggregate market value of the common stock of the registrant held by non-affiliates of the registrant was approximately $45.3 million (based on the closing sale price of the registrant’s common stock on that date).

As of February 28, 2020, there were 46,813,117 shares of common stock outstanding.

Portions of the definitive proxy statement for the registrant’s 2020 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K. Such proxy statement will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2019.

|

|

|

|

|

|

|

Page |

|

Item 1. |

5 | |

|

Item 1A. |

12 | |

|

Item 1B. |

32 | |

|

Item 2. |

32 | |

|

Item 3. |

32 | |

|

Item 4. |

32 | |

|

Item 5. |

33 | |

|

Item 6. |

34 | |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

36 |

|

Item 7A. |

55 | |

|

Item 8. |

57 | |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

91 |

|

Item 9A. |

91 | |

|

Item 9B. |

91 | |

|

Item 10. |

92 | |

|

Item 11. |

92 | |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

92 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

92 |

|

Item 14. |

92 | |

|

Item 15. |

93 | |

|

Item 16. |

95 | |

| 96 | ||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Form 10-K”) includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, statements we make regarding the outlook for our future business and financial performance, such as those contained in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause our actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions and the following:

|

· |

declines in the level of oil and natural gas exploration and production (“E&P”) activity within Canada and the United States; |

|

· |

oil and natural gas price fluctuations; |

|

· |

loss of significant customers; |

|

· |

inability to successfully implement our strategy of increasing sales of products and services into the United States; |

|

· |

significant competition for our products and services; |

|

· |

our inability to accurately predict customer demand; |

|

· |

impairment in the carrying value of long-lived assets and goodwill; |

|

· |

our inability to successfully develop and implement new technologies, products and services; |

|

· |

our inability to protect and maintain critical intellectual property assets; |

|

· |

currency exchange rate fluctuations; |

|

· |

losses and liabilities from uninsured or underinsured business activities; |

|

· |

our failure to identify and consummate potential acquisitions; |

|

· |

our inability to integrate or realize the expected benefits from acquisitions; |

|

· |

impact of severe weather conditions; |

|

· |

restrictions on the availability of our customers to obtain water essential to the drilling and hydraulic fracturing processes; |

|

· |

our inability to meet regulatory requirements for use of certain chemicals by our tracer diagnostics business; |

|

· |

change in trade policy, including the impact of additional tariffs; |

|

· |

changes in legislation or regulation governing the oil and natural gas industry, including restrictions on emissions of greenhouse gases (“GHGs”); |

|

· |

failure to comply with or changes to federal, state and local and non-U.S. laws and other regulations, including anti-corruption and environmental regulations and the U.S. Tax Cuts and Jobs Act of 2017 (the “2017 Tax Act”); |

|

· |

loss of our information and computer systems; |

|

· |

system interruptions or failures, including cyber-security breaches, identity theft or other disruptions that could compromise our information; |

|

· |

our failure to establish and maintain effective internal control over financial reporting; |

|

· |

our success in attracting and retaining qualified employees and key personnel; and |

|

· |

our inability to satisfy technical requirements and other specifications under contracts and contract tenders. |

See Item 1A. “Risk Factors” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K for a further description of these and other factors that could cause actual results to differ materially from those in the forward-looking statements. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this Form 10-K. Any forward-looking statement made by us in this Form 10-K speaks only as of the date on which we make it. Factors or events

3

that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

We own or have the rights to use various trademarks, service marks and trade names referred to in this Form 10-K, including, among others, AirLock, MultiCycle, OST, Mongoose, PurpleSeal Express, Repeat Precision, NCS Multistage and NCS and their respective logos. Solely for convenience, we refer to trademarks, service marks and trade names in this Form 10-K without the TM, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, service marks or trade names appearing in this Form 10-K are the property of their respective owners.

Available information

Our website address is www.ncsmultistage.com. Information that we furnish to or file with the Securities and Exchange Commission (the “SEC”), including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, and any amendments to, or exhibits included in, those reports or statements are available for download, free of charge, on our website as soon as reasonably practicable after such materials are filed with or furnished to the SEC. From time to time, we also post announcements, updates, events, investor information and presentations on our website at http://ir.ncsmultistage.com in addition to copies of all recent press releases as means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Reports and statements that we file with or furnish to the SEC, including related exhibits, are also available on the SEC’s website at www.sec.gov. The contents of the websites referred to above are not incorporated into this filing. References to the URLs for these websites are intended to be inactive textual references only.

4

NCS Multistage Holdings, Inc. (“NCS,” the “Company,” “we,” “our” or “us”) is a leading provider of highly engineered products and support services that facilitate the optimization of oil and natural gas well completions and field development strategies. We provide our products and services primarily to E&P companies for use in onshore wells, predominantly wells that have been drilled with horizontal laterals in unconventional oil and natural gas formations. Our products and services are utilized in oil and natural gas basins throughout North America and in selected international markets, including Argentina, China, Russia, the Middle East and the North Sea. Our extensive research and development efforts are influenced and driven by the needs of our customers, allowing us to introduce innovative and commercial solutions that improve customer efficiency and profitability. We provided our products and services to over 325 customers in 2019, including leading large independent oil and natural gas companies and major oil companies.

Our primary offering is our fracturing systems products and services, which enable efficient pinpoint stimulation: the process of individually stimulating each entry point into a formation targeted by an oil or natural gas well. We began providing pinpoint stimulation products and services in 2006 and our fracturing systems products and services are typically utilized in cemented wellbores and enable our customers to precisely place stimulation treatments in a more controlled and repeatable manner as compared with traditional completion techniques. Fracturing systems products and services include our casing-installed sliding sleeves and downhole frac isolation assembly. Customers typically purchase our casing-installed sliding sleeves, a consumable product that is cemented at intervals into the casing of the wellbore and can also utilize services associated with our downhole frac isolation assembly, where our personnel supervise the use of the downhole frac isolation assembly during completion operations. Our fracturing systems products and services are utilized in conjunction with third-party providers of pressure pumping, coiled tubing and other services.

We own a 50% controlling interest in Repeat Precision, LLC (“Repeat Precision”), which we consolidate. Repeat Precision markets composite frac plugs and related products directly to customers and provides high-quality machining services for NCS products.

We provide tracer diagnostics services for well completion and reservoir characterization that utilize downhole chemical and radioactive tracers. Our customers utilize these services to better characterize their assets and to optimize completion designs. Chemical and radioactive tracer studies may provide a cost-effective and reliable means to determine the production profile along a lateral, assess fluid and proppant communication between wells during completions and determine stage and cluster level efficiency of completion designs.

We sell products for well construction, including our AirLock casing buoyancy system, liner hanger systems and toe initiation sleeves. Our customers utilize these products to safely and efficiently install casing and production liners, facilitate cementing operations and initiate a flow path into the formation at the commencement of stimulation operations.

We complement our proprietary products and services with our in-house reservoir strategies expertise, encompassing completions engineering, reservoir engineering and geology. These capabilities allow us to engage with our customers on well completion design and well spacing decisions, thereby supporting our customers’ completion optimization strategies and building lasting relationships.

Our revenue for the years ended December 31, 2019, 2018 and 2017, was $205.5 million, $227.0 million and $201.6 million, respectively. Our net (loss) income attributable to NCS Multistage Holdings, Inc. for the years ended December 31, 2019, 2018 and 2017, was $(32.8) million, $(190.3) million and $2.1 million, respectively. Our total assets for the years ended 2019, 2018 and 2017, were $202.6 million, $229.7 million and $463.9 million, respectively. For additional financial information by geographic area, see “Note 17. Segment and Geographic Information” of our consolidated financial statements.

Our business strategy is to increase the adoption of our products and services in all geographies, continue to be an innovator of technology and create value for our stockholders. We intend to achieve these objectives by (i) pursuing disciplined organic growth through increasing market adoption of our products and services in the United States, Canada and in select international markets, (ii) developing and introducing innovative technologies that are aligned with customer needs, (iii) maintaining financial strength and flexibility and (iv) selectively pursuing complementary acquisitions and joint ventures.

5

Through implementing this strategy, including the investment in Repeat Precision and the acquisition of Spectrum Tracer Services, LLC (“Spectrum”) in 2017, we have diversified our revenue base. In 2019, approximately 45% of our revenue was derived from fracturing systems products and services, nearly 25% was derived from Repeat Precision and approximately 15% was derived from each of our well construction products and tracer diagnostics services. This represents a more balanced portfolio, serving a larger addressable market than in 2016, when over 90% of our revenue was derived from fracturing services products and services, with the remainder from well construction products. In addition, this diversification of our revenue base has, in part, contributed to a reduction in the percentage of revenue derived from the Canadian market from 71% in 2016 to 42% in 2019.

Products and Services

We provide highly engineered products and support services that facilitate the optimization of oil and natural gas well completions and field development strategies. Our key products and services include:

|

· |

Fracturing Systems. Our fracturing systems products and services encompasses our technology developed to enable efficient pinpoint stimulation and re-stimulation strategies. Pinpoint stimulation is the process of individually stimulating each entry point into a formation targeted by an oil or natural gas well, a process that we believe improves on traditional completion techniques. Our pinpoint stimulation solutions and refined field processes are designed to enable efficient, controlled, verifiable and repeatable completions. |

Our fracturing systems products and services are comprised of our casing-installed sliding sleeves and our downhole frac isolation assemblies, which are deployed using coiled tubing. Our services include advising customers on optimizing completion designs and operating the downhole frac isolation assemblies.

|

· |

Casing-installed sliding sleeves. Our casing-installed sliding sleeves are a consumable product, sold to our customers and cemented in place in a well’s casing. We produce two primary models of sliding sleeves: our GripShift sliding sleeves, which can be opened only once, and our MultiCycle sliding sleeves, introduced in late 2013, which can be opened and closed multiple times throughout the life of a well giving our customers the benefit of additional completion options and the ability to better optimize a well’s production phase. Our casing-installed sliding sleeves can be utilized in both cemented and open-hole wellbores, with no practical limitation on the number of stages that can be installed in a well, and feature an inner-diameter which is the same as the casing in the wellbore. During completion operations, the downhole frac isolation assembly is placed in the sleeve and the inner barrel of the sleeve is shifted down, exposing the frac ports to the formation, allowing the completion of that stage to begin. |

|

· |

Downhole frac isolation assembly. Our proprietary downhole frac isolation assembly is comprised of several subcomponents, including a resettable bridge plug for stage isolation, a sleeve locator to efficiently locate our sliding sleeves in the wellbore, an abrasive perforating sub that can perforate the casing where our sliding sleeves are not installed and gauge packages that can measure and record downhole data. The assembly, which is attached to a third-party’s coiled tubing reel, is primarily used to locate our sliding sleeves, to establish wellbore isolation and to shift our sliding sleeves open or closed. In addition, gauges within the downhole frac isolation assembly record downhole pressure and temperature data, which can be utilized to optimize the design of future completions. Further, because our downhole frac isolation assembly is deployed on coiled tubing, our customers have access to real-time downhole pressure measurements which can be used to adjust strategies during a well completion. We typically own the assemblies and utilize them in our service to our customers. Our personnel operate the assemblies during completion operations in coordination with other on-site service providers. |

|

· |

Sand jet perforating. Our sand jet perforating technology uses a variation of the downhole frac isolation assembly utilized for shifting sleeves. Sand jet perforating is typically used with cemented wellbores. To cut access points into the formation, sand-laden fluid is pumped down the coiled tubing and through tungsten-carbide nozzles. The high-velocity slurry cuts through the casing and cement and into the formation. The tunnels created through this process serve as initiation points for stimulation. Stimulation treatments are pumped down the annulus between the coiled tubing and the casing. Although the sand jet perforating process requires more time per stage than using sliding sleeves, it provides a practical option for pinpoint stimulation in wells that are already cased, as in the case of drilled, but uncompleted wells. |

|

· |

SpotFrac system. Our SpotFrac system provides a means to straddle and mechanically isolate producing zones for targeted refracturing applications. The system includes a sand jet perforating assembly, enabling additional stages to be added if desired, and can perforate, isolate and stimulate multiple stages in a single trip. |

|

· |

BallShift sleeves. Our BallShift sliding sleeves can be cemented in place and are activated by pumping a ball from the surface that lands on seats in the sleeves, providing pinpoint stimulation. In some instances, the BallShift sleeves will be utilized together with our coiled-tubing deployed technology in a hybrid application to increase the number of stages that can be run in extended-reach applications, with the BallShift sleeves installed at the toe of such wells. |

6

|

· |

Repeat Precision. We own a 50% interest in Repeat Precision. Repeat Precision markets its high-performance Purple Seal line of composite frac plugs and bridge plugs, RP single-use disposable setting tools, Purple Seal Express systems, which combine a Purple Seal Frac Plug with a single-use disposable setting tool, and related products. It sells these products directly to E&P customers as well as to other oilfield services companies that act as distributors. Repeat Precision also provides high-quality machining services for certain NCS products. |

|

· |

Tracer Services. We provide chemical and radioactive tracer diagnostics technologies used by E&P companies to assess completion performance, evaluate well production, and optimize field development strategies. Our fracture fluid identifier tracers, water-soluble tracers (“WSTs”), oil-soluble tracers (“OSTs”) and natural gas tracers enable efficient, cost-effective downhole diagnostics, providing E&P companies with critical data to better optimize reservoir development and production. |

|

· |

Well Construction. Our well construction products are designed to allow our customers to safely and efficiently install casing and production liners, facilitate cementing operations and initiate a flow path into the formation at the commencement of stimulation operations. Our well construction products include: |

|

· |

AirLock casing buoyancy system. Our AirLock casing buoyancy system facilitates landing casing strings in horizontal wells without altering a customer’s preferred casing and cementing operations. The AirLock system, which is installed with a well’s casing, allows the vertical casing section to be filled with fluid, while the lateral section remains air-filled and buoyant. The enhanced buoyancy significantly reduces sliding friction, while the enhanced weight of the vertical section provides the force needed to push the casing to the toe of the well, ensuring the casing reaches the desired depth and reducing casing running time and cost. Our AirLock system consists of two components that are made up in the casing string during run-in: a debris-trap and a seal collar. The debris-trap is installed in a casing connection just above the float shoe and the seal collar is installed at the bottom-most point of the vertical portion of the wellbore. The seal collar contains a breakable seal that locks air in the lower section of casing while the upper section is run and filled with fluid. After the casing is landed, surface pressure is increased to fragment the seal at a predetermined pressure, leaving an unrestricted casing bore, while seal fragments are collected by the debris-trap, facilitating cementing operations. |

|

· |

Liner hanger systems. Our proprietary liner hanger systems are specifically designed to perform in complex horizontal wells and are fully compatible with our fracturing systems products. The liner hanger is used to distribute the loads and weight of the liner to the supporting casing. |

|

· |

Toe initiation sleeves. Our toe initiation sleeves are designed to provide initial formation access for multistage completions. After shifting open the toe initiation sleeve, a customer can perform a casing integrity test, a pre-frac injection fall-off test, flush the wellbore to facilitate the pumping of completion tools to the toe of the well or execute the first fracturing stage for the well. |

|

· |

Reservoir Strategies. Our specialized team of engineering consultants advises customers on optimized completion designs and field development strategies and evaluates well performance. Our in-house engineers help us strengthen our relationships with our customers and demonstrate the benefits of our fracturing systems products and services as compared to traditional completion techniques. |

Business History

We were incorporated in Delaware on November 28, 2012, under the name “Pioneer Super Holdings, Inc.” On December 13, 2016, we changed our name to “NCS Multistage Holdings, Inc.” On May 3, 2017, we completed the initial public offering (“IPO”) of our common stock.

Intellectual Property and Patent Protection

We have dedicated resources for the development of new technology and products designed to enhance the safety and efficiency of well construction and completions processes. Our sales and earnings are influenced by our ability to successfully introduce new or improved products to the market. Our MultiCycle sliding sleeves, downhole frac isolation assembly, AirLock casing buoyancy systems and other equipment involve a high degree of proprietary technology developed over several years, some of which are protected by patents.

We hold 29 U.S. utility patents and 25 related international utility patents that relate to our Airlock casing buoyancy system, OSTs, casing installed sliding sleeves, frac isolation assemblies, and the methods utilized in the provision of our services. Our U.S. utility patents expire between 2030 and 2037. Our international utility patents expire between 2025 and 2036.

We also have a number of U.S. and international patent applications pending. Some of these patent applications cover equipment and methods which are currently in development. The applications are in various stages of the patent prosecution process and patents may not issue on such applications in any jurisdiction for some time, if they issue at all.

7

We believe that our patents have historically been important in enabling us to compete in the market to supply our customers with our products and services. We intend to enforce, and have in the past vigorously enforced, our patents. We may from time to time in the future be involved in litigation to determine the enforceability, scope and validity of our patent rights. In addition to patent rights, we use a significant amount of trade secrets, or “know-how,” and other proprietary information and technology as well as licenses from third party intellectual property.

Customers

Our customer base primarily consists of oil and natural gas producers in North America and certain international markets as well as oilfield service companies. For the years ended December 31, 2019, 2018 and 2017, we had over 325, 310 and 240 customers, respectively. Our top five customers accounted for approximately 22%, 24% and 30% of our revenue for the years ended December 31, 2019, 2018 and 2017, respectively. No customer represented more than 10% of our revenue for the years ended December 31, 2019 and 2018. Crescent Point Energy (“Crescent Point”) accounted for 14% of our revenue during the year ended December 31, 2017. No other customer accounted for more than 10% of our revenue during 2017. Although we believe we have a broad customer base and wide geographic coverage of operations, the loss of one or more of our significant customers could have a material adverse effect on our results of operations.

Sales and Marketing

Our sales and marketing activities are performed through a technically-trained direct sales force. We recognize the importance of a technical marketing program in demonstrating the advantages of new technologies that offer benefits relative to established industry methodologies. Our technical sales force advises customers on the benefits of pinpoint stimulation, MultiCycle sliding sleeves, well construction products, tracer diagnostics services and our technical engineering resources.

In the U.S. and Canada, sales of our fracturing systems products and services, liner hangers, tracer diagnostics services and engineering services are made directly to E&P companies. Our customers also hire coiled tubing companies and pressure pumping services companies that work alongside us during the completion of a well. We provide our AirLock casing buoyancy system, liner hanger products and toe initiation sleeves directly to E&P companies as well as to oilfield services companies that act as distributors for those products. Although we do not typically maintain supply or service contracts with our customers, a significant portion of our sales represents repeat business. Repeat Precision, which maintains a sales force separate from NCS, sells its products directly to E&P companies as well as to oilfield services companies that act as distributors.

International sales are made through local NCS entities or to our local operating partners on a free on board or free carrier basis with a point of sale in the United States. Some of the locations in which we have operating partners or sales representatives include China and the Middle East. Our operating partners and representatives do not have authority to contractually bind our company, but market our products in their respective territories as part of their product or service offering.

We provide extensive support services and have developed proprietary methodologies for assessing and reporting the information that is collected on our downhole gauges and through tracer diagnostics evaluations. In addition, we provide engineering services to work with customers to evaluate post-completion well performance and on a pre-job basis to simulate the production and economic outcomes from pinpoint stimulation strategies relative to traditional completion techniques. We also provide technical education to the coiled tubing services companies and pressure pumping services companies, explaining the benefits of utilizing our technology for their operations and our customers.

In addition to the technical marketing effort, we occasionally engage in field trials to demonstrate the economic benefits of our products and services. Periodically, we will provide engineering services to E&P companies on a discounted basis, in exchange for their agreement to provide production data for direct comparison of the results of pinpoint stimulation to traditional completion techniques.

Seasonality

A substantial portion of our business is subject to quarterly variability. In Canada, we typically experience higher activity levels in the first quarter of each year, as our customers take advantage of the winter freeze to gain access to remote drilling and production areas. In the past, our revenue in Canada has declined during the second quarter due to warming weather conditions that result in thawing, softer ground, difficulty accessing drill sites and road bans that curtail drilling and completion activity. Access to well sites typically improves throughout the third and fourth quarters in Canada, leading to activity levels that are higher than in the second quarter, but lower than activity in the first quarter. Our business can also be impacted by a reduction in customer activity during the winter holidays in late December and early January. In recent years, many customers in the U.S. exhausted their capital budgets prior to the end of the year, leading to reductions in drilling and completion activity during the fourth quarter.

8

Suppliers and Raw Materials

We acquire component parts and raw materials from suppliers, including machine shops. The prices we pay for our raw materials may be affected by, among other things, energy, steel and other commodity prices, tariffs and duties on imported materials and foreign currency exchange rates. Most of the raw materials we use in our operations, such as steel in various forms, electronic components, chemicals and elastomers are available from many sources.

We generally try to purchase our raw materials from multiple suppliers, so we are not dependent on any one supplier. We will generally utilize multiple machine shops for the manufacturing of our component parts so that we are not dependent on any one machine shop. Our suppliers are also active in multiple regions which allows us to react to changes in foreign currency exchange rates and tariffs and duties. For example, we have made changes to the suppliers of certain raw materials based on tariff rates. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information.

During 2017, we added suppliers to increase third-party component part supply capacity. In addition, Repeat Precision allows us to reduce our costs for certain product categories.

Operating Risks and Insurance

We currently carry a variety of insurance for our operations. Although we believe we currently maintain insurance coverage adequate for the risks involved, there is a risk our insurance may not be sufficient to cover any particular loss or that our insurance may not cover all losses.

Competition

The markets in which we operate are highly competitive. To be successful, we must provide services and products that meet the specific needs of E&P companies at competitive prices. We compete in all areas of our operations with a number of companies, some of which have financial and other resources greater than or comparable to ours.

We believe that we compete not only against other providers of pinpoint stimulation equipment and services, but also with companies that support the other primary means of hydraulically fracturing a horizontal well, including plug and perf and ball drop completions. We also compete with other suppliers of well construction products, tracer diagnostics services, and composite frac plugs.

Our major competitors for our completion products and services include Baker Hughes Company (“Baker Hughes”), Core Laboratories N.V., Forum Energy Technologies, Inc., Halliburton Company, Innovex Downhole Solutions, Nine Energy Service, Inc., Oil States International, Inc., Packers Plus Energy Services, Schlumberger Limited, Schoeller-Bleckmann Oilfield Equipment AG and Weatherford International public limited company as well as a number of smaller or regional competitors.

We believe that the most significant factors influencing a customer’s decision to utilize our equipment and services are technology, service quality, safety track record and price. While we must be competitive in our pricing, we believe our customers select our products and services based on the technical attributes of our products and equipment, the level of technical and operational service we provide before, during and after the job, and the know-how derived from our extensive operational track record.

Environmental and Occupational Health and Safety Matters

We are subject to stringent and complex federal, state, provincial and local laws and regulations governing the discharge of materials into the environment or otherwise relating to protection of worker health, safety and the environment. Compliance with these laws and regulations may require the acquisition of permits to conduct regulated activities, capital expenditures to prevent, limit or address emissions and discharges, and stringent practices to handle, recycle and dispose of certain wastes and materials. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial or corrective obligations, and the issuance of injunctive relief.

We believe that we are in substantial compliance with applicable environmental, health and safety laws and regulations. Further, we do not anticipate that compliance with existing environmental, health and safety laws and regulations will have a material effect on our consolidated financial statements. However, laws and regulations protecting the environment generally have become more stringent in recent years and are expected to continue to do so. It is possible, that substantial costs for compliance with applicable environmental, health and safety laws and regulations may be incurred in the future. Moreover, it is possible that other developments, such as the adoption of stricter environmental laws, regulations, and enforcement policies, could result in additional costs or liabilities that we cannot currently quantify.

9

While we do not anticipate that compliance with existing environmental, health and safety laws and regulations will have a direct adverse effect on our operations, our customers are subject to a wide range of such laws and regulations, which could materially and adversely affect their businesses and indirectly, through reduced demand for our products and services, have a material adverse effect on our business, financial condition and results of operations, including with respect to the following:

|

· |

Air Emissions. The Federal Clean Air Act (the “CAA”) and comparable state laws regulate emissions of various air pollutants through air emissions permitting programs and the imposition of other emission control requirements. In addition, the Environmental Protection Agency (“EPA”) has developed, and continues to develop, stringent regulations governing emissions of toxic air pollutants at specified sources. Non-compliance with air permits or other requirements of the CAA and associated state laws and regulations can result in the imposition of administrative, civil and criminal penalties, as well as the issuance of orders or injunctions limiting or prohibiting non-compliant operations. |

|

· |

Water Discharges. The Federal Clean Water Act (the “CWA”), and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into state waters or waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. Federal and state regulatory agencies can impose administrative, civil and criminal penalties as well as other enforcement mechanisms for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations. |

|

· |

Climate Change. Our customers are or may become subject to statutes or regulations aiming to reduce emissions of GHGs. In December 2009, the EPA determined that emissions of carbon dioxide, methane and other GHGs present an endangerment to public health and the environment because emissions of such gases are, according to the EPA, contributing to warming of the earth’s atmosphere and other climatic changes. Based on these findings, the EPA has begun adopting and implementing regulations to restrict emissions of GHGs under existing provisions of the CAA. For example, in June 2016, the EPA published final rules under the CAA that establish new and more stringent emission control standards for methane and volatile organic compounds (“VOCs”) released from new and modified oil and natural gas development and production operations. These rules could have an adverse effect on our customers and result in an indirect material adverse effect on our business. However, the EPA has taken action to stay final implementation of the rules and has proposed certain modifications. The rules also have been the subject of litigation. As a result, the future implementation of these rules remains uncertain. In addition, the United States and Canada are among almost 200 nations that, in December 2015, agreed to the Paris Agreement, an international climate change agreement that calls for countries to set their own GHG emissions targets and be transparent about the measures each country will use to achieve its GHG emissions targets. The agreement entered into force on November 4, 2016. On June 1, 2017, the current United States administration announced that the United States would be pulling out of the Paris Agreement. Although it is not possible at this time to predict how any legal requirements imposed following the implementation of the Paris Agreement that may be adopted or issued to address GHG emissions would impact our business or that of our customers, any such future laws, regulations or legal requirements imposing reporting or permitting obligations on, or limiting emissions of GHGs from, oil and natural gas exploration activities could require our customers to incur costs to reduce emissions of GHGs associated with their operations. In addition, substantial limitations on GHG emissions could adversely affect demand for the oil and natural gas our customers produce. |

|

· |

Non-Hazardous and Hazardous Wastes. The Resource Conservation and Recovery Act (“RCRA”) and comparable state laws control the management and disposal of hazardous and non-hazardous waste. These laws and regulations govern the generation, storage, treatment, transfer and disposal of wastes that our customers generate. Drilling fluids, produced waters, and most of the other wastes associated with the exploration, development, and production of oil or natural gas, if properly handled, are currently exempt from regulation as hazardous waste under RCRA and, instead, are regulated under RCRA’s less stringent non-hazardous waste provisions, state laws or other federal laws. It is possible, however, that certain oil and natural gas drilling and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. A loss of the RCRA exclusion for drilling fluids, produced waters and related wastes could result in an increase in our customers’ costs to manage and dispose of generated wastes and a corresponding decrease in their drilling operations, which developments could have a material adverse effect on our business. |

The Comprehensive Environmental Response, Compensation, and Liability Act, and comparable state laws, impose joint and several liability, without regard to fault or legality of conduct, on classes of persons who are considered to be responsible for the release of a hazardous substance into the environment. These persons include the owner or operator of the site where the release occurred, and anyone who disposed or arranged for the disposal of a hazardous substance released at the site. In addition, it is not uncommon for neighboring landowners and other third-parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment.

The oil and natural gas industry is extensively regulated by numerous federal, state and local authorities. Legislation affecting the oil and natural gas industry is under constant review for amendment or expansion, frequently increasing the regulatory burden. Also, numerous departments and agencies, at the federal, state and local level, are authorized to issue rules and regulations that are binding on the oil and natural gas industry and its individual members, some of which carry substantial penalties for failure to comply.

10

Although changes to the regulatory burden on the oil and natural gas industry could affect the demand for our services, we would not expect to be affected any differently or to any greater or lesser extent than other companies in the industry with similar operations.

Our customers’ operations are subject to various types of regulation at the federal, state and local level. These types of regulation include requiring permits for the drilling of wells, drilling bonds and reports concerning operations. The effect of these regulations may be to limit or increase the cost of oil and natural gas E&P, which could have a material adverse effect on our customers and indirectly materially and adversely affect our business.

We supply equipment and services to customers in the oil and natural gas industry conducting hydraulic fracturing operations. Although we do not directly engage in hydraulic fracturing activities, our customers purchase our products and services for use in their hydraulic fracturing activities. Hydraulic fracturing is typically regulated by state oil and natural gas commissions and similar agencies. Some states have adopted, and other states are considering adopting, regulations that could impose new or more stringent permitting, disclosure or well construction requirements on hydraulic fracturing operations. States could also elect to prohibit high volume hydraulic fracturing altogether, following the approach taken by the State of New York in 2015. Aside from state laws, local land use restrictions may restrict drilling in general or hydraulic fracturing in particular. Municipalities may adopt local ordinances attempting to prohibit hydraulic fracturing altogether or, at a minimum, allow such fracturing processes within their jurisdictions to proceed but regulating the time, place and manner of those processes. In addition, federal agencies have asserted regulatory authority over the process and various studies have also been conducted or are currently underway by the EPA, and other federal agencies concerning the potential environmental impacts of hydraulic fracturing activities. State and federal regulatory agencies have recently focused on a possible connection between the operation of injection wells used for oil and natural gas waste disposal and seismic activity. Similar concerns have been raised that hydraulic fracturing may also contribute to seismic activity. At the same time, certain environmental groups have suggested that additional laws may be needed to more closely and uniformly limit or otherwise regulate the hydraulic fracturing process, and legislation has been proposed by some members of Congress to provide for such regulation.

The adoption of new laws or regulations at the federal or state levels prohibiting, limiting or otherwise regulating the hydraulic fracturing process could make it more difficult, or even impossible, to complete oil and natural gas wells, increase our customers’ costs of compliance and doing business, and otherwise adversely affect the hydraulic fracturing services they perform, which could negatively impact demand for our products and services. In addition, heightened political, regulatory, and public scrutiny of hydraulic fracturing practices could expose us or our customers to increased legal and regulatory proceedings, which could be time-consuming, costly, or result in substantial legal liability or significant reputational harm. We could be directly affected by adverse litigation involving us, or indirectly affected if the cost of compliance limits the ability of our customers to operate. Such costs and scrutiny could directly or indirectly, through reduced demand for our products and services, have a material adverse effect on our business, financial condition and results of operations.

We are subject to a number of federal and state laws and regulations, including the federal Occupational Safety and Health Act and comparable state statutes, establishing requirements to protect the health and safety of workers. Substantial fines and penalties can be imposed and orders or injunctions limiting or prohibiting certain operations may be issued in connection with any failure to comply with laws and regulations relating to worker health and safety.

Part of our business involves the use of radioactive tracers, typically consisting of three standard isotopes (Iridium 192, Scandium 46 and Antimony 124), to help determine the existence of fractures within a well formation. The use of these materials requires us to obtain and comply with radioactive materials licenses issued by the U.S. Nuclear Regulatory Commission (“NRC”) or its counterparts in the states where we perform these services if they are among the states to which the NRC has delegated its regulatory authority pursuant to the Atomic Energy Act (so-called “Agreement States”). Under the terms of these licenses, we are required to train designated personnel, maintain records, submit periodic reports, ensure the safety and reliability of related equipment and storage facilities, conduct radiation safety monitoring, and ensure the proper disposal of materials and equipment at the end of their useful lives. In the event we fail to adequately comply with these requirements, we could be subject to enforcement action, which could include fines, injunctive relief, or the revocation of our licenses.

As of December 31, 2019, we had 395 employees of which 394 are full-time employees. As of such date, 268 of our employees were based in the United States, 122 were based in Canada and five were based outside of North America. Our international operations are currently serviced by employees operating out of the United States and Canada. In addition, our consolidated joint venture, Repeat Precision, has 301 employees, 21 of which are based in the U.S. and 280 of which are based in Mexico. We are not a party to any collective bargaining agreements, and we consider our relations with our employees to be good.

11

Described below are certain risks that we believe apply to our business and the industry in which we operate. You should carefully consider each of the following risk factors in conjunction with other information provided in this Form 10-K and in our other public disclosures. The risks described below highlight potential events, trends or other circumstances that could adversely affect our business, financial condition, results of operations, cash flows, liquidity or access to sources of financing, and consequently, the market value of our common stock. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially adversely affect our business, financial condition and results of operations. All forward-looking statements made by us or on our behalf are qualified by the risks described below.

Risks Related to Our Business and the Oil and Natural Gas Industry

Our business depends on the levels of expenditures by companies in the oil and natural gas industry and particularly on the level of E&P activity within Canada and the United States.

Demand for our products and services depends substantially on the level of expenditures by companies in the oil and natural gas industry. These expenditures are generally dependent on our customers’ views of future oil and natural gas prices and are sensitive to our customers’ views of future economic growth and the resulting impact on demand for oil and natural gas. Declines, as well as anticipated declines, in oil and gas prices could result in project modifications, delays or cancellations, general business disruptions, and delays in payment of, or nonpayment of, amounts that are owed to us. For example, between the third quarter of 2014 and the first quarter of 2016, oil and natural gas commodity prices declined significantly. The low commodity price environment resulted in a reduction in the drilling, completion and other production activities of most of our customers and a reduction in their spending on our products and services. The reduction in demand from our customers reduced the prices we were able to charge our customers for our products and services. Although oil pricing has improved since mid-2016, oil and natural gas prices remain volatile, and prolonged reductions in oil and natural gas prices have had and may continue to have a material adverse effect on our business, financial condition and results of operations. In addition, more stable or higher commodity prices do not necessarily translate to a higher level of expenditures by companies in the oil and natural gas industry. For example, in recent years, investors in E&P companies have been prioritizing free cash flow and return of capital to shareholders over production growth, leading to lower expenditures. This trend may continue, even if commodity prices were to increase.

Many factors over which we have no control affect the supply of and demand for, and our customers’ willingness to explore, develop and produce oil and natural gas, and therefore, influence demand levels and prices for our products and services, including:

|

· |

the domestic and foreign supply of and demand for oil and natural gas; |

|

· |

the level of prices, and expectations about future prices, of oil and natural gas; |

|

· |

the level of global oil and natural gas E&P; |

|

· |

the cost of exploring for, developing, producing and delivering oil and natural gas; |

|

· |

the expected decline rates of current production; |

|

· |

the price and quantity of foreign imports; |

|

· |

political and economic conditions in oil producing countries, including the Middle East, Africa, South America and Russia; |

|

· |

the ability of members of the Organization of Petroleum Exporting Countries (“OPEC”) to agree to and maintain oil price and production controls; |

|

· |

speculative trading in crude oil and natural gas derivative contracts; |

|

· |

the level of consumer product demand; |

|

· |

the discovery rates of new oil and natural gas reserves; |

|

· |

contractions in the credit market; |

|

· |

the strength or weakness of the U.S. dollar; |

|

· |

available pipeline and other transportation capacity; |

|

· |

the levels of oil and natural gas storage; |

|

· |

weather conditions and other natural disasters; |

|

· |

regional or global health epidemics; |

|

· |

political instability in oil and natural gas producing countries; |

12

|

· |

domestic and foreign tax policy; |

|

· |

domestic and foreign governmental approvals and regulatory requirements and conditions; |

|

· |

the continued threat of terrorism and the impact of military and other action, including military action in the Middle East; |

|

· |

technical advances affecting energy demand, generation and consumption; |

|

· |

the proximity and capacity of oil and natural gas pipelines and other transportation facilities; |

|

· |

alternative fuel requirements or technological advances and the demand and availability of alternative fuel sources; |

|

· |

fuel conservation measures; |

|

· |

the ability of oil and natural gas producers to raise equity capital and debt financing; |

|

· |

merger and divestiture activity among oil and natural gas producers; and |

|

· |

overall domestic and global economic conditions. |

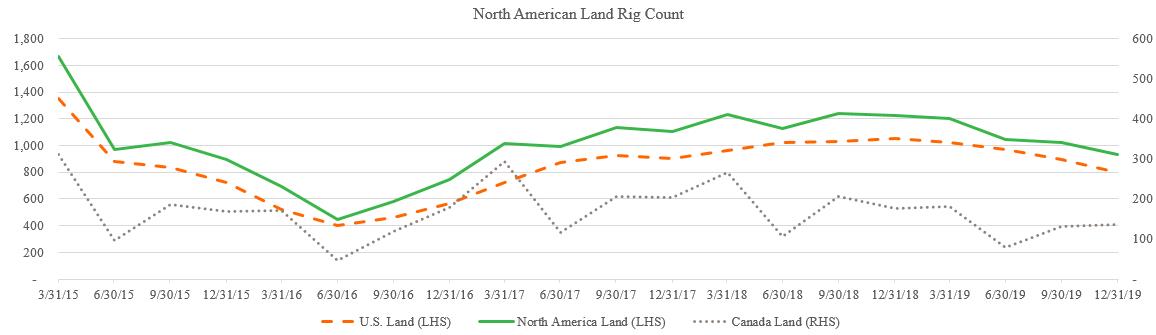

These factors and the volatility of the energy markets make it difficult to predict future oil and natural gas price movements with any certainty. Any of the above factors could impact the level of oil and natural gas E&P activity and could have a material adverse effect on our business, financial condition and results of operations. In addition, regardless of the macro commodity price environment, our current or prospective customers may experience certain constraints that disproportionately impact their business and reduce their expenditures. During the second half of 2018, our Canadian customers experienced a widening of oil price differentials due to pipeline constraints which continued through the end of 2019 and are expected to continue well into the future. Drilling and completion activity in the U.S. and Canada fell in 2019 as compared to 2018 and E&P capital budgets which have been announced for 2020 indicate a further reduction in activity. Further, should a low commodity price environment impact our customers’ expenditures, we could encounter difficulties such as an inability to access needed capital on attractive terms or at all, the incurrence of further impairment charges, an inability to meet the financial ratios contained in our debt agreements, a need to reduce our capital spending and other similar impacts any of which could have a material adverse effect on our business, financial condition and results of operations.

The cyclicality of the oil and natural gas industry may cause our results of operations to fluctuate.

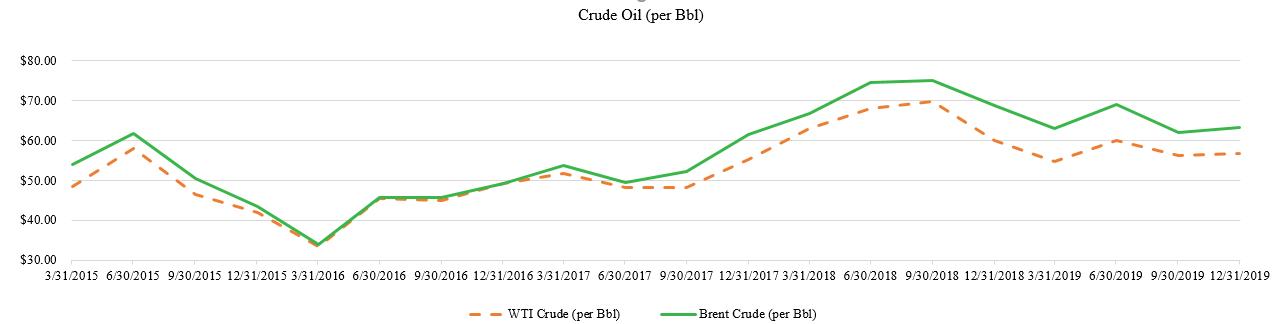

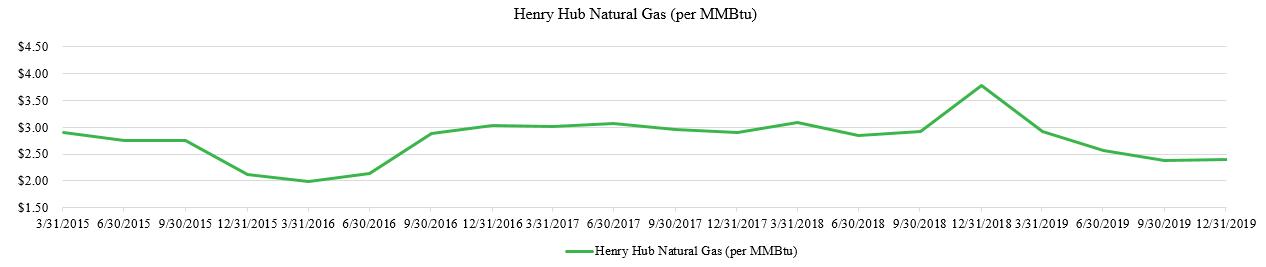

We derive our revenues from companies in the oil and natural gas E&P industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. Prices for oil and natural gas historically have been extremely volatile and are expected to continue to be volatile. During the past five years, the posted West Texas Intermediate (“WTI”) price for oil has ranged from a low of $26.21 per barrel, or Bbl, in February 2016 to a high of $77.41 per Bbl in June 2018. Over the same period, the Henry Hub spot market price of natural gas has ranged from a low of $1.49 per million British thermal units, or MMBtu, in March 2016 to a high of $6.24 per MMBtu in January 2018. During 2018, WTI prices ranged from $44.48 to $77.41 per Bbl and during 2019, WTI prices ranged from $46.31 to $66.24 per Bbl. During 2018, the Henry Hub spot market price of natural gas ranged from $2.49 to $6.24 per MMBtu and during 2019, the Henry Hub spot market price of natural gas ranged from $1.75 to $4.25 per MMBtu. We have, and may in the future, experience significant fluctuations in operating results as a result of the reactions of our customers to changes in oil and natural gas prices. For example, prolonged low commodity prices experienced by the oil and natural gas industry during 2015 and 2016, combined with adverse changes in the capital and credit markets, caused many E&P companies to reduce their capital budgets and drilling activity. This resulted in a significant decline in demand for oilfield services and adversely impacted the prices oilfield services companies could charge for their services. We have master services agreements (“MSAs”) with most of our customers which have no minimum purchase requirements. As a result, most of our customers are not obligated to buy our products or utilize our services for an extended period or at all.

Low commodity price environments can negatively impact oil and natural gas E&P companies and, in some cases, impair their ability to timely pay for products or services provided or can result in their insolvency or bankruptcy, any of which exposes us to credit risk of our oil and natural gas E&P customers.

We are subject to the risk of loss resulting from nonpayment or nonperformance by our customers, many of whose operations may be concentrated in certain markets which, as described above, are subject to volatility and, therefore, credit risk. Our credit procedures and policies may not be adequate to fully reduce customer credit risk. If we are unable to adequately assess the creditworthiness of existing or future customers or unanticipated deterioration in their creditworthiness, any resulting increase in nonpayment or nonperformance by them could have a material adverse effect on our business, financial condition and results of operations. Further, in weak economic and commodity price environments, we may experience difficulties, delays or failures in collecting outstanding receivables from many customers, due to, among other reasons, a reduction in their cash flow from operations, their inability to access the credit markets and, in certain cases, their insolvencies. Further, laws in some jurisdictions in which we operate could make collection unlikely, difficult or time consuming. Such collection issues could have a material adverse effect on our business, financial condition and results of operations.

13

To the extent one or more of our key customers commences bankruptcy proceedings, our contracts with these customers may be subject to rejection under applicable provisions of the United States Bankruptcy Code and similar international laws, or may be renegotiated. Further, during any such bankruptcy proceeding, prior to assumption, rejection or renegotiation of such contracts, the bankruptcy court may temporarily authorize the payment of value for our services less than contractually required, which could also have a material adverse effect on our business, financial condition and results of operations.

We may not be able to successfully implement our strategy of increasing sales of our products and services for use in basins located in the United States.

A key component of our growth strategy is to increase our market share in the United States. We sell a variety of products and services in the United States, including our fracturing systems, well construction, tracer diagnostic services and composite frac plugs and related products through Repeat Precision. In many of the product and service categories, we have been selling in the United States for a shorter period of time than we have been selling in Canada and thus must convince potential customers about either the value of the emerging technology compared to traditional methods or, in the case of more mature technology offerings, our differentiated benefits.

Our primary offering is our fracturing systems products and services. Currently, most E&P companies in the United States rely on traditional well completion techniques and do not utilize pinpoint stimulation. In certain circumstances, it has been and may continue to be difficult convincing potential customers of the benefits of our technologies relative to traditional well completion techniques. If we are unable to convince potential customers in the United States of the benefits of pinpoint stimulation, our strategy to increase the level of sales of our products and services in the United States would be negatively impacted, harming our growth prospects. Additionally, the sales of our products and services depend in large part on the perception of pinpoint stimulation in the oil and natural gas industry. Unfavorable industry reports or poor well performance for wells that were completed using pinpoint stimulation would harm the perception of pinpoint stimulation and technological advances in traditional well completion techniques could make it more difficult to convince potential customers to adopt pinpoint stimulation, which could impact our ability to grow our U.S. sales and harm our growth prospects. In other product and service categories, we often compete in markets with many other competitors which may make it difficult to increase market share in the United States, as further described in the risk factor below.

Competition within our industry may adversely affect our ability to market our services.

The markets in which we operate are generally highly competitive. The principal competitive factors in our market are technology, service quality, safety track record and price. We compete with large national and multi-national companies that have substantially longer operating histories, greater financial, technical and other resources and greater name recognition than we do. Several of our competitors provide a broader array of services and have a stronger presence in more geographic markets. In addition, we compete with several smaller companies capable of competing effectively on a regional or local basis. These companies may be able to charge lower prices for competing products and services, particularly if a company maintains a lower cost structure by investing in less research and development activities. These products and services offered by lower-priced competitors may be more attractive to our customers in lower commodity price environments, even if the products or services offered are inferior. Also, our competitors may be able to respond more quickly to new or emerging technologies, products and services and changes in customer requirements. These responses may come from direct competitors who offer similar products or services or competitors who offer substitutes. In certain circumstances, work is awarded on a bid basis, which further increases competition based on price. Pricing is often the primary factor in determining which qualified contractor is awarded the work. The competitive environment may be further intensified when oil and gas companies reduce their expenditures, leading to excess capacity and additional pricing pressure. In addition, mergers and acquisitions among oil and natural gas companies or other events that have the effect of reducing the number of available customers may make the environment more competitive. As a result of competition, we may lose market share or be unable to maintain or increase prices for our present products or services or to acquire additional business opportunities, which could have a material adverse effect on our business, financial condition and results of operations.

A single customer constituted 8% of our revenue for the years ended December 31, 2019 and 2018 and 14% of our revenue for the year ended December 31, 2017. The loss of that customer or any other of our significant customers, or their failure to pay the amounts they owe us, could cause our revenue to decline substantially.

Our largest customer is Crescent Point which accounted for approximately 8% for the years ended December 31, 2019 and 2018 and 14% of our revenue for the year ended December 31, 2017. Additionally, our top five customers accounted for approximately 22%, 24% and 30% of our revenue for the years ended December 31, 2019, 2018 and 2017, respectively. It is likely that we will continue to derive a significant portion of our revenue from these customers in the near future. If any of these customers decided not to continue to use our products and services, our revenue would decline, which could have a material adverse effect on our business, financial condition and results of operations. In addition, we are subject to credit risk due to the concentration of our customer base. Any nonperformance by these customers, including their failure to pay the amounts they owe us, either as a result of changes in general financial and economic conditions, conditions in the oil and natural gas industry or otherwise, could have a material adverse effect on our business, financial condition and results of operations.

14

Impairment in the carrying value of long-lived assets and goodwill could negatively affect our operating results

We evaluate our property and equipment and finite-lived intangible assets for impairment whenever changes in circumstances indicate that the carrying amount of an asset group may not be recoverable. Should the review indicate that the carrying value is not fully recoverable, the amount of the impairment loss is determined by comparing the carrying value to the estimated fair value. We assess recoverability based on undiscounted future net cash flows, which requires us to make judgements regarding long-term forecasts which are uncertain and require various assumptions. If changes in these assumptions occur, our expectations regarding future net cash flows may change such that a material impairment could result. There was no impairment of fixed assets and finite-lived intangible assets during the years ended December 31, 2019 or 2017. For the year ended December 31, 2018, we recognized an impairment charge of $73.5 million related to identifiable intangible assets. See “Note 2. Summary of Significant Accounting Policies” and “Note 7. Goodwill and Intangibles” of our consolidated financial statements for further information related to these charges. There was no impairment related to fixed assets in 2018.

An assessment for goodwill impairment is performed annually or when there is an indication an impairment may have occurred. Goodwill is reviewed for impairment by comparing the carrying value of the reporting unit’s net assets (including allocated goodwill) to the fair value of the reporting unit. Determining the fair value of a reporting unit requires the use of estimates, assumptions and judgement. For the year ended December 31, 2019, we recognized an impairment charge of $7.9 million for our tracer diagnostic services reporting unit. For the year ended December 31, 2018, we recognized an impairment charge of $154.0 million for two reporting units, fracturing systems and well construction of $122.1 million and tracer diagnostic services of $31.9 million. See “Note 2. Summary of Significant Accounting Policies” and “Note 7. Goodwill and Intangibles” for further information related to these charges. No impairment loss was recorded for the year ended December 31, 2017.

We are unable to predict whether further impairments of one or more of our long-lived assets or investments may occur in the future. A determination that goodwill, a long-lived asset, or other investments are impaired would result in additional non-cash charges that could materially adversely affect our business, financial condition and results of operations.

Our success depends on our ability to develop and implement new technologies, products and services.

Our success depends on the ongoing development and implementation of new product designs and improvements, and on our ability to protect and maintain critical intellectual property assets related to these developments. If we are unable to continue to develop and produce competitive technology or deliver it to our clients in a timely and cost-competitive manner in the various markets we serve, it could have a material adverse effect on our business, financial condition and results of operations. Also, if we are not able to obtain patent or other intellectual property protection of our technology, we may not be able to recoup development costs or fully exploit systems, services and technologies in a manner that allows us to meet evolving industry requirements at prices acceptable to our customers. In addition, some of our competitors are large national and multinational companies that may be able to devote greater financial, technical, manufacturing and marketing resources to research and development of new systems, services and technologies than we are able to do.

Investments in new technologies involve uncertainties and risk. Commercial success depends on many factors, including the levels of innovation, the development costs and the availability of capital resources to fund those costs, the levels of competition from others developing similar or other competing technologies, our ability to obtain or maintain government permits or certifications, the effectiveness of production, distribution and marketing efforts, and the costs to customers to deploy and provide support for the new technologies. In addition, it may take long periods of time to develop new technologies and we may not accurately predict the future needs of our customers or the competitive landscape. We may not achieve significant revenues from new product and service investments for a number of years, if at all, which could have a material adverse effect on our business, financial condition and results of operations.

Advancements in drilling and well completion technologies could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our industry is characterized by rapid and significant technological advancements and introductions of new products and services using new technologies. As new well completion technologies develop, we may be placed at a competitive disadvantage, and competitive pressure may force us to implement new technologies at a substantial cost. We may not be able to successfully acquire or use new technologies. New technologies, services or standards, including improvements to existing competing technologies, could render our technologies, products or services obsolete, which could have a material adverse effect on our business, financial condition and results of operations. In addition, the development of new processes to replace hydraulic fracturing altogether or that replace our technologies, could cause a decline in the demand for the products and services that we provide and could result in a material adverse effect on our business, financial condition and results of operations.

15

Our competitors may infringe upon, misappropriate, violate or challenge the validity or enforceability of our intellectual property and we may not be able to adequately protect or enforce our intellectual property rights in the future.

We currently hold multiple U.S. and international patents and have multiple pending patent applications for products and processes. Patent rights give the owner of a patent the right to exclude third parties from making, using, selling, and offering for sale the inventions claimed in the patents in the applicable country. Patent rights do not necessarily grant the owner of a patent the right to practice the invention claimed in a patent, but merely the right to exclude others from practicing the invention claimed in the patent. It may be possible for a third-party to design around our patents. Furthermore, patent rights have strict territorial limits. We may not be able to enforce our patents against infringement occurring in “non-covered” territories. Also, we do not have patents in every jurisdiction in which we conduct business and our patent portfolio will not protect all aspects of our business and may relate to obsolete or unusual methods, which would not prevent third parties from entering the same market.

Despite our efforts to safeguard our intellectual property rights, we may not be successful in doing so, or the steps taken by us in this regard may not be adequate to detect or deter misappropriation of our technology or to prevent an unauthorized third party from copying or otherwise obtaining and using our products, technology or other information that we regard as proprietary. Moreover, our competitors may independently develop equivalent knowledge, methods and know‑how. Competitors could purchase our products and attempt to replicate some or all of the competitive advantages we derive from our development efforts, infringe our intellectual property rights, design around our protected technology or develop their own competitive technologies that fall outside of our intellectual property rights. If we do not prevail in the Federal Court lawsuit, it could impact the strength or validity of the patents in question. Our inability to adequately protect our intellectual property could allow our competitors and other third parties to produce products based on our patented or proprietary technology and other intellectual property rights, providing increased competition and pricing pressure, which could substantially impair our ability to compete.

In addition, by customarily entering into employment, confidentiality and/or license agreements with our employees, customers and potential customers and suppliers, we attempt to limit access to and distribution of our technology. Our rights in our confidential information, trade secrets, and confidential know-how will not prevent third parties from independently developing similar information. Publicly available information (e.g. information in expired issued patents, published patent applications, and scientific literature) can also be used by third parties to independently develop technology. This independently developed technology may be equivalent or superior to our proprietary technology.