Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - RED TRAIL ENERGY, LLC | certification3119-30x19.htm |

| EX-32.2 - EXHIBIT 32.2 - RED TRAIL ENERGY, LLC | certification3229-30x19.htm |

| EX-32.1 - EXHIBIT 32.1 - RED TRAIL ENERGY, LLC | certification3219-30x19.htm |

| EX-31.2 - EXHIBIT 31.2 - RED TRAIL ENERGY, LLC | certification3129-30x19.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

For the fiscal year ended September 30, 2019 | |

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

For the transition period from __________ to __________ | |

COMMISSION FILE NUMBER 000-52033 | |

RED TRAIL ENERGY, LLC

(Exact name of registrant as specified in its charter)

North Dakota | 76-0742311 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

3682 Highway 8 South, P.O. Box 11, Richardton, ND 58652 | ||||

(Address of principal executive offices) | ||||

(701) 974-3308 | ||||

(Registrant's telephone number, including area code) | ||||

Securities registered pursuant to Section 12(b) of the Act: None. | ||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: Class A Membership Units | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o | Accelerated Filer o |

Non-Accelerated Filer x | Smaller Reporting Company o |

Emerging Growth Company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

The aggregate market value of the membership units held by non-affiliates of the registrant as of March 31, 2019 was $34,969,920. There is no established public trading market for our membership units. The aggregate market value was computed by reference to the most recent offering price of our Class A units which was $1 per unit.

As of December 20, 2019, there were 40,148,160 Class A Membership Units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant has incorporated by reference into Part III of this Annual Report on Form 10-K portions of its definitive proxy statement to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year covered by this Annual Report.

1

INDEX

Page Number | |

2

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains historical information, as well as forward-looking statements that involve known and unknown risks and relate to future events, our future financial performance, or our expected future operations and actions. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "future," "intend," "could," "hope," "predict," "target," "potential," or "continue" or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions based on current information and involve numerous assumptions, risks and uncertainties. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the reasons described in this report. While it is impossible to identify all such factors, factors that could cause actual results to differ materially from those estimated by us include:

• | The reduction or elimination of the renewable fuels use requirement in the Federal Renewable Fuels Standard (RFS); |

• | The Chinese distillers grains tariffs and their impact on world distillers grains markets; |

• | The Chinese and Brazilian ethanol import duties and their impact on world ethanol demand and prices; |

• | Any delays in shipping our products by rail and corresponding decreases in our sales as a result of these shipping delays; |

• | An unfavorable spread between the market price of our products and our feedstock costs; |

• | Fluctuations in the price and market for ethanol, distillers grains and corn oil; |

• | Availability and costs of our raw materials, particularly corn and natural gas; |

• | Changes in or lack of availability of credit; |

• | Changes in the environmental regulations that apply to our plant operations and our ability to comply with such regulations; |

• | Ethanol supply exceeding demand and corresponding ethanol price reductions impacting our ability to operate profitably and maintain a positive spread between the selling price of our products and our raw material costs; |

• | Our ability to generate and maintain sufficient liquidity to fund our operations, meet debt service requirements and necessary capital expenditures; |

• | Our ability to continue to meet our loan covenants; |

• | Limitations and restrictions contained in the instruments and agreements governing our indebtedness; |

• | Results of our hedging transactions and other risk management strategies; |

• | Changes in or elimination of governmental laws, tariffs, trade or other controls or enforcement practices that currently benefit the ethanol industry including: |

◦ | national, state or local energy policy - examples include legislation already passed such as the California low-carbon fuel standard as well as potential legislation in the form of carbon cap and trade; |

◦ | legislation mandating the use of ethanol or other oxygenate additives; or |

◦ | environmental laws and regulations that apply to our plant operations and their enforcement. |

• | Changes and advances in ethanol production technology; and |

• | Competition from alternative fuels and alternative fuel additives. |

Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in this report. We are not under any duty to update the forward-looking statements contained in this report. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this report. You should read this report and the documents that we reference in this report and have filed as exhibits completely and with the understanding that our actual future results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements.

AVAILABLE INFORMATION

Information about us is also available at our website at www.redtrailenergyllc.com, under "SEC Compliance," which includes links to reports we have filed with the Securities and Exchange Commission. The contents of our website are not incorporated by reference in this Annual Report on Form 10-K.

3

PART I

ITEM 1. BUSINESS

Business Development

Red Trail Energy, LLC was formed as a North Dakota limited liability company in July of 2003, for the purpose of constructing, owning and operating a fuel-grade ethanol plant near Richardton, North Dakota in western North Dakota. References to "we," "us," "our" and the "Company" refer to Red Trail Energy, LLC. We began production in January 2007.

In March 2017, we entered into a new $10 million revolving loan (the "Revolving Loan") with U.S. Bank National Association ("U.S. Bank"). As part of this transaction, we signed a Credit Agreement dated March 17, 2017 (the "Credit Agreement"). Interest accrues on any outstanding balance on the Revolving Loan at a rate of 1.77% in excess of the one-month London Interbank Offered Rate ("LIBOR"). In May 2019, we renewed our Revolving Loan with U.S. Bank. The renewal extended the maturity date until May 31, 2020. On October 1, 2019 we terminated our Revolving Loan with U.S. Bank.

Principal Products

The principal products that we produce are ethanol, distillers grains and corn oil. The table below shows the approximate percentage of our total revenue which is attributed to each of our primary products for each of our last three fiscal years.

Product | Fiscal Year 2019 | Fiscal Year 2018 | Fiscal Year 2017 | ||||||

Ethanol | 78 | % | 76 | % | 82 | % | |||

Distillers Grains | 19 | % | 21 | % | 14 | % | |||

Corn Oil | 3 | % | 3 | % | 4 | % | |||

Ethanol

Ethanol is ethyl alcohol, a fuel component made primarily from corn and various other grains, which can be used as: (i) an octane enhancer in fuels; (ii) an oxygenated fuel additive for the purpose of reducing ozone and carbon monoxide vehicle emissions; and (iii) a non-petroleum-based gasoline substitute. Ethanol produced in the United States is primarily used for blending with unleaded gasoline and other fuel products. Ethanol blended fuel is typically designated in the marketplace according to the percentage of the fuel that is ethanol, with the most common fuel blend being E10, which contains 10% ethanol. The United States Environmental Protection Agency (the "EPA") has approved the use of gasoline blends that contain 15% ethanol, or E15, for use in all vehicles manufactured in model year 2001 and later. In 2019, the EPA changed regulations which now allow E15 to be sold year-round in all markets in the United States. In addition, flexible fuel vehicles can use gasoline blends that contain up to 85% ethanol called E85.

Distillers Grains

The principal co-product of the ethanol production process is distillers grains, a high protein animal feed supplement primarily marketed to the dairy and beef industry. We produce two forms of distillers grains: distillers dried grains and modified distillers grains. Modified distillers grains is processed corn mash that has been dried to approximately 50% moisture which has a shelf life of approximately seven days and is often sold to nearby markets. Distillers dried grains is processed corn mash that has been dried to approximately 10% moisture. It has a longer shelf life and may be sold and shipped to any market regardless of its vicinity to our ethanol plant.

Corn Oil

In March 2012, we commenced operating our corn oil extraction equipment. The corn oil that we are capable of producing is not food grade corn-oil and it cannot be used for human consumption. The primary uses of the corn oil that we produce are for animal feed, industrial uses and biodiesel production.

Principal Product Markets

We market nearly all of our products through a professional third party marketer, RPMG, Inc. ("RPMG"). The only products we sell which are not marketed by RPMG are E85 and E30 and certain modified distillers grains which we market

4

internally to local customers. RPMG is a subsidiary of Renewable Products Marketing Group, LLC ("RPMG, LLC"). We are a part owner of RPMG, LLC which allows us to realize favorable marketing fees for our products and allows us to share in the profits generated by RPMG, LLC. Our ownership interest in RPMG, LLC also entitles us to a seat on its board of directors which is filled by Gerald Bachmeier, our Chief Executive Officer. Except for the modified distillers grains and E85/E30 we market locally, RPMG decides where our products are marketed and sold. Our products are primarily sold in the domestic market; however, as domestic production of ethanol, distillers grains and corn oil continue to expand, we anticipate increased international sales of our products. Recently, the United States has exported a significant amount of distillers grains to Mexico, Vietnam, Indonesia, South Korea and the European Union. China was not a significant source of export demand due to increased tariffs which make United States distillers grains not feasible for export to China. In addition, the United States exported significant amounts of ethanol to Brazil, Canada, India and the European Union.

We expect our product marketer to explore all markets for our products, including export markets. However, due to high transportation costs, and the fact that we are not located near a major international shipping port, we expect a majority of our products to continue to be marketed and sold domestically.

Distribution Methods

Our ethanol plant is located near Richardton, North Dakota in Stark County, in the western half of North Dakota. We selected the Richardton site because of its proximity to existing coal supplies, the initial fuel source for our ethanol plant, and accessibility to road and rail transportation. Our plant is served by the Burlington Northern and Santa Fe Railway Company.

We sell and market the ethanol, distillers grains and corn oil produced at the plant through normal and established markets, including local, regional and national markets. Our products are primarily shipped by rail and by truck in our local market. We have separate marketing agreements with RPMG for our ethanol, distillers grains and corn oil. Whether or not our products are sold in local markets will depend on decisions made by RPMG, except for the modified distillers grains which we internally market locally. Local markets are evaluated on a case-by-case basis.

Ethanol

We have an exclusive marketing agreement with RPMG for the purposes of marketing and distributing all of the ethanol we produce at the ethanol plant. Because we are an owner of RPMG, LLC, our marketing fees are based on RPMG's actual cost to market our ethanol. Our ethanol marketing agreement provides that we can sell our ethanol either through an index arrangement or at a fixed price agreed to between us and RPMG. The term of our ethanol marketing agreement is perpetual, until it is terminated according to the terms of the agreement. The primary reasons the ethanol marketing agreement would terminate are if we cease to be an owner of RPMG, LLC, if there is a breach of the agreement which is not cured, or if we give advance notice to RPMG that we would like to terminate the agreement. Notwithstanding our right to terminate the ethanol marketing agreement, we may be obligated to continue to market our ethanol through RPMG for a period of time after the termination. Further, following the termination, we agreed to accept an assignment of certain railcar leases which RPMG has secured to service us. If the ethanol marketing agreement is terminated, it would trigger a redemption of our ownership interest in RPMG, LLC.

Distillers Grains

On August 29, 2013, we executed a distillers grain marketing agreement with RPMG effective starting on October 1, 2013. Pursuant to the marketing agreement, RPMG markets all of the dried distillers grains we produce and we will continue to internally market our modified distillers grains. Due to the fact that we are a part owner of RPMG, LLC, RPMG will only charge us its actual cost of marketing our distillers grains to its customers. The initial term of the marketing agreement was one year and thereafter the agreement renews for additional one year periods unless we elect not to renew the agreement. The agreement may be terminated by either party based on certain events described in the agreement or based on the bankruptcy or insolvency of either party.

We market and sell our modified distillers grains internally. Substantially all of our sales of modified distillers grains are to local farmers and feed lots.

Corn Oil

In March 2012, we executed a corn oil marketing agreement with RPMG to sell all of the corn oil that we produce. We pay RPMG a commission based on each pound of corn oil that RPMG sells on our behalf. The initial term of the corn oil marketing agreement was one year and the agreement automatically renews for additional one year terms unless either party gives notice that it will not extend the agreement past the current term.

5

New Products and Services

We did not introduce any new products or services during our 2019 fiscal year.

Sources and Availability of Raw Materials

Corn

Our ethanol plant used approximately 22.6 million bushels of corn during our 2019 fiscal year, or approximately 62,000 bushels per day, as the feedstock for its dry milling process. Our commodity manager is responsible for purchasing corn for our operations, scheduling corn deliveries and establishing hedging positions to protect the price we pay for corn.

During our 2019 fiscal year, we were able to secure sufficient corn to operate the plant and do not anticipate any problems securing enough corn during our 2020 fiscal year. Almost all of our corn is supplied from farmers and local grain elevators in North Dakota and South Dakota. During our 2019 fiscal year, corn prices have been higher than prior years, mainly due to weather issues which delayed corn planting and many believe will impact the amount of corn harvested in the fall of 2019. Despite these issues, we have not had difficulty securing the corn we require for our operations and we anticipate that we will be able to secure the corn we need to operate the ethanol plant during our 2020 fiscal year, although potentially at a higher price. While we do not anticipate encountering problems sourcing corn, a shortage of corn could develop, particularly if we experience an extended drought or other production problem during our 2020 fiscal year. Poor weather can be a major factor in increasing corn prices. If the United States were to endure an entire growing season with poor weather conditions, it could result in a prolonged period of higher than normal corn prices.

Corn prices are also impacted by world supply and demand, the price of other commodities, current and anticipated stocks, domestic and export prices and supports and the government's current and anticipated agricultural policy. Corn prices have been volatile in the past and volatility could return to the market in the future. While we have experienced several years of very favorable corn crops with relatively flat corn demand which reduced market corn prices, if poor weather conditions lead to a decrease in the amount of corn produced in the future, it could result in corn price volatility and increased corn prices.

Natural Gas

Following our natural gas conversion project which was completed during the second quarter of our 2015 fiscal year, we use natural gas as the fuel source to power our ethanol plant. We are using natural gas to produce process steam and to dry our distillers grains products. Due to our close proximity to the Bakken oil field which produces a significant amount of natural gas, we anticipate that natural gas prices in our area will remain lower and the cost to transport the natural gas to our ethanol plant will be low. We entered into a natural gas supply agreement with Rainbow Gas Company which provides a supply of natural gas to the ethanol plant. We do not anticipate any difficulty securing the natural gas we require to operate the ethanol plant.

Electricity

The production of ethanol uses significant amounts of electricity. We entered into a contract with Roughrider Electric Cooperative to provide our needed electrical energy. This contract was renewed in August 2019. This contract automatically renews unless either party gives notice of its intent not to renew the agreement.

Water

To meet the plant's water requirements, we entered into a ten-year contract with Southwest Water Authority to purchase raw water. Our contract requires us to purchase a minimum of 160 million gallons of water per year. We anticipate receiving adequate water supplies during our 2020 fiscal year.

Patents, Trademarks, Licenses, Franchises and Concessions

We do not currently hold any patents, trademarks, franchises or concessions. We were granted a perpetual and royalty free license by ICM, Inc. ("ICM") to use certain ethanol production technology necessary to operate our ethanol plant. The cost of the license granted by ICM was included in the amount we paid to Fagen, Inc. to design and build the plant.

6

Seasonality of Sales

We experience some seasonality of demand for our ethanol, distillers grains and corn oil. Since ethanol is predominantly blended with gasoline for use in automobiles, ethanol demand tends to shift in relation to gasoline demand. As a result, we experience some seasonality of demand for ethanol in the summer months related to increased driving and, as a result, increased gasoline demand. In addition, we experience some increased ethanol demand during holiday seasons related to increased gasoline demand. We also experience decreased distillers grains demand during the summer months due to natural depletion in the number of animals at feed lots and during times when cattle are turned out to pasture. Finally, corn oil is used for biodiesel production which typically decreases in the winter months due to decreased biodiesel demand. This decrease in biodiesel demand leads to decreased corn oil demand during the winter months.

Working Capital

We primarily use our working capital for purchases of raw materials necessary to operate our ethanol plant and for capital expenditures to maintain and upgrade the plant. During our 2019 fiscal year, our primary sources of working capital were cash from our operations as well as our revolving line-of-credit with U.S. Bank. We are in the process of securing a new line of credit with another financial institution to replace the U.S. Bank line of credit. Management anticipates that we will have sufficient working capital to operate at capacity during our 2020 fiscal year without seeking additional sources of equity or debt financing. However, if we experience unfavorable operating conditions during our 2020 fiscal year, it is possible we may need to secure additional sources of working capital.

Dependence on a Few Major Customers

As discussed above, we rely on RPMG for the sale and distribution of all of our ethanol, dried distillers grains and corn oil. Accordingly, we are highly dependent on RPMG for the successful marketing of most of our products. We anticipate that we would be able to secure alternate marketers should RPMG fail, however, a loss of our relationship with RPMG could significantly harm our financial performance.

Competition

We are in direct competition with numerous ethanol producers, many of which have greater resources than we have. Larger ethanol producers may be able to take advantage of economies of scale due to their larger size and increased bargaining power with both customers and raw material suppliers. As of November 26, 2019, the Renewable Fuels Association ("RFA") estimates that there are 212 ethanol production facilities in the United States with capacity to produce approximately 16.6 billion gallons of ethanol annually. The RFA also estimates that approximately 9% of the ethanol production capacity in the United States is currently idled. In the past, the ethanol industry experienced consolidation where a few larger ethanol producers emerged who control a large portion of United States ethanol production. The largest ethanol producers include Archer Daniels Midland, Flint Hills Resources, Green Plains Renewable Energy, POET, and Valero Renewable Fuels, each of which are capable of producing significantly more ethanol than we produce. Collectively this group controls approximately 42% of the ethanol production capacity in the United States.

The following table identifies the largest ethanol producers in the United States along with their production capacities.

U.S. FUEL ETHANOL PRODUCTION CAPACITY BY TOP PRODUCERS

Producers of Approximately 800

million gallons per year (MMgy) or more

Company | Current Capacity (MMgy) | Percent of Total Industry Capacity | ||||

Archer Daniels Midland | 1,716 | 10 | % | |||

POET Biorefining | 1,711 | 10 | % | |||

Valero Renewable Fuels | 1,697 | 10 | % | |||

Green Plains Renewable Energy | 1,111 | 7 | % | |||

Flint Hills Resources | 840 | 5 | % | |||

TOTAL | 7,075 | 42 | % | |||

Updated: November 26, 2019

7

Ethanol Competition

Ethanol is a commodity product where competition in the industry is predominantly based on price and consistent fuel quality. Larger ethanol producers may be able to realize economies of scale in their operations that we are unable to realize. Further, we have experienced increased competition from oil companies who have purchased ethanol production facilities, including Valero Renewable Fuels and Flint Hills Resources, which are subsidiaries of larger energy companies. These oil companies are required to blend a certain amount of ethanol each year. Therefore, the oil companies may be able to operate their ethanol production facilities at times when it is unprofitable for us to operate our ethanol plant. Further, some ethanol producers own multiple ethanol plants which may allow them to compete more effectively by providing them flexibility to run certain production facilities while they have other facilities shut down. This added flexibility may allow these ethanol producers to compete more effectively, especially during periods when operating margins are unfavorable in the ethanol industry. Finally some ethanol producers who own ethanol plants in geographically diverse areas of the United States may spread the risk they encounter related to feedstock prices due to localized decreased corn production and supplies.

We anticipate competition from renewable fuels that do not use corn as the feedstock. Many of the current ethanol production incentives are designed to encourage the production of renewable fuels using raw materials other than corn. One type of ethanol production feedstock that is being explored is cellulose. Cellulose is the main component of plant cell walls and is the most common organic compound on earth. Cellulose is found in wood chips, corn stalks, rice straw, amongst other common plants. Cellulosic ethanol is ethanol produced from cellulose. If this technology can be profitably employed on a commercial scale, it could potentially lead to ethanol that is less expensive to produce than corn based ethanol. Cellulosic ethanol may also capture more government subsidies and assistance than corn-based ethanol. This could decrease demand for our product or result in competitive disadvantages for our ethanol production process.

A number of automotive, industrial and power generation manufacturers are developing alternative clean power systems using fuel cells, plug-in hybrids, electric cars or clean burning gaseous fuels. Electric car technology has grown in popularity, especially in urban areas. While in the past there were a limited number of vehicle recharging stations, making electric cars not feasible for all consumers, there has been increased focus on developing these recharging stations which have made electric car technology more widely available. Additional competition from these other sources of alternative energy, particularly in the automobile market, could reduce the demand for ethanol, which would negatively impact our profitability.

In addition to domestic producers of ethanol, we face competition from ethanol produced in foreign countries, particularly Brazil. Ethanol imports have been lower in recent years and ethanol exports have been higher which was one of the reasons for improved operating margins in the ethanol industry. As of May 1, 2013, Brazil increased its domestic ethanol use requirement from 20% to 25% which decreased the amount of ethanol available in Brazil for export. Further, in August 2017, Brazil instituted a quota and tariff on ethanol produced in the United States and exported to Brazil which also is likely to decrease the amount of ethanol Brazil has available for export. Brazil increased the quota during our 2019 fiscal year which resulted in additional demand from Brazil. In the future, we may experience increased ethanol imports from Brazil which could put negative pressure on domestic ethanol prices and result in excess ethanol supply in the United States.

Competition among ethanol producers may continue to increase as gasoline demand decreases due to more fuel efficient vehicles being produced. If the concentration of ethanol used in most gasoline does not increase and gasoline demand is lower due to increased fuel efficiency by the vehicles operated in the United States, competition may increase among ethanol producers to supply the ethanol market.

Finally, many ethanol producers are increasing their production capacities through expansion projects which started becoming operational during our 2018 fiscal year. These expansion projects have increased the supply of ethanol in the market which has negatively impacted market ethanol prices and may continue to result in excess ethanol supply in the future. During our 2019 fiscal year many ethanols reduced production or ceased production altogether due to unfavorable operating margins which somewhat offset the additional ethanol production from these expansion projects.

Distillers Grains Competition

Our ethanol plant competes with other ethanol producers in the production and sales of distillers grains. Distillers grains are primarily used as an animal feed which replaces corn and soybean meal. As a result, we believe that distillers grains prices are positively impacted by increases in corn and soybean prices. In addition, in recent years the United States ethanol industry has increased exports of distillers grains which management believes has positively impacted demand and prices for distillers grains in the United States. In the event these distillers grains exports decrease, it could lead to an oversupply of distillers grains in the

8

United States which could result in increased competition among ethanol producers for sales of distillers grains and could negatively impact distillers grains prices in the United States.

Corn Oil Competition

We compete with many ethanol producers for the sale of corn oil. Many ethanol producers have installed the equipment necessary to separate corn oil from the distillers grains they produce which has increased competition for corn oil sales and has resulted in lower market corn oil prices.

Governmental Regulation and Federal Ethanol Supports

Federal Ethanol Supports

The ethanol industry is dependent on the ethanol use requirement in the Federal Renewable Fuels Standard (the "RFS"). The RFS requires that in each year, a certain amount of renewable fuels must be used in the United States. The RFS is a national program that does not require that any renewable fuels be used in any particular area or state, allowing refiners to use renewable fuel blends in those areas where it is most cost-effective. The RFS statutory volume requirement increases incrementally each year until the United States is required to use 36 billion gallons of renewable fuels by 2022. Starting in 2009, the RFS required that a portion of the RFS must be met by certain "advanced" renewable fuels. These advanced renewable fuels include ethanol that is not made from corn, such as cellulosic ethanol and biomass based biodiesel. The use of these advanced renewable fuels increases each year as a percentage of the total renewable fuels required to be used in the United States.

The EPA has the authority to waive the RFS statutory volume requirement, in whole or in part, provided one of the following two conditions have been met: (1) there is inadequate domestic renewable fuel supply; or (2) implementation of the requirement would severely harm the economy or environment of a state, region or the United States. Annually, the EPA is required to pass a rule that establishes the number of gallons of different types of renewable fuels that must be used in the United States which is called the renewable volume obligations ("RVO").

The statutory RVO for all renewable fuels for 2018 was 19.29 billion gallons, of which corn-based ethanol could meet 15 billion gallons of the RVO. On November 30, 2018, the final RVO for 2019 was set at 19.92 billion gallons and the corn-based ethanol RVO was set at 15 billion gallons. On December 19, 2019, the final RVO for 2020 was set at 20.09 billion gallons and the corn-based ethanol RVO was set at 15 billion gallons. During 2019 it came to light that the EPA was issuing waivers of the RVO obligations for certain small refineries. These small refinery waivers resulted in significant decreases in ethanol demand during 2018 and 2019 which are below the RVO requirements. Many in the ethanol industry believe these waivers did not meet the standards set out in the RFS. The ethanol industry has been pushing to EPA and the Trump administration to reverse the effects of these small refinery waivers which we believe contributed to poor operating margins during 2018 and 2019.

Most ethanol that is used in the United States is sold in a blend called E10. E10 is a blend of 10% ethanol and 90% gasoline. E10 is approved for use in all standard vehicles. Estimates indicate that gasoline demand in the United States is approximately 143 billion gallons per year. Assuming that all gasoline in the United States is blended at a rate of 10% ethanol and 90% gasoline, the maximum domestic demand for ethanol is approximately 14.3 billion gallons per year. This is commonly referred to as the "blend wall," which represents a theoretical limit where more ethanol cannot be blended into the national gasoline pool. This is a theoretical limit because it would not be possible to blend ethanol into every gallon of gasoline that is being used in the United States and it discounts the use of higher percentage blends such as E15 or E85. These higher percentage blends may lead to additional ethanol demand if they become more widely available and accepted by the market.

Many in the ethanol industry believe that it will be impossible to meet the RFS requirement in future years without an increase in the percentage of ethanol that can be blended with gasoline for use in standard (non-flex fuel) vehicles. The EPA has approved the use of E15, gasoline which is blended at a rate of 15% ethanol and 85% gasoline, in vehicles manufactured in the model year 2001 and later. However, there are still state hurdles that need to be addressed in some states before E15 will become more widely available. Many states still have regulatory issues that prevent the sale of E15. Sales of E15 may be limited because it is not approved for use in all vehicles, the EPA requires a label that management believes may discourage consumers from using E15, and retailers may choose not to sell E15 due to concerns regarding liability. In June 2019, the Trump Administration approved the use of E15 year-round which has somewhat expanded the use of E15, but has not been significant enough to offset demand losses which resulted from the small refinery exemption waivers from the RFS.

9

Effect of Governmental Regulation

The government's regulation of the environment changes constantly. We are subject to extensive air, water and other environmental regulations and we have been required to obtain a number of environmental permits to construct and operate the ethanol plant. It is possible that more stringent federal or state environmental rules or regulations could be adopted, which could increase our operating costs and expenses. It also is possible that federal or state environmental rules or regulations could be adopted that could have an adverse effect on the use of ethanol. Plant operations are governed by the Occupational Safety and Health Administration ("OSHA"). OSHA regulations may change such that the costs of operating the ethanol plant may increase. Any of these regulatory factors may result in higher costs or other adverse conditions effecting our operations, cash flows and financial performance.

We have obtained all of the necessary permits to operate the ethanol plant. During our 2019 fiscal year, we incurred costs and expenses of approximately $40,000 complying with environmental laws, including the cost of obtaining permits. Although we have been successful in obtaining all of the permits currently required, any retroactive change in environmental regulations, either at the federal or state level, could require us to obtain additional or new permits or spend considerable resources in complying with such regulations. Management believes converting the plant to use natural gas as the fuel source instead of coal has reduced our environmental compliance costs.

In late 2009, California passed a Low Carbon Fuels Standard ("LCFS"). The California LCFS requires that renewable fuels used in California must accomplish certain reductions in greenhouse gases which is measured using a lifecycle analysis, similar to the RFS. The LCFS could have a negative impact on demand for corn-based ethanol and result in decreased ethanol prices affecting our ability to operate profitably.

In August 2017, Brazil instituted an import quota for ethanol produced in the United States and exported to Brazil, along with a 20% tariff on ethanol imports in excess of the quota. In September 2019, the Brazilians increased the tariff free import quota from 600 million liters to 750 million liters. This tariff and quota have reduced exports of ethanol to Brazil and may continue to negatively impact ethanol exports from the United States. Any reduction in ethanol exports could negatively impact market ethanol prices in the United States. In addition, the Chinese government increased the tariff on United States ethanol imports into China from 30% to 45% and subsequently to 70%. Due to other recent tariff activity between the United States and China, management does not expect these Chinese tariffs to be removed in the near term, despite recent positive discussions. Both China and Brazil have been major sources of import demand for United States ethanol and distillers grains. These trade actions may result in negative operating margins for United States ethanol producers.

Employees

As of December 20, 2019, we had 48 full-time employees. We anticipate that we will have approximately 48 full-time employees during the next 12 months.

Item 1A. Risk Factors

You should carefully read and consider the risks and uncertainties below and the other information contained in this report. The risks and uncertainties described below are not the only ones we may face. The following risks, together with additional risks and uncertainties not currently known to us or that we currently deem immaterial could impair our financial condition and results of operation.

Risks Relating to Our Business

The EPA has issued small refinery waivers to the RFS requirement which has resulted in demand destruction and negatively impacted profitability in the ethanol industry. During 2019, the ethanol industry learned that the EPA has been issuing small refinery waivers to the ethanol use requirements in the RFS. In previous years, when the EPA issued small refinery waivers, it reallocated the waived requirements to other refiners. The EPA under the Trump Administration was granting significantly more waivers that in the past and was not reallocating the waived amounts to other refiners. These actions have resulted in demand destruction in 2018 and 2019 which led to reduced demand for ethanol. This reduction in ethanol demand has negatively impacted profitability in the ethanol industry. We believe that these small refinery exemptions will continue to be granted by the EPA and that it will continue to negatively impact profitability in the ethanol industry which could reduce or eliminate the value of our units.

10

A decrease in the spread between the price we receive for our products and our raw material costs will negatively impact our profitability. Practically all of our revenue is derived from the sale of our ethanol, distillers grains and corn oil. Our primary raw material costs are corn costs and energy costs. Our profitability depends on a positive spread between the market price of the ethanol, distillers grains and corn oil we produce and the raw material costs related to these products. While ethanol, distillers grains and corn oil prices typically change in relation to corn prices, this correlation may not always exist. In the event the prices for our products decrease at a time when our raw material costs are increasing, we may not be able to profitably operate the plant. In the event the spread between the price we receive for our products and the raw material costs associated with producing those products is negative for an extended period of time, we may not be able to maintain liquidity and we may fail which could negatively impact the value of our units.

Declines in the price of ethanol or distillers grain would significantly reduce our revenues. The sales prices of ethanol and distillers grains can be volatile as a result of a number of factors such as overall supply and demand, the price of gasoline and corn, levels of government support, tariffs and import quotas, and the availability and price of competing products. We are dependent on a favorable spread between the price we receive for our ethanol and distillers grains and the price we pay for corn and natural gas. Any lowering of ethanol and distillers grains prices, especially if it is associated with increases in corn and natural gas prices, may affect our ability to operate profitably. We anticipate the price of ethanol and distillers grains to continue to be volatile in our 2020 fiscal year as a result of the net effect of changes in the price of gasoline and corn and increased ethanol supply offset by changes in ethanol demand. Declines in the prices we receive for our ethanol and distillers grains will lead to decreased revenues and may result in our inability to operate the ethanol plant profitably for an extended period of time which could decrease the value of our units.

Decreasing gasoline prices could negatively impact our ability to operate profitably. Discretionary blending is an important secondary market which is often determined by the price of ethanol versus the price of gasoline. In periods when discretionary blending is financially unattractive, demand for ethanol may be reduced. Historically, the price of ethanol has been less than the price of gasoline which increased demand for ethanol from fuel blenders. However, recently, low oil prices have driven down the price of gasoline which has reduced the spread between the price of gasoline and the price of ethanol which could discourage discretionary blending, and result in a downwards market adjustment in the price of ethanol. If oil and gasoline prices remain lower for a significant period of time, it could hurt our ability to profitably operate the ethanol plant which could decrease the value of our units.

Increases in the price of corn or natural gas would reduce our profitability. Our primary source of revenue is from the sale of ethanol, distillers grains and corn oil. Our results of operations and financial condition are significantly affected by the cost and supply of corn and natural gas. Changes in the price and supply of corn and natural gas are subject to and determined by market forces over which we have no control including weather and general economic factors.

Ethanol production requires substantial amounts of corn. Generally, higher corn prices will produce lower profit margins and, therefore, negatively affect our financial performance. If a period of high corn prices were to be sustained for some time, such pricing may reduce our ability to operate profitably because of the higher cost of operating our plant. We may not be able to offset any increase in the price of corn by increasing the price of our products. If we cannot offset increases in the price of corn, our financial performance may be negatively affected.

The prices for and availability of natural gas are subject to volatile market conditions. These market conditions often are affected by factors beyond our control such as higher prices as a result of colder than average weather conditions or natural disasters, overall economic conditions and foreign and domestic governmental regulations and relations. Significant disruptions in the supply of natural gas could impair our ability to manufacture ethanol and more significantly, distillers grains for our customers. Furthermore, increases in natural gas prices or changes in our natural gas costs relative to natural gas costs paid by competitors may adversely affect our results of operations and financial condition.

Our business is not diversified which could negatively impact our ability to operate profitably. Our success depends largely on our ability to profitably operate our ethanol plant. We do not have any other lines of business or other sources of revenue if we are unable to operate our ethanol plant and manufacture ethanol, distillers grains and corn oil. If economic or political factors adversely affect the market for ethanol, distillers grains or corn oil, we have no other line of business to fall back on. Our business would also be significantly harmed if the ethanol plant could not operate at full capacity for any extended period of time.

Our inability to maintain or secure credit facilities we may require in the future may negatively impact our liquidity. While we do not currently require more financing than we have, in the future we may need additional financing. If we require financing in the future and we are unable to secure such financing, or we are unable to secure the financing we require on reasonable terms, it may have a negative impact on our liquidity. This could negatively impact the value of our units.

11

We engage in hedging transactions which involve risks that could harm our business. We are exposed to market risk from changes in commodity prices, including the prices we pay for our raw materials and the prices we receive for our finished products. We seek to minimize our exposure to fluctuations in the prices of corn, ethanol and distillers grains through the use of hedging instruments. However, our hedging activities may not successfully reduce the risk caused by price fluctuations which may leave us vulnerable to volatility in corn, ethanol and distillers grains prices. Alternatively, we may choose not to engage in hedging transactions in the future and our operations and financial conditions may be adversely affected during periods in which the prices for these commodities fluctuate. Further, using cash for margin calls to support our hedge positions can have an impact on the cash we have available for our operations which could negatively impact our liquidity. The effects of our hedging activities may negatively impact our ability to profitably operate which could reduce the value of our units.

We may violate the terms of our credit agreements and financial covenants which could result in our lender demanding immediate repayment of our loans. Our primary lender waived compliance with all financial covenants at September 30, 2019. On October 1, 2019, we terminated our loan with U.S. Bank. We are in the process of securing a new line of credit. Management anticipates in the future we will be in compliance with our loan covenants in our anticipated new line of credit. However, if we violate the terms of our credit agreement, our primary lender could deem us in default of our loans and require us to immediately repay any outstanding balance of our loans.

Changes and advances in ethanol production technology could require us to incur costs to update the ethanol plant or could otherwise hinder our ability to compete in the ethanol industry or operate profitably. Advances and changes in the technology of ethanol production are expected to occur. Such advances and changes may make the ethanol production technology installed in our ethanol plant less desirable or obsolete. These advances could allow our competitors to produce ethanol at a lower cost than us. If we are unable to adopt or incorporate technological advances, our ethanol production methods and processes could be less efficient than our competitors, which could cause the ethanol plant to become uncompetitive or completely obsolete. If our competitors develop, obtain or license technology that is superior to ours or that makes our technology obsolete, we may be required to incur significant costs to enhance or acquire new technology so that our ethanol production remains competitive. Alternatively, we may be required to seek third-party licenses, which could also result in significant expenditures. These third-party licenses may not be available or, once obtained, they may not continue to be available on commercially reasonable terms. These costs could negatively impact our financial performance by increasing our operating costs and reducing our net income which could decrease the value of our units.

We depend on our management and key employees, and the loss of these relationships could negatively impact our ability to operate profitably. We are highly dependent on our management team to operate our ethanol plant. We may not be able to replace these individuals should they decide to cease their employment with us, or if they become unavailable for any other reason. While we seek to compensate our management and key employees in a manner that will encourage them to continue their employment with us, they may choose to seek other employment. Any loss of these officers and key employees may prevent us from operating the ethanol plant profitably and could decrease the value of our units.

Failures of our information technology infrastructure could have a material adverse effect on operations. We utilize various software applications and other information technology that are critically important to our business operations. We rely on information technology networks and systems, including the Internet, to process, transmit and store electronic and financial information, to manage a variety of business processes and activities, including production, manufacturing, financial, logistics, sales, marketing and administrative functions. We depend on our information technology infrastructure to communicate internally and externally with employees, customers, suppliers and others. We also use information technology networks and systems to comply with regulatory, legal and tax requirements. These information technology systems, some of which are managed by third parties, may be susceptible to damage, disruptions or shutdowns due to failures during the process of upgrading or replacing software, databases or components thereof, power outages, hardware failures, computer viruses, attacks by computer hackers or other cybersecurity risks, telecommunication failures, user errors, natural disasters, terrorist attacks or other catastrophic events. If any of our significant information technology systems suffer severe damage, disruption or shutdown, and our disaster recovery and business continuity plans do not effectively resolve the issues in a timely manner, our product sales, financial condition and results of operations may be materially and adversely affected.

A cyber attack or other information security breach could have a material adverse effect on our operations and result in financial losses. We are regularly the target of attempted cyber and other security threats and must continuously monitor and develop our information technology networks and infrastructure to prevent, detect, address and mitigate the risk of unauthorized access, misuse, computer viruses and other events that could have a security impact. If we are unable to prevent cyber attacks and other information security breaches, we may encounter significant disruptions in our operations which could adversely impact our business, financial condition and results of operations or result in the unauthorized disclosure of confidential information. Such breaches may also harm our reputation, result in financial losses or subject us to litigation or other costs or penalties.

12

Risks Related to the Ethanol Industry

The ethanol industry is an industry that is changing rapidly which can result in unexpected developments that could negatively impact our operations and the value of our units. The ethanol industry has grown significantly in the last decade. This rapid growth has resulted in significant shifts in supply and demand of ethanol over a very short period of time. As a result, past performance by the ethanol plant or the ethanol industry generally might not be indicative of future performance. We may experience a rapid shift in the economic conditions in the ethanol industry which may make it difficult to operate the ethanol plant profitably. If changes occur in the ethanol industry that make it difficult for us to operate the ethanol plant profitably, it could result in a reduction in the value of our units.

Excess ethanol supply in the market could put negative pressure on the price of ethanol which could lead to tight operating margins and may impact our ability to operate profitably. In the past the ethanol industry has confronted market conditions where ethanol supply exceeded demand which led to unfavorable operating conditions. A disconnect between ethanol supply and demand can result in lower ethanol prices which can result in unfavorable operating conditions. The United States has recently benefited from additional exports of ethanol which may not continue to occur during our 2020 fiscal year. We may experience periods of ethanol supply and demand imbalance during our 2020 fiscal year, particularly if the EPA issues additional small refinery waivers from the RFS. If we experience excess ethanol supply, either due to increased ethanol production, lower ethanol demand or lower overall gasoline demand, it could negatively impact the price of ethanol which could hurt our ability to profitably operate the ethanol plant.

Distillers grains demand and prices may be negatively impacted by the Chinese anti-dumping duty. China was previously the world's largest importer of distillers grains produced in the United States. On January 12, 2016, the Chinese government announced that it would commence an anti-dumping and countervailing duty investigation related to distillers grains imported from the United States. On January 10, 2017, China announced a final ruling related to its anti-dumping and countervailing duty investigation imposing anti-dumping duties from a range of 42.2% to 53.7% and anti-subsidy duties from 11.2% to 12.0%. The imposition of these duties has resulted in a significant decline in demand from this top importer and negatively impacted prices for distillers grains produced in the United States. Due to recent trade disputes between the United States and China we expect these tariffs to continue into our 2020 fiscal year. This reduction in demand has negatively impacted our ability to profitably operate the ethanol plant.

Demand for ethanol may not continue to grow unless ethanol can be blended into gasoline in higher percentage blends for standard vehicles. Currently, ethanol is primarily blended with gasoline for use in standard (non-flex fuel) vehicles to create a blend which is 10% ethanol and 90% gasoline. Estimates indicate that approximately 143 billion gallons of gasoline are sold in the United States each year. Assuming that all gasoline in the United States is blended at a rate of 10% ethanol and 90% gasoline, the maximum domestic demand for ethanol is 14.3 billion gallons. This is commonly referred to as the "blend wall," which represents a theoretical limit where more ethanol cannot be blended into the national gasoline pool. Many in the ethanol industry believe that the ethanol industry has reached and surpassed this blend wall. In order to expand demand for ethanol, higher percentage blends of ethanol must be utilized in standard vehicles. Such higher percentage blends of ethanol are a contentious issue. Automobile manufacturers and environmental groups have fought against higher percentage ethanol blends. The EPA approved the use of E15 for standard vehicles produced in the model year 2001 and later. The fact that E15 has not been approved for use in all vehicles and the labeling requirements associated with E15 may lead to gasoline retailers refusing to carry E15. Without an increase in the allowable percentage blends of ethanol that can be used in all vehicles, demand for ethanol may not continue to increase which could decrease the selling price of ethanol and could result in our inability to operate the ethanol plant profitably which could reduce or eliminate the value of our units.

A reduction in ethanol exports to Brazil due to the imposition by the Brazilian government of a tariff on U.S. ethanol could have a negative impact on ethanol prices. Brazil has historically been a top destination for ethanol produced in the United States. However, in 2017, Brazil imposed a tariff on ethanol which is produced in the United States and exported to Brazil. This tariff has resulted in a decline in demand for ethanol from Brazil and could negatively impact the market price of ethanol in the United States and could negatively impact our ability to profitably operate the ethanol plant.

Chinese ethanol tariffs could have a negative impact on ethanol prices. As a result of recent trade disputes between the United States and China, China has imposed a 70% tariff on ethanol produced in the United States. This tariff has effectively closed the Chinese market for United States ethanol exports. China represents a significant potential source of demand for ethanol. Without access to the Chinese market, we may continue to experience excess ethanol supply which could negatively impact ethanol prices in the United States. These lower ethanol prices could negatively impact our ability to profitably operate the ethanol plant.

We operate in an intensely competitive industry and compete with larger, better financed entities which could impact our ability to operate profitably. There is significant competition among ethanol producers. There are numerous producer-owned

13

and privately-owned ethanol plants operating throughout the Midwest and elsewhere in the United States. We also face competition from outside of the United States. The largest ethanol producers include Archer Daniels Midland, Flint Hills Resources, Green Plains Renewable Energy, POET, and Valero Renewable Fuels, each of which is capable of producing significantly more ethanol than we produce. Further, many believe that there will be further consolidation occurring in the ethanol industry in the future which could lead to a few companies which control a significant portion of the United States ethanol production market. We may not be able to compete with these larger entities. These larger ethanol producers may be able to affect the ethanol market in ways that are not beneficial to us which could negatively impact our financial performance.

Technology advances in the commercialization of cellulosic ethanol may decrease demand for corn-based ethanol which may negatively affect our profitability. The current trend in ethanol production research is to develop an efficient method of producing ethanol from cellulose-based biomass, such as agricultural waste, forest residue, municipal solid waste, and energy crops. This trend is driven by the fact that cellulose-based biomass is generally cheaper than corn, and producing ethanol from cellulose-based biomass would create opportunities to produce ethanol in areas of the country which are unable to grow corn. The Energy Independence and Security Act of 2007 and the 2008 Farm Bill offer strong incentives to develop commercial scale cellulosic ethanol. The RFS requires that 16 billion gallons per year of advanced bio-fuels must be consumed in the United States by 2022. Additionally, state and federal grants have been awarded to several companies which are seeking to develop commercial-scale cellulosic ethanol plants. This has encouraged innovation and has led to several companies which are either in the process or have completed construction of commercial scale cellulosic ethanol plants. If an efficient method of producing ethanol from cellulose-based biomass is developed, we may not be able to compete effectively. If we are unable to produce ethanol as cost-effectively as cellulose-based producers, our ability to generate revenue and our financial condition will be negatively impacted.

Risks Related to Regulation and Governmental Action

Government incentives for ethanol production may be eliminated in the future, which could hinder our ability to operate at a profit. The ethanol industry is assisted by various federal ethanol production and tax incentives, including the RFS set forth in the Energy Policy Act of 2005. The RFS helps support a market for ethanol that might disappear without this incentive. The United States Environmental Protection Agency ("EPA") has the authority to waive the RFS statutory volume requirement, in whole or in part, provided certain conditions have been met. Annually, the EPA passes a rule that establishes the number of gallons of different types of renewable fuels that must be used in the United States which is called the renewable volume obligations. In the past, the EPA has set the renewable volume obligations below the statutory volume requirements. In addition, the EPA has recently expanded its use of waivers to small refineries. The effect of these waivers is that the refinery is no longer required to earn or purchase blending credits, known as RINs, negatively affecting ethanol demand and resulting in lower ethanol prices. On October 15, 2019, the EPA released a supplemental notice seeking additional comment on a proposed rule on adjustments to the way that annual renewable fuel percentages are calculated. The supplemental notice was issued in response to an announcement by President Trump of a proposed plan to require refiners not exempt from the rules to blend additional gallons of ethanol to make up for the gallons exempted by the EPA's expanded use of waivers to small refineries. The proposed plan was expected to calculate the volume that refiners were required to blend by using a three-year average of exempted gallons. However, the EPA proposed to use a three-year average to account for the reduction in demand resulting from the waivers using the number of gallons of relief recommended by the United States Department of Energy. If the EPA were to significantly reduce the volume requirements under the RFS or if the RFS were to be otherwise reduced or eliminated by the exercise of the EPA waiver authority or by Congress, the market price and demand for ethanol could decrease which will negatively impact our financial performance.

Changes in environmental regulations or violations of these regulations could be expensive and reduce our profitability. We are subject to extensive air, water and other environmental laws and regulations. In addition, some of these laws require our plant to operate under a number of environmental permits. These laws, regulations and permits can often require expensive pollution control equipment or operational changes to limit actual or potential impacts to the environment. A violation of these laws and regulations or permit conditions can result in substantial fines, damages, criminal sanctions, permit revocations and/or plant shutdowns. In the future, we may be subject to legal actions brought by environmental advocacy groups and other parties for actual or alleged violations of environmental laws or our permits. Additionally, any changes in environmental laws and regulations, both at the federal and state level, could require us to spend considerable resources in order to comply with future environmental regulations. The expense of compliance could be significant enough to reduce our profitability and negatively affect our financial condition.

The California Low Carbon Fuel Standard may decrease demand for corn based ethanol which could negatively impact our profitability. California passed a Low Carbon Fuels Standard ("LCFS") which requires that renewable fuels used in California must accomplish certain reductions in greenhouse gases which reductions are measured using a lifecycle analysis. Management believes that these regulations could preclude corn-based ethanol produced in the Midwest from being used in California. California represents a significant ethanol demand market. If the ethanol industry is unable to supply corn-based ethanol

14

to California, it could significantly reduce demand for the ethanol we produce which could result in a reduction of our revenues and negatively impact our ability to profitably operate the ethanol plant.

Government policies and regulations, particularly those affecting the agricultural sector and related industries, could adversely affect our operations and profitability. Agricultural commodity production and trade flows are significantly affected by government policies and regulations. Governmental policies affecting the agricultural industry, such as taxes, trade tariffs, duties, subsidies, import and export restrictions on commodities and commodity products, can influence industry profitability, the planting of certain crops, the location and size of crop production, whether unprocessed or processed commodity products are traded, and the volume and types of imports and exports. In addition, international trade disputes can adversely affect trade flows by limiting or disrupting trade between countries or regions. Future governmental policies, regulations or actions affecting our industry may adversely affect the supply of, demand for and prices of our products, restrict our ability to do business and cause our financial results to suffer. We may experience negative impacts of higher ethanol tariffs and other disruptions to international agricultural trade related to current trade actions announced by the Trump administration and responsive actions announced by trading partners, including by China. In April of 2018, the Chinese government increased the tariff on U.S. ethanol imports into China from 30% to 45% and ultimately to 70%. We cannot estimate the exact effect this tariff increase will have on the overall domestic ethanol market. However, the increased tariff is expected to reduce overall U.S. ethanol export demand, which could have a negative effect on U.S. domestic ethanol prices.

ITEM 2. PROPERTIES

Our ethanol plant is located just east of the city limits of Richardton, North Dakota, and just north and east of the entrance/exit ramps to Interstate I-94. The plant complex is situated inside a footprint of approximately 25 acres of land which is part of an approximately 135 acre parcel. We acquired ownership of the land in 2004 and 2005. Included in the immediate campus area of the plant are perimeter roads, buildings, tanks and equipment. An administrative building and parking area are located approximately 400 feet from the plant complex. During 2008, we purchased an additional 10 acre parcel of land that is adjacent to our current property. Our rail unloading facility and storage site was built on this property. During our 2012 fiscal year, we purchased an additional approximately 110 acres of land that is adjacent to our current property. During our 2017 fiscal year, we purchased approximately 338 acres of land which we will use as part of our rail yard allowing us to ship larger trains.

The site also contains improvements such as rail tracks and a rail spur, landscaping, drainage systems and paved access roads. The ethanol plant was placed in service in January 2007 and is in excellent condition and is capable of functioning in excess of its 50 million gallon name-plate production capacity.

During our 2019 fiscal year, all of our tangible and intangible property, real and personal, served as the collateral for our senior credit facility with U.S. Bank. Our senior credit facility is discussed in more detail under "ITEM 7. Management's Discussion and Analysis - Capital Resources."

ITEM 3. LEGAL PROCEEDINGS

From time to time in the ordinary course of business, we may be named as a defendant in legal proceedings related to various issues, including without limitation, workers' compensation claims, tort claims, or contractual disputes. We are not currently involved in any material legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES

None.

15

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED MEMBER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

There is no established trading market for our membership units. We have engaged FNC Ag Stock, LLC to create a Qualified Matching Service ("QMS") in order to facilitate trading of our units. The QMS consists of an electronic bulletin board that provides information to prospective sellers and buyers of our units. Please see the table below for information on the prices of units transferred in transactions completed via the QMS. We do not become involved in any purchase or sale negotiations arising from the QMS and we take no position as to whether the average price or the price of any particular sale is an accurate measure of the value of our units. As a limited liability company, we are required to restrict the transfers of our membership units in order to preserve our partnership tax status. Our membership units may not be traded on any established securities market or readily traded on a secondary market (or the substantial equivalent thereof). All transfers are subject to a determination that the transfer will not cause the Company to be deemed a publicly traded partnership.

We have no role in effecting the transactions beyond approval, as required under our Operating Agreement and the issuance of new certificates. So long as we remain a publicly reporting company, information about us will be publicly available through the SEC's EDGAR filing system. However, if at any time we cease to be a publicly reporting company, we may continue to make information about us publicly available on our website.

As of December 20, 2019, there were 930 holders of record of our Class A membership units.

In May of 2018 a total of 1,318,180 Units were purchased other than through a publicly announced plan or program, pursuant to a Membership Unit Repurchase Agreement, a private transaction between the Company and a Member.

The following table contains historical information by quarter for the past two years regarding the actual unit transactions that were completed by our unit-holders during the periods specified. The information was compiled by reviewing the completed unit transfers that occurred on the QMS bulletin board or through private transfers during the quarters indicated.

Quarter | Low Price | High Price | Average Price | # of Units Traded | |||||||||||

2018 1st | $ | 1.35 | $ | 1.35 | $ | 1.35 | 114,500 | ||||||||

2018 2nd | $ | 1.35 | $ | 1.35 | $ | 1.35 | 5,000 | ||||||||

2018 3rd | $ | 1.35 | $ | 1.35 | $ | 1.35 | 37,500 | ||||||||

2018 4th | $ | 1.25 | $ | 1.25 | $ | 1.25 | 5,000 | ||||||||

2019 1st | $ | 1.25 | $ | 1.28 | $ | 1.27 | 45,000 | ||||||||

2019 2nd | $ | 1.00 | $ | 1.00 | $ | 1.00 | 80,000 | ||||||||

2019 3rd | $ | 1.00 | $ | 1.00 | $ | 1.00 | 59,500 | ||||||||

2019 4th | $ | 1.03 | $ | 1.05 | $ | 1.04 | 80,000 | ||||||||

Distributions

Our board of governors has complete discretion over the timing and amount of distributions to our members. Our expectations with respect to our ability to make future distributions are discussed in greater detail in "Item 7 - Management Discussion and Analysis of Financial Condition and Results of Operations."

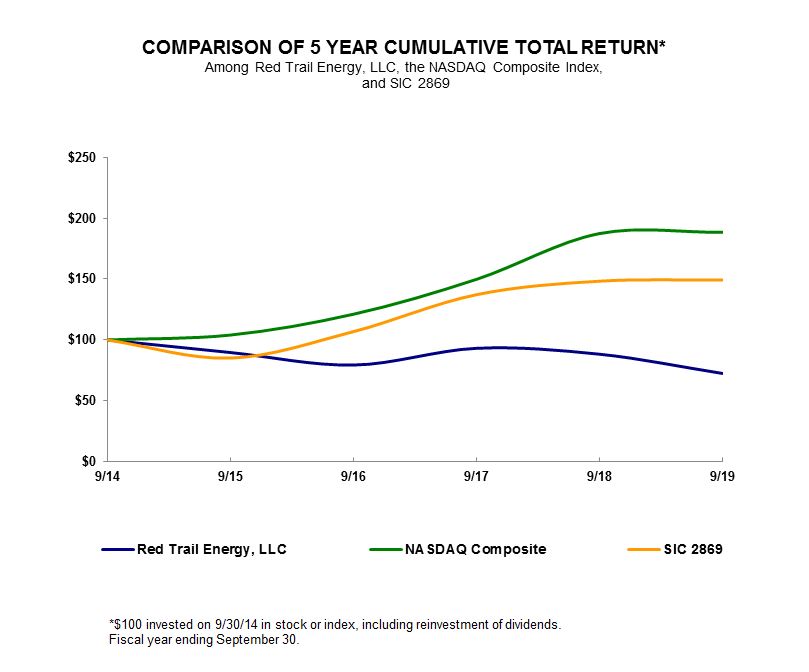

PERFORMANCE GRAPH

The graph below matches the cumulative 5-Year total return of holders of Red Trail Energy, LLC's common membership units with the cumulative total returns of the NASDAQ Composite index and a customized peer group of twenty six companies that includes: Aemetis Inc., Amyris Inc., Benchmark Energy Corp, Bioamber Inc., Bluefire Renewables Inc., Cardinal Ethanol LLC, Celanese Corp, Cleantech Biofuels Inc., Codexis Inc., Esp Resources Inc., Evolution Fuels Inc., Green Plains Inc., Green Plains Partners LP, Greenbelt Resources Corp, Innophos Holdings Inc., Kreido Biofuels Inc., Methes Energies International Ltd, New America Energy Corp, Newmarket Corp, Pacific Ethanol Inc., Rayonier Advanced Materials Inc., Red Trail Energy LLC, Renewable Energy Group Inc., Rex American Resources Corp, Sino United Worldwide Consolidated Ltd and Westlake Chemical Partners LP. The graph assumes that the value of the investment in our common stock, in each index, and in the peer group (including reinvestment of dividends) was $100 on September 30, 2014 and tracks it through September 30, 2019.

16

Pursuant to the rules and regulations of the Securities and Exchange Commission, the performance graph and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 6. SELECTED FINANCIAL DATA

The following table presents selected financial and operating data as of the dates and for the periods indicated. The selected balance sheet financial data as of September 30, 2017, 2016 and 2015 and the selected income statement data and other financial data for the periods ended September 30, 2016 and 2015 have been derived from our audited financial statements that are not included in this Form 10-K. The selected balance sheet financial data as of September 30, 2019 and 2018 and the selected statement of operations data and other financial data for the fiscal years ended September 30, 2019, 2018 and 2017 have been derived from the audited Financial Statements included elsewhere in this Form 10-K. You should read the following table in conjunction with "Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements and the accompanying notes included elsewhere in this Form 10-K. Among other things, those financial statements include more detailed information regarding the basis of presentation for the following financial data.

17

Years Ended | ||||||||||||||||||||

Statement of Operations Data: | September 30, 2019 | September 30, 2018 | September 30, 2017 | September 30, 2016 | September 30, 2015 | |||||||||||||||

Revenues | $ | 103,697,726 | $ | 103,577,061 | $ | 109,609,359 | $ | 105,159,602 | $ | 100,795,412 | ||||||||||

Cost of Goods Sold | 104,690,474 | 106,713,199 | 102,061,933 | 97,414,865 | 91,984,165 | |||||||||||||||

Gross Profit (Loss) | (992,748 | ) | (3,136,138 | ) | 7,547,426 | 7,744,737 | 8,811,247 | |||||||||||||

General and Administrative | 3,135,825 | 2,557,189 | 2,382,272 | 2,399,733 | 2,471,783 | |||||||||||||||

Operating Income (Loss) | (4,128,573 | ) | (5,693,327 | ) | 5,165,154 | 5,345,004 | 6,339,464 | |||||||||||||

Other Income (Expense) | 385,884 | 554,156 | 3,199,696 | 558,757 | 2,227,797 | |||||||||||||||

Net Income (Loss) | $ | (3,742,689 | ) | $ | (5,139,171 | ) | $ | 8,364,850 | $ | 5,903,761 | $ | 8,567,261 | ||||||||

Weighted Average Units Outstanding - Basic | 40,148,160 | 41,025,743 | 41,454,828 | 40,148,160 | 40,148,160 | |||||||||||||||

Weighted Average Units Outstanding - Diluted | 40,148,160 | 41,025,743 | 41,454,828 | 40,148,160 | 40,148,160 | |||||||||||||||

Net Income (Loss) Per Unit - Basic and Diluted | $ | (0.09 | ) | $ | (0.13 | ) | $ | 0.20 | $ | 0.15 | $ | 0.21 | ||||||||

Balance Sheet Data: | September 30, 2019 | September 30, 2018 | September 30, 2017 | September 30, 2016 | September 30, 2015 | |||||||||||||||

Current Assets | $ | 21,504,778 | $ | 24,984,683 | $ | 29,645,105 | $ | 24,681,404 | $ | 23,051,396 | ||||||||||

Net Property and Equipment | 39,312,192 | 43,357,257 | 47,141,736 | 47,224,703 | 50,940,083 | |||||||||||||||

Total Assets | 65,581,121 | 72,465,492 | 80,702,120 | 75,591,411 | 77,567,266 | |||||||||||||||

Current Liabilities | 5,006,857 | 8,146,757 | 7,020,438 | 7,932,689 | 9,940,702 | |||||||||||||||

Long-Term Liabilities | — | — | 2,921 | 5,538 | 1,862,246 | |||||||||||||||

Members' Equity | 60,574,264 | 64,318,735 | 73,678,761 | 67,653,184 | 65,764,317 | |||||||||||||||

Book Value Per Unit | $ | 1.51 | $ | 1.57 | $ | 1.78 | $ | 1.69 | $ | 1.64 | ||||||||||

Dividends Declared Per Unit | $ | — | $ | 0.07 | $ | 0.12 | $ | 0.10 | $ | 0.35 | ||||||||||

* See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for further discussion of our financial results.

18

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations