Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERITAGE FINANCIAL CORP /WA/ | form8-kxq2x2018investorpre.htm |

Q2 2018 Investor Presentation

FORWARD – LOOKING STATEMENT This presentation contains forward-looking statements that are subject to risks and uncertainties, including, but not limited to: • The expected revenues, cost savings, synergies and other benefits from our other merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to, customer and employee retention, might be greater than expected; • The credit and concentration risks of lending activities; • Changes in general economic conditions, either nationally or in our market areas; • Competitive market pricing factors and interest rate risks; • Market interest rate volatility; • Balance sheet (for example, loan) concentrations; • Fluctuations in demand for loans and other financial services in our market areas; • Changes in legislative or regulatory requirements or the results of regulatory examinations; • The ability to recruit and retain key management and staff; • Risks associated with our ability to implement our expansion strategy and merger integration; • Stability of funding sources and continued availability of borrowings; • Adverse changes in the securities markets; • The inability of key third-party providers to perform their obligations to us; • The expected revenues, cost savings, synergies and other benefits from the Premier Commercial Bancorp merger might not be realized within the expected time frames or at all, and costs or difficulties relating to integration matters, including but not limited to, customer and employee retention might be greater than expected; • Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and • These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission. Heritage cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to Heritage. Heritage does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for the third quarter of 2018 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect Heritage’s operating and stock price performance. 2

COMPANY OVERVIEW 3

OVERVIEW Three banks, one charter Overview NASDAQ Symbol HFWA Market Capitalization $1.35 billion Institutional Ownership 72.7% Total Assets $5.2 billion Headquarters Olympia, WA # of Branches 65 Year Established 1927 Note: Totals assets as of 06/30/2018 include pro forma impact of Premier Commercial Bancorp merger and market information as of 07/25/2018 4

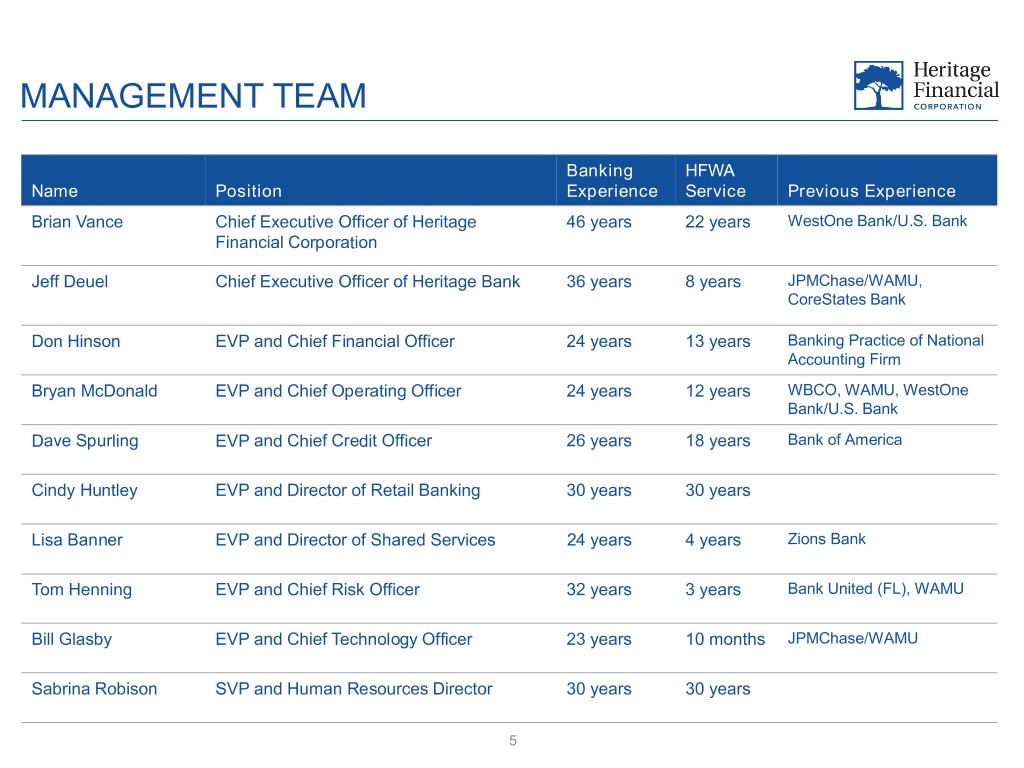

MANAGEMENT TEAM Banking HFWA Name Position Experience Service Previous Experience Brian Vance Chief Executive Officer of Heritage 46 years 22 years WestOne Bank/U.S. Bank Financial Corporation Jeff Deuel Chief Executive Officer of Heritage Bank 36 years 8 years JPMChase/WAMU, CoreStates Bank Don Hinson EVP and Chief Financial Officer 24 years 13 years Banking Practice of National Accounting Firm Bryan McDonald EVP and Chief Operating Officer 24 years 12 years WBCO, WAMU, WestOne Bank/U.S. Bank Dave Spurling EVP and Chief Credit Officer 26 years 18 years Bank of America Cindy Huntley EVP and Director of Retail Banking 30 years 30 years Lisa Banner EVP and Director of Shared Services 24 years 4 years Zions Bank Tom Henning EVP and Chief Risk Officer 32 years 3 years Bank United (FL), WAMU Bill Glasby EVP and Chief Technology Officer 23 years 10 months JPMChase/WAMU Sabrina Robison SVP and Human Resources Director 30 years 30 years 5

COMPANY STRATEGY . Disciplined approach to acquisition . Completed acquisition for Puget Sound Bancorp, Inc. on January 16, opportunities 2018 . Completed acquisition of Premier Commercial Bancorp on July 2, 2018 . Allocate capital to organically grow our . Successful hiring of individuals and teams of bankers in Seattle and core banking business Portland markets . Improve operational efficiencies and . Achieving increased efficiencies with operational scale, internal focus on rationalize branch network improving processes and technology solutions . Closed/Consolidated 19 branches since beginning of 2010 . Generate strong profitability and risk . 1.18% return on average assets (adjusted for 0.17% impact of merger adjusted returns and contract settlement expenses) . 12.93% return on average tangible common equity (adjusted for 1.94% impact of merger and contract settlement expenses) . Maintain underwriting standards and . 0.35% NPA/Assets credit quality . Long track record of strong underwriting . Focus on core deposits is key to . 29.2% non-interest bearing deposits franchise value over the long term . 0.23% cost of total deposits . Proactive capital management . 48.3% dividend payout ratio for 2018, including regular and special dividends . Retain strong pro forma capital ratios 6 Note: Financial information for the quarter-end period as of 06/30/2018

TRAJECTORY OF HFWA . HFWA has been the most acquisitive bank in Oregon and Washington since 2012 with 5 acquisitions* Where We’ve Been . 4x growth since 2012 – from $1.3 billion to $5.2 billion of assets (with Premier), annualized growth of 28.4% . Post-WBCO merger – targeted execution by organically building a foothold in Seattle and Portland, and supplementing with strategic acquisitions of Puget Sound and Premier Commercial . HFWA has executed on its growth plan without any major issues nd Where We . 2 largest publicly traded, traditional commercial bank which is solely focused in Pacific Northwest** Are Now . Scarcity value from the perspective of an investor, or an acquiror . Strength of currency – $1.35B market cap., and average trading volume of $12MM per day . Strong reputation and credibility in the marketplace – succinct communication and execution of strategic plan . Fortress balance sheet – capital, liquidity, lack of leverage, core deposit base and credit quality . Deep management bench and strong, dedicated culture – team in place to manage HFWA for long-term . Well positioned to create shareholder value Note: Total assets includes the pro forma impact of the Premier Commercial Bancorp merger *For M&A transactions announced since 1/1/2012 for companies headquartered in Oregon or Washington **Excludes UMPQ, WAFD, BANR and HMST, since each company has operations outside of Oregon/Washington/Idaho 7

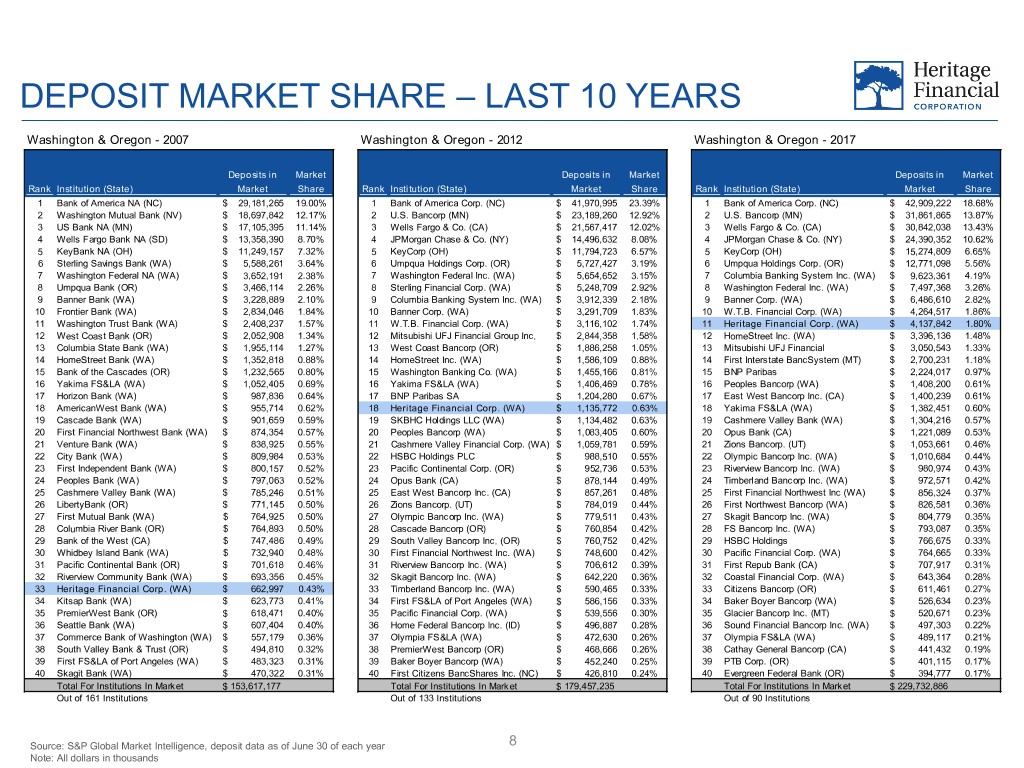

DEPOSIT MARKET SHARE – LAST 10 YEARS Washington & Oregon - 2007 Washington & Oregon - 2012 Washington & Oregon - 2017 Deposits in Market Deposits in Market Deposits in Market Rank Institution (State) Market Share Rank Institution (State) Market Share Rank Institution (State) Market Share 1 Bank of America NA (NC) $ 29,181,265 19.00% 1 Bank of America Corp. (NC) $ 41,970,995 23.39% 1 Bank of America Corp. (NC) $ 42,909,222 18.68% 2 Washington Mutual Bank (NV) $ 18,697,842 12.17% 2 U.S. Bancorp (MN) $ 23,189,260 12.92% 2 U.S. Bancorp (MN) $ 31,861,865 13.87% 3 US Bank NA (MN) $ 17,105,395 11.14% 3 Wells Fargo & Co. (CA) $ 21,567,417 12.02% 3 Wells Fargo & Co. (CA) $ 30,842,038 13.43% 4 Wells Fargo Bank NA (SD) $ 13,358,390 8.70% 4 JPMorgan Chase & Co. (NY) $ 14,496,632 8.08% 4 JPMorgan Chase & Co. (NY) $ 24,390,352 10.62% 5 KeyBank NA (OH) $ 11,249,157 7.32% 5 KeyCorp (OH) $ 11,794,723 6.57% 5 KeyCorp (OH) $ 15,274,809 6.65% 6 Sterling Savings Bank (WA) $ 5,588,261 3.64% 6 Umpqua Holdings Corp. (OR) $ 5,727,427 3.19% 6 Umpqua Holdings Corp. (OR) $ 12,771,098 5.56% 7 Washington Federal NA (WA) $ 3,652,191 2.38% 7 Washington Federal Inc. (WA) $ 5,654,652 3.15% 7 Columbia Banking System Inc. (WA) $ 9,623,361 4.19% 8 Umpqua Bank (OR) $ 3,466,114 2.26% 8 Sterling Financial Corp. (WA) $ 5,248,709 2.92% 8 Washington Federal Inc. (WA) $ 7,497,368 3.26% 9 Banner Bank (WA) $ 3,228,889 2.10% 9 Columbia Banking System Inc. (WA) $ 3,912,339 2.18% 9 Banner Corp. (WA) $ 6,486,610 2.82% 10 Frontier Bank (WA) $ 2,834,046 1.84% 10 Banner Corp. (WA) $ 3,291,709 1.83% 10 W.T.B. Financial Corp. (WA) $ 4,264,517 1.86% 11 Washington Trust Bank (WA) $ 2,408,237 1.57% 11 W.T.B. Financial Corp. (WA) $ 3,116,102 1.74% 11 Heritage Financial Corp. (WA) $ 4,137,842 1.80% 12 West Coast Bank (OR) $ 2,052,908 1.34% 12 Mitsubishi UFJ Financial Group Inc. $ 2,844,358 1.58% 12 HomeStreet Inc. (WA) $ 3,396,136 1.48% 13 Columbia State Bank (WA) $ 1,955,114 1.27% 13 West Coast Bancorp (OR) $ 1,886,258 1.05% 13 Mitsubishi UFJ Financial $ 3,050,543 1.33% 14 HomeStreet Bank (WA) $ 1,352,818 0.88% 14 HomeStreet Inc. (WA) $ 1,586,109 0.88% 14 First Interstate BancSystem (MT) $ 2,700,231 1.18% 15 Bank of the Cascades (OR) $ 1,232,565 0.80% 15 Washington Banking Co. (WA) $ 1,455,166 0.81% 15 BNP Paribas $ 2,224,017 0.97% 16 Yakima FS&LA (WA) $ 1,052,405 0.69% 16 Yakima FS&LA (WA) $ 1,406,469 0.78% 16 Peoples Bancorp (WA) $ 1,408,200 0.61% 17 Horizon Bank (WA) $ 987,836 0.64% 17 BNP Paribas SA $ 1,204,280 0.67% 17 East West Bancorp Inc. (CA) $ 1,400,239 0.61% 18 AmericanWest Bank (WA) $ 955,714 0.62% 18 Heritage Financial Corp. (WA) $ 1,135,772 0.63% 18 Yakima FS&LA (WA) $ 1,382,451 0.60% 19 Cascade Bank (WA) $ 901,659 0.59% 19 SKBHC Holdings LLC (WA) $ 1,134,482 0.63% 19 Cashmere Valley Bank (WA) $ 1,304,216 0.57% 20 First Financial Northwest Bank (WA) $ 874,354 0.57% 20 Peoples Bancorp (WA) $ 1,083,405 0.60% 20 Opus Bank (CA) $ 1,221,089 0.53% 21 Venture Bank (WA) $ 838,925 0.55% 21 Cashmere Valley Financial Corp. (WA) $ 1,059,781 0.59% 21 Zions Bancorp. (UT) $ 1,053,661 0.46% 22 City Bank (WA) $ 809,984 0.53% 22 HSBC Holdings PLC $ 988,510 0.55% 22 Olympic Bancorp Inc. (WA) $ 1,010,684 0.44% 23 First Independent Bank (WA) $ 800,157 0.52% 23 Pacific Continental Corp. (OR) $ 952,736 0.53% 23 Riverview Bancorp Inc. (WA) $ 980,974 0.43% 24 Peoples Bank (WA) $ 797,063 0.52% 24 Opus Bank (CA) $ 878,144 0.49% 24 Timberland Bancorp Inc. (WA) $ 972,571 0.42% 25 Cashmere Valley Bank (WA) $ 785,246 0.51% 25 East West Bancorp Inc. (CA) $ 857,261 0.48% 25 First Financial Northwest Inc (WA) $ 856,324 0.37% 26 LibertyBank (OR) $ 771,145 0.50% 26 Zions Bancorp. (UT) $ 784,019 0.44% 26 First Northwest Bancorp (WA) $ 826,581 0.36% 27 First Mutual Bank (WA) $ 764,925 0.50% 27 Olympic Bancorp Inc. (WA) $ 779,511 0.43% 27 Skagit Bancorp Inc. (WA) $ 804,779 0.35% 28 Columbia River Bank (OR) $ 764,893 0.50% 28 Cascade Bancorp (OR) $ 760,854 0.42% 28 FS Bancorp Inc. (WA) $ 793,087 0.35% 29 Bank of the West (CA) $ 747,486 0.49% 29 South Valley Bancorp Inc. (OR) $ 760,752 0.42% 29 HSBC Holdings $ 766,675 0.33% 30 Whidbey Island Bank (WA) $ 732,940 0.48% 30 First Financial Northwest Inc. (WA) $ 748,600 0.42% 30 Pacific Financial Corp. (WA) $ 764,665 0.33% 31 Pacific Continental Bank (OR) $ 701,618 0.46% 31 Riverview Bancorp Inc. (WA) $ 706,612 0.39% 31 First Repub Bank (CA) $ 707,917 0.31% 32 Riverview Community Bank (WA) $ 693,356 0.45% 32 Skagit Bancorp Inc. (WA) $ 642,220 0.36% 32 Coastal Financial Corp. (WA) $ 643,364 0.28% 33 Heritage Financial Corp. (WA) $ 662,997 0.43% 33 Timberland Bancorp Inc. (WA) $ 590,465 0.33% 33 Citizens Bancorp (OR) $ 611,461 0.27% 34 Kitsap Bank (WA) $ 623,773 0.41% 34 First FS&LA of Port Angeles (WA) $ 586,156 0.33% 34 Baker Boyer Bancorp (WA) $ 526,634 0.23% 35 PremierWest Bank (OR) $ 618,471 0.40% 35 Pacific Financial Corp. (WA) $ 539,556 0.30% 35 Glacier Bancorp Inc. (MT) $ 520,671 0.23% 36 Seattle Bank (WA) $ 607,404 0.40% 36 Home Federal Bancorp Inc. (ID) $ 496,887 0.28% 36 Sound Financial Bancorp Inc. (WA) $ 497,303 0.22% 37 Commerce Bank of Washington (WA) $ 557,179 0.36% 37 Olympia FS&LA (WA) $ 472,630 0.26% 37 Olympia FS&LA (WA) $ 489,117 0.21% 38 South Valley Bank & Trust (OR) $ 494,810 0.32% 38 PremierWest Bancorp (OR) $ 468,666 0.26% 38 Cathay General Bancorp (CA) $ 441,432 0.19% 39 First FS&LA of Port Angeles (WA) $ 483,323 0.31% 39 Baker Boyer Bancorp (WA) $ 452,240 0.25% 39 PTB Corp. (OR) $ 401,115 0.17% 40 Skagit Bank (WA) $ 470,322 0.31% 40 First Citizens BancShares Inc. (NC) $ 426,810 0.24% 40 Evergreen Federal Bank (OR) $ 394,777 0.17% Total For Institutions In Mark et $ 153,617,177 Total For Institutions In Mark et $ 179,457,235 Total For Institutions In Mark et $ 229,732,886 Out of 161 Institutions Out of 133 Institutions Out of 90 Institutions Source: S&P Global Market Intelligence, deposit data as of June 30 of each year 8 Note: All dollars in thousands

STRONG AND DIVERSE ECONOMIC LANDSCAPE . Thriving local economy with job growth in technology and Headquartered in Western Washington aerospace sectors . Washington named “America’s Top State for Business in 2017” by CNBC(1) . Washington state has the country’s largest concentration of STEM workers (science, technology, education and math)(1) . Seattle economy ranks 12th largest in the country by GDP, which increased 5.2% since 2014(2) . Seattle’s population grew 12.1% from 2010 to 2017(3) . Median household income for Seattle and Bellevue is $85,936 and $112,936, respectively, which is 41% and 85% higher than the national average of $61,045 (3) . Fortune 500 companies headquartered in Seattle-Bellevue MSA, Major Operations in Western Washington include: Amazon, Costco, Microsoft, PACCAR, Nordstrom, Weyerhaeuser, Expeditors, Alaska Air, Expedia and Starbucks . King County home prices increased 15.4% from December 2016 to December 2017(4) Note: Information for Seattle MSA, where available (1) www.cnbc.com (2) Bureau of Economic Analysis (3) U.S. Census data 9 (4) www.zillow.com

HISTORICAL GROWTH $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 (1) goodwill and adjustments accounting purchase include Assets Acquired millions; in dollars All Note: of as financials, Company Source: Premier Commercial Bancorp assets do not include purchase accounting adjustments or goodwill adjustments accounting purchase include Premier assets do not Commercial Bancorp $- . In addition to organic growth, HFWA has completed 8 whole bank mergers FDIC 2 and mergers bank whole 8 completed has HFWA growth, organic to addition In 1998 $74 $401 assets in $74M with Bancorporation Pacific North Acquired Inc. withInc. $61M in assets Bancshares Independent Washington Acquired 1999 $61 $450 2000 6 $574 /30/2018 2001 $610 2002 $595 2003 Organic $641 2004 $697 with $57M in assets in with $57M Bancorp Washington Western Acquired 2005 Acquired Assets Acquired – $751 ORGANIC AND ACQUISITIVE AND ORGANIC 2006 $57 $796 2007 $886 10 2008 Premier Commercial Bancorp $946 $345M in assets, respectively assets, in $345M and $211M acquiring Bank Cowlitz and Bank Commercial 2FDIC deals Completed 2009 $1,015 Commercial Bank with Bank Commercial Northwest and Inc. Bancshares, Community Valley Acquired and $65M in assets, respectively assets, in $65M and 2010 $556 $812 2011 $1,369 assets in $1.7B with Company Banking Washington with Merger - 2012 Pierce Pierce - assisted transactions since 1998. since transactions assisted $ $1,346 254M 2013 $319 $1,340 $1,747 $1,747 2014 $1,712 assets in with $639M Bancorp Sound Puget of acquisition Completed 2015 $3,651 with $382M in assets (1) assets in with $382M Bancorp Commercial Premier of acquisition Completed 2016 $3,879 2017 $4,113 2018 YTD $639 $382 $4,150

M&A UPDATE 11

ACQUISITION OF PUGET SOUND BANCORP, INC. • Completed Puget Sound Bancorp, Inc. acquisition on January 16, 2018 • Puget Sound is a “pure play” business banking franchise headquartered in the Seattle metropolitan area with fair value of assets of $639.2 million (1) • Acquisition follows HFWA’s stated strategic goal of growing in the Seattle-Bellevue market Merger • The exchange ratio decreased from 1.3200x at announcement to 1.1688x at closing pursuant to the Overview terms of the merger agreement • HFWA issued an aggregate of 4.1 million shares of its common stock in the transaction, approximately 530,000 fewer shares compared to announcement Transaction Multiples as of: (2) (3) Announcement Closing Exchange Ratio 1.3200x 1.1688x Attractive Deal Deal Value ($mm) $126.1 $130.8 Metrics for Sha re s Issue d 4,644,928 4,112,258 HFWA 2019 Estimated EPS Accretion (%) 3.95% 5.67% 2019 Estimated EPS Accretion ($) 0.06 per share $0.09 per share Internal Rate of Return 16% 18% Tangible Book Value Per Share Earnback(4) 4.5 years 2.1 years Source: HFWA and PUGB as of 12/31/2017 (1) Fair value estimate with final asset valuation not yet final (2) Based on HFWA closing price on 7/26/2017 of $27.15 and an exchange ratio of 1.3200x (3) Based on HFWA closing price on 1/12/2018 of $31.80 and an exchange ratio of 1.1688x (4) Tangible Book Value Earnback Period measures the number of years required for the pro forma company’s projected TBVPS to exceed the projected TBVPS of standalone HFWA 12

KING COUNTY* METRO MARKET • $1.5 billion in total funds under management in the Seattle/Bellevue markets King County Funds Under Management = Loans + Deposits $1,600 $1,485 $1,487 $1,400 $1,200 $602 $596 $1,000 $800 $576 $587 $598 $600 $538 $545 $103 $108 $102 $99 $95 $883 $892 $400 $496 $478 $200 $440 $449 $473 $- 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 HFWA Branch Loans Deposits Source: Company financials as of 06/30/2018 Note: All dollars in millions * Deposits include Seattle and Bellevue branch deposits as well as deposits managed by commercial bankers in these two branches. However, this does not include deposits generated from other King County branch locations or CDARS in Bellevue. 13

SEATTLE METRO MARKET • Seattle Metro market is one of the fastest growing in the country • Annual population growth exceeded the Top 15 MSAs since 2015, and the Seattle MSA expected to grow at 1.3% CAGR in next five years • Median household income for the Seattle MSA has trended above the Top 15 MSAs and the U.S., and is expected to reach $92k by 2023 Annual Population Growth 3.0% 2.38% 2.5% 2.03% 2.04% 1.89% 2.0% 1.72% 1.79% 1.65% 1.56% 1.5% 1.21% 1.31% 1.00% 1.12% 1.07% 0.90% 0.93% 0.84% 1.0% 0.79% 0.74% 0.71% 0.70% 0.69% 0.57% 0.62% 0.56% 0.56% 0.43% 0.5% -0.13% 0.0% 2011 2012 2013 2014 2015 2016 2017 2018 2018-2023 -0.5% Seattle MSA Top 15 MSAs U.S. Median Household Income $100 $92 $82 $75 $77 $80 $71 $68 $69 $66 $63 $63 $65 $66 $62 $64 $58 $58 $59 $61 $57 $58 $54 $56 $57 $60 $50 $50 $49 $52 $40 $20 $- 2011 2012 2013 2014 2015 2016 2017 2018 2018-2023 Seattle MSA Top 15 MSAs U.S. Source: S&P Global Market Intelligence, Claritas Note: Top 15 MSA data is based on median of the group Note: Date for actuals, estimates and projections is January 1 of the relevant year 14 Note: All dollars in thousands

PREMIER COMMERCIAL BANCORP • Completed acquisition of Premier Commercial Bancorp on July 2, 2018 • Premier is the largest commercial bank under $1 billion in assets headquartered in the Portland MSA with total assets of $381.7 million(1) Merger Overview • Acquisition follows HFWA’s stated strategic goal of growing in the Portland- Vancouver-Hillsboro market with the addition of six strategically located branches • HFWA issued 2,848,579 shares of its common stock in the transaction Transaction Metrics as of: (2) (3) Announcement Closing Exchange Ratio 0.4863x 0.4863x Attractive Deal Deal Value ($mm) $88.6 $99.3 221.8% 243.6% Metrics for Price/ Tangible Book Value (MRQ) Price/ Earnings (LTM)(4) 20.1x 22.0x HFWA 2019 Estimated EPS Accretion (%) 3.29% 3.29% 2019 Estimated EPS Accretion ($) $0.07 per share $0.07 per share Internal Rate of Return >15% >15% Tangible Book Value Per Share Earnback(5) 1.5 Years 1.4 Years Source: HFWA and PRCB as of 6/30/2018 (1) Carrying value estimate with final asset valuation not yet final (2) Based on HFWA’s closing stock price of $31.10 on 3/8/2018 and financials as of 12/31/2017 (3) Based on HFWA’s closing stock price of $34.85 on 6/29/2018 and financials as of 3/31/2018 (4) Excludes impact of the deferred tax asset impairment due to the Tax Cuts and Jobs Act (5) Tangible Book Value Earnback Period measures the number of years required for the pro forma company’s projected TBVPS to exceed the projected TBVPS of standalone HFWA 15

PRO FORMA BRANCH FOOTPRINT HFWA Branch Footprint . Acquisition is consistent with HFWA’s focus on I-5 strategy . Premier has 6 branch locations in the cities of Hillsboro, Beaverton, Forest Grove, Tigard, Newberg and Portland . On a pro forma basis, HFWA will have 9 branch locations in the Portland-Vancouver-Hillsboro MSA Branch Footprint in Portland MSA Heritage Branch Premier Branch 16

ACQUISITION TRANSFORMS PRESENCE IN PORTLAND . $429 million of loans and $431 million of deposits, pro forma in the Portland MSA – combined funds under management of $861 million . 12% of HFWA’s loan portfolio and 10% of HFWA’s deposit base is in Portland MSA on a pro forma basis . Further accelerates HFWA’s recruiting efforts in the Portland market . HFWA’s 2nd largest market opportunity . Retention of Premier’s key lenders Loans in Portland MSA Deposits in Portland MSA $500 $500 ~5x increase for HFWA $429 ~4x increase for HFWA $431 $400 $400 $335 $319 $300 $300 $200 $200 $94 $112 $100 $100 $- $- HFWA Premier Pro Forma HFWA Premier Pro Forma Source: Company information, data as of 6/30/2018 including pro forma impact of Premier Commercial Bancorp merger 17 Note: All dollars in millions

FUTURE GROWTH AND OPPORTUNITIES Pacific Northwest Banking Landscape Expected Consolidation and Future Opportunities • Significant number of banks remaining in HFWA footprint, further consolidation is expected - 11 banks between $200 and $500 million in assets - 5 banks between $500 million and $1.0 billion in assets - 7 banks between $1.0 billion and 3.0 billion in assets • HFWA positioned to be the acquiror of choice in the Pacific Northwest Bank Headquarters Note: Financial information as of the most recent quarter publicly available 18

FINANCIAL UPDATE 19

FINANCIAL UPDATE – Q2 2018 • On January 16, 2018 completed acquisition of Puget Sound Bancorp and the systems conversion was completed during the second quarter • On July 2, 2018 completed acquisition of Premier Commercial Bancorp, increasing total assets over $5 billion • Return on average assets was 1.01%, return on average equity was 7.47% and return on tangible common equity was 10.99% • Diluted earnings per share were $0.35 for the quarter, net of $0.06 per share impact from merger-related expenses and consultant agreement buyout • Dividend declared on July 24, 2018 of $0.15 per share • Heritage was added to the S&P SmallCap 600 Index Source: Company financials, as of 6/30/2018 20

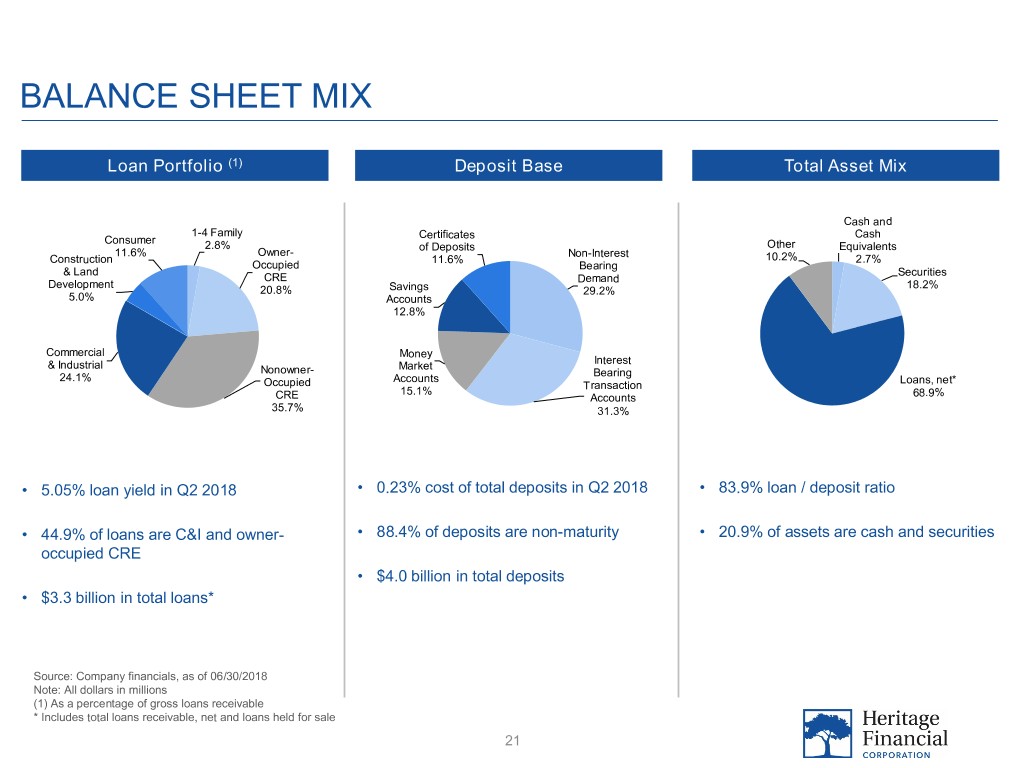

BALANCE SHEET MIX Loan Portfolio (1) Deposit Base Total Asset Mix Cash and 1-4 Family Certificates Cash Consumer 2.8% of Deposits Other Equivalents 11.6% Owner- Non-Interest Construction 11.6% 10.2% 2.7% Occupied Bearing & Land Securities CRE Demand Development 18.2% 20.8% Savings 29.2% 5.0% Accounts 12.8% Commercial Money Interest & Industrial Market Nonowner- Bearing 24.1% Accounts Loans, net* Occupied Transaction 15.1% 68.9% CRE Accounts 35.7% 31.3% • 5.05% loan yield in Q2 2018 • 0.23% cost of total deposits in Q2 2018 • 83.9% loan / deposit ratio • 44.9% of loans are C&I and owner- • 88.4% of deposits are non-maturity • 20.9% of assets are cash and securities occupied CRE • $4.0 billion in total deposits • $3.3 billion in total loans* Source: Company financials, as of 06/30/2018 Note: All dollars in millions (1) As a percentage of gross loans receivable * Includes total loans receivable, net and loans held for sale 21

BALANCE SHEET TRENDS Loans* Deposits $3,400 6.00% $4,100 0.30% $3,332 $3,285 $4,000 $3,969 $3,300 $3,905 $3,900 $3,200 5.00% $3,800 5.05% 0.20% $3,100 4.93% 4.91% $3,700 0.23% 4.75% 4.72% 0.20% 0.21% $3,000 $3,600 0.20% 0.18% 4.00% $3,500 $2,900 $2,851 $3,393 $2,803 $3,400 $3,321 $2,800 $2,755 $3,291 0.10% $3,300 3.00% $2,700 $3,200 $2,600 $3,100 $3,000 0.00% $2,500 2.00% Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Total Deposits Cost of Total Deposits Total Loans* Loan Yield Investment Securities FHLB Advances $900 5.00% $140 5.00% $874 $120 $117 $850 $111 $811 $822 4.00% 4.00% $800 $93 $791 $100 $800 3.00% $76 3.00% 2.43% 2.53% $80 2.25% 2.24% 2.29% $750 2.04% $60 1.70% 2.00% 1.53% 2.00% $700 1.38% $40 $31 0.89% 1.00% 1.00% $650 $20 $600 0.00% $- 0.00% Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Total Investment Securities Yield on Securities** Total FHLB Advances Cost of FHLB Advances Source: Company financials, as of 06/30/2018 Note: End of period balance. All dollars in millions *Loans include loans receivable, net and loans held for sale 22 **Includes taxable and tax-exempt securities without adjustment for tax-equivalent basis

NET INTEREST MARGIN • Stable core net interest margin Net Interest Margin (Core vs. Accretion)* 5.00% 4.22% 4.03% 4.12% 3.95% 3.89% 3.92% 3.85% 3.86% 0.16% 0.19% 4.00% 0.29% 0.18% 0.17% 0.14% 0.17% 0.11% 3.00% 2.00% 3.96% 4.03% 3.77% 3.68% 3.75% 3.75% 3.75% 3.74% 1.00% 0.00% Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Core NIM Accretion* Source: Company financials, as of 06/30/2018 *Impact on net interest margin from incremental accretion on purchased loans 23

CORE DEPOSIT FRANCHISE • Low cost of deposits despite increases in Fed Funds Rate Deposit Mix Cost of Deposits vs. Fed Funds Rate • Non-Interest Bearing Demand: 15% CAGR 2.25% • Total Deposits: 8% CAGR $4,000 2.00% 2.00% $3,500 1.75% $3,000 1.75% 1.50% $2,500 1.50% $2,000 1.25% $1,500 $1,000 1.00% 0.75% $500 0.75% $- 0.50% 2015 2016 2017 Q1 2018 Q2 2018 0.50% CDs 0.23% 0.18% 0.18% 0.21% Savings Accounts 0.25% 0.16% Money Market Accounts 0.00% Interest Bearing Demand 2015 2016 2017 Q1 2018 Q2 2018 Non-Interest Bearing Demand Cost of Total Deposits Fed Funds Rate Source: Company financials, as of 06/30/2018 24 Note: All dollars in thousands

PROFITABILITY TRENDS Adjusted ROAA Adjusted ROATCE 1.40% 15.00% 1.18% 12.93% 1.20% 1.16% 12.50% 1.06% 1.07% 12.50% 11.37% 1.04% 11.18% 10.85% 1.00% 10.00% 0.80% 7.50% 0.60% 5.00% 0.40% 0.20% 2.50% 0.00% 0.00% 2015 2016 2017* Q1 2018* Q2 2018* 2015 2016 2017* Q1 2018* Q2 2018* Adjusted Net Income Adjusted Earnings per Share $45,000 $42,528 $1.50 $1.41 $38,918 $1.30 $40,000 $37,489 $1.25 $1.25 $35,000 $30,000 $1.00 $25,000 $0.75 $20,000 $13,055 $13,958 $15,000 $0.50 $0.39 $0.41 $10,000 $0.25 $5,000 $- $- 2015 2016 2017* Q1 2018* Q2 2018* 2015 2016 2017* Q1 2018* Q2 2018* Source: Company financials, as of 06/30/2018 Note: All dollars in thousands, except per share *Adjusted for merger-related expenses and consultant agreement buyout. Refer to the Appendix for non-GAAP measures. 25

NON-INTEREST EXPENSE • Continue to manage non-interest expense and leverage our operational scale Adjusted Non-Interest Expense and NIE/Avg. Assets $120,000 4.00% $810 $100,000 3.50% $80,000 $64,268 3.01% $61,405 $60,000 3.00% 2.84% $58,134 2.84% 2.81% 2.76% $40,000 $4,808 $2,573 2.50% $48,074 $19,294 $20,000 $45,068 $45,497 $18,543 $13,396 $13,839 $- 2.00% 2015 2016 2017* Q1 2018* Q2 2018* Merger-Related Expenses & Consultant Agreement Buyout Adjusted Compensation & Benefits Expense Adjusted Non-Compensation Expense Adjusted NIE/Avg. Assets Source: Company financials, as of 06/30/2018 Note: All dollars in thousands *Adjusted for merger-related expenses and consultant agreement buyout. Refer to Appendix 26 for detail of non-GAAP measures.

CREDIT QUALITY TRENDS • Maintaining high standards for credit quality and a low ratio of NPAs / Assets Non-Performing Assets and Allowance for Loan Losses 1.60% 2.50% 1.40% 2.00% 1.81% 1.20% 1.74% 1.68% 1.65% 1.60% 1.54% 1.48% 1.00% 1.40% 1.34% 1.50% 0.80% 1.00% NPAs 0.60%NPAs / Assets Receivable,net 0.41% 0.40% 0.34% 0.35% 0.30% 0.30% 0.30% 0.29% 0.28% 0.26% 0.50% 0.20% ALLL +Discounts Acquired / Loans 0.00% 0.00% Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2016 2016 2016 2017 2017 2017 2017 2018 2018 NPAs / Assets ALLL+Discount/Loans Receivable, net Source: Company financials, as of 06/30/2018 Note: All dollars in thousands 27 Merger with Puget Sound Bancorp, Inc. closed during Q1 2018

CREDIT QUALITY VS. PEER GROUP • Superior credit quality compared to HFWA’s Western U.S. peers Non-Performing Assets – Since 2008 vs. Western U.S. Peers 5.00% 4.50% 4.13% 4.00% 3.50% 3.32% 3.00% 2.80% 2.57% 2.50% 2.19% 2.07% 2.13% 2.00% 1.41% NPAs NPAs / Assets 1.50% 1.24% 0.82% 1.00% 0.74% 0.57% 0.57% 0.47% 0.43% 0.32% 0.33% 0.35% 0.50% 0.30% 0.26% 0.30% 0.26% 0.00% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q2 2018 HFWA Median Source: SNL Financial, as of the most recent quarter available. HFWA as of 06/30/2018 Note: All dollars in thousands Note: Peer group consists of select banks headquartered in the Western U.S. with $1B- $13B in assets: BANC, BANR, BMRC, BOCH, BSRR, COLB, CVBF, CVCY, FFNW, FFWM, FIBK, GBCI, HMST, HTBK, LBC, OPB, OVLY, PMBC, PPBI, TCBK, WABC 28

LOAN CHARGE-OFFS • Net loan charge-offs of $1.0 year-to-date 2018 • Net loan charge-offs of $3.2 million during 2017 Net Charge Offs $3,000 0.80% 0.70% $2,500 $2,361 * $2,235 * 0.60% $2,000 0.50% $1,500 0.38% $1,218 0.40% $1,039 $1,000 0.30% $727 0.32% $652 0.20% 0.20% Loans Avg. NCOs / $500 0.13% $382 $305 $356 0.09% $125 0.10% 0.13% 0.02% Net Charge Offs/(Recoveries) $- 0.06% 0.05% 0.05% $(26) $(23) 0.00% 0.00% $(500) $(290) 0.00% -0.10% -0.05% $(1,000) -0.20% Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 Net Charge Offs /(Recoveries) NCOs / Avg. Loans Source: Company financials, as of 06/30/2018 Note: All dollars in thousands 29 *Increase in net charge-offs primarily related to the closure of PCI pool of loans

CAPITAL RATIO TRENDS Tangible Common Equity Ratio Leverage Ratio 16.00% 16.00% 12.00% 12.00% 10.3% 10.5% 10.4% 10.2% 10.4% 10.4% 9.6% 9.7% 9.7% 9.7% 9.6% 9.5% 8.00% 8.00% 4.00% 4.00% 0.00% 0.00% Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Tier-1 Capital Ratio Risk Based Capital Ratio 20.00% 20.00% 16.00% 16.00% 13.2% 13.1% 13.0% 12.8% 12.7% 12.6% 12.2% 12.1% 12.0% 11.8% 11.8% 11.7% 12.00% 12.00% 8.00% 8.00% 4.00% 4.00% 0.00% 0.00% Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 30 Source: Company financials, as of 06/30/2018

SHAREHOLDER RETURN 31

TOTAL SHAREHOLDER RETURN Total Return* – Last Twelve Months Ticker HFWA 50.0% Exchange NASDAQ 40.0% +37.8% Stock Price $ 36.60 Market Cap. ($MM) $ 1,346 30.0% Dividend Yield (Regular Div. Only) 1.64% 20.0% +17.1% +16.3% Average Daily Volume (3 Mo.) 10.0% +16.2% Avg. Daily Volume (Shares) 327,987 Avg. Daily Volume ($000s) $ 12,004 0.0% -10.0% 52-Week High and Low Price 7/25/2017 10/25/2017 1/25/2018 4/25/2018 7/25/2018 52-Week High (7/24/2018) $ 37.38 S&P 500 SNL Bank SNL U.S. Bank $1B-$5B HFWA 52-Week Low (9/07/2017) $ 25.25 Per Share - - Tg. Book Value Per Share $ 12.70 Dividends Per Share*** $0.80 100% EPS - 2018E** $ 1.70 $0.70 90% 80% Number of Research Analysts 6 $0.60 $0.25 $0.10 56% 70% $0.50 $0.10 55% 60% $0.40 44% 43% 50% Valuation Ratios 42% $0.30 40% $0.51 30% Price / Tg. Book Value 288.2% $0.20 $0.43 $0.47 Price / 2018E EPS** 21.5x 20% $0.10 $0.15 $0.15 10% $- 0% Source: SNL Financial, as of 07/25/2018 Note: SNL U.S. Bank $1B-$5B index includes banks nationwide with total 2015 2016 2017 Q1 2018 Q2 2018 assets of $1.0 billion to $5.0 billion Regular Dividends Special Dividends Dividend Payout Ratio *Total return includes stock price appreciation and reinvested dividends **Average Street EPS estimates, per FactSet Research Systems, Inc. 32 ***Dividends based on date declared

HISTORY OF GROWING DIVIDENDS • Quarterly cash dividend increased 15% year-over-year to $0.15 per share in Q2 2018 – Increased quarterly dividend six times since 2013 – Paid a special dividend for seven consecutive years - - • Dividend yield of 1.67%* Quarterly Cash Dividends $0.40 $0.35 $0.30 $0.25 $0.25 $0.20 $0.16 $0.10 $0.15 $0.10 $0.10 $0.15 $0.15 $0.15 $0.12 $0.12 $0.12 $0.12 $0.13 $0.13 $0.13 $0.05 $0.09 $0.09 $0.10 $0.11 $0.11 $0.11 $0.11 $- Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2014 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 Regular Dividends Special Dividends Source: SNL Financial, as of 7/20/2018 *Yield represents Q3 2018 regular dividends annualized and closing stock price on 7/20/18 of $36.00 33

INVESTMENT THESIS • Significant scarcity value as a $5+ billion commercial bank in the Pacific Northwest • Located in key markets in Western Washington – one of the strongest economic regions in the country • Proven track record of executing on M&A – Financially and strategically rewarding for shareholders • Long track record of profitability • Disciplined capital management • Conservative credit strategy and track record of strong underwriting • Committed to increasing shareholder value 34

APPENDIX 35

NON-GAAP FINANCIAL MEASURES Adjusted NIE / Average Assets $ in thousands 2014 2015 2016 2017 Q1 2018 Q2 2018 Noninterest expense $ 99,379 $ 106,208 $ 106,473 $ 110,575 $ 36,747 $ 35,706 - Merger related expenses (9,537) - - (810) (4,808) (880) - Consultant agreement buyout - - - - - (1,693) Adjusted noninterest expense 89,842 106,208 106,473 109,765 31,939 33,133 Average assets 2,846,290 3,527,515 3,745,535 3,981,352 4,553,585 4,726,719 Adjusted NIE / average assets 3.16% 3.01% 2.84% 2.76% 2.84% 2.81% 36

NON-GAAP FINANCIAL MEASURES Adjusted Profitability Measures $ in thousands, except earnings per share 2014 2015 2016 2017 Q1 2018 Q2 2018 Net income $ 21,014 $ 37,489 $ 38,918 $ 41,791 $ 9,087 $ 11,857 + Merger related expenses 9,537 - - 810 4,808 880 + Consultant agreement buyout - - - - - 1,693 - Tax effect of adjustments (2,932) - - (73) (840) (472) Adjusted net income 27,619 37,489 38,918 42,528 13,055 13,958 - Dividends and undistributed earnings allocated to participating securities (163) (328) (358) (293) (51) (57) Adjusted net income allocated to common shareholders 27,456 37,161 38,560 42,235 13,004 13,901 Diluted wtd avg shares outstanding 25,477,289 29,812,340 29,692,153 29,849,331 33,348,102 34,107,292 Adjusted diluted earnings per share $ 1.08 $ 1.25 $ 1.30 $ 1.41 $ 0.39 $ 0.41 Average assets 2,846,290 3,527,515 3,745,535 3,981,352 4,553,585 4,726,719 Adjusted return on avg assets 0.97% 1.06% 1.04% 1.07% 1.16% 1.18% Avg shareholders' equity $ 374,907 $ 464,102 $ 485,877 $ 499,776 $ 614,974 $ 636,735 - Avg intangibles (97,618) (128,890) (127,149) (125,774) (191,335) (203,838) Avg tangible common equity 277,289 335,212 358,728 374,002 423,639 432,897 Adjusted return on avg tang common equity 9.96% 11.18% 10.85% 11.37% 12.50% 12.93% 37