Attached files

| file | filename |

|---|---|

| EX-31.B - EX-31.B - Scripps Networks Interactive, Inc. | sni-ex31b_101.htm |

| EX-31.A - EX-31.A - Scripps Networks Interactive, Inc. | sni-ex31a_102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended DECEMBER 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 1-34004

SCRIPPS NETWORKS INTERACTIVE, INC.

(Exact name of Registrant as specified in its Charter)

|

Ohio |

61-1551890 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

9721 Sherrill Boulevard Knoxville, Tennessee |

37932 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (865) 694-2700

Securities registered pursuant to Section 12(b) of the Act: Class A Common Shares, Par Value $0.01 Per Share, traded on The NASDAQ Stock Market LLC.

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new of revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of Class A Common Shares of the registrant held by non-affiliates of the registrant on June 30, 2017, was approximately $5,902,000,000. All Class A Common Shares beneficially held by executives and directors of the registrant and signatories to the Scripps Family Agreement have been deemed, solely for the purposes of the foregoing calculation, to be held by affiliates of the registrant. There is no active market for our Common Voting Shares.

As of January 31, 2018, there were 96,250,145 of the registrant’s Class A Common Shares, $0.01 par value per share, outstanding and 33,850,481 of the registrant’s Common Voting Shares, $0.01 par value per share, outstanding.

This Amendment No. 1 on Form 10-K/A amends the Scripps Networks Interactice, Inc. (“SNI”, “Scripps” or “the Company”) Annual Report on Form 10-K for the fiscal year ending December 31, 2017, as filed with the Securities and Exchange Commission (“SEC”) on February 27, 2018 (the “Original Filing”). We are filing this Amendment No. 1 to include the information required by Part III of Form 10-K that was not included in the Original Filing, as we do not plan to file our definitive proxy statement within 120 days after the end of our fiscal year ended December 31, 2017. As required by Rule 12b-15 under the Securities Exchange Act of 1934, new certificates of our principal executive officer and principal financial officer are being filed as exhibits to this Amendment No. 1 on Form 10-K/A.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing. Accordingly, this Amendment No. 1 should be read in conjunction with our filings with the SEC subsequent to the date of the Original Filing.

|

|

PART III |

|

|

|

|

|

|

ITEM 10. |

|

|

4 |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

5 |

|

|

|

ITEM 11. |

|

|

6 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

20 |

|

|

|

|

|

|

33 |

|

|

|

|

|

|

36 |

|

|

|

|

|

|

36 |

|

|

|

ITEM 12. |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

37 |

|

|

|

|

REPORT ON THE SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS |

|

37 |

|

|

ITEM 13. |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

41 |

|

|

|

|

|

41 |

|

|

|

ITEM 14. |

|

|

42 |

|

|

|

|

|

|

42 |

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

ITEM 15. |

|

|

44 |

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

SECTION 16(a) BENEFICIAL OWNERSHIP COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and beneficial owners of more than 10 percent of the Company’s Class A Common Shares (“10 percent shareholders”), to file with the SEC initial reports of ownership and reports of changes in ownership of Class A Common Shares and other equity securities of the Company. Executive officers, directors and 10 percent shareholders are required by SEC regulations to furnish the Company with copies of all forms they file pursuant to Section 16(a).

The following individuals filed late Form 4s, by one business day, one business day and 22 business days, respectively during the year ended December 31, 2017: Mary M. Peirce (director) (one report relating to a gift of Class A Common Shares), Cynthia L. Gibson (executive officer) (one report relating to a receipt of Class A Common Shares) and Paul K. Scripps (one report related to an exercise of options to purchase Class A Common Shares).

To the Company’s knowledge, based solely on review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the year ended December 31, 2017, other than as set forth above, all Section 16(a) filing requirements applicable to its executive officers, directors and 10 percent shareholders were complied with.

4

The Company demonstrates its commitment to operate at the highest ethical standards by enforcing the principles in its Code of Ethics which is applicable to all employees. The Company’s Chief Ethics and Compliance Officer is responsible for implementation and oversight of the ethics program. Additionally, the Company has in place a Code of Business Conduct and Ethics for the Chief Executive Officer and the Senior Financial Officers. It is the responsibility of the Audit Committee and the Chief Financial Officer to make sure that this policy is operative and has effective reporting and enforcement mechanisms. The Code of Business Conduct and Ethics for the Chief Executive Officer and Senior Financial Officers is available for review on the Company’s website and to any shareholder who requests a printed copy. Amendments to the policies and waivers of provisions applicable to executive officers or directors may only be made by the Board or an authorized committee of the Board. Any such amendment or waiver will be promptly disclosed on the Company’s website within four business days.

The Company believes it has an obligation to provide employees with the guidance and support needed to ensure that the best, most ethical choices are made at work. To support this commitment, the Company established a means for employees to submit confidential and anonymous reports of suspected or actual violations of the Company’s Code of Ethics relating, among other things, to: accounting and auditing matters; antitrust activity; confidentiality and misappropriation; conflicts of interest, discrimination or harassment; diverting of product or business activity; embezzlement; falsification of contracts, reports or records; gifts or entertainment; improper supplier or contractor activity; securities violations; sexual harassment; substance abuse; theft; or unsafe working conditions. To submit a report, an employee may call a toll-free number that is answered by a trained professional of EthicsPoint, an independent firm. This number (888-258-3507) is operational 24 hours a day, seven days a week. Employees may also raise questions online through the Internet (www.ethicspoint.com).

5

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION & ANALYSIS

In this section, we describe our compensation philosophy objectives and programs for our Chairman, President and Chief Executive Officer (“CEO”) and our other NEOs. The Compensation Discussion & Analysis (“CD&A”) provides:

|

|

• |

A summary of our business results and the alignment between executive pay, short-term and long-term Company performance; |

|

|

• |

How our Board’s Compensation Committee determines compensation design and pay levels for specific 2017 decisions, including our compensation governance approach; and |

|

|

• |

A detailed description of the elements of the Company’s executive compensation program. |

Executive Summary

Our executive compensation programs are designed to reward financial results and effective strategic leadership to build sustainable value for shareholders by correlating the timing and amount of actual pay with performance goals over various time horizons without excessive risk-taking.

As part of our annual compensation governance process, we review the appropriate group of peer companies against which we benchmark all elements of compensation program design and company-wide pay levels. Our compensation decisions and program designs for our NEOs, as discussed in this section, are intended to focus on both the short-term and long-term growth of the organization.

Our NEOs for Fiscal 2017 were:

|

Name |

Current Title |

|

Kenneth W. Lowe |

Chairman, President & Chief Executive Officer |

|

Lori A. Hickok |

Executive Vice President, Chief Financial & Development Officer |

|

Burton F. Jablin |

Chief Operating Officer |

|

Cynthia L. Gibson |

Executive Vice President, Chief Legal & Business Affairs Officer |

|

Mark S. Hale |

Executive Vice President, Global Operations & Chief Technology Officer |

Fiscal 2017 Business Review

We are a global media company with respected high-profile brands and are a leading developer of lifestyle-oriented content, providing primarily home, food and travel lifestyle-related programming. Our content is distributed via multiple methods, including television, the internet, digital platforms and licensing arrangements. The SNI portfolio of networks includes HGTV, Food Network, Travel Channel, DIY Network, Cooking Channel and Great American Country within and outside the United States, with the exception of Great American Country, which is only distributed in the United States, and Fine Living, AFC and TVN’s portfolio of networks outside the United States. Additionally, outside the United States, we participate in UKTV, a joint venture with the BBC. Our businesses engage audiences and efficiently serve advertisers by producing and delivering entertaining and highly-useful content that focuses on specifically-defined topics of interest.

The growth of our international business, through acquisitions and joint ventures, as well as organically, has been, and continues to be, a strategic priority for the Company. During 2017, we launched Food Network Italy as a free-to-air channel, Food Network South Africa and HGTV Poland. In 2016, we launched Cooking Channel in Canada, marking the first time we distributed this network outside the United States and Caribbean; introduced HGTV in the Middle East and North Africa; and launched HGTV as a free-to-air channel in New Zealand as a first-of-its-kind offering in the region. During 2015, we acquired TVN, a Polish media company, which operates a portfolio of 12 free-to-air and pay-TV lifestyle and entertainment networks; launched Travel Channel as a 24/7 free-to-air channel in the UK; expanded distribution of Food Network across Latin America and HGTV in APAC; launched Food Network in Australia; secured a large volume output deal in Australia to launch Food Network and HGTV-branded blocks on newly-launched 9LIFE, Australia’s first free-to-air lifestyle network.

Consolidated operating revenues increased $160.4 million, or 4.7 percent, in 2017 compared with 2016. The year-over-year growth in consolidating operating revenues in 2017 was the result of an increase in both advertising sales and distribution fees within the U.S. Networks segment as well as growth in advertising sales at TVN within the International Networks segment. Consolidated

6

income from operations before income taxes increased $33.4 million, or 2.6 percent, in 2017 compared with 2016, primarily driven by the aforementioned increase in operating revenues, a $102.8 million increase in foreign currency transaction net gains, which are

included within miscellaneous, net, a $57.4 million decrease in goodwill write-down, and a $36.3 million decrease in interest expense, net, as a result of debt repayments in 2016 and 2017, partially offset by a $192.9 decrease in (loss) gain on sale of investments primarily as a result of the $208.2 million gain realized on the sale of Fox-BRV Southern Sports Holdings (“Fox Sports South”) in 2016, $29.3 million of Merger related expenses and investments in programming and marketing.

Although International Networks experienced growth, primarily at TVN and has increased its contribution to the consolidated results, U.S. Networks continues to account for the majority of the Company’s performance. U.S. Networks generated operating revenues of $2,967.0 million, representing 83.3 percent of consolidated operating revenues, for the year ended December 31, 2017 compared with $2,871.4 million, representing 84.4 percent of consolidated operating revenues, for the year ended December 31, 2016.

International Networks generated operating revenues of $621.8 million, representing 17.5 percent of consolidated operating revenues, for the year ended December 31, 2017 compared with $557.1 million, representing 16.4 percent of consolidated operating revenues, for the year ended December 31, 2016.

Our CODM, whom we have identified as our CEO, evaluates the operating performance of our businesses and makes decisions about the allocation of resources to the businesses using a measure we refer to as segment profit (loss). Segment profit (loss) is defined as income (loss) from operations before income taxes excluding depreciation, amortization, goodwill write-down, interest expense, net, equity in earnings of affiliates, gain (loss) on derivatives, gain (loss) on sale of investments and other miscellaneous non-operating expenses, which are included in net income (loss) determined in accordance with GAAP.

Consolidated segment profit was $1,426.8 million in 2017 compared with $1,401.5 million in 2016, an increase of $25.3 million, or 1.8%

A reconciliation of segment profit to income (loss) from operations before income taxes as determined in accordance with GAAP is provided for on pages 37-39 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017.

7

Key Fiscal 2017 Executive Compensation Decisions

Important decisions and payouts related to 2017 are summarized below, and discussed in greater detail in the following pages.

|

Base Salary |

Each NEO, except for Mr. Lowe, received a base salary increase effective January 1, 2017 ranging from 8.3% to 17.6% based on individual contributions to overall corporate results and salary level relative to market. |

|

Annual Incentives |

Our financial goals, segment profit (65% weight) and revenue (35% weight), were achieved at 98.52% and 97.55% of target respectively, resulting in a weighted average payout of 90.90% of target. |

|

Long-term Incentives |

For the 2016 PBRSU grants the metric was adjusted cash flow. The Company achieved 107.74 of target respectively, which resulted in a payout of 138.70%. All NEOs received a payout under the 2016 PBRSU grants. |

|

Employment Arrangements |

We entered into new or amended employment contracts with certain NEOs. Given the need to maintain stable leadership in a time of significant change in the media industry, the Board recognized the importance of the NEOs continued leadership and as such entered into new employment contract with 4 of them in 2017. |

Business Results’ Impact on Compensation

We establish target compensation at the beginning of the performance period. An executive’s actual pay will be above or below the target level based on individual, organizational and stock performance. A substantial portion of each NEO’s compensation is in the form of equity and correlated with stock price performance so as the stock price rises or falls, so does the NEO’s actual compensation.

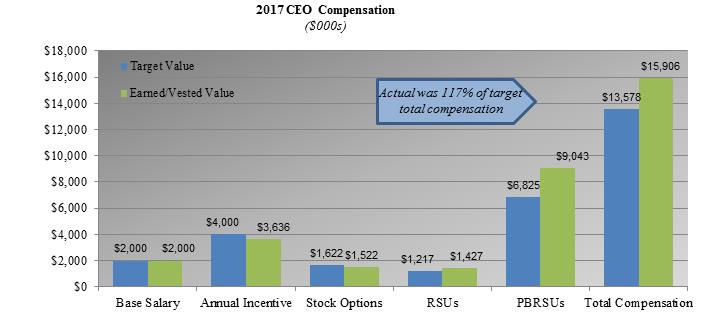

We employ a variety of quantitative criteria to assess the performance of our executives. Our objectives include achieving segment profit and revenue targets in order to align executive pay with shareholder interests. The chart below illustrates the relationship between performance and our CEO’s compensation.

Target value represents stock options, time-based RSUs and PBRSUs at grant date value. Earned/vested value represents stock options, time-based RSUs and PBRSUs granted in 2014, 2015 and 2016 that vested in 2017 and PBRSU awards granted in 2016 and earned in 2017. All earned/vested equity awards are valued based on the Company’s share price on December 29, 2017. For 2017, CEO compensation earned was slightly above total target value compensation, primarily driven by achievement results associated with PBRSUs and vested RSUs currently above grant value.

8

Below we highlight certain executive compensation practices that we consider instrumental in driving Company performance while mitigating risk, as well as practices that we avoid because we do not believe they would serve the interests of our shareholders.

|

|

||||

|

Our Compensation Core Values |

||||

|

|

||||

|

Market Competitive |

Review Peer Group |

Focus on Performance |

||

|

Benchmark pay based on size-adjusted median of companies with which we compete with for business and for talent |

Annually review peer group for appropriateness, and adjust when necessary to ensure a relevant comparison for executive compensation decisions |

Maintain a pay mix that is heavily performance-based |

||

|

Diversified Metrics over Varying Time Horizons |

Program Transparency |

Performance Reviews & Risk Consideration |

||

|

Use different performance metrics in annual incentive plan and long-term incentive plan, to avoid heavy reliance on one definition of success |

Fully disclose the financial performance drivers in numeric terms used in our incentive programs |

Committee annually reviews performance goals for annual and long-term incentive awards to confirm using diversified and rigorous, yet attainable targets, and avoiding excessive risk taking |

||

|

Restrictive Covenants |

Independent Committee Consultant |

Review Committee Charter |

||

|

NEOs are subject to restrictive covenants upon separation, including non-compete, non-solicitation and non-disclosure obligations |

Retain an independent compensation consultant engaged by, and reporting directly to, the Committee |

Review charter annually to maintain strong oversight and governance protocols |

||

|

Clawback Policy |

No Hedging |

No Excise Tax Gross-Ups for New Employees |

||

|

Maintain a clawback policy to permit repayment or forfeitures of compensation based on restated financial results |

Do not permit hedging transactions or short sales by executives or directors |

Eliminated excise tax gross-up provisions to new executives |

||

|

Substantial Stock Ownership Guidelines |

Double Trigger Vesting |

No Stock Option Grants |

||

|

Maintain stock ownership guidelines for executives |

Require double trigger vesting for cash severance payments for termination following a change in control |

Do not grant stock options |

||

Role of the Compensation Committee

The Compensation Committee is responsible for reviewing and approving the Company’s executive compensation policies, plan designs and the compensation of our senior officers, including our NEOs. The Compensation Committee considers various factors in determining compensation levels for NEOs, including the officer’s responsibilities and performance, the effectiveness of our programs in supporting the Company’s short and long-term strategic objectives, and overall financial performance. Additionally, the Compensation Committee coordinates the full Board’s annual review of the CEO’s performance and considers the Board’s assessment in its compensation decisions related to the CEO.

To this end, the Compensation Committee conducts an annual review of executive officer pay levels, reviews market data provided by the independent consultant, and approves changes to program designs, including post-termination arrangements, based on an assessment of competitive market practice and emerging trends. Additionally, the Compensation Committee recommends succession plans to the Board and evaluates the risks associated with the Company’s executive compensation programs.

Role of the Compensation Consultant

In 2017 the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”) to provide executive compensation consulting services. Meridian’s services to the Compensation Committee and the Nominating and Governance

9

Committee have included updates on best practices and market trends in executive and director compensation, recommendations regarding executive and director compensation, and an independent review of compensation proposals by the Company’s senior management. Meridian attended meetings at the Compensation Committee’s request and was available to provide guidance as questions and issues arose. Meridian provides no other services to the Company other than independent compensation advisory services. The Compensation Committee determined that Meridian is independent after consideration of the SEC independence factors.

Role of Executive Officers in Compensation Decisions

At the request of the Compensation Committee, the CEO presents individual pay recommendations for each of the NEOs, other than himself. In forming his recommendations, he is advised by information provided by human resource management (i.e., Executive Vice President, Chief Human Resource Officer and Senior Vice President, Compensation and Benefits) and the independent compensation consultant with regards to assessments of individual contributions, achievement of performance objectives and other qualitative factors. The Compensation Committee considers these recommendations in approving the pay levels of each NEO. The CEO does not make recommendations concerning his own compensation.

The CEO and members of human resource management regularly attend Compensation Committee meetings. Human resource management typically presents recommendations for changes to program designs and individual pay levels for executive officers, taking into consideration individual performance of each incumbent, appropriate benchmarking information and issues that may arise from an accounting, legal or tax perspective.

Compensation Program Overview

The Company’s executive compensation program is designed to meet the following three objectives that align with and support the Company’s strategic business goals:

|

|

• |

Attract and retain executives who lead the Company’s efforts to build short-term and long-term value for shareholders |

|

|

• |

Reward achievement of annual operating performance goals and sustained increases in shareholder value |

|

|

• |

Emphasize variable performance-based components of the compensation program more heavily than fixed components |

The key elements of the Company’s executive compensation program are base salary, annual incentives, long-term incentives consisting of time-based RSUs and PBRSUs, and retirement benefits. The compensation program also includes certain perquisites, but these perquisites are not a significant element of compensation. Each element of compensation is designed to fulfill the objectives discussed above.

|

Program |

Form |

Fixed or Variable |

Objectives |

|

Base Salary |

Cash |

Fixed |

● Serves as attraction and retention incentive |

|

|

|

|

● Rewards individual performance |

|

Annual Incentive |

Cash |

Variable |

● Rewards annual operating results |

|

|

|

|

● Emphasizes variable performance-based compensation |

|

Long-term Incentive, which includes: |

|

|

● Serves as attraction and retention incentive |

|

|

|

|

● Emphasizes variable performance-based compensation |

|

|

|

|

● Aligns interests with shareholders |

|

RSUs |

Equity |

Fixed |

● Rewards for maintaining and increasing stock price and enhancing long-term value |

|

PBRSUs |

Equity |

Variable |

● Rewards based on Company performance |

|

|

|

|

● Rewards for maintaining and increasing stock price and enhancing long-term value |

|

Retirement Benefits |

Cash |

Fixed |

● Serves as attraction and retention incentive |

Pay Mix

A significant portion of the compensation program for the NEOs is “variable” or “at risk.” This means that it is contingent upon achieving specific results that are essential to the Company’s long-term success and growth in shareholder value. As described above, the variable components of the 2017 compensation program include annual incentives and long-term incentives. The Compensation Committee has not established a specific formula for the allocation of “fixed” and “variable” compensation components and instead retains the discretion to modify the allocation from year to year.

10

As illustrated for the 2017 annual program elements, approximately 70% of the total direct compensation opportunity (i.e., “TDC”, or the sum of base salary, annual incentives, fixed equity, and variable equity at target) for the Company’s NEOs (other than the CEO) was weighted — assuming payout at target levels — toward variable and equity components. The TDC opportunity for the CEO was weighted towards variable and equity components at approximately 83%.

To assist in reviewing the levels of compensation in 2017 Meridian collected and analyzed market data, including base salary, target short- and long-term incentive opportunities for each of the NEOs from the following published and proprietary sources:

Primary Data Sources. The Compensation Committee relies on data sources from a third-party administered survey sponsored by Cable and Telecommunications Human Resources Association (“CTHRA”) and from publicly available proxy data from a peer group of 9 publicly-traded companies in the media industry, including:

|

AMC Networks Inc. |

Lions Gate Entertainment Corp. |

Twenty-First Century Fox Inc. |

|

CBS Corp. |

Sirius XM Holdings Inc. |

Viacom, Inc. |

|

Discovery Communications, Inc. |

Time Warner Inc. |

|

11

The companies in this peer group represent some of the many companies in the media industry with which we compete in business and for talent. All pay opportunities were compared with the size-adjusted median of this proxy peer group using regression analysis based on revenue to reflect pay of similarly-situated executives in comparable positions.

Data from the CTHRA Cable Programmers, Broadcast Networks Compensation Survey includes data from over 40 national cable and broadcast networks that participate in the survey each year.

Secondary Data Sources. To obtain a broader understanding of market pay levels and compensation and benefit practices, the Compensation Committee also reviews survey data from the Towers Watson Executive Compensation Database, for both general industry and media cuts.

Market data provides an important reference point by indicating what an executive could expect to earn at a similar peer company and what the Company might expect to pay if it should have to recruit from the outside. However, market data is only one of the many factors that the Compensation Committee considers to assess the reasonableness of pay opportunities provided to the Company’s executive officers. The Compensation Committee also considers other relevant factors such as the incumbent’s experience, tenure in position, talent supply and demand, cost constraints of the Company and internal equity.

Tally Sheets

In determining executive compensation for each NEO, the Compensation Committee also reviews tally sheets which provide:

|

|

• |

History of targeted pay for the last five years; |

|

|

• |

Value of outstanding equity awards at various stock price levels; |

|

|

• |

Present value of accrued benefits under each retirement plan and current level of perquisites provided; |

|

|

• |

Cumulative stock exercises and stock vesting over time; and |

|

|

• |

Update on stock ownership levels. |

Analysis of Each Compensation Element

Following is a brief summary of each element of the 2017 compensation program for the NEOs.

Base Salary. After discussing the individual performance, experience, scope of responsibilities, and Mr. Lowe’s recommendations for the other NEOs, the Compensation Committee established the base salaries for each NEO. In general, the increases are intended to align base salary levels with the market and to reflect the individual performance and scope of responsibilities of each NEO. Mr. Lowe did not receive a salary increase in 2017 due to entering into a new employment contract with the company in 2016. The salary increases in 2017 for the other NEOs were outcomes due to observations in market changes.

|

NEO |

|

2017 Base Salary Percentage Increase |

|

|

|

Mr. Lowe |

|

|

0.0 |

% |

|

Ms. Hickok |

|

|

12.9 |

% |

|

Mr. Jablin |

|

|

15.4 |

% |

|

Ms. Gibson |

|

|

17.6 |

% |

|

Mr. Hale |

|

|

8.3 |

% |

|

|

|

|

|

|

Please refer to the Salary column of the Summary Compensation Table for the 2017 base salaries of the NEOs.

12

Annual Incentive. The annual incentive payout for the NEOs is based on the extent to which certain pre-established performance goals are achieved during the year. The annual incentive program is consistent with the Company’s pay for performance philosophy and is also “at risk” because the Company must achieve certain performance goals established by the Compensation Committee for the NEOs to receive an annual incentive payout.

Target Incentive Opportunities. The NEOs had the opportunity to earn targeted incentive cash payments that were expressed as a percentage of each executive’s annual base salary. The target annual incentive opportunities were established by the Compensation Committee, according to each executive’s position and level of responsibility and positioning versus market. The target annual incentive opportunity increased for all NEOs in 2017 due to observations in market changes, with the exception of Mr. Lowe. The following table shows the target annual incentive opportunity as of December 31, 2017 (expressed as a percentage of base salary) for each NEO.

|

NEO |

|

2017 Target Incentive as a Percent of Base Salary |

|

|

|

Mr. Lowe |

|

|

200 |

% |

|

Ms. Hickok |

|

|

85 |

% |

|

Mr. Jablin |

|

|

150 |

% |

|

Ms. Gibson |

|

|

85 |

% |

|

Mr. Hale |

|

|

85 |

% |

|

|

|

|

|

|

Performance Goals and Actual Results for 2017. The target annual incentives are earned based on the extent to which certain performance goals are achieved. The Compensation Committee established two performance goals for the 2017 annual performance period: segment profit and revenue, which are described in more detail below:

|

Segment profit is the measure by which the Company evaluates the operating performance of each business segment and the measure of performance most frequently used by investors to determine the value of the enterprise. The segment profit goal was based on the consolidated performance of the Company. Segment profit is a supplemental non-GAAP financial measure that is defined in our notes to the financial statements. Segment profit for 2017 was adjusted to exclude the following items, which were identified by the committee when it established the goals in February, 2017 (i) the effects of currency fluctuations above or below budgeted levels, (ii) programming amortization as a result of purchase accounting (iii), transaction and integration costs related to the Discovery transaction, (iv) revenue and related segment profit related to an entity that was sold during the 2017 year for the period subsequent to the sale, (v) unbudgeted revenue and related segment profit related to an entity that was purchased during the 2017 year, (vi) fifty percent of unbudgeted severance costs and (vii) unbudgeted expenses related to an international restructuring project. |

|

|

|

|

|

Revenue |

Revenue growth is primarily achieved through growth in advertising sales and distribution fee revenues from our television networks. Continued growth in revenues allows us to invest and grow our existing brands and allows us the flexibility to take advantage of promising opportunities in the global media marketplace. The revenue goal was based on the Company’s operating revenue as set forth in our financial statements. |

The above combination of a growth measure (revenue) and a profitability measure (segment profit) creates a balance between growing the Company and managing expenses.

The following table provides the weights of each metric, the range of performance and payout, and the actual achievement level for each performance goal along with the payout percentage for 2017. All amounts are shown in millions.

|

|

|

Weights (% of Total) |

|

|

Threshold |

|

|

Target |

|

|

Maximum |

|

|

Actual |

|

|||||

|

Segment Profit(1) |

|

|

65 |

% |

|

$ |

1,192.3 |

|

|

$ |

1,472.0 |

|

|

$ |

1,766.4 |

|

|

$ |

1,449.4 |

|

|

Revenue |

|

|

35 |

% |

|

$ |

2,930.3 |

|

|

$ |

3,617.6 |

|

|

$ |

4,341.1 |

|

|

$ |

3,528.8 |

|

|

Payout Percent of Target |

|

|

|

|

|

|

6 |

% |

|

|

100 |

% |

|

|

200 |

% |

|

|

|

|

13

|

(1) |

Actual segment profit results include adjustments for one-time items noted in the definition above and, therefore, differ from the reported segment profit in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017. |

For more information on the 2017 target annual incentive opportunity for the NEOs, please refer to the “Grants of Plan-Based Awards” Table. The “Estimated Possible Payouts Under Non-Equity Incentive Plan Awards” column of that table provides the estimated payouts for the NEOs at threshold, target and maximum performance levels for 2017. Please refer to the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table for the actual amounts earned by each NEO.

Long-Term Incentives. The Company’s long-term incentive awards are consistent with the Company’s pay for performance philosophy and are intended to create a direct correlation between the level of compensation paid to the NEOs and the Company’s financial performance and stock price. This approach:

|

|

• |

Rewards performance that delivers creation of sustainable shareholder value; |

|

|

• |

Provides a long-term retention incentive for key employees based on the vesting period; and |

|

|

• |

Increases stock ownership of the NEOs so that their interests are more closely aligned with the long-term interest of the Company’s shareholders. |

Long-Term Incentive Opportunities. Under the Company’s Long-Term Incentive Plan, the NEOs were granted equity awards as recommended by the CEO and approved by the Compensation Committee. The Compensation Committee approved the 2017 target value of the equity awards as a percent of base salary for each NEO based on each NEO’s position and level of responsibility.

Decisions regarding long-term incentive grants were made based on role and competitive market data to reward value creation and meet retention objectives. The Compensation Committee also determined that it was important to maintain internal equity among the NEOs, especially for positions of similar scope and authority in the Company. Therefore, in addition to the other factors cited, the targets reflect the Compensation Committee’s strategy to ensure proper internal alignment among the NEOs. There was no change to the target value of equity awards for the NEOs from 2017. This table shows the 2017 long-term incentive opportunities (expressed as a percentage of base salary) for each NEO.

|

NEO |

|

2017 Long-Term Incentive as a Percent of Base Salary |

|

|

|

Mr. Lowe |

|

|

275 |

% |

|

Ms. Hickok |

|

|

125 |

% |

|

Mr. Jablin |

|

|

225 |

% |

|

Ms. Gibson |

|

|

125 |

% |

|

Mr. Hale |

|

|

125 |

% |

|

|

|

|

|

|

During 2017 we eliminated the use of stock options and used two long-term incentive vehicles targeting the mix in the table below.

|

Form of Equity |

|

Percent of Target Long-Term Incentive Award |

|

|

|

Restricted Share Units (RSUs) |

|

|

30 |

% |

|

Performance-Based Restricted Share Units (PBRSUs) |

|

|

70 |

% |

This combination of these forms of equity balances the need for retention with the focus on share price appreciation, both on an absolute and a relative basis.

Time-Based Restricted Share Units. Each RSU corresponds in value to a single share of Company Class A Common Stock. Therefore, as share price increases, RSUs become more valuable. This creates an incentive for our NEOs to increase share price which benefits our shareholders. Time-based RSUs also provide NEOs the opportunity to increase their stock ownership levels. In addition, RSUs serve as an effective retention incentive as they vest over three years and unvested RSUs are forfeited if the employee

14

voluntarily terminates before retirement. This serves to align the interests of the NEOs with those of our shareholders. These grants provide for accelerated vesting on pro-rata basis for termination without “cause” or for “good reason”.

Performance-Based Restricted Share Units (2017 Grants). PBRSU awards provide NEOs with an opportunity to increase their stock ownership levels and at the same time serve as retention incentives. The number of shares ultimately earned is dependent upon the level of the Company’s achievement of performance targets.

For the 2017 PBRSU grant, the two-year performance period began on January 1, 2017 and ends on December 31, 2018. Shares are earned if the targeted adjusted cash flow is achieved by more than the threshold as illustrated in the table below.

|

Performance Payout |

|

|||||

|

≤ 80% |

|

= |

|

|

0 |

% |

|

85% |

|

= |

|

|

25 |

% |

|

90% |

|

= |

|

|

50 |

% |

|

95% |

|

= |

|

|

75 |

% |

|

100% |

|

= |

|

|

100 |

% |

|

105% |

|

= |

|

|

125 |

% |

|

110% |

|

= |

|

|

150 |

% |

|

115% |

|

= |

|

|

175 |

% |

|

≥ 120% |

|

= |

|

|

200 |

% |

The earned units, if any, vest 50% on each of February 28, 2019 and February 28, 2020. These grants provide for accelerated vesting in full for termination without “cause” or for “good reason”.

Performance-Based Restricted Share Units (2016 Grants). For the 2016 PBRSU grant, the two-year performance period began on January 1, 2016 and ended on December 31, 2017. The Company’s adjusted cash flow was 107.74% of $2,672.0M, the target for the performance period, resulting in a payout of 138.70%.

Additional Information. For more information on the equity awards granted to NEOs in 2017, please refer to the “Grants of Plan-Based Awards” table. For information about the total number of stock options, RSUs and PBRSUs outstanding as of the end of 2017 with respect to each NEO, please refer to the “Outstanding Equity Awards at Fiscal Year-End” table.

Retirement Plans

The Company provides savings and retirement benefits through the Scripps Networks Interactive Pension Plan and the Scripps Networks Interactive 401K Savings Plan.

The pension plan is closed to new participants and the credited service levels used for benefit calculation purposes are frozen; however, consideration of salary growth to calculate benefit levels continues for a ten-year transition period that ends December 31, 2019. Plan participants will continue to accrue service for vesting and early retirement eligibility.

The 401K Savings Plan includes a Company match of 50% of the employee’s contribution up to 6% of eligible compensation, and a Company contribution of up to 8% based on a combination of age and service. This Company contribution, which went into effect on January 1, 2010, was intended to mirror some of the financial benefits available under the defined benefit plan that was frozen.

To attract and retain key executive talent, the Company has determined that it is important to provide the management team, including the NEOs, with retirement benefits that are in addition to those generally provided to its employees. These restorative plans listed below allow the NEOs to receive the same benefit as other plan participants:

|

|

• |

The Company supplements the pension plan for pension-eligible executives whose salary and contributions exceed the IRS limitations through the Company’s Supplemental Executive Retirement Plan (“SERP”). Consistent with the transitional freeze of the defined benefit plan, the SERP was also transitionally frozen, effective January 1, 2010. |

|

|

• |

The NEOs may also defer specified portions of their compensation under the Executive Deferred Compensation Plan, and receive matching contributions, in each case in excess of what they are able to defer under the 401K Savings Plan due to IRS limitations. |

15

The Company believes that the SERP and the Executive Deferred Compensation Plan are important retention tools, as many of the companies with which the Company competes for executive talent provide similar benefits to their senior executives.

Perquisites

The Company provides executives with benefits comparable to those they would receive at other companies within our industry and are necessary for us to remain competitive in the marketplace. Our Compensation Committee considers these arrangements to be fair and reasonable in light of the relatively low cost to the Company.

In 2017, the NEOs received a financial planning benefit pursuant to the terms of their employment agreements, plus an additional payment to cover the taxes associated with the compensation value of this benefit. They also received membership in dining and business clubs. In addition, Mr. Lowe receives a monthly travel stipend for his trips to New York.

The NEOs are also eligible for an executive physical. Typically, the majority of the cost associated with this benefit is covered under the healthcare plans offered to the Company’s employees; however, if certain tests or procedures are not covered, the Company will pay for the difference.

For more information about the perquisites provided in 2017 to each NEO, please refer to the “All Other Compensation” column of the Summary Compensation Table.

Other Plans and Agreements

Employment Agreements. The Company maintains employment agreements with each of the NEOs. These employment agreements enhance retention for the NEOs and also protect the Company’s interests by imposing confidentiality, non-competition, non-solicitation and other restrictive covenants on the executives.

On April 24, 2017 we entered into a new employment agreement with Ms. Gibson. The agreement extended the term to December 31, 2019. Under the employment agreement, Ms. Gibson will receive an annual base salary of not less than $800,000, with a target annual incentive opportunity of 85% of her base salary.

On July 28, 2017, the Company entered into amendments to the employment agreements of Burton Jablin and Mark Hale. The amendments provided for a one-year extension of the term through December 31, 2018 of Mr. Hale’s and Mr. Jablin’s employment agreements. In addition, under Mr. Jablin’s amendment, he will receive an annual base salary of not less than $1,500,000, with a target annual incentive opportunity of 150% of his base salary.

On July 28, 2017, the Company also entered into a new employment agreement appointing Lori Hickok to the position of Executive Vice President, Chief Financial & Development Officer. The terms of the Employment Agreement are retroactive to July 1, 2017, continuing until December 31, 2020. Under the employment agreement, Ms. Hickok will receive an annual base salary of not less than $875,000, with a target annual incentive opportunity of 85% of her base salary. For additional details on the employment agreements for our NEOs, please refer to the “Employment Agreements” section contained within this CD&A.

Each NEO would be entitled to severance benefits under his/her employment agreement in the event of an involuntary termination of employment without “cause” or a termination by the executive for “good reason,” death or disability. Each NEO, other than Jablin would also be entitled to certain severance benefits upon a termination of employment following the expiration of the term. The severance benefits for each of the NEOs are determined based upon a multiple of base pay and annual incentive.

16

In exchange for the severance benefits, the NEOs agree not to disclose Company confidential information and agree not to compete against the Company or solicit its employees or customers for a period of time after termination. These provisions protect the Company’s interests and help to ensure its long-term success.

Executive Severance Plan. Effective January 1, 2011, the Company adopted the Executive Severance Plan, (“ESP”), which provides severance benefits to certain executives upon involuntary termination, death and disability. The ESP also provides benefits for termination for “good reason” for executives with employment agreements. The severance benefits are generally based upon a multiple of base salary and annual incentive, depending upon the level of responsibility of the executive. The ESP was adopted to codify existing practices, to ensure consistency in benefits payable upon termination and to provide for protection of the Company through the inclusion of confidentiality, non-compete and non-interference obligations in exchange for the receipt of benefits. All NEOs are covered under the ESP.

On July 27, 2017, the Company amended the ESP to (i) provide that the plan may not be amended or terminated following the announcement of the proposed merger with Discovery Communications, Inc. and for two years following the consummation of the merger and (ii) clarify that “good reason” termination protection applies to individuals who terminate their employment on the basis of a good reason termination event on or after attaining retirement age.

Change in Control Plan. All NEOs are provided change in control protection under the Company’s Executive Change in Control Plan. Under this plan, a NEO would be entitled to certain severance benefits if a change in control were to occur and the Company terminated the executive’s employment without “cause” or the executive terminated his/her employment with the Company for “good reason” within a two-year period following the change in control. In addition to the benefits available under the Executive Change in Control Plan under these circumstances, Mr. Lowe is entitled to certain additional benefits under his employment agreement. The severance levels in the Change in Control Plan were adopted by the Compensation Committee in 2008.

This plan was frozen to new participants beginning in 2012. A new plan, 2012 Executive Change in Control Plan, was added for new hires beginning in 2012 that is the same as the 2008 plan with the exception that it does not include a gross-up provision.

On July 27, 2017, the Company amended and restated its Executive Change in Control Plan and its 2012 Executive Change in Control Plan. The amendments (i) provide that the plans may not be amended or terminated following the announcement of the proposed merger with Discovery Communications, Inc. and for two years following the consummation of the merger, (ii) clarify that severance amounts include payment of a prorated annual bonus in respect of the year of termination, and (iii) clarify that “good reason” termination protection applies to individuals who voluntarily terminate their employment on the basis of a good reason termination event on or after attaining retirement age.

The Company believes that the occurrence, or potential occurrence, of a change in control transaction will create uncertainty regarding the continued employment of NEOs. The change in control protections allow NEOs to focus on the Company’s business and objectively evaluate the benefits to shareholders of proposed transactions without being distracted by potential job loss. It also enhances retention following a change in control, as the severance benefits are payable only if the executive incurs a qualifying termination within a certain period following a change in control, rather than merely as a result of the change in control. In addition, the Change in Control Plan conditions the severance benefits upon certain confidentiality, non-compete and non-solicitation obligations which further protect the continuity of the Company’s business following a change in control.

Most equity awards held by employees would immediately vest upon a change in control, under the Long-Term Incentive Plan. Unlike the cash severance described above, the vesting is not contingent upon a qualifying termination within a certain period following a change in control. This single trigger is appropriate because the equity of the Company will change and the Company believes NEOs, along with all participants, should have the same opportunity to realize value as common shareholders. Commencing in 2017, all equity grants to Mr. Lowe would vest on a “double trigger” basis.

Additional Information. Please refer to the “Description of Potential Payments Upon Termination or Change in Control” section of this proxy statement for information regarding potential payments and benefits, if any, that each NEO is entitled to receive under his/her employment agreement and applicable plans in connection with his/her termination of employment as well as in connection with a change in control.

17

Equity Grant Practices. The Compensation Committee approves annual equity awards at its February meeting, which are subsequently issued on March 1st based on the closing price of the Company’s Class A Common Shares on such date (or the last trading day prior to such date). This meeting date is set typically two years in advance. The Compensation Committee does not grant equity compensation awards in anticipation of the release of material nonpublic information. Similarly, the Company does not time the release of material nonpublic information based on equity award grant dates.

Stock Ownership Guidelines. Effective November 2011, the Company adopted stock ownership guidelines for all NEOs in addition to executive officers to encourage ownership in the Company for the executives who have a direct impact on the decisions that contribute to the long-term success of the Company.

The guidelines give the executive five years to attain the prescribed ownership levels which are established as a target multiple of base pay. The target multiples for the NEOs are on the table to the right.

|

|

|

Multiple of |

|

2017 |

|

NEO |

|

Salary |

|

Ownership |

|

Mr. Lowe |

|

5.0x |

|

12.7x |

|

Ms. Hickok |

|

2.0x |

|

4.3x |

|

Mr. Jablin |

|

3.0x |

|

4.5x |

|

Ms. Gibson |

|

2.0x |

|

3.4x |

|

Mr. Hale |

|

2.0x |

|

4.6x |

|

|

|

|

|

|

Shares owned outright as well as time-based RSUs are included in the totals. As of December 31, 2017, all of the NEOs have met the target stock ownership levels.

Mandatory Retirement Policy. Effective January 1, 2011, the Company adopted a mandatory retirement policy pursuant to which all bona fide executives as defined under the Age Discrimination in Employment Act, will be required to retire at the age of 65, unless otherwise determined by the Compensation Committee. Each of the NEOs qualifies as a bona fide executive and will be subject to the policy. Mr. Lowe’s employment agreement, which was approved by the Board in 2016, extended his employment until December 31, 2019, which is approximately three years after he turns 65.

Anti-hedging and Prohibition on Pledging Policy. Our policy on insider trading prohibits directors, officers and certain key employees from engaging in short sales, purchases of puts and calls and other speculative or hedging transactions with respect to Company stock, regardless of whether they do or do not hold material, non-public information. In addition, directors, officers and certain key employees are prohibited from holding Company stock in a margin account or pledging Company stock to secure a loan unless a prior approval is obtained.

Income Deduction Limitations. In structuring our executive compensation program, the Compensation Committee takes into account the tax treatment of our compensation arrangements. For example, the Compensation Committee reviews and considers the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code (“Section 162(m)”). Section 162(m) generally provides that the Company may not deduct compensation paid to a “covered employee” (generally our named executive officers serving on the last day of the year other than the chief financial officer) to the extent it exceeds $1 million. Qualified performance-based compensation paid pursuant to shareholder approved plans is not subject to the $1 million deduction limit, provided that certain requirements are satisfied.

In making compensation decisions in 2017 and prior years, the Compensation Committee often sought to structure our annual incentive program and performance-based restricted shares with the intention that they would be exempt from the $1 million deduction limit as “qualified performance-based compensation.” However, the Compensation Committee never adopted a policy that would have required all compensation to be deductible, because the committee wanted to preserve the ability to pay compensation to our executives in appropriate circumstances, even if such compensation would not be deductible under Section 162(m).

18

The Tax Cuts and Jobs Act, which was enacted on December 22, 2017, includes a number of significant changes to Section 162(m), such as the repeal of the qualified performance-based compensation exemption and the expansion of the definition of “covered employees” (for example, by including the chief financial officer and certain former named executive officers as covered employees).

As a result of these changes, except as otherwise provided in the transition relief provisions of the Tax Cuts and Jobs Act, compensation paid to any of our covered employees generally will not be deductible in 2018 or future years, to the extent that it exceeds $1 million.

The Company has taken steps that it deemed appropriate with the intention of preserving the deductibility of certain compensation arrangements that were in place as of November 2, 2017 under the applicable transition rules. However, due to uncertainties regarding the scope of transition relief under the Tax Cuts and Jobs Act, there can be no guarantee that any compensation in excess of $1 million paid to our covered employees after 2017 will be or remain exempt from Section 162(m).

Compensation Risk Assessment. Members of management from the Company’s human resources, finance and legal groups assessed whether the Company’s compensation policies and practices encourage excessive or inappropriate risk taking by our employees, including employees other than our NEOs and reported the results to the Compensation Committee.

Specifically, the review included a detailed analysis of the following risk factors related to compensation: pay mix, performance goals, performance metrics/target, market comparisons and checks and balances. The review also analyzed whether there was any link between the Company’s key business risks and its compensation programs.

Based upon the review, and in consultation with Meridian, the Compensation Committee determined that its compensation policies and practices did not create risks that are “reasonably likely to have a material adverse effect” on the Company.

19

Summary Compensation Table

The following table presents information concerning compensation paid to the NEOs in 2015, 2016 and 2017. The narrative following the tables describes current employment agreements and employment terms with each of our NEOs.

Summary Compensation Table — 2015 to 2017

|

Name and Principal Position |

|

Year |

|

Salary ($) |

|

|

Bonus ($)(1) |

|

|

Stock Awards ($)(2)(3) |

|

|

Option Awards ($)(4) |

|

|

Non-Equity Incentive Plan Compensation ($)(5) |

|

|

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(6) |

|

|

All Other Compensation ($)(7) |

|

|

Total ($) |

|

||||||||

|

Kenneth W. Lowe |

|

2017 |

|

|

2,000,000 |

|

|

|

|

|

|

|

5,500,032 |

|

|

|

|

|

|

|

3,636,100 |

|

|

|

4,382,472 |

|

|

|

871,311 |

|

|

|

16,389,916 |

|

|

Chairman, President & |

|

2016 |

|

|

1,683,858 |

|

|

|

|

|

|

|

19,057,503 |

|

|

|

1,888,955 |

|

|

|

3,329,010 |

|

|

|

2,028,569 |

|

|

|

796,344 |

|

|

|

28,784,239 |

|

|

Chief Executive Officer |

|

2015 |

|

|

1,467,000 |

|

|

|

|

|

|

|

2,420,604 |

|

|

|

1,573,534 |

|

|

|

2,039,548 |

|

|

|

1,315,473 |

|

|

|

499,158 |

|

|

|

9,315,317 |

|

|

Lori Hickok |

|

2017 |

|

|

875,000 |

|

|

|

|

|

|

|

1,093,783 |

|

|

|

|

|

|

|

676,087 |

|

|

|

579,529 |

|

|

|

212,624 |

|

|

|

3,437,023 |

|

|

Executive Vice President, |

|

2016 |

|

|

775,000 |

|

|

|

|

|

|

|

581,235 |

|

|

|

429,306 |

|

|

|

578,218 |

|

|

|

514,990 |

|

|

|

184,710 |

|

|

|

3,063,459 |

|

|

Chief Financial & Development Officer |

|

2015 |

|

|

675,000 |

|

|

|

|

|

|

|

1,506,226 |

|

|

|

329,101 |

|

|

|

469,221 |

|

|

|

96,339 |

|

|

|

154,590 |

|

|

|

3,230,477 |

|

|

Burton F. Jablin |

|

2017 |

|

|

1,500,000 |

|

|

|

|

|

|

|

2,924,994 |

|

|

|

|

|

|

|

2,045,306 |

|

|

|

873,319 |

|

|

|

475,944 |

|

|

|

7,819,563 |

|

|

Chief Operating Officer |

|

2016 |

|

|

1,110,000 |

|

|

|

|

|

|

|

1,498,542 |

|

|

|

1,106,792 |

|

|

|

1,274,086 |

|

|

|

889,495 |

|

|

|

456,679 |

|

|

|

6,335,594 |

|

|

|

|

2015 |

|

|

1,050,000 |

|

|

|

|

|

|

|

1,116,022 |

|

|

|

725,479 |

|

|

|

1,122,923 |

|

|

|

197,847 |

|

|

|

287,837 |

|

|

|

4,500,108 |

|

|

Cynthia L. Gibson |

|

2017 |

|

|

800,000 |

|

|

|

|

|

|

|

999,955 |

|

|

|

|

|

|

|

618,137 |

|

|

|

|

|

|

|

142,963 |

|

|

|

2,561,055 |

|

|

Executive Vice President, |

|

2016 |

|

|

680,000 |

|

|

|

|

|

|

|

510,051 |

|

|

|

376,690 |

|

|

|

507,340 |

|

|

|

|

|

|

|

139,350 |

|

|

|

2,213,431 |

|

|

Chief Legal & Business Affairs Officer |

|

2015 |

|

|

630,000 |

|

|

|

|

|

|

|

472,552 |

|

|

|

307,159 |

|

|

|

437,940 |

|

|

|

|

|

|

|

99,799 |

|

|

|

1,947,450 |

|

|

Mark S. Hale |

|

2017 |

|

|

650,000 |

|

|

|

500,000 |

|

|

|

812,458 |

|

|

|

|

|

|

|

502,236 |

|

|

|

415,502 |

|

|

|

164,136 |

|

|

|

3,044,333 |

|

|

Executive Vice President, |

|

2016 |

|

|

600,000 |

|

|

|

250,000 |

|

|

|

450,016 |

|

|

|

332,371 |

|

|

|

447,652 |

|

|

|

413,713 |

|

|

|

159,897 |

|

|

|

2,653,649 |

|

|

Global Operations & Chief Technology Officer |

|

2015 |

|

|

578,500 |

|

|

|

|

|

|

|

433,944 |

|

|

|

282,054 |

|

|

|

402,140 |

|

|

|

116,444 |

|

|

|

142,412 |

|

|

|

1,955,494 |

|

|

(1) |

Reflects the retention bonus paid to Mr. Hale under the terms of his employment agreement. |

|

(2) |

Reflects the aggregate grant date fair value of the PBRSUs granted at target performance payout and the time-based RSUs granted to our NEOs. The aggregate grant date fair value was determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation - Stock Compensation (“FASB ASC Topic 718”). See Note 18 of the Consolidated Financial Statements contained in this Annual Report on Form 10-K for an explanation of the assumptions made in valuing these awards. For additional information about the equity awards granted in 2017, please refer to the “Grants of Plan-Based Awards” section within this CD&A. For information on all outstanding equity awards as of December 31, 2017, please refer to the Outstanding Equity Awards at Fiscal Year End table. |

|

(3) |

The grant date fair value of the PBRSUs granted in 2017 at the maximum performance payout would be as follows: Mr. Lowe: $7,699,997.38; Ms. Hickok: $1,531,328.56; Mr. Jablin: $4,095,008.06; Ms. Gibson: $1,399,984.98 and Mr. Hale: $1,137,457.80. |

|

(4) |

Reflects the aggregate grant date fair value of the stock options granted to our NEOs in prior years. |

|

(5) |

Reflects the annual incentive earned by each NEO under the Executive Annual Incentive Plan for the applicable calendar year. For additional information about the 2017 annual incentive opportunities, please refer to the narrative summary on executive annual incentive plans in this CD&A. |

|

(6) |

Reflects the increase in the present value of the accumulated benefits under the pension plan and the SERP for the applicable calendar year. Ms. Gibson is not eligible to participate in the pension plan or SERP. For information on these plans, please refer to the Pension Benefits table. The NEOs did not accrue any preferential or above-market earnings on non-qualified deferred compensation. |

|

(7) |

Reflects the perquisites and other benefits outlined in the table below. For more information about these benefits, refer to the narrative summary on executive benefits within this CD&A. |

20

|

Name |

|

|

|

Financial Planning ($)(1) |

|

|

Legal Fees ($) |

|

Club Dues ($)(2) |

|

|

Tax Gross-Up ($)(3) |

|

|

Matching Contribution ($)(4) |

|

|

Company Contribution ($)(5) |

|

|

Senior Executive Physical ($)(6) |

|

Charitable Matching Gift ($)(7) |

|

|

Other ($)(8) |

|

|

Total ($) |

|

||||||||

|

Mr. Lowe |

|

2017 |

|

|

15,000 |

|

|

|

|

|

20,178 |

|

|

|

10,840 |

|

|

|

169,083 |

|

|

|

558,210 |

|

|

|

|

|

2,000 |

|

|

|

96,000 |

|

|

|

871,311 |

|

|

|

|

2016 |

|

|

15,000 |

|

|

|

|

|

25,594 |

|

|

|

10,840 |

|

|

|

150,386 |

|

|

|

496,024 |

|

|

|

|

|

2,500 |

|

|

|

96,000 |

|

|

|

796,344 |

|

|

|

|

2015 |

|

|

15,000 |

|

|

|

|

|

14,942 |

|

|

|

10,840 |

|

|

|

105,197 |

|

|

|

345,180 |

|

|

|

|

|

|

|

|

|

8,000 |

|

|

|

499,159 |

|

|

Ms. Hickok |

|

2017 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

7,227 |

|

|

|

45,673 |

|

|

|

149,224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

212,624 |

|

|

|

|

2016 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

3,765 |

|

|

|

40,493 |

|

|

|

129,953 |

|

|

|

|

500 |

|

|

|

|

|

|

|

184,710 |

|

|

|

|

|

2015 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

3,765 |

|

|

|

31,287 |

|

|

|

109,538 |

|

|

|

|

|

|

|

|

|

|

|

|

|

154,590 |

|

|

Mr. Jablin |

|

2017 |

|

|

12,000 |

|

|

|

|

|

|

|

|

|

8,672 |

|

|

|

104,804 |

|

|

|

348,468 |

|

|

|

|

|

2,000 |

|

|

|

|

|

|

|

475,944 |

|

|

|

|

2016 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

7,227 |

|

|

|

71,460 |

|

|

|

233,390 |

|

|

|

|

|

2,500 |

|

|

|

|

|

|

|

324,577 |

|

|

|

|

2015 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

7,227 |

|

|

|

62,972 |

|

|

|

205,139 |

|

|

|

|

|

2,500 |

|

|

|

|

|

|

|

287,838 |

|

|

Ms. Gibson |

|

2017 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

3,907 |

|

|

|

42,406 |

|

|

|

81,650 |

|

|

|

|

|

5,000 |

|

|

|

|

|

|

|

142,963 |

|

|

|

|

2016 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

3,765 |

|

|

|

35,568 |

|

|

|

53,353 |

|

|

|

|

|

7,500 |

|

|

|

|

|

|

|

110,186 |

|

|

|

|

2015 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

3,765 |

|

|

|

32,977 |

|

|

|

48,057 |

|

|

|

|

|

5,000 |

|

|

|

|

|

|

|

99,799 |

|

|

Mr. Hale |

|

2017 |

|

|

10,000 |

|

|

|

|

|

|

|

|

|

6,659 |

|

|

|

34,509 |

|

|

|

109,967 |

|

|

|

|

|

3,000 |

|

|

|

|

|

|

|

164,136 |

|

|

|

|

2016 |

|

|

10,000 |

|

|

|

|

|

1,799 |

|

|

|

3,765 |

|

|

|

31,407 |

|

|

|

101,732 |

|

|

|

|

|

2,500 |

|

|

|

|

|

|

|

151,203 |

|

|

(1) |

Represents the amount paid to our NEOs for financial planning services. |

|

(2) |

Represents the amount paid for dining and business clubs. |

|

(3) |

Represents reimbursement of taxes imposed on the financial planning benefit. |

|

(4) |

Represents the amount of all matching contributions earned under the Company’s 401(k) Plan and Deferred Compensation Plan. |

|

(5) |

Represents the amount of all age plus service contributions earned under the Company’s 401(k) Plan and Deferred Compensation Plan. |

|

(6) |

Represents the cost of the senior executive physical, if any, that is in excess of the cost of a physical covered under the Company’s general health plan. |

|

(7) |

Represents the amount of matching charitable contributions under the Company’s matching gift program. |

|

(8) |

Represents the amount of a travel stipend. |

Employment Agreements