Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-34004

SCRIPPS NETWORKS INTERACTIVE, INC.

(Exact name of registrant as specified in its charter)

| Ohio | 61-1551890 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) | |

| 312 Walnut Street Cincinnati, Ohio |

45202 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (513) 824-3200

| Title of each class |

Name of each exchange on which registered | |

| Securities registered pursuant to Section 12(b) of the Act: Class A Common shares, $.01 par value |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: Not applicable

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the

Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of Class A Common shares of the registrant held by non-affiliates of the registrant on June 30, 2009, was approximately $2,560,980,469. All Class A Common shares beneficially held by executives and directors of the registrant and The Edward W. Scripps Trust have been deemed, solely for the purpose of the foregoing calculation, to be held by affiliates of the registrant. There is no active market for our Common Voting shares.

As of January 29, 2010, there were 129,538,215 of the registrant’s Class A Common shares, $.01 par value per share, outstanding and 36,338,226 of the registrant’s Common Voting shares, $.01 par value per share, outstanding.

Certain information required for Part III of this report is incorporated herein by reference to the proxy statement for the 2010 annual meeting of shareholders.

Table of Contents

Index to Scripps Networks Interactive, Inc. Annual Report on Form 10-K for the Year Ended December 31, 2009

2

Table of Contents

As used in this Annual Report on Form 10-K, the terms “SNI,” “we,” “our” or “us” may, depending on the context, refer to Scripps Networks Interactive, Inc., to one or more of its consolidated subsidiary companies, or to all of them taken as a whole.

Our Company Web site is www.scrippsnetworksinteractive.com. Copies of all of our SEC filings filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on our Web site as soon as reasonably practicable after we electronically file the material with, or furnish it to, the SEC. Our Web site also includes copies of the charters for our Compensation, Nominating & Governance and Audit Committees, our Corporate Governance Principles, our Insider Trading Policy, our Ethics Policy and our Code of Ethics for the CEO and Senior Financial Officers. All of these documents are also available to shareholders in print upon request.

Our Annual Report on Form 10-K contains certain forward-looking statements related to our businesses that are based on our current expectations. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from the expectations expressed in the forward-looking statements. Such risks, trends and uncertainties, which in most instances are beyond our control, include changes in advertising demand and other economic conditions; consumers’ tastes; program costs; labor relations; technological developments; competitive pressures; interest rates; regulatory rulings; the risk that the benefits from the separation transaction may not be fully realized or may take longer to realize than expected; and reliance on third-party vendors for various products and services. The words “believe,” “expect,” “anticipate,” “estimate,” “intend” and similar expressions identify forward-looking statements. All forward-looking statements, which are as of the date of this filing, should be evaluated with the understanding of their inherent uncertainty. We undertake no obligation to publicly update any forward-looking statements to reflect events or circumstances after the date the statement is made.

| Item 1. | Business |

Separation from The E. W. Scripps Company

As previously disclosed in our registration statement on Form 10 filed with the U.S. Securities and Exchange Commission, Scripps Networks Interactive, Inc. was formed on July 1, 2008 and became a publicly traded company as the result of the separation of The E. W. Scripps Company (our “Former Parent” or “E. W. Scripps”) into two publicly traded companies. The separation was completed through a tax free distribution of Scripps Networks Interactive shares to E. W. Scripps shareholders following the close of business on June 30, 2008.

Business Overview

Scripps Networks Interactive is a leading lifestyle content and interactive services company with respected, high-profile television and interactive brands. Our businesses engage audiences and efficiently serve advertisers by delivering entertaining and highly useful content that focuses on specifically defined topics of interest.

We manage our operations through two reportable operating segments: Lifestyle Media and Interactive Services. Lifestyle Media, includes Home and Garden Television (“HGTV”), Food Network, Travel Channel, DIY Network (“DIY”), Fine Living Network (“FLN”), which will be re-branded as the Cooking Channel in 2010, Great American Country (“GAC”), and associated Web sites that are part of the aforementioned television brands, and other Internet-based businesses serving food or shelter related categories such as RecipeZaar.com, HGTVPro.com and FrontDoor.com. Interactive Services includes online comparison shopping and consumer information services, bizrate, Shopzilla, and beso.

Our Lifestyle Media segment earns revenue principally from advertising sales, affiliate fees and ancillary sales, including the sale and licensing of consumer products. Revenues from the Interactive Services segment are generated primarily from referral fees and commissions paid by merchants and service providers for online leads generated by the company’s comparison shopping Web sites. Revenues from the Lifestyle Media segment accounted for 89 percent, 85 percent and 84 percent of our consolidated revenues for 2009, 2008 and 2007, respectively, and revenues from the Interactive Services segment accounted for 11 percent, 15 percent and 16 percent of our consolidated revenues for those periods, respectively.

We seek to engage audiences that are highly desirable to advertisers with entertaining and informative lifestyle content that is produced for television, the Internet and any other media platforms consumers choose. We intend to expand and enhance our Lifestyle Media brands through the creation of popular new programming and content, the use of new distribution platforms, such as mobile phones and video-on-demand,

3

Table of Contents

the licensing and sale of branded consumer products and through international expansion. At our Interactive Services businesses, we aggregate large audiences on the Internet by organizing searchable and highly useful consumer information. We intend to enhance our Interactive Services businesses by improving the overall search comprehensiveness and usefulness of our Web sites, diversifying sources of revenue, increasing the volume of user-generated consumer information and entering new geographic markets.

Business Segments

Our Lifestyle Media business segment includes six national television networks and our portfolio of related interactive lifestyle brands. The segment generates revenue principally from the sale of advertising time on national television networks and interactive media platforms and from affiliate fees paid by cable television operators, direct-to-home satellite services and other distributors that carry our network programming. In 2009, revenues from advertising sales and affiliate fees were approximately 74 percent and 24 percent, respectively, of total revenue for the Lifestyle Media segment. Our Lifestyle Media segment also earns revenue from the licensing of its content to third parties, primarily in international markets, and the licensing of its brands for consumer products such as videos, books, kitchenware and tools.

The advertising revenue generated by our national television networks depends on the number of households subscribing to each service and on viewership ratings as determined by Nielsen Media Research and other third-party research companies.

HGTV and Food Network and their targeted home and food programming categories appeal strongly to women viewers with higher incomes in the 18 to 49 age range, an audience demographic that is traditionally valued by advertisers. Travel Channel and its targeted travel programming categories appeal to viewers who are more affluent than the average cable viewer and skews slightly to adult men in the 18 to 49 range. GAC appeals to women viewers, while DIY typically has a higher percentage of adult male viewers. FLN, originally intended to appeal to both higher income men and women, will likely appeal more to women with higher incomes in the 18 to 49 age range under the Cooking Channel brand. Advertising revenue can fluctuate relative to the popularity of specific programs and blocks of programming during defined periods of the day.

Affiliate fee revenues are negotiated with individual cable television and direct-to-home satellite operators and other distributors. The negotiations typically result in multi-year carriage agreements with scheduled, graduated rate increases. As an incentive to obtain long-term distribution agreements for our newer networks, we may make cash payments to cable and direct-to-home satellite operators, provide an initial period during which a distributor’s affiliate fee payments are waived, or both. The amount of the fee we receive is determined by the number of subscribers with access to our network programming.

As consumer acceptance of high-definition television grows, the company is developing an increasing amount of original programming in high-definition format. Lifestyle Media operates three high-definition channels, HGTV-HD, Food Network-HD, and Travel Channel-HD, and plans to debut DIY-HD and Cooking Channel-HD in 2010. The company’s high-definition television networks are accessible by an estimated 32 million U.S. households.

The company is also executing its growth strategy internationally. The company, through equity ownership positions in joint ventures and other partnerships, seeks to become a world leader in lifestyle media and brand-related products and services. The company’s objective is to broaden its brand authority to include lifestyle interests beyond food, home and travel, and to invest in a mix of mature and emerging markets. The company initiated its international strategy with the launch of Food Network on B-Sky-B in the United Kingdom, reaching 10 million households. The Food Network’s distribution in the U.K., other European markets, the Middle East and Africa is supported by a joint venture the company entered into and controls with Liberty Global Inc.’s Chello Zone. The company is considering entering or creating partnerships in other international markets including the Asia-Pacific, India and Latin America.

The company’s lifestyle-oriented interactive businesses are focused on the internal development and acquisition of interactive, media brands that are intended to diversify sources of revenue and enhance our competitive advantage as a leading provider of food, home and lifestyle content. Revenue generated by our lifestyle interactive businesses is derived primarily from the sale of display, banner, rich media and video advertising and sponsorships.

The lifestyle-oriented interactive businesses consist of multiple Web sites, including our six network-branded Web sites, FoodNetwork.com, HGTV.com, TravelChannel.com, DIYNetwork.com, FineLiving.com and GACTV.com. In addition to serving as the home Web sites for the segment’s television programming networks, the Web sites provide informational and instructional content on specific topics within their broader lifestyle content categories. Features such as HGTV KitchenDesign, HGTV BathDesign, and DIY Home Improvement are intended to aggregate engaged audiences with interests in specific lifestyle topics. All of the segment’s interactive services benefit from archived television network programming of which approximately 90 percent is owned by the company. Our ownership of programming enables us to efficiently and economically repurpose it for use on the Internet and other interactive distribution channels, including mobile and video-on-demand.

The lifestyle Web sites also consist of other digital services including HGTVPro.com, which appeals to construction professionals and advanced do-it-yourself enthusiasts; RecipeZaar.com, a recipe-sharing social networking Web site; and

4

Table of Contents

FrontDoor.com, a local real estate search and consumer information site that features millions of home listings and thousands of videos. The lifestyle Web sites accounted for about 6 percent of the segment’s total revenue in 2009. The strategic focus of the lifestyle interactive businesses is to grow advertising and sponsorship revenues by increasing the number of page views and video plays and attracting more unique visitors to our Web sites through site enhancements, adding more video, new tools, etc. Our strategy also includes attracting a broader audience through the placement of our video programming on national video streaming sites, and developing new sources of revenue that capitalize on traffic growth at our Web sites.

HGTV

HGTV is America’s leader in home television programming and is one of cable and satellite television’s top-rated networks. HGTV reaches about 99 million domestic households via cable and direct satellite television services. The network’s companion Web site is one of the nation’s leading online home and garden destinations, attracting an average of about 3 million unique visitors per month. The network’s programming also can be seen in 96 countries and territories.

HGTV television programming and Internet content commands an audience interested specifically in home and shelter-related topics. HGTV is television’s only network dedicated solely to such topics as decorating, interior design, home remodeling, landscape design and real estate. HGTV strives to engage audiences by creating original programming that is entertaining, instructional and informative.

The network ended 2009 with its highest ever annual prime-time ratings. Programming highlights included HGTV Design Star, House Hunters, and My First Place. The network also has developed successful programming events, including the HGTV Dream Home Giveaway and HGTV Green Home Giveaway and annual live coverage of the Rose Bowl Parade.

FOOD NETWORK

Food Network is a leading cable and satellite television network that has been credited with redefining the television food genre. The network engages viewers with likable hosts and personalities who explore interesting and different ways to approach food and food-related topics. Food Network is available in 99 million U.S. television households and its programming can be seen internationally in 150 countries and territories. The network’s Web site, FoodNetwork.com, consistently ranks as one of America’s top food and cooking Internet destinations, with an average of about 13 million unique visitors per month. The company owns approximately 69 percent of the Food Network and is the managing partner. The Tribune Company has a noncontrolling interest of approximately 31 percent in Food Network.

Food Network programming and Internet content attracts audiences interested in food-related topics. Food Network is television’s only network dedicated solely to such topics as food preparation, dining out, entertaining, food manufacturing, nutrition and healthy eating. Food Network engages audiences by creating original programming that is entertaining, instructional and informative.

Food Network achieved record growth in viewership in 2009. Programming highlights included Next Food Network Star, Ace of Cakes, Diners, Drive-ins and Dives, and Iron Chef America. Many of the programs on Food Network feature or are hosted by high-profile television personalities such as Bobby Flay, Rachael Ray, Giada De Laurentiis, Alton Brown, Guy Fieri and Paula Deen.

TRAVEL CHANNEL

We acquired a controlling interest in the Travel Channel business in December 2009, giving the company its third fully-distributed lifestyle network. Travel Channel is a leading travel multi-media brand, offering quality television, video, Internet and mobile entertainment and information to travel enthusiasts. The network has grown into one of the largest specialty cable networks in the U.S., available in 95 million domestic television households.

Travel Channel finished 2009 with a record year in primetime and total-day ratings.

Programming highlights in 2009 included Samantha Brown’s Great Weekends, Anthony Bourdain: No Reservations, Andrew Zimmern’s Bizarre World, Man v. Food, Ghost Adventures, and Dhani Tackles the Globe. Many of the programs on Travel Channel feature or are hosted by high-profile television personalities such as Samantha Brown, Anthony Bourdain, Andrew Zimmern, Adam Richman, and Dhani Jones.

DIY NETWORK (DIY)

DIY is America’s only television network and Web site dedicated solely to presenting entertaining and informational programming and content across a broad range of do-it-yourself categories including home building; home improvement; automotive restoration and repair; crafts; gardening; landscaping, hobbies and woodworking. The network is available in approximately 53 million U.S. households via cable and direct-to-home satellite television services. DIY programming also is distributed internationally in 21 countries and territories. The television network’s companion Web site – DIYNetwork.com – consistently ranks among America’s top 15 home and garden Internet destinations with an average of about 2 million unique visitors per month.

FINE LIVING NETWORK (FLN)

FLN will be rebranded the Cooking Channel in 2010 to take advantage of the expanding interest in food and cooking in America. Cooking Channel will be a 24-hour network that caters to avid food lovers by focusing on food information and instructional cooking programming. Offered in both standard

5

Table of Contents

and high definition, the rebranded network will debut with a Video-on-demand (“VOD”) offering and a fully interactive Internet and broadband platform as it delivers more content focused on baking, ethnic cuisine, wine and spirits, healthy and vegetarian cooking and kids' foods. We expect Cooking Channel to be available in about 56 million households. Currently FLN television programming also can be seen internationally in 37 countries and territories.

GREAT AMERICAN COUNTRY (GAC)

Distributed in the U.S. via cable and direct-to-home satellite television services, the network reaches about 58 million households with original programming, special musical performances and live concerts. GAC operates a companion Web site, GACTV.com. GAC is the only network operated by the company with direct competition to its programming. The network strives to provide its viewers with a more focused country music experience.

HGTVPro.com

HGTVPro.com is a video-rich interactive service delivered via the Internet which appeals to professional builders, remodelers and contractors. Content includes professional-level best practices, tips and techniques, new product information and industry trends. HGTVPro.com attracts about 1 million unique visitors per month. HGTVPro.com is an authoritative source of information on the Internet for home construction professionals and advanced do-it-yourself, home-improvement enthusiasts. The Web site features original video content, industry news and detailed tips and instructions on a wide variety of home construction topics.

RECIPEZAAR.com

RecipeZaar.com is a leading user-generated recipe and community Internet site featuring nearly 400,000 recipes. RecipeZaar.com provides food enthusiasts with a browsing tool, search capabilities and personalized features. RecipeZaar.com is one of the Internet’s top 10 food and cooking category sites, attracting about 4 million unique visitors per month. RecipeZaar.com aggregates an audience on the Internet by creating an engaged community of food enthusiasts interested in home recipes, menu planning and other food-related topics. The social-networking Web site features volumes of user-generated content, including recipes, photos, menus and reviews.

FRONTDOOR.com

FrontDoor.com is an online real estate listing service that provides localized, in-depth information on homes in neighborhoods and communities across the U.S. The interactive service provides consumers with original video content, financial tools and calculators. FrontDoor.com is a comprehensive resource on the Internet for home buyers and home sellers. The Web site features searchable national real estate listings, video of featured properties for sale, buyers’ and sellers’ guides, calculators and other tools, and a library of video content on real estate-related topics.

Our Interactive Services segment includes Internet-based businesses that strive to simplify online shopping for consumers by aggregating, organizing, ranking and displaying relevant and searchable consumer information. Consumers who use our Interactive Services Web sites are presented with easy-to-use search results generated from continuously growing databases of information on a wide range of products that are offered for sale on the Internet by third-party retailers. Our Interactive Services brands include bizrate, Shopzilla and beso in the United States; Shopzilla.co.uk and bizrate.co.uk in the United Kingdom; Shopzilla.fr and PrixMoinsCher.fr in France; and Shopzilla.de and SparDeinGeld.de in Germany. The Web sites collectively attract approximately 30 million unique visitors each month.

Bizrate.com and Shopzilla.com are among the leading online search and comparison shopping Web sites and aggregate one of the Internet’s largest organized indexes of products and services. The sites are free to consumers who access the index via simplified, intuitively designed Internet pages that feature prominently displayed and easy-to-use search boxes. The bizrate brand also operates a consumer feedback network that annually collects and publishes on its Web sites millions of consumer reviews of stores and products.

The bizrate Web site’s proprietary shopping search logic system and patented relevance function, ShopRank, make it possible for consumers to instantly obtain accurate search results for specific products and services. Search query results are organized and displayed on graphically designed, layered presentation pages that include product listings, images, comparative pricing information, links to online merchants and service providers and user-generated and professional product reviews. Search results also include merchant reliability rankings based on the shared experiences of bizrate users.

The index of products and services serves as the primary database for bizrate. The database is aggregated using a highly automated system for identifying products, building online catalogs and classifying and organizing product information feeds from merchants and service providers. Bizrate builds advertising relationships with participating online merchants by providing them with a scalable, self-service sign-up process, an efficient cost-per-click pricing structure and a real-time reporting system that enables them to manage the return on the investment they are making to advertise on bizrate.

Bizrate devotes considerable time and financial resources to continuously improving the user experience, the effectiveness of its proprietary search logic system for consumers and merchant advertisers, the design of its Web sites and the expansion of its searchable index of products and services.

Beso is a taste-based shopping Web site where consumers can browse the latest products and sales from their preferred retailers and favorite brands in one place.

The segment’s businesses strive to help online consumers make educated purchasing decisions by ranking products on such factors as comparative pricing, availability,

6

Table of Contents

quality and reliability. The quality and reliability of individual online merchants are ranked based on the collective, shared experiences of consumers using the segment’s Web sites. Users also are presented with supporting consumer news and information, user-generated and professional product reviews, calculators and other tools that are intended to help them complete their purchasing decisions.

The Interactive Services segment derives the largest percentage of its revenue from direct referral fees paid by online merchants and service providers (advertisers) that enter into contractual agreements allowing them to place text-based, linked advertisements on the segment’s Web sites. The referral fees paid by advertisers are based on a cost-per-click pricing structure, which means that advertisers pay only when consumers click on their linked ads. Cost-per-click pricing provides advertisers with an efficient means of evaluating the effectiveness of their advertising. Of particular importance for advertisers is the number of sales resulting from users clicking on their linked advertising. The segment’s search businesses encourage sustained advertising relationships with merchants and service providers by demonstrating a measurable return on investment for the referral fees they pay.

The advertising links placed by merchants and service providers serve as the primary database of information for the segment’s Web sites. Because the success of our Interactive Services businesses depends largely on a quality user experience and repeated visits by users, ad links are intentionally presented in an unobtrusive and uniform format that provides users with impartial and factual information on products and services.

The Interactive Services segment also derives revenue from contractual advertising agreements with general search engines. The agreements allow the general search engines to leverage relationships with their respective advertisers by placing sponsored links on our Interactive Services Web sites. Similar to our direct advertising relationships with merchants and service providers, the general search engines pay referral fees on a cost-per-click basis.

Revenue categories as a percentage of total Interactive Services segment revenue are as follows:

| • | Direct referral fees from advertising merchants, 70 percent in 2009 vs. 56 percent in 2008. |

| • | Sponsored link referral fees from general search engines, 30 percent in 2009 vs. 44 percent in 2008. |

The Interactive Services segment measures operating performance in terms of net revenue, which is defined as total revenue minus traffic acquisition costs. Traffic acquisition costs are those marketing expenses related to generating user traffic to the segment’s Web sites. The success of the segment’s businesses is largely dependent on the ability to efficiently and economically attract a high volume of user traffic.

The segment’s businesses use a combination of online and off-line strategies to increase consumer awareness and subsequently generate user traffic. They include:

| • | Search Engine Marketing. Search Engine Marketing refers to the purchase of text-based advertising links on general search engines such as Google and Yahoo!. The positioning and display of those paid advertising links is dependent on the acquisition of relevant keywords that determine the quality and effectiveness of general search results. The segment’s businesses participate in continuous keyword bidding auctions that are hosted by general search engines with the objective of acquiring keywords that result in the most advantageous positioning and display of purchased advertising links adjacent to general search results. |

| • | Search Engine Optimization. Search Engine Optimization refers to the continuous, algorithmic selection of relevant keywords that, when used by general search engine users, result in the most advantageous positioning and display of links to the segment’s Web sites within general search results. Traffic generated by Search Engine Optimization generally results in higher net revenues for the segment’s businesses than traffic generated by Search Engine Marketing. |

| • | Offline advertising and marketing techniques, which refers to the purchase of television, newspaper, magazine, and other more traditional forms of advertising, and the execution of effective public relations campaigns, to increase brand awareness for the segment’s businesses. |

The company expects its Interactive Services businesses to benefit from the growth in online shopping and overall consumer acceptance of Internet commerce in the United States and internationally.

As of December 31, 2009, we had approximately 1,800 full-time equivalent employees, of whom approximately 1,400 were with Lifestyle Media.

7

Table of Contents

| Item 1A. | Risk Factors |

A number of significant risk factors could materially affect our specific business operations, and cause our performance to differ materially from any future results projected or implied by our prior statements. The risk factors generally have been separated into three groups: (i) risks relating to the separation; (ii) risks relating to our common shares; and (iii) risks relating to our business. Based on the information currently known to us, we believe that the following information identifies the most significant risk factors affecting our company in each category of risk. The risks and uncertainties our company faces, however, are not limited to those set forth in the risk factors described below. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

In addition, past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods.

If any of the following risks or uncertainties develops into actual events, these events could have a material adverse effect on our business, financial condition or results of operations. In such case, the trading price of our common shares could decline.

Risks Relating to the Separation

The tax rules applicable to the separation could restrict us from engaging in certain corporate transactions for a period of time after the separation.

To preserve the tax-free treatment to E. W. Scripps of the distribution, under the Tax Allocation Agreement that we entered into with E. W. Scripps, for the two-year period following the distribution, we are subject to restrictions with respect to:

| • | entering into any transaction pursuant to which all or a portion of our shares would be acquired, whether by merger or otherwise, unless certain tests are met; |

| • | issuing equity securities beyond certain thresholds; |

| • | repurchasing Scripps Networks Interactive common shares beyond certain thresholds; |

| • | ceasing to actively conduct the Scripps Networks Interactive business; and |

| • | taking any other action that prevents the spin-off and related transactions from being tax-free. |

These restrictions could limit our ability to pursue strategic transactions or engage in new businesses or other transactions that might increase the value of our business.

In connection with the separation, E. W. Scripps will indemnify us for certain liabilities. There can be no assurance that the indemnity will be sufficient to insure us against the full amount of such liabilities, or that E. W. Scripps’ ability to satisfy its indemnification obligations will not be impaired in the future.

Pursuant to the Separation and Distribution Agreement, E. W. Scripps agreed to indemnify us from certain liabilities with respect to events that took place prior to, on or after the distribution date relating to its business or for which it has otherwise retained responsibility in whole or in part. The potential liabilities subject to such indemnity from E. W. Scripps cannot be predicted or quantified, and such indemnification obligation of E. W. Scripps is not limited to any maximum amount. There can be no assurance that the indemnity from E. W. Scripps will be sufficient to protect us against the full amount of such liabilities, or that E. W. Scripps will be able to fully satisfy its indemnification obligations. Moreover, even if we ultimately succeed in recovering from E. W. Scripps any amounts for which we are held liable, we will be temporarily required to bear those losses ourselves until such recovery.

Until the Edward W. Scripps Trust terminates, our pension plan and the E. W. Scripps pension plan operate under a “controlled-group” status, potentially subjecting us to liability in the event that E. W. Scripps is unable to satisfy its long-term pension obligations.

Any of these circumstances could adversely affect our business, results of operations and financial condition.

Certain of our directors may have actual or potential conflicts of interest because of their positions in Scripps Networks Interactive and E. W. Scripps.

Three directors of Scripps Networks Interactive are also members of the E. W. Scripps Board of Directors. These directors are trustees of The Edward W. Scripps Trust. These common directors could create, or appear to create, potential conflicts of interest when Scripps Networks Interactive’s and E. W. Scripps’ management and directors face decisions that could have different implications for the two companies.

8

Table of Contents

Risks Relating to Our Class A Common Shares

Common Voting Shares are principally held by The Edward W. Scripps Trust, and this could inhibit potential changes of control.

We have two classes of shares: Common Voting Shares and Class A Common Shares. Holders of Class A Common Shares are entitled to elect one-third of the board of directors, but are not permitted to vote on any other matters except as required by Ohio law. Holders of Common Voting Shares are entitled to elect the remainder of the Board and to vote on all other matters. The Edward W. Scripps Trust (“Trust”) holds approximately 88 percent of the Common Voting Shares. As a result, the Trust has the ability to elect two-thirds of the board of directors and to direct the outcome of any matter that does not require a vote of the Class A Common Shares. Because this concentrated control could discourage others from initiating any potential merger, takeover or other change of control transaction that may otherwise be beneficial to our business, the market price of our Class A Common Shares could be adversely affected.

Following termination of the Edward W. Scripps Trust, descendants of Edward W. Scripps will control us.

Certain descendants of Robert Paine Scripps who are beneficiaries of the Edward W. Scripps Trust and certain descendants of John P. Scripps are parties to an agreement (“Scripps Family Agreement”) to restrict the transfer and govern the voting of E. W. Scripps Common Voting Shares that such persons (and trusts of which they are trustees) may acquire or own at or after the termination of the Trust. This agreement has been amended to restrict the transfer and govern the voting of our Common Voting Shares that such persons and trusts may acquire or own at or after the termination of the Trust. E. W. Scripps is a party to the Scripps Family Agreement, and we have become a party thereto by executing the amendment. Our obligations under this agreement generally will relate to facilitating meetings of the signatories to the agreement to enable them to decide how to vote their shares at annual or special meetings of our shareholders. The Scripps Family Agreement facilitates the ability of its signatories to control us and E. W. Scripps following termination of the Trust.

Federal law and Federal Communications Commission (“FCC”) regulations applicable because of E. W. Scripps’ and Scripps Networks Interactive’s common directors and voting shareholders may limit Scripps Networks Interactive’s activities, including the ability to own or operate media properties it does not presently own or operate.

For FCC purposes, the common directors and five percent or greater voting shareholders of E. W. Scripps and Scripps Networks Interactive are deemed to hold attributable interests in each of the companies. As a result, the business and conduct of one company may have the effect of limiting the activities or strategic business alternatives available to the other company.

Risks Relating to Our Business

A wide range of factors could materially affect future developments and performance. The most significant factors affecting our operations include those listed below.

Changes in public and consumer tastes and preferences could reduce demand for our services and reduce profitability of our businesses.

Each of our businesses provides content and services whose success is primarily dependent upon acceptance by the public. We must consistently create and distribute offerings that appeal to the prevailing consumer tastes at any point in time. Audience preferences change frequently and it is a challenge to anticipate what content will be successful at any point. Other factors, including the availability of alternative forms of entertainment and leisure time activities, general economic conditions and the growing competition for consumer discretionary spending may also affect the audience for our content and services. If our Lifestyle Media businesses do not achieve sufficient consumer acceptance, our revenue from advertising sales, which are based in part on network ratings, may decline and adversely affect our profitability. If our Interactive Services businesses are unable to provide service and content popular with the public, traffic to the sites will decrease, which may result in a decrease in referral revenue and profitability.

If we are unable to maintain distribution agreements with cable and satellite distributors at acceptable rates and terms, our revenues and profitability could be negatively affected.

We enter into long-term contracts for the distribution of our national television networks on cable and satellite television systems. Our long-term distribution arrangements enable us to reach a large percentage of cable and direct broadcast satellite households across the United States. As these contracts expire, we must renew or renegotiate them. If we are unable to renew them on acceptable terms or at rates similar to those in other affiliate contracts, we may lose distribution rights and/or affiliate fee revenues..

The loss of a significant number of affiliation arrangements on basic programming tiers could reduce the distribution of our national television networks, thereby adversely affecting affiliate fee revenue, and potentially impacting our ability to sell advertising or the rates we charge for such advertising.

Networks that are carried on digital tiers are dependent upon the continued upgrade of cable systems to digital capability and the public’s continuing acceptance of, and willingness to pay for upgrades to digital cable as well as our ability to negotiate favorable carriage agreements on widely accepted digital tiers.

9

Table of Contents

Consolidation among cable television system operators has given the largest cable and satellite television systems considerable leverage in their relationship with programmers. The two largest cable television system operators provide service to approximately 40 percent of households receiving cable or satellite television service today, while the two largest satellite television operators provide service to an additional 30 percent of such households.

Continued consolidation within the industry could reduce the number of distributors available to carry our programming, subject our affiliate fee revenue to greater volume discounts, and further increase the negotiating leverage of the cable and satellite television system operators.

Advertising and marketing spending by our customers is subject to seasonal and cyclical variations.

Revenues in our Lifestyle Media segment are influenced by advertiser demand and are generally higher in the second and fourth quarters due to the increased demand in the spring and holiday seasons. Referral fee revenues in our Interactive Services segment are highest in the fourth quarter primarily due to the increased online shopping activity during the holiday season. If a short-term negative impact on our business were to occur during a time of high seasonal demand, there could be a disproportionate effect on the operating results of that business for the year.

Our businesses face significant competitive pressures related to attracting consumers and advertisers, and failure by us to maintain our competitive advantage may affect the profitability of the businesses.

We face substantial competition in our Lifestyle Media and Interactive Services businesses from alternative providers of similar services. Our national television networks compete for viewers with other broadcast and national television networks as well as with home video products and Internet usage, and they compete for carriage of their programming with other programming providers. Additionally, our national television networks compete for advertising revenues with a variety of other media alternatives including other broadcast and national television networks, the Internet, newspapers, radio stations, and billboards. Our Lifestyle Media branded Web sites compete for visitors and advertising dollars with other forms of media aimed at attracting similar audiences and must maintain popular content in order to maintain and increase site traffic. Our Interactive Services businesses compete for marketing service revenues with other comparison shopping services, general search engines, and other providers of information on shopping and essential home services. Our ability to maintain our relationship with participating retailers and service providers is largely dependent on our ability to provide them a cost effective means of attracting customers. Competition in each of these areas may divert consumers from our services, which could reduce the profitability of our businesses.

Changes in consumer behavior resulting from new technologies and distribution platforms may impact the performance of our businesses.

We must adapt to advances in technologies and distribution platforms related to content transfer and storage to ensure that our content remains desirable and widely available to our audiences. The ability to anticipate and take advantage of new and future sources of revenue from technological developments will affect our ability to continue to increase our revenue and expand our business. Additionally, we must adapt to the changing consumer behavior driven by advances such as video-on-demand, devices providing consumers the ability to view content from remote locations, and general preferences for user-generated and interactive content. Changes of these types may impact our traditional distribution methods for our services and content. If we cannot ensure that our distribution methods and content are responsive to our target audiences, there could be a negative effect on our business.

Our Lifestyle Media business is subject to risks of adverse changes in laws and regulations, which could result in reduced distribution of certain of our national television networks.

Our programming services, and the distributors of the services, including cable operators, satellite operators and Internet companies, are regulated by U.S. federal laws and regulations issued and administered by various federal agencies, including the FCC, as well as by state and local governments. The U.S. Congress and the FCC currently have under consideration, and may in the future adopt, new laws, regulations and policies regarding a wide variety of matters that could, directly or indirectly, affect our operations. For example, legislators and regulators continue to consider rules that would effectively require cable television operators to offer all programming on an à la carte basis (which would allow viewers to subscribe to individual networks rather than a package of channels) and/or require programmers to sell channels to distributors on an à la carte basis. Certain cable television operators and other distributors have already introduced tiers, or more targeted channel packages, to their customers that may or may not include some or all of our networks. The unbundling of program services at the retail and/or wholesale level could reduce distribution of certain of our program services, thereby leading to reduced viewership and increased marketing expenses, and could affect our ability to compete for or attract the same level of advertising dollars or distribution fees.

We purchase keyword advertising on general search engines to attract consumers to our interactive services Web sites, and changes to our contracts with the search engines or the search engines’ practices could make it more difficult and/or costly to attract traffic to our sites.

We attract traffic to our Interactive Services Web sites through search results displayed by Google, Yahoo! and other

10

Table of Contents

popular general search engines. Search engines typically provide two types of search results, algorithmic listings and sponsored listings. We rely on both algorithmic and sponsored listings to attract consumers to our comparison shopping Internet sites.

Algorithmic listings cannot be purchased, and instead are determined and displayed solely by a set of formulas designed and controlled by the search engine. Search engines revise their algorithms from time to time in an attempt to optimize their search result listings. Modification of such algorithms may result in fewer consumers clicking through to our Internet sites.

We also rely on purchased listings to attract consumers to our Web sites. Many general search engines also operate Internet shopping services. Modification or termination of our contractual relationships with general search engines to purchase keyword advertising could result in fewer consumers clicking through to our Internet site. We may incur additional expenses to replace this traffic.

Approximately 30 percent of our 2009 referral fee revenue came from one general search engine and a change in this relationship could reduce the revenue of the business.

We are currently operating under an agreement with Google to participate in its sponsored links program. Under the agreement, we display listings from the search engine’s advertisers as a part of our service and we receive a share of the revenues earned by the search engine when consumers visit the advertisers’ Web sites. Our revenues could be negatively impacted if this agreement is not renewed upon expiration or if the agreement is not renewed on similar terms.

Changes in economic conditions in the United States, the regional economies in which we operate or in specific economic sectors could adversely affect the profitability of our businesses.

Approximately 80 percent of our consolidated revenues in 2009 were derived from marketing and advertising spending by businesses operating in the United States. Advertising and marketing spending is sensitive to economic conditions, and tends to decline in recessionary periods. A decline in economic conditions could reduce advertising prices and volume, resulting in a decrease in our advertising revenues. A decline in economic conditions could also impact consumer discretionary spending. Such a reduction in consumer spending may impact the volume of online shopping, which could adversely affect our comparison shopping businesses.

We may not be able to protect intellectual property rights upon which our business relies, and if we lose intellectual property protection, we may lose valuable assets.

Our business depends on our intellectual property, including internally developed technology, data resources and brand identification. We attempt to protect these intellectual property rights through a combination of copyright, trade secret, patent and trademark law and contractual restrictions, such as confidentiality agreements. We also depend on our trade names and domain names. We file applications for patents, trademarks, and other intellectual property registrations, but we may not be granted such intellectual property protections. In addition, even if such registrations are issued, they may not fully protect all important aspects of our business and there is no guarantee that our business does not or will not infringe upon intellectual property rights of others. Furthermore, intellectual property laws vary from country to country, and it may be more difficult to protect and enforce our intellectual property rights in some foreign jurisdictions. In the future, we may need to litigate in the United States or elsewhere to enforce our intellectual property rights or determine the validity and scope of the proprietary rights of others. This litigation could potentially be expensive and possibly divert the attention of our management.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our service, technology and other intellectual property, and we cannot be certain that the steps we have taken will prevent any misappropriation or confusion among consumers and merchants, or unauthorized use of these rights. If we are unable to protect and enforce our intellectual property rights, then we may not realize the full value of these assets, and our business may suffer.

We may be subject to claims of infringement of third-party intellectual property rights, which could harm our business.

From time to time, third parties may assert against us or our customers alleged patent, copyright, trademark, or other intellectual property rights to technologies that are important to our business. We may be subject to intellectual property infringement claims from certain individuals and companies who have acquired patent portfolios for the sole purpose of asserting such claims against other companies. Any claims that our products or processes infringe the intellectual property rights of others, regardless of the merit or resolution of such claims, could cause us to incur significant costs in responding to, defending, and resolving such claims, and may divert the efforts and attention of our management and technical personnel away from our business. In addition, if we are unable to continue use of certain intellectual property rights, our revenue could be negatively impacted.

Our Interactive Services businesses are subject to online security risks, including security breaches and identity theft.

Our Interactive Services businesses transmit confidential information over public networks. A significant number of participating retailers authorize us to bill their credit cards directly for referrals provided to the retailer. We rely upon encryptions

11

Table of Contents

and authentication technology provided by third parties to secure transmission of such confidential information.

Our Web site infrastructure is vulnerable to computer viruses and similar disruptions, and we may be subject to “denial-of-service” attacks that might make our Web sites unavailable for periods of time.

If we are unable to successfully integrate key acquisitions, such as Travel Channel, our business results could be negatively impacted.

We may grow through acquisitions in certain markets. Acquisitions involve risks, including difficulties in integrating acquired operations, diversions of management resources, debt incurred in financing such acquisitions and other unanticipated problems and liabilities. If we are unable to mitigate these risks, the integration and operations of an acquired business could be adversely impacted.

Recent turmoil in the financial markets may impede access to or increase the cost of financing our operations and investments.

U.S. and global credit and equity markets have recently undergone significant disruption, making it more difficult for many businesses to obtain financing on acceptable terms. If these conditions continue or worsen, our cost for borrowing for operations or investments may increase the cost of obtaining financing. In addition, our borrowing costs can be affected by short and long-term debt ratings assigned by independent rating agencies which are based, in significant part, on our performance as measured by credit metrics such as interest coverage and leverage ratios. A decrease in these ratings could increase our cost of borrowing or make it more difficult for us to obtain financing.

We could suffer losses due to asset impairment charges.

We test our goodwill and intangible assets for impairment during the fourth quarter of every year and on an interim date should factors or indicators become apparent that would require an interim test. If the fair value of a reporting unit or an intangible asset is revised downward due to declines in business performance, impairment could result and a non-cash charge could be required. This could materially affect our reported net earnings.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

Lifestyle Media operates from an owned production and office facility in Knoxville. We also operate from a leased office facility in Knoxville and leased facilities in New York, Nashville, and Washington, DC. Substantially all equipment is owned by Lifestyle Media.

Interactive Services operates from leased facilities in Los Angeles and London, as well as separate leased co-location facilities in Los Angeles, Houston and Seattle. Substantially all of our equipment is owned by our Interactive Services’ businesses.

Our corporate office headquarters operate from a leased facility in Cincinnati and we also lease facilities in London that support our international operations.

Management believes its properties are adequate to support the business efficiently and that the properties and equipment have been well maintained.

| Item 3. | Legal Proceedings |

From time to time, the Company receives notices from third parties claiming that it infringes their intellectual property rights. Claims of intellectual property infringement could require us to enter into royalty or licensing agreements on unfavorable terms, incur substantial monetary liability or be enjoined preliminarily or permanently from further use of the intellectual property in question. In addition, certain agreements entered into by the Company may require the Company to indemnify the other party for certain third-party intellectual property infringement claims, which could increase the Company’s damages and its costs of defending against such claims. Even if the claims are without merit, defending against the claims can be time-consuming and costly.

The costs and other effects of pending or future litigation, governmental investigations, legal and administrative cases and proceedings (whether civil or criminal), settlements, judgments and investigations, claims and changes in those matters (including those matters described above), and developments or assertions by or against the Company relating to intellectual property rights and intellectual property licenses, could have a material adverse effect on the Company’s business, financial condition and operating results. No current legal matters are expected to result in any material loss.

| Item 4. | [Removed and Reserved]. |

12

Table of Contents

Executive Officers of the Company - Executive officers serve at the pleasure of the Board of Directors.

| Name |

Age | Position | ||

| Kenneth W. Lowe | 59 | Chairman of the Board, President and Chief Executive Officer (since July 2008); President, Chief Executive Officer and Director, The E. W. Scripps Company (2000 to 2008) | ||

| Anatolio B. Cruz III |

51 | Chief Legal Officer and Corporate Secretary (since July 2008); Executive Vice President and General Counsel, The E. W. Scripps Company (2007 to 2008); Senior Vice President and General Counsel, The E. W. Scripps Company (2004 to 2007); Vice President, Deputy General Counsel and Assistant Secretary, BET Holdings, Inc. (1999 to 2004) | ||

| John F. Lansing |

52 | President, Scripps Networks, LLC (since January 2005); Senior Vice President/Scripps Networks, The E. W. Scripps Company (2006 to 2008); Senior Vice President/Television, The E. W. Scripps Company (2002 to 2005) | ||

| Joseph G. NeCastro |

53 | Chief Administrative Officer and Chief Financial Officer (since February 2010); Executive Vice President and Chief Financial Officer (2008 to 2010); Executive Vice President and Chief Financial Officer, The E. W. Scripps Company (2006-2008); Senior Vice President and Chief Financial Officer, The E. W. Scripps Company (2002 to 2006) | ||

| Mark S. Hale |

51 | Executive Vice President and Chief Technology Officer (since February 2010); Senior Vice President, Technology Operations and Chief Technology Officer (2008 to 2010); Senior Vice President/Technology Operations, The E. W. Scripps Company (2006 to 2008); Vice President/Technology Operations, The E. W. Scripps Company (2005 to 2006); Executive Vice President of Scripps Networks, LLC (1998 to 2005) | ||

| Lori A. Hickok |

46 | Executive Vice President, Finance (since February 2010); Senior Vice President, Finance (2008 to 2010); Vice President and Controller, The E. W. Scripps Company (2002 to 2008) | ||

13

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our Class A Common shares are traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “SNI.” As of December 31, 2009, there were approximately 37,100 owners of our Class A Common shares, based on security position listings, and 19 owners of our Common Voting shares (which do not have a public market).

The following table reflects the range of high and low selling prices of our common stock by quarterly period since our common stock began trading on the NYSE on June 12, 2008.

| 2009 |

High | Low | ||||

| First quarter |

$ | 24.37 | $ | 18.51 | ||

| Second quarter |

$ | 30.43 | $ | 23.60 | ||

| Third quarter |

$ | 37.41 | $ | 26.58 | ||

| Fourth quarter |

$ | 42.21 | $ | 36.36 | ||

| 2008 |

||||||

| Second quarter * |

$ | 43.49 | $ | 38.00 | ||

| Third quarter |

$ | 44.98 | $ | 34.88 | ||

| Fourth quarter |

$ | 37.14 | $ | 20.00 | ||

| * | Represents “when issued” trading on the NYSE for the period from June 12, 2008 through June 30, 2008 when our separation from E. W. Scripps was completed. |

Under a share repurchase program authorized by the Board of Directors on July 29, 2008, we are authorized to repurchase up to 5 million Class A Common shares. As of December 31, 2009, no shares have been repurchased against the July 29, 2008, authorization. There is no expiration date for the program and we are under no commitment or obligation to repurchase any particular amount of Class A Common shares under the program.

There were no sales of unregistered equity securities during the quarter for which this report is filed.

Dividends – Our Board of Directors declared quarterly cash dividends of 7.5 cents per share that have been paid for each of the quarters in 2008 and 2009 following the separation from E. W. Scripps. We currently expect that comparable quarterly cash dividends will continue to be paid in the future. Future dividends are, however, subject to our earnings, financial condition and capital requirements.

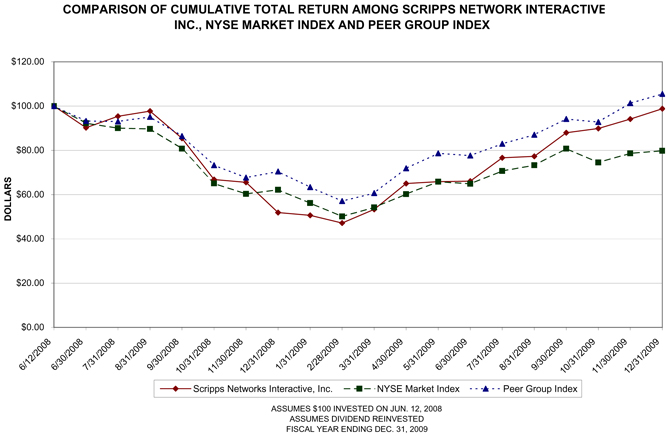

Performance Graph – The following graph compares the cumulative total stockholder return on our Class A Common shares with the comparable cumulative return of the NYSE market index and an index based on a peer group of media companies for the period from June 12, 2008, the date our common shares began trading on the NYSE, to December 31, 2009. The performance graph assumes that the value of the investment in our common shares, the NYSE market index, and peer group of media companies was $100 on June 12, 2008 and that all dividends were reinvested.

The companies that comprise our peer group are Discovery Holding Company, The Walt Disney Company, Time Warner Inc., Viacom, Inc., and EBay.

The peer group index is weighted based on market capitalization.

| Item 6. | Selected Financial Data |

The Selected Financial Data required by this item is filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Information at page F-1 of this Form 10-K.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Management’s Discussion and Analysis of Financial Condition and Results of Operations required by this item is filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Information at page F-1 of this Form 10-K.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

The market risk information required by this item is filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Information at page F-1 of this Form 10-K.

14

Table of Contents

| Item 8. | Financial Statements and Supplementary Data |

The Financial Statements and Supplementary Data required by this item are filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Information at page F-1 of this Form 10-K.

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

None.

| Item 9A. | Controls and Procedures |

The Controls and Procedures required by this item are filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Information at page F-1 of this Form 10-K.

| Item 9B. | Other Information |

None.

15

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

Information regarding executive officers is included in Part I of this Form 10-K as permitted by General Instruction G(3).

Information required by Item 10 of Form 10-K relating to directors is incorporated by reference to the material captioned “Election of Directors” in our definitive proxy statement for the Annual Meeting of Shareholders (“Proxy Statement”). Information regarding Section 16(a) compliance is incorporated by reference to the material captioned “Report on Section 16(a) Beneficial Ownership Compliance” in the Proxy Statement.

We have adopted a code of ethics that applies to all employees, officers and directors of SNI. We also have a code of ethics for the CEO and Senior Financial Officers. This code of ethics meets the requirements defined by Item 406 of Regulation S-K and the requirement of a code of business conduct and ethics under NYSE listing standards. Copies of our codes of ethics are posted on our Web site at www.scrippsnetworksinteractive.com.

Information regarding our audit committee financial expert is incorporated by reference to the material captioned “Corporate Governance” in the Proxy Statement.

The Proxy Statement will be filed with the Securities and Exchange Commission in connection with our 2010 Annual Meeting of Stockholders.

| Item 11. | Executive Compensation |

The information required by Item 11 of Form 10-K is incorporated by reference to the material captioned “Compensation Discussion and Analysis” and “Executive Compensation Tables” in the Proxy Statement.

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

The information required by Item 12 of Form 10-K is incorporated by reference to the material captioned “Report on the Security Ownership of Certain Beneficial Owners” and “Equity Compensation Plan Information” in the Proxy Statement.

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

The information required by Item 13 of Form 10-K is incorporated by reference to the materials captioned “Corporate Governance” and “Report on Related Party Transactions” in the Proxy Statement.

| Item 14. | Principal Accounting Fees and Services |

The information required by Item 14 of Form 10-K is incorporated by reference to the material captioned “Independent Auditors” in the Proxy Statement.

| Item 15. | Exhibits and Financial Statement Schedules |

Financial Statements and Supplemental Schedule

| (a) | The consolidated and combined financial statements of SNI are filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Information at page F-1. |

The reports of Deloitte & Touche LLP, an Independent Registered Public Accounting Firm, dated March 1, 2010, are filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Information at page F-1.

| (b) | The Company’s consolidated and combined supplemental schedules are filed as part of this Form 10-K. See Index to Consolidated and Combined Financial Statement Schedules at page S-1. |

Exhibits

The information required by this item appears at page E-1 of this Form 10-K.

16

Table of Contents

Signatures

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SCRIPPS NETWORKS INTERACTIVE, INC. | ||||||

| Dated: March 1, 2010 | By: | /s/ Kenneth W. Lowe | ||||

| Kenneth W. Lowe | ||||||

| Chairman of the Board of Directors, President and Chief Executive Officer | ||||||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant in the capacities indicated, on March 1, 2010.

| Signature |

Title | |||

| /s/ Kenneth W. Lowe Kenneth W. Lowe |

Chairman of the Board of Directors, President and Chief Executive Officer (Principal Executive Officer) | |||

| /s/ Joseph G. NeCastro Joseph G. NeCastro |

Chief Administrative Officer and Chief Financial Officer | |||

| /s/ John H. Burlingame John H. Burlingame |

Director | |||

| /s/ Michael R. Costa Michael R. Costa |

Director | |||

| /s/ David A. Galloway David A. Galloway |

Director | |||

| /s/ Jarl Mohn Jarl Mohn |

Director | |||

| /s/ Nicholas B. Paumgarten Nicholas B. Paumgarten |

Director | |||

| /s/ Mary Peirce Mary Peirce |

Director | |||

| /s/ Dale Pond Dale Pond |

Director | |||

| /s/ Jeffrey Sagansky Jeffrey Sagansky |

Director | |||

| /s/ Nackey E. Scagliotti Nackey E. Scagliotti |

Director | |||

| /s/ Ronald W. Tysoe Ronald W. Tysoe |

Director | |||

17

Table of Contents

Scripps Networks Interactive, Inc.

Index to Consolidated and Combined Financial Statement Information

| Item No. |

Page | |||

| 1. |

F-2 | |||

| 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|||

| F-3 | ||||

| F-3 | ||||

| F-4 | ||||

| F-5 | ||||

| F-6 | ||||

| F-6 | ||||

| F-6 | ||||

| F-7 | ||||

| F-7 | ||||

| F-9 | ||||

| F-10 | ||||

| F-11 | ||||

| 3. |

F-14 | |||

| 4. |

F-15 | |||

| 5. |

F-17 | |||

| 6. |

F-19 | |||

| 7. |

F-20 | |||

| 8. |

F-21 | |||

| 9. |

F-22 | |||

| 10. |

F-23 | |||

F-1

Table of Contents

The selected consolidated and combined statements of operations data for the three years ended December 31, 2009 and the consolidated balance sheet data at December 31, 2009 and 2008 should be read in conjunction with the audited financial statements and related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other financial information presented elsewhere in this annual report. The selected consolidated and combined statement of operations data for the year ended December 31, 2005 and the consolidated and combined balance sheet data at December 31, 2006 and 2005 have been derived from financial statements contained in the Registration Statement filed on Form 10 that is not included herein.

Five-Year Financial Highlights

| (in millions, except per share data) |

||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 (3) | ||||||||||||||||

| Summary of Operations |

||||||||||||||||||||

| Operating revenues (1): |

||||||||||||||||||||

| Lifestyle Media |

$ | 1,367 | $ | 1,312 | $ | 1,185 | $ | 1,052 | $ | 903 | ||||||||||

| Interactive Services |

174 | 238 | 220 | 228 | 99 | |||||||||||||||

| Total operating revenues |

$ | 1,541 | $ | 1,551 | $ | 1,405 | $ | 1,281 | $ | 1,002 | ||||||||||

| Segment profit (loss) (1)(2): |

||||||||||||||||||||

| Lifestyle Media |

$ | 637 | $ | 632 | $ | 587 | $ | 504 | $ | 403 | ||||||||||

| Interactive Services |

31 | 63 | 47 | 53 | 28 | |||||||||||||||

| Corporate |

(66 | ) | (49 | ) | (35 | ) | (33 | ) | (25 | ) | ||||||||||

| Total segment profit |

$ | 602 | $ | 645 | $ | 599 | $ | 524 | $ | 406 | ||||||||||

| Income from continuing operations attributable to SNI common shareholders (4) |

$ | 273 | $ | 23 | $ | 268 | $ | 235 | $ | 176 | ||||||||||

| Per Share Data |

||||||||||||||||||||

| Income from continuing operations attributable to SNI common shareholders (4) |

$ | 1.65 | $ | .14 | $ | 1.64 | $ | 1.44 | $ | 1.08 | ||||||||||

| Cash dividends (5) |

.30 | .15 | ||||||||||||||||||

| Balance Sheet Data |

||||||||||||||||||||

| Total assets (7) |

$ | 2,963 | $ | 1,773 | $ | 2,018 | $ | 2,385 | $ | 2,011 | ||||||||||

| Long-term debt (6)(7) |

884 | 80 | 503 | 765 | 824 | |||||||||||||||

| Redeemable noncontrolling interests |

114 | 9 | 23 | 23 | 23 | |||||||||||||||

| Total SNI shareholders’ equity |

1,384 | 1,132 | 991 | 1,164 | 775 | |||||||||||||||

| Noncontrolling interest |

151 | 147 | 137 | 117 | 83 | |||||||||||||||

| Total equity |

$ | 1,535 | $ | 1,279 | $ | 1,128 | $ | 1,281 | $ | 858 | ||||||||||

Certain amounts may not foot since each is rounded independently.

Notes to Selected Financial Data

The selected consolidated and combined statements of operations data for all periods prior to July 1, 2008 are presented on a carve-out basis and reflect the results of operations and financial position of our businesses when they were a part of The E. W. Scripps Company. Results for those periods include estimates of our portion of The E. W. Scripps Company’s corporate expenses. The financial information for those years do not reflect what our results of operations and financial position would have been had we been a separate, stand-alone publically-traded company.

| (1) | Operating revenues and segment profit (loss) represent the revenues and the profitability measures used to evaluate the operating performance of our business segments in accordance with financial accounting standards for disclosures about segments of an enterprise and related information. See page F-7. |

| (2) | Segment profit is a supplemental non-GAAP financial measure. GAAP means generally accepted accounting principles in the United States. Our chief operating decision maker evaluates the operating performance of our reportable segments and makes decisions about the allocation of resources to our reportable segments using a measure we call segment profit. Segment profit excludes interest, income taxes, depreciation and amortization, divested operating units, restructuring activities, investment results and certain other items that are included in net income determined in accordance with accounting principles generally accepted in the United States of America. For a reconciliation of this financial measure to operating income see the table on page F-8. |

| (3) | In June 2005, we acquired Shopzilla, a Web-based product comparison shopping service. |

| (4) | Operating results in 2008 include a non-cash charge to write-down the goodwill related to our Shopzilla business. Income from continuing operations was reduced $244 million, $1.49 per share. |

| (5) | Our first dividend as a stand-alone public company was paid in the third quarter of 2008. Accordingly, there are no dividends reported for the first two quarters of 2008 or the prior year periods. |

| (6) | The E. W. Scripps Company utilized a centralized approach to cash management and financing of its operations. Based on the historical funding requirements of our company, specifically the costs to fund acquisitions, fund investments in programming and support the expansion of Scripps Networks Interactive businesses, all of E. W. Scripps’ consolidated third party debt was allocated to us for all periods prior to the July 1, 2008 separation date. |

| (7) | On December 15, 2009, we acquired a 65% controlling interest in the Travel Channel. In connection with the acquisition, TCM Sub, LLC, a majority-owned subsidiary of SNI, completed a private placement of $885 million aggregate principal Senior Notes that mature in 2015. |

F-2

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

This discussion and analysis of financial condition and results of operations is based upon the consolidated and combined financial statements and the notes thereto. You should read this discussion in conjunction with those financial statements.

This discussion and the information contained in the notes to the consolidated and combined financial statements contain certain forward-looking statements that are based on our current expectations. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from the expectations expressed in the forward-looking statements. Such risks, trends and uncertainties, which in most instances are beyond our control, include changes in advertising demand and other economic conditions; consumers’ tastes; program costs; labor relations; technological developments; competitive pressures; interest rates; regulatory rulings; and reliance on third-party vendors for various products and services. The words “believe,” “expect,” “anticipate,” “estimate,” “intend” and similar expressions identify forward-looking statements. All forward-looking statements, which are as of the date of this filing, should be evaluated with the understanding of their inherent uncertainty. We undertake no obligation to publicly update any forward-looking statements to reflect events or circumstances after the date the statement is made.

On July 1, 2008, Scripps Networks Interactive spun off from The E. W. Scripps Company (“E. W. Scripps”) and began operations as a separate publicly-traded company. Scripps Networks Interactive is a leading lifestyle content and Internet search company with respected, high-profile television and interactive brands.