Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Mattersight Corp | matr-ex991_6.htm |

| 8-K - 8-K - Mattersight Corp | matr-8k_20180214.htm |

Q4 2017 Earnings Webinar February 2018 Exhibit 99.2

Safe Harbor Language During today’s call we will be making both statements regarding historical facts and “forward-looking statements” that are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 in order to help you better understand our business. These forward-looking statements are not limited to historical fact, reference our plans, intentions, forecast, expectations, beliefs, strategies and objectives, and involve risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties associated with our business are highlighted in our filings with the SEC, including our Annual Report filed on Form 10-K for the year ended December 31, 2016, our quarterly reports on Form 10-Q, as well as our earnings press release issued earlier today. Mattersight Corporation undertakes no obligation to publicly update or revise any forward-looking statements in this call. Also, be advised that this call is being recorded and is copyrighted by Mattersight Corporation.

Discussion Topics Q4 Highlights Q4 Results Key Trends 2018 Guidance Q&A

Q4 Highlights Record Revenues Record Subscription Revenues PBR seats and revenue growing rapidly Record Adjusted EBITDA Continued Progress on New Logo Acquisition

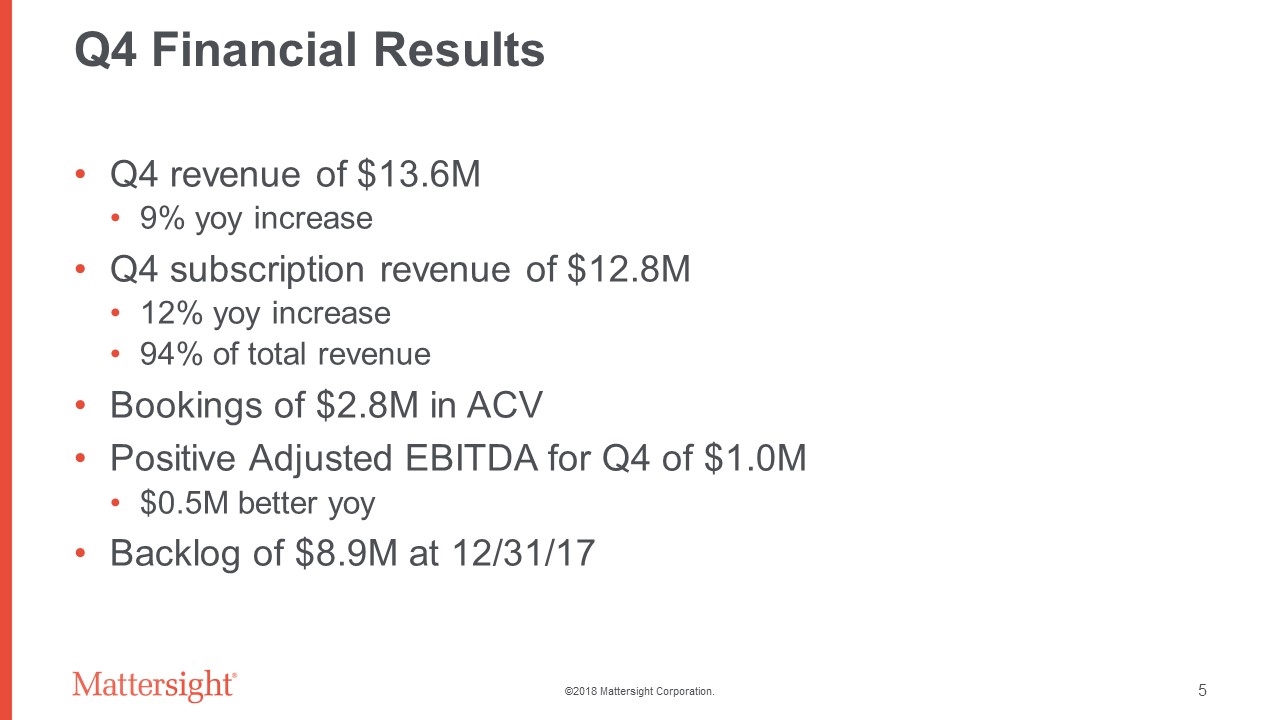

Q4 Financial Results Q4 revenue of $13.6M 9% yoy increase Q4 subscription revenue of $12.8M 12% yoy increase 94% of total revenue Bookings of $2.8M in ACV Positive Adjusted EBITDA for Q4 of $1.0M $0.5M better yoy Backlog of $8.9M at 12/31/17

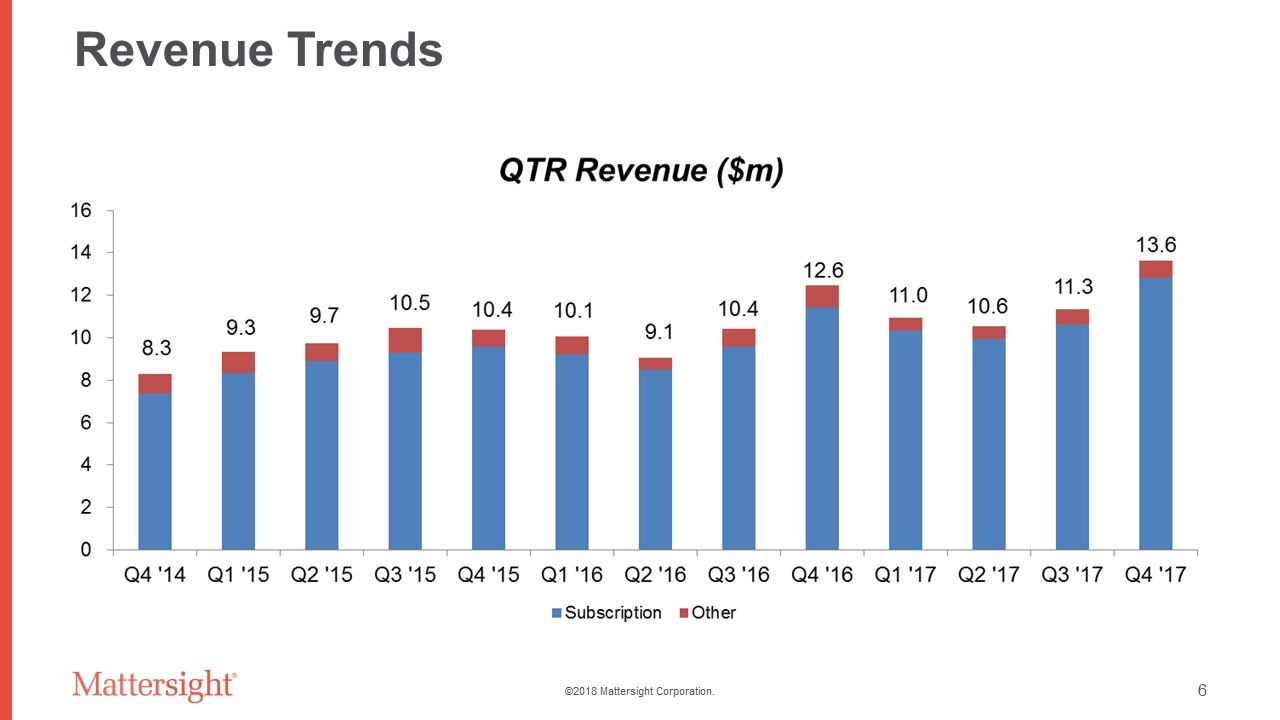

Revenue Trends

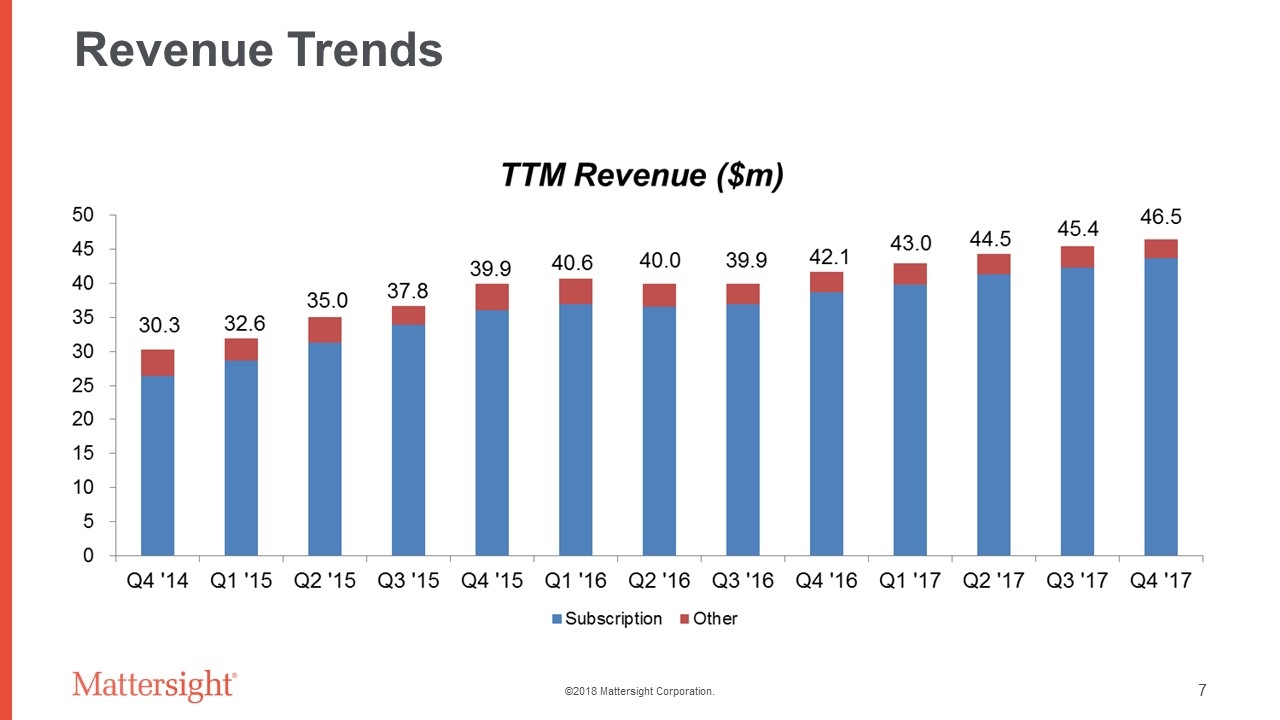

Revenue Trends

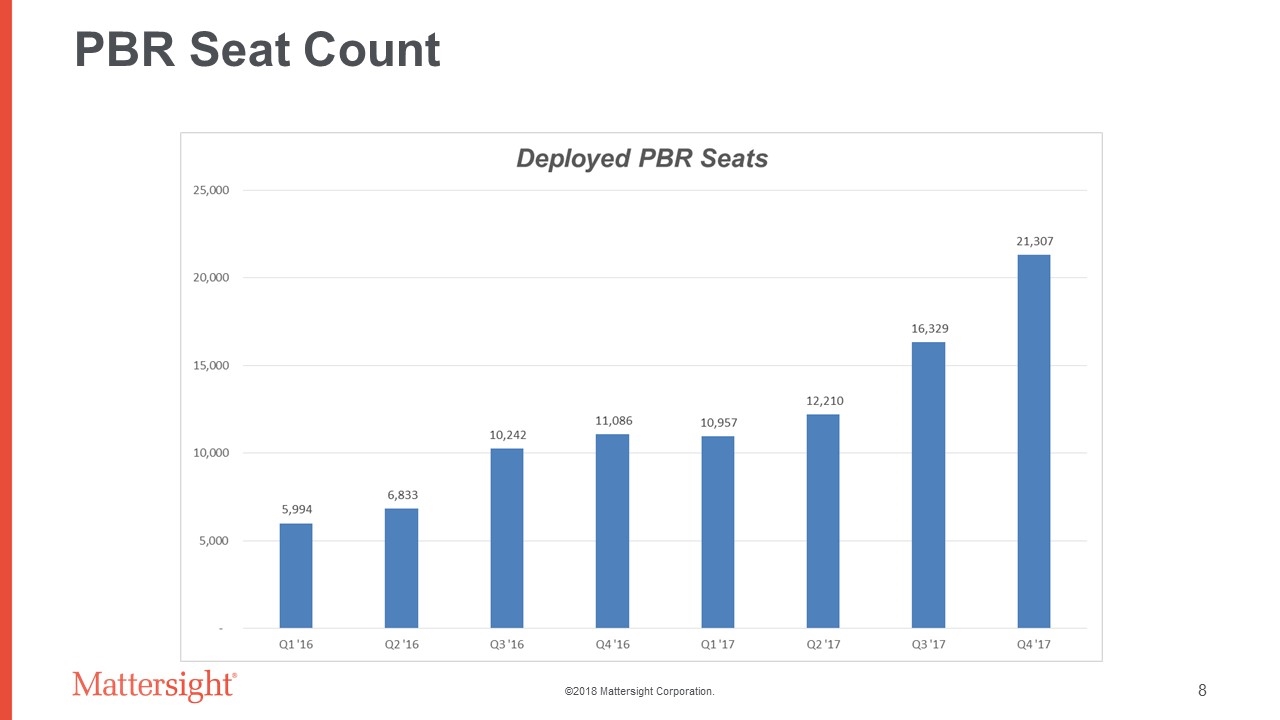

PBR Seat Count

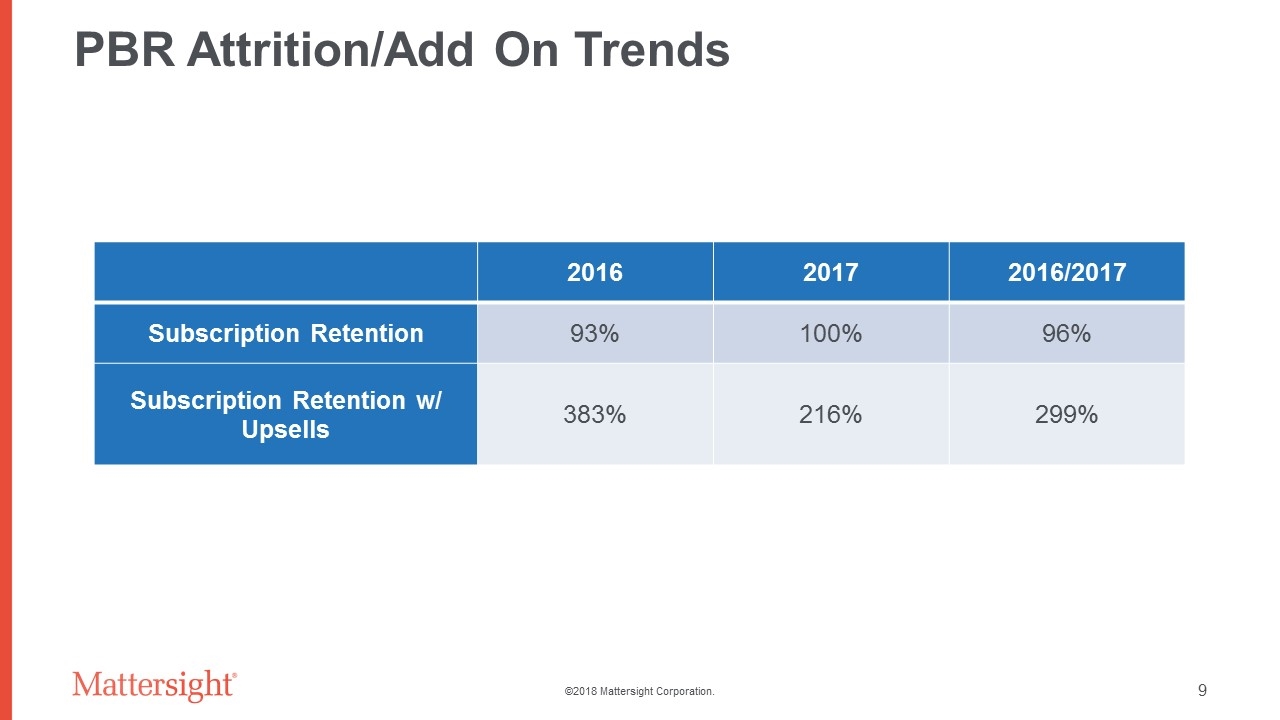

PBR Attrition/Add On Trends 2016 2017 2016/2017 Subscription Retention 93% 100% 96% Subscription Retention w/ Upsells 383% 216% 299%

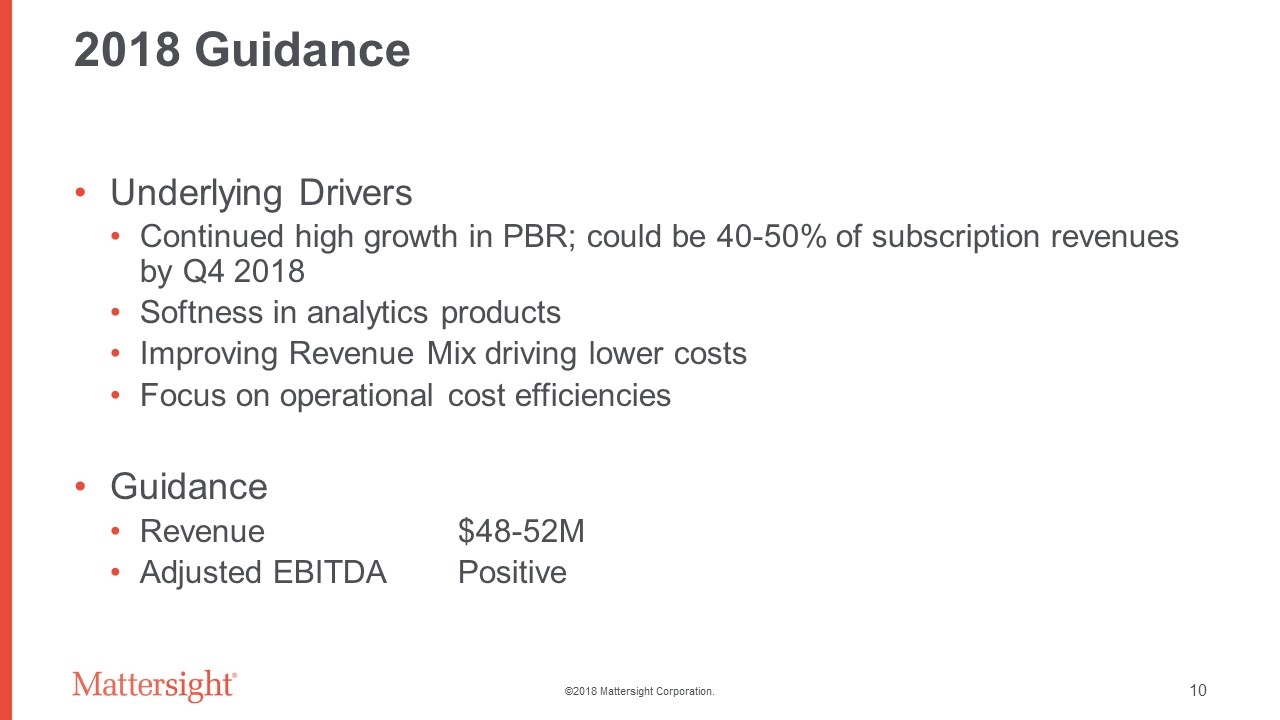

2018 Guidance Underlying Drivers Continued high growth in PBR; could be 40-50% of subscription revenues by Q4 2018 Softness in analytics products Improving Revenue Mix driving lower costs Focus on operational cost efficiencies Guidance Revenue $48-52M Adjusted EBITDA Positive

Q&A

Thank You Kelly Conway 847.582.7200 kelly.conway@mattersight.com David Gustafson 847.582.7016 david.gustafson@mattersight.com Dave Mullen 312.954.7380 dave.mullen@mattersight.com