Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 1, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-27975

eLoyalty Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 36-4304577 | |

| (State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

150 Field Drive, Suite 250

Lake Forest, Illinois 60045

(Address of Registrant’s Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (847) 582-7000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.01 per share Preferred Stock Purchase Rights |

NASDAQ Global Market None |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨

|

Accelerated filer x

|

Non-accelerated filer ¨

|

Smaller reporting company ¨

| |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates of the registrant, based upon the closing price per share of registrant’s Common Stock on June 25, 2010, as reported by The NASDAQ Stock Market LLC, is approximately $89,439,562.

The number of shares of the registrant’s Common Stock outstanding as of March 10, 2011 was 15,613,247.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of eLoyalty’s Proxy Statement for its 2011 Annual Meeting of Stockholders, to be filed within 120 days after the end of eLoyalty’s fiscal year, are incorporated herein by reference into Part III where indicated.

Table of Contents

PART I

| Item |

Page | |||||

| Item 1. |

2 | |||||

| Item 1A. |

6 | |||||

| Item 1B. |

12 | |||||

| Item 2. |

12 | |||||

| Item 3. |

12 | |||||

| Item 4. |

12 | |||||

| PART II | ||||||

| Item 5. |

12 | |||||

| Item 6. |

13 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | ||||

| Item 7A. |

28 | |||||

| Item 8. |

29 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

58 | ||||

| Item 9A. |

58 | |||||

| Item 9B. |

58 | |||||

| PART III | ||||||

| Item 10. |

58 | |||||

| Item 11. |

59 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

59 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

60 | ||||

| Item 14. |

60 | |||||

| PART IV | ||||||

| Item 15. |

61 | |||||

| 62 | ||||||

| I-1 | ||||||

Table of Contents

PART I

| Item 1. | Business. |

Overview

eLoyalty Corporation (together with its subsidiaries and predecessors, “eLoyalty,” “we,” “us,” or the “Company”) helps its clients achieve breakthrough results with revolutionary analytics and advanced technologies that drive continuous business improvement. With a long track record of delivering proven solutions for many Fortune 1000 companies, our offerings currently include the Behavioral Analytics™ Service, Integrated Contact Solutions, and Consulting Services, which are aligned to enable focused business transformation.

The Company has been focused on growing and developing its business through two primary Business Units: the Behavioral Analytics™ Service and Integrated Contact Solutions. Through its Business Units, the Company generates three types of revenue: (1) Managed services revenue, which is recurring, annuity revenue from long-term (generally one- to five-year) contracts; (2) Consulting services revenue, which is generally project-based and sold on a time-and-materials or fixed-fee basis; and (3) Product revenue, which is generated through the resale of third-party software and hardware. The chart below shows the relationship between these Business Units and the types of revenue generated from each.

| Business Unit | Managed Services Revenue |

Consulting Services Revenue |

Product Revenue | |||

| Behavioral Analytics™ Service |

Subscription and amortized deployment revenue; marketing application hosting and email fulfillment revenue |

Follow-on consulting revenue | None | |||

| Integrated Contact Solutions |

Contact center monitoring and support revenue; remote application support revenue |

System integration revenue for the Integrated Contact Solutions Service Line; consulting revenue for the traditional CRM Service Line |

Hardware and software resale revenue, primarily from products of Cisco Systems, Inc. (“Cisco”) |

On March 17, 2011, the Company entered into an Acquisition Agreement providing for the sale of all its assets used in the Integrated Contact Solutions Business Unit to a subsidiary of TeleTech Holdings, Inc. (“TeleTech”). Under the terms of the Acquisition Agreement, TeleTech will pay to the Company $40.85 million in cash at closing, subject to adjustment, and assume certain liabilities of the Integrated Contact Solutions Business Unit. The purchase price adjustments are related to working capital and prepaid managed services contracts.

The Company expects the sale of the Integrated Contact Solutions Business Unit to close in the second quarter of 2011. However, the closing of the transaction is subject to various conditions, including approval by our stockholders, the receipt of required third-party consents and approvals, and other closing conditions customary for transactions of this type. No assurances can be given that the transaction will be consummated on the terms contemplated or at all. If the transaction is consummated as proposed, then the Company will continue to operate its Behavioral Analytics™ Business Unit and will change its corporate name to Mattersight Corporation.

Set forth below is a description of the differentiated capabilities that the Company currently offers in its primary Business Units.

Behavioral Analytics™ Service Business Unit

Behavioral AnalyticsTM Service Line

eLoyalty pioneered this solution, which improves the reliability of call recording and applies human behavioral modeling to analyze and improve customer interactions and help optimize the performance of call center agents. Using the Behavioral Analytics™ Service, eLoyalty can help clients:

| • | Automatically measure customer satisfaction and agent performance on every call; |

| • | Identify and understand customer personality; |

| • | Improve rapport between agent and customer; |

| • | Reduce call handle times while improving customer satisfaction; |

2

Table of Contents

| • | Identify opportunities to improve self-service applications; |

| • | Improve cross-sell and up-sell success rates; |

| • | Improve the efficiency and effectiveness of collection efforts; |

| • | Identify customer experience issues and score calls for retention risk; |

| • | Measure and improve supervisor effectiveness and coaching; and |

| • | Improve agent effectiveness by analyzing key attributes of desktop usage. |

eLoyalty has designed a scalable application platform to enable the Company to implement and operate the Behavioral Analytics™ Service for its clients. The Behavioral Analytics™ Service is primarily hosted by eLoyalty and delivered as a managed subscription service. Managed services revenue consists of deployment and subscription services and Consulting services revenue consists of post-deployment follow-on services, which consist of coaching and training and custom data analysis.

Marketing Managed Services Line

Marketing Managed Services revenue is derived from marketing application hosting and email fulfillment services.

Integrated Contact Solutions Business Unit

Integrated Contact Solutions Service Line

The Company’s Integrated Contact Solutions Service Line focuses on helping clients improve customer service business performance through the implementation of the following solution offerings:

| • | Cisco VoIP (Voice over Internet Protocol) Solutions – clients realize the benefits of transitioning their contact centers, distributed branches/stores, and corporate telephony to a single VoIP network infrastructure from the traditional two-network (voice network and separate data network) model. These benefits include cost savings, remote worker enablement, centralized reporting, and application enhancements. The Company has developed a set of solutions, tools, and methodologies to help clients financially model, plan, configure, integrate, and support Converged Internet Protocol (“IP”) network solutions within their customer interaction and collaboration environments. |

| • | Managed Support Services – clients realize the benefits of proactive monitoring of their voice and data networks to avoid system degradation and downtime that can effect business operations. We also provide 24x7 maintenance services, operations, and applications services to help enhance, administer, and manage VoIP contact center and telephony platforms that include technology from Cisco Systems and other third-party vendors. |

| • | Business Application Services – clients realize the benefits of reduced average handle time, improved first call resolution, improved self-service automation, and email and chat integration within their contact centers and across their branch/store networks. |

Traditional CRM Service Line

The Company’s traditional CRM Service Line focuses on operational consulting to enhance customer service business performance through improved process efficiencies, redesign of workflows, and improved contact center operations and workforce management. We also generate Managed services revenue from this Service Line by providing remote application support to clients.

Types of Revenue

Managed services, Consulting services, and the resale of Product are frequently sold and delivered together. Consulting services engagements relating to the design and implementation of customer service or marketing solutions may lead to the sale of one of our Managed services, which may also include a long-term maintenance and support or hosting relationship and the sale of Product.

Managed Services

Growth in Managed services revenue is primarily driven by the sale of Behavioral Analytics™ Service and Integrated Contact Solutions engagements. These Managed services are described below:

| • | The Behavioral Analytics™ Service includes the deployment and ongoing operation of our proprietary Behavioral Analytics™ System. Based on each client’s business requirements, the Behavioral Analytics™ System is configured and integrated into the client’s environment and then deployed in either a remote-hosted or, in one case, an on-premise hosted environment. The Behavioral Analytics™ Service is provided on a subscription basis and the contract duration generally is three to five years. The fees and costs related to the initial deployment are deferred and amortized over the term of the contract. |

| • | Contact Center Managed Services include monitoring and support related to complex IP and traditional contact center voice architectures. These services include routine maintenance and technology upgrades and the resolution of highly complex issues that involve multiple technology components and vendors. Our support and monitoring services reduce the cost and impact of contact center downtime for our clients and anticipate problems before they occur. |

3

Table of Contents

In addition, we also generate Managed services revenue from two other sources. Marketing Managed Services revenue is generated from hosted customer and campaign data management and mass email fulfillment services. We also continue to provide remote call center application support and maintenance services to a small number of long-term clients. These two sources of Managed services revenue are likely to diminish over time as we focus on growth through our other service offerings.

Consulting Services

In addition to the Consulting services revenue generated by Behavioral Analytics™ Service and Integrated Contact Solutions engagements, we derive a portion of our revenue from a broad range of traditional CRM consulting work with long-standing accounts, as well as newer accounts more recently obtained through our Behavioral Analytics™ Service and Integrated Contact Solutions Service Lines. Our Consulting services are billed on a time-and-materials basis or on a fixed-fee basis and generally include a combination of the following:

| • | Evaluating our clients’ efficiency and effectiveness in handling customer interactions. We observe, measure, and analyze the critical aspects of each customer interaction, including the number of legacy systems used to handle the situation, interaction time, reason for interaction, and actions taken to resolve any customer issues. |

| • | Performing detailed financial analysis to calculate the expected return on investment for the implementation of various Customer Service / CRM solutions. This process helps our clients establish goals, alternatives, and priorities and assigns client accountability throughout resulting projects. |

| • | Implementing the operations, process, and human performance aspects of Customer Service / CRM solutions. |

Product

We also generate revenue from the resale of Product, which consists of software and hardware primarily sold through our Integrated Contact Solutions Service Line. The vast majority of this revenue relates to reselling products from Cisco.

Business Segments

Since 2008, the Company has operated in two business segments: the Behavioral Analytics™ Service Business Unit and the Integrated Contact Solutions Business Unit. These segments are consistent with the Company’s management of the business and reflect its internal financial reporting structure and operating focus.

The Behavioral Analytics™ Service Business Unit focuses on solutions that improve the reliability of call recording and applies human behavioral modeling to analyze and improve customer interactions and help optimize the performance of call center agents. The Behavioral Analytics™ Service is primarily a hosted solution and is delivered as a managed subscription service. Revenue generated from follow-on consulting services, deployments, and subscription services, as well as marketing application hosting, and email fulfillment services are included in this Business Unit’s financial results.

The Integrated Contact Solutions Business Unit focuses on helping clients realize the benefits of transitioning their contact centers to a single network infrastructure from the traditional two-network (voice network and separate data network) model. Revenue generated from Consulting services, Managed services, Product resale, remote application support services, and traditional CRM are included in this Business Unit’s financial results.

Management believes that Segment Operating Income/(Loss) Before Stock-Based Compensation, Severance and Related Costs, and Depreciation and Amortization is an appropriate measure of evaluating the operational performance of the Company’s segments. However, this measure should be considered in addition to, not as a substitute for, or superior to, income from operations or other measures of financial performance prepared in accordance with accounting principles generally accepted in the United States. The Company does not allocate severance and related costs, depreciation and amortization, or other items below the Operating Income/(Loss) level to its business segments. Also, the Company does not track or review asset information, other than capital investments, by reportable segments. See Note Sixteen “Segments” of the “Notes to Consolidated Financial Statements” included in Part II Item 8 of this Annual Report on Form 10-K (this “Form 10-K”) for the revenue and net (loss)/income of each of our business segments for the fiscal years ended 2010 and 2009. Prior to 2008, the Company operated in one business segment and did not record financial information for the two current business segments.

International Operations

The Company’s services are delivered to clients in North America (U.S. and Canada), Europe, and Australia. The Company’s long-lived assets are and have been predominately located in North America and consist of equipment, software, furniture and fixtures, and leasehold improvements (net of accumulated depreciation). Net revenue for the Company’s international operations (Europe and Australia) was $2.5 million, $3.1 million, and $2.5 million for the fiscal years ended 2010, 2009, and 2008, respectively.

4

Table of Contents

Methods of Distribution

A substantial majority of our Consulting services, Managed services, and Product are provided to our clients through direct contractual relationships. Approximately 14% of our revenue in 2010 was generated from ongoing relationships with other companies, with which we partner to make our services and third-party products available to the clients of such companies.

Intellectual Property Rights

We view as proprietary the intellectual property that we develop internally in order to improve and enhance the service offerings of our Business Units, as well as that associated with the work product resulting from our services for clients. We seek to protect our intellectual property rights by applying for patents, copyrights, and trademarks, as appropriate, as well as by enforcing applicable trade secret laws and contractual restrictions on disclosure, licensing, copying, reverse engineering, and assignment.

A majority of our clients require that we grant to them licenses in and to the intellectual property rights associated with the original work product resulting from our services, and in some cases our clients require assignment of ownership in the intellectual property rights to certain custom work product developed in the course of a consulting engagement. Absent an agreement to the contrary, each grant of proprietary and intellectual property rights would limit our ability to reuse work product components with other clients. As a result, it is our practice to retain the rights in the underlying core intellectual property on which such work product is based, including methodologies, workplans, and software. Further, it is our policy to obtain from our clients a license to permit us to market custom software and other original materials to other clients. These arrangements may be nonexclusive or exclusive, and licensors to us may retain the right to sell products and services that compete with those of the Company.

Seasonality

We typically experience declines in revenue and earnings in the fourth quarter of our fiscal year, as the total number of billable hours and days on Consulting services engagements are reduced due to holidays and vacations.

Clients

During fiscal year 2010, our five and 20 largest clients accounted for 31% and 67% of our total revenue, respectively. In fiscal year 2010, there were no clients that accounted for 10% or more of total revenue. For fiscal year 2010, 27 clients each accounted for over $1 million of total revenue. Our focus is on developing long-term relationships with our clients, but our activities with specific clients may fluctuate periodically, as individual Consulting services projects are initiated and progress through their lifecycle. As a result, the percentage of total revenue contributed by any particular client can be expected to vary, perhaps significantly, among periods. See Note Two “Summary of Significant Accounting Policies” of the “Notes to Consolidated Financial Statements” included in Part II Item 8 of this Form 10-K.

Competition

We operate in a highly competitive and rapidly changing market and compete with a variety of organizations that offer services similar to ours. The market includes a variety of participants that compete with us at various levels of our business, including strategic consulting firms, systems integrators, web-consulting firms, software vendors, voice recording and voice analytic service providers, online agencies, and firms that provide both consulting and systems integration services, including certain of our vendors. In our opinion, few competitors offer the full range and depth of services that we can provide, but they may compete with us on individual factors such as expertise, price, or capacity.

Many of our competitors have longer operating histories, more clients, longer relationships with their clients, greater brand or name recognition, and significantly greater financial, technical, marketing, and public relations resources than we do. As a result, our competitors may be in a better position to respond quickly to new or emerging technologies and changes in client requirements. They may also develop and promote their products and services more effectively than we do. New market entrants also pose a threat to our business. Existing or future competitors may develop or offer solutions that are comparable or superior to ours at a lower price.

Environmental Issues

There are no known material compliance issues with any federal, state, or local environmental regulations.

Employees

As of January 1, 2011, we employed 369 persons, none of whom is represented by a union.

Available Information and Other

Our principal internet address is www.eloyalty.com. Our Annual, Quarterly, and Current Reports on Forms 10-K, 10-Q, and 8-K, and any amendments thereto, as well as the Forms 3, 4, and 5 beneficial ownership reports filed with respect to our stock, are made available free of charge on our website as soon as reasonably practicable after such material has been filed with, or furnished to, the Securities and Exchange Commission (“SEC”). However, the information found on our website is not part of this or any other report filed by us with the SEC. These reports may also be obtained at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements, and other information regarding SEC registrants, including eLoyalty.

5

Table of Contents

eLoyalty was incorporated in Delaware in May 1999. Our executive office is currently located at 150 Field Drive, Suite 250, Lake Forest, Illinois 60045 and our main telephone number is (847) 582-7000. Effective June 1, 2011, our executive office will be our location at 200 South Wacker Drive, Suite 820, Chicago, Illinois 60606 and our main telephone number will be (877) 356-9252.

| Item 1A. | Risk Factors. |

There are a number of risks and uncertainties that could adversely affect our business and our overall financial performance. In addition to the matters discussed elsewhere in this Form 10-K, we believe the more significant of such risks and uncertainties include the following:

RISK FACTORS RELATING TO THE PROPOSED SALE OF OUR INTEGRATED CONTACT SOLUTIONS BUSINESS UNIT

If we fail to complete the sale of the Integrated Contact Solutions Business Unit, our business may be harmed.

The completion of the sale of the Integrated Contact Solutions Business Unit is subject to the satisfaction of a number of conditions, and we cannot guarantee that the sale will be completed. We also cannot be sure that other circumstances, such as the occurrence of a material adverse effect, will not arise that would allow TeleTech to terminate the Acquisition Agreement prior to closing. If the sale of the Integrated Contact Solutions Business Unit is not approved or does not close, then our board of directors will be forced to evaluate other alternatives, which may be less favorable to us than the proposed sale of the Integrated Contact Solutions Business Unit.

As a result of our announcement of the sale of our Integrated Contact Solutions Business Unit on March 17, 2011, third parties may be unwilling to enter into material agreements with respect to our Integrated Contact Solutions Business Unit. New or existing customers and business partners may prefer to enter into agreements with our competitors who have not expressed an intention to sell their business, because customers and business partners may perceive that such new relationships are likely to be more stable. Employees working in the Integrated Contact Solutions Business Unit may become concerned about the future of the business and lose focus or seek other employment. If we fail to complete the sale of the Integrated Contact Solutions Business Unit, the failure to maintain existing business relationships or enter into new ones could adversely affect our business, results of operations and financial condition. In addition, if we fail to complete the proposed sale of the Integrated Contact Solutions Business Unit, we will retain and continue to operate the Integrated Contact Solutions Business Unit. The resultant potential for loss or disaffection of employees or Integrated Contact Solutions Business Unit customers could have a material, negative impact on the value of our Integrated Contact Solutions Business Unit.

In addition, if the sale of the Integrated Contact Solutions Business Unit is not consummated, our directors, executive officers, and other employees will have expended extensive time and effort and will have experienced significant distractions from their work during the pendency of the transaction and we will have incurred significant third-party transaction costs, in each case, without any commensurate benefit, which may have a material and adverse effect on our stock price and results of operations.

The holders of our Common Stock are unlikely to receive any of the proceeds from the sale of the Integrated Contact Solutions Business Unit.

The purchase price for the assets of the Integrated Contact Solutions Business Unit will be paid directly to the Company. Management could spend or invest the net proceeds from the sale of the Integrated Contact Solutions Business Unit in ways with which our stockholders may not agree. We intend to use a portion of the net proceeds from the sale to support the development of our Behavioral Analytics™ Service Business Unit and for general corporate purposes, including our continued investment in the personnel required to sell and manage complex, long-term relationships with the customers of our Behavioral Analytics™ Service, as well as investment in the resources required to develop, deliver, and support our Behavioral Analytics™ Service. The investment of these proceeds may not yield a favorable return.

In addition, under the terms of the certificate of designations governing our outstanding Series B convertible preferred stock (the “Series B Stock”), the completion of the proposed sale would create certain preference rights in favor of the holders of Series B Stock. In particular, we will be prohibited from paying dividends or making any other distributions (including through stock repurchases) to the holders of our Common Stock until the holders of Series B Stock have received payment of their full liquidation preference, which is currently approximately $19.4 million. As a result of the preference rights for the Series B Stock and our need for cash resources to operate the Behavioral Analytics™ Service Business Unit, we do not expect that any proceeds from the proposed sale of the Integrated Contact Solutions Business Unit will remain for distribution to the holders of our Common Stock.

The Acquisition Agreement may expose us to contingent liabilities.

Under the Acquisition Agreement, we agree to indemnify TeleTech for breaches or violations of any representation, warranty, covenant, or agreement made by us in the Acquisition Agreement, for pre-closing and other liabilities related to the Integrated Contact Solutions Business Unit, and for other matters, subject to certain limitations. Significant indemnification claims by TeleTech could have a material adverse effect on our financial condition. We will generally not be obligated to indemnify TeleTech for any breach of the representations and warranties made by us under the Acquisition Agreement until the aggregate amount of claims for indemnification for such breach exceeds $200,000. In the event that claims for indemnification for breach of the representations and warranties made by us under the Acquisition Agreement exceed the stated threshold, we may be obligated to indemnify TeleTech for any damages or loss resulting from such breach in an amount not to exceed $1.5 million. Claims for indemnification for breach of any covenant, agreement, or other matter made by us in the Acquisition Agreement, including claims with respect to excluded assets or retained liabilities, or claims for fraud or intentional misrepresentation, are not subject to the limits described above.

6

Table of Contents

Our Integrated Contact Solutions Business Unit has historically generated a substantial portion of our revenue. After its sale, we will be a much smaller company, and in order to succeed, we will need to achieve profitability of our Behavioral Analytics™ Business Unit.

Our Integrated Contact Solutions Business Unit has historically been the source of a substantial portion of our revenue. For the fiscal year ended January 1, 2011, our Integrated Contact Solutions Business Unit accounted for $60 million, or 68%, of our total revenues of $88 million, while our Behavioral Analytics™ Service Business Unit accounted for only $28 million of our total revenues. In addition, after the sale, our customer concentration will increase. The Company’s top five clients accounted for 31% of total revenue in fiscal year 2010, whereas the top five clients for the Behavioral Analytics™ Service Business Unit accounted for 70% of that Business Unit’s revenue in fiscal year 2010. Higher concentration of revenue with a single client or a limited group of clients creates increased revenue risk if one of these clients significantly reduces its demand for our Behavioral Analytics™ Service. Furthermore, we intend to invest a portion of the net proceeds of the sale of the Integrated Contact Solutions Business Unit to grow our Behavioral Analytics™ Business Unit. There is no guarantee that we will be able to achieve sustained growth or profitability in our Behavioral Analytics™ Business Unit or in new business opportunities we may pursue.

Our Behavioral Analytics™ Business Unit is generating losses and has uncertain future revenue and income potential.

We are currently experiencing losses in our Behavioral Analytics™ Business Unit and we expect to continue to use cash and incur operating expenses to support its growth, including costs associated with recruiting, training, and managing our sales force, costs to develop and acquire new technology, and promotional costs associated with reaching new customers. These investments, which typically are made in advance of revenue, may not yield increased revenue to offset these expenses. As a result of these factors, the future revenue and income potential of our Behavioral Analytics™ Business Unit is uncertain. Any evaluation of our Behavioral Analytics™ Business Unit and our prospects following the sale of the Integrated Contact Solutions Business Unit must be considered in light of these factors and the risks and uncertainties often encountered by companies in the early stage of development. Some of these risks and uncertainties relate to our ability to do the following:

| • | maintain our current relationships, and develop new relationships, with customers, service providers and business partners; |

| • | continue to grow our revenue and meet anticipated growth targets; |

| • | manage our expanding operations and implement and improve our operational, financial and management controls; |

| • | successfully introduce new, and upgrade our existing, products and services for consumers; |

| • | respond to government regulations relating to our Behavioral Analytics™ Service Business Unit; |

| • | respond effectively to competition; and |

| • | attract and retain qualified management and employees. |

If we are unable to address these risks, our business, results of operations, and prospects could suffer.

We will be a very small public company with a large cash balance.

Once the sale of the Integrated Contact Solutions Business Unit is completed, we will remain a publicly traded company and will continue to be subject to SEC and Nasdaq rules and regulations, including the Sarbanes-Oxley Act of 2002. While all public companies face the costs and burdens associated with being publicly traded, the costs and burden of being a public company will be a significant portion of our annual revenues after the sale of our Integrated Contact Solutions Business Unit is consummated. In addition, given our size and the fact that the sole focus of our business will be our Behavioral Analytics™ Business Unit, our management will have an even greater expectation from stockholders and industry analysts to produce improved quarterly financial results for our Behavioral Analytics™ Business Unit as compared to the periods prior to the sale of the Integrated Contact Solutions Business Unit, when the diversity of our revenue streams could enable one of our segments to offset weakness in the other. After giving effect to the sale of the Integrated Contact Solutions Business Unit, on a pro forma basis, we would have had approximately $50.9 million in cash, cash equivalents, and investments as of January 1, 2011. Having a large cash balance relative to our market capitalization could make us a takeover target in the future, which could cause distractions for our management and our board of directors and otherwise prevent us from executing on our strategy for the Behavioral Analytics™ Business Unit to build long-term stockholder value.

7

Table of Contents

RISK FACTORS RELATING TO THE COMPANY GENERALLY

We have not realized a profit in ten years and there is no guarantee that we will realize a profit in the foreseeable future.

As of January 1, 2011, we had an accumulated deficit of $204.1 million. We incurred net losses available to common stockholders of $14.6 million in 2010, $11.9 million in 2009, and $22.9 million in 2008, and may continue to incur net losses in the future.

Our financial results could be adversely affected by economic and political conditions and the effects of these conditions on our clients’ businesses and levels of business activity.

Global economic and political conditions affect our clients’ businesses and the markets they serve. A severe and/or prolonged economic downturn or a negative or uncertain political climate could adversely affect our clients’ financial conditions and the levels of business activity of our clients and the industries we serve. This may reduce demand for our services or depress pricing of those services and have a material adverse effect on our results of operations. Changes in global economic conditions could also shift demand to services for which we do not have competitive advantages, and this could negatively affect the amount of business that we are able to obtain. In addition, these economic conditions may cause our clients to delay payments for services we have provided to them, resulting in a negative impact to our cash flow. If we are unable to successfully anticipate changing economic and political conditions, then we may be unable to effectively plan for and respond to those changes, and our business could be negatively affected.

Our financial results are subject to significant fluctuations because of many factors, any of which could adversely affect our stock price.

It is possible that in some future periods our operating results may be below the expectations of public market analysts and investors. In this event, the price of our Common Stock may fall. Our revenue and operating results may vary significantly due to a number of factors, many of which are not in our control. We may incur an impairment of goodwill if our financial results are adversely impacted by these factors and we continue to incur financial losses or our stock price declines. These factors include:

| • | Unanticipated cancellations or deferrals of, or reductions in the scope of, major engagements; |

| • | Our ability to deliver complex projects and to provide scalable and reliable solutions hosting; |

| • | The number, size, and scope of our projects; |

| • | Our client retention and acquisition rate and satisfaction with our services and solutions; |

| • | The length of the sales cycle associated with our solutions; |

| • | The sale of product; |

| • | The efficiency with which we utilize our employees; |

| • | How we plan and manage our existing and new engagements; |

| • | Completion of the transactions contemplated by the Acquisition Agreement; |

| • | Our ability to manage future growth, particularly the growth of the Behavioral Analytics™ Service; |

| • | Changes in pricing policies by us or our competitors; |

| • | Number of billing days; and |

| • | Availability of qualified employees. |

We depend on a limited number of clients for a significant portion of our revenue, and the loss of a significant client or a substantial decline in the number or scope of projects that we do for a significant client, could have a material adverse effect on our businesses.

We derive, and expect to continue to derive for the foreseeable future, a significant portion of our total revenue from a limited number of clients. See “Business” and “Clients” in Part I Item 1 and “Year Ended January 1, 2011 Compared with the Year Ended December 26, 2009” included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II Item 7 of this Form 10-K. With the exception of our subscription clients for the Behavioral Analytics™ Service, the volume of services that we provide for a specific client is likely to vary from year to year, and a major client in one year might not use our services in a subsequent year. To the extent that any significant client uses less of our services or terminates its relationship with us, as may occur as clients respond to conditions affecting their own businesses, our total revenue could decline substantially and that could seriously harm our business.

8

Table of Contents

We depend on good relations with our major clients, and any harm to these good relations may materially and adversely affect our business and our ability to compete effectively.

To attract and retain clients, we depend to a large extent on our relationships with our clients and our reputation for high quality consulting services and managed services. We design, create, implement, host, maintain, and support applications and solutions that are often critical to our clients’ businesses. We believe that we generally enjoy good relations with our clients. However, if a client is not satisfied with our services, products, or solutions, including those of subcontractors or vendors that we may utilize, it may be damaging to our reputation and business. Any defects or errors in our services or solutions or failure to meet our clients’ expectations could result in:

| • | Delayed or lost revenue; |

| • | Obligations to provide additional services to a client at a reduced fee or at no charge; |

| • | Negative publicity, which could damage our reputation and adversely affect our ability to attract or retain clients; and |

| • | Claims for damages against us, regardless of our responsibility for such failure. |

If we fail to meet our contractual obligations with our clients, then we could be subject to legal liabilities or loss of clients. Although our contracts typically include provisions to limit our exposure to legal claims for the services and solutions we provide and the applications and systems we develop or integrate, these provisions may not protect us in all cases.

If we do not effectively manage the risks associated with increasingly complex client projects and new service offerings, our profit margins and our financial results may suffer.

We may fail to estimate accurately the time and resources necessary for the performance of our services. It can be difficult to judge the time and resources necessary to complete consulting services projects, to deploy, support, and operate hosted solutions, to support and maintain complex contact center architectures, and/or to anticipate the amount of product needed to complete a project. A number of different risks must be accounted for, including, but not limited to, the variability and predictability of the number, size, scope, cost, and duration of and revenue from client engagements, unanticipated cancellations or deferrals of client contracts or follow-on phases of engagements in process, collection of revenue, variable employee utilization rates, project personnel costs, and other engagement requirements. Accurate estimates as to the costs and timing of completion of engagements is particularly important for the contracts that are performed on a fixed-price or not-to-exceed basis. Our failure to estimate accurately these risks could reduce the profitability of, or result in a loss on, our engagements and could damage our client relationships and our reputation.

Our industry is very competitive and, if we fail to compete successfully, our market share and business will be adversely affected.

We operate in a highly competitive and rapidly changing market and compete with a variety of organizations that offer services similar to those we offer. The market includes a variety of participants that compete with us at various levels of our business, including strategic consulting firms, systems integrators, general information-technology services providers, web consulting firms, voice recording and voice analytic service providers, application service providers, and other firms that provide both consulting and systems integration services and solutions. New market entrants also pose a threat to our business.

Many of our competitors have longer operating histories, more clients and longer relationships with their clients, greater brand or name recognition, and significantly greater financial, technical, marketing, and public relations resources than we do. As a result, our competitors may have comparatively better abilities to compete for specific clients and market share generally, including through substantial economic incentives to clients to secure contracts. Existing or future competitors may develop or offer solutions that are comparable or superior to ours at a lower price. In addition, our competitors may be in a better position to respond quickly to new or emerging technologies and changes in client requirements or expectations. They may also develop and promote their products and services more effectively than we do and be better able to compete for skilled professionals by offering substantial compensation incentives.

We rely heavily on our senior management team for the success of our business.

Given the highly specialized nature of our services, senior management must have a thorough understanding of our service offerings as well as the skills and experience necessary to manage the organization. If one or more members of our senior management team leaves and we cannot replace them with a suitable candidate quickly, then we could experience difficulty in managing our business properly, and this could harm our business prospects, client relationships, employee morale, and results of operations.

Our ability to recruit talented professionals and retain our existing professionals is critical to the success of our business.

We believe that our success will depend substantially on our ability to attract, train, motivate, and retain highly skilled management, strategic, technical, product development, and other key professional employees. The information-technology services industry continues to be people-intensive and faces a shortage of qualified personnel, especially those with specialized skills or experience. We compete with other companies to recruit and hire from this limited pool. If we cannot hire and retain qualified personnel, or if a significant number of our current employees leave, then we may be unable to complete or retain existing engagements or bid for new engagements of similar scope and revenue.

9

Table of Contents

If one or more of our key personnel were unable or unwilling to continue in their present positions and we had difficulty replacing such persons, then we could potentially suffer the loss of client relationships or new business opportunities and our business could be seriously harmed. In addition, there is no guarantee that the employee and customer non-solicitation and non-competition agreements we have entered into with our senior professionals would deter them from departing us for our competitors or that such agreements would be upheld and enforced by a court or other arbiter across all jurisdictions where we engage in business.

We must keep pace with the rapid rate of technological innovation and change, as well as evolving industry standards, in order to build our business.

Our industry is characterized by rapid and continually changing technologies, the introduction of many new products and services, and evolving industry standards and client preferences. Our solutions must meet the requirements of, and achieve significant acceptance among our current and prospective clients within, this environment. Our future business will depend on our continuing ability to adapt to and incorporate changing technologies and emerging industry standards and to remain knowledgeable with respect to our core areas of expertise.

In addition, our future business depends upon continued growth in the acceptance and use of the Behavioral Analytics™ Service by our current and prospective clients. Their acceptance and usage in turn may depend upon factors such as: the actual or perceived benefits of adoption of the Behavioral Analytics™ Service and related methodologies and technologies, including the predictability of a meaningful return on investment, cost efficiencies, or other measurable economic benefits; the actual or perceived reliability, scalability, ease of use, and access to such new technologies and methodologies; and the willingness to adopt new business methods incorporating a customer-centric approach.

We cannot assure that we will be successful in anticipating or responding to these developments and challenges on a timely or competitive basis or at all, or that our ideas and solutions will be successful in the marketplace. In addition, new or disruptive technologies and methodologies by our competitors may make our service or solution offerings uncompetitive. Any of these circumstances could adversely affect our ability to obtain and successfully complete substantial new client engagements that are important to maintain and grow our business.

We depend on our ability to rapidly learn, use, and integrate software and other technology developed by third parties to successfully compete, and our ability to maintain and grow our business may be affected by our ability to maintain strong relationships with software providers and other alliance partners.

To provide certain of our solutions and services, we rely on third-party software, telephony, and other infrastructure and related services. If we are unable to integrate these components in a fully functional manner, we may experience difficulties that could delay or prevent the successful development, introduction, or marketing of new solutions. We could also incur substantial costs if we need to modify our services or infrastructure to adapt to changes in these third-party products and services.

We have invested time and resources in initiating and maintaining strong relationships with certain software and technology providers and we plan to make additional investments in this regard in the future. The benefits we anticipate from these relationships play an important role in our future growth strategies. We rely on these relationships with third-party vendors and alliance partners to allow us to learn rapidly about their existing and next-generation technologies, to develop appropriate methods to integrate their products and services into our solutions, and to obtain joint sponsorship of solution offerings. If we are unable to successfully initiate and/or maintain these relationships, then our ability to successfully create and deploy new solution offerings incorporating their technologies would be significantly reduced. In addition, we may be adversely affected by the failure of one or more of our vendors or alliance partners, which could lead to reduced marketing exposure, fewer sales leads or joint marketing opportunities, and a diminished ability to gain access to or develop leading-edge solutions. As our most important alliance relationships are non-exclusive, our alliance partners are also free to establish similar or preferred relationships with our competitors. These circumstances could adversely impact the success of our growth strategies that, in turn, could adversely affect our results of operations.

It may be difficult for us to access debt or equity markets to meet our financial needs.

In the event, for any reason, we need to raise additional funds in the future, through public or private debt or equity financings, such funds may not be available or may not be available on terms favorable to us.

We have a limited ability to protect our intellectual property rights, which are important to our success and competitive position.

Our ability to protect our software, methodologies, and other intellectual property is important to our success and our competitive position. We view as proprietary the intellectual property that we develop internally in order to improve and enhance the service offerings of our Business Units, as well as that associated with the work product resulting from our services for clients. We seek to protect our intellectual property rights by applying for patents, copyrights, and trademarks, as appropriate, as well as by enforcing applicable trade secret laws and contractual restrictions on disclosure, licensing, copying, reverse engineering, and assignment.

10

Table of Contents

Despite our efforts to protect our intellectual property rights from unauthorized use or disclosure, others may attempt to disclose, obtain, or use our rights. The steps we take may not be adequate to prevent or deter infringement or other misappropriation of our intellectual property rights. In addition, we may not detect unauthorized use of, or take timely and effective actions to enforce and protect, our intellectual property rights.

We may be required to obtain licenses from others to refine, develop, market, and deliver current and new services and solutions. There can be no assurance that we will be able to obtain any of these licenses on commercially reasonable terms or at all, or that rights granted by these licenses ultimately will be valid and enforceable.

Others could claim that our services, products, or solutions infringe upon their intellectual property rights or violate contractual protections.

We believe that our services, products, and solutions do not infringe upon the intellectual property rights of others. However, we or our clients may be subject to claims that our services, products, or solutions, or the products of our software providers or other alliance partners, infringe upon the intellectual property rights of others. Any such infringement claims may result in substantial costs, divert management attention and other resources, harm our reputation, and prevent us from offering some services, products, or solutions. A successful infringement claim against us could materially and adversely affect our business.

In our contracts, we generally agree to indemnify our clients for expenses and liabilities resulting from claimed infringement by our services, products, or solutions, excluding third-party components, of the intellectual property rights of others. In some instances, the amount of these indemnity obligations may be greater than the revenue we receive from the client under the applicable contract. In addition, our business includes the development of customized software modules in connection with specific client engagements, particularly in our systems integration business. We often assign to clients the copyright and, at times, other intellectual property rights in and to some aspects of the software and documentation developed for these clients in these engagements. Although our contracts with our clients generally provide that we also retain rights to our intellectual property, it is possible that clients may assert rights to, and seek to limit our ability to resell or reuse, this intellectual property.

Increasing government regulation could cause us to lose clients or impair our business.

We are subject not only to laws and regulations applicable to businesses generally, but we, and the solutions we offer to our clients, also may be subject to United States and foreign laws and regulations, specifically those applicable to data privacy and security, electronic commerce, and call recording. Laws and regulations recently enacted in the United States, both at the state and federal level, have imposed significant new requirements relating to the privacy and security of personal data, as well as the reporting of breaches with respect to personal data. Legislation that may be enacted in the future may add further requirements in these and other areas. In addition, we may be affected indirectly by legislation to the extent that it impacts our existing and prospective clients; for example, our clients in the health care industry are currently impacted by the uncertainty surrounding the health care reform effort. Any such laws and regulations therefore could affect our existing business relationships or prevent us from obtaining new clients.

The unauthorized disclosure of the confidential client data that we maintain could result in a significant loss of business to eLoyalty and subject us to substantial liability.

In the course of implementing our Behavioral Analytics™ Service, we record and analyze telephone calls between our clients’ customer service agents and customers. These calls contain numerous references to highly sensitive confidential or personally-identifiable data of the customers of our clients, and many of our clients are required to comply with federal and state laws concerning privacy and security. In addition, we have made certain contractual commitments to our clients regarding this confidential data.

We take extensive precautions to prevent the unauthorized disclosure or loss of such data and to protect the Company through technical and contractual means. Nonetheless, the disclosure or loss of such data could result in the considerable diminution of our business and prospects and could subject us to substantial liability.

In addition, the laws and regulations and industry standards governing these matters are changing rapidly. It is possible that the resources we devote to comply with such laws and regulations, industry standards, and our clients’ particular requirements could increase materially. In our contracts, we generally agree to indemnify our clients for expenses and liabilities resulting from unauthorized disclosure of confidential data. In some instances, the amount of these indemnity obligations may be greater than the revenue we receive from the client under the applicable contract.

We must maintain our reputation and expand our name recognition to remain competitive.

We believe that establishing and maintaining a good reputation and brand name is critical for attracting and expanding our targeted client base. If our reputation is damaged or if potential clients do not know what solutions we provide, then we may become less competitive or lose our market share. Promotion and enhancement of our name will depend largely on our success in providing high quality services, software, and solutions, which cannot be assured. If clients do not perceive our solutions to be effective or of higher quality than those available from our competitors, then our brand name and reputation could be materially and adversely affected.

Our clients use our solutions for critical applications. Any errors, defects, or other performance problems, including those in our proprietary software or products supplied by third-party vendors, could result in financial or other damages. In addition to any liability we might have, performance problems could also adversely affect our brand name and reputation.

11

Table of Contents

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Properties. |

Our principal physical properties employed in our business consist of our leased office facilities in Chicago and Lake Forest, Illinois; Edina, Minnesota; and Austin, Texas. Both of our business segments use the Lake Forest, Illinois and Austin, Texas facilities in their operations. The Edina, Minnesota and Chicago, Illinois facilities are primarily used by our Behavioral Analytics™ Service segment. Our executive offices are located at the Lake Forest, Illinois facility. Effective June 1, 2011, our executive office will be our location at 200 South Wacker Drive, Suite 820, Chicago, Illinois 60606.

Our total employable space is approximately 51,000 square feet. We do not own any real estate and believe that our leased facilities are appropriate for our current business requirements.

| Item 3. | Legal Proceedings. |

The Company, from time to time, has been subject to legal claims arising in connection with its business. While the results of these claims cannot be predicted with certainty, there are no asserted claims against the Company that, in the opinion of management, if adversely decided, would have a material effect on the Company’s financial position, results of operations, or cash flows.

| Item 4. | [Removed and Reserved.] |

PART II.

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities. |

Our Common Stock, par value $0.01 per share, is traded on the NASDAQ Global Market under the symbol ELOY. If the transaction with respect to the Integrated Contact Solutions Business Unit is consummated as proposed, the Company intends to trade under the ticker symbol “MATR”; an application to reserve this ticker symbol has been submitted to NASDAQ. The following table sets forth, for the periods indicated, the quarterly high and low sales prices of our Common Stock on the NASDAQ Global Market.

| High | Low | |||||||

| Fiscal Year 2010 |

||||||||

| Fourth Quarter |

$ | 7.50 | $ | 6.02 | ||||

| Third Quarter |

6.90 | 5.25 | ||||||

| Second Quarter |

7.61 | 5.14 | ||||||

| First Quarter |

7.28 | 4.90 | ||||||

| Fiscal Year 2009 |

||||||||

| Fourth Quarter |

$ | 8.58 | $ | 6.23 | ||||

| Third Quarter |

10.02 | 7.22 | ||||||

| Second Quarter |

10.46 | 4.20 | ||||||

| First Quarter |

5.00 | 2.45 | ||||||

There were approximately 92 owners of record of our Common Stock as of March 10, 2011. The last reported sale price of the Common Stock on the NASDAQ Global Market on March 10, 2011 was $6.99.

Stock Performance Graph

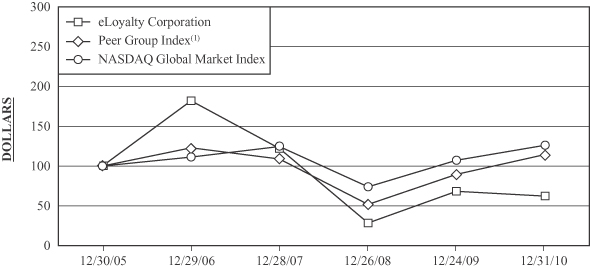

The following graph compares the cumulative total stockholder return on eLoyalty Common Stock with the cumulative total return of (i) a peer group of other publicly-traded information-technology consulting companies selected by the Company (the “Peer Group Index”), and (ii) the NASDAQ Global Market Index. Cumulative total stockholder return is based on the period from December 30, 2005 through the Company’s fiscal year end on Saturday, January 1, 2011. The comparison assumes that $100 was invested on December 30, 2005 in each of eLoyalty Common Stock, the Peer Group Index, and the NASDAQ Global Market Index, and that any and all dividends were reinvested.

12

Table of Contents

Comparative Cumulative Total Return

For eLoyalty Corporation,

Peer Group Index and NASDAQ Global Market Index

| 12/30/05 | 12/29/06 | 12/28/07 | 12/26/08 | 12/24/09 | 12/31/10 | |||||||||||||||||||

| eLoyalty Corporation |

$ | 100.00 | $ | 182.22 | $ | 122.25 | $ | 28.18 | $ | 68.03 | $ | 62.20 | ||||||||||||

| Peer Group Index(1) |

100.00 | 122.97 | 108.76 | 51.37 | 89.26 | 114.41 | ||||||||||||||||||

| NASDAQ Global Market Index |

100.00 | 111.16 | 124.64 | 73.80 | 107.07 | 125.99 | ||||||||||||||||||

| (1) | The Peer Group Index consists of The Hackett Group, Sapient Corporation, Convergys Corporation, Verint Systems, Inc., Ciber, Inc., and Nice Systems Limited. In fiscal year 2010, Nice Systems Limited was added to the Peer Group Index to replace Diamond Management & Technology Consultants, which was removed because its public information is no longer available. In fiscal year 2009, Ciber, Inc. was added to the Peer Group Index to replace Perot Systems Corporation, which was removed because its public information was no longer available. |

Repurchase of Equity Securities

The following table provides information relating to the Company’s purchase of shares of its Common Stock in the fourth quarter of 2010. All of these purchases reflect shares withheld upon vesting of restricted stock or installment stock to satisfy tax-withholding obligations.

| Period |

Total Number of Shares Purchased |

Average Price Paid Per Share |

||||||

| September 26, 2010 – October 25, 2010 |

— | $ | — | |||||

| October 26, 2010 – November 25, 2010 |

— | $ | — | |||||

| November 26, 2010 – January 01, 2011 |

34,205 | $ | 6.37 | |||||

| Total |

34,205 | $ | 6.37 | |||||

See “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” included in Part III Item 12 of this Form 10-K for more information about securities authorized for issuance under our various compensation plans.

Dividends

Historically, we have not paid cash dividends on our Common Stock, and we do not expect to do so in the future. If the proposed sale of our Integrated Contact Solutions Business Unit is completed, then we will be prohibited from paying dividends on our Common Stock until the Company pays the full liquidation preference (currently approximately $19.4 million) on its outstanding Series B Stock.

The Series B Stock accrues dividends at the rate of 7% per year payable semi-annually in January and July if declared by the Board of Directors. The Company paid cash dividends of $0.6 million on January 4, 2010, July 1, 2010 and July 1, 2009. The Company’s Board of Directors did not declare dividends on the Series B Stock for the January 1, 2011 or January 1, 2009 dividend payment dates. Under the terms of the Series B Stock certificate of designations, unpaid dividends are cumulative and accrue at the rate of 7% per annum. Payment of future dividends on the Series B Stock will be determined by the Company’s Board of Directors based on the Company’s outlook and macro-economic conditions. The amount of each dividend accrual would decrease by any conversions of the Series B Stock into Common Stock, as Series B Stock conversions require us to pay accrued but unpaid dividends at the time of conversion. Conversions of Series B Stock became permissible at the option of the holder after June 19, 2002. For further discussion see Part II, Item 7, “Liquidity and Capital Resources”.

| Item 6. | Selected Financial Data. |

The following tables summarize our selected financial data. This information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations, and the Consolidated Financial Statements of the Company and notes thereto, which are included elsewhere in this Form 10-K. The statements of operations data for the fiscal years ended 2010, 2009, 2008, 2007, and 2006 and the balance sheet data as of January 1, 2011, December 26, 2009, December 27, 2008, December 29, 2007, and December 30, 2006, below, are derived from our audited financial statements.

13

Table of Contents

| Consolidated Statements of Operations Data (In thousands, except share and per share data) |

||||||||||||||||||||

| For the Fiscal Years Ended | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Services |

$ | 71,808 | $ | 79,862 | $ | 77,796 | $ | 88,046 | $ | 71,980 | ||||||||||

| Product |

12,581 | 17,780 | 9,777 | 9,185 | 13,579 | |||||||||||||||

| Revenue before reimbursed expenses (net revenue) |

84,389 | 97,642 | 87,573 | 97,231 | 85,559 | |||||||||||||||

| Reimbursed expenses |

3,715 | 3,971 | 3,624 | 4,874 | 4,269 | |||||||||||||||

| Total revenue |

88,104 | 101,613 | 91,197 | 102,105 | 89,828 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Cost of services(1)(2) |

43,326 | 52,442 | 53,586 | 58,496 | 58,604 | |||||||||||||||

| Cost of product |

10,360 | 14,814 | 7,945 | 6,993 | 10,183 | |||||||||||||||

| Cost of revenue before reimbursed expenses |

53,686 | 67,256 | 61,531 | 65,489 | 68,787 | |||||||||||||||

| Reimbursed expenses |

3,715 | 3,971 | 3,624 | 4,874 | 4,269 | |||||||||||||||

| Total cost of revenue, exclusive of depreciation and amortization shown below: |

57,401 | 71,227 | 65,155 | 70,363 | 73,056 | |||||||||||||||

| Selling, general and administrative(1)(2) |

38,273 | 35,163 | 41,182 | 47,075 | 25,328 | |||||||||||||||

| Severance and related costs(1) |

1,180 | 1,341 | 1,635 | 1,333 | 737 | |||||||||||||||

| Depreciation |

4,074 | 4,242 | 3,845 | 3,186 | 2,095 | |||||||||||||||

| Amortization of intangibles |

144 | 223 | 340 | 423 | 370 | |||||||||||||||

| Total operating expenses |

101,072 | 112,196 | 112,157 | 122,380 | 101,586 | |||||||||||||||

| Operating loss |

(12,968 | ) | (10,583 | ) | (20,960 | ) | (20,275 | ) | (11,758 | ) | ||||||||||

| Interest and other (expense) income, net |

(121 | ) | 53 | 70 | 1,484 | 681 | ||||||||||||||

| Loss from continuing operations before income taxes |

(13,089 | ) | (10,530 | ) | (20,890 | ) | (18,791 | ) | (11,077 | ) | ||||||||||

| Income tax (provision) benefit |

(93 | ) | (44 | ) | (15 | ) | 53 | (71 | ) | |||||||||||

| Loss from continuing operations |

(13,182 | ) | (10,574 | ) | (20,905 | ) | (18,738 | ) | (11,148 | ) | ||||||||||

| Loss on discontinued operations |

(136 | ) | (46 | ) | (748 | ) | — | — | ||||||||||||

| Net loss |

(13,318 | ) | (10,620 | ) | (21,653 | ) | (18,738 | ) | (11,148 | ) | ||||||||||

| Dividends related to Series B Stock |

(1,273 | ) | (1,292 | ) | (1,296 | ) | (1,405 | ) | (1,464 | ) | ||||||||||

| Net loss available to common stockholders |

$ | (14,591 | ) | $ | (11,912 | ) | $ | (22,949 | ) | $ | (20,143 | ) | $ | (12,612 | ) | |||||

| Per common share: |

||||||||||||||||||||

| Basic loss from continuing operations |

$ | (0.96 | ) | $ | (0.80 | ) | $ | (2.02 | ) | $ | (2.23 | ) | $ | (1.65 | ) | |||||

| Basic loss from discontinued operations |

$ | (0.01 | ) | $ | — | $ | (0.07 | ) | $ | — | $ | — | ||||||||

| Basic net loss available to common stockholders |

$ | (1.06 | ) | $ | (0.90 | ) | $ | (2.21 | ) | $ | (2.40 | ) | $ | (1.86 | ) | |||||

| Per common share: |

||||||||||||||||||||

| Diluted loss from continuing operations(3) |

$ | (0.96 | ) | $ | (0.80 | ) | $ | (2.02 | ) | $ | (2.23 | ) | $ | (1.65 | ) | |||||

| Diluted loss from discontinued operations(3) |

$ | (0.01 | ) | $ | — | $ | (0.07 | ) | $ | — | $ | — | ||||||||

| Diluted net loss available to common stockholders(3) |

$ | (1.06 | ) | $ | (0.90 | ) | $ | (2.21 | ) | $ | (2.40 | ) | $ | (1.86 | ) | |||||

| (In millions) | ||||||||||||||||||||

| Basic weighted average shares outstanding |

13.70 | 13.26 | 10.37 | 8.40 | 6.77 | |||||||||||||||

| Diluted weighted average shares outstanding(3) |

17.70 | 17.49 | 14.00 | 12.90 | 11.70 | |||||||||||||||

| (1) | Stock-based compensation, primarily restricted stock, is included in individual line items above: |

14

Table of Contents

| (In thousands) For the Fiscal Year Ended |

||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Cost of services |

$ | 99 | $ | 504 | $ | 3,345 | $ | 1,004 | $ | 1,632 | ||||||||||

| Selling, general and administrative |

5,102 | 5,793 | 11,335 | 9,444 | 2,386 | |||||||||||||||

| Severance and related costs |

76 | 248 | 103 | 196 | — | |||||||||||||||

| (2) | Beginning in fiscal year 2007, the Company classified certain expenses within Cost of services as Selling, general and administrative expense. Beginning in fiscal year 2008, certain data center expenses that had been previously reported as Selling, general and administrative have been reclassified as Cost of services within our Behavioral Analytics™ Service Business Unit. |

| (3) | In periods in which there is a loss, the dilutive effect of Common Stock equivalents is not included in the diluted loss per share calculation as they are antidilutive. |

| Consolidated Balance Sheet Data (In thousands) As of |

||||||||||||||||||||

| January 1, 2011 |

December 26, 2009 |

December 27, 2008 |

December 29, 2007 |

December 30, 2006 |

||||||||||||||||

| Total cash(1) |

$ | 23,332 | $ | 32,727 | $ | 30,719 | $ | 23,867 | $ | 31,928 | ||||||||||

| Short-term investments(2) |

$ | — | $ | — | $ | 108 | $ | 451 | $ | — | ||||||||||

| Working capital(3) |

$ | 11,857 | $ | 18,211 | $ | 24,688 | $ | 20,621 | $ | 32,640 | ||||||||||

| Total assets |

$ | 66,192 | $ | 70,603 | $ | 64,223 | $ | 60,051 | $ | 64,568 | ||||||||||

| Long-term obligations |

$ | 17,520 | $ | 11,231 | $ | 7,846 | $ | 9,041 | $ | 5,471 | ||||||||||

| Redeemable preferred stock |

$ | 18,100 | $ | 18,442 | $ | 18,460 | $ | 19,100 | $ | 20,902 | ||||||||||

| Stockholders’ (deficit) equity |

$ | (4,154 | ) | $ | 6,031 | $ | 12,847 | $ | 7,803 | $ | 18,614 | |||||||||

| Capital leases |

$ | 2,367 | $ | 2,657 | $ | 3,172 | $ | 1,491 | $ | — | ||||||||||

| (1) | Total cash consisted of cash and cash equivalents of $20.9 million, $29.0 million, $27.1 million, $21.4 million, and $31.6 million, and restricted cash of $2.5 million, $3.7 million, $3.7 million, $2.5 million, and $0.3 million, as of January 1, 2011, December 26, 2009, December 27, 2008, December 29, 2007, and December 30, 2006, respectively. |

| (2) | In 2008 and 2007, included in other current assets are $0.1 million and $0.5 million of investments, respectively, which represent the market value of equity securities in an unrelated publicly traded company. In 2009, these equity securities were sold for $0.3 million. |

| (3) | Represents total current assets less total current liabilities. |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Critical Accounting Policies and Estimates

Our management’s discussion and analysis of financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to the costs and timing of completion of client projects, our ability to collect accounts receivable, the timing and amounts of expected payments associated with cost reduction activities, and the ability to realize our net deferred tax assets, contingencies, and litigation. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition

Behavioral Analytics™ Service Business Unit

Behavioral Analytics™ Service Line

Managed services revenue included in the Behavioral Analytics™ Service Line consists of planning, deployment, training, and subscription fees. Planning, deployment, and training fees, which are considered to be installation fees related to long-term subscription contracts, are deferred until an installation is complete and are then recognized over the term of the applicable subscription contract. The terms of these subscription contracts generally range from three to five years. Installation costs incurred are deferred up to an amount not to exceed the amount of deferred installation revenue and additional amounts that are recoverable based on the contractual arrangement. These costs are included in Prepaid expenses and Other long-term assets. Such costs are amortized over the term of the subscription contract. Costs in excess of the foregoing revenue amount are expensed in the period incurred.

15

Table of Contents

The amount of revenue generated from Behavioral Analytics™ Service subscription fees is based on a number of factors, such as the number of agents accessing the Behavioral Analytics™ System and/or the number of hours of calls analyzed during the relevant month of the term of the subscription contract. This revenue is recognized as the service is performed for the client.

Consulting services revenue included in the Behavioral Analytics™ Service Line primarily consists of fees charged to our clients to provide post-deployment follow-on consulting services, which generally consist of custom data analysis, the implementation of enhancements, and training. These follow-on consulting services are generally performed for our clients on a fixed-fee basis. Revenue is recognized as the services are performed, with performance generally assessed on the ratio of actual hours incurred to date compared to the total estimated hours over the entire term of the contract.

Marketing Managed Services Line

Marketing Managed Services revenue is derived from marketing application hosting and email fulfillment. Revenue related to hosting services is generally in the form of fixed monthly fees received from our clients and is recognized as the services are performed for each client. Any related setup fee would be recognized over the contract period of the hosting arrangement. Revenue related to email fulfillment services is recognized as the services are provided to the client, based on the number of emails distributed for the client.

Integrated Contact Solutions Business Unit

Integrated Contact Solutions Service Line

Managed services revenue included in the Integrated Contact Solutions Service Line consists of fees generated from our contact center support and monitoring services. Support and monitoring services are generally contracted for a fixed fee, and the revenue is recognized ratably over the term of the contract. Support fees that are contracted on a time-and-materials basis are recognized as the services are performed for the client.