Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - UNITED INSURANCE HOLDINGS CORP. | exh32230sep17.htm |

| EX-32.1 - EXHIBIT 32.1 - UNITED INSURANCE HOLDINGS CORP. | exh32130sep17.htm |

| EX-31.2 - EXHIBIT 31.2 - UNITED INSURANCE HOLDINGS CORP. | exh31230sep17.htm |

| EX-31.1 - EXHIBIT 31.1 - UNITED INSURANCE HOLDINGS CORP. | exh31130sep17.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________

FORM 10-Q

_______________________

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017

Commission File Number 001-35761

_____________________

United Insurance Holdings Corp.

(Exact name of Registrant as specified in its charter)

_______________________

Delaware | 75-3241967 | |||

(State of Incorporation) | (IRS Employer Identification Number) | |||

800 2nd Avenue S

St. Petersburg, Florida 33701

(Address, including zip code, of principal executive offices)

727-895-7737

(Registrant's telephone number, including area code)

_______________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | £ | Accelerated filer | þ | |

Non-accelerated filer | £ | Smaller reporting company | £ | |

Emerging growth company | £ | |||

If an emerging growth company, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No R

As of November 8, 2017; 42,753,504 shares of common stock, par value $0.0001 per share, were outstanding.

UNITED INSURANCE HOLDINGS CORP.

PART I. FINANCIAL INFORMATION | ||

Item 1. Financial Statements | ||

Consolidated Balance Sheets | ||

Unaudited Consolidated Statements of Comprehensive Income | ||

Unaudited Consolidated Statements of Cash Flows | ||

Notes to Unaudited Consolidated Financial Statements | ||

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

Item 3. Quantitative and Qualitative Disclosures About Market Risk | ||

Item 4. Controls and Procedures | ||

PART II. OTHER INFORMATION | ||

Item 1. Legal Proceedings | ||

Item 1A. Risk Factors | ||

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | ||

Item 3. Defaults Upon Senior Securities | ||

Item 4. Mine Safety Disclosures | ||

Item 5. Other Information | ||

Item 6. Exhibits | ||

Signatures | ||

Throughout this Form 10-Q, we present amounts in all tables in thousands, except for share amounts, per share amounts, policy counts or where more specific language or context indicates a different presentation. In the narrative sections of this Quarterly Report, we show full values rounded to the nearest thousand.

2

UNITED INSURANCE HOLDINGS CORP.

FORWARD-LOOKING STATEMENTS

Statements in this Quarterly Report on Form 10-Q as of September 30, 2017 and for the three and nine months then ended or in documents incorporated by reference, contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements about anticipated revenues, earnings per share, estimated unpaid losses on insurance policies, investment returns and expectations about our liquidity, and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management’s beliefs and assumptions. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “endeavor,” “project,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” or “continue” or the negative variations there of, or comparable terminology are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation:

• | the regulatory, economic and weather conditions in the states in which we operate; |

• | the impact of new federal or state regulations that affect the property and casualty insurance market; |

• | the cost, variability and availability of reinsurance; |

• | assessments charged by various governmental agencies; |

• | pricing competition and other initiatives by competitors; |

• | our ability to attract and retain the services of senior management; |

• | the outcome of litigation pending against us, including the terms of any settlements; |

• | dependence on investment income and the composition of our investment portfolio and related market risks; |

• | our exposure to catastrophic events and severe weather conditions; |

• | downgrades in our financial strength ratings; |

• | risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and |

• | other risks and uncertainties described in the section entitled "Risk Factors" in Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2016. |

We caution you not to place reliance on these forward-looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. In addition, we prepare our financial statements in accordance with U.S. generally accepted accounting principles (GAAP), which prescribes when we may reserve for particular risks, including litigation exposures. Accordingly, our results for a given reporting period could be significantly affected if and when we establish a reserve for a major contingency. Therefore, the results we report in certain accounting periods may appear to be volatile, and past results may not be indicative of results in future periods.

These forward-looking statements are subject to numerous risks, uncertainties and assumptions about us described in our filings with the Securities and Exchange Commission (SEC). The forward-looking events that we discuss in this Form 10-Q are valid only as of the date of this Form 10-Q and may not occur, or may have different consequences, in light of the risks, uncertainties and assumptions that we describe from time to time in our filings with the SEC. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from our forward-looking statements is included in the section entitled “RISK FACTORS” in Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2016. Except as required by applicable law, we undertake no obligation and disclaim any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3

UNITED INSURANCE HOLDINGS CORP.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Consolidated Balance Sheets

September 30, 2017 | December 31, 2016 | |||||||

ASSETS | (Unaudited) | |||||||

Investments available for sale, at fair value: | ||||||||

Fixed maturities (amortized cost of $715,374 and $497,616, respectively) | $ | 718,785 | $ | 494,516 | ||||

Equity securities (adjusted cost of $52,845 and $24,074, respectively) | 61,639 | 28,398 | ||||||

Other investments (amortized cost of $7,835 and $5,493, respectively) | 8,157 | 5,733 | ||||||

Total investments | $ | 788,581 | $ | 528,647 | ||||

Cash and cash equivalents | 280,268 | 150,688 | ||||||

Accrued investment income | 5,229 | 3,735 | ||||||

Property and equipment, net | 19,344 | 17,860 | ||||||

Premiums receivable, net | 70,019 | 38,883 | ||||||

Reinsurance recoverable on paid and unpaid losses | 489,348 | 24,028 | ||||||

Prepaid reinsurance premiums | 285,121 | 132,564 | ||||||

Goodwill | 59,679 | 14,254 | ||||||

Deferred policy acquisition costs | 101,314 | 65,473 | ||||||

Intangible assets | 55,109 | 12,371 | ||||||

Other assets | 29,210 | 11,183 | ||||||

Total Assets | $ | 2,183,222 | $ | 999,686 | ||||

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

Liabilities: | ||||||||

Unpaid losses and loss adjustment expenses | $ | 682,161 | $ | 140,855 | ||||

Unearned premiums | 577,805 | 372,223 | ||||||

Reinsurance payable | 241,768 | 99,891 | ||||||

Other liabilities | 127,153 | 91,215 | ||||||

Notes payable | 53,119 | 54,175 | ||||||

Total Liabilities | $ | 1,682,006 | $ | 758,359 | ||||

Commitments and contingencies (Note 11) | ||||||||

Stockholders' Equity: | ||||||||

Preferred stock, $0.0001 par value; 1,000,000 shares authorized; none issued or outstanding | — | — | ||||||

Common stock, $0.0001 par value; 50,000,000 shares authorized; 42,953,087 and 21,858,697 issued; 42,741,004 and 21,646,614 outstanding for 2017 and 2016, respectively | 4 | 2 | ||||||

Additional paid-in capital | 375,666 | 99,353 | ||||||

Treasury shares, at cost; 212,083 shares | (431 | ) | (431 | ) | ||||

Accumulated other comprehensive income | 7,678 | 822 | ||||||

Retained earnings | 118,299 | 141,581 | ||||||

Total Stockholders' Equity | $ | 501,216 | $ | 241,327 | ||||

Total Liabilities and Stockholders' Equity | $ | 2,183,222 | $ | 999,686 | ||||

See accompanying Notes to Unaudited Consolidated Financial Statements.

4

UNITED INSURANCE HOLDINGS CORP.

Consolidated Statements of Comprehensive Income

(Unaudited)

Three Months Ended | Nine Months Ended | |||||||||||||||

September 30, | September 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

REVENUE: | ||||||||||||||||

Gross premiums written | $ | 267,219 | $ | 194,341 | $ | 788,408 | $ | 541,053 | ||||||||

Decrease (increase) in gross unearned premiums | 782 | (20,821 | ) | (76,758 | ) | (56,446 | ) | |||||||||

Gross premiums earned | 268,001 | 173,520 | 711,650 | 484,607 | ||||||||||||

Ceded premiums earned | (115,507 | ) | (53,299 | ) | (292,355 | ) | (148,837 | ) | ||||||||

Net premiums earned | 152,494 | 120,221 | 419,295 | 335,770 | ||||||||||||

Investment income | 4,901 | 2,663 | 12,489 | 7,786 | ||||||||||||

Net realized gains (losses) | (71 | ) | 106 | (554 | ) | 478 | ||||||||||

Other revenue | 13,804 | 4,212 | 40,604 | 11,650 | ||||||||||||

Total revenue | 171,128 | 127,202 | 471,834 | 355,684 | ||||||||||||

EXPENSES: | ||||||||||||||||

Losses and loss adjustment expenses | 143,127 | 72,746 | 293,398 | 199,615 | ||||||||||||

Policy acquisition costs | 46,546 | 31,333 | 125,302 | 84,086 | ||||||||||||

Operating expenses | 6,891 | 5,558 | 19,020 | 15,326 | ||||||||||||

General and administrative expenses | 19,316 | 12,329 | 58,825 | 31,759 | ||||||||||||

Interest expense | 771 | 206 | 2,282 | 397 | ||||||||||||

Total expenses | 216,651 | 122,172 | 498,827 | 331,183 | ||||||||||||

Income (loss) before other income | (45,523 | ) | 5,030 | (26,993 | ) | 24,501 | ||||||||||

Other income | 36 | 11 | 94 | 80 | ||||||||||||

Income (loss) before income taxes | (45,487 | ) | 5,041 | (26,899 | ) | 24,581 | ||||||||||

Provision for income taxes | (17,475 | ) | 1,618 | (10,043 | ) | 8,366 | ||||||||||

Net income (loss) | $ | (28,012 | ) | $ | 3,423 | $ | (16,856 | ) | $ | 16,215 | ||||||

OTHER COMPREHENSIVE INCOME: | ||||||||||||||||

Change in net unrealized gains (losses) on investments | 2,672 | (3,495 | ) | 10,509 | 10,305 | |||||||||||

Reclassification adjustment for net realized investment losses (gains) | 71 | (106 | ) | 554 | (478 | ) | ||||||||||

Income tax benefit (expense) related to items of other comprehensive income | (1,050 | ) | 1,298 | (4,207 | ) | (3,776 | ) | |||||||||

Total comprehensive income | $ | (26,319 | ) | $ | 1,120 | $ | (10,000 | ) | $ | 22,266 | ||||||

Weighted average shares outstanding | ||||||||||||||||

Basic | 42,524,400 | 21,448,892 | 35,341,994 | 21,406,599 | ||||||||||||

Diluted | 42,741,004 | 21,643,401 | 35,563,032 | 21,604,135 | ||||||||||||

Earnings per share | ||||||||||||||||

Basic | $ | (0.66 | ) | $ | 0.16 | $ | (0.48 | ) | $ | 0.76 | ||||||

Diluted | $ | (0.66 | ) | $ | 0.16 | $ | (0.47 | ) | $ | 0.75 | ||||||

Dividends declared per share | $ | 0.06 | $ | 0.06 | $ | 0.18 | $ | 0.17 | ||||||||

See accompanying Notes to Unaudited Consolidated Financial Statements.

5

UNITED INSURANCE HOLDINGS CORP.

Consolidated Statements of Cash Flows

(Unaudited)

Nine Months Ended September 30, | ||||||||

2017 | 2016 | |||||||

OPERATING ACTIVITIES | ||||||||

Net income (loss) | $ | (16,856 | ) | $ | 16,215 | |||

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||

Depreciation and amortization | 24,206 | 8,640 | ||||||

Bond amortization and accretion | 3,663 | 2,621 | ||||||

Net realized gains (losses) | 554 | (478 | ) | |||||

Provision for uncollectable premiums/over and short | 205 | 57 | ||||||

Deferred income taxes, net | 380 | 1,575 | ||||||

Stock based compensation | 1,931 | 1,429 | ||||||

Changes in operating assets and liabilities: | ||||||||

Accrued investment income | (183 | ) | 155 | |||||

Premiums receivable | 98 | 2,260 | ||||||

Reinsurance recoverable on paid and unpaid losses | (445,090 | ) | (11,097 | ) | ||||

Prepaid reinsurance premiums | (130,013 | ) | (55,890 | ) | ||||

Deferred policy acquisition costs, net | (35,841 | ) | (18,164 | ) | ||||

Other assets | (12,354 | ) | (2,301 | ) | ||||

Unpaid losses and loss adjustment expenses | 480,777 | 20,901 | ||||||

Unearned premiums | 76,758 | 56,446 | ||||||

Reinsurance payable | 119,471 | 59,036 | ||||||

Other liabilities | 16,631 | 7,914 | ||||||

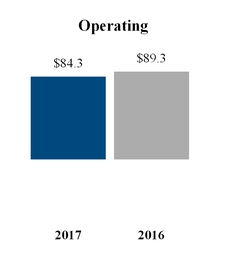

Net cash provided by operating activities | $ | 84,337 | $ | 89,319 | ||||

INVESTING ACTIVITIES | ||||||||

Proceeds from sales and maturities of investments available for sale | 106,150 | 147,266 | ||||||

Purchases of investments available for sale | (136,319 | ) | (146,535 | ) | ||||

Cash from acquisition | 95,284 | — | ||||||

Purchase of subsidiary, net of cash acquired | — | (32,840 | ) | |||||

Cost of property, equipment and capitalized software acquired | (4,243 | ) | (2,726 | ) | ||||

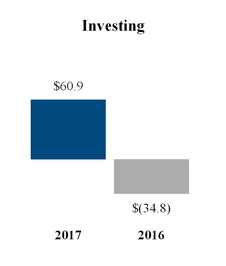

Net cash provided by (used in) investing activities | $ | 60,872 | $ | (34,835 | ) | |||

FINANCING ACTIVITIES | ||||||||

Tax withholding payment related to net settlement of equity awards | — | (270 | ) | |||||

Proceeds from borrowings | — | 5,200 | ||||||

Repayments of borrowings | (1,142 | ) | (969 | ) | ||||

Dividends | (6,426 | ) | (3,675 | ) | ||||

Bank overdrafts | (8,061 | ) | — | |||||

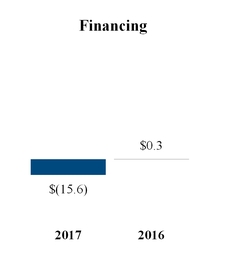

Net cash (used in) provided by financing activities | $ | (15,629 | ) | $ | 286 | |||

Increase in cash | 129,580 | 54,770 | ||||||

Cash and cash equivalents at beginning of period | 150,688 | 84,786 | ||||||

Cash and cash equivalents at end of period | $ | 280,268 | $ | 139,556 | ||||

Supplemental Cash Flows Information | ||||||||

Interest paid | $ | 2,001 | $ | 201 | ||||

Income taxes paid | $ | 4,206 | $ | 7,199 | ||||

Non-cash transactions | ||||||||

Issuance of common stock in connection with acquisition | $ | 274,384 | $ | — | ||||

See accompanying Notes to Unaudited Consolidated Financial Statements.

6

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

1) ORGANIZATION, CONSOLIDATION AND PRESENTATION

(a)Business

United Insurance Holdings Corp. (referred to in this document as we, our, us, the Company or UPC Insurance) is a property and casualty insurance holding company that sources, writes, and services residential and commercial property and casualty insurance policies using a network of agents and four wholly owned insurance subsidiaries. Our primary insurance subsidiary is United Property & Casualty Insurance Company (UPC), which was formed in Florida in 1999 and has operated continuously since that time. Our other subsidiaries include United Insurance Management, L.C. (UIM), (our managing general agent) that manages substantially all aspects of UPC's business; Skyway Claims Services, LLC (our claims adjusting affiliate) that provides services to our insurance affiliates; UPC Re (our reinsurance affiliate) that provides a portion of the reinsurance protection purchased by our insurance affiliates, Family Security Holdings, LLC (FSH), Family Security Insurance Company, Inc. (FSIC), Interboro Insurance Company (IIC), AmCo Holding Company (AmCo), American Coastal Insurance Company (ACIC) and BlueLine Cayman Holdings (BLUE).

On April 29, 2016, we acquired IIC via merger. On April 3, 2017, we merged with AmCo and its two wholly owned subsidiaries, ACIC and BLUE. See Note 4 in our Notes to Unaudited Consolidated Financial Statements for additional information regarding these acquisitions.

Our primary products are homeowners' and commercial insurance, which we currently offer in Connecticut, Florida, Georgia, Hawaii, Louisiana, Massachusetts, New Jersey, New York, North Carolina, Rhode Island, South Carolina, and Texas, under authorization from the insurance regulatory authorities in each state. We are also licensed to write property and casualty insurance in Alabama, Delaware, Maryland, Mississippi, New Hampshire, and Virginia; however, we have not commenced writing in these states.

We conduct our operations under one business segment.

(b)Consolidation and Presentation

We prepare our financial statements in conformity with U.S. generally accepted accounting principles (GAAP). While preparing our consolidated financial statements, we make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements, as well as reported amounts of revenues and expenses during the reporting period. Accordingly, actual results could differ from those estimates. Reported amounts that require us to make extensive use of estimates include our reserves for unpaid losses and loss adjustment expenses, reinsurance recoverable, deferred policy acquisition costs, investments and goodwill. Except for the captions on our Unaudited Consolidated Balance Sheets and Unaudited Consolidated Statements of Comprehensive Income, we generally use the term loss(es) to collectively refer to both loss and loss adjustment expenses.

We include all of our subsidiaries in our unaudited consolidated financial statements, eliminating all significant intercompany balances and transactions during consolidation.

We prepared the accompanying Unaudited Consolidated Balance Sheet as of September 30, 2017, with the Audited Consolidated Balance Sheet amounts as of December 31, 2016, presented for comparative purposes, and the related Unaudited Consolidated Statements of Comprehensive Income and Statements of Cash Flows in accordance with the instructions for Form 10-Q and Article 10-01 of Regulation S-X. In compliance with those instructions, we have omitted certain information and footnote disclosures normally included in annual consolidated financial statements prepared in accordance with GAAP, though management believes the disclosures made herein are sufficient to ensure that the information presented is not misleading.

Our results of operations and our cash flows as of the end of the interim periods reported herein do not necessarily indicate our results for the remainder of the year or for any other future period.

Management believes our unaudited consolidated interim financial statements include all the normal recurring adjustments necessary to fairly present our Unaudited Consolidated Balance Sheet as of September 30, 2017, our Unaudited Consolidated Statements of Comprehensive Income and our Unaudited Consolidated Statements of Cash Flows for all periods presented.

7

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

Our unaudited consolidated interim financial statements and footnotes should be read in conjunction with our consolidated financial statements and footnotes in our Annual Report filed on Form 10-K for the year ended December 31, 2016.

2) SIGNIFICANT ACCOUNTING POLICIES

(a) Changes to significant accounting policies

We have made no changes to our significant accounting policies as reported in our 2016 Form 10-K.

(b) Fair value assumptions

The carrying amounts for the following financial instrument categories approximate their fair values at September 30, 2017 and December 31, 2016, because of their short-term nature: cash and cash equivalents, accrued investment income, premiums receivable, reinsurance recoverable, reinsurance payable, other assets, and other liabilities. The carrying amount of the notes payable to the Florida State Board of Administration, the Branch Banking & Trust Corporation (BB&T) and the senior notes payable approximate fair value as the interest rates are variable. The carrying amount of our note payable with Interboro, LLC approximates fair value due to the short-term nature of the loan.

(c) Recently Adopted Accounting Pronouncements

In March 2016, the FASB issued Accounting Standards Update No. 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (ASU 2016-09). This update was intended to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. ASU 2016-09 became effective for annual periods beginning after December 15, 2016. The new guidance did not impact the way in which we account for share-based payment transactions and therefore, the adoption as of January 1, 2017 had no impact on our results of operations or financial position.

(d) Pending Accounting Pronouncements

We have evaluated recent accounting pronouncements that have had or may have a significant effect on our financial statements or on our disclosures.

In May 2017, the FASB issued Accounting Standards Update (ASU) No. 2017-09, Compensation-Stock Compensation (Topic 718)-Scope of Modification Accounting (ASU 2017-09). This update provides guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting in Topic 718. ASU 2017-09 is effective for annual periods beginning after December 15, 2017, including interim periods within those annual periods, with early adoption permitted for certain requirements. We do not intend to early adopt and are assessing the impact of adopting this new accounting standard on our consolidated financial statements and related disclosures.

In January 2017, the FASB issued Accounting Standards Update (ASU) No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment (ASU 2017-04). This update simplifies the manner in which an entity is required to test goodwill for impairment by eliminating Step 2 from the goodwill impairment test. ASU 2017-07 is effective for annual periods beginning after December 15, 2019, including interim periods within those annual periods, with early adoption permitted for certain requirements. We do not intend to early adopt and are assessing the impact of adopting this new accounting standard on our consolidated financial statements and related disclosures.

In May 2014, the FASB issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (ASU 2014-09). Insurance contracts are excluded from the scope of this guidance. Under the standard, guidance is provided on revenue recognition for entities that enter into contracts with customers to transfer goods or services or enter into contracts for the transfer of nonfinancial assets. The transaction price is attributed to underlying performance obligations in the contract and revenue is recognized as the entity satisfies the performance obligation and transfers control of the good or service to the customer. ASU 2014-09 is effective beginning in the first quarter of 2018, with early adoption permitted. We do not intend to early adopt and note that the standard is not applicable to our insurance contracts. We do not believe that the adoption

8

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

of this new accounting standard will have a material impact on our consolidated financial statements and related disclosures.

3) INVESTMENTS

The following table details the difference between cost or adjusted/amortized cost and estimated fair value, by major investment category, at September 30, 2017 and December 31, 2016:

Cost or Adjusted/Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||

September 30, 2017 | |||||||||||||||

U.S. government and agency securities | $ | 204,132 | $ | 618 | $ | 1,294 | $ | 203,456 | |||||||

Foreign government | 2,025 | 32 | — | 2,057 | |||||||||||

States, municipalities and political subdivisions | 194,327 | 2,249 | 429 | 196,147 | |||||||||||

Public utilities | 19,601 | 205 | 51 | 19,755 | |||||||||||

Corporate securities | 277,481 | 2,692 | 580 | 279,593 | |||||||||||

Asset backed securities | 16,711 | 11 | 8 | 16,714 | |||||||||||

Redeemable preferred stocks | 1,097 | 29 | 63 | 1,063 | |||||||||||

Total fixed maturities | 715,374 | 5,836 | 2,425 | 718,785 | |||||||||||

Mutual funds | 28,949 | 858 | — | 29,807 | |||||||||||

Public utilities | 1,342 | 300 | — | 1,642 | |||||||||||

Other common stocks | 19,804 | 7,790 | 149 | 27,445 | |||||||||||

Non-redeemable preferred stocks | 2,750 | 56 | 61 | 2,745 | |||||||||||

Total equity securities | 52,845 | 9,004 | 210 | 61,639 | |||||||||||

Other long-term investments | 7,835 | 322 | — | 8,157 | |||||||||||

Total investments | $ | 776,054 | $ | 15,162 | $ | 2,635 | $ | 788,581 | |||||||

December 31, 2016 | |||||||||||||||

U.S. government and agency securities | $ | 151,656 | $ | 189 | $ | 1,893 | $ | 149,952 | |||||||

Foreign government | 2,031 | 30 | — | 2,061 | |||||||||||

States, municipalities and political subdivisions | 170,636 | 1,027 | 2,551 | 169,112 | |||||||||||

Public utilities | 7,687 | 116 | 73 | 7,730 | |||||||||||

Corporate securities | 164,424 | 1,238 | 1,126 | 164,536 | |||||||||||

Redeemable preferred stocks | 1,182 | 5 | 62 | 1,125 | |||||||||||

Total fixed maturities | 497,616 | 2,605 | 5,705 | 494,516 | |||||||||||

Public utilities | 1,343 | 164 | — | 1,507 | |||||||||||

Other common stocks | 19,815 | 4,552 | 319 | 24,048 | |||||||||||

Non-redeemable preferred stocks | 2,916 | 10 | 83 | 2,843 | |||||||||||

Total equity securities | 24,074 | 4,726 | 402 | 28,398 | |||||||||||

Other long-term investments | 5,493 | 267 | 27 | 5,733 | |||||||||||

Total investments | $ | 527,183 | $ | 7,598 | $ | 6,134 | $ | 528,647 | |||||||

9

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

When we sell investments, we calculate the gain or loss realized on the sale by comparing the sales price (fair value) to the cost or adjusted/amortized cost of the security sold. We determine the cost or adjusted/amortized cost of the security sold using the specific-identification method. The following table details our realized gains (losses) by major investment category for the three and nine month periods ended September 30, 2017 and 2016:

2017 | 2016 | ||||||||||||||

Gains (Losses) | Fair Value at Sale | Gains (Losses) | Fair Value at Sale | ||||||||||||

Three Months Ended September 30, | |||||||||||||||

Fixed maturities | $ | 123 | $ | 11,368 | $ | 508 | $ | 11,009 | |||||||

Equity securities | 1 | 156 | — | — | |||||||||||

Total realized gains | 124 | 11,524 | 508 | 11,009 | |||||||||||

Fixed maturities | (195 | ) | 10,517 | (396 | ) | 7,635 | |||||||||

Equity securities | — | — | (6 | ) | 17 | ||||||||||

Total realized losses | (195 | ) | 10,517 | (402 | ) | 7,652 | |||||||||

Net realized investment gains (losses) | $ | (71 | ) | $ | 22,041 | $ | 106 | $ | 18,661 | ||||||

Nine Months Ended September 30, | |||||||||||||||

Fixed maturities | $ | 263 | $ | 30,264 | $ | 1,806 | $ | 47,391 | |||||||

Equity securities | 8 | 175 | 24 | 10,769 | |||||||||||

Total realized gains | 271 | 30,439 | 1,830 | 58,160 | |||||||||||

Fixed maturities | (815 | ) | 47,913 | (1,170 | ) | 20,663 | |||||||||

Equity securities | (10 | ) | 100 | (182 | ) | 17,025 | |||||||||

Total realized losses | (825 | ) | 48,013 | (1,352 | ) | 37,688 | |||||||||

Net realized investment gains (losses) | $ | (554 | ) | $ | 78,452 | $ | 478 | $ | 95,848 | ||||||

The table below summarizes our fixed maturities at September 30, 2017 by contractual maturity periods. Actual results may differ, as issuers may have the right to call or prepay obligations, with or without penalties, prior to the contractual maturities of those obligations.

September 30, 2017 | |||||||||||||

Cost or Amortized Cost | Percent of Total | Fair Value | Percent of Total | ||||||||||

Due in one year or less | $ | 50,426 | 7.0 | % | $ | 50,362 | 7.0 | % | |||||

Due after one year through five years | 332,620 | 46.5 | % | 334,135 | 46.5 | % | |||||||

Due after five years through ten years | 192,314 | 26.9 | % | 194,266 | 27.0 | % | |||||||

Due after ten years | 17,043 | 2.4 | % | 17,089 | 2.4 | % | |||||||

Asset and mortgage backed securities | 122,971 | 17.2 | % | 122,933 | 17.1 | % | |||||||

Total | $ | 715,374 | 100.0 | % | $ | 718,785 | 100.0 | % | |||||

10

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

The following table summarizes our net investment income by major investment category:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Fixed maturities | $ | 4,111 | $ | 2,251 | $ | 10,696 | $ | 6,693 | |||||||

Equity securities | 375 | 259 | 940 | 726 | |||||||||||

Cash and cash equivalents | 285 | 38 | 445 | 87 | |||||||||||

Other investments | 124 | 110 | 385 | 266 | |||||||||||

Other assets | 6 | 5 | 23 | 14 | |||||||||||

Investment income | 4,901 | 2,663 | 12,489 | 7,786 | |||||||||||

Investment expenses | (213 | ) | (155 | ) | (482 | ) | (360 | ) | |||||||

Net investment income | $ | 4,688 | $ | 2,508 | $ | 12,007 | $ | 7,426 | |||||||

Portfolio monitoring

We have a comprehensive portfolio monitoring process to identify and evaluate each fixed income and equity security whose carrying value may be other-than-temporarily impaired.

For each fixed income security in an unrealized loss position, we determine if the loss is temporary or other-than-temporary. If our management decides to sell the security or determines that it is more likely than not that we will be required to sell the security before recovery of the cost or amortized cost basis for reasons such as liquidity needs, contractual or regulatory requirements, then the security's decline in fair value is considered other-than-temporary and is recorded in earnings.

If we have not made the decision to sell the fixed income security and it is more likely than not that we will be required to sell the fixed income security before recovery of its amortized cost basis, we evaluate whether we expect the security to receive cash flows sufficient to recover the entire cost or amortized cost basis of the security. We calculate the estimated recovery value by discounting the best estimate of future cash flows at the security's original or current effective rate, as appropriate, and compare this to the cost or amortized cost of the security. If we do not expect to receive cash flows sufficient to recover the entire cost or amortized cost basis of the fixed income security, the credit loss component of the impairment is recorded in earnings, with the remaining amount of the unrealized loss related to other factors recognized in other comprehensive income.

For equity securities, we consider various factors, including whether we have the intent and ability to hold the equity security for a period of time sufficient to recover its cost basis. If we lack the intent or ability to hold to recovery, or if we believe the recovery period is extended, the equity security's decline in fair value is considered other-than-temporary and is recorded in earnings.

Our portfolio monitoring process includes a quarterly review of all securities to identify instances where the fair value of a security compared to its cost or amortized cost (for fixed income securities) or cost (for equity securities) is below established thresholds. The process also includes the monitoring of other impairment indicators such as ratings, ratings downgrades and payment defaults. The securities identified, in addition to other securities for which we may have a concern, are evaluated for potential other-than-temporary impairment using information relevant to the collectability or recovery of the security that is reasonably available. Inherent in our evaluation of other-than-temporary impairment for these fixed income and equity securities are assumptions and estimates about the financial condition and future earnings potential of the issue or issuer. Some of the factors that may be considered in evaluating whether a decline in fair value is other-than-temporary are: (1) the financial condition, near-term and long-term prospects of the issue or issuer, including relevant industry specific market conditions and trends, geographic location and implications of rating agency actions and offering prices; (2) the specific reasons that a security is in an unrealized loss position, including overall market conditions which could affect liquidity; and (3) the length of time and extent to which the fair value has been less than amortized cost or cost.

11

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

The following table presents an aging of our unrealized investment losses by investment class:

Less Than Twelve Months | Twelve Months or More | ||||||||||||||||||||

Number of Securities(1) | Gross Unrealized Losses | Fair Value | Number of Securities(1) | Gross Unrealized Losses | Fair Value | ||||||||||||||||

September 30, 2017 | |||||||||||||||||||||

U.S. government and agency securities | 147 | $ | 741 | $ | 81,333 | 57 | $ | 553 | $ | 36,900 | |||||||||||

States, municipalities and political subdivisions | 62 | 274 | 50,719 | 23 | 155 | 16,625 | |||||||||||||||

Public utilities | 9 | 24 | 3,966 | 4 | 27 | 625 | |||||||||||||||

Corporate securities | 152 | 515 | 77,334 | 21 | 65 | 3,531 | |||||||||||||||

Asset backed securities | 16 | 8 | 10,367 | — | — | — | |||||||||||||||

Redeemable preferred stocks | — | — | — | 3 | 63 | 308 | |||||||||||||||

Total fixed maturities | 386 | 1,562 | 223,719 | 108 | 863 | 57,989 | |||||||||||||||

Other common stocks | 9 | 87 | 765 | 4 | 62 | 429 | |||||||||||||||

Non-redeemable preferred stocks | 5 | 6 | 347 | 6 | 55 | 877 | |||||||||||||||

Total equity securities | 14 | 93 | 1,112 | 10 | 117 | 1,306 | |||||||||||||||

Total | 400 | $ | 1,655 | $ | 224,831 | 118 | $ | 980 | $ | 59,295 | |||||||||||

December 31, 2016 | |||||||||||||||||||||

U.S. government and agency securities | 186 | $ | 1,893 | $ | 111,216 | — | $ | — | $ | — | |||||||||||

States, municipalities and political subdivisions | 201 | 2,551 | 136,360 | — | — | — | |||||||||||||||

Public utilities | 8 | 73 | 2,222 | — | — | — | |||||||||||||||

Corporate securities | 215 | 1,100 | 88,605 | 1 | 26 | 1,021 | |||||||||||||||

Redeemable preferred stocks | 7 | 62 | 764 | — | — | — | |||||||||||||||

Total fixed maturities | 617 | 5,679 | 339,167 | 1 | 26 | 1,021 | |||||||||||||||

Other common stocks | 16 | 140 | 2,450 | 17 | 179 | 1,732 | |||||||||||||||

Non-redeemable preferred stocks | 12 | 52 | 1,830 | 7 | 31 | 369 | |||||||||||||||

Total equity securities | 28 | 192 | 4,280 | 24 | 210 | 2,101 | |||||||||||||||

Other long-term investments | 1 | 27 | 987 | — | — | — | |||||||||||||||

Total | 646 | $ | 5,898 | $ | 344,434 | 25 | $ | 236 | $ | 3,122 | |||||||||||

(1) This amount represents the actual number of discrete securities, not the number of shares or units of those securities. The numbers are not presented in thousands.

During our quarterly evaluations of our securities for impairment, we determined that none of our investments in debt and equity securities that reflected an unrealized loss position were other-than-temporarily impaired. The issuers of our debt securities continue to make interest payments on a timely basis. We do not intend to sell nor is it likely that we would be required to sell the debt securities before we recover our amortized cost basis. The near-term prospects of all the issuers of the equity securities we own indicate we could recover our cost basis, and we also do not intend to sell these securities until their value equals or exceeds their cost.

During the three and nine months ended September 30, 2017 and 2016, we recorded no other-than-temporary impairment charges.

12

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

Fair value measurement

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The hierarchy for inputs used in determining fair value maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that observable inputs be used when available. Assets and liabilities recorded on the Unaudited Consolidated Balance Sheets at fair value are categorized in the fair value hierarchy based on the observability of inputs to the valuation techniques as follows:

Level 1: Assets and liabilities whose values are based on unadjusted quoted prices for identical assets or liabilities in an active market that we can access.

Level 2: Assets and liabilities whose values are based on the following:

(a) Quoted prices for similar assets or liabilities in active markets;

(b) Quoted prices for identical or similar assets or liabilities in markets that are not active; or

(c) Valuation models whose inputs are observable, directly or indirectly, for substantially the full term of the asset or liability.

Level 3: Assets and liabilities whose values are based on prices or valuation techniques that require inputs that are both unobservable and significant to the overall fair value measurement. Unobservable inputs reflect our estimates of the assumptions that market participants would use in valuing the assets and liabilities.

We estimate the fair value of our investments using the closing prices on the last business day of the reporting period, obtained from active markets such as the NYSE, NASDAQ, and NYSE MKT. For securities for which quoted prices in active markets are unavailable, we use a third-party pricing service that utilizes quoted prices in active markets for similar instruments, benchmark interest rates, broker quotes and other relevant inputs to estimate the fair value of those securities for which quoted prices are unavailable. Our estimates of fair value reflect the interest rate environment that existed as of the close of business on September 30, 2017 and December 31, 2016. Changes in interest rates subsequent to September 30, 2017 may affect the fair value of our investments.

The fair value of our fixed-maturities is initially calculated by a third-party pricing service. Valuation service providers typically obtain data about market transactions and other key valuation model inputs from multiple sources and, through the use of proprietary models, produce valuation information in the form of a single fair value for individual fixed income and other securities for which a fair value has been requested. The inputs used by the valuation service providers include, but are not limited to, market prices from recently completed transactions and transactions of comparable securities, interest rate yield curves, credit spreads, liquidity spreads, currency rates, and other information, as applicable. Credit and liquidity spreads are typically implied from completed transactions and transactions of comparable securities. Valuation service providers also use proprietary discounted cash flow models that are widely accepted in the financial services industry and similar to those used by other market participants to value the same financial information. The valuation models take into account, among other things, market observable information as of the measurement date, as described above, as well as the specific attributes of the security being valued, including its term, interest rate, credit rating, industry sector and, where applicable, collateral quality and other issue or issuer specific information. Executing valuation models effectively requires seasoned professional judgment and experience.

For our Level 3 assets, our internal pricing methods are primarily based on models using discounted cash flow methodologies that determine a single best estimate of fair value for individual financial instruments. In addition, our models use a discount rate and internally assigned credit ratings as inputs (which are generally consistent with any external ratings) and those we use to report our holdings by credit rating. Market related inputs used in these fair values, which we believe are representative of inputs other market participants would use to determine fair value of the same instruments include: interest rate yield curves, quoted market prices of comparable securities, credit spreads, and other applicable market data. As a result of the significance of non-market observable inputs, including internally assigned credit ratings as described above, judgment is required in developing these fair values. The fair value of these financial assets may differ from the amount actually received if we were to sell the asset. Moreover, the use of different valuation assumptions may have a material effect on the fair values on the financial assets.

13

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

Any change in the estimated fair value of our securities would impact the amount of unrealized gain or loss we have recorded, which could change the amount we have recorded for our investments and other comprehensive income on our Unaudited Consolidated Balance Sheet as of September 30, 2017.

The following table presents the fair value of our financial instruments measured on a recurring basis by level at September 30, 2017 and December 31, 2016:

Total | Level 1 | Level 2 | Level 3 | ||||||||||||

September 30, 2017 | |||||||||||||||

U.S. government and agency securities | $ | 203,456 | $ | — | $ | 203,456 | $ | — | |||||||

Foreign government | 2,057 | — | 2,057 | — | |||||||||||

States, municipalities and political subdivisions | 196,147 | — | 196,147 | — | |||||||||||

Public utilities | 19,755 | — | 19,755 | — | |||||||||||

Corporate securities | 279,593 | — | 279,593 | — | |||||||||||

Asset backed securities | 16,714 | — | 16,714 | — | |||||||||||

Redeemable preferred stocks | 1,063 | 1,063 | — | — | |||||||||||

Total fixed maturities | 718,785 | 1,063 | 717,722 | — | |||||||||||

Mutual funds | 29,807 | 29,807 | — | — | |||||||||||

Public utilities | 1,642 | 1,642 | — | — | |||||||||||

Other common stocks | 27,445 | 27,445 | — | — | |||||||||||

Non-redeemable preferred stocks | 2,745 | 2,745 | — | — | |||||||||||

Total equity securities | 61,639 | 61,639 | — | — | |||||||||||

Other long-term investments | 8,157 | 300 | 7,173 | 684 | |||||||||||

Total investments | $ | 788,581 | $ | 63,002 | $ | 724,895 | $ | 684 | |||||||

December 31, 2016 | |||||||||||||||

U.S. government and agency securities | $ | 149,952 | $ | — | $ | 149,952 | $ | — | |||||||

Foreign government | 2,061 | — | 2,061 | — | |||||||||||

States, municipalities and political subdivisions | 169,112 | — | 169,112 | — | |||||||||||

Public utilities | 7,730 | — | 7,730 | — | |||||||||||

Corporate securities | 164,536 | — | 164,536 | — | |||||||||||

Redeemable preferred stocks | 1,125 | 1,125 | — | — | |||||||||||

Total fixed maturities | 494,516 | 1,125 | 493,391 | — | |||||||||||

Public utilities | 1,507 | 1,507 | — | — | |||||||||||

Other common stocks | 24,048 | 24,048 | — | — | |||||||||||

Non-redeemable preferred stocks | 2,843 | 2,843 | — | — | |||||||||||

Total equity securities | 28,398 | 28,398 | — | — | |||||||||||

Other long-term investments | 5,733 | 300 | 3,735 | 1,698 | |||||||||||

Total investments | $ | 528,647 | $ | 29,823 | $ | 497,126 | $ | 1,698 | |||||||

14

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

The table below presents the rollforward of our Level 3 investments held at fair value during the nine months ended September 30, 2017:

Other Investments | ||||

December 31, 2016 | $ | 1,698 | ||

Transfers in | — | |||

Transfers out | (990 | ) | ||

Partnership income | 35 | |||

Return of capital | (141 | ) | ||

Unrealized gains in accumulated other comprehensive income | 82 | |||

September 30, 2017 | $ | 684 | ||

We are responsible for the determination of fair value and the supporting assumptions and methodologies. We have implemented a system of processes and controls designed to provide assurance that our assets and liabilities are appropriately valued. For fair values received from third parties, our processes are designed to provide assurance that the valuation methodologies and inputs are appropriate and consistently applied, the assumptions are reasonable and consistent with the objective of determining fair value, and the fair values are accurately recorded.

At the end of each quarter, we determine whether we need to transfer the fair values of any securities between levels of the fair value hierarchy and, if so, we report the transfer as of the end of the quarter. During the first nine months of 2017, we transferred one investment from a Level 3 to a Level 2 investment, due to changes in the availability of market observable inputs. We used unobservable inputs to derive our estimated fair value for Level 3 investments, and the unobservable inputs are significant to the overall fair value measurement.

For our investments in U.S. government securities that do not have prices in active markets, agency securities, state and municipal governments, and corporate bonds, we obtain the fair values from our investment custodians, which use a third-party valuation service. The valuation service calculates prices for our investments in the aforementioned security types on a month-end basis by using several matrix-pricing methodologies that incorporate inputs from various sources. The model the valuation service uses to price U.S. government securities and securities of states and municipalities incorporates inputs from active market makers and inter-dealer brokers. To price corporate bonds and agency securities, the valuation service calculates non-call yield spreads on all issuers, uses option-adjusted yield spreads to account for any early redemption features, then adds final spreads to the U.S. Treasury curve at 3 p.m. (ET) as of quarter end. Since the inputs the valuation service uses in their calculations are not quoted prices in active markets, but are observable inputs, they represent Level 2 inputs.

15

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

Other investments

We acquired investments in limited partnerships, recorded in the other investments line of our Unaudited Consolidated Balance Sheets, that are currently being accounted for at fair value utilizing a discounted cash flow methodology. The estimated fair value of our investments in the limited partnership interests was $7,857,000. We have fully funded our investments in DCR Mortgage Partners VI, L.P. (DCR VI) and DCR Mortgage Partners VII, L.P. (DCR VII); however, we are still obligated to fund an additional $316,000, $802,000, and $495,000 for our investments in Kayne Anderson Senior Credit Fund II, L.P. (Kayne II), Kayne Anderson Senior Credit Fund III, L.P. (Kayne III), and Blackstone Alternative Solutions 2015 Trust (Blackstone), respectively. The information presented in the table below is as of September 30, 2017.

Initial Investment | Book Value | Unrealized Gain | Unrealized Loss | Fair Value | ||||||||||||||||

DCR Mortgage Partners VI, L.P. | $ | 301 | $ | 362 | $ | 322 | $ | — | $ | 684 | ||||||||||

Total Level 3 limited partnership investments | 301 | 362 | 322 | — | 684 | |||||||||||||||

DCR Mortgage Partners VII, L.P. | 4,000 | 4,056 | — | — | 4,056 | |||||||||||||||

Kayne Senior Credit Fund II, L.P. | 1,684 | 1,444 | — | — | 1,444 | |||||||||||||||

Kayne Senior Credit Fund III, L.P. | 1,198 | 1,198 | — | — | 1,198 | |||||||||||||||

Blackstone Alternative Solutions 2015 Trust | 505 | 475 | — | — | 475 | |||||||||||||||

Total Level 2 limited partnership investments | 7,387 | 7,173 | — | — | 7,173 | |||||||||||||||

Total limited partnership investments | $ | 7,688 | $ | 7,535 | $ | 322 | $ | — | $ | 7,857 | ||||||||||

Other short-term investments | 300 | 300 | — | — | 300 | |||||||||||||||

Total other investments | $ | 7,988 | $ | 7,835 | $ | 322 | $ | — | $ | 8,157 | ||||||||||

The following table summarizes the quantitative impact that the significant unobservable inputs used to estimate the fair value of our Level 3 investment has on the estimated fair value on our investment shown in the tables above. Due to Kayne II, Kayne III, DCR VII, and Blackstone being carried at cost, we have excluded them from the table below. The DCR VI investment was valued using a duration of 60 months for both periods presented below.

Fair Value | Valuation | Rate | ||||||||

Impact | Technique | Unobservable Input | Adjustment | |||||||

September 30, 2017 | ||||||||||

DCR VI | $ | (44 | ) | Discounted cash flow | Discount rate based on D&B paydex scale | 2.35% | ||||

December 31, 2016 | ||||||||||

DCR VI | $ | (56 | ) | Discounted cash flow | Discount rate based on D&B paydex scale | 2.35% | ||||

RCH | $ | (341 | ) | Discounted cash flow | Discount rate based on D&B paydex scale | 7.35% | ||||

4) | ACQUISITIONS AND MERGERS |

We account for business acquisitions in accordance with the acquisition method of accounting, which requires, among other things, that most assets acquired, liabilities assumed and earn-out consideration be recognized at their fair values as of the acquisition date. Measurement period adjustments to provisional purchase price allocations are recognized in the period in which they are determined as if the accounting had been completed on the acquisition date.

16

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

AmCo Holding Company

On April 3, 2017, the Company completed its merger with AmCo. The transaction was completed through a series of mergers that ultimately resulted in the Company issuing 20,956,355 shares of its common stock, $0.0001 par value per share, as merger consideration to the equity holders of RDX Holding, LLC, a Delaware limited liability company. The acquisition of AmCo supported the Company's growth strategy and further strengthened the Company's overall position in the commercial property and casualty insurance market.

The operations of AmCo are included in our Unaudited Consolidated Statements of Comprehensive Income effective April 3, 2017. We have one year from the acquisition date to finalize the allocation of the purchase price of AmCo and its subsidiaries. The preliminary purchase price allocation was as follows:

Cash and cash equivalents | $ | 95,284 | |

Investments | 222,920 | ||

Premium and agents' receivable | 31,439 | ||

Reinsurance recoverable | 20,230 | ||

Prepaid reinsurance premiums | 22,544 | ||

Intangible assets | 30,286 | ||

Insurance contract asset | 33,812 | ||

Goodwill | 46,109 | ||

Other assets | 25,932 | ||

Unpaid losses and loss adjustment expenses | (60,529 | ) | |

Unearned premiums | (128,824 | ) | |

Reinsurance payable | (22,406 | ) | |

Deferred taxes | (15,046 | ) | |

Other liabilities | (27,367 | ) | |

Total purchase price | $ | 274,384 | |

The unaudited pro forma financial information below has been prepared as if the AmCo merger had taken place on January 1, 2016. The unaudited pro forma financial information is not necessarily indicative of the results that we would have achieved had the transaction taken place on January 1, 2016, and the unaudited pro forma information does not purport to be indicative of future financial operating results.

Nine Months Ended September 30, | |||||||||||||||||||||||

2017 | 2016 | ||||||||||||||||||||||

As | Pro Forma | As | Pro Forma | ||||||||||||||||||||

Reported | Adjustments | Pro Forma | Reported | Adjustments | Pro Forma | ||||||||||||||||||

Revenues | $ | 471,834 | $ | 38,096 | $ | 509,930 | $ | 355,684 | $ | 135,087 | $ | 490,771 | |||||||||||

Net income (loss) | $ | (16,856 | ) | $ | 6,712 | $ | (10,144 | ) | $ | 16,215 | $ | 30,187 | $ | 46,402 | |||||||||

Diluted earnings per share | $ | (0.47 | ) | $ | — | $ | (0.24 | ) | $ | 0.75 | $ | — | $ | 1.09 | |||||||||

Interboro Insurance Company

On April 29, 2016, we completed the acquisition of IIC. The purchase price for IIC consisted of $48,450,000 in cash, $8,550,000 in a note payable and an accrued liability for $3,471,000 paid during July 2016. The acquisition of IIC supported

17

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

the Company's growth strategy and further strengthened the Company's overall position in the property and casualty insurance market in the state of New York.

The operations of IIC are included in our Unaudited Consolidated Statements of Comprehensive Income effective April 29, 2016. The final purchase price allocation is as follows:

Cash and cash equivalents | $ | 15,554 | |

Investments | 66,527 | ||

Premium and agents' receivable | 3,186 | ||

Reinsurance receivable | 1,042 | ||

Intangible assets | 5,877 | ||

Insurance contract asset | 8,334 | ||

Goodwill | 10,157 | ||

Other assets | 3,980 | ||

Deferred taxes | 575 | ||

Unpaid losses and loss adjustment expenses | (24,967 | ) | |

Unearned premiums | (26,243 | ) | |

Advanced premiums | (1,472 | ) | |

Other liabilities | (2,079 | ) | |

Total purchase price | $ | 60,471 | |

5) EARNINGS PER SHARE

Basic earnings per share (EPS) is based on the weighted average number of common shares outstanding for the period, excluding any dilutive common share equivalents. Diluted EPS reflects the potential dilution resulting from vesting of restricted stock awards. The following table shows the computation of basic and diluted EPS for the three and nine month periods ended September 30, 2017 and September 30, 2016, respectively:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Numerator: | ||||||||||||||||

Net income (loss) attributable to common stockholders | $ | (28,012 | ) | $ | 3,423 | $ | (16,856 | ) | $ | 16,215 | ||||||

Denominator: | ||||||||||||||||

Weighted-average shares outstanding | 42,524,400 | 21,448,892 | 35,341,994 | 21,406,599 | ||||||||||||

Effect of dilutive securities | 216,604 | 194,509 | 221,038 | 197,536 | ||||||||||||

Weighted-average diluted shares | 42,741,004 | 21,643,401 | 35,563,032 | 21,604,135 | ||||||||||||

Basic earnings per share | $ | (0.66 | ) | $ | 0.16 | $ | (0.48 | ) | $ | 0.76 | ||||||

Diluted earnings per share | $ | (0.66 | ) | $ | 0.16 | $ | (0.47 | ) | $ | 0.75 | ||||||

See Note 16 for additional information on the stock grants related to dilutive securities.

18

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

6) PROPERTY AND EQUIPMENT, NET

Property and equipment, net consists of the following:

September 30, 2017 | December 31, 2016 | |||||||

Land | $ | 2,114 | $ | 2,114 | ||||

Building and building improvements | 5,502 | 5,502 | ||||||

Computer hardware and software | 18,346 | 14,699 | ||||||

Office furniture and equipment | 3,248 | 2,652 | ||||||

Total, at cost | 29,210 | 24,967 | ||||||

Less: accumulated depreciation and amortization | (9,866 | ) | (7,107 | ) | ||||

Property and equipment, net | $ | 19,344 | $ | 17,860 | ||||

Depreciation and amortization expense under property and equipment was $723,000 and $605,000 for the three months ended September 30, 2017 and 2016, respectively, and $2,759,000 and $1,820,000 for the nine months ended September 30, 2017 and 2016, respectively.

7) GOODWILL AND INTANGIBLE ASSETS

Goodwill

The changes in the carrying amount of goodwill for the nine months ended September 30, 2017 and 2016 are as follows:

September 30, | ||||||||

2017 | 2016 | |||||||

Balance at beginning of period | $ | 14,254 | $ | 3,413 | ||||

Acquisitions | 46,109 | 10,841 | ||||||

Adjustments to finalize purchase price allocation | (684 | ) | — | |||||

Impairment | — | — | ||||||

Balance at end of period | $ | 59,679 | $ | 14,254 | ||||

Using a qualitative assessment, we completed our most recent goodwill impairment testing during the fourth quarter of 2016 and determined that there was no impairment in the value of the asset as of December 31, 2016.

No impairment loss in the value of goodwill or goodwill amortization expense was recognized during the nine months ended September 30, 2017. Additionally, there was no accumulated impairment or accumulated amortization related to goodwill at September 30, 2017 or December 31, 2016.

Intangible Assets

The following is a summary of intangible assets excluding goodwill recorded as other assets at September 30, 2017 and December 31, 2016:

19

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

September 30, 2017 | December 31, 2016 | |||||||

Intangible assets subject to amortization | $ | 51,554 | $ | 9,064 | ||||

Indefinite-lived intangible assets(1) | 3,555 | 3,307 | ||||||

Total | $ | 55,109 | $ | 12,371 | ||||

(1) Indefinite-lived intangible assets are comprised of state insurance and agent licenses, as well as perpetual software licenses.

Intangible assets subject to amortization consisted of the following:

Weighted-average remaining amortization period (in years) | Gross carrying amount | Accumulated amortization | Net carrying amount | |||||||||||

September 30, 2017 | ||||||||||||||

Value of Business Acquired | 0.5 | $ | 42,788 | $ | (25,882 | ) | $ | 16,906 | ||||||

Agency agreements acquired | 8.2 | 34,661 | (5,546 | ) | 29,115 | |||||||||

Trade names acquired | 6.2 | 6,381 | (848 | ) | 5,533 | |||||||||

Total | $ | 83,830 | $ | (32,276 | ) | $ | 51,554 | |||||||

December 31, 2016 | ||||||||||||||

Value of Business Acquired | 0.3 | $ | 8,975 | $ | (7,867 | ) | $ | 1,108 | ||||||

Agency agreements acquired | 3.8 | 10,284 | (2,784 | ) | 7,500 | |||||||||

Trade names acquired | 2.1 | 720 | (264 | ) | 456 | |||||||||

Total | $ | 19,979 | $ | (10,915 | ) | $ | 9,064 | |||||||

No impairment in the value of amortizing or non-amortizing intangible assets was recognized during the three and nine months ended September 30, 2017 and September 30, 2016.

Amortization expense of our intangible assets was $9,839,000 and $21,361,000 for the three and nine months ended September 30, 2017, respectively. Amortization expense of our intangible assets was $3,439,000 and $6,791,000 for the three and nine months ended September 30, 2016, respectively.

Estimated amortization expense of our intangible assets to be recognized by the Company over the next five years is as follows:

Year ending December 31, | Estimated Amortization Expense | |||

Remaining 2017 | $ | 11,818 | ||

2018 | 13,920 | |||

2019 | 5,355 | |||

2020 | 4,267 | |||

2021 | 3,555 | |||

2022 | 3,246 | |||

20

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

8) REINSURANCE

Our reinsurance program is designed, utilizing our risk management methodology, to address our exposure to catastrophes. According to the Insurance Service Office (ISO), a catastrophe loss is defined as a single unpredictable incident or series of closely related incidents that result in $25,000,000 or more in U.S. industry-wide direct insured losses to property and that affect a significant number of policyholders and insurers (ISO catastrophes). In addition to ISO catastrophes, we also include as catastrophes those events (non-ISO catastrophes), which may include losses, that we believe are, or will be, material to our operations, either in amount or in number of claims made.

Our program provides reinsurance protection for catastrophes including hurricanes, tropical storms, and tornadoes. These reinsurance agreements are part of our catastrophe management strategy, which is intended to provide our shareholders an acceptable return on the risks assumed in our property business, and to reduce variability of earnings, while providing protection to our policyholders.

Effective June 1, 2017, UPC Insurance, through our wholly owned insurance subsidiaries UPC, ACIC, FSIC and IIC, entered into reinsurance agreements with several private reinsurers and with the Florida State Board of Administration (SBA), which administers the Florida Hurricane Catastrophe Fund (FHCF). These agreements provide coverage for catastrophe losses from named or numbered windstorms and earthquakes in all states UPC operates except for the FHCF agreement which only provides coverage in Florida against storms that the National Hurricane Center designates as hurricanes.

Highlights of the coverage embedded these contracts include:

• | More frequency and severity protection than in any prior year, with an overall program exhaustion point of $2,747,500,000; |

◦ | Sufficient coverage for a single 1-in-400 year event (AIR Touchstone v3.1 Standard Event Set); |

◦ | Sufficient coverage for a 1-in-100 year event followed by a 1-in-50 year event in the same season; |

• | Group retention of $55,000,000 for a first event and $30,000,000 for a second and subsequent events including a $5,000,000 retention related to our captive reinsurer BlueLine Cayman Holding; this represents approximately 11% of group equity for a first event, lower than in any prior year for UPC Insurance; |

• | Realized cost synergies by placing a combined program with American Coastal that surpassed our previously stated goal of $20,000,000 annually; |

• | Coverage from 43 reinsurers with 70% of the open market limit placed on a fully collateralized basis to mitigate credit risk; carriers providing uncollateralized limit have minimum A.M. Best financial strength ratings of A-; |

• | Approximately $87,500,000 of multi-year limit; and |

• | Coverage expanded to include the entire life of a hurricane in lieu of an hours clause |

For the FHCF Reimbursement Contracts effective June 1, 2017, UPC Insurance has elected a 45% coverage for all its insurance subsidiaries with Florida exposure. We estimate the mandatory FHCF layer will provide approximately $789,000,000 of aggregate coverage with varying retentions and limits among the three FHCF contracts that all inure to the benefit of the open market coverage secured from private reinsurers.

The $1,928,000,000 of aggregate open market catastrophe reinsurance coverage is structured into multiple layers with a cascading feature that all layers drop down as layers below them are exhausted. Any remaining unused layer protection drops down for subsequent events until exhausted, ensuring there are no potential gaps in coverage up to the $2,747,500,000 program exhaustion point.

The total cost of the 2017-18 catastrophe reinsurance program is estimated to be $314,169,000.

Effective December 1, 2016, UPC Insurance, through our wholly owned insurance subsidiary, UPC, entered into a quota share reinsurance agreement (the "quota share agreement") with private reinsurers. Also, effective January 1, 2017, we renewed our aggregate excess of loss reinsurance agreement (the "aggregate excess of loss agreement," and, together with the quota share agreement, the "agreements") with private reinsurers. These agreements provide coverage for in-force, new and renewal business. The quota share agreement provides coverage only for UPC, while the aggregate excess of loss agreement provides coverage for UPC, ACIC, FSIC, and IIC. These new reinsurance programs are designed to work in conjunction with our catastrophe excess of loss reinsurance program to provide us broad risk transfer protection and to lessen financial volatility.

21

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

The quota share agreement includes a cession rate of 20% (15% on single year and 5% over a two-year period) for all subject business. The quota share agreement provides coverage for all catastrophe perils (e.g. hurricanes, tropical storms, tropical depressions and earthquakes), other-catastrophe perils (e.g. weather-related perils other than hurricanes, tropical storms, tropical depressions and earthquakes), and attritional losses. For other-catastrophe perils, the quota share agreement provides coverage alongside the aggregate excess of loss program described herein, after our retention has been satisfied. For catastrophe perils, the quota share agreement provides ground-up protection that effectively reduces our retention for catastrophe losses. Quota share agreement reinsurers' participation in paying attritional losses is subject to an attritional loss ratio cap.

The aggregate excess of loss agreement provides coverage only for other-catastrophe perils. Under this agreement, for other-catastrophe losses in excess of $1,000,000 but less than $15,000,000, UPC will retain, in the aggregate, 100% of those losses up to $30,000,000. The reinsurers will then be liable for all losses excess of $30,000,000 in the aggregate not to exceed an annual aggregate limit of $30,000,000. This program was placed at 85% rather than 100% because of the quota share agreement reinsurers' participation in paying other-catastrophe losses after the $30,000,000 retention. We have now met the $30,000,000 retention under this reinsurance program, which means the next $30,000,000 of catastrophe losses in excess of our $1,000,000 retention, other than from named windstorms or earthquakes, incurred during the remainder of 2017 will be ceded to third party reinsurers up to the $60,000,000 exhaustion point.

We amortize our prepaid reinsurance premiums over the annual agreement period, and we record that amortization in ceded premiums earned on our Unaudited Consolidated Statements of Comprehensive Income. The table below summarizes the amounts of our ceded premiums written under the various types of agreements, as well as the amortization of prepaid reinsurance premiums:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Excess-of-loss | $ | (28,306 | ) | $ | (476 | ) | $ | (400,773 | ) | $ | (182,503 | ) | |||

Equipment & identity theft | (2,606 | ) | (2,359 | ) | (7,275 | ) | (6,136 | ) | |||||||

Novation of auto policies (1) | — | — | — | (2,396 | ) | ||||||||||

Flood | (5,559 | ) | (5,006 | ) | (14,319 | ) | (12,969 | ) | |||||||

Ceded premiums written | $ | (36,471 | ) | $ | (7,841 | ) | $ | (422,367 | ) | $ | (204,004 | ) | |||

Increase (decrease) in ceded unearned premiums | (79,036 | ) | (45,458 | ) | 130,012 | 55,167 | |||||||||

Ceded premiums earned | $ | (115,507 | ) | $ | (53,299 | ) | $ | (292,355 | ) | $ | (148,837 | ) | |||

(1) Reflects ceding of auto policy premiums to Maidstone Insurance Company as part of the settlement of the novation agreement entered into at the closing of the Interboro Insurance Company transaction.

Current year catastrophe losses disaggregated between named and numbered storms and all other catastrophe loss events are shown in the following table for the three and nine months ended September 30, 2017 and 2016.

22

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

2017 | 2016 | |||||||||||||||||||

Number of Events | Incurred Loss and LAE (1) | Combined Ratio Impact | Number of Events | Incurred Loss and LAE (1) | Combined Ratio Impact | |||||||||||||||

Three Months Ended September 30, | ||||||||||||||||||||

Current period catastrophe losses incurred | ||||||||||||||||||||

Named and numbered storms | 4 | $ | 83,460 | 54.7 | % | 3 | $ | 2,600 | 2.2 | % | ||||||||||

All other catastrophe loss events | 15 | (845 | ) | (0.6 | )% | 15 | 2,509 | 2.0 | % | |||||||||||

Total | 19 | $ | 82,615 | 54.1 | % | 18 | $ | 5,109 | 4.2 | % | ||||||||||

Nine Months Ended September 30, | ||||||||||||||||||||

Current period catastrophe losses incurred | ||||||||||||||||||||

Named and numbered storms | 4 | $ | 83,724 | 20.0 | % | 3 | $ | 4,069 | 1.2 | % | ||||||||||

All other catastrophe loss events | 15 | 31,301 | 7.5 | % | 15 | 19,816 | 5.9 | % | ||||||||||||

Total | 19 | $ | 115,025 | 27.5 | % | 18 | $ | 23,885 | 7.1 | % | ||||||||||

(1) Incurred loss and LAE is equal to losses and LAE paid plus the change in case and incurred but not reported reserves. Shown net of losses ceded to reinsurers. Incurred loss and LAE and number of events includes the development on storms during both the three and nine months ended September 30, 2017. During the third quarter of 2017 we incurred losses and LAE from four new storms.

We collected cash recoveries under our reinsurance agreements totaling $20,419,000 and $9,747,000 for the three month periods ended September 30, 2017 and 2016, respectively, and $40,984,000 and $10,604,000 for the nine month periods ended September 30, 2017 and 2016, respectively.

We write flood insurance under an agreement with the National Flood Insurance Program. We cede 100% of the premiums written and the related risk of loss to the federal government. We earn commissions for the issuance of flood policies based upon a fixed percentage of net written premiums and the processing of flood claims based upon a fixed percentage of incurred losses, and we can earn additional commissions by meeting certain growth targets for the number of in-force policies. We recognized commission revenue from our flood program of $308,000 and $270,000 for the three month periods ended September 30, 2017 and 2016, respectively, and $905,000 and $772,000 for the nine month periods ended September 30, 2017 and 2016, respectively.

9) LIABILITY FOR UNPAID LOSSES AND LOSS ADJUSTMENT EXPENSE

We determine the reserve for unpaid losses on an individual-case basis for all incidents reported. The liability also includes amounts for incurred but not reported (IBNR) claims as of the balance sheet date.

The table below shows the analysis of our reserve for unpaid losses for the nine months ended September 30, 2017 and September 30, 2016 on a GAAP basis:

23

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

September 30, | |||||||

2017 | 2016 | ||||||

Balance at January 1 | $ | 140,855 | $ | 76,792 | |||

Less: reinsurance recoverable on unpaid losses | 18,724 | 2,114 | |||||

Net balance at January 1 | $ | 122,131 | $ | 74,678 | |||

Acquisition of IIC reserves | — | 22,576 | |||||

Acquisition of AMCO reserves (net of reinsurance recoverables of $19,945) | 40,583 | — | |||||

Incurred related to: | |||||||

Current year | 296,217 | 190,031 | |||||

Prior years | (2,819 | ) | 9,585 | ||||

Total incurred | $ | 293,398 | $ | 199,616 | |||

Paid related to: | |||||||

Current year | 160,952 | 129,927 | |||||

Prior years | 84,497 | 53,437 | |||||

Total paid | $ | 245,449 | $ | 183,364 | |||

Net balance at September 30 | $ | 210,663 | $ | 113,506 | |||

Plus: reinsurance recoverable on unpaid losses | 471,498 | 9,154 | |||||

Balance at September 30 | $ | 682,161 | $ | 122,660 | |||

Composition of reserve for unpaid losses and LAE: | |||||||

Case reserves | $ | 289,938 | $ | 75,305 | |||

IBNR reserves | 392,223 | 47,355 | |||||

Balance at September 30 | $ | 682,161 | $ | 122,660 | |||

Based upon our internal analysis and our review of the statement of actuarial opinion provided by our actuarial consultants, we believe that the reserve for unpaid losses reasonably represents the amount necessary to pay all claims and related expenses which may arise from incidents that have occurred as of the balance sheet date.

As reflected by our losses incurred related to prior years, the favorable development experienced in 2017 was primarily the result of losses related to the 2016 and 2015 accident years coming in better than expected. During 2016, we had a reserve deficiency. Since we place substantial reliance on loss-development-based actuarial models when determining our estimate of ultimate losses, the deficiencies resulted from additional development on prior accident years which caused our ultimate losses to increase.

10) LONG-TERM DEBT

Long-Term Debt

The table below presents all long-term debt outstanding as of September 30, 2017 and December 31, 2016:

24

UNITED INSURANCE HOLDINGS CORP.

Notes to Unaudited Consolidated Financial Statements

September 30, 2017

Effective Interest Rate | Carrying Value at | ||||||||||

Maturity | September 30, 2017 | December 31, 2016 | |||||||||

Senior Notes Payable | December 5, 2026 | 7.26% | $ | 30,000 | $ | 30,000 | |||||

Florida State Board of Administration Note Payable | July 1, 2026 | 2.27% | 10,294 | 11,176 | |||||||

Interboro, LLC Promissory Note Payable | October 29, 2017 | 6.00% | 8,550 | 8,550 | |||||||

BB&T Term Note Payable | May 26, 2031 | 2.94% | 4,738 | 4,998 | |||||||

Total long-term debt | $ | 53,582 | $ | 54,724 | |||||||

Senior Notes Payable

On December 5, 2016, we issued $30,000,000 of senior notes to private investors pursuant to an Indenture dated as of December 5, 2016, by and between the Company and the trustee. The notes bear interest at a floating rate equal to the three month LIBOR plus 5.75% per annum, with interest payable quarterly in arrears. The notes will mature 10 years after the issue date, have no scheduled amortization, and may be redeemed at par any time without a pre-payment penalty.

Florida State Board of Administration Note Payable