Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERITAGE FINANCIAL CORP /WA/ | form8-kxq22017investorpres.htm |

Q2 2017 Investor Presentation

FORWARD – LOOKING STATEMENT

2

This presentation contains forward-looking statements that are subject to risks and uncertainties, including, but not limited to:

• The expected revenues, cost savings, synergies and other benefits from our other merger and acquisition activities might not be realized within the anticipated time frames or at all, and

costs or difficulties relating to integration matters, including but not limited to, customer and employee retention might be greater than expected;

• The credit and concentration risks of lending activities;

• Changes in general economic conditions, either nationally or in our market areas;

• Competitive market pricing factors and interest rate risks;

• Market interest rate volatility;

• Balance sheet (for example, loans) concentrations;

• Fluctuations in demand for loans and other financial services in our market areas;

• Changes in legislative or regulatory requirements or the results of regulatory examinations;

• The ability to recruit and retain key management and staff;

• Risks associated with our ability to implement our expansion strategy and merger integration;

• Stability of funding sources and continued availability of borrowings;

• Adverse changes in the securities markets;

• The inability of key third-party providers to perform their obligations to us;

• The proposed merger with Puget Sound Bancorp, Inc. (“Puget Sound”) may not close when expected or at all because required regulatory, shareholder or other approvals and

conditions to closing are not received or satisfied on a timely basis or at all, which may have an effect on the trading prices of the Company’s stock;

• Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in

significant declines in valuation; and

• These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission.

The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made

and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to

reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for the third quarter of 2017 and

beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating and stock price performance.

Additional Information

Heritage Financial Corporation (“Heritage”) will file a registration statement on Form S-4 with the SEC in connection with the proposed transaction. The registration statement will include a

proxy statement of Puget Sound that also constitutes a prospectus of Heritage, which will be sent to the shareholders of Puget Sound. Puget Sound shareholders are advised to read the

proxy statement/prospectus when it becomes available because it will contain important information about Heritage, Puget Sound and the proposed transaction. When filed, this document and

other documents relating to the merger filed by Heritage can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by

accessing Heritage’s website at www.hf-wa.com under the tab “Investor Relations” and then under “SEC Filings.” Alternatively, these documents, when available, can be obtained free of

charge from Heritage upon written request to Heritage Financial Corporation, Attn: Investor Relations, 201 Fifth Avenue S.W., Olympia, Washington 98501 or by calling (360) 943-1500 or from

Puget Sound, upon written request to Puget Sound Bancorp, Inc., Attn: Investor Relations, 10500 NE 8th Street, #1500, Bellevue, Washington 98004.

Participants In The Solicitation

Heritage, Puget Sound and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Puget Sound shareholders in

connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Heritage may be found in the definitive proxy statement of

Heritage filed with the SEC by Heritage on March 23, 2017. This definitive proxy statement can be obtained free of charge from the sources indicated above. Information about the directors

and executive officers of Puget Sound will be included in the proxy statement/prospectus when filed with the SEC. Additional information regarding the interests of these participants will also be

included in the proxy statement/prospectus regarding the proposed transaction when it becomes available.

3

COMPANY OVERVIEW

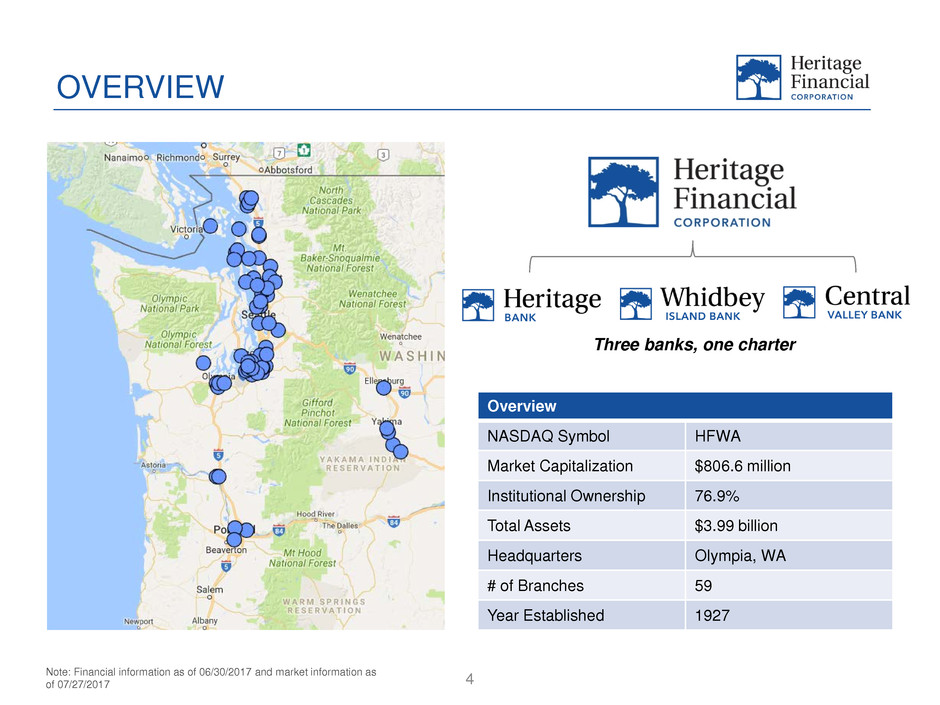

OVERVIEW

4

Overview

NASDAQ Symbol HFWA

Market Capitalization $806.6 million

Institutional Ownership 76.9%

Total Assets $3.99 billion

Headquarters Olympia, WA

# of Branches 59

Year Established 1927

Note: Financial information as of 06/30/2017 and market information as

of 07/27/2017

Three banks, one charter

$4

01

$4

50

$5

74

$6

10

$5

95

$6

41

$6

97

$7

51

$7

96

$8

86

$9

46

$1

,0

15

$8

12

$1

,3

69

$1

,3

46

$1

,3

40

$1

,7

12

$3

,6

51

$3

,8

79

$3

,9

91

$74 $61

$57 $556

$319

$1,747

$567

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Q2

2017*

Organic Acquired Assets

5

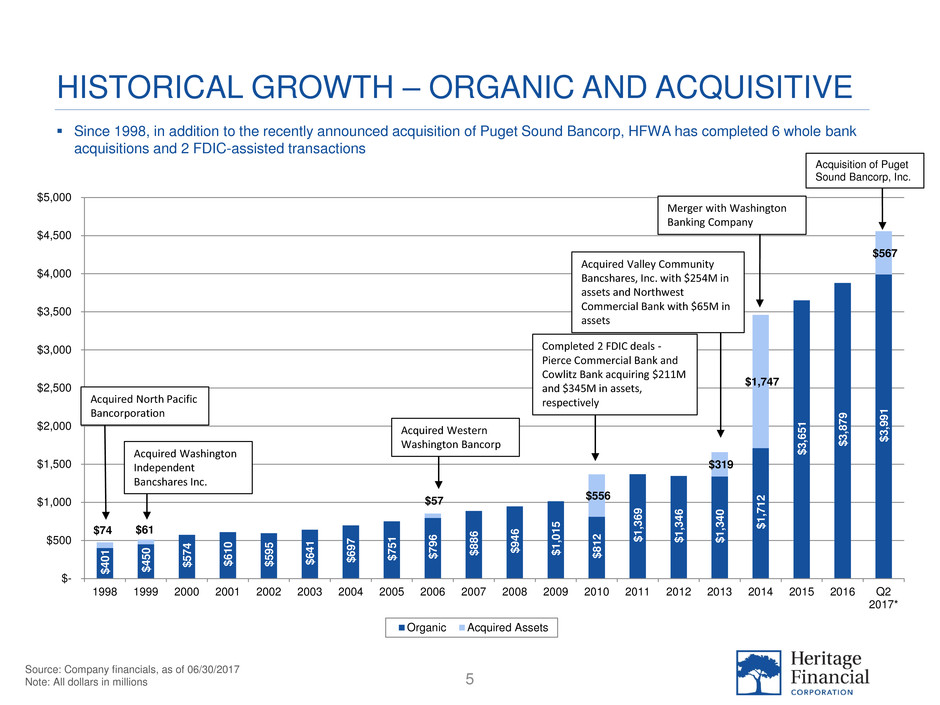

HISTORICAL GROWTH – ORGANIC AND ACQUISITIVE

Source: Company financials, as of 06/30/2017

Note: All dollars in millions

Acquired North Pacific

Bancorporation

Acquired Washington

Independent

Bancshares Inc.

Acquired Western

Washington Bancorp

Completed 2 FDIC deals -

Pierce Commercial Bank and

Cowlitz Bank acquiring $211M

and $345M in assets,

respectively

Acquired Valley Community

Bancshares, Inc. with $254M in

assets and Northwest

Commercial Bank with $65M in

assets

Merger with Washington

Banking Company

Since 1998, in addition to the recently announced acquisition of Puget Sound Bancorp, HFWA has completed 6 whole bank

acquisitions and 2 FDIC-assisted transactions

Acquisition of Puget

Sound Bancorp, Inc.

6

FINANCIAL UPDATE

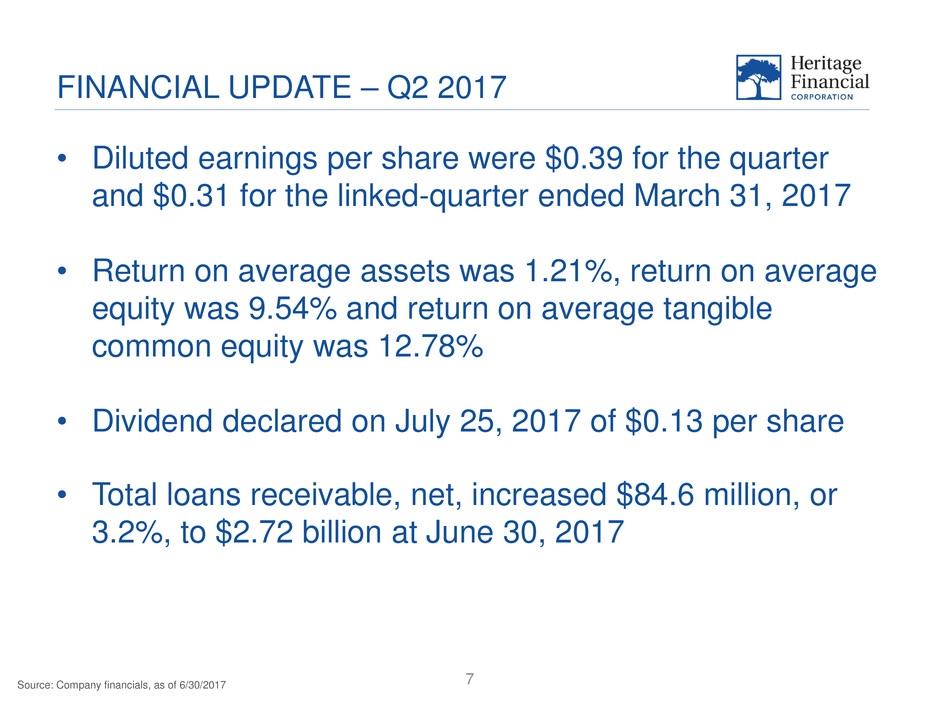

FINANCIAL UPDATE – Q2 2017

7

• Diluted earnings per share were $0.39 for the quarter

and $0.31 for the linked-quarter ended March 31, 2017

• Return on average assets was 1.21%, return on average

equity was 9.54% and return on average tangible

common equity was 12.78%

• Dividend declared on July 25, 2017 of $0.13 per share

• Total loans receivable, net, increased $84.6 million, or

3.2%, to $2.72 billion at June 30, 2017

Source: Company financials, as of 6/30/2017

8

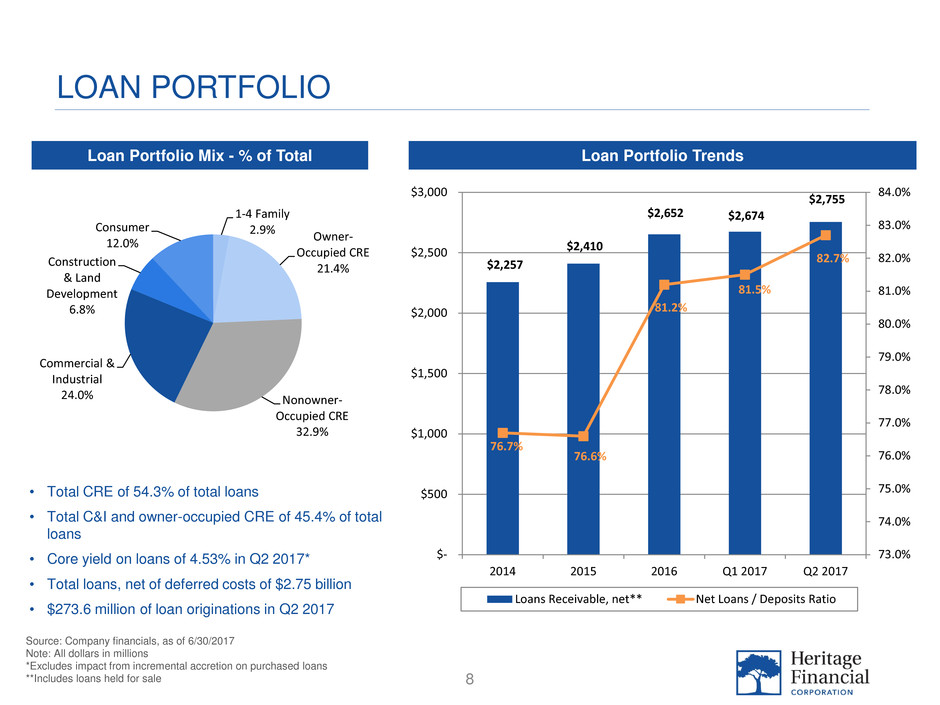

LOAN PORTFOLIO

Loan Portfolio TrendsLoan Portfolio Mix - % of Total

Source: Company financials, as of 6/30/2017

Note: All dollars in millions

*Excludes impact from incremental accretion on purchased loans

**Includes loans held for sale

• Total CRE of 54.3% of total loans

• Total C&I and owner-occupied CRE of 45.4% of total

loans

• Core yield on loans of 4.53% in Q2 2017*

• Total loans, net of deferred costs of $2.75 billion

• $273.6 million of loan originations in Q2 2017

$2,257

$2,410

$2,652 $2,674

$2,755

76.7%

76.6%

81.2%

81.5%

82.7%

73.0%

74.0%

75.0%

76.0%

77.0%

78.0%

79.0%

80.0%

81.0%

82.0%

83.0%

84.0%

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2014 2015 2016 Q1 2017 Q2 2017

Loans Receivable, net** Net Loans / Deposits Ratio

1-4 Family

2.9% Owner-

Occupied CRE

21.4%

Nonowner-

Occupied CRE

32.9%

Commercial &

Industrial

24.0%

Construction

& Land

Development

6.8%

Consumer

12.0%

9

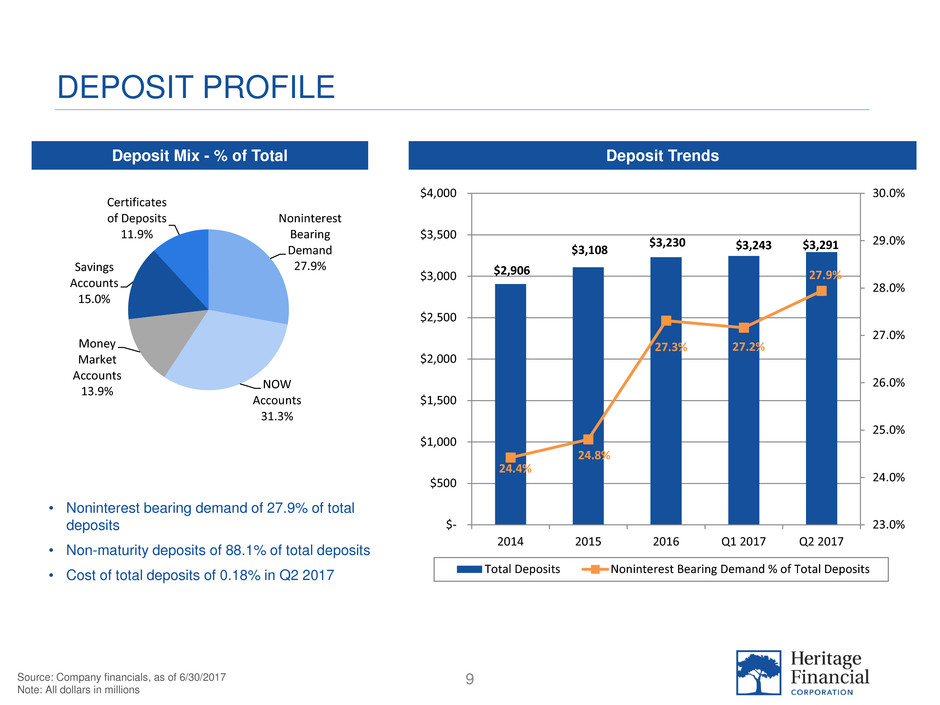

DEPOSIT PROFILE

Deposit TrendsDeposit Mix - % of Total

Source: Company financials, as of 6/30/2017

Note: All dollars in millions

• Noninterest bearing demand of 27.9% of total

deposits

• Non-maturity deposits of 88.1% of total deposits

• Cost of total deposits of 0.18% in Q2 2017

Noninterest

Bearing

Demand

27.9%

NOW

Accounts

31.3%

Money

Market

Accounts

13.9%

Savings

Accounts

15.0%

Certificates

of Deposits

11.9%

$2,906

$3,108

$3,230 $3,243 $3,291

24.4%

24.8%

27.3% 27.2%

27.9%

23.0%

24.0%

25.0%

26.0%

27.0%

28.0%

29.0%

30.0%

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

2014 2015 2016 Q1 2017 Q2 2017

Total Deposits Noninterest Bearing Demand % of Total Deposits

10

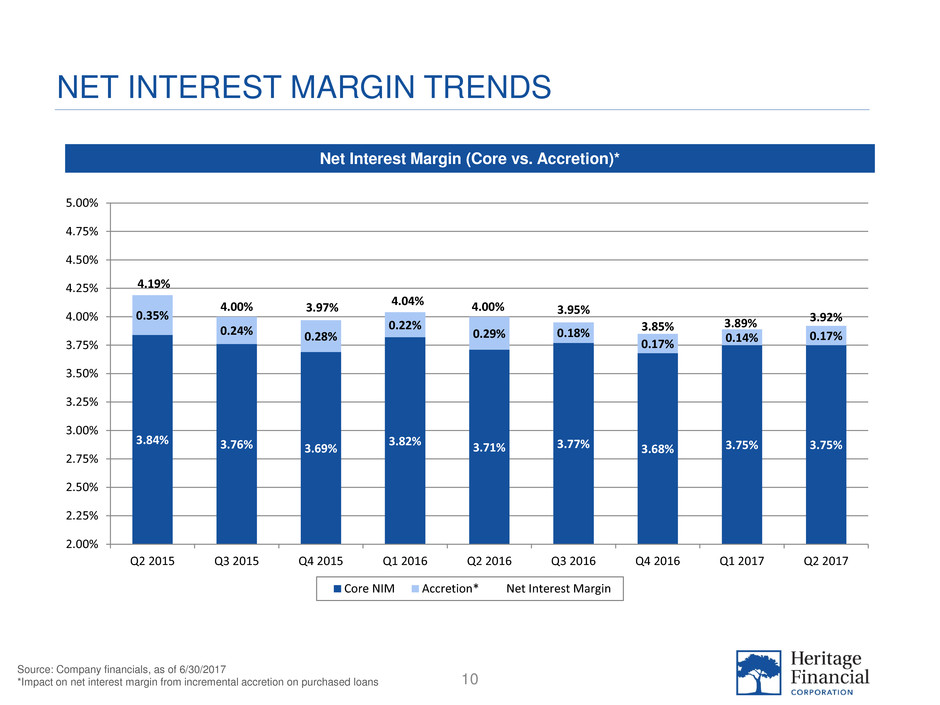

NET INTEREST MARGIN TRENDS

Net Interest Margin (Core vs. Accretion)*

Source: Company financials, as of 6/30/2017

*Impact on net interest margin from incremental accretion on purchased loans

3.84% 3.76% 3.69%

3.82% 3.71% 3.77% 3.68% 3.75% 3.75%

0.35%

0.24% 0.28%

0.22%

0.29% 0.18%

0.17% 0.14%

0.17%

4.19%

4.00% 3.97% 4.04% 4.00% 3.95%

3.85% 3.89%

3.92%

2.00%

2.25%

2.50%

2.75%

3.00%

3.25%

3.50%

3.75%

4.00%

4.25%

4.50%

4.75%

5.00%

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Core NIM Accretion* Net Interest Margin

11

CASH, INTEREST EARNING DEPOSITS & INVESTMENT SECURITIES

Cash, Interest Earning Deposits & Investment SecuritiesInvestment Portfolio Mix

Source: Company financials, as of 6/30/2017

Note: All dollars in millions

• Total cash, interest earning deposits and investment

securities of $914.8 million, or 22.9% of total assets

• Average yield on taxable investment securities of

2.22% in Q2 2017

• Average yield on non-taxable investment securities of

2.33% in Q2 2017 (tax equivalent yield of 3.58%)

$779 $812 $795 $783 $791

$132

$133

$104 $104 $124

$-

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2014 2015 2016 Q1 2017 Q2 2017

Total Investment Securities Cash & Interest Earning Deposits

MBS &

CMOs U.S.

Gov't

Agency

62.0%

Municipal

Securities

30.9%

US Treasury

& U.S. Gov't

Agency

1.2%

Corporate &

CLOs

2.6%

Other

3.3%

12

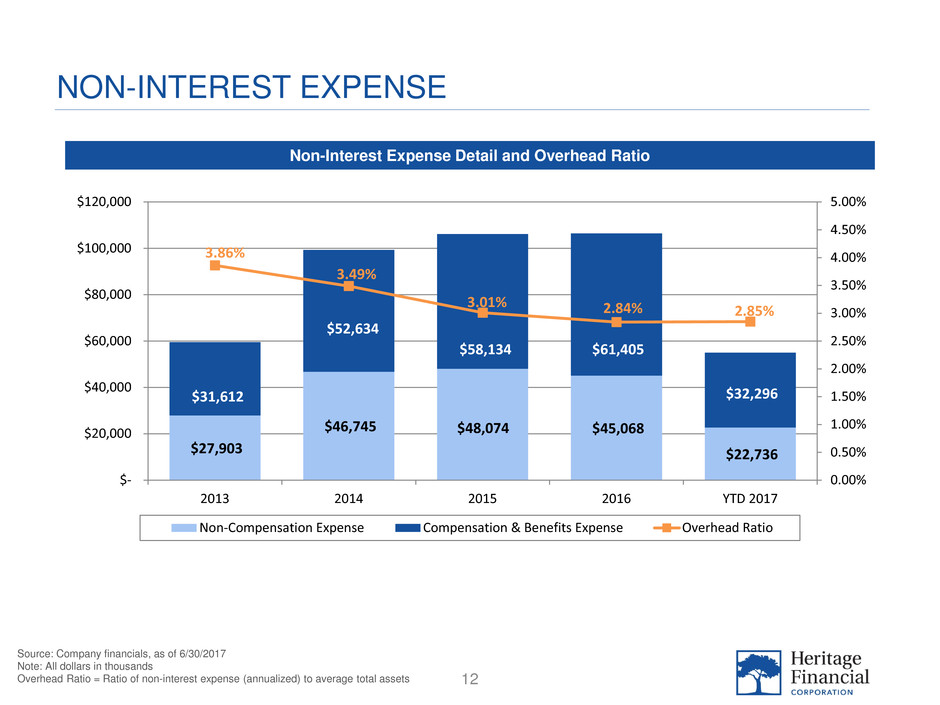

NON-INTEREST EXPENSE

Source: Company financials, as of 6/30/2017

Note: All dollars in thousands

Overhead Ratio = Ratio of non-interest expense (annualized) to average total assets

Non-Interest Expense Detail and Overhead Ratio

$27,903

$46,745 $48,074 $45,068

$22,736

$31,612

$52,634

$58,134 $61,405

$32,296

3.86%

3.49%

3.01% 2.84% 2.85%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

$-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

2013 2014 2015 2016 YTD 2017

Non-Compensation Expense Compensation & Benefits Expense Overhead Ratio

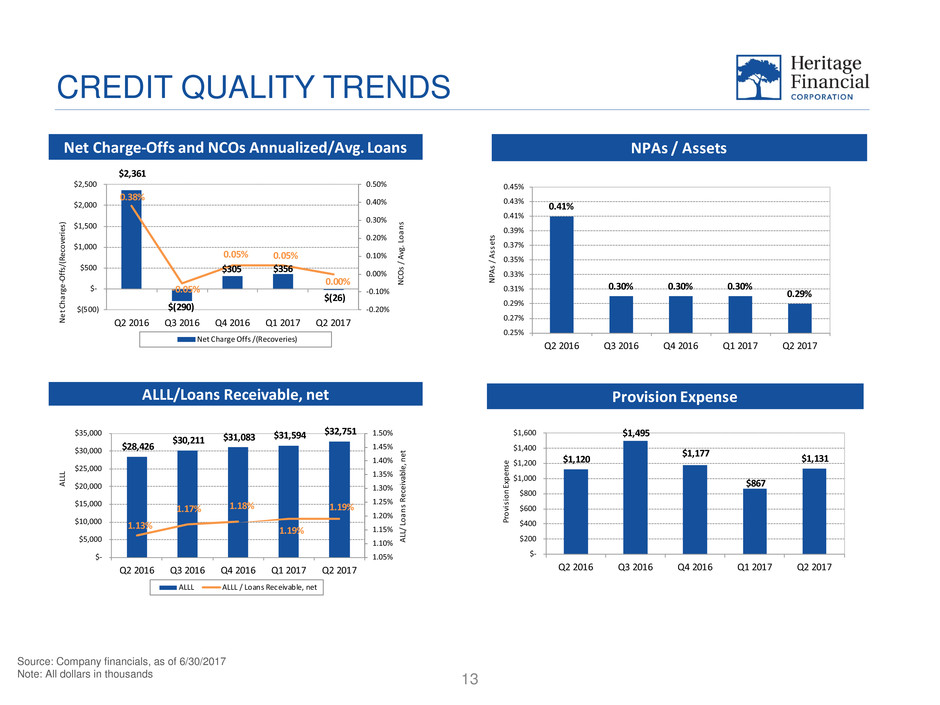

CREDIT QUALITY TRENDS

13

Source: Company financials, as of 6/30/2017

Note: All dollars in thousands

- -

- -

$28,426

$30,211

$31,083 $31,594 $32,751

1.13%

1.17%

1.18%

1.19%

1.19%

1.05%

1.10%

1.15%

1.20%

1.25%

1.30%

1.35%

1.40%

1.45%

1.50%

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

A

LL

L/

L

o

a

n

s,

n

et

A

LL

L

ALLL ALLL / Loans Receivable, net

ALLL/Loans Receivable, net

$28,426

$30,211 $31,083 $31,594

$32,751

1.13%

1.17% 1.18%

1.19%

1.19%

1.05%

1.10%

1.15%

1.20%

1.25%

1.30%

1.35%

1.40%

1.45%

1.50%

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

A

LL

/

Lo

a

n

s

R

ec

ei

va

bl

e,

n

et

A

LL

L

ALLL ALLL / Loans Receivable, net

$2,361

$(290)

$305 $356

$(26)

0.38%

-0.05%

0.05% 0.05%

0.00%

-0.20%

-0.10%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

$(500)

$-

$500

$1,000

$1,500

$2,000

$2,500

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

N

CO

s

/

A

vg

. L

o

a

n

s

N

e

t C

h

a

rg

e

-O

ff

s/

(R

ec

o

ve

ri

es

)

Net Charge Offs /(Recoveries)

Net Charge-Offs and NCOs Annualized/Avg. Loans NPAs / Assets

$1,120

$1,495

$1,177

$867

$1,131

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Pr

o

vi

si

o

n

Ex

p

en

se

Provision Expense

0.41%

0.30% 0.30% 0.30%

0.29%

0.25%

0.27%

0.29%

0.31%

0.33%

0.35%

0.37%

0.39%

0.41%

0.43%

0.45%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

N

PA

s

/

A

ss

et

s

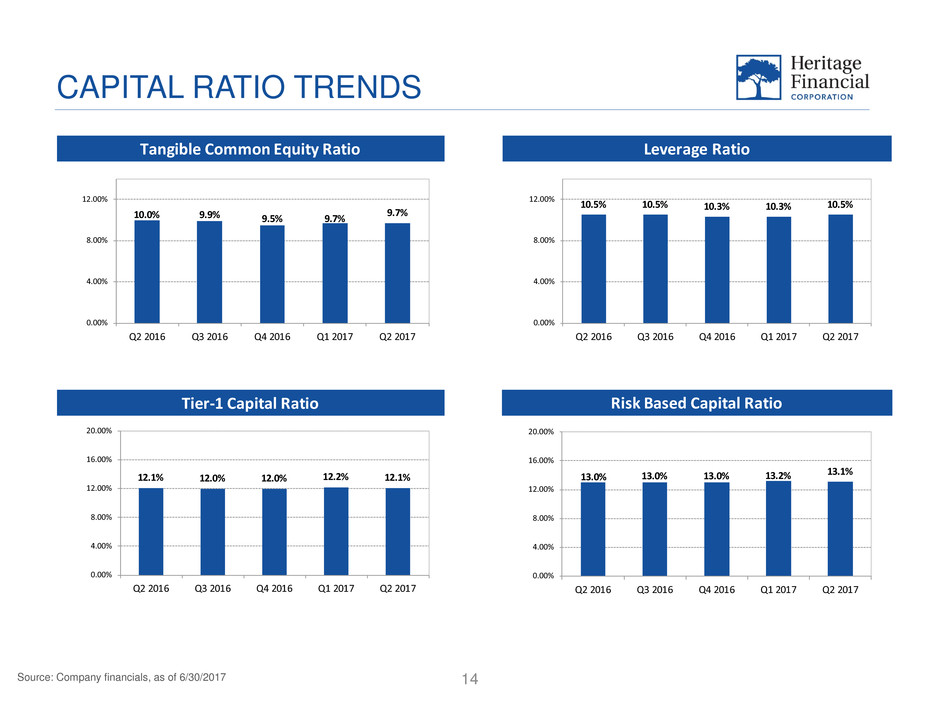

CAPITAL RATIO TRENDS

14Source: Company financials, as of 6/30/2017

- -

- -

Tier-1 Capital Ratio

10.5% 10.5% 10.3% 10.3% 10.5%

0.00%

4.00%

8.00%

12.00%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

10.0% 9.9% 9.5% 9.7%

9.7%

0.00%

4.00%

8.00%

12.00%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

12.1% 12.0% 12.0% 12.2% 12.1%

0.00%

4.00%

8.00%

12.00%

16.00%

20.00%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

13.0% 13.0% 13.0% 13.2% 13.1%

0.00%

4.00%

8.00%

12.00%

16.00%

20.00%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Tangible Common Equity Ratio

Risk Based Capital Ratio

Leverage Ratio

PROFITABILITY TRENDS

15

Source: Company financials, as of 6/30/2017

Note: All dollars in thousands, except per share

Return on Average Assets and Return on Average Tangible Common Equity

Ratios are annualized

- -

- -

- -

Diluted Earnings Per Share

$0.30

$0.37

$0.33

$0.31

$0.39

$-

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Return on Average Assets

$8,895

$11,039

$9,893 $9,316

$11,828

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Dividends Per Share*

0.96%

1.16%

1.03%

0.97%

1.21%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

10.03%

11.99%

10.84% 10.51%

12.78%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Return on Average Tangible Common Equity

Net Income

16

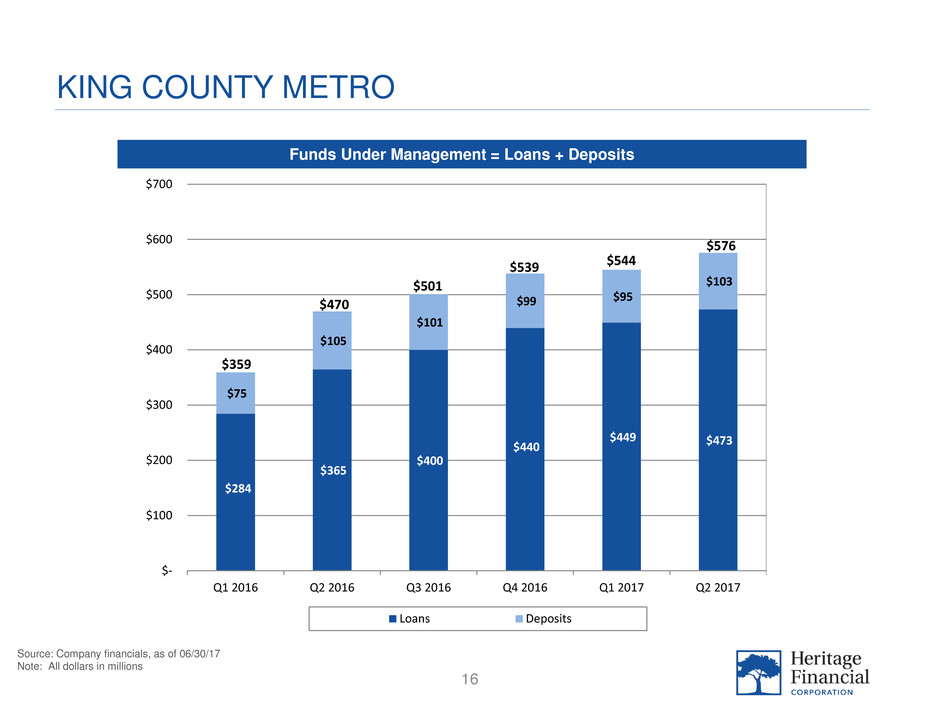

KING COUNTY METRO

Source: Company financials, as of 06/30/17

Note: All dollars in millions

Funds Under Management = Loans + Deposits

$284

$365

$400

$440

$449 $473

$75

$105

$101

$99 $95

$103

$-

$100

$200

$300

$400

$500

$600

$700

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Loans Deposits

$359

$470

$501

$539 $544

$576

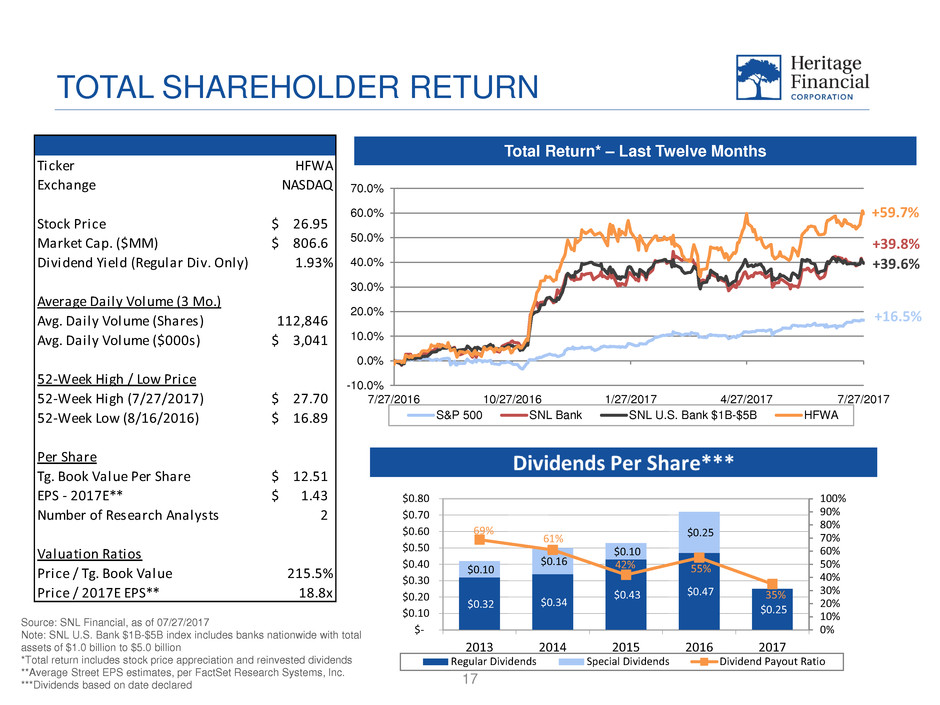

TOTAL SHAREHOLDER RETURN

17

Total Return* – Last Twelve Months

Source: SNL Financial, as of 07/27/2017

Note: SNL U.S. Bank $1B-$5B index includes banks nationwide with total

assets of $1.0 billion to $5.0 billion

*Total return includes stock price appreciation and reinvested dividends

**Average Street EPS estimates, per FactSet Research Systems, Inc.

***Dividends based on date declared

+16.5%

+39.6%

+59.7%

- -

Dividends Per Share***

+39.8%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

7/27/2016 10/27/2016 1/27/2017 4/27/2017 7/27/2017

S&P 500 SNL Bank SNL U.S. Bank $1B-$5B HFWA

Ticker HFWA

Exchange NASDAQ

Stock Price 26.95$

Market Cap. ($MM) 806.6$

Dividend Yield (Regular Div. Only) 1.93%

Average Daily Volume (3 Mo.)

Avg. Daily Volume (Shares) 112,846

Avg. Daily Volume ($000s) 3,041$

52-Week High / Low Price

52-Week High (7/27/2017) 27.70$

52-Week Low (8/16/2016) 16.89$

Per Share

Tg. Book Value Per Share 12.51$

EPS - 2017E** 1.43$

Number of Research Analysts 2

Valuation Ratios

Price / Tg. Book Value 215.5%

Price / 2017E EPS** 18.8x

$0.32 $0.34

$0.43 $0.47

$0.25

$0.10

$0.16

$0.10

$0.25 69% 61%

42% 55%

35%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$-

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

2013 2014 2015 2016 2017

Regular Dividends Special Dividends Dividend Payout Ratio

Heritage Financial Corporation to Acquire Puget Sound Bancorp, Inc.

NASDAQ: HFWA OTCQB: PUGB

“Pure Play” Business Banking Franchise

in Desirable Seattle-Bellevue Market

18

19

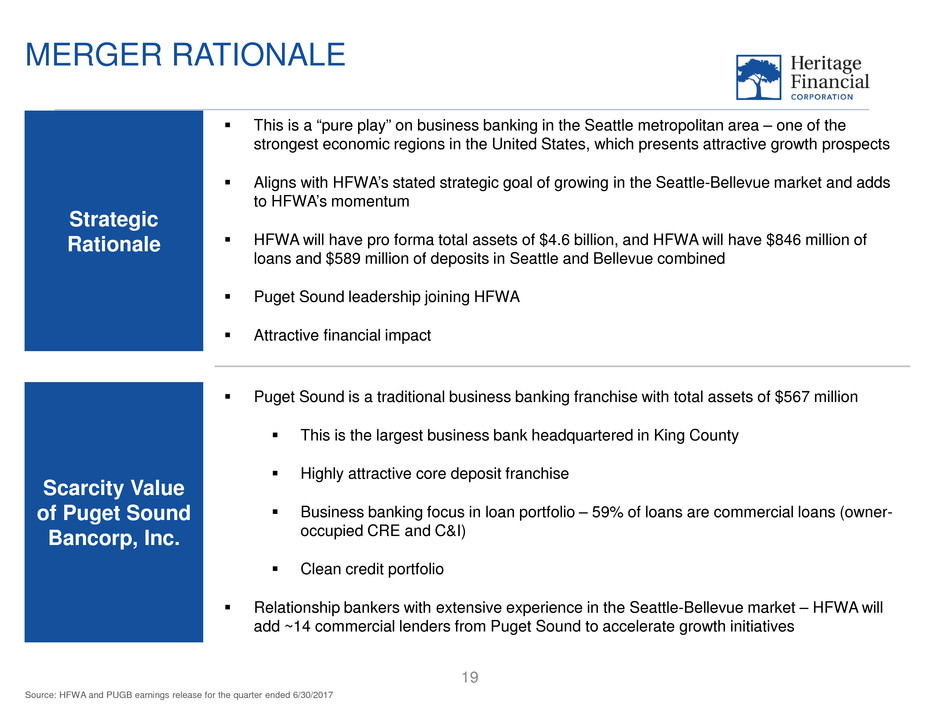

This is a “pure play” on business banking in the Seattle metropolitan area – one of the

strongest economic regions in the United States, which presents attractive growth prospects

Aligns with HFWA’s stated strategic goal of growing in the Seattle-Bellevue market and adds

to HFWA’s momentum

HFWA will have pro forma total assets of $4.6 billion, and HFWA will have $846 million of

loans and $589 million of deposits in Seattle and Bellevue combined

Puget Sound leadership joining HFWA

Attractive financial impact

MERGER RATIONALE

Strategic

Rationale

Scarcity Value

of Puget Sound

Bancorp, Inc.

Puget Sound is a traditional business banking franchise with total assets of $567 million

This is the largest business bank headquartered in King County

Highly attractive core deposit franchise

Business banking focus in loan portfolio – 59% of loans are commercial loans (owner-

occupied CRE and C&I)

Clean credit portfolio

Relationship bankers with extensive experience in the Seattle-Bellevue market – HFWA will

add ~14 commercial lenders from Puget Sound to accelerate growth initiatives

Source: HFWA and PUGB earnings release for the quarter ended 6/30/2017

OVERVIEW OF PUGET SOUND BANCORP, INC.

20

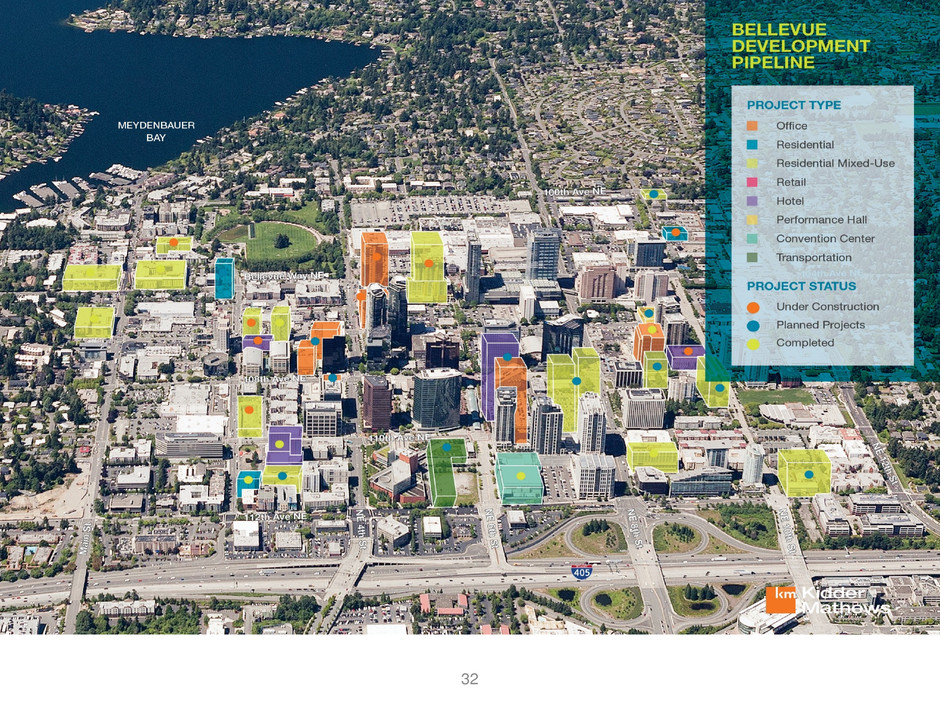

1 office location in downtown Bellevue, Washington

Founded in 2005 to meet the specialized needs of small and medium-sized

businesses, select commercial real estate projects, professional service

providers and high net worth individuals and provide a full suite of financial

products including cash management services

One of Washington state’s top commercial banks

37% of loans are commercial and industrial

22% of loans are owner-occupied commercial real estate

24% of loans are non-owner-occupied commercial real estate

Attractive low cost, core deposit base

44% of deposits are non-interest bearing and 93% are non-CDs

0.18% total cost of deposits in Q2 2017

Core earnings driven from spread income (Q2 2017)

17% increase in operating revenue compared to Q2 2016

18% increase in net income compared to Q2 2016

Net income of $1.3 million and ROAA of 0.93%

No significant revenue from gain on sale of loans

Loan and deposit growth of 5.6% and 15.0% (annualized vs. Q1 2017)

0.00% ratio of non-performing assets / total assets

Source: SNL Financial, PUGB earnings release and call report data for the quarter ended 6/30/2017

Note: All dollars in thousands

(1) Operating revenue = net interest income + non-interest income

Financial Highlights

Q2 2016 Q1 2017 Q2 2017

Balance Sheet

Total Assets 467,076$ 547,754$ 567,165$

Gross Loans (Incl. HFS) 361,924$ 365,889$ 371,004$

Total Deposits 409,115$ 486,880$ 505,135$

Tangible Common Equity 47,330$ 50,080$ 51,801$

Loans / Deposits Ratio 88% 75% 73%

Deposit Mix (% of Total)

Non-Interest Bearing Deposits 42% 42% 44%

Non-CDs 93% 91% 93%

Credit Quality

NPAs/Assets 0.10% 0.07% 0.00%

Loan Loss Reserves / Gross Loans 1.16% 1.20% 1.19%

Income Statement

Net Interest Income 4,095$ 4,659$ 4,845$

Non-Interest Income 200$ 222$ 190$

Non-Interest Expense 2,619$ 2,874$ 3,224$

Operating Revenue (1) 4,295$ 4,881$ 5,035$

Pre-Tax Income 1,602$ 1,947$ 1,811$

Net Income 1,072$ 1,316$ 1,266$

Performance Ratios

Return on Average Assets 0.94% 1.01% 0.93%

Net Interest Margin 3.79% 3.77% 3.76%

Yield on Loans 4.67% 4.66% 4.73%

Cost of Deposits 0.19% 0.17% 0.18%

Non-Interest Expense / Avg. Assets 2.23% 2.15% 2.36%

Efficiency Ratio 61.0% 58.9% 64.0%

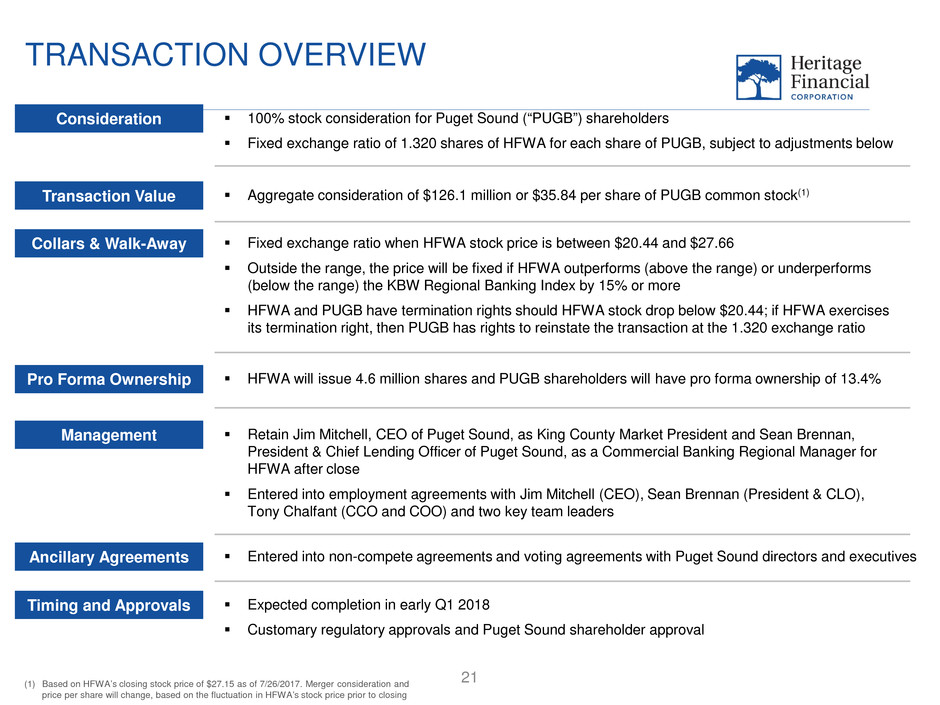

TRANSACTION OVERVIEW

21

Transaction Value Aggregate consideration of $126.1 million or $35.84 per share of PUGB common stock(1)

Timing and Approvals Expected completion in early Q1 2018

Customary regulatory approvals and Puget Sound shareholder approval

Ancillary Agreements Entered into non-compete agreements and voting agreements with Puget Sound directors and executives

Consideration 100% stock consideration for Puget Sound (“PUGB”) shareholders

Fixed exchange ratio of 1.320 shares of HFWA for each share of PUGB, subject to adjustments below

Collars & Walk-Away Fixed exchange ratio when HFWA stock price is between $20.44 and $27.66

Outside the range, the price will be fixed if HFWA outperforms (above the range) or underperforms

(below the range) the KBW Regional Banking Index by 15% or more

HFWA and PUGB have termination rights should HFWA stock drop below $20.44; if HFWA exercises

its termination right, then PUGB has rights to reinstate the transaction at the 1.320 exchange ratio

Pro Forma Ownership HFWA will issue 4.6 million shares and PUGB shareholders will have pro forma ownership of 13.4%

(1) Based on HFWA’s closing stock price of $27.15 as of 7/26/2017. Merger consideration and

price per share will change, based on the fluctuation in HFWA’s stock price prior to closing

Management Retain Jim Mitchell, CEO of Puget Sound, as King County Market President and Sean Brennan,

President & Chief Lending Officer of Puget Sound, as a Commercial Banking Regional Manager for

HFWA after close

Entered into employment agreements with Jim Mitchell (CEO), Sean Brennan (President & CLO),

Tony Chalfant (CCO and COO) and two key team leaders

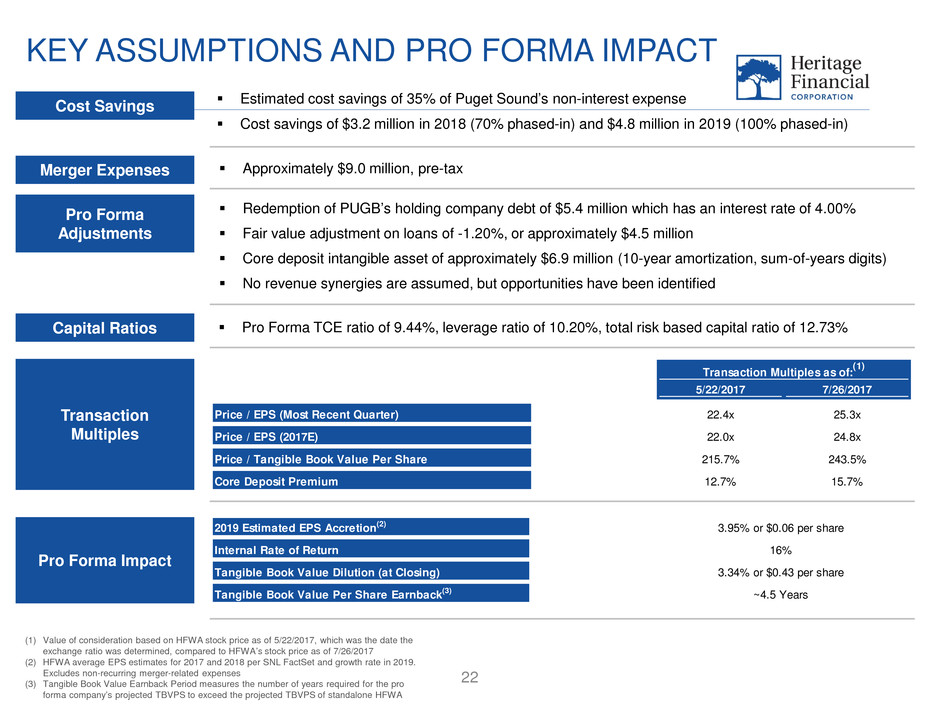

2019 Estimated EPS Accretion(2) 3.95% or $0.06 per share

Internal Rate of Return 16%

Tangible Book Value Dilution (at Closing) 3.34% or $0.43 per share

Tangible Book Value Per Share Earnback(3) ~4.5 Years

5/22/2017 7/26/2017

Price / EPS (Most Recent Quarter) 22.4x 25.3x

Price / EPS (2017E) 22.0x 24.8x

Price / Tangible Book Value Per Share 215.7% 243.5%

Core Deposit Premium 12.7% 15.7%

Transaction Multiples as of:(1)

KEY ASSUMPTIONS AND PRO FORMA IMPACT

22

(1) Value of consideration based on HFWA stock price as of 5/22/2017, which was the date the

exchange ratio was determined, compared to HFWA’s stock price as of 7/26/2017

(2) HFWA average EPS estimates for 2017 and 2018 per SNL FactSet and growth rate in 2019.

Excludes non-recurring merger-related expenses

(3) Tangible Book Value Earnback Period measures the number of years required for the pro

forma company’s projected TBVPS to exceed the projected TBVPS of standalone HFWA

Cost Savings Estimated cost savings of 35% of Puget Sound’s non-interest expense

Cost savings of $3.2 million in 2018 (70% phased-in) and $4.8 million in 2019 (100% phased-in)

Merger Expenses Approximately $9.0 million, pre-tax

Pro Forma

Adjustments

Redemption of PUGB’s holding company debt of $5.4 million which has an interest rate of 4.00%

Fair value adjustment on loans of -1.20%, or approximately $4.5 million

Core deposit intangible asset of approximately $6.9 million (10-year amortization, sum-of-years digits)

No revenue synergies are assumed, but opportunities have been identified

Transaction

Multiples

Pro Forma Impact

Pro Forma TCE ratio of 9.44%, leverage ratio of 10.20%, total risk based capital ratio of 12.73%Capital Ratios

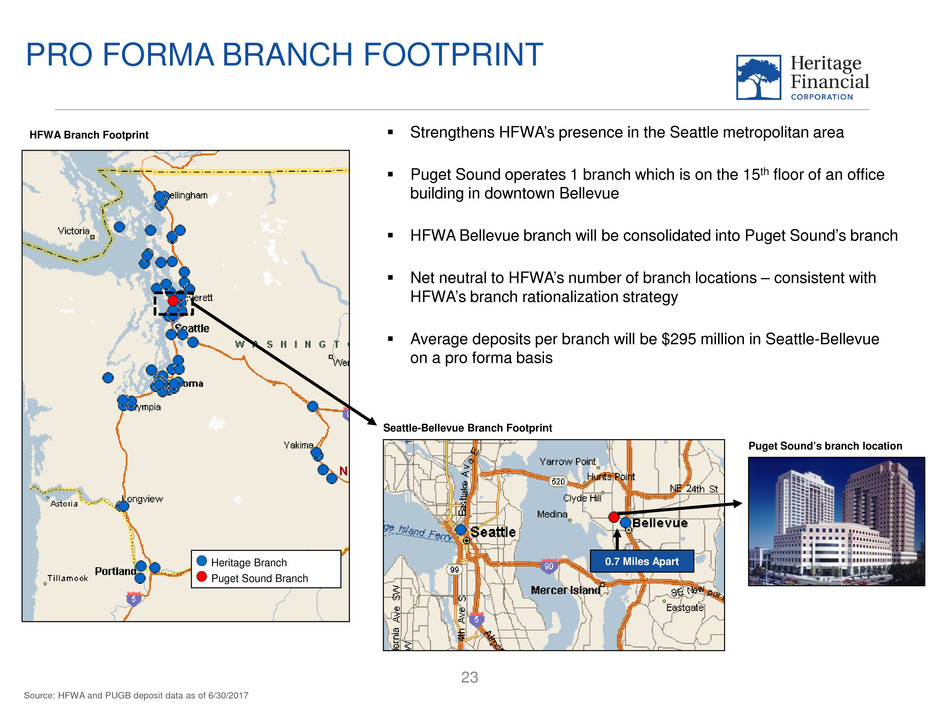

PRO FORMA BRANCH FOOTPRINT

23

Heritage Branch

Puget Sound Branch

Strengthens HFWA’s presence in the Seattle metropolitan area

Puget Sound operates 1 branch which is on the 15th floor of an office

building in downtown Bellevue

HFWA Bellevue branch will be consolidated into Puget Sound’s branch

Net neutral to HFWA’s number of branch locations – consistent with

HFWA’s branch rationalization strategy

Average deposits per branch will be $295 million in Seattle-Bellevue

on a pro forma basis

0.7 Miles Apart

Source: HFWA and PUGB deposit data as of 6/30/2017

HFWA Branch Footprint

Seattle-Bellevue Branch Footprint

Puget Sound’s branch location

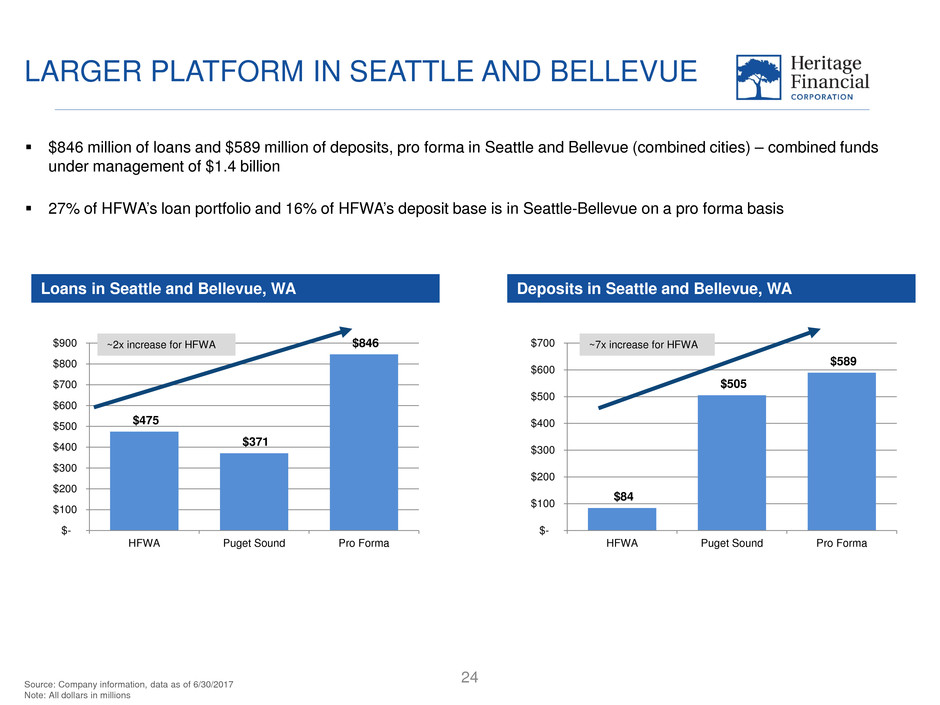

$475

$371

$846

$-

$100

$200

$300

$400

$500

$600

$700

$800

$900

HFWA Puget Sound Pro Forma

$84

$505

$589

$-

$100

$200

$300

$400

$500

$600

$700

HFWA Puget Sound Pro Forma

LARGER PLATFORM IN SEATTLE AND BELLEVUE

24

Loans in Seattle and Bellevue, WA

$846 million of loans and $589 million of deposits, pro forma in Seattle and Bellevue (combined cities) – combined funds

under management of $1.4 billion

27% of HFWA’s loan portfolio and 16% of HFWA’s deposit base is in Seattle-Bellevue on a pro forma basis

~2x increase for HFWA

Source: Company information, data as of 6/30/2017

Note: All dollars in millions

Deposits in Seattle and Bellevue, WA

~7x increase for HFWA

Seattle, WA and Bellevue, WA (Combined Cities)

Rank

Total

In-Market

HQ Institution (State)

Number of

Branches

Deposits in

Market

Market

Share

1 Bank of America Corp. (NC) 46 16,529,180$ 28.9%

2 Wells Fargo & Co. (CA) 35 7,845,087$ 13.7%

3 U.S. Bancorp (MN) 31 7,084,457$ 12.4%

4 JPMorgan Chase & Co. (NY) 41 5,851,757$ 10.2%

5 KeyCorp (OH) 34 4,876,303$ 8.5%

6 1 Washington Federal Inc. (WA) 18 2,361,085$ 4.1%

7 2 HomeStreet Inc. (WA) 14 2,159,250$ 3.8%

8 Mitsubishi UFJ Financial 6 1,652,375$ 2.9%

9 W.T.B. Financial Corp. (WA) 3 1,335,868$ 2.3%

10 East West Bancorp Inc. (CA) 4 1,242,090$ 2.2%

11 Columbia Banking System Inc. (WA) 5 1,033,851$ 1.8%

12 Umpqua Holdings Corp. (OR) 12 1,005,138$ 1.8%

13 Zions Bancorp. (UT) 1 898,744$ 1.6%

14 HSBC Holdings 2 744,044$ 1.3%

15 Banner Corp. (WA) 7 516,037$ 0.9%

16 Pro Forma HFWA 2 497,681$ 0.9%

16 3 Puget Sound Bancorp Inc. (WA) 1 409,466$ 0.7%

17 Cathay General Bancorp (CA) 2 291,831$ 0.5%

18 Opus Bank (CA) 3 215,363$ 0.4%

19 4 Seattle Bank (WA) 1 168,452$ 0.3%

20 5 First Sound Bank (WA) 1 120,460$ 0.2%

21 Peoples Bancorp (WA) 3 120,295$ 0.2%

22 BayCom Corp. (CA) 2 101,501$ 0.2%

23 6 Sound Financial Bancorp Inc. (WA) 1 98,900$ 0.2%

24 Northern Trust Corp. (IL) 1 88,958$ 0.2%

25 Heritage Financial Corp. (WA) 2 88,215$ 0.2%

Total For Institutions In Market 293 $ 57,107,753

Out of 40 Institutions

STRENGTHENING MARKET SHARE

25

Puget Sound has significant scarcity value

in this market

Puget Sound is the largest business

bank in Seattle or Bellevue

3rd largest deposit market share

among banks headquartered in

Seattle or Bellevue

Limited opportunities to acquire a quality

franchise in Seattle-Bellevue

Source: SNL Financial, FDIC deposit data as of 6/30/2016

Note: All dollars in thousands

Note: Information for Seattle MSA, where available

(1) www.cnbc.com

(2) Bureau of Economic Analysis

(3) Nielsen U.S. Census data

(4) www.zillow.com

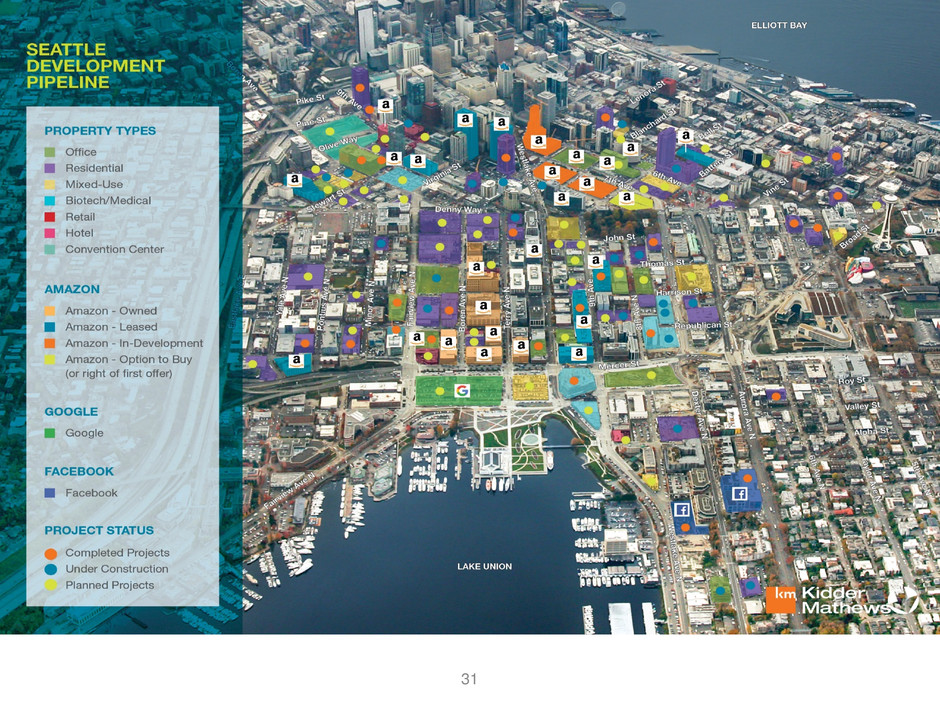

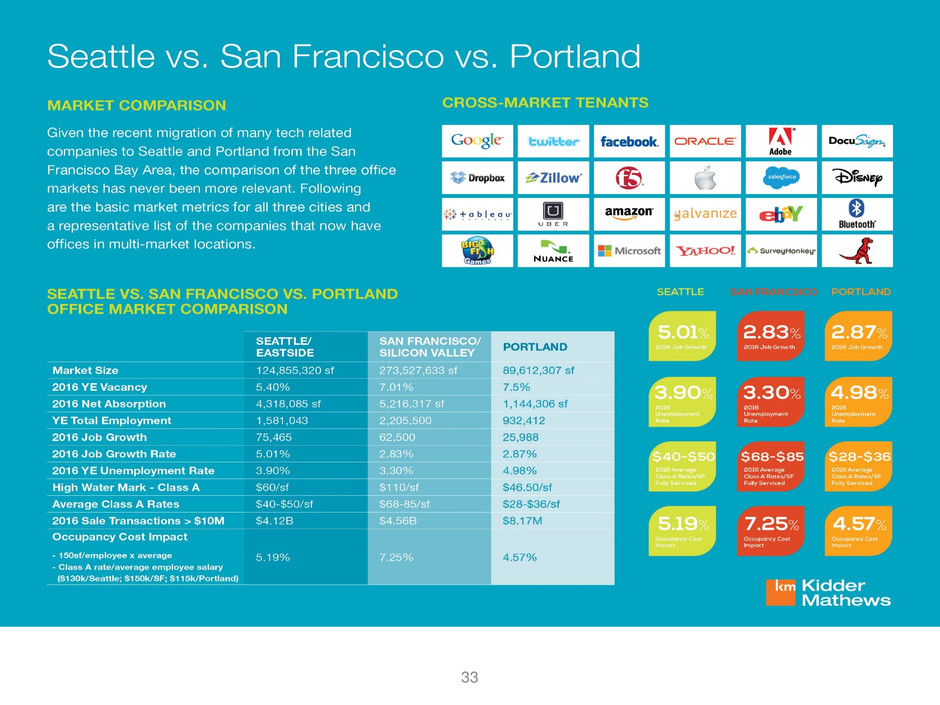

STRONG AND DIVERSE ECONOMIC LANDSCAPE

26

Thriving local economy with job growth in technology and aerospace

sectors

Washington named “America’s Top State for Business in 2017” by

CNBC(1)

Washington state has the country’s largest concentration of STEM

workers (science, technology, education and math) (1)

Seattle economy ranks 12th largest in the country by GDP, which

increased 5.2% since 2014(2)

Seattle’s population grew 12.1% from 2010 to 2017(3)

Median household income for Seattle and Bellevue is $74,688 and

$101,036, respectively, which is 30% and 76% higher than the

national average of $57,462 (3)

Fortune 500 companies headquartered in Seattle-Bellevue MSA,

include: Amazon, Costco, Microsoft, PACCAR, Nordstrom,

Weyerhaeuser, Expeditors, Alaska Air, Expedia and Starbucks

Seattle home prices increased 12.7% from June 2016 to June 2017(4)

Headquartered in Western Washington

Major Operations in Western Washington

HFWA INVESTMENT THESIS

27

• Western Washington geographic footprint with vibrant

economy and attractive long-term demographics

• Management team with proven skills in both organic

growth as well as the acquisition and integration of whole

banks and commercial banking teams

• Disciplined credit and capital management

• Strong financial performance

28

APPENDIX

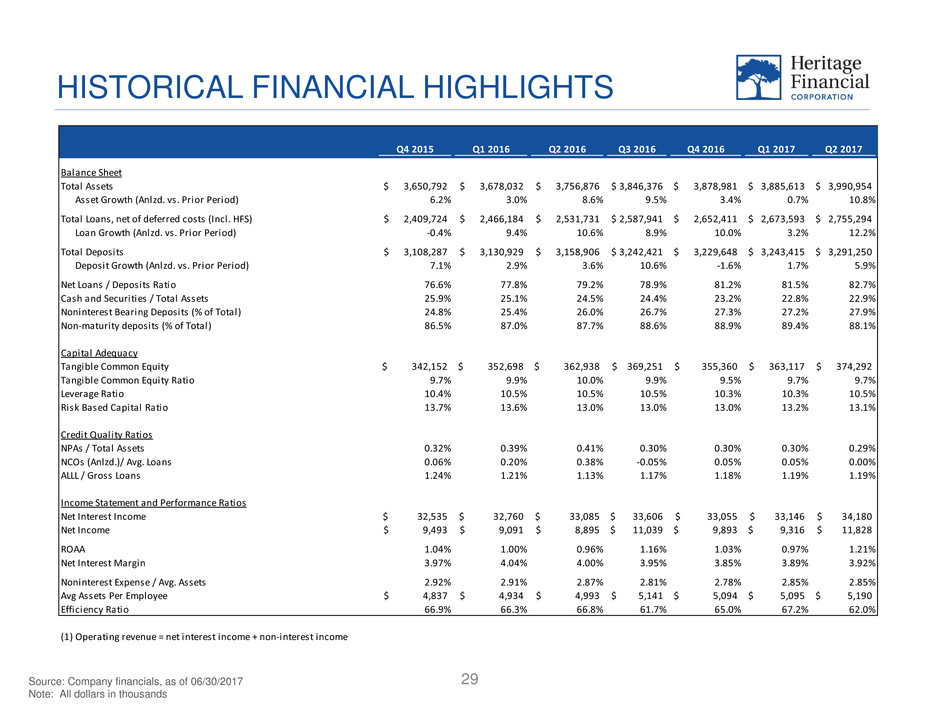

HISTORICAL FINANCIAL HIGHLIGHTS

29Source: Company financials, as of 06/30/2017

Note: All dollars in thousands

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Balance Sheet

Total Assets 3,650,792$ 3,678,032$ 3,756,876$ 3,846,376$ 3,878,981$ 3,885,613$ 3,990,954$

Asset Growth (Anlzd. vs. Prior Period) 6.2% 3.0% 8.6% 9.5% 3.4% 0.7% 10.8%

Total Loans, net of deferred costs (Incl. HFS) 2,409,724$ 2,466,184$ 2,531,731$ 2,587,941$ 2,652,411$ 2,673,593$ 2,755,294$

Loan Growth (Anlzd. vs. Prior Period) -0.4% 9.4% 10.6% 8.9% 10.0% 3.2% 12.2%

Total Deposits 3,108,287$ 3,130,929$ 3,158,906$ 3,242,421$ 3,229,648$ 3,243,415$ 3,291,250$

Deposit Growth (Anlzd. vs. Prior Period) 7.1% 2.9% 3.6% 10.6% -1.6% 1.7% 5.9%

Net Loans / Deposits Ratio 76.6% 77.8% 79.2% 78.9% 81.2% 81.5% 82.7%

Cash and Securities / Total Assets 25.9% 25.1% 24.5% 24.4% 23.2% 22.8% 22.9%

Noninterest Bearing Deposits (% of Total) 24.8% 25.4% 26.0% 26.7% 27.3% 27.2% 27.9%

Non-maturity deposits (% of Total) 86.5% 87.0% 87.7% 88.6% 88.9% 89.4% 88.1%

Capital Adequacy

Tangible Common Equity 342,152$ 352,698$ 362,938$ 369,251$ 355,360$ 363,117$ 374,292$

Tangible Common Equity Ratio 9.7% 9.9% 10.0% 9.9% 9.5% 9.7% 9.7%

Leverage Ratio 10.4% 10.5% 10.5% 10.5% 10.3% 10.3% 10.5%

Risk Based Capital Ratio 13.7% 13.6% 13.0% 13.0% 13.0% 13.2% 13.1%

Credit Quality Ratios

NPAs / Total Assets 0.32% 0.39% 0.41% 0.30% 0.30% 0.30% 0.29%

NCOs (Anlzd.)/ Avg. Loans 0.06% 0.20% 0.38% -0.05% 0.05% 0.05% 0.00%

ALLL / Gross Loans 1.24% 1.21% 1.13% 1.17% 1.18% 1.19% 1.19%

Income Statement and Performance Ratios

Net Interest Income 32,535$ 32,760$ 33,085$ 33,606$ 33,055$ 33,146$ 34,180$

Net Income 9,493$ 9,091$ 8,895$ 11,039$ 9,893$ 9,316$ 11,828$

ROAA 1.04% 1.00% 0.96% 1.16% 1.03% 0.97% 1.21%

Net Interest Margin 3.97% 4.04% 4.00% 3.95% 3.85% 3.89% 3.92%

Noninterest Expense / Avg. Assets 2.92% 2.91% 2.87% 2.81% 2.78% 2.85% 2.85%

Avg Assets Per Employee 4,837$ 4,934$ 4,993$ 5,141$ 5,094$ 5,095$ 5,190$

Efficiency Ratio 66.9% 66.3% 66.8% 61.7% 65.0% 67.2% 62.0%

(1) Operating revenue = net interest income + non-interest income

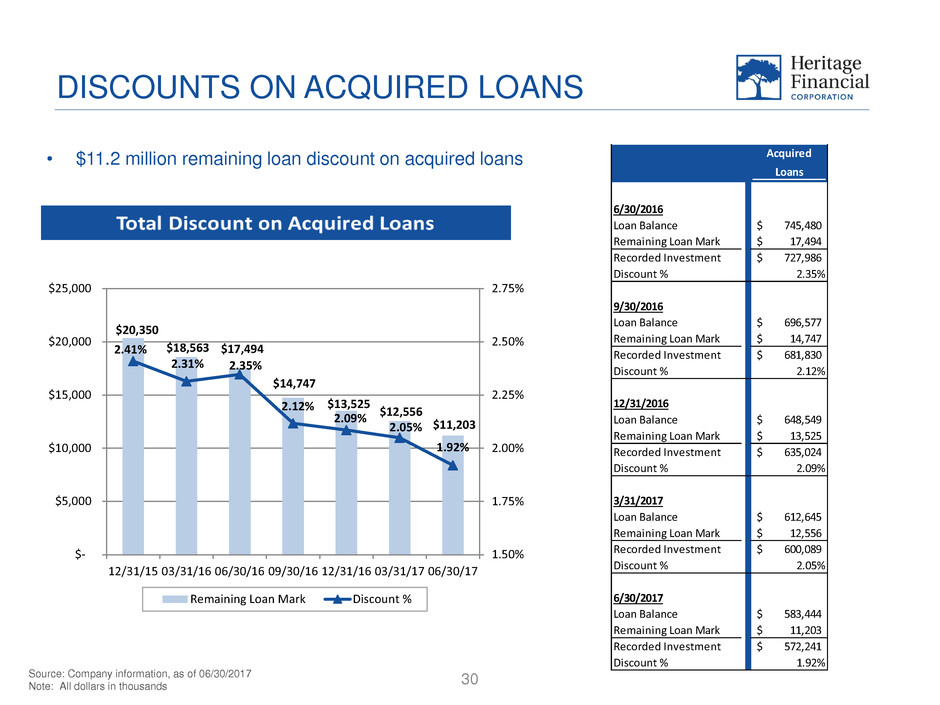

DISCOUNTS ON ACQUIRED LOANS

30

• $11.2 million remaining loan discount on acquired loans

Source: Company information, as of 06/30/2017

Note: All dollars in thousands

Acquired

Loans

6/30/2016

Loan Balance 745,480$

Remaining Loan Mark 17,494$

Recorded Investment 727,986$

Discount % 2.35%

9/30/2016

Loan Balance 696,577$

Remaining Loan Mark 14,747$

Recorded Investment 681,830$

Discount % 2.12%

12/31/2016

Loan Balance 648,549$

Remaining Loan Mark 13,525$

Recorded Investment 635,024$

Discount % 2.09%

3/31/2017

Loan Balance 612,645$

Remaining Loan Mark 12,556$

Recorded Investment 600,089$

Discount % 2.05%

6/30/2017

Loan Balance 583,444$

Remaining Loan Mark 11,203$

Recorded Investment 572,241$

Discount % 1.92%

$20,350

$18,563 $17,494

$14,747

$13,525

$12,556

$11,203

2.41%

2.31% 2.35%

2.12%

2.09%

2.05%

1.92%

1.50%

1.75%

2.00%

2.25%

2.50%

2.75%

$-

$5,000

$10,000

$15,000

$20,000

$25,000

12/31/15 03/31/16 06/30/16 09/30/16 12/31/16 03/31/17 06/30/17

Remaining Loan Mark Discount %

31

32

33