Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANALOGIC CORP | d419778d8k.htm |

Exhibit 10.1

July 17, 2017

BY HAND AND BY E-MAIL MFROST@ANALOGIC.COM

Mark Frost

57 Porter Road

Boxford, MA 01921

Re: Separation Agreement

Dear Mark:

The purpose of this separation agreement (“Agreement”) is to confirm the terms of your separation from Analogic Corporation. (“Analogic” or the “Company”). The Severance Pay and Benefits described below are contingent on your agreement to and compliance with the provisions of this Agreement. Unless you rescind your assent as set forth in Section 8 below, this Agreement shall be effective on the 8th day following your signing of this Agreement (the “Effective Date”), at which time it shall become final and binding on all parties.

1. Separation. Your employment with the Company shall terminate effective September 11, 2017 (the “Separation Date”). If, on the Separation Date, you are a member of the board of directors of any of the Company’s subsidiaries or affiliated entities (an “Affiliated Entity”), or hold any other office or position with the Company or any Affiliated Entity, you shall, unless otherwise requested by the Company, be deemed to have resigned from all such offices and positions as of the Separation Date. You agree to execute such documents and take such other actions as the Company may request to reflect such resignation.

2. Separation Pay and Benefits. If you sign and do not rescind this Agreement as set forth in Section 8 below, and if you execute and deliver the Affirmation of Release set forth in Exhibit D as of the Separation Date, then the Company will:

| (i) | beginning on the first regular payroll date following sixtieth (60th) day after the Separation Date pay to you a sum equal to your most recent Annual Base Salary for a period of twelve (12) months, such payment to be made in approximately equal installments according to the Company’s then-current payroll practices (except in the case of amounts that are subject to a prior deferral election). |

| (ii) | provide continued coverage under the Company’s group medical and dental plans (the “Health Plans”), if and to the extent permitted by such plans and subject to their terms, and also subject to you paying your normal proportion of the cost thereof, for a period of twelve (12) months from the Separation Date, and if the Health Plans do not permit such continued coverage, and if you are eligible for and properly elect health care continuation coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), Executive’s COBRA |

| payments, and if applicable for family coverage, for health coverage that is paid by the Company to active and similarly-situated employees who receive the same type of coverage, for a period of equal to twelve (12) months from the Date of Termination, unless the provision of the foregoing benefits will violate the nondiscrimination benefits of applicable law, in which case the Company payments will not apply. Any obligations under this Section 2(ii) shall cease at such earlier time as you become eligible for coverage under another employer’s group medical plan, and you shall immediately inform the Company in writing of such occurrence. |

| (iii) | pay to you a sum equal to your actual bonus as calculated according to the FY17 Annual Incentive Program, payable at such time and in the manner provided in such Program. |

| (iv) | make available outplacement assistance, such assistance to be provided through a Company-approved program and provider. |

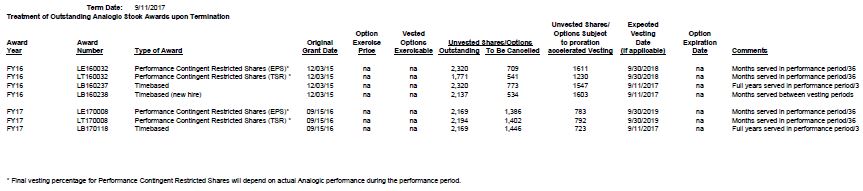

3. Equity Awards. Any vesting of outstanding equity awards to which you may be entitled will be determined in accordance with the applicable award agreement. For the avoidance of doubt, a schedule of your unvested awards is attached hereto as Exhibit A.

4. Acknowledgments. You acknowledge and agree that except for

| (i) | unpaid regular wages and vacation time accrued through the Separation Date (which shall be paid by the Company in the first regularly scheduled payroll following the Separation Date); |

| (ii) | reimbursement for any outstanding business expenses documented and submitted in accordance with Company policy |

| (iii) | any vested amounts, if any, due to you pursuant to the Company’s 401(k) savings plan and non-qualified deferred compensation plan; |

| (iv) | the separation pay and benefits described in Section 2 (Separation Pay and Benefits) above; and |

| (v) | the equity awards described in Section 3 (Equity Awards) above; |

you have been paid and provided all wages, vacation pay, holiday pay, commissions and any other form of compensation or benefit that may be due to you now or which would have become due in the future in connection with your employment with or separation of employment from the Company. Unless expressly provided in this Agreement, you will not be eligible for or receive any Company provided or paid benefits for any period after the Separation Date.

4. Unemployment Insurance. You may seek unemployment benefits as a result of your separation from the Company. Decisions regarding eligibility for and amounts of

2

unemployment benefits are made by the applicable state agency, not by the Company. Please refer to the unemployment benefits notice attached as Exhibit B.

5. Confidentiality; Non-Disparagement; Non-Solicitation; Return of Company Property. You hereby covenant and agree to:

| (i) | promptly return to the Company any keys, credit cards, passes, confidential documents or material, computer equipment, or other property belonging to the Company, and you shall also return all writings, files, records, correspondence, notebooks, notes and other documents and things (including any copies thereof) containing confidential information or relating to the business or proposed business of the Company or its affiliated entities or containing any trade secrets relating to the Company or its affiliated entities. For purposes of the preceding sentence, the term “trade secrets” shall have the meaning ascribed to it under the Uniform Trade Secrets Act. You will represent in writing to the Company upon termination of employment that you has complied with the foregoing provisions of this Section. You may retain your company-issued laptop and mobile phone, provided that you first make them available to the Company for the removal of confidential information or other Company property therefrom. |

| (ii) | pay in full all outstanding balances on any Company credit card no later than the Separation Date; and you further acknowledge that, if the Company has reimbursed you for expenses but you have not paid the associated balances as of the Separation Date, the Company may deduct the amount of such unpaid balances from your Severance Pay until these deductions pay the balance in full; |

| (iii) | abide by the terms of your proprietary information and invention assignment agreement, a copy of which is attached hereto as Exhibit C, and the terms of which are hereby incorporated into this Agreement by reference; |

| (iv) | abide by any and all common law and/or statutory obligations relating to the protection and non-disclosure of the Company’s trade secrets and/or confidential and proprietary documents and information, and you specifically agree that you will not disclose any confidential or proprietary information that you acquired as an employee of the Company to any other person or entity, or use such information in any manner that is detrimental to the interests of the Company; |

| (v) | keep confidential and not publicize or disclose the existence and terms of this Agreement, other than to (a) an immediate family member, legal counsel, accountant or financial advisor, provided that any such individual to whom disclosure is made shall be bound by these confidentiality obligations; or (b) a state or federal tax authority or government agency to which disclosure is mandated by applicable state or federal law; |

3

| (vi) | not make any statements that are disparaging about or adverse to the business interests of the Company or which are intended to harm the reputation of the Company, including, but not limited to, any statements that disparage any product, service, finances, employees, officers, directors, capability or any other aspect of the business of Company. The Company will instruct its senior leadership team to refrain from making disparaging statements about you; |

| (vii) | for the period ending one year after the Separation Date, you will not directly or indirectly, either alone or in association with others (I) solicit, induce or attempt to induce any employee or independent contractor of the Company to terminate his or her employment or other engagement with the Company, or (II) hire, or recruit or attempt to hire, or engage or attempt to engage as an independent contractor, any person who was employed or otherwise engaged by the Company at any time during your employment with the Company; provided, however, that this clause (II) shall not apply to the recruitment or hiring or other engagement of any individual whose employment or other engagement with the Company has been terminated for a period of 60 days or longer; and |

| (viii) | For the period ending one year after the Separation Date, not directly or indirectly, either alone or in association with others, solicit, divert or take away, or attempt to divert or take away (“Solicit”), the business or patronage of any of the clients, customers, or business partners of the Company which were contacted, solicited, or served by the Company during the 12-month period prior to the Separation Date (“Customers”). You further represent and warrant that you have not Solicited the business or patronage of any Customers. |

Your breach of this Section 5 will constitute a material breach of this Agreement and, in addition to any other legal or equitable remedy available to the Company, will entitle the Company to stop providing and/or recover any Severance Pay and Benefits. You understand that nothing in this Agreement is designed to interfere with, restrain, or prevent employee communications protected by state or federal law, including as protected by (a) section 7 of the National Labor Relations Act (or court order), regarding wages, hours, or other terms and conditions of employment, (b) SEC Rule 21F-17, or (c) the immunity provided under 18 U.S.C. section 833(a) for confidential disclosures of trade secrets to government officials or lawyers solely for the purpose of reporting or investigating a suspected violation of law or in a sealed filing in court or other proceeding relating to such suspected violation.

6. Cooperation. You agree that, consistent with your business and personal affairs, during and after you employment by the Company, you will assist the Company and its affiliated entities in the defense of any claims, or potential claims that may be made or are threatened to be made against any of them in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”), and will assist the Company and its affiliated entities in the prosecution of any claims that may be made by the Company or its affiliated entities in any Proceeding, to the extent that such claims may relate to your employment or the period of your

4

employment by the Company. The Company agrees to reimburse Executive for all of your reasonable out-of-pocket expenses associated with such assistance, including travel expenses. Any amounts to be paid to you pursuant to this Section 6 shall be paid by the Company no later than thirty (30) days of the date on which you notify the Company that such expenses were incurred.

7. Release of Claims.

| (i) | You hereby acknowledge and agree that by signing this Agreement, you are waiving your right to assert any Claim (as defined below) against the Company, and any of its affiliates, subsidiaries, parent companies, predecessors, and successors, and all of their respective past and present officers, directors, stockholders, partners, members, employees, agents, representatives, plan administrators, attorneys, insurers and fiduciaries (each in their individual and corporate capacities) (individually and collectively, the “Released Parties”) arising from acts or omissions that occurred on or before the Separation Date or the Effective Date, whichever is later. |

| (ii) | Your waiver and release is intended to bar any form of legal claim, lawsuit, charge, complaint or any other form of action (jointly referred to as “Claims”) against the Released Parties seeking money or any other form of relief, including but not limited to equitable relief (whether declaratory, injunctive or otherwise), damages or any other form of monetary recovery (including but not limited to back pay, front pay, compensatory damages, emotional distress damages, punitive damages, attorneys’ fees and any other costs), each as they may have been amended through the Separation Date or Effective Date, whichever is later. You understand that there could be unknown or unanticipated Claims resulting from your employment with the Company and the termination of your employment, and you agree that such Claims are included in this waiver and release. You specifically waive and release the Company from any Claims arising from or related to your employment relationship with the Company or the termination of your employment, including without limitation Claims under any statute, ordinance, regulation, executive order, common law, constitution and/or other source of law of any state, country and/or locality (collectively and individually referred to as “Law”), including but not limited to the United States, the Commonwealth of Massachusetts, and any other state or locality where you worked for the Company. |

| (iii) | Without limiting the foregoing general waiver and release, except for Claims resulting from the failure of the Company to perform its obligations under this Agreement, you specifically waive and release the Company from any Claims arising from or related to your employment relationship with the Company or the termination thereof, including without limitation: |

5

| (a) | Claims under any Law concerning discrimination, harassment or fair employment practices, including but not limited to Massachusetts General Laws Chapter 151B, Title VII of the Civil Rights Act of 1964 (42 U.S.C. § 2000e et seq.), 42 U.S.C. § 1981, the Age Discrimination in Employment Act (29 U.S.C. § 621 et seq.) (“ADEA”) and the Americans with Disabilities Act (42 U.S.C. § 12101 et seq.), each as they may have been amended through the Separation Date or Effective Date, whichever is later; |

| (b) | Claims under any Law relating to wages, hours, whistleblowing, leaves of absences or any other terms and conditions of employment, including but not limited to the Family and Medical Leave Act of 1993 (29 U.S.C. § 2601 et seq.), the Massachusetts Payment of Wages Law (Massachusetts General Laws Chapter 149, §§ 148, 150), Massachusetts General Laws Chapter 149 in its entirety, and Massachusetts General Laws Chapter 151 in its entirety (including but not limited to the minimum wage and overtime provisions), each as they may have been amended through the Separation Date or Effective Date, whichever is later. You specifically acknowledge that you are waiving any Claims for unpaid wages under these and other Laws; |

| (c) | Claims under any local, state or federal common law theory; |

| (d) | Claims arising under the Company’s policies or benefit plans; and |

| (e) | Claims arising under any other Law or constitution. |

| (iv) | Further, consistent with the provisions of state and federal discrimination laws (the “Discrimination Laws”), nothing in the general waiver and release set forth above in this Section 7 (Release of Claims) shall be deemed to prohibit you from challenging the validity of this release under the Discrimination Laws or from filing a charge or complaint of age or other related discrimination with the Equal Employment Opportunity Commission (“EEOC”) or similar state agency, or from participating in any investigation or proceeding conducted by the EEOC or such state agency. However, the release in this Section 7 (Release of Claims) does prohibit you from seeking or receiving monetary damages or other individual-specific relief in connection with any such charge or complaint of age or other employment-related discrimination. Further, nothing in this Agreement shall be deemed to limit Analogic’s right to seek immediate dismissal of such charge or complaint on the basis that your signing of this Agreement constitutes a full release of any individual rights under the Discrimination Laws, or Analogic’s right to seek restitution or other legal remedies to the extent permitted by law of the economic benefits provided to you under this Agreement in the event that you successfully challenge the validity of this release and prevail in any claim under the Discrimination Laws. |

6

| (v) | If your release of Claims pursuant to this Section 7 (Release of Claims) is determined to be unenforceable in whole or part (except for your release of federal age discrimination Claims, which shall not be subject to this sentence), the Company will have the option, in its sole discretion, to either (a) declare the entire Agreement null and void and require you to refund the Separation Pay and Benefits provided for in this Agreement; or (b) enforce the portions of the Agreement found not to be unenforceable. In the event that any other provision of this Agreement is determined to be unenforceable in whole or in part (including your release of federal age discrimination Claims) the remainder of the Agreement shall be enforced in full. |

| (vi) | This Section 7 (Release of Claims) shall not release the Company from any obligation expressly set forth in this Agreement, or preclude you from pursuing any claims to enforce this Agreement. You acknowledge and agree that, but for providing this waiver and release, you would not be receiving the Severance Pay and Benefits provided for in this Agreement. |

| (vii) | Reaffirmation of Release of Claims. Analogic shall have no obligation to provide you with the separation pay and benefits set forth in Section 2 (Separation Pay and Benefits) of this Agreement unless and until you execute and return the Affirmation of Release attached as Exhibit D as of the Separation Date. You also acknowledge and agree that the release of claims in this Section 7 (Release of Claims) shall be fully effective in the event that you fail or refuse to execute the affirmation. |

8. Consideration Period. Because you are at least 40 years of age, you have specific rights under the Older Workers Benefit Protection Act (“OWBPA”), which prohibits discrimination on the basis of age. The release set forth in Section 7 (Release of Claims) is intended to release any rights you may have against the Company alleging discrimination on the basis of age. Accordingly, it is the Company’s desire and intent that you fully understand the provisions and effects of this Agreement. To that end, you are encouraged and given the opportunity to consult with legal counsel for the purpose of reviewing the terms of this Agreement. Consistent with the provisions of the OWBPA, you have 21 days to consider and accept the provisions of this Agreement. The parties agree that any changes to this agreement, whether material or immaterial, do not restart such 21 period, which shall terminate 21 days from the date this agreement was originally provided to you, or August 1, 2017. In addition, you may rescind your assent to this Agreement if, within 7 days after the date you sign this Agreement, you deliver a written notice of rescission. To be effective, such notice of rescission must be postmarked and sent by certified mail, return receipt requested, or delivered within the seven-day period to Company’s Vice President of Human Resources

Notwithstanding anything to the contrary in this Agreement, the release in Section 7 (Release of Claims) does not cover rights or Claims under the ADEA that arise from acts or omissions that

7

occur after the date you sign this Agreement or the Affirmation of Release contained in Exhibit D, as the case may be.

9. Section 409A. Subject to the provisions in this Section 9, any severance payments or benefits under this Agreement shall begin only upon the date of Executive’s “separation from service” (determined as set forth below) which occurs on or after the date of termination of employment. The following rules shall apply with respect to distribution of the payments and benefits, if any, to be provided to Executive under this Agreement:

| (i) | It is intended that each installment of the severance payments and benefits provided under this Agreement shall be treated as a separate “payment” for purposes of Section 409A of the Internal Revenue Code and the guidance issued thereunder (“Section 409A”). Neither you nor the Company shall have the right to accelerate or defer the delivery of any such payments or benefits except to the extent specifically permitted or required by Section 409A. |

| (ii) | If, as of the date of your “separation from service” from the Company, you are not a “specified employee” (within the meaning of Section 409A), then each installment of the severance payments and benefits shall be made on the dates and terms set forth in this Agreement. |

| (iii) | If, as of the date of your “separation from service” from the Company, Executive is a “specified employee” (within the meaning of Section 409A), then: |

| (a) | Each installment of the severance payments and benefits due under this Agreement that, in accordance with the dates and terms set forth herein, will in all circumstances, regardless of when the separation from service occurs, be paid within the short-term deferral period (as defined under Section 409A) shall be treated as a short-term deferral within the meaning of Treasury Regulation Section 1.409A-1(b)(4) to the maximum extent permissible under Section 409A and shall be paid at the time and in the matter set forth in this Agreement; and |

| (b) | Each installment of the severance payments and benefits due under this Agreement that is not described in paragraph (a) above and that would, absent this subsection, be paid within the six-month period following Executive’s “separation from service” from the Company shall not be paid until the date that is six months and one day after such separation from service (or, if earlier, Executive’s death), with any such installments that are required to be delayed being accumulated during the six-month period and paid in a lump sum on the date that is six months and one day following Executive’s separation from service and any subsequent installments, if any, being paid in accordance with the dates and terms set forth herein; provided, however, that the preceding provisions of this sentence shall not apply to any installment of severance payments and |

8

| benefits if and to the maximum extent that such installment is deemed to be paid under a separation pay plan that does not provide for a deferral of compensation by reason of the application of Treasury Regulation 1.409A-1(b)(9)(iii) (relating to separation pay upon an involuntary separation from service). Any installments that qualify for the exception under Treasury Regulation Section 1.409A-1(b)(9)(iii) must be paid no later than the last day of Executive’s second taxable year following the taxable year in which the separation from service occurs. |

| (iv) | The determination of whether and when Executive’s separation from service from the Company has occurred shall be made in a manner consistent with, and based on the presumptions set forth in, Treasury Regulation Section 1.409A-1(h). Solely for purposes of this paragraph (iv), “Company” shall include all persons with whom the Company would be considered a single employer as determined under Treasury Regulation Section 1.409A-(h)(3). |

| (v) | All reimbursements and in-kind benefits provided under this Agreement shall be made or provided in accordance with the requirements of Section 409A to the extent that such reimbursements or in-kind benefits are subject to Section 409A, including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during Executive’s lifetime (or during a shorter period of time specified in this Agreement), (ii) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year, (iii) the reimbursement of an eligible expense will be made on or before the last day of the calendar year following the year in which the expense is incurred and (iv) the right to reimbursement is not subject to set off or liquidation or exchange for any other benefit. |

| (vi) | The Company may withhold (or cause to be withheld) from any payments made under this Agreement, all federal, state, city or other taxes as shall be required to be withheld pursuant to any law or governmental regulation or ruling. |

9. Miscellaneous.

| (i) | The Company disclaims any liability to you. This Agreement is not an admission by the Company of any liability or wrongdoing, nor that any actions or inactions of the Company are or were wrongful, and it shall not be interpreted as such. |

| (ii) | Except as expressly provided for herein, this Agreement supersedes any and all prior oral and/or written agreements, and sets forth the entire agreement between the Company and you in respect of your separation from the Company. |

| (iii) | No variations or modifications hereof shall be deemed valid unless reduced to writing and signed by the Company and you. |

9

| (iv) | The provisions of this Agreement are severable, and if for any reason any part hereof shall be found to be unenforceable, the remaining provisions shall be enforced in full. |

| (v) | This Agreement may be signed on one or more copies, each of which when signed will be deemed to be an original, and all of which together will constitute one and the same Agreement. |

| (vi) | The validity, interpretation and performance of this Agreement, and any and all other matters relating to your employment and separation of employment from the Company, shall be governed by and construed in accordance with the internal laws of the Commonwealth of Massachusetts, without giving effect to conflict of law principles. Both parties agree that any action, demand, claim or counterclaim relating to (a) your employment and separation of your employment, and/or (b) the terms and provisions of this Agreement or to its breach, shall be commenced in the Commonwealth of Massachusetts in a court of competent jurisdiction. |

| (vii) | BOTH PARTIES AGREE THAT ANY ACTION, DEMAND, CLAIM OR COUNTERCLAIM ARISING OUT OF THIS AGREEMENT SHALL BE RESOLVED BY A JUDGE ALONE, AND BOTH PARTIES HEREBY WAIVE AND FOREVER RENOUNCE THE RIGHT TO A TRIAL BEFORE A CIVIL JURY. |

It is the Company’s desire and intent to make certain that you fully understand the provisions and effects of this Agreement. To that end, you have been encouraged and given an opportunity to consult with legal counsel, and you acknowledge having done so. By executing this Agreement, you are acknowledging that (a) you have been afforded sufficient time to understand the provisions and effects of this Agreement and to consult with legal counsel; (b) your agreements and obligations under this Agreement are made voluntarily, knowingly and without duress; and (c) neither the Company nor its agents or representatives have made any representations inconsistent with the provisions of this Agreement.

10

If the foregoing correctly sets forth our arrangement, please sign, date and return the enclosed copy of this Agreement to the person identified above, within the time frame set forth above.

| Very truly yours,

ANALOGIC CORPORATION |

Accepted and Agreed To: | |||

| /s/ Fred B. Parks | /s/ Mark Frost | |||

| Fred B. Parks President and CEO |

Mark Frost Dated: July 20, 2017 | |||

11

EXHIBIT A

Unvested Equity Awards

Term Date: 9/11/2017 Treatment of Outstanding Analogic Stock Awards upon Termination Unvested Shares/ Expected Option Vested Options Subject Vesting Option Award Award Original Exercise Options Unvested Shares/Options to proration Date Expiration Year Number Type of Award Grant Date Price Exercisable Outstanding To Be Cancelled accelerated Vesting (if applicable) Date Comments FY16 LE160032 Performance Contingent Restricted Shares (EPS)* 12/03/15 na na 2,320 709 1611 9/30/2018 na Months served in performance period/36 FY16 LT160032 Performance Contingent Restricted Shares (TSR) * 12/03/15 na na 1,771 541 1230 9/30/2018 na Months served in performance period/36 FY16 LB160237 Timebased 12/03/15 na na 2,320 773 1547 9/11/2017 na Full years served in performance period/3 FY16 LB160238 Timebased (new hire) 12/03/15 na na 2,137 534 1603 9/11/2017 na Months served between vesting periods FY17 LE170008 Performance Contingent Restricted Shares (EPS)* 09/15/16 na na 2,169 1,386 783 9/30/2019 na Months served in performance period/36 FY17 LT170008 Performance Contingent Restricted Shares (TSR) * 09/15/16 na na 2,194 1,402 792 9/30/2019 na Months served in performance period/36 FY17 LB170118 Timebased 09/15/16 na na 2,169 1,446 723 9/11/2017 na Full years served in performance period/3 * Final vesting percentage for Performance Contingent Restricted Shares will depend on actual Analogic performance during the performance period.

12

How long does it take to process a new claim?It takes approximately three to four weeks to process a new claim. If you are determined to be eligible for UI benefits, you will receive payments for the weeks that you are eligible, except for the first week, which is a waiting period required by Massachusetts Law.How to request your weekly benefit payment:Beginning on the Sunday after you apply for benefits, you must request your benefit payment (sign or certify your eligibility for UI benefits) weekly. A payment will be made to you for the previous week, after you request the benefit payment and we have determined that you are eligible. To request benefit payment:Go to www.mass.gov/dua select UI Online for Claimants. Then log in to your account using your SSN and password that you created. Select Request Benefit Payment and answer the questions.2. Call the automated TeleCert service at 617-626-6338. Follow the voice prompts and answer the questions using the keypad on your phone. TeleCert is available in English and Spanish.How to apply for benefits from out of state:If you worked in Massachusetts and have moved to another state, you may still be eligible for benefits. This type of claim is known as an interstate claim. Interstate claims are subject to Massachusetts Law as if you were still living in the commonwealth. You can apply for your interstate unemployment claim using UI Online or by calling TeleClaim Center.Need help?If you have any questions concerning your eligibility or need assistance applying for unemplyment benefits, please review the frequently asked questions on our website, www.mass.gov/data or call the TeleClaim Center.This pamphlet includes important information how to apply for Unemployment insurance benefits.This pamphlet Includes important information on how to apply for Unemployment Insurance benefits.Este folleto contiene Information Importants sobre como solicitar los beneficier del Seguro de Desempleo.(Illegible)THE COMMONWEALTH OF MASSACHUSETTS EXECUTIVE OFFICE OF LABOR AND WORDFORCE DEVELOPMENT DEPARTMENT OF UNEMPLOYMENT ASSISTANCEEqual Opportunity Employer ProgramAucllary aids and services are available upon request to individuals with disabilities. For hearing-impaired relay services, call 711 www.mass.gov/dua (Illegible) The commonwealth of MassachusettsEXECUTIVE OFFICES LABOR AND WORDORCE DEVELOPMENT DEPARTMENT OF UNEMPOLEMENT ASSISTANCE To Massachusetts workers:How to Apply for unemployment insurance Benefits To Massachusetts Employers:Under the state’s Employment and Training Law, you are required to give a copy of this pamphlet to each of your employees who is separated from work, permanently or temporarily. Please complete the information below:Analogic Corporation Employer Name 60075390 DUA Employer Account Number (EAN)04-2454372 Federal Employer ID Number (optional) 8 Centennial Drive, Peabody, MA 01960Address (to which DUA should mail request for separation and information)

What is Unemployment Insurance? Unemployment Insurance (UI) is a temporary income protection program for workers who have lost their jobs through no fault of their own, but are able to work, available for work, and looking for work. Funding for UI benefits comes from quarterly contributions paid by the state’s employers to the Department of Unemployment Assistance (DUA); no deductions are made from employees’ pay. When should you apply for UI benefits? If you have been separated from work, or your work schedule has been reduced, you should apply for UI benefits during your first week of total or partial unemployment. Your claim will begin on the Sunday of the calendar week in which your claim is filed. This date is known as your effective claim date. Waiting more than a full week to request benefits will delay the beginning of your claim and benefits may not be paid for the week(s) of unemployment that occurred prior to the week of filing. How to apply for UI benefits: We are committed to providing you with prompt and courteous service. Our goal is to ensure that you can apply for benefits quickly and efficiently. Simply follow these steps: Be ready with the following information: Social Security Number Date of birth (month, day, year) Home address, telephone number, and email address (if available) Whether you have filed a UI claim in Massachusetts, or in any other state during the past 12 months The names and addresses of all employers you have worked for during the past 15 months, and the dates you worked for each employer. If you are reopening a claim, be prepared to provide the same information for any employment you have had since your claim was last active. Your Military discharge papers-form DD-214, member 4 (if you were separated from Military service with any branch of the U.S. armed forces within the past 18 months)If you were employed by the federal government within the past 18 months, the SF-8 and/or SF-50 form given to you by your government employer at the time of your separation The reason why you are no longer working or why your hours have been reduced Last day of employment The names, dates of birth, and Social Security Numbers of any dependent children that you plan to claim as a dependent Alien registration number or verification that you were legally eligible to work in the United States, and that you are currently eligible to begin a new job Select the method that is most convenient for you: There are two ways you can apply for benefits. Apply using UI Online: UI Online is a safe, secure, easy-to-use, self-service system. If you choose to use UI Online, you will complete the information online and submit your application using a computer with internet access. If you do not have access to a computer, visit your local library or One-Stop Career Center to use free, publicly-available computers. To apply using UI Online (5:00 a.m. to 10:00 p.m. daily): 1. Go to www.mass.gov/dua and select UI Online for Calmants (Illeligible). 2. Then select Apply for Benefits. When you apply for benefits using UI Online for the first time, you will be asked to enter your Social Security Number (SSN), create a password, and select a security question and answer. It is important for you to remember your password and security question and answer. You will use your SSN and password to access UI Online each week to request your benefit payment. If you forget your password, you can reset it by clicking Forgot Password, answering the security question, and selecting a new password. 3. Complete all information requested. You will receive a confirmation message after you submit your application. If your application is interrupted, you can go back and complete it before 10:00 p.m. on Saturday of the same week. Tip: Be sure to provide your telephone number and email address – it will make it easier for us to contact you if there are questions about your application. Apply by phone using the TeleClaim Center: To apply for benefits by phone (8.30 a.m. to 4:30 p.m. Monday through Friday): 1. Call the TeleClaim Center toll-free at 877-626-6800:from area codes 351, 413, 508, 774, and 978; or 617-626-6800 from any other area code. 2. Select English or another language. 3. Press 1-to apply for benefits. Enter your SSN and the year you were born. You will then be connected to an agent who will take the information necessary to file your claim. Note: During peak periods from Monday through Thursday, call scheduling may be implemented providing priority for callers based on the last digit of their Social Security number. This helps ensure that everyone can get through to the TeleClaim Center in a timely manner. Please check the schedule below before calling: If the last digit of your SSN is: Assigned day to call TeleClaim is: 0,1 Monday 2,3 Tuesday 4, 5, 6 Wednesday 7, 8, 9 Thursday Any last digit Friday How to create or change your Personal Identification Number (PIN) For TeleCert: When you apply for benefits by telephone for the first time, you will be asked to create your PIN. If you have previously created your PIN, call the PIN Service Line at 617-626-6943. The PIN Service Line is available seven days a week from 5 a.m. to 10 p.m. You will need a touch-tone phone to use the PIN Service Line. Note: Please be aware that smart phones with QWERTY keyboard sometimes do not work when answering the security question. Instead, use a cellular phone or land line.

Exhibit C Proprietary Information and Invention Assignment Agreement Proprietary Information and Inventions Agreement I recognize that ANALOGIC CORPORATION, a publicly held corporation, hereinafter called “the Corporation,” is engaged in the manufacture of electronic instrumentation. I understand that: As part of my job with the Corporation I am expected to make new contributions and inventions of value to the Corporation; and My employment creates a relationship of confidence and trust between me and the Corporation with respect to any information of a confidential or secret nature: applicable to the business of the Corporation and its subsidiaries [if any], and applicable to the business of any client of the Corporation, which may be made known to me by the Corporation or its subsidiaries (if any) or by any client of the Corporation or learned by me during the period of my employment (all such information being hereinafter called “Proprietary Information”). By way of illustration, but not limitation, Proprietary Information includes trade secrets, processes, formulas, data, know-how, improvements, inventions, techniques and customer lists. In consideration of my employment or continued employment, as the case may be, and the compensation received from time to time, I hereby agree as follows: At all times, both during my employment and after its termination, I will keep in confidence and trust all such Proprietary Information and I will not use such Proprietary Information other than in the course of my work for the Corporation nor disclose any of such Proprietary information or anything relating to it without written consent of the Corporation. In the event of the termination of my employment by me or by the Corporation for any reason, I will deliver to the Corporation all documents and data of any nature pertaining to my work and I shall not take with me any documents or data of any description or any reproduction of any description containing or pertaining to any Proprietary Information. HR042 Rev Apr 2012

Proprietary information and Inventions Agreement Page 2 3. I will promptly disclose to the Corporation, or any persons designated byIt, all improvements, inventions, formulas, processes, techniques, know-how and data, whether or not patentable, made or conceived or first reduced to practice or learned byme, either alone or jointly with others, during the period of my employment, whether or not in the course of my employment.4. I agree that all said improvements, inventions, formulas, processes, techniques, know-how and data which are related to or useful in the business of the Corporation or its subsidiaries (if any) or of any client of the Corporation, or result from tasks assigned to me by the Corporation (hereinafter collectively called “Inventions”), shall be the sole property of the Corporation and its assigns or of its client, and the Corporation and its assigns or its client shall be the sole owner of all patents and other rights in connection therewith; provided, however, that this sentence shall not apply to improvements, inventions, formulas, processes, techniques, know-how and data which are related to or useful in the business of clients of the Corporation if the same are not related to, or useful in the performance of, contracts between the Corporation and its clients. I further agree as to all such Inventions to assist the Corporation in every proper way (but at Company’s expense) to obtain and from time to time enforce patents on said Inventions in any and all countries, and to that end I will execute all documents for use in applying for and obtaining such patents thereon and enforcing same, as Corporation may desire, together with any assignments thereof to Corporation or persons designated by it and I will give testimony, both by deposition and in person in court or before any other tribunal, in any proceeding relating to the granting of a patent application, proceedings relating to the enforcement of a patent, and proceedings relating to the protection of the rights of the Corporation or persons designated by it in Proprietary Information. My obligation to assist the Corporation in obtaining and enforcing patents for such Inventions in any and all countries and in otherwise protecting rights in Proprietary information as herein provided, shall continue beyond the termination of my employment but the Corporation shall compensate me at a reasonable rate after such termination for time actually spent by me at the Corporation’s request on such assistance and shall also reimburse me for all out-of-pocket expenses incurred by me in connection with the performance of such obligation. 5. As a matter of record I attach hereto a complete list of inventions or improvements which have been made or conceived or first reduced to practice by me alone or jointly with others prior to my employment, which I desire to remove from the operation of this Agreement; and I covenant that such list is complete. If no such list is attached to this Agreement, I represent that I do not have such inventions and improvements at the time of signing this Agreement.6. I represent that my performance of all the terms of this Agreement and as an employee of the Corporation does not and will not breach any agreement to keep in confidence proprietary information acquired by me in confidence or in trust prior to my employment with the Corporation and I agree not to enter into any agreements either written or oral in conflict herewith.16

Proprietary Information and Inventions Agreement Page 337. This Agreement shall be effective as of the first day of my employment by the Corporation; namely: 8. This Agreement shall be binding upon me, my heirs, executors, assigns, and administrators and shall inure to the benefit of the Corporation, its successors and assigns. Name: Signature: (print) Mark T Frost /s/ Mark T Frost 1/26/63 12/2/15 Date of Birth: Date: Deborah Marino 12/2/2015 Witness Name: Date: (print)

EXHIBIT D

Affirmation of Release

I hereby reaffirm in its entirety the provisions of the Separation Agreement with Analogic Corporation dated July 17, 2017 signed by me including, without limitation, the release of claims contained in Section 7 of that Separation Agreement.

|

|

| MARK FROST |

| DATE: | ||

18