Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-6715

Analogic Corporation

(Exact name of registrant as specified in its charter)

| Massachusetts | 04-2454372 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 8 Centennial Drive, Peabody, Massachusetts | 01960 | |

| (Address of principal executive offices) | (Zip Code) | |

(978) 326-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $.05 par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file report pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer þ | |||||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant at January 31, 2010 was approximately $515,577,000. As of September 15, 2010, there were 12,882,910 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s definitive proxy statement, which will be issued in connection with the 2011 Annual Meeting of Stockholders, are incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

Table of Contents

| Item 1. | Business |

Throughout this Annual Report on Form 10-K, unless the context states otherwise, the words “we,” “us,” “our” and “Analogic” refer to Analogic Corporation and all of its subsidiaries taken as a whole, and “our board of directors” refers to the board of directors of Analogic Corporation. All dollar amounts in this Item 1 are in thousands.

Available Information

Our website address is www.analogic.com. The information on our website is not incorporated by reference into this document and should not be considered to be a part of this document. Our website address is included in this document as an inactive textual reference only.

We make available free of charge through our website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to the reports as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”).

Description of Business

Analogic is a high technology company that designs and manufactures advanced medical imaging and security systems and subsystems sold to Original Equipment Manufacturers (“OEMs”) and end users primarily in the healthcare and airport security markets. We were incorporated in the Commonwealth of Massachusetts in November 1967 and are recognized worldwide for advancing state-of-the-art technology in the areas of medical Computed Tomography (“CT”), Magnetic Resonance Imaging (“MRI”), Digital Mammography, Specialized Ultrasound, and Automatic Explosives Detection Systems (“EDS”) for airport security.

Our OEM customers incorporate our technology into systems they in turn sell for various medical and security applications. We also sell our ultrasound products directly into specialized clinical end-user markets through our direct worldwide sales force under the brand name B-K Medical (“B-K Medical”).

We operate primarily within two major markets: Medical Technology and Security Technology. Our Medical Technology business consists of three reporting segments:

| • | CT and MRI, which primarily includes electronic systems and subsystems for CT and MRI medical imaging equipment; |

| • | Specialized Ultrasound, which designs, manufactures, and distributes ultrasound systems and probes in the urology, ultrasound-guided surgery, anesthesia and general radiology markets; and |

| • | Digital Radiography, which consists primarily of state-of-the-art, direct conversion amorphous selenium-based, digital, flat-panel, x-ray detectors for diagnostic and interventional applications in mammography. |

Our Security Technology business consists of advanced explosives and weapons detection systems for aviation security.

2

Table of Contents

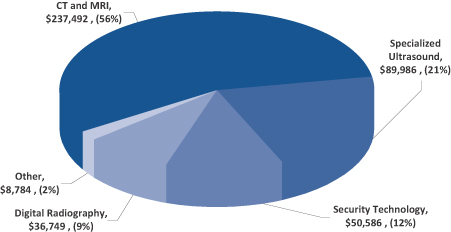

See Note 17 to the Notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for financial information regarding our segments. The following chart shows net revenue by segment for the fiscal year ended July 31, 2010 (“fiscal year 2010”):

CT and MRI

Our CT and MRI business, which accounted for approximately 56% of our net revenue in fiscal year 2010, consists primarily of electronic systems and subsystems for medical imaging, sold globally to OEM producers of CT, MRI, and Ultrasound equipment.

We are an industry leader in the development and sale of CT x-ray detectors, data acquisition systems (“DAS”), data management systems (“DMS”) and integrated gantries that become part of OEM CT imaging systems around the world. Our detection and DAS subsystems convert x-ray energy to useful digital signals for the generation of anatomical images for medical diagnostics and disease treatment. The detector, DAS and DMS products we sell range from low slice count sub-systems to the most advanced multi-slice (>256 slices) systems enabling advanced diagnostics such as cardiac imaging. Our CT products are designed to allow our customers to remain at the forefront of this rapidly advancing field. Leveraging our experience in integrating CT components and technology, we have also developed higher-level integrated systems for the radiotherapy market primarily used for image guided radiation treatment of cancerous tumors.

For OEM producers of MRI equipment, we supply MRI power products that include Radio Frequency (“RF”) and gradient amplifiers. These amplifiers are key components in MRI systems and provide power to the magnetic coils. We have developed a wide range of amplifier solutions for our customers ranging from low-magnetic-field systems (< 0.3 Tesla) to ultra high-field systems (> 7.0 Tesla) designed for academic research hospitals.

We also design and manufacture precision motion control systems, which we supply to OEM customers for use in computer-controlled automation systems primarily in the semiconductor and medical markets.

Specialized Ultrasound

Our Specialized Ultrasound business, which designs and manufactures ultrasound systems and probes for specialized end-user markets in urology, surgery, anesthesia as well as radiology, accounted for approximately 21% of our net revenue in fiscal year 2010. Our ultrasound scanners use acoustic waves to generate real-time images of the internal anatomy that are used for medical diagnostic and interventional procedures. These ultrasound systems are also used for guiding surgical procedures and for guiding prostate cancer treatment employing a procedure called brachytherapy.

3

Table of Contents

In fiscal year 2009, we introduced a new family of ultrasound scanners called the Flex Focus, under the brand name B-K Medical, and in fiscal year 2010 introduced the Flex Focus 400 Anesthesia, particularly suited for guiding the placement of nerve blocks prior to surgical procedures. The Flex Focus system has a unique award winning design in a small footprint that can be easily moved from room to room in a hospital. With its large 19” screen and high resolution imaging engine, the Flex Focus provides a unique solution in the mobile ultrasound market. This system is a portable unit that can be used for multiple applications in a variety of settings. Our B-K Medical business operates primarily on a direct sales basis in Europe and the U.S, and with a network of independent distributors worldwide.

Digital Radiography

Our Digital Radiography products accounted for approximately 9% of our net revenue in fiscal year 2010. Digital Radiography products consist primarily of digital mammography Selenium based x-ray detectors manufactured and sold through our ANRAD Corporation (“Anrad”) subsidiary, which sells directly to OEM customers for diagnostic and interventional applications in mammography. These x-ray detector plates are used by OEMs in mammography systems to convert x-ray signals into high resolution 2-D as well as 3-D images of the breast tissues to aid in the diagnosis of breast cancer. Currently, the detectors plates for mammography applications are sold to medical OEMs for use in products sold outside of the U.S. Our largest customer in this business is currently awaiting U.S Food and Drug Administration (“FDA”) approval for its products to be sold in the U.S.

Security Technology

Our Security Technology business, which provides advanced explosives and weapons detection systems for aviation security, accounted for approximately 12% of our net revenue in fiscal year 2010. Utilizing our medical CT technology, we design and manufacture EDS for airport security for both checked bag and checkpoint applications. These systems generate data for three-dimensional images of objects contained within a piece of baggage. The EDS for checked baggage is marketed by L-3 Communications Corporation (“L-3”) under the eXaminer product family name. In 2010, we signed an agreement with Smiths Detection (“Smiths”), based in London, England, to develop advanced imaging subsystems for use in a next-generation explosives detection system to be manufactured and marketed by Smiths. The agreement provides for Smiths Detection to fund the engineering development over a period of approximately two years.

The eXaminer product family is sold to the U.S. Federal Government for installation at major U.S. airports to scan checked baggage and to international airport security authorities for installation at airports in Europe, Asia, and Central America.

Other

Other, which consists primarily of our hotel business and general corporate income and expenses, accounted for approximately 2% of our net revenue in fiscal year 2010. We own a hotel, managed for us under a contract with Marriott Corporation, which is located on approximately 7.5 acres of land adjacent to our principal executive offices and manufacturing facility in Peabody, Massachusetts. The facility is strategically situated in an industrial park and is in close proximity to the historic and tourist area of Boston’s North Shore, approximately 18 miles from Boston. It has 256 guest rooms, a ballroom, several function rooms, and recreational facilities.

Competition

We are subject to competition based upon product design, performance, pricing, quality, and service. We believe that our innovative engineering and product reliability have been important factors in our historical growth. While we try to maintain competitive pricing on those products that are directly comparable to products manufactured by others, in many instances, our products conform to more exacting specifications and carry a higher price than analogous products manufactured by others.

4

Table of Contents

Our CT and MRI systems are customized for the needs of our customers. We consider selection by our OEM customers for the design and manufacture of these products and our other medical products to be due more to the “make-or-buy” decision of the individual OEM customers rather than a function of other competitors in the field. Many OEM customers and potential OEM customers of ours have the capacity to design and manufacture these products for themselves. In our area of expertise, the continued signing of new contracts indicates strength in our relationships with our major customers.

Our primary competitors in the security market for CT-level explosives detection are dominated by divisions of a small number of large companies, our customer, L-3, Safran Morpho (formerly GE’s security business), and Science Applications International Corp., which acquired Reveal Imaging Technologies in August 2010.

Our Specialized Ultrasound business participates in niche markets primarily focused in urology and image guided surgery. We compete in these specialized markets based on image quality, ease of use, mobility, reliability and flexibility with a variety of ultrasound probes. Our competitors are primarily smaller companies focused in these niche areas and small business units of larger medical device companies.

Marketing and Distribution

Our CT and MRI, Digital Radiography, and Security Technology businesses, which currently only sell to OEM customers, sell products domestically and abroad directly primarily through our headquarters in the United States. Products are sold through our subsidiaries in Europe, Canada, and the United States, and on occasion through a network of our independent sales representatives and distributors located around the world.

B-K Medical distributes its products to end users globally both through a direct sales force and through independent distributors. B-K Medical’s subsidiaries, which accounted for 78% of the B-K Medical revenues in fiscal year 2010 generated from product sales, service and application support, are present in the main markets including United States, Germany, Benelux, United Kingdom, Italy, and Scandinavia. B-K Medical’s remaining revenue is generated through a network of non-exclusive, specialized independent distributors in more than 50 other countries.

Seasonal Aspect of Business

There are no material seasonal elements to our business, although plant closings in the summer, particularly in Europe, tend to decrease the procurement activities of certain customers during the first quarter of our fiscal year. In addition, many of our Medical Technology customers tend to purchase more products during the last two months of the calendar year, which falls within the second quarter of our fiscal year.

Material Customers

We had three customers, as set forth in the table below, who accounted for 10% or more of our net product and engineering revenue during fiscal year 2010, the fiscal year ended July 31, 2009 (“fiscal year 2009”), or the fiscal year ended July 31, 2008 (“fiscal year 2008”).

| Year Ended July 31, | |||||||||

| 2010 | 2009 | 2008 | |||||||

| Koninklijke Philips Electronics N.V. (“Philips”) |

15 | % | 15 | % | * | ||||

| Toshiba Corporation (“Toshiba”) |

12 | % | 14 | % | 17 | % | |||

| L-3 Communications Corporation (“L-3”) |

* | 11 | % | 11 | % | ||||

Note (*): Total net product and engineering revenue was less than 10% in this fiscal year.

5

Table of Contents

Philips’s product and engineering revenue are in the CT and MRI segment, Toshiba’s product and engineering revenue are in the CT and MRI and Digital Radiography segments, and L-3’s product and engineering revenue are in the Security Technology segment.

Our ten largest customers as a group accounted for 66%, 67%, and 67% of our net product and engineering revenue for fiscal years 2010, 2009, and 2008, respectively. Loss of any one of these customers would have a material adverse effect on our business. Philips accounted for 16% and 12%, respectively, of net accounts receivable at July 31, 2010 and 2009, respectively, and L-3 accounted for 13% of net accounts receivable at July 31, 2010 and 2009.

Backlog

Our OEM business involves large customers whose placement of large orders can vary based on timing. Our backlog, which consists of cancellable and non-cancellable orders that are expected to ship primarily within the next 12 months, was $119,105 at July 31, 2010 as compared to $78,434 at July 31, 2009. The increase in backlog of $40,671 was due primarily to increased backlog of $21,995 and $7,824 in CT and MRI and Security Technology. The increase in demand for CT and MRI was due primarily to the improving economy. Also contributing to the increase in CT and MRI was the transition to maintain consignment inventories for some of our OEM customers during fiscal year 2009 that reduced backlog at July 31, 2009. The increase in backlog for Security Technology was due primarily to an engineering project that began in December 2009 for an OEM customer.

Government Contracts

We do a significant amount of business with agencies of the Federal Government, either directly or as a subcontractor. Our contracts with government agencies, and the government contracts of other parties under which we serve as a subcontractor, are subject to termination at the election of the government agency. While none of our government contracts or subcontracts provide for renegotiation of profits at the election of the Government, it is possible that the government agency could request, and that we could under certain circumstances agree to, the renegotiation of the payments provided for under such contracts. However, we have not in the past renegotiated significant payment terms under our government contracts or subcontracts.

Sources of Raw Materials and Components

In general, our products are composed of internally-designed electronic and mechanical elements, including proprietary integrated circuits, printed circuit boards, detectors, power supplies, and displays manufactured by us and others in accordance with our specifications. We believe that items procured from third-party suppliers are available from more than one source. However, it might become necessary, if a given component ceases to be available, for us to modify a product design to adapt to a substitute component, or to purchase new tooling to enable a new supplier to manufacture the component, either of which could result in additional expense and/or delay in product sales. Also, from time to time the availability of certain electronic components has been disrupted. Accordingly, we carry a safety stock of raw materials and components in an effort to ensure our ability to make timely delivery to our customers.

In fiscal year 2010, there were capacity constraints in the components industry that were driven by the economic downturn. As economic conditions improved, the subsequent demand increase caused material shortages that added expediting costs. This impacted manufacturing efficiencies when meeting customer demand. As the market stabilizes, we may see improvement in the component market, but this is as yet unseen.

Patents and Licenses

We hold patents of varying duration issued in the United States, which cover technologies that we have developed. In many instances, we hold corresponding foreign patents. We regularly file U.S. patent applications

6

Table of Contents

and, where appropriate, foreign patent applications. We also file continuations to cover both new and improved methods, apparatus, processes, designs, and products.

We also rely on a combination of trade secret, copyright, and trademark laws, as well as contractual agreements to safeguard our proprietary rights in technology and products. In seeking to limit access to sensitive information to the greatest practical extent, we routinely enter into confidentiality and assignment of invention agreements with each of our employees, and confidentiality agreements with our key customers and vendors.

We believe that any legal protection afforded by patent and copyright laws is of secondary importance as a factor in our ability to compete. Future prospects are more a function of the continuing level of excellence and creativity of our engineers in developing products that satisfy customer needs, and the marketing skills and managerial competence of our personnel in selling those products. Moreover, we believe that market positioning and rapid market entry are important to the success of our products. Management is of the opinion that the loss of patent protection would not have a material effect on our competitive position.

Research and Product Development

Research and product development (“R&D”) is a significant element of our business. We maintain a constant and comprehensive R&D program directed toward the creation of new products, the improvement and refinement of our present products, and the expansion of their applications. Certain R&D projects are funded by our OEM customers and such funding is generally treated as engineering revenue, with the associated costs classified as engineering cost of sales. The cost of internally-funded R&D efforts are included within operating expenses.

The cost of internally-funded R&D, included in operating expenses, amounted to $49,150 in fiscal year 2010, $45,276 in fiscal year 2009, and $48,947 in fiscal year 2008. The cost of customer-funded R&D, which is classified as engineering cost of sales, amounted to $18,566 in fiscal year 2010, $21,398 in fiscal year 2009, and $14,480 in fiscal year 2008.

We capitalized $461 and $1,672 in fiscal year 2010 and fiscal year 2009, respectively, of computer software testing and coding costs incurred after technological feasibility was established. These costs are amortized into product cost of sales using a straight-line method over the estimated economic life of the related products, generally three years.

Environment

Our manufacturing facilities are subject to numerous environmental laws and regulations, particularly with respect to industrial waste and emissions. Compliance with these laws and regulations has not had a material impact on our capital expenditures, earnings, or competitive position.

Employees

As of July 31, 2010, we employed approximately 1,400 employees.

Financial Information about Foreign and Domestic Operations and Export Revenue

Our domestic and foreign revenues were $327,598, or 77% of total revenues, and $95,999, or 23% of total revenues, respectively, in fiscal year 2010 as compared to $309,885, or 78%, and $86,264, or 22%, respectively, in fiscal year 2009, and $327,181, or 79%, and $86,328, or 21%, respectively, in fiscal year 2008.

7

Table of Contents

| Item 1A. | Risk Factors |

This Annual Report on Form 10-K contains statements, which, to the extent that they are not a recitation of historical facts, constitute “forward-looking statements” pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that all forward-looking statements, including without limitation, statements about product development, market and industry trends, strategic initiatives, regulatory approvals, sales, profits, expenses, price trends, research and development expenses and trends, and capital expenditures, involve risk and uncertainties, and actual events and results may differ significantly from those indicated in any forward-looking statement as a result of a number of important factors, including those discussed below and elsewhere in this Form 10-K. In some cases these forward-looking statements can be identified by the use of words such as “may,” “will,” “could,” “should,” “would,” “expect,” “project,” “predict,” “potential” or the negative of these words or comparable words.

You should carefully consider the risks described below before making an investment decision with respect to our common stock. Additional risks not presently known to us, or that we currently deem immaterial, may also impair our business. Any of these could have a material and negative effect on our business, financial condition, or results of operations.

Because a significant portion of our revenue currently comes from a small number of customers, any decrease in revenue from these customers could harm our operating results.

We depend on a small number of customers for a large portion of our business, and changes in our customers’ orders could have a significant impact on our operating results. If a major customer significantly reduces the amount of business it does with us, there would be an adverse impact on our operating results.

We had three customers, as set forth in the table below, who accounted for 10% or more of our net product and engineering revenue during fiscal years 2010, 2009, or 2008.

| Year Ended July 31, | |||||||||

| 2010 | 2009 | 2008 | |||||||

| Philips |

15 | % | 15 | % | * | ||||

| Toshiba |

12 | % | 14 | % | 17 | % | |||

| L-3 |

* | 11 | % | 11 | % | ||||

Note (*): Total net product and engineering revenue was less than 10% in this fiscal year.

Our ten largest customers as a group accounted for 66%, 67%, and 67% of our net product and engineering revenue for fiscal years 2010, 2009, and 2008, respectively. Philips accounted for 16% and 12%, respectively, of net accounts receivable at July 31, 2010 and 2009, respectively, and L-3 accounted for 13% of net accounts receivable at July 31, 2010 and 2009.

Although we seek to broaden our customer base, we will continue to depend on sales to a relatively small number of major customers. Because it often takes significant time to replace lost business, it is likely that our operating results would be adversely affected if one or more of our major customers were to cancel, delay, or reduce significant orders in the future. Our customer agreements typically permit the customer to discontinue future purchases after timely notice.

In addition, we generate significant accounts receivable in connection with the products we sell and the services we provide to our major customers. Although our major customers are large corporations, if one or more of our customers were to become insolvent or otherwise be unable to pay for our products and services, our operating results and financial condition could be adversely affected.

8

Table of Contents

Competition from existing or new companies in the medical and security imaging technology industry could cause us to experience downward pressure on prices, fewer customer orders, reduced margins, the inability to take advantage of new business opportunities, and the loss of market share.

We operate in a highly competitive industry. We are subject to competition based on product design, performance, pricing, quality, and service offerings, and we believe our innovative engineering and product reliability have been important factors in our historical growth. While we try to maintain competitive pricing on those products which are directly comparable to products manufactured by others, in many instances our products conform to more exacting specifications and may carry a higher price than analogous products manufactured by others.

Our competitors include divisions of larger, more diversified organizations as well as specialized companies. Some of them have greater resources and larger staffs than we have. Many of our existing and potential OEM customers have the ability to design and manufacture internally the products that we manufacture for them. We face competition from the research and product development groups and manufacturing operations of our existing and potential customers, who continually compare the benefits of internal research, product development, and manufacturing with the costs and benefits of outsourcing.

We depend on our suppliers, some of which are the sole-source for certain components, and our production could be substantially curtailed if these suppliers were not able to meet our demands and alternative sources were not available.

We order raw materials and components to complete our customers’ orders, and some of these raw materials and components are ordered from sole-source suppliers. Although we work with our customers and suppliers to minimize the impact of shortages in raw materials and components, we sometimes experience short-term adverse effects due to price fluctuations and delayed shipments. In the past, there have been industry-wide shortages of electronics components. If a significant shortage of raw materials or components were to occur, we might have to delay shipments or pay premium pricing, which could adversely affect our operating results. In some cases, supply shortages of particular components could substantially curtail our production of products using these components. We are not always able to pass on price increases to our customers. Accordingly, some raw material and component price increases could adversely affect our operating results. We also depend on a small number of suppliers to provide many of the other raw materials and components that we use in our business. Some of these suppliers are affiliated with customers or competitors, and others are small companies. If we were unable to continue to purchase these raw materials and components from our suppliers, our operating results could be adversely affected. Because many of our costs are fixed, our margins depend on the volume of output at our facilities, and a reduction in volume could adversely affect our margins.

We rely on successful performance by and relationships with subcontractors. This reliance could have a material adverse effect on our results of operations and financial condition.

We have formed arrangements with subcontractors for various services and components. We have formed these arrangements because it is commercially more efficient to outsource these services and purchase these components than it would be for us to perform or manufacture these services and components, which in some cases require, among other things, a high degree of technical skill and advanced equipment that is not practical or cost-effective for us to develop or acquire. As a result, if one of our subcontractors were to experience quality problems, capacity constraints, decreased yields, or delivery delays, or were to raise prices significantly, we could face product liability claims, product shortages, decreased revenues or lost customers, which could adversely affect our operating results.

If we were to be left with excess inventory, our operating results could be adversely affected.

Because of long lead times and specialized product designs, in certain cases we purchase components and manufacture products in anticipation of customer orders based on customer forecasts. For a variety of reasons,

9

Table of Contents

such as decreased end-user demand for our products, our customers might not purchase all the products that we have manufactured or for which we have purchased components. In either event, we would attempt to recoup material and manufacturing costs by means such as returning components to our vendors, disposing of excess inventory through other channels, or requiring our OEM customers to purchase or otherwise compensate us for such excess inventory. Some of our significant customer agreements do not give us the ability to require our OEM customers to do this. To the extent that we were unsuccessful in recouping our material and manufacturing costs, our net sales and operating results could be adversely affected. Moreover, carrying excess inventory would reduce the working capital we have available to continue to operate and grow our business.

Uncertainties and adverse trends affecting our industry or any of our major customers could adversely affect our operating results.

Our business operates primarily within two major markets within the electronics industry, Medical Technology and Security Technology. These markets are subject to rapid technological change and pricing and margin pressure and have historically been cyclical and subject to significant downturns characterized by diminished product demand, rapid declines in average selling prices, and production over-capacity. In addition, changes in government policy relating to reimbursement for the purchase or use of medical and security-related capital equipment could also affect our sales. Our customers’ markets are also subject to economic cycles and are likely to experience recessionary periods in the future. The economic conditions affecting our industry in general, or any of our major customers in particular, might adversely affect our operating results. Our other businesses are subject to the same or greater technological and cyclical pressures.

In Security Technology, our OEM customers’ purchasing dynamics are generally affected by the level of government funding, the expansion of airport terminals and the fluctuations in airline passenger volume.

Our customers’ delay in obtaining or inability to obtain any necessary United States or foreign regulatory clearances or approvals for their products could have a material adverse effect on our business.

Our products are used by a number of our customers in the production of medical devices that are subject to a high level of regulatory oversight. A delay in obtaining or inability to obtain any necessary United States or foreign regulatory clearances or approvals for products could have a material adverse effect on our business. The process of obtaining clearances and approvals can be costly and time-consuming. There is a further risk that any approvals or clearances, once obtained, might be withdrawn or modified. Medical devices cannot be marketed in the United States without clearance from the FDA. Medical devices sold in the United States must also be manufactured in compliance with FDA rules and regulations, which regulate the design, manufacturing, packing, storage, and installation of medical devices. Moreover, medical devices are required to comply with FDA regulations relating to investigational research and labeling. States may also regulate the manufacturing, sale, and use of medical devices. Medical devices are also subject to approval and regulation by foreign regulatory and safety agencies.

Our business strategy involves the pursuit of acquisitions or business combinations, which, if consummated, could be difficult to integrate, disrupt our business, dilute stockholder value, or divert management attention.

As part of our business strategy, we might seek attractive acquisitions and other business combinations. Acquisitions are typically accompanied by a number of risks, including the difficulty of integrating the operations and personnel of the acquired companies, the potential disruption of our ongoing business and distraction of management, expenses related to the acquisition, and potential unknown or underestimated liabilities associated with acquired businesses. If we do not successfully complete acquisitions that we pursue in the future, we could incur substantial expenses and devote significant management time and resources without generating any benefit to us. In addition, substantial portions of our available cash might be utilized as consideration for these acquisitions.

10

Table of Contents

Our annual and quarterly operating results are subject to fluctuations, which could affect the market price of our common stock.

Our annual and quarterly results could vary significantly depending on various factors, many of which are beyond our control, and may not meet the expectations of securities analysts or investors. If this occurs, the price of our common stock could decline. These factors include:

| • | variations in the timing and volume of customer orders relative to our manufacturing capacity; |

| • | introduction and market acceptance of our customers’ new products; |

| • | changes in demand for our customers’ existing products; |

| • | the timing of our expenditures in anticipation of future orders; |

| • | effectiveness in managing our manufacturing processes; |

| • | changes in competitive and economic conditions generally or in our customers’ markets; |

| • | changes in the cost or availability of components or skilled labor; |

| • | changes in our effective tax rate; |

| • | fluctuations in manufacturing yields; |

| • | foreign currency exposure; and |

| • | investor and analyst perceptions of events affecting us, our competitors, and/or our industry. |

A delay in anticipated sales could result in the deferral of the associated revenue beyond the end of a particular quarter, which would have a significant effect on our operating results for that quarter. In addition, most of our operating expenses do not vary directly with net revenue and are difficult to adjust in the short term. As a result, if revenue for a particular quarter was below our expectations, we could not proportionately reduce operating expenses for that quarter. Hence, the revenue shortfall could have a disproportionate adverse effect on our operating results for that quarter.

Loss of any of our key personnel could hurt our business because of their industry experience and their technological expertise.

We operate in a highly competitive industry and depend on the services of our key senior executives and our technological experts. The loss of the services of one or several of our key employees or an inability to attract, train, and retain qualified and skilled employees, specifically engineering and operations personnel, could result in the loss of customers or otherwise inhibit our ability to operate and grow our business successfully.

If we are unable to maintain our expertise in research and product development, manufacturing processes, and marketing new products, we might not be able to compete successfully.

We believe that our future success depends upon our ability to provide research and product development, provide manufacturing services that meet the changing needs of our customers, and market new products. This requires that we successfully anticipate and respond to technological changes in design and manufacturing processes in a cost-effective and timely manner. As a result, we continually evaluate the advantages and feasibility of new product designs and manufacturing processes. We may not be able to develop and introduce new and improved products in a timely or efficient manner, and new and improved products, if developed, may not achieve market acceptance.

Major terrorist attacks and threats have increased financial expectations that may not materialize.

Major terrorist attacks and threats have created increased interest in our security and inspection systems. However, the level of demand for our products is not predictable and may vary over time. We do not know what solutions will continue to be adopted by the U.S. Department of Homeland Security as a result of terrorism and

11

Table of Contents

whether our products will continue to be a part of the solutions. Additionally, should our products be considered as a part of the future security solution, it is unclear what the level of purchases may be and how quickly funding to purchase our products may be made available. These factors could adversely impact us and create unpredictability in our revenues and operating results.

We are exposed to risks associated with international operations and markets.

We market, manufacture, and sell products in international markets, and have established offices and subsidiaries in Europe, Canada, and China. Net revenue outside the United States accounted for 23%, 22%, and 21% of our total revenue for fiscal years 2010, 2009, and 2008, respectively. From our U.S. operations, we also ship directly to customers in Europe and Asia, for which shipments accounted for 42%, 40%, and 29% of our total net revenue for fiscal years 2010, 2009, and 2008, respectively. There are inherent risks in transacting business internationally, including:

| • | changes in applicable laws and regulatory requirements; |

| • | export and import restrictions; |

| • | export controls relating to technology; |

| • | tariffs and other trade barriers; |

| • | intellectual property laws that offer less protection for our proprietary rights; |

| • | difficulties in staffing and managing foreign operations; |

| • | longer payment cycles; |

| • | problems in collecting accounts receivable; |

| • | political instability; |

| • | fluctuations in currency exchange rates; |

| • | expatriation controls; and |

| • | potential adverse tax consequences. |

Any one or more of these factors may have a material adverse effect on our future international activities and, consequently, on our business and results of operations.

If we become subject to intellectual property infringement claims, we could incur significant expenses and could be prevented from selling specific products.

We may become subject to claims that we infringe the intellectual property rights of others in the future. We cannot ensure that, if made, these claims will not be successful. Any claim of infringement could cause us to incur substantial costs defending against the claim even if the claim is invalid, and could distract management from other business. Any judgment against us could require substantial payment in damages and could also include an injunction or other court order that could prevent us from offering certain products.

If operators of our security and inspection systems fail to detect weapons, explosives or other devices that are used to commit a terrorist act, we could be exposed to product liability and related claims for which we may not have adequate insurance coverage.

Our business exposes us to potential product liability risks that are inherent in the development, manufacturing, sale and service of security inspection systems. Our customers use our security and inspection systems to help them detect items that could be used in performing terrorist acts or other crimes. The training, reliability and competence of the customer’s operators are crucial to the detection of suspicious items. In addition, our security and inspection systems are not designed to work under all circumstances. We test the reliability of our security and inspection systems during both their development and manufacturing phases. We

12

Table of Contents

also perform such tests if we are requested to perform installation, warranty or post-warranty servicing. However, our security inspection systems are advanced mechanical and electronic devices and therefore can malfunction.

As a result of the September 11, 2001, and 1993 World Trade Center terrorist attacks, and the potential for future attacks, product liability insurance coverage for such threats is extremely difficult and costly to obtain. It is possible, subject to the applicability of the Support Anti-terrorism by Fostering Effective Technologies Act of 2002 (the “SAFETY Act”), that if we were found liable following a major act of terrorism, our insurance might not fully cover the claims for damages.

The SAFETY Act is a Federal law enacted to provide certain legal liability protections for providers of certain anti-terrorism technologies. If applicable to claims against Analogic, the SAFETY Act could mitigate some of this risk.

Our security and inspections systems business depends in part on purchases of products and services by the U.S. Federal Government and its agencies, which purchases may be only partially funded, and are subject to potential termination and reductions and delays in government spending.

Sales of our security and inspection systems, in some cases as an indirect subcontractor or team member with prime contractors and in other cases directly to the U.S. Government and its agencies, accounted for approximately 12% of our total net revenue in each of fiscal years 2010, 2009, and 2008, respectively. Our security and inspection systems are included in many different domestic programs. Over the lifetime of a program, the award of many different individual contracts and subcontracts could impact our products’ requirements. The funding of U.S. Government programs is subject to Congressional appropriations. Although multiple-year contracts may be planned in connection with major procurements, Congress generally appropriates funds only on a single fiscal year basis. Consequently, programs are often only partially funded initially, and additional funds are committed only as Congress makes further appropriations and prime contracts receive such funding. The reduction or delay in funding or termination of a government program in which we are involved could result in a loss of or delay in receiving anticipated future revenues attributable to that program and contracts or orders received. The U.S. Government could reduce or terminate a prime contract under which we are a subcontractor or team member irrespective of the quality of our products or services. The termination of a program or delays in the reduction in or failure to commit additional funds to a program in which we are involved could negatively impact our revenue and have a material adverse effect on our financial condition and results of operations.

Changes in laws affecting the health care industry could adversely affect our business, operations and financial condition.

In recent years, the healthcare industry has undergone significant changes driven by various efforts to reduce costs, including increased levels of managed care, cuts in Medicare, consolidation of healthcare distribution companies and collective purchasing arrangements by office-based healthcare practitioners. In addition, numerous governments have undertaken efforts to control healthcare costs through legislation and regulation. In the United States, the Federal government recently passed comprehensive healthcare reform legislation. Many of the details regarding the implementation of this legislation are yet to be determined and we currently cannot predict whether or to what extent such implementation or adoption of reforms may affect our business. We anticipate that the current administration, Congress and certain state legislatures will continue to review and assess alternative healthcare delivery systems and payment methods with an objective of ultimately reducing healthcare costs and expanding access. Public debate of these issues will likely continue in the future. The implementation of health care reform and medical cost containment measures in the United States and in foreign countries in which we operate could:

| • | limit the use of our products and adversely affect the use of new therapies for which our products may be targeted ; |

| • | reduce reimbursement available to our customers for using our products; and |

13

Table of Contents

| • | decrease the price we might establish for our products and products that we may develop, which would result in lower product revenues to us. |

In addition, because we operate in a highly regulated industry, other governmental actions may adversely affect our business, operations and financial condition, including:

| • | changes in the FDA and foreign regulatory approval processes that may delay or prevent the approval of new products and result in lost market opportunity; |

| • | changes in FDA and foreign regulations that may require additional safety monitoring, labeling changes, restrictions on product distribution or use, or other measures after the introduction of our products to market, which could increase our costs of doing business, or otherwise adversely affect the market for our products; |

| • | new laws, regulations and judicial decisions affecting pricing or marketing practices; and |

| • | changes in the tax laws relating to our operations. |

| Item 1B. | Unresolved Staff Comments |

Not applicable

| Item 2. | Properties |

We own the land and building for our principal executive offices and major manufacturing facility located in Peabody, Massachusetts. This facility consists of approximately 514,000 square feet of manufacturing, engineering, and office space. We own approximately 65 acres of land at this location, which can accommodate future expansion as required. We use approximately 7.5 acres of this land for the Peabody Marriott Hotel, which is owned by one of our wholly owned subsidiaries and managed by the Marriott Corporation.

We and our subsidiaries own and lease various other office, manufacturing, engineering, and sales facilities in both the United States and abroad. We believe that our existing facilities are generally adequate to meet our current needs, and that suitable additional or substitute space will be available on commercially reasonable terms when needed.

See Notes to Consolidated Financial Statements for further information concerning certain leases.

| Item 3. | Legal Proceedings |

Not applicable

| Item 4. | Removed and Reserved |

Executive Officers of the Registrant

Our current executive officers are:

| Name |

Age | Position | Date Since Office Has Been Held | |||

| James W. Green |

52 | President and Chief Executive Officer | 2007 | |||

| Michael L. Levitz |

37 | Vice President, Chief Financial Officer, and Treasurer | 2009 | |||

| John J. Fry |

48 | Vice President, General Counsel, and Secretary | 2007 | |||

| Donald B. Melson |

58 | Vice President and Corporate Controller | 2006 |

14

Table of Contents

Our executive officers are elected annually by our Board of Directors (the “Board”) and hold office until their successors are chosen and qualified, subject to earlier removal by the Board.

There are no arrangements or understandings between any of our executive officers and any other person(s) pursuant to which such executive officer was selected as an officer.

James W. Green joined us as President and Chief Executive Officer in May 2007. Mr. Green was previously Regional Vice President, California Division, of Quest Diagnostics Incorporated, a leading provider of diagnostic testing, information, and services, from April 2005 to May 2007. Before joining Quest Diagnostics Incorporated, Mr. Green was Senior Vice President & General Manager of Computed Tomography for Philips Medical Systems, a global leader in the business of developing, manufacturing, and marketing computed tomography equipment used in medical imaging applications, from October 2001 to April 2005.

Michael L. Levitz joined us as Vice President, Chief Financial Officer, and Treasurer in July 2009. From October 2007 to July 2009, Mr. Levitz was Vice President and Controller of the Cytyc business unit of Hologic Inc., a developer, manufacturer, and supplier of premium diagnostic products, medical imaging systems, and surgical products focused on the healthcare needs of women. From April 2006 until Cytyc Corporation’s merger with Hologic Inc. in October 2007, Mr. Levitz was Vice President and Corporate Controller of Cytyc Corporation, a global leader in innovative diagnostic and medical devices focused on women’s health. Mr. Levitz was Assistant Corporate Controller of Cytyc Corporation from September 2002 to April 2006. Prior to this position, Mr. Levitz was Controller at NEON Communications, Inc. from 2001 to 2002 and Director of Financial Reporting from 2000 to 2001. From 1995 to 2000, Mr. Levitz served in various positions in the high technology audit practice of Arthur Andersen LLP, most recently as Audit Manager.

John J. Fry joined us as Vice President, General Counsel, and Secretary in November 2007. From April 2005 until joining us, Mr. Fry was a principal of the law firm, Driggs, Hogg, & Fry Co., L.P.A. (formerly Driggs, Lucas, Brubaker & Hogg Co., L.P.A.), where his practice focused primarily on technology and intellectual property law. From August 1995 to April 2005, he held various legal positions at Philips Medical Systems (formerly Marconi Medical Systems and Picker International), including Senior Corporate Counsel and Intellectual Property Manager and counsel to Philips’ computed tomography business.

Donald B. Melson joined us as Vice President and Corporate Controller in March 2006. Mr. Melson was previously Vice President and Corporate Controller of Millipore Corporation, a publicly held global manufacturer of products and services for biopharmaceutical manufacturing and life science laboratories, from 2000 to 2006. Prior to this position, Mr. Melson held a number of financial management positions in Millipore Corporation and W. R. Grace & Co. Mr. Melson began his career in the audit practice of Ernst & Young and is a certified public accountant.

15

Table of Contents

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock trades on the NASDAQ Global Select Market under the symbol: ALOG. The following table sets forth the high and low sales prices per share of our common stock, as reported by the NASDAQ Global Select Market, for each quarterly period indicated in the table below:

| Fiscal Year |

High | Low | ||||

| 2009 |

||||||

| First Quarter |

$ | 76.93 | $ | 34.57 | ||

| Second Quarter |

44.00 | 24.63 | ||||

| Third Quarter |

37.23 | 24.39 | ||||

| Fourth Quarter |

39.34 | 33.39 | ||||

| 2010 |

||||||

| First Quarter |

$ | 41.26 | $ | 33.20 | ||

| Second Quarter |

42.01 | 34.40 | ||||

| Third Quarter |

48.51 | 37.35 | ||||

| Fourth Quarter |

48.58 | 40.70 | ||||

As of August 31, 2010, there were approximately 885 holders of record of our common stock. Because many of the shares are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of individual stockholders represented by these holders of record. Our Board declared cash dividends of $0.10 per share for each of the quarters of fiscal years 2010 and 2009. Our policy is to retain sufficient earnings to provide funds for the operation and expansion of our business.

The following table contains information about our purchases of our equity securities during the three months ended July 31, 2010. All of the shares shown as purchased in the table below were surrendered by our employees in order to meet tax withholding obligations in connection with the vesting of restricted stock awards. These transactions were not part of a publicly announced program to repurchase shares of our common stock.

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share (1) |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs | |||||

| 5/1/10-5/31/10 |

786 | $ | 41.93 | — | — | ||||

| 6/1/10-6/30/10 |

— | — | — | — | |||||

| 7/1/10-7/31/10 |

1,424 | 44.56 | — | — | |||||

| Total |

2,210 | $ | 43.63 | — | — | ||||

| (1) | For purposes of determining the number of shares to be surrendered, the price per share deemed to be paid was the closing price of our common stock on the NASDAQ Global Select Market on the vesting date. |

16

Table of Contents

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information about the shares of our common stock authorized for issuance under our equity compensation plans as of July 31, 2010:

Equity Compensation Plan Information

| Plan Category |

(a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

(b) Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

(c) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) |

|||||

| Equity compensation plans approved by security holders |

320,009 | $ | 54.38 | 2,127,840 | (1) | |||

| Equity compensation plans not approved by security holders |

— | — | — | |||||

| Total |

320,009 | $ | 54.38 | 2,127,840 | (1) | |||

| (1) | Includes 446,038 shares issuable under our Employee Stock Purchase Plan in connection with current and future offering periods under that plan. |

17

Table of Contents

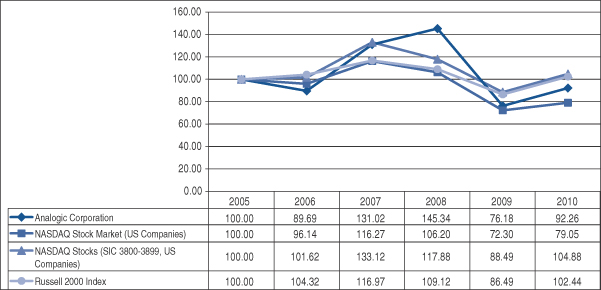

Comparison of Five-Year Cumulative Total Returns

The graph below compares the cumulative total stockholder return on our common stock with the cumulative total return of the Center for Research in Security Prices of the University of Chicago (“CRSP”) Total Return Index for the NASDAQ Stock Market (U.S. Companies) and the CRSP Total Return Index for all NASDAQ stocks with SIC Codes related to our business in the areas of measuring instruments, photo goods, medical goods, optical goods, and timepieces. The graph below also compares the cumulative total stockholder return on our common stock with the cumulative total return of the Russell 2000 Index, which we plan to use going forward instead of the NASDAQ Stock Market (US Companies). The reason for this change is because our investors predominantly use the Russell 2000 Index to benchmark their investment performance. The graph assumes $100 invested on July 31, 2005, in our common stock and $100 invested at that time in each of the NASDAQ indexes. The comparison assumes that all dividends are reinvested.

Comparison of Five-Year Cumulative Total Returns

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

18

Table of Contents

| Item 6. | Selected Financial Data |

The following selected consolidated financial data are derived from our Consolidated Financial Statements and notes thereto and should be read in connection with, and are qualified in their entirety by, our Consolidated Financial Statements and notes thereto and other financial information included elsewhere in this Annual Report on Form 10-K.

| (In thousands, except per share data) | |||||||||||||||||

| Year Ended July 31, | |||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||

| Total net revenue (A) |

$ | 423,597 | $ | 396,149 | $ | 413,509 | $ | 340,782 | $ | 351,445 | |||||||

| Total cost of sales (B) |

273,516 | 270,953 | 262,411 | 223,567 | 230,310 | ||||||||||||

| Gross margin |

150,081 | 125,196 | 151,098 | 117,215 | 121,135 | ||||||||||||

| Income (loss) from operations (B) |

20,995 | (4,185 | ) | 24,311 | 2,325 | (5,249 | ) | ||||||||||

| Income from continuing operations before discontinued operations and cumulative effect of change in accounting principle (C) |

15,555 | 3,705 | 23,486 | 15,380 | 4,600 | ||||||||||||

| Income from discontinued operations, net of tax |

— | — | — | — | 139 | ||||||||||||

| Gain on disposal of discontinued operations, net of tax (D) |

— | — | — | — | 20,207 | ||||||||||||

| Cumulative effect of change in accounting principle, net of tax |

— | — | — | — | 120 | ||||||||||||

| Net income (E) |

$ | 15,555 | $ | 3,705 | $ | 23,486 | $ | 15,380 | $ | 25,066 | |||||||

| Basic net income per share: |

|||||||||||||||||

| Income from continuing operations |

$ | 1.24 | $ | 0.29 | $ | 1.78 | $ | 1.11 | $ | 0.34 | |||||||

| Income from discontinued operations, net of tax |

— | — | — | — | 0.01 | ||||||||||||

| Gain on disposal of discontinued operations, net of tax |

— | — | — | — | 1.47 | ||||||||||||

| Cumulative effect of change in accounting principle, net of tax |

— | — | — | — | 0.01 | ||||||||||||

| Based net income per share |

$ | 1.24 | $ | 0.29 | $ | 1.78 | $ | 1.11 | $ | 1.83 | |||||||

| Diluted net income per share: |

|||||||||||||||||

| Income from continuing operations |

$ | 1.23 | $ | 0.29 | $ | 1.77 | $ | 1.10 | $ | 0.33 | |||||||

| Income from discontinued operations, net of tax |

— | — | — | — | 0.01 | ||||||||||||

| Gain on disposal of discontinued operations, net of tax |

— | — | — | — | 1.46 | ||||||||||||

| Cumulative effect of change in accounting principle, net of tax |

— | — | — | — | 0.01 | ||||||||||||

| Diluted net income per share |

$ | 1.23 | $ | 0.29 | $ | 1.77 | $ | 1.10 | $ | 1.81 | |||||||

| Cash dividends declared per common share |

$ | 0.40 | $ | 0.40 | $ | 0.40 | $ | 0.40 | $ | 0.38 | |||||||

| Weighted average shares outstanding: |

|||||||||||||||||

| Basic |

12,584 | 12,835 | 13,180 | 13,814 | 13,704 | ||||||||||||

| Diluted |

12,655 | 12,932 | 13,290 | 13,946 | 13,853 | ||||||||||||

| Cash, cash equivalents, and marketable securities |

$ | 169,254 | $ | 160,293 | $ | 186,442 | $ | 228,545 | $ | 258,237 | |||||||

| Working capital |

281,727 | 264,140 | 287,260 | 300,114 | 334,955 | ||||||||||||

| Total assets |

485,776 | 464,114 | 511,165 | 459,141 | 488,645 | ||||||||||||

| Long-term liabilities |

6,665 | 6,444 | 8,993 | 456 | 840 | ||||||||||||

| Stockholders’ equity |

409,042 | 397,519 | 428,506 | 393,357 | 431,925 | ||||||||||||

| (A) | We acquired Copley Controls Corporation (“Copley”) on April 14, 2008. The Copley business accounted for net revenue of $18,300 during fiscal year 2008. |

19

Table of Contents

| (B) | In fiscal year 2009, we recorded a $6,619 restructuring charge for the severance and personnel related costs of 201 employees that were involuntarily terminated as well as for facility exit costs, all of which were recorded in operating expenses. Also, in fiscal year 2009, we recorded $811 in general and administrative expenses for a settlement of a dispute with a customer. In fiscal year 2008, we recorded a pre-tax voluntary retirement charge of $3,419 related to a fiscal year 2008 voluntary retirement program and a pre-tax restructuring charge of $597 for severance and personnel related costs for the involuntary termination of 32 employees, all of which were recorded in operating expenses. In fiscal year 2007, we recorded $9,705 of pre-tax charges related primarily to the future use and realizability of certain inventory, software license, and capitalized software. Of the total charges, $8,625 was recorded in cost of sales and $1,080 was recorded in operating expenses. In fiscal year 2006, we recorded $14,876 of pre-tax charges related primarily to the future use and realizability of certain inventory and capitalized software. Of the total charges, $7,361 was recorded in cost of sales and $7,515 was recorded in operating expenses. |

| (C) | In fiscal year 2007, we recorded a gain on the sale of other investments on a pre-tax basis of $4,036 related to the sale of equity interests in fiscal year 2007. In fiscal year 2008, we recorded a gain on the sale of other investments on a pre-tax basis of $2,000 related to our sale of 20% of our 45% equity interest in a China based company (for a remaining interest of 25%). |

| (D) | We recorded a gain on the sale of Camtronics Medical Systems, Ltd. (“Camtronics”) as a discontinued operation in fiscal year 2006. |

| (E) | We had an income tax benefit in fiscal year 2009 of $4,915, which was due primarily to Internal Revenue Service (“IRS”) refunds of $8,143 received in fiscal year 2009. The impact of these refunds, which included $1,262 of interest, was a reduction of unrecognized tax benefits by approximately $3,280, of which $1,356 was recorded as a tax benefit in fiscal year 2009. Also contributing to the income tax benefit for fiscal year 2009 were the reversal of $920 of tax reserves due to the expiration of statutes of limitations, and $1,820 for the reversal of a valuation allowance on Belgium net operating loss carryforwards that management has determined are more likely than not to be recognized. |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion provides an analysis of our financial condition and results of operations and should be read in conjunction with the audited consolidated financial statements and notes thereto included elsewhere in this Annual Report on Form 10-K. The discussion contains statements, which, to the extent that they are not a recitation of historical facts, constitute “forward-looking statements” pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including statements about product development, market and industry trends, strategic initiatives, regulatory approvals, sales, profits, expenses, price trends, research and development expenses and trends, and capital expenditures, we make in this document or in any document incorporated by reference are forward-looking. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause our actual results, performance, or achievements to differ from the projected results. See “Risk Factors” in Item 1A for a discussion of the primary risks and uncertainties known to us at this time.

Our Management’s Discussion and Analysis is presented in six sections as follows:

| • | Business Overview |

| • | Fiscal Year 2010 Overview |

| • | Results of Operations |

| • | Liquidity and Capital Resources |

| • | Critical Accounting Policies |

| • | New Accounting Pronouncements |

We report our financial condition and results of operations on a fiscal year basis ending July 31. All dollar amounts in this Item 7 are in thousands except per share data.

20

Table of Contents

Business Overview

Analogic is a high technology company that designs and manufactures advanced medical imaging and security systems and subsystems sold to OEMs and end users primarily in the healthcare and airport security markets. We were incorporated in the Commonwealth of Massachusetts in November 1967 and are recognized worldwide for advancing state-of-the-art technology in the areas of medical CT, MRI, Digital mammography, Specialized Ultrasound, and EDS for airport security. Our OEM customers incorporate our technology into systems they in turn sell for various medical and security applications. We also sell our ultrasound products directly into specialized clinical end-user markets through our direct worldwide sales force under the brand name B-K Medical.

We operate primarily within two major markets: Medical Technology and Security Technology. Medical Technology consists of three reporting segments: CT and MRI, Digital Radiography, and Specialized Ultrasound.

A significant portion of our products are sold to OEMs, whose purchasing dynamics have an impact on our reported sales. OEMs that purchase our CT and MRI and Digital Radiography products generally incorporate those products as components in their systems, which are in turn sold to end users, primarily hospitals and medical clinics. In our Security Technology business, a major OEM customer purchases and resells our products to end users including domestic and foreign airports as well as the U.S Transportation Security Administration (“TSA”). In Security Technology, our OEM customers’ purchasing dynamics are affected by the level of government funding, the expansion of airport terminals and fluctuations in airline passenger volume.

Fiscal Year 2010 Overview

The following is a summary of the matters that our management believes are most important in understanding our results of operations for the periods indicated. This summary is not a substitute for the detail provided in the following pages or for the audited consolidated financial statements and notes that appear elsewhere in this document.

| Percentage Change |

|||||||||||

| Fiscal Year | |||||||||||

| 2010 | 2009 | ||||||||||

| Total net revenue |

$ | 423,597 | $ | 396,149 | 7 | % | |||||

| Income (loss) from operations |

20,995 | (4,185 | ) | N/A | |||||||

| Operating margin percentage |

5 | % | -1 | % | |||||||

| Net income |

$ | 15,555 | $ | 3,705 | 320 | % | |||||

| Diluted net income per share |

1.23 | 0.29 | 324 | % | |||||||

The increase in net revenue, income from operations, net income, and diluted net income per share in fiscal year 2010 as compared to fiscal year 2009 primarily reflected the improvement in hospital spending on capital equipment, which drove increased demand in our Medical Technology business, the impact of new innovative products in both Medical Technology and Security Technology, and a diligent focus on cost containment and operational efficiency, which enabled the positive recovery from the downturn of fiscal year 2009.

We had cash and cash equivalents and marketable securities of $169,254 and $160,293 at July 31, 2010 and 2009, respectively. The interest earned on our cash and cash equivalents over the past 12 month continued to be impacted by the global decline in interest rates. We have historically invested primarily in U.S government backed securities, bonds, and certificates of deposit. The interest rates of these instruments have declined significantly over the last year. The following table sets forth an overview of cash flows for fiscal years 2010 and 2009.

| Year ended July 31, | ||||||||

| 2010

|

2009

|

|||||||

| Net cash provided by operating activities |

$ | 27,117 | $ | 16,728 | ||||

| Net cash provided by (used for) investing activities |

28,899 | (38,495 | ) | |||||

| Net cash used for financing activities |

(4,520 | ) | (30,185 | ) | ||||

| Effect of exchange rate changes on cash |

(2,097 | ) | (2,105 | ) | ||||

| Net increase (decrease) in cash and cash equivalents |

$ | 49,399 | $ | (54,057 | ) | |||

21

Table of Contents

During fiscal year 2010, our cash from our operating activities improved notably from fiscal year 2009 due primarily to the significant increase in income from operations of $25,180 on higher revenues and operating margins. The net cash provided by investing activities in fiscal year 2010 was due primarily to the maturity of $40,438 of short-term held-to-maturity marketable securities, which was partially offset by property, plant, and equipment additions of $9,407 and an investment in an affiliate of $1,920. The net cash used for financing activities in fiscal year 2010 was due primarily to $5,044 of dividends paid to stockholders.

Results of Operations

Fiscal Year 2010 Compared to Fiscal Year 2009

Net Revenue

Product Revenue

Product revenue for fiscal year 2010 as compared with fiscal year 2009 is summarized in the table below.

| Year Ended July 31, | Percentage Change |

||||||||

| 2010 | 2009 | ||||||||

| Product Revenue: |

|||||||||

| Medical Technology : |

|||||||||

| CT and MRI |

$ | 228,408 | $ | 210,691 | 8 | % | |||

| Digital Radiography |

36,227 | 31,902 | 14 | % | |||||

| Specialized Ultrasound |

89,986 | 82,599 | 9 | % | |||||

| Total Medical Technology |

354,621 | 325,192 | 9 | % | |||||

| Security Technology |

39,144 | 40,578 | -4 | % | |||||

| Total |

$ | 393,765 | $ | 365,770 | 8 | % | |||

CT and MRI

The increase in product revenue for our CT and MRI segment for fiscal year 2010 versus the prior year was due primarily to increases in demand by our OEM customers as a result of the improvement in hospital spending on capital equipment, as well as the impact of new products introduced in fiscal year 2010.

Digital Radiography

The increase in product revenue for Digital Radiography Products for fiscal year 2010 versus the prior year was due primarily to increased shipments of mammography detectors to OEM customers outside the United States. As of July 31, 2010, our major OEM customer for mammography detectors had not yet received clearance from the United States Food and Drug Administration to market their system, which incorporates our selenium-based detector, in the United States.

Specialized Ultrasound

The increase in Specialized Ultrasound product revenue in fiscal year 2010 versus the prior year was due primarily to increases in demand for our new product lines, the Flex Focus and Pro Focus UltraView ultrasound scanners, which were introduced late in the second and third quarters of fiscal year 2009, respectively, the improvement in hospital spending on capital equipment in general, and expansion of our direct sales force.

Security Technology

The decrease in product revenue for Security Technology in fiscal year 2010 versus the prior year was due primarily to the fluctuating demand by our OEM customer as a result of changing requirements and procurement

22

Table of Contents

procedures in the United States by the TSA. This decrease was offset in large part by an increase in sales of spare parts and accessories and initial revenues from the introduction of our new high-speed explosives detection system, which was certified by the TSA in fiscal year 2010.

Engineering Revenue

Engineering revenue for fiscal year 2010 as compared with fiscal year 2009 is summarized in the table below.

| Year Ended July 31, | Percentage Change |

||||||||

| 2010 | 2009 | ||||||||

| Engineering Revenue: |

|||||||||

| Medical Technology : |

|||||||||

| CT and MRI |

$ | 9,084 | $ | 11,554 | -21 | % | |||

| Digital Radiography |

522 | 1,058 | -51 | % | |||||

| Specialized Ultrasound |

— | — | 0 | % | |||||

| Total Medical Technology |

9,606 | 12,612 | -24 | % | |||||

| Security Technology |

11,442 | 8,478 | 35 | % | |||||

| Total |

$ | 21,048 | $ | 21,090 | 0 | % | |||

CT and MRI

The decrease in CT and MRI engineering revenue in fiscal year 2010 versus the prior year was due primarily to the timing of completed milestones on projects for various OEM customers.

Digital Radiography

The decrease in Digital Radiography engineering revenue in fiscal year 2010 versus the prior year was due primarily to the timing of completed milestones on a project for an OEM customer in fiscal year 2010 as compared to the prior year.

Security Technology

The increase in Security Technology engineering revenue in fiscal year 2010 versus the prior year was due primarily to an engineering project that began in December 2009 for an OEM customer. This was partially offset by a decrease in engineering revenue on a time and materials project with an OEM customer to transition the high-speed eXaminer XLB explosive detection system from a prototype into a manufacturable product.

Other Revenue

Other Revenue for fiscal year 2010 as compared with fiscal year 2009 is summarized in the table below.

| Year Ended July 31, |

Percentage Change |

||||||||

| 2010 | 2009 | ||||||||

| Other Revenue: |

|||||||||

| Hotel |

$ | 8,784 | $ | 9,289 | -5 | % | |||

The decreases in fiscal year 2010 versus the prior year comparable period was due primarily to lower occupancy and a decline in room rates at the hotel due to lower business and personal travel as a result of the continuing economic pressures in the consumer market.

23

Table of Contents

Gross Margin

Product Gross Margin

Product gross margin for fiscal year 2010 as compared with fiscal year 2009 is summarized in the table below.

| Year Ended July 31, | Percentage Change |

||||||||||

| 2010 | 2009 | ||||||||||

| Product gross margin |

$ | 145,415 | $ | 122,913 | 18.3 | % | |||||

| Product gross margin % |

36.9 | % | 33.6 | % | |||||||

Product gross margin percentage increased in fiscal year 2010 versus the prior year due primarily to lower labor costs as a result of restructuring, improved manufacturing efficiency as a result of higher production throughput and improved component pricing from our vendors.

Engineering Gross Margin

Engineering gross margin for fiscal year 2010 as compared with fiscal year 2009 is summarized in the table below.

| Year Ended July 31, | Percentage Change | |||||||||

| 2010 | 2009 | |||||||||

| Engineering gross margin (loss) |

$ | 2,482 | $ | (308 | ) | N/A | ||||

| Engineering gross margin % |

11.8 | % | -1.5 | % | ||||||