Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONDOR HOSPITALITY TRUST, INC. | d383913d8k.htm |

Exhibit 99.1

Condor Hospitality Trust, Inc.

Investor Presentation | June 2017

NASDAQ: CDOR

Safe Harbor Statement

All

statements made today, other than statements of historical fact, are or may be deemed to be “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,”

“strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions.

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to

differ materially from those indicated in any forward-looking statements are discussed under the heading “Risk Factors” in our publicly available reports filed with the Securities and Exchange Commission.

Investor Inquiries

Jonathan J. Gantt

Chief Financial Officer & Senior Vice President T: 301.861.3305 E: jgantt@trustcondor.com

Cover Images

Atlanta Aloft Downtown | Atlanta, Georgia

Year-to-Date 2017 Update

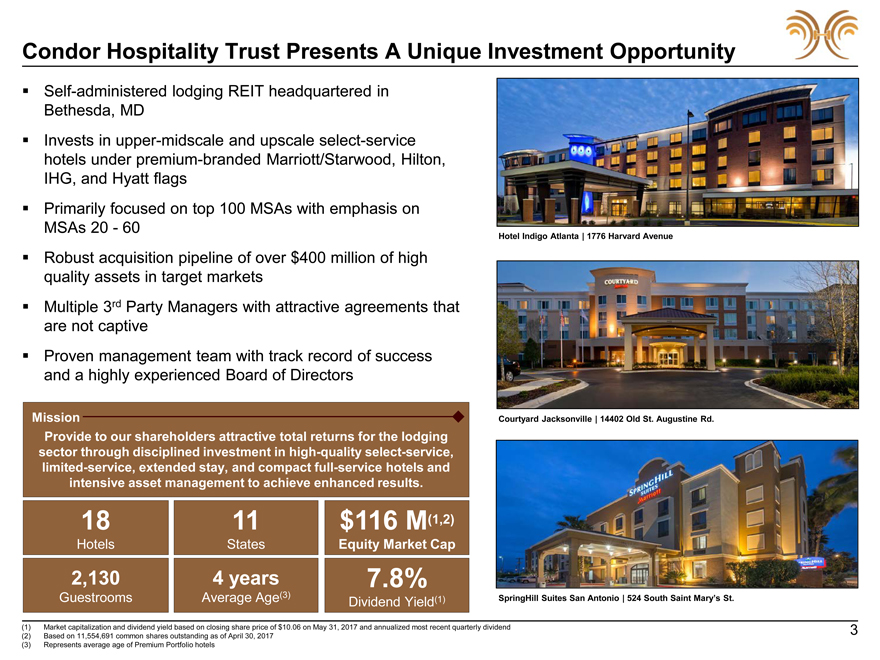

Condor Hospitality Trust Presents A Unique Investment Opportunity

Self-administered lodging REIT headquartered in Bethesda, MD

Invests in upper-midscale and

upscale select-service hotels under premium-branded Marriott/Starwood, Hilton, IHG, and Hyatt flags Primarily focused on top 100 MSAs with emphasis on MSAs 20—60

Hotel Indigo Atlanta | 1776 Harvard Avenue

Robust acquisition pipeline of over

$400 million of high quality assets in target markets Multiple 3rd Party Managers with attractive agreements that are not captive Proven management team with track record of success and a highly experienced Board of Directors

Mission Courtyard Jacksonville | 14402 Old St. Augustine Rd.

Provide to our shareholders

attractive total returns for the lodging sector through disciplined investment in high-quality select-service, limited-service, extended stay, and compact full-service hotels and intensive asset management to achieve enhanced results.

18 11 $116 M(1,2)

Hotels States Equity Market Cap

2,130 4 years 7.8%

Guestrooms Average Age(3) Dividend Yield(1) SpringHill Suites San Antonio |

524 South Saint Mary’s St.

(1) Market capitalization and dividend yield based on closing share price of $10.06 on May 31, 2017 and annualized most recent

quarterly dividend 3 (2) Based on 11,554,691 common shares outstanding as of April 30, 2017 (3) Represents average age of Premium Portfolio hotels

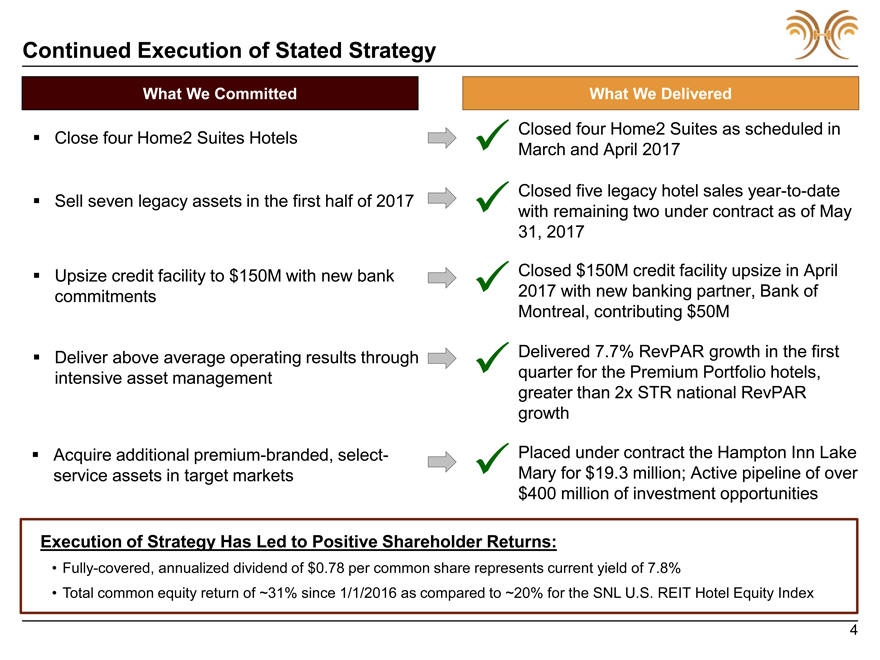

Continued Execution of Stated Strategy

What We Committed

Close four Home2 Suites Hotels

Sell seven legacy assets in the first half of 2017

Upsize credit facility to $150M with new

bank commitments

Deliver above average operating results through intensive asset management

Acquire additional premium-branded, select-service assets in target markets

What We Delivered

Closed four Home2 Suites as scheduled in March and April 2017 Closed five legacy hotel sales

year-to-date with remaining two under contract as of May 31, 2017 Closed $150M credit facility upsize in April 2017 with new banking partner, Bank of Montreal,

contributing $50M

Delivered 7.7% RevPAR growth in the first quarter for the Premium Portfolio hotels, greater than 2x STR national RevPAR growth Placed under

contract the Hampton Inn Lake Mary for $19.3 million; Active pipeline of over $400 million of investment opportunities

Execution of Strategy Has Led to

Positive Shareholder Returns:

Fully-covered, annualized dividend of $0.78 per common share represents current yield of 7.8%

Total common equity return of ~31% since 1/1/2016 as compared to ~20% for the SNL U.S. REIT Hotel Equity Index 4

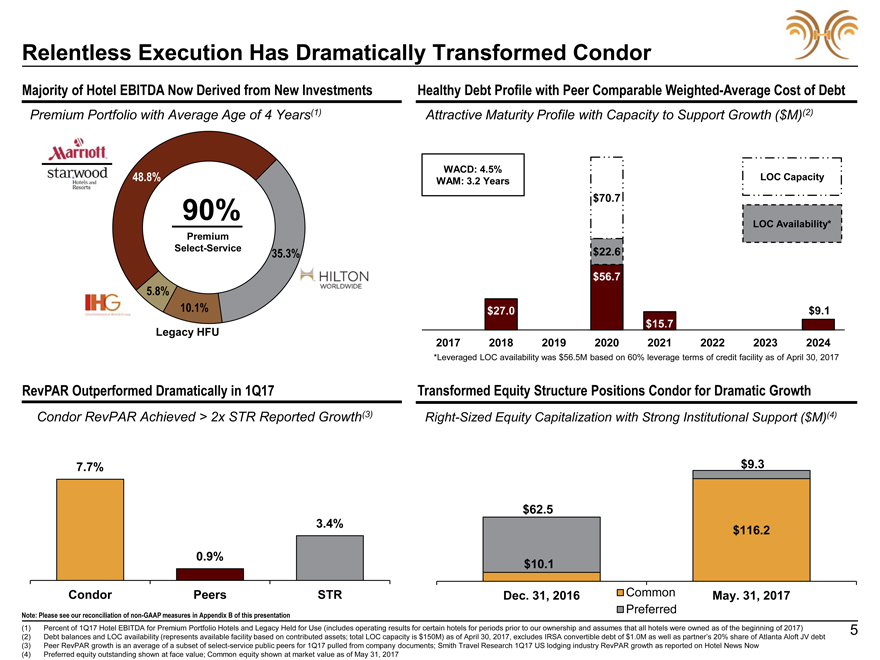

Relentless Execution Has Dramatically Transformed Condor

Majority of Hotel EBITDA Now Derived from New Investments

Premium Portfolio with Average Age

of 4 Years(1)

48.8%

90%

Premium

Select-Service 35.3%

5.8%

10.1%

Legacy HFU

Healthy Debt Profile with Peer Comparable Weighted-Average Cost of

Debt

Attractive Maturity Profile with Capacity to Support Growth ($M)(2)

WACD: 4.5%

WAM: 3.2 Years LOC Capacity $70.7

LOC Availability*

$22.6 $56.7

$27.0 $9.1 $15.7 2017 2018 2019 2020 2021 2022 2023 2024

*Leveraged LOC availability was

$56.5M based on 60% leverage terms of credit facility as of April 30, 2017

RevPAR Outperformed Dramatically in 1Q17

Condor RevPAR Achieved > 2x STR Reported Growth(3)

7.7%

3.4% 0.9% Condor Peers STR

Transformed Equity Structure Positions Condor for Dramatic Growth

Right-Sized Equity Capitalization with Strong Institutional Support ($M)(4)

$9.3

$62.5 $116.2

$10.1

Dec. 31, 2016 Common May. 31, 2017

Preferred

Note: Please see our reconciliation of

non-GAAP measures in Appendix B of this presentation

(1) Percent of 1Q17

Hotel EBITDA for Premium Portfolio Hotels and Legacy Held for Use (includes operating results for certain hotels for periods prior to our ownership and assumes that all hotels were owned as of the beginning of 2017)

(2) Debt balances and LOC availability (represents available facility based on contributed assets; total LOC capacity is $150M) as of April 30, 2017,

excludes IRSA convertible debt of $1.0M as well as partner’s 20% share of Atlanta Aloft JV debt

(3) Peer RevPAR growth is an average of

a subset of select-service public peers for 1Q17 pulled from company documents; Smith Travel Research 1Q17 US lodging industry RevPAR growth as reported on Hotel News Now

(4) Preferred equity outstanding shown at face value; Common equity shown at market value as of May 31, 2017

5

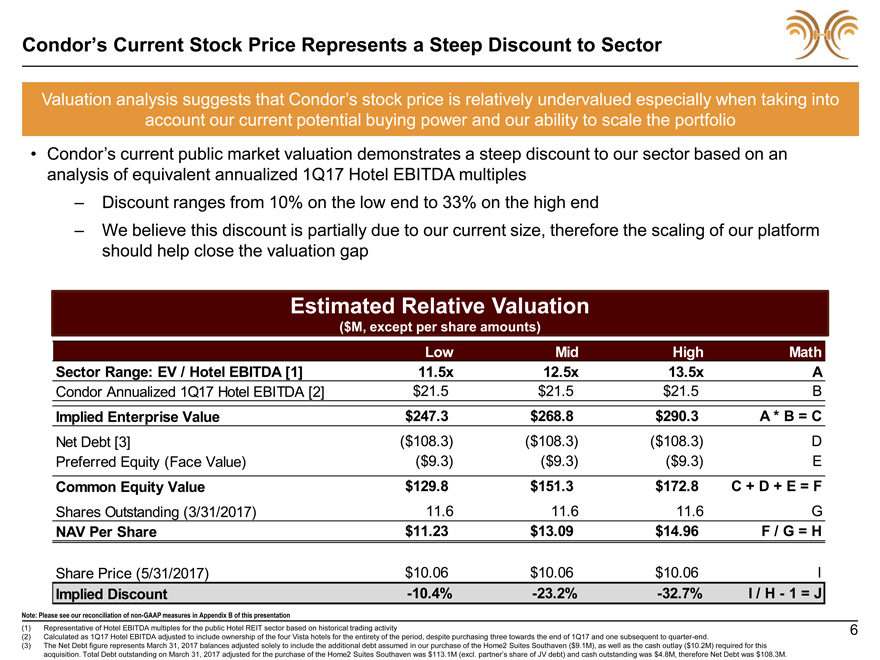

Condor’s Current Stock Price Represents a Steep Discount to Sector

Valuation analysis suggests that Condor’s stock price is relatively undervalued especially when taking into account our current potential buying power and our ability to scale

the portfolio

Condor’s current public market valuation demonstrates a steep discount to our sector based on an analysis of equivalent annualized 1Q17 Hotel

EBITDA multiples

Discount ranges from 10% on the low end to 33% on the high end

We believe this discount is partially due to our current size, therefore the scaling of our platform should help close the valuation gap

Estimated Relative Valuation

($M, except per share

amounts)

Low MidHighMath

Sector Range: EV / Hotel EBITDA [1] 11.5x 12.5x13.5xA

Condor Annualized 1Q17 Hotel EBITDA [2] $21.5 $21.5$21.5B

Implied Enterprise Value $247.3 $268.8$290.3A * B = C

Net Debt

[3] ($108.3) ($108.3)($108.3)D

Preferred Equity (Face Value) ($9.3) ($9.3)($9.3)E

Common Equity Value $129.8 $151.3$172.8C + D + E = F

Shares Outstanding

(3/31/2017) 11.6 11.611.6G

NAV Per Share $11.23 $13.09$14.96F / G = H

Share Price (5/31/2017) $10.06 $10.06$10.06I

Implied

Discount -10.4% -23.2%-32.7%I / H—1 = J

Note: Please see our reconciliation of non-GAAP

measures in Appendix B of this presentation

(1) Representative of Hotel EBITDA multiples for the public Hotel REIT sector based on historical trading activity

(2) Calculated as 1Q17 Hotel EBITDA adjusted to include ownership of the four Vista hotels for the entirety of the period, despite purchasing three towards the end

of 1Q17 and one subsequent to quarter-end.

(3) The Net Debt figure represents March 31, 2017 balances adjusted solely

to include the additional debt assumed in our purchase of the Home2 Suites Southaven ($9.1M), as well as the cash outlay ($10.2M) required for this acquisition. Total Debt outstanding on March 31, 2017 adjusted for the purchase of the Home2

Suites Southaven was $113.1M (excl. partner’s share of JV debt) and cash outstanding was $4.8M, therefore Net Debt was $108.3M.

6

Condor Portfolio, Management, and Performance

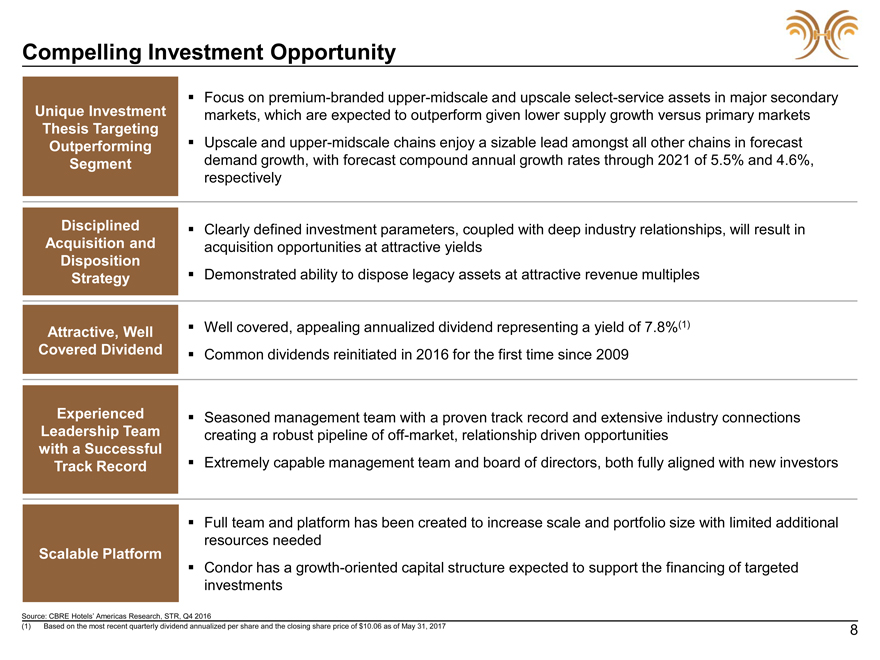

Compelling Investment Opportunity

Focus on premium-branded upper-midscale and upscale select-service assets in major secondary

Unique Investment markets, which are expected to outperform given lower supply growth versus primary markets

Thesis Targeting

Outperforming Upscale and

upper-midscale chains enjoy a sizable lead amongst all other chains in forecast

Segment demand growth, with forecast compound annual growth

rates through 2021 of 5.5% and 4.6%,

respectively

Disciplined Clearly defined investment parameters, coupled with deep industry relationships, will result in

Acquisition and acquisition opportunities at attractive yields

Disposition

Strategy

Demonstrated ability to dispose legacy assets at attractive revenue multiples

Attractive, Well Well covered, appealing annualized dividend

representing a yield of 7.8%(1)

Covered Dividend Common dividends reinitiated in 2016 for the first time since 2009

Experienced Seasoned management team with a proven track record and extensive industry connections

Leadership Team creating a robust pipeline of off-market, relationship driven opportunities

with a Successful

Track Record Extremely

capable management team and board of directors, both fully aligned with new investors

Full team and platform has been created to increase scale and portfolio size

with limited additional

resources needed

Scalable

Platform

Condor has a growth-oriented capital structure expected to support the financing of targeted

investments

Source: CBRE Hotels’ Americas Research, STR, Q4 2016

(1) Based on the most recent quarterly dividend annualized per share and the closing share price of $10.06 as of May 31, 2017 8

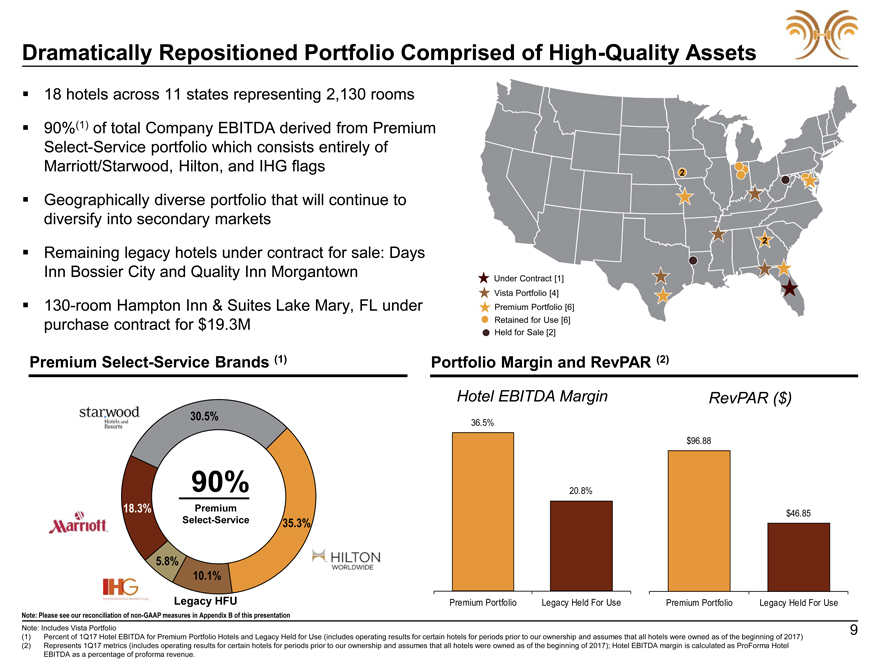

Dramatically Repositioned Portfolio Comprised of High-Quality Assets

18 hotels across 11 states representing 2,130 rooms

90%(1) of total Company EBITDA derived

from Premium

Select-Service portfolio which consists entirely of

Marriott/Starwood, Hilton, and IHG flags 2

Geographically diverse

portfolio that will continue to

diversify into secondary markets

2

Remaining legacy hotels under contract for sale: Days

Inn Bossier City and Quality Inn Morgantown Under Contract [1]

Vista

Portfolio [4]

130-room Hampton Inn & Suites Lake Mary, FL under Premium Portfolio [6]

purchase contract for $19.3M Retained for Use [6]

Held for Sale [2]

Premium Select-Service Brands (1) Portfolio Margin and RevPAR (2)

Hotel EBITDA MarginRevPAR ($)

30.5%36.5%

$96.88

90%20.8%

18.3% Premium$46.85

Select-Service35.3%

5.8%

10.1%

Legacy HFUPremium PortfolioLegacy Held For UsePremium PortfolioLegacy Held For Use

Note: Please see our reconciliation of non-GAAP measures in Appendix B of this presentation

Note: Includes Vista Portfolio 9

(1) Percent of

1Q17 Hotel EBITDA for Premium Portfolio Hotels and Legacy Held for Use (includes operating results for certain hotels for periods prior to our ownership and assumes that all hotels were owned as of the beginning of 2017)

(2) Represents 1Q17 metrics (includes operating results for certain hotels for periods prior to our ownership and assumes that all hotels were owned as of

the beginning of 2017); Hotel EBITDA margin is calculated as ProForma Hotel

EBITDA as a percentage of proforma revenue.

Unique Investment Thesis Will Drive Outperformance

Expect Premium Select-Service in

Secondary Lodging Markets to Drive

Outsized Returns

Slower Supply Growth in Strong Demand Growth

forMinimal Competition Enables

Targeted Secondary Markets Premium Select-ServiceAccretive Valuations

Supply growth has had a far greater impact on the Demand for upper-midscale and upscale select- Condor is exclusively focused on higher yielding

top 20 lodging markets than on secondary service product remains strong especially amongpremium select-service hotels located in

markets with ~62% of new room supply “next generation” travelerssecondary markets in contrast to many publicly

concentrated in only the top 20 markets(1,2) traded lodging REITs and institutional investors

Upscale and upper-midscale chains enjoy athat focus on lower yielding large portfolios in

Rooms under construction as a percentage of sizable lead amongst all other chains in forecastprimary markets

existing supply averages 5.7% in the top 20 demand growth, with forecast compound annual

lodging markets as compared to only 4.0% in growth rates through 2021 of 5.5% and 4.6%, Select-service assets provide higher

going-in cap

markets ranked 21-60

(1)(2) respectively(1)rates that lower the cost per key and higher

EBITDA margins that provide more current

Secondary markets less affected by alternative income, resulting in (1) less volatility across

lodging platforms like Airbnb cycles, (2) stable cash-on-cash yields and

(3) less

reliance on cap rate compression to drive

investment returns

Source: CBRE Hotel’s Americas Research, STR, Q4 2016

Lodging markets

ranked by CBRE as of Q4 2016

10

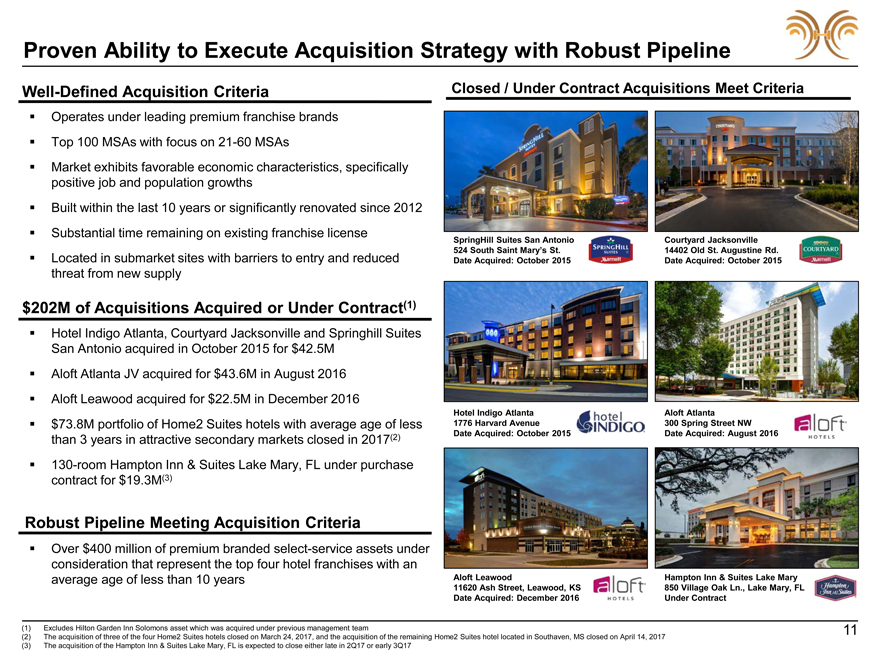

Proven Ability to Execute Acquisition Strategy with Robust Pipeline

Well-Defined Acquisition Criteria Closed / Under Contract Acquisitions Meet Criteria

Operates

under leading premium franchise brands Top 100 MSAs with focus on 21-60 MSAs

Market exhibits favorable economic

characteristics, specifically positive job and population growths Built within the last 10 years or significantly renovated since 2012 Substantial time remaining on existing franchise license Located in submarket sites with barriers to entry and

reduced threat from new supply

$202M of Acquisitions Acquired or Under Contract(1)

Hotel Indigo Atlanta, Courtyard Jacksonville and Springhill Suites San Antonio acquired in October 2015 for $42.5M

Aloft Atlanta JV acquired for $43.6M in August 2016 Aloft Leawood acquired for $22.5M in December 2016

$73.8M portfolio of Home2 Suites hotels with average age of less than 3 years in attractive secondary markets closed in 2017(2) 130-room

Hampton Inn & Suites Lake Mary, FL under purchase contract for $19.3M(3)

Robust Pipeline Meeting Acquisition Criteria

Over $400 million of premium branded select-service assets under consideration that represent the top four hotel franchises with an average age of less than 10 years

SpringHill Suites San Antonio Courtyard Jacksonville

524 South Saint Mary’s St. 14402 Old St. Augustine Rd.

Date Acquired: October 2015 Date Acquired: October 2015

Hotel Indigo

Atlanta Aloft Atlanta

1776 Harvard Avenue 300 Spring Street NW

Date Acquired: October 2015 Date Acquired: August 2016

Aloft

Leawood Hampton Inn & Suites Lake Mary

11620 Ash Street, Leawood, KS 850 Village Oak Ln., Lake Mary, FL

Date Acquired: December 2016 Under Contract

(1)

Excludes Hilton Garden Inn Solomons asset which was acquired under previous management team

(2) The acquisition of three of the four Home2 Suites hotels closed on

March 24, 2017, and the acquisition of the remaining Home2 Suites hotel located in Southaven, MS closed on April 14, 2017 (3) The acquisition of the Hampton Inn & Suites Lake Mary, FL is expected to close either late in 2Q17 or

early 3Q17

11

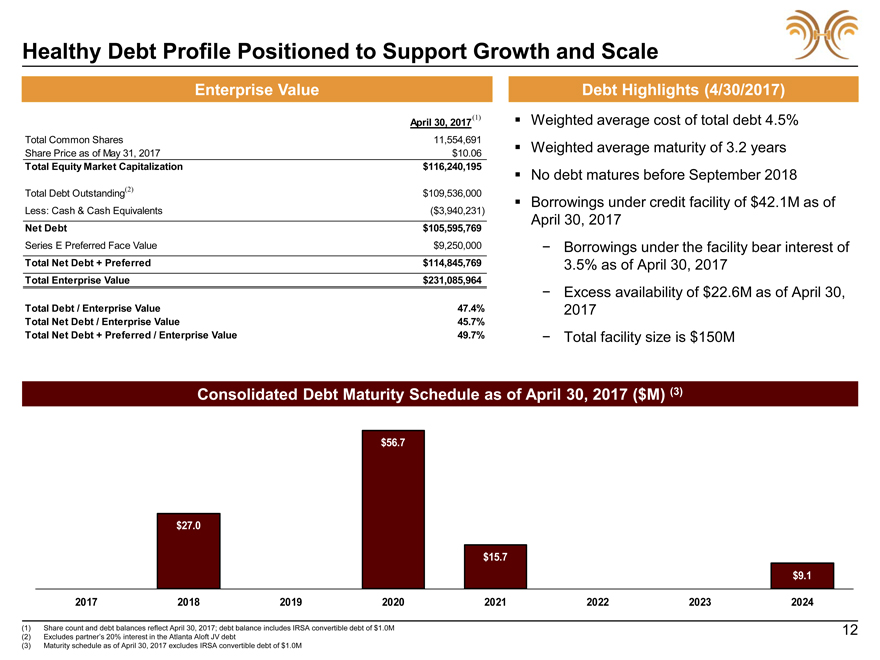

Healthy Debt Profile Positioned to Support Growth and Scale

Enterprise Value Debt Highlights (4/30/2017)

April 30, 2017(1)

Weighted average cost of total debt 4.5%

Total Common Shares 11,554,691 Weighted average maturity of 3.2 years

Share Price as of May 31, 2017 $10.06

Total Equity Market

Capitalization $116,240,195 No debt matures before September 2018

Total Debt Outstanding(2) $109,536,000 Borrowings

under credit facility of $42.1M as of

Less: Cash & Cash Equivalents ($3,940,231)April 30, 2017

Net Debt $105,595,769

Series E Preferred Face

Value $9,250,000-Borrowings under the facility bear interest of

Total Net Debt + Preferred $114,845,7693.5% as of

April 30, 2017

Total Enterprise Value $231,085,964

-Excess availability of $22.6M as of April 30,

Total Debt / Enterprise

Value 47.4%2017

Total Net Debt / Enterprise Value 45.7%

Total Net Debt + Preferred / Enterprise Value 49.7%-Total facility size is $150M

Consolidated Debt Maturity Schedule as of April 30, 2017 ($M) (3)

$56.7

$27.0

$15.7

$9.1

2017 2018 201920202021202220232024

Share count and

debt balances reflect April 30, 2017; debt balance includes IRSA convertible debt of $1.0M

Excludes partner’s 20% interest in the Atlanta Aloft JV debt

Maturity schedule as of April 30, 2017 excludes IRSA convertible debt of $1.0M

12

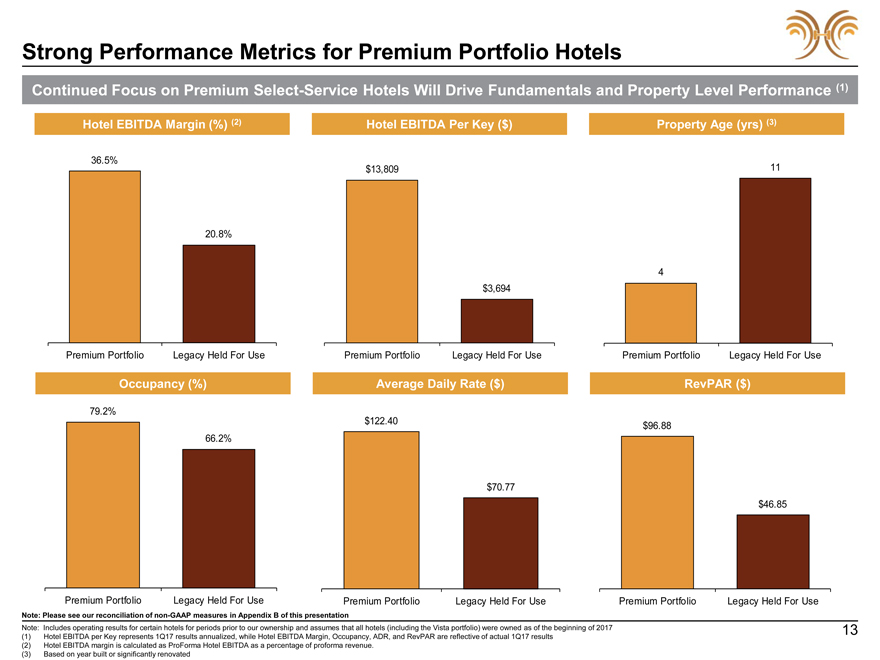

Strong Performance Metrics for Premium Portfolio Hotels

Continued Focus on Premium Select-Service Hotels Will Drive Fundamentals and Property Level Performance (1)

Hotel EBITDA Margin (%) (2) Hotel EBITDA Per Key ($) Property Age (yrs) (3)

36.5% $13,80911

20.8%

4

$3,694

Premium Portfolio Legacy Held For Use Premium PortfolioLegacy Held For UsePremium PortfolioLegacy Held For Use

Occupancy (%) Average Daily Rate ($) RevPAR ($)

79.2%

$122.40$96.88

66.2%

$70.77

$46.85

Premium Portfolio Legacy Held For Use Premium PortfolioLegacy

Held For UsePremium PortfolioLegacy Held For Use

Note: Please see our reconciliation of non-GAAP measures in Appendix B of

this presentation

Note: Includes operating results for certain hotels for periods prior to our ownership and assumes that all hotels (including the Vista

portfolio) were owned as of the beginning of 2017 (1) Hotel EBITDA per Key represents 1Q17 results annualized, while Hotel EBITDA Margin, Occupancy, ADR, and RevPAR are reflective of actual 1Q17 results (2) Hotel EBITDA margin is calculated as

ProForma Hotel EBITDA as a percentage of proforma revenue.

(3) Based on year built or significantly renovated

13

Experienced Management Team Poised to Drive Condor’s Growth

Bill Blackham, President, CEO and Board Member Since March 2015

Long and accomplished track

record creating and growing companies, raising capital and building strong

management teams

Former President and CEO of Eagle Hospitality Properties Trust (“Eagle”), an NYSE-listed hotel REIT

—As President and CEO, Mr. Blackham led Eagle from its September 2004 IPO through its sale to an

Apollo affiliate in August 2007

—During his tenure, Eagle acquired over $225 million

of hotel assets, growing to an enterprise value of

nearly $700 million

—While a public company, Eagle generated a total return of 67.8%, outperforming major indices such as

the SNL US REIT Hotel Index (53.1%), MSCI US REIT Index (47.7%), and S&P 500 Index (33.1%) (1)

—B.S. Boston College, M.B.A. Wharton – University of Pennsylvania

Jeffrey W.

Dougan Jonathan J. GanttArinn A. CaveyLauren E. Green

SVP and COO SVP and CFOChief Accounting OfficerCorporate

Counsel

Oversees the Company’s third party Formulates and executes financial Responsible for overseeing the Responsible for overseeing the

management companies, hotel policy and leads the Company’sCompany’s financial plans anddisposition process of the

operations, as well as maintains capital raising effortsprovides direction for accounting,Company’s legacy assets

relationships with current and future financial reporting, tax and budget

brand families Most recently served as Director ofactivities Assists in completing acquisition

Treasury, Capital Markets, and M&Atransactions, interfacing directly with

Previously

served more than 25 at Starwood Hotels Has extensive audit experience inmembers of the executive team,

years in the hospitality

industry, consumer and industrial marketsoutside counsel, and business unit

most recently as a Vice President of 10

years private equity experienceand has provided professional auditheads

Operations for Stonebridge BS Cornell; MBA Tuck at

Dartmouthservices to private and publicly-held

Hospitality companies

(1) Source: SNL Financial

14

Highly Experienced Board with Substantial Hotel REIT Experience

Board Highlights

J. William Blackham

President and CEO

Former President and CEO | Eagle Hospitality

James H. Friend

President | Friend Development Group

Donald J. Landry J. William BlackhamJames H. Friend, ChairmanDonald J. Landry

Former CEO |

Choice Hotels (NYSE: CHH)

Director | Hersha Hospitality (NYSE: HT)

Daphne J.

Dufresne

Managing Partner | GenNx360 Capital Partners

Daniel R. Elsztain

Chief Real Estate Officer | IRSA

John M. Sabin

CFO | Revolution, LLCDaphne J. DufresneDaniel R. ElsztainJohn M. Sabin

Director | Hersha

Hospitality (NYSE: HT)

Jeff Giller

Partner | StepStone Real Estate L.P.

Brendan MacDonald

Partner | StepStone Real Estate L.P.

Mark Linehan

President and CEO | Wynmark Company

Jeff GillerBrendan MacDonaldMark Linehan

15

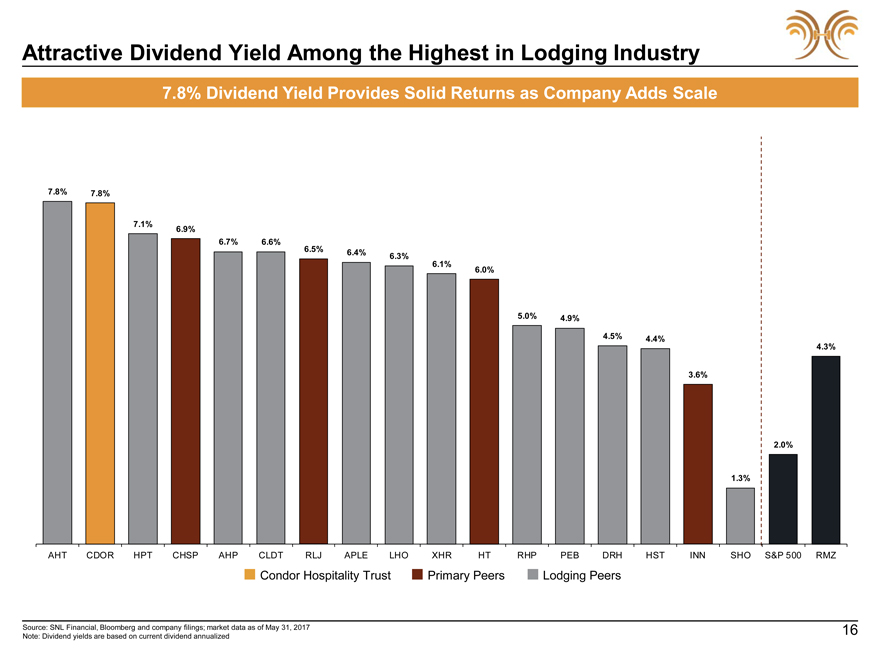

Attractive Dividend Yield Among the Highest in Lodging Industry

7.8% Dividend Yield Provides Solid Returns as Company Adds Scale

7.8% 7.8%

7.1% 6.9%

6.7%6.6%

6.5%6.4%

6.3%

6.1%6.0%

5.0%4.9%

4.5%4.4%

4.3%

3.6%

2.0%

1.3%

AHT CDOR HPT CHSP AHPCLDTRLJAPLELHOXHRHTRHPPEBDRHHSTINNSHOS&P 500RMZ

Condor Hospitality TrustPrimary PeersLodging Peers

Source: SNL Financial,

Bloomberg and company filings; market data as of May 31, 2017 16

Note: Dividend yields are based on current dividend

annualized

Appendix A | Acquisition Case Studies

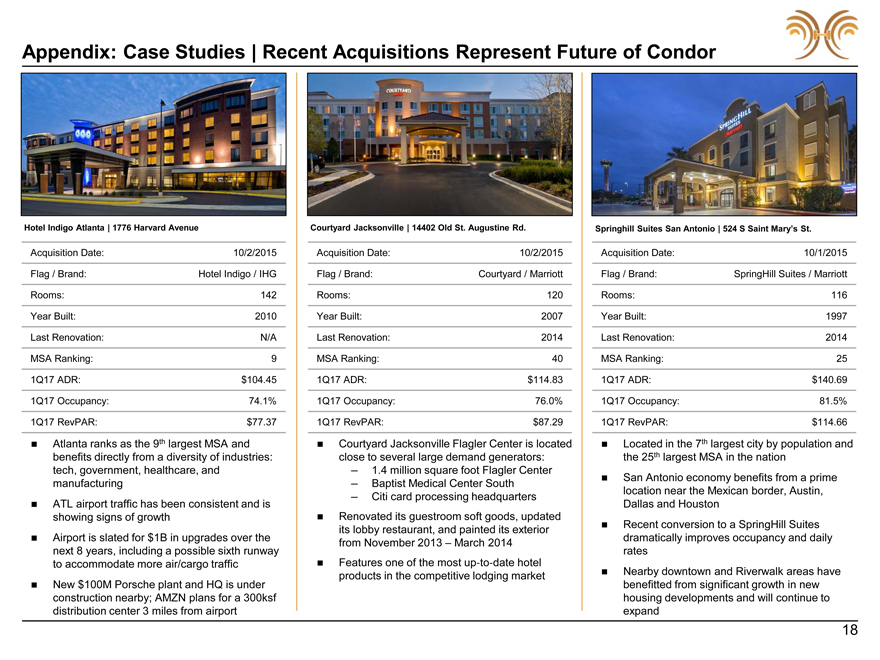

Appendix: Case Studies | Recent Acquisitions Represent Future of Condor

Hotel Indigo Atlanta | 1776 Harvard Avenue

Acquisition Date: 10/2/2015 Flag / Brand: Hotel

Indigo / IHG Rooms: 142 Year Built: 2010 Last Renovation: N/A MSA Ranking: 9 1Q17 ADR: $104.45 1Q17 Occupancy: 74.1% 1Q17 RevPAR: $77.37

Atlanta ranks as the 9th

largest MSA and benefits directly from a diversity of industries: tech, government, healthcare, and manufacturing ATL airport traffic has been consistent and is showing signs of growth Airport is slated for $1B in upgrades

over the next 8 years, including a possible sixth runway to accommodate more air/cargo traffic New $100M Porsche plant and HQ is under construction nearby; AMZN plans for a 300ksf distribution center 3 miles from airport

Courtyard Jacksonville | 14402 Old St. Augustine Rd.

Acquisition Date: 10/2/2015 Flag / Brand:

Courtyard / Marriott Rooms: 120 Year Built: 2007 Last Renovation: 2014 MSA Ranking: 40 1Q17 ADR: $114.83 1Q17 Occupancy: 76.0% 1Q17 RevPAR: $87.29

Courtyard

Jacksonville Flagler Center is located close to several large demand generators:

1.4 million square foot Flagler Center

Baptist Medical Center South

Citi card processing headquarters Renovated its guestroom soft

goods, updated its lobby restaurant, and painted its exterior from November 2013 – March 2014 Features one of the most up-to-date hotel products in the competitive

lodging market

Springhill Suites San Antonio | 524 S Saint Mary’s St.

Acquisition Date: 10/1/2015 Flag / Brand: SpringHill Suites / Marriott Rooms: 116 Year Built: 1997 Last Renovation: 2014 MSA Ranking: 25 1Q17 ADR: $140.69 1Q17

Occupancy: 81.5% 1Q17 RevPAR: $114.66

Located in the 7th largest city by population and the 25th largest MSA in the nation San Antonio economy benefits from a

prime location near the Mexican border, Austin, Dallas and Houston Recent conversion to a SpringHill Suites dramatically improves occupancy and daily rates Nearby downtown and Riverwalk areas have benefitted from significant growth in new housing

developments and will continue to expand

18

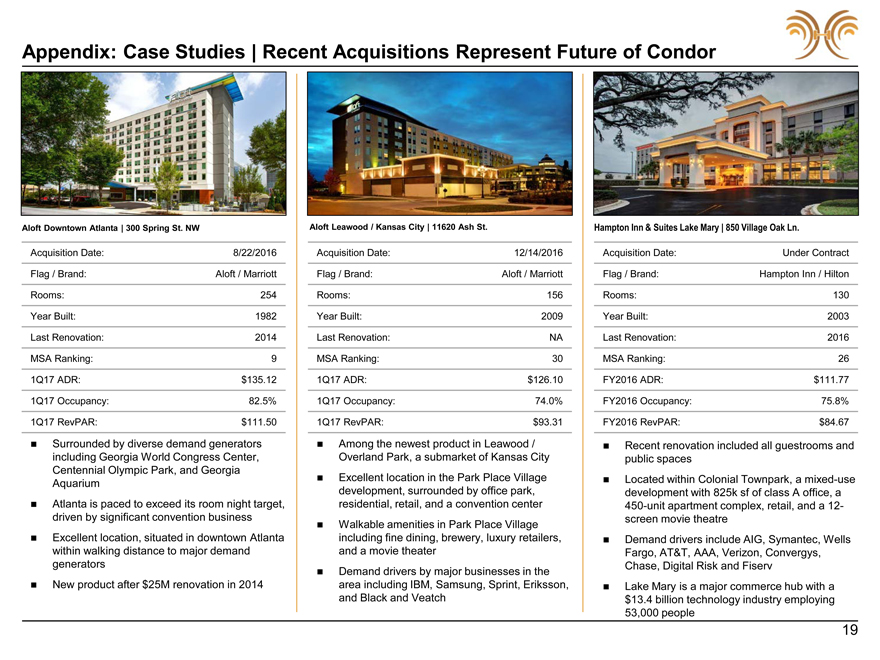

Appendix: Case Studies | Recent Acquisitions Represent Future of Condor

Aloft Downtown Atlanta | 300 Spring St. NW

Acquisition

Date: 8/22/2016

Flag / Brand: Aloft / Marriott

Rooms: 254

Year Built: 1982

Last Renovation: 2014

MSA Ranking: 9

1Q17 ADR: $135.12

1Q17

Occupancy: 82.5%

1Q17 RevPAR: $111.50

Surrounded by diverse demand generators

including Georgia World Congress Center,

Centennial Olympic Park, and Georgia

Aquarium

Atlanta is paced to exceed its room night target,

driven by significant

convention business

Excellent location, situated in downtown Atlanta

within

walking distance to major demand

generators

New

product after $25M renovation in 2014

Aloft Leawood / Kansas City | 11620 Ash St.

Acquisition Date: 12/14/2016 Flag / Brand: Aloft / Marriott Rooms: 156 Year Built: 2009 Last Renovation: NA MSA Ranking: 30 1Q17 ADR: $126.10 1Q17 Occupancy: 74.0% 1Q17 RevPAR:

$93.31

Among the newest product in Leawood / Overland Park, a submarket of Kansas City Excellent location in the Park Place Village development, surrounded by

office park, residential, retail, and a convention center Walkable amenities in Park Place Village including fine dining, brewery, luxury retailers, and a movie theater Demand drivers by major businesses in the area including IBM, Samsung, Sprint,

Eriksson, and Black and Veatch

Hampton Inn & Suites Lake Mary | 850 Village Oak Ln.

Acquisition Date: Under Contract Flag / Brand: Hampton Inn / Hilton Rooms: 130 Year Built: 2003 Last Renovation: 2016 MSA Ranking: 26 FY2016 ADR: $111.77 FY2016 Occupancy: 75.8%

FY2016 RevPAR: $84.67

Recent renovation included all guestrooms and public spaces Located within Colonial Townpark, a

mixed-use development with 825k sf of class A office, a 450-unit apartment complex, retail, and a 12-screen movie theatre Demand

drivers include AIG, Symantec, Wells Fargo, AT&T, AAA, Verizon, Convergys, Chase, Digital Risk and Fiserv Lake Mary is a major commerce hub with a $13.4 billion technology industry employing 53,000 people

19

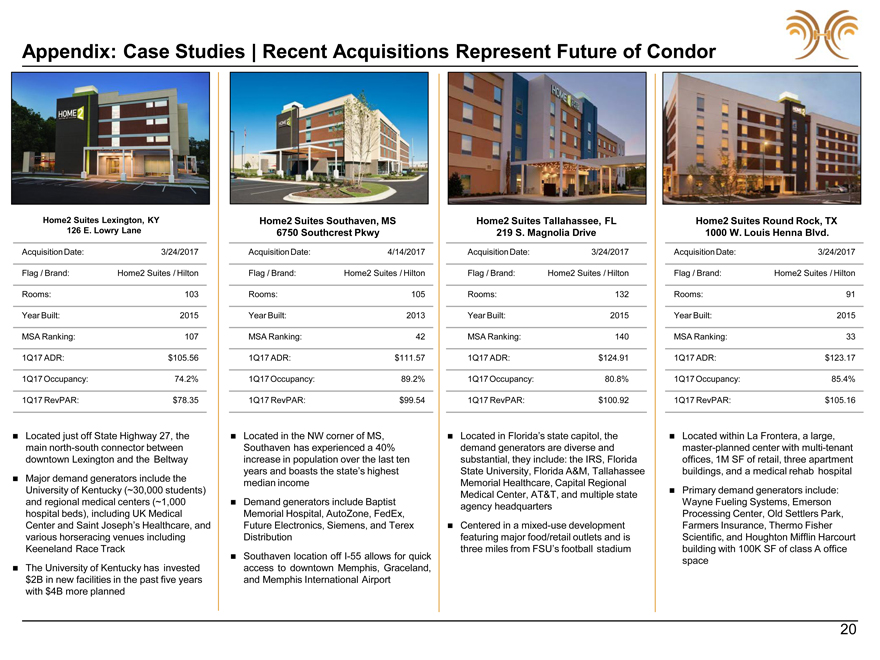

Appendix: Case Studies | Recent Acquisitions Represent Future of Condor

Home2 Suites Lexington, KY Home2 Suites Southaven, MSHome2 Suites Tallahassee, FLHome2 Suites Round Rock, TX

126 E. Lowry Lane 6750 Southcrest Pkwy219 S. Magnolia Drive1000 W. Louis Henna Blvd.

AcquisitionDate: 3/24/2017 AcquisitionDate:4/14/2017AcquisitionDate:3/24/2017AcquisitionDate:3/24/2017

Flag / Brand: Home2 Suites / Hilton Flag / Brand:Home2 Suites / HiltonFlag / Brand:Home2 Suites / HiltonFlag / Brand:Home2 Suites / Hilton

Rooms: 103 Rooms:105Rooms:132Rooms:91

Year

Built: 2015 Year Built:2013Year Built:2015Year Built:2015

MSA Ranking: 107 MSA Ranking:42MSA Ranking:140MSA

Ranking:33

1Q17 ADR: $105.56 1Q17 ADR:$111.571Q17 ADR:$124.911Q17 ADR:$123.17

1Q17Occupancy: 74.2% 1Q17Occupancy:89.2%1Q17Occupancy:80.8%1Q17Occupancy:85.4%

1Q17 RevPAR: $78.35 1Q17 RevPAR:$99.541Q17 RevPAR:$100.921Q17 RevPAR:$105.16

Located just off State Highway 27, the Located in the NW corner of MS, Located in Florida’s state capitol, the Located within La Frontera, a large,

main north-south connector between Southaven has experienced a 40%demand generators are diverse andmaster-planned center with multi-tenant

downtown Lexington and the Beltway increase in population over the last tensubstantial, they include: the IRS, Floridaoffices, 1M SF of

retail, three apartment

years and boasts the state’s highestState University, Florida A&M, Tallahasseebuildings, and a medical rehab hospital

Major demand generators include the median incomeMemorial Healthcare, Capital Regional

University of Kentucky (~30,000 students) Medical Center, AT&T, and multiple state Primary demand generators include:

and regional medical centers (~1,000 Demand generators include Baptistagency headquartersWayne Fueling Systems, Emerson

hospital beds), including UK Medical Memorial Hospital, AutoZone, FedEx,Processing Center, Old Settlers Park,

Center and Saint Joseph’s Healthcare, and Future Electronics, Siemens, and Terex Centered in a mixed-use

developmentFarmers Insurance, Thermo Fisher

various horseracing venues including Distributionfeaturing major food/retail outlets and

isScientific, and Houghton Mifflin Harcourt

Keeneland Race Track three miles from FSU’s football stadiumbuilding with 100K SF of class

A office

Southaven location off I-55 allows for quickspace

The University of Kentucky has invested access to downtown Memphis, Graceland,

$2B in new facilities in the past five years and Memphis International Airport

with $4B more planned

20

Appendix B | Non-GAAP Reconciliation

Non-GAAP Reconciliation: Condor Hospitality Trust, Inc. EBITDA,

Adjusted EBITDA, and Hotel EBITDA

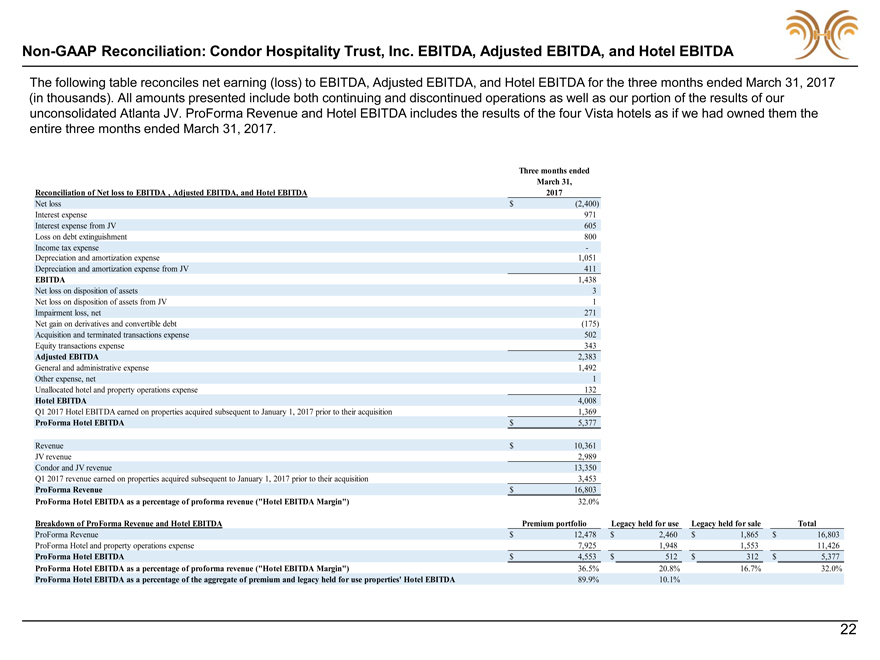

The following table reconciles net earning (loss) to EBITDA, Adjusted EBITDA, and Hotel EBITDA for the three months ended

March 31, 2017 (in thousands). All amounts presented include both continuing and discontinued operations as well as our portion of the results of our unconsolidated Atlanta JV. ProForma Revenue and Hotel EBITDA includes the results of the four

Vista hotels as if we had owned them the entire three months ended March 31, 2017.

Three months ended

March 31,

Reconciliation of Net loss to EBITDA , Adjusted EBITDA,

and Hotel EBITDA 2017

Net loss $(2,400)

Interest expense 971

Interest expense from JV

605

Loss on debt extinguishment 800

Income tax

expense -

Depreciation and amortization expense 1,051

Depreciation and amortization expense from JV 411

EBITDA 1,438

Net loss on disposition of

assets 3

Net loss on disposition of assets from JV 1

Impairment loss, net 271

Net gain on derivatives and convertible

debt (175)

Acquisition and terminated transactions expense 502

Equity transactions expense 343

Adjusted

EBITDA 2,383

General and administrative expense 1,492

Other expense, net 1

Unallocated hotel and property operations

expense 132

Hotel EBITDA 4,008

Q1 2017 Hotel EBITDA earned on properties acquired subsequent to January 1, 2017 prior to their acquisition 1,369

ProForma Hotel EBITDA $5,377

Revenue $10,361

JV revenue 2,989

Condor and JV

revenue 13,350

Q1 2017 revenue earned on properties acquired subsequent to January 1, 2017 prior to their

acquisition 3,453

ProForma Revenue $16,803

ProForma Hotel EBITDA as a percentage of proforma revenue (“Hotel EBITDA Margin”) 32.0%

Breakdown of ProForma Revenue and Hotel EBITDA Premium portfolio Legacy held for useLegacy held for saleTotal

ProForma Revenue $12,478$2,460$1,865$16,803

ProForma Hotel and property

operations expense 7,9251,9481,55311,426

ProForma Hotel EBITDA $4,553$512$312$5,377

ProForma Hotel EBITDA as a percentage of proforma revenue (“Hotel EBITDA Margin”) 36.5%20.8%16.7%32.0%

ProForma Hotel EBITDA as a percentage of the aggregate of premium and legacy held for use properties’ Hotel EBITDA 89.9%10.1%

22

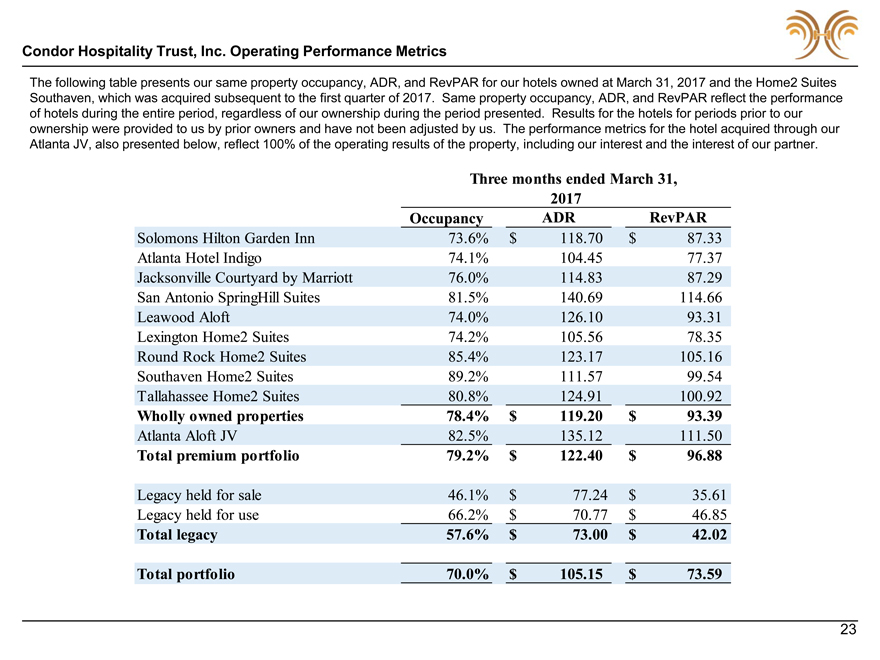

Condor Hospitality Trust, Inc. Operating Performance Metrics

The following table presents our same property occupancy, ADR, and RevPAR for our hotels owned at March 31, 2017 and the Home2 Suites Southaven, which was acquired subsequent

to the first quarter of 2017. Same property occupancy, ADR, and RevPAR reflect the performance of hotels during the entire period, regardless of our ownership during the period presented. Results for the hotels for periods prior to our ownership

were provided to us by prior owners and have not been adjusted by us. The performance metrics for the hotel acquired through our Atlanta JV, also presented below, reflect 100% of the operating results of the property, including our interest and the

interest of our partner.

Three months ended March 31,

2017

Occupancy ADRRevPAR

Solomons Hilton Garden

Inn 73.6% $118.70$87.33

Atlanta Hotel Indigo 74.1% 104.4577.37

Jacksonville Courtyard by Marriott 76.0% 114.8387.29

San Antonio

SpringHill Suites 81.5% 140.69114.66

Leawood Aloft 74.0% 126.1093.31

Lexington Home2 Suites 74.2% 105.5678.35

Round Rock Home2

Suites 85.4% 123.17105.16

Southaven Home2 Suites 89.2% 111.5799.54

Tallahassee Home2 Suites 80.8% 124.91100.92

Wholly owned

properties 78.4% $119.20$93.39

Atlanta Aloft JV 82.5% 135.12111.50

Total premium portfolio 79.2% $122.40$96.88

Legacy held for

sale 46.1% $77.24$35.61

Legacy held for use 66.2% $70.77$46.85

Total legacy 57.6% $73.00$42.02

Total

portfolio 70.0% $105.15$73.59

23