Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERITAGE FINANCIAL CORP /WA/ | form8-kxq12017investorpres.htm |

Investor Presentation

May 2017

FORWARD – LOOKING STATEMENT

2

This presentation contains forward-looking statements that are subject to risks and uncertainties, including, but not limited to:

• The expected revenues, cost savings, synergies and other benefits from our other merger and acquisition activities might not

be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but

not limited to, customer and employee retention might be greater than expected;

• The credit and concentration risks of lending activities;

• Changes in general economic conditions, either nationally or in our market areas;

• Competitive market pricing factors and interest rate risks;

• Market interest rate volatility;

• Balance sheet (for example, loans) concentrations;

• Fluctuations in demand for loans and other financial services in our market areas;

• Changes in legislative or regulatory requirements or the results of regulatory examinations;

• The ability to recruit and retain key management and staff;

• Risks associated with our ability to implement our expansion strategy and merger integration;

• Stability of funding sources and continued availability of borrowings;

• Adverse changes in the securities markets;

• The inability of key third-party providers to perform their obligations to us;

• Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets,

which estimates may prove to be incorrect and result in significant declines in valuation; and

• These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission.

The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these

statements as speaking only as of the date they are made and based only on information then actually known to the Company.

The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our

actual results for the second quarter of 2017 and beyond to differ materially from those expressed in any forward-looking

statements by, or on behalf of, us, and could negatively affect the Company’s operating and stock price performance.

3

COMPANY OVERVIEW

OVERVIEW

4

Overview

NASDAQ Symbol HFWA

Market Capitalization $784.5 million

Institutional Ownership 75.1%

Total Assets $3.89 billion

Headquarters Olympia, WA

# of Branches 59

Year Established 1927

Note: Financial information as of 03/31/2017 and market information as

of 05/01/2017

Three banks, one charter

5

HISTORICAL GROWTH – ORGANIC AND ACQUISITIVE

Source: Company financials, as of 12/31/2016

Note: All dollars in millions

Acquired North Pacific

Bancorporation

Acquired Washington

Independent

Bancshares Inc.

Acquired Western

Washington Bancorp

Completed 2 FDIC deals -

Pierce Commercial Bank and

Cowlitz Bank acquiring $211M

and $345M in assets,

respectively

Acquired Valley Community

Bancshares, Inc. with $254M in

assets and Northwest Commercial

Bank with $65M in assets

Merger with Washington

Banking Company

In addition to organic growth, HFWA has completed 6 whole bank mergers and 2 FDIC-assisted transactions since 1998

6

STRONG AND DIVERSE ECONOMIC LANDSCAPE

• Thriving local economy with job growth in technology

and aerospace sectors

• Seattle economy ranks 11th largest in the country by

GDP, which increased 4.1% since 2013

• Seattle’s population grew 5.2% from 2010 to 2014

• Washington per capita income ranked 13th in the

United States at $51,146, 7.3% higher than the national

average*

• Fortune 500 companies headquartered in Washington,

include Amazon, Costco, Microsoft, PACCAR,

Nordstrom, Weyerhaeuser, Expeditors, Alaska Air,

Expedia and Starbucks

• Seattle home prices increased 12.2% from February

2016 to February 2017**

Headquartered in Western Washington

Major Operations in Western Washington

Note: Information for Seattle MSA, where available

Sources: U.S. Department of Commerce, Federal Reserve Bank of St. Louis, Office of

Financial Management, U.S. Census Bureau, City of Seattle, Puget Sound Economic

Forecaster, National Association of Home Builders, S&P Case-Shiller

* Per Office of Financial Management Information as of 7/13/2016

** Per the Case-Shiller Home Price Index as of 4/25/2017

Joint Base Lewis-McChord

7

FINANCIAL UPDATE

FINANCIAL UPDATE – Q1 2017

8

• Diluted earnings per share were $0.31 for the quarter

• Return on average assets was 0.97%, return on average

equity was 7.78% and return on average tangible

common equity was 10.51%

• Dividend declared on April 25, 2017 of $0.13 per share,

an increase of 8.3% from $0.12 per share paid in the first

quarter

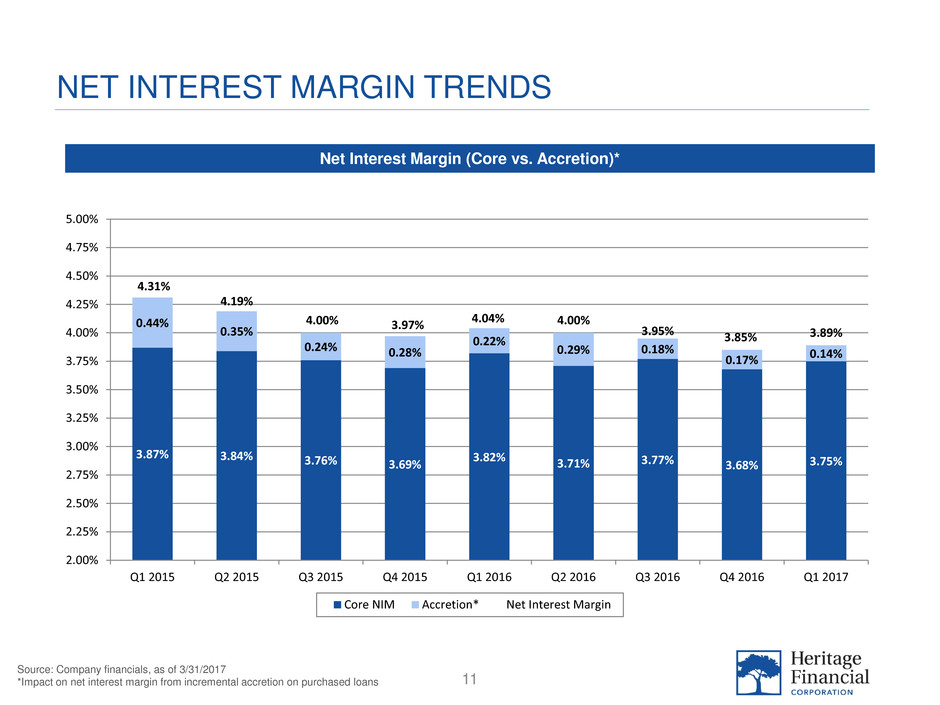

• Net interest margin, excluding incremental accretion on

purchased loans, increased to 3.75% for the first quarter

Source: Company financials, as of 3/31/2017

9

LOAN PORTFOLIO

Loan Portfolio TrendsLoan Portfolio Mix - % of Total

Source: Company financials, as of 3/31/2017

Note: All dollars in millions

*Excludes impact from incremental accretion on purchased loans

**Includes loans held for sale

• Total CRE of 54.3% of total loans

• Total C&I and owner-occupied CRE of 45.3% of total

loans

• Core yield on loans of 4.52% in Q1 2017*

• Total loans, net of deferred costs of $2.7 billion

• $158.1 million of loan originations in Q1 2017

1-4 Family

2.9% Owner-

Occupied CRE

21.4%

Nonowner-

Occupied CRE

32.9%

Commercial &

Industrial

23.9%

Construction

& Land

Development

6.7%

Consumer

12.2%

$1,232

$2,257

$2,410

$2,652

$2,674 86.0%

76.7% 76.6%

81.2% 81.5%

70.0%

72.0%

74.0%

76.0%

78.0%

80.0%

82.0%

84.0%

86.0%

88.0%

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2013 2014 2015 2016 Q1 2017

Loans Receivable, net** Net Loans / Deposits Ratio

10

DEPOSIT PROFILE

Deposit TrendsDeposit Mix - % of Total

Source: Company financials, as of 3/31/2017

Note: All dollars in millions

• Noninterest bearing demand of 27.2% of total

deposits

• Non-maturity deposits of 89.4% of total deposits

• Cost of total deposits of 0.16% in Q1 2017

Noninterest

Bearing

Demand

27.2%

NOW

Accounts

30.5%

Money

Market

Accounts

16.0%

Savings

Accounts

15.7%

Certificates

of Deposits

10.6%

$1,399

$2,906

$3,108 $3,230 $3,243

25.0%

24.4%

24.8%

27.3% 27.2%

22.0%

23.0%

24.0%

25.0%

26.0%

27.0%

28.0%

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

2013 2014 2015 2016 Q1 2017

Total Deposits Noninterest Bearing Demand % of Total Deposits

11

NET INTEREST MARGIN TRENDS

Net Interest Margin (Core vs. Accretion)*

Source: Company financials, as of 3/31/2017

*Impact on net interest margin from incremental accretion on purchased loans

3.87% 3.84% 3.76% 3.69%

3.82% 3.71% 3.77% 3.68% 3.75%

0.44%

0.35%

0.24% 0.28%

0.22%

0.29% 0.18%

0.17% 0.14%

4.31%

4.19%

4.00% 3.97% 4.04% 4.00% 3.95% 3.85% 3.89%

2.00%

2.25%

2.50%

2.75%

3.00%

3.25%

3.50%

3.75%

4.00%

4.25%

4.50%

4.75%

5.00%

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Core NIM Accretion* Net Interest Margin

12

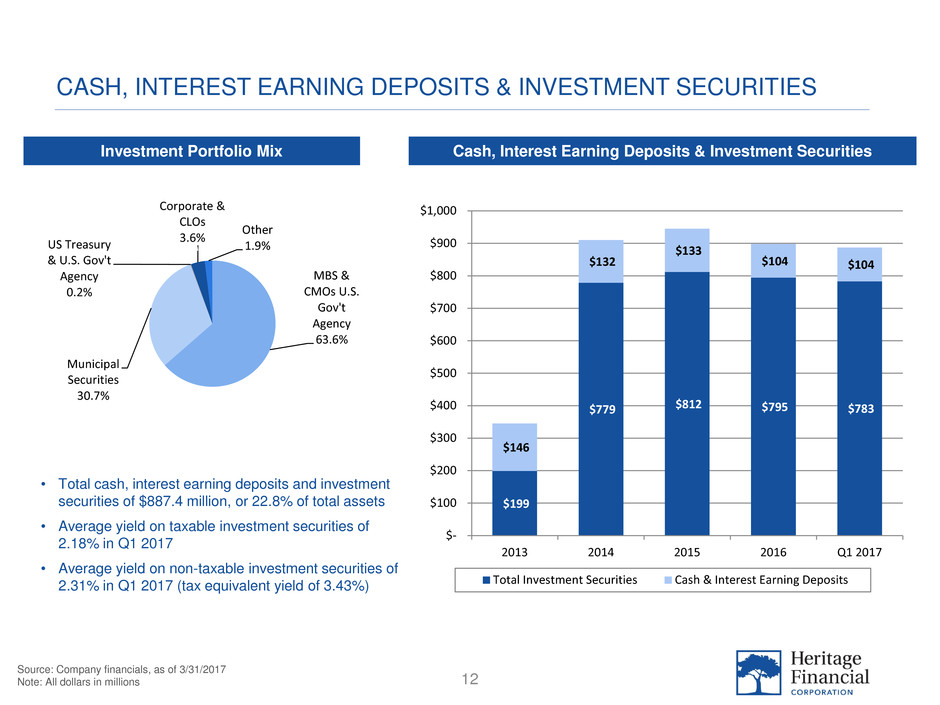

CASH, INTEREST EARNING DEPOSITS & INVESTMENT SECURITIES

Cash, Interest Earning Deposits & Investment SecuritiesInvestment Portfolio Mix

Source: Company financials, as of 3/31/2017

Note: All dollars in millions

• Total cash, interest earning deposits and investment

securities of $887.4 million, or 22.8% of total assets

• Average yield on taxable investment securities of

2.18% in Q1 2017

• Average yield on non-taxable investment securities of

2.31% in Q1 2017 (tax equivalent yield of 3.43%)

$199

$779 $812 $795 $783

$146

$132

$133

$104 $104

$-

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2013 2014 2015 2016 Q1 2017

Total Investment Securities Cash & Interest Earning Deposits

MBS &

CMOs U.S.

Gov't

Agency

63.6%

Municipal

Securities

30.7%

US Treasury

& U.S. Gov't

Agency

0.2%

Corporate &

CLOs

3.6%

Other

1.9%

13

NON-INTEREST EXPENSE

Source: Company financials, as of 3/31/2017

Note: All dollars in thousands

Overhead Ratio = Ratio of non-interest expense (annualized) to average total assets

Non-Interest Expense Detail and Overhead Ratio

$27,903

$46,745 $48,074 $45,068

$11,199

$31,612

$52,634

$58,134 $61,405

$16,024

3.86%

3.49%

3.01% 2.84% 2.85%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

$-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

2013 2014 2015 2016 Q1 2017

Non-Compensation Expense Compensation & Benefits Expense Overhead Ratio

CREDIT QUALITY TRENDS

14

Source: Company financials, as of 3/31/2017

Note: All dollars in thousands

- -

- -

$29,667 $28,426

$30,211 $31,083 $31,594

1.21%

1.13%

1.17%

1.18%

1.19%

1.05%

1.10%

1.15%

1.20%

1.25%

1.30%

1.35%

1.40%

1.45%

1.50%

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

A

LL

L/

L

o

a

n

s,

n

et

A

LL

L

ALLL ALLL / Loans Receivable, net

ALLL/Loans Receivable, net

$29,667 $28,426

$30,211 $31,083 $31,594

1.21%

1.13%

1.17%

1.18%

1.19%

1.05%

1.10%

1.15%

1.20%

1.25%

1.30%

1.35%

1.40%

1.45%

1.50%

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

A

LL

/

Lo

a

n

s

R

ec

ei

va

bl

e,

n

et

A

LL

L

ALLL ALLL / Loans Receivable, net

$1,218

$2,361

$(290)

$305 $356

0.20%

0.38%

-0.05%

0.05%

0.05%

-0.10%

-0.05%

0.00%

0.05%

0.10%

0.15%

0.20%

0.25%

0.30%

0.35%

0.40%

0.45%

$(500)

$-

$500

$1,000

$1,500

$2,000

$2,500

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

N

CO

s

/

A

vg

. L

o

a

n

s

N

e

t C

h

a

rg

e

-O

ff

s/

(R

ec

o

ve

ri

es

)

Net Charge Offs /(Recoveries)

Net Charge-Offs and NCOs Annualized/Avg. Loans NPAs / Assets

$1,139 $1,120

$1,495

$1,177

$867

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Pr

o

vi

si

o

n

Ex

p

en

se

Provision Expense

0.39%

0.41%

0.30% 0.30% 0.30%

0.00%

0.05%

0.10%

0.15%

0.20%

0.25%

0.30%

0.35%

0.40%

0.45%

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

N

PA

s

/

A

ss

et

s

CAPITAL RATIO TRENDS

15Source: Company financials, as of 3/31/2017

- -

- -

Tier-1 Capital Ratio

10.2% 10.4% 10.3% 10.3%

0.00%

4.00%

8.00%

12.00%

2014 2015 2016 Q1 2017

9.8% 9.7% 9.5% 9.7%

0.00%

4.00%

8.00%

12.00%

2014 2015 2016 Q1 2017

13.9%

12.7% 12.0% 12.2%

0.00%

4.00%

8.00%

12.00%

16.00%

20.00%

2014 2015 2016 Q1 2017

15.1%

13.7% 13.0% 13.2%

0.00%

4.00%

8.00%

12.00%

16.00%

20.00%

2014 2015 2016 Q1 2017

Tangible Common Equity Ratio

Risk Based Capital Ratio

Leverage Ratio

PROFITABILITY TRENDS

16

Source: Company financials, as of 3/31/2017

Note: All dollars in thousands, except per share

- -

ROAA

0.74%

1.06% 1.04%

0.97%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

2014 2015 2016 Q1 2017

7.58%

11.18% 10.85% 10.51%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

2014 2015 2016 Q1 2017

ROATCE

- -

- -

Diluted Earnings Per Share

$0.30 $0.30

$0.37

$0.33 $0.31

$-

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

$9,091 $8,895

$11,039

$9,893 $9,316

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Dividends Per Share*Net Income

17

KING COUNTY METRO

Source: Company financials, as of 03/31/17

Note: All dollars in millions

Funds Under Management = Loans + Deposits

$276 $284

$365

$400

$440 $449

$83 $75

$105

$101

$99 $95

$-

$100

$200

$300

$400

$500

$600

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Loans Deposits

$359$359

$470

$501

$539 $544

18

19

20

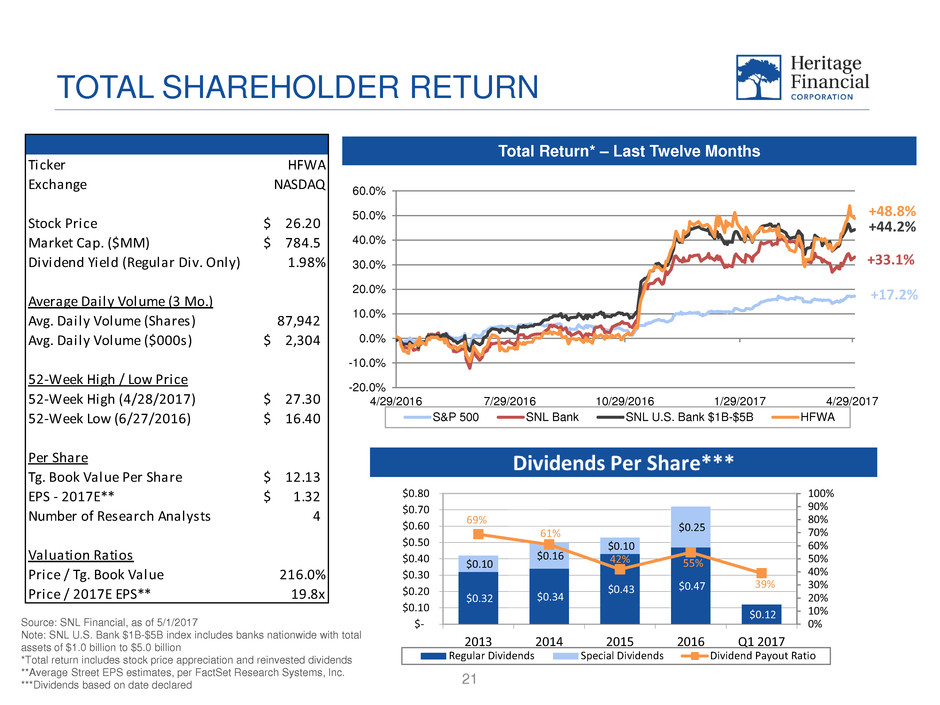

TOTAL SHAREHOLDER RETURN

21

Total Return* – Last Twelve Months

Source: SNL Financial, as of 5/1/2017

Note: SNL U.S. Bank $1B-$5B index includes banks nationwide with total

assets of $1.0 billion to $5.0 billion

*Total return includes stock price appreciation and reinvested dividends

**Average Street EPS estimates, per FactSet Research Systems, Inc.

***Dividends based on date declared

+17.2%

+44.2%

+48.8%

- -

Dividends Per Share***

+33.1%

$0.32 $0.34

$0.43 $0.47

$0.12

$0.10

$0.16

$0.10

$0.25

69%

61%

42% 55%

39%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$-

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

2013 2014 2015 2016 Q1 2017

Regular Dividends Special Dividends Dividend Payout Ratio

Ticker HFWA

Exchange NASDAQ

Stock Price 26.20$

Market Cap. ($MM) 784.5$

Dividend Yield (Regular Div. Only) 1.98%

Average Daily Volume (3 Mo.)

Avg. Daily Volume (Shares) 87,942

Avg. Daily Volume ($000s) 2,304$

52-Week High / Low Price

52-Week High (4/28/2017) 27.30$

52-Week Low (6/27/2016) 16.40$

Per Share

Tg. Book Value Per Share 12.13$

EPS - 2017E** 1.32$

Number of Research Analysts 4

Valuation Ratios

Price / Tg. Book Value 216.0%

Price / 2017E EPS** 19.8x

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

4/29/2016 7/29/2016 10/29/2016 1/29/2017 4/29/2017

S&P 500 SNL Bank SNL U.S. Bank $1B-$5B HFWA

HFWA INVESTMENT THESIS

22

• Western Washington geographic footprint with vibrant

economy and attractive long-term demographics

• Continued focus on growth trends and capital

management

– Grow organically and continue to evaluate M&A opportunities

– Continue to focus on improving shareholder value

• Attractive valuation

23

APPENDIX

HISTORICAL FINANCIAL HIGHLIGHTS

24Source: Company financials, as of 03/31/2017

Note: All dollars in thousands

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Balance Sheet

Total Assets 3,595,378$ 3,650,792$ 3,678,032$ 3,756,876$ 3,846,376$ 3,878,981$ 3,885,613$

Asset Growth (Anlzd. vs. Prior Period) 13.2% 6.2% 3.0% 8.6% 9.5% 3.4% 0.7%

Total Loans, net of deferred costs (Incl. HFS) 2,412,025$ 2,409,724$ 2,466,184$ 2,531,731$ 2,587,941$ 2,652,411$ 2,673,593$

Loan Growth (Anlzd. vs. Prior Period) 9.8% -0.4% 9.4% 10.6% 8.9% 10.0% 3.2%

Total Deposits 3,054,198$ 3,108,287$ 3,130,929$ 3,158,906$ 3,242,421$ 3,229,648$ 3,243,415$

Deposit Growth (Anlzd. vs. Prior Period) 14.6% 7.1% 2.9% 3.6% 10.6% -1.6% 1.7%

Net Loans / Deposits Ratio 78.0% 76.6% 77.8% 79.2% 78.9% 81.2% 81.5%

Cash and Securities / Total Assets 24.6% 25.9% 25.1% 24.5% 24.4% 23.2% 22.8%

Noninterest Bearing Deposits (% of Total) 25.0% 24.8% 25.4% 26.0% 26.7% 27.3% 27.2%

Non-maturity deposits (% of Total) 85.7% 86.5% 87.0% 87.7% 88.6% 88.9% 89.4%

Capital Adequacy

Tangible Common Equity 340,355$ 342,152$ 352,698$ 362,938$ 369,251$ 355,360$ 363,117$

Tangible Common Equity Ratio 9.8% 9.7% 9.9% 10.0% 9.9% 9.5% 9.7%

Leverage Ratio 10.5% 10.4% 10.5% 10.5% 10.5% 10.3% 10.3%

Risk Based Capital Ratio 13.4% 13.7% 13.6% 13.0% 13.0% 13.0% 13.2%

Credit Quality Ratios

NPAs / Total Assets 0.33% 0.32% 0.39% 0.41% 0.30% 0.30% 0.30%

NCOs (Anlzd.)/ Avg. Loans 0.02% 0.06% 0.20% 0.38% -0.05% 0.05% 0.05%

ALLL / Gross Loans 1.21% 1.24% 1.21% 1.13% 1.17% 1.18% 1.19%

Income Statement and Performance Ratios

Net Interest Income 31,940$ 32,535$ 32,760$ 33,085$ 33,606$ 33,055$ 33,146$

Net Income 9,492$ 9,493$ 9,091$ 8,895$ 11,039$ 9,893$ 9,316$

ROAA 1.06% 1.04% 1.00% 0.96% 1.16% 1.03% 0.97%

Net Interest Margin 4.00% 3.97% 4.04% 4.00% 3.95% 3.85% 3.89%

Noninterest Expense / Avg. Assets 3.05% 2.92% 2.91% 2.87% 2.81% 2.78% 2.85%

Avg Assets Per Employee 4,634$ 4,837$ 4,934$ 4,993$ 5,141$ 5,094$ 5,095$

Efficiency Ratio 65.9% 66.9% 66.3% 66.8% 61.7% 65.0% 67.2%

(1) Operating revenue = net interest income + non-interest income

DISCOUNTS ON ACQUIRED LOANS

25

• $12.6 million remaining loan discount on acquired loans

Source: Company information, as of 03/31/2017

Note: All dollars in thousands

Acquired

Loans

3/31/2016

Loan Balance 801,913$

Remaining Loan Mark 18,563$

Recorded Investment 783,350$

Discount % 2.31%

6/30/2016

Loan Balance 745,480$

Remaining Loan Mark 17,494$

Recorded Investment 727,986$

Discount % 2.35%

9/30/2016

Loan Balance 696,577$

Remaining Loan Mark 14,747$

Recorded Investment 681,830$

Discount % 2.12%

12/31/2016

Loan Balance 648,549$

Remaining Loan Mark 13,525$

Recorded Investment 635,024$

Discount % 2.09%

3/31/2017

Loan Balance 612,645$

Remaining Loan Mark 12,556$

Recorded Investment 600,089$

Discount % 2.05%