Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | a2017-058kannualshareholde.htm |

Enterprise Financial Services Corp

ANNUAL SHAREHOLDER MEETING – MAY 2, 2017

2

JOHN S. EULICH

CHAIRMAN, EFSC

2017 ANNUAL SHAREHOLDER MEETING

3

JAMES J. MURPHY, JR.

THANK YOU FOR YOUR SERVICE AND

MANY CONTRIBUTIONS

2002-2017

4

WILLIAM H. DOWNEY

THANK YOU FOR YOUR SERVICE AND

MANY CONTRIBUTIONS

2002-2017

5

ELOISE E. SCHMITZ

WELCOME NEW EFSC DIRECTORS

NEVADA A. KENT IV

MICHAEL W. WALSH JAMES B. LALLY

6

LEGAL MEETING

2017 ANNUAL SHAREHOLDER MEETING

7

PETER F. BENOIST

THANK YOU FOR YOUR

YEARS OF DEDICATION TO EFSC

2002-2017

8

HIGH PERFORMANCE LEADERSHIP

9

KEENE S. TURNER

CHIEF FINANCIAL OFFICER, EFSC

2017 ANNUAL SHAREHOLDER MEETING

10

2016 HIGHLIGHTS

Record Earnings Per Share $2.41 $2.03

Growth of Earnings Per Share 28% 22%

Return on Assets 1.29% 1.09%

Efficiency Ratio 52% 55%

EFSC Stock Price $43.00

EFSC Dividend/Share $0.41

Core*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

11

FULL YEAR EARNINGS PER SHARE TREND

$1.66

$0.51 < $0.02>

$0.04 <$0.16>

$2.03

2015 YTD Net Interest

Income

Portfolio Loan

Loss Provision

Non Interest

Income

Non Interest

Expense

2016 YTD

CHANGES IN CORE EPS*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

12

POSITIVE MOMENTUM IN CORE*

EARNINGS PER SHARE

$0.28

$0.31

$0.37

$0.33

$0.35

$0.38

$0.44

$0.49

$0.47

$0.49 $0.49

$0.59 $0.59

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

111% Core EPS Growth from Q1 2014 to Q1 2017

13

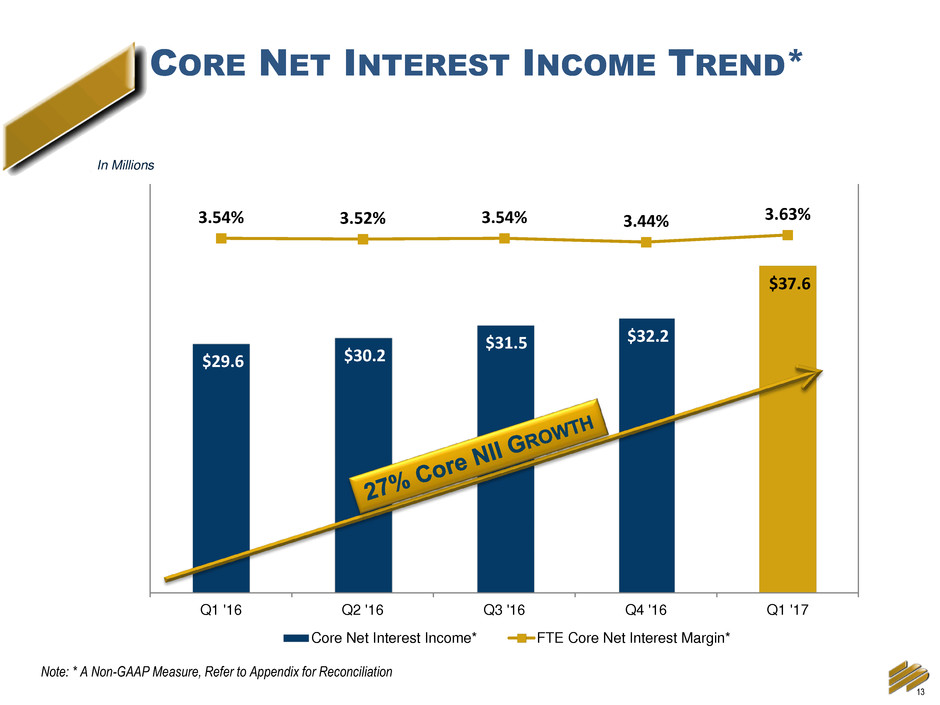

CORE NET INTEREST INCOME TREND*

In Millions

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

$29.6 $30.2

$31.5 $32.2

$37.6

3.54% 3.52% 3.54% 3.44% 3.63%

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00%

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0

$10.0

$11.0

$12.0

$13.0

$14.0

$15.0

$16.0

$17.0

$18.0

$19.0

$20.0

$21.0

$22.0

$23.0

$24.0

$25.0

$26.0

$27.0

$28.0

$29.0

$30.0

$31.0

$32.0

$33.0

$34.0

$35.0

$36.0

$37.0

$38.0

$39.0

$40.0

$41.0

$42.0

$43.0

$44.0

$45.0

$46.0

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

Core Net Interest Income* FTE Core Net Interest Margin*

14

CREDIT TRENDS FOR PORTFOLIO LOANS

-1 bps

-6 bps

14 bps

12 bps

-1 bps

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

Net Charge-offs (1)

Q1 2017 EFSC PEER(2)

NPA’S/ASSETS = 0.33% 0.66%

NPL’S/LOANS = 0.36% 0.77%

ALLL/NPL’S = 283% 112%

ALLL/LOANS (4) = 1.02% 1.04%

(1) Portfolio loans only, excludes non-core acquired loans

(2) Peer data as of 12/31/2016 (source: SNL Financial)

(3) Excludes JCB

(4)1.65% including JCB Credit Mark

In Millions

$82

$51

$154

$80

$56

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

Portfolio Loan Growth (3)

In Millions

Net Charge-offs (1)

2016 NCO = 5 bps

$0.8 $0.7

$3.0

$1.0

$1.5

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

Provision for Portfolio Loans

15

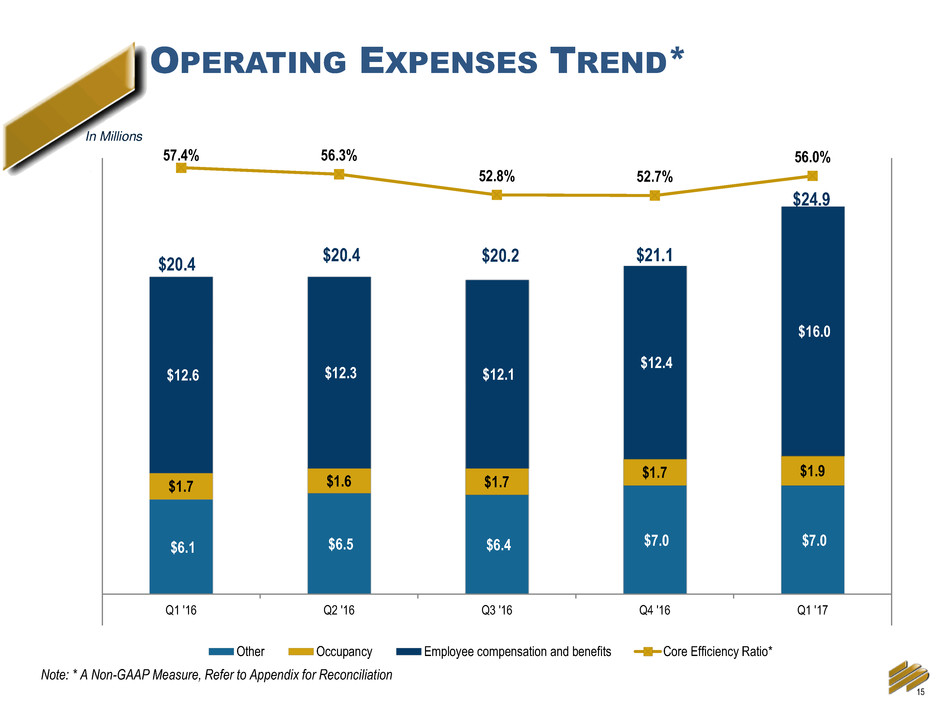

OPERATING EXPENSES TREND*

In Millions

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

$6.1 $6.5 $6.4 $7.0 $7.0

$1.7 $1.6 $1.7

$1.7 $1.9

$12.6 $12.3 $12.1

$12.4

$16.0

57.4% 56.3%

52.8% 52.7%

56.0%

-2

3

8

13

18

23

28

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

Other Occupancy Employee compensation and benefits Core Efficiency Ratio*

$20.4

$21.1 $20.2 $20.4

$24.9

16

2016 HIGHLIGHTS

Record Earnings Per Share $2.41 $2.03

Growth of Earnings Per Share 28% 22%

Return on Assets 1.29% 1.09%

Efficiency Ratio 52% 55%

EFSC Stock Price $43.00

EFSC Dividend/Share $0.41

Core*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

17

SCOTT R. GOODMAN

PRESIDENT, ENTERPRISE BANK & TRUST

2017 ANNUAL SHAREHOLDER MEETING

18 SOURCE: SNL FINANCIAL

EFSC (16 BRANCHES TOTAL, 6 BRANCHES IN ST. LOUIS MSA)

JCB (18 BRANCHES TOTAL, 17 BRANCHES IN ST. LOUIS MSA)

ST. LOUIS MSA

STRATEGIC, IN-MARKET ACQUISITION OF

JEFFERSON COUNTY BANCSHARES, INC. (“JCB”)

JCB ASSETS ELEVATE US TO A $5 BILLION

FINANCIAL INSTITUTION

OUR FOOTPRINT IN THE ST. LOUIS MARKET

ENHANCED WITH 18 ADDITIONAL BRANCHES

TOP FOUR DEPOSIT MARKET SHARE IN

THE ST. LOUIS MSA

INTRODUCTION OF 37,000 NEW JCB

CUSTOMERS

MO

19

(1) COMMUNITY BANKS DEFINED AS INSTITUTIONS HAVING LESS THAN $10 BILLION IN DEPOSITS

SOURCE: SNL FINANCIAL, FDIC; DEPOSIT DATA AS OF JUNE 30, 2016

TOP 4 DEPOSIT MARKET SHARE

EFSC IS THE SECOND LARGEST COMMUNITY BANK BY

DEPOSITS IN MISSOURI (1)

STRENGTHENS EFSC’S ALREADY SIGNIFICANT ST.

LOUIS FOOTPRINT

Rank Institution

# of

Branches

June '16

Total

Deposits

Market

Share

(%)

1 U.S. Bancorp (MN) 117 13,440,724 19.26

2 Bank of America Corp, (NC) 52 11,264,321 16.15

3 Commerce Bancshares Inc. (MO) 48 6,450,739 9.25

4 Enterprise Financial Services Corp (MO) 23 2,980,987 4.27 %

5 Regions Financial Corp. (AL) 62 2,761,735 3.96

6 PNC Financial Services Group (PA) 43 2,231,254 3.2

7 First Banks Inc. (MO) 48 2,187,788 3.14

8 Banc Ed Corp. (IL) 20 1,533,999 2.2

9 Stupp Bros. Inc. (MO) 22 1,449,099 2.08

10 Central Bancompany Inc. (MO) 15 1,310,776 1.88

Top 10 Institutions 450 45,611,422 65.39

Total for Institutions in Market 892 69,769,443 100.00 %

20

JCB’S EXPANDED COMMERCIAL AND RETAIL CUSTOMER BASES ARE

COMPLEMENTARY TO EFSC’S EXISTING PRODUCT SETS

OPPORTUNITY TO DEEPEN CLIENT RELATIONSHIPS ACROSS THE EFSC

PRODUCT SET

FEE INCOME OPPORTUNITIES (1)

(1) REPRESENT ILLUSTRATIVE AREAS OF POTENTIAL FEE INCOME ENHANCEMENT; POTENTIAL REVENUE ENHANCEMENTS NOT INCLUDED IN ESTIMATES OF FINANCIAL IMPACT PROVIDED HEREIN

WEALTH MANAGEMENT

CARD SERVICES

TREASURY MANAGEMENT

MORTGAGE

21

PORTFOLIO LOAN TRENDS

$2,833

$2,884

$3,038

$3,118

$3,853

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

In Millions

*Note: 12% excluding acquisition of JCB

JCB $678

22

$1,545 $1,541

$1,599

$1,633

$1,774

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

COMMERCIAL & INDUSTRIAL LOAN TRENDS

In Millions

JCB $79

*Note: 10% excluding acquisition of JCB

23

DEPOSIT TRENDS

$2,932

$3,028

$3,125

$3,233

$4,032

24.5% 24.9% 24.4% 26.8% 25.7%

-30.0%

-20.0%

-10.0%

0.0%

10.0%

20.0%

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

800

1,300

1,800

2,300

2,800

3,300

3,800

4,300

Deposits DDA %

Last Twelve Months Growth Rate = 38%, 11% Excluding Acquisition of JCB

In Millions

JCB $774

24

ST. LOUIS

PORTFOLIO LOANS & DEPOSITS

In Millions

$1,468

$1,737

$2,448

Q1 '16 Q4 '16 Q1 '17

Deposits JCB Deposits

$1,427 $1,556

$2,210

Q1 '16 Q4 '16 Q1 '17

Loans JCB Loans

JCB

$678

JCB

$774

25

KANSAS CITY

PORTFOLIO LOANS & DEPOSITS

$532

$591 $614

Q1 '16 Q4 '16 Q1 '17

Loans

In Millions

$650 $659

$773

Q1 '16 Q4 '16 Q1 '17

Deposits

26

ARIZONA

PORTFOLIO LOANS & DEPOSITS

$188

$226 $236

Q1 '16 Q4 '16 Q1 '17

Loans

In Millions

$100 $107 $113

Q1 '16 Q4 '16 Q1 '17

Deposit

27

SPECIALIZED LENDING

PORTFOLIO LOANS

In Millions

$686

$745 $793

Q1 '16 Q4 '16 Q1 '17

Loans

ENTERPRISE VALUE LENDING

LIFE INSURANCE PREMIUM FINANCING

TAX CREDIT PROGRAMS

AIRCRAFT FINANCE

MEMBER FDIC 28

NET PROMOTER SCORE

Industry-leading customer service and satisfaction

2015 2016 Banking Average

KC 46 65

35

St. Louis 58 61

Average 52 63

Enterprise won a total of three 2016

Greenwich Excellence Awards in the

Middle Market segment.

Source: Greenwich Associates

29

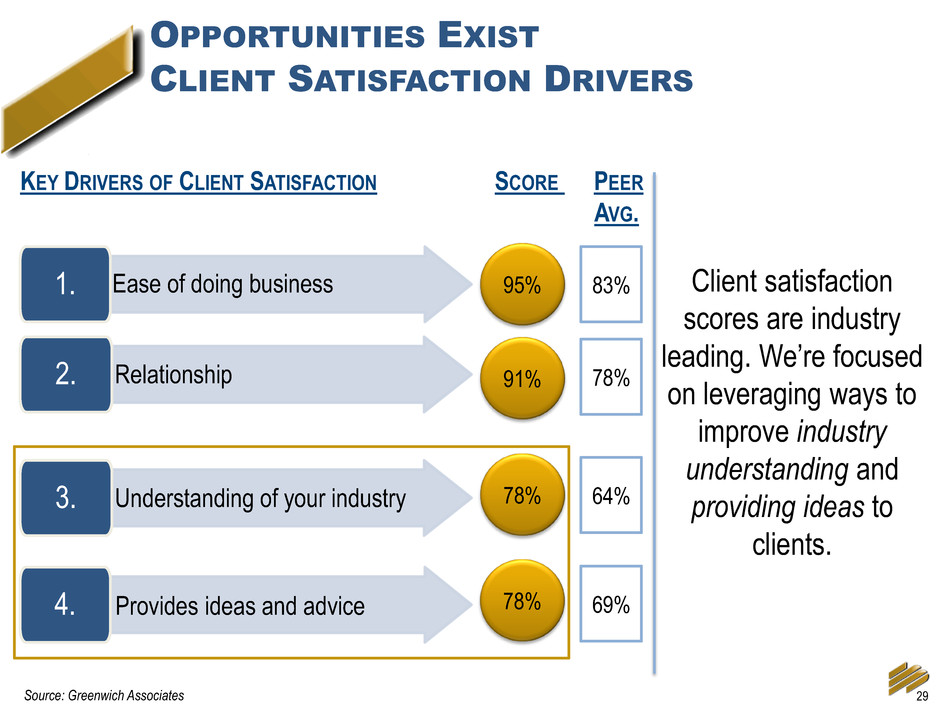

OPPORTUNITIES EXIST

CLIENT SATISFACTION DRIVERS

Client satisfaction

scores are industry

leading. We’re focused

on leveraging ways to

improve industry

understanding and

providing ideas to

clients.

1. Ease of doing business

2. Relationship

3. Understanding of your industry

4. Provides ideas and advice

KEY DRIVERS OF CLIENT SATISFACTION SCORE PEER

AVG.

95%

91%

78%

78%

83%

78%

64%

69%

Source: Greenwich Associates

30

JAMES B. LALLY

PRESIDENT & CEO, EFSC

2017 ANNUAL SHAREHOLDER MEETING

31

EFSC MARKET CAPITALIZATION

Total Shareholder Return

EFSC 146%

SNL US Bank Index 46% > 100%

0.00

200.00

400.00

600.00

800.00

1,000.00

1,200.00

EFSC Market Capitalization

March 31, 2014 - April 26, 2017

Market Cap

at 3/31/14:

$395mm

Market Cap

at 4/26/17:

$1,034 mm

161.4%

32

I

M

P

R

O

V

E

.

.

.

Diversified,

double-

digit

revenue

growth

Low cost,

resilient

funding

Superior

return on

investment

(ROI)

Align and

manage

support

functions

to drive

profitability

Service Levels

Urban Markets

Operating

Leverage

Scalability

Cost/Unit

Shareholder

Returns

PROCESS EVOLUTION

33

INNOVATION INTO ACTION

Executive

Team

Innovation

Team

• Financial Plan/Return

• Resource Needs

• Risk Analysis (Legal,

compliance, vendor)

P

rioritiz

ation

• Review Project Status

• Oversee periodic look-

back, post implementation

Animation

Team

Implementation

&

Accountability

Rec

om

m

en

d

“Go

/No G

o”

• Idea Creation/Formation

Idea Charter Prioritize Analyze

Go /

No Go

Implement

34

MARKETING & SALES FUNNEL

Awareness

Interest

Consideration

Intent

Evaluation

Purchase

NOW… …FUTURE

Marketing

Sales

Marketing

Sales

35

2017 ANNUAL SHAREHOLDER MEETING