Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Mattersight Corp | matr-ex991_14.htm |

| 8-K - 8-K - Mattersight Corp | matr-8k_20170208.htm |

Q4 2016 Earnings Webinar February 2017 Exhibit 99.2

Safe Harbor Language During today’s call we will be making both historical and forward-looking statements in order to help you better understand our business. These forward-looking statements include references to our plans, intentions, expectations, beliefs, strategies and objectives. Any forward-looking statements speak only as of today’s date. In addition, these forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those stated or implied by the forward-looking statements. The risks and uncertainties associated with our business are highlighted in our filings with the SEC, including our Annual Report filed on Form 10-K for the year ended December 31, 2015, our quarterly reports on Form 10-Q, as well as our earnings press release issued earlier today. Mattersight Corporation undertakes no obligation to publicly update or revise any forward-looking statements in this call. Also, be advised that this call is being recorded and is copyrighted by Mattersight Corporation. © 2017 Mattersight Corporation.

Discussion Topics Q4 Highlights Financial Results Deal Commentary Outlook © 2017 Mattersight Corporation.

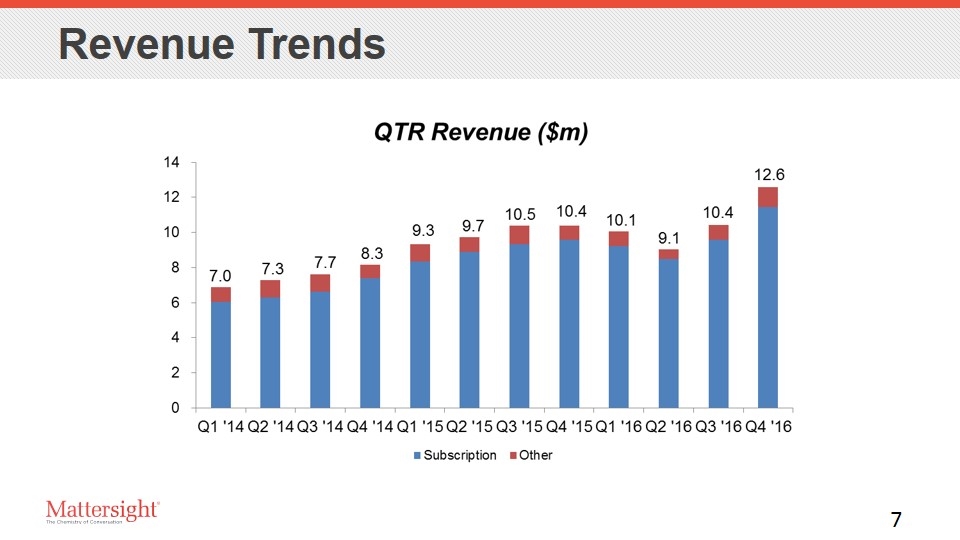

Q4 Headlines Q4 revenue of $12.6M, a new record 20% increase sequentially Q4 subscription revenue of $11.4M 19% increase sequentially Bookings of $6.4M in ACV Positive adjusted EBITDA of $0.5M © 2017 Mattersight Corporation.

IntroducingOur New CFO Dave Mullen MATR board member since 2009 27 years experience as a technology CFO NAVTEQ, Allscripts, CCC Information Services

Financial Results Revenue growth linked to: Freeing up backlog Seasonal seat count increases Subscription revenue $11.4M 19% increase sequentially 91% of total revenue Gross margin 69% Continuing upward trend Positive adjusted EBITDA of $0.5M $2.8M improvement over q3 © 2017 Mattersight Corporation.

Revenue Trends

Deal Commentary Best bookings quarter of 2016 Significant Q4 Deals Won RFP for enterprise-wide call capture and analytics at existing account Won RFP for analytics at a global hotel chain Largest routing deal to date at an existing account Pipeline Robust pipeline entering 2017 Deals are typically non competitive Significant interest across our product suite © 2017 Mattersight Corporation.

Business Outlook Powerful product suite that can create a large SW company Enormous emerging market Premier customers Focus on customer value Strong people in many key positions

2017 Outlook © 2017 Mattersight Corporation. Expect revenue will be $50M+ for full year Expect to be adjusted EBITDA positive for full year Factors contributing to the pace of growth: Timing of contract signing Size of contract Timing of go live Seat count ramp

Q&A

Thank You Kelly Conway 847.582.7200 kelly.conway@mattersight.com David Gustafson 847.582.7016 david.gustafson@mattersight.com Dave Mullen 312-954-7380 dave.mullen@mattersight.com © 2017 Mattersight Corporation.