Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS RELEASE - ENTERPRISE FINANCIAL SERVICES CORP | ex991financialstatementsan.htm |

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | a8kearningsreleasedoc123116.htm |

Enterprise Financial Services Corp

2016 FOURTH QUARTER EARNINGS RELEASE

2

Some of the information in this report contains “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements typically are identified with use of terms such as “may,” “might,” “will, “should,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “could,” “continue” and the negative of these terms and similar words, although some

forward-looking statements may be expressed differently. Forward-looking statements also include, but are not limited to, statements regarding plans, objectives,

expectations or consequences of announced transactions (including the Company's announced pending merger with Jefferson County Bancshares, Inc. (“JCB”)),

and statements about the future performance, operations products and services of the Company and its subsidiaries. Our ability to predict results or the actual

effect of future plans or strategies is inherently uncertain. You should be aware that our actual results could differ materially from those anticipated by the forward-

looking statements or historical performance due to a number of factors, including, but not limited to: our ability to efficiently integrate acquisitions into our

operations, retain the customers of these businesses and grow the acquired operations; reputational risks; credit risk; changes in the appraised valuation of real

estate securing impaired loans; outcomes of litigation and other contingencies; exposure to general and local economic conditions; risks associated with rapid

increases or decreases in prevailing interest rates; consolidation within the banking industry; competition from banks and other financial institutions; our ability to

attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in regulatory requirements; changes in

accounting regulation or standards applicable to banks; and other risks discussed under the caption “Risk Factors” of our most recently filed Form 10-K and in Part

II, 1A of our most recently filed Form 10-Q, all of which could cause the Company’s actual results to differ from those set forth in the forward-looking statements.

Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s analysis and expectations only as of the date of

such statements. Forward-looking statements speak only as of the date they are made, and the Company does not intend, and undertakes no obligation, to publicly

revise or update forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise, except as required by

federal securities law. You should understand that it is not possible to predict or identify all risk factors. Readers should carefully review all disclosures we file from

time to time with the Securities and Exchange Commission (the “SEC”) which are available on our website at www.enterprisebank.com under "Investor Relations."

Additional Information about the Merger and Where to Find It

In connection with the proposed merger transaction, the Company filed a Registration Statement on Form S-4 (file no. 333-214990) with the SEC that includes a Proxy

Statement of JCB, and a Prospectus of the Company, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the

Registration Statement and the Proxy Statement/Prospectus regarding the merger and any other relevant documents filed with the SEC, as well as any amendments

or supplements to those documents, because they will contain important information.

A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about the Company and JCB, may be obtained at the SEC’s website

www.sec.gov. The Company, JCB, and some of their directors and executive officers may be deemed participants in the solicitation of proxies from the shareholders

of JCB in connection with the proposed merger. Information about the directors and executive officers of the Company is set forth in the Proxy Statement for the

Company’s 2016 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 16, 2016. Additional information regarding the interests of those

participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the

proposed merger. Free copies of this document may be obtained as described in the preceding paragraph.

FORWARD-LOOKING STATEMENTS

3

SUSTAIN CORE GROWTH TRENDS

SUCCESSFULLY CLOSE, CONVERT AND INTEGRATE

JEFFERSON COUNTY BANCSHARES

MAINTAIN FOCUS ON LONG-TERM STRATEGIC

DEVELOPMENT

2017 FOCUS

4

CONTINUED GROWTH IN CORE EPS

DRIVE NET INTEREST INCOME GROWTH

IN DOLLARS WITH FAVORABLE LOAN

GROWTH TRENDS

DEFEND NET INTEREST MARGIN

MAINTAIN HIGH QUALITY CREDIT

PROFILE

ACHIEVE FURTHER IMPROVEMENT IN

OPERATING LEVERAGE

ENHANCE DEPOSIT LEVELS TO

SUPPORT GROWTH

FINANCIAL SCORECARD

20%

12%

6 bps*

15 bps NPLs/Loans

3%

16%

Q4 2016 Compared to Q4 2015

* Plus 1 bp excluding $50 Million subordinated debt offering

5

PORTFOLIO LOAN TRENDS

$2,751

$2,833

$2,884

$3,038

$3,118

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

In Millions

6

$1,484

$1,545 $1,541

$1,599

$1,633

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

COMMERCIAL & INDUSTRIAL LOAN TRENDS

In Millions

7

PORTFOLIO LOAN DETAILS

Q4 ’16 Q3 ‘16

QTR

CHANGE

Q4 ‘15

LTM

CHANGE

ENTERPRISE VALUE LENDING $ 389 $ 395 $ (6) $ 350 $ 39

C&I GENERAL 794 756 38 732 62

LIFE INSURANCE PREMIUM FINANCING 306 299 7 265 41

TAX CREDIT 144 149 (5) 137 7

COMMERCIAL REAL ESTATE 1,089 1,045 44 932 157

RESIDENTIAL REAL ESTATE 241 234 7 197 44

CONSUMER & OTHER 155 160 (5) 138 17

PORTFOLIO LOANS $ 3,118 $ 3,038 $ 80 $ 2,751 $ 367

In Millions

8

PORTFOLIO LOANS BY BUSINESS UNIT

$1,387

$1,484

$1,556

$1,100

$1,200

$1,300

$1,400

$1,500

$1,600

Q4 '15 Q3 '16 Q4 '16

St. Louis

$535 $586 $591

0

200

400

600

800

1000

1200

1400

Q4 '15 Q3 '16 Q4 '16

$190 $218 $226

0

500

1000

1500

Q4 '15 Q3 '16 Q4 '16

Arizona

In Millions

Kansas City

$639

$750 $745

$-

$200

$400

$600

$800

$1,000

Q4 '15 Q3 '16 Q4 '16

Specialized Lending

9

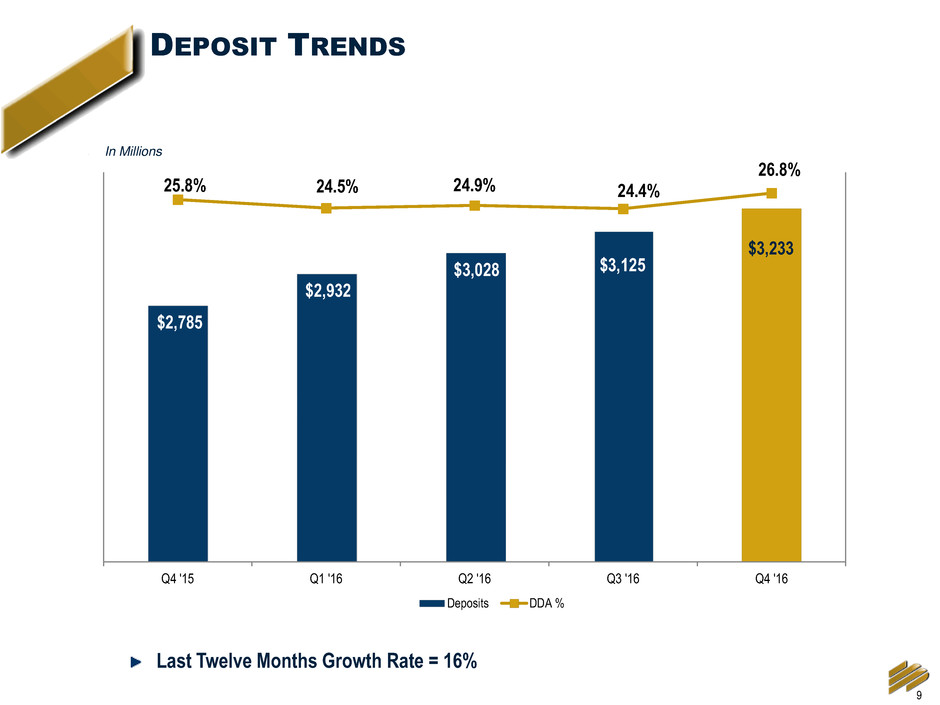

DEPOSIT TRENDS

$2,785

$2,932

$3,028 $3,125

$3,233

25.8% 24.5% 24.9% 24.4%

26.8%

-30.0%

-5.0%

20.0%

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Deposits DDA %

Last Twelve Months Growth Rate = 16%

In Millions

10

CORE FEE INCOME*

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

Other Core Fee Income Detail Core Fee Income

$1.7 $1.7 $1.6 $1.7 $1.7

$2.0 $2.0 $2.2 $2.2 $2.2

$1.7 $1.8

$2.1

$2.7 $2.2

$1.7

$0.5 $0.2

$0.2 $1.7

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Wealth Management Deposit Service Charges Other State Tax Credits

$7.1

$6.0 $6.1

$6.8

$7.8

$0.6

$1.0 $1.0

$0.4

$0.3 $0.2

$0.6

$0.8 $0.9

$0.2

$0.1

$0.4

$0.1

Q4 '15 Q3 '16 Q4 '16

Miscellaneous CDE Card Services Swap Fees Mortgage

$2.7

$1.7

$2.2

In Millions

11

FULL YEAR EARNINGS PER SHARE TREND

$1.66

$0.51 < $0.02>

$0.04 <$0.16>

$2.03

2015 YTD Net Interest

Income

Portfolio Loan

Loss Provision

Non Interest

Income

Non Interest

Expense

2016 YTD

CHANGES IN CORE EPS*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

12

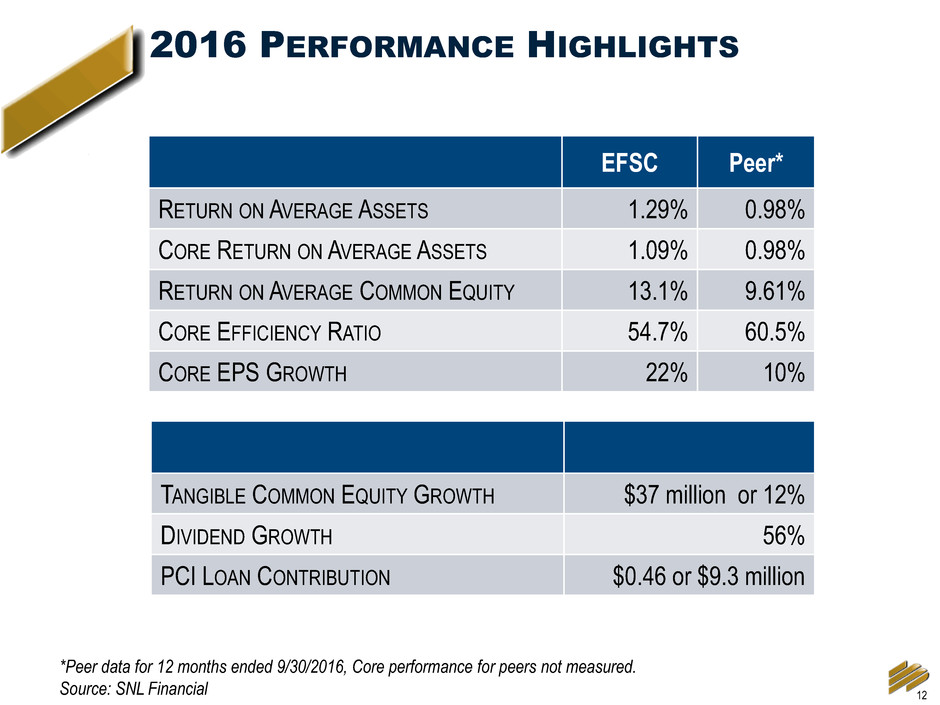

2016 PERFORMANCE HIGHLIGHTS

EFSC Peer*

RETURN ON AVERAGE ASSETS 1.29% 0.98%

CORE RETURN ON AVERAGE ASSETS 1.09% 0.98%

RETURN ON AVERAGE COMMON EQUITY 13.1% 9.61%

CORE EFFICIENCY RATIO 54.7% 60.5%

CORE EPS GROWTH 22% 10%

TANGIBLE COMMON EQUITY GROWTH $37 million or 12%

DIVIDEND GROWTH 56%

PCI LOAN CONTRIBUTION $0.46 or $9.3 million

*Peer data for 12 months ended 9/30/2016, Core performance for peers not measured.

Source: SNL Financial

13

EARNINGS PER SHARE TREND

$0.49 $0.02

$0.07

$0.04 < $0.03>

$0.59

Q3 '16 Net Interest

Income

Portfolio Loan

Loss Provision

Non Interest

Income

Non Interest

Expense

Q4 '16

CHANGES IN CORE EPS*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

14

CORE NET INTEREST INCOME TREND*

In Millions

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

$28.7

$29.6

$30.2

$31.5

$32.2

3.50% 3.54% 3.52% 3.54% 3.44%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

$18.0

$19.0

$20.0

$21.0

$22.0

$23.0

$24.0

$25.0

$26.0

$27.0

$28.0

$29.0

$30.0

$31.0

$32.0

$33.0

$34.0

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Core Net Interest Income* FTE Net Interest Margin*

15

CREDIT TRENDS FOR PORTFOLIO LOANS

-10 bps

-1 bps

-6 bps

14 bps

12 bps

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Net Charge-offs (1)

(1) Portfolio loans only, excludes PCI (Purchased Credit Impaired) loans

Q4 2016 EFSC PEER(2)

NPA’S/ASSETS = 0.39% 0.51%

NPL’S/LOANS = 0.48% 0.64%

ALLL/NPL’S = 252% 138%

ALLL/LOANS = 1.20% 1.10%

(2) Peer data as of 9/30/2016 (source: SNL Financial)

In Millions

2015 NCO = 6 bps

$149

$82

$51

$154

$80

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Portfolio Loan Growth

In Millions

Net Charge-offs (1)

2016 NCO = 5 bps

$0.5

$0.8 $0.7

$3.0

$1.0

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Provision for Portfolio Loans

16

OPERATING EXPENSES TREND*

In Millions

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

$6.5 $6.1 $6.5 $6.4

$7.0

$1.7 $1.7 $1.6 $1.7

$1.7

$11.8 $12.6 $12.3 $12.1

$12.4

56.1% 57.4% 56.3%

52.8% 52.7%

-1

4

9

14

19

24

Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Other Occupancy Employee compensation and benefits Core Efficiency Ratio*

$20.4 $21.1 $20.0 $20.2 $20.4

17

POSITIVE MOMENTUM IN CORE*

EARNINGS PER SHARE

$0.28

$0.31

$0.37

$0.33

$0.35

$0.38

$0.44

$0.49

$0.47

$0.49 $0.49

$0.59

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation

111% Core EPS Growth from Q1 2014 to Q4 2016

Appendix

19

USE OF NON-GAAP FINANCIAL MEASURES

The Company's accounting and reporting policies conform to generally accepted accounting principles in the United States

(“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as

Core net interest margin and other Core performance measures, in this presentation that are considered “non-GAAP financial

measures.” Generally, a non-GAAP financial measure is a numerical measure of a company's financial performance, financial

position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable

measure calculated and presented in accordance with GAAP.

The Company considers its Core performance measures presented in this presentation as important measures of financial

performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the

impact of PCI loans and related income and expenses, the impact of nonrecurring items, and the Company's operating

performance on an ongoing basis. Core performance measures include contractual interest on PCI loans but exclude

incremental accretion on these loans. Core performance measures also exclude the Change in FDIC receivable, Gain or loss of

other real estate from PCI loans and expenses directly related to the PCI loans and other assets formerly covered under FDIC

loss share agreements. Core performance measures also exclude certain other income and expense items, such as executive

separation costs, merger related expenses, facilities charges, and gain/loss on sale of investment securities, the Company

believes to be not indicative of or useful to measure the Company's operating performance on an ongoing basis. The attached

tables contain a reconciliation of these Core performance measures to the GAAP measures.

The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and

ratios, provide meaningful supplemental information regarding the Company's performance and capital strength. The Company's

management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the

Company's operating results and related trends and when forecasting future periods. However, these non-GAAP measures and

ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP.

In the tables below, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial

measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the

financial measure for the periods indicated.

Peer group data consists of median of publicly traded banks with total assets from $1-$10 billion with commercial loans greater

than 20% and consumer loans less than 10%.

20

EARNINGS PER SHARE

$0.67 <$0.14>

$0.06 $0.59

EPS Non-Core Acquired

Assets

Other Non-Core

Expenses

Core

EPS

* A Non GAAP Measure, Refer to Appendix for Reconciliation

REPORTED VS. CORE EPS*

Q4 2016

21

FULL YEAR EARNINGS PER SHARE

$2.41 <$0.46>

$0.08 $2.03

EPS Non-Core Acquired

Assets

Other Non-Core

Expenses

Core

EPS

* A Non GAAP Measure, Refer to Appendix for Reconciliation

REPORTED VS. CORE EPS*

Q4 2016

22

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, Dec 31, Dec 31,

(in thousands, except per share data) 2016 2016 2016 2016 2015 2016 2015

CORE PERFORMANCE MEASURES

Net interest income 35,454$ 33,830$ 33,783$ 32,428$ 32,079$ 135,495$ 120,410$

Less: Incremental accretion income 3,279 2,296 3,571 2,834 3,412 11,980 12,792

Core net interest income 32,175 31,534 30,212 29,594 28,667 123,515 107,618

Total noninterest income 9,029 6,976 7,049 6,005 6,557 29,059 20,675

Less: Gain (loss) on sale of other real estate from PCI loans 1,085 (225) 705 - 81 1,565 107

Less: Other income from PCI assets 95 287 239 - - 621 -

Less: Gain on sale of investment securities - 86 - - - 86 23

Less: Change in FDIC loss share receivable - - - - (580) - (5,030)

Core noninterest income 7,849 6,828 6,105 6,005 7,056 26,787 25,575

Total core revenue 40,024 38,362 36,317 35,599 35,723 150,302 133,193

Provision for portfolio loan losses 964 3,038 716 833 543 5,551 4,872

Total noninterest expense 23,181 20,814 21,353 20,762 22,886 86,110 82,226

Less: Merger related expenses 1,084 302 - - - 1,386 -

Less: Facilities disposal 1,040 - - - - 1,040 -

Less: Other expenses related to PCI loans 172 270 325 327 423 1,094 1,558

Less: Executive severance - - 332 - - 332 -

Less: FDIC loss share termination - - - - 2,436 - 2,436

Less: FDIC clawback - - - - - - 760

Less: Other non-core expenses (209) - 250 - - 41 -

Core noninterest expense 21,094 20,242 20,446 20,435 20,027 82,217 77,472

Core income before income tax expense 17,966 15,082 15,155 14,331 15,153 62,534 50,849

Core income tax expense 6,021 5,142 5,237 4,897 5,073 21,297 17,058

Core net income 11,945$ 9,940$ 9,918$ 9,434$ 10,080$ 41,237$ 33,791$

Core diluted earnings per share 0.59$ 0.49$ 0.49$ 0.47$ 0.49$ 2.03$ 1.66$

Core return on average assets 1.19% 1.04% 1.07% 1.04% 1.13% 1.09% 1.00%

Core return on average common equity 12.31% 10.47% 10.89% 10.66% 11.46% 11.10% 10.08%

Core return on average tangible common equity 13.44% 11.46% 11.98% 11.76% 12.68% 12.18% 11.22%

Core efficiency ratio 52.70% 52.77% 56.30% 57.40% 56.06% 54.70% 58.17%

NET INTEREST MARGIN TO CORE NET INTEREST MARGIN (FULLY TAX EQUIVALENT)

Net interest income 35,884$ 34,263$ 34,227$ 32,887$ 32,546$ 137,261$ 122,141$

Less: Incremental accretion income 3,279 2,296 3,571 2,834 3,412 11,980 12,792

Core net interest income 32,605$ 31,967$ 30,656$ 30,053$ 29,134$ 125,281$ 109,349$

Average earning assets 3,767,272$ 3,589,080$ 3,506,801$ 3,413,792$ 3,304,827$ 3,570,186$ 3,163,339$

Reported net interest margin 3.79% 3.80% 3.93% 3.87% 3.91% 3.84% 3.86%

Core net interest margin 3.44% 3.54% 3.52% 3.54% 3.50% 3.51% 3.46%

For the Quarter ended For the Year ended

23

Q & A

FOURTH QUARTER 2016 EARNINGS WEBCAST