Attached files

| file | filename |

|---|---|

| EX-99.7 - EX-99.7 - INTERSIL CORP/DE | d255657dex997.htm |

| EX-99.6 - EX-99.6 - INTERSIL CORP/DE | d255657dex996.htm |

| EX-99.5 - EX-99.5 - INTERSIL CORP/DE | d255657dex995.htm |

| EX-99.4 - EX-99.4 - INTERSIL CORP/DE | d255657dex994.htm |

| EX-99.3 - EX-99.3 - INTERSIL CORP/DE | d255657dex993.htm |

| EX-99.1 - EX-99.1 - INTERSIL CORP/DE | d255657dex991.htm |

| EX-2.1 - EX-2.1 - INTERSIL CORP/DE | d255657dex21.htm |

| 8-K - 8-K - INTERSIL CORP/DE | d255657d8k.htm |

The acquisition of Intersil is expected to (1) bolster the lineup of power management–related analog devices, key devices essential to future growth in our strategic focus domains, (2) enhance the ability to deliver to customers solutions such as kits combining Renesas microcontrollers (MCUs) and high-precision analog products from Intersil, (3) expand sales and design-ins outside of Japan, and (4) strengthen global management capabilities by welcoming Intersil’s management team with broad management expertise to Renesas Group. The acquisition is therefore seen as an effective measure to enhance Renesas’ competitiveness in fields where Renesas is focusing its efforts to boost sales and profits, and strengthening the company’s position as a global leader.

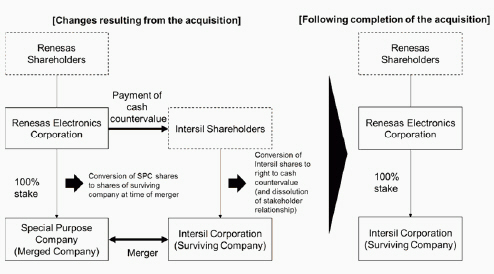

2. Acquisition Method

The acquisition will be implemented as follows. Renesas will establish for the purpose of the acquisition a wholly-owned subsidiary (“acquisition subsidiary”) in Delaware, United States that will then merge with Intersil (in a reverse triangular merger). The surviving company following the merger will be Intersil. Cash will be issued for Intersil’s shares as consideration for the merger, and the shares of the acquisition subsidiary owned by Renesas will be converted into outstanding shares in the surviving company, making the surviving company a wholly-owned subsidiary of Renesas. The acquisition will take effect following approval by Intersil shareholders and the relevant governmental authorities, and fulfilment of the other customary closing conditions pertaining to merger agreements. Under the merger agreement concluded between the parties for the purpose of implementing the acquisition, Renesas guarantees the fulfillment of obligations by the acquisition subsidiary.

For the purpose of the acquisition Intersil shares are to be acquired at a price of US$22.50 per share (for a total of approximately US$3,219 million (approximately ¥321.9 billion at an exchange rate of 100 yen to the dollar). Current cash reserves are expected to be sufficient to cover the purchase price, therefore Renesas has no plans to borrow new funds or issue new shares.

3. Schematic Diagram of the Acquisition

4. Overview of Intersil (Surviving Company)

| (1) | Name | Intersil Corporation (NASDAQ:ISIL) | ||||

| (2) | Address | 1001 Murphy Ranch Road, Milpitas, CA 95035 | ||||

| (3) | Name and title of representative director | Necip Sayiner, President, Chief Executive Officer, and Director | ||||

| (4) | Type of business | Manufacturer of high performance analog integrated circuits. | ||||

| (5) | Capital | 1,559,334 thousand US$ | ||||

| (6) | Established | August, 1999 | ||||

| (7) | Major | FMR LLC | 13.27% | |||

| shareholders and | BlackRock, Inc. | 8.40% | ||||

| their ownership | The Vanguard Group, Inc. | 6.95% | ||||

| ratios | Goldman Sachs Asset Management LP | 5.40% | ||||

| Ridge Worth Capital Management LLC | 5.30% | |||||

| Franklin Resources, Inc. | 5.30% | |||||

| (8) | Ties between Renesas and Intersil | Capital ties | There are no relevant capital ties between Renesas and Intersil. Further, there are no relevant capital ties between persons or companies related to Renesas and persons or companies related to Intersil. | |||

| Personal ties | There are no relevant personal ties between Renesas and Intersil. Further, there are no relevant personal ties between persons or companies related to Renesas and persons or companies related to Intersil. | |||||||

| Transactional ties | There are no relevant transactional ties between Renesas and Intersil. Further, there are no relevant transactional ties between persons or companies related to Renesas and persons or companies related to Intersil. | |||||||

| (9) | Consolidated business performance and consolidated financial status of Intersil over the most recent three years | |||||||

| Accounting period | FY2013 | FY2014 | FY2015 | |||||||||

| Consolidated net assets (millions of US$) |

957.8 | 981.5 | 954.7 | |||||||||

| Consolidated total assets (millions of US$) |

1,191.4 | 1,154.3 | 1,138.6 | |||||||||

| Consolidated net assets per share (millions of US$) |

7.50 | 7.54 | 7.19 | |||||||||

| Consolidated sales (millions of US$) |

575.2 | 562.6 | 521.6 | |||||||||

| Consolidated operating profit (millions of US$) |

13.5 | 74.7 | (14.2 | ) | ||||||||

| Consolidated current net profit (millions of US$) |

2.9 | 54.8 | 7.2 | |||||||||

| Consolidated current net profit per share (US$) |

0.02 | 0.42 | 0.05 | |||||||||

Change in Specified Subsidiary Company

| (1) Name | Intersil Luxembourg S.a.r.l | |

| (2) Address | 6C, rue Gabriel Lippmann L-5365 Munsbach, Grand Duche de Luxembourg Luxembourg | |

| (3) | Name and title of representative director | Andrew Hughes | ||||||

| (4) | Type of business | Holding company | ||||||

| (5) | Capital | US$ 91.5 Million | ||||||

| (6) | Established | June 2010 | ||||||

| (7) | Major shareholders and their ownership ratios | Intersil Communications LLC – 23.4% Intersil Swiss Holding S.a.r.l – 76.6% | ||||||

| (8) | Ties between Renesas and Intersil | Capital ties | There are no relevant capital ties between Renesas and Intersil Luxembourg S.a.r.l. Further, there are no relevant capital ties between persons or companies related to Renesas and persons or companies related to Intersil Luxembourg S.a.r.l. | |||||

| Personal ties | There are no relevant personal ties between Renesas and Intersil Luxembourg S.a.r.l. Further, there are no relevant personal ties between persons or companies related to Renesas and persons or companies related to Intersil Luxembourg S.a.r.l. | |||||||

| Transactional ties | There are no relevant transactional ties between Renesas and Intersil Luxembourg S.a.r.l. Further, there are no relevant transactional ties between persons or companies related to Renesas and persons or companies related to Intersil Luxembourg S.a.r.l. | |||||||

| (9) | Non-consolidated business performance and non-consolidated financial status of Intersil Luxembourg S.a.r.l over the most recent three years | |||||||

| Accounting period | FY2013 | FY2014 | FY2015 | |||||||||||

| Non-consolidated net assets (millions of US$) |

75.5 | 59.9 | 45.0 | |||||||||||

| Non-consolidated total assets (millions of US$) |

705.1 | 705.0 | 753.1 | |||||||||||

| Non-consolidated net assets per share (US$) |

0.82 | 0.65 | 0.49 | |||||||||

| Non-consolidated sales (millions of US$) |

0.0 | 0.0 | 0.0 | |||||||||

| Non-consolidated operating profit(loss)(millions of US$) |

(10.3 | ) | (10.7 | ) | (14.8 | ) | ||||||

| Non-consolidated current net profit(loss) (millions of US$) |

(8.2 | ) | (15.6 | ) | (14.8 | ) | ||||||

| Non-consolidated current net profit (loss) per share (US$) |

(0.09 | ) | (0.17 | ) | (0.16 | ) |

| (1) | Name | Intersil International Operations Sdn. Bhd. | ||||

| (2) | Address | Level 8, Symphony House Block D13, Pusat Dagangan Dana 1, Jalan PJU 1A/46 Petaling Jaya, Selangor Darul Ehsan Kuala Lumpur, 47301 (Malaysia) | ||||

| (3) | Name and title of representative director |

Andrew Hughes | ||||

| (4) | Type of business | Subcontracting activities, logistics and sale of semiconductor products | ||||

| (5) | Capital | $137.9 Million | ||||

| (6) | Established | June 2009 | ||||

| (7) | Major shareholders and their ownership ratios |

Intersil Holding GmbH – 100% | ||||

| (8) | Ties between Renesas and Intersil |

Capital ties | There are no relevant capital ties between Renesas and Intersil International Operations Sdn. Bhd. Further, there are no relevant capital ties between persons or companies related to Renesas and persons or companies related to Intersil International Operations Sdn. Bhd. | |||

| Personal ties | There are no relevant personal ties between Renesas and Intersil International Operations Sdn. Bhd. Further, there are no relevant personal ties between persons or companies related to Renesas and persons or companies related to Intersil International Operations Sdn. Bhd. | |||||

| Transactional ties | There are no relevant transactional ties between Renesas and Intersil International Operations Sdn. Bhd. Further, there are no relevant transactional ties between persons or companies related to Renesas and persons or companies related to Intersil International Operations Sdn. Bhd. | |||||

| (9) Non-consolidated business performance and non-consolidated financial status of Intersil International Operations Sdn. Bhd over the most recent three years |

||||||

| Accounting period | FY2013 | FY2014 | FY2015 | |||||||||

| Non-consolidated net assets (millions of US$) |

623.8 | 642.1 | 552.1 | |||||||||

| Non-consolidated total assets (millions of US$) |

668.3 | 690.6 | 602.8 | |||||||||

| Non-consolidated net assets per share (US$) |

1.46 | 1.51 | 1.29 | |||||||||

| Non-consolidated sales (millions of US$) |

453.3 | 441.5 | 445.5 | |||||||||

| Non-consolidated operating profit (millions of US$) |

(9.9 | ) | 23.0 | 36.9 | ||||||||

| Non-consolidated current net profit (loss) (millions of US$) |

(9.9 | ) | 23.0 | 36.8 | ||||||||

| Non-consolidated current net profit (loss) per share (US$) |

(0.02 | ) | 0.05 | 0.09 | ||||||||

5. Number of Shares to Be Acquired, Acquisition Price, and Share Ownership Before and After Acquisition

| (1) | Shares owned before transfer | 0 share (Number of shares with voting right: 0 share) (Ownership percentage: 0.0%) | ||

| (2) | Number of shares to be acquired | 143,050,746 shares (Number of shares with voting right: 143,050,746 shares) (Percentage of outstanding shares: 100.0%) | ||

| (3) | Acquisition price | US$3,219 million (approximately ¥321.9 billion at an exchange rate of 100 yen to the dollar) | ||

| (4) | Shares owned after transfer | 100 shares (Number of shares with voting right: 100 shares) (Ownership percentage: 100.0%) | ||

(Note) Based on the number of shares on a fully-diluted basis as of September 13, 2016 (reflecting dilutions, etc., that occurred following the stock-related compensation from the said acquisition.) Above figures have been rounded off to the closest whole number.

6. Schedule

| (1) | Renesas Board approval | September 13, 2016 | ||

| (2) | Intersil Board approval | September 13, 2016 | ||

| (3) | Conclusion of merger agreement | September 13, 2016 | ||

| (4) | Intersil General Shareholders approval of the merger agreement | Undecided (Scheduled to be called according to the merger agreement and related regulations) | ||

| (5) | Effective date of merger | Within first half of the fiscal year ending December 31, 2017 | ||

(Note) The conclusion of the transaction is subject to regulatory approvals and other customary closing conditions in the U.S and other countries.

7. Future Outlook

As a result of this acquisition Intersil will become a consolidated subsidiary of Renesas. The impact on the consolidated performance of the Renesas Group will be disclosed in a timely manner as the acquisition proceeds.

Additional Information and Where to Find It

This communication is being made in respect of the proposed transaction involving Intersil and Renesas. Intersil intends to file with the SEC a proxy statement in connection with the proposed transaction with Renesas as well as other documents regarding the proposed transaction. The definitive proxy statement will be sent or given to the stockholders of Intersil and will contain important information about the proposed transaction and related matters. INTERSIL’S SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement and other relevant materials (when they become available), and any other documents filed by Intersil with the SEC, may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, security holders of Intersil will be able to obtain free copies of the proxy statement through Intersil’s website, www.intersil.com, or by contacting Intersil by mail at Attn: Corporate Secretary, 1001 Murphy Ranch Road, Milpitas, California 95035.

Participants in the Solicitation

Intersil, Renesas and their respective directors, executive officers and other members of management and certain of their respective employees may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information about Intersil’s directors and executive officers is included in Intersil’s Annual Report on Form 10-K for the fiscal year ended January 1, 2016 filed with the SEC on February 12, 2016, and the proxy statement filed with the SEC on March 4, 2016 for Intersil’s annual meeting of stockholders held on April 21, 2016. Additional information regarding these persons and their interests in the merger will be included in the proxy statement relating to the proposed merger when it is filed with the SEC. These documents, when available, can be obtained free of charge from the sources indicated above.

Safe Harbor for Forward-looking Statements

Throughout this document pertaining to the merger transaction between Intersil and Renesas, Intersil makes forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. You should not place undue reliance on these statements. These forward-looking statements include statements that reflect the current expectations, estimates, beliefs, assumptions, and projections of Intersil’s senior management about future events with respect to Intersil’s business and its industry in general. Statements that include words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “potential,” “continue,” “goals,” “targets” and variations of these words (or negatives of these words) or similar expressions of a future or forward-looking nature identify forward-looking statements. In addition, any statements that refer to projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking

statements. Although Intersil believes the expectations reflected in any forward-looking statements are reasonable, they involve known and unknown risks and uncertainties, are not guarantees of future performance, and actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements and any or all of Intersil’s forward-looking statements may prove to be incorrect. Consequently, no forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by such forward looking statements will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Intersil or its businesses or operations. Factors which could cause Intersil’s actual results to differ from those projected or contemplated in any such forward-looking statements include, but are not limited to, the following factors: the ability of the parties to consummate the merger transaction in a timely manner or at all; satisfaction of the conditions precedent to consummation of the merger transaction, including the ability to secure regulatory approvals in a timely manner or at all, and approval by Intersil’s stockholders; the possibility of litigation and other unknown liabilities; the parties’ ability to successfully integrate their operations, product lines, technology and employees and realize synergies and other benefits from the merger transaction; the potential impact of the announcement or consummation of the merger transaction on the parties’ relationships with customers, suppliers and other third parties; and other risks described in Intersil’s filings with the SEC. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Intersil’s most recent Annual Report on Form 10-K, and Intersil’s more recent Quarterly Report on Form 10-Q and Current Reports on Form 8-K filed with the SEC (which you may obtain for free at the SEC’s website at http://www.sec.gov or on Intersil’s website at http://ir.intersil.com). Intersil can give no assurance that the conditions to the merger will be satisfied. Except as required by applicable law, Intersil cannot undertake any obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. Intersil does not intend, and assumes no obligation, to update any forward-looking statements.

Forward-Looking Statements

The statements in this press release with respect to the plans, strategies and financial outlook of Renesas Electronics and its consolidated subsidiaries (collectively “we”) are forward-looking statements involving risks and uncertainties. We caution you in advance that actual results may differ materially from such forward-looking statements due to several important factors including, but not limited to, general economic conditions in our markets, which are primarily Japan, North America, Asia, and Europe; demand for, and competitive pricing pressure on, products and services in the marketplace; ability to continue to win acceptance of products and services in these highly competitive markets; and fluctuations in currency exchange rates, particularly between the yen and the U.S. dollar. Amongst other factors, downturn of the world economy; deteriorating financial conditions in world markets, or deterioration in domestic and overseas stock markets may cause actual results to differ from the projected results forecast.

About Renesas Electronics Corporation

Renesas Electronics Corporation (TSE: 6723) delivers trusted embedded design innovation with complete semiconductor solutions that enable billions of connected, intelligent devices to enhance the way people work and live—securely and safely. The number one global supplier of microcontrollers, and a leader in Analog & Power and SoC products, Renesas provides the expertise, quality, and comprehensive solutions for a broad range of Automotive, Industrial, Home Electronics (HE), Office Automation (OA) and Information Communication Technology (ICT) applications to help shape a limitless future. Learn more at renesas.com.

###

| Media Contacts | Investor Contacts | |

| Kyoko Okamoto | Makie Uehara | |

| Renesas Electronics Corporation | Renesas Electronics Corporation | |

| +81 3-6773-3001 | +81 3-6773-3002 | |

| pr@renesas.com | ir@renesas.com | |