Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - INTERSIL CORP/DE | isil-20121228xex32.htm |

| EX-23 - EX-23 - INTERSIL CORP/DE | isil-20121228xex23.htm |

| EX-3.2 - EX-3.2 - INTERSIL CORP/DE | isil-20121228ex326f47eed.htm |

| EX-31.2 - EX-31.2 - INTERSIL CORP/DE | isil-20121228ex312bd1ca5.htm |

| EX-21 - EX-21 - INTERSIL CORP/DE | isil-20121228ex21bb70abc.htm |

| EX-31.1 - EX-31.1 - INTERSIL CORP/DE | isil-20121228ex311b8ed0d.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 28, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ___

Commission file number 000-29617

INTERSIL CORPORATION

(Exact name of Registrant as specified in its charter)

|

Delaware |

59-3590018 |

|

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

|

|

|

|

1001 Murphy Ranch Road Milpitas, California |

95035 |

|

(Address of principal executive offices) |

(Zip Code) |

|

|

|

|

Registrant’s telephone number, including area code |

408-432-8888 |

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

|

Title of each class |

Name of each exchange on which registered |

|

Class A Common Stock, par value $0.01 per share |

The NASDAQ Stock Market LLC |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: |

|

|

None |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [x] Yes [ ] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [ x] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [x] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [x] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [x] |

Accelerated filer [ ] |

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company) |

Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).[ ]Yes[x]No

The aggregate market value of our Class A Common Stock, par value $0.01 per share, held by non-affiliates (based upon the closing sale price of $10.65 on the Nasdaq Global Select Market) on June 29, 2012 was approximately $1,358.5 million.

As of February 15, 2013, there were 126,318,002 shares of our Class A Common Stock, par value $0.01 per share, outstanding.

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth herein, is incorporated by reference from the Registrant’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held May 8, 2013.

INTERSIL CORPORATION

FORM 10-K

December 28, 2012

|

Item 1. |

3 | |

|

Item 1A. |

8 | |

|

Item 1B. |

14 | |

|

Item 2. |

15 | |

|

Item 3. |

15 | |

|

Item 4. |

15 | |

|

|

|

|

|

|

|

|

|

Item 5. |

15 | |

|

Item 6. |

18 | |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 |

|

Item 7A. |

31 | |

|

Item 8. |

32 | |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

65 |

|

Item 9A. |

65 | |

|

Item 9B. |

66 | |

|

|

|

|

|

|

|

|

|

Item 10. |

66 | |

|

Item 11. |

67 | |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

67 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

67 |

|

Item 14. |

67 | |

|

|

|

|

|

|

|

|

|

Item 15. |

68 | |

2

Forward Looking Statements

This Annual Report on Form 10-K contains statements relating to expected future results and business trends of Intersil Corporation (“Intersil,” which may also be referred to as “we,” “us” or “our”) that are based upon our current estimates, expectations, assumptions and projections about our industry, as well as upon certain views and beliefs held by management, that are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. In addition, any statements that refer to expectations, projections, or other characterizations of future events or circumstances, including any underlying assumptions, are “forward-looking statements.” These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the section entitled “Risk Factors” in Part I, Item 1A of this report. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document.

Company Overview

We develop, manufacture and market high-performance analog, mixed-signal, and power management integrated circuits (“IC(s)”). We believe our product portfolio addresses some of the largest opportunities within the industrial & infrastructure, consumer and personal computing electronics markets.

Our mission is to provide differentiated, high-performance analog, mixed-signal, and power management ICs that meet our customers’ needs and exceed their expectations. We were formed in August 1999 when we acquired the semiconductor business of Harris Corporation (“Harris”) and began operating as Intersil. Since then, we have expanded our product portfolio through internal product development and through various acquisitions.

Our internet address is www.intersil.com. We post all Securities and Exchange Commission (“SEC”) filings free of charge on our website, including our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, the filings of our officers and directors pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), our proxy statements on Schedule 14A related to our annual shareholders’ meeting and any amendments to these reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act.

We have adopted a Corporate Code of Ethics, which is applicable to our Senior Financial Officers, including our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and other professionals. A complimentary copy of the Code of Ethics is available on our website. The content on any website referred to in this filing is not incorporated by reference into this filing unless expressly noted otherwise.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. You may also read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549 and may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090.

3

Business Strategy

Our business strategy emphasizes the following key elements:

|

· |

Focus on our areas of technical strength in markets where we believe we can develop or sustain market leadership. |

|

· |

Participate in Large Vertical Markets. We develop products for the consumer electronics market with the potential for high growth. |

|

· |

Maintain Technology Leadership. We have more than 650 employees engaged in research and development working on innovative products for high-performance analog, mixed-signal, and power management solutions. We continue to expand our strong intellectual property position by seeking to increase our existing portfolio of approximately 1,400 patents. |

|

· |

Maintain Quality Customer Service. Quality customer service is critical to our customer’s satisfaction and retention. |

|

· |

Partner with Leaders in Semiconductor Markets, Products and Services. |

|

o |

Partner with Leaders in our Target Markets. We partner with industry leaders to deliver advanced technology for rapidly emerging applications. Our customer base illustrates the acceptance of our products to date. We continue to partner with these customers and others to develop and market our next generation products. |

|

o |

Utilize Specialty Expertise in Manufacturing Services. We employ high-volume and specialty suppliers of products and services in our industry. We outsource most of our manufacturing requirements. We utilize merchants who specialize in those products and services and deliver them at reasonable cost. This reduces our capital requirements and enhances our flexibility to manage our ever-changing business. |

Products and Technology

Our strategy is to utilize our technical expertise and customer relationships to provide differentiated IC products.

Industrial & Infrastructure

Our products enable multiple functions in thousands of industrial and infrastructure systems. From the most advanced aviation and satellite systems to factory automation equipment and automotive systems, Intersil’s power management, analog and mixed signal ICs provide the electronic building blocks of these systems. Industrial & infrastructure products represented 57.1% of revenue during 2012.

Personal Computing

Our products provide the power management functions for all types of personal computers, including Ultrabooks®, Notebooks and desktops. These functions include power management for the central processing unit (“CPU”), battery charging, display power and other types of power related functions within a personal computer. Personal computing power management products represented 23.2% of revenue during 2012.

Consumer

Our products enable multiple functions for today’s high end consumer electronics, including smart phones, tablets, displays and many other consumer electronic devices. These functions include power management, battery charging, light and proximity sensing and display image quality enhancement functions. Consumer products represented 19.7% of revenue during 2012.

Glossary

Analog integrated circuits—circuits that operate with voltage and current varying in a continuous fashion; in contrast, digital chips only use and create voltages or currents at discrete levels, with no intermediate values. Some examples of analog ICs are operational amplifiers, voltage references, and comparators.

4

Mixed-signal integrated circuits—any IC that has both analog circuits and digital circuits. Examples of mixed-signal ICs include analog-to-digital/digital-to-analog converters, digitally controlled potentiometers, and real time clocks.

Power management circuits—high performance power IC solutions for an electronic device such as a personal computer, satellite, or automotive system.

Vertical markets—focus on specific end-use applications such as smartphones, personal computers and flat-panel televisions. Vertical markets are distinct from horizontal markets in that horizontal markets focus on general purpose IC products that can be used in thousands of applications such as data converters, voltage regulators and many other IC component products.

Geographic Financial Summary

We operate exclusively in the semiconductor industry and primarily the high-performance analog, mixed-signal, and power management sector of that industry. Substantially all revenue results from the sale of semiconductor products. All intercompany revenue and balances have been eliminated. The revenue noted in this section is based on shipping destination.

A summary of the operations by geographic area is below (in millions):

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

||||

|

|

|

December 28, 2012 |

|

December 30, 2011 |

|

December 31, 2010 |

|

United States operations |

|

|

|

|

|

|

|

Revenue |

|

$ 85.4 |

|

$ 102.9 |

|

$ 138.0 |

|

Tangible long-lived assets |

|

54.1 |

|

52.5 |

|

58.2 |

|

International operations |

|

|

|

|

|

|

|

Revenue |

|

$ 522.5 |

|

$ 657.6 |

|

$ 684.4 |

|

Tangible long-lived assets |

|

31.3 |

|

38.5 |

|

45.3 |

We market our products for sale to customers, including distributors, primarily in China, the U.S., South Korea, Taiwan and Japan. A summary of percentage of revenue by country is below and shows countries where values exceeded 10% in any one year presented:

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

||||

|

|

|

December 28, 2012 |

|

December 30, 2011 |

|

December 31, 2010 |

|

Revenue by country |

|

|

|

|

|

|

|

China (includes Hong Kong) |

|

55.4% |

|

54.9% |

|

48.8% |

|

United States |

|

14.0% |

|

13.5% |

|

16.8% |

Revenue from two distributor customers and two contract manufacturers totaled 43.5% of revenue in 2012. Aeco Technology Co., Ltd (“Aeco”), a distributor, represented 12.8% of revenue and 18.3% of accounts receivable for the period ending December 28, 2012. Avnet, Inc (“Avnet”), a distributor, represented 14.9% of revenue and 19.2% of accounts receivable for the period ending December 28, 2012. The loss of any one or more of these customers could result in a materially negative impact on our business.

Revenue from two distributor customers and two contract manufacturers totaled 40.8% of revenue in 2011. Aeco represented 11.4% of revenue and 14.8% of accounts receivable for the period ending December 30, 2011. Avnet represented 11.4% of revenue and 19.1% of accounts receivable for the period ending December 30, 2011. In January 2011, we announced the termination of our distribution relationship with Arrow Electronics, effective April 2011, in order to increase focus within our distribution channel and allow more streamlined customer support. We simultaneously strengthened our relationship with Avnet, which enabled Avnet to integrate our unique product portfolio into its existing design chain services and expand our product offering to their global network of customers.

5

Revenue from three distributor customers and two contract manufacturers totaled 45.2% of revenue in 2010. Aeco represented 11.0% of revenue and 11.9% of accounts receivable for the period ending December 31, 2010.

Sales, Marketing and Distribution

In 2012, we derived approximately 43.7% of our revenue from original equipment manufacturer (“OEM”) customers, original design manufacturer (“ODM”) customers, and contract manufacturers. We derived approximately 56.3% of our revenue through distributors and value-added resellers.

Our sales organization is supported by customer service and logistics organizations throughout the world. Product orders flow to our fabrication facility or to foundries where the semiconductor wafers are made. Most of our semiconductors are assembled and tested at the facilities of independent subcontractors. Finished products are then shipped to customers either indirectly via third-parties or directly via company-managed warehouses.

To serve our customer base, we maintain a highly focused sales team, which focuses on those major accounts that are strategic to our marketing and product strategies. Our direct geographical sales organizations sell products in regions throughout the world. The geographical sales force works closely with a network of distributors and manufacturers’ representatives, creating a worldwide selling network. Dedicated direct sales organizations operate in North American, European, Japanese and Asia/Pacific markets. We strategically locate sales offices near major OEM and ODM customers throughout the world. The technical applications organization is deployed alongside the direct sales force, ensuring both applications and product/customer focus. Our dedicated marketing organization supports field sales and is aligned by specific product group.

Distributors and value-added resellers handle a wide variety of products, including products sold by other companies that compete with our products. Most of our sales to distributors include agreements allowing for market price fluctuations and/or the right to return some unsold products. Some of our distribution agreements contain an industry standard stock rotation provision allowing for minimum levels of inventory returns or scrap. In our experience, these inventory returns can usually be resold.

Research and Development (“R&D”)

We believe that the continued introduction of new products in our target markets is essential to our growth. We incurred costs of $166.9 million, $185.5 million and $183.3 million on R&D projects in 2012, 2011 and 2010, respectively, including equity-based employee compensation. We believe that we must continue to innovate, enhance and expand our products and services to maintain our leadership position, and we intend to achieve this through in-house R&D, licensed technology and selective acquisitions. As of December 28, 2012, we had more than 650 employees engaged in R&D. We introduce hundreds of new products each year over many different product families that serve many different markets.

Manufacturing

Our products utilize silicon wafers containing ICs. Our business is dependent upon reliable fabrication, packaging and testing of these wafers. We fabricate wafers of ICs in our Florida manufacturing facility. We also have wafers of ICs manufactured by leading foundry suppliers such as IBM Microelectronics, Taiwan Semiconductor Manufacturing Company and United Microelectronics Corporation. We believe that our strategy of employing internal and foundry suppliers provides an increased level of flexibility and capacity to meet production demand. During 2012, we internally produced approximately 12% of our wafers and outsourced the remaining 88% to our foundry partners.

Following fabrication, wafers are subject to packaging and testing processes. The majority of these processes are performed by independent subcontractors located in Malaysia, Taiwan, China and Singapore. However, we maintain internal assembly and test capabilities for certain products in Florida and California.

6

In 2012, we did not experience delays in obtaining raw materials. However, our reliance on foundry suppliers for silicon wafers, the building block of our products, is critical and the relative importance of this part of the supply chain continues to increase, increasing our risk of incurring a production-limiting shortfall. As is typical in the industry, we must allow for significant lead times in delivery of certain materials. The production of ICs, from wafer fabrication through packaging and final testing, may take from eight to sixteen weeks. We manufacture thousands of product types and our customers often require delivery within a short period of time following their order. To consistently meet these requirements, we maintain a substantial work-in-process and finished goods inventory. Manufacture, assembly and testing of ICs is a complex process. Normal risks include errors and interruptions in the production process, defects and shortages in raw materials, disruptions at supplier locations, unexpected demand, as well as other risks, all of which can have an unfavorable impact to production costs, gross margins and our ability to meet customer demand.

Backlog

Our product sales are made pursuant to purchase orders that are generally booked up to six months in advance of delivery. Our standard terms and conditions of sale provide that these orders may not be cancelled or rescheduled thirty days prior to the most current customer request date (“CRD”) for standard products and ninety days prior to CRD for semi-custom and custom products. Backlog is influenced by several factors, including end market demand, pricing and customer order patterns in reaction to product lead times. Additionally, we believe backlog can fall faster than consumption rates in periods of weak end market demand since production lead times can be shorter. Conversely, we believe backlog can grow faster than consumption in periods of strong end market demand as production and delivery times increase and some customers may increase orders in excess of their current consumption to reduce their own risk of production disruptions. Our backlog for sales to distributors is valued at list price, which can be substantially higher than the prices ultimately recognized as revenue. Considering these practices and our experience, backlog alone cannot be consistently relied on to predict actual revenue for future periods.

Our six month backlog as of December 28, 2012, was $114.6 million compared to the six-month backlog as of December 30, 2011, of $134.8 million.

Seasonality

The consumer and personal computing markets have historically experienced weaker demand in the first half of the year than in the second half of the year in the semiconductor industry. However, macroeconomic conditions, acquisitions and the cyclical nature of the industry have had a greater impact on quarterly fluctuations in recent years.

Competition

The high-performance analog, mixed-signal, and power management market is extremely competitive. We compete in our target markets with many companies that may have significantly greater financial, technical, manufacturing and marketing resources than us, including but not limited to Texas Instruments, Analog Devices, Linear Technology, ON Semiconductor and Maxim Integrated Products. We compete on the basis of technical performance, product features, customized design, price, availability, quality, reliability, sales and technical support. Our ability to compete successfully depends on elements both within and outside of our control, including successful and timely development of new products and manufacturing processes, product performance and quality, manufacturing yields, product availability, intellectual property protection obtained by us and our competitors, customer service, pricing, industry trends and general economic trends.

Trademarks and Patents

We own rights in trademarks, trade secrets, and patents that are important to our business. Intersil procures trademark rights through registration applications or trademark usage. We use trademarks to identify Intersil products and build brand awareness, including through periodic advertising. We seek to maintain our trade secrets through security measures, policies and the use of confidentiality agreements. We also file patent applications to secure exclusive patent rights to potentially valuable inventions in the United States and in select foreign countries where we believe filing for such protection is appropriate. We may, however, elect, in certain cases, not to seek patent protection for potentially valuable inventions, if we determine other protection, such as maintaining the invention as a trade secret, to be more advantageous. The expiration dates of our patents range from 2013 to 2030. While our patents, trademarks and trade secrets benefit us, we believe that our competitive position and future success is largely determined by other factors including our innovative skills, technical expertise, and management ability; the success of new products being developed by us; and customer support.

7

Employees

Our worldwide workforce consisted of 1,488 employees (full and part-time) as of December 28, 2012. None of our employees are subject to a collective bargaining agreement.

Environmental Matters

We believe that our operations are substantially in compliance with applicable environmental requirements. Our costs and capital expenditures to comply with environmental regulations have been immaterial during the last three years. However, we are subject to numerous federal, state and international environmental laws and regulatory requirements. From time to time, we become involved in investigations or litigations of various potential environmental issues concerning activities at our facilities or former facilities or remediation as a result of past activities (including past activities of companies we have acquired). Further, we may receive notices from the U.S. Environmental Protection Agency or equivalent state or international environmental agencies that we are a potentially responsible party under the Comprehensive Environmental Response, Compensation and Liability Act (commonly known as the “Superfund Act”) and/or equivalent laws. Such notices assert potential liability for cleanup costs at various sites, which may include sites owned by us, sites we previously owned and treatment or disposal sites not owned by us, allegedly containing hazardous substances attributable to us from past operations. While it is not feasible to predict the outcome of many of these proceedings, in the opinion of our management, any payments we may be required to make as a result of such claims in existence will not have a material adverse effect on our financial condition, results of operations or cash flows. To the extent any known contamination was caused prior to August 1999, Intersil is indemnified against any associated environmental liabilities. This indemnification does not expire, nor does it have a maximum amount.

You should carefully consider and evaluate all of the information in this Annual Report on Form 10-K, including the risk factors listed below. The risks described below are not the only ones facing us. Additional risks not now known to us or that we currently deem immaterial may also impair our business operations. If any of these risks occur, our business could be materially harmed. If our business is harmed, the trading price of our Class A common stock could decline.

As discussed in “Forward Looking Statements” in Item 1 above, this Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward looking statements, including as a result of the risks described in the cautionary statements in this “Risk Factors” section and elsewhere in this Annual Report on Form 10-K, in our other filings with the SEC, and in material incorporated by reference. We undertake no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Global economic conditions and uncertainty, as well as the highly cyclical nature of the semiconductor industry, could adversely affect our revenue, gross margin and expenses, collectability of accounts receivable and supplier relationships, and our ability to access capital markets.

Our operations and performance depend significantly on worldwide economic conditions, in which significant uncertainty currently exists. This uncertainty poses a risk as consumers and businesses may postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values, which could have a material negative effect on the demand for our products and services.

Political and/or economic conditions outside the United States could change in manners that negatively affect our operations and prospects in those countries.

Our operations in jurisdictions outside the United States are subject to various risks inherent in foreign operations. These risks include, among other risks: i) increases in taxes, tariffs and governmental royalties, ii) changes in laws and policies governing operations of foreign-based companies, iii) loss of revenue, equipment and property as a result of expropriation, acts of terrorism, war, civil unrest, boycotts, trade restrictions and other political risks, iv) unilateral or forced renegotiation, modification or nullification of existing contracts with governmental entities, v) difficulties enforcing our rights against a governmental agency because of the doctrine of sovereign immunity and foreign sovereignty over international operations and vi) currency restrictions and exchange rate fluctuations. Our international operations may also be adversely affected by United States laws and policies affecting foreign trade and taxation. The realization of any of these factors could materially and adversely affect our business, financial condition and results of operations.

8

We may be unsuccessful in developing and selling new products required to maintain or expand our business.

We operate in a dynamic environment characterized by price erosion, rapid technological change, ever increasing complexity, cost and time to develop new products, and design and other technological obsolescence. Our competitiveness and future success depend on our ability to achieve design wins for our products with current and future customers and introduce new or improved products that meet customer needs while achieving favorable margins. A failure to achieve design wins, to introduce these new products in a timely manner or to achieve market acceptance for these products, could harm our business.

The introduction of new products presents significant business challenges because product development commitments and expenditures must be made well in advance of the related revenues. The success of a new product depends on accurate forecasts of long-term market demand, future technological developments and a variety of specific implementation factors, including:

|

· |

timely and efficient completion of process design and development; |

|

· |

timely and efficient implementation of manufacturing and assembly processes; |

|

· |

product performance; |

|

· |

the quality and reliability of the product; and |

|

· |

effective marketing, sales and service. |

The failure of our products to achieve market acceptance due to these or other factors could harm our business.

A downturn in the personal computing end market could cause a reduction in demand for our products and limit our ability to maintain revenue levels and operating results.

A significant portion of our revenue (approximately 23% of fiscal 2012 revenue) is derived from customers participating in the personal computing end market. Any deterioration in this end market or our inability to compete for new solutions within the personal computing end market could lead to a reduction in demand for our products which could adversely affect our revenue and results of operations.

The consumer end market is characterized by rapid product obsolescence and requires that we have the right products at the right time for our customers to fulfill demand for products in the consumer end market. If we are unable to forecast demand for our products, or we don't have products to ship at the right time, our financial condition and results may be adversely affected.

Our revenue from the consumer end market consists primarily of revenue from our products designed and used in a broad range of products including smart phones, flat panel displays, gaming consoles, and other hand held devices and is characterized by rapidly changing market requirements and products. Our success in this market will depend principally on our ability to:

|

· |

meet the market windows for consumer products; |

|

· |

predict technology and market trends; |

|

· |

develop products on a timely basis; and |

|

· |

avoid cancellations or delay of products. |

Any of the foregoing problems could materially and adversely affect our business, financial condition, and results of operations.

We may experience a disruption of our business activities due to the transition to a new Chief Executive Officer.

On December 10, 2012, our Board of Directors announced the appointment of Board of Directors member James Diller as interim President and CEO following the resignation of Dave Bell as President and CEO and a Director of Intersil. We may experience disruption in our business activities as we transition to a new CEO, and our relationships with employees, customers and suppliers could be adversely affected by this transition. Our future success is dependent on our success in selecting and recruiting a new chief executive officer who can make a successful transition into his or her new role and ultimately develop and implement a strategic plan. If our new chief executive officer fails to effectively manage our business, our financial condition, results of operations and reputation could be harmed. Until a new chief executive officer is identified, it may be more difficult for us to hire and retain senior management and other key personnel.

9

We may experience a disruption of our business activities related to the successful execution of our restructuring plans.

We have implemented restructuring plans and may implement future plans as well. In connection with these plans, we have and may further reduce headcount and eliminate certain sites, which will require restructuring charges in the period(s) implemented. The implementation of restructuring plans may be disruptive to our business, which may adversely affect operations and be harmful to our business.

Our business has been and is expected to continue to be characterized by average selling prices (“ASPs”) that decline over relatively short time periods, which can negatively affect our results of operations unless we are able to sell more units, reduce our costs, and introduce new products with higher ASPs or some combination thereof.

ASPs for our products have historically declined over relatively short time periods. For example, in 2012 our ASPs decreased 2% compared with 2011. ASP's in 2011 decreased approximately 5% compared with 2010. Declining sales prices at the product level have been a phenomenon of the semiconductor industry for much of its existence. Fluctuations in ASPs are expected to continue into the future. Although individual products generally experience ASP declines over time, we endeavor to continually introduce new products which typically enter the market at prices higher than existing products. We are unable to predict pricing conditions for any future periods. When our ASPs decline, our revenue and net income decline unless we are able to compensate by selling more units, reduce our costs or introduce new, higher margin products that offer advanced features.

We may not be able to compete successfully in the highly competitive semiconductor industry.

The semiconductor industry is intensely competitive and many of our direct and indirect competitors have substantially greater financial, technological, manufacturing, marketing and sales resources. The current level of competition in the semiconductor market is high and may increase in the future. We currently compete directly with companies that have developed similar products, including Texas Instruments, Inc.; Analog Devices, Inc.; Maxim Integrated Products, Inc.; Linear Technology Corp. and others. We also compete indirectly with numerous semiconductor companies that offer products based on alternative solutions. These direct and indirect competitors are established, multinational semiconductor companies as well as emerging companies. Our ability to compete successfully in the rapidly evolving and increasingly more complex area of IC technology depends on several factors, including:

|

· |

success in designing and manufacturing new products that implement new technologies; |

|

· |

protection of our proprietary products, processes, trade secrets and know-how; |

|

· |

maintaining high product quality and reliability; |

|

· |

pricing policies of our competitors; |

|

· |

performance of competitors’ products; |

|

· |

ability to deliver in large volume on a timely basis; |

|

· |

marketing, manufacturing and distribution capability; and |

|

· |

financial strength. |

To the extent that our products achieve market success, competitors typically seek to offer competitive products or lower prices, which, if successful, could harm our business.

Production time and the cost of our products could increase if we were to lose one of our suppliers or if one of those suppliers increased the prices of raw materials.

Our operating results could be adversely affected if we were unable to obtain adequate supplies of raw materials in a timely manner or if the costs of raw materials increased significantly. Our manufacturing operations depend upon obtaining adequate supplies of raw materials on a timely basis. We purchase raw materials, such as silicon wafers, from a limited number of suppliers on a just-in-time basis. From time to time, suppliers may extend lead times, limit supplies or increase prices due to capacity constraints or other factors.

10

Because we depend on third-party manufacturing suppliers, we may experience delays beyond our control in delivering those products to our customers.

We use both internal wafer fabrication facilities and third-party wafer fabrication suppliers in manufacturing our products. We intend to continue to rely on third-party suppliers and other specialist suppliers for most of our manufacturing requirements. Many of these third-party suppliers are not obligated to supply products to us for any specific period, in any specific quantity or at any specific price. As a result, we cannot directly control semiconductor delivery schedules, which could lead to product shortages, quality assurance problems and increases in the cost of our products. We may experience delays and we cannot be sure that we will be able to obtain semiconductors within the time frames and in the volumes required by us at an affordable cost or at all. Some of our suppliers are located in geographically unstable locations around the world and we may be subject to delays due to earthquakes, tsunamis, tropical storms, floods or other natural disasters. Any disruption in the availability of wafers and other semiconductor materials or any problems associated with the delivery, quality or cost of the fabrication, assembly and testing of our products could significantly hinder our ability to deliver our products to our customers and may result in a decrease in sales of our products. If the third-party suppliers we use are unable to provide our products, we may be required to seek new suppliers and we cannot be certain that their services will be available at favorable terms or that sufficient capacity will be available within a reasonable time period.

In addition, the manufacture of our products is a highly complex and precise process, requiring production in a highly controlled environment. Changes in manufacturing processes or the inadvertent use of defective or contaminated materials by a third-party supplier could adversely affect their ability to achieve acceptable manufacturing yields and product reliability. If our suppliers do not achieve adequate yields or product reliability, our customer relationships could suffer. This could ultimately lead to a loss of sales of our products and have a negative effect on our reputation, business, financial condition and/or results of operations.

Delays in production at new facilities, in implementing new production techniques or in curing problems associated with technical equipment malfunctions may lower yields and reduce our revenues and profitability.

Our manufacturing processes are very complex, require advanced and costly equipment and are continuously modified to improve yields and product performance. Impurities or other difficulties in the manufacturing process can lower yields. Our manufacturing efficiency is an important factor in our future profitability and we may not be able to maintain our manufacturing efficiency or increase manufacturing efficiency to the same extent as our competitors.

We may experience difficulty in beginning production at new facilities or in effecting transitions to new manufacturing processes. Resultant delays can be unpredictable and can result in late product deliveries and reduced yields. We may experience manufacturing problems in achieving acceptable yields or experience product delivery delays in the future as a result of, among other things, capacity constraints, construction delays, upgrading or expanding existing facilities or changing our process technologies, any of which could result in a loss of future revenues. Increases in fixed costs and operating expenses related to increases in production capacity may adversely affect our operating results if revenues do not increase proportionately.

We use a significant amount of intellectual property (“IP”) in our business. If we are unable to protect this IP, we could lose our right to prevent others from using our key technologies, resulting in decreased revenues.

We rely on IP rights to protect our technology. Our rights include, but not are limited to, rights existing under patent, trade secret, trademark, mask work and copyright law. Some of our technology is not covered by any patent or patent application, and there are risks that our patents may be invalidated, circumvented or challenged.

Competitors may develop technologies that are similar or superior to our technology, duplicate our technology or design around our patents. In addition, effective patent, trademark, copyright, mask work and trade secret protection may be unavailable, limited or not applied for in certain foreign countries.

We also seek to protect our proprietary technology, including technology that may not be patented or patentable, in part by confidentiality agreements and, if applicable, inventors’ rights agreements with our collaborators, advisors, employees and consultants. We cannot assure that these agreements will always be undertaken or will not be breached or that we will have adequate remedies for any breach.

Some of our current licenses to use others’ technology and IP are scheduled to expire periodically over the next several years, unless extended. We will need to negotiate renewals of these agreements or obtain the technology and IP from alternative sources. We may not be able to obtain alternative technology and IP, or renewals on substantially similar terms as those that currently exist or at all.

The failure to protect our IP, to extend its existing license agreements or utilize alternative technology could adversely affect our revenues.

11

Products we manufacture and sell, or products formerly produced and sold by us and now manufactured and sold by purchasers of business that we have divested, may infringe other parties’ IP rights. We may have to pay others for infringement and misappropriation of their IP rights, suspend the manufacture, use or sale of some affected products, or incur the cost of defending in litigation, resulting in significant expense to us.

The semiconductor industry is characterized by vigorous protection and pursuit of IP rights. We have received, and may receive in the future, notices of claims of infringement and misappropriation of other parties’ proprietary rights. In the event of an adverse decision in a patent, trademark, copyright, mask work or trade secret action, we could be required to withdraw the product or products found to be infringing from the market or redesign products offered for sale or under development. We have, at times, assumed indemnification obligations in favor of our customers that could be triggered upon an allegation or finding of our infringement of other parties’ proprietary rights. We have also, at times, assumed indemnification obligations in favor of the purchasers of businesses that we have divested that could be triggered upon an allegation or finding of infringement of other parties’ proprietary rights by those purchasers.

These indemnification obligations would be triggered for reasons including the sale or supply of a product that was later discovered to infringe another party’s proprietary rights. Whether or not these infringement claims are successfully asserted, we would likely incur significant costs and diversion of our resources with respect to the defense of these claims. To address any potential claims or actions asserted against us or those we have indemnified, we may seek to obtain a license under a third-party’s IP rights. However, in such an instance, a license may not be available on commercially reasonable terms, if at all. Litigation could result in significant expense to us, adversely affecting sales of the challenged product or technology and diverting the efforts of our technical and management personnel, whether or not the litigation is determined in our favor. In the event of an adverse outcome in any litigation, we may be required to:

|

· |

pay substantial damages, which may include enhanced damages for willful infringement, and incur significant attorneys’ fees; |

|

· |

indemnify customers for damages they might suffer if the products they purchase from us infringe IP rights of others; |

|

· |

indemnify purchasers of businesses that we have divested for damages they might suffer if certain of the products they sell infringe IP rights of others; |

|

· |

stop our manufacture, use, sale or importation of infringing products; |

|

· |

expend significant resources to develop or acquire non-infringing technology; |

|

· |

discontinue the use of some processes; or |

|

· |

obtain licenses to IP rights covering products and technology that may, or may have been found to, infringe or misappropriate such IP rights. |

If our products contain defects or fail to achieve industry reliability standards, our reputation may be harmed, and we may incur significant unexpected expenses and lose sales opportunities. Our insurance coverage for such events may be insufficient.

Our products may contain undetected errors or defects that may:

|

· |

cause delays in product introductions and shipments; |

|

· |

result in increased costs and diversion of development resources; |

|

· |

cause us to incur increased charges due to obsolete or unusable inventory; |

|

· |

require design modifications; or |

|

· |

decrease market acceptance or customer satisfaction with these products, resulting in product returns, recalls and lost sales. |

In addition, we may not find defects or failures timely, which may result in loss or delay in market acceptance and could significantly harm our operating results. Our current or potential customers also might seek to recover from us any losses resulting from defects or failures in our products. Further, such claims might be significantly higher than the revenues and profits we receive from the products involved, as we are usually a component supplier with limited value content relative to the value of a complete system or sub-system. Liability claims could require us to spend significant time and money in litigation or to pay significant damages for which we may have insufficient insurance coverage. Any of these claims, whether or not successful, could seriously damage our reputation and business.

12

Our financial results may be adversely impacted by higher than expected tax rates, exposure to additional income tax liabilities and the adoption of new accounting pronouncements regarding income tax accounting.

As a global company, our effective tax rate is highly dependent upon the geographic composition of worldwide earnings and tax regulations. We are subject to income taxes in the United States and many foreign jurisdictions and significant judgment is required to determine worldwide tax liabilities. Our effective tax rate, as well as our actual taxes payable, could be adversely affected by changes in the mix of earnings between countries with differing tax rates, the valuation of tax assets, tax credits, unrecognized tax benefits, the lack of sufficient excess tax benefits (credits) in our hypothetical pool of additional paid in capital in situations where our realized tax deductions for certain stock-based compensation awards are less than those originally anticipated, applicable tax laws or material audit assessments, which could affect our profitability. In particular, the carrying value of deferred tax assets, which are predominantly in the United States, is dependent on our ability to generate future taxable income in the United States. In addition, the amount of income taxes we pay is subject to ongoing audits in various jurisdictions and a material assessment by a governing tax authority could affect our profitability. We currently have a tax holiday in Malaysia resulting in a tax rate of 0%. This tax holiday began on July 1, 2009 and terminates on July 1, 2019. Our Malaysian tax holiday is subject to our compliance with certain conditions. Applicable guidance requires us to record our tax expense based on various estimates of probabilities of sustaining certain tax positions. As a result of this and other factors, our tax expense could be volatile, which could have a material adverse effect on our future results.

Our future success depends on international sales and the management of global operations.

Non-U.S. sales accounted for approximately 85% of our revenue in 2012. We expect that international sales will continue to account for a significant majority of our total revenue in future years. We are subject to various challenges related to the management of global operations, and international sales are subject to risks including, but not limited to:

|

· |

trade balance issues; |

|

· |

economic and political conditions; |

|

· |

changes in currency controls; |

|

· |

differences in our ability to acquire and enforce our IP and contract rights in varying jurisdictions; and |

|

· |

the need for technical support resources in different locations. |

Many of the challenges noted above are applicable in China, which is a large and fast growing market for semiconductors and therefore an area of additional and continued growth for our business. As the business volume between China and the rest of the world grows, there is inherent risk, based on the complex relationships between China, Taiwan, Japan, and the United States, that political and diplomatic influences might lead to trade disruptions which would adversely affect our business with China and/or Taiwan and perhaps the entire Asia/Pacific region. A significant trade disruption in these areas could have a material, adverse impact on our future revenue and profits.

We are subject to export restrictions and laws affecting trade and investments.

We are subject to U.S. laws and regulations that limit and restrict the export of some of our products. Compliance with these laws has limited our sales of restricted products in the recent past and could limit them in the future. We maintain an export compliance program but there are risks that the compliance controls could be circumvented, exposing us to legal liabilities. We must also comply with export restrictions and laws imposed by other countries affecting trade and investments.

Most of our distributors and resellers, can terminate their contract with us with little or no notice. The termination by a distributor could result in a materially negative impact on our business, including revenue and accounts receivable.

In 2012, our distributors accounted for approximately 56% of our revenue. Our distributors can terminate their agreement with us with minimal notice. Two distributors each accounted for greater than 10% of our revenue in 2012. The termination of a significant distributor or reseller could impact our revenue and limit our access to certain end-customers. It could also result in the return of excess inventory. Since many distributors simply resell our products, they generally operate on low profit margins. If a distributor or reseller were to terminate their agreement or go out of business, our accounts receivable from them could be subject to collection risk. We consolidated our primary broad line distributors in April 2011 resulting in the termination of Arrow Electronics and increasing our reliance on Avnet, Inc. in order to increase focus within our distribution channel and allow more streamlined customer support.

13

Our distribution channels recently have experienced consolidation due to merger and acquisition activity in that business sector. Consolidation may result in our distributors allocating fewer resources to the distribution and sale of our products, which could adversely affect our financial results. At times, our sales are concentrated in a small number of distributors, which are in various international locations and of various financial strengths. Financial difficulties, inability to access capital markets, or other reasons may affect our distributors' performance, which could materially harm our business and our operating results.

Restrictions in our revolving credit facility may limit our activities.

Our current credit facility may impose restrictions that limit our ability to engage in certain activities including our ability to enter into certain transactions, make investments or other specified restricted payments, pay certain dividends or repurchase our capital stock, create certain liens on our assets and incur certain subsidiary indebtedness. Our credit facility requires us to maintain compliance with specified financial ratios. These covenants could restrict our ability to finance future operations or capital needs, respond to changing business and economic conditions or engage in other transactions or business activities that may be important to our growth strategy or otherwise important to us. Our ability to comply with these financial restrictions and covenants is dependent on our future performance, which is subject to prevailing economic conditions and other factors, including factors that are beyond our control such as foreign exchange rates, interest rates, changes in technology and changes in the level of competition. If we breach any of the covenants under our credit facility or the indenture governing our outstanding notes and do not obtain appropriate waivers, then, subject to applicable cure periods, our outstanding indebtedness could be declared immediately due and payable. In addition, the lenders under our credit facility could institute foreclosure proceedings against the U.S. assets used to secure the borrowing under such facility.

We are subject to litigation risks.

From time to time, we are subject to legal claims and are involved in a variety of routine legal matters that arise in the normal course of business. We believe it is unlikely that the final outcome of these legal claims will have a material adverse effect on our consolidated financial position or results of operation. However, claims, the claims process, and litigation are inherently uncertain and unpredictable. An unfavorable resolution of any particular legal claim or proceeding could have a material adverse effect on our consolidated financial position or results of operations.

Environmental liabilities and other governmental regulatory matters could force us to expend significant capital and incur substantial costs.

We are subject to various environmental laws relating to the management, disposal and remediation of hazardous materials and the discharge of pollutants into the environment. We are also subject to laws relating to workplace safety and worker health which, among other things, regulate employee exposure to hazardous substances. Harris has agreed to indemnify us for all environmental liabilities related to events or activities occurring before our acquisition of their semiconductor business. This indemnification does not expire, nor is it subject to a dollar limitation.

Based on our experience, we believe that the future cost of compliance with existing environmental and health and safety laws (and liability for known environmental conditions) even without the indemnification from Harris will not have a material adverse effect on our business, financial condition or results of operations. However, we cannot predict:

|

· |

what environmental or health and safety legislation or regulations will be enacted in the future; |

|

· |

how existing or future laws or regulations will be enforced, administered or interpreted; |

|

· |

the amount of future expenditures which may be required to comply with these environmental or health and safety laws or to respond to future cleanup matters or other environmental claims; or |

|

· |

the extent of our obligations to the purchasers of our environmentally challenged sites. |

Item 1B. Unresolved Staff Comments.

None.

14

Item 2. Properties.

In the United States, we lease approximately 166,000 square feet for our corporate headquarters in Milpitas, California, which also includes facilities for sales, design and testing functions. Additional manufacturing, warehouse and office facilities are housed in approximately 529,000 square feet of owned facilities on approximately 118 acres of land in Palm Bay, Florida. Additionally, we conduct engineering activity and maintain regional sales offices aggregating approximately 285,000 square feet in various locations throughout the world including the United States, Asia and Europe. Except for our Florida facilities, which we own, all of our offices are leased and lease periods vary but all expire by 2021.

We believe that our current facilities are suitable and adequate for our present purposes, and that the productive capacity in our facilities is being substantially utilized.

Texas Advanced Optoelectronic Solutions, Inc. (“TAOS”) named Intersil as a defendant in a lawsuit filed on November 25, 2008 in the United States District Court for the Eastern District of Texas. In this action, TAOS alleges patent infringement, breach of contract, trade secret misappropriation, and tortuous interference with a business relationship pertaining to optical sensors, seeking damages and injunctive relief. We dispute TAOS’ claims and are defending ourselves vigorously. The parties are waiting for the court to evaluate the claims in TAOS’ patent(s), after which a claim construction opinion will be issued by the court.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

Our Class A Common Stock has been traded on the NASDAQ Stock Market since February 2000 under the symbol ISIL. We currently have the Global Select Market listing status on the NASDAQ Stock Market. Prior to February 2000, there was no public market for our common stock. The following table sets forth, for the periods indicated, the high and low closing prices per share of our Class A Common Stock as reported in NASDAQ Stock Market trading.

|

Quarter: |

|

High |

|

Low |

|

First quarter of 2011 (from January 1, 2011 to April 1, 2011) |

|

$ 15.40 |

|

$ 11.35 |

|

Second quarter of 2011 (from April 2, 2011 to July 1, 2011) |

|

15.34 |

|

12.12 |

|

Third quarter of 2011 (from July 2, 2011 to September 30, 2011) |

|

13.03 |

|

10.09 |

|

Fourth quarter of 2011 (from October 1, 2011 to December 30, 2011) |

|

12.73 |

|

9.82 |

|

First quarter of 2012 (from December 31, 2011 to March 30, 2012) |

|

11.78 |

|

10.04 |

|

Second quarter of 2012 (from March 31, 2012 to June 29, 2012) |

|

11.22 |

|

10.10 |

|

Third quarter of 2012 (from June 30, 2012 to September 28, 2012) |

|

10.74 |

|

8.74 |

|

Fourth quarter of 2012 (from September 29, 2012 to December 28, 2012) |

|

8.55 |

|

6.53 |

(b) Holders

On February 15, 2013, the last reported sale price for our Class A Common Stock was $8.74 per share. As of the same date, there were 311 record holders of our Class A Common Stock.

15

(c) Dividends

In 2012 and 2011, we declared and paid quarterly dividends totaling $0.48 per share annually. The first quarter dividend in 2013 has been declared by our Board of Directors at $0.12 per share, to be paid February 22, 2013 which if annualized equates to $0.48 per share.

Our dividend policy is impacted by, among other items, our views on potential future capital requirements relating to R&D, creation and expansion of sales distribution channels, investments and acquisitions, share dilution, our stock repurchase program, legal risks, liquidity and profitability. The terms of our revolving credit facility also restrict us from paying excessive dividends and making excessive investments in capital expenditures during the term of the revolving credit facility. Determination to declare and pay a dividend will be made in a timely manner by our Board of Directors in light of these and other factors the Board of Directors deems relevant.

(d) Equity compensation plan information

The table and notes below summarize the status of our equity compensation plans under which we issue stock options (“Options”) and restricted and deferred stock awards (“Awards”) (shares in thousands):

|

Plan Category |

|

Number of securities to be issued upon exercise of outstanding Options and Awards |

|

Weighted-average exercise price of outstanding Options |

|

Number of securities remaining available for future issuance under equity compensation plans |

|

Equity compensation plans approved by shareholders: |

|

|

|

|

|

|

|

Xicor 1998 and 2002 Equity Incentive Plans(1) |

|

131 |

|

$ 14.91 |

|

None |

|

Techwell 2006 Stock Incentive Plan (1)(2) |

|

55 |

|

12.56 |

|

None |

|

Intersil 1999 Equity Compensation Plan(3) |

|

2,200 |

|

25.48 |

|

None |

|

Intersil 2009 Option Exchange Plan |

|

1,400 |

|

13.08 |

|

None |

|

Intersil 2008 Equity Compensation Plan(4) |

|

11,527 |

|

12.45 |

|

11,497 |

|

Intersil Employee Stock Purchase Plan(5) |

|

6,533 |

|

N/A |

|

1,696 |

|

Equity compensation plans not approved by shareholders(6) |

|

- |

|

N/A |

|

None |

|

Total(7) |

|

21,846 |

|

$ 14.90 |

|

13,193 |

16

|

1) |

Each of these plans in these totals has been acquired by a purchase method accounting acquisition made by Intersil. At the time of the respective acquisitions Intersil ceased making grants, and will not make any additional grants, under these plans. Future grants are expected to be made under the 2008 Equity Compensation Plan. |

|

2) |

The number of securities for the Techwell 2006 Stock Incentive Plan includes 50 shares that are deferred or restricted stock units outstanding. The weighted-average exercise price displayed is only for 5 stock options. |

|

3) |

The number of securities for the Intersil 1999 Equity Compensation Plan includes 44 shares that are deferred or restricted stock units outstanding. The weighted-average exercise price displayed is only for 2,156 stock options. |

|

4) |

The number of securities for the Intersil 2008 Equity Compensation Plan includes 3,273 shares that are deferred or restricted stock units outstanding. The weighted-average exercise price displayed is only for 8,254 stock options. Grants of deferred or restricted stock units reduce the shares available for future grants by 2.33 shares each or 12,246 shares in 2011. |

|

5) |

The Employee Stock Purchase Plan (“ESPP”) does not employ a “look-back” option feature; therefore there are no options or right to purchase outstanding stock until the final day of the subscription period (which is then settled immediately). |

|

6) |

There are no equity compensation plans that have not been approved by shareholders. |

|

7) |

The number of securities for the total of the plans includes 3,367 shares that are deferred or restricted stock units outstanding. The weighted-average exercise price displayed is only for 11,946 stock options. |

(e) Performance Graph

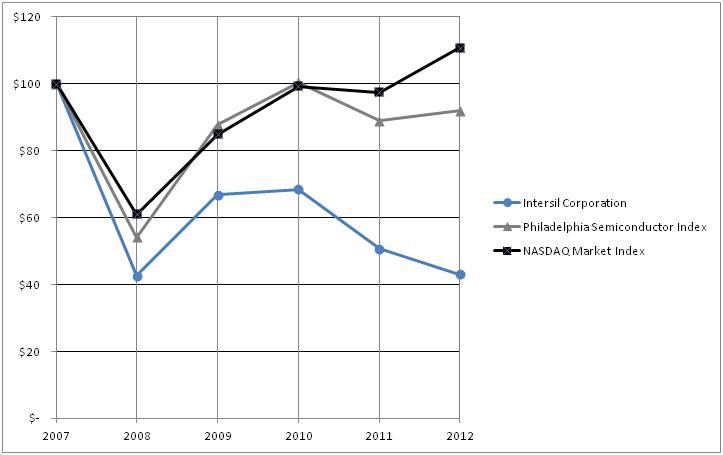

The following graph presents a comparison of the cumulative total shareholder return, assuming dividend reinvestment, on our stock with the cumulative total return of the NASDAQ Market Index and the Philadelphia Semiconductor Index for the period of five years commencing December 28, 2007 and ending December 28, 2012. The graph assumes that $100 was invested on December 28, 2007 in each of Intersil common stock, the NASDAQ Market Index, and the Philadelphia Semiconductor Index, and that all dividends were reinvested.

17

(f) Recent Sales of Unregistered Securities

We did not sell unregistered securities during 2012.

(g) Issuer Purchases of Equity Securities

We repurchased the following shares in our fourth quarter ended December 28, 2012.

|

Period |

|

Total number of shares purchased |

|

Average price paid per share |

|

Total number of shares purchased as part of publicly announced plan |

|

Maximum dollar value that may yet be purchased under the plan (in millions)(1) |

|

|

|

|

|

|

|

|

|

|

|

September 29 to October 26, 2012 |

|

1,020,677 |

|

$ 7.27 |

|

1,020,677 |

|

$ 36.18 |

|

October 27 to November 23, 2012 |

|

189,614 |

|

7.60 |

|

189,614 |

|

34.74 |

|

November 24 to December 28, 2012 |

|

- |

|

- |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

1,210,291 |

|

$ 7.32 |

|

1,210,291 |

|

$ 34.74 |

|

(1) |

A description of the maximum number of shares of common stock that may be purchased under the stock repurchase program is set forth in the Notes to our consolidated financial statements contained in this Annual Report on Form 10-K. |

Item 6. Selected Financial Data.

The following table sets forth our selected financial data. The historical financial data for each year in the five year period ended December 28, 2012 is derived from our audited consolidated financial statements. 2008 is a 53 week year.All other periods presented are fiscal years and include 52 weeks, including 2012. Additional information regarding 2008 and 2009 can be found in our 2008 and 2009 annual reports on form 10-K filed with the SEC. This information should be read in conjunction with the consolidated financial statements included elsewhere in this report and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

|

2012 |

|

2011 |

|

2010 |

|

2009 |

|

2008 |

|

|

|

(c)(e)(f) |

|

(b)(c)(d)(e) |

|

(b)(c) |

|

(b)(e) |

|

(a)(b)(e) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, except per share amounts) |

||||||||

|

Revenue |

|

$ 607.9 |

|

$ 760.5 |

|

$ 822.4 |

|

$ 611.4 |

|

$ 769.7 |

|

Net (loss) income |

|

(37.6) |

|

67.2 |

|

26.4 |

|

38.6 |

|

(1,062.5) |

|

Basic (loss) earnings per share |

|

(0.30) |

|

0.53 |

|

0.21 |

|

0.32 |

|

(8.59) |

|

Diluted (loss) earnings per share |

|

(0.30) |

|

0.53 |

|

0.21 |

|

0.32 |

|

(8.39) |

|

Total assets |

|

1,227.8 |

|

1,569.2 |

|

1,672.5 |

|

1,165.8 |

|

1,133.6 |

|

Dividends per common share |

|

0.48 |

|

0.48 |

|

0.48 |

|

0.48 |

|

0.48 |

18

The following transactions affect the comparability of the results between the periods above:

|

a) |

During 2008, we recorded a charge related to the impairment of goodwill of $1,154.7 million. |

|

b) |

During 2008, 2009, 2010 and 2011, we recorded impairment charges and losses on investments in auction rate securities of $31.8 million, $14.3 million, $1.2 million and $6.5 million, respectively. |

|

c) |

During 2010, 2011 and 2012, we recorded discrete income tax charges (credits) of $68.8 million, $(20.6) million and $16.8 million, respectively, which are due primarily to a provision established upon the completion of field work of multi-year Internal Revenue Service (“IRS”) examinations. |

|

d) |

During 2011, we recorded costs related to loss on debt extinguishment charge of $8.4 million. |

|

e) |

During 2008, 2009, 2011 and 2012 we recorded restructuring charges of $8.7 million, $2.1 million, $4.1 million, and $10.5 million, respectively. |

|

f) |

During 2012, we recorded income net of expenses from IP agreements of $14.4 million and losses related to settlement of our interest rate swaps of $5.8 million. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion in conjunction with our accompanying consolidated financial statements, including the related notes. This discussion generally refers to elements within our accompanying consolidated financial statements on a pre-tax basis unless otherwise stated. Except for historical information, the discussions in this section contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those discussed below. For further information regarding risks and uncertainties, see Item 1A. “Risk Factors” in this Annual Report on Form 10-K.

Overview

We focus our efforts on the high-performance analog, mixed-signal and power management markets of the semiconductor industry. Digital and analog semiconductor components are the basic ingredient in today’s electronic devices. In contrast to the binary nature of digital components, analog components monitor, evaluate and modify electrical signals and strengths allowing them to deal with basic and essential properties such as heat, touch, light and sound. The high-performance analog, mixed-signal, and power management markets are distinguished by its highly differentiated and technologically advanced products which can be building blocks for more complex circuits or highly integrated for specific applications.

We utilize a 52/53 week fiscal year, ending on the nearest Friday to December 31. The next 53 week fiscal year will occur in 2013 with an extra week to be reported in our second quarter. All years presented are fiscal years and contain 52 weeks. Quarterly or annual periods vary from exact calendar quarters or years.

19

Statement of Operations ($ in millions and % of revenue):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

||||||

|

Revenue |

$ 607.9 |

|

100.0 |

% |

|

$ 760.5 |

|

100.0 |

% |

|

$ 822.4 |

|

100.0 |

% |

|

Cost of revenue |

277.7 |

|

45.7 |

|

|

323.2 |

|

42.5 |

|

|

344.1 |

|

41.8 |

|

|

Gross profit |

330.2 |

|

54.3 |

|

|

437.3 |

|

57.5 |

|

|

478.3 |

|

58.2 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

166.9 |

|

27.5 |

|

|

185.5 |

|

24.4 |

|

|

183.3 |

|

22.3 |

|

|

Selling, general and administrative |

134.3 |

|

22.1 |

|

|

140.0 |

|

18.4 |

|

|

137.5 |

|

16.7 |

|

|

Amortization of purchased intangibles |

29.2 |

|

4.8 |

|

|

26.8 |

|

3.5 |

|

|

27.7 |

|

3.4 |

|

|

Income from IP agreements |

(14.4) |

|

(2.4) |

|

|

- |

|

- |

|

|

- |

|

- |

|

|

Restructuring and related costs |

10.5 |

|

1.7 |

|

|

4.1 |

|

0.5 |

|

|

- |

|

- |

|

|

Acquisition-related costs |

- |

|

- |

|

|

0.3 |

|

0.1 |

|

|

8.0 |

|

1.0 |

|

|

Operating income |

3.7 |

|

0.6 |

|

|

80.7 |

|

10.6 |

|

|

121.8 |

|

14.8 |

|

|

Interest income |

0.5 |

|

0.1 |

|

|

2.7 |

|

0.4 |

|

|

3.1 |

|

0.4 |

|

|

Interest expense and fees |

(12.8) |

|

(2.1) |

|

|

(14.5) |

|

(1.9) |

|

|

(12.9) |

|

(1.6) |

|

|

Loss on extinguishment of debt |

- |

|

- |

|

|

(8.4) |

|

(1.1) |

|

|

- |

|

- |

|

|

Gain (loss) on deferred compensation investments, net |

0.9 |

|

0.1 |

|

|

(0.5) |

|

(0.1) |

|

|

0.9 |

|

0.1 |

|

|

Loss on sale of investments |

- |

|

- |

|

|

(6.5) |

|

(0.9) |

|

|

(0.1) |

|

(0.0) |

|

|

Other-than-temporary impairment losses |

- |

|

- |

|

|

- |

|

- |

|

|

(1.1) |

|

(0.1) |

|

|

(Loss) income before income taxes |

(7.7) |

|

(1.3) |

|

|

53.4 |

|

7.0 |

|

|

111.8 |

|

13.6 |

|

|