Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - UNITED INSURANCE HOLDINGS CORP. | exh992pressrelease-kiliman.htm |

| 8-K - 8-K - UNITED INSURANCE HOLDINGS CORP. | form8-kq22016investorprese.htm |

United Insurance Holdings Corp.

NASDAQ: UIHC

UPC Insurance and American Coastal Insurance Combination

Creating a Leading Specialty Property CAT Underwriter

August 17, 2016

2AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

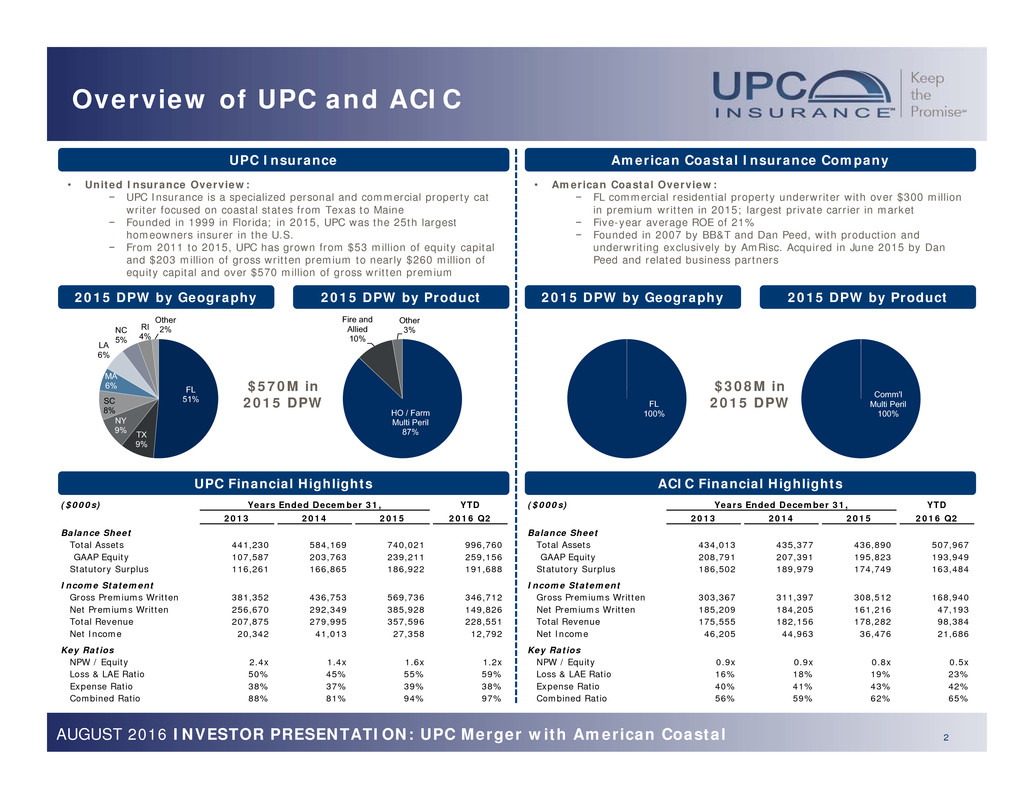

($000s) Years Ended December 31, YTD

2013 2014 2015 2016 Q2

Balance Sheet

Total Assets 434,013 435,377 436,890 507,967

GAAP Equity 208,791 207,391 195,823 193,949

Statutory Surplus 186,502 189,979 174,749 163,484

Income Statement

Gross Premiums Written 303,367 311,397 308,512 168,940

Net Premiums Written 185,209 184,205 161,216 47,193

Total Revenue 175,555 182,156 178,282 98,384

Net Income 46,205 44,963 36,476 21,686

Key Ratios

NPW / Equity 0.9x 0.9x 0.8x 0.5x

Loss & LAE Ratio 16% 18% 19% 23%

Expense Ratio 40% 41% 43% 42%

Combined Ratio 56% 59% 62% 65%

($000s) Years Ended December 31, YTD

2013 2014 2015 2016 Q2

Balance Sheet

Total Assets 441,230 584,169 740,021 996,760

GAAP Equity 107,587 203,763 239,211 259,156

Statutory Surplus 116,261 166,865 186,922 191,688

Income Statement

Gross Premiums Written 381,352 436,753 569,736 346,712

Net Premiums Written 256,670 292,349 385,928 149,826

Total Revenue 207,875 279,995 357,596 228,551

Net Income 20,342 41,013 27,358 12,792

Key Ratios

NPW / Equity 2.4x 1.4x 1.6x 1.2x

Loss & LAE Ratio 50% 45% 55% 59%

Expense Ratio 38% 37% 39% 38%

Combined Ratio 88% 81% 94% 97%

Overview of UPC and ACIC

American Coastal Insurance Company

ACIC Financial Highlights

UPC Insurance

UPC Financial Highlights

• United Insurance Overview:

− UPC Insurance is a specialized personal and commercial property cat

writer focused on coastal states from Texas to Maine

− Founded in 1999 in Florida; in 2015, UPC was the 25th largest

homeowners insurer in the U.S.

− From 2011 to 2015, UPC has grown from $53 million of equity capital

and $203 million of gross written premium to nearly $260 million of

equity capital and over $570 million of gross written premium

• American Coastal Overview:

− FL commercial residential property underwriter with over $300 million

in premium written in 2015; largest private carrier in market

− Five-year average ROE of 21%

− Founded in 2007 by BB&T and Dan Peed, with production and

underwriting exclusively by AmRisc. Acquired in June 2015 by Dan

Peed and related business partners

2015 DPW by Geography 2015 DPW by Product 2015 DPW by Geography 2015 DPW by Product

FL

51%

TX

9%

NY

9%

SC

8%

MA

6%

LA

6%

NC

5%

RI

4%

Other

2%

HO / Farm

Multi Peril

87%

Fire and

Allied

10%

Other

3%

FL

100%

Comm'l

Multi Peril

100%

$570M in

2015 DPW

$308M in

2015 DPW

3AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

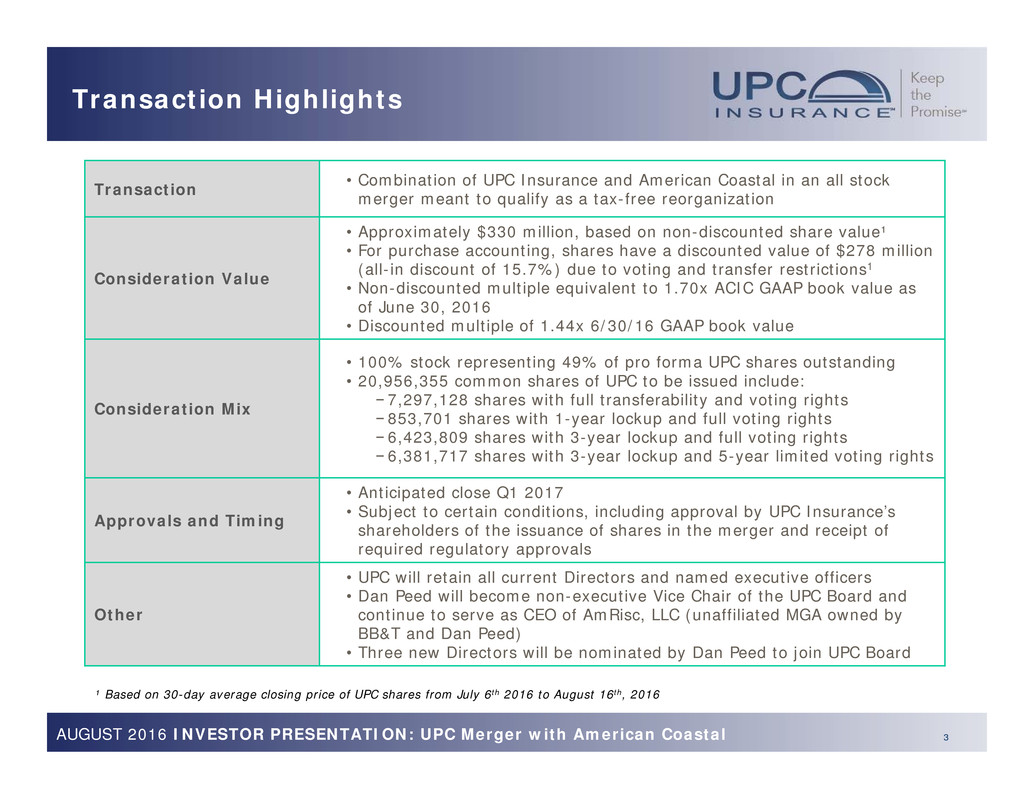

Transaction Highlights

Transaction • Combination of UPC Insurance and American Coastal in an all stock merger meant to qualify as a tax-free reorganization

Consideration Value

• Approximately $330 million, based on non-discounted share value¹

• For purchase accounting, shares have a discounted value of $278 million

(all-in discount of 15.7%) due to voting and transfer restrictions1

• Non-discounted multiple equivalent to 1.70x ACIC GAAP book value as

of June 30, 2016

• Discounted multiple of 1.44x 6/30/16 GAAP book value

Consideration Mix

• 100% stock representing 49% of pro forma UPC shares outstanding

• 20,956,355 common shares of UPC to be issued include:

− 7,297,128 shares with full transferability and voting rights

− 853,701 shares with 1-year lockup and full voting rights

− 6,423,809 shares with 3-year lockup and full voting rights

− 6,381,717 shares with 3-year lockup and 5-year limited voting rights

Approvals and Timing

• Anticipated close Q1 2017

• Subject to certain conditions, including approval by UPC Insurance’s

shareholders of the issuance of shares in the merger and receipt of

required regulatory approvals

Other

• UPC will retain all current Directors and named executive officers

• Dan Peed will become non-executive Vice Chair of the UPC Board and

continue to serve as CEO of AmRisc, LLC (unaffiliated MGA owned by

BB&T and Dan Peed)

• Three new Directors will be nominated by Dan Peed to join UPC Board

¹ Based on 30-day average closing price of UPC shares from July 6th 2016 to August 16th, 2016

4AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

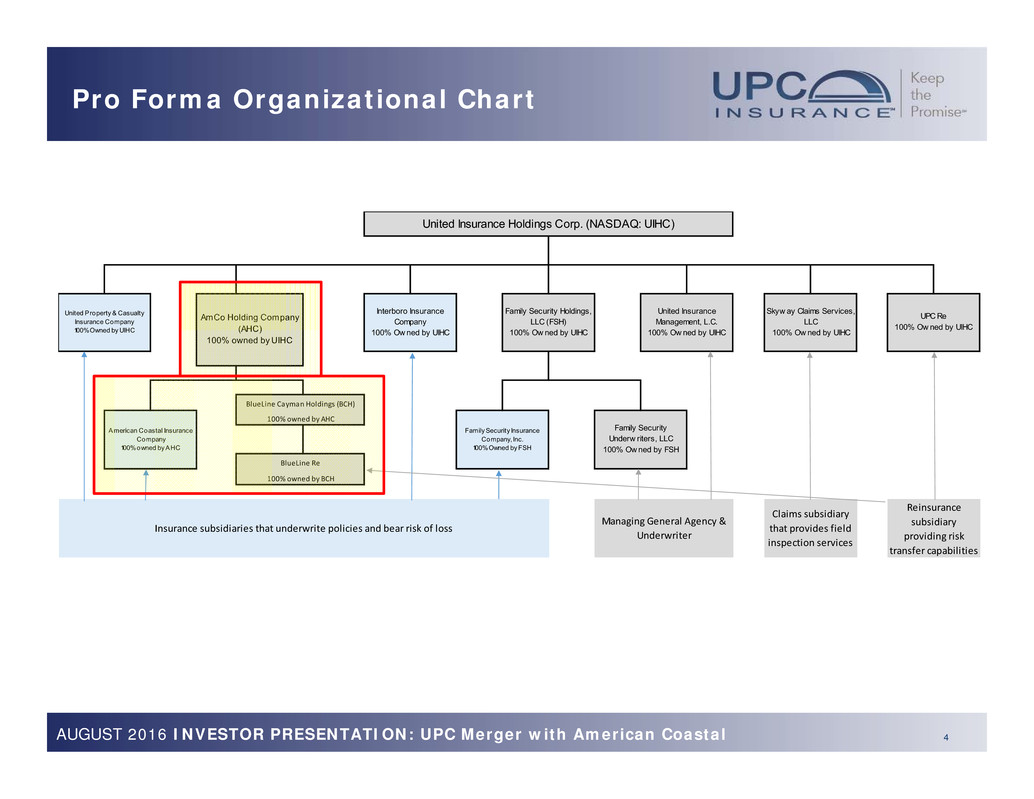

Pro Forma Organizational Chart

Insurance subsidiaries that underwrite policies and bear risk of loss Managing General Agency & Underwriter

Claims subsidiary

that provides field

inspection services

Reinsurance

subsidiary

providing risk

transfer capabilities

Family Security Insurance

Company, Inc.

100% Owned by FSH

Family Security

Underw riters, LLC

100% Ow ned by FSH

American Coastal Insurance

Company

100% owned by AHC

BlueLine Re

100% owned by AHC

100% owned by BCH

UPC Re

100% Ow ned by UIHC

United Insurance Holdings Corp. (NASDAQ: UIHC)

United Property & Casualty

Insurance Company

100% Owned by UIHC

Interboro Insurance

Company

100% Ow ned by UIHC

Family Security Holdings,

LLC (FSH)

100% Ow ned by UIHC

United Insurance

Management, L.C.

100% Ow ned by UIHC

AmCo Holding Company

(AHC)

100% owned by UIHC

BlueLine Cayman Holdings (BCH)

Skyw ay Claims Services,

LLC

100% Ow ned by UIHC

5AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

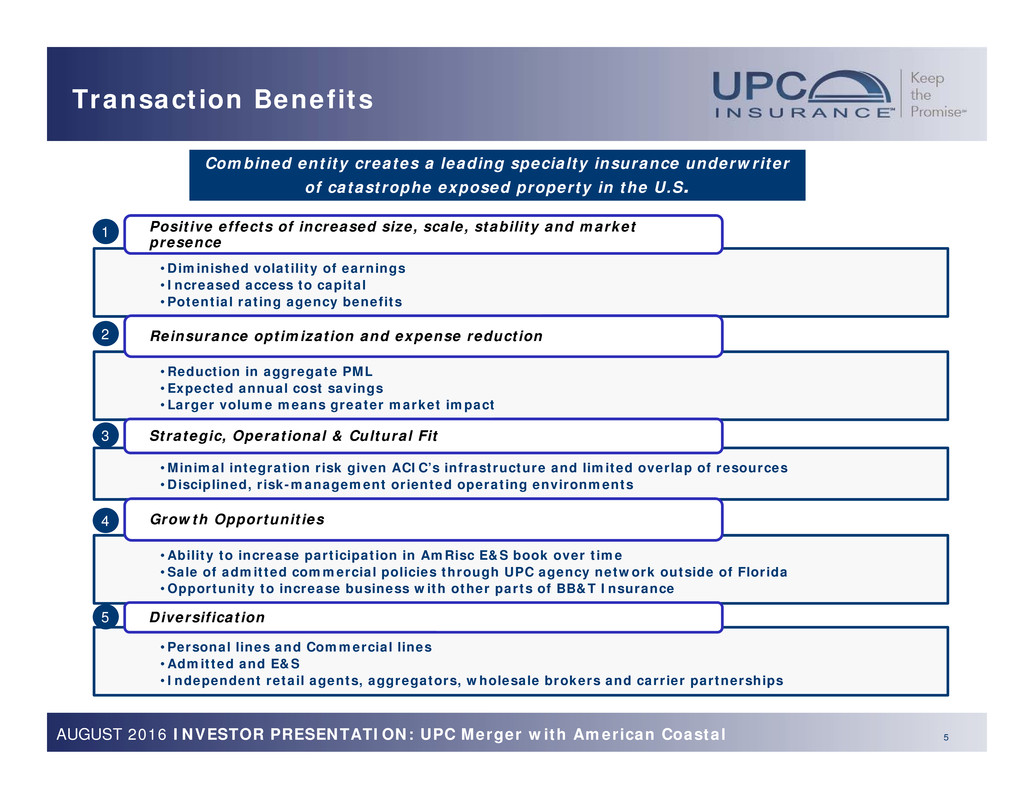

Transaction Benefits

•Diminished volatility of earnings

•Increased access to capital

•Potential rating agency benefits

Positive effects of increased size, scale, stability and market

presence

•Reduction in aggregate PML

•Expected annual cost savings

•Larger volume means greater market impact

Reinsurance optimization and expense reduction

•Minimal integration risk given ACIC’s infrastructure and limited overlap of resources

•Disciplined, risk-management oriented operating environments

Strategic, Operational & Cultural Fit

•Ability to increase participation in AmRisc E&S book over time

•Sale of admitted commercial policies through UPC agency network outside of Florida

•Opportunity to increase business with other parts of BB&T Insurance

Growth Opportunities

•Personal lines and Commercial lines

•Admitted and E&S

•Independent retail agents, aggregators, wholesale brokers and carrier partnerships

Diversification

1

2

3

4

5

Combined entity creates a leading specialty insurance underwriter

of catastrophe exposed property in the U.S.

6AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

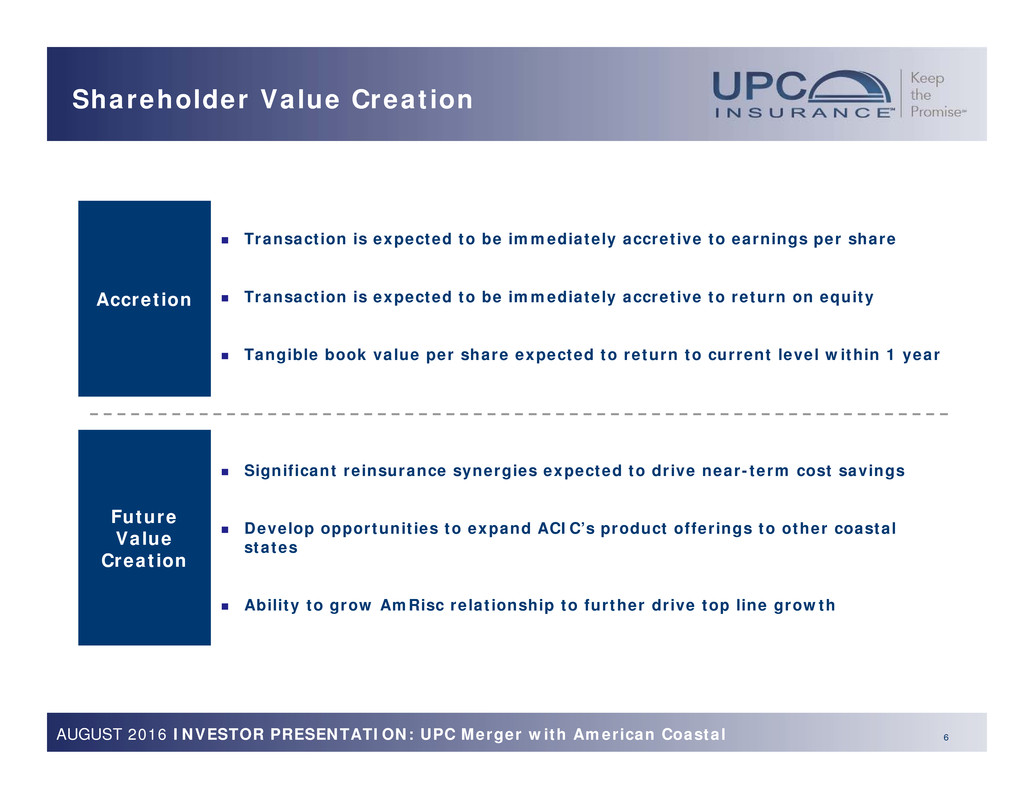

Shareholder Value Creation

Transaction is expected to be immediately accretive to earnings per share

Transaction is expected to be immediately accretive to return on equity

Tangible book value per share expected to return to current level within 1 year

Significant reinsurance synergies expected to drive near-term cost savings

Develop opportunities to expand ACIC’s product offerings to other coastal

states

Ability to grow AmRisc relationship to further drive top line growth

Accretion

Future

Value

Creation

7AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

Daniel Peed, CPCU, ARe

CEO of American Coastal

Background

• Currently serves as CEO of American Coastal and President and CEO of

AmRisc, LLC

• Mr. Peed has over 30 years of experience in the insurance industry

Includes both insurance and reinsurance underwriting focused on commercial property risk

• Mr. Peed previously was a Senior Vice President at Sorema N.A. Reinsurance

Company from 1991 – 2000

• He started his career as a Loss Prevention Consultant at Factory Mutual

Insurance Company (FM Global) from 1985 - 1991

• Mr. Peed received his MBA with insurance focus from University of North

Texas and a B.S. in Petroleum Engineering from Texas A&M University

AmRisc Overview

• AmRisc is a specialty windstorm MGA that has produced and underwritten

over $7 billion of direct written premium at a cumulative combined ratio of

approximately 55% since its founding in 2000

• These results include all the hurricane activity of 2004, 2005, 2008, and

2011

• AmRisc underwrites commercial property risks, including commercial

property construction, catastrophe property, commercial flood, residential

flood, tech property, and county habitational property risks

• The company was founded by Mr. Peed and others in 2000 and is based in

Houston, Texas

8AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

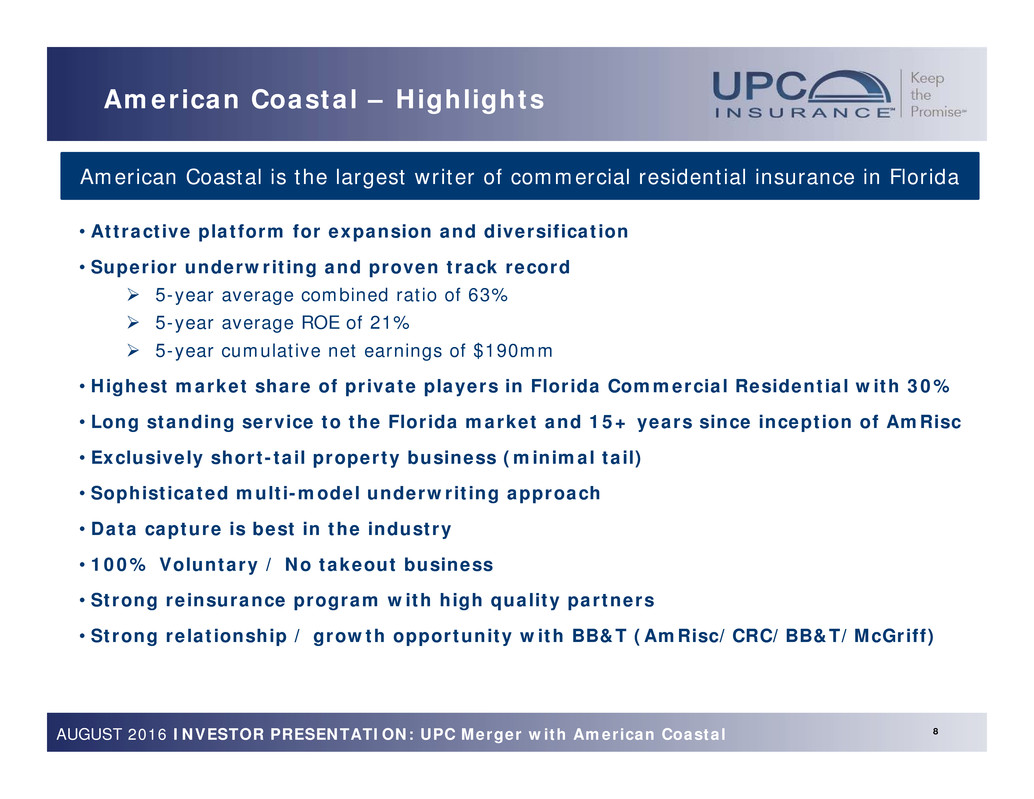

American Coastal – Highlights

American Coastal is the largest writer of commercial residential insurance in Florida

•Attractive platform for expansion and diversification

•Superior underwriting and proven track record

5-year average combined ratio of 63%

5-year average ROE of 21%

5-year cumulative net earnings of $190mm

•Highest market share of private players in Florida Commercial Residential with 30%

•Long standing service to the Florida market and 15+ years since inception of AmRisc

•Exclusively short-tail property business (minimal tail)

•Sophisticated multi-model underwriting approach

•Data capture is best in the industry

•100% Voluntary / No takeout business

•Strong reinsurance program with high quality partners

•Strong relationship / growth opportunity with BB&T (AmRisc/CRC/BB&T/McGriff)

9AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

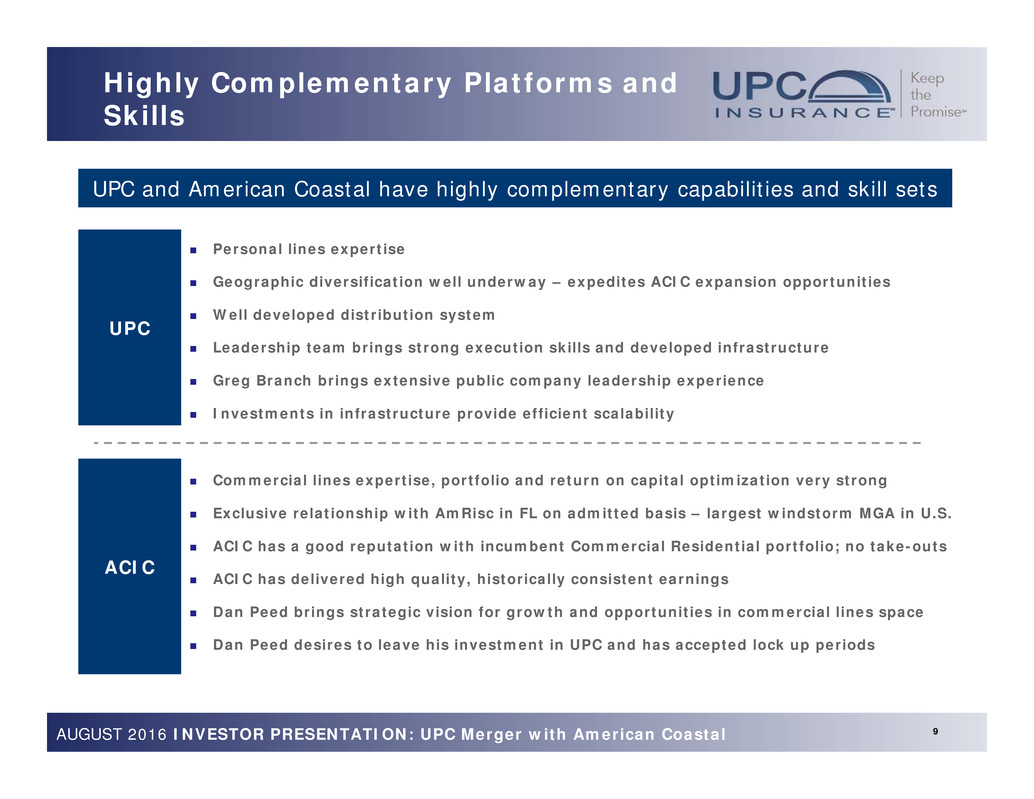

Highly Complementary Platforms and

Skills

UPC and American Coastal have highly complementary capabilities and skill sets

Commercial lines expertise, portfolio and return on capital optimization very strong

Exclusive relationship with AmRisc in FL on admitted basis – largest windstorm MGA in U.S.

ACIC has a good reputation with incumbent Commercial Residential portfolio; no take-outs

ACIC has delivered high quality, historically consistent earnings

Dan Peed brings strategic vision for growth and opportunities in commercial lines space

Dan Peed desires to leave his investment in UPC and has accepted lock up periods

UPC

ACIC

Personal lines expertise

Geographic diversification well underway – expedites ACIC expansion opportunities

Well developed distribution system

Leadership team brings strong execution skills and developed infrastructure

Greg Branch brings extensive public company leadership experience

Investments in infrastructure provide efficient scalability

10AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

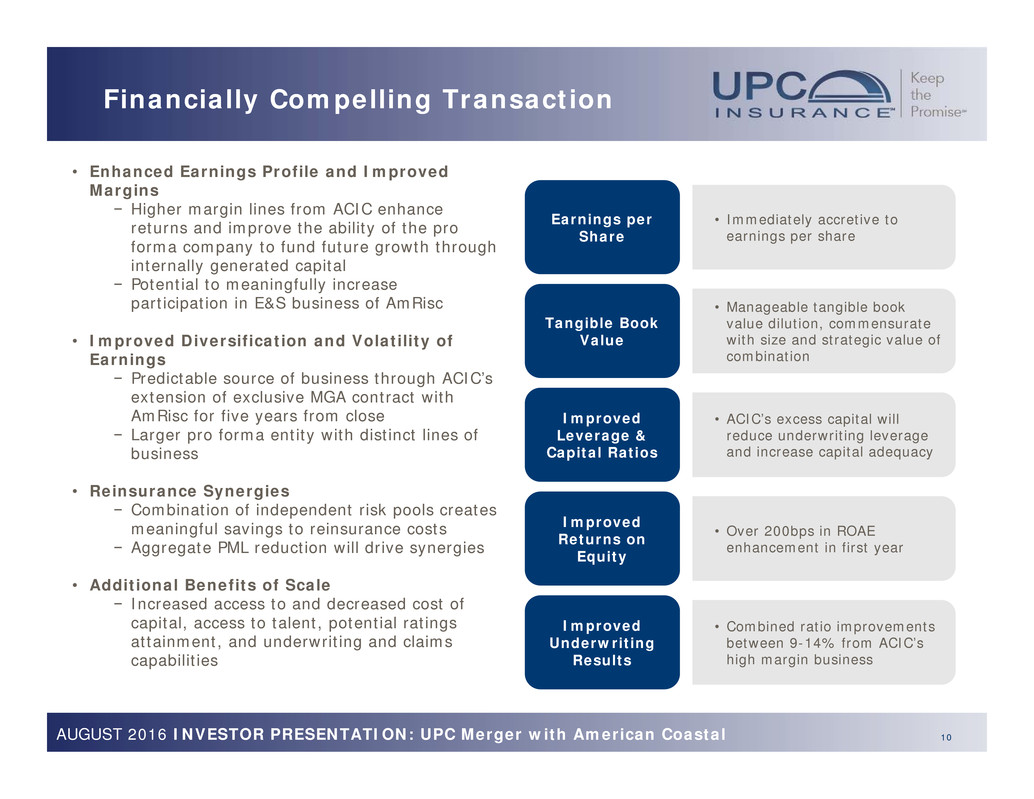

Financially Compelling Transaction

Earnings per

Share

Tangible Book

Value

Improved

Leverage &

Capital Ratios

Improved

Underwriting

Results

• Immediately accretive to

earnings per share

• Combined ratio improvements

between 9-14% from ACIC’s

high margin business

• Manageable tangible book

value dilution, commensurate

with size and strategic value of

combination

• ACIC’s excess capital will

reduce underwriting leverage

and increase capital adequacy

• Enhanced Earnings Profile and Improved

Margins

− Higher margin lines from ACIC enhance

returns and improve the ability of the pro

forma company to fund future growth through

internally generated capital

− Potential to meaningfully increase

participation in E&S business of AmRisc

• Improved Diversification and Volatility of

Earnings

− Predictable source of business through ACIC’s

extension of exclusive MGA contract with

AmRisc for five years from close

− Larger pro forma entity with distinct lines of

business

• Reinsurance Synergies

− Combination of independent risk pools creates

meaningful savings to reinsurance costs

− Aggregate PML reduction will drive synergies

• Additional Benefits of Scale

− Increased access to and decreased cost of

capital, access to talent, potential ratings

attainment, and underwriting and claims

capabilities

Improved

Returns on

Equity

• Over 200bps in ROAE

enhancement in first year

11AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

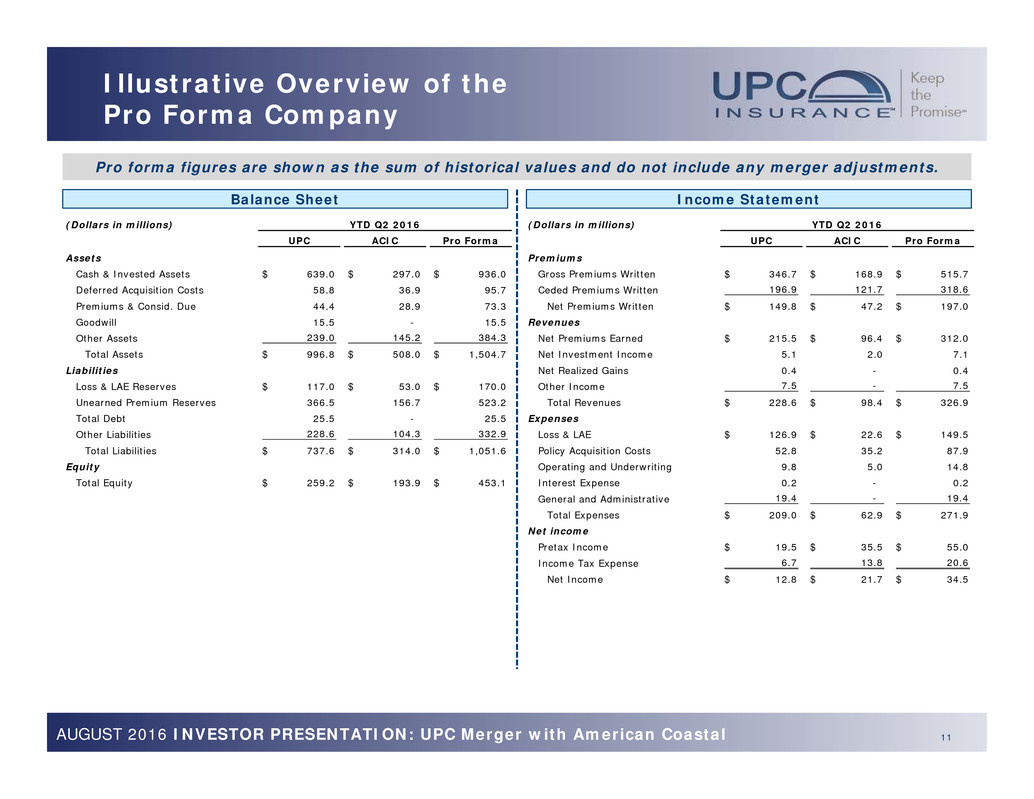

Illustrative Overview of the

Pro Forma Company

Balance Sheet Income Statement

Pro forma figures are shown as the sum of historical values and do not include any merger adjustments.

(Dollars in millions) YTD Q2 2016

UPC ACIC Pro Forma

Assets

Cash & Invested Assets 639.0$ 297.0$ 936.0$

Deferred Acquisition Costs 58.8 36.9 95.7

Premiums & Consid. Due 44.4 28.9 73.3

Goodwill 15.5 - 15.5

Other Assets 239.0 145.2 384.3

Total Assets 996.8$ 508.0$ 1,504.7$

Liabilities

Loss & LAE Reserves 117.0$ 53.0$ 170.0$

Unearned Premium Reserves 366.5 156.7 523.2

Total Debt 25.5 - 25.5

Other Liabilities 228.6 104.3 332.9

Total Liabilities 737.6$ 314.0$ 1,051.6$

Equity

Total Equity 259.2$ 193.9$ 453.1$

(Dollars in millions) YTD Q2 2016

UPC ACIC Pro Forma

Premiums

Gross Premiums Written 346.7$ 168.9$ 515.7$

Ceded Premiums Written 196.9 121.7 318.6

Net Premiums Written 149.8$ 47.2$ 197.0$

Revenues

Net Premiums Earned 215.5$ 96.4$ 312.0$

Net Investment Income 5.1 2.0 7.1

Net Realized Gains 0.4 - 0.4

Other Income 7.5 - 7.5

Total Revenues 228.6$ 98.4$ 326.9$

Expenses

Loss & LAE 126.9$ 22.6$ 149.5$

Policy Acquisition Costs 52.8 35.2 87.9

Operating and Underwriting 9.8 5.0 14.8

Interest Expense 0.2 - 0.2

General and Administrative 19.4 - 19.4

Total Expenses 209.0$ 62.9$ 271.9$

Net income

Pretax Income 19.5$ 35.5$ 55.0$

Income Tax Expense 6.7 13.8 20.6

Net Income 12.8$ 21.7$ 34.5$

12AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

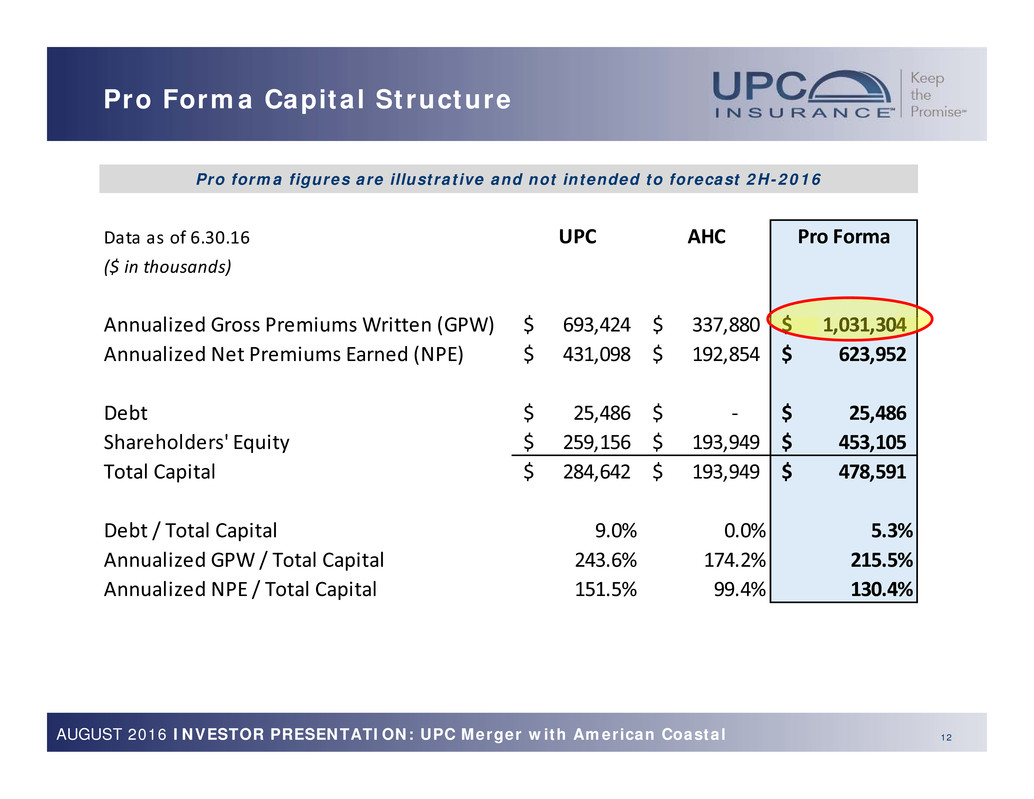

Pro Forma Capital Structure

Data as of 6.30.16 UPC AHC Pro Forma

($ in thousands)

Annualized Gross Premiums Written (GPW) 693,424$ 337,880$ 1,031,304$

Annualized Net Premiums Earned (NPE) 431,098$ 192,854$ 623,952$

Debt 25,486$ -$ 25,486$

Shareholders' Equity 259,156$ 193,949$ 453,105$

Total Capital 284,642$ 193,949$ 478,591$

Debt / Total Capital 9.0% 0.0% 5.3%

Annualized GPW / Total Capital 243.6% 174.2% 215.5%

Annualized NPE / Total Capital 151.5% 99.4% 130.4%

Pro forma figures are illustrative and not intended to forecast 2H-2016

13AUGUST 2016 INVESTOR PRESENTATION: UPC Merger with American Coastal

Conclusion

UPC’s merger with ACIC creates a very unique catastrophe

property underwriting specialist with over $1 billion of premium

in force

ACIC’s relationship with AmRisc provides unparalleled access to

commercial property expertise and great growth potential

Attractive financial terms provide for substantial upside for

shareholders

Insider ownership and restrictions placed on new shares being

issued create proper alignment of shareholder interests

The growth and stability of future earnings and returns on equity

are enhanced by this transaction

14

Cautionary Statement Regarding

Forward Looking Statements

This communication contains “forward-looking statements” that involve significant risks and uncertainties. All

statements other than statements of historical fact are statements that could be deemed forward-looking

statements, including: any statements regarding the anticipated timing of filings and approvals relating to the

proposed merger; any statements regarding the expected timing of the completion of the proposed merger;

any statements regarding the ability to complete the proposed merger considering the various closing

conditions; any statements of expectation or belief; any statement regarding the future financial performance

of the Company; and any statements of assumptions underlying any of the foregoing. These statements are

made as of the date of this communication and reflect management’s expectations, estimates and

assumptions based on current and available information at the time the document was prepared. Forward-

looking statements often include words such as “anticipate,” “believe,” “estimate,” “target,” “expect,”

“predict,” “plan,” “possible,” “potential,” “project,” “hope,” “intend,” “likely,” “will,” “should,” “could,” “may,”

“foreseeable,” “would” and similar expressions. However, the absence of these words or similar expressions

does not mean that a statement is not forward-looking. Readers are cautioned not to place undue reliance on

forward-looking statements. Forward-looking statements are not guarantees of future performance and

involve risks, uncertainties and other factors that may cause actual performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by those

statements. Risks and uncertainties that could cause results to differ from expectations include, but are not

limited to: uncertainties as to the timing of the proposed merger; the possibility that various closing

conditions for the proposed merger may not be satisfied or waived, including that the stockholders of the

Company may not approve the Company’s issuance of common stock, par value $0.0001 per share, as

consideration for the proposed merger or that a governmental entity may prohibit, delay or refuse to grant

approval for the consummation of the proposed merger; the effects of disruption from the proposed merger

making it more difficult for the Company to maintain relationships with employees (including potential

difficulties in employee retention); the response of customers, vendors, other business partners and

governmental entities to the announcement of the proposed merger; legal proceedings that may be instituted

against the Company, its board of directors, executive officers and others following the announcement of the

definitive agreement entered into in respect of the merger; other business effects, including the effects of

industrial, economic, political or weather conditions outside of the Company’s control; transaction costs;

actual or contingent liabilities, including those related to dependence on key commercial relationships or the

expertise of certain personnel; and other risks and uncertainties discussed in this communication and other

documents filed with the SEC by the Company, as well as the Schedule 14A to be filed with the SEC by the

Company. The Company does not undertake any obligation to update any forward-looking statements as a

result of new information, future developments or otherwise, except as expressly required by law.

15

Additional Information Regarding

the Transaction and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy the

securities of the Company or the solicitation of any vote or approval. This communication is being

made in respect of the proposed merger transaction involving the Company, Kilimanjaro Corp., Kili

LLC, AmCo Holding Company, RDX Holding, LLC and certain members of RDX Holding, LLC. The

proposed issuance by the Company of shares of common stock in connection with such merger will be

submitted to the stockholders of the Company for their consideration. In connection therewith, the

Company intends to file relevant materials with the SEC, including a definitive proxy statement.

However, such documents are not currently available. The definitive proxy statement will be mailed to

the stockholders of the Company. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION,

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT

REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE

FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE,

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders may obtain free copies of the definitive proxy statement, any

amendments or supplements thereto and other documents containing important information about the

Company, once such documents are filed with the SEC, through the website maintained by the SEC at

www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of

charge on the Company’s website at www.upcinsurance.com under the heading “Documents” within

the “SEC Filings” section in the “Investors Relations” portion of the Company’s website. Stockholders of

the Company may also obtain a free copy of the definitive proxy statement and any filings with the

SEC that are incorporated by reference in the definitive proxy statement by contacting the Company’s

Investor Relations Department at (727) 895-7737.

16

Participants in the Solicitation

The Company and its directors, executive officers and certain other members of management and

employees may be deemed to be participants in the solicitation of proxies in connection with the

proposed transaction. Information about the directors and executive officers of the Company is set

forth in its proxy statement for its 2016 annual meeting of stockholders, which was filed with the SEC

on April 5, 2016, its annual report on Form 10-K for the fiscal year ended December 31, 2015, which

was filed with the SEC on March 2, 2016, and in subsequent documents filed with the SEC, each of

which can be obtained free of charge from the sources indicated above. Other information regarding

the participants in the proxy solicitation of the stockholders of the Company and a description of their

direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and

definitive proxy statements and other relevant materials to be filed with the SEC when they become

available.