Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - LegacyTexas Financial Group, Inc. | ex992q22016dividendannounc.htm |

| EX-99.1 - EXHIBIT 99.1 - LegacyTexas Financial Group, Inc. | ex991q22016earningsrelease.htm |

| 8-K - 8-K - LegacyTexas Financial Group, Inc. | a8kq22016covererslides.htm |

July 20, 2016

EXHIBIT 99.3

Second Quarter 2016

Investor Presentation

2

Safe harbor statement

When used in filings by LegacyTexas Financial Group, Inc. (the "Company”) with the Securities and Exchange Commission (the “SEC”),

in the Company's press releases or other public or stockholder communications, and in oral statements made with the approval of an

authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,”

“project,” “intends” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties that could cause actual

results to differ materially from historical earnings and those presently anticipated or projected, including, among other things: the

expected cost savings, synergies and other financial benefits from acquisition or disposition transactions might not be realized

within the expected time frames or at all and costs or difficulties relating to integration matters might be greater than expected;

changes in economic conditions; legislative changes; changes in policies by regulatory agencies; fluctuations in interest rates; the

risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and

changes in estimates of the adequacy of the allowance for loan losses; the Company's ability to access cost-effective funding;

fluctuations in real estate values and both residential and commercial real estate market conditions; demand for loans and deposits

in the Company's market area; fluctuations in the price of oil, natural gas and other commodities; competition; changes in

management’s business strategies and other factors set forth in the Company's filings with the SEC.

The Company does not undertake - and specifically declines any obligation - to publicly release the result of any revisions which may

be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events.

SECOND QUARTER 2016

3

Today’s presenters

SECOND QUARTER 2016

Kevin Hanigan

President and Chief Executive Officer

• CEO and President of LegacyTexas Financial Group, Inc.

• Former Chairman and Chief Executive Officer of Highlands Bancshares in 2010

• Former Chairman and Chief Executive Officer of Guaranty Bank in 2009

• 35+ years of Texas banking experience

Mays Davenport

Executive Vice President, Chief Financial Officer

• Former Executive Vice President at LegacyTexas Bank

• Senior management experience for retail branch, treasury management, human resources, marketing,

mortgage, and wealth advisory functions

• Certified Public Accountant, former national accounting and tax advisory firm experience

• 23+ years of Texas banking experience

4

Profitability

Recent

Recognitions

• Recognized as the #2 Fastest Growing North Texas Company and ranked among the top 100

North Texas Public Companies by Dallas Business Journal

• Awarded 2015 Raymond James Community Bankers Cup-recognizes top 10% of community

banks (with assets between $500 million and $10 billion)

• Rated by S&P Global Market Intelligence as #8 in the 100 best-performing community banks

in 2015 (with assets between $1 billion and $10 billion)

• Named one of 25 KBW "Challenger Banks" who can most effectively challenge large universal

banks for market share

Capital

Key franchise highlights

Quarterly earnings of $23.2 million and basic EPS of $0.50 for Q2 2016

• Return on average assets of 1.2%, return on average equity of 11.1%

• Exceptional loan growth of $423.7 million for Q2 2016 with 8.0% linked quarter growth¹

• Efficiency ratio of 48.2%, improved from 49.0% for Q1 2016

Asset quality

Growth balanced with disciplined underwriting and risk management resulting in strong asset

quality

• NPAs / loans + OREO: 0.99% 1

• NCOs / average loans: 0.01% for Q2 20161

Profitability levered excess capital while maintaining strong capital levels

• TCE / TA2: 8.4%

• Estimated Tier 1 common risk-based capital3: 9.28%

Source: Company Documents

1 Excludes Warehouse Purchase Program loans and loans held for sale

2 See the section labeled "Supplemental Information- Non-GAAP Financial Measures“

3 Calculated at the Company level, which is subject to the capital adequacy requirements of the Federal Reserve

SECOND QUARTER 2016 – FRANCHISE HIGHLIGHTS

5

Source: Company Documents

¹ Based on deposit market share of banks headquartered in Texas

² Includes banks headquartered in the Dallas-Fort Worth-Arlington, TX MSA

North Texas focused

Leading market position

#1

in Collin

County among

independent

banks¹

#2

in Collin

County among

all banks

#3

among Dallas

based banks in

DFW²

SECOND QUARTER 2016 – FRANCHISE HIGHLIGHTS

Employment by industry

42%

8%

3%

4%

13%

1%

5%

9%

7%

6%

2%

Service-providing

Goods-providing

Construction

Manufacturing

Trade, transportation and

utilities

Information

Financial activities

Professional and business

services

Education and health

services

Leisure and hospitality

Other

Source: Bureau of Labor Statistics

Note: Represents latest available data for the Dallas-Fort Worth-Arlington, TX MSA (i.e., data as of

2015Q4)

21 DFW companies in Fortune 500

6

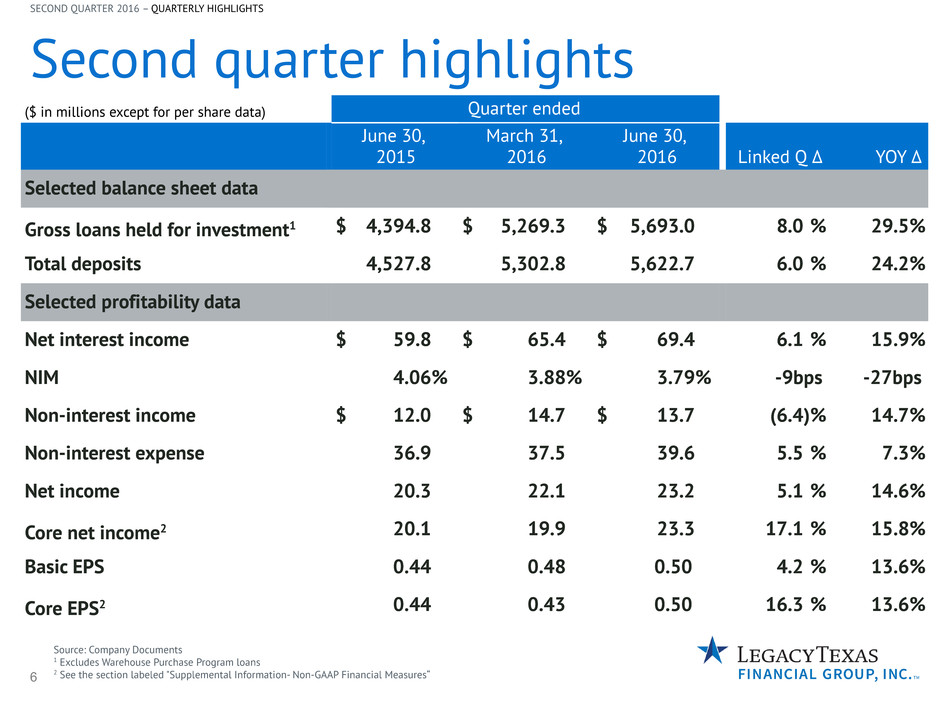

Second quarter highlights

($ in millions except for per share data) Quarter ended

June 30,

2015

March 31,

2016

June 30,

2016 Linked Q ∆ YOY ∆

Selected balance sheet data

Gross loans held for investment1 $ 4,394.8 $ 5,269.3 $ 5,693.0 8.0 % 29.5%

Total deposits 4,527.8 5,302.8 5,622.7 6.0 % 24.2%

Selected profitability data

Net interest income $ 59.8 $ 65.4 $ 69.4 6.1 % 15.9%

NIM 4.06% 3.88% 3.79% -9bps -27bps

Non-interest income $ 12.0 $ 14.7 $ 13.7 (6.4)% 14.7%

Non-interest expense 36.9 37.5 39.6 5.5 % 7.3%

Net income 20.3 22.1 23.2 5.1 % 14.6%

Core net income2 20.1 19.9 23.3 17.1 % 15.8%

Basic EPS 0.44 0.48 0.50 4.2 % 13.6%

Core EPS2 0.44 0.43 0.50 16.3 % 13.6%

Source: Company Documents

1 Excludes Warehouse Purchase Program loans

2 See the section labeled "Supplemental Information- Non-GAAP Financial Measures“

SECOND QUARTER 2016 – QUARTERLY HIGHLIGHTS

7

44.3%

22.7%

8.6%

4.9% 18.4%

1.1%

Originated loans

Acquired from LegacyTexas Group, Inc.

2011Y 2012Y 2013Y 2014Y 2015Y 2016 Q2

$1,228

$1,691

$2,050

$2,634

$3,667

$5,693

$1,400

($ in millions)

Robust commercially focused growth

Source: Company Documents

1 Excludes Warehouse Purchase Program loans

2 Represents balance acquired on January 1, 2015

Gross loans held for investment at June 30, 2016, excluding Warehouse Purchase Program loans,

grew $423.7 million, or 8.0%, from March 31, 2016, with $338.5 million of growth in commercial real

estate and commercial and industrial loans.

As of June 30, 20161

Total Loans HFI1

Quarterly yield on loans held for investment1: 4.84%

SECOND QUARTER 2016 – BALANCE SHEET

Commercial RE

C&I (ex-energy)

Energy

C&D

Consumer RE

Other Consumer

2

$5,067

8

• Reserve-based energy portfolio at

June 30, 2016 consisted of 49% crude

oil reserves and 51% natural gas

reserves

• At June 30, 2016, 44 reserve-based

borrowers and 5 midstream borrowers

• $321 million, or 59%, of our

outstanding energy loans are backed by

private equity firms with significant

capital invested and additional equity

commitments available Permian

Bakken

Eagle Ford

Ark-La-Tex

Mid-Con

Energy lending

Source: Company documents for loans managed by Energy Finance group

R: 000

G: 048

B: 135

R: 111

G: 162

B: 135

SECOND QUARTER 2016 – ENERGY LENDING

Geographic Concentration of

Reserves

Texas Panhandle

Marcellus

Gulf of Mexico

Central/Southern

Louisiana

Other

23%

5%

2%

21%13%

5%

8%

2%

4%

17%

9

31%

8%

61%

2016 2017 2018

47%

35%

12%

60%

48%

18%

85% 84%

49%

78%

86%

73%

1 % of engineered PDP volumes

Source: Company documents for loans managed by Energy Finance group

• Reserve-based loans are almost exclusively first liens, with only a $5 million

commitment to a 2nd lien facility at June 30, 2016

• No unsecured commitments/exposure

• At June 30, 2016, only $3.3 million in outstanding loans to oil field service

companies, of which only $133,000 are criticized

Energy lending

R: 000

G: 048

B: 135

R: 111

G: 162

B: 135

SECOND QUARTER 2016 – ENERGY LENDING

Hedging Percentages at June 30, 2016 compared to

March 31, 2016 with June 30, 2016 Weighted Average Prices1

$63.33 $56.19

$58.78

$3.31 $3.09 $2.89

SNC Breakout of

Reserve-Based Energy Loans

Non-LTXB

Led SNC

LTXB Led SNC Direct and Other

Participations

March 31, 2016 June 30, 2016

Oil Oil

Gas Gas

10

Energy lending

Source: Company documents

Outstanding loan balances and related loan loss reservesSubstandard energy loans

R: 000

G: 048

B: 135

R: 111

G: 162

B: 135

The allowance for loan losses allocated to energy loans at June 30, 2016 totaled $21.9 million,

or 4.0% of total energy loans (including both reserve-based and midstream), up $4.5 million

($0.10 per share on a pre-tax basis, $0.06 per share after tax) from $17.4 million at March 31,

2016.

SECOND QUARTER 2016 – ENERGY LENDING

($ in millions)($ in millions)

Energy

reserves $4.7 $4.9 $12.0 $17.4 $21.9

Reserve-based Reserve %Midstream

$21.3

$31.1

Substandard performing

Substandard non-performing

2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2

$58.6

$8.1

$38.7

$48.1

$81.5$36.2

$12.1

$25.2

$26.6

$5.2

2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2

$402.6

$431.4

$459.8 $461.1

$489.1

$64.6 $63.7

$54.8

1.1% 1.1%

2.3%

3.3%

4.0%

11

Collateral Mix of Houston Portfolio

• Continued low LTV in Houston CRE portfolio - 66% for entire Houston portfolio, 70% for energy

corridor only

• Low loan price per square foot - energy corridor ranges $74-$122 with average of $100

• Only one Houston area loss since the 2003 inception of CRE lending in Houston, totaling only $34

thousand

36%

26%

35%

3%

Office

Retail

Multifamily

Other

Commercial Real Estate- Houston

Source: Company Documents

SECOND QUARTER 2016 – BALANCE SHEET

$ in thousands except % data

Total

Houston CRE

Portfolio

Energy Corridor

(all office)

Remainder

Houston

Portfolio

Outstanding Balance at June 30,

2016 $ 465,951 $ 75,486 $ 390,465

% of Houston CRE Portfolio 16% 84%

Weighted Average Debt Service

Coverage 1.79X 1.71X 1.80X

Weighted Average Yield on Debt 11.91% 11.16% 12.07%

12

Originated Deposits

Acquired from LegacyTexas Group, Inc.

Deposit Cost

2011Y 2012Y 2013Y 2014Y 2015Y 2016 Q2

$1,963 $2,178

$2,265

$2,658

$3,599

$5,623

$1,6281.11%

0.54% 0.43% 0.34%

0.29% 0.33%

Total deposits at June 30, 2016 increased by $319.8 million from March 31, 2016, with all deposit

categories growing on a linked-quarter basis. Time and non-interest-bearing demand deposits

increased by $206.2 million and $60.9 million, respectively, on a linked-quarter basis, while

interest-bearing demand and savings and money market deposits increased by $28.9 million and

$23.9 million, respectively, for the same period.

Core funded, low cost deposit base

Source: Company Documents

1 Represents balance acquired on January 1, 2015

($ in millions)

Total Deposits

Cost of deposits: 0.33%

SECOND QUARTER 2016 – BALANCE SHEET

As of June 30, 2016

22.0%

14.4%

40.0%

23.6% Non-interest

bearing-demand

Interest-bearing

demand

Savings and money

market

Time

$5,227

1

13

Solid net interest income growth

Source: Company Documents

Net interest income and NIM

R: 000

G: 048

B: 135

R: 111

G: 162

B: 135

• Net interest income for the second quarter of 2016 increased by $4.0 million, or 6.1%, from the linked quarter

and $9.5 million, or 15.9%, from the second quarter of 2015.

• Net interest margin for the quarter ended June 30, 2016 was 3.79%, a nine basis point decrease from the first

quarter of 2016 and a 27 basis point decrease from the second quarter of 2015. Accretion of purchase

accounting fair value adjustments contributed seven basis points to the net interest margin for the quarter

ended June 30, 2016 and for the quarter ended March 31, 2016. Accretion contributed 20 basis points for the

quarter ended June 30, 2015.

SECOND QUARTER 2016 – INCOME STATEMENT

Net interest income ($mm) NIM

2012Y 2013Y 2014Y 2015Y 2015 Q2 2016 Q2

$116 $118 $133

$241

$60 $69

3.61% 3.71%

3.78%

4.00%

4.06%

3.79%

14

Net interest income Core non-interest income Core non-interest expense Efficiency ratio

2013Y 2014Y 2015Y 2015 Q2 2016 Q2

$118

$133

$241

$60 $69

$21 $21

$45

$12 $13

$88 $87

$150

$37 $40

63.4%

57.0%

52.4% 51.6%

48.2%

• Efficiency ratio improved to 48.17%, compared to 48.96% for the first quarter of 2016 and 51.61% for the

second quarter of 2015.

• Core non-interest income increased by $1.4 million from the linked quarter and by $1.0 million year-over-year.

Core non-interest expense increased by $2.1 million from the first quarter of 2016 and by $2.7 million from

the second quarter of 2015.

Disciplined expense management

SECOND QUARTER 2016 – INCOME STATEMENT

Source: Company Documents

Note: Core non-interest income and core non-interest expense exclude changes in the value of private equity funds, gains (losses) from securities transactions and

fixed assets, net gain on sale of insurance subsidiary operations, goodwill impairment, merger and acquisition costs and one-time payroll costs. Efficiency ratio metrics

exclude the aforementioned items, as well as gain (loss) on foreclosed assets and amortization of intangible assets.

($ in millions)

15

Strong asset quality

Source: Company documents

1 Held for investment, excluding Warehouse Purchase Program loans

NCOs / average loans HFI¹NPAs / loans HFI1 + OREO

R: 000

G: 048

B: 135

R: 111

G: 162

B: 135

• Growth balanced with disciplined underwriting and risk management resulting in strong asset quality

• All of the key credit quality ratios remained strong, with asset quality metrics continuing to compare

favorably to industry

SECOND QUARTER 2016 – ASSET QUALITY

2012Y 2013Y 2014Y 2015Y 2016 Q2

1.72%

1.10%

0.91% 0.89%

0.99%

2012Y 2013Y 2014Y 2015Y 2016 Q2

0.17%

0.10%

0.02%

0.09%

0.01%

16

Prudent capital management

Source: Company documents

1 Calculated at the Company level, which is subject to the capital adequacy requirements of the Federal Reserve

TCE / TA Tier 1 common risk-based¹

Tier 1 leverage¹

• Profitability levered excess capital while maintaining strong capital levels

• In November 2015, the Company completed a public offering of $75.0 million of fixed-to-

floating rate subordinated notes due in 2025, the proceeds of which are being used for general

corporate purposes, potential strategic acquisitions and investments in the Bank as regulatory

capital.

SECOND QUARTER 2016 – CAPITAL

2012Y 2013Y 2014Y 2015Y 2016 Q2

13.5% 14.7% 13.0%

8.3% 8.4%

2012Y 2013Y 2014Y 2015Y 2016 Q2

21.7%

18.2%

15.1%

9.6% 9.3%

2012Y 2013Y 2014Y 2015Y 2016 Q2

14.0% 15.7% 13.9%

9.5% 8.9%

17

Key investment highlights

One of the largest independent Texas financial services companies built

upon a strong customer focus and a long history of serving Texans

Robust loan growth and disciplined expense management

Growth balanced with disciplined underwriting and risk management

resulting in strong asset quality

Capital ratios remain strong; provides dry powder for robust organic growth

SECOND QUARTER 2016 – INVESTMENT HIGHLIGHTS

18

Looking ahead

Expand our Texas footprint and solidify our deep-rooted culture

Focus on growth – organically and through selective acquisitions

Diversify income sources

Prudent and focused expense management

Maintain strong asset quality

Strategic capital deployment

SECOND QUARTER 2016 – LOOKING AHEAD

19

Manifesto

We believe in our customers. Their goals. Their

dreams. Their ambitions for tomorrow.

And since 1952, we’ve been doing whatever it takes to support them as they

advance in business and in life.

We are responsive, accountable, trusted, experts at what we do. And we

listen. Because we believe that true understanding is the first step toward

bold, meaningful results.

Fueled by an independent spirit, inspired by the ingenuity of our customers

and grounded by the values of our community, we are a family like no other.

We are LegacyTexas.

SECOND QUARTER 2016 – OUR VISION

Appendix

21

Supplemental Information – Non-GAAP Financial Measures (unaudited)

At or For the Quarters Ended

June 30,

2016

March 31,

2016

December 31,

2015

September 30,

2015

June 30,

2015

(Dollars in thousands, except per share amounts)

GAAP net income available to common shareholders 1 $23,114 $21,954 $16,336 $17,768 $20,091

Distributed and undistributed earnings to participating securities 1 103 128 110 127 160

Merger and acquisition costs — — — — 5

Net (gain) on sale of insurance subsidiary operations (39) — — — —

One-time (gain) loss on assets 155 (2,184) (133) (130) (142)

(Gain) loss on sale of available-for-sale securities (42) — (11) 16 —

Core (non-GAAP) net income $23,291 $19,898 $16,302 $17,781 $20,114

Average shares for basic earnings per share 46,135,999 46,024,250 45,939,817 45,862,840 45,760,232

GAAP basic earnings per share $0.50 $0.48 $0.36 $0.39 $0.44

Core (non-GAAP) basic earnings per share $0.50 $0.43 $0.35 $0.39 $0.44

Average shares for diluted earnings per share 46,352,141 46,152,301 46,267,956 46,188,461 46,031,267

GAAP diluted earnings per share $0.50 $0.48 $0.35 $0.38 $0.44

Core (non-GAAP) diluted earnings per share $0.50 $0.43 $0.35 $0.38 $0.44

Reconciliation of Core (non-GAAP) to GAAP Net Income and Earnings per Share (net of tax):

¹ Unvested share-based awards that contain nonforfeitable rights to dividends (whether paid or unpaid) are participating securities and are included

in the computation of GAAP earnings per share pursuant to the two-class method described in ASC 260-10-45-60B.

At or For the Years Ended

December 31,

2015

December 31,

2014

December 31,

2013

December 31,

2012

December 31,

2011

GAAP net income available to common shareholders 1 $70,382 $30,942 $31,294 $35,135 $26,205

Distributed and undistributed earnings to participating securities 1 534 336 394 106 123

Merger and acquisition costs 1,009 7,071 431 2,683 306

Costs relating to sale of VPM — – – 84 –

One-time payroll and severance costs — 234 436 777 –

One-time (gain) loss on assets 149 319 (574) (1,353) (497)

Goodwill impairment — – – 532 176

(Gain) loss on sale of available-for-sale securities (132) – 115 (659) (4,074)

Core (non-GAAP) net income $71,942 $38,902 $32,096 $37,305 $22,239

Average shares for basic earnings per share 45,847,284 37,919,065 37,589,548 35,879,704 32,219,841

GAAP basic earnings per share $1.54 $0.82 $0.83 $0.98 $0.81

Core (non-GAAP) basic earnings per share $1.57 $1.03 $0.85 $1.04 $0.69

Average shares for diluted earnings per share 46,125,447 38,162,094 37,744,786 35,998,345 32,283,107

GAAP diluted earnings per share $1.53 $0.81 $0.83 $0.98 $0.81

Core (non-GAAP) diluted earnings per share $1.56 $1.02 $0.85 $1.04 $0.69

22

Calculation of Tangible Book Value:

Supplemental Information – Non-GAAP Financial Measures (unaudited)

At or For the Quarters Ended

June 30, 2016 March 31, 2016 December 31, 2015 September 30, 2015 June 30, 2015

(Dollars in thousands, except per share amounts)

Total shareholders' equity $843,304 $823,052 $804,076 $792,637 $776,924

Less: Goodwill (178,559) (180,776) (180,776) (180,632) (180,632)

Less: Identifiable intangible assets, net (838) (924) (1,030) (1,142) (1,280)

Total tangible shareholders' equity $663,907 $641,352 $622,270 $610,863 $595,012

Shares outstanding at end of period 47,670,440 47,645,826 47,645,826 47,640,193 47,619,493

Book value per share- GAAP $17.69 $17.27 $16.88 $16.64 $16.32

Tangible book value per share- Non-GAAP $13.93 $13.46 $13.06 $12.82 $12.50

Calculation of Tangible Equity to Tangible Assets:

Total assets $8,057,005 $7,562,126 $7,691,940 $6,878,843 $6,669,624

Less: Goodwill (178,559) (180,776) (180,776) (180,632) (180,632)

Less: Identifiable intangible assets, net (838) (924) (1,030) (1,142) (1,280)

Total tangible assets $7,877,608 $7,380,426 $7,510,134 $6,697,069 $6,487,712

Equity to assets- GAAP 10.47% 10.88% 10.45% 11.52% 11.65%

Tangible equity to tangible assets- Non-GAAP 8.43% 8.69% 8.29% 9.12% 9.17%

At or For the Years Ended

December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011

Total shareholders' equity $568,223 $544,460 $520,871 $406,309

Less: Goodwill (29,650) (29,650) (29,650) (818)

Less: Identifiable intangible assets, net (813) (1,239) (1,653) (420)

Total tangible shareholders' equity $537,760 $513,571 $489,568 $405,071

Shares outstanding at end of period 40014851 39,938,816 39,612,911 33,700,399

Book value per share- GAAP $14.20 $13.63 $13.15 $12.06

Tangible book value per share- Non-GAAP $13.44 $12.86 $12.36 $12.02

Calculation of Tangible Equity to Tangible Assets:

Total assets $4,164,114 $3,525,232 $3,663,058 $3,180,578

Less: Goodwill (29,650) (29,650) (29,650) (818)

Less: Identifiable intangible assets, net (813) (1,239) (1,653) (420)

Total tangible assets $4,133,651 $3,494,343 $3,631,755 $3,179,340

Equity to assets- GAAP 13.65% 15.44% 14.22% 12.77%

Tangible equity to tangible assets- Non-GAAP 13.01% 14.70% 13.48% 12.74%