Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - hhgregg, Inc. | consent-2016331_ex231.htm |

| EX-32.2 - EXHIBIT 32.2 - hhgregg, Inc. | hgg-2016331xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - hhgregg, Inc. | hgg-2016331_ex321.htm |

| EX-31.1 - EXHIBIT 31.1 - hhgregg, Inc. | hgg-2016331_ex311.htm |

| EX-31.2 - EXHIBIT 31.2 - hhgregg, Inc. | hgg-2016331_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33600

hhgregg, Inc.

(Exact name of registrant as specified in its charter)

Indiana | 47-4850538 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

4151 East 96th Street Indianapolis, IN | 46240 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (317) 848-8710 | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $.0001 per share | New York Stock Exchange | |

Securities registered pursuant to section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated Filer | ý | |

Non-accelerated filer | ¨(Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the last day of the second fiscal quarter ended September 30, 2015 was approximately $61,049,302 based on the closing stock price of $4.87 per share on that day. (For purposes of this calculation, all of the registrant’s directors and executive officers are deemed affiliates of the registrant.)

The number of shares of hhgregg, Inc.’s common stock outstanding as of May 16, 2016 was 27,707,978.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement (to be filed pursuant to Regulation 14A within 120 days after the Registrant’s fiscal year-end of March 31, 2016) for the regular meeting of stockholders to be held on August 1, 2016 are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

Part I. | ||

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

Part II. | ||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | ||

Item 9B. | Other Information | |

Part III. | ||

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accounting Fees and Services | |

Part IV. | ||

Item 15. | Exhibits, Financial Statement Schedules | |

2

Cautionary Note Regarding Forward-Looking Statements

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their companies. Some of the statements in this document and any documents incorporated by reference constitute “forward-looking statements” within the meaning of Section 21E of the Exchange Act. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our businesses or our industries’ actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. Such statements include statements about our plans, strategies, prospects, changes, outlook and trends in our business and the markets in which we operate; our drivers of customer loyalty, referrals and repeat business; the impact of a motivated full-time sales force; expectations around slowing future store growth; expectations around becoming a national retailer; our approach to building store density; impact of our store development strategy on our results of operations, net sales growth and capital expenditures; how we enhance our brand image and customer experience; awareness around our financing offers; non-recourse nature of financing offerings; increasing our service offerings; changes to our e-commerce experience; improvements to customer delivery capabilities; the richness of our products’ features and innovations; our ability to compete in our market and industry; our ability to cut costs; our ability to generate strong cash flows; customer purchases of higher-margin, feature rich products; the outcome and impact of legal proceedings; payment of dividends; emphasis on appliances in our marketing strategies; expectations around the U.S. housing market and general economy; impact of accounting policies and estimates; expectations around capital expenditures; our revolving credit facility; ability to fund operations; ability to obtain additional debt financing; and our interest rate risk. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “tends,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of those terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially because of market conditions in our industries or other factors that are in some cases beyond our control. All of the forward-looking statements are subject to risks and uncertainties. Some of the key factors that could cause actual results to differ from our expectations are:

• | our ability to successfully execute our strategies and initiatives, particularly in returning the Company to profitable growth; |

• | our ability to increase customer traffic and conversion; |

• | competition in the retail industry; |

• | our ability to maintain a positive brand perception and recognition; |

• | our ability to attract and retain qualified personnel; |

• | our ability to maintain the security of customer, associate and Company information; |

• | rules, regulations, contractual obligations, compliance requirements and fees associated with accepting a variety of payment methods; |

• | our ability to effectively achieve cost cutting initiatives; |

• | our ability to generate strong cash flows to support our operating activities; |

• | our relationships and operations of our key suppliers; |

• | our ability to generate sufficient cash flows to recover the fair value of long-lived assets; |

• | our ability to maintain and upgrade our information technology systems; |

• | the fluctuation of our comparable store sales; |

• | the effect of general and regional economic and employment conditions on our net sales; |

• | our ability to meet financial performance guidance; |

• | disruption in our supply chain; |

• | changes in trade regulation, currency fluctuations and prevailing interest rates; and |

• | the potential for litigation. |

Other factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report on Form 10-K are more fully described in the “Risk Factors” section and elsewhere herein. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking

3

statements included herein are made only as of the date hereof. Except as required by law, we do not undertake and specifically decline any obligation to update any of these forward-looking statements or to publicly announce the results of any revisions to these forward-looking statements to reflect future events or developments.

4

PART I. | |

ITEM 1. | Business. |

Our Company

Unless the context otherwise requires, the terms “we”, “us”, “our”, “hhgregg” and the “Company” in this Annual Report on Form 10-K refer to hhgregg, Inc. and its subsidiaries. Our fiscal year ends on March 31, refer to Note 1 of the Consolidated Financial Statements.

Founded in 1955 and operating under the name hhgregg® , we are a multi-regional retailer which provides an extensive selection of premium appliances, consumer electronics, home products and computers and tablets in our 226 brick-and-mortar stores in 20 states and nationwide via hhgregg.com. We operate in one reportable segment and do not have international operations.

We differentiate ourselves from our competitors by providing our customers with a consultative and educational purchase experience, combined with superior delivery and installation capabilities on many of our products. Our superior customer purchase experience has enabled us to successfully compete against other leading appliance and consumer electronics retailers over the course of our 61-year history. We have a knowledgeable and friendly salesforce that is trained to meet the buying needs of our customers. We design our stores and e-commerce platform to be visually appealing to our customers and to highlight our premium selection of appliances, consumer electronics, and furniture.

Our sales can be categorized into four product categories:

• | Appliances: We offer a broad selection of major appliances, including the latest generation refrigerators, cooking ranges, dishwashers, freezers, washers and dryers, grills, air conditioners and small home appliances sold under a variety of leading brand names. Representative brands include Amana, Bosch, Frigidaire, GE, Haier, KitchenAid, LG, Maytag, Samsung and Whirlpool. For fiscal 2016, home appliances represented 53% of net sales. Historically, our appliance business has provided us with financial stability and consistently strong cash flow |

• | Consumer electronics: We offer a broad selection of the latest consumer electronics products, such as 4K and OLED televisions, audio systems, cameras and Blu-ray players. Representative brands include Curtis, Epson, Haier, Hisene, LG, RCA, Phillips, Samsung, Seiki, Sharp, and Sony. For fiscal 2016, consumer electronics products represented 36% of net sales. Our consumer electronics products are typically more seasonal in nature. |

• | Home products: We offer furniture, mattresses and other home products. Our furniture selections focus on the great room, a large room in a modern house that combines features of a living room with those of a dining room or family room. Representative brands include Bello, Corinthian, Delta, Jackson, Homestretch, Serta, South Motion, Standard Furniture, Steve Silver and Tempur-Pedic. For fiscal 2016, home products represented 6% of net sales. |

• | Computers and tablets: We offer a broad selection of computers, computer accessories and tablets. Representative brands include Apple, Asus, Canon, Curtis, Dell, Kindle, Lenovo, Hewlett Packard, Samsung and Toshiba. For fiscal 2016, computers and tablets represented 5% of net sales. |

Additionally, we sell a comprehensive suite of services including third-party premium service plans (“PSPs”), third-party in-home service and repair of our products, delivery and installation and in-home repair and maintenance. Services and PSP revenues are included as a component of net sales in each of the categories listed above. Our suite of services is aimed at enhancing our customers’ superior purchase experience and aims to be a connection for us to our customers for the life of the product.

Brand Platform

Our brand platform is focused on service, selection and satisfaction. We want hhgregg to be the first, last and best place for our customers to turn to for the products that make a house a home. Our objective with our brand platform is to serve our customers in a manner that generates loyalty, referrals and repeat business. We focus on making every customer’s purchase experience a positive one and aim to be the primary destination for home appliances, consumer electronics, computers and tablets and home products in our markets.

Our philosophy for providing our customers with a superior purchase experience includes:

5

• | employing a highly motivated, commissioned sales force and training them so they are able to educate our customers on the benefits of feature-rich, higher-margin products; |

• | offering a deep product assortment in our four core categories; |

• | providing a warm and bright store ambiance that favorably showcases our products; |

• | providing quick and efficient delivery for many of our products and quality in-home installation services; |

• | offering extended-term financing through third-party providers to qualified customers; |

• | soliciting customer feedback to allow us to monitor and improve individual store, employee and delivery team performance; |

• | offering customer support through our central call center seven days per week or via social media; and |

• | delivering a multi-channel that is integrated with our store network and gives our customers 24-hour access to our products and information. |

Our Brand Platform has the following key components:

Multi-channel. Our multi-channel strategy provides our customers with a superior shopping experience by allowing consumers to experience an integrated online and in-store purchase experience through our website, mobile app, social media and brick and mortar stores. Our website, hhgregg.com, provides a 24/7 shopping experience for our customers and helps reduce the complexity of product decisions for home product purchases by providing product information, features and benefits of our products and services, customer ratings and reviews, availability of rebate incentive opportunities, store locations and hours of operation. These tools help consumers make more informed decisions and give them confidence as they undertake the purchasing process. Additionally, these tools drive in-store purchases of our merchandise and services. Our multi-channel strategy, which we call Store2Door service, gives customers the ability to make a purchase in store, to buy online and pick up either in store or to buy online and have the product shipped or delivered. Over the past year, we have added features including an expanded assortment of products available online only, a mobile phone application, mobile commerce capabilities, online financing application process and we have continued to make infrastructure upgrades. We expect to continue to focus investment dollars on our multi-channel capabilities in fiscal 2017.

Fine Lines. In order to enhance our appliance product selection, we plan to open additional Fine Lines departments. Fine Lines departments incorporate ultra premium appliance brands that are not found in our hhgregg stores. Fine Lines departments have historically improved our appliance revenues in stores. As of March 31, 2016, 11 of our stores had Fine Lines departments. We expect to open up to 15 additional Fine Lines departments in fiscal 2017.

Attractive Finance Offerings. We offer customers financing through a private-label credit card with a third-party financial institution. The third-party financial institution assumes the risk of collection from our customers and has no recourse against us for any uncollected amounts. Additionally, we offer secondary financing for lower-middle income customers that do not qualify for the private-label credit card and “lease to own” financing. Both financing offers are offered through third-party providers and are non-recourse to our business.

Best in class delivery and installation capabilities. We offer delivery for many of our products and also provide quality in-home installation services through our outsourced delivery partners. Our network of 14 regional and local distribution centers provides a local supply of inventory that supports our delivery strategy. We conduct a significant number of customer surveys each year to provide us with feedback to continue improving our superior customer purchase experience to ensure customer satisfaction. Over the past 12 months, we have invested in greater delivery capabilities so customers can better communicate with the delivery drivers regarding the time of their delivery.

Highly trained sales associates. We are able to educate our customers on the features and benefits of the products we offer through our extensively trained, commissioned sales force. We believe that when fully informed, customers frequently purchase higher-end, more feature-rich products. We seek to hire individuals who are career-oriented and motivated by a commission-based environment. Our sales associates are compensated based on both sales and profitability of the products and services they sell. New sales associates are required to complete an initial in-house training program focused on product knowledge and functionality, customer service and general store operations before interacting with our customers. Sales associates also participate in on-going training to stay current with new product offerings and customer service initiatives. This on-going training includes quarterly meetings with vendors to learn about upcoming product releases.

6

Merchandising and Purchasing

Merchandise. We offer an extensive product and brand selection at everyday competitive prices and provide a balance of appliances, consumer electronics products, home products and computers and tablets. Our premium products help drive margins and profitability while our lower-margin products help drive customer traffic. In addition, we offer additional products not carried in the stores via www.hhgregg.com.

Vendor Relationships. Our top 10 and 20 suppliers accounted for 84.5% and 91.8%, respectively, of merchandise purchased by us during fiscal 2016. Our key suppliers include Bosch, Curtis, Frigidaire, GE, Haier, Hewlett Packard, LG, Samsung, Sony and Whirlpool.

Our purchasing strategy varies by vendor and product line. We do not have long-term contracts with any of our major suppliers. Inventory purchases are managed through the placement of purchase orders with our vendors. Our ability to sell a broad selection of products has made us an important partner to our vendors for showcasing their heavily-featured product offerings and introducing new products and technologies to consumers. In an effort to support our strategy, vendors offer us various incentives including volume discounts, trade financing, co-op advertising, purchase discounts and allowances, promotional items and, in some cases, inventory on a consignment basis.

Distribution and Warehousing

Our distribution and warehousing functions are designed to optimize inventory availability and turnover, increase delivery efficiency and minimize product handling. Our distribution and warehousing system at March 31, 2016 consisted of five regional distribution centers, or RDCs, and nine local distribution centers, or LDCs. RDCs receive products directly from manufacturers and stock merchandise for local customer delivery as well as store and LDC replenishment. LDCs receive inventory daily from their respective RDCs or directly from manufacturers for home delivery. Merchandise is generally not transferred between stores. Our RDCs and LDCs operate seven days per week. All of our distribution facilities are leased.

The following table sets forth certain information relating to our RDCs and LDCs as of March 31, 2016:

Facility | Opening Date | Area Served | Size (sq. ft) | |||

RDC: | ||||||

Atlanta, Georgia | January 2003 | Southeast | 273,200 | |||

Brandywine, Maryland | March 2010 | Mid-Atlantic | 393,440 | |||

Aurora, Illinois | July 2011 | Great Lakes | 247,360 | |||

Indianapolis, Indiana | June 1986 | Midwest | 319,458 | |||

Davenport, Florida | April 2008 | Florida | 282,126 | |||

LDC: | ||||||

Charlotte, North Carolina | April 2005 | Charlotte | 60,000 | |||

Cincinnati, Ohio | March 1999 | Cincinnati | 100,800 | |||

Cleveland, Ohio | September 2001 | Cleveland | 60,000 | |||

Columbus, Ohio | August 1999 | Columbus | 89,643 | |||

Pembroke Park, Florida | May 2011 | Miami | 66,095 | |||

Nashville, Tennessee | October 2006 | Nashville | 50,000 | |||

Philadelphia, Pennsylvania | April 2010 | Philadelphia | 86,304 | |||

Pittsburgh, Pennsylvania | September 2011 | Pittsburgh | 20,465 | |||

Raleigh, North Carolina | August 2007 | Raleigh | 108,000 | |||

Competition

The appliance and consumer electronics industries are highly competitive and concentrated among a group of major retailers. The home furnishing industry, including the furniture and mattress businesses, are highly fragmented with sales coming from various types of retailers. Our stores compete against other consumer electronics retailers, home furnishing retailers, specialty home office retailers, mass merchants, home improvement superstores and internet-based businesses. Our stores also compete against independent dealers, regional chain discount stores, wholesale clubs and other specialty single- and

7

multi-unit retail stores. Mass merchants continue to increase their offerings of consumer electronics products. Additionally, internet retailers continue to gain market share in smaller size consumer electronics products.

Our product offerings compete on product selection, price and customer service. We differentiate ourselves through our emphasis on an extensive product offering and customer service and satisfaction while matching our competitors on price, with some exceptions including certain holiday promotions. We believe that our highly trained commissioned sales force, broad product and brand offerings and customer support services, including delivery and installation and finance offerings, allow us to compete effectively in our markets for the following reasons:

• | Our commissioned sales force is motivated to attend to customer needs quickly and is knowledgeable about the products we carry. The majority of our key competitors pay their sales force on an hourly basis. Because our sales staff is commissioned and highly trained in product knowledge, we believe our sales force is driven to more quickly and efficiently assist our customers in making their purchase decisions. We believe that when fully informed, customers purchase higher-end, feature-rich products due to an appreciation of the performance of those products. |

• | By combining this knowledgeable sales force with a broad selection of key brands and products with complex, premium features, we differentiate ourselves from our competitors. |

• | We promote our products both in our stores and through advertising. We also highlight our service offerings, such as delivery, in-home installation and private-label and other credit financing promotions. These services are key to our customer base, which appreciates better product information, high-end products, quality delivery and installation and financing offers. |

Environmental Matters

We are not aware of any federal, state or local provisions which have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, that have materially affected, or are likely to materially affect, our net earnings or competitive position, or have resulted or are expected to result in material capital expenditures. During fiscal 2016, we had no capital expenditures for environmental control facilities and no such expenditures are anticipated in the foreseeable future.

Seasonality

We experience seasonal fluctuations in our net sales and operating results due in part to seasonal shopping patterns for our products. For example, in fiscal 2016 and 2015, we generated 30.3% and 31.3%, respectively, of our net sales in the fiscal quarter ended December 31, which includes the holiday selling season.

Trade Names and Trademarks

We have registered, acquired the registration of, have pending registrations for, or claim ownership of the following trade names and trademarks that are important in our branding and marketing of our business: Extraordinary Appliances for the Heart of your Home®, Fear of Better Options™, FOBO™, hhgregg®, hhgregg (Stylized)®, hhgregg (and Design)®, HHGREGG.COM®, Fill Your Home with Happy®, Fine Lines®, hhgregg Fine Lines (and Design)®.

Employees

As of March 31, 2016, we employed approximately 5,100 employees, of whom approximately 73% were full-time. We have no collective bargaining agreements covering any of our employees and have never experienced any material labor disruption. We consider our employee relations to be good.

Reincorporation

On August 31, 2015, hhgregg Inc., a Delaware corporation and our predecessor entity, changed its state of incorporation from Delaware to Indiana. This reincorporation was effectuated by a merger ("Reincorporation Merger") of the Company with and into hhgregg Indiana, Inc., an Indiana corporation (“hhgregg Indiana”), then a wholly-owned Indiana subsidiary of the Company established for such purpose. At that time, hhgregg Indiana changed its name to “hhgregg, Inc.”

8

Working Capital

We fund our business operations through a combination of available cash, cash from operations and our revolving credit facility as described in Note 5 of the Consolidated Financial Statements.

Available Information

We are subject to the reporting requirements of the Exchange Act and its rules and regulations. The Exchange Act requires us to file reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the “SEC”). Copies of these reports, proxy statements and other information can be read and copied at:

SEC Public Reference Room

100 F Street N.E.

Washington, D.C. 20549

Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

The SEC maintains a website that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC’s website at www.sec.gov.

We make available, free of charge on our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file these documents with, or furnish them to, the SEC. These documents are posted on our website at www.hhgregg.com — select the “Investor Relations” link and then the “Financials and SEC Filings” link.

We also make available, free of charge on our website, the charters of the Audit Committee, Compensation Committee, Executive Committee and Nominating and Corporate Governance Committee, as well as the Code of Business Conduct and Ethics, Whistleblower Policy, Related Party Policy and the Corporate Governance Guidelines. These documents are posted on our website at www.hhgregg.com — select the “Investor Relations” link and then the “Corporate Governance” link.

Copies of any of the above-referenced documents will also be made available to any stockholder, free of charge, upon written request to:

hhgregg, Inc.

Director of Investor Relations

4151 E 96th Street

Indianapolis, IN 46240

9

ITEM 1A. | Risk Factors |

Described below are certain risks that our management believes are applicable to our business and the industry in which we operate. You should carefully consider each of the following risks and all of the information set forth in this Annual Report on Form 10-K.

If any of the events described below occur, our business, financial condition, results of operations, liquidity or access to the capital markets could be materially adversely affected. The following risks could cause our actual results to differ materially from our historical experience and from results predicted by forward-looking statements made by us or on our behalf related to conditions or events we anticipate may occur in the future. All forward-looking statements made by us or on our behalf are qualified by the risks below.

Our success depends upon our effective execution of our strategies.

Our success depends on our ability to effectively identify, develop and execute our strategies. In the upcoming year we intend to execute on key initiatives to grow revenue, increase productivity and the organization of our business as described in Item 7 “Management's Discussion and Analysis of Financial Condition and Results of Operations - Overview.” During fiscal 2017, our focus remains on continuing the Company's return to profitable growth, building upon the efforts from fiscal 2016, and impacting the long-term health of the Company. However, it may take longer than expected to achieve our objectives, and actual results may be materially different than planned. Our ability to improve our operating results depends upon a significant number of factors, some of which are beyond our control, including:

• | customer response to our marketing and merchandise strategies; |

• | our ability to properly deploy and utilize capital and other resources to better position our business to drive additional traffic and increase sales in our comparable store base; |

• | our ability to maintain and increase net sales in both new and existing product categories; |

• | our ability to provide customers with highly trained and consultative sales associates, best-in-class delivery and installation services and compelling financing offers; |

• | our ability to respond to competitive pressures in our industry and maintain our market share; |

• | our ability to effectively manage inventory; |

• | the success of our omnichannel strategy; |

• | our ability to benefit from capital improvements made to our store environment; |

• | our ability to access adequate and uninterrupted supply of merchandise from suppliers at expected levels and on acceptable terms; and |

• | general economic conditions. |

Failure to execute these initiatives and strategies could have a material adverse effect on our business, financial condition and results of operations.

Our ability to increase sales and store productivity is largely dependent upon our ability to increase customer traffic and conversion.

Customer traffic depends upon our ability to successfully market compelling merchandise assortments as well as present an appealing shopping environment and experience to customers. Our marketing model utilizes all of the major channels for advertising with a focus on TV, print, digital and direct mail. As part of our strategic initiatives, we continually test a variety of marketing media mix tactics to learn and make adjustments between medias in order to efficiently and effectively reach our targeted customers to deliver sustainable profits. Our marketing strategy may fail to reach the intended market and may not be successful in generating incremental customer traffic or increasing conversion rates. This could result in a continued or accelerated reduction in customer traffic and conversion. Any such outcome, alone or in combination with other events or circumstances, may adversely affect our operating results. In addition, external events outside of our control, including pandemics, terrorist threats, domestic conflicts and civil unrest, may influence customers' decisions to visit stores or might otherwise cause customers to avoid public places. There is no assurance that we will be able to reverse any decline in traffic or that any such decline in store traffic will be offset by an increase in web sales. We may need to respond to any declines in

10

customer traffic or conversion rates by increasing markdowns or promotions to attract customers, which could adversely impact our gross margins, operating results and cash flows from operating activities.

The retail industry that we compete in has strong competition from traditional store-based retailers, multi-channel retailers, internet-based businesses, our vendors, and other forms of retail e-commerce, which directly affects our sales and margins.

The retail industry for major home appliances, consumer electronics and home furniture is intensely competitive. We compete with many other local, regional, and national retailers, e-commerce retailers and certain of our vendors who offer products directly to consumers. Price is of primary importance to customers and price transparency and comparability continues to increase, particularly as a result of digital technology. Some online-only businesses have lower operating costs than us and are not required to collect and remit sales taxes in all U.S. states, which can negatively impact the ability of multi-channel retailers to be price competitive on a tax-included basis. The ability of consumers to compare prices on a real-time basis puts additional pressure on us to maintain competitive prices to attract customers. Also, some of our competitors have greater financial resources than us and may be able to offer lower prices than us for a sustained period of time. Our competitors may use a number of different strategies to compete against us, including lower pricing, more aggressive advertising and marketing, enhanced product and service offerings, extension of credit to customers on terms more favorable than we make available, innovative store formats, including store within a store, improved retail sales methods, enhanced customer service experiences, online product offerings and expansion into markets where we currently operate.

The retail industry continues to experience a trend towards an increase in sales initiated online and using mobile applications. Customer expectations about the methods by which they purchase and receive products or services are becoming more demanding. Customers are increasingly using technology and mobile devices to rapidly compare products and prices, determine real-time product availability and purchase products which changes the way we interact with them. We must continually anticipate and adapt to these changes in the purchasing process. Our website, hhgregg.com, is a sales channel for our products, and is also a method of making product information available to customers that impacts our in-store sales. In addition to hhgregg.com, we have multiple affiliated websites and mobile apps through which we seek to inform, cross-sell and otherwise interact with our customers. Our website is a significant component of our advertising strategy. In order to promote our products and services, allow our customers to complete credit applications in the privacy of their homes and drive traffic to our stores, we must effectively create, design, publish and distribute content over the internet. There can be no assurance that we will be able to design and publish web content with a high level of effectiveness or grow our e-commerce business in a profitable manner. Because our business strategy is based on offering superior levels of customer service and a full range of services to complement the products we offer, our cost structure is higher than some of our competitors, and this, in conjunction with price transparency, puts pressure on our margins.

If we fail to anticipate changes in consumer preferences and maintain positive brand perception and recognition or if there is a lack of new product introductions and innovation, our net sales and profitability may decline.

Our products must appeal to a broad range of consumers whose preferences cannot be predicted with certainty and are subject to change. Our ability to maintain and increase net sales depends to a large extent on the periodic introduction and availability of new products and technologies. Our success depends upon our ability to anticipate and respond in a timely manner to trends in consumer preferences relating to major household appliances and consumer electronics such as OLED and Ultra HD 4K televisions as well as alternative options for delivery of those products quickly and at a low-cost to consumers. Significant deviations from the anticipated consumer preferences for the products we sell or related services we provide could result in lost net sales and lower margins due to the need to mark down excess inventory. If we are unable to effectively introduce and sell new products to our customers, our business and results of operations could be adversely affected. Conversely, if we fail to anticipate or react to consumer demand for our products, we may experience inventory shortages, which would result in lost sales and could negatively affect our customer goodwill, our brand image and our profitability.

We believe that a focus on customer service fosters the development of our brand recognition and reputation. If we are unable to maintain our high level of customer service, our brand recognition, reputation, business and results of operations could be adversely affected. Additionally, the increasing usage of web-based social media means that consumer feedback and other information about our Company are shared with a broad audience in a manner that is easily accessible and rapidly disseminated. The impact of such feedback could negatively affect our brand perception and recognition, and as a result could result in declines in customer loyalty, lower employee retention and productivity, vendor relationship issues and other factors, all of which could materially and adversely affect our business and results of operations.

11

If we fail to hire, train and retain key management, qualified managers, sales associates and other employees, we could have difficulty implementing our business strategy, which may result in reduced net sales, operating margins and profitability.

Our performance is highly dependent on attracting and retaining qualified employees, including our senior management team and other key employees. A key element of our competitive strategy is to provide product expertise to our customers through our extensively trained, commissioned sales associates, which, we believe, results in more of our customers purchasing higher-margin, feature-rich products. The turnover rate in the retail industry is relatively high, and there is an ongoing need to recruit and train new employees. If we are unable to attract and retain qualified personnel as needed in the future, our level of customer service may decline, which may decrease our net sales and profitability. Other factors that impact our ability to maintain sufficient levels of qualified employees in all areas of the business include, but are not limited to, the Company’s reputation, employee morale, the current macroeconomic environment, competition from other employers and our ability to offer adequate compensation packages. Adverse changes in health care costs could also adversely impact our ability to achieve our operational and financial goals and to offer attractive benefit programs to our employees. Our ability to control labor costs, which may impact our ability to hire and retain qualified personnel, is subject to numerous external factors, including prevailing wage rates, the impact of legislation or regulations governing healthcare benefits or labor relations. If our labor and/or benefit costs increase, we may not be able to hire or maintain qualified personnel to the extent necessary to execute our competitive strategy, which could adversely affect our results of operations.

If we do not maintain the security of customer, associate, or Company information, we could damage our reputation, incur substantial additional costs and become subject to litigation.

The use and handling of personally identifiable data by us, our employees, our business associates and third parties is regulated at the state, federal and international levels. We are also contractually obligated to comply with certain industry standards regarding payment card information. Increasing costs associated with information security, such as increased investment in technology, the costs of compliance and costs resulting from consumer fraud, could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of customer and other confidential information over public networks, including the use of cashless payments. While we take significant steps to protect this information, lapses in our controls or the intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate customer and other confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and customer personal data. Furthermore, because the methods used to obtain unauthorized access change frequently and may not be immediately detected, we may be unable to anticipate these methods or promptly implement preventative measures. There is no guarantee that the procedures that we have implemented to protect against unauthorized access to secured data are adequate to safeguard against all data security breaches. Any such compromise of our security or the security of information residing with our business associates or third parties could have a material adverse affect on our reputation and may expose us to material costs, penalties, compensation claims, lost sales, fines and lawsuits. In addition, any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

We are subject to payment-related risks that could increase our operating costs, expose us to fraud or theft, subject us to potential liability, impact our credit card financing offers available to customers and potentially disrupt our business and have a material adverse impact on our net sales and profitability.

We accept payments using a variety of methods, including cash, checks, credit and debit cards, our private label credit cards, and gift cards, and we may offer new payment options over time. Acceptance of these payment options subjects us to rules, regulations, contractual obligations and compliance requirements, including payment network rules and operating guidelines, data security standards and certification requirements, and rules governing electronic funds transfers. These requirements may change over time or be reinterpreted, making compliance more difficult or costly. For certain payment methods, including credit and debit cards, we pay interchange and other fees, which may increase over time and raise our operating costs. We rely on third parties to provide payment processing services, including the processing of credit cards, debit cards, and other forms of electronic payment. If these companies become unable to provide these services to us, or if their systems are compromised, it could potentially disrupt our business. The payment methods that we offer also subject us to potential fraud and theft by criminals, who are becoming increasingly more sophisticated, seeking to obtain unauthorized access to or exploit weaknesses that may exist in the payment systems. If we fail to comply with applicable rules or requirements for the payment methods we accept, or if payment-related data is compromised due to a breach or misuse of data, we may be liable for costs incurred by payment card issuing banks and other third parties or subject to fines and higher transaction fees, or our ability to accept or facilitate certain types of payments may be impaired. In addition, our customers

12

could lose confidence in certain payment types, which may result in a shift to other payment types or potential changes to our payment systems that may result in higher costs. As a result, our business and operating results could be adversely affected.

We offer private-label credit cards through third-party financial institutions that manage and directly extend credit to our customers. Additionally, we offer secondary financing for lower-middle income customers that do not qualify for the private-label credit card and “lease to own” financing, both of which are through third-party providers and non-recourse to our business. If any of our programs ended prematurely, the terms and provisions, or interpretations thereof, were substantially modified, or approval rates or types of financing offered to our customers amended, promotional financing volumes and our net sales and results of operations, could be materially adversely affected.

Failure to effectively achieve our cost cutting initiatives could have a material adverse affect on our profitability.

As part of our continuing efforts to improve operating efficiencies and reduce operating costs, we have implemented numerous cost cutting initiatives. We plan to continue to implement additional cost cutting initiatives in fiscal 2017 and beyond. If we are unable to achieve, or have any unexpected delays in achieving, the anticipated cost savings and benefits associated with these initiatives, our results of operations and cash flow may be adversely affected.

Additionally, certain elements of our cost structure are largely fixed in nature. The negative impact of consumer spending on our sales results makes it more challenging for us to maintain or increase our operating income. The competitiveness in our industry and increasing price transparency means that the focus on achieving efficient operations is greater than ever. Failure to manage our labor and benefit rates, advertising and marketing expenses, operating leases, other store expenses or indirect spending could materially adversely affect our profitability.

We depend upon strong cash flows from our operations to supply capital to fund our operations.

Our business depends upon our operations to continue to generate strong cash flow to supply capital to support our general operating activities. Our inability to continue to generate sufficient cash flows to support these activities could adversely affect our financial performance including our earnings per share. We borrow on occasion to finance our activities, and if financing were not available to us in adequate amounts and on appropriate terms we needed, it could also adversely affect our financial performance.

A disruption in our relationships with, or in the operations of, any of our key suppliers could cause our net sales and profitability to decline.

The success of our business and our growth strategy depends to a significant degree on our relationships with our suppliers. Our largest suppliers include Bosch, Curtis, Frigidaire, GE, Haier, Hewlett Packard, LG, Samsung, Sony and Whirlpool. Our top 10 and 20 suppliers represented 84.5% and 91.8%, respectively, of our purchases in fiscal 2016. The loss of any one or more of our key suppliers or our failure to establish and maintain terms with these and other suppliers could materially adversely affect our supply and assortment of products, as we may not be able to find suitable replacements to supply products at competitive prices. Our ability to continue to identify and develop relationships with qualified suppliers who can satisfy our high standards for quality and responsible sourcing, as well as our need to access products in a timely and efficient manner, is a significant challenge. Our ability to access products from our suppliers can be adversely affected by political instability, military conflict, the financial instability of suppliers (particularly in light of continuing economic difficulties in various regions of the world), suppliers’ noncompliance with applicable laws, trade restrictions, tariffs, currency exchange rates, any disruptions in our suppliers’ logistics or supply chain networks, and other factors beyond our or our suppliers’ control.

If products that we purchase from vendors are damaged or prove to be defective, we may not be able to return products to these vendors and obtain refunds or replacements of our purchase price or obtain other indemnification from them, which could have a material adverse affect on our net sales and results of operations.

The financial condition of our suppliers may also adversely affect their access to capital and liquidity with which to maintain their inventory, production levels and product quality and to operate their businesses, all of which could adversely affect our supply chain. Negative impacts on the financial condition of any of our suppliers may cause suppliers to reduce their offerings of customer incentives and vendor allowances, cooperative marketing expenditures and product promotions. It may also cause them to change their pricing policies, which could impact demand for their products. The current weakness in, and volatility of, the overall economy makes it difficult for us and our suppliers to accurately forecast future product demand trends, which could cause us to carry too much or too little merchandise in various product categories.

13

We could incur additional charges due to impairment of long-lived assets.

At March 31, 2016, we had long-lived asset balances of $87.5 million, which are subject to periodic testing for impairment. During fiscal 2016 and 2015, we have recorded impairment charges of $20.9 million and $47.9 million, respectively. See Note 2 of the Notes to Consolidated Financial Statements, included elsewhere in this Annual Report on Form 10-K for further information. Failure to achieve sufficient levels of cash flow generated from operations at individual store locations could result in additional impairment charges for the related fixed assets, which could have a material adverse effect on our reported results of operations.

Any failure of our e-commerce functions or other information technology infrastructure or management information systems could cause a disruption in our business and our results of operations could be materially adversely impacted.

Our ability to operate our business from day to day largely depends on the efficient operation of our information technology infrastructure and management information systems. We use our management information systems to conduct our operations and for critical corporate and business planning functions, including store operations, sales management, merchandising, marketing, supply chain and inventory management, financial reporting and accounting, delivery and other customer services and various administrative functions. Our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, catastrophic events such as fires, tornadoes and hurricanes, and usage errors by our employees. Operating legacy systems subjects us to inherent costs and risks associated with maintaining, upgrading and replacing these systems and retaining sufficiently skilled personnel to maintain and operate the systems, demands on management time, and other risks and costs. Any failure that is not covered by our disaster recovery plan could cause an interruption in our operations and adversely affect our results of operations.

In addition, we utilize complex information technology platforms to operate our websites and mobile applications. Disruptions to these services, such as those caused by unforeseen traffic levels or other technical difficulties, could cause us to forgo material revenues and adversely affect our reputation with consumers. Performance issues with these customer-facing technology systems, including temporary outages caused by distributed denial of service or other cyber-attacks, or a complete failure of one or more of them without a disaster recovery plan that can be quickly implemented could quickly destroy the positive benefits they provide to our business and negatively affect our customers’ perceptions of hhgregg as a reliable online vendor and source of information about appliances, consumer electronics, furniture and other home products and services, which could negatively affect our results of operations.

Our comparable store sales may not be an indication of our future results of operations because they fluctuate

significantly.

Our historical comparable store sales figures have fluctuated significantly from quarter to quarter. A number of factors have historically affected, and will continue to affect, our comparable store sales results, including:

• | Changes in competition, such as pricing pressure and the opening of new stores by competitors in our markets; |

• | General economic conditions; |

• | New product introductions; |

• | Consumer trends; |

• | Changes in our marketing programs; |

• | Changes in our merchandise mix; |

• | Changes in the relative sales price points of our major product categories; |

• | Our ability to offer attractive credit programs to our customers; |

• | Weather conditions in our markets; |

• | Timing of promotional events; |

• | Reduction in new store openings; |

• | The percentage of our stores that are mature stores; |

• | The locations of our stores and the traffic drawn to those areas; |

• | How often we update our stores; and |

• | Our ability to execute our business strategies effectively. |

Changes in our quarterly and annual comparable store sales results could cause the price of our common stock to fluctuate significantly.

14

Our business is dependent on the general economic conditions in our markets.

In general, our sales depend on discretionary spending by our customers. General economic factors and other conditions that may affect our business include periods of slow economic growth or recession, political factors including uncertainty in social or fiscal policy, an overly anti-business climate or sentiment, volatility and/or lack of liquidity from time to time in U.S. and world financial markets and the consequent reduced availability and/or higher cost of borrowing to us and our customers, slower rates of growth in real disposable personal income, sustained high rates of unemployment, high consumer debt levels, increasing fuel and energy costs, inflation or deflation of commodity prices, natural disasters and acts of terrorism and developments in the war against terrorism. Additionally, any of these circumstances concentrated in the region of the U.S. in which we operate could have a material adverse effect on our net sales and results of operations. General economic conditions and discretionary spending are beyond our control and are affected by, among other things:

• | consumer confidence in the economy; |

• | unemployment trends; |

• | consumer debt levels; |

• | consumer credit availability; |

• | the housing and home improvement markets; |

• | gasoline and fuel prices; |

• | interest rates and inflation; |

• | slower rates of growth in real disposable personal income; |

• | natural disasters; |

• | national and international geopolitical concerns; |

• | tax rates and tax policy; and |

• | other matters that influence consumer confidence and spending. |

Volatility in financial markets may cause some of the above factors to change with an even greater degree of frequency and magnitude. The above factors could result in slowdown in the economy or an uncertain economic outlook, which could have a material adverse effect on our business and results of operations.

Other conditions that may impact our results of operations include disruptions in the availability of content such as sporting events or other televised content. Such disruptions may influence the demand for hardware that our customers purchase to access such content, which would have an adverse effect on our results of operations.

We may fail to meet analyst expectations, which could cause the price of our stock to decline.

Our common stock is traded publicly and various securities analysts follow our financial results and issue reports on us. These reports include information about our historical financial results as well as the analysts’ estimates of our future performance. The analysts’ estimates are based upon their own independent opinions and can be different from our estimates or expectations. If our operating results are below the estimates or expectations of public market analysts and investors, our stock price could decline. If our stock price is volatile, we may become involved in litigation in the future. Any litigation could result in substantial costs and a diversion of management’s attention and resources that are needed to successfully run our business.

Disruptions in our supply chain and other factors affecting the distribution of our merchandise, including our third-paty delivery services, could adversely impact our business.

Any disruption in the operation of our distribution centers could result in our inability to meet our customers’ delivery requirements, which could impair our ability to meet customer demand for products and result in lost sales; increased costs; damage to our reputation; inability to stock our stores; or longer lead time associated with distributing merchandise. Any such disruption within our supply chain network, including damage or destruction to one of our five regional distribution centers; weather-related events; natural disasters; trade restrictions; tariffs; third-party strikes, lock-outs, work stoppages or slowdowns; shipping capacity constraints; supply or shipping interruptions or costs; or other factors beyond our control could negatively impact our financial performance or financial condition.

In addition, our deliveries are outsourced to third-party delivery providers. Our third-party delivery services are subject to risks that are beyond our control. If our products are not delivered to our customers on time, our customers may cancel their orders or we may lose business from these customers in the future. As a result, our net sales and profitability may decline.

15

We are subject to certain statutory, regulatory and legal developments which could have a material adverse impact on our business.

Our statutory, regulatory and legal environment exposes us to complex compliance and litigation risks that could materially adversely affect our operations and financial results. The most significant compliance and litigation risks we face are:

• | The difficulty of complying with sometimes conflicting statutes and regulations in local, state and national jurisdictions; |

• | The impact of proposed, new or changing statutes and regulations, including, but not limited to, corporate governance matters, environmental, financial reform, Health Insurance Portability and Accountability Act, health care reform, labor reform, Payment Card Industry compliance and/or other as yet unknown legislation that could affect how we operate and execute our strategies as well as alter our expense structure; |

• | The impact of changes in tax laws (or interpretations thereof by courts and taxing authorities) and accounting standards; |

• | The impact of litigation trends, including class action lawsuits involving consumers and stockholders, and labor and employment matters; and |

• | Changes in trade regulations, currency fluctuations, economic or political instability, natural disasters, public health emergencies and other factors beyond our control may increase the cost of items we purchase or create shortages of these items, which in turn could have a material adverse effect on our cost of goods, or may force us to increase prices, thereby adversely impacting net sales and profitability. |

Adapting to regulatory changes and defending against lawsuits and other proceedings may involve significant expense and divert management’s attention and resources from other matters, which could adversely affect our results of operations.

Our executive officers, directors and stockholders affiliated with our directors own a large percentage of our voting common stock and could limit the influence of our other stockholders on corporate decisions.

Our executive officers, directors, current holders of more than 5% of our outstanding common stock and their respective affiliates beneficially own, in the aggregate, approximately 49.0% of our outstanding common stock. As a result, any person who acquires shares of our common stock will likely have little or no ability to influence control of the Company. The interests of these stockholders may not always coincide with our corporate interests or the interests of our other stockholders, and they may act in a manner with which our other stockholders may not agree or that may not be in the best interests of our other stockholders.

We have anti-takeover defense provisions in our certificate of incorporation and bylaws that may deter potential acquirers and depress the price of our common stock.

Our articles of incorporation and bylaws contain provisions that could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, control of us. These provisions:

• | authorize our board of directors to issue “blank check” preferred stock and determine the powers, preferences and privileges of those shares without prior stockholder approval; |

• | limit the calling of special meetings of stockholders; |

• | impose a requirement that an affirmative vote of the holders of 66 2/3% of the outstanding shares of common stock is required to amend certain provisions of the articles of incorporation and bylaws; |

• | the prohibition on action by written consent of shareholders as required by the Indiana Business Corporation Law, or the IBCL; and |

• | the application of the Business Combination provisions of the IBCL. |

Because of these various provisions in our articles of incorporation and bylaws, a takeover attempt or third-party acquisition of us, including a takeover attempt that may result in a premium over the market price for shares of our common stock, could be delayed, deterred or prevented. In addition, these provisions may prevent the market price of our common stock from increasing in response to actual or rumored takeover attempts and may also prevent changes in our management. As a result, these anti-takeover and change of control provisions may limit the price investors are willing to pay in the future for shares of our common stock.

16

ITEM 1B. | Unresolved Staff Comments. |

None.

17

ITEM 2. | Properties. |

Stores and Store Operations

Operations. Our store operations are organized into 22 geographic regions. Each region is supervised by a regional manager who monitors store operations and meets regularly with store managers to discuss merchandising, new product introductions, sales promotions, customer feedback and store operating performance. A store is typically overseen by a general manager, one or two sales managers and a staff averaging 12 salespeople and six additional support staff. Our stores are open seven days a week.

Locations. As of March 31, 2016, we leased all of our stores and distribution centers, which are located in Alabama, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Mississippi, Missouri, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Virginia, West Virginia, and Wisconsin. Our stores average approximately 31,000 square feet. We also lease our corporate headquarters which is located in Indianapolis, Indiana. Our corporate headquarters includes a store, corporate training center, regional distribution and warehousing facility, and corporate call center. Our distribution and warehousing system consists of five RDCs, and nine LDCs. For a description of our RDCs and LDCs, see “Item 1. Business-Distribution and Warehousing.”

The following table sets forth our store locations as of March 31, 2016. During fiscal 2016 there was one store opening and three store closures.

State | Number of stores open | |

Alabama | 6 | |

Delaware | 3 | |

Florida | 36 | |

Georgia | 16 | |

Illinois | 19 | |

Indiana | 17 | |

Kentucky | 6 | |

Louisiana | 3 | |

Maryland | 11 | |

Mississippi | 1 | |

Missouri | 3 | |

New Jersey | 3 | |

North Carolina | 17 | |

Ohio | 28 | |

Pennsylvania | 19 | |

South Carolina | 7 | |

Tennessee | 10 | |

Virginia | 15 | |

West Virginia | 1 | |

Wisconsin | 5 | |

226 | ||

Market and Site Selection. We target markets that meet our demographic and competitive criteria, including areas that demonstrate above average economic growth and household incomes and home ownership rates. Our target markets typically include most or all of our major competitors. When considering new sites, we analyze total store and market potential and advertising and occupancy costs for a market, as well as proximity to distribution facilities. Within our markets, we open or acquire our stores in power centers or freestanding locations in high traffic areas, usually near our major competitors. Primary site evaluation criteria include total sales volume potential, co-tenancies, traffic patterns, visibility, access, parking availability

18

and occupancy costs. We initially open multiple stores in a new market and add stores to the market over time to increase market share and to further leverage our fixed costs.

Historically, we have been able to locate and open stores profitably in a wide variety of trade areas by negotiating lease terms that we believe are favorable. In fiscal 2016, we opened one new store and remodeled the sales floor at several locations. At their lease expiration, we closed two stores in April 2015 and one store in January 2016. As a natural course of business, we regularly evaluate our real estate positions to determine when and where it makes the most sense to operate for our customers and our company. Based on the age of the real estate in these location, we did not find it prudent to reinvest in these locations.

ITEM 3. | Legal Proceedings. |

We are engaged in various legal proceedings in the ordinary course of business and have certain unresolved claims pending. Although we diligently defend against these claims, we may enter into discussions regarding settlement of these and other lawsuits and may enter into settlement agreements, if we believe settlement is in the best interests of our Company and our stockholders. The ultimate liability, if any, for the aggregate amounts claimed cannot be determined at this time. However, management believes, based on the examination of these matters and experiences to date, that the ultimate liability, if any, in excess of amounts already provided for in the consolidated financial statements is not likely to have a material effect on our consolidated financial position, results of operations or cash flows.

The Company is the defendant in a class action lawsuit captioned, Dwain Underwood, on behalf of himself and all others similarly situated v. Gregg Appliances, Inc. and hhgregg, Inc., filed in the Superior Court in Marion County, Indiana, where a former employee alleged that the Company breached a contract by failing to correctly calculate his (and other class members) incentive bonus. On July 9, 2014, the judge granted the plaintiff’s motion for class certification, and on July 17, 2015, the judge granted the plaintiff’s motion for summary judgment, although no finding on damages was made. The Company's interlocutory appeal was accepted on October 23, 2015. The Company has completed the appeal briefing process and oral argument is scheduled for June 29, 2016. If the Company does not ultimately prevail in this case, the potential liability is approximately $2.4 million based on those individuals included in the class, excluding potential interest and other fees which cannot be determined at this time. The Company believes the loss is not probable, and thus, as of March 31, 2016, a liability has not been recorded for this matter.

ITEM 4. | Mine Safety Disclosures. |

Not applicable.

19

PART II. | |

ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market for Registrant’s Common Equity

Our common stock is traded on the New York Stock Exchange under the ticker symbol “HGG”. The table below sets forth the high and low sales prices of our common stock as reported on the New York Stock Exchange — Composite Index during the periods indicated.

Stock Price | |||||||

High | Low | ||||||

Fiscal 2016 | |||||||

Fourth Quarter | $ | 3.82 | $ | 1.53 | |||

Third Quarter | 5.69 | 3.66 | |||||

Second Quarter | 6.43 | 3.28 | |||||

First Quarter | 6.35 | 3.20 | |||||

Fiscal 2015 | |||||||

Fourth Quarter | $ | 7.39 | $ | 5.04 | |||

Third Quarter | 7.99 | 4.83 | |||||

Second Quarter | 10.42 | 5.95 | |||||

First Quarter | 10.21 | 7.87 | |||||

Holders

As of May 2, 2016, there were 60 holders of record of our common stock (which does not include the number of individual beneficial owners whose shares were held on their behalf by brokerage firms in street name).

Dividends

We did not pay cash dividends on our common stock during the last two fiscal years and do not expect to pay cash dividends in the near future. In addition, the terms of our credit facilities place restrictions on our ability to pay dividends and otherwise transfer assets to our stockholders. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources” for more information on our credit facilities.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

From time to time, we repurchase our common stock in the open market pursuant to programs approved by our Board of Directors. We may repurchase our common stock for a variety of reasons, such as acquiring shares to offset dilution related to equity-based incentives, including stock options and restricted stock units, and optimizing our capital structure.

On May 14, 2014, our Board of Directors authorized a new stock repurchase program, which became effective on May 20, 2014 (the “May 2014 Program”) allowing the Company to repurchase up to $40.0 million of its common stock. The stock repurchase program allows for the repurchase of our common stock on the open market or in privately negotiated transactions in accordance with applicable laws and regulations and expired on May 20, 2015. During fiscal 2016, there were no shares repurchased. During fiscal 2015, we repurchased 0.8 million shares at a cost of $5.3 million.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes information as of March 31, 2016 relating to our equity compensation plans to which grants of options, restricted stock units or other rights to acquire shares of our common stock may be granted from time to time:

20

(a) | (b) | (c) | ||||||||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (#) | Weighted-average exercise price of outstanding options, warrants and rights ($) (1) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (#) | |||||||||||

Equity compensation plans approved by securities holders | 3,197,551 | $ | 11.86 | 5,141,459 | ||||||||||

Equity compensation plans not approved by securities holders | N/A | N/A | N/A | |||||||||||

Total | 3,197,551 | $ | 11.86 | 5,141,459 | ||||||||||

(1) | This number reflects the exclusion of 370,383 shares in the form of restricted stock units granted pursuant to our equity plans included in column (a). These awards allow for the distribution of shares to the grant recipient upon vesting and do not have an associated exercise price. Accordingly, these awards are not reflected in the weighted-average exercise price. |

21

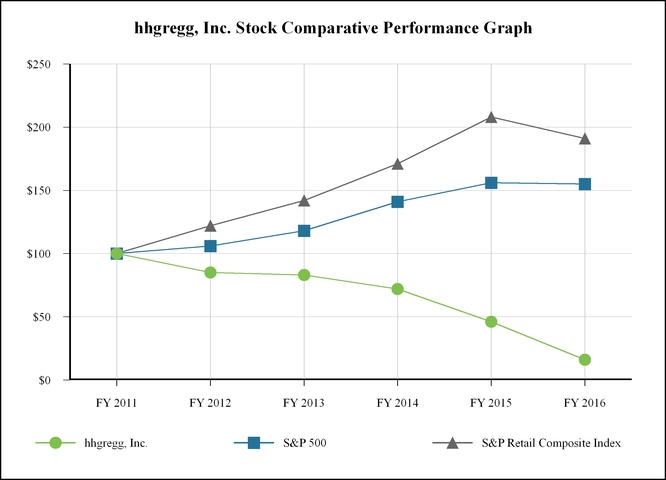

hhgregg Stock Comparative Performance Graph

The information contained in this hhgregg Stock Comparative Performance Graph section shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The graph and table below compares the cumulative total stockholder return on our common stock for the last five fiscal years with the cumulative total return on the Standard & Poor’s 500 Index (“S&P 500”), and the Standard & Poor’s Retail Composite Index (“S&P Retail Composite Index”). The S&P Retail Composite Index is a capitalization-weighted index of domestic equities traded on the New York Stock Exchange (“NYSE”) and the National Association of Securities Dealers Automated Quotes (“NASDAQ”), and includes high-capitalization stocks representing the retail sector of the S&P 500.

The graph assumes an investment of $100 at the close of trading on March 31, 2011 in hhgregg common stock, the S&P 500 and the S&P Retail Composite Index and reinvestment of any dividends. The comparison in the graph below is based solely on historical data and is not intended to forecast the possible future performance of our common stock.

FY 2011 | FY 2012 | FY 2013 | FY 2014 | FY 2015 | FY 2016 | ||||||||||||

hhgregg, Inc. | 100 | 84.99 | 82.52 | 71.77 | 45.78 | 15.76 | |||||||||||

S&P 500 | 100 | 106.23 | 118.36 | 141.22 | 155.97 | 155.35 | |||||||||||

S&P Retail Composite Index | 100 | 121.78 | 142.07 | 171.45 | 207.66 | 191.40 | |||||||||||

22

ITEM 6. | Selected Financial Data. |

The following table sets forth our selected historical consolidated financial data and store operating information as of the dates and for the periods indicated. The selected historical consolidated statement of operations and balance sheet data as of and for each of the fiscal years ended March 31, 2016, 2015, 2014, 2013 and 2012 are derived from, and are qualified in their entirety by, our historical audited consolidated financial statements. Historical results are not necessarily indicative of the results to be expected in the future. You should read the following data together with Item 1. “Business,” Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements and the related notes. In the following tables (including the footnotes thereto), dollars are in thousands, except share and per share data and as otherwise indicated.

Fiscal Year Ended March 31, | ||||||||||||||||||||

2016 (1) | 2015 (1) (10) | 2014 (1) (9) | 2013 (1) | 2012 (1) (4) (8) | ||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Net sales | $ | 1,959,998 | $ | 2,129,374 | $ | 2,338,570 | $ | 2,474,759 | $ | 2,493,392 | ||||||||||

Gross profit | 553,782 | 605,838 | 664,539 | 717,586 | 720,388 | |||||||||||||||

(Loss) income from operations | (51,725 | ) | (99,448 | ) | 2,677 | 43,759 | 109,800 | |||||||||||||