Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PHILLIPS EDISON GROCERY CENTER REIT II, INC. | ntriiearningscallq120168-k.htm |

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 1 Phillips Edison Grocery Center REIT II, Inc. First Quarter 2016 Results www.grocerycenterREIT2.com 888.518.8073 Exhibit 99.1

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 2 Agenda • Portfolio & Results • Financials • Strategy R. Mark Addy - President and COO

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 3 Forward Looking Statements This presentation and the corresponding call may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to the Company’s expectations regarding the performance of its business, its financial results, its liquidity and capital resources, the quality of the Company’s portfolio of grocery anchored shopping centers and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, such as the risks that retail conditions may adversely affect our base rent and, subsequently, our income, and that our properties consist primarily of retail properties and our performance, therefore, is linked to the market for retail space generally, as well as other risks described under the section entitled “Risk Factors“ in the Company's Annual Report on Form 10-K for the year ended December 31, 2015, and the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation, the corresponding call and in the Company’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward- looking statement, whether as a result of new information, future events, or otherwise.

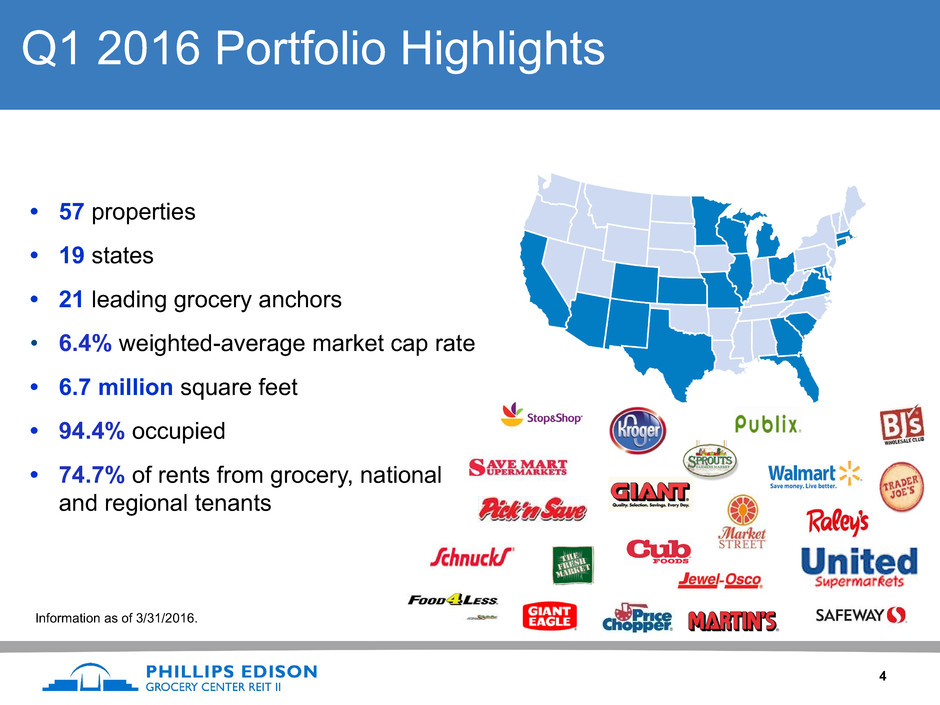

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 4 Q1 2016 Portfolio Highlights • 57 properties • 19 states • 21 leading grocery anchors • 6.4% weighted-average market cap rate • 6.7 million square feet • 94.4% occupied • 74.7% of rents from grocery, national and regional tenants Information as of 3/31/2016.

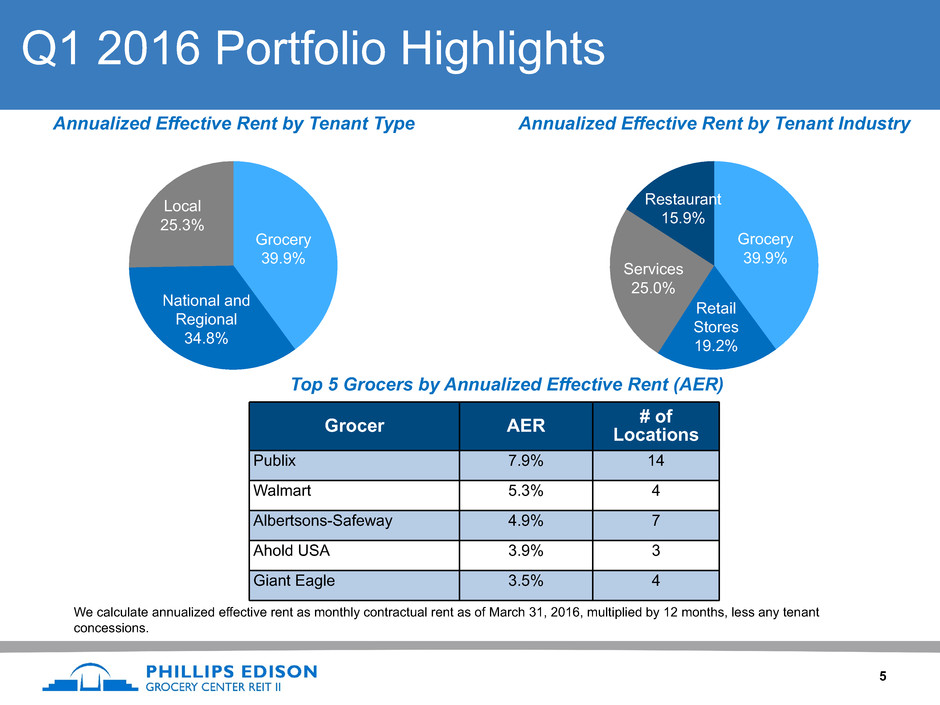

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 5 Q1 2016 Portfolio Highlights Grocer AER # ofLocations Publix 7.9% 14 Walmart 5.3% 4 Albertsons-Safeway 4.9% 7 Ahold USA 3.9% 3 Giant Eagle 3.5% 4 Top 5 Grocers by Annualized Effective Rent (AER) Annualized Effective Rent by Tenant Type Annualized Effective Rent by Tenant Industry We calculate annualized effective rent as monthly contractual rent as of March 31, 2016, multiplied by 12 months, less any tenant concessions. Grocery 39.9% National and Regional 34.8% Local 25.3% Grocery 39.9% Retail Stores 19.2% Services 25.0% Restaurant 15.9%

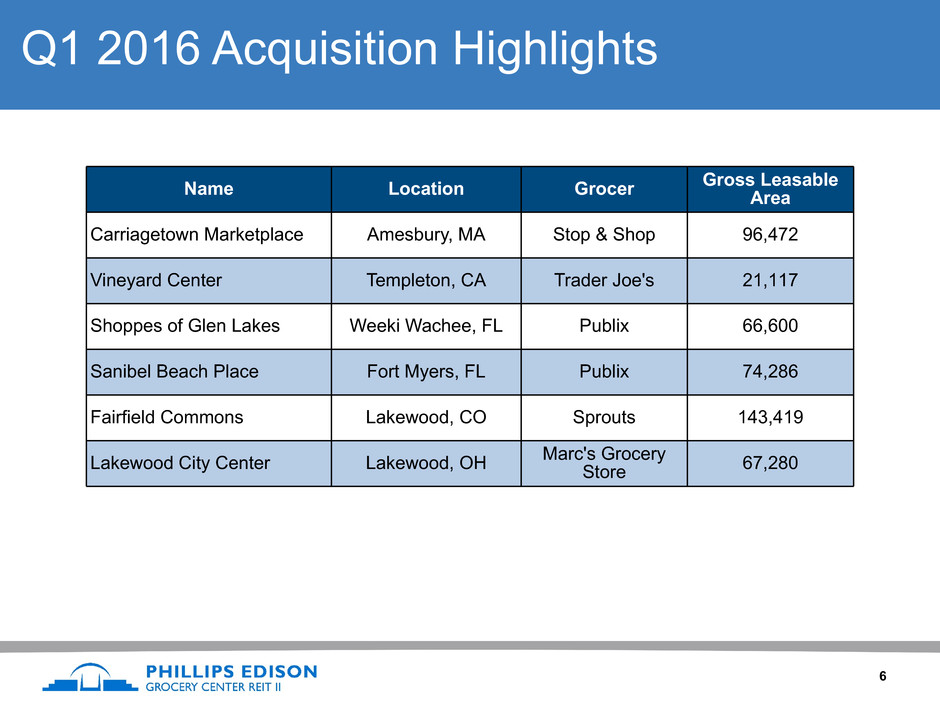

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 6 Q1 2016 Acquisition Highlights Name Location Grocer Gross LeasableArea Carriagetown Marketplace Amesbury, MA Stop & Shop 96,472 Vineyard Center Templeton, CA Trader Joe's 21,117 Shoppes of Glen Lakes Weeki Wachee, FL Publix 66,600 Sanibel Beach Place Fort Myers, FL Publix 74,286 Fairfield Commons Lakewood, CO Sprouts 143,419 Lakewood City Center Lakewood, OH Marc's GroceryStore 67,280

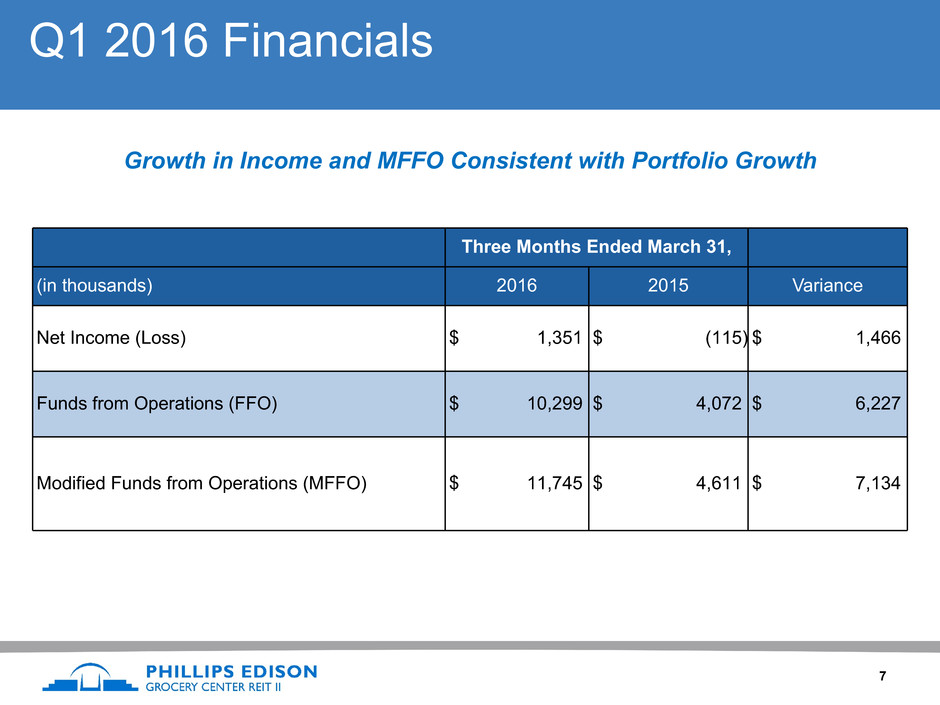

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 7 Q1 2016 Financials Growth in Income and MFFO Consistent with Portfolio Growth Three Months Ended March 31, (in thousands) 2016 2015 Variance Net Income (Loss) $ 1,351 $ (115) $ 1,466 Funds from Operations (FFO) $ 10,299 $ 4,072 $ 6,227 Modified Funds from Operations (MFFO) $ 11,745 $ 4,611 $ 7,134

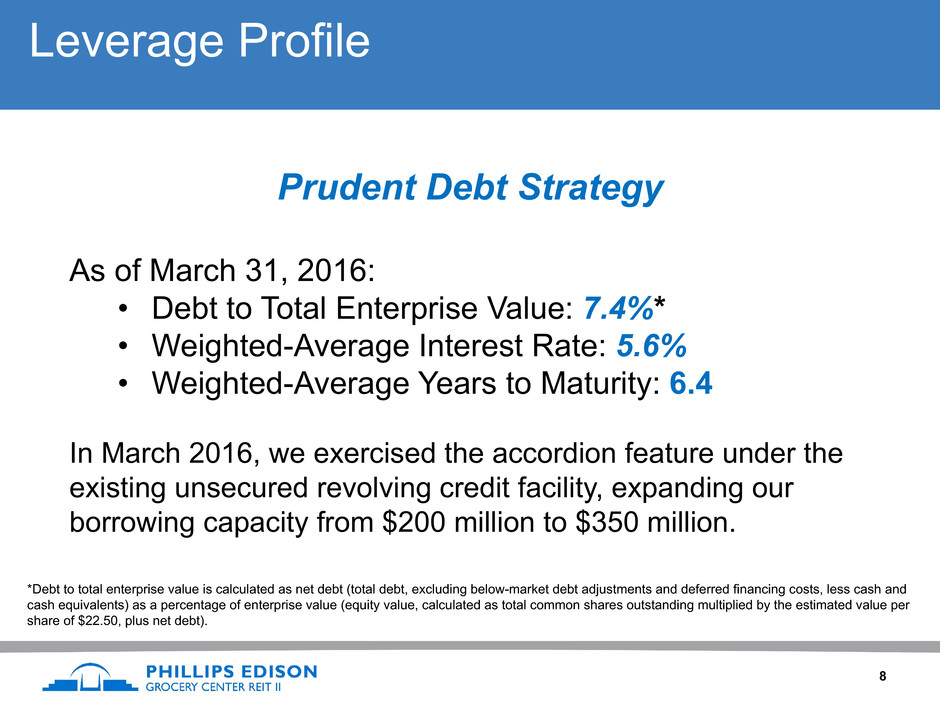

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 8 Prudent Debt Strategy As of March 31, 2016: • Debt to Total Enterprise Value: 7.4%* • Weighted-Average Interest Rate: 5.6% • Weighted-Average Years to Maturity: 6.4 In March 2016, we exercised the accordion feature under the existing unsecured revolving credit facility, expanding our borrowing capacity from $200 million to $350 million. Leverage Profile *Debt to total enterprise value is calculated as net debt (total debt, excluding below-market debt adjustments and deferred financing costs, less cash and cash equivalents) as a percentage of enterprise value (equity value, calculated as total common shares outstanding multiplied by the estimated value per share of $22.50, plus net debt).

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 9 FINRA Rule 15-02 & Amended SRP Update • Declared estimated net asset value per share of $22.50 as of March 31, 2016* • The Board approved an amended Share Repurchase Program, which will allow the Company to make monthly share repurchases on the last business day of each month * Please note that the estimated value per share is not intended to represent an enterprise or liquidation value of our company. It is important to remember that the estimated value per share may not reflect the amount you would obtain if you were to sell your shares or if we liquidated our assets. Further, the estimated NAV per share is as of a moment in time, and the value of our shares and assets may change over time as a result of several factors including, but not limited to, future acquisitions or dispositions, other developments related to individual assets, and changes in the real estate and capital markets, and we do not undertake to update the estimated NAV per share to account for any such events. You should not rely on the estimated NAV per share as being an accurate measure of the then-current value of your shares in making a decision to buy or sell your shares, including whether to participate in our dividend reinvestment plan or our share repurchase program. For a description of the methodology and assumptions used to determine the estimated NAV per share, see Current Report on Form 8-K that we filed with the U.S. Securities and Exchange Commission on April 15, 2016.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 10 • $250 million joint venture with TPG Real Estate • Investment in additional high-quality grocery-anchored acquisitions • Focus on acquisitions and property operations • Commitment to maximize value for shareholders Strategy Update

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 11 Appendix

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 12 Reconciliation of Non-GAAP Financials Funds from Operations and Modified Funds from Operations Funds from operations (“FFO”) is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss), computed in accordance with GAAP excluding extraordinary items, as defined by GAAP, and gains (or losses) from sales of depreciable real estate property (including deemed sales and settlements of pre-existing relationships), plus depreciation and amortization on real estate assets and impairment charges, and after related adjustments for unconsolidated partnerships, joint ventures and noncontrolling interests. We believe that FFO is helpful to our investors and our management as a measure of operating performance because it, when compared year to year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, development activities, general and administrative expenses, and interest costs, which are not immediately apparent from net income. Since the definition of FFO was promulgated by NAREIT, GAAP has expanded to include several new accounting pronouncements, such that management and many investors and analysts have considered the presentation of FFO alone to be insufficient. Accordingly, in addition to FFO, we use modified funds from operations (“MFFO”), which excludes from FFO the following items: • acquisition fees and expenses; • straight-line rent amounts, both income and expense; • amortization of above- or below-market intangible lease assets and liabilities; • amortization of discounts and premiums on debt investments; • gains or losses from the early extinguishment of debt; • gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; • gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting; • gains or losses related to consolidation from, or deconsolidation to, equity accounting; • gains or losses related to contingent purchase price adjustments; and • adjustments related to the above items for unconsolidated entities in the application of equity accounting. We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods and, in particular, after our acquisition stage is complete, because MFFO excludes acquisition expenses that affect operations only in the period in which the property is acquired. Thus, MFFO provides helpful information relevant to evaluating our operating performance in periods in which there is no acquisition activity.

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 13 Reconciliation of Non-GAAP Financials Many of the adjustments in arriving at MFFO are not applicable to us. Nevertheless, as explained below, management’s evaluation of our operating performance may also exclude items considered in the calculation of MFFO based on the following economic considerations. • Adjustments for straight-line rents and amortization of discounts and premiums on debt investments—GAAP requires rental receipts and discounts and premiums on debt investments to be recognized using various systematic methodologies. This may result in income recognition that could be significantly different than underlying contract terms. By adjusting for these items, MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments and aligns results with management’s analysis of operating performance. The adjustment to MFFO for straight-line rents, in particular, is made to reflect rent and lease payments from a GAAP accrual basis to a cash basis. • Adjustments for amortization of above- or below-market intangible lease assets—Similar to depreciation and amortization of other real estate-related assets that are excluded from FFO, GAAP implicitly assumes that the value of intangibles diminishes ratably over the lease term and should be recognized in revenue. Since real estate values and market lease rates in the aggregate have historically risen or fallen with market conditions, and the intangible value is not adjusted to reflect these changes, management believes that by excluding these charges, MFFO provides useful supplemental information on the performance of the real estate. • Gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting—This item relates to a fair value adjustment, which is based on the impact of current market fluctuations and underlying assessments of general market conditions and specific performance of the holding, which may not be directly attributable to current operating performance. As these gains or losses relate to underlying long-term assets and liabilities, management believes MFFO provides useful supplemental information by focusing on the changes in core operating fundamentals rather than changes that may reflect anticipated, but unknown, gains or losses. • Adjustment for gains or losses related to early extinguishment of derivatives and debt instruments—Similar to extraordinary items excluded from FFO, these adjustments are not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs. The following section presents our calculation of FFO and MFFO and provides additional information related to our operations. As a result of the timing of the commencement of our initial public offering and our active real estate operations, FFO and MFFO are not relevant to a discussion comparing operations for the periods presented. We expect revenues and expenses to increase in future periods as we continue to acquire additional investments.

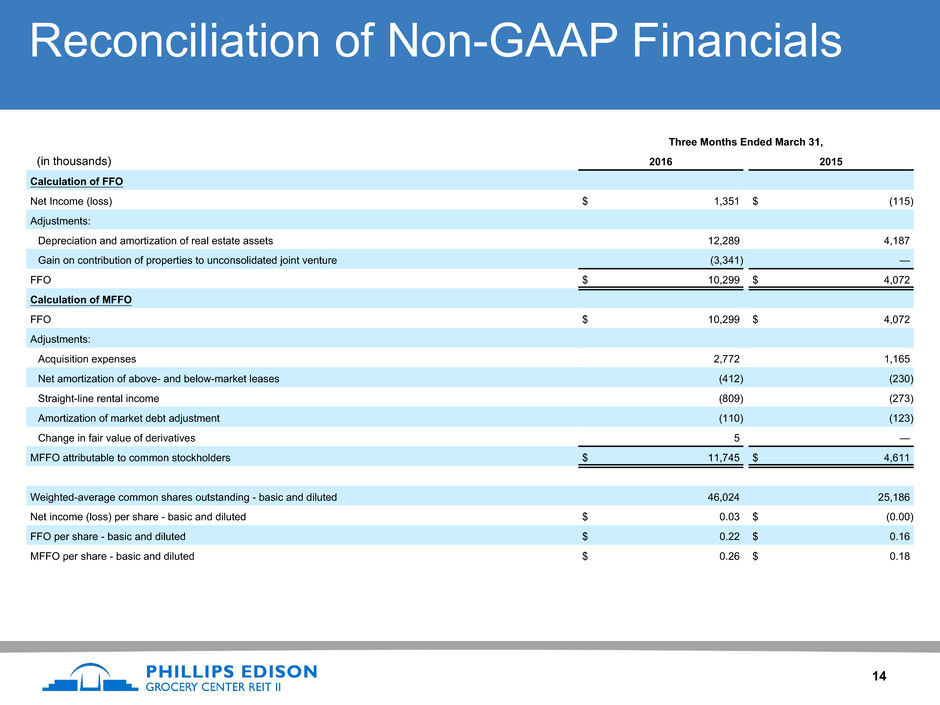

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 14 Reconciliation of Non-GAAP Financials Three Months Ended March 31, (in thousands) 2016 2015 Calculation of FFO Net Income (loss) $ 1,351 $ (115) Adjustments: Depreciation and amortization of real estate assets 12,289 4,187 Gain on contribution of properties to unconsolidated joint venture (3,341) — FFO $ 10,299 $ 4,072 Calculation of MFFO FFO $ 10,299 $ 4,072 Adjustments: Acquisition expenses 2,772 1,165 Net amortization of above- and below-market leases (412) (230) Straight-line rental income (809) (273) Amortization of market debt adjustment (110) (123) Change in fair value of derivatives 5 — MFFO attributable to common stockholders $ 11,745 $ 4,611 Weighted-average common shares outstanding - basic and diluted 46,024 25,186 Net income (loss) per share - basic and diluted $ 0.03 $ (0.00) FFO per share - basic and diluted $ 0.22 $ 0.16 MFFO per share - basic and diluted $ 0.26 $ 0.18

The Grocery REITPhillips Edison-ARC Grocery Center REIT II 15 Thank You www.grocerycenterREIT2.com 888.518.8073