Attached files

| file | filename |

|---|---|

| 8-K - CAPSTEAD MORTGAGE CORPORATION 8-K 5-6-2016 - CAPSTEAD MORTGAGE CORP | form8k.htm |

Exhibit 99.1

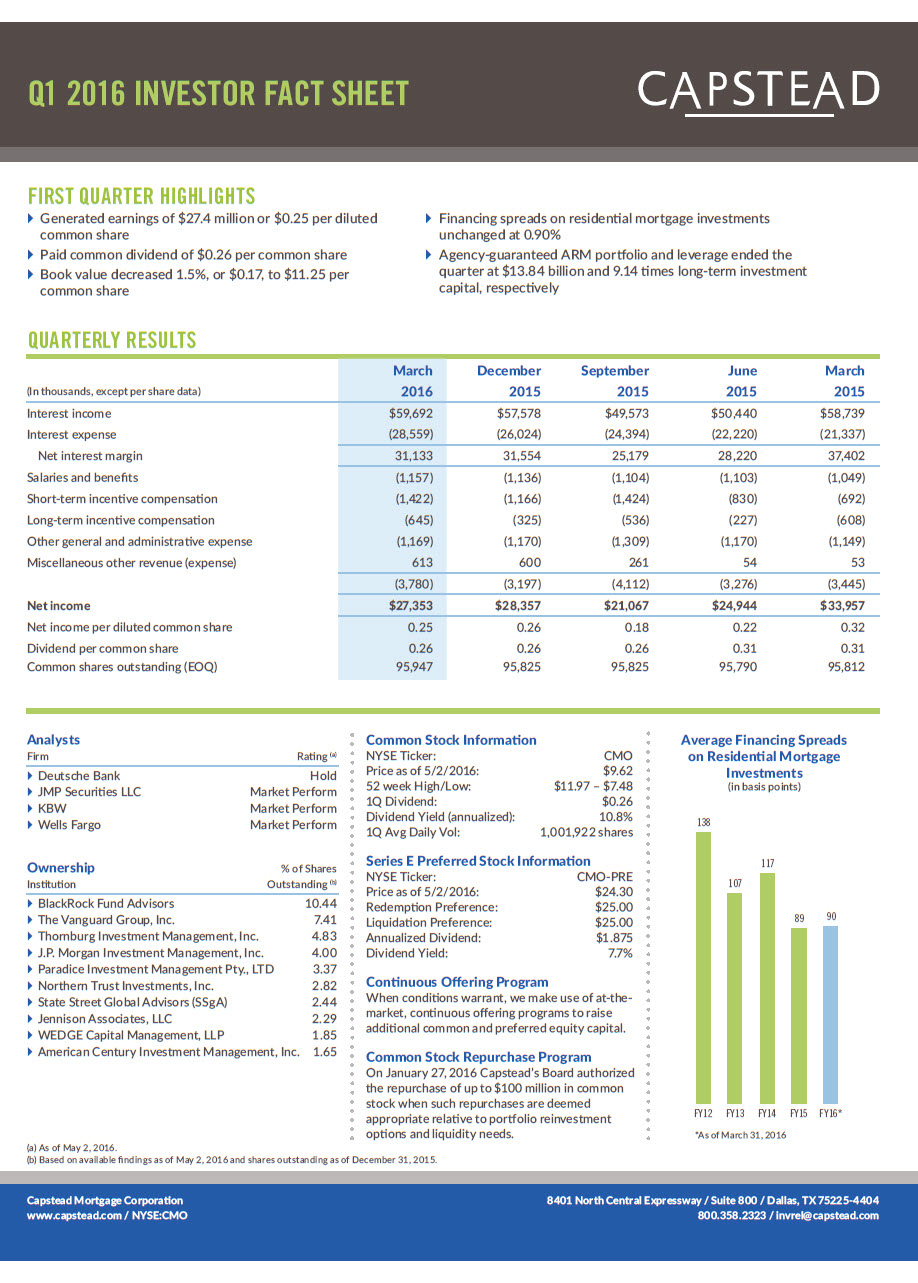

Q1 2016 INVESTOR FACT SHEET ABOUT US Capstead is based in Dallas, Texas and is listed on the New YorkStock Exchange (symbol CMO and CMOPRE). Having been formedin 1985, we hold the distncton of being the oldest publicly-tradedmortgage REIT. We invest in a leveraged portolio of short-duraton agency-guaranteed (i.e. Fannie Mae, Freddie Mac and Ginnie Mae) residental ARM securites that is appropriately hedged and canearn atractve risk-adjusted returns over the long term, with litle, if any, credit risk. Duraton is a measure of market price sensitvity tointerest rate movements. A shorter duraton generally indicates lessinterest rate risk. Our short-duraton strategy differentates us from our peersbecause the adjustable-rate mortgages underlying our portolioreset to more current interest rates within a relatvely short periodof tme positoning us: ``to benefit from future recoveries in financing spreads that typically contract during periods of rising interest rates, and``to experience smaller fluctuatons in portolio values from changes in interest rates compared to portolios containinga significant amount of longer-duraton ARM or fixed-ratemortgage securites. QUALITY ASSETS Agency-guaranteed residental mortgage securites are consideredto have litle, if any, credit risk, partcularly given federal governmentsupport for Fannie Mae and Freddie Mac. These mortgage investments are highly liquid and can be financed with multplefunding providers through standard repurchase arrangements. CONSERVATIVELY FINANCED We leverage our portolio to provide the financial flexibility neededto successfully manage through periods of changing market conditons, and we have long-standing relatonships with numerouslending counterpartes. Our use of interest rate swap agreementshelps further mitgate the effects of rising short-term interest rates. EXPERIENCED MANAGEMENT IN A STOCKHOLDER FRIENDLY STRUCTURE Our top four executve officers have over 100 years of combinedmortgage finance industry experience. We are internally-managedwith low operatng costs and a strong focus on performance-basedcompensaton. This structure greatly enhances the alignment of management interests with those of our stockholders. Long-term Investment Capital (in millions) Long-term Unsecured BorrowingsPreferred Stock Portolio Leverage* $12.62 $1.38 Total Assets (in millions) $14,387 $14,446 Common Stock $1,595 $1,464 $1,489 $1,396 $1,381 $98 $197 Billion Billion $14,467 $14,014 $14,110 9.14:1 Portolio Leverage Secured Borrowingsdivided by Long-Term $1,086 2012 2013 2014 2015 2016* *As of March 31, 2016 Capstead Mortgage Corporatonwww.capstead.com / NYSE:CMO Investment Capital 2012 2013 2014 2015 2016* 8401 North Central Expressway / Suite 800 / Dallas, TX 75225-4404 800.358.2323 / invrel@capstead.com

Q1 2016 INVESTOR FACT SHEET FIRST QUARTER HIGHLIGHTS `` Generated earnings of $27.4 million or $0.25 per diluted `` Financing spreads on residental mortgage investments common share unchanged at 0.90% `` Paid common dividend of $0.26 per common share `` Agency-guaranteed ARM portolio and leverage ended the `` Book value decreased 1.5%, or $0.17, to $11.25 per quarter at $13.84 billion and 9.14 tmes long-term investment common share capital, respectvely QUARTERLY RESULTS March December September June March (In thousands, except per share data) 2016 2015 2015 2015 2015 Interest income $59,692 $57,578 $49,573 $50,440 $58,739 Interest expense (28,559) (26,024) (24,394) (22,220) (21,337) Net interest margin 31,133 31,554 25,179 28,220 37,402 Salaries and benefits (1,157) (1,136) (1,104) (1,103) (1,049) Short-term incentve compensaton (1,422) (1,166) (1,424) (830) (692) Long-term incentve compensaton (645) (325) (536) (227) (608) Other general and administratve expense (1,169) (1,170) (1,309) (1,170) (1,149) Miscellaneous other revenue (expense) 613 600 261 54 53 (3,780) (3,197) (4,112) (3,276) (3,445) Net income $27,353 $28,357 $21,067 $24,944 $33,957 Net income per diluted common share 0.25 0.26 0.18 0.22 0.32 Dividend per common share 0.26 0.26 0.26 0.31 0.31 Common shares outstanding (EOQ) 95,947 95,825 95,825 95,790 95,812 Analysts Common Stock Informaton Average Financing Spreads Firm Ratng (a) NYSE Ticker: CMO on Residental Mortgage ``Deutsche Bank Hold ``JMP Securites LLC Market Perform ``KBW Market Perform ``Wells Fargo Market Perform Ownership % of Shares Insttuton Outstanding (b) ``BlackRock Fund Advisors 10.44 ``The Vanguard Group, Inc. 7.41 ``Thornburg Investment Management, Inc. 4.83 ``J.P. Morgan Investment Management, Inc. 4.00 ``Paradice Investment Management Pty., LTD 3.37 ``Northern Trust Investments, Inc. 2.82 ``State Street Global Advisors (SSgA) 2.44 ``Jennison Associates, LLC 2.29 ``WEDGE Capital Management, LLP 1.85 ``American Century Investment Management, Inc. 1.65 (a) As of May 2, 2016. Price as of 5/2/2016: $9.62 52 week High/Low: $11.97- $7.48 1Q Dividend: $0.26 Dividend Yield (annualized): 10.8% 1Q Avg Daily Vol: 1,001,922 shares Series E Preferred Stock Informaton NYSE Ticker: CMO-PRE Price as of 5/2/2016: $24.30 Redempton Preference: $25.00 Liquidaton Preference: $25.00 Annualized Dividend: $1.875 Dividend Yield: 7.7% Contnuous Offering Program When conditons warrant, we make use of at-the-market, contnuous offering programs to raise additonal common and preferred equity capital. Common Stock Repurchase Program On January 27, 2016 Capstead’s Board authorizedthe repurchase of up to $100 million in commonstock when such repurchases are deemed appropriate relatve to portolio reinvestmentoptons and liquidity needs. Investments (in basis points) 138 117 107 89 90 FY12 FY13 FY14 FY15 FY16* *As of March 31, 2016 (b) Based on available findings as of May 2, 2016 and shares outstanding as of December 31, 2015. Capstead Mortgage Corporaton 8401 North Central Expressway / Suite 800 / Dallas, TX 75225-4404 www.capstead.com / NYSE:CMO 800.358.2323 / invrel@capstead.com