Attached files

| file | filename |

|---|---|

| EX-12 - EX-12 - CAPSTEAD MORTGAGE CORP | cmo-ex12_9.htm |

| EX-32 - EX-32 - CAPSTEAD MORTGAGE CORP | cmo-ex32_6.htm |

| EX-31.1 - EX-31.1 - CAPSTEAD MORTGAGE CORP | cmo-ex311_7.htm |

| EX-23 - EX-23 - CAPSTEAD MORTGAGE CORP | cmo-ex23_8.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

✓ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2016

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ______________

Commission File Number:001-08896

CAPSTEAD MORTGAGE CORPORATION

(Exact name of Registrant as specified in its Charter)

|

Maryland |

|

75‑2027937 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

8401 North Central Expressway, Suite 800, Dallas, TX |

|

75225-4404 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (214) 874-2323

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

Common Stock ($0.01 par value) |

|

New York Stock Exchange |

|

$7.50% Series E Cumulative Redeemable Preferred Stock ($0.10 par value) |

|

New York Stock Exchange |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ✓ NO

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES NO ✓

Indicate by check mark whether the Registrant (1) has filed all documents and reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES ✓ NO

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that Registrant was required to submit and post such files). YES ✓ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer ✓ Accelerated filer Non-accelerated filer Smaller reporting company

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). YES NO ✓

At June 30, 2016 the aggregate market value of the common stock held by nonaffiliates was $915,329,927.

Number of shares of Common Stock outstanding at February 24, 2017: 96,062,865

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Registrant’s definitive Proxy Statement, to be issued in connection with the 2017 Annual Meeting of Stockholders of the Registrant, are incorporated by reference into Part III.

2016 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

|

|

|

Page |

|||

|

|

|

|

|

|||

|

ITEM 1. |

|

2 |

||||

|

|

|

|

|

|||

|

ITEM 1A. |

|

4 |

||||

|

|

|

|

|

|||

|

ITEM 1B. |

|

4 |

||||

|

|

|

|

|

|||

|

ITEM 2. |

|

4 |

||||

|

|

|

|

|

|||

|

ITEM 3. |

|

4 |

||||

|

|

|

|

|

|||

|

ITEM 4. |

|

4 |

||||

|

|

||||||

|

|

|

|

|

|||

|

ITEM 5. |

|

5 |

||||

|

|

|

|

|

|||

|

ITEM 6. |

|

6 |

||||

|

|

|

|

|

|||

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

7 |

|||

|

|

|

|

|

|||

|

ITEM 7A. |

|

34 |

||||

|

|

|

|

|

|||

|

ITEM 8. |

|

34 |

||||

|

|

|

|

|

|||

|

ITEM 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure |

|

61 |

|||

|

|

|

|

|

|||

|

ITEM 9A. |

|

61 |

||||

|

|

|

|

|

|||

|

ITEM 9B. |

|

63 |

||||

|

|

||||||

|

|

|

|

|

|||

|

ITEM 10 |

|

63 |

||||

|

|

|

|

|

|||

|

ITEM 11. |

|

63 |

||||

|

|

|

|

|

|||

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

63 |

|||

|

|

|

|

|

|||

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

63 |

|||

|

|

|

|

|

|||

|

ITEM 14. |

|

63 |

||||

|

|

||||||

|

|

|

|

|

|||

|

ITEM 15. |

|

64 |

||||

|

|

|

|

||||

|

|

66 |

|||||

Capstead Mortgage Corporation operates as a self-managed real estate investment trust for federal income tax purposes (a “REIT”) and is based in Dallas, Texas. Unless the context otherwise indicates, Capstead Mortgage Corporation, together with its subsidiaries, is referred to as “Capstead” or the “Company.” Capstead was incorporated in the state of Maryland in 1985 and its common and preferred stocks are listed on the New York Stock Exchange under the symbols “CMO” and “CMOPRE,” respectively.

Capstead’s investment strategy involves managing a leveraged portfolio of residential mortgage pass-through securities consisting almost exclusively of relatively short-duration adjustable-rate mortgage (“ARM”) securities issued and guaranteed by government-sponsored enterprises, either Fannie Mae or Freddie Mac, or by an agency of the federal government, Ginnie Mae. Residential mortgage pass-through securities guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae, referred to as “Agency Securities,” are considered to have limited, if any, credit risk because of federal government support. This strategy differentiates Capstead from its peers because ARM loans underlying its investment portfolio can reset to more current interest rates within a relatively short period of time. This positions the Company to benefit from a potential recovery in financing spreads that typically contract during periods of rising interest rates and can result in smaller fluctuations in portfolio values compared to portfolios containing a significant amount of longer-duration ARM and fixed-rate mortgage securities. Duration is a common measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk.

For further discussion of the Company’s business and financial condition, see Item 7 of this report, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is incorporated herein by reference.

Competition

As a residential mortgage REIT that focuses on investing in ARM Agency Securities, Capstead competes for the acquisition of suitable investments with other mortgage REITs, commercial banks, insurance companies, and institutional investors such as private equity funds, mutual funds, pension funds and sovereign wealth funds. Many of these entities have lower yield requirements as well as greater financial resources and access to capital than the Company. Increased competition for the acquisition of ARM Agency Securities can result in higher pricing levels for such assets. In addition, the availability of ARM Agency Securities for purchase in the secondary markets varies substantially with changes in market conditions and ARM origination levels, which have not kept pace with related runoff in recent years. Although higher pricing levels generally correspond to a higher book value per common share for the Company, higher prices paid for acquisitions can adversely affect portfolio yields and future profitability.

In addition, the federal government, through the Federal Reserve, and to a lesser extent, Fannie Mae and Freddie Mac, has accumulated substantial holdings of primarily fixed-rate Agency Securities, largely in order to provide stimulus to the economy through what has been referred to as quantitative easing programs. These programs have had the effect of supporting higher pricing for the entire Agency Securities market, including pricing for ARM Agency Securities. While the Federal Reserve ceased adding to its holdings of fixed-rate Agency Securities late in 2014, it continues to provide economic stimulus by replacing portfolio runoff through open market purchases. The Federal Reserve has indicated that it intends to eventually cease replacing portfolio runoff. This action, or a more dramatic reduction in government holdings of fixed-rate Agency Securities in the future, could result in lower pricing levels for Agency Securities, adversely affecting the Company’s book value per common share.

2

Regulation and Related Matters

Operating as a REIT investing in Agency Securities subjects Capstead to various federal tax and regulatory requirements. For further discussion, see Item 7 of this report, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” on pages 27 through 32 under the captions “Risks Related to Capstead’s Status as a REIT and Other Tax Matters” and “Risk Factors Related to Capstead’s Corporate Structure,” which is incorporated herein by reference.

Employees

As of December 31, 2016, Capstead had 13 full-time employees and one part-time employee.

Website Access to Company Reports and Other Company Information

Capstead makes available on its website at www.capstead.com, free of charge, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, investor presentations and press releases, including any amendments to such documents as soon as reasonably practicable after such materials are electronically filed or furnished to the Securities and Exchange Commission (“SEC”) or otherwise publicly released.

The SEC maintains a website (www.sec.gov) through which investors may view materials filed with the SEC. Investors may also read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The Company makes available on its website charters for the committees of its board of directors, its Board of Directors’ Guidelines, its Amended and Restated Bylaws, its Code of Business Conduct and Ethics, its Financial Code of Professional Conduct and other information, including amendments to such documents and waivers, if any, to the codes. Such information will also be furnished, free of charge, upon written request to Capstead Mortgage Corporation, Attention: Stockholder Relations, 8401 North Central Expressway, Suite 800, Dallas, Texas 75225-4404.

Cautionary Statement Concerning Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Forward-looking statements are based largely on the expectations of management and are subject to a number of risks and uncertainties including, but not limited to, the following:

|

• |

changes in general economic conditions; |

|

• |

fluctuations in interest rates and levels of mortgage prepayments; |

|

• |

the effectiveness of risk management strategies; |

|

• |

the impact of differing levels of leverage employed; |

|

• |

liquidity of secondary markets and credit markets; |

|

• |

the availability of financing at reasonable levels and terms to support investing on a leveraged basis; |

|

• |

the availability of new investment capital; |

|

• |

the availability of suitable qualifying investments from both an investment return and regulatory perspective; |

|

• |

changes in market conditions as a result of federal corporate and individual income tax reform, federal government fiscal challenges and Federal Reserve monetary policy, including policy regarding its holdings of Agency and U.S. Treasury Securities; |

3

|

• |

deterioration in credit quality and ratings of existing or future issuances of Fannie Mae, Freddie Mac or Ginnie Mae securities; |

|

• |

changes in legislation or regulation affecting Fannie Mae, Freddie Mac, Ginnie Mae and similar federal government agencies and related guarantees; |

|

• |

changes in legislation or regulation affecting exemptions for mortgage REITs from regulation under the Investment Company Act of 1940; |

|

• |

other changes in legislation or regulation affecting the mortgage and banking industries; and |

|

• |

increases in costs and other general competitive factors. |

In addition to the above considerations, actual results and liquidity are affected by other risks and uncertainties which could cause actual results to be significantly different from those expressed or implied by any forward-looking statements included herein. It is not possible to identify all of the risks, uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Forward-looking statements speak only as of the date the statement is made and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein.

Under the captions “Risk Factors” and “Critical Accounting Policies” on pages 23 through 32 and 32 through 33, respectively, of Item 7 are discussions of risk factors and critical accounting policies affecting Capstead’s financial condition and results of operations that are an integral part of this report which are incorporated herein by reference. Readers are strongly urged to consider the potential impact of these factors and accounting policies on the Company while reading this document.

None.

Capstead’s headquarters are located in Dallas, Texas in office space leased by the Company.

None.

Not applicable.

4

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The New York Stock Exchange trading symbol for Capstead’s common stock is CMO. As of December 31, 2016, the Company had 1,093 common stockholders of record and depository companies held shares of common stock for 33,528 beneficial owners.

The high and low sales prices and dividends declared on Capstead’s common stock were as follows:

|

|

|

Year ended December 31, 2016 |

|

|

Year ended December 31, 2015 |

|

||||||||||||||||||

|

|

|

Sales Prices |

|

|

Dividends |

|

|

Sales Prices |

|

|

Dividends |

|

||||||||||||

|

|

|

High |

|

|

Low |

|

|

Declared |

|

|

High |

|

|

Low |

|

|

Declared |

|

||||||

|

First quarter |

|

$ |

9.97 |

|

|

$ |

7.48 |

|

|

$ |

0.26 |

|

|

$ |

12.58 |

|

|

$ |

11.55 |

|

|

$ |

0.31 |

|

|

Second quarter |

|

|

10.03 |

|

|

|

9.25 |

|

|

|

0.23 |

|

|

|

12.01 |

|

|

|

11.04 |

|

|

|

0.31 |

|

|

Third quarter |

|

|

10.46 |

|

|

|

9.35 |

|

|

|

0.23 |

|

|

|

11.75 |

|

|

|

9.71 |

|

|

|

0.26 |

|

|

Fourth quarter |

|

|

10.58 |

|

|

|

8.93 |

|

|

|

0.23 |

|

|

|

10.54 |

|

|

|

8.64 |

|

|

|

0.26 |

|

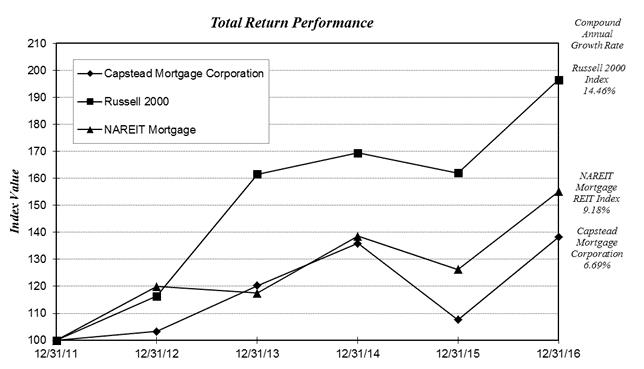

Set forth below is a graph comparing the yearly percentage change in the cumulative total return on Capstead’s common stock, with the yearly percentage change in the cumulative total return of the Russell 2000 Index and the NAREIT Mortgage REIT Index for the five years ended December 31, 2016 assuming the investment of $100 on December 31, 2011 and the reinvestment of dividends. The stock price and dividend performance reflected in the graph is not necessarily indicative of future performance.

|

|

|

Year ended December 31 |

|

|||||||||||||||||||||

|

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

2015 |

|

|

2016 |

|

||||||

|

Capstead Mortgage Corporation |

|

$ |

100.00 |

|

|

$ |

103.26 |

|

|

$ |

120.24 |

|

|

$ |

135.88 |

|

|

$ |

107.66 |

|

|

$ |

138.24 |

|

|

Russell 2000 Index |

|

|

100.00 |

|

|

|

116.35 |

|

|

|

161.52 |

|

|

|

169.43 |

|

|

|

161.95 |

|

|

|

196.45 |

|

|

NAREIT Mortgage REIT Index |

|

|

100.00 |

|

|

|

119.89 |

|

|

|

117.54 |

|

|

|

138.56 |

|

|

|

126.26 |

|

|

|

155.11 |

|

See Item 11 of this report for information regarding equity compensation plans which is incorporated herein by reference. Capstead did not issue any unregistered securities during the past three fiscal years.

5

This table summarizes selected financial information, including key operating data (in thousands, except percentages, ratios and per share data). For additional information, refer to the audited consolidated financial statements and notes thereto included under Item 8 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included under Item 7 of this report.

|

|

|

As of or for the year ended December 31 |

|

|||||||||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

|||||

|

Selected statement of income data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income on residential mortgage investments (before investment premium amortization) |

|

$ |

342,778 |

|

|

$ |

337,179 |

|

|

$ |

328,621 |

|

|

$ |

341,009 |

|

|

$ |

352,608 |

|

|

Investment premium amortization |

|

|

(130,084 |

) |

|

|

(121,190 |

) |

|

|

(101,872 |

) |

|

|

(125,872 |

) |

|

|

(96,677 |

) |

|

Related interest expense |

|

|

(107,653 |

) |

|

|

(85,521 |

) |

|

|

(65,155 |

) |

|

|

(66,368 |

) |

|

|

(69,101 |

) |

|

|

|

|

105,041 |

|

|

|

130,468 |

|

|

|

161,594 |

|

|

|

148,769 |

|

|

|

186,830 |

|

|

Other interest income (expense) (a) |

|

|

(7,196 |

) |

|

|

(8,113 |

) |

|

|

(8,173 |

) |

|

|

(8,165 |

) |

|

|

(7,790 |

) |

|

|

|

|

97,845 |

|

|

|

122,355 |

|

|

|

153,421 |

|

|

|

140,604 |

|

|

|

179,040 |

|

|

Other revenue (expense) |

|

|

(14,972 |

) |

|

|

(14,030 |

) |

|

|

(12,601 |

) |

|

|

(14,117 |

) |

|

|

(15,414 |

) |

|

Net income |

|

$ |

82,873 |

|

|

$ |

108,325 |

|

|

$ |

140,820 |

|

|

$ |

126,487 |

|

|

$ |

163,626 |

|

|

Net income per diluted common share (b) |

|

$ |

0.70 |

|

|

$ |

0.97 |

|

|

$ |

1.33 |

|

|

$ |

0.93 |

|

|

$ |

1.50 |

|

|

Cash dividends per share of common stock |

|

|

0.95 |

|

|

|

1.14 |

|

|

|

1.36 |

|

|

|

1.24 |

|

|

|

1.49 |

|

|

Average number of diluted shares of common stock outstanding |

|

|

95,819 |

|

|

|

95,701 |

|

|

|

95,629 |

|

|

|

95,393 |

|

|

|

95,012 |

|

|

Selected balance sheet data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential mortgage investments |

|

$ |

13,316,282 |

|

|

$ |

14,154,737 |

|

|

$ |

13,908,104 |

|

|

$ |

13,475,874 |

|

|

$ |

13,860,158 |

|

|

Total assets |

|

|

13,576,876 |

|

|

|

14,446,366 |

|

|

|

14,386,951 |

|

|

|

14,013,751 |

|

|

|

14,466,947 |

|

|

Secured borrowings |

|

|

12,145,346 |

|

|

|

12,958,394 |

|

|

|

12,806,843 |

|

|

|

12,482,900 |

|

|

|

12,784,238 |

|

|

Long-term investment capital (“LTIC”): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unsecured borrowings (net of related investments in statutory trusts prior to dissolution in December 2013) |

|

|

98,090 |

|

|

|

97,986 |

|

|

|

97,882 |

|

|

|

97,783 |

|

|

|

97,662 |

|

|

Preferred stockholders’ equity |

|

|

199,059 |

|

|

|

197,172 |

|

|

|

183,936 |

|

|

|

165,756 |

|

|

|

188,992 |

|

|

Common stockholders’ equity |

|

|

1,048,628 |

|

|

|

1,101,152 |

|

|

|

1,206,835 |

|

|

|

1,200,027 |

|

|

|

1,308,133 |

|

|

Book value per common share (unaudited) |

|

|

10.85 |

|

|

|

11.42 |

|

|

|

12.52 |

|

|

|

12.47 |

|

|

|

13.58 |

|

|

Key operating data: (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio acquisitions (principal amount) |

|

|

3,086,706 |

|

|

|

3,761,789 |

|

|

|

3,191,256 |

|

|

|

3,187,534 |

|

|

|

4,206,459 |

|

|

Portfolio runoff (principal amount) |

|

|

3,844,590 |

|

|

|

3,421,026 |

|

|

|

2,801,144 |

|

|

|

3,483,756 |

|

|

|

2,784,687 |

|

|

Common equity capital raised |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

|

142,036 |

|

||||

|

Common stock repurchases |

|

– |

|

|

– |

|

|

– |

|

|

|

7,292 |

|

|

|

35,062 |

|

|||

|

Year-end portfolio leverage ratio (c) |

|

9.02:1 |

|

|

9.28:1 |

|

|

8.60:1 |

|

|

8.53:1 |

|

|

8.02:1 |

|

|||||

|

Average total financing spreads (d) |

|

|

0.64 |

% |

|

|

0.81 |

% |

|

|

1.06 |

% |

|

|

0.96 |

% |

|

|

1.26 |

% |

|

Average financing spreads on residential mortgage investments (d) |

|

|

0.72 |

|

|

|

0.89 |

|

|

|

1.17 |

|

|

|

1.07 |

|

|

|

1.38 |

|

|

Average mortgage prepayment rates, (expressed as constant prepayment rates, or CPRs) |

|

|

23.20 |

|

|

|

20.37 |

|

|

|

17.28 |

|

|

|

21.45 |

|

|

|

17.60 |

|

|

Return on average LTIC |

|

|

6.77 |

|

|

|

7.91 |

|

|

|

9.97 |

|

|

|

8.73 |

|

|

|

11.00 |

|

|

Return on average common equity capital |

|

|

6.20 |

|

|

|

7.86 |

|

|

|

10.37 |

|

|

|

7.08 |

|

|

|

11.15 |

|

|

(a) |

Consists principally of interest on unsecured borrowings and is presented net of earnings of related statutory trusts prior to dissolution in December 2013. |

|

(b) |

Net income per diluted common share in 2016 includes a separation of service charge of $0.03 per common share related to a July 2016 leadership change. Net income per diluted common share in 2013 includes reductions in net income available to common stockholders totaling $0.23 per common share related to convertible preferred stock redemption preference premiums paid and dividends accruing on then-outstanding shares of convertible preferred stock from the May 2013 initial issuance of the Company’s Series E preferred stock through the June 2013 redemption of the convertible preferred stock. |

|

(c) |

Year-end portfolio leverage ratios were calculated by dividing secured borrowings by long-term investment capital. |

|

(d) |

Financing spreads on residential mortgage investments is a non-GAAP financial measure based solely on yields on Capstead’s residential mortgage investments, net of secured borrowing rates adjusted for currently-paying interest rate swap agreements held for hedging purposes. This measure differs from total financing spreads, an all-inclusive GAAP measure that includes yields on all interest-earning assets, as well as rates paid on all interest-bearing liabilities, principally unsecured borrowings. See Item 7 on page 15 for the Company’s rationale for using this non-GAAP financial measure and a reconciliation to its related GAAP financial measure, total financing spreads. |

6

Overview

Capstead operates as a self-managed REIT earning income from investing in a leveraged portfolio of residential mortgage pass-through securities consisting nearly exclusively of short-duration ARM Agency Securities, which reset to more current interest rates within a relatively short period of time and are considered to have limited, if any, credit risk. By investing in short-duration ARM Agency Securities, the Company is positioned to benefit from future recoveries in financing spreads that typically contract during periods of rising interest rates and to experience smaller fluctuations in portfolio values compared to leveraged portfolios containing a significant amount of longer-duration ARM or fixed-rate mortgage securities. Duration is a common measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk.

Capstead finances its residential mortgage investments by leveraging its long-term investment capital with secured borrowings consisting primarily of borrowings under repurchase arrangements with commercial banks and other financial institutions. Long-term investment capital totaled $1.35 billion at December 31, 2016, consisting of $1.05 billion of common and $199 million of preferred stockholders’ equity together with $98 million of unsecured borrowings maturing in 2035 and 2036 (recorded amounts).

Long-term investment capital decreased by $51 million during 2016 due to $30 million in declines in net unrealized gains associated with the Company’s residential mortgage investments and interest rate swap agreements held for hedging purposes ($0.32 per outstanding share of common stock), and $22 million in capital returned to stockholders in the form of dividend distributions in excess of earnings ($0.25 per share). Less than $2 million in new preferred equity capital was raised during 2016 pursuant to an at-the-market continuous offering program. Book value (total stockholders’ equity, less liquidation preferences for outstanding shares of preferred stock, divided by outstanding shares of common stock) declined 5.0%, or $0.57 per share to $10.85 per share. This change in book value, combined with $0.95 per share in common dividends declared, produced an economic return to Capstead common stockholders of 3.33% in 2016.

Capstead’s residential mortgage investments and related secured borrowings were managed lower during 2016 by not completely replacing portfolio runoff to end the year at $13.32 billion and $12.15 billion, respectively, compared to $14.15 billion and $12.96 billion at the end of 2015. This was largely a response to the decline in long-term investment capital. Portfolio leverage (secured borrowings divided by long-term investment capital) declined modestly during the year to 9.02 to one at December 31, 2016 from 9.28 to one at December 31, 2015. Management believes current portfolio leverage levels represent an appropriate use of leverage under current market conditions for a portfolio consisting of seasoned, short-duration ARM Agency Securities.

Capstead reported net income of $83 million or $0.70 per diluted common share in 2016, including a $0.03 per share separation of service charge associated with a July 2016 leadership change. This compares to 2015 earnings of $108 million or $0.97 per diluted common share. Earnings were negatively impacted by an 18 basis point increase in average secured borrowing rates that was only partially offset by a nine basis point increase in average cash yields on the Company’s ARM securities portfolio. Cash yields are expected to continue trending higher as coupon interest rates on mortgage loans underlying the currently-resetting portion of the portfolio reset higher based on higher prevailing six- and 12-month interest rate indices. Portfolio yields were also negatively impacted by an eight basis point increase in yield adjustments for investment premium amortization caused by higher mortgage prepayment levels. Mortgage prepayment levels increased in the second quarter and remained elevated through year-end, largely in response to a favorable refinancing environment during much of the year. However, with the sharp increase in interest rates post-election, refinancing opportunities have diminished considerably, leading to expectations of lower mortgage prepayment levels in future periods.

7

The size and composition of Capstead’s investment portfolio depends on investment strategies being implemented by management, as well as overall market conditions, including the availability of attractively priced investments and suitable financing to leverage the Company’s investment capital. Market conditions are influenced by, among other things, current and future expectations for short- and longer-term interest rates, mortgage prepayments and market liquidity.

Risk Factors and Critical Accounting Policies

Under the captions “Risk Factors” and “Critical Accounting Policies” are discussions of risk factors and critical accounting policies affecting Capstead’s financial condition and earnings that are an integral part of this discussion and analysis. Readers are strongly urged to consider the potential impact of these factors and accounting policies on the Company and its financial results.

Common Stock Repurchase Program

On January 27, 2016 Capstead’s board of directors authorized the repurchase of up to $100 million in common stock when such repurchases are deemed appropriate relative to portfolio reinvestment options and liquidity needs. As of February 24, 2017, no shares had been repurchased under this program. Any repurchases made pursuant to the program will be made in the open market from time to time in accordance with and as permitted by securities laws and other legal requirements. The timing, manner, price and amount of any repurchases will be determined by the Company in its discretion and will be subject to economic and market conditions, stock price, applicable legal requirements and other factors. In addition, the Company may enter into Rule 10b5-1 plans under which repurchases can be made. The authorization does not obligate the Company to acquire any particular amount of common stock and repurchases under the program and the program itself may be suspended or discontinued at the Company’s discretion without prior notice.

Preferred Equity Capital Issuances

During the year ended December 31, 2016, Capstead issued 78,000 shares of its 7.50% Series E Cumulative Redeemable Preferred Stock through an at-the-market continuous offering program at an average price of $24.23, net of underwriting fees and other costs, for net proceeds of approximately $2 million. No shares were issued subsequent to year-end through February 24, 2017 pursuant to this program. Additional amounts of preferred capital may be raised in the future under this program or by other means, subject to market conditions, compliance with federal securities laws and tax regulations as well as blackout periods associated with the dissemination of important Company-specific news.

Book Value per Common Share

All but $5 million of Capstead’s residential mortgage investments portfolio and all of its interest rate swap agreements are recorded at fair value on the Company’s balance sheet and are therefore included in the calculation of book value per share of common stock. The Company’s borrowings, however, are not recorded at fair value on the balance sheet. Fair value is impacted by market conditions, including changes in interest rates, and the availability of financing at reasonable rates and leverage levels, among other factors. The Company’s investment strategy attempts to mitigate these risks by focusing on investments in Agency Securities, which are considered to have little, if any, credit risk and are collateralized by ARM loans with interest rates that reset periodically to more current levels, generally within five years. Because of these characteristics, the fair value of the Company’s portfolio is considerably less vulnerable to significant pricing declines caused by credit concerns or rising interest rates compared to leveraged portfolios containing a significant amount of non-agency securities or longer-duration ARM and/or fixed-rate Agency Securities.

8

The following table illustrates the progression of Capstead’s book value per share of common stock as well as changes in book value expressed as percentages of beginning book value for the indicated periods:

|

|

|

As of and for the year ended December 31 |

|

|||||||||||||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|||||||||||||||

|

Book value per common share, beginning of year |

|

$ |

11.42 |

|

|

|

|

|

|

$ |

12.52 |

|

|

|

|

|

|

$ |

12.47 |

|

|

|

|

|

|

Change in unrealized gains and losses on mortgage securities classified as available-for-sale |

|

|

(0.51 |

) |

|

|

|

|

|

|

(1.02 |

) |

|

|

|

|

|

|

0.28 |

|

|

|

|

|

|

Change in unrealized gains and losses on interest rate swap agreements designated as cash flow hedges of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secured borrowings |

|

|

0.18 |

|

|

|

|

|

|

|

0.12 |

|

|

|

|

|

|

|

0.06 |

|

|

|

|

|

|

Unsecured borrowings |

|

|

0.01 |

|

|

|

|

|

|

|

(0.05 |

) |

|

|

|

|

|

|

(0.26 |

) |

|

|

|

|

|

|

|

|

(0.32 |

) |

|

|

(2.8 |

)% |

|

|

(0.95 |

) |

|

|

(7.6 |

)% |

|

|

0.08 |

|

|

|

0.6 |

% |

|

Capital transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividend distributions in excess of earnings |

|

|

(0.25 |

) |

|

|

|

|

|

|

(0.17 |

) |

|

|

|

|

|

|

(0.04 |

) |

|

|

|

|

|

Effects of preferred equity capital transactions |

|

– |

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

(0.01 |

) |

|

|

|

|

||

|

Other (principally related to equity awards) |

|

– |

|

|

|

|

|

|

|

0.02 |

|

|

|

|

|

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

(0.25 |

) |

|

|

(2.2 |

)% |

|

|

(0.15 |

) |

|

|

(1.2 |

)% |

|

|

(0.03 |

) |

|

|

(0.2 |

)% |

|

Book value per common share, end of year |

|

$ |

10.85 |

|

|

|

|

|

|

$ |

11.42 |

|

|

|

|

|

|

$ |

12.52 |

|

|

|

|

|

|

Change in book value per common share during the indicated year |

|

$ |

(0.57 |

) |

|

|

(5.0 |

)% |

|

$ |

(1.10 |

) |

|

|

(8.8 |

)% |

|

$ |

0.05 |

|

|

|

0.4 |

% |

Residential Mortgage Investments

The following table illustrates the progression of Capstead’s portfolio of residential mortgage investments for the indicated periods (dollars in thousands):

|

|

|

As of and for the year ended December 31 |

|

|||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|||

|

Residential mortgage investments, beginning of year |

|

$ |

14,154,737 |

|

|

$ |

13,908,104 |

|

|

$ |

13,475,874 |

|

|

Portfolio acquisitions (principal amount) at average lifetime purchased yields of 2.27%, 2.47% and 2.44%, respectively |

|

|

3,086,706 |

|

|

|

3,761,789 |

|

|

|

3,191,256 |

|

|

Investment premiums on acquisitions* |

|

|

98,407 |

|

|

|

125,262 |

|

|

|

116,707 |

|

|

Portfolio runoff (principal amount) |

|

|

(3,844,590 |

) |

|

|

(3,421,026 |

) |

|

|

(2,801,144 |

) |

|

Investment premium amortization* |

|

|

(130,084 |

) |

|

|

(121,190 |

) |

|

|

(101,872 |

) |

|

Change in net unrealized gains on securities classified as available-for-sale |

|

|

(48,894 |

) |

|

|

(98,202 |

) |

|

|

27,283 |

|

|

Residential mortgage investments, end of year |

|

$ |

13,316,282 |

|

|

$ |

14,154,737 |

|

|

$ |

13,908,104 |

|

|

* |

Residential mortgage investments typically are acquired at a premium to the securities’ unpaid principal balances. Investment premiums are recognized in earnings as portfolio yield adjustments using the interest method over the estimated lives of the related investments. As such, the level of mortgage prepayments impacts how quickly investment premiums are amortized. The single largest determinant in amortizing investment premiums is actual portfolio runoff (scheduled and unscheduled principal paydowns) for a given accounting period. |

9

Capstead’s investment strategy focuses on managing a portfolio of residential mortgage investments consisting almost exclusively of ARM Agency Securities. Agency Securities are considered to have limited, if any, credit risk because the timely payment of principal and interest is guaranteed by Fannie Mae and Freddie Mac, which are government-sponsored enterprises, or Ginnie Mae, which is an agency of the federal government. Federal government support for Fannie Mae and Freddie Mac has largely alleviated market concerns regarding the ability of Fannie Mae and Freddie Mac to fulfill their guarantee obligations.

By focusing on investing in short-duration ARM Agency Securities, changes in fair value caused by changes in interest rates are typically relatively modest compared to changes in fair value of longer-duration ARM or fixed-rate assets. Declines in fair value caused by increases in interest rates are generally recoverable in a relatively short period of time as coupon interest rates on the underlying mortgage loans reset to rates more reflective of the then-current interest rate environment. This investment strategy positions the Company to benefit from potential recoveries in financing spreads that typically contract during periods of rising interest rates.

Capstead classifies its ARM securities based on the average length of time until the loans underlying each security reset to more current rates (“months-to-roll”) (less than 18 months for “current-reset” ARM securities, and 18 months or greater for “longer-to-reset” ARM securities). The Company’s ARM holdings featured the following characteristics at December 31, 2016 (dollars in thousands):

|

ARM Type |

|

Amortized Cost Basis (a) |

|

|

Net WAC (b) |

|

|

Fully Indexed WAC (b) |

|

|

Average Net Margins (b) |

|

|

Average Periodic Caps (b) |

|

|

Average Lifetime Caps (b) |

|

|

Months To Roll |

|

|||||||

|

Current-reset ARMs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Agency Securities |

|

$ |

3,981,669 |

|

|

|

2.77 |

% |

|

|

3.13 |

% |

|

|

1.70 |

% |

|

|

3.02 |

% |

|

|

9.56 |

% |

|

|

5.8 |

|

|

Freddie Mac Agency Securities |

|

|

1,588,609 |

|

|

|

2.84 |

|

|

|

3.31 |

|

|

|

1.81 |

|

|

|

2.53 |

|

|

|

9.59 |

|

|

|

6.9 |

|

|

Ginnie Mae Agency Securities |

|

|

1,717,835 |

|

|

|

2.25 |

|

|

|

2.38 |

|

|

|

1.51 |

|

|

|

1.06 |

|

|

|

8.30 |

|

|

|

6.6 |

|

|

Residential mortgage loans |

|

|

1,848 |

|

|

|

3.80 |

|

|

|

3.10 |

|

|

|

2.08 |

|

|

|

1.63 |

|

|

|

11.04 |

|

|

|

4.9 |

|

|

(55% of total) |

|

|

7,289,961 |

|

|

|

2.66 |

|

|

|

2.99 |

|

|

|

1.68 |

|

|

|

2.45 |

|

|

|

9.27 |

|

|

|

6.2 |

|

|

Longer-to-reset ARMs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Agency Securities |

|

|

2,678,228 |

|

|

|

2.67 |

|

|

|

3.31 |

|

|

|

1.62 |

|

|

|

3.33 |

|

|

|

7.68 |

|

|

|

42.7 |

|

|

Freddie Mac Agency Securities |

|

|

2,124,054 |

|

|

|

2.71 |

|

|

|

3.34 |

|

|

|

1.66 |

|

|

|

2.86 |

|

|

|

7.77 |

|

|

|

43.2 |

|

|

Ginnie Mae Agency Securities |

|

|

1,115,625 |

|

|

|

2.92 |

|

|

|

2.36 |

|

|

|

1.51 |

|

|

|

1.04 |

|

|

|

7.96 |

|

|

|

38.9 |

|

|

(45% of total) |

|

|

5,917,907 |

|

|

|

2.73 |

|

|

|

3.14 |

|

|

|

1.61 |

|

|

|

2.73 |

|

|

|

7.76 |

|

|

|

42.2 |

|

|

|

|

$ |

13,207,868 |

|

|

|

2.69 |

|

|

|

3.06 |

|

|

|

1.65 |

|

|

|

2.58 |

|

|

|

8.59 |

|

|

|

22.3 |

|

|

Gross WAC (rate paid by borrowers) (c) |

|

|

|

|

|

|

3.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Amortized cost basis represents the Company’s investment (unpaid principal balance plus unamortized investment premiums) before unrealized gains and losses. At December 31, 2016, the ratio of amortized cost basis to unpaid principal balance for the Company’s ARM holdings was 103.16. This table excludes $3 million in fixed-rate agency-guaranteed mortgage pass-through securities, residential mortgage loans and private residential mortgage pass-through securities held as collateral for structured financings. |

|

(b) |

Net WAC, or weighted average coupon, is the weighted average interest rate of the mortgage loans underlying the indicated investments, net of servicing and other fees as of the indicated date. Net WAC is expressed as a percentage calculated on an annualized basis on the unpaid principal balances of the mortgage loans underlying these investments. As such, it is similar to the cash yield on the portfolio which is calculated using amortized cost basis. Fully indexed WAC represents the weighted average coupon upon one or more resets using interest rate indexes and net margins as of the indicated date. Average net margins represent the weighted average levels over the underlying indexes that the portfolio can adjust to upon reset, usually subject to initial, periodic and/or lifetime caps on the amount of such adjustments during any single interest rate adjustment period and over the contractual term of the underlying loans. ARM securities with initial fixed-rate periods of five years or longer typically have either 200 or 500 basis point initial caps with 200 basis point periodic caps. Additionally, certain ARM securities held by the Company are subject only to lifetime caps or are not subject to a cap. For presentation purposes, average periodic caps in the table above reflect initial caps until after an ARM security has reached its initial reset date and lifetime caps, less the current net WAC, for ARM securities subject only to lifetime caps. At year-end, 76% of current-reset ARMs were subject to periodic caps averaging 1.74%; 15% were subject to initial caps averaging 3.49%; 8% were subject to lifetime caps averaging 7.35%; and 1% were not subject to a cap. All longer-to-reset ARM securities at December 31, 2016 were subject to initial caps. |

|

(c) |

Gross WAC is the weighted average interest rate of the mortgage loans underlying the indicated investments, including servicing and other fees paid by borrowers, as of the indicated date. |

10

ARM securities held by Capstead are backed by mortgage loans that have coupon interest rates that adjust at least annually to more current interest rates or begin doing so after an initial fixed-rate period. These coupon interest rate adjustments are usually subject to periodic and lifetime limits, or caps, on the amount of such adjustments during any single interest rate adjustment period and over the contractual term of the underlying loans. After the initial fixed-rate period, if applicable, the coupon interest rates of mortgage loans underlying the Company’s ARM securities typically adjust either (a) annually based on specified margins over the one-year London interbank offered rate (“LIBOR”) or the one-year Constant Maturity U.S. Treasury Note Rate (“CMT”), (b) semiannually based on specified margins over six-month LIBOR, or (c) monthly based on specified margins over indices such as one-month LIBOR, the Eleventh District Federal Reserve Bank Cost of Funds Index, or over a rolling twelve month average of the one-year CMT index.

After consideration of any applicable initial fixed-rate periods, at December 31, 2016 approximately 89%, 7% and 4% of the Company’s ARM securities were backed by mortgage loans that reset annually, semi-annually and monthly, respectively. Approximately 85% of the Company’s current-reset ARM securities have reached an initial coupon reset date, while only $5 million of its longer-to-reset ARM securities have reached an initial coupon reset date. Additionally, at December 31, 2016 approximately 8% of the Company’s ARM securities were backed by interest-only loans, with remaining interest-only payment periods averaging 23 months. All percentages are based on averages of the characteristics of mortgage loans underlying each security and calculated using unpaid principal balances as of the indicated date.

Secured Borrowings

Capstead has traditionally financed its residential mortgage investments by leveraging its long-term investment capital borrowings under repurchase arrangements with commercial banks and other financial institutions. Repurchase arrangements entered into by the Company involve the sale and a simultaneous agreement to repurchase the transferred assets at a future date and are accounted for as financings. The Company maintains the beneficial interest in the specific securities pledged during the term of each repurchase arrangement and receives the related principal and interest payments.

In August 2015 the Company began supplementing its borrowings under repurchase arrangements with advances from the Federal Home Loan Bank (“FHLB”) of Cincinnati. In January 2016 the FHLB system regulator finalized rules that generally preclude captive insurers from remaining members beyond February 19, 2017 with transition rules requiring outstanding advances to be repaid upon maturity or by that date. In response to this action, the Company migrated all of its $2.88 billion of FHLB advances outstanding at December 31, 2015 back to repurchase arrangements by November 2016. All $60 million of FHLB stock held by the Company in connection with advance activity at December 31, 2015 was redeemed during 2016.

The terms and conditions of secured borrowings are negotiated on a transaction-by-transaction basis when each such borrowing is initiated or renewed. None of the Company’s counterparties are obligated to renew or otherwise enter into new borrowings at the conclusion of existing borrowings. Collateral requirements in excess of amounts borrowed (referred to as “haircuts”) averaged 4.6 percent and ranged from 3.0 to 5.0 percent of the fair value of pledged residential mortgage pass-through securities at December 31, 2016. After considering haircuts and related interest receivable on the collateral, as well as interest payable on these borrowings, the Company had $683 million of capital at risk with its lending counterparties at December 31, 2016. The Company did not have capital at risk with any single counterparty exceeding 4.3% of total stockholders’ equity at December 31, 2016.

Secured borrowing rates are generally fixed based on prevailing rates corresponding to the terms of the borrowings. Interest may be paid monthly or at the termination of a borrowing at which time the Company may enter into a new borrowing at prevailing haircuts and rates with the same counterparty or repay that counterparty and negotiate financing with a different counterparty. When the fair value of pledged securities declines due to changes in market conditions or the publishing of monthly security pay-

11

down factors, lenders typically require the Company to post additional securities as collateral, pay down borrowings or fund cash margin accounts with the counterparties in order to re-establish the agreed-upon collateral requirements, referred to as margin calls. Conversely, if collateral fair values increase, lenders are required to release collateral back to the Company pursuant to Company-issued margin calls.

As of December 31, 2016 the Company’s secured borrowings totaled $12.15 billion with 21 counter-parties at average rates of 0.96%, before the effects of currently-paying interest rate swap agreements held as cash flow hedges and 1.04% including the effects of these derivatives. To help mitigate exposure to rising short-term interest rates, the Company uses pay-fixed, receive-variable interest rate swap agreements with two- and three-year interest payment terms supplemented with longer-maturity secured borrowings, when available at attractive rates and terms. Excluding $500 million notional amount of swap agreements that expired January 2, 2017, at year-end the Company held $7.65 billion notional amount of portfolio financing-related interest rate swap agreements with contract expirations occurring at various dates through the fourth quarter of 2019 and a weighted average expiration of 14 months.

After consideration of all portfolio financing-related swap positions entered into as of year-end, the Company’s residential mortgage investments and secured borrowings had estimated durations at December 31, 2016 of 11½ and 8½ months, respectively, for a net duration gap of approximately 3 months – see pages 21 and 22 under the caption “Interest Rate Risk” for further information about the Company’s sensitivity to changes in market interest rates. The Company intends to continue to manage interest rate risk associated with holding and financing its residential mortgage investments by utilizing suitable derivative financial instruments such as interest rate swap agreements as well as longer-maturity secured borrowings, if available at attractive rates and terms.

Off-Balance Sheet Arrangements and Contractual Obligations

As of December 31, 2016, Capstead did not have any off-balance sheet arrangements. The Company’s contractual obligations at December 31, 2016 were as follows (in thousands):

|

|

|

Payments Due by Period* |

|

|||||||||||||||||

|

|

|

Total |

|

|

12 Months or Less |

|

|

13 – 36 Months |

|

|

37 – 60 Months |

|

|

>Than 60 Months |

|

|||||

|

Secured borrowings |

|

$ |

12,158,717 |

|

|

$ |

12,157,670 |

|

|

$ |

726 |

|

|

$ |

229 |

|

|

$ |

92 |

|

|

Unsecured borrowings |

|

|

213,192 |

|

|

|

4,514 |

|

|

|

10,550 |

|

|

|

11,509 |

|

|

|

186,619 |

|

|

Interest rate swap agreements designated as cash flow hedges of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secured borrowings |

|

|

16 |

|

|

|

16 |

|

|

– |

|

|

– |

|

|

– |

|

|||

|

Unsecured borrowings |

|

|

29,039 |

|

|

|

2,959 |

|

|

|

4,360 |

|

|

|

3,335 |

|

|

|

18,385 |

|

|

Portfolio acquisitions settling subsequent to year-end |

|

|

55,000 |

|

|

|

55,000 |

|

|

– |

|

|

– |

|

|

– |

|

|||

|

Corporate office lease |

|

|

1,039 |

|

|

|

292 |

|

|

|

597 |

|

|

|

150 |

|

|

– |

|

|

|

|

|

$ |

12,457,003 |

|

|

$ |

12,220,451 |

|

|

$ |

16,233 |

|

|

$ |

15,223 |

|

|

$ |

205,096 |

|

|

* |

Secured borrowings include an interest component based on contractual rates in effect at year-end. Unsecured borrowings include an interest component based on market interest rate expectations as of year-end. Obligations under interest rate swap agreements are net of variable-rate payments owed to the Company under the agreements’ terms that are based on market interest rate expectations as of year-end. |

Utilization of Long-term Investment Capital and Potential Liquidity

Capstead’s investment strategy involves managing an appropriately leveraged portfolio of ARM Agency Securities that management believes can produce attractive risk-adjusted returns over the long term, while reducing, but not eliminating, sensitivity to changes in interest rates. The potential liquidity inherent in the Company’s unencumbered residential mortgage investments is as important as the actual level of cash

12

and cash equivalents carried on the balance sheet because secured borrowings generally can be increased or decreased on a daily basis to meet cash flow requirements and otherwise manage capital resources efficiently. Potential liquidity is affected by, among other factors:

|

• |

current portfolio leverage levels, |

|

• |

changes in market value of assets pledged and interest rate swap agreements held for hedging purposes as determined by lending and swap counterparties, |

|

• |

mortgage prepayment levels, |

|

• |

collateral requirements of lending and swap counterparties, and |

|

• |

general conditions in the commercial banking and mortgage finance industries. |

The Company’s utilization of its long-term investment capital and its estimated potential liquidity were as follows as of December 31, 2016 in comparison with December 31, 2015 (in thousands):

|

|

|

Investments (a) |

|

|

Secured Borrowings |

|

|

Capital Employed |

|

|

Potential Liquidity (b) |

|

|

Portfolio Leverage |

||||

|

Balances as of December 31, 2016: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential mortgage investments |

|

$ |

13,316,282 |

|

|

$ |

12,145,346 |

|

|

$ |

1,170,936 |

|

|

$ |

560,166 |

|

|

|

|

Cash collateral receivable from swap counterparties, net (c) |

|

|

|

|

|

|

|

|

|

|

29,952 |

|

|

– |

|

|

|

|

|

Other assets, net of other liabilities |

|

|

|

|

|

|

|

|

|

|

144,889 |

|

|

|

56,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,345,777 |

|

|

$ |

616,898 |

|

|

9.02:1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances as of December 31, 2015 |

|

$ |

14,154,737 |

|

|

$ |

12,958,394 |

|

|

$ |

1,396,310 |

|

|

$ |

702,881 |

|

|

9.28:1 |

|

(a) |

Investments are stated at balance sheet carrying amounts, which generally reflect estimated fair value as of the indicated dates. |

|

(b) |

Potential liquidity is based on maximum amounts of borrowings available under existing uncommitted financing arrangements considering management’s estimate of the fair value of residential mortgage investments held as of the indicated dates adjusted for other sources of liquidity such as cash and cash equivalents. |

|

(c) |

Cash collateral receivable from swap counterparties is presented net of cash collateral payable to swap counterparties, if applicable, and the fair value of interest rate swap positions as of the indicated date. |

In order to efficiently manage its liquidity and capital resources, Capstead attempts to maintain sufficient liquidity reserves to fund borrowing and interest rate swap margin calls under stressed market conditions, including margin calls resulting from monthly principal payments (remitted to the Company 20 to 45 days after any given month-end), as well as reasonably possible declines in the market value of pledged assets and swap positions. Should market conditions deteriorate, management may reduce portfolio leverage and increase liquidity by raising new equity capital, selling mortgage securities and/or curtailing the replacement of portfolio runoff. Additionally, the Company routinely does business with a large number of lending counterparties, which bolsters financial flexibility to address challenging market conditions and limits exposure to any individual counterparty.

Future levels of portfolio leverage will be dependent on many factors, including the size and composition of the Company’s investment portfolio (see “Liquidity and Capital Resources”). During 2016 the portfolio and related secured borrowings were managed lower largely in response to a $51 million decline in long-term investment capital. Portfolio leverage ended the year down modestly. Potential liquidity declined during this period with the decline in long-term investment capital, higher haircut requirements for borrowings under repurchase arrangements relative to FHLB advances, and higher mortgage securities principal remittance receivables as a result of higher mortgage prepayment levels at year-end. Management believes current portfolio leverage levels represent an appropriate use of leverage under current market conditions for a portfolio consisting of seasoned, short-duration ARM Agency Securities.

13

Supplemental Analysis of Quarterly Financing Spreads

Quarterly financing spreads and mortgage prepayment rates were as follows for the indicated periods:

|

|

|

2016 |

|

|

2015 |

|

||||||||||||||||||||||||||

|

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

||||||||

|

Total financing spreads: (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yields on all interest-earning assets |

|

|

1.49 |

% |

|

|

1.45 |

% |

|

|

1.53 |

% |

|

|

1.69 |

% |

|

|

1.62 |

% |

|

|

1.40 |

% |

|

|

1.42 |

% |

|

|

1.66 |

% |

|

Borrowing rates on all interest- paying liabilities |

|

|

0.94 |

|

|

|

0.89 |

|

|

|

0.89 |

|

|

|

0.87 |

|

|

|

0.79 |

|

|

|

0.74 |

|

|

|

0.68 |

|

|

|

0.65 |

|

|

Total financing spreads |

|

|

0.55 |

|

|

|

0.56 |

|

|

|

0.64 |

|

|

|

0.82 |

|

|

|

0.83 |

|

|

|

0.66 |

|

|

|

0.74 |

|

|

|

1.01 |

|

|

Financing spreads on residential mortgage investments, a non- GAAP financial measure: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash yields on residential mortgage investments (b) |

|

|

2.55 |

|

|

|

2.52 |

|

|

|

2.50 |

|

|

|

2.47 |

|

|

|

2.44 |

|

|

|

2.42 |

|

|

|

2.41 |

|

|

|

2.42 |

|

|

Investment premium amortization (b) |

|

|

(1.05 |

) |

|

|

(1.06 |

) |

|

|

(0.96 |

) |

|

|

(0.75 |

) |

|

|

(0.81 |

) |

|

|

(0.99 |

) |

|

|

(0.95 |

) |

|

|

(0.72 |

) |

|

Yields on residential mortgage investments |

|

|

1.50 |

|

|

|

1.46 |

|

|

|

1.54 |

|

|

|

1.72 |

|

|

|

1.63 |

|

|

|

1.43 |

|

|

|

1.46 |

|

|

|

1.70 |

|

|

Unhedged secured borrowing rates (c) |

|

|

0.79 |

|

|

|

0.69 |

|

|

|

0.67 |

|

|

|

0.65 |

|

|

|

0.48 |

|

|

|

0.45 |

|

|

|

0.41 |

|

|

|

0.38 |

|

|

Hedged secured borrowing rates (c) |

|

|

0.95 |

|

|

|

0.93 |

|

|

|

0.96 |

|

|

|

0.93 |

|

|

|

0.87 |

|

|

|

0.84 |

|

|

|

0.77 |

|

|

|

0.75 |

|

|

Secured borrowing rates |

|

|

0.89 |

|

|

|

0.84 |

|

|

|

0.84 |

|

|

|

0.82 |

|

|

|

0.73 |

|

|

|

0.69 |

|

|

|

0.62 |

|

|

|

0.59 |

|

|

Financing spreads on residential mortgage investments |

|

|

0.61 |

|

|

|

0.62 |

|

|

|

0.70 |

|

|

|

0.90 |

|

|

|

0.90 |

|

|

|

0.74 |

|

|

|

0.84 |

|

|

|

1.11 |

|

|

Constant prepayment rate (“CPR”) |

|

|

25.59 |

|

|

|

25.80 |

|

|

|

23.19 |

|

|

|

18.23 |

|

|

|

19.62 |

|

|

|

23.21 |

|

|

|

21.98 |

|

|

|

16.66 |

|

|

(a) |

All interest-earning assets include residential mortgage investments, overnight investments and cash collateral receivable from interest rate swap counterparties. All interest-paying liabilities include unsecured borrowings and cash collateral payable to interest rate swap counterparties. |

|

(b) |

Cash yields are based on the cash component of interest income. Investment premium amortization is determined using the interest method which incorporates actual and anticipated future mortgage prepayments. Both are expressed as a percentage calculated on average amortized cost basis for the indicated periods. |

|

(c) |

Unhedged borrowing rates represent average rates on secured borrowings, before consideration of related currently-paying interest rate swap agreements. Hedged borrowing rates represent the average fixed-rate payments made on currently-paying interest rate swap agreements held for portfolio hedging purposes adjusted for differences between LIBOR-based variable-rate payments received on these swaps and unhedged borrowing rates, as well as the effects of any hedge ineffectiveness. Average fixed-rate swap payments were 0.80%, 0.75%, 0.73% and 0.69% for the fourth, third, second and first quarters of 2016, respectively, while the variable-rate payment adjustments equated to 0.15%, 0.18%, 0.23% and 0.24% on average currently-paying swap notional amounts outstanding for the same periods, respectively. During 2016 and 2015, fixed-rate swap payments averaged 0.74% and 0.57% while variable-rate payment adjustments averaged 0.20% and 0.24% on average notional amounts outstanding, respectively. |

Cash yields continue to benefit from higher coupon interest rates as mortgage loans underlying the Company’s current-reset ARM securities reset to higher rates based on higher prevailing six- and 12-month interest rate indices. The majority of these loans reset annually based on margins over indices such as 12-month LIBOR, which increased over 50 basis points per year in 2016 and 2015 to 1.69% at December 31, 2016. These increases were driven largely by market volatility associated with changing expectations regarding Federal Reserve interest rate policy that culminated in 25 basis point Federal Funds rate increases in December 2016 and 2015 and, more recently, changing market conditions associated with money market reform.

14