Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CAPSTEAD MORTGAGE CORP | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - CAPSTEAD MORTGAGE CORP | ex31_2.htm |

| EX-32 - EXHIBIT 32 - CAPSTEAD MORTGAGE CORP | ex32.htm |

| EX-31.1 - EXHIBIT 31.1 - CAPSTEAD MORTGAGE CORP | ex31_1.htm |

| EX-23 - EXHIBIT 23 - CAPSTEAD MORTGAGE CORP | ex23.htm |

| EX-12 - EXHIBIT 12 - CAPSTEAD MORTGAGE CORP | ex12.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended:

|

December 31, 2014

|

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ______________

|

Commission File Number:

|

001-08896

|

CAPSTEAD MORTGAGE CORPORATION

(Exact name of Registrant as specified in its Charter)

|

Maryland

|

75‑2027937

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

8401 North Central Expressway, Suite 800, Dallas, TX

|

75225-4404

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (214) 874-2323

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Exchange on Which Registered

|

|

Common Stock ($0.01 par value)

|

New York Stock Exchange

|

|

$7.50% Series E Cumulative Redeemable Preferred Stock ($0.10 par value)

|

New York Stock Exchange

|

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☑ NO ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ NO ☑

Indicate by check mark whether the Registrant (1) has filed all documents and reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES ☑ NO☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that Registrant was required to submit and post such files).

YES ☑ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer ☑

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☑

At June 30, 2014 the aggregate market value of the common stock held by nonaffiliates was $1,238,555,013.

Number of shares of Common Stock outstanding at February 27, 2015: 95,812,050

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Registrant’s definitive Proxy Statement, to be issued in connection with the 2015 Annual Meeting of Stockholders of the Registrant, are incorporated by reference into Part III.

CAPSTEAD MORTGAGE CORPORATION

2014 FORM 10-K ANNUAL REPORT

|

PART I

|

Page

|

|

|

ITEM 1.

|

2

|

|

|

ITEM 1A.

|

4

|

|

|

ITEM 1B.

|

4

|

|

|

ITEM 2.

|

4

|

|

|

ITEM 3.

|

4

|

|

|

ITEM 4.

|

4

|

|

|

PART II

|

||

|

ITEM 5.

|

4

|

|

|

ITEM 6.

|

6

|

|

|

ITEM 7.

|

7

|

|

|

ITEM 7A.

|

34

|

|

|

ITEM 8.

|

34

|

|

|

ITEM 9.

|

61

|

|

|

ITEM 9A.

|

61

|

|

|

ITEM 9B.

|

63

|

|

|

PART III

|

||

|

ITEM 10

|

63

|

|

|

ITEM 11.

|

63

|

|

|

ITEM 12.

|

63

|

|

|

ITEM 13.

|

63

|

|

|

ITEM 14.

|

63

|

|

|

PART IV

|

||

|

ITEM 15.

|

64

|

|

|

66

|

||

PART I

Capstead Mortgage Corporation operates as a self-managed real estate investment trust for federal income tax purposes (a “REIT”) and is based in Dallas, Texas. Unless the context otherwise indicates, Capstead Mortgage Corporation, together with its subsidiaries, is referred to as “Capstead” or the “Company.” Capstead was incorporated in the state of Maryland in 1985 and its common and preferred stocks are listed on the New York Stock Exchange under the symbols “CMO” and “CMOPRE,” respectively.

Capstead’s investment strategy involves managing an appropriately leveraged portfolio of residential mortgage pass-through securities consisting almost exclusively of relatively short-duration adjustable-rate mortgage (“ARM”) securities issued and guaranteed by government-sponsored enterprises, either Fannie Mae or Freddie Mac (together, the “GSEs”), or by an agency of the federal government, Ginnie Mae. Residential mortgage pass-through securities guaranteed by the GSEs or Ginnie Mae, referred to as “Agency Securities,” are considered to have limited, if any, credit risk because of federal government support for the GSEs. This strategy differentiates Capstead from its peers because ARM loans underlying its investment portfolio can reset to more current interest rates within a relatively short period of time. This positions the Company to benefit from a potential recovery in financing spreads that typically contract during periods of rising interest rates and can result in smaller fluctuations in portfolio values compared to portfolios containing a significant amount of longer-duration ARM and fixed-rate mortgage securities. Duration is a common measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk.

For further discussion of the Company’s business and financial condition, see Item 7 of this report, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is incorporated herein by reference.

Competition

As a residential mortgage REIT that focuses on investing in ARM Agency Securities, Capstead competes for the acquisition of suitable investments with other mortgage REITs, commercial banks, savings banks, insurance companies, and institutional investors such as private equity funds, mutual funds, pension funds and sovereign wealth funds. Many of these entities have lower yield requirements as well as greater financial resources and access to capital than the Company. Increased competition for the acquisition of ARM Agency Securities can result in higher pricing levels for such assets. In addition, the availability of ARM Agency Securities for purchase in the secondary markets varies substantially with changes in market conditions. Although higher pricing levels generally correspond to a higher book value per common share for the Company, higher prices paid for acquisitions can adversely affect portfolio yields and future profitability.

In addition, the federal government, through the Federal Reserve and the GSEs, has accumulated substantial holdings of primarily fixed-rate Agency Securities, largely in order to provide stimulus to the economy through what has been referred to as quantitative easing programs. These programs have had the effect of supporting higher pricing for the entire Agency Securities market, including pricing for ARM Agency Securities. While the Federal Reserve ceased adding to its holdings of fixed-rate Agency Securities late in 2014, it continues to provide economic stimulus by replacing portfolio runoff through open market purchases. The Federal Reserve has indicated that it intends to cease replacing portfolio runoff after it begins to raise short-term interest rates. This action, or a more dramatic reduction in government holdings of fixed-rate Agency Securities in the future, could result in lower pricing levels for Agency Securities, adversely affecting the Company’s book value per common share.

Regulation and Related Matters

Operating as a REIT investing in Agency Securities subjects Capstead to various federal tax and regulatory requirements. For further discussion, see Item 7 of this report, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” on pages 28 through 32 under the captions “Risks Related to Capstead’s Status as a REIT and Other Tax Matters” and “Risk Factors Related to Capstead’s Corporate Structure,” which is incorporated herein by reference.

Employees

As of December 31, 2014, Capstead had 13 full-time employees and one part-time employee.

Website Access to Company Reports and Other Company Information

Capstead makes available on its website at www.capstead.com, free of charge, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, investor presentations and press releases, including any amendments to such documents as soon as reasonably practicable after such materials are electronically filed or furnished to the Securities and Exchange Commission (“SEC”) or otherwise publicly released.

The SEC maintains an Internet site (www.sec.gov) through which investors may view materials filed with the SEC. Investors may also read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The Company makes available on its website charters for the committees of its board of directors, its Board of Directors’ Guidelines, its Amended and Restated Bylaws, its Code of Business Conduct and Ethics, its Financial Code of Professional Conduct and other information, including amendments to such documents and waivers, if any, to the codes. Such information will also be furnished, free of charge, upon written request to Capstead Mortgage Corporation, Attention: Stockholder Relations, 8401 North Central Expressway, Suite 800, Dallas, Texas 75225-4404.

Cautionary Statement Concerning Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Forward-looking statements are based largely on the expectations of management and are subject to a number of risks and uncertainties including, but not limited to, the following:

| • | changes in general economic conditions; |

| • | fluctuations in interest rates and levels of mortgage prepayments; |

| • | the effectiveness of risk management strategies; |

| • | the impact of differing levels of leverage employed; |

| • | liquidity of secondary markets and credit markets; |

| • | the availability of financing at reasonable levels and terms to support investing on a leveraged basis; |

| • | the availability of new investment capital; |

| • | the availability of suitable qualifying investments from both an investment return and regulatory perspective; |

| • | changes in legislation or regulation affecting the GSEs, Ginnie Mae and similar federal government agencies and related guarantees; |

|

•

|

other changes in legislation or regulation affecting the mortgage and banking industries;

|

| • | changes in market conditions as a result of Federal Reserve monetary policy or federal government fiscal challenges; |

| • | deterioration in credit quality and ratings of existing or future issuances of GSE or Ginnie Mae securities; |

| • | changes in legislation or regulation affecting exemptions for mortgage REITs from regulation under the Investment Company Act of 1940; and |

| • | increases in costs and other general competitive factors. |

In addition to the above considerations, actual results and liquidity are affected by other risks and uncertainties which could cause actual results to be significantly different from those expressed or implied by any forward-looking statements included herein. It is not possible to identify all of the risks, uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Forward-looking statements speak only as of the date the statement is made and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein.

Under the captions “Risk Factors” and “Critical Accounting Policies” on pages 23 through 32 and 32 through 33, respectively, of Item 7 are discussions of risk factors and critical accounting policies affecting Capstead’s financial condition and results of operations that are an integral part of this report. Readers are strongly urged to consider the potential impact of these factors and accounting policies on the Company while reading this document.

None.

Capstead’s headquarters are located in Dallas, Texas in office space leased by the Company.

None.

Not applicable.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The New York Stock Exchange trading symbol for Capstead’s common stock is CMO. As of December 31, 2014, the Company had 1,201 common stockholders of record and depository companies held shares of common stock for 49,462 beneficial owners.

The high and low sales prices and dividends declared on Capstead’s common stock were as follows:

|

Year ended December 31, 2014

|

Year ended December 31, 2013

|

|||||||||||||||||||||||

|

Sales Prices

|

Dividends

|

Sales Prices

|

Dividends

|

|||||||||||||||||||||

|

High

|

Low

|

Declared

|

High

|

Low

|

Declared

|

|||||||||||||||||||

|

First quarter

|

$

|

13.15

|

$

|

11.97

|

$

|

0.34

|

$

|

13.22

|

$

|

11.62

|

$

|

0.31

|

||||||||||||

|

Second quarter

|

13.43

|

12.52

|

0.34

|

13.28

|

11.67

|

0.31

|

||||||||||||||||||

|

Third quarter

|

13.32

|

12.20

|

0.34

|

12.52

|

11.08

|

0.31

|

||||||||||||||||||

|

Fourth quarter

|

13.14

|

12.24

|

0.34

|

12.54

|

11.25

|

0.31

|

||||||||||||||||||

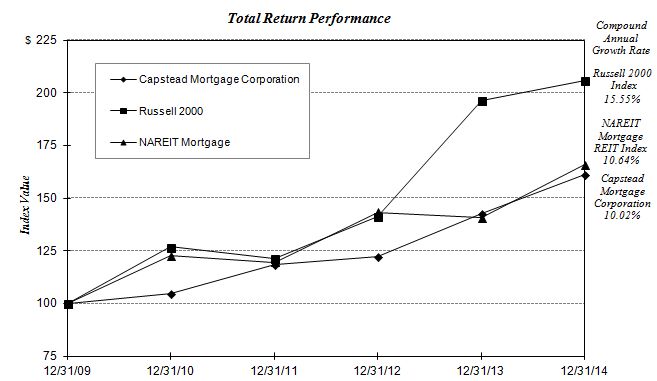

Set forth below is a graph comparing the yearly percentage change in the cumulative total return on Capstead’s common stock, with the cumulative total return of the Russell 2000 Index and the NAREIT Mortgage REIT Index for the five years ended December 31, 2014 assuming the investment of $100 on December 31, 2009 and the reinvestment of dividends. The stock price and dividend performance reflected in the graph is not necessarily indicative of future performance.

|

Year ended December 31

|

||||||||||||||||||||||||

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

|||||||||||||||||||

|

Capstead Mortgage Corporation

|

$

|

100.00

|

$

|

104.61

|

$

|

118.65

|

$

|

122.51

|

$

|

142.66

|

$

|

161.21

|

||||||||||||

|

Russell 2000 Index

|

100.00

|

126.86

|

121.56

|

141.43

|

196.34

|

205.95

|

||||||||||||||||||

|

NAREIT Mortgage REIT Index

|

100.00

|

122.60

|

119.63

|

143.43

|

140.62

|

165.76

|

||||||||||||||||||

See Item 11 of this report for information regarding equity compensation plans which is incorporated herein by reference. Capstead did not issue any unregistered securities during the past three fiscal years.

This table summarizes selected financial information, including key operating data (in thousands, except percentages, ratios and per share data). For additional information, refer to the audited consolidated financial statements and notes thereto included under Item 8 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included under Item 7 of this report.

|

As of or for the year ended December 31

|

||||||||||||||||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||||||||

|

Selected statement of income data:

|

||||||||||||||||||||

|

Interest income on residential mortgage investments (before investment premium amortization)

|

$

|

328,621

|

$

|

341,009

|

$

|

352,608

|

$

|

311,154

|

$

|

256,069

|

||||||||||

|

Investment premium amortization

|

(101,872

|

)

|

(125,872

|

)

|

(96,677

|

)

|

(68,077

|

)

|

(57,581

|

)

|

||||||||||

|

Related interest expense

|

(65,155

|

)

|

(66,368

|

)

|

(69,101

|

)

|

(57,328

|

)

|

(47,502

|

)

|

||||||||||

|

161,594

|

148,769

|

186,830

|

185,749

|

150,986

|

||||||||||||||||

|

Other interest income (expense) (a)

|

(8,173

|

)

|

(8,165

|

)

|

(7,790

|

)

|

(8,192

|

)

|

(7,200

|

)

|

||||||||||

|

153,421

|

140,604

|

179,040

|

177,557

|

143,786

|

||||||||||||||||

|

Other revenue (expense)

|

(12,601

|

)

|

(14,117

|

)

|

(15,414

|

)

|

(17,353

|

)

|

(16,890

|

)

|

||||||||||

|

Net income

|

$

|

140,820

|

$

|

126,487

|

$

|

163,626

|

$

|

160,204

|

$

|

126,896

|

||||||||||

|

Net income per diluted common share (b)

|

$

|

1.33

|

$

|

0.93

|

$

|

1.50

|

$

|

1.75

|

$

|

1.52

|

||||||||||

|

Cash dividends per share of common stock

|

1.36

|

1.24

|

1.49

|

1.76

|

1.51

|

|||||||||||||||

|

Average diluted common stock outstanding

|

95,629

|

95,393

|

95,012

|

79,696

|

69,901

|

|||||||||||||||

|

Selected balance sheet data:

|

||||||||||||||||||||

|

Residential mortgage investments

|

$

|

13,908,104

|

$

|

13,475,874

|

$

|

13,860,158

|

$

|

12,264,906

|

$

|

8,515,691

|

||||||||||

|

Total assets

|

14,389,069

|

14,015,968

|

14,469,263

|

12,844,622

|

8,999,362

|

|||||||||||||||

|

Repurchase arrangements and similar borrowings

|

12,806,843

|

12,482,900

|

12,784,238

|

11,352,444

|

7,792,743

|

|||||||||||||||

|

Long-term investment capital (“LTIC”):

|

||||||||||||||||||||

|

Unsecured borrowings (net of related investments in statutory trusts prior to dissolution in December 2013)

|

100,000

|

100,000

|

99,978

|

99,978

|

99,978

|

|||||||||||||||

|

Preferred stockholders’ equity

|

183,936

|

165,756

|

188,992

|

184,514

|

179,323

|

|||||||||||||||

|

Common stockholders’ equity

|

1,206,835

|

1,200,027

|

1,308,133

|

1,108,193

|

848,102

|

|||||||||||||||

|

Book value per common share (unaudited)

|

12.52

|

12.47

|

13.58

|

12.52

|

12.02

|

|||||||||||||||

|

Key operating data: (unaudited)

|

||||||||||||||||||||

|

Portfolio acquisitions (principal amount)

|

$

|

3,191,256

|

$

|

3,187,534

|

$

|

4,206,459

|

$

|

5,673,803

|

$

|

3,299,600

|

||||||||||

|

Portfolio runoff (principal amount)

|

2,801,144

|

3,483,756

|

2,784,687

|

2,127,812

|

2,932,978

|

|||||||||||||||

|

Common equity capital raised

|

–

|

–

|

142,036

|

231,673

|

10,423

|

|||||||||||||||

|

Common stock repurchases

|

–

|

7,292

|

35,062

|

–

|

–

|

|||||||||||||||

|

Year-end portfolio leverage ratio (c)

|

8.59:1

|

8.52:1

|

8.00:1

|

8.15:1

|

6.91:1

|

|||||||||||||||

|

Average financing spreads on residentialmortgage investments (d)

|

1.17

|

%

|

1.07

|

%

|

1.38

|

%

|

1.68

|

%

|

1.93

|

%

|

||||||||||

|

Average total financing spreads (d)

|

1.06

|

0.96

|

1.26

|

1.56

|

1.74

|

|||||||||||||||

|

Average mortgage prepayment rates, (expressed as constant prepayment rates, or CPRs)

|

17.28

|

21.45

|

17.60

|

16.58

|

29.47

|

|||||||||||||||

|

Return on average LTIC

|

9.95

|

8.72

|

10.98

|

13.14

|

12.08

|

|||||||||||||||

|

Return on average common equity capital

|

10.37

|

7.08

|

11.15

|

13.94

|

12.68

|

|||||||||||||||

|

(a)

|

Consists principally of interest on unsecured borrowings and is presented net of earnings of related statutory trusts prior to dissolution in December 2013.

|

|

(b)

|

Net income per diluted common share in 2013 includes reductions in net income available to common stockholders totaling $0.23 related to convertible preferred stock redemption preference premiums paid and dividends accruing on then-outstanding shares of convertible preferred stock from the May 2013 issue date of the Company’s Series E preferred stock through the June 2013 redemption of the convertible preferred stock. See Item 7 pages 8 and 14 for further discussion.

|

|

(c)

|

Year-end portfolio leverage ratios were calculated by dividing repurchase arrangements and similar borrowings by long-term investment capital.

|

|

(d)

|

Financing spreads on residential mortgage investments is a non-GAAP financial measure based solely on yields on Capstead’s residential mortgage investments, net of borrowing rates on repurchase arrangements and similar borrowings, adjusted for currently-paying interest rate swap agreements held for hedging purposes. This measure differs from total financing spreads, an all-inclusive GAAP measure that includes yields on all interest-earning assets, as well as rates paid on all interest-bearing liabilities, principally unsecured borrowings. See Item 7 page 14 for reconciliations of these measures and the Company’s rationale for using this non-GAAP financial measure.

|

Overview

Capstead operates as a self-managed REIT and earns income from investing in a leveraged portfolio of residential mortgage pass-through securities consisting almost exclusively of short-duration ARM Agency Securities, which are considered to have limited, if any, credit risk and reset to more current interest rates within a relatively short period of time. Capstead’s strategy of investing in ARM Agency Securities positions the Company to benefit from potential recoveries in financing spreads that typically contract during periods of rising interest rates and experience smaller fluctuations in portfolio values compared to leveraged portfolios containing a significant amount of longer-duration ARM or fixed-rate mortgage securities. Duration is a common measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk.

Capstead finances its portfolio of ARM Agency Securities with borrowings under repurchase arrangements with commercial banks and other financial institutions (referred to as “repo” borrowings) supported by its long-term investment capital. As of December 31, 2014, long-term investment capital totaled $1.49 billion and consisted of $1.21 billion of common and $184 million of perpetual preferred stockholders’ equity (recorded amounts) and $100 million of unsecured borrowings that mature in 2035 and 2036. Long-term investment capital increased by $25 million during 2014 primarily as a result of higher portfolio pricing levels and Series E preferred capital raised using an at-the-market continuous offering program, partially offset by lower pricing levels for interest rate swap agreements held for hedging purposes and dividend distributions in excess of earnings.

Capstead’s holdings of residential mortgage investments increased by $432 million during 2014 to $13.91 billion, with portfolio acquisitions exceeding portfolio runoff by $390 million (principal amount) and the remainder primarily attributable to an increase in overall portfolio pricing levels. Repo borrowings increased by $324 million during 2014 to $12.81 billion. Portfolio leverage (repo borrowings divided by long-term investment capital) increased to 8.59 to one at December 31, 2014 from 8.52 to one at December 31, 2013. Management believes borrowing at current levels represents an appropriate and prudent use of leverage for a portfolio consisting of seasoned, short-duration ARM Agency Securities.

Capstead’s net income totaled $141 million or $1.33 per diluted common share for the year ended December 31, 2014, compared to $126 million or $0.93 per diluted common share in 2013. Net income per diluted common share for 2013 includes reductions in net income available to common stockholders totaling $0.23 per diluted common share pertaining to redemption preference premiums paid and other effects of second quarter 2013 preferred capital transactions. See pages 8 and 14 for further information.

Earnings were higher in 2014 reflecting improved net interest margins primarily as a result of $24 million in lower investment premium amortization reflecting lower mortgage prepayment rates, partially offset by lower cash yields on the portfolio and slightly lower borrowing costs. Lower mortgage prepayment rates reflected higher prevailing mortgage interest rates during 2014 compared to rates that were available during the first half of 2013, which has made it less economically advantageous for borrowers to refinance. Cash yields declined because of the effects of ARM loan coupon interest rates resetting lower to more current rates as well as lower coupon interest rates on acquisitions. Lower short-term incentive compensation costs also contributed to higher earnings in 2014.

Financing spreads on residential mortgage investments averaged 1.17% during 2014, compared to 1.07% during 2013. Financing spreads on residential mortgage investments is a non-GAAP financial measure based solely on yields on residential mortgage investments, net of repo borrowing rates, adjusted for currently-paying interest rate swap agreements held for hedging purposes. This measure differs from total financing spreads, an all-inclusive GAAP measure that includes yields on all interest-earning assets,as well as rates paid on all interest-bearing liabilities, principally unsecured borrowings. See page 14 for a reconciliation of these GAAP and non-GAAP financial measures. Yields on residential mortgage investments improved ten basis points to average 1.69% during 2014, reflecting 17 basis points in lower yield adjustments for investment premium amortization offset by seven basis points in lower cash yields. Repo borrowing rates, adjusted for currently-paying interest rate swap agreements held for hedging purposes, were lower by less than one basis point, averaging 0.52% during 2014.

Capstead remains a leader among its mortgage REIT peers in terms of operating efficiency. Operating costs (salaries and benefits, incentive compensation and other general and administrative expense) expressed as an annualized percentage of long-term investment capital averaged 0.83% for 2014, six basis points lower than in 2013, primarily reflecting lower short-term incentive compensation costs.

The size and composition of Capstead’s investment portfolio depends on investment strategies being implemented by management, as well as overall market conditions, including the availability of attractively priced investments and suitable financing to leverage the Company’s investment capital. Market conditions are influenced by, among other things, current and future expectations for short-term interest rates, mortgage prepayments and market liquidity.

Risk Factors and Critical Accounting Policies

Under the captions “Risk Factors” and “Critical Accounting Policies” are discussions of risk factors and critical accounting policies affecting Capstead’s financial condition and earnings that are an integral part of this discussion and analysis. Readers are strongly urged to consider the potential impact of these factors and accounting policies on the Company and its financial results.

Capital Transactions

In 2013 Capstead redeemed its then-outstanding convertible preferred stock using $164 million in net proceeds from a public offering of 6.8 million shares ($170 million face amount) of its 7.50% Series E Cumulative Redeemable Preferred Stock, liquidation preference $25.00 per share, together with $43 million of cash on hand. The convertible preferred stock that was redeemed had redemption preferences aggregating $207 million, a total of approximately $20 million in excess of these shares’ recorded amounts on the balance sheet. This redemption preference premium is reflected as a reduction in net income available to common stockholders for the year ended December 31, 2013.

In late 2013 the Company began issuing additional shares of Series E preferred stock through an at-the-market continuous offering program. During the year ended December 31, 2014, the Company issued 757,000 shares of Series E preferred stock at an average price of $24.01, net of expenses, for net proceeds of $18 million under this program. Another 222,000 shares of Series E preferred stock were issued subsequent to year-end through February 27, 2015 at an average price of $24.65, net of expenses, for net proceeds of $5 million.

Additional amounts of Series E preferred capital and new common equity capital may be raised in the future under continuous offering programs or by other means, subject to market conditions, compliance with federal securities laws and blackout periods associated with the dissemination of earnings and dividend announcements and other important Company-specific news.

Book Value per Common Share

Nearly all of Capstead’s residential mortgage investments and all of its interest rate swap agreements are reflected at fair value on the Company’s balance sheet and are therefore included in the calculation of book value per common share (total stockholders’ equity, less liquidation preferences for outstanding shares of preferred stock, divided by outstanding shares of common stock). Fair value is impacted by market conditions, including changes in interest rates, and the availability of financing at reasonable rates and leverage levels, among other factors. The Company’s investment strategy attempts to mitigate these risks by focusing on investments in Agency Securities, which are considered to have little, if any, credit risk and are collateralized by ARM loans with interest rates that reset periodically to more current levels generally within five years. Because of these characteristics, the fair value of the Company’s portfolio is considerably less vulnerable to significant pricing declines caused by credit concerns or rising interest rates compared to leveraged portfolios containing a significant amount of non-agency securities or longer-duration ARM and/or fixed-rate Agency Securities.

The following table illustrates the progression of Capstead’s book value per common share as well as changes in book value expressed as percentages of beginning book value for the indicated periods:

|

As of and for the year ended December 31

|

||||||||||||||||||||||||

|

2014

|

2013

|

2012

|

||||||||||||||||||||||

|

Book value per common share, beginning of year

|

$

|

12.47

|

$

|

13.58

|

$

|

12.52

|

||||||||||||||||||

|

Change in unrealized gains and losses on mortgage securities classified as available-for-sale

|

0.28

|

(1.05

|

)

|

0.95

|

||||||||||||||||||||

|

Change in unrealized gains and losses on interest rate swap agreements designated as cash flow hedges of: Repo borrowings

|

0.06

|

0.08

|

(0.04

|

)

|

||||||||||||||||||||

|

Unsecured borrowings

|

(0.26

|

)

|

0.19

|

0.02

|

||||||||||||||||||||

|

0.08

|

0.6

|

%

|

(0.78

|

)

|

(5.8

|

)%

|

0.93

|

7.4

|

%

|

|||||||||||||||

|

One-time effects of second quarter 2013 preferred capital transactions

|

–

|

(0.28

|

)

|

–

|

||||||||||||||||||||

|

Other capital transactions:

|

||||||||||||||||||||||||

|

Dividend distributions in excess of core earnings available to common stockholders*

|

(0.04

|

)

|

(0.08

|

)

|

(0.01

|

)

|

||||||||||||||||||

|

(Dilution) accretion from capital raises

|

(0.01

|

)

|

–

|

0.12

|

||||||||||||||||||||

|

Accretion from common stock repurchases

|

–

|

0.01

|

0.02

|

|||||||||||||||||||||

|

Accretion related to stock awards

|

0.02

|

0.02

|

–

|

|||||||||||||||||||||

|

(0.03

|

)

|

(0.2

|

)%

|

(0.33

|

)

|

(2.4

|

)%

|

0.13

|

1.1

|

%

|

||||||||||||||

|

Book value per common share, end of year

|

$

|

12.52

|

$

|

12.47

|

$

|

13.58

|

||||||||||||||||||

|

Change in book value per common share during the indicated year

|

$

|

0.05

|

0.4

|

%

|

$

|

(1.11

|

)

|

(8.2

|

)%

|

$

|

1.06

|

8.5

|

%

|

|||||||||||

| * | Core earnings available to common stockholders is a non-GAAP financial measure that differs from net income available to common stockholders by excluding $0.23 in redemption preference premiums paid and other effects of the second quarter 2013 preferred capital transactions. See page 14 for a reconciliation of these financial measures and the Company’s rationale for using this non-GAAP financial measure. |

Residential Mortgage Investments

Capstead’s investment strategy focuses on managing a large portfolio of residential mortgage investments consisting almost exclusively of ARM Agency Securities. Agency Securities are considered to have limited, if any, credit risk because the timely payment of principal and interest is guaranteed by the GSEs, which are federally chartered corporations, or Ginnie Mae, which is an agency of the federal government. Federal government support for the GSEs has largely alleviated market concerns regarding the ability of the GSEs to fulfill their guarantee obligations.

ARM securities are backed by residential mortgage loans that have coupon interest rates that adjust at least annually to more current interest rates or begin doing so after an initial fixed-rate period. After the initial fixed-rate period, if applicable, the coupon interest rates of mortgage loans underlying the Company’s ARM securities typically adjust either:

| • | annually based on specified margins over the one-year Constant Maturity U.S. Treasury Note Rate (“CMT”) or the one-year London interbank offered rate (“LIBOR”), |

| • | semiannually based on specified margins over six-month LIBOR, or |

| • | monthly based on specified margins over indices such as one-month LIBOR, the Eleventh District Federal Reserve Bank Cost of Funds Index, or over a rolling twelve month average of the one-year CMT index. |

These coupon interest rate adjustments are usually subject to periodic and lifetime limits, or caps, on the amount of such adjustments during any single interest rate adjustment period and over the contractual term of the underlying loans.

By focusing on investing in short-duration ARM Agency Securities, changes in fair value caused by changes in interest rates are typically relatively modest compared to changes in fair value of investments in longer-duration ARM or fixed-rate assets. Declines in fair value caused by increases in interest rates are generally recoverable in a relatively short period of time as coupon interest rates on the underlying mortgage loans reset to rates more reflective of the then current interest rate environment. This investment strategy positions the Company to benefit from potential recoveries in financing spreads that typically contract during periods of rising interest rates.

The following table illustrates the progression of Capstead’s portfolio of residential mortgage investments for the indicated periods (dollars in thousands):

|

As of and for the year ended December 31

|

||||||||||||

|

2014

|

2013

|

2012

|

||||||||||

|

Residential mortgage investments, beginning of year

|

$

|

13,475,874

|

$

|

13,860,158

|

$

|

12,264,906

|

||||||

|

Increase (decrease) in net unrealized gains on securities classified as available-for-sale

|

27,283

|

(101,001

|

)

|

91,750

|

||||||||

|

Portfolio acquisitions (principal amount) at average lifetime purchased yields of 2.44%, 2.28% and 2.17%, respectively

|

3,191,256

|

3,187,534

|

4,206,459

|

|||||||||

|

Investment premiums on acquisitions*

|

116,707

|

138,811

|

178,407

|

|||||||||

|

Portfolio runoff (principal amount)

|

(2,801,144

|

)

|

(3,483,756

|

)

|

(2,784,687

|

)

|

||||||

|

Investment premium amortization*

|

(101,872

|

)

|

(125,872

|

)

|

(96,677

|

)

|

||||||

|

Residential mortgage investments, end of year

|

$

|

13,908,104

|

$

|

13,475,874

|

$

|

13,860,158

|

||||||

| * | Residential mortgage investments typically are acquired at a premium to the securities’ unpaid principal balances. Investment premiums are recognized in earnings as portfolio yield adjustments using the interest method over the estimated lives of the related investments. As such, the level of mortgage prepayments impacts how quickly investment premiums are amortized. |

Capstead classifies its ARM securities based on the average length of time until the loans underlying each security reset to more current rates (“months-to-roll”) (less than 18 months for “current-reset” ARM securities, and 18 months or greater for “longer-to-reset” ARM securities). After consideration of any applicable initial fixed-rate periods, at December 31, 2014 approximately 86%, 9% and 5% of the Company’s ARM securities were backed by mortgage loans that reset annually, semi-annually and monthly, respectively. Approximately 80% of the Company’s current-reset ARM securities have reached an initial coupon reset date, while none of its longer-to-reset ARM securities have reached an initial coupon reset date. Additionally, at December 31, 2014 approximately 12% of the Company’s ARM securities were backed by interest-only loans, with remaining interest-only payment periods of up to nine years. All percentages are based on averages of the characteristics of mortgage loans underlying each security and calculated using unpaid principal balances as of the indicated date. The Company’s ARM holdings featured the following characteristics at December 31, 2014 (dollars in thousands):

|

ARM Type

|

Amortized

Cost Basis (a)

|

Net

WAC (b)

|

Fully

Indexed

WAC (b)

|

Average

Net

Margins (b)

|

Average

Periodic

Caps (b)

|

Average

Lifetime

Caps (b)

|

Months

To

Roll

|

|||||||||||||||||||||

|

Current-reset ARMs:

|

||||||||||||||||||||||||||||

|

Fannie Mae Agency Securities

|

$

|

4,362,189

|

2.26

|

%

|

2.14

|

%

|

1.70

|

%

|

3.28

|

%

|

9.93

|

%

|

5.6

|

|||||||||||||||

|

Freddie Mac Agency Securities

|

1,647,969

|

2.38

|

2.23

|

1.82

|

2.35

|

10.27

|

7.0

|

|||||||||||||||||||||

|

Ginnie Mae Agency Securities

|

1,652,852

|

2.46

|

1.62

|

1.51

|

1.06

|

8.48

|

8.1

|

|||||||||||||||||||||

|

Residential mortgage loans

|

3,059

|

3.38

|

2.23

|

2.03

|

1.57

|

10.98

|

4.7

|

|||||||||||||||||||||

|

(56% of total)

|

7,666,069

|

2.33

|

2.05

|

1.69

|

2.60

|

9.69

|

6.4

|

|||||||||||||||||||||

|

Longer-to-reset ARMs:

|

||||||||||||||||||||||||||||

|

Fannie Mae Agency Securities

|

2,607,355

|

2.78

|

2.25

|

1.69

|

4.42

|

7.79

|

38.3

|

|||||||||||||||||||||

|

Freddie Mac Agency Securities

|

1,941,687

|

2.85

|

2.30

|

1.74

|

3.72

|

7.92

|

41.7

|

|||||||||||||||||||||

|

Ginnie Mae Agency Securities

|

1,434,718

|

2.83

|

1.62

|

1.51

|

1.10

|

7.91

|

38.8

|

|||||||||||||||||||||

|

(44% of total)

|

5,983,760

|

2.82

|

2.11

|

1.66

|

3.40

|

7.86

|

39.5

|

|||||||||||||||||||||

|

$

|

13,649,829

|

2.54

|

2.08

|

1.68

|

2.95

|

8.89

|

20.9

|

|||||||||||||||||||||

|

Gross WAC (rate paid by borrowers) (c)

|

3.15

|

|||||||||||||||||||||||||||

| (a) | Amortized cost basis represents the Company’s investment (unpaid principal balance plus unamortized investment premiums) before unrealized gains and losses. At December 31, 2014, the ratio of amortized cost basis to unpaid principal balance for the Company’s ARM holdings was 103.27. This table excludes $6 million in fixed-rate Agency Securities, residential mortgage loans and private residential mortgage pass-through securities held as collateral for structured financings. |

| (b) | Net WAC, or weighted average coupon, is the weighted average interest rate of the mortgage loans underlying the indicated investments, net of servicing and other fees as of the indicated date. Net WAC is expressed as a percentage calculated on an annualized basis on the unpaid principal balances of the mortgage loans underlying these investments. Fully indexed WAC represents the weighted average coupon upon one or more resets using interest rate indexes and net margins as of the indicated date. Average net margins represent the weighted average levels over the underlying indexes that the portfolio can adjust to upon reset, usually subject to initial, periodic and/or lifetime caps on the amount of such adjustments during any single interest rate adjustment period and over the contractual term of the underlying loans. ARM securities issued by the GSEs with initial fixed-rate periods of five years or longer typically have either 200 or 500 basis point initial caps with 200 basis point periodic caps. Additionally, certain ARM securities held by the Company are subject only to lifetime caps or are not subject to a cap. For presentation purposes, average periodic caps in the table above reflect initial caps until after an ARM security has reached its initial reset date and lifetime caps, less the current net WAC, for ARM securities subject only to lifetime caps. At year-end, 69% of current-reset ARMs were subject to periodic caps averaging 1.80%; 20% were subject to initial caps averaging 2.66%; 10% were subject to lifetime caps averaging 7.69%; and 1% were not subject to a cap. All longer-to-reset ARM securities at December 31, 2014 were subject to initial caps. |

| (c) | Gross WAC is the weighted average interest rate of the mortgage loans underlying the indicated investments, including servicing and other fees paid by borrowers, as of the indicated balance sheet date. |

Capstead pledges its residential mortgage investments as collateral under repurchase arrangements with commercial banks and other financial institutions, referred to as counterparties, the terms and conditions of which are negotiated on a transaction-by-transaction basis when each such repo borrowing is initiated or renewed. None of the Company’s counterparties are obligated to renew or otherwise enter into new repurchase transactions at the conclusion of existing repurchase transactions. Repurchase arrangements entered into by the Company involve the sale and a simultaneous agreement to repurchase the transferred assets at a future date, routinely with terms of 30 to 90 days, and are accounted for as borrowings by the Company. The Company maintains the beneficial interest in the specific securities pledged during each borrowing’s term and receives the related principal and interest payments. The amount borrowed is generally equal to the fair value of the securities pledged, as determined by the lending counterparty, less an agreed-upon discount, referred to as a “haircut.” Haircuts on outstanding repo borrowings averaged 4.5 percent and ranged from 3.0 to 5.0 percent of the fair value of pledged residential mortgage pass-through securities at December 31, 2014, little changed from the prior year. After considering haircuts and related interest receivable on the collateral, as well as interest payable on these borrowings, the Company had $702 million of capital at risk with its lending counterparties at December 31, 2014. The Company did not have capital at risk with any single counterparty exceeding 4.0% at December 31, 2014.

Repo borrowing rates are fixed based on prevailing rates corresponding to the terms of the borrowings, and interest is paid at the termination of a repurchase arrangement at which time the Company may enter into a new repurchase arrangement at prevailing haircuts and rates with the same counterparty or repay that counterparty and negotiate financing with a different counterparty. When the fair value of pledged securities declines due to changes in market conditions or the publishing of monthly security pay down factors, lenders typically require the Company to post additional securities as collateral, pay down borrowings or fund cash margin accounts with the counterparties in order to re-establish the agreed-upon collateral requirements, referred to as margin calls. Conversely, if collateral fair values increase, lenders are required to release collateral back to the Company pursuant to Company-issued margin calls.

As of December 31, 2014 the Company’s repo borrowings totaled $12.81 billion with 27 counterparties at average rates of 0.38%, before the effects of interest rate swap agreements held as cash flow hedges and 0.58% including the effects of these derivatives. To help mitigate exposure to higher short-term interest rates and to secure longer-term, committed financing, Capstead may enter into longer-dated repurchase arrangements if available at attractive rates and terms. To this end, during the third and fourth quarters of 2014 the Company entered into $1.78 billion in 12- to 18-month repo borrowings at average rates of 0.56%.

To further reduce exposure to higher short-term interest rates, the Company uses currently-paying and forward-starting, one-month LIBOR-indexed, pay-fixed, receive-variable, interest rate swap agreements that require interest payments for two-year terms. Variable payments received by the Company under these swap agreements offset a significant portion of the interest accruing on a like amount of the Company’s 30- to 90-day repo borrowings. As a result, the Company’s effective borrowing rate for these borrowings consists of fixed-rate payments made on the swap agreements adjusted for differences between variable rate payments received on the swap agreements and related actual repo borrowing rates, as well as the effects of measured hedge ineffectiveness.

At December 31, 2014, the Company held portfolio financing-related swap agreements totaling $7.70 billion notional amount with average contract expirations of 12 months. These swap positions consisted of (a) $7.20 billion notional amount in currently-paying swap agreements requiring the payment of fixed rates of interest averaging 0.51% for average remaining interest-payment terms of 12 months and (b) $500 million notional amount in forward-starting swap agreements that will begin requiring fixed rate interest payments averaging 0.72% for two-year periods commencing in January 2015, with average contract expirations of 24 months.

The Company entered into new forward-starting swap agreements during 2014 with notional amounts totaling $2.30 billion requiring fixed rate interest payments averaging 0.62% for two-year periods commencing on various dates between April 2014 and January 2015. Also during 2014, $1.30 billion notional amount of swaps requiring fixed rate interest payments averaging 0.55% matured, while $4.30 billion notional amount of previously acquired forward-starting swaps requiring fixed rate interest payments averaging 0.54% moved into current-pay status.

After consideration of all portfolio financing-related swap positions entered into as of year-end, the Company’s residential mortgage investments and related repo borrowings had estimated durations at December 31, 2014 of 11¼ and 9 months, respectively, for a net duration gap of approximately 2¼ months – see pages 21 and 22 under the caption “Interest Rate Risk” for further information about the Company’s sensitivity to changes in market interest rates. The Company intends to continue to manage interest rate risk associated with holding and financing is residential mortgage investments by utilizing suitable derivative financial instruments such as interest rate swap agreements as well as longer-dated repo borrowings if available at attractive terms.

Analysis of Quarterly Financing Spreads

Components of quarterly financing spreads on residential mortgage investments, a non-GAAP financial measure, and mortgage prepayment rates, were as follows for the indicated periods:

|

2014

|

2013

|

|||||||||||||||||||||||||||||||

|

Q4

|

Q3

|

Q2

|

Q1

|

Q4

|

Q3

|

Q2

|

Q1

|

|||||||||||||||||||||||||

|

Yields on residential mortgage investments:(a)

|

||||||||||||||||||||||||||||||||

|

Cash yields

|

2.43

|

%

|

2.44

|

%

|

2.46

|

%

|

2.46

|

%

|

2.48

|

%

|

2.50

|

%

|

2.52

|

%

|

2.57

|

%

|

||||||||||||||||

|

Investment premium amortization

|

(0.77

|

)

|

(0.84

|

)

|

(0.75

|

)

|

(0.67

|

)

|

(0.74

|

)

|

(1.14

|

)

|

(0.99

|

)

|

(0.84

|

)

|

||||||||||||||||

|

Adjusted yields

|

1.66

|

1.60

|

1.71

|

1.79

|

1.74

|

1.36

|

1.53

|

1.73

|

||||||||||||||||||||||||

|

Related borrowing rates:(b)

|

||||||||||||||||||||||||||||||||

|

Repo borrowing rates

|

0.36

|

0.32

|

0.32

|

0.34

|

0.38

|

0.37

|

0.39

|

0.41

|

||||||||||||||||||||||||

|

Fixed swap rates

|

0.51

|

0.50

|

0.49

|

0.50

|

0.52

|

0.59

|

0.65

|

0.71

|

||||||||||||||||||||||||

|

Adjusted borrowing rates

|

0.56

|

0.51

|

0.49

|

0.49

|

0.49

|

0.49

|

0.53

|

0.58

|

||||||||||||||||||||||||

|

Financing spreads on residential mortgage investments(c)

|

1.10

|

1.09

|

1.22

|

1.30

|

1.25

|

0.87

|

1.00

|

1.15

|

||||||||||||||||||||||||

|

CPR

|

17.58

|

19.18

|

17.22

|

15.16

|

17.14

|

25.49

|

23.12

|

20.05

|

||||||||||||||||||||||||

| (a) | Cash yields are based on the cash component of interest income. Investment premium amortization is determined using the interest method which incorporates actual and anticipated future mortgage prepayments. Both are expressed as a percentage calculated on an annualized basis on average amortized cost basis for the indicated periods. |

| (b) | Repo borrowing rates represent average rates on repurchase agreements and similar borrowings, before consideration of related currently-paying interest rate swap agreements. |

Fixed swap rates represent the average fixed-rate payments made on currently-paying interest rate swap agreements held for portfolio hedging purposes and exclude effects of the spread between LIBOR-based variable-rate payments received on these swaps and designated 30- to 90-day repo borrowing rates, as well as the effects of any hedge ineffectiveness. These effects averaged 18 and 19 basis points on average currently-paying swap notional amounts outstanding during 2014 and 2013, respectively.

Adjusted borrowing rates reflect repo borrowing rates, fixed swap rates and the above-mentioned differences. All rates presented are expressed as a percentage calculated on an annualized basis for the indicated periods.

| (c) | See page 14 for the Company’s rationale for using this non-GAAP financial measure and a reconciliation to its related GAAP financial measure, total financing spreads. |

Declines in cash yields have been muted in recent quarters as coupon interest rates on more of the loans underlying the portfolio reset to fully-indexed levels. Investment premium amortization is primarily driven by changes in mortgage prepayment rates and investment premium levels. During the first three quarters of 2013 the Company experienced relatively high levels of mortgage prepayments driven by improving housing markets and the availability of generationally-low mortgage interest rates that made it economically advantageous for mortgagors to refinance. Mortgage prepayment rates began declining in September 2013 and reached a two-year low in the first quarter of 2014 largely because of higher prevailing mortgage interest rates as well as seasonal factors. Average quarterly mortgage prepayment rates increased in both the second and third quarters of 2014 in large part due to seasonal factors. In 2014 mortgage prepayment rates peaked in August at a CPR of 20.05% before beginning to recede in September reflecting the end of the summer selling season. The cost basis of the portfolio (expressed as a ratio of amortized cost basis to unpaid principal balance) remained fairly stable during 2014, having increased less than 2 basis points during the year to 103.27 at December 31, 2014. By comparison, from the end of 2010 to December 31, 2013 the Company’s cost basis increased a total of 123 basis points as older lower-basis securities prepaid and were replaced at higher prices, contributing to higher premium levels and larger yield adjustments for investment premium amortization.

Adjusted for portfolio financing-related and currently-paying interest rate swap agreements, borrowing rates averaged 0.56% during the fourth quarter of 2014, an increase of five basis points from the third quarter of 2014 reflecting a greater use of longer-dated repo borrowings and more portfolio-financing related interest rate swap agreements moving into current-pay status, as well as market pressure on year-end repo borrowing rates. Future borrowing rates will be dependent on market conditions, including the availability of longer-term repo borrowings and interest rate swap agreements at attractive rates. See NOTE 7 to the consolidated financial statements for further information regarding the Company’s currently-paying and forward-starting swap agreements.

Reconciliation of GAAP and non-GAAP Financing Spread Disclosures

Financing spreads on residential mortgage investments differs from total financing spreads, an all-inclusive GAAP measure, that is based on all interest-earning assets and liabilities. Management believes presenting financing spreads on residential mortgage investments provides useful information for evaluating portfolio performance. The following reconciles these measures for the indicated periods:

|

2014

|

2013

|

|||||||||||||||||||||||||||||||

|

Q4

|

Q3

|

Q2

|

Q1

|

Q4

|

Q3

|

Q2

|

Q1

|

|||||||||||||||||||||||||

|

Financing spreads on residential mortgage investments

|

1.10

|

%

|

1.09

|

%

|

1.22

|

%

|

1.30

|

%

|

1.25

|

%

|

0.87

|

%

|

1.00

|

%

|

1.15

|

%

|

||||||||||||||||

|

Impact of lower yields on other interest-earning assets*

|

(0.05

|

)

|

(0.04

|

)

|

(0.05

|

)

|

(0.04

|

)

|

(0.03

|

)

|

(0.02

|

)

|

(0.05

|

)

|

(0.05

|

)

|

||||||||||||||||

|

Impact of higher borrowing rates on other interest-paying liabilities*

|

(0.07

|

)

|

(0.06

|

)

|

(0.07

|

)

|

(0.07

|

)

|

(0.07

|

)

|

(0.06

|

)

|

(0.06

|

)

|

(0.06

|

)

|

||||||||||||||||

|

Total financing spreads

|

0.98

|

0.99

|

1.10

|

1.19

|

1.15

|

0.79

|

0.89

|

1.04

|

||||||||||||||||||||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||||||||

|

Financing spreads on residential mortgage investments

|

1.17

|

%

|

1.07

|

%

|

1.38

|

%

|

1.68

|

%

|

1.93

|

%

|

||||||||||

|

Impact of lower yields on other interest- earning assets*

|

(0.05

|

)

|

(0.04

|

)

|

(0.06

|

)

|

(0.04

|

)

|

(0.07

|

)

|

||||||||||

|

Impact of higher borrowing rates on other interest-paying liabilities*

|

(0.06

|

)

|

(0.07

|

)

|

(0.06

|

)

|

(0.08

|

)

|

(0.12

|

)

|

||||||||||

|

Total financing spreads

|

1.06

|

0.96

|

1.26

|

1.56

|

1.74

|

|||||||||||||||

|

*

|

Other interest-earning assets consist of overnight investments and cash collateral receivable from interest rate swap counterparties. Other interest-paying liabilities consist of $100 million in unsecured borrowings (at an average borrowing rate of 8.49%) that the Company considers a component of its long-term investment capital and, where applicable, cash collateral payable to interest rate swap counterparties.

|

Reconciliation of Net income Available to Common Stockholders to Core Earnings Available to Common Stockholders and Related Per Share Information

Core earnings available to common stockholders and core earnings per diluted common share are non-GAAP financial measures that differ from the related GAAP measures of net income available to common stockholders and net income per diluted common share by excluding certain effects of the May 2013 initial public offering of the Company’s Series E preferred stock and the June 2013 redemption of then-outstanding convertible preferred stock. Management believes presenting this metric on a core earnings basis provides useful, comparative information for evaluating performance. The following reconciles these measures for the year ended December 31, 2013 (in thousands, except per share amounts):

|

Per diluted

common share

|

||||||||

|

Net income available to common stockholders

|

$

|

89,027

|

$

|

0.93

|

||||

|

Redemption preference premiums paid

|

19,924

|

0.21

|

||||||

|

Convertible preferred dividends accruing from the Series E preferred stock issue date to the convertible preferred redemption date

|

1,741

|

0.02

|

||||||

|

Core earnings available to common stockholders

|

$

|

110,692

|

$

|

1.16

|

||||

Utilization of Long-term Investment Capital and Potential Liquidity

Capstead’s investment strategy involves managing an appropriately leveraged portfolio of ARM Agency Securities that management believes can produce attractive risk-adjusted returns over the long term, while reducing, but not eliminating, sensitivity to changes in interest rates. Repo borrowings generally can be increased or decreased on a daily basis to meet cash flow requirements and otherwise manage capital resources efficiently. Consequently, potential liquidity inherent in the Company’s unencumbered residential mortgage investments is as important as the actual level of cash and cash equivalents carried on the balance sheet. Potential liquidity is affected by, among other things:

| · | current portfolio leverage levels, |

| · | changes in market value of assets pledged and interest rate swap agreements held for hedging purposes as determined by lending and swap counterparties, |

| · | principal prepayments, |

| · | collateral requirements of lenders and swap counterparties, and |

| · | general conditions in the commercial banking and mortgage finance industries. |

Future levels of portfolio leverage will be dependent upon many factors, including the size and composition of the Company’s investment portfolio (see “Liquidity and Capital Resources”). The Company’s utilization of its long-term investment capital and its estimated potential liquidity were as follows as of December 31, 2014 in comparison with December 31, 2013 (in thousands):

|

Investments (a)

|

Repo

Borrowings

|

Capital

Employed

|

Potential

Liquidity (b)

|

Portfolio

Leverage

|

|||||||||||||

|

Balances as of December 31, 2014:

|

|||||||||||||||||

|

Residential mortgage investments

|

$

|

13,908,104

|

$

|

12,806,843

|

$

|

1,101,261

|

$

|

446,049

|

|||||||||

|

Cash collateral receivable from swap counterparties, net (c)

|

27,762

|

–

|

|||||||||||||||

|

Other assets, net of other liabilities

|

361,748

|

307,526

|

|||||||||||||||

|

$

|

1,490,771

|

$

|

753,575

|

8.59:1

|

|||||||||||||

|

Balances as of December 31, 2013

|

$

|

13,475,874

|

$

|

12,482,900

|

$

|

1,465,783

|

$

|

770,639

|

8.52:1

|

||||||||

| (a) | Investments are stated at balance sheet carrying amounts, which generally reflect estimated fair value as of the indicated dates. |

| (b) | Potential liquidity is based on maximum amounts of borrowings available under existing uncommitted repurchase arrangements considering management’s estimate of the fair value of related collateral as of the indicated dates adjusted for other sources of liquidity such as cash and cash equivalents. |

| (c) | Cash collateral receivable from swap counterparties is presented net of cash collateral payable to swap counterparties, if applicable, and the fair value of interest rate swap positions as of the indicated date. |

In order to prudently and efficiently manage its liquidity and capital resources, Capstead attempts to maintain sufficient liquidity reserves to fund borrowing and interest rate swap margin calls under stressed market conditions, including margin calls resulting from monthly principal payments (remitted to the Company 20 to 45 days after any given month-end), as well as reasonably possible declines in the market value of pledged assets and swap positions. Should market conditions deteriorate, management may reduce portfolio leverage and increase liquidity by raising new equity capital, selling mortgage securities and/or curtailing the replacement of portfolio runoff. Additionally, the Company routinely does business with a large number of lending counterparties, which bolsters financial flexibility to address challenging market conditions and limits exposure to any individual counterparty.

At December 31, 2014 portfolio leverage and potential liquidity were largely unchanged from the prior year-end while the portfolio and long-term investment capital increased modestly. Management believes current portfolio leverage levels represent an appropriate and prudent use of leverage under current market conditions for a portfolio consisting of seasoned, short-duration ARM Agency Securities.

Tax Considerations of Dividends Paid on Capstead Common and Preferred Shares

Capstead’s common and preferred dividend distributions are generally characterized as ordinary income or non-taxable return of capital based on the relative amounts of the Company’s earnings and profits (taxable income, with certain prescribed adjustments) to total distributions applicable for a given tax year. Distributions in excess of earnings and profits, if any, are characterized as non-taxable return of capital, reducing the tax basis of the related shares. If the Company were to realize gains on sales of assets, a portion of its dividends may be characterized as long-term capital gains. Except in limited circumstances, none of the Company’s dividends will be considered qualifying dividends eligible to be taxed at a reduced dividend tax rate. All dividends taxable in 2014, 2013 and 2012 have been characterized as ordinary income.

In accordance with the spillover distribution provisions of IRC 857(b)(9), $0.226769 of the fourth quarter 2014 common dividend of $0.34 paid in January 2015 was taxable in 2014 and the remaining $0.113231 is expected to be taxable in 2015. Similarly, $0.214753 of the fourth quarter 2013 common dividend of $0.31 paid in January 2014 was taxable in 2013 and the remaining $0.095247 was taxable in 2014. Dividend characterization for all tax years is available in the investor relations section of the Company’s website at www.capstead.com. Due to the complex nature of applicable tax rules, it is recommended that stockholders consult their tax advisors to ensure proper tax treatment of dividends received.

Off-Balance Sheet Arrangements and Contractual Obligations

At December 31, 2014, Capstead did not have any off-balance sheet arrangements. The Company’s contractual obligations at December 31, 2014 were as follows (in thousands):

|

Payments Due by Period*

|

||||||||||||||||||||

|

Total

|

12 Months

or Less

|

13 – 36

Months

|

37 – 60

Months

|

>Than

60 Months

|

||||||||||||||||

|

Repo borrowings

|

$

|

12,824,838

|

$

|

11,972,335

|

$

|

852,085

|

$

|

290

|

$

|

128

|

||||||||||

|

Unsecured borrowings

|

232,336

|

8,153

|

10,894

|

11,661

|

201,628

|

|||||||||||||||

|

Interest rate swap agreements designated as cash flow hedges of:

|

||||||||||||||||||||

|

Repo borrowings

|

16,533

|

16,533

|

–

|

–

|

–

|

|||||||||||||||

|

Unsecured borrowings

|

25,280

|

–

|

4,042

|

3,195

|

18,043

|

|||||||||||||||

|

Portfolio acquisitions settling subsequent to year-end

|

39,956

|

39,956

|

–

|

–

|

–

|

|||||||||||||||

|

Corporate office lease

|

1,597

|

277

|

573

|

597

|

150

|

|||||||||||||||

|

$

|

13,140,540

|

$

|

12,037,254

|

$

|

867,594

|

$

|

15,743

|

$

|

219,949

|

|||||||||||

| * | Repo borrowings include an interest component based on contractual rates in effect at year-end. Obligations under interest rate swap agreements are net of variable-rate payments owed to the Company under the agreements’ terms that are based on market interest rate expectations as of year-end. |

RESULTS OF OPERATIONS

|

Year ended December 31

|

||||||||||||

|

2014

|

2013

|

2012

|

||||||||||

|

Income statement data (in thousands, except per share data)

|

||||||||||||

|

Interest income on residential mortgage investments (before investment premium amortization)

|

$

|

328,621

|

$

|

341,009

|

$

|

352,608

|

||||||

|

Investment premium amortization

|

(101,872

|

)

|

(125,872

|

)

|

(96,677

|

)

|

||||||

|

Related interest expense

|

(65,155

|

)

|

(66,368

|

)

|

(69,101

|

)

|

||||||

|

161,594

|

148,769

|

186,830

|

||||||||||

|

Other interest income (expense)

|

(8,173

|

)

|

(8,165

|

)

|

(7,790

|

)

|

||||||

|

153,421

|

140,604

|

179,040

|

||||||||||

|

Other revenue (expense):

|

||||||||||||

|

Salaries and benefits

|

(4,112