Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - WESTMOUNTAIN GOLD, INC. | exhibit31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - WESTMOUNTAIN GOLD, INC. | exhibit31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - WESTMOUNTAIN GOLD, INC. | exhibit32_1.htm |

| EX-21.1 - EXHIBIT 21.1 - WESTMOUNTAIN GOLD, INC. | exhibit21_1.htm |

| EX-32.2 - EXHIBIT 32.2 - WESTMOUNTAIN GOLD, INC. | exhibit32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2015

o TRANSACTION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transaction period from ________ to ________

Commission File No. 0-53028

WESTMOUNTAIN GOLD, INC.

(Exact Name of Issuer as specified in its charter)

| Colorado |

| 26-1315498 |

| (State or other jurisdiction of incorporation) |

| (IRS Employer File Number) |

| 120 E Lake St. Ste. 401 Sandpoint, ID |

| 83864 |

| (Address of principal executive offices) |

| (zip code) |

(208)265-1717 (Registrant's telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Exchange Act:

| Common |

| OTCBB |

| (Title of each class) |

| (Name of each exchange on which registered) |

Securities registered pursuant to Section 12 (g) of the Exchange Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þYes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer |

| o |

| Non-accelerated filer | o | Smaller reporting company |

| þ |

| (Do not check if a smaller reporting company) |

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

As of April 30, 2015 (the last business day of our most recently completed second fiscal quarter), based upon the last reported trade on that date, the aggregate market value of the voting and non-voting common equity held by non-affiliates (for this purpose, all outstanding and issued common stock minus stock held by the officers, directors and known holders of 10% or more of the Company’s common stock) was $1,810,302. This value was computed by reference to the price at which the registrant’s common stock was last sold as of April 30, 2015, and excludes the market value of the registrant’s voting and non-voting common stock beneficially owned by directors and executive officers of the registrant and known holders of 10% or more of the registrant’s common equity. These determinations and the underlying assumptions should not be deemed to constitute an admission that all directors and executive officers of the registrant and known holders of 10% or more of the registrant’s common equity are, in fact, affiliates of the registrant, or that there are no other persons who may be deemed to be affiliates of our company. Further information concerning shareholdings of our directors, executive officers and beneficial owners of more than 5% of the registrant’s outstanding common equity is included in Part III, Item 12 of this Annual Report on Form 10-K.

As of February 10, 2016, the Company had 61,650,537 shares of common stock issued.

NO DOCUMENTS INCORPORATED BY REFERENCE

“Base Metal” means a classification of metals usually considered to be of low value and higher chemical activity when compared with the precious metals (gold, silver, platinum, etc.). This nonspecific term generally refers to the high-volume, low-value metals copper, lead, tin, and zinc.

“Claim” means a mining interest giving its holder the right to prospect, explore for and exploit minerals within a defined area.

“Deposit” means an informal term for an accumulation of mineral ores.

“Development Stage”means the stage in which a company is engaging in the preparation of its mineral asset projects containing established commercially minable mineral reserves for extraction, which has not yet reached Production Stage.

“Diamond Core” means a rotary type of rock drill that cuts a core of rock and is recovered in long cylindrical sections, two centimeters or more in diameter.

“Exploration Stage” means the earliest stage of mineral commercialization, in which a company is investigating, exploring, defining and evaluating its mineral asset projects for potential mineral reserves, but is not yet in either the development or production stage and for which no decision has yet been reached to actively prepare it for commercial development.

“Feasibility Study” means an engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability.

“Grade” means the metal content of ore, usually expressed in troy ounces per ton (2,000 pounds) or in grams per ton or metric tons which contain 2,204.6 pounds or 1,000 kilograms.

“Mineralization” means the concentration of metals within a body of rock.

“Mining” means the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

“Ore” means material containing minerals that can be economically extracted.

“Precious Metals” means any of several relatively scarce and valuable metals, such as gold, silver, and the platinum-group metals.

“Probable Reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for Proven Reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Reserves, is high enough to assume continuity between points of observation.

“Production Stage” means the stage in which a company is actively engaging in the process of extraction and exploitation of mineral reserves from its mineral asset projects to produce a marketable metal or mineral product.

“Proven Reserves” means reserves for which quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of the reserves are well-established.

“Reclamation” means the process of returning land to another use after mining is completed.

“Recovery” means that portion of the metal contained in the ore that is successfully extracted by processing, expressed as a percentage.

“Reserves” means that part of a mineral deposit that could be economically and legally extracted or produced at the time of reserve determination.

“Sampling” means selecting a fractional, but representative, pare of a mineral deposit for analysis.

“Underground” means a mine working or excavation closed to the surface.

“Vein” means a fissure, faults or crack in the rock filled by minerals that have traveled upward from some deep source.

| Page | |||||

| PART 1 | |||||

| ITEM 1. | Description of Business | 3 | |||

| ITEM 1A. | Risk Factors | 5 | |||

| ITEM 2. | Properties | 15 | |||

| ITEM 3. | Legal Proceedings | 19 | |||

| ITEM 4. | Mine Safety Disclosure | 19 | |||

| PART II | |||||

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 19 | |||

| ITEM 6. | Selected Financial Data | 22 | |||

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 23 | |||

| ITEM 8. | Consolidated Financial Statements and Supplementary Data | 29 | |||

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 58 | |||

| ITEM 9A. | Controls and Procedures | 58 | |||

| ITEM 9B. | Other Information | 59 | |||

| ITEM 10. | Directors, Executive Officers and Corporate Governance | 59 | |||

| ITEM 11. | Executive Compensation | 63 | |||

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 69 | |||

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 70 | |||

| ITEM 14. | Principal Accounting Fees and Services | 70 | |||

| PART IV | |||||

| ITEM 15. | Description of Business | 71 | |||

| SIGNATURES | 72 | ||||

PART I

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this 2015 Annual Report on Form 10-K should be considered carefully in evaluating us and our prospects. This 2015 Annual Report on Form 10-K and other publicly available documents, contain, and our officers and representatives may from time to time make, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"). These forward-looking statements include, without limitation, statements regarding: proposed new operations or enhancements in technology; our statements concerning litigation or other matters; statements concerning projections, predictions, expectations, estimates or forecasts for our business, financial and operating results and future economic performance; statements of management’s goals and objectives; trends affecting our financial condition, results of operations or future prospects; our financing plans or growth strategies; possible changes in legislation; and other similar expressions concerning matters that are not historical facts. Words such as "expects," "anticipates," "intends," "plans," “goals,” "believes," “projects,” "estimates," “strategies,” “future,” “likely,” “may,” “should,” “will,” and similar expressions or variations of such words, as well as statements in future tense, are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report.

Forward-looking statements are neither historical facts nor assurances of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Instead, forward-looking statements are the good faith beliefs, expectations and assumptions of our management based on facts and factors as we currently know them. Because forward-looking statements related to the future, they are subject to risks, inherent uncertainties, and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results, outcomes, and financial condition may differ materially from those discussed in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, the following:

- our inability to raise additional funds to support operations and capital expenditures;

- our inability to efficiently operate due to weather, equipment failure, personnel issues, or any number of other factors;

- our inability to mine ore off the surface, transport the ore off the mountain, and milling the ore in an efficient manner;

- our inability to manage and maintain the growth of our business; and

- other factors discussed throughout this report, including, without limitation, under the headings "Management's Discussion and Analysis of Financial Condition and Results of Operations," “Risk Factors.”

Readers are urged not to place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date of this report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, including, without limitation, actual results or changes in assumptions or other factors affecting forward-looking statements, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

2

ITEM 1. DESCRIPTION OF BUSINESS

(a) History of the Company

WestMountain Gold, Inc. (“WMTN”, the “Company”, “we”, “us”, “our”, and similar phrases, as the context requires) is an exploration stage mining company, in accordance with applicable guidelines of the Securities and Exchange Commission (“SEC”), which pursues gold projects that are anticipated to have low operating costs and high returns on capital.

We were incorporated in the state of Colorado on October 18, 2007, under the name WestMountain Index Advisor, Inc.. We acquired Terra Mining Corporation (“TMC”) on February 28, 2011 and accounted for the transaction as a reverse acquisition using the purchase method of accounting, whereby TMC is deemed to be the accounting acquirer (legal acquiree) and WMTN to be the accounting acquiree (legal acquirer). Our financial statements before the date of the acquisition are those of TMC with the results of WMTN being consolidated from the date of the acquisition. The equity section and earnings per share have been retroactively restated to reflect the reverse acquisition and no goodwill has been recorded. We adopted TMC’s fiscal year, which is October 31. On February 28, 2013, we changed our name to WestMountain Gold, Inc.

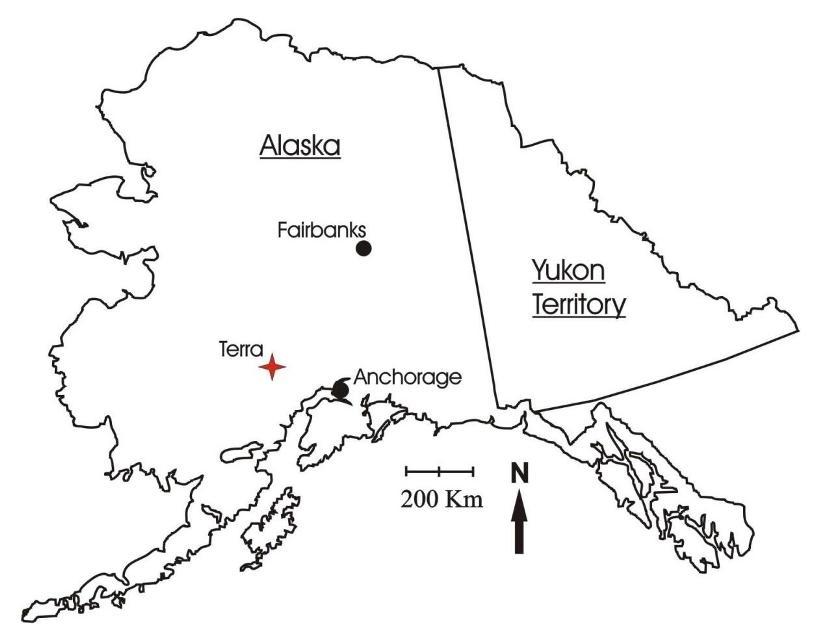

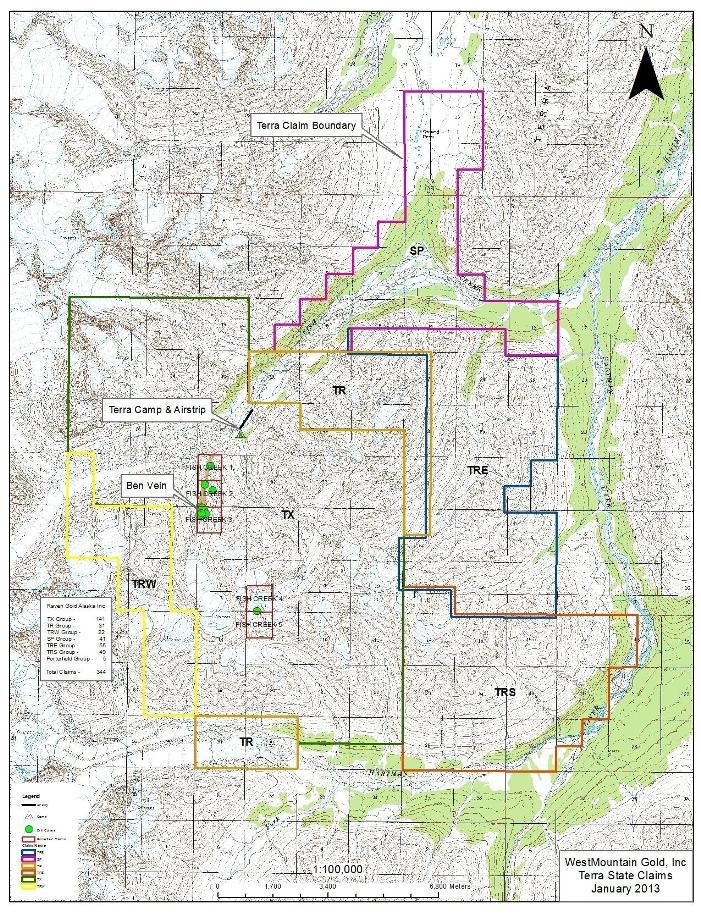

TMC’s wholly owned subsidiary, Terra Gold Corporation (“TGC”), is currently focused on mineral production from mineralized material at a high-grade gold system called the “TMC project” in the state of Alaska. The TMC project consists of 344 Alaska state mining claims including 5 unpatented lode mining claims held under lease (subject to a 3-4% NSR royalty to the lessor, dependent upon the gold price) covering 223 square kilometers (22,300 hectares). The property is centered on an 8-km-long (800 hectares) trend of high-grade gold vein occurrences. All government permits and reclamation plans for continued exploration through 2013 were renewed in 2010. The $136,730 of fees to maintain the Terra claims through 2015 were paid by us on November 20, 2014. The property lies approximately 200 km (20,000 hectares) west-northwest of Anchorage and is accessible via helicopter or fixed-wing aircraft. The property has haul roads, a mill facility and adjoining camp infrastructure, a tailings pond and other infrastructure. The remote camp is powered by diesel powered generators and water is supplied to the mill by spring fed sources and year round water wells.

Outcropping gold veins were first discovered at Terra in the late 1990's by Kennecott Exploration. The claims were transferred to Mr. Ben Porterfield in 2000. AngloGold Ashanti (USA) Exploration Inc. optioned these claims in 2004 and staked additional claims in the vicinity. Initial detailed soil and rock surveys were conducted at Terra that same year with results leading to the definition of an initial zone of high-grade gold veins over a 2.5 km (250 hectares) strike length. AngloGold followed up with a discovery drill program of 12 holes in 2005 and drilled three additional holes in 2006. A total of 587 rock samples were collected on the property. The TMC project was joint-ventured to International Tower Hill Mines Ltd. (“ITH”) in August of 2006.

On September 15, 2010, WMTN and its wholly owned subsidiary, TGC, and Raven Gold Alaska, Inc. (“Raven”) signed an Exploration, Development and Mine Operating Agreement (“JV Agreement”) pertaining to the TMC Project. WMTN made payments of cash and stock to Raven pursuant to the JV Agreement.

On February 12, 2014, the Company, through TGC, acquired 100% ownership interest in the TMC Project from Raven for $1.8 million in cash and 200,000 shares of WMTN. No further payments are due to Raven from TGC under the JV Agreement, (including but not limited to any royalty or residual payments), and each party is fully released from its obligations to the other under the JV Agreement. The $1.8 million of cash paid and 200,000 shares of common stock of the Company (valued at $136,000 at the time) that were issued to Raven is recorded as Mining Claims in the accompanying consolidated balance sheet.

(b) Significant Business Transactions Overview

The Company did not enter into any business transactions that we consider significant during the three months ended October 31, 2015.

(c) Business of Issuer

Business Overview

We intend to devote substantially all of our efforts on growing the Company’s operations in the mineral exploration and mining sector. We are currently focused on further exploration of the TMC project for mineral reserves and to gauge the prospects for efficient mining operations if such reserves are discovered. Additionally, we are engaged in limited extraction and exploitation of mineralized material through surface mining techniques at the TMC project. Our primary key market priority will be to proceed with the TMC project and other mining opportunities that may present themselves from time to time. We cannot guarantee that the TMC project, or any project that we embark upon, will be successful. We have budgeted expenditures for the TMC project for the next twelve months of approximately $2,400,000, depending on additional financing, for general and administrative expenses and exploration, mining and exploration to implement the business plan as described above. Approximately $1.3 million of these budgeted expenditures are for mining and exploration expenses and the other $1.1 million are for corporate general and administrative expenses.

3

We are currently considered an exploration stage company under SEC criteria because it has not demonstrated the existence of proven or probable reserves at the TMC project. Accordingly, as required under SEC guidelines and U.S. GAAP for companies in the exploration stage, substantially all of our investment in mining properties to date, including construction of the mill, mine facilities and exploration expenditures, have been expensed as incurred and therefore do not appear as assets on our balance sheet. We expect construction expenditures and underground mine exploration and capital improvements will continue during 2016 and subsequent years. We expect to remain as an exploration stage company for the foreseeable future. We do not exit the exploration stage until such time that we demonstrate the existence of proven or probable reserves that meet SEC guidelines. Likewise, unless mineralized material is classified as proven or probable reserves, substantially all expenditures for mine exploration and construction will continue to be expensed as incurred.

We may choose to scale back operations to operate at break-even with a smaller level of business activity, while adjusting overhead depending on the availability of additional financing. In addition, we expect that we will need to raise additional funds if we decide to pursue more rapid expansion, appropriate responses to competitive pressures, or the acquisition of complementary businesses or technologies, or if we must respond to unanticipated events that require us to make additional investments. We cannot assure that additional financing will be available when needed on favorable terms, or at all.

We are exposed to various risks related to the volatility of the price of gold, our need for additional financing, our joint venture agreements, our reserve estimates, operating as a going concern, unique difficulties and uncertainties in mining exploration ventures, and a volatile market price for our common stock. These risks and uncertainties are discussed in more detail below in this report.

Competition

We are an exploration stage mineral resource exploration company that competes with other mineral resource exploration companies for financing and for the acquisition of mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to achieve the financing necessary for us to acquire mineral property interests and conduct exploration activities.

We will also compete with other mineral exploration companies for financing from a limited number of investors that are prepared to make investments in mineral exploration companies. The presence of competing mineral exploration companies may adversely impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

Environmental and Other Government Regulation and Standards

The Company’s business is subject to extensive federal, state and local laws and regulations, including regulation of mining and exploration activities which could involve the discharge of materials and contaminants into the environment, the investigation and cleanup of such discharges, disturbance of land, reclamation of disturbed lands, associated potential impacts to threatened or endangered species and other environmental concerns. In particular, statutes including, but not limited to, the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the National Environmental Policy Act and the Comprehensive Environmental Response, Compensation and Liability Act impose permit requirements, effluent standards, air emission standards, waste handling and disposal restrictions and other design and operational requirements, as well as record keeping and reporting requirements, upon various aspects of mineral exploration, extraction and processing. In addition, the Company’s existing operations may become subject to additional environmental control and mitigation requirements if applicable federal, state and local laws and regulations governing environmental protection, land use and species protection are amended or become more stringent in the future. The Company is aware that federal regulation under the Resource Conservation and Recovery Act governing the manner in which secondary materials and by-products of mineral extraction and beneficiation are handled, stored and reclaimed or reused is subject to frequency review by the regulatory agencies which could affect the Company’s current and future facility design, operations, and permitting requirements. In addition, future building of mines and other systems by the Company may be delayed by permit review processes. The Company could be required to conduct investigatory and remedial actions to mitigate pollution conditions caused by or attributed to its operations or former operations. In order to comply with applicable regulations, the Company is and may be required, from time to time, to obtain work permits, post bonds and perform remediation work for any physical disturbance to land, which could cause significant adverse consequences on the Company’s operations.

Seasonality

Currently, the Company’s operations are limited to those occurring at the TMC project in Alaska. Due to the remote location of the TMC project, the long winter at that location, and harsh weather conditions during the winter, the Company’s operations at the TMC project are currently limited to the months of May through September.

Employees

As of October 31, 2015, we had four full-time and one part-time employees. Additionally, we use employees of Minex Exploration, an Idaho partnership affiliated with our Chief Executive Officer, as contractors for exploration of the TMC project. Most of our employees are based in Sandpoint, ID. The Chief Executive Officer is based out of the Sandpoint, ID office and the Chief Financial Officer is based out of Denver, CO but travels to the Sandpoint, ID office on a regular basis.

4

WEBSITE ACCESS TO UNITED STATES SECURITIES AND EXCHANGE COMMISSION REPORTS

We file annual and quarterly reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC's Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information concerning filers. We also maintain a web site at http://www.westmountaingold.com that provides additional information about us and links to documents we file with the SEC. Our charters for the Audit, Compensation and Nominations and Governance Committees and the Code of Conduct & Ethics are also available on our website.

ITEM 1A. RISK FACTORS

There are certain inherent risks which will have an effect on the Company’s exploration in the future and the most significant risks and uncertainties known and identified by our management are described below.

We are currently in default on several of our notes. If we are unable to extend our debt as it becomes due, we will risk forfeiture of all of our assets.

Under the Loan Modification Agreement with BOCO dated as of May 15, 2015, the Company had payments of $209,346 plus interest and approximately $700,000 plus interest due on October 1, 2015 and November 15, 2015, respectively. The Company did not make these payments in full and on time and is currently in default under its BOCO Notes, which are secured by all of the Company’s assets. Due to the default, interest on the outstanding amounts now accrues at the default rate of 45% per annum. Additionally, under the terms of the Loan Modification Agreement and related notes and security agreements, BOCO has certain rights upon a default by the Company, including the right to accelerate the amounts due thereunder and foreclose on all of the Company’s assets.

In addition, the outstanding balance of $200,000 plus interest on the Andres Notes was due and payable on October 31, 2015, which the Company has not paid and, is therefore currently in default. The Andres Notes are not secured, but provide other standard rights to the holder thereof upon default.

As of the filing of this Annual Report on Form 10-K, neither BOCO nor Andres has taken action to exercise their respective rights in response to the Company’s default. Further, neither BOCO nor Andres has indicated its intention regarding its rights and remedies under their respective agreements. While the Company intends to pay the amounts due when it has sufficient funds to do so, there can be no assurance if and when the Company will generate sufficient revenues or financing to make such payments. Furthermore, there can be no assurance whether or when BOCO and/or Andres may exercise its rights and remedies under the respective agreements, including, in the case of BOCO, foreclosing on all of the Company’s assets.

If we do not obtain additional financing, our business will fail.

Our current operating funds are significantly less than necessary to complete all intended exploration of the property, and therefore we will need to obtain additional financing in order to complete our business plan. We anticipate that we will require a minimum of $500,000 to $1,000,000 to fund our continued operations for the next three to five months to commence seasonal operations for 2016. As of October 31, 2015, we had approximately $383,412 in cash.

We have budgeted expenditures for the TMC project for the next twelve months of approximately $2,200,000, depending on additional financing, for general and administrative, mining and exploration expenses. Additionally, we have debt payments that are currently past due totaling $1,058,380 plus accrued interest, and additional debt payments in the amount of $2,500 come due on November 15, 2016.

Our business plan calls for significant expenses in connection with the exploration of the property. We do not currently have sufficient funds to conduct continued exploration on the property and require additional financing in order to determine whether the property contains economic mineralization. We will also require additional financing if the costs of the exploration of the property are greater than anticipated.

5

We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including the market prices for copper, silver and gold, investor acceptance of our property, approval of BOCO Investments under our loan covenants and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

The most likely source of future funds presently available to us is through the sale of equity capital, which would be subject to the factors listed above. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be our sale of a partial interest in the property to a third party in exchange for cash or exploration expenditures, which is not presently contemplated. There can be no assurance that we will be able to successfully identify and close on the necessary additional financing or that the proposed terms of any such financing will be favorable or acceptable to the Company.

The volatility of the price of gold could adversely affect our future operations and our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration, if warranted, are directly related to the market price of gold and other precious metals. The price of gold may also have a significant influence on the market price of our common stock and the value of our properties. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of gold may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices.

As of February 12, 2016, the price of gold was $1,237.26 per ounce, based on the daily London PM fix on that date. The volatility of mineral prices is beyond our control and represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold prices decline or remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

A single major shareholder and creditor has substantial influence over our company.

As of October 31, 2015, BOCO owns or controls approximately 31.9 million shares as of the filing date or approximately 50.8% of our issued and outstanding common stock including shares beneficially owned within sixty days, and including (i) the potential conversion of $1,852,115 of debt due and payable by the Company on November 15, 2017, that as of October 31, 2015, is currently convertible along with accrued interest into Company common stock at a rate of $0.12 per share (subject to re-pricing provisions in the promissory note evidencing the debt); (ii) and the potential conversion of $250,000 of Series A Convertible Preferred Stock (convertible into 250,000 shares of common stock). See Notes 7 and 8 to the Company’s Financial Statements for a more detailed description of terms of the Loan Modification Agreement dated May 15, 2015 regarding the aforementioned debt and related Secured Promissory Notes and Promissory Notes in addition to the Series A Convertible Preferred Stock.

As a major creditor and shareholder of the Company, BOCO has additional influence and control over the Company. BOCO has imposed a number of loan covenants on the Company which restrict our ability to operate our business as well as our ability to raise additional financing.

6

BOCO could cause a change of control of our board of directors, approve or disapprove any matter requiring stockholder approval, or cause, delay or prevent a change in control or sale of the Company, which in turn could adversely affect the market price of our common stock.

We have no proven or probable reserves and our decision to continue further exploration is not based on a study demonstrating economic recovery of any mineral reserves and is therefore inherently risky.

Any funds spent by us on exploration could be lost. We have not established the presence of any proven or probable mineral reserves, as defined by the SEC, at any of our properties. Under Industry Guide 7, the SEC has defined a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Any mineralized material discovered or produced by us should not be considered proven or probable reserves.

In order to demonstrate the existence of proven or probable reserves, it would be necessary for us to perform additional exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and obtain a positive feasibility study which demonstrates with reasonable certainty that the deposit can be economically and legally extracted and produced. We have not completed a feasibility study with regard to all or a portion of any of our properties to date. The absence of proven or probable reserves makes it more likely that our properties may cease to be profitable and that the money we spend on exploration may never be recovered.

Since we have no proven or probable reserves, our investment in mineral properties is not reported as an asset in our financial statements which may cause volatility in our net earnings and have a negative impact on the price of our stock.

We prepare our financial statements in accordance with accounting principles generally accepted in the United States of America and report substantially all exploration and construction expenditures as expenses until such time, if ever, we are able to establish proven or probable reserves. Since it is uncertain when, if ever, we will establish proven or probable reserves, it is uncertain whether we will ever report these types of future capital expenditures as an asset. Accordingly, our financial statements report fewer assets and greater expenses than would be the case if we had proven or probable reserves, which could produce volatility in our earnings and have a negative impact on our stock price.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Our reserve and resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally calculate reserves and resources in accordance with Canadian practices. The Geologic Report, upon which we have based our mineralization estimates, was prepared in accordance with Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) National Instrument 43-101 (NI 43-101) and Form 43-101F1 (43-101F1). These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred mineral resources, which are generally not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves.

Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report “resources” as in place, tonnage and grade without reference to unit measures.

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in this report, or in the documents incorporated herein by reference, may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

7

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, estimates of mineralized material presented in our press releases and regulatory filings are based upon estimates made by us and our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. There can be no assurance that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale metallurgical tests will be recovered at production scale.

The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

There is substantial doubt about our ability to continue as a going concern.

The financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The company has incurred losses since its inception resulting in an accumulated deficit of $21,424,146 as of October 31, 2015 and further losses are anticipated in the development of its business. Accordingly, there is substantial doubt about the Company’s ability to continue as a going concern.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware that new mineral exploration companies normally encounter substantial difficulties and such enterprises experience high rates of failure. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

Because we have limited business operations, we face a high risk of business failure.

We started exploring our properties in the summer of 2011. While we have continued to explore the TMC project and have conducted only limited mining during the summer months since then, we do not yet have sufficient information about the project to evaluate the likelihood that our business will be successful. Although we were incorporated in the state of Colorado on October 18, 2007, the Company just acquired our mineral properties with our acquisition of TMC on February 28, 2011. TMC itself has only been in existence since March 25, 2010. We have generated aggregate revenues of $3,290,812 as of the date of this Form 10-K.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any significant revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from exploration of the mineral claims and the production of minerals from the claims, we will not be able to earn profits or continue operations.

8

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We are dependent on key personnel.

Our success depends to a significant degree upon the continued contributions of key management and other personnel, some of whom could be difficult to replace, particularly Greg Schifrin, our CEO. We do not maintain key man life insurance covering certain of our officers. Our success will depend on the performance of our officers, our ability to retain and motivate our officers, our ability to integrate new officers into our operations and the ability of all personnel to work together effectively as a team. Our failure to retain and recruit officers and other key personnel could have a material adverse effect on our business, financial condition and results of operations.

We lack an operating history and we expect to have losses in the future.

Except for our initial exploration efforts as described above, we have not progressed substantially on implementing our proposed business plan. We have commenced only limited business operations and have not realized any significant revenues or generated profit from our operations. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent, in part, upon the following:

|

| ● | Our ability to locate a profitable mineral property; |

|

| ● | Our ability to generate sufficient revenues; and |

|

| ● | Our ability to reduce exploration costs. |

Based upon current plans, we expect to incur operating losses in foreseeable future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. We cannot guarantee that we will be successful in generating significant revenues in the future. Failure to generate significant revenues will cause the business to fail and we may cease operations.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. Although we conducted a due diligence investigation prior to entering into the acquisition of TMC, risk remains regarding any undisclosed or unknown liabilities associated with this project. The payment of such liabilities, whether by settlement, judgement, or otherwise, may have a material adverse effect on our financial position.

Because we are small and do not have sufficient capital, we may have to cease operation even if we have found mineralized material.

Because we are small and do not have sufficient capital, we must limit our exploration. Because we may have to limit our exploration, we may be unable to, or elect not to mine mineralized material, even if our mineral claims contain mineralized material. If we cannot, or elect not to, mine mineralized material, we may have to cease operations.

If we become subject to onerous government regulation or other legal uncertainties as we move to production, our business will be negatively affected. Governmental regulations impose material restrictions on mineral property exploration. Under Alaska mining law, to engage in exploration will require permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. If we proceed to commence drilling operations on the mineral claims, we will incur additional regulatory compliance costs.

9

In addition, the legal and regulatory environment that pertains to mineral exploration is uncertain and may change. Uncertainty and new regulations could increase our costs of doing business and prevent us from exploring for ore deposits. The growth of demand for ore may also be significantly slowed. This could delay growth in potential demand for and limit our ability to generate revenues. In addition to new laws and regulations being adopted, existing laws may be applied to limit or restrict mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

We are subject to governmental regulations, which affect our operations and costs of conducting our business.

Our current and future operations are and will be governed by laws and regulations, including:

|

| ● | laws and regulations governing mineral concession acquisition, prospecting, exploration, mining and production; |

|

| ● | laws and regulations related to exports, taxes and fees; |

|

| ● | labor standards and regulations related to occupational health and mine safety; and |

|

| ● | environmental standards and regulations related to clean water, waste disposal, toxic substances, land use and environmental protection; and other matters. |

Companies engaged in mining exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Failure to comply with applicable laws, regulations and permits may result in enforcement actions, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. We may be required to compensate those suffering loss or damage by reason of our mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation, could have a material adverse impact on our business and cause increases in capital expenditures or require abandonment or delays in exploration.

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All phases of our operations are subject to various federal and state environmental regulation. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. These laws address, among other issues, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays and may cause material changes or delays in our operations and future activities. It is possible that future changes in these laws or regulations could have a significant adverse impact on our properties or some portion of our business, causing us to re-evaluate those activities at that time.

U.S. Federal Laws. The Comprehensive Environmental, Response, Compensation, and Liability Act (CERCLA), and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, demands for reimbursement for government-incurred cleanup costs, or natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (RCRA), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

10

We may also be subject to compliance with other federal environmental laws, including the Clean Air Act, National Environmental Policy Act (NEPA) and other environmental laws and regulations.

Additionally, the State of Alaska Department of Natural Resources has established a pool of funds to cover reclamation to which all permittees with exploration and mining projects are required to contribute. Currently, a $750 per acre disturbance reclamation bond is required for disturbance of 5 acres or more and/or removal of more the 50,000 cubic yards of material.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. While we currently have supplies and equipment for use in our operations, but will need additional supplies and equipment to support full operations under our business plan. We do not have existing relationships with suppliers and will need to identify and develop strategic relationships with suppliers to ensure access to supplies and equipment prior to commencement of full operations. Additionally, our claims are in remote, difficult to access locations where resources are scarce and require specialized transportation for much of our necessary supplies and equipment that can result in delivery delays and increased acquisition expenses. If we cannot find the products and equipment we need or fail to develop and maintain relationships with suppliers, we will have to suspend our exploration plans until we do find and obtain the products and equipment we need.

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue to source exploration mineral claims. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish the existence of commercially exploitable reserves of gold on our properties. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Weather and location challenges may restrict and delay our work on our property.

We plan to conduct our exploration on a seasonal basis. Because of the severe Alaska winters and lack of sunlight and with our current operational capabilities, we are only able to perform exploration and surface mining operations for approximately five months per year. It is possible that snow or rain could restrict and delay work on the properties to a significant degree. Our property is located in a relatively remote location, which creates additional transportation and energy costs and challenges. Currently, we have drilled our test sites with helicopter-supported drill rigs, which are expensive to operate.

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration programs may be slowed down or suspended.

11

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a shareholder's ability to buy and sell our stock.

Our stock is categorized as a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Additionally, brokers may be less willing to execute transactions in securities subject to the penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

The sale of a significant number of our shares of common stock could depress the price of our common stock.

Sales or issuances of a large number of shares of common stock in the public market or the perception that sales may occur could cause the market price of our common stock to decline. As of October 31, 2015, there were approximately 65 million shares of common stock and warrants issued and outstanding. Significant shares of common stock are held by our principal shareholders, other Company insiders and other large shareholders. As “affiliates” (as defined under Rule 144 of the Securities Act (“Rule 144”)) of the Company, our principal shareholders, other Company insiders and other large shareholders may only sell their shares of common stock in the public market pursuant to an effective registration statement or in compliance with Rule 144.

The market price of our common stock may be volatile.

The market price of our common stock has been and is likely in the future to be volatile. Our common stock price may fluctuate in response to factors such as:

| ● | Announcements by us regarding resources, liquidity, significant acquisitions, equity investments and divestitures, strategic relationships, addition or loss of significant customers and contracts, capital expenditure commitments, loan, note payable and agreement defaults, loss of our subsidiaries and impairment of assets, |

| ● | Issuance or repayment of debt, accounts payable or convertible debt for general or merger and acquisition purposes, |

| ● | Sale of a significant number of shares of our common stock by shareholders, |

| ● | General market and economic conditions, |

| ● | Quarterly variations in our operating results, |

| ● | Investor relation activities, |

| ● | Announcements of technological innovations, |

| ● | New product introductions by us or our competitors, |

| ● | Competitive activities, and |

| ● | Additions or departures of key personnel. |

These broad market and industry factors may have a material adverse effect on the market price of our common stock, regardless of our actual operating performance. These factors could have a material adverse effect on our business, financial condition and results of operations.

We may engage in acquisitions, mergers, strategic alliances, joint ventures and divestitures that could result in financial results that are different than expected.

In the normal course of business, we may engage in discussions relating to possible acquisitions, equity investments, mergers, strategic alliances, joint ventures and divestitures. All such transactions are accompanied by a number of risks, including:

|

| ● | Use of significant amounts of cash, | |

|

| ● | Potentially dilutive issuances of equity securities on potentially unfavorable terms, | |

| ● | Incurrence of debt on potentially unfavorable terms as well as impairment expenses related to goodwill and amortization expenses related to other intangible assets, | ||

|

| ● | The possibility that we may pay too much cash or issue too many of our shares as the purchase price for an acquisition relative to the economic benefits that we ultimately derive from such acquisition. | |

| ● | The process of integrating any acquisition may create unforeseen operating difficulties and expenditures. Additionally, areas where we may face difficulties that are foreseeable include: | ||

| ● | Diversion of management time, during the period of negotiation through closing and after closing, from its focus on operating the businesses to issues of integration, | ||

| ● | The need to integrate each company's accounting, management information, human resource and other administrative systems to permit effective management, and the lack of control if such integration is delayed or not implemented, | ||

| ● | The need to implement controls, procedures and policies appropriate for a public company that may not have been in place in private companies, prior to acquisition, | ||

| ● | The need to incorporate acquired technology, content or rights into our products and any expenses related to such integration, and | ||

|

|

| ● | The need to successfully develop any acquired in-process technology to realize any value capitalized as intangible assets. |

From time to time, we may engage in discussions with candidates regarding potential divestures. If a divestiture does occur, we cannot be certain that our business, operating results and financial condition will not be materially and adversely affected. A successful divestiture depends on various factors, including our ability to:

|

| ● | Effectively transfer liabilities, contracts, facilities and employees to any purchaser, |

| ● | Identify and separate the intellectual property to be divested from the intellectual property that we wish to retain, | |

|

| ● | Reduce fixed costs previously associated with the divested assets or business, and |

|

| ● | Collect the proceeds from any divestitures. |

In addition, if customers of the divested business do not receive the same level of service from the new owners, this may adversely affect our other businesses to the extent that these customers also purchase other products offered by us. All of these efforts require varying levels of management resources, which may divert our attention from other business operations.

If we do not realize the expected benefits or synergies of any divestiture transaction, our consolidated financial position, results of operations, cash flows and stock price could be negatively impacted.

13

Our directors and officers may have conflicts of interest with the Company as a result of their relationships with other companies.

To the extent that any of our officers and directors are also directors and officers of other companies, conflicts of interest may arise between their duties as our officers and directors and as directors and officers of other companies. In addition, in the past the Company entered into supplier, financing and consulting arrangements with entities controlled by directors of the Company, and we may consider entering into such arrangements in the future. These factors could have a material adverse effect on our business, financial condition and results of operations.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws.

Without any anti-takeover provisions, there are limited deterrents for a take-over of our Company, which may result in a change in our management and directors that we cannot control.

The laws of the State of Colorado and our Articles of Incorporation and Bylaws may protect our directors from certain types of lawsuits.

The laws of the State of Colorado provide that our directors will not be liable to us or our shareholders for monetary damages for all but certain types of conduct as directors of the company. Our Articles of Incorporation and Bylaws permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing shareholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

Because our executive officers and directors have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Our officers have other business interests. While each officer spends more than 40 hours per week on our business, if the demands on our executive officers from their other obligations increase, they may no longer be able to devote sufficient time to the management of our business. This could negatively impact our business exploration and could cause our business to fail.

Transfer of our securities may be restricted by virtue of state securities “blue sky” laws, which prohibit trading absent compliance with individual state laws, and Rule 144. These restrictions may make it difficult or impossible to sell shares in those states.

Transfers of our common stock may be restricted under the securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as “blue sky” laws and by federal Rule 144. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities held by many of our stockholders have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. Additionally, unless the shares are registered with the SEC, any sale must also comply with the provisions of Rule 144, which requires, among other things, that the company is current in its reporting obligations. These restrictions may prohibit the secondary trading of our common stock and there can be no assurance that exemptions will be available and/or compliance with Rule 144 will be possible. Investors should consider the secondary market for our securities to be a limited one.

We are subject to corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We must comply with corporate governance requirements under the Sarbanes-Oxley Act of 2002 and the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010, as well as additional rules and regulations currently in place and that may be subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. We are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial.

14

Our management has concluded that our disclosure controls and procedures were not effective due to the presence of the following material weaknesses in internal control over financial reporting:

We currently lack appropriate segregation of duties over treasury management due to lack of personnel. We expect to revise our procedures during 2016 once we have fully reconstituted our board of directors.

There is a lack of disclosure controls to ensure adequate disclosures are made in our periodic filings.

We have not maintained continuity in key personnel or have adequate staffing to ensure adequately efficient preparation of financial and operational statements.

The Company lacks sufficient personnel and financial resources to implement adequate handling, tracking, accounting and safeguarding of ore and finished goods inventory assets.

We formed an audit committee on October 26, 2012, which, until their recent resignations, consisted of two independent directors with significant financial expertise. We plan to name new members to the audit committee following the addition of independent members to the board of directors. An audit committee is expected to improve oversight in the establishment and monitoring of required internal controls and procedures.

Management anticipates that such disclosure controls and procedures will not be effective until the material weaknesses are remediated. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

ITEM 2. PROPERTIES

The WMTN principal executive offices are located at 120 E. Lake St. Ste. 401, Sandpoint, ID 83864, and our telephone number is (208)265-1717. On April 1, 2011, we entered into a lease at 120 Lake Street, Suite 401, Sandpoint, ID 83864. This office is leased at the net of $1,000 per month and expired March 31, 2013. On April 5, 2015, we entered into Commercial Lease Amendment to extend the lease for one year. The office is shared with an entity affiliated with our Chief Executive Officer.

On June 6, 2014 we signed a one year lease for a residential property located in Anchorage, AK for $3,175 per month. The lease expired on June 6, 2015 and the Company continues to lease the property on a month-to-month basis at the same cost. The property is used as a central office for operations in Alaska and to house personnel traveling from the mining camp during the mining season.

On January 1, 2015 the Company signed a three-year lease for a testing and processing facility in Anchorage, AK for $3,500 per month. The property, which includes a warehouse and storage yard, will house processing, recovery and metallurgical testing equipment and serve as a staging area as the company moves forward with TMC project development.

Other than our mining claims, leases, and other real property interests specifically related to mining, WMTN does not own real estate nor have plans to acquire any real estate.

Alaska Property - The TMC Project

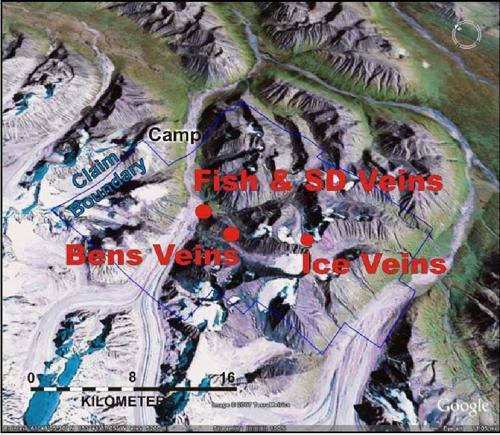

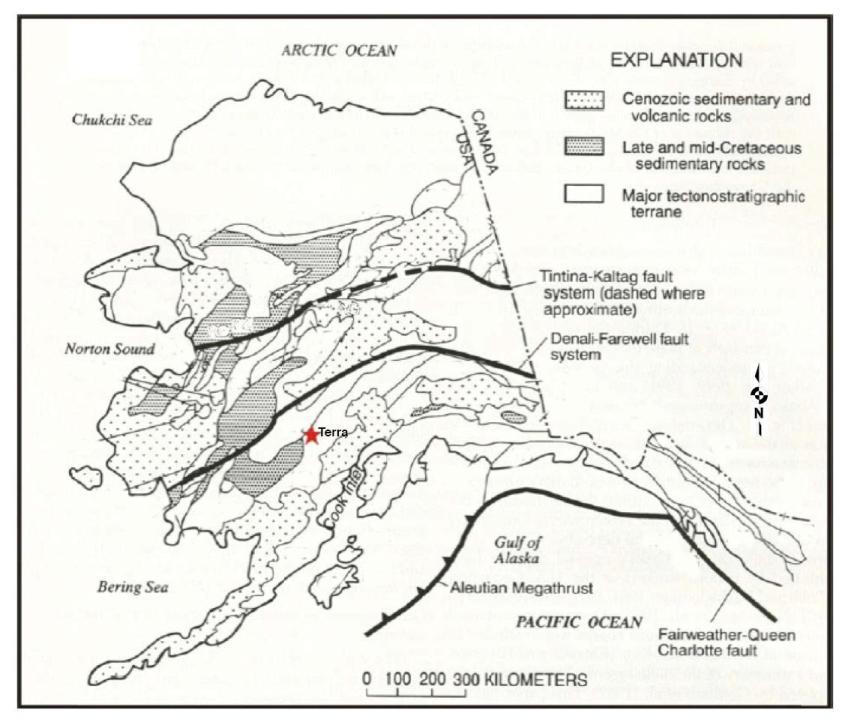

The TMC project consists of 344 Alaska state mining claims including 5 unpatented lode mining claims held under lease (subject to a 3-4% net smelter return (“NSR”) royalty to the lessor, dependent upon the gold price) covering 223 square kilometers (22,300 hectares). The property is centered on an 8-km-long (800 hectares) trend of high-grade gold vein occurrences. All government permits and reclamation plans for continued exploration through 2019 were renewed in 2015. The $163,720 of fees to maintain the Terra claims through 2016 were paid by the Company on November 27, 2015. The property lies approximately 200 km west-northwest of Anchorage between the Revelation and Terra Cotta mountains of the Alaska Range in southwestern Alaska and is accessible via helicopter or fixed-wing aircraft. The property has haul roads, a mill facility and adjoining camp infrastructure, a tailings pond and other infrastructure. The remote camp is powered by diesel powered generators and water is supplied to the mill by spring fed sources and wells.

15

Outcropping gold veins were first discovered at the TMC project (also referred to as “Terra” in the following maps) in the late 1990's by Kennecott Exploration. The claims were transferred to Mr. Ben Porterfield in 2000. AngloGold Ashanti (USA) Exploration Inc. optioned these claims in 2004 and staked additional claims in the vicinity. Initial detailed soil and rock surveys were conducted at the TMC project that same year with results leading to the definition of an initial zone of high-grade gold veins over a 2.5 km (250 hectares) strike length. AngloGold followed up with a discovery drill program of 12 holes in 2005 and drilled three additional holes in 2006. A total of 587 rock samples were collected on the property.

TMC received geological reports in June 2010 and February 2010 from the State of Alaska Division of Mines and Geology that represented a 400m spacing aerial magnetic and resistivity survey that included the area of the TMC project.

A total of 44 drill holes have been completed on the TMC project. The mineralization has been characterized as deep epithermal or mesothermal and could have significant extent down dip and along strike. Furthermore, there is potential to develop a number of continuous high-grade veins forming a highly attractive mining target. Gold characterization work on Bens Vein indicates a large percentage of the gold and silver reports to a gravity concentrate.

16

Terra Property Location (from Puchner and Meyers, 2007)

17

State Claim Groups held by the TMC Project in 2012

TMC property illustrating target vein locations

18