Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the fiscal year ended October 31, 2013

o TRANSACTION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

For the transaction period from ________ to ________

Commission File No. 0-53028

WESTMOUNTAIN GOLD, INC.

(Exact Name of Issuer as specified in its charter)

|

Colorado

|

26-1315498

|

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer File Number)

|

|

120 E Lake St. Ste. 401 Sandpoint, ID

|

83864

|

|

|

(Address of principal executive offices)

|

(zip code)

|

(208)265-1717

(Registrant's telephone number, including area code)Securities registered pursuant to Section 12 (b) of the Exchange Act:

|

Common

|

OTCBB

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12 (g) of the Exchange Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þYes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

As of April 30, 2013 (the last business day of our most recently completed second fiscal quarter), based upon the last reported trade on that date, the aggregate market value of the voting and non-voting common equity held by non-affiliates (for this purpose, all outstanding and issued common stock minus stock held by the officers, directors and known holders of 10% or more of the Company’s common stock) was $10,767,879.

As of February 12, 2014, the Company had 25,484,997 shares of common stock issued.

TABLE OF CONTENTS

|

Page

|

|||||

|

PART 1

|

|||||

|

ITEM 1.

|

Description of Business

|

3

|

|||

|

ITEM 1A.

|

Risk Factors

|

5

|

|||

|

ITEM 1B

|

Unresolved Staff Comments

|

15

|

|||

|

ITEM 2.

|

Properties

|

15

|

|||

|

ITEM 3.

|

Legal Proceedings

|

18

|

|||

|

ITEM 4.

|

Mine Safety Disclosure

|

18

|

|||

|

PART II

|

|||||

|

ITEM 5.

|

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

19

|

|||

|

ITEM 6.

|

Selected Financial Data

|

22

|

|||

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

22

|

|||

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

26

|

|||

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

27

|

|||

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

27

|

|||

|

ITEM 9A.

|

Controls and Procedures

|

29

|

|||

|

ITEM 9B.

|

Other Information

|

29

|

|||

|

PART III

|

|||||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

29

|

|||

|

ITEM 11.

|

Executive Compensation

|

34

|

|||

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

42

|

|||

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

44

|

|||

|

ITEM 14.

|

Principal Accounting Fees and Services

|

44

|

|||

|

PART IV

|

|||||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

46

|

|||

|

SIGNATURES

|

F-26

|

||||

2

PART I

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this report, should be considered carefully in evaluating us and our prospects. This report (including without limitation the following factors that may affect operating results) contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act") regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, development of new products, enhancements or technologies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed below and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements which speak only as of the date of this report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report.

ITEM 1. DESCRIPTION OF BUSINESS

THE COMPANY AND OUR BUSINESS

WestMountain Gold, Inc. (“WMTN” or the “Company”) is an exploration stage mining company, in accordance with applicable guidelines of the SEC, which pursues gold projects that are anticipated to have low operating costs and high returns on capital.

We acquired Terra Mining Corporation (“TMC”) on February 28, 2011 and accounted for the transaction as a reverse acquisition using the purchase method of accounting, whereby TMC is deemed to be the accounting acquirer (legal acquiree) and WMTN to be the accounting acquiree (legal acquirer). Our financial statements before the date of the acquisition are those of TMC with the results of WMTN being consolidated from the date of the acquisition. The equity section and earnings per share have been retroactively restated to reflect the reverse acquisition and no goodwill has been recorded. We adopted TMC’s fiscal year, which is October 31.

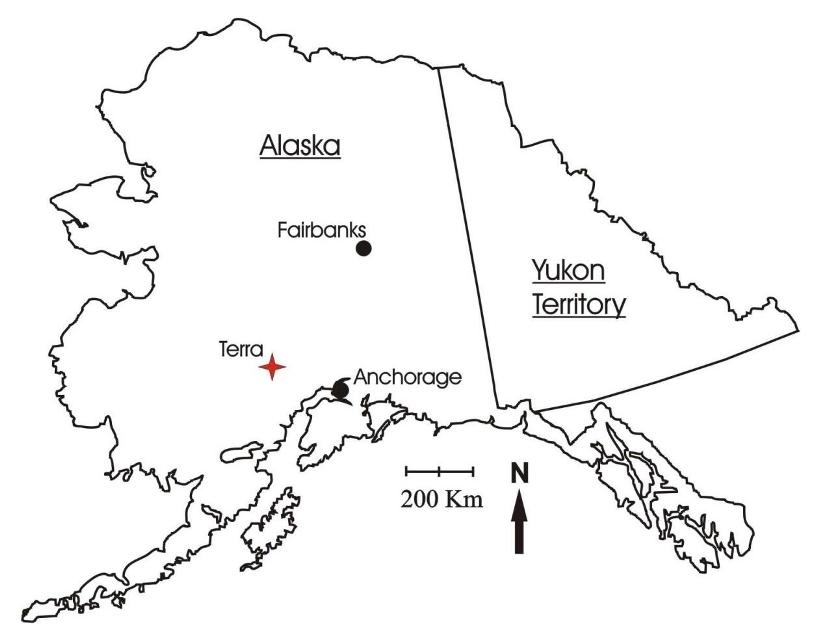

TMC’s wholly owned subsidiary, Terra Gold Corporation (“TGC”), is a joint venture partner with Raven Gold Alaska, Inc. (“Raven”) on a high-grade gold system called the TMC project. We are currently focused on mineral production from mineralized material at this project in the state of Alaska. The TMC project consists of 344 Alaska state mining claims including 5 unpatented lode mining claims held under lease (subject to a 3-4% NSR royalty to the lessor, dependent upon the gold price) covering 223 square kilometers (22,300 hectares). The property is centered on an 8-km-long (800 hectares) trend of high-grade gold vein occurrences. All government permits and reclamation plans for continued exploration through 2013 were renewed in 2010. The $92,560 of fees to maintain the Terra claims through 2014 were paid by us on November 18, 2013. The property lies approximately 200 km (20,000 hectares) west-northwest of Anchorage and is accessible via helicopter or fixed-wing aircraft. The property has haul roads, a mill facility and adjoining camp infrastructure, a tailings pond and other infrastructure. The remote camp is powered by diesel powered generators and water is supplied to the mill by spring fed sources and year round water wells.

Outcropping gold veins were first discovered at Terra in the late 1990's by Kennecott Exploration. The claims were transferred to Mr. Ben Porterfield in 2000. AngloGold Ashanti (USA) Exploration Inc. optioned these claims in 2004 and staked additional claims in the vicinity. Initial detailed soil and rock surveys were conducted at Terra that same year with results leading to the definition of an initial zone of high-grade gold veins over a 2.5 km (250 hectares) strike length. AngloGold followed up with a discovery drill program of 12 holes in 2005 and drilled three additional holes in 2006. A total of 587 rock samples were collected on the property. The Terra project was joint-ventured to International Tower Hill Mines Ltd. (“ITH”) in August of 2006.

On September 15, 2010, TMC and its wholly owned subsidiary, TGC, and Raven signed an Exploration, Development and Mine Operating Agreement (“JV Agreement”). TMC agreed to have 250,000 shares of WMTN common stock issued to Raven, no later than one year after the closing of the acquisition of TMC by WMTN, and an additional 250,000 shares of WMTN common stock issued on or before each of December 31, 2011, 2012 and 2014. The $50,000 due with the signing of the Letter of Intent in February 2010 was paid September 17, 2010. TMC has spent $7,400,000 of project expenses through October 31, 2013 as defined by the JV Agreement. The Company filed its annual JV report on December 13, 2013. TMC is reviewing the project expenses with Raven to determine if the Company has achieved its 51% interest in the JV.

3

The JV Agreement has a term of twenty years, which can continue longer as long as products are produced on a continuous basis and thereafter until all materials, equipment and infrastructure are salvaged and disposed of, environmental compliance is completed and accepted and the parties have completed a final accounting.

We are considered an exploration stage company under SEC criteria because it has not demonstrated the existence of proven or probable reserves at the TMC project. Accordingly, as required under SEC guidelines and U.S. GAAP for companies in the exploration stage, substantially all of our investment in mining properties to date, including construction of the mill, mine facilities and exploration expenditures, have been expensed as incurred and therefore do not appear as assets on our balance sheet. We expect construction expenditures and underground mine exploration and capital improvements will continue during 2014 and subsequent years. We expect to remain as an exploration stage company for the foreseeable future. We do not exit the exploration stage until such time that we demonstrate the existence of proven or probable reserves that meet SEC guidelines. Likewise, unless mineralized material is classified as proven or probable reserves, substantially all expenditures for mine exploration and construction will continue to be expensed as incurred.

As of Feburary 13, 2014, we have $2,852,115 plus accrued interest of $495,938 due to BOCO Investments LLC on three secured promissory notes that are now in default. We are currently attempting to negotiate an extension or other modification as we do not have the ability to repay the amount due. There can be no assurance that we will be able to renegotiate the terms of these promissory notes under terms that are favorable to the Company. We have budgeted expenditures for the TMC project for the next twelve months of approximately $2,900,000, depending on additional financing, for general and administrative expenses and exploration. We must expend an additional $2,100,000 for a total of $9,500,000 plus option payments of $450,000 by December 31, 2014 as an “earn in” on the TMC project to own rights to 80% of the project. Even if economic reserves are found, if we are unable to raise this capital, we will not be able to complete our earn in on this project.

Our principal source of liquidity for the next several years will need to be the continued raising of capital through the issuance of equity or debt. WMTN plans to raise funds for each step of the project and as each step is successfully completed, raise the capital for the next phase. WMTN believes this will reduce the cost of capital as compared to trying to raise all the anticipated capital at once up front. However, since WMTN’s ability to raise additional capital will be affected by many factors, most of which are not within our control (see “Risk Factors”), no assurance can be given that WMTN will in fact be able to raise the additional capital as it is needed.

We may choose to scale back operations to operate at break-even with a smaller level of business activity, while adjusting overhead depending on the availability of additional financing. In addition, we expect that we will need to raise additional funds if we decide to pursue more rapid expansion, appropriate responses to competitive pressures, or the acquisition of complementary businesses or technologies, or if we must respond to unanticipated events that require us to make additional investments. We cannot assure that additional financing will be available when needed on favorable terms, or at all.

Our independent registered accounting firm has expressed substantial doubt about our ability to continue as a going concern as a result of the Company’s history of net loss. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to successfully execute the plans to pursue the TMC project as described in this Form 10-K. The outcome of these matters cannot be predicted at this time. These consolidated financial statements do not include any adjustments to the amounts and classifications of assets and liabilities that might be necessary should we be unable to continue our business.

CORPORATE INFORMATION

We were incorporated in the state of Colorado on October 18, 2007.

Our principal executive office is located at 120 E. Lake St. Ste., 401, Sandpoint, ID 83864, and our telephone number is (208)265-1717. Our principal website address is located at www.westmountaingold.com. The information on our website is not incorporated as a part of this Form 10-K.

THE COMPANY’S COMMON STOCK

Our common stock currently trades on the OTCQB market under the symbol "WMTN."

Our primary key market priority will be to proceed with the TMC project and other mining opportunities that may present themselves from time to time. We cannot guarantee that the TMC project will be successful or that any project that we embark upon will be successful. Our goal is to build our Company into a successful mineral exploration and development company.

PRIMARY RISKS AND UNCERTAINTIES

We are exposed to various risks related to the volatility of the price of gold, our need for additional financing, our joint venture agreements, our reserve estimates, operating as a going concern, unique difficulties and uncertainties in mining exploration ventures, and a volatile market price for our common stock. These risks and uncertainties are discussed in more detail below in this item.

4

EMPLOYEES

As of October 31, 2013, we had six full-time and part-time employees. Additionally, we use employees of Minex Exploration, an Idaho partnership affiliated with our Chief Executive Officer, as contractors for exploration of our Alaska property. Most of our employees are based in Sandpoint, ID. The Chief Executive Officer and the Chief Financial Officer are based out of the Sandpoint, ID office.

WEBSITE ACCESS TO UNITED STATES SECURITIES AND EXCHANGE COMMISSION REPORTS

We file annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission ("SEC"). You may read and copy any document we file at the SEC's Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information concerning filers. We also maintain a web site at http://www.westmountaingold.com that provides additional information about us and links to documents we file with the SEC. Our charters for the Audit, Compensation and Nominations and Governance Committees and the Code of Conduct & Ethics are also available on our website.

ITEM 1A. RISK FACTORS

There are certain inherent risks which will have an effect on the Company’s exploration in the future and the most significant risks and uncertainties known and identified by our management are described below.

If we do not obtain additional financing, our business will fail.

For the year ended October 31, 2013, we had revenues of $94,000. For the year ended October 31, 2012, we had no revenues.

The net loss for the year ended October 31, 2013 and 2012 was $7,610,000 and $5,550,000, respectively. The net loss included $3,447,000 and $1,993,000 of non-cash expenses for the years ended October 31, 2013 and 2012, respectively.

Our current operating funds are less than necessary to complete all intended exploration of the property, and therefore we will need to obtain additional financing in order to complete our business plan. As of October 31, 2013, we had approximately $82,000 in cash.

We have budgeted expenditures for the TMC project for the next twelve months of approximately $2,900,000, depending on additional financing, for general and administrative expenses and exploration.

Our business plan calls for significant expenses in connection with the exploration of the property. We do not currently have sufficient funds to conduct continued exploration on the property and require additional financing in order to determine whether the property contains economic mineralization. We will also require additional financing if the costs of the exploration of the property are greater than anticipated.

As of February 12, 2014, we have $2,852,115 plus accrued interest of $495,938 due to BOCO Investments LLC on three secured promissory notes that are now in default. We are currently attempting to negotiate an extension or other modification of these notes, as we do not have the ability to repay the amount due. If the Company is not successful at negotiating an extension or other modification, it may have to restructure its operations, divest all or a portion of its business, or file for bankruptcy.

On March 20, 2013, the Company entered into forward sale and loan agreements with three accredited investors for an aggregate loan of $600,000. The Company was required to tender, in the aggregate, no less than 600 ounces of gold in bar form to the three accredited investors by September 15, 2013. On November 1, 2013, the Company settled with one of the parties that had an agreement for 200 ounces of gold for 310,000 shares of common stock valued at $1.00 per share, plus warrants for an additional 310,000 shares at an exercise price of $1.50 per share. As of the date of this filing, the Company is in default under the other two agreements and is still negotiating with the two investors to reach a settlement agreement with them. Under these two agreements, the Company is obligated to tender no less than 400 ounces of gold or pay the principal sum of $600,000.

We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including the market prices for copper, silver and gold, investor acceptance of our property and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be our sale of a partial interest in the property to a third party in exchange for cash or exploration expenditures, which is not presently contemplated.

5

The volatility of the price of gold could adversely affect our future operations and our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration, if warranted, are directly related to the market price of gold and other precious metals. The price of gold may also have a significant influence on the market price of our common stock and the value of our properties. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of gold may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices.

As of February 12, 2014, the price of gold was $1,289.50 per ounce, based on the daily London PM fix on that date. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold prices decline or remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

Our Joint Venture Agreement and Amended Claim Agreement are critical to our operations and are subject to cancellation.

On September 15, 2010, we signed an Exploration, Development and Mine Operating Agreement (“JV Agreement”) with Raven.

TMC has spent $7,400,000 of project expenses through October 31, 2013 as defined by the JV Agreement. The Company filed its annual JV report on December 13, 2013. TMC is reviewing the project expenses with Raven to determine if the Company has achieved its 51% interest in the JV.

The failure to operate in accordance with the JV Agreement could result in our interest in the JV Agreement being terminated. See Note 3 to the Consolidated Financial Statements for a discussion of this critical agreement.

On January 7, 2011, TMC entered into an Amended Claims Agreement with Ben Porterfield related to five mining claims known as Fish Creek 1-5 (ADL-648383 through ADL-648387), which claims have been assigned to the TMC project. As part of this Amended Claims Agreement, Ben Porterfield consented to certain conveyances, assignments, contributions and transfers related to the above five mining claims.

The failure to operate in accordance with the Amended Claims Lease or Agreement could result in the lease pertaining to the mining claims that are the subject of the Amended Claims Agreement being terminated. See Note 3 to the Consolidated Financial Statements for a discussion of this critical agreement.

Our management and a major shareholder and creditor have substantial influence over our company.

As of February 12, 2014, Greg Schifrin, our CEO, and Mr. James Baughman together, either directly or indirectly, own or control 6.7 million shares as of the filing date or approximately 26.4% of our issued and outstanding common stock including shares beneficially owned within sixty days.

BOCO owns or controls 11.2 million shares as of the filing date or approximately 34.3% of our issued and outstanding common stock including shares beneficially owned within sixty days, and (i) including the potential conversion of $1,852,115 of debt that is due and payable by the Company on October 31, 2013, that as of February 11, 2014, is convertible along with accrued interest into Company common stock at a rate of $0.75 per share (ii) the potential conversion of $250,000 of Series A Convertible Preferred Stock; (iii) Promissory Notes totaling $500,000 that were due on October 31, 2013 and December 31, 2013; (iv) and various warrants. See Note 7 and 8 to the Company’s Financial Statements for a more detailed description of this Secured Promissory and Promissory Notes, Series A Convertible Preferred Stock and various warrants. We are currently attempting to negotiate an extension or other modification of these notes as we do not have the ability to repay the amount due. If the Company is not successful in negotiating an extension or other modification, it may have to restructure its operations, divest all or a portion of its business, or file for bankruptcy.

6

As a major creditor and shareholder of the Company, BOCO has additional influence and control over the Company.

Mr. Schifrin, Mr. Baughman and BOCO, in combination with other large shareholders, could cause a change of control of our board of directors, approve or disapprove any matter requiring stockholder approval, cause, delay or prevent a change in control or sale of the Company, which in turn could adversely affect the market price of our common stock.

We have no proven or probable reserves and our decision to continue further exploration is not based on a study demonstrating economic recovery of any mineral reserves and is therefore inherently risky.

Any funds spent by us on exploration could be lost. We have not established the presence of any proven or probable mineral reserves, as defined by the SEC, at any of our properties. Under Industry Guide 7, the SEC has defined a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Any mineralized material discovered or produced by us should not be considered proven or probable reserves.

In order to demonstrate the existence of proven or probable reserves, it would be necessary for us to perform additional exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and obtain a positive feasibility study which demonstrates with reasonable certainty that the deposit can be economically and legally extracted and produced. We have not completed a feasibility study with regard to all or a portion of any of our properties to date. The absence of proven or probable reserves makes it more likely that our properties may cease to be profitable and that the money we spend on exploration may never be recovered.

Since we have no proven or probable reserves, our investment in mineral properties is not reported as an asset in our financial statements which may cause volatility in our net earnings and have a negative impact on the price of our stock.

We prepare our financial statements in accordance with accounting principles generally accepted in the United States of America and report substantially all exploration and construction expenditures as expenses until such time, if ever, we are able to establish proven or probable reserves. Since it is uncertain when, if ever, we will establish proven or probable reserves, it is uncertain whether we will ever report these types of future capital expenditures as an asset. Accordingly, our financial statements report fewer assets and greater expenses than would be the case if we had proven or probable reserves, which could produce volatility in our earnings and have a negative impact on our stock price.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Our reserve and resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally calculate reserves and resources in accordance with Canadian practices. The Geologic Report, upon which we have based our mineralization estimates, was prepared in accordance with Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) National Instrument 43-101 (NI 43-101) and Form 43-101F1 (43-101F1). These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred mineral resources, which are generally not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves.

Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report “resources” as in place, tonnage and grade without reference to unit measures.

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in this report, or in the documents incorporated herein by reference, may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, estimates of mineralized material presented in our press releases and regulatory filings are based upon estimates made by us and our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale metallurgical tests will be recovered at production scale.

7

The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

There is substantial doubt about our ability to continue as a going concern.

Our audited financial statements for the period from inception (March 25, 2010) to October 31, 2013 indicate that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report result from our limited history of operations, limited assets, and operating losses since inception. In addition, among other factors, as of October 31, 2013, we reported a net operating loss of over $17.7 million. If we are not able to continue as a going concern, it is likely investors will lose their investments.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

Because we have limited business operations, we face a high risk of business failure.

We started exploring our properties in the summer of 2011. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Although we were incorporated in the state of Colorado on October 18, 2007, the Company just acquired our mineral properties with our acquisition of TMC on February 28, 2011. We have reported revenues of $94,000 as of the date of this Form 10-K. TMC itself has only been in existence since March 25, 2010.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any significant revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from exploration of the mineral claims and the production of minerals from the claims, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We are dependent on key personnel.

Our success depends to a significant degree upon the continued contributions of key management and other personnel, some of whom could be difficult to replace. We do not maintain key man life insurance covering certain of our officers. Our success will depend on the performance of our officers, our ability to retain and motivate our officers, our ability to integrate new officers into our operations and the ability of all personnel to work together effectively as a team. Our failure to retain and recruit officers and other key personnel could have a material adverse effect on our business, financial condition and results of operations.

8

We lack an operating history and we expect to have losses in the future.

Except for our initial exploration efforts as described above, we have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the following:

|

●

|

Our ability to locate a profitable mineral property;

|

|

|

|

●

|

Our ability to generate revenues; and

|

|

|

●

|

Our ability to reduce exploration costs.

|

Based upon current plans, we expect to incur operating losses in foreseeable future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. We cannot guarantee that we will be successful in generating significant revenues in the future. Failure to generate significant revenues will cause us to go out of business.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. Although we conducted a due diligence investigation prior to entering into the acquisition of TMC, risk remains regarding any undisclosed or unknown liabilities associated with this project. The payment of such liabilities may have a material adverse effect on our financial position.

Because we are small and do not have sufficient capital, we may have to cease operation even if we have found mineralized material.

Because we are small and do not have sufficient capital, we must limit our exploration. Because we may have to limit our exploration, we may be unable to mine mineralized material, even if our mineral claims contain mineralized material. If we cannot mine mineralized material, we may have to cease operations.

If we become subject to onerous government regulation or other legal uncertainties as we move to production, our business will be negatively affected. Governmental regulations impose material restrictions on mineral property exploration. Under Alaska mining law, to engage in exploration will require permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. If we proceed to commence drilling operations on the mineral claims, we will incur additional regulatory compliance costs.

In addition, the legal and regulatory environment that pertains to mineral exploration is uncertain and may change. Uncertainty and new regulations could increase our costs of doing business and prevent us from exploring for ore deposits. The growth of demand for ore may also be significantly slowed. This could delay growth in potential demand for and limit our ability to generate revenues. In addition to new laws and regulations being adopted, existing laws may be applied to limit or restrict mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

We are subject to governmental regulations, which affect our operations and costs of conducting our business.

Our current and future operations are and will be governed by laws and regulations, including:

- laws and regulations governing mineral concession acquisition, prospecting, exploration, mining and production;

- laws and regulations related to exports, taxes and fees;

- labor standards and regulations related to occupational health and mine safety;

- environmental standards and regulations related to clean water, waste disposal, toxic substances, land use and environmental protection; and other matters.

9

Companies engaged in mining exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Failure to comply with applicable laws, regulations and permits may result in enforcement actions, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. We may be required to compensate those suffering loss or damage by reason of our mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation, could have a material adverse impact on our business and cause increases in capital expenditures or require abandonment or delays in exploration.

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All phases of our operations are subject to environmental regulation. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays and may cause material changes or delays in our operations and future activities. It is possible that future changes in these laws or regulations could have a significant adverse impact on our properties or some portion of our business, causing us to re-evaluate those activities at that time.

U.S. Federal Laws. The Comprehensive Environmental, Response, Compensation, and Liability Act (CERCLA), and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, demands for reimbursement for government-incurred cleanup costs, or natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (RCRA), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

We may also be subject to compliance with other federal environmental laws, including the Clean Air Act, National Environmental Policy Act (NEPA) and other environmental laws and regulations.

The State of Alaska Department of Natural Resources requires a pool of funds from all permittees with exploration and mining projects to cover reclamation. There is a $750 per acre disturbance reclamation bond that is required for disturbance of 5 acres or more and/or removal of more the 50,000 cubic yards of material. We exceeded the minimum requirements in 2013 and posted a reclamation bond of approximately $23,000 on December 23, 2013.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after we raise additional funding. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

10

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue to source exploration mineral claims. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that additional commercially exploitable reserves of gold exist on our properties. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Weather and location challenges may restrict and delay our work on our property.

We plan to conduct our exploration on a seasonal basis. Because of the severe Alaska winters and lack of sunlight and with current operations, we are only able to perform exploration operations for approximately five months per year. It is possible that snow or rain could restrict and delay work on the properties to a significant degree. Our property is located in a relatively remote location, which creates additional transportation and energy costs and challenges. Currently, we have drilled our test sites with helicopter-supported drill rigs, which are expensive to operate. While are constructing an underground portal to process gold in 2014, we may not have sufficient funds to complete these improvements, which would further increase the cost of exploration.

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration programs may be slowed down or suspended.

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a shareholder's ability to buy and sell our stock.

Our stock is categorized as a penny stock. The SEC has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

The sale of a significant number of our shares of common stock could depress the price of our common stock.

Sales or issuances of a large number of shares of common stock in the public market or the perception that sales may occur could cause the market price of our common stock to decline. As of February 12, 2014 there were 25.5 million shares of common stock and warrants issued and outstanding. Therefore, the amount of shares that have been registered by the Company for resale by certain investors (up to 6,707,715 shares of common stock) constitutes a significant percentage of the issued and outstanding shares and the sale of all or a portion of these shares could have a negative effect on the market price of our common stock. Significant shares of common stock are held by our principal shareholders, other Company insiders and other large shareholders. As “affiliates” (as defined under Rule 144 of the Securities Act (“Rule 144”)) of the Company, our principal shareholders, other Company insiders and other large shareholders may only sell their shares of common stock in the public market pursuant to an effective registration statement or in compliance with Rule 144.

11

The market price of our common stock may be volatile.

The market price of our common stock has been and is likely in the future to be volatile. Our common stock price may fluctuate in response to factors such as:

|

●

|

Announcements by us regarding resources, liquidity, significant acquisitions, equity investments and divestitures, strategic relationships, addition or loss of significant customers and contracts, capital expenditure commitments, loan, note payable and agreement defaults, loss of our subsidiaries and impairment of assets,

|

|

|

●

|

Issuance or repayment of debt, accounts payable or convertible debt for general or merger and acquisition purposes,

|

|

|

●

|

Sale of a significant number of shares of our common stock by shareholders,

|

|

|

●

|

General market and economic conditions,

|

|

|

●

|

Quarterly variations in our operating results,

|

|

|

●

|

Investor relation activities,

|

|

|

●

|

Announcements of technological innovations,

|

|

|

●

|

New product introductions by us or our competitors,

|

|

|

●

|

Competitive activities, and

|

|

|

●

|

Additions or departures of key personnel.

|

These broad market and industry factors may have a material adverse effect on the market price of our common stock, regardless of our actual operating performance. These factors could have a material adverse effect on our business, financial condition and results of operations.

We may engage in acquisitions, mergers, strategic alliances, joint ventures and divestitures that could result in financial results that are different than expected.

In the normal course of business, we may engage in discussions relating to possible acquisitions, equity investments, mergers, strategic alliances, joint ventures and divestitures. All such transactions are accompanied by a number of risks, including:

|

|

●

|

Use of significant amounts of cash,

|

|

|

●

|

Potentially dilutive issuances of equity securities on potentially unfavorable terms,

|

|

|

●

|

Incurrence of debt on potentially unfavorable terms as well as impairment expenses related to goodwill and amortization expenses related to other intangible assets,

|

|

|

●

|

The possibility that we may pay too much cash or issue too many of our shares as the purchase price for an acquisition relative to the economic benefits that we ultimately derive from such acquisition.

|

|

|

●

|

The process of integrating any acquisition may create unforeseen operating difficulties and expenditures. The areas where we may face difficulties in the foreseeable include:

|

|

|

●

|

Diversion of management time, during the period of negotiation through closing and after closing, from its focus on operating the businesses to issues of integration,

|

|

|

●

|

The need to integrate each company's accounting, management information, human resource and other administrative systems to permit effective management, and the lack of control if such integration is delayed or not implemented,

|

|

|

●

|

The need to implement controls, procedures and policies appropriate for a public company that may not have been in place in private companies, prior to acquisition,

|

|

|

●

|

The need to incorporate acquired technology, content or rights into our products and any expenses related to such integration, and

|

|

|

●

|

The need to successfully develop any acquired in-process technology to realize any value capitalized as intangible assets.

|

From time to time, we may engage in discussions with candidates regarding potential divestures. If a divestiture does occur, we cannot be certain that our business, operating results and financial condition will not be materially and adversely affected. A successful divestiture depends on various factors, including our ability to:

|

|

●

|

Effectively transfer liabilities, contracts, facilities and employees to any purchaser,

|

|

|

●

|

Identify and separate the intellectual property to be divested from the intellectual property that we wish to retain,

|

|

|

●

|

Reduce fixed costs previously associated with the divested assets or business, and

|

|

|

●

|

Collect the proceeds from any divestitures.

|

In addition, if customers of the divested business do not receive the same level of service from the new owners, this may adversely affect our other businesses to the extent that these customers also purchase other products offered by us. All of these efforts require varying levels of management resources, which may divert our attention from other business operations.

If we do not realize the expected benefits or synergies of any divestiture transaction, our consolidated financial position, results of operations, cash flows and stock price could be negatively impacted.

12

Our directors and officers may have conflicts of interest with the Company as a result of their relationships with other companies.

Some of our officers and directors are also directors and officers of other companies, and conflicts of interest may arise between their duties as our officers and directors and as directors and officers of other companies. In addition, the Company has entered into supplier, financing and consulting arrangements with entities controlled by directors of the Company. These factors could have a material adverse effect on our business, financial condition and results of operations.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws.

Without any anti-takeover provisions, there are limited deterrents for a take-over of our Company, which may result in a change in our management and directors.

The laws of the State of Colorado and our Articles of Incorporation and Bylaws may protect our directors from certain types of lawsuits.

The laws of the State of Colorado provide that our directors will not be liable to us or our shareholders for monetary damages for all but certain types of conduct as directors of the company. Our Articles of Incorporation and Bylaws permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing shareholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

Because our executive officers and directors have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Our officers have other business interests. While each officer spends more than 40 hours per week on our business, if the demands on our executive officers from their other obligations increase, they may no longer be able to devote sufficient time to the management of our business. This could negatively impact our business exploration and could cause our business to fail.

Transfer of our securities may be restricted by virtue of state securities “blue sky” laws which prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

Transfers of our common stock may be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as "blue sky" laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities held by many of our stockholders have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions may prohibit the secondary trading of our common stock. Investors should consider the secondary market for our securities to be a limited one.

We are subject to corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We must comply with corporate governance requirements under the Sarbanes-Oxley Act of 2002 and the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010, as well as additional rules and regulations currently in place and that may be subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. We are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial.

Our management has concluded that our disclosure controls and procedures were not effective due to the presence of the following material weaknesses in internal control over financial reporting:

We currently lack appropriate segregation of duties over treasury management. We expect to revise our procedures before the end of 2014.

We formed an audit committee on October 26, 2012 which consists of two independent directors with significant financial expertise. An audit committee is expected to improve oversight in the establishment and monitoring of required internal controls and procedures. We expect to expand the audit committee during 2014.

Management anticipates that such disclosure controls and procedures will not be effective until the material weaknesses are remediated. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

13

GLOSSARY OF TECHNICAL TERMS

“Base Metal” means a classification of metals usually considered to be of low value and higher chemical activity when compared with the precious metals (gold, silver, platinum, etc.). This nonspecific term generally refers to the high-volume, low-value metals copper, lead, tin, and zinc.

“Claim” means a mining interest giving its holder the right to prospect, explore for and exploit minerals within a defined area.

“Diamond Core” means a rotary type of rock drill that cuts a core of rock and is recovered in long cylindrical sections, two centimeters or more in diameter.

“Deposit” means an informal term for an accumulation of mineral ores.

“Exploration Stage” means a prospect that is not yet in either the development or production stage

“Feasibility Study” means an engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability.

“Grade” means the metal content of ore, usually expressed in troy ounces per ton (2,000 pounds) or in grams per ton or metric tons which contain 2,204.6 pounds or 1,000 kilograms.

“Mineralization” means the concentration of metals within a body of rock.

“Mining” means the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

“Underground” means a mine working or excavation closed to the surface.

“Ore” means material containing minerals that can be economically extracted.

“Precious Metals” means any of several relatively scarce and valuable metals, such as gold, silver, and the platinum-group metals.

“Probable Reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for Proven Reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Reserves, is high enough to assume continuity between points of observation.

“Proven Reserves” means reserves for which quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of the reserves are well-established.

“Production Stage” means a project that is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

“Reclamation” means the process of returning land to another use after mining is completed.

“Recovery” means that portion of the metal contained in the ore that is successfully extracted by processing, expressed as a percentage.

“Reserves” means that part of a mineral deposit that could be economically and legally extracted or produced at the time of reserve determination.

“Sampling” means selecting a fractional, but representative, pare of a mineral deposit for analysis.

“Vein” means a fissure, faults or crack in the rock filled by minerals that have traveled upward from some deep source.

14

ITEM 1B. UNRESOLVED STAFF COMMENTS

We have no unresolved Staff comments.

ITEM 2. PROPERTIES

The WMTN principal executive offices are located at 120 E. Lake St. Ste. 401, Sandpoint, ID 83864, and our telephone number is (208)265-1717. On September 1, 2012, we leased our corporate office at the rate of $400 per month to August 31, 2013. We currently lease the office on a month to month basis. On April 1, 2011, we entered into a lease at 120 Lake Street, Suite 401, Sandpoint, ID 83864. This office is leased at the net of $1,000 per month and expired March 31, 2013. On June 4, 2013, we entered into Commercial Lease Amendment II. The office is shared with an entity affiliated with our Chief Executive Officer.

Other than our mining claims, leases, and other real property interests specifically related to mining, WMTN does not own real estate nor have plans to acquire any real estate.

Alaska Property - The TMC Project

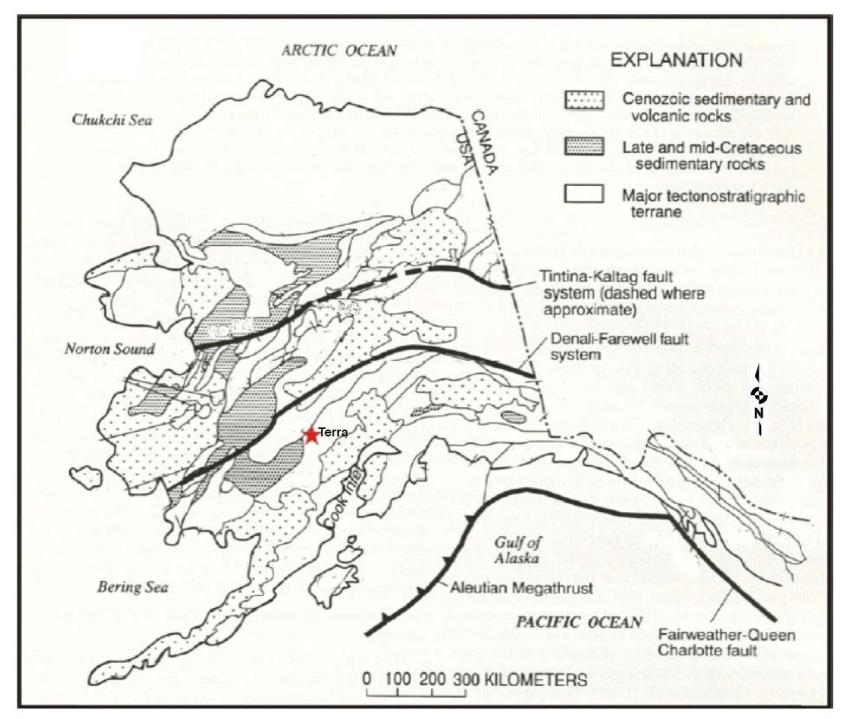

The TMC project consists of 344 Alaska state mining claims including 5 unpatented lode mining claims held under lease (subject to a 3-4% net smelter return (“NSR”) royalty to the lessor, dependent upon the gold price) covering 223 square kilometers (22,300 hectares). The property is centered on an 8-km-long (800 hectares) trend of high-grade gold vein occurrences. All government permits and reclamation plans for continued exploration through 2013 were renewed in 2010. The $92,560 of fees to maintain the Terra claims through 2014 were paid by the Company on November 18, 2013. The property lies approximately 200 km west-northwest of Anchorage between the Revelation and Terra Cotta mountains of the Alaska Range in southwestern Alaska at 61° 41’ 52.17”N latitude by 153° 41’ 05.59W longitude and is accessible via helicopter or fixed-wing aircraft. The property has haul roads, a mill facility and adjoining camp infrastructure, a tailings pond and other infrastructure. The remote camp is powered by diesel powered generators and water is supplied to the mill by spring fed sources and wells.

Outcropping gold veins were first discovered at Terra in the late 1990's by Kennecott Exploration. The claims were transferred to Mr. Ben Porterfield in 2000. AngloGold Ashanti (USA) Exploration Inc. optioned these claims in 2004 and staked additional claims in the vicinity. Initial detailed soil and rock surveys were conducted at Terra that same year with results leading to the definition of an initial zone of high-grade gold veins over a 2.5 km (250 hectares) strike length. AngloGold followed up with a discovery drill program of 12 holes in 2005 and drilled three additional holes in 2006. A total of 587 rock samples were collected on the property. The Terra project was joint-ventured to International Tower Hill Mines Ltd. (“ITH”) in August of 2006.

TMC received geological reports in June 2010 and February 2010 from the State of Alaska Division of Mines and Geology that represented a 400m spacing aerial magnetic and resistivity survey that included the area of the TMC Project.

A total of 44 drill holes have been completed on the TMC property. The TMC mineralization has been characterized as deep epithermal or mesothermal and could have significant extent down dip and along strike. Furthermore, there is potential to develop a number of continuous high-grade veins forming a highly attractive mining target. Gold characterization work on Bens Vein indicates a large percentage of the gold and silver reports to a gravity concentrate.

15

Terra Property Location (from Puchner and Meyers, 2007)

16

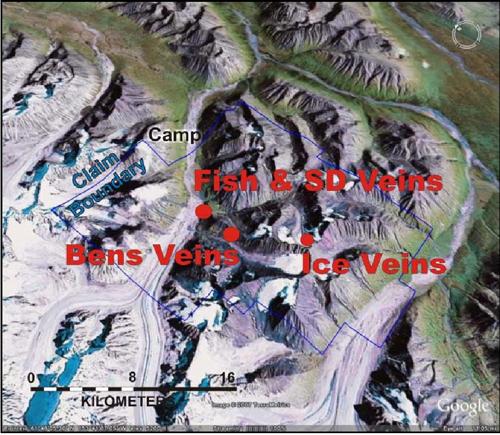

State Claim Groups held by the TMC Project in 2012

17

TMC property illustrating target vein locations

In the Bens Vein zone the main vein system has a core high grade zone of around 29,893 tonnes with 29.48 g/t gold at a 10 g/t cutoff which expands significantly when the cutoff is lowered to 1 g/t. Drilling on Bens Vein zone has outlined an open-ended mineralized zone over 350m long and 250m down dip with an average true width of ~1.3m that has around 852,942 tonnes with 15.3 g/t gold at a 5 g/t cutoff. Drilling on the project has identified numerous veins, Environmental baseline studies were started in 2010 on the Terra property in anticipation of future development. The 2005-2013 drill results for the Ben Vein Zone are encouraging not only because they outlined a consistent and well mineralized main vein structure but also because a large number of well-mineralized hanging wall and foot wall subsidiary veins were encountered. These subsidiary veins offer significant potential for expansion of the system with intercepts such as holes TR-07-20 with new footwall zone of 0.6m @ 43.2 g/t gold and TR-07-22 with new hanging wall zone 0.8m @ 14.5 g/t gold. From the data currently available it appears that a higher grade shoot is developing within the overall Bens Vein system which could form the nucleus for an initial mining target on the project.

ITEM 3. LEGAL PROCEEDINGS

There are no pending legal proceedings against us that are expected to have a material adverse effect on our cash flows, financial condition or results of operations.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

18

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is $.001 par value, 200,000,000 shares authorized and as of February 12, 2014, we had 25,174,997 issued and outstanding, held by 170 shareholders of record. The number of stockholders, including beneficial owners holding shares through nominee names is approximately 350. Each share of Common Stock entitles its holder to one vote on each matter submitted to the shareholders for a vote, and no cumulative voting for directors is permitted. Stockholders do not have any preemptive rights to acquire additional securities issued by the Company. As of February 12, 2014, we had 16,815,308 shares of common stock reserved for issuance upon exercise of outstanding warrants.

Corporate Stock Transfer, Inc. is the transfer agent and registrar for our Common Stock.

Preferred Stock

Our preferred stock is $0.10 par value, 1,000,000 shares authorized and as of February 12, we had 12,100 shares issued and outstanding. On November 29, 2013, our Board of Directors of the Company approved a Certificate of Designation of Rights and Preferences of Series A Convertible Preferred Stock. The Certificate of Designation was filed with the state of Colorado on December 2, 2013. Each holder of outstanding shares of Series A Preferred shall be entitled to the number of votes equal to the number of whole shares of common stock of the Corporation into which the shares of Series A Preferred held by such holder are then convertible as of the applicable record date. We cannot amend, alter or repeal any preferences, rights, or other terms of the Series A Preferred so as to adversely affect the Series A Preferred , without the written consent or affirmative vote of the holders of at least sixty-six and two-thirds percent (66.66%) of the then outstanding shares of Series A Preferred, voting as a separate voting group, given by written consent or by vote at a meeting called for such purpose for which notice shall have been duly given to the holders of the Series A Preferred.

Stock Incentive Plan

On February 28, 2013, the 2012 Stock Incentive Plan was approved at the Annual Stockholder Meeting. We were authorized to issue options for, and have reserved for issuance, up to 4,000,000 shares of common stock under the 2012 Stock Incentive Plan. As of February 12, 2014, all 4,000,000 shares of common stock remain available for grant under the 2012 Stock Incentive Plan.

Change in Control Provisions

Our articles of incorporation provide for a maximum of five directors. There is no provision for classification or staggered terms for the members of the Board of Directors.

Our articles of incorporation also provide that except to the extent the provisions of Colorado General Corporation Law require a greater voting requirement, any action, including the amendment of the Company’s articles or bylaws, the approval of a plan of merger or share exchange, the sale, lease, exchange or other disposition of all or substantially all of the Company’s property other than in the usual and regular course of business, shall be authorized if approved by a simple majority of stockholders, and if a separate voting group is required or entitled to vote thereon, by a simple majority of all the votes entitled to be cast by that voting group.

Our bylaws provide that only the Chief Executive Officer or a majority of the Board of Directors may call a special meeting. The bylaws do not permit the stockholders of the Company to call a special meeting of the stockholders for any purpose.

Amendment of Bylaws

Our Board of Directors has the authority to amend our bylaws; however, the stockholders, under the provisions of our articles of incorporation as well as our bylaws, have the concurrent power to amend the bylaws.

19

Market Price of and Dividends on Common Equity and Related Stockholder Matters

Our common stock trades on OTCQB Exchange under the symbol "WMTN". The following table sets forth the range of the high and low sale prices of the common stock for the periods indicated:

|

Quarter Ended

|

High

|

Low

|

||||||

|

January 31, 2013

|

$ | 1.01 | $ | 0.58 | ||||

|

April 30, 2013

|

$ | 1.00 | $ | 0.52 | ||||

|

July 31, 2013

|

$ | 1.50 | $ | 0.74 | ||||

|

October 31, 2013

|

$ | 1.35 | $ | 0.83 | ||||

|

January 31, 2012

|

$ | 3.99 | $ | 1.60 | ||||

|

April 30, 2012

|

$ | 1.60 | $ | 1.00 | ||||

|

July 31, 2012

|

$ | 1.19 | $ | 0.30 | ||||

|

October 31, 2012

|

$ | 1.13 | $ | 0.30 | ||||