Attached files

| file | filename |

|---|---|

| EX-10.25 - REQUEST - WESTMOUNTAIN GOLD, INC. | wmtn_ex1025.htm |

| EXCEL - IDEA: XBRL DOCUMENT - WESTMOUNTAIN GOLD, INC. | Financial_Report.xls |

| EX-10.26 - SUBSCRIPTION AGREEMENT - WESTMOUNTAIN GOLD, INC. | wmtn_ex1026.htm |

| EX-31.1 - CERTIFICATION - WESTMOUNTAIN GOLD, INC. | wmtn_ex311.htm |

| EX-21.1 - SUBSIDIARIES - WESTMOUNTAIN GOLD, INC. | wmtn_ex211.htm |

| EX-32.1 - CERTIFICATION - WESTMOUNTAIN GOLD, INC. | wmtn_ex321.htm |

| EX-31.2 - CERTIFICATION - WESTMOUNTAIN GOLD, INC. | wmtn_ex312.htm |

| EX-31.2 - CERTIFICATION - WESTMOUNTAIN GOLD, INC. | wmtn_ex322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the fiscal year ended October 31, 2011

o TRANSACTION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

For the transaction period from ________ to ________

Commission File No. 0-53028

WESTMOUNTAIN INDEX ADVISOR, INC.

(Exact Name of Issuer as specified in its charter)

|

Colorado

|

26-1315498

|

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer File Number)

|

|

2186 S. Holly St., Suite 104 Denver, CO

|

80222

|

|

|

(Address of principal executive offices)

|

(zip code)

|

(303) 800-0678

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Exchange Act:

|

Common

|

OTCBB

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12 (g) of the Exchange Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

| Non-accelerated filer | o | Smaller reporting company | þ | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

As of April 30, 2011 (the last business day of our most recently completed second fiscal quarter), based upon the last reported trade on that date, the aggregate market value of the voting and non-voting common equity held by non-affiliates (for this purpose, all outstanding and issued common stock minus stock held by the officers, directors and known holders of 10% or more of the Company’s common stock) was $29,686,697.

As of December 20, 2011, the Company had 18,765,664 shares of common stock issued.

TABLE OF CONTENTS

|

Page

|

|||||

|

PART 1

|

|||||

|

ITEM 1.

|

Description of Business

|

3 | |||

|

ITEM 1A.

|

Risk Factors

|

5 | |||

|

ITEM 1B

|

Unresolved Staff Comments

|

11 | |||

|

ITEM 2.

|

Properties

|

11 | |||

|

ITEM 3.

|

Legal Proceedings

|

11 | |||

|

ITEM 4.

|

Submission of Matters to Vote of Securities Holders

|

11 | |||

|

PART II

|

|||||

|

ITEM 5.

|

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

12 | |||

|

ITEM 6.

|

Selected Financial Data

|

13 | |||

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

14 | |||

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

18 | |||

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

18 | |||

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

18 | |||

|

ITEM 9A.

|

Controls and Procedures

|

18 | |||

|

ITEM 9B.

|

Other Information

|

19 | |||

|

PART III

|

|||||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

20 | |||

|

ITEM 11.

|

Executive Compensation

|

24 | |||

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

24 | |||

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

24 | |||

|

ITEM 14.

|

Principal Accounting Fees and Services

|

24 | |||

|

PART IV

|

|||||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

25 | |||

|

SIGNATURES

|

29 | ||||

2

PART I

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this report, should be considered carefully in evaluating us and our prospects. This report (including without limitation the following factors that may affect operating results) contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act") regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, development of new products, enhancements or technologies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed below and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements which speak only as of the date of this report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report.

ITEM 1. DESCRIPTION OF BUSINESS

THE COMPANY AND OUR BUSINESS

WestMountain Index Advisor, Inc. (“WestMountain,” “WMTN” or the “Company”) is an exploration and development company that explores, acquires, and develops advanced stage properties. We have a high-grade gold system in the resource definition phase with 168,000 oz of inferred gold which in total offers potential of greater than 1,000,000 ounces. The property consists of 240 Alaska state mining claims covering approximately 130 square kilometers. All Government permits and reclamation plans for continued exploration through 2014 were renewed in 2010.

We have budgeted expenditures for the next twelve months of approximately $3,500,000, depending on additional financing, for general and administrative expenses and exploration and development to implement the business plan as described above. For further details see “Cash Requirements” below.

WMTN believes that it will have to raise substantial additional capital in order to fully implement the business plan. If economic reserves of gold and/or other minerals are proven, additional capital will be needed to actually develop and mine those reserves. As discussed under “Cash Requirements” below, we must expend $9,050,000 over the next four years as our “earn in” on the TMC project to own rights to 80% of the project. Even if economic reserves are found, if we are unable to raise this capital, we will not be able to complete our earn in on this project.

Our principal source of liquidity for the next several years will need to be the continued raising of capital through the issuance of equity or debt and the exercise of warrants. WMTN plans to raise funds for each step of the project and as each step is successfully completed, raise the capital for the next phase. WMTN believes this will reduce the cost of capital as compared to trying to raise all the anticipated capital at once up front. However, since WMTN’s ability to raise additional capital will be affected by many factors, most of which are not within our control (see “Risk Factors”), no assurance can be given that WMTN will in fact be able to raise the additional capital as it is needed.

Our primary activity will be to proceed with the Terra Mining Corporation (“TMC”) project and other mining opportunities that may present themselves from time to time. We cannot guarantee that the TMC project will be successful or that any project that we embark upon will be successful. Our goal is to build our Company into a successful mineral exploration and development Company.

CORPORATE INFORMATION

We were incorporated in the state of Colorado on October 18, 2007. Our principal executive office is located at 2186 S. Holly St., Suite 104, Denver, CO 80222, and our telephone number is (303) 800-0678. The Company’s principal website address is located at www.terraminingcorp.com. The information on our website is not incorporated as a part of this Form 10-K.

3

THE COMPANY’S COMMON STOCK

Our common stock currently trades on the Over the Counter Bulletin Board (“OTCBB”) under the symbol “WMTN.”

INDUSTRY OVERVIEW

KEY MARKET PRIORITIES

Our primary key market priority will be to proceed with the TMC project and other mining opportunities that may present themselves from time to time. We cannot guarantee that the TMC project will be successful or that any project that we embark upon will be successful. Our goal is to build our Company into a successful mineral exploration and development Company.

PRIMARY RISKS AND UNCERTAINTIES

We are exposed to various risks related to the volatility of the price of gold, our reserve estimates, operating as a going concern, unique difficulties and uncertainties in mining exploration ventures, our need for additional financing, and a volatile market price for our common stock. These risks and uncertainties are discussed in more detail below in this item.

EMPLOYEES

As of October 31, 2011, we had five full-time and part-time employees and we use employees of Minex Exploration, an Idaho partnership affiliated with our Chief Executive Officer, as contractors for exploration and development of our Alaska property. Most employees were based in Sandpoint, ID. The Chief Executive Officer is based out of the Sandpoint, ID office. The Chief Financial Officer is based out of Seattle, WA.

WEBSITE ACCESS TO UNITED STATES SECURITIES AND EXCHANGE COMMISSION REPORTS

We file annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission ("SEC"). You may read and copy any document we file at the SEC's Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information concerning filers. We also maintain a web site at http://www.terraminingcorp.com that provides additional information about our Company and links to documents we file with the SEC. The Company's charters for the Compensation Committee and the Code of Conduct & Ethics are also available on our website. The Company does not have an Auditing or Nominations Committee at this time. The information on our website is not part of this Form 10-K.

4

ITEM 1A. RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the following risk factors and other information in this prospectus before deciding to invest in shares of the Company’s Common Stock. The most significant risks and uncertainties known and identified by our management are described below; however, they are not the only risks that we face. If any of the following risks actually occurs, our business, financial condition, liquidity, results of operations and prospects for growth could be materially adversely affected, the trading price of our Common Stock could decline, and you may lose all or part of your investment. You should acquire shares of our Common Stock only if you can afford to lose your entire investment. We make various statements in this section that constitute “forward-looking statements”. See “Forward-Looking Statements” beginning on page 3 of this prospectus.

The volatility of the price of gold could adversely affect our future operations and our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market price of gold and other precious metals. The price of gold may also have a significant influence on the market price of our common stock and the value of our properties. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of gold may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices.

As of December 16, 2011, the price of gold was $1,577 per ounce, based on the daily London PM fix on that date. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold prices decline or remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, estimates of mineralized material presented in our press releases and regulatory filings are based upon estimates made by us and our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale metallurgical tests will be recovered at production scale.

The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

We need to continue as a going concern if our business is to succeed.

The audited financial statements for WMTN for the period of inception from March 25, 2010 to October 31, 2011 indicates that there are a number of factors that raise substantial doubt about its ability to continue as a going concern. Such factors identified in the report result from our limited history of operations, limited assets, and operating losses since inception. If we are not able to continue as a going concern, it is likely investors will lose their investments.

5

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

If we do not obtain additional financing, our business will fail.

During the fiscal year ended October 31, 2011 and 2010, we had no revenues.

Net loss for the year ended October 31, 2011 was $4,035,260 as compared to a net loss of $495,018 for the period from inception of to October 31, 2010. The net loss included $900,000 of non-cash expenses related to the transaction that acquired the TMC and the TMC project.

Our current operating funds are less than necessary to complete all intended exploration of the property, and therefore we will need to obtain additional financing in order to complete our business plan. As of December 20, 2011 we had cash in the amount of $200,000.

Our business plan calls for significant expenses in connection with the exploration of the property. We do not currently have sufficient funds to conduct continued exploration on the property and require additional financing in order to determine whether the property contains economic mineralization. We will also require additional financing if the costs of the exploration of the property are greater than anticipated.

We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including the market prices for copper, silver and gold, investor acceptance of our property and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be our sale of a partial interest in the property to a third party in exchange for cash or exploration expenditures, which is not presently contemplated.

Because we have commenced limited business operations, we face a high risk of business failure.

We started exploring our properties in the summer of 2011. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Although we were incorporated in the state of Colorado on October 18, 2007, the Company just acquired our mineral properties with our acquisition of TMC on February 28, 2011. We have not earned any revenues as of the date of this prospectus. TMC itself has only been in existence since March 25, 2010.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the mineral claims and the production of minerals from the claims, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

6

We are dependent on key personnel.

Our success depends to a significant degree upon the continued contributions of key management and other personnel, some of whom could be difficult to replace. We do not maintain key man life insurance covering certain of our officers. Our success will depend on the performance of our officers, our ability to retain and motivate our officers, our ability to integrate new officers into our operations and the ability of all personnel to work together effectively as a team. Our failure to retain and recruit officers and other key personnel could have a material adverse effect on our business, financial condition and results of operations.

We lack an operating history and we expect to have losses in the future.

Except for our initial exploration efforts as described above, we have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the following:

|

●

|

Our ability to locate a profitable mineral property;

|

|

●

|

Our ability to generate revenues; and

|

|

●

|

Our ability to reduce exploration costs.

|

Based upon current plans, we expect to incur operating losses in foreseeable future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. Although we conducted a due diligence investigation prior to entering into the acquisition of TMC, risk remains regarding any undisclosed or unknown liabilities associated with this project. The payment of such liabilities may have a material adverse effect on our financial position.

Because we are small and do not have sufficient capital, we may have to cease operation even if we have found mineralized material.

Because we are small and do not have sufficient capital, we must limit our exploration. Because we may have to limit our exploration, we may be unable to mine mineralized material, even if our mineral claims contain mineralized material. If we cannot mine mineralized material, we may have to cease operations.

7

If we become subject to onerous government regulation or other legal uncertainties, our business will be negatively affected.

Governmental regulations impose material restrictions on mineral property exploration and development. Under Alaska mining law, to engage in exploration will require permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. If we proceed to commence drilling operations on the mineral claims, we will incur additional regulatory compliance costs.

In addition, the legal and regulatory environment that pertains to mineral exploration is uncertain and may change. Uncertainty and new regulations could increase our costs of doing business and prevent us from exploring for ore deposits. The growth of demand for ore may also be significantly slowed. This could delay growth in potential demand for and limit our ability to generate revenues. In addition to new laws and regulations being adopted, existing laws may be applied to limit or restrict mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after this offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue to source exploration mineral claims. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that additional commercially exploitable reserves of gold exist on our properties. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Weather and location challenges may restrict and delay our work on our property.

We plan to conduct our exploration on a seasonal basis, it is possible that snow or rain could restrict and delay work on the properties to a significant degree. Our property is located in a relatively remote location, which creates additional transportation and energy costs and challenges.

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

8

Trading of our stock may be restricted by Blue Sky eligibility and the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.

We currently are not Blue Sky eligible in certain states so trading of the Company’s stock in such states may be restricted. In addition, the SEC has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Under the penny stock rules, additional sales practice requirements are imposed on broker-dealers who sell to persons other than established customers and "accredited investors." The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to broker-dealers ability to trade in the Company’s securities. The Blue Sky eligibility and the penny stock rules may discourage investor interest in and limit the marketability of, the Company’s common stock.

The sale of a significant number of our shares of common stock could depress the price of our common stock.

Sales or issuances of a large number of shares of common stock in the public market or the perception that sales may occur could cause the market price of our common stock to decline. As of December 20, 2011, there were 25.4 million shares of common stock and warrants issued and outstanding on a fully diluted basis. Therefore the amount of shares being registered for resale constitutes a significant percentage of the issued and outstanding shares and the sale of all or a portion of these shares could have a negative effect on the market price of our common stock. Significant shares of common stock are held by our principal shareholders, other Company insiders and other large shareholders. As “affiliates” (as defined under Rule 144 of the Securities Act (“Rule 144”)) of the Company, our principal shareholders, other Company insiders and other large shareholders may only sell their shares of common stock in the public market pursuant to an effective registration statement or in compliance with Rule 144.

We may engage in acquisitions, mergers, strategic alliances, joint ventures and divestitures that could result in financial results that are different than expected.

In the normal course of business, we may engage in discussions relating to possible acquisitions, equity investments, mergers, strategic alliances, joint ventures and divestitures. All such transactions are accompanied by a number of risks, including:

|

●

|

Use of significant amounts of cash,

|

|

●

|

Potentially dilutive issuances of equity securities on potentially unfavorable terms,

|

|

●

|

Incurrence of debt on potentially unfavorable terms as well as impairment expenses related to goodwill and amortization expenses related to other intangible assets, and

|

|

●

|

The possibility that we may pay too much cash or issue too many of our shares as the purchase price for an acquisition relative to the economic benefits that we ultimately derive from such acquisition.

|

|

●

|

The process of integrating any acquisition may create unforeseen operating difficulties and expenditures. The areas where we may face difficulties in the foreseeable include:

|

|

●

|

Diversion of management time, during the period of negotiation through closing and after closing, from its focus on operating the businesses to issues of integration,

|

|

●

|

The need to integrate each Company's accounting, management information, human resource and other administrative systems to permit effective management, and the lack of control if such integration is delayed or not implemented,

|

|

●

|

The need to implement controls, procedures and policies appropriate for a public company that may not have been in place in private companies, prior to acquisition,

|

|

●

|

The need to incorporate acquired technology, content or rights into our products and any expenses related to such integration, and

|

|

●

|

The need to successfully develop any acquired in-process technology to realize any value capitalized as intangible assets.

|

9

From time to time, we may engage in discussions with candidates regarding potential divestures. If a divestiture does occur, we cannot be certain that our business, operating results and financial condition will not be materially and adversely affected. A successful divestiture depends on various factors, including our ability to:

|

●

|

Effectively transfer liabilities, contracts, facilities and employees to any purchaser,

|

|

●

|

Identify and separate the intellectual property to be divested from the intellectual property that we wish to retain,

|

|

●

|

Reduce fixed costs previously associated with the divested assets or business, and

|

|

●

|

Collect the proceeds from any divestitures.

|

In addition, if customers of the divested business do not receive the same level of service from the new owners, this may adversely affect our other businesses to the extent that these customers also purchase other products offered by us. All of these efforts require varying levels of management resources, which may divert our attention from other business operations.

If we do not realize the expected benefits or synergies of any divestiture transaction, our consolidated financial position, results of operations, cash flows and stock price could be negatively impacted.

The market price of our common stock may be volatile.

The market price of our common stock has been and is likely in the future to be volatile. Our common stock price may fluctuate in response to factors such as:

|

●

|

Announcements by us regarding liquidity, significant acquisitions, equity investments and divestitures, strategic relationships, addition or loss of significant customers and contracts, capital expenditure commitments, loan, note payable and agreement defaults, loss of our subsidiaries and impairment of assets,

|

|

●

|

Issuance of convertible or equity securities for general or merger and acquisition purposes,

|

|

●

|

Issuance or repayment of debt, accounts payable or convertible debt for general or merger and acquisition purposes,

|

|

●

|

Sale of a significant number of shares of our common stock by shareholders,

|

|

●

|

General market and economic conditions,

|

|

●

|

Quarterly variations in our operating results,

|

|

●

|

Investor relation activities,

|

|

●

|

Announcements of technological innovations,

|

|

●

|

New product introductions by us or our competitors,

|

|

●

|

Competitive activities, and

|

|

●

|

Additions or departures of key personnel.

|

10

These broad market and industry factors may have a material adverse effect on the market price of our common stock, regardless of our actual operating performance. These factors could have a material adverse effect on our business, financial condition and results of operations.

Our management has substantial influence over our company.

As of December 20, 2011, Greg Schifrin, our CEO, and Mr. James Baughman together, either directly or indirectly, own or control 6.7 million shares as of the filing date or approximately 33.0% of the Company’s issued and outstanding common stock and 26.3% of our common stock on a fully diluted basis.

Mr. Schifrin and Mr. Baughman, in combination with other large shareholders, could cause a change of control of our board of directors, approve or disapprove any matter requiring stockholder approval, cause, delay or prevent a change in control or sale of the Company, which in turn could adversely affect the market price of our common stock.

Conflict of interest.

Some of our officers and directors are also directors and officers of other companies, and conflicts of interest may arise between their duties as our officers and directors and as directors and officers of other companies. These factors could have a material adverse effect on our business, financial condition and results of operations.

We have limited insurance.

We have limited director and officer insurance and commercial insurance policies. Any significant insurance claims would have a material adverse effect on our business, financial condition and results of operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We have three unresolved Staff comments related to our Registration Statement on Form S-1 filed with the SEC on September 9, 2011 and amended on October 18, 2011 and November 15, 2011.

ITEM 2. PROPERTIES

The WMTN principal executive offices are located at 2186 S. Holly St., Suite 104, Denver, CO 80222, and its telephone number is (303) 800-0678. Our corporate office is leased monthly lease at the rate of $560 per month and expired October 31, 2011 and is being leased on a monthly basis. On April 1, 2011, we entered into a lease at 120 Lake Street, Suite 401, Sandpoint, ID 83864. This office is leased at the net of $1,000 per month and expires March 31, 2012. The office is shared with an entity affiliated with our Chief Executive Officer. We have the option to extend the lease for one year.

Other than our mining claims, leases, and other real property interests specifically related to mining, WMTN does not own real estate nor have plans to acquire any real estate.

ITEM 3. LEGAL PROCEEDINGS

There are no pending legal proceedings against us that are expected to have a material adverse effect on our cash flows, financial condition or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not applicable.

11

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock currently trades on the Over the Counter Bulletin Board (“OTCBB”) under the symbol “WMTN.” The following table sets forth the range of the high and low sale prices of the common stock for the periods indicated:

|

Quarter Ended

|

High

|

Low

|

||||||

|

January 31, 2011

|

$ | - | $ | - | ||||

|

April 30, 2011

|

$ | 3.97 | $ | 3.75 | ||||

|

July 31, 2011

|

$ | 3.97 | $ | 1.25 | ||||

|

October 31, 2011

|

$ | 3.99 | $ | 1.25 | ||||

|

March 31, 2010

|

$ | 0.66 | $ | 0.66 | ||||

|

June 30, 2010

|

$ | 0.66 | $ | 0.66 | ||||

|

September 30, 2010

|

$ | 2.76 | $ | 0.66 | ||||

|

December 31, 2010

|

$ | 2.77 | $ | 0.30 | ||||

As of October 31, 2011, the closing price of the Company's common stock was $3.99 per share. As of December 20, 2011, there were 18,772,664 shares of common stock outstanding held by approximately 124 stockholders of record. The number of stockholders, including the beneficial owners' shares through nominee names is approximately 152.

DIVIDEND POLICY

We have never paid any cash dividends and intend, for the foreseeable future, to retain any future earnings for the development of our business. Our future dividend policy will be determined by the board of directors on the basis of various factors, including our results of operations, financial condition, capital requirements and investment opportunities.

RECENT SALES OF UNREGISTERED SECURITIES

During the three months ended October 31, 2011, there were the following sales of unregistered equity securities:

On August 24, 2011, the Company granted Logic under the Logic Agreement a warrant for 700,000 shares at $1.00 per share. The warrant expires August 23, 2014 and does not have registration rights. The warrants may be called by the Company if it has registered the sale of the underlying shares with the SEC and a closing price of $4.00 or more for the Company’s common stock has been sustained for five trading days.

On August 24, 2011, we granted 550,000 shares of restricted common stock to officers and directors that were valued at $0.30 per share. A notice filing under Regulation D was filed with the SEC on September 1, 2011 with regard to this stock issuance.

On August 24, 2011, we granted CPP under its Service Agreement a warrant for 250,000 shares at $0.50 per share and 250,000 shares at $0.75 per share. The warrants expire August 23, 2014 and do not have registration rights. The warrants may be called by the Company if it has registered the sale of the underlying shares with the SEC and a closing price of $2.00 or more for the Company’s common stock has been sustained for five trading days.

In conjunction with an Employment Agreement dated April 9, 2011, the Board of Directors awarded Mr. Scott 54,000 shares of our common stock that were valued at $.30 per share.

As of October 31, 2011, we signed Subscription Agreements with four additional Accredited investors for $525,100 and issued 190,946 shares of restricted common stock at $2.75 per share. The restricted common stock does not have registration rights. In addition, we issued warrants for 190,946 shares at $4.25 per share. The warrants expire by August to October, 2014 and do not have registration rights. The warrants may be called by the Company if it has registered the sale of the underlying shares with the SEC and a closing price of $4.00 or more for the Company’s common stock has been sustained for five trading days. A notice filing under Regulation D was filed with the SEC on September 1, 2011 and October 21, 2011 with regard to this stock issuance.

Except as disclosed, all of the above private placements of our securities were conducted under the exemption from registration as provided under Section 4(2) of the Securities Act of 1933.

12

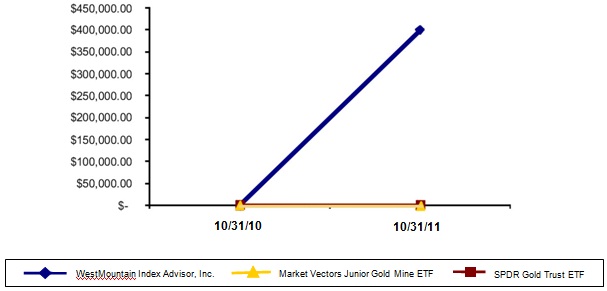

Performance Graph

Comparison of Cumulative Total Return

Among WestMountain Index Advisor, Inc., Market Vectors Junior Gold Mine ETF

and SPDR Gold Trust ETF

The above assumes that $100 was invested in the common stock and each index on October 31, 2010. Although the company has not declared a dividend on its common stock, the total return for each index assumes the reinvestment of dividends. Stockholder returns over the periods presented should not be considered indicative of future returns. The foregoing table shall not be deemed incorporated by reference by any general statement incorporating by reference the Form 10-K into any filing under the Securities Act or the Exchange Act, except to the extent the company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the acts.

EQUITY COMPENSATION PLAN INFORMATION

We do not have any equity compensation plans in effect.

ITEM 6. SELECTED FINANCIAL DATA

In the following table, we provide you with our selected consolidated historical financial and other data. We have prepared the consolidated selected financial information using our consolidated financial statements for the year ended October 31, 2011 and the period from inception of March 25, 2010 to October 31, 2010. When you read this selected consolidated historical financial and other data, it is important that you read along with it the historical financial statements and related notes in our consolidated financial statements included in this report, as well as Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

Year Ended,

|

||||||||

|

10/31/2011 (2)

|

10/31/2010 (1)

|

|||||||

|

(in thousands, except for per share data)

|

||||||||

|

STATEMENT OF OPERATIONS DATA:

|

||||||||

|

Revenue

|

$ | - | $ | - | ||||

|

Net loss

|

(4,035,260 | ) | (495,018 | ) | ||||

|

Net loss applicable to WestMountain Index Advisors, Inc. common shareholders

|

(4,035,260 | ) | (495,018 | ) | ||||

|

Net loss per share

|

(0.32 | ) | (0.13 | ) | ||||

|

BALANCE SHEET DATA:

|

||||||||

|

Total assets

|

1,298,696 | 675,781 | ||||||

|

Stockholder's deficit

|

(109,066 | ) | (267,016 | ) | ||||

|

(1) Reflects net loss of Terra Mining Corporation and subsidiary.

|

||||||||

|

(2) Reflects net loss of WestMountain Index Advisor, Inc. which Terra Mining Corporation and subsidiary acquired on February 28, 2011.

|

||||||||

13

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

WMTN is an exploration and development company that explores, acquires, and develops advanced stage properties. We have a high-grade gold system in the resource definition phase with 168,000 oz of inferred gold which in total offers potential of greater than 1,000,000 ounces. The property consists of 240 Alaska state mining claims covering approximately 130 square kilometers. All Government permits and reclamation plans for continued exploration through 2014 were renewed in 2010.

We have budgeted expenditures for the next twelve months of approximately $3,500,000, depending on additional financing, for general and administrative expenses and exploration and development to implement the business plan as described above. For further details see “Cash Requirements” below.

WMTN believes that it will have to raise substantial additional capital in order to fully implement the business plan. If economic reserves of gold and/or other minerals are proven, additional capital will be needed to actually develop and mine those reserves. As discussed under “Cash Requirements” below, we must expend $9,050,000 over the next four years as our “earn in” on the TMC project to own rights to 80% of the project. Even if economic reserves are found, if we are unable to raise this capital, we will not be able to complete our earn in on this project.

Our principal source of liquidity for the next several years will need to be the continued raising of capital through the issuance of equity or debt and the exercise of warrants. WMTN plans to raise funds for each step of the project and as each step is successfully completed, raise the capital for the next phase. WMTN believes this will reduce the cost of capital as compared to trying to raise all the anticipated capital at once up front. However, since WMTN’s ability to raise additional capital will be affected by many factors, most of which are not within our control (see “Risk Factors”), no assurance can be given that WMTN will in fact be able to raise the additional capital as it is needed.

Our primary activity will be to proceed with the Terra Mining Corporation (“TMC”) project and other mining opportunities that may present themselves from time to time. We cannot guarantee that the TMC project will be successful or that any project that we embark upon will be successful. Our goal is to build our Company into a successful mineral exploration and development Company.

RESULTS OF OPERATIONS

The following table presents certain consolidated statement of operations information and presentation of that data as a percentage of change from year-to-year.

(dollars in thousands)

|

Year Ended October 31,

|

|||||||||||||||||

|

2011

|

2010

|

$ Variance

|

% Variance

|

||||||||||||||

|

Revenue

|

$ | - | $ | - | $ | - | |||||||||||

|

Cost of sales

|

- | - | - | ||||||||||||||

|

Gross profit

|

- | - | - | ||||||||||||||

|

Selling, general and administrative expenses

|

1,710 | 442 | 1,268 | -286.9 | % | ||||||||||||

|

Exploration expenses

|

1,461 | - | 1,461 | -100.0 | % | ||||||||||||

|

Operating loss

|

(3,171 | ) | (442 | ) | (2,729 | ) | -617.4 | % | |||||||||

|

Other income (expense):

|

|||||||||||||||||

|

Interest expense

|

- | (13 | ) | 13 | 100.0 | % | |||||||||||

|

Consulting income - Terra Mining Corporation

|

50 | - | 50 | 100.0 | % | ||||||||||||

|

Finance fee

|

(14 | ) | (40 | ) | 26 | 65.0 | % | ||||||||||

|

Merger expense

|

(900 | ) | - | (900 | ) | -100.0 | % | ||||||||||

|

Total other expense

|

(864 | ) | (53 | ) | (811 | ) | -1530.2 | % | |||||||||

|

Net loss

|

$ | (4,035 | ) | $ | (495 | ) | $ | (3,540 | ) | -715.2 | % | ||||||

14

YEAR ENDED OCTOBER 31, 2011 COMPARED TO THE PERIOD FROM INCEPTION OF MARCH 25, 2010 TO OCTOBER 31, 2010

EXPENSES

Selling, general and administrative expenses for the year ended October 31, 2011 increased $1,268,000 to $1,710,000 as compared to $442,000 for the period from inception of March 25, 2010 to October 31, 2010. Exploration expenses for the year ended October 31, 2011 increased $1,461,000 to $1,461,000 as compared to $0 for the period from inception of March 25, 2010 to October 31, 2010. We acquired TMC on February 28, 2011.

Such expenses for the year ended October 31, 2011 and for the period from inception of March 25, 2010 to October 31, 2010 consisted primarily of employee and independent contractor expenses, rent, audit, overhead, amortization and depreciation, professional and consulting fees, sales and marketing costs, investor relations, legal, and other general and administrative costs and exploration expenses.

NET LOSS

Net loss for the year ended October 31, 2011 was $4,035,000 as compared to a net loss of $495,000 for the period from inception of March 25, 2010 to October 31, 2010. The net loss included $900,000 of non-cash expenses related to the reverse merger transaction.

LIQUIDITY AND CAPITAL RESOURCES

We had cash of approximately $10,000, working capital deficit of approximately $1,138,000 and no indebtedness as of October 31, 2011. In addition, we have $1,155,000 million due under operating leases in 2011 and future years. Further, we have $8,100,000 in mining expenditures in 2012 and future years.

With the acquisition of TMC, we expect that compared to the historic expenses incurred by TMC and, subject to raising additional capital, expenditures will ramp up for exploration and development. We have budgeted expenditures for the next twelve months of approximately $3,500,000, depending on additional financing, for general and administrative expenses and exploration and development. We may choose to scale back operations to operate at break-even with a smaller level of business activity, while adjusting overhead depending on the availability of additional financing. In addition, we expect that we will need to raise additional funds if it decides to pursue more rapid expansion, the development of new or enhanced services or products, appropriate responses to competitive pressures, or the acquisition of complementary businesses or technologies, or if it must respond to unanticipated events that require it to make additional investments. We cannot assure that additional financing will be available when needed on favorable terms, or at all.

If economic reserves of gold and/or other minerals are proven, additional capital will be needed to actually develop and mine those reserves. We must expend $9.1 million over the next four years as our “earn in” on the TMC project to own rights to 80% of the project. Even if economic reserves are found, if we are unable to raise this capital, we will not be able to complete our earn in on this project.

OPERATING ACTIVITIES

Net cash used in operating activities for the year ended October 31, 2011 was $1,630,000. This amount was primarily related to a net loss of $4,035,000, depreciation and amortization, non-cash expenses related to the reverse merger transaction of $1,039,000, $734,000 of non-cash expenses related to operations and decrease in accounts payable and accrued expenses of $1,093,000, offset by and an increase in prepaid expenses of $290,136 and contractual rights of $150,000.

15

INVESTING ACTIVITIES

Net cash used in investing activities for the year ended October 31, 2011 was $317,000. This amount reflects cash expenditures of $414,000, offset by cash acquired in merger of $101,000.

FINANCING ACTIVITIES

Net cash provided by financing activities for the year ended October 31, 2011 was $1,445,000. This amount was primarily related to the issuance of promissory notes and common stock of $2,070,000, offset by the repayment of debenture notes of $630,000.

Our unaudited contractual cash obligations as of October 31, 2011 are summarized in the table below:

|

Less Than

|

Greater Than

|

|||||||||||||||||||

|

Contractual Cash Obligations

|

Total

|

1 Year

|

1-3 Years

|

3-5 Years

|

5 Years

|

|||||||||||||||

|

Operating leases

|

$ | 1,155,350 | $ | 280,350 | $ | 500,000 | $ | 250,000 | $ | 125,000 | ||||||||||

|

Capital lease obligations

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Note payable

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Mining expenditures

|

8,100,000 | 3,500,000 | 3,600,000 | 1,000,000 | 0 | |||||||||||||||

|

Acquisitions

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

| $ | 9,255,350 | $ | 3,780,350 | $ | 4,100,000 | $ | 1,250,000 | $ | 125,000 | |||||||||||

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The application of GAAP involves the exercise of varying degrees of judgment. On an ongoing basis, we evaluate our estimates and judgments based on historical experience and various other factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. We believe that of our significant accounting policies (see summary of significant accounting policies more fully described in Note 2 to the financial statements set forth in this report), the following policies involve a higher degree of judgment and/or complexity:

Cash and Cash Equivalents

The Company classifies highly liquid temporary investments with an original maturity of three months or less when purchased as cash equivalents. The Company maintains cash balances at various financial institutions. Balances at US banks are insured by the Federal Deposit Insurance Corporation up to $250,000. Beginning December 31, 2010, through December 31, 2012, all noninterest-bearing transaction accounts are fully insured, regardless of the balance of the account, at all FDIC-insured institutions. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risk for cash on deposit. As of October 31, 2011, the Company had no uninsured cash amounts.

16

Equipment

Equipment consists of machinery, furniture and fixtures and software, which are stated at cost less accumulated depreciation and amortization. Depreciation is computed by the straight-line method over the estimated useful lives or lease period of the relevant asset, generally 3 years.

Mineral Properties

Costs of acquiring mineral properties are capitalized by project area upon purchase of the associated claims. Costs to maintain the mineral rights and leases are expensed as incurred. When a property reaches the production stage, the related capitalized costs will be amortized, using the units of production method on the basis of periodic estimates of ore reserves.

The Company has access to the camp by airplane. There is no road access from camp to the project area where drilling and bulk sampling mining occurs. It is approximately 1 1/2 miles from camp to the project area. Power generation is by diesel generator at the camp. Fuel is brought in for the generators by a cargo plane to the airstrip.

Long-Lived Assets

The Company reviews its long-lived assets for impairment annually or when changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Long-lived assets under certain circumstances are reported at the lower of carrying amount or fair value. Assets to be disposed of and assets not expected to provide any future service potential to the Company are recorded at the lower of carrying amount or fair value (less the projected cost associated with selling the asset). To the extent carrying values exceed fair values, an impairment loss is recognized in operating results. As of October 31, 2011, there are no impairments recognized.

Alaska Reclamation and Remediation Liabilities

TMC operates in Alaska. The State of Alaska Department of Natural Resources requires a pool of funds from all permittees with exploration and mining projects to cover reclamation. There is a $750 per acre disturbance reclamation bond that is required for disturbance of 5 acres or more and/or removal of more the 50,000 cubic yards of material. In year one, TMC does not expect to exceed the minimum requirements and is not expected to be required to file a reclamation bond. As the project advances and feasibility justifies expansion, TMC may exceed the minimums outlined and may be required to file a reclamation plan and bond.

The Company expects to record reclamation bond as a liability in the period in which the Company is required to pay a reclamation bond. A corresponding asset is also recorded and depreciated over the life of the asset. After the initial measurement of the asset retirement obligation, the liability will be adjusted at the end of each reporting period to reflect changes in reclamation bond.

Mineral Exploration and Development Costs

All exploration expenditures are expensed as incurred. Significant property acquisition payments for active exploration properties are capitalized. If no minable ore body is discovered, previously capitalized costs are expensed in the period the property is abandoned. Expenditures to develop new mines, to define further mineralization in existing ore bodies, and to expand the capacity of operating mines, are capitalized and amortized on a unit of production basis over proven and probable reserves.

Should a property be abandoned, its capitalized costs are charged to operations. The Company charges to operations the allocable portion of capitalized costs attributable to properties sold. Capitalized costs are allocated to properties sold based on the proportion of claims sold to the claims remaining within the project area.

17

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We have no investments in any market risk sensitive instruments either held for trading purposes or entered into for other than trading purposes.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Reference is made to our consolidated financial statements beginning on page F-1 of this report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Not applicable.

ITEM 9A. CONTROLS AND PROCEDURES

MANAGEMENT'S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

a) Evaluation of Disclosure Controls and Procedures

We have adopted and maintain disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods required under the SEC’s rules and forms and that the information is gathered and communicated to our management to allow for timely decisions regarding required disclosure.

As required by Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, our management conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of October 31, 2011. Our disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and our management necessarily was required to apply its judgment in evaluating and implementing our disclosure controls and procedures. Based upon the evaluation described above, our management concluded that they believe that our disclosure controls and procedures were not effective, as of the end of the period covered by this report, in providing reasonable assurance that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management to allow timely decisions regarding required disclosures, and is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Management identified the weaknesses discussed below.

18

Identified Material Weakness

A material weakness in our internal control over financial reporting is a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected. Management identified material weaknesses during its assessment of internal controls over financial reporting as of October 31, 2011:

We do not have an audit committee. An audit committee would improve oversight in the establishment and monitoring of required internal controls and procedures.

(b) Changes In Internal Control Over Financial Reporting

During the quarter ended October 31, 2011, there were no other changes in our internal controls over financial reporting during this fiscal quarter that materially affected, or is reasonably likely to have a materially affect, on our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

There were no disclosures of any information required to be filed on Form 8-K during the three months ended October 31, 2011 that were not filed.

19

PART III

Except as otherwise disclosed below, the following information required by the Instructions to Form 10-K is incorporated herein by reference from various sections of the WestMountain Index Advisor, Inc. Proxy Statement for the annual meeting of shareholders to be held in March 2012, as summarized below:

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

"Election of Directors;" "Section 16(a) Beneficial Ownership Reporting Compliance;" "Corporate Governance;" and "Meetings and Committees of the Board of Directors." – see the WestMountain Index Advisor, Inc. Proxy Statement for the annual meeting of shareholders to be held in March 2012.

The following table sets forth, as of October 31, 2011, the name, age, and position of each executive officer and director and the term of office of each director of the Company, as well as certain biographical information, is set forth below.

|

Name

|

Age

|

Positions and Offices Held

|

Since

|

|||

|

Gregory Schifrin

|

53 |

Director, President and Chief Executive Officer

|

February 28, 2011

|

|||

|

James Baughman

|

55 |

Director, Chief Operating Officer and Senior Vice President

|

February 28, 2011

|

|||

|

Mark Scott

|

58 |

Chief Financial Officer and Secretary

|

February 28, 2011

|

|||

|

Kevin Cassidy

|

55 |

Independent Director

|

August 24, 2011

|

|||

|

Michael Lavigne

|

54 |

Independent Director

|

August 24, 2011

|

Business Experience Descriptions

Set forth below is certain biographical information regarding each of the Company's executive officers and directors.

Our Management Directors

Gregory Schifrin

Mr. Schifrin has worked as a geologist and manager for 28 years in mining and mineral exploration industry where he has been involved in precious, base metals, and uranium exploration and development. Mr. Schifrin has provided technical services and project management for major and junior mining companies.

From December 2007 to the present Mr. Schifrin was the President and Director of Silver Verde May Mining Corporation. During his tenure Mr. Schifrin managed corporate finance, accounting, legal and regulatory requirements, exploration, geologic evaluation, project generation and land acquisition. Mr. Schifrin also served as President and a Director in February and March 2010 of American Mining Corporation.

20

From 1985 to the Present, Mr. Schifrin was the cofounder and President of Minex Exploration, a mining industry known exploration consulting and service company, where Mr. Schifrin managed a staff of 15 to 20 personnel, clients and contracts, accounting, legal and regulatory requirements, as well as managing exploration projects, grassroots through drilling and development phase, throughout North America for major and junior mining companies.

From October 1992 to the Present, Mr. Schifrin co-founded Selkirk Environmental, Inc., an environmental consulting and service company where he managed environmental regulatory compliance, risk analysis, pollution cleanup and environmental assessment for public and private clients.

From November of 2006 to December 2007, Mr. Schifrin was the President and CEO of Golden Eagle Mining Corporation, where he managed corporate affairs, geological exploration, property acquisition and accounting.

In August of 1983, Mr. Schifrin received a Bachelor of Science degree in Geology from the University of Idaho, Moscow. He is a registered professional geologist in the State of Washington. Mr. Schifrin resides in Sandpoint, Idaho.

Mr. Schifrin was appointed as a Director based on his significant experience in the mining and mineral exploration industry.

James Baughman

Mr. Baughman has worked as a geologist for more than 25 years in mining operations and mineral exploration projects for precious, base metals, and uranium. Mr. Baughman has provided technical services and project management for a number of major and junior mining companies.

From July of 2004 to May of 2006, Mr. Baughman was the co-founder, President and Chief Executive Officer of High Plains Uranium Corp, where he managed the company’s corporate finance, accounting, legal and regulatory requirements. He also managed a successful initial public offering on the TSX.

From May of 2006 to October of 2006, Mr. Baughman was the Chief Executive Officer of Kenai Resources, formerly known as Triumph Gold Corp., where he managed the company's properties in Venezuela and Oregon. He also managed the consulting engineers and geologists, and prepared engineering reports.

From October of 2006 to the September 2010, Mr. Baughman led an acquisition of mineral rights on uranium properties, hired professional staff, developed company presentation and conducted road shows to investors and potential investors for US Uranium Corp., a company he co-founded. Mr. Baughman also served as Chief Operating Officer and a Director in March 2010 of American Mining Corporation.

James Baughman is a Director of Big Bear Mining Corp. Mr. Baughman is currently assisting several private mining development companies and is on the Advisory Board of a Canadian exploration company. In July of 1983, Mr. Baughman received a Bachelor of Science degree in Geology from the University of Wyoming, Laramie. He is a registered professional geologist in the State of Wyoming. Mr. Baughman resides in Aurora, Colorado.

Mr. Baughman was appointed as a Director based on his significant experience in the mining and mineral exploration industry.

21

Our Independent Directors

Kevin Cassidy

Mr. Cassidy is the Managing Member and Founder of Logic International Consulting Group, LLC, a consulting firm specializing in the development of global trading businesses and the creation of the requisite infrastructure, management and support paradigms of said platforms.

Previously Mr. Cassidy was a Founding Partner & Chief Operating Officer of Archeus Capital Management, LLC, a multi strategy hedge fund which managed in excess of $3.5 billion in assets. Mr. Cassidy was responsible to optimize the use of the firm’s Capital Balance which regularly exceeded $1 billion by deploying an effective treasury and cash management strategy at the firm.

Mr. Cassidy also served as the Chief Operating Officer for Bank Julius Baer (BJB), based in Zurich. BJB at that time was the largest privately held Bank in Switzerland. He was a member of the BJB Management Committee and responsible for organizing and directing the re-branding of the BJB global trading platform, including both new product and business development. In addition, Mr. Cassidy developed the global FX Option Trading Business and Operating Support Paradigm for the Bank.

Prior to BJB, Mr. Cassidy was Managing Director of UBS, where he was the Global Head of Fixed Income Derivatives Support. He also served as the Global Head of the Bank’s Derivatives Infrastructure, including operations, finance, IT systems and legal. While at UBS, Mr. Cassidy was also President of UBS Securities Swaps Inc., the bank’s US based derivatives platform and business center.

Earlier in his career, Mr. Cassidy was Managing Director of Bear Sterns, where he was credited with the development of multiple new products, including, Currency Exchange Warrants (CEW’s) and Remarketed Preferred, and was also responsible for the new product planning and development group.

Mr. Cassidy began his career at Merrill Lynch, where he rose to the position of Senior Section Manager in charge of New Product Planning & Development. In this position, he was credited with the development of (i) the Remarketed Preferred Product and Trading Platform, and (ii) the development of the Short Term Put Securities Product and Global Trading Platform.

Mr. Cassidy was appointed a Director based on his significant experience and contacts in the banking industry. We expect Mr. Cassidy to advise and assist the Company with regard to raising additional capital for the development of the business.

22

Michael Lavigne

Michael Lavigne has served as the CEO and a board member of Silver Verde May Mining Company, Inc. from December 2008 to the present. Silver Verde May, an exploration stage mining company located in Wallace, Idaho, holds a number of properties in Idaho, Utah and Wyoming. From August 2008, Mr. Lavigne served as a consultant for Golden Eagle Mining Company, which was acquired by Silver Verde May in December 2008. Mr. Lavigne also serves on the board of Mascot Mining which holds properties in Idaho and Montana.

Mr. Lavigne is the owner and Managing Partner of Capital Peak Partners, LLC. Capital Peak provides consulting services in the area of corporate and business development. Capital Peak Partners was founded in September of 2010.

Previously Mr. Lavigne held a number of positions in the travel and hospitality industry. From November 2006 to July 2008, Mr. Lavigne founded and served as a director and CEO of Travel Services Group. From September 2003 to October 2006, Mr. Lavigne was the COO of Glacier Bay Cruise Lines, an adventure cruise in South East Alaska. Mr. Lavigne was a director of Coastal Hotel Group, a partner in NorthCoast Hotels and a member of Starwood Hotel’s Leisure Travel Advisory Board. Also, Mr. Lavigne was the CEO and chairman of Global Leisure, Inc., the parent company of Maupin Tours, Sunmakers, Jet Set North America, Hawaii Leisure and Regency Pacific.

Prior to the travel and hospitality business Mr. Lavigne was involved in the securities and corporate finance business and served as the managing Director of Northwest Capital and Advisory Services and the CEO and chairman of RCL Northwest. Mr. Lavigne was a board member of the Spokane Stock Exchange, a registered national securities exchange which listed primarily mining and resources related companies.

Mr. Lavigne has been on a number of community and charitable boards including, The Giving Back Fund, Communities and Schools of Seattle, The Seahawk Academy and the Jacob Green Golf Classic.

Mr. Lavigne received his BA in Accounting from the University of Idaho and a JD from Gonzaga University School of Law.

Mr. Lavigne was appointed as a Director based on his significant experience in the mining and mineral exploration industry.

Other Executive Officers

Mark Scott

Mr. Scott has served as Chief Financial Officer and Secretary since February 28, 2011 and as a consultant from December 2010. He has significant financial, capital market and relations experience in public microcap companies. Mr. Scott currently also serves as Chief Financial Officer, Secretary and Treasurer of Visualant, Inc., positions he has held since May 2010 and as Chief Financial Officer of Sonora Resources Corp., a position he has held since June 2011. Mr. Scott previously served as Chief Financial Officer of IA Global, Inc. from October 2003 to June 2011. Previously, he held executive financial positions with Digital Lightwave; Network Access Solutions; and Teltronics, Inc.