Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LegacyTexas Financial Group, Inc. | a8k4q2015covererslides.htm |

| EX-99.1 - EXHIBIT 99.1 - LegacyTexas Financial Group, Inc. | ex991q42015earningsrelease.htm |

| EX-99.2 - EXHIBIT 99.2 - LegacyTexas Financial Group, Inc. | ex992q42015dividendannounc.htm |

January 27, 2016 EXHIBIT 99.3 Fourth Quarter and Full Year 2015 Investor Presentation

2 Safe harbor statement When used in filings by LegacyTexas Financial Group, Inc. (the "Company”) with the Securities and Exchange Commission (the “SEC”), in the Company's press releases or other public or stockholder communications, and in oral statements made with the approval of an authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “intends” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical earnings and those presently anticipated or projected, including, among other things: the expected cost savings, synergies and other financial benefits from the Company-LegacyTexas Group, Inc. merger (the “Merger”) might not be realized within the expected time frames or at all and costs or difficulties relating to integration matters might be greater than expected; changes in economic conditions; legislative changes; changes in policies by regulatory agencies; fluctuations in interest rates; the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses; the Company's ability to access cost-effective funding; fluctuations in real estate values and both residential and commercial real estate market conditions; demand for loans and deposits in the Company's market area; fluctuations in the price of oil, natural gas and other commodities; competition; changes in management’s business strategies and other factors set forth in the Company's filings with the SEC. The Company does not undertake - and specifically declines any obligation - to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. FOURTH QUARTER AND FY 2015

3 Today’s presenters FOURTH QUARTER AND FY 2015 Kevin Hanigan President and Chief Executive Officer • CEO and President of LegacyTexas Financial Group, Inc. • Former Chairman and Chief Executive Officer of Highlands Bancshares in 2010 • Former Chairman and Chief Executive Officer of Guaranty Bank in 2009 • 35+ years of Texas banking experience Mays Davenport Executive Vice President, Chief Financial Officer • Former Executive Vice President at LegacyTexas Bank • Senior management experience for retail branch, treasury management, human resources, marketing, mortgage, and wealth advisory functions • Certified Public Accountant, former national accounting and tax advisory firm experience • 23+ years of Texas banking experience

4 LegacyTexas A complete transformation into a commercial bank 2010Q4 2015Q4 Company name Charter Savings & Loan Holding Company Bank Holding Company Market capitalization ($mm) $407 $1,192 ROAA 0.87% 0.95% Net interest margin 2.98% 3.94% Efficiency ratio 63.49% 51.85% Total assets ($bn) $2.9 $7.7 Total loans HFI ($bn)1 $1.1 $5.1 % C&I 3.5% 31.8% FOURTH QUARTER AND FY 2015 – FRANCHISE HIGHLIGHTS Source: Company Documents Note: Market and financial data for 2010 and 2015 are as of December 31, 2010 and 2015, respectively. 1 Excludes Warehouse Purchase Program loans

5 Key franchise highlights - Q4 2015 One of the largest independent Texas financial services companies built upon a strong customer focus and a long history of serving Texans • #1 market share in affluent Collin County among independent banks • #2 overall in Collin County • #3 deposit market share among Dallas-based banks in Dallas-Fort Worth Profitability Robust loan and deposit growth with disciplined expense management • Return on average assets of 1.0%, quarterly basic EPS of $0.36 • Reserve on energy loans totaled $12.0 million, or 2.3% of total energy loans, up $7.1 million ($0.15 per share pre-tax, $0.10 after tax) from $4.9 million at Q3 2015 • Exceptional loan growth for Q4 2015 with 8.1% linked quarter growth¹ • Efficiency ratio of 51.9% with further positive operating leverage expected Asset quality Growth balanced with disciplined underwriting and risk management resulting in strong asset quality • NPAs / loans + OREO: 0.89% 1 • NCOs / average loans: 0.04% for Q4 20151 Capital Profitability levered excess capital while maintaining strong capital levels • TCE / TA2: 8.3% • Estimated Tier 1 common risk-based capital3: 9.56% Source: Company Documents 1 Excludes Warehouse Purchase Program loans 2 See the section labeled "Supplemental Information- Non-GAAP Financial Measures“ 3 Calculated at the Company level, which is subject to the capital adequacy requirements of the Federal Reserve FOURTH QUARTER AND FY 2015 – FRANCHISE HIGHLIGHTS Franchise

6 Collin Dallas Tarrant National $84,284 $50,825 $60,927 $55,551 Median household income Source: Company Documents ¹ Based on deposit market share of banks headquartered in Texas ² Includes banks headquartered in the Dallas-Fort Worth-Arlington, TX MSA A Legacy united Leading market position… …in attractive Dallas markets Fastest growing metro in the U.S. (Census)#1 Best places to live in America (Money Magazine)#1 Best places to find a new job (Money Magazine)#4 Largest metro for self-employment#5 Lowest cost of doing business in the U.S.#5 Largest concentration of tech workers in the U.S.#6 #1 in Collin County among independent banks¹ #2 in Collin County among all banks #3 among Dallas based banks in DFW² FOURTH QUARTER AND FY 2015 – FRANCHISE HIGHLIGHTS Dallas – Fort Worth MSA franchise 21 DFW companies in Fortune 500

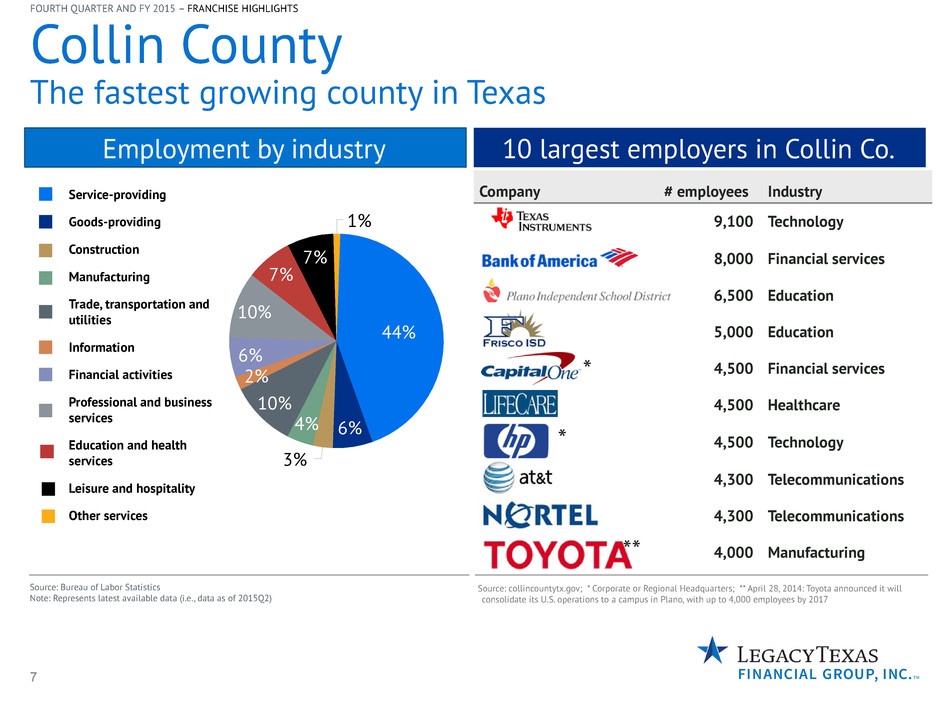

7 44% 6% 3% 4% 10% 2% 6% 10% 7% 7% 1% Employment by industry 10 largest employers in Collin Co. Collin County The fastest growing county in Texas Source: Bureau of Labor Statistics Note: Represents latest available data (i.e., data as of 2015Q2) Company # employees Industry 9,100 Technology 8,000 Financial services 6,500 Education 5,000 Education * 4,500 Financial services 4,500 Healthcare * 4,500 Technology 4,300 Telecommunications 4,300 Telecommunications ** 4,000 Manufacturing Source: collincountytx.gov; * Corporate or Regional Headquarters; ** April 28, 2014: Toyota announced it will consolidate its U.S. operations to a campus in Plano, with up to 4,000 employees by 2017 FOURTH QUARTER AND FY 2015 – FRANCHISE HIGHLIGHTS Service-providing Goods-providing Construction Manufacturing Trade, transportation and utilities Information Financial activities Professional and business services Education and health services Leisure and hospitality Other services

8 Fourth quarter highlights ($ in millions except for per share data) Quarter ended December 31, 2014 September 30, 2015 December 31, 2015 Linked Q ∆ YOY ∆ Selected balance sheet data Gross loans held for investment1 $ 2,633.7 $ 4,688.8 $ 5,066.5 8.1 % 92.4% Total deposits 2,657.8 4,770.1 5,226.7 9.6 % 96.7% Selected profitability data Net interest income $ 35.8 $ 61.2 $ 63.7 4.2 % 77.9% NIM 3.84% 4.00% 3.94% -6bps 10bps Non-interest income $ 5.3 $ 11.9 $ 11.6 (2.2)% 119.0% Non-interest expense 29.8 37.8 39.0 3.2 % 31.0% Net income 5.5 17.9 16.4 (8.1)% 200.9% Core net income2 11.2 17.8 16.3 (8.3)% 45.7% Basic EPS 0.14 0.39 0.36 (7.7)% 157.1% Core EPS2 0.29 0.39 0.35 (10.3)% 20.7% Source: Company Documents 1 Excludes Warehouse Purchase Program loans 2 See the section labeled "Supplemental Information- Non-GAAP Financial Measures“ FOURTH QUARTER AND FY 2015 – QUARTERLY HIGHLIGHTS

9 Originated loans Acquired from LegacyTexas Group, Inc. 2011Y 2012Y 2013Y 2014Y 2015Y $3,667 $1,400 ($ in millions) Robust commercially focused growth Source: Company Documents 1 Excludes Warehouse Purchase Program loans 2 Represents balance acquired on January 1, 2015 Gross loans held for investment at December 31, 2015, excluding Warehouse Purchase Program loans, grew $377.7 million, or 8.1%, from September 30, 2015, with $317.3 million of growth in commercial real estate and commercial and industrial loans. As of December 31, 20151 Total Loans HFI1 Quarterly yield on loans: 4.94% FOURTH QUARTER AND FY 2015 – BALANCE SHEET 43.0% 22.7% 9.1% 5.3% 18.5% 1.4% Commercial RE C&I (ex-energy) Energy C&D Consumer RE Other Consumer $1,228 $1,691 $2,050 $2,634 $5,067 2

10 Oil Gas 2016 2017 2018 75% 52% 19% 77% 70% 54% 35% 9% 56% • Reserve based energy portfolio at December 31, 2015 consisted of 53% gas and 47% oil • At December 31, 2015, 40 reserve based borrowers and 7 midstream borrowers • Reserve based loans are almost exclusively first liens, with only a $5 million commitment to a 2nd lien facility at December 31, 2015 • At December 31, 2015, only $4.7 million in outstanding loans to oil field service companies, of which only $365,000 are criticized Energy lending Source: Company documents R: 000 G: 048 B: 135 R: 111 G: 162 B: 135 FOURTH QUARTER AND FY 2015 – ENERGY LENDING Hedging Percentages at 12/31/15 with Weighted Average Prices $68.94 $63.79 $73.99 $3.41 $3.40 $3.24 Shared National Credit Breakout of Reserve Based Energy Loans Non-LTXB Led SNC LTXB Led SNC Direct and Other Participations

11 Substandard performing Substandard non-performing 2014 Q4 2015 Q1 2015 Q2 2015 Q3 2015 Q4 $12.0 $41.5 $58.6 $8.1 $38.7 $36.2 $12.1 Energy lending Source: Company documents Recent market transactions - criticized energy borrowersSubstandard energy loans R: 000 G: 048 B: 135 R: 111 G: 162 B: 135 • The $24.1 million decrease in substandard non-performing energy loans from Q3 2015 was primarily due to the sale of a $24.3 million non-performing energy relationship to an unrelated third party during the fourth quarter of 2015. The resulting new loan, which is performing, was graded as substandard at December 31, 2015, and included in the $38.7 million reported for substandard performing. • The year-over-year increase in substandard performing energy loans resulted from collateral value deterioration due to commodity price declines. At December 31, 2015, the Company did not have any specific loss reserves set aside for these loans. FOURTH QUARTER AND FY 2015 – ENERGY LENDING ($ in thousands) Borrower 1 LTXB Exposure Global Facility 100% PDP Transaction amount PDP Multiple Company A $14,201 $199,725 $209,807 $475,000 2.26 Company B $5,070 $24,197 $17,384 $40,000 2.30 Company C $5,968 $34,100 $32,149 $85,800 2.69 Company D $24,290 $24,290 $10,899 $25,075 2.30 ($ in millions) 1 Companies A, B, and D were rated substandard, Company C was rated special mention $5.2

12 Energy lending Energy outstanding loan balances and related loan loss reserves Source: Company Documents R: 000 G: 048 B: 135 R: 111 G: 162 B: 135 • We enhanced the allowance for loan losses on energy loans to $12.0 million at December 31, 2015, from $4.9 million at September 30, 2015, entirely due to increased qualitative reserve factors. The Company has not experienced a loss on energy loans to date. • Continued pressure on the price of oil has led to a sustained increase in economic and regulatory uncertainty surrounding energy loans, resulting in increased risk rating downgrades, primarily in the special mention category, which consists entirely of performing loans. • The Company believes that the current level of loan loss reserve for energy loans is sufficient to cover credit losses in the portfolio based on currently available information; however, future sustained declines in oil pricing could lead to further risk rating downgrades, additional loan loss reserves, or losses. FOURTH QUARTER AND FY 2015 – ENERGY LENDING ($ in millions) $8.8 $31.1 Energy reserves $3.4 $4.9 $12.0 Reserve based Midstream Reserve % $64.6 2014 Q4 2015 Q3 2015 Q4 $359.6 $431.4 $459.8 0.9% 1.1% 2.3%

13 Collateral Mix of Houston Portfolio • Continued low LTV in Houston CRE portfolio - 65% for entire Houston portfolio, 70% for energy corridor only • Low loan price per square foot - energy corridor ranges $74-$119 with average of $99 • Only one Houston area loss since the 2003 inception of CRE lending in Houston, totaling only $34 thousand 35% 30% 31% 4% Office Retail Multifamily Other Commercial Real Estate- Houston Source: Company Documents FOURTH QUARTER AND FY 2015 – BALANCE SHEET $ in thousands except % data Total Houston CRE Portfolio Energy Corridor (all office) Remainder Houston Portfolio Outstanding Balance at Dec 31, 2015 $ 438,597 $ 75,454 $ 363,143 % of Houston CRE Portfolio 17% 83% Weighted Average Debt Service Coverage 1.83X 1.58X 1.89X Weighted Average Yield on Debt 12.17% 10.27% 12.64%

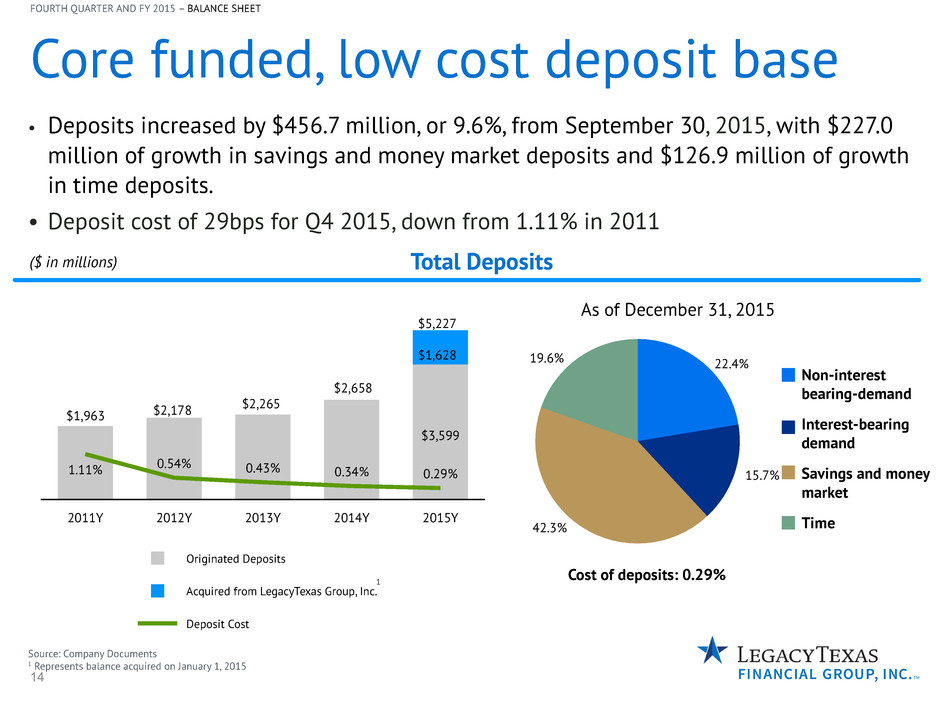

14 Originated Deposits Acquired from LegacyTexas Group, Inc. Deposit Cost 2011Y 2012Y 2013Y 2014Y 2015Y $3,599 1.11% 0.54% 0.43% 0.34% 0.29% • Deposits increased by $456.7 million, or 9.6%, from September 30, 2015, with $227.0 million of growth in savings and money market deposits and $126.9 million of growth in time deposits. • Deposit cost of 29bps for Q4 2015, down from 1.11% in 2011 Core funded, low cost deposit base Source: Company Documents 1 Represents balance acquired on January 1, 2015 ($ in millions) Total Deposits Cost of deposits: 0.29% FOURTH QUARTER AND FY 2015 – BALANCE SHEET As of December 31, 2015 22.4% 15.7% 42.3% 19.6% Non-interest bearing-demand Interest-bearing demand Savings and money market Time $1,963 $2,178 $2,265 $2,658 $5,227 $1,628 1

15 Solid net interest income growth Source: Company Documents Net interest income and NIM R: 000 G: 048 B: 135 R: 111 G: 162 B: 135 • Net interest income for the fourth quarter of 2015 increased by $2.6 million, or 4.2%, from the linked quarter and $27.9 million, or 77.9%, from the fourth quarter of 2014. • Net interest margin for the quarter ended December 31, 2015 was 3.94%, a six basis point decrease from the linked quarter and a ten basis point increase compared to the fourth quarter of 2014. Net interest margin excluding accretion of purchase accounting fair value adjustments on acquired loans was 3.84% for the quarter ended December 31, 2015, down four basis points from 3.88% for the quarter ended September 30, 2015. FOURTH QUARTER AND FY 2015 – INCOME STATEMENT Net interest income ($mm) NIM 2013Y 2014Y 2015Y 2014 Q4 2015 Q4 $118 $133 $241 $36 $643.71% 3.78% 4.00% 3.84% 3.94%

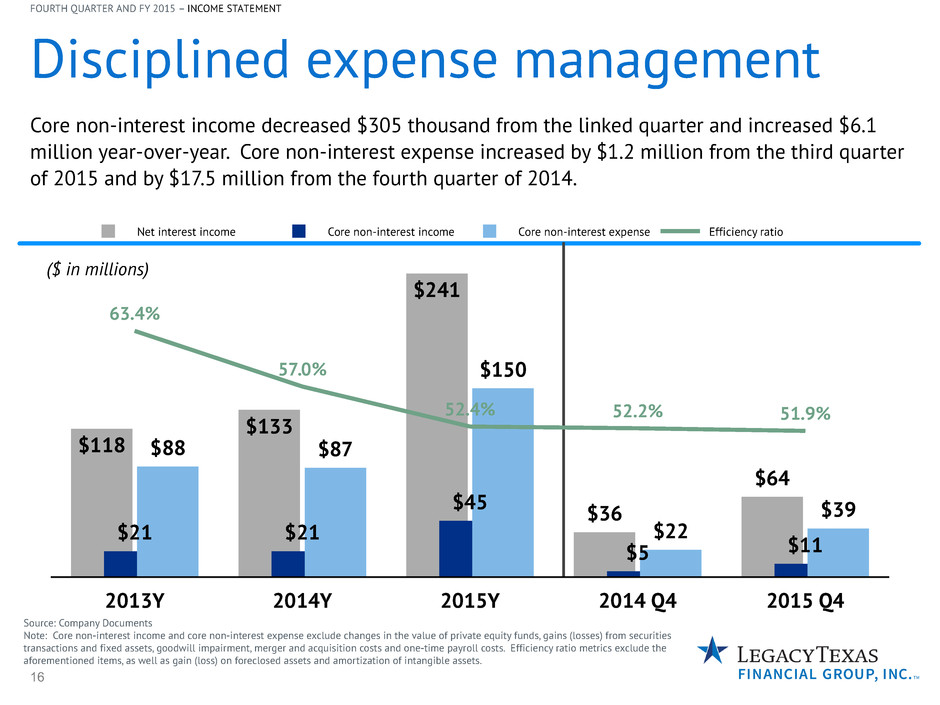

16 Disciplined expense management FOURTH QUARTER AND FY 2015 – INCOME STATEMENT Source: Company Documents Note: Core non-interest income and core non-interest expense exclude changes in the value of private equity funds, gains (losses) from securities transactions and fixed assets, goodwill impairment, merger and acquisition costs and one-time payroll costs. Efficiency ratio metrics exclude the aforementioned items, as well as gain (loss) on foreclosed assets and amortization of intangible assets. ($ in millions) Core non-interest income decreased $305 thousand from the linked quarter and increased $6.1 million year-over-year. Core non-interest expense increased by $1.2 million from the third quarter of 2015 and by $17.5 million from the fourth quarter of 2014. Net interest income Core non-interest income Core non-interest expense Efficiency ratio 2013Y 2014Y 2015Y 2014 Q4 2015 Q4 $118 $133 $241 $36 $64 $21 $21 $45 $5 $11 $88 $87 $150 $22 $39 63.4% 57.0% 52.4% 52.2% 51.9%

17 Strong asset quality Source: Company documents 1 Held for investment, excluding Warehouse Purchase Program loans NCOs / average loans HFI¹NPAs / loans HFI1 + OREO R: 000 G: 048 B: 135 R: 111 G: 162 B: 135 • Growth balanced with disciplined underwriting and risk management resulting in strong asset quality • All of the key credit quality ratios remained strong, with asset quality metrics continuing to compare favorably to industry FOURTH QUARTER AND FY 2015 – ASSET QUALITY 2012Y 2013Y 2014Y 2015Y 1.72% 1.10% 0.91% 0.89% 2012Y 2013Y 2014Y 2015Y 0.17% 0.10% 0.02% 0.09%

18 Prudent capital management Source: Company documents 1 Calculated at the Company level, which is subject to the capital adequacy requirements of the Federal Reserve TCE / TA Tier 1 common risk-based¹ Tier 1 leverage¹ • Profitability levered excess capital while maintaining strong capital levels • In November 2015, the Company completed a public offering of $75.0 million of fixed-to- floating rate subordinated notes due in 2025, the proceeds of which are being used for general corporate purposes, potential strategic acquisitions and investments in the Bank as regulatory capital. FOURTH QUARTER AND FY 2015 – CAPITAL 2011Y 2012Y 2013Y 2014Y 2015Y 12.7% 13.5% 14.7% 13.0% 8.3% 2011Y 2012Y 2013Y 2014Y 2015Y 24.4% 21.7% 18.2% 15.1% 9.6% 2011Y 2012Y 2013Y 2014Y 2015Y 12.6% 14.0% 15.7% 13.9% 9.5%

19 Key investment highlights One of the largest independent Texas financial services companies built upon a strong customer focus and a long history of serving Texans Robust loan growth and disciplined expense management Growth balanced with disciplined underwriting and risk management resulting in strong asset quality Capital ratios remain strong; provides dry powder for robust organic growth FOURTH QUARTER AND FY 2015 – INVESTMENT HIGHLIGHTS

20 Looking ahead Expand our Texas footprint and solidify our deep-rooted culture Focus on growth – organically and through selective acquisitions Diversify income sources Prudent and focused expense management Maintain strong asset quality Strategic capital deployment FOURTH QUARTER AND FY 2015 – LOOKING AHEAD

21 Manifesto We believe in our customers. Their goals. Their dreams. Their ambitions for tomorrow. And since 1952, we’ve been doing whatever it takes to support them as they advance in business and in life. We are responsive, accountable, trusted, experts at what we do. And we listen. Because we believe that true understanding is the first step toward bold, meaningful results. Fueled by an independent spirit, inspired by the ingenuity of our customers and grounded by the values of our community, we are a family like no other. We are LegacyTexas. FOURTH QUARTER AND FY 2015 – OUR VISION

Appendix

23 Supplemental Information – Non-GAAP Financial Measures (unaudited) At or For the Quarters Ended December 31, 2015 September 30, 2015 June 30, 2015 March 31, 2015 December 31, 2014 (Dollars in thousands, except per share amounts) GAAP net income available to common shareholders 1 $16,336 $17,768 $20,091 $16,186 $5,412 Distributed and undistributed earnings to participating securities 1 110 127 160 138 54 Merger and acquisition costs — — 5 1,004 5,765 One-time (gain) loss on assets (133) (130) (142) 554 (45) (Gain) loss on sale of available-for-sale securities (11) 16 — (137) — Core (non-GAAP) net income $16,302 $17,781 $20,114 $17,745 $11,186 Average shares for basic earnings per share 45,939,817 45,862,840 45,760,232 45,824,812 38,051,511 GAAP basic earnings per share $0.36 $0.39 $0.44 $0.35 $0.14 Core (non-GAAP) basic earnings per share $0.35 $0.39 $0.44 $0.39 $0.29 Average shares for diluted earnings per share 46,267,956 46,188,461 46,031,267 46,002,821 38,275,814 GAAP diluted earnings per share $0.35 $0.38 $0.44 $0.35 $0.14 Core (non-GAAP) diluted earnings per share $0.35 $0.38 $0.44 $0.39 $0.29 Reconciliation of Core (non-GAAP) to GAAP Net Income and Earnings per Share (net of tax): ¹ Unvested share-based awards that contain nonforfeitable rights to dividends (whether paid or unpaid) are participating securities and are included in the computation of GAAP earnings per share pursuant to the two-class method described in ASC 260-10-45-60B. At or For the Years Ended December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 GAAP net income available to common shareholders 1 $70,382 $30,942 $31,294 $35,135 $26,205 Distributed and undistributed earnings to participating securities 1 534 336 394 106 123 Merger and acquisition costs 1,009 7,071 431 2,683 306 Costs relating to sale of VPM — – – 84 – One-time payroll and severance costs — 234 436 777 – One-time (gain) loss on assets 149 319 (574) (1,353) (497) Goodwill impairment — – – 532 176 (Gain) loss on sale of available-for-sale securities (132) – 115 (659) (4,074) Core (non-GAAP) net income $71,942 $38,902 $32,096 $37,305 $22,239 Average shares for basic earnings per share 45,847,284 37,919,065 37,589,548 35,879,704 32,219,841 GAAP basic earnings per share $1.54 $0.82 $0.83 $0.98 $0.81 Core (non-GAAP) basic earnings per share $1.57 $1.03 $0.85 $1.04 $0.69 Average shares for diluted earnings per share 46,125,447 38,162,094 37,744,786 35,998,345 32,283,107 GAAP diluted earnings per share $1.53 $0.81 $0.83 $0.98 $0.81 Core (non-GAAP) diluted earnings per share $1.56 $1.02 $0.85 $1.04 $0.69

24 Calculation of Tangible Book Value: Supplemental Information – Non-GAAP Financial Measures (unaudited) At or For the Quarters Ended December 31, 2015 September 30, 2015 June 30, 2015 March 31, 2015 (Dollars in thousands, except per share amounts) Total shareholders' equity $804,076 $792,637 $776,924 $761,059 Less: Goodwill (180,776) (180,632) (180,632) (179,258) Less: Identifiable intangible assets, net (1,030) (1,142) (1,280) (1,042) Total tangible shareholders' equity $622,270 $610,863 $595,012 $580,759 Shares outstanding at end of period 47,645,826 47,640,193 47,619,493 47,602,721 Book value per share- GAAP $16.88 $16.64 $16.32 $15.99 Tangible book value per share- Non-GAAP $13.06 $12.82 $12.50 $12.20 Calculation of Tangible Equity to Tangible Assets: Total assets $7,691,940 $6,878,843 $6,669,624 $6,510,951 Less: Goodwill (180,776) (180,632) (180,632) (179,258) Less: Identifiable intangible assets, net (1,030) (1,142) (1,280) (1,042) Total tangible assets $7,510,134 $6,697,069 $6,487,712 $6,330,651 Equity to assets- GAAP 10.45% 11.52% 11.65% 11.69% Tangible equity to tangible assets- Non-GAAP 8.29% 9.12% 9.17% 9.17% At or For the Years Ended December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Total shareholders' equity $568,223 $544,460 $520,871 $406,309 Less: Goodwill (29,650) (29,650) (29,650) (818) Less: Identifiable intangible assets, net (813) (1,239) (1,653) (420) Total tangible shareholders' equity $537,760 $513,571 $489,568 $405,071 Shares outstanding at end of period $40,014,851 39,938,816 39,612,911 33,700,399 Book value per share- GAAP $14.20 $13.63 $13.15 $12.06 Tangible book value per share- Non-GAAP $13.44 $12.86 $12.36 $12.02 Calculation of Tangible Equity to Tangible Assets: Total assets $4,164,114 $3,525,232 $3,663,058 $3,180,578 Less: Goodwill (29,650) (29,650) (29,650) (818) Less: Identifiable intangible assets, net (813) (1,239) (1,653) (420) Total tangible assets $4,133,651 $3,494,343 $3,631,755 $3,179,340 Equity to assets- GAAP 13.65% 15.44% 14.22% 12.77% Tangible equity to tangible assets- Non-GAAP 13.01% 14.70% 13.48% 12.74%