Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Benefit Street Partners Realty Trust, Inc. | v426540_8k.htm |

Exhibit 99.1

Financing the Growth of Commercial Real Estate Financing the Growth of Commercial Real Estate THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY REALTY FINANCE TRUST . AN OFFERING IS MADE ONLY BY A PROSPECTUS . THIS LITERATURE MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS . AS SUCH, A COPY OF THE CURRENT PROSPECTUS MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING . BEFORE YOU MAKE AN INVESTMENT IN REALTY FINANCE TRUST, YOU SHOULD READ AND CAREFULLY REVIEW THE CURRENT PROSPECTUS IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS INCLUDING THE RISKS, CHARGES AND EXPENSES OF REALTY FINANCE TRUST . No offering is made except by a prospectus filed with the Department of Law of the State of New York . Neither the Attorney - General of the State of New York nor any other state or federal regulator has passed on or endorsed the merits of Realty Finance Trust or confirmed the adequacy or accuracy of the prospectus . Any representation to the contrary is unlawful . All information contained in this material is qualified in its entirety by the terms of the current prospectus . The achievement of any goals is not guaranteed . Realty Finance Trust, Inc. Publicly Registered Non - Traded Real Estate Investment Trust Note: This program does not own the properties pictured. The properties serve as the underlying collateral for mezzanine loans held by RFT.

Realty Finance Trust, Inc. 2 IMPORTANT INFORMATION Risk Factors Investing in our common stock involves a high degree of risk . You should purchase these securities only if you can afford a complete loss of your investment . See the section entitled “Risk Factors” in the prospectus for a discussion of the risks which should be considered in connection with your investment in our common stock . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s prospectus for a more complete list of risk factors, as well as a discussion of forward - looking statements and other offering details. This program does not own the properties pictured throughout this presentation . The properties serve as the underlying collateral for mezzanine loans and CMBS bonds held by Realty Finance Trust, Inc .

Realty Finance Trust, Inc. 3 Our focus on originating and acquiring commercial real estate debt investments emphasizes the payment of current returns to investors and preservation of invested capital as our primary objectives . We also seek to realize appreciation in the value of our investments. RFT’s advisor has experience in originating, managing and disposing of commercial real estate debt investments similar to RFT’s targeted loans and investments. RFT will seek to: □ Focus on the origination of new loans; □ I nvest in loans expected to be realized within one to ten years; □ Maximize current income; □ L end to creditworthy borrowers; □ L end on properties leased to high - quality tenants; □ Originate a portfolio of loans secured by core property types and diversified by geographic location, tenancy and borrower; and □ S ource off - market transactions. FOCUSED INVESTMENT STRATEGY

Realty Finance Trust, Inc. 4 4 NEW ESTIMATED PER SHARE NAV Estimated Per Share NAV “On November 4, 2015, the board of directors (the “Board”) of Realty Finance Trust, Inc. (the “Company”), upon the recommendations of Realty Finance Advisors, LLC (the “Advisor”) and the Conflicts Committee (defined below), unanimously approved and established an estimated net asset value (“NAV”) per share of the Company’s common stock of $25.27. The estimated per share NAV is based upon the estimated value of the Company’s assets less the Company’s liabilities as of September 30, 2015 (the “Valuation Date”). This valuation was performed in accordance with the provisions of Practice Guideline 2013 - 01, Valuations of Publicly Registered Non - Listed REITs, issued by the Investment Program Association in April 2013 (the “IPA Valuation Guidelines”). The Company believes that there have been no material changes between the Valuation Date and the date of this filing that would impact the estimated per share NAV. On August 5, 2015, the Board unanimously approved the formation of a conflicts committee (the “Conflicts Committee”) of the Board, composed solely of all of the Company’s independent directors. The Board delegated to the Conflicts Committee the responsibility for the oversight of the valuation process of the Company’s per share NAV in accordance with the valuation guidelines previously adopted by the Board. Pursuant to the Company’s valuation guidelines, the Advisor, under the oversight of the Conflicts Committee, is responsible for calculating the Company’s per share NAV, taking into consideration the valuations of the Company’s assets by an independent valuer , as necessary .” From Realty Finance Trust 8 - k Filed November 10, 2015

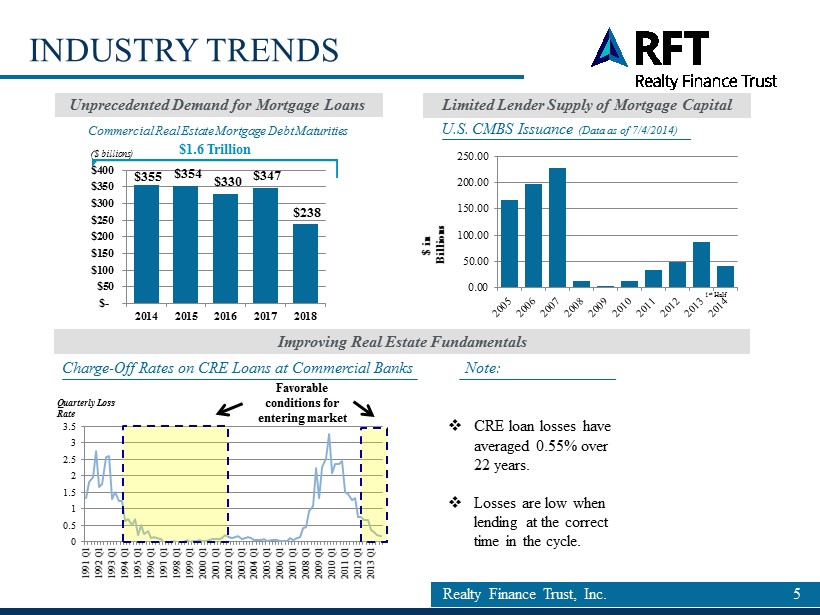

Realty Finance Trust, Inc. 5 5 Unprecedented Demand for Mortgage Loans Improving Real Estate Fundamentals Limited Lender Supply of Mortgage Capital INDUSTRY TRENDS $355 $354 $330 $347 $238 $- $50 $100 $150 $200 $250 $300 $350 $400 2014 2015 2016 2017 2018 Commercial Real Estate Mortgage Debt Maturities ($ billions) $1.6 Trillion U.S. CMBS Issuance (Data as of 7/4/2014) $ in Billions 0.00 50.00 100.00 150.00 200.00 250.00 1 st Half Charge - Off Rates on CRE Loans at Commercial Banks Note: □ CRE loan losses have averaged 0.55% over 22 years. □ Losses are low when lending at the correct time in the cycle. Quarterly Loss Rate 0 0.5 1 1.5 2 2.5 3 3.5 1991 Q1 1992 Q1 1993 Q1 1994 Q1 1995 Q1 1996 Q1 1997 Q1 1998 Q1 1999 Q1 2000 Q1 2001 Q1 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 2008 Q1 2009 Q1 2010 Q1 2011 Q1 2012 Q1 2013 Q1 Favorable conditions for entering market

Realty Finance Trust, Inc. 6 6 Asset Type Geographic Location Rate Type Fixed 9% Floating 91% Hospitality 27% Industrial 2% Mixed Use 14% Multifamily 18% Office 23% Retail 17% Far West 20% Great Lakes 15% Mideast 17% New England 3% Plains 3% Rocky Mountain 7% Southeast 19% Southwest 14% Portfolio as of September 30, 2015. PORTFOLIO DIVERSIFICATION

Realty Finance Trust, Inc. 7 Summary Number of Investments 82 Current Balance 1,040.7 Current Future Funding 118.4 Total Committed Balance 1,252.1 Current Market Value 1,165.0 Total Portfolio Leverage (448.5) Invested Equity 716.5 Portfolio Leverage 41.60% Debt / Equity Ratio 0.74x Wtd Avg LTV Ratio (at Origination ) (1) 72.9% Weighted Average Coupon (1 ), (2) 6.7% Weighted Average Life (1) 2.8 Years (1) Excluding CMBS investments (2) Weighted by Position Balance, not Equity Amount Portfolio Growth 2014 2015 ($ in millions) Q3 Q4 Q1 Q2 Q3 Senior $126.2 $250.1 $342.9 $538.7 $657.8 Mezzanine 171.9 191.9 206.9 244.2 271.9 Subordinated 15.4 15.5 10 10 10 Total Loans 313.5 457.5 559.8 792.9 $939.7 CMBS $38.6 $50.2 $58.4 $93.2 $101.0 Total Portfolio $352.1 $507.7 $618.1 $886.1 $1,040.7 Total Equity $243.8 $330.5 $413.0 $515.5 $604.5 Figures in millions where applicable. Portfolio as of September 30, 2015. FINANCIAL PERFORMANCE

Realty Finance Trust, Inc. 8 □ We continue to build a diversified portfolio of commercial real estate (CRE) debt investments □ Our origination strategy is focused on senior and mezzanine CRE loans throughout the country □ Obtaining a fully levered portfolio to maximize the earnings potential of our capital is our goal . To accomplish this we will : - Maximize the use of our current warehouse facilities - Seek to secure additional financing lines to grow the portfolio - Evaluate the opportunity to execute a second Collateralized Loan Obligation (CLO) STRATEGIC INITIATIVES

Realty Finance Trust, Inc. 9 RISK FACTORS Investing in our common stock involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 28 for a discussion of the risks that should be considered in connection with your investment in our common stock, including : □ We have a limited operating history and no established financing sources, except as set forth in this prospectus . □ Our organizational documents permit us to pay distributions from any source, including unlimited amounts from offering procee ds. Any of these distributions may reduce the amount of capital we ultimately invest in our targeted assets and negatively impact the va lue of your investment, especially if a substantial portion of our distributions are paid from offering proceeds. To date, distributions are primarily being paid from offering proceeds . □ If distributions are declared and paid, the amount of the distributions paid may decrease or distributions may be eliminated at any time. Due to the risks involved in the ownership of commercial real estate investments, there is no guarantee of any return on your inv est ment and you may lose all or a portion of your investment. □ You will not have the opportunity to evaluate a significant portion of our investments before we make them . □ The collateral securing our commercial real estate debt and commercial real estate securities may decrease in value or lose a ll value over time, which could adversely affect our operations . □ Our borrowers may not be able to make debt service payments to us due to changes in economic conditions, regulatory requireme nts and other factors . □ We depend on our advisor to select investments and conduct our operations. Adverse changes in the financial condition of our adv isor or our relationship with our advisor could adversely affect us . □ No public trading market currently exists for our shares of common stock, nor may a public market ever exist, and we are not obl igated to effectuate a liquidity event by a specified date or at all. Our stockholders may hold shares of our common stock indefinitely . □ We established the initial offering price on an arbitrary basis; as a result, the actual value of your investment may be subs tan tially less than what you pay.

Realty Finance Trust, Inc. 10 RISK FACTORS (CONTINUED) □ Our share repurchase program is subject to numerous restrictions, may be cancelled at any time and should not be relied upon as a me ans of liquidity . □ There are substantial conflicts among the interests of our investors, our interests and the interests of our advisor, sponsor , d ealer manager and our and their respective affiliates, which could result in decisions that are not in the best interests of our stockholders . □ Our sponsor currently sponsors other non - traded, publicly offered investment programs which invest generally in real estate asse ts, but not primarily in our target assets, most of which have substantially more resources than we do. □ Our investment policies may be changed without stockholder consent . □ We are obligated to pay substantial fees to our advisor, which may result in our advisor recommending riskier investments . □ We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the val ue of your investment if income on, or the value of, the property securing the debt falls . □ Our failure to continue to qualify as a REIT would result in higher taxes, may adversely affect our operations, would reduce the amount of income available for distribution and would limit our ability to make distributions to our stockholders . □ To the extent we invest in commercial real estate structured securities, we will be subject to risks relating to the volatility in the value of our assets and underlying collateral, default on underlying income streams, fluctuations in interests rates, decreased value and liq uidity of the investments and other risks . □ Commencing on the NAV pricing date, the offering price and repurchase price for our shares, including shares sold pursuant to ou r DRIP, will be based on our NAV, which may not accurately reflect the value of our assets. □ There are limitations on ownership and transferability of our shares . □ Disclosures made by American Realty Capital Properties, Inc., or ARCP, an entity previously sponsored by the parent of our sp ons or may adversely affect our ability to raise substantial funds . □ Distributions are not guaranteed, we may not be able to pay distributions and they are subject to change at any time.

Realty Finance Trust, Inc. 11 This presentation contains forward - looking statements. You can identify forward - looking statements by the use of forward - looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anti cip ates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases. You can also identify forward - looking statements by disc ussions of strategy, plans or intentions. Statements regarding the following subjects may be impacted by a number of risks and uncertainties which ma y cause our actual results, performance or achievements to be materially different from any future results, performances or achievements express ed or implied by the forward - looking statements: • our use of the proceeds of this offering ; • our business and investment strategy ; • our ability to make investments in a timely manner or on acceptable terms ; • current credit market conditions and our ability to obtain long - term financing for our property investments in a timely manner a nd on terms that are consistent with what we project when we invest in the property ; • the effect of general market, real estate market, economic and political conditions, including the recent economic slowdown a nd dislocation in the global credit markets ; • our ability to make scheduled payments on our debt obligations ; • our ability to generate sufficient cash flows to make distributions to our stockholders ; • the degree and nature of our competition ; • the availability of qualified personnel ; • our ability to qualify and maintain our qualification as a REIT; and • other subjects referenced in this prospectus, including those set forth under the caption “Risk Factors.” The forward - looking statements contained in this presentation reflect our beliefs, assumptions and expectations of our future pe rformance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncer tai nties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial co ndition, liquidity and results of operations may vary materially from those expressed in our forward - looking statements. You should carefully consider these risks before you make an investment decision with respect to our common stock. For more information regarding risks that may cause our actual results to differ materially from any forward - looking statements, see “Risk Factors” in the current prospectus. We disclaim any obligation to publicly update or revise any forward - looking statements to reflect change s in underlying assumptions or factors, new information, future events or other changes. NOTE REGARDING FORWARD - LOOKING STATEMENTS

Financing the Growth of Commercial Real Estate www.RealtyFinanceTrust.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (844) 276 - 1077 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.americanrealtycap.com