Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Otter Tail Corp | t82833_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Otter Tail Corp | t82833_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Otter Tail Corp | t82833_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Otter Tail Corp | t82833_ex31-1.htm |

| 10-Q - FORM 10-Q - Otter Tail Corp | t82833_10q.htm |

Exhibit 10.3

Confidential treatment has been requested for portions of this exhibit pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The copy filed herewith omits the information subject to the confidentiality request. Omissions are designated as [**]. A complete version of this exhibit has been filed separately with the Securities and Exchange Commission.

Execution Version

BIG STONE SOUTH – ELLENDALE PROJECT

PROJECT OWNERSHIP AGREEMENT

Dated as of June 12, 2015

| Confidential |

TABLE OF CONTENTS

| Page | |||||

| ARTICLE 1 DEFINITIONS, SCHEDULES AND EXHIBITS | 2 | ||||

| 1.1 | Definitions | 2 | |||

| 1.2 | Certain Conflicts Between Project Agreements | 22 | |||

| 1.3 | Schedules and Exhibits | 22 | |||

| ARTICLE 2 TERM | 22 | ||||

| 2.1 | Term | 22 | |||

| ARTICLE 3 PROJECT OWNERSHIP, INTERESTS AND GOVERNANCE | 22 | ||||

| 3.1 | Nature of Ownership and Ownership Percentages | 22 | |||

| 3.1.1 | Nature of Ownership Interest | 22 | |||

| 3.1.2 | Property Interests Created Prior to the Effective Date | 23 | |||

| 3.1.3 | Ownership Percentage | 23 | |||

| 3.1.4 | [RESERVED] | 24 | |||

| 3.1.5 | Waiver of Right to Partition | 24 | |||

| 3.1.6 | Discretely Owned Substation Assets | 25 | |||

| 3.2 | Management Committee | 25 | |||

| 3.2.1 | Establishment | 25 | |||

| 3.2.2 | Powers | 25 | |||

| 3.2.3 | Composition, Attendance, Meetings, Etc | 28 | |||

| 3.2.4 | Voting | 32 | |||

| ARTICLE 4 CONSTRUCTION; OPERATION AND MAINTENANCE; AND CAPITAL IMPROVEMENTS | 32 | ||||

| 4.1 | Construction | 32 | |||

| 4.1.1 | [RESERVED] | 32 | |||

| 4.1.2 | Replacement Construction Management Agreement | 32 | |||

| 4.2 | Operation and Maintenance | 33 | |||

| 4.2.1 | [RESERVED] | 33 | |||

| 4.2.2 | Replacement Operation and Maintenance Agreement | 33 | |||

| 4.2.3 | Voting with Respect to Operation and Maintenance Agreement | 34 | |||

| 4.3 | Business with Affiliates | 34 | |||

| 4.3.1 | Affiliate Contracts | 34 | |||

| 4.3.2 | Disqualified Affiliate Matters | 35 | |||

| 4.4 | Principles Applicable to Upgrades and Other Modifications | 36 | |||

| 4.4.1 | General Principles | 36 | |||

| 4.4.2 | [RESERVED] | 38 | |||

| 4.4.3 | Principles Applicable to Generator Interconnection Requests | 38 | |||

| ARTICLE 5 PAYMENT PROCEDURES | 39 | ||||

| 5.1 | Payment/Invoices | 39 | |||

| 5.1.1 | General | 39 | |||

| 5.1.2 | Main Escrow Account | 39 | |||

| - i - | Confidential |

| 5.1.3 | Manner of Payment | 40 | |||

| 5.1.4 | No Counterclaim; No Set-Off | 40 | |||

| ARTICLE 6 BUDGETS, ACCOUNTING | 40 | ||||

| 6.1 | Construction Phase | 40 | |||

| 6.1.1 | Project Budgets | 40 | |||

| 6.1.2 | CM Costs | 40 | |||

| 6.2 | Operating Phase | 41 | |||

| 6.2.1 | Capital and Annual Operating Expense Budgets | 41 | |||

| 6.2.2 | Operating Expenses and Capital Expenses | 41 | |||

| 6.2.3 | Budget Deadlock | 41 | |||

| 6.3 | Interest | 42 | |||

| 6.4 | Disputed Contributions | 42 | |||

| 6.5 | Inspection and Audit Rights | 42 | |||

| 6.6 | NERC Compliance Policy | 43 | |||

| 6.7 | Records | 43 | |||

| ARTICLE 7 TAXES AND ASSESSMENTS | 43 | ||||

| 7.1 | Management of Tax Matters | 43 | |||

| 7.1.1 | Personal Taxes | 43 | |||

| 7.1.2 | Sales, Consumer and Use Taxes | 44 | |||

| 7.2 | Payment of Taxes | 44 | |||

| 7.3 | Sharing of Taxes and Related Payments | 44 | |||

| 7.4 | Tax Credits or Other Tax Benefits | 44 | |||

| 7.5 | Non-creation of Taxable Entity | 45 | |||

| ARTICLE 8 INSURANCE AND CASUALTY DAMAGE | 45 | ||||

| 8.1 | Insurance | 45 | |||

| 8.2 | Casualty | 45 | |||

| 8.3 | Insurance Proceeds | 45 | |||

| 8.4 | Destruction Event | 46 | |||

| 8.4.1 | Damage or Destruction of Substantially All of the Project | 46 | |||

| 8.4.2 | Payment of Restoration Costs | 48 | |||

| ARTICLE 9 CONDEMNATION | 48 | ||||

| 9.1 | Condemnation of the Project | 48 | |||

| 9.2 | [RESERVED] | 48 | |||

| 9.3 | [RESERVED] | 48 | |||

| 9.4 | Notice of Condemnation | 48 | |||

| 9.5 | Condemnation Awards | 49 | |||

| ARTICLE 10 TRANSFERS | 49 | ||||

| 10.1 | General Transfer Rule | 49 | |||

| 10.2 | Permitted Transfers | 49 | |||

| 10.2.1 | Transfer to Affiliate(s) | 49 | |||

| 10.2.2 | Collateral Assignment | 49 | |||

| 10.2.3 | Transfer to Another Owner | 49 | |||

| - ii - | Confidential |

| 10.2.4 | Transfer to a Third Party | 49 | |||

| 10.2.5 | Management Committee Approval | 50 | |||

| 10.2.6 | Change of Control | 50 | |||

| 10.2.7 | Freeze | 50 | |||

| 10.2.8 | Exercise of a Collateral Assignment | 50 | |||

| 10.3 | Rules and Conditions to Transfer | 50 | |||

| 10.3.1 | For Permitted Transfers | 50 | |||

| 10.4 | First Negotiation | 52 | |||

| 10.4.1 | ROFN Offeree Owner’s Option | 52 | |||

| 10.4.2 | Right of Offering Owner to Sell to Third Party | 55 | |||

| ARTICLE 11 FINANCING; FINANCING INSTRUMENTS | 56 | ||||

| 11.1 | Pledge of Separate Property | 56 | |||

| 11.2 | Financing Instruments | 56 | |||

| 11.3 | Financing Party Cure Rights | 57 | |||

| ARTICLE 12 REPRESENTATIONS, WARRANTIES AND COVENANTS | 57 | ||||

| 12.1 | Representations and Warranties | 57 | |||

| 12.1.1 | Organization and Good Standing | 57 | |||

| 12.1.2 | Power and Authority | 57 | |||

| 12.1.3 | Authorization | 57 | |||

| 12.1.4 | No Violation | 57 | |||

| 12.1.5 | Approvals and Consents | 58 | |||

| 12.1.6 | Binding Effect | 58 | |||

| 12.1.7 | Joint Use | 58 | |||

| 12.2 | Covenants | 58 | |||

| 12.2.1 | Compliance with Project Agreements | 58 | |||

| 12.2.2 | [RESERVED] | 58 | |||

| 12.2.3 | Governmental Approvals | 58 | |||

| 12.2.4 | Project Real Property | 59 | |||

| 12.2.5 | Availability of Personnel and Resources | 59 | |||

| 12.2.6 | Risk of Loss and Damage | 59 | |||

| 12.2.7 | [RESERVED] | 59 | |||

| 12.2.8 | [RESERVED] | 59 | |||

| 12.2.9 | Deposit by Assignee if No Longer Creditworthy | 59 | |||

| ARTICLE 13 MAXIMUM CM COSTS | 60 | ||||

| 13.1 | Meeting to Consider Proposed Increase in the Maximum CM Cost Amount | 60 | |||

| 13.2 | Failure to Approve | 60 | |||

| 13.3 | Approval | 60 | |||

| 13.4 | Initial Round of the Cost Offering | 61 | |||

| 13.4.1 | Election Notice | 61 | |||

| 13.4.2 | Allocation Between Owners | 61 | |||

| 13.4.3 | Effect of Full Subscription by Owners | 61 | |||

| 13.4.4 | Effect of Partial Subscription | 61 | |||

| - iii - | Confidential |

| ARTICLE 14 DEFAULTS RELATED TO CONSTRUCTION ACTIVITIES | 62 | ||||

| 14.1 | Definitions for Defaults Related to Construction Activities | 62 | |||

| 14.1.1 | Definition of Construction Period Payment Default | 62 | |||

| 14.2 | Provisions Governing Construction Period Payment Defaults | 62 | |||

| 14.2.1 | [RESERVED] | 62 | |||

| 14.2.2 | Suspension of Defaulting CPP Owner Voting Rights Upon Construction Period Payment Default | 62 | |||

| 14.2.3 | Non-Defaulting CPP Owner Advance Following Construction Period Payment Default | 62 | |||

| 14.2.4 | Requirements for and Effect of Cure of Construction Period Payment Default | 63 | |||

| 14.2.5 | Automatic Freeze of Defaulting CPP Owner’s Interest if Curable Construction Period Payment Default Not Cured or Uncurable Construction Period Payment Default Occurs; Provisions Applicable to Automatic Freeze | 65 | |||

| 14.3 | [RESERVED] | 66 | |||

| 14.4 | [RESERVED] | 66 | |||

| 14.5 | [RESERVED] | 66 | |||

| 14.6 | [RESERVED] | 66 | |||

| 14.7 | [RESERVED] | 66 | |||

| 14.8 | Additional Cure Period for Financing Instrument | 66 | |||

| ARTICLE 15 DEFAULTS RELATED TO OPERATIONS ACTIVITIES; GENERAL DEFINITIONS; COVENANT DEFAULTS; INJUNCTIVE RELIEF, SPECIFIC PERFORMANCE, AND SET-OFF RIGHTS | 67 | ||||

| 15.1 | General Provisions Related to Defaults | 67 | |||

| 15.1.1 | [RESERVED] | 67 | |||

| 15.1.2 | [RESERVED] | 67 | |||

| 15.1.3 | Covenant Default | 67 | |||

| 15.2 | Provisions Governing Operations Payment Defaults | 68 | |||

| 15.2.1 | Requirements for Cure of Operations Payment Default | 68 | |||

| 15.2.2 | Remedies Applicable to Operations Payment Default | 69 | |||

| 15.3 | [RESERVED] | 69 | |||

| 15.4 | [RESERVED] | 69 | |||

| 15.5 | Provisions Applicable to Certain Defaults | 69 | |||

| 15.5.1 | Available Damages | 69 | |||

| 15.5.2 | No Consequential Damages | 69 | |||

| 15.5.3 | Remedies Not Exclusive | 70 | |||

| 15.5.4 | Interest on Overdue Obligations | 70 | |||

| 15.6 | Common Provisions Applicable to All Defaults | 70 | |||

| 15.6.1 | Injunctive Relief and Specific Performance | 70 | |||

| 15.6.2 | Right of Set-Off | 70 | |||

| - iv - | Confidential |

| 15.7 | Additional Cure Period for Financing Instrument | 70 | |||

| ARTICLE 16 THIRD PARTY CLAIMS; SHARED LIABILITY; EFFECT OF INSURANCE; AND CONTRIBUTION | 71 | ||||

| 16.1 | Third Party Claims | 71 | |||

| 16.1.1 | Indemnification | 71 | |||

| 16.1.2 | Notice of Third Party Claims | 72 | |||

| 16.1.3 | Defense of Third Party Claims | 72 | |||

| 16.1.4 | Prejudicial Actions | 73 | |||

| 16.2 | Exceptions and Clarifications | 73 | |||

| 16.2.1 | Shared Liability | 73 | |||

| 16.2.2 | Effect of Insurance | 74 | |||

| 16.2.3 | Right of Contribution | 74 | |||

| 16.2.4 | Project Costs | 75 | |||

| ARTICLE 17 CONFIDENTIALITY | 76 | ||||

| 17.1 | Confidentiality of Information | 76 | |||

| 17.2 | Information Not Deemed Confidential Information | 76 | |||

| 17.3 | Requirement to Disclose Confidential Information | 77 | |||

| 17.4 | Compliance with FERC Standards of Conduct | 77 | |||

| 17.5 | Restrictions on Access to Critical Energy Infrastructure Information | 77 | |||

| 17.6 | Property of Owner | 77 | |||

| 17.7 | No Accuracy Warranty | 78 | |||

| 17.8 | Breach of Confidentiality Provisions | 78 | |||

| 17.9 | Public Disclosure | 78 | |||

| 17.10 | Public Disclosure Laws | 78 | |||

| ARTICLE 18 DISPUTE RESOLUTION FOR EXCLUDED MATTERS | 78 | ||||

| 18.1 | Excluded Matters | 78 | |||

| 18.2 | Appointment of Arbitrator | 78 | |||

| 18.3 | Arbitration Process | 79 | |||

| 18.4 | Effect of Arbitrator’s Decision | 79 | |||

| 18.4.1 | Percentage Calculation Dispute | 79 | |||

| 18.5 | Fees of Arbitrator | 79 | |||

| 18.6 | Confidentiality | 79 | |||

| ARTICLE 19 TERMINATION | 79 | ||||

| 19.1 | Termination | 79 | |||

| 19.1.1 | Termination of the Project | 79 | |||

| 19.1.2 | Termination of this Agreement | 80 | |||

| 19.2 | Retirement and Retirement Costs | 80 | |||

| 19.3 | Effect of Project Termination | 80 | |||

| 19.3.1 | Wind-up Plan | 80 | |||

| 19.3.2 | Allocations and Distributions Upon Termination of Project | 81 | |||

| - v - | Confidential |

| ARTICLE 20 MISCELLANEOUS | 82 | ||

| 20.1 | Survival | 82 | |

| 20.2 | Forward Contracts; Single Agreement | 82 | |

| 20.3 | Force Majeure | 82 | |

| - vi - | Confidential |

| SCHEDULES AND EXHIBITS | ||||

| SCHEDULE 1 | Generally Applicable Provisions | |||

| SCHEDULE 3.2.3.1.8 | Authorized Owner Representatives as of the Effective Date | |||

| EXHIBIT A | Development Period Assets | |||

| EXHIBIT B | Ownership Percentages | |||

| EXHIBIT C | Discretely Owned Substation Assets and Discretely Owned Substation Owners | |||

| EXHIBIT D | [RESERVED] | |||

| EXHIBIT E-1 | Form of Assignment, Assumption, Partial Novation and Joinder Agreement | |||

| EXHIBIT E-2 | Form of Assignment, Assumption, Novation and Joinder Agreement | |||

| EXHIBIT F | Insurance Plan | |||

| EXHIBIT G | NERC Compliance Policy | |||

| EXHIBIT I-1 | [RESERVED] | |||

| EXHIBIT J | Form of Transmission Easement Agreement and Memorandum of Project Ownership Agreement. | |||

| EXHIBIT K | [RESERVED] | |||

| EXHIBIT L | [RESERVED] | |||

| EXHIBIT M | [RESERVED] | |||

| EXHIBIT N-1A | [RESERVED] | |||

| EXHIBIT N-2 | [RESERVED] | |||

| EXHIBIT O | [RESERVED] | |||

| EXHIBIT P | Methodology for Recalculating Interests for Capital Improvements | |||

| - i - | Confidential |

PROJECT OWNERSHIP AGREEMENT

THIS PROJECT OWNERSHIP AGREEMENT is entered into and effective as of June 12, 2015 (the “Effective Date”) by and between Montana-Dakota Utilities Co., a division of MDU Resources Group, Inc., a Delaware corporation (“MDU”), and Otter Tail Power Company, a corporation organized and existing under the laws of the State of Minnesota (“OTP”). MDU and OTP shall be referred to herein: (i) individually as an “Owner” and collectively as the “Owners,” and (ii) individually as a “Party” and collectively as the “Parties.”

RECITALS

A. The Owners have determined that the Project and the Discretely Owned Substation Assets are necessary to: (i) enhance service reliability for electric customers in North Dakota, South Dakota and the MISO territories; (ii) strengthen the transmission network to meet additional demands for electric power; and (iii) enhance transmission system capacity to support the installation of renewable energy resources;

B. The Owners have further determined that because the Project is both local and regional in nature, it is most efficient and effective for the Owners to enter into this Agreement to provide for the construction and operation of the Project in a collaborative manner;

C. The Owners have entered into the Project Development Agreement pursuant to which they have or are currently undertaking Development Work;

D. Contemporaneously herewith, the Owners have entered into: (i) the Construction Management Agreement; (ii) the Project Transmission Capacity Exchange Agreement; (iii) Operation and Maintenance Agreement; and (iv) such other agreements as the Owners have deemed necessary;

E. In accordance with Section 9.1.2 of the Project Development Agreement, the Parties should enter into the Project Agreements; and

F. Each Owner desires to enter into this Agreement and the other Project Agreements to facilitate the completion of the Project.

AGREEMENT

In consideration of the foregoing Recitals, the mutual covenants set forth in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Owner agrees as follows:

ARTICLE 1

DEFINITIONS, SCHEDULES AND EXHIBITS

| 1.1 | Definitions. In addition to the other terms defined herein, the following terms, whether in the singular or in the plural, when used herein, in Schedule 1 (Generally Applicable Provisions), in the exhibits attached hereto or in notices given under this Agreement and initially capitalized, have the meanings specified below: |

| Confidential |

“Abandoning Owner” has the meaning given in Section 8.4.1.1.

“Advance” has the meaning given in Section 14.2.3.

“Advancing Owners” has the meaning given in Section 14.2.4.3.

“Affiliate Contracts” has the meaning given in Section 4.3.1.2.

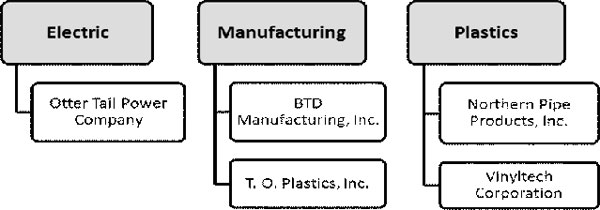

“Affiliate” means any Person that, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, an Owner.

“Agreement” means this Project Ownership Agreement, as it may be supplemented or amended.

“Alternate” has the meaning given in Section 3.2.3.1.2.

“Applicable Energy Regulations” means the rules, Orders, regulations, practices, procedures and protocols established in compliance with Applicable Law by applicable Transmission Providers (such as the Midwest Independent Transmission System Operator, Inc.), electric reliability organizations (such as the North American Electric Reliability Corporation and the Midwest Reliability Organization) and comparable Persons that are applicable to the Services, the Maintenance Services, the Control Center Services, the Construction Work, the Discretely Owned Substation Assets, the Project or the performance of the obligations of the Parties hereunder.

“Applicable Law” means: (i) any and all laws (including all statutory enactments and common law), ordinances, constitutions, regulations, treaties, rules, codes, standards, Governmental Approvals, requirements and Orders that (a) have been adopted, enacted, implemented, promulgated, ordered, issued, entered or deemed applicable by or under the authority of any Governmental Body having jurisdiction over a specified Person (or the Properties of such Person) and (b) are applicable to the Services, the Construction Work, the Discretely Owned Substation Assets, the Maintenance Services, the Control Center Services, the Project or the performance of the obligations of the Parties (each in its respective capacities) under this Agreement; and (ii) Applicable Energy Regulations.

“Applicable Maintenance Activity(s)” means the Maintenance Activity(s) for which a Maintenance Provider or a Control Center Authority is responsible under the Operation and Maintenance Agreement, as more particularly set forth in Appendix A thereto.

“Arbitrator” has the meaning given in Section 18.2 of this Agreement or Article I of Schedule 1, as applicable.

“Authorized Owner Representatives” has the meaning given in Section 3.2.3.1.2.

“Big Stone South Substation” means the substation owned by OTP and described on Exhibit C, which substation is not part of the Project.

“Bona Fide Third Party Transaction” has the meaning given in Section 10.4.1.8.

| - 3 - | Confidential |

“Books and Records” has the meaning given in Section 6.5.

“BSSE Design Criteria Guidelines” means the requirements established in Appendix C of the Operation and Maintenance Agreement, as such requirements are amended by the Management Committee.

“Budget Deadlock” has the meaning given in Section 6.2.3.

“Budgets” means one or more of the Project Budget and Final Budget.

“Business Day” means any day other than a Saturday, Sunday or federal holiday.

“Capital Expenses” means expenses incurred in connection with Capital Improvements.

“Capital Improvements” means capital additions or modifications to the Project that are undertaken after the applicable In-Service Date and will be funded by the Owners according to Ownership Percentages pursuant to Section 4.4.1(x) in accordance with a Final Budget. Capital Improvements include Modifications that are required by Applicable Law, but exclude (i) work undertaken pursuant to the Construction Management Agreement or the Construction Agreements in accordance with the Project Plan, (ii) Upgrades, and (iii) Non-Project Modifications.

“Casualty” means damage or destruction to Property.

“CEII” has the meaning given in Section 17.5.

“Chair” means the Owner Representative who is acting as the chair of the Management Committee, which Owner Representative may change from time to time in accordance with Section 3.2.3.5.

“Change in Law” means any change in, or enactment of, any Applicable Law or official published policy regarding the interpretation or enforcement of any Applicable Law by a Governmental Body that takes effect after the Effective Date and affects or relates to the performance of the obligations of the Owners (individually or collectively) under this Agreement, including the imposition of any new Governmental Approval requirements; provided, however, a change in Applicable Law affecting only a tax payable or any other cost of performance hereunder will not constitute a Change in Law.

“Change of Control” means for any Person, (i) a change in any Person or Persons that directly or indirectly possess the power either to (a) vote fifty percent (50%) or more of the securities or interests having ordinary voting power for the election of directors (or other comparable controlling body) of such Person or (b) direct or cause the direction of management or policies of such Person, whether through the ownership of voting securities or interests, by contract or otherwise, or (ii) the creation of a Person or Persons that directly or indirectly possess the power either to (a) vote fifty percent (50%) or more of the securities or interests having ordinary voting power for the election of directors (or other comparable controlling body) of such Person or (b) direct or cause the direction of management or policies of such Person, whether through the ownership of voting securities or interests, by contract or otherwise, in each case where no such Person or Persons existed before, or (iii) if such Person is a cooperative or a joint

| - 4 - | Confidential |

action agency, the merger or consolidation of such Person with or into another Person in accordance with Applicable Law.

“CM Costs” has the meaning given in Section 5.4.1 of the Construction Management Agreement.

“CM Subcontract” means each contract, agreement or other arrangement with the Construction Manager or a CM Subcontractor on the one hand, and any CM Subcontractor on the other hand, establishing the terms of performance of any part of the Construction Management Services.

“CM Subcontractor” means each and every supplier, subcontractor, vendor, consultant or contractor of any tier performing any part of the Construction Management Services or Real Property Management Services, directly or indirectly, for the Construction Manager. Reference to an Owner as a “CM Subcontractor” excludes any reference to the owner’s Affiliates and to such Owner in any other capacity.

“Code” means the Internal Revenue Code of 1986, as amended from time to time.

“Collateral Assignment” has the meaning given in Section 10.2.2.

“Commission” or “Commissioning” (or any derivation thereof) means the process of verifying the safety, reliability and performance (including testing) of the Project in accordance with the applicable Construction Agreements and Good Utility Practice.

“Complete Taking” has the meaning given in Section 9.1.

“Condemnation Action” means a taking by any Governmental Body (or other Person with power of eminent domain) by exercise of any right of eminent domain or by appropriation and an acquisition by any Governmental Body (or other Person with power of eminent domain) through a negotiated purchase in lieu thereof.

“Condemnation Awards” has the meaning given in Section 9.5.

“Confidential Information” has the meaning given in Section 17.1.

“Consequential Damages” has the meaning given in Section 15.5.2.1.

“Construction Agreements” means all contracts, agreements or arrangements establishing the terms of performance of any part of the Construction Work, including CM Subcontracts, Subcontracts and Development Period Contracts, but specifically excluding (i) this Agreement, (ii) the Construction Management Agreement, (iii) the Real Property Agreements and (iv) construction contracts arising from the Substation Work.

“Construction Management Agreement” means that certain Construction Management Agreement, by and between the Owners and the Construction Manager, effective as of the Effective Date.

| - 5 - | Confidential |

“Construction Management Services” has the meaning given in Section 2.2.1 of the Construction Management Agreement.

“Construction Manager” means OTP, solely in its capacity as the Construction Manager under the Construction Management Agreement and permitted successors and assigns. Reference to the Construction Manager excludes any reference to the Construction Manager in any other capacity.

“Construction Period Payment Default” has the meaning given in Section 14.1.1.1.

“Construction Work Schedule” has the meaning given in Section 3.2.2.2(xiv).

“Construction Work” means all activities that are necessary, desirable or incidental to placing the Project in service, and achieving Final Completion of the Project in accordance with Good Utility Practice and the Project Plan, other than: (i) the Services and (ii) the obligations of the Owners (individually or collectively through the Management Committee) under the Construction Management Agreement.

“Consumables” means items such as compressed chemicals, oils, lubricants, cleaning supplies, gaskets, valve packing, light bulbs, and comparable items which, by normal industry practices, are considered consumables and are replaced on a regular basis, required for cleaning or preparing the Project to be placed in service.

“Contractor Procured Materials” means all Equipment and Materials that are procured for the Project and not designated as Owner Procured Materials.

“Contractor” means any Person with whom the Owners enter into a Construction Agreement. Reference to an Owner as a “Contractor” excludes any reference to such Owner in any other capacity.

“Control Center Authority” means a Person designated as a “Control Center Authority” in the Operation and Maintenance Agreement, which Person, when acting under the Operation and Maintenance Agreement in such capacity, will have day-to-day operational control over the Project, including a Person that executes a joinder in a form acceptable to such Person and the Management Committee to become a Control Center Authority under the Operation and Maintenance Agreement. Reference to a Control Center Authority excludes any reference to a Control Center Authority in any other capacity.

“Control Center Services” means the services to be provided by a Control Center Authority as set forth in the Operation and Maintenance Agreement.

“Cost Offering Effective Date” has the meaning given in Section 13.4.3(i).

“Cost Offering Initial Round Subscription Date” has the meaning given in Section 13.4.1.

“Cost Offering” has the meaning given in Section 13.3.

| - 6 - | Confidential |

“Covenant Default” has the meaning given in Section 15.1.3.

“CPP Default Accrued Interest” has the meaning given in Section 14.2.4.5.

“CPP Default Cure Period” has the meaning given in Section 14.2.4.1.

“CPP Default Late Fee” has the meaning given in Section 14.2.4.4.

“CPP Default OPCs” has the meaning given in Section 14.2.4.3.

“Creditworthiness Failure Notice” has the meaning given in Section 12.2.9.

“Creditworthiness Loss Triggered Advance” has the meaning given in Section 12.2.9.

“Creditworthy” means, as of the date of a proposed Transfer, a credit rating (determined without regard to any Third Party credit enhancement) obtained during the twelve (12) Month period immediately preceding such date, of at or above the Minimum Rating. For purposes of this definition, “Minimum Rating” means at least two ratings of S&P BBB-, Moody’s Baa3, Fitch BBB-, or better, or the equivalent for another nationally recognized rating agency of similar standing to S&P or Moody’s or Fitch (provided that at least one of such ratings must be from S&P or Moody’s) on: (i) the long term unsecured obligations of a transferee or its guarantor; or (ii) in the absence of a rating under clause (i), the most recent long-term fixed rate Debt instrument issued by or on behalf of a tax-exempt transferee or its guarantor during the twelve (12) Month period preceding the date of a proposed Transfer. A rating of BBB- (S&P or Fitch) or Baa3 (Moody’s) or equivalent for another agency where the rating agency has publicly announced that such rating is currently on review for a possible downgrade, cannot be used to qualify as Creditworthy.

“Curable Construction Period Payment Default” has the meaning given in Section 14.2.4.

“Damages” means any loss, charge, deficiency, tax, fine, interest, assessment, judgment, award, demand, liability, penalty or costs and expenses, including amounts paid in settlement, reasonable attorneys and other professional fees and reasonable costs of investigation.

“Debt” means for any Person, without duplication:

(i) indebtedness of such Person for borrowed money;

(ii) obligations of such Person evidenced by bonds, debentures, notes, mortgages or other similar instruments;

(iii) obligations of such Person to pay (a) amounts due under financing leases, or (b) the deferred purchase price of Property or services (other than accounts payable in the ordinary course of business), or (c) amounts due under capitalized or operating leases;

(iv) obligations of such Person under direct or indirect guarantees in respect of, and obligations (contingent or otherwise) of such Person to purchase or otherwise acquire, or

| - 7 - | Confidential |

otherwise to assure a creditor against loss in respect of, indebtedness or obligations of another Person;

(v) obligations of such Person under interest rate or currency protection agreements or other hedging instruments;

(vi) obligations of such Person to purchase securities (or other Property) that arise out of, or in connection with, the sale of the same or substantially similar securities (or Property); or

(vii) deferred obligations of such Person to reimburse any bank or other Person in respect of amounts paid or advanced under a letter of credit or other instrument.

“Default” means the occurrence of any Construction Period Payment Default, Operations Payment Default, or Covenant Default. The existence or non-existence of a Default may be disputed in good faith by either Owner.

“Defaulting Owner” means an Owner that is in Default, including a Defaulting CPP Owner.

“Defaulting Owner Advance Amounts” has the meaning given in Section 14.2.4.6.1.

“Defaulting CPP Owner” has the meaning given in Section 14.2.2.

“Deficiency Amount” has the meaning given in Section 14.2.3.

“Destruction Event” has the meaning given in Section 8.4.1.1.

“Destruction Windup Plan” has the meaning given in Section 8.4.1.1.

“Development Period Assets” has the meaning given in Section 3.1.2.

“Development Period Contracts” has the meaning given in Section 3.1.2.

“Development Work” means the matters, actions and activities undertaken by the Parties to the Project Development Agreement in furtherance of the development of the Project.

“Disclosing Party” has the meaning given in Section 17.3.

“Discretely Owned Substation Assets” means the Big Stone South Substation and the Ellendale 345 kV Substation, all as identified in Exhibit C. Discretely Owned Substation Assets will not constitute part of the Project.

“Discretely Owned Substation Costs” means the costs incurred by a Discretely Owned Substation Owner for the engineering, procurement, construction or commissioning of upgrades to the Discretely Owned Substation Assets that are necessary in connection with the Project.

“Discretely Owned Substation Owner” means an Owner that owns a Discretely Owned Substation Asset as provided in Section 3.1.1.2.

| - 8 - | Confidential |

“Dispute” has the meaning given in Section 3.1 of Schedule 1.

“Disqualified Affiliate Matters” has the meaning given in Section 4.3.2.

“Distributable Cash” has the meaning given in Section 19.3.1.2.

“E&O Committee” has the meaning given in Section 3.2.3.7.3.

“Effective Date” has the meaning given in the first paragraph of this Agreement.

“Ellendale 345 kV Substation” means the substation owned by MDU and described as the Ellendale 345 kV Substation on Exhibit C.

“Emergency” means any circumstance or condition that will or could imminently be expected to materially harm the safe and reliable operation of all or a portion of the Project, the Transmission Grid or otherwise endanger public safety, Property or the environment.

“Equipment” means any product that: (i) is to be incorporated into the Project; (ii) is an assembly of operational or non-operational parts, whether motorized or manually operated; and (iii) requires service connections such as wiring.

“Escrow Agreement” means that certain Escrow Agreement, by and between the Owners and the Escrow Agent, effective as of the Effective Date.

“Escrow Agent” means U.S. Bank National Association or such other bank as determined by the Management Committee for establishment and maintenance of the Project Accounts.

“Excluded Matter” means Percentage Calculation Disputes as provided in Section 18.1.

“Fair Market Value” means the value that would be obtained for the Ownership Percentage of an Owner in an arms-length transaction between an informed and willing buyer and an informed and willing seller, taking into account the then applicable facts and circumstances.

“FERC” means the Federal Energy Regulatory Commission, a regulatory Governmental Body of the United States, or any successor thereto.

“FERC Standards of Conduct” has the meaning given in Section 17.4.

“Final Budget” has the meaning given in Section 6.2.1.

“Final Completion” with respect to the Project means the determination by the Management Committee that “Final Completion” thereof has been achieved in accordance with Section 11.4 of the Construction Management Agreement.

“Final Completion Date” means the date determined in accordance with Section 11.4 of the Construction Management Agreement as the date on which Final Completion of the Project occurs.

“Final Offered Terms” has the meaning given in Section 10.4.1.4.

| - 9 - | Confidential |

“Final Order” means an Order as to which: (i) no request for stay is pending before the issuing Governmental Body, no such stay is in effect, and, if any deadline for filing any such request is designated by Applicable Law, such deadline has passed; (ii) no petition for rehearing or reconsideration of such action is pending before the issuing Governmental Body, and if any deadline for filing any such petition is designated by Applicable Law, such deadline has passed; (iii) the issuing Governmental Body does not have the action under reconsideration on its own motion; and (iv) no appeal to a court, or request for stay by a court, of the issuing Governmental Body’s action is pending or in effect, and, if any deadline for filing any such appeal or request is designated by Applicable Law, such deadline has passed.

“Financing” means: (i) Debt on terms acceptable to an Owner, the proceeds of which are intended to be used, in whole or in part, to finance the costs of construction of the Project (including Capital Improvements that become part of the Project), (ii) Debt as to which the Liens (including Permitted Owner Liens) of one or more Financing Parties have previously been perfected and which Liens will attach to or encumber that Owner’s Ownership Percentage, (iii) Debt heretofore or hereafter secured under a mortgage, deed of trust or security agreement or instrument which grants a Lien on substantially all of the tangible property of either Owner, or (iv) any refinancing, renewal, or continuation, in whole or in part, of any of the foregoing.

“Financing Instrument” means a mortgage, deed of trust or security agreement or instrument, and any amendment or supplement thereto entered into at any time, pursuant to which a Lien of one or more Financing Parties has been granted prior to, at or after the Effective Date, and will attach to, cover and encumber an Owner’s Ownership Percentage or any other interest of such Owner in the Project to secure Debt of such Owner.

“Financing Parties” means any and all lenders, bondholders, underwriters and financing institutions, including credit enhancers and institutional investors, providing or facilitating a Financing and any trustee(s) or agent(s) acting on any of their behalf, and any successors, assigns or other transferees of any of the foregoing.

“Fiscal Year” means the period of January 1 through December 31, unless otherwise determined by the Management Committee.

“Force Majeure” means the occurrence of an event or series of events that is beyond the reasonable control of the Person affected that hinders the performance under contract of such Person and does not result from the fault, negligence, intentional misconduct or willful misconduct of the affected Person or such Person’s failure to comply with Applicable Law or Good Utility Practice; and such event or series of events could not have been avoided by the affected Person through the exercise of reasonable diligence, including the expenditure of reasonable monies and/or taking reasonable precautionary measures, including (to the extent that such events satisfy the foregoing criteria), the following:

| (i) | acts of God or the public enemy; | |

| (ii) | expropriation or confiscation of the Project, or the Discretely Owned Substation Assets; | |

| (iii) | war, terrorism, rebellion, sabotage, civil unrest or riot; |

| - 10 - | Confidential |

| (iv) | fires, explosions, hurricanes, floods, tornadoes, microbursts, other abnormally severe weather events or other natural catastrophes; | |

| (v) | actions or inaction of a Governmental Body affecting performance required in connection with the Construction Work. the Discretely Owned Substation Assets or the obligations of the Parties under this Agreement; | |

| (vi) | a Change in Law; | |

| (vii) | as to the Construction Manager, delays in the delivery of Owner Procured Materials; | |

| (viii) | conditions at, on or affecting the Project Real Property that could not have been reasonably anticipated, including the existence of Hazardous Substances or archeological materials; | |

| (ix) | operating conditions on the Transmission Grid that restrict outages, testing, commissioning or access; and | |

| (x) | strikes and other labor disturbances. |

Under no circumstance will an event of Force Majeure excuse a Person’s obligations to make payments when due under this Agreement, unless such Force Majeure event results in a failure of the Federal Reserve wire system or other failure of the banking system that deprives a Person of access to otherwise available funds.

“Formula” shall mean, in the case of an Owner, the total CM Costs paid by the Owner divided by the total CM Costs paid by both Owners.

“Freeze” has the meaning given in Section 14.2.5.

“Good Utility Practice” means any of the practices, methods or acts engaged in or approved by a significant portion of the electric utility industry in the region during the relevant time period, or any of the practices, methods and acts which, in the exercise of reasonable judgment in light of the facts known at the time the decision was made, could have been expected to accomplish the desired result at a reasonable cost consistent with good business practices, reliability, safety and expedition in a manner that: (i) is consistent with Applicable Law; (ii) makes due consideration for reliability, safety and protection of the Project and the Transmission Grid; and (iii) is consistent with manufacturer’s recommendations and warranties. Good Utility Practice is not intended to be limited to the optimum practice, method or act to the exclusion of all others, but rather to be a range of acceptable practices, methods or acts generally accepted in the region.

“Governmental Approval(s)” means all waivers, franchises, variances, permits, authorizations, certificates, licenses and Orders of or from any Governmental Body having jurisdiction over either Owner, the Construction Manager, CM Subcontractors, Contractor, Subcontractor, Maintenance Provider, Control Center Authority, the Services, the Maintenance Services, the Control Center Services, the Construction Work or any portion of the Project, or the Discretely Owned Substation Assets, as may be in effect from time to time.

| - 11 - | Confidential |

“Governmental Body” means any: (i) nation, state, county, city, town, village, district or other jurisdiction of any nature; (ii) federal, state, local, municipal, tribal, foreign or other government; or (iii) governmental or quasi-governmental authority of any nature (including any governmental agency, branch, board, commission, department, instrumentality, office or other entity, and any court), in any such case exercising, or entitled to exercise, administrative, executive, judicial, legislative, police, regulatory or taxing authority or power of any nature over this Agreement, any part of the Project, the performance of the Services, the Construction Work, the Project Real Property, the Construction Manager or either of the Owners. For purposes of this definition, a Person that establishes Applicable Energy Regulations will be deemed to be a Governmental Body; provided, however, an Owner will never be deemed to be a Governmental Body except when an Owner is a Transmission Provider establishing Applicable Energy Regulations in its capacity as a Person entitled to exercise functional control over a portion of the Transmission Grid in accordance with Applicable Law established by other Governmental Bodies that have jurisdiction over such Owner.

“Hazardous Substances” means petroleum hydrocarbons, including crude oil or any fraction thereof, asbestos, radon, polychlorinated biphenyls (PCBs), methane and all other substances which now are or in the future may be defined by Applicable Law as “hazardous substances,” “hazardous wastes,” “extremely hazardous wastes,” “toxic substances,” “infectious wastes,” “biohazardous wastes,” “medical wastes,” “radioactive wastes” or which are otherwise listed, defined or regulated in any manner pursuant to any Applicable Law that pertains to the protection of human health and safety or the environment.

“Incremental Cost Offering CP Percentage” has the meaning given in Section 13.4.3(ii).

“Indemnified Persons” has the meaning given in Section 16.1.1.

“Indemnifying Owner” has the meaning given in Section 16.1.1.

“Individually Enforceable Obligations” has the meaning given in Section 15.1.3.2.

“Inflation Factor” means the percentage obtained by determining the change in the unadjusted, non-seasonal Consumer Price Index/All Urban Consumers (1982-84=100), published in the National Income and Product Account by the U. S. Department of Commerce, Bureau of Labor Statistics during the period in question. To the extent available on a timely basis the percentage change will be calculated using the final adjusted value for the applicable date of determination. If such final adjusted value is unavailable on a timely basis, then the preliminary value for the date of determination will be used and subsequently adjusted when the final adjusted value for such date is published. If such final adjusted value is subsequently determined to be incorrect, then it will be adjusted when the corrected final adjusted value for such date is published.

“In-Service Date” means the date on which the Project is placed in service and the Maintenance Provider and the Control Center Authority begin performance of the Maintenance Services and Control Center Services, respectively.

| - 12 - | Confidential |

“Insurance Plan” means the plan for the Project insurance set forth in Exhibit F, as it may be changed by the Management Committee from time to time.

“Insurance Proceeds” has the meaning given in Section 8.3.

“Interconnection Agreement” means an agreement providing for the terms and conditions pursuant to which the Project, or any portion thereof, is interconnected with the Transmission Grid.

“Interconnection Coordinator” has the meaning given in Section 4.4.1(ii).

“Late Payment Rate” means the lesser of (i) the Prime Rate plus two percent (2%) per annum or (ii) the highest per annum interest rate allowed by Applicable Law.

“Lien Waiver” means a waiver of Liens in substantially the form approved by the Management Committee from time to time.

“Lien” means any lien (including a mechanic’s lien, a materialmen’s lien and a supplier’s lien), security interest, option, easement, restriction on transferability, defect of title or other claim, demand, charge or encumbrance of any nature whatsoever, including any restriction on the use, voting, Transfer, receipt of income or other exercise of any attributes of ownership.

“Main Escrow Account” means an account established by the Owners pursuant to the Escrow Agreement for the purpose of receiving funds for the payment or reimbursement of Project Costs.

“Maintenance Activity(s)” means a maintenance activity that is specified in Appendix A to the Operation and Maintenance Agreement.

“Maintenance Costs” means the costs incurred by a Maintenance Provider in the performance of the Maintenance Services

“Maintenance Provider” means, with respect to the Project, the Person designated as the “Maintenance Provider” for the Project in the Operation and Maintenance Agreement. Reference to a Maintenance Provider excludes any reference to a Maintenance Provider in any other capacity.

“Maintenance Services” means the services set forth in Article 3 of the Operation and Maintenance Agreement and the other provisions thereof as applicable to a Maintenance Provider with respect to the Applicable Maintenance Activities set forth in Appendix A of the Operation and Maintenance Agreement.

“Management Committee Powers” has the meaning given in Section 3.2.2.2.

“Management Committee” means the Management Committee established pursuant to this Agreement.

| - 13 - | Confidential |

“Materials” means any products, supplies or materials that are to be incorporated into the Project, whether or not substantially shaped, cut, worked, mixed, finished, refined or otherwise fabricated or processed. The term “Materials” is intended to include any item that is to be incorporated into the Project that is not an item of Equipment or a Consumable.

“Maximum CM Cost Amount” means Three Hundred and Sixty Million Dollars ($360,000,000).

“Maximum Cost Offering Amount” has the meaning given in Section 13.4.1.

“MDU” has the meaning given in the first paragraph of this Agreement.

“Minimum Rating” has the meaning given in the definition of Creditworthy.

“Modifications” means any capital additions or modifications to the Project that are undertaken after the In-Service Date, including (i) Capital Improvements, (ii) Upgrades, and (iii) Non-Project Modifications.

“Month” means a calendar month.

“Moody’s” means Moody’s Investors Service, Inc.

“NERC” means the North American Electric Reliability Corporation, a reliability organization responsible for the oversight of the regional reliability councils established to ensure the reliability and stability of the bulk electric supply system in North America including the Transmission Grid.

“NERC Compliance Policy” means the NERC Requirements as set forth in Exhibit G.

“New Maximum CM Cost Amount” has the meaning given in Section 13.4.3(i).

“Non-Defaulting CPP Owner” has the meaning given in Section 14.2.3.

“Non-Defaulting Owner” means an Owner that is not in Default, including a Non-Defaulting CPP Owner.

“Non-Exclusive Defaults” has the meaning given in Section 15.5.1.

“Non-Performing Owner” has the meaning given in Section 15.1.3.1(i).

“Non-Prevailing Party” means (i) the objecting Owner if the Arbitrator’s determination confirms the Percentage Calculation, or (ii) the non-objecting Owner if the Arbitrator’s determination confirms the Percentages set forth in the applicable Notice.

“Non-Pro Rata Upgrade” has the meaning given in Section 4.4.1(ix)(ii).

“Non-Project Modification” means a Modification that is not approved by the Management Committee for inclusion in a Final Budget and that is undertaken by one but not both of the Owners as permitted by this Agreement. A Non-Project Modification will not constitute

| - 14 - | Confidential |

part of the Project and is not governed by the Project Agreements, except as provided in Section 4.4.

“Notice” means a Recalculation Notice or an Objection Notice under Section 3.1.3.3.1.

“Objecting Owner(s)” has the meaning given in Sections 3.1.3.3.1.

“Objection Notice” has the meaning given in Section 3.1.3.3.1.

“Offered Percentage” has the meaning given in Section 10.4.

“Offered Terms” has the meaning given in Section 10.4.

“Offering Owner” has the meaning given in Section 10.4.

“Operating Expenses” means all expenses of operating and maintaining the Project, without duplication, including all amounts payable under the Project Agreements (other than the Construction Management Agreement); expenses of obtaining and maintaining Governmental Approvals; expenses of performance of obligations under the Project Agreements (other than the Construction Management Agreement); Maintenance Costs and Control Center Costs, as defined in the Operations and Maintenance Agreement; expenses associated with Project Real Property and other assets of the Project; insurance premiums, deductibles, and self-insured retentions as provided in Appendix F to the Operation and Maintenance Agreement; Taxes; utilities; licenses; impositions; general, administrative, and management expenses; consulting and professional fees; and all other fees, costs and expenses, in each case necessary for the operation and maintenance of the Project and the conduct of the business of the Owners as tenants-in-common. The following do not constitute Operating Expenses: (i) expenses of any Financing sought or obtained by an Owner; (ii) amounts paid by either Owner to a Transmission Grid operator or a regional transmission organization; (iii) expenses of either Owner that are not related to the Project; (iv) expenses of either Owner that are related to the Project but are not due and owing to such Owner pursuant to a written contract among the Owner in its capacity as a provider of goods or services to the other Owner and such Owner in its capacity as an Owner; (v) expenses of either Owner that are related to the Project but have not been approved by the Management Committee or approved pursuant to a dispute resolution process; (vi) expenses for which an individual Owner, the Construction Manager, a Maintenance Provider or a Control Center Authority is solely responsible under a Project Agreement (other than in respect of its Ownership Percentage); (vii) CM Costs; or (viii) expenses incurred by a Party in connection with improvements to a Discretely Owned Substation Asset as required by Section 3.1.6.

“Operating Standard” means the requirements, as applicable, for the operation and management of the Project, in all material respects, in accordance with:

| (i) | (a) requirements of Governmental Approvals and Applicable Law; (b) Good Utility Practice; (c) additional requirements adopted by the Management Committee; and (d) the requirements of applicable insurance policies then in effect; and | |

| (ii) | the warranties, operating manuals and procedures for the Project and applicable portions thereof. |

| - 15 - | Confidential |

“OP Default OPCs” has the meaning given in Section 15.2.1.3.

“Operating Year” means the twelve (12) Month calendar year; provided, however, the first Operating Year will begin on the In-Service Date of the Project and end on December 31 of that year.

“Operation and Maintenance Agreement” means that certain Operation and Maintenance Agreement, by and between the Owners and the Maintenance Provider and Control Center Authority, effective as of the Effective Date.

“Operations Payment Default” means the failure of an Owner to pay, when due, any Operating Expenses or Capital Expenses required to be paid by it under this Agreement, if payment is not received within fifteen (15) days after the date such payment was due.

“Order” means any judgment, award, decision, directive, consent decree, injunction (whether temporary, preliminary or permanent), ruling, writ or order adopted, enacted, implemented, promulgated, issued, entered or deemed applicable by or under the authority of any Governmental Body or Arbitrator (but as to an Arbitrator, with respect to injunctive and other equitable relief, only to the extent permitted by this Agreement) that is binding on any Person or its Property under Applicable Law.

“Original Base MVA” means the Base MVA as originally determined pursuant to Paragraph 1(a)(i) of Exhibit P (Methodology For Recalculating Interests For Upgrades) promptly after the Substantial Completion Date, without regard to any adjustments of such Base MVA as so originally determined.

“Original Maximum CM Cost Amount” means the Maximum CM Cost Amount immediately preceding the applicable Proposed Increase in the Maximum CM Cost Amount.

“OTP” has the meaning given in the first paragraph of this Agreement.

“Owner” means each Person set forth in the preamble that is a party to this Agreement; provided, however, the term “Owner”: (i) excludes any Person whose Ownership Percentage becomes zero in accordance with the terms of this Agreement from and after the effective date when its Ownership Percentage became zero; provided, further, that any such Person whose Ownership Percentage becomes zero is not released from its obligations under (a) this Agreement or the Project Transmission Capacity Exchange Agreement to the extent the same arose, accrued or first became performable prior to the effective date when its Ownership Percentage became zero; and (ii) includes a Person that later executes a Transfer Agreement as transferee in accordance with the provisions of this Agreement from and after the effective date set forth in such Transfer Agreement. Reference to an “Owner” means an owner of an Ownership Percentage under this Agreement and excludes reference to any other capacity of such Person, including serving as a Construction Manager, Contractor, Subcontractor, Maintenance Provider or Control Center Authority.

“Owner Claiming Contribution” has the meaning given in Section 16.2.3.2.

| - 16 - | Confidential |

“Owner Procured Materials” means the items of Equipment and Materials proposed in the procurement plan other than such items that the Management Committee, after consultation with the Construction Manager, directs the Construction Manager not to procure.

“Owner Representative” has the meaning given in Section 3.2.3.1.

“Owner Subject To Contribution” has the meaning given in Section 16.2.3.2.

“Ownership Percentage(s)” has the meaning given in Section 3.1.3.1.1.

“Party” or “Parties” has the meaning set forth in the preamble.

“Percentage Calculation Dispute” has the meaning given in Section 18.1.

“Percentage Calculation” has the meaning given in Section 3.1.3.3.1.

“Percentages” means the Ownership Percentages.

“Performing Owner” has the meaning given in Section 15.1.3.1.

“Permitted Owner Lien” means a Lien against the Ownership Percentage of either Owner that such Owner grants, or has granted, to a Financing Party.

“Permitted Purpose” has the meaning given in Section 17.1.

“Permitted Transfer” has the meaning given in Section 10.2.

“Person” means any individual, corporation, partnership, limited liability company, association, joint stock company, trust, unincorporated organization, joint venture, Governmental Body or other entity with legal constitution under Applicable Law.

“Personal Taxes” has the meaning given in Section 7.1.1.

“Prime Rate” means the per annum (365 or 366 days, as appropriate) prime rate as published on the last banking day of the applicable Month in the “Money Rates” table of The Wall Street Journal; provided, however, if more than one such prime rate is published, the mean will be used for purposes of this Agreement, until the Management Committee specifies a different reference publication or equivalent bank rate.

“Pro Rata Upgrade” has the meaning given in Section 4.4.1(ix)(i).

“Proceeding” means any suit, litigation, arbitration, hearing, audit, investigation or other action (whether civil, criminal, administrative or investigative) commenced, brought, conducted, heard by or before, or otherwise involving, any Governmental Body or Arbitrator.

“Procured Materials” means Owner Procured Materials and Contractor Procured Materials, in the aggregate.

| - 17 - | Confidential |

“Project” means, (i) as more particularly identified in Appendix A to the Construction Management Agreement, a 345 kV transmission line from the Ellendale 345 kV Substation to the Big Stone South Substation and consisting of all the equipment and materials, installations and facilities, including associated site improvements, appurtenances and structures procured, installed or constructed between the deadend towers within the Ellendale 345 kV Substation and the Big Stone South Substation; (ii) Capital Improvements, including those required by interconnection requests; (iii) Upgrades; (iv) Project Real Property and all Property interests that arise in connection with the Project Real Property ; and (v) all other Property related to or associated with the Project Real Property in which the Owners have joint right, title or interest, including the Governmental Approvals, the Project Agreements, the Procured Materials, the Construction Agreements and the Real Property Agreements. The Project does not, however, include Discretely Owned Substation Assets or Non-Project Modifications.

“Project Account” means the Main Escrow Account and any sub-accounts thereof established by or at the direction of the Management Committee under the Escrow Agreement.

“Project Agreements” means this Agreement, the Construction Management Agreement, the Project Transmission Capacity Exchange Agreement, the Operation and Maintenance Agreement, the Transmission Easement Agreements and any other contract or agreement designated as a “Project Agreement” by the Management Committee, which in no event may include (i) the Construction Agreements, (ii) Real Property Agreements, or (iii) any contract or agreement that relates to the Discretely Owned Substation Assets or Non-Project Modifications, except in the case of agreements between the Owners with respect to such assets.

“Project Budget” means the Project Budget forecasting the cost to complete the Project as provided in Section 5.1.1 of the Construction Management Agreement.

“Project Capacity” means the then current maximum power that can be transmitted over the Project, without consideration of constraints imposed by the balance of the Transmission Grid or the Discretely Owned Substation Assets.

“Project Change Request” means a submittal by the Construction Manager to the Management Committee, as provided in Section 5.3.2 of the Construction Management Agreement.

“Project Costs” means the CM Costs, Operating Expenses, Capital Expenses, Construction Work costs and any other amounts related to the Project incurred at the direction of the Management Committee; provided, however, (i) costs incurred in connection with Discretely Owned Substation Assets do not constitute Project Costs and (ii) costs incurred by an Owner, Construction Manager, Maintenance Provider or Control Center Authority in negotiation of the commercial terms of: (A) the Project Agreements; (B) the Construction Agreements; or (C) any contract regarding the operation or maintenance of the Project does not constitute a Project Cost unless the counterparty is a Third Party.

“Project Design Book” means the compilation, in electronic format, of documents, drawings, GPS coordinates, route maps, access routes and associated contact information, and information that reflects the final specifications and design of the Project, including “as built”

| - 18 - | Confidential |

design, engineering and construction documents, required to be delivered by any Contractor in accordance with the provisions of the applicable Construction Agreement.

“Project Development Agreement” means that certain Project Development Agreement between the Parties, dated effective as of June 27, 2012, establishing the terms and conditions pursuant to which Development Work was undertaken prior to the Effective Date.

“Project Plan” has the meaning given in Section 3.2.2.2(xiv), a copy of which as of the Effective Date is attached as Appendix A to the Construction Management Agreement, which may be revised from time to time pursuant to Section 4.1.2 of the Construction Management Agreement.

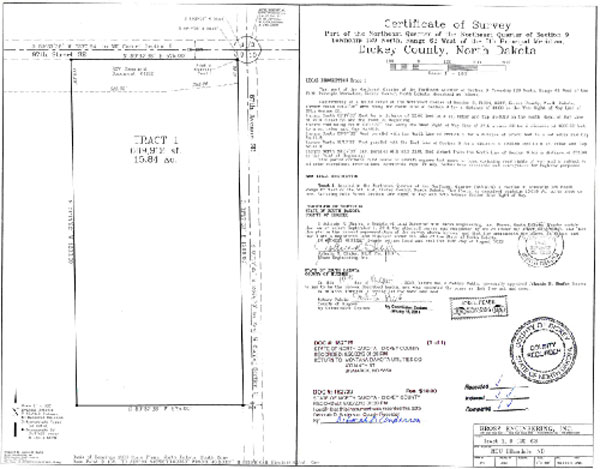

“Project Real Property” means the fee interests, licenses, rights-of-way, easements, access and egress rights and other real property interests on which the Project is to be located, including any licenses, rights-of-way, easements and other real property interests necessary for access to and egress from the Project.

“Project Transmission Capacity Exchange Agreement” means that certain Project Transmission Capacity Exchange Agreement by and between the Owners, effective as of the Effective Date.

“Property” means any kind of property or asset, whether real, personal, mixed, tangible or intangible.

“Proposed Budget” means a five-year budget describing Capital Expenses and other Operating Expenses that the Maintenance Provider recommends.

“Proposed Increase in the Maximum CM Cost Amount” means a Project Change Request provided by the Construction Manager to the Management Committee that estimates an amount of an increase in the Maximum CM Cost Amount, which, based on estimates and information then known to the Construction Manager, reasonably would be necessary to achieve Final Completion.

“Real Property Agreements” means contracts, agreements, instruments or arrangements providing for the acquisition of Project Real Property.

“Real Property Management Services” means the services furnished by the Construction Manager to the Owners to acquire the Project Real Property.

“Rebuild Election Notice” has the meaning given in Section 8.4.1.1.

“Rebuilding Owner” has the meaning given in Section 8.4.1.1.

“Recalculation Notice” has the meaning given in Section 3.1.3.3.1.

“Representatives” has the meaning given in Section 17.1.

| - 19 - | Confidential |

“Responsible Entities” means the Maintenance Provider and the Control Center Authority with assigned responsibility for maintenance or operation of the Project as set forth in the Operation and Maintenance Agreement.

“ROFN Closing” has the meaning given in Section 10.4.1.7.

“ROFN Election Notice” has the meaning given in Section 10.4.1.5.

“ROFN Offeree Owner” has the meaning given in Section 10.4.

“ROFN Option Period” has the meaning given in Section 10.4.1.

“ROFN Trigger Notice” has the meaning given in Section 10.4.

“ROFN” has the meaning given in Section 10.4.

“S&P” means Standard & Poor’s Ratings Group, a division of McGraw-Hill Inc.

“Sales Taxes” has the meaning given in Section 7.1.2.

“Scope of Work” has the meaning given in Section 3.2.2.2(xiv).

“Senior Executive(s)” means an officer of an Owner who is authorized to settle the applicable dispute and who is not an Authorized Owner Representative.

“Services” means the Maintenance Services, the Construction Management Services, the Real Property Management Services and the Control Center Services.

“Shared Liability Claim” has the meaning given in Section 16.2.1.

“Shared Liability” has the meaning given in Section 16.2.1.

“Subcontract” means each contract, agreement or arrangement between any Contractor or Subcontractor, on the one hand, and any Subcontractor, on the other hand, establishing the terms of performance of any part of the Construction Work.

“Subcontractor” means each and every supplier, subcontractor, vendor, consultant or contractor of any tier performing any part of the Construction Work including providing any studies, reports, plans, evaluations or Procured Materials, in connection with the Construction Work, directly or indirectly for or to any Contractor. Reference to an Owner as a “Subcontractor” excludes any reference to such Owner in any other capacity.

“Substantial Completion” means the achievement of the following conditions as to the Project: (i) completion of Construction Work to the extent required for the safe, reliable and continuous operation of the Project consistent with Good Utility Practice and Applicable Law; (ii) completion of Commissioning of the Project; (iii) vendor and construction documentation (including start-up procedures and copies of applicable portions of the Project Design Book) and any special tools necessary to support continuous, safe and reliable operation of the Project have been delivered to the Maintenance Provider; (iv) the Project has been energized and placed in

| - 20 - | Confidential |

service (unless otherwise specified by the Management Committee); and (v) unless waived by the Construction Manager as to any Lien or indemnity agreement (such waiver only to be effective as to establishing the existence of Substantial Completion and for no other purpose), the Construction Manager has received from each Contractor under a Construction Agreement and Subcontractor under a Subcontract, in each case, with a contract value equal to or greater than One Hundred Thousand Dollars ($100,000), duly executed Lien Waivers.

“Substantial Completion Date” means the date that Substantial Completion has occurred.

“Substation Work” means all activities that are necessary, desirable or incidental to complete the obligations of each Owner to construct its respective Discretely Owned Substation Assets.

“Taxes” has the meaning given in Section 7.1.1.

“Third Party Claim Damages” has the meaning given in Section 16.1.1.

“Third Party Claim” has the meaning given in Section 16.1.1.

“Third Party” means any Person that is neither a party nor an Affiliate of a party to this Agreement.

“Transfer Agreement” has the meaning given in Section 10.3.1.3.

“Transfer Effective Date” has the meaning given in Section 12.2.9.

“Transfer” has the meaning given in Section 10.1.

“Transmission Easement Agreements” means those certain transmission easement agreements as set forth in the Form Transmission Easement Agreement and Memorandum of the Project Ownership Agreement and as shown in Exhibit J, dated as of the Effective Date, by and between a Discretely Owned Substation Owner and the other Owner.

“Transmission Grid” means the electric transmission system to which the Project will be directly interconnected and of which it will become a part.

“Transmission Information” has the meaning given in Section 17.4.

“Transmission Provider” means any Person, including an Owner, who exercises functional control over the operation of a portion of the Transmission Grid as necessary to effectuate transmission transactions that it administers and provides transmission service under a tariff, rate schedule or other agreement.

“Uncurable Construction Period Payment Default” has the meaning given in Section 14.2.4.

| - 21 - | Confidential |

“Uniform System of Accounts” means the FERC’s “Uniform System of Accounts Prescribed for Public Utilities and Licensees (Class A and Class B),” in effect as of the Effective Date, as such Uniform System of Accounts may be modified from time to time.

“Upgrade” means a Modification undertaken after the In-Service Date that increases the Project Capacity, whether such Upgrade is a Pro-Rata Upgrade or a Non-Pro Rata Upgrade.

“Wind-up Plan” has the meaning given in Section 19.3.1.

| 1.2 | Certain Conflicts Between Project Agreements. As between the Owners: (i) in the event of any conflict between this Agreement and the Construction Management Agreement with respect to the authority, rights and obligations of the Construction Manager, the Construction Management Agreement will control; and (ii) in the event of any conflict between this Agreement and the Operation and Maintenance Agreement with respect to the authority, rights and obligations of the Maintenance Provider or Control Center Authority, the Operation and Maintenance Agreement will control. |

| 1.3 | Schedules and Exhibits. This Agreement consists of this document itself and the Schedules and Exhibits that are specifically made a part hereof and incorporated herein by reference. |

ARTICLE 2

TERM

| 2.1 | Term. The term of this Agreement will commence at the Effective Date and will continue until this Agreement has been terminated pursuant to Section 19.1.2. |

ARTICLE 3

PROJECT OWNERSHIP, INTERESTS AND GOVERNANCE

| 3.1 | Nature of Ownership and Ownership Percentages. |

| 3.1.1 | Nature of Ownership Interest. |

| 3.1.1.1 | Project Held as Tenancy-in-Common. The Project will be owned by the Owners as tenants-in-common in undivided ownership interests. Such ownership interests will be (i) in accordance with the Ownership Percentages described in Section 3.1.3.1.1, as adjusted pursuant to this Agreement. | |

| 3.1.1.2 | Discretely Owned Substation Assets. The Discretely Owned Substation Assets are owned individually by the Owners as follows: the Big Stone South Substation is owned by OTP and the Ellendale 345 kV Substation owned by MDU. The Discretely Owned Substation Assets are not part of the Project and the costs associated with the same are not used to determine the Ownership Percentages. | |

| - 22 - | Confidential |

| 3.1.1.3 | Transmission Revenues. Transmission-related revenues arising from an Owner’s Ownership Percentage in the Project and its ownership of the Discretely Owned Substation Assets are the individual Property of the Owner. | |

| 3.1.2 | Property Interests Created Prior to the Effective Date. The Owners acknowledge and agree that all Property interests created under the Project Development Agreement (the “Development Period Assets”), including (i) those Property interests set forth on Exhibit A and (ii) the contracts entered into prior to the Effective Date under the Project Development Agreement that remain, in whole or in part, executory as of the Effective Date, each of which is set forth in Exhibit A (the “Development Period Contracts”), have been or are hereby transferred to and are to be utilized by, in and as part of the Project, in the name of the Owners, free and clear of any and all Liens other than Permitted Owner Liens. |

| 3.1.3 | Ownership Percentage. |

| 3.1.3.1 | Exhibit B. | |

| 3.1.3.1.1 | Ownership Percentage. Exhibit B sets forth the Ownership Percentage of each Owner (the “Ownership Percentage(s)”) as of the Effective Date. The Ownership Percentages of the Owners may be increased or decreased after the Final Completion Date, and Exhibit B revised, for (i) Non-Pro Rata Upgrades in accordance with the formula set forth in Exhibit P, or (ii) termination of the Project and completion of the Wind-up Plan, and from time to time after the Effective Date as a result of the occurrences set forth in Articles 10 (Transfers) or 13 (Maximum CM Costs) or 14 (Defaults Related to Construction Activities) or 19 (Termination) in accordance with the Formula. Any change in the Ownership Percentage(s) shall become effective on the later of (A) the date on which the revised Schedule 2 to the Project Transmission Capacity Exchange Agreement is accepted for filing by the FERC, or (B) the date specified by the Owners as the effective date of the change. | |

| 3.1.3.2 | [RESERVED]. | |

| 3.1.3.3 | Calculation Upon Project Termination or Upon a Recalculation Notice. | |

| 3.1.3.3.1 | Recalculation of Percentages. (i) As soon as practicable after termination of the Project and completion of the Wind-up Plan, or (ii) within sixty (60) days after receipt by an Owner of a revised Exhibit B as a result of the occurrences set forth in Section 4.4.1(ix) (Non-Pro Rata Upgrade), or Articles 10 (Transfers), 13 (Maximum CM Costs), 14 (Defaults Related to Construction Activities) or 19 (Termination), an Owner |

| - 23 - | Confidential |

| provides notice to the Management Committee and the other Owner that the Owner Percentages as shown on the most recent Exhibit B is incorrect (which notice must include such Owner’s “Percentage Calculation,” which is defined below), (each under clauses (i) and (ii) a “Recalculation Notice”), the Management Committee and a Senior Executive of the Owner that sent a Recalculation Notice will meet in good faith during the twenty (20) day period following the Management Committee’s receipt of the Recalculation Notice to determine whether the Ownership Percentages set forth on the most recent Exhibit B are correct. If, at the end of such period, the Management Committee and such Senior Executive do not agree on whether the Ownership Percentages set forth on the most recent Exhibit B are correct, then the Owner objecting to the calculation of the Owner Percentages (such Owner for purposes of this Section 3.1.3.3 and Article 18, an “Objecting Owner”) shall deliver a notice to the Management Committee and the other Owner specifying its objections thereto in reasonable detail (an “Objection Notice”). | ||

| 3.1.3.3.2 | Dispute Resolution Concerning Percentage Calculation. If, following termination of the Project and completion of the Wind-up Plan, or as a result of the occurrences set forth in Section 4.4.1(ix) (Non-Pro Rata Upgrade), or Articles 10 (Transfers), 13 (Maximum CM Costs), 14 (Defaults Related to Construction Activities) or 19 (Termination), a dispute exists as to the Ownership Percentage to be set forth in a revised Exhibit B, the Owners will resolve the dispute in accordance with Article 18 (Dispute Resolution for Excluded Matters). | |

| 3.1.3.3.3 | No Effect on Prior Decisions. If any Ownership Percentages are changed pursuant to Section 3.1.3 or Article 18, actions requiring a vote of and actions by the Management Committee that were taken based on the vote levels established by such Ownership Percentages reflected in Exhibit B prior to any such change will remain in full force and effect and will not be subject to challenge as a result of any such change; provided, however, the foregoing will not apply to Management Committee actions that apply to and affect the proper allocation of CM Costs or Distributable Cash or pro rata allocations related thereto, between the Owners, and any such change(s) to Exhibit B will be retroactively effective and adjusted. |

| 3.1.4 | [RESERVED]. | |

| 3.1.5 | Waiver of Right to Partition. The Owners recognize that the physical partition of the Project or any part thereof would be impractical and inconsistent with the |

| - 24 - | Confidential |

| purposes for which this Agreement is made. Each of the Owners agrees that it will not take any action at any time by a Proceeding or otherwise exercise any right available under Applicable Law to partition the Project or any part thereof in any way, whether by partition in kind or by sale and division of the proceeds thereof. Each of the Owners further irrevocably waives the right of partition and the benefit of all Applicable Law (including statutory and common law) that may now or hereafter authorize such partition of the Project or any part thereof. If any such right of partition accrues, after the Effective Date, each Owner will from time to time upon the written request of the other Owner execute and deliver such further instruments as may be necessary to confirm the foregoing waiver and release of its right to partition. By way of clarification, the Owners acknowledge and agree that the waiver of the right to partition the Project contained in this Section 3.1.5 only applies to the Project. The provisions of this Section 3.1.5 will be binding upon and inure to the benefit of the Owners, their respective successors and assigns, including Financing Parties and their respective successors and assigns, and will run with the Project. Each Owner agrees to insert a similar covenant in any contract with any Person (other than another Owner) that acquires all or any portion of its Ownership Percentage, which covenant will be enforceable by either Owner or by the Management Committee. This waivers specified in this Section 3.1.5 will be summarized in the Transmission Easement Agreement(s) in substantially the form attached hereto as Exhibit J, which will be recorded in all relevant jurisdictions. | |

| 3.1.6 | Discretely Owned Substation Assets. |

| 3.1.6.1 | Creation of Transmission Easement and Survival of Rights. Each Discretely Owned Substation Owner will grant the other Owner an irrevocable, non-fee or royalty bearing (i) non-exclusive limited right to connect its Ownership Percentage of the Project to the Discretely Owned Substation Assets and (ii) non-exclusive easement for the transmission of energy and data through the Discretely Owned Substation Assets. The non-exclusive rights to connect to and easements granted through the Discretely Owned Substation Assets shall be a limited to an initial term of ninety-nine (99) years from the Effective Date. | |

| 3.1.6.2 | Discretely Owned Substation Owner Obligations. Each Discretely Owned Substation Owner agrees to construct the Discretely Owned Substation Assets prior to Substantial Completion and to pay for the Discretely Owned Substation Costs thereof. | |

| 3.2 | Management Committee. |

| 3.2.1 | Establishment. The Owners hereby establish the Management Committee which will consist of the representatives appointed by the Owners in accordance with Section 3.2.3.1. |

| 3.2.2 | Powers. |

| - 25 - | Confidential |