Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Shepherd's Finance, LLC | Financial_Report.xls |

| EX-24.1 - POWER OF ATTORNEY - Shepherd's Finance, LLC | shepherds_s1-ex2401.htm |

| EX-23.1 - CONSENT - Shepherd's Finance, LLC | shepherds_s1-ex2301.htm |

As filed with the Securities and Exchange Commission on April 28, 2015

Registration No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Shepherd’s Finance, LLC

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

6153 (Primary Standard Industrial Classification Code Number) |

36-4608739 (I.R.S. Employer Identification No.) |

12627 San Jose Blvd., Suite 203

Jacksonville, FL 32223

(302) 752-2688

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel M. Wallach

Chief Executive Officer

12627 San Jose Blvd., Suite 203

Jacksonville, FL 32223

(302) 752-2688

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including copies of all communications sent to agent for service, should be sent to:

|

Michael K. Rafter, Esq. Nelson Mullins Riley & Scarborough LLP Atlantic Station 201 17th Street NW, Suite 1700 Atlanta, Georgia 30363 Telephone: (404) 322-6627 Facsimile: (404) 322-6050 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [_]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [_]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [_]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [_] | Accelerated filer [_] |

Non-accelerated filer [_] (Do not check if a smaller reporting company) |

Smaller reporting company [X] |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee (2) | ||

| Fixed Rate Subordinated Notes | $ 70,000,000 | $ 8,134 | ||

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o).

(2) As discussed below, pursuant to Rule 457(p) under the Securities Act, this Registration Statement includes $690 million of unsold securities that have been previously registered, with respect to which the Registrant paid filing fees of $80,220. The filing fees previously paid with respect to securities being carried forward to this registration statement reduce the amount of fees currently due from $8,134 to $0.

Pursuant to Rule 415(a)(6) under the Securities Act of 1933, as amended, the securities registered pursuant to this Registration Statement include unsold securities previously registered for sale pursuant to the Registrant’s registration statement on Form S-1 (File No. 333-181360) initially filed by the Registrant on May 11, 2012 (the “Prior Registration Statement”). The Prior Registration Statement registered securities with a maximum offering price of $700 million for sale pursuant to the Registrant’s offering. Of these amounts, approximately $690 million of offering securities remain unsold. These unsold amounts are being carried forward to this Registration Statement and the filing fees paid with respect to the initial registration of the unsold securities is being used to offset filing fees that would otherwise be due in connection with the filing of this Registration Statement. Pursuant to Rule 415(a)(6), the offering of unsold securities under the Prior Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement.

———————————————————

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant files a further amendment which specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement becomes effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission and various states is effective. This prospectus is not an offer to sell these securities and is not solicitating an offer to buy these securities in any state where the offer or sale is not permitted. |

$70,000,000 Fixed Rate Subordinated Notes

Shepherd’s Finance, LLC is offering up to $70,000,000 in aggregate principal amount of our Fixed Rate Subordinated Notes (“Notes”) on a continuous basis. The initial minimum investment amount required is $500. From time to time, we may, however, change the minimum investment amount that is required. The maximum investment amount per investor is $1,000,000 aggregate principal amount, or $1,000,000 per Note, but a higher maximum investment amount may be approved on a case-by-case basis. We previously sold our Notes in a public offering. Pursuant to Rule 415(a)(6) under the Securities Act of 1933, as amended, the Notes include unsold securities previously registered for sale pursuant to our registration statement on Form S-1 (File No. 333-181360) that we initially filed on May 11, 2012 (the “Prior Registration Statement”). The Prior Registration Statement registered securities with a maximum offering price of $700 million for sale pursuant to our offering. Of these amounts, approximately $690 million of offering securities remain unsold. These unsold amounts are being carried forward to this offering and the offering of unsold securities under the Prior Registration Statement will be deemed terminated as of the date of effectiveness of this offering. As of March 31, 2015, we have issued Notes with an aggregate principal amount of approximately $5,668,000. The term “Notes”, as used throughout this prospectus, can mean both the Notes offered herewith, and Notes offered in prior or future offerings of the Company.

We issue the Notes in varying purchase amounts and maturities that we establish from time to time. For each purchase amount and maturity, we also establish an interest rate. The maturity dates for our Notes may range from one year to four years.

We may market our Notes in many ways, including but not limited to, publishing the then current features (e.g., the maturities and interest rates currently offered by us) of the Notes in newspapers or on billboards, advertising on the internet, and through direct mail campaigns. At any time, you also may obtain the then applicable features of the Notes from our web site at www.shepherdsfinance.com or by calling (302) 752-2688 (30-ASK-ABOUT). However, the information on our website is not a part of this prospectus. Upon any change in the features of the Notes, we will file a Rule 424(b)(2) prospectus supplement setting forth the then applicable features.

We are offering the Notes directly, without an underwriter or placement agent, and on a continuous basis. We do not have to sell any minimum amount of Notes to accept and use the proceeds of this offering. Therefore, once you purchase a Note, we may immediately use the proceeds of your investment and your investment will be returned only if we repay your Note. We cannot assure you that all or any portion of the Notes we are offering will be sold. We have not made any arrangement to place any of the proceeds from this offering in an escrow, trust, or similar account. The Notes are not listed on any securities exchange and there will not be any public trading market for the Notes. We have the right to reject any investment, in whole or in part, for any reason.

We may redeem any Note, in whole or in part, at any time prior to maturity, upon 30 to 60 days’ written notice, for a redemption price equal to the principal amount plus any earned but unpaid interest thereon to the date of redemption. Additionally, you may request early redemption of a Note purchased by you at any time on or after 180 calendar days after issuance of a Note, but we reserve the right to decline your request for any reason. If we grant your redemption request, we will mail you a payment equal to the principal amount plus any earned but unpaid interest to the date of redemption, minus a 180-day interest penalty.

The Notes mature between one and four years from the date of issuance. Between 30 to 60 days prior to the maturity date, we will mail to you a letter notifying you of the upcoming maturity date and, if we are offering you any renewal options and have an effective offering available, a current prospectus and a renewal form containing instructions to exercise the renewal options. If you do not respond, principal and any earned but unpaid interest will be paid to you.

You should read this prospectus and any applicable prospectus supplement carefully before you invest in the Notes. The Notes are our general unsecured obligations and are subordinated in right of payment to all of our present and future senior debt. As of December 31, 2014, we had approximately $5,802,000 in debt outstanding that ranks equal or senior to the Notes offered pursuant to this prospectus, including approximately $5,427,000 in Notes issued pursuant to the prior offering. We expect to incur additional debt in the future, including, without limitation, the Notes offered pursuant to this prospectus and senior debt (from banks or related parties).

The Notes are not certificates of deposit or similar obligations guaranteed by any depository institution and are not insured by the Federal Deposit Insurance Corporation (FDIC) or any governmental or private insurance fund, or any other entity. We do not contribute funds to a separate account such as a sinking fund to repay the Notes upon maturity.

We are an “emerging growth company” under the federal securities laws and are subject to reduced public company reporting requirements. See “Risk Factors” beginning on page 14 for significant factors you should consider before buying the Notes. These risks include the following:

| · | Our Notes are not insured or guaranteed by the FDIC or any third party, so repayment of your Note depends upon our equity (which may be limited at times), our experience, the collateral securing our loans, and our ability to manage our business and generate adequate cash flows. | |

| · | The Notes are risky speculative investments. Therefore, you should not invest in the Notes unless you are able to afford the loss of your entire investment. | |

| · | There will not be any market for the Notes, so you should only purchase them if you do not have any need for your money prior to the maturity of the Note. | |

| · | You will not have the benefit of an independent review of the terms of the Notes, the prospectus, or our Company, as is customarily performed in underwritten offerings. | |

| · | Payment on the Notes is subordinate to the payment of our outstanding present and future senior debt, if any. Since there is no limit on the amount of senior debt we may incur, our present and future senior debt may make it difficult to repay the Notes. | |

| · | The indenture and terms of our Notes do not restrict our use of leverage. A relatively small loss can cause over leveraged companies a material adverse change in their financial position. If this happened to us, it may make it difficult to repay the Notes. | |

| · | If we are unable to raise substantial funds, we will be limited in our ability to diversify the loans we make, and our ability to repay the Notes that have been sold will be dependent on the performance of the specific loans we make. | |

| · | If we are unable to meet our Note maturity and redemption obligations, and we are unable to obtain additional financing or other sources of capital, we may be forced to sell off our operating assets or we might be forced to cease our operations, and you could lose some or all of your investment. | |

| · | We are controlled by Daniel M. Wallach, as, currently, he is our only executive officer and beneficially owns all of our outstanding common membership interests. | |

| · | Currently, we are reliant on a single developer and homebuilder, the Hoskins Group, for majority of our revenues and a portion of our capital. | |

| · | In December 2014, we agreed to a purchase and sale agreement with a third party to sell them senior portions of some of our loans. This is a new activity for our Company, and will increase our leverage. While the agreement is intended to increase our profitability, large loan losses and/or idle cash, could actually reduce our profitability, which could impair our ability to pay principal and/or interest on the Notes. | |

| · | We have a limited operating history and limited experience operating as a company, so we may not be able to successfully operate our business or generate sufficient revenue. | |

| · | Our operations are not subject to the stringent banking regulatory requirements designed to protect investors, so repayment of your investment is completely dependent upon our successful operation of our business. | |

| · | Most of our assets are commercial construction loans to homebuilders and/or developers which are a higher than average credit risk, and therefore could expose us to higher rates of loan defaults, which could impact our ability to repay amounts owed to you. | |

| · | Our Chief Executive Officer (who is also on our Board of Managers) will face conflicts of interest as a result of the secured affiliated loans made to us, which could result in actions that are not in the best interests of our Note holders. |

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission, and neither the Securities and Exchange Commission nor any state securities commission has passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Price to Public | Underwriting Discount and Commission (1) | Proceeds to Company (2) | |

| Per Note | 100% | None | 100% |

| Total | $70,000,000 | None | $70,000,000 |

__________

(1) The Notes are not being offered or sold pursuant to any underwriting or similar agreement, and no commissions or other remuneration will be paid in connection with their sale. The Notes will be sold at face value.

(2) We will receive all of the net proceeds from the sale of the Notes, which, if we sell all of the Notes covered by this prospectus, we estimate will total approximately $69,589,000 after expenses.

The date of this prospectus is ____________, 2015

SUITABILITY STANDARDS

An investment in our Notes involves significant risks and is only suitable for persons who have adequate financial means, desire a relatively long-term investment and will not need liquidity from their investment. This investment is not suitable for persons who seek liquidity or guaranteed income.

We have not established general suitability standards for investors in our Notes; however, certain states in which we intend to sell the Notes have established special suitability standards. Notes will be sold only to investors in these states who meet the special suitability standards set forth below:

| · | For Alaska Residents – Notes will only be sold to residents of the State of Alaska representing that they have (i) a minimum annual gross income of $60,000 and a minimum net worth of $60,000, or (ii) a minimum net worth of $225,000. In each case, net worth is to be calculated exclusive of an individual’s principal automobile, principal residence, and home furnishings. |

| · | For California Residents – Notes will only be sold to residents of the State of California representing that they have (i) a gross income of $65,000 and net worth of $250,000, or (ii) a net worth of $500,000. |

| · | For Idaho Residents – Notes will only be sold to residents of the State of Idaho representing that they have (i) a liquid net worth of $85,000 and annual gross income of $85,000, or (ii) a liquid net worth of $300,000. Additionally, the investor’s total investment in the Notes shall not exceed 10% of his or her liquid net worth. Liquid net worth is that portion of net worth consisting of cash, cash equivalents and readily marketable securities. |

| · | For Iowa Residents – Notes will only be sold to residents of the State of Iowa representing that they have (i) a liquid net worth of $85,000 and annual gross income of $85,000, or (ii) a liquid net worth of $300,000. Additionally, the investor’s total investment in the Notes shall not exceed 10% of his or her liquid net worth. Liquid net worth is that portion of net worth consisting of cash, cash equivalents and readily marketable securities. |

| · | For Kansas Residents – It is required by the Office of the Kansas Securities Commissioner that Kansas investors limit their aggregate investment in the securities of the Issuer and other similar programs to not more than 10% of their liquid net worth. For these purposes, liquid net worth shall be defined as that portion of total net worth (total assets minus liabilities) that is comprised of cash, cash equivalents and readily marketable securities, as determined in conformity with U.S. Generally Acceptable Accounting Principles. |

| · | For Maine Residents – The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar offerings not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. |

| · | For Massachusetts and New Mexico Residents – It is required by the Securities Divisions of each of Massachusetts and New Mexico that Massachusetts and New Mexico investors limit their aggregate investment in our Notes and other similar programs to not more than 10% of their liquid net worth. For these purposes, liquid net worth shall be defined as that portion of total net worth (total assets minus liabilities) that is comprised of cash, cash equivalents and readily marketable securities, as determined in conformity with U.S. Generally Acceptable Accounting Principles. It is further required by the Securities Divisions of each of Massachusetts and New Mexico that Massachusetts and New Mexico investors have (i) a net income of at least $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year, or (ii) an individual net worth, or joint net worth with that person’s spouse, in excess of $1,000,000, excluding the value of the person’s primary residence. |

| · | For Oregon Residents – Notes will only be sold to residents of the State of Oregon representing that they have (i) an annual gross income of $70,000 and a liquid net worth of $70,000, or (ii) a net worth of $250,000. Further, investors in the State of Oregon may not invest more than 10% of their liquid net worth in the offering. |

| · | For Tennessee Residents – An investment by a Tennessee resident must not exceed ten percent (10%) of their liquid net worth. |

| i |

SHEPHERD’S FINANCE, LLC

TABLE OF CONTENTS

| SUITABILITY STANDARDS | i |

| QUESTIONS AND ANSWERS | 1 |

| PROSPECTUS SUMMARY | 8 |

| Our Company and Our Business | 8 |

| The Offering | 10 |

| Summary of Consolidated Financial Data | 12 |

| RISK FACTORS | 13 |

| Risks Related to Our Offering and Structure | 13 |

| Risks Related to Our Business | 17 |

| Risks Related to Conflicts of Interest | 24 |

| FORWARD-LOOKING STATEMENTS | 25 |

| USE OF PROCEEDS | 26 |

| SELECTED FINANCIAL DATA | 27 |

| BUSINESS | 29 |

| Overview | 29 |

| Investment Objectives and Opportunity | 30 |

| Commercial Construction and Development Loans | 35 |

| Credit Quality Information | 37 |

| Competition | 40 |

| Regulatory Matters | 41 |

| Legal Proceedings | 41 |

| Reports to Security Holders | 42 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 42 |

| Overview | 42 |

| Critical Accounting Estimates | 45 |

| Consolidated Results of Operations | 48 |

| Consolidated Financial Position | 50 |

| Contractual Obligations | 55 |

| Liquidity and Capital Resources | 56 |

| Inflation, Interest Rates, and Housing Starts | 58 |

| Recent Accounting Pronouncements | 59 |

| Subsequent Events | 59 |

| MANAGEMENT | 60 |

| Executive Officers and Board of Managers | 60 |

| Committees of the Board of Managers | 60 |

| Limitations on Liability | 61 |

| EXECUTIVE COMPENSATION | 62 |

| Executive Officer Compensation | 62 |

| Board of Managers Compensation | 63 |

| PRINCIPAL SECURITY HOLDERS | 63 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 63 |

| Transactions with Affiliates | 63 |

| Affiliate Transaction Policy | 64 |

| DESCRIPTION OF NOTES | 64 |

| General | 64 |

| Established Features of Notes | 65 |

| Subordination | 65 |

| Redemption by Us Prior to Maturity | 66 |

| Redemption at the Request of the Holder Prior to Maturity | 66 |

| Redemption upon Your Death | 66 |

| Extension at Maturity | 66 |

| No Restrictions on Additional Debt or Business | 66 |

| Modification of Indenture | 66 |

| Place, Method and Time of Payment | 67 |

| Events of Default | 67 |

| Satisfaction and Discharge of Indenture | 67 |

| Reports | 67 |

| Service Charges | 67 |

| Book Entry Record of Your Ownership | 68 |

| Transfer | 68 |

| Concerning the Trustee | 68 |

| ii |

| PLAN OF DISTRIBUTION | 68 |

| CHARITABLE MATCH PROGRAM | 69 |

| LEGAL MATTERS | 69 |

| EXPERTS | 69 |

| WHERE YOU CAN FIND MORE INFORMATION | 69 |

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell the Notes only in jurisdictions where offers and sales are permitted.

| iii |

QUESTIONS AND ANSWERS

Below we have provided some of the more frequently asked questions and answers relating to the offering of the Notes. Please see the “Prospectus Summary” and the remainder of the prospectus for more information about the offering of the Notes.

| Q: | Who is Shepherd’s Finance, LLC? |

| A: | Shepherd’s Finance, LLC, along with our consolidated subsidiary, (“Shepherd’s Finance,” “we,” “our,” “us” or the “Company”) is a finance company organized as a limited liability company in the State of Delaware. Our business is focused on commercial lending to participants in the residential construction and development industry. Our Chief Executive Officer (who is also on our Board of Managers) is Daniel M. Wallach. Mr. Wallach is responsible for overseeing our day-to-day operations. We were organized in the Commonwealth of Pennsylvania in 2007 under the name 84 RE Partners, LLC and changed our name to Shepherd’s Finance, LLC on December 2, 2011, after we terminated our relationship with 84 Lumber Company, as discussed further below. We converted to a Delaware limited liability company on March 29, 2012. We are located in Jacksonville, Florida. |

| All of our outstanding membership interests are owned directly or beneficially by Mr. Wallach and his wife; therefore, Mr. Wallach is able to exercise significant control over our business, including with respect to the composition of our Board of Managers. A Manager may be removed by a vote of holders of 80% of our outstanding voting membership interests. | |

| Q: | What are your primary business activities? |

| A: | We extend and service commercial loans to small-to-medium sized homebuilders for the purchase of lots and/or the construction of homes thereon. We also extend and service loans for the purchase of undeveloped land and the development of that land into residential building lots. Most of the loans are for “spec homes” or “spec lots,” meaning they are built or developed speculatively (with no specific end-user homeowner in mind). The loans are secured, and the collateral is the land, lots, and constructed items thereon, as well as additional collateral, as we deem appropriate. At the end of December, 2011 we had development loans in two subdivisions both in Pittsburgh, Pennsylvania. As of December 31, 2014, we had construction loans in seven states to ten borrowers, along with the still progressing Pittsburgh development loans (both of which have sold through about 50% of their eventual total size). We intend to continue expanding our lending activity and further diversify our loan portfolio. |

| Q: | What is your experience in this type of lending? |

| A: | Our Chief Executive Officer, Daniel M. Wallach, has been in the housing industry since 1985. For 11 years, he was the CFO of 84 Lumber Company (“84 Lumber”), a multi-billion dollar supplier of building materials to home builders. He also was responsible for 84 Lumber’s lending business for 20 years. During those years, he was responsible for the creation and implementation of many secured lending programs to builders, some of which were performed fully by 84 Lumber, and some of which were performed in partnership with banks. In general, both the creation of all loans and the resolution of defaulted loans were Mr. Wallach’s responsibility, whether the loans were company loans or loans in partnership with banks. Through these programs, he was responsible for the creation of approximately $2,000,000,000 in loans which generated interest spread of $50,000,000 after deducting for loan losses. Through the years, Mr. Wallach managed the development of systems for reducing and managing the risks and losses on defaulted loans. Mr. Wallach also was responsible for 84 Lumber’s unsecured debt to builders, which reached over $300,000,000 at its peak. He also gained experience in securing defaulted unsecured debt. This offering is our first public offering of securities. |

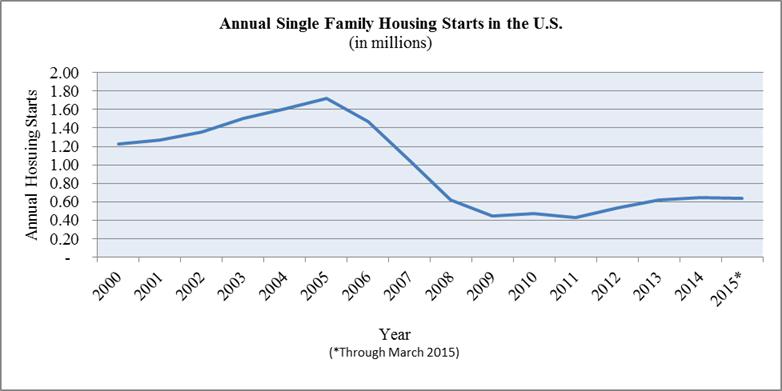

| Q: | Given the current low number of housing starts in the U.S. today, why will your potential customers want to borrow from you? |

| A: | While the number of housing starts dropped to historically low levels several years ago, there are still more than 500,000 single family homes being built in the U.S. on a yearly basis. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Inflation, Interest Rates, and Housing Starts.” Many small-to-medium sized home builders can build homes for customers who have their own financing, but are unable to obtain or supply their own financing to build speculative or model homes. The ability to have available either a speculative home or a model home can greatly increase the total number of homes a builder can sell per year, so despite the high cost of providing financing to builders today, we believe that there is a significant demand. Banks, which historically have been the most popular provider of financing for builders, are mostly not in that business today, or are in the business at a greatly reduced level. We believe that this void in supply gives us the opportunity to profit in this niche business of providing financing to small-to-medium sized home builders. |

| 1 |

| Q: | What is the role of the Board of Managers? |

| A: | While our Chief Executive Officer is responsible for our day-to-day operations, our Board of Managers is responsible for overseeing our business. Our Board of Managers is comprised of Daniel M. Wallach, who is also our Chief Executive Officer, and three independent Managers – Bill Myrick, Eric Rauscher, and Kenneth R. Summers. |

| Q: | What kind of offering is this? |

| A: | We are offering up to $70,000,000 in Notes. |

| Q: | How are the Notes sold? |

| A: | The Notes are offered directly by us without an underwriter or placement agent. We may market the Notes by advertisements in local and/or national newspapers, roadway sign advertisements, advertisements on the internet, or through direct mail campaigns and other miscellaneous media in states in which we have properly registered the offering or qualified for an exemption from registration. |

| Q: | What will you do with the proceeds raised from this offering? |

| A: | If all of the Notes offered by this prospectus are sold, we expect to receive approximately $69,589,000 in net proceeds (after deducting all costs and expenses associated with this offering). We intend to use substantially all of the net proceeds from this offering as follows and in the following order of priority: |

| · | to make payments on other borrowings, including loans from affiliates; |

| · | to pay Notes on their scheduled due date and Notes that we are required to redeem early; |

| · | to make interest payments on the Notes; and |

| · | to the extent we have remaining net proceeds and adequate cash on hand, to fund any one or more of the following activities: |

| o | to extend commercial construction loans to homebuilders to build single or multi-family homes or develop lots; |

| o | to make distributions to equity owners, including the preferred equity; |

| o | for working capital and other corporate purposes; |

| o | to purchase defaulted secured debt from financial institutions at a discount; |

| o | to purchase defaulted unsecured debt from suppliers to homebuilders at a discount and then secure it with real estate or other collateral; |

| o | to purchase real estate, in which we will operate our business; and |

| o | to redeem Notes which we have decided to redeem prior to maturity. |

| 2 |

| Q: | What is a Note? |

| A: | A Note is our promise to pay you a specified rate of interest for a specific period of time and to repay your principal investment upon maturity. The Notes are our general unsecured obligations and are subordinate in right of payment to all present and future senior debt. “Subordinated” means that if we are unable to pay our debts as they come due, all of the senior debt would be paid in full first. After the senior debt is paid in full, any remaining money would be used to repay the Notes and other subordinated debt that are equal to the Notes in priority. As of December 31, 2014, we had $0 in senior debt and approximately $5,802,000 in subordinated debt, which amount includes Notes issued pursuant to this offering. We expect to incur debt in the future, including but not limited to, more senior debt and the Notes offered pursuant to this offering. |

| Q: | What is an indenture? |

| A: | As required by United States federal law, the Notes will be governed by a document called an “indenture.” An indenture is a contract between us and a trustee. The main role of the trustee is to enforce your rights against us if we are in default of our obligations under the Notes. Defaults are described in this prospectus under “Description of Notes – Events of Default.” There are some limitations on the extent to which the trustee acts on your behalf. These limitations are described in this prospectus under “Description of Notes – Events of Default.” |

| The Notes are issued under an indenture dated ___________ between us and _________ (“_________”), as trustee. The indenture does not limit the principal amount of debt securities that we may issue under it. The indenture is governed by Pennsylvania law and is qualified under the Trust Indenture Act of 1939. | |

| Q: | Is my investment in the Notes insured or guaranteed? |

| A: | No, the Notes are: |

| · | NOT certificates of deposit with an insured financial institution; |

| · | NOT guaranteed by any depository institution; and |

| · | NOT insured by the FDIC or any governmental or private insurance fund, or any other person or entity. |

| The Notes are backed only by the faith and credit of our Company and our operations. You are dependent upon our ability to effectively manage our business to generate sufficient cash flow, including cash flow from our commercial lending activities, for the repayment of principal at maturity and the ongoing payment of interest on the Notes. |

| Q: | How is the interest rate determined? |

| A: | From time to time, we will establish the interest rate(s) we are offering for various purchase amounts and maturities. By referring to the features (e.g. the maturities and interest rates) which are in effect at the time, you will see the interest rate(s) and maturity date(s) we are currently offering for your desired purchase amount. The interest rate offered on the Notes depends on which maturity date and purchase amount you select. The interest rate on a Note purchased by you is fixed and will not change over the term of the Note. |

| Q: | How is interest calculated and paid to me? |

| A: | Interest will be calculated based on the actual number of days your Note is outstanding. Interest is calculated and compounded monthly based on a 365-day year (366-day in case of a leap year). Interest will be earned daily, and we will pay interest to you monthly or at maturity as you request. If you choose to be paid interest at maturity rather than monthly, the interest will be compounded monthly. If any day on which a payment is due with respect to a Note is not a business day, then you will not be entitled to payment of the amount due until the following business day, and no additional interest will be due as a result of such delay. If you elect to be paid interest monthly, interest on your Note will be paid on the first business day of every month. Your first interest payment date will be the month following the month in which the Note is issued, except that if a new Note is issued within the last 10 days preceding an interest payment date, the first interest payment will be made on the next succeeding interest payment date (i.e. approximately 35-40 days after issuance). No payments under $50 will be made, with any interest payment being accrued to your benefit and earning interest on a monthly compounding basis until the payment due to you is at least $50 on an interest payment date. |

| 3 |

| Q: | If I elect to have interest on the Note paid in one lump sum at maturity, can I change my election later? |

| A: | Yes, we will allow you to change your election so that you receive monthly payments of earned and unpaid interest instead. You should contact us at (302) 752-2688 (30-ASK-ABOUT) or use our website, www.shepherdsfinance.com, to find out what you need to do to change your election. |

| Q: | When do the Notes mature? |

| A: | All of our maturity dates will be at least one year from the date of issuance, but no longer than four years from the date of issuance. Not all maturity dates may be offered at all times. We will publish the maturity date(s) we are offering from time to time along with the other established features of the Notes we are then offering. |

| Q: | May I renew a Note purchased by me? |

| A: | Between 30 to 60 days prior to the maturity date of the Note, you will receive a letter notifying you of the upcoming maturity date and, if we are offering you any renewal options and have an effective offering available: (1) a current prospectus and (2) a renewal form containing your renewal options. The renewal form will describe the terms of the Notes offered at that time and you may select one of the renewal options offered. We may, at our choosing, offer any one or more of the following renewal options (most likely at an interest rate different from your interest rate) at: |

| · | the same term length as the original term length; |

| · | a different term length; |

| · | various term lengths, from which you may select; or |

| · | other renewal terms that may be offered by us at our choosing. |

| If you properly complete, execute and return the renewal form at least five business days prior to the maturity date, your Note will be deemed renewed under the renewal terms selected, provided that those terms are still effective (or were effective in the last seven days) at the time we receive your renewal. A Note confirmation will be issued by us within five business days after the original maturity date. Rates are subject to change. You should contact Shepherd’s Finance to confirm the rate in effect at the time of your investment. Our current rates are also included in our SEC filings, which can be found at www.sec.gov. We will honor the rate on the renewal form if it is either current or received within seven (7) days of the date that the particular interest rate and maturity offering selected were discontinued. | |

| If you do not respond or if there are no options for renewal offered to you, then principal and any earned but unpaid interest will be paid to you at maturity. | |

| Q: | May I redeem a Note prior to maturity? |

| A: | Beginning 180 calendar days after the issuance date, you may request, in writing, that we redeem the Note. Your request, however, is subject to our consent and we may decline your request at our choosing. If we agree to your redemption request, a 180-day interest penalty will be imposed. This means that you will not receive the last 180 days’ worth of interest and, if the accrued and unpaid interest is not sufficient to cover the amount of the penalty, then any remaining amount of the penalty shall be deducted from the principal amount of the Note (i.e. we will subtract the remaining interest penalty from your original investment). |

| 4 |

| Q: | What happens if I die prior to the maturity date? |

| A. | At the written request of the executor or administrator of your estate (or if your Note is held jointly with another investor, the joint owner of your Note), we will redeem any Note at any time after death. The redemption price will be equal to the principal amount plus earned but unpaid interest payable on the Note, without any interest penalty. We will seek to honor any such request as soon as reasonably possible based on our cash position at the time and our then current cash needs, but generally within two weeks of the request. It is possible that the subordination provisions in the indenture may restrict our ability to honor your request. |

| Q: | Can you force me to redeem my Note? |

| A: | Yes. At any time we may call all or a portion of your Note for redemption. We will give you 30 to 60 days’ notice of the mandatory redemption and repay your Note for a price equal to the principal amount plus earned but unpaid interest to the day we repay your Note. |

| Q: | Are there any JOBS Act considerations? |

| A. | In April 2012, President Obama signed into law the Jumpstart Our Business Startups Act, or the “JOBS Act.” We are an “emerging growth company,” as defined in the JOBS Act, and are eligible to take advantage of certain exemptions from, or reduced disclosure obligations relating to, various reporting requirements that are normally applicable to public companies. Such exemptions include, among other things, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations relating to executive compensation in proxy statements and periodic reports, and exemptions from the requirement to hold a non-binding advisory vote on executive compensation and obtain shareholder approval of any golden parachute payments not previously approved. |

| Additionally, under Section 107 of the JOBS Act, an “emerging growth company” may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This means an “emerging growth company” can delay adopting certain accounting standards until such standards are otherwise applicable to private companies. We intend to take advantage of such extended transition period. Since we will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, our financial statements may not be comparable to the financial statements of companies that comply with public company effective dates. If we were to subsequently elect to instead comply with these public company effective dates, such election would be irrevocable pursuant to Section 107 of the JOBS Act. | |

| We will remain an “emerging growth company” until the earliest of (i) the last day of the first fiscal year in which we have total annual gross revenues of $1 billion or more, (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement, (iii) the date on which we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act (which would occur if the market value of our common equity held by non-affiliates exceeds $700 million, measured as of the last business day of our most recently completed second fiscal quarter), or (iv) the date on which we have, during the preceding three year period, issued more than $1 billion in non-convertible debt. | |

| Q: | What are some of the significant risks of my investment in the Notes? |

| A: | You should carefully read and consider all risk factors beginning on page 14 of this prospectus prior to investing. Below is a summary of some of the significant risks of an investment in the Notes: |

| · | Our Notes are not insured or guaranteed by the FDIC or any third party, so repayment of your Note depends upon our equity (which may be limited at times), our experience, the collateral securing our loans and our ability to manage our business and generate adequate cash flows. |

| · | The Notes are risky speculative investments. Therefore, you should not invest in the Notes unless you are able to afford the loss of your entire investment. |

| 5 |

| · | There will not be any market for the Notes, so you should only purchase them if you do not have any need for your money prior to the maturity of the Note. |

| · | You will not have the benefit of an independent review of the terms of the Notes, the prospectus or our Company as is customarily performed in underwritten offerings. |

| · | Payment on the Notes is subordinate to the payment of our outstanding present and future senior debt, if any. Since there is no limit on the amount of senior debt we may incur, our present and future senior debt may make it difficult to repay the Notes. |

| · | The indenture and terms of our Notes do not restrict our use of leverage. A relatively small loss can cause over leveraged companies a material adverse change in their financial position. If this happened to us, it may make it difficult to repay the Notes. |

| · | If we are unable to raise substantial funds, we will be limited in our ability to diversify the loans we make, and our ability to repay the Notes that have been sold will be dependent on the performance of the specific loans we make. |

| · | If we are unable to meet our Note maturity and redemption obligations, and we are unable to obtain additional financing or other sources of capital, we may be forced to sell off our operating assets or we might be forced to cease our operations, and our you could lose some or all of your investment. |

| · | There is no “early warning” on your Note if we perform poorly. Only interest and principal payment defaults on your Note can trigger a default on your Note prior to a bankruptcy. |

| · | Management has broad discretion over the use of proceeds from this offering, and it is possible that the funds will not be used effectively to generate enough cash for payment of principal and interest on the Notes. |

| · | The indenture does not contain the type of covenants restricting our actions, such as restrictions on creating senior debt, paying distributions to our owners, merging, recapitalizing, and/or entering into highly leveraged transactions. The indenture does not contain provisions requiring early payment of Notes in the event we suffer a material adverse change in our business or fail to meet certain financial standards. Therefore, the indenture provides very little protection of your investment. |

| · | We are controlled by Daniel M. Wallach, as, currently, he is our only executive officer and beneficially owns all of our outstanding common equity membership interests. |

| · | If we lose or are unable to hire or retain key personnel, we may be delayed or unable to implement our business plan, which would adversely affect our ability to repay the Notes. |

| · | Currently, we are reliant on a single developer and homebuilder, the Hoskins Group, for the majority of our revenues and a portion of our capital. |

| · | In December 2014, we agreed to a purchase and sale agreement with a third party to sell them senior portions of some of our loans. This is a new activity for our Company, and will increase our leverage. While the agreement is intended to increase our profitability, large loan losses and/or idle cash, could actually reduce our profitability, which could impair our ability to pay principal and/or interest on the Notes |

| · | We have a limited operating history and limited experience operating as a company, so we may not be able to successfully operate our business or generate sufficient revenue. |

| · | We have two lines of credit from affiliates which allow us to incur a significant amount of secured debt. These lines are collateralized by a lien against all of our assets. Our purchase and sale agreement functions as secured debt as well. We expect to incur a significant amount of additional debt in the future, including issuance of the Notes, which will subject us to increased risk of loss. |

| · | Our operations are not subject to the stringent banking regulatory requirements designed to protect investors, so repayment of your investment is completely dependent upon our successful operation of our business. |

| 6 |

| · | Most of our assets are commercial construction loans to homebuilders and/or developers which are a higher than average credit risk, and therefore could expose us to higher rates of loan defaults, which could impact our ability to repay amounts owed to you. |

| · | We depend on the availability of significant sources of credit to meet our liquidity needs and our failure to maintain these sources of credit could materially and adversely affect our liquidity in the future. |

| · | If the proceeds from the issuance of the Notes exceed the cash flow needed to fund the desirable business opportunities that are identified, we may not be able to invest all of the funds in a manner that generates sufficient income to pay the interest and principal on the Notes. |

| · | The collateral securing our real estate loans may not be sufficient to pay back the principal amount in the event of a default by the borrowers. |

| · | Currently we are substantially reliant on the local homebuilding industry in the Pittsburgh, Pennsylvania market. |

| · | Our business is not industry-diversified and the homebuilding industry has undergone a significant downturn. Further deterioration in industry or economic conditions could further decrease demand and pricing for new homes and residential home lots. A decline in housing values similar to the recent national downturn in the real estate market would have a negative impact on our business. Smaller value declines will also have a negative impact on our business. These factors may decrease the likelihood we will be able to generate enough cash to repay the Notes. |

| · | Additional competition may decrease our profitability, which would adversely affect our ability to repay the Notes. |

| · | We expect to be substantially reliant upon the net offering proceeds we receive from the sale of our Notes to meet principal and interest obligations on previously issued Notes. |

| · | Because we require a substantial amount of cash to service our debt, we may not be able to pay our obligations under the Notes. |

| · | Additional competition for investment dollars may decrease our liquidity, which would adversely affect our ability to repay the Notes. |

| · | Our real estate loans are illiquid, which could restrict our ability to respond rapidly to changes in economic conditions. |

| · | Our Chief Executive Officer (who is also on our Board of Managers) will face conflicts of interest as a result of the secured affiliated loans made to us, which could result in actions that are not in the best interests of our Note holders. |

| · | Our Chief Executive Officer will face conflicts of interest as a result of his equity ownership in the Company, which could result in actions that are not in the best interests of our Note holders. |

| Q: | How do I purchase a Note? |

| A. | You may purchase a Note from us by visiting our website at www.shepherdsfinance.com and following the instructions under the heading “Investors” and then “Our Investment Process” or by calling (302) 752-2688 (30-ASK-ABOUT) to request a copy of the prospectus along with an investment application. Upon receipt of your application and investment check and the posting of your investment, we will send you a confirmation, which describes, among other things, the term, interest rate, and principal amount of your Note. |

|

We reserve the right to reject any investment. Among other reasons, we may reject an investment if the information in your investment application is incorrect or incomplete, or if the interest rate or maturity you have selected has not been offered by us in the past seven (7) calendar days for your desired investment amount at the time we receive your investment documents.

| |

| Q: | Whom may I contact for more information? |

| A: | You can obtain additional copies of this prospectus and review the established features of the Notes at www.shepherdsfinance.com or by calling (302) 752-2688 (30-ASK-ABOUT). However, the information contained on our website is not part of this prospectus. If you have questions about the suitability of an investment in the Notes for you, you should contact your own investment, tax, and other financial advisors. |

| 7 |

PROSPECTUS SUMMARY

This summary highlights selected information, most of which was not otherwise addressed in the “Questions and Answers” section of this prospectus. For more information about us, you should carefully read the entire prospectus, including the section entitled “Risk Factors,” the consolidated financial statements and other consolidated financial data, any related prospectus supplement, and the documents we have referred you to in the “Where You Can Find More Information” section. There will be no trading market for the Notes, so you will not be able to use the money you invest until the maturity or other repayment of the Note. Your right to be repaid prior to maturity is at our sole discretion, except upon your death.

Our Company and Our Business

We were organized in the Commonwealth of Pennsylvania in 2007 under the name 84 RE Partners, LLC and changed our name to Shepherd’s Finance, LLC on December 2, 2011. We converted to a Delaware limited liability company on March 29, 2012. Our business is focused on commercial lending to participants in the residential construction and development industry. We believe this market is underserved because of the lack of traditional lenders currently participating in the market. We are located in Jacksonville, Florida. Our operations are governed pursuant to our operating agreement.

From 2007 through the majority of 2011, we were the lessor in three commercial real estate leases with a then affiliate, 84 Lumber Company. Beginning in late 2011, we began commercial lending to residential homebuilders. Our current loan portfolio is described more fully in this section under the sub heading “Commercial Construction and Development Loans.” We have a limited operating history as a finance company. We currently have two paid employees, including our Vice President of Operations. Our only executive officer is our Chief Executive Officer, Daniel M. Wallach. We currently use our CEO to originate most of our new loans, and augment that with several people to whom we pay consulting fees. Our Board of Managers is comprised of Mr. Wallach and three independent Managers–Bill Myrick, Eric Rauscher, and Kenneth R. Summers. Our officers are responsible for our day-to-day operations, while the Board of Managers is responsible for overseeing our business.

The commercial loans we extend are secured by mortgages on the underlying real estate. We extend and service commercial loans to small-to-medium sized homebuilders for the purchase of lots and/or the construction of homes thereon. We also extend and service loans for the purchase of undeveloped land and the development of that land into residential building lots. In addition, we may, depending on our cash position and the opportunities available to us, do none, any or all of the following: purchase defaulted unsecured debt from suppliers to homebuilders at a discount (and then secure that debt with real estate or other collateral), purchase defaulted secured debt from financial institutions at a discount, and purchase real estate in which we will operate our business.

Our Chief Executive Officer, Daniel M. Wallach, has been in the housing industry since 1985. He was the CFO of a multi-billion dollar supplier of building materials to home builders for 11 years. He also was responsible for that company’s lending business for 20 years. During those years, he was responsible for the creation and implementation of many secured lending programs to builders. Some of these were performed fully by that company, and some were performed in partnership with banks. In general, the creation of all loans, and the resolution of defaulted loans, was his responsibility, whether the loans were company loans or loans in partnership with banks. Through these programs, he was responsible for the creation of approximately $2,000,000,000 in loans which generated interest spread of $50,000,000, after deducting for loan losses. Through the years, he managed the development of systems for reducing and managing the risks and losses on defaulted loans. Mr. Wallach also was responsible for that company’s unsecured debt to builders, which reached over $300,000,000 at its peak. He also gained experience in securing defaulted unsecured debt.

During 2014, our loan assets increased 100% from $4,045,000 on December 31, 2013 to $8,097,000 on December 31, 2014. During that same period of time our equity increased 61% from $1,904,000 to $3,057,000. As of December 31, 2014, we have a limited number of construction loans in seven states with ten borrowers, and have two development loans in Pittsburgh, Pennsylvania. At the end of 2014, we entered into a purchase and sale agreement for portions of our loans, which should allow us to increase our loan balances and commitments significantly in 2015.

| 8 |

We currently have six sources of capital:

| December 31, 2014 | December 31, 2013 | |||||||

| Capital Source | ||||||||

| Purchase and sale agreement (executed December 24, 2014) with 1st Financial Bank USA (“Loan Purchaser”) which buys portions of some of our loans (those purchases are accounted for as a secured line of credit) | $ | – | $ | – | ||||

| Secured line of credit from affiliates | – | – | ||||||

| Unsecured Notes through our Notes offer | 5,427,000 | 1,739,000 | ||||||

| Other unsecured debt | 375,000 | 1,500,000 | ||||||

| Preferred equity | 1,000,000 | – | ||||||

| Common equity | 2,057,000 | 1,904,000 | ||||||

| Total | $ | 8,859,000 | $ | 5,143,000 | ||||

Certain features of the purchase and sale agreement with a third party have added liquidity and flexibility, which have lessened the need for the lines of credit from affiliates. Eventually, the Company intends to permanently replace the lines of credit to affiliates with a secured line of credit from a bank or through other liquidity.

Over many of the past eight years, the housing market has been plagued by declining values and a lack of housing starts. More recently, values and starts have been rising. We believe that, despite the issues in the speculative construction industry that were a result of the declining values and a lack of housing starts, it is a good time for this type of lending because:

| · | Many traditional lenders to this market have exited or cut back, reducing competition and allowing large spreads (the difference between cost of funds and the rate we charge our borrowers). Better builders can be obtained as customers, with higher spreads; |

| · | The number of housing starts and the value of homes built are both low but improving. We believe that we were at the bottom of the housing cycle in 2008, and it is likely that housing starts and values will both continue to increase over time. Increases in both of these items should have a positive effect on our performance; |

| · | There are fixed costs involved in running this kind of operation, such as payroll and the costs of being subject to public company reporting requirements. These require a fixed interest rate spread in dollars to cover these costs. Interest spread in 2013 of $439,000 was enough to cover these costs, and our spread of $705,000 in 2014 generated a profit; and |

| · | We engage in various activities to try to mitigate the risks inherent in this type of lending by: |

| · | Keeping the loan-to-value ratio, or LTV, between 60% and 75% on a portfolio basis, however, individual loans may, from time to time, have a greater LTV; |

| · | Generally using deposits from the builder on home construction loans to ensure the completion of the home. Lending losses on defaulted loans are usually a higher percentage when the home is not built, or is only partially built; |

| · | Having a higher yield than other forms of secured real estate lending; |

| · | Paying major subcontractors and suppliers directly, which reduces the frequency of liens on the property (liens generally hurt the net realized value of loss mitigation techniques); |

| · | Aggressively working with builders who are in default on their loan before and during foreclosure. This technique generally yields a reduced realized loss; and |

| · | Market grading. We review all lending markets, analyzing their historic housing start cycles. Then, the current position of housing starts is examined in each market. Markets are classified into volatile, average, or stable, and then graded based on that classification and our opinion of where the market is in its housing cycle. This grading is then used to determine the builder deposit amount, the LTV, and the yield. |

| 9 |

The Offering

| Securities Offered | We are offering up to $70,000,000 in aggregate principal amount of our Notes. The Notes are governed by an indenture between us and _________, as trustee. The Notes do not have the benefit of a sinking fund and will not be guaranteed by the FDIC or any governmental or private insurance fund, or any other person or entity. |

| Minimum Investment (in whole dollars) | A minimum investment of $500 is required. |

| Maximum Investment (in whole dollars) | The maximum investment is $1,000,000 per Note, or $1,000,000 in the aggregate per investor, but a higher maximum investment amount may be approved by us on a case-by-case basis. |

| Interest Rate | Various rates will be offered by us from time to time, which will be impacted by the maturity date selected by you (see Maturity below) and the denomination/purchase amount selected by you. |

| Payment of Interest | Interest will be calculated based on the actual number of days your Note is outstanding. Interest is calculated and compounded monthly based on a 365/366 day year. Interest will be earned daily, and we will pay interest to you monthly or at maturity as you request. If you choose to be paid interest at maturity rather than monthly, the interest will be compounded monthly. If any day on which a payment is due with respect to a Note is not a business day, then you will not be entitled to payment of the amount due until the following business day, and no additional interest will be due as a result of such delay. If you elect to be paid interest monthly, interest on your Note will be paid on the first business day of every month. Your first interest payment date will be the month following the month in which the Note is issued, except that if a new Note is issued within the last 10 days preceding an interest payment date, the first interest payment will be made on the next succeeding interest payment date (i.e. approximately 35-40 days after issuance). No payments under $50 will be made, with any interest payment being accrued to your benefit and earning interest on a monthly compounding basis until the payment due to you is at least $50 on an interest payment date. |

| Maturity | Ranging from one year to four years from the date of issuance. |

| Renewals |

If we have an effective offering available (and deliver you a current prospectus), we may, at our choosing, offer any one or more of the following renewal options (most likely at an interest rate different from your interest rate) at: · the same term length as the original term length; · a different term length; · various term lengths, from which you may select; or · other renewal terms may be offered by us at our choosing.

If you properly complete, execute and return the renewal form at least five business days prior to the maturity date, your Note will be deemed renewed under the renewal terms selected, provided that those terms are still effective (or were effective in the last seven days) at the time we receive your renewal. A Note confirmation will be issued by us within five business days after the original maturity date. Rates are subject to change. You should contact Shepherd’s Finance to confirm the rate in effect at the time of your investment. Our current rates are also included in our SEC filings, which can be found at www.sec.gov. We will honor the rate on the renewal form if it is either current or received within seven (7) days of the date that the particular interest rate and maturity offering selected were discontinued. If you do not respond or if there are no options for renewal offered to you, then principal and any earned but unpaid interest will be paid to you at maturity. |

| 10 |

| Redemption by You | Subject to our agreement in our sole discretion, you may redeem a Note purchased by you at any time beginning 180 calendar days after the issuance date, with a 180-day interest penalty. This means that you will not receive the last 180 days’ worth of interest and, if the accrued and unpaid interest is not sufficient to cover the amount of the penalty, then any remaining amount of the interest penalty shall be deducted from the principal amount of the Note (i.e., we will subtract the remaining interest penalty from your original investment). |

| Redemption in the Event of Death | Unless the subordination provisions in the indenture restrict our ability to make the redemption, at the written request of the executor or administrator of your estate (or if your Note is jointly held with another investor, at the written request of your joint investor), we will redeem the Note at any time after death for a redemption price equal to the principal amount plus earned but unpaid interest payable on the Note, without any interest penalty. We will seek to honor any such redemption request as soon as reasonably possible, based on our then current cash position and needs, but generally within two weeks of the request. |

| Redemption by Us | At any time we may call your Note for redemption upon 30 to 60 days’ notice. The redemption price will be equal to the principal amount plus accrued and unpaid interest to the date of the redemption. |

| Subordination | The Notes are subordinated, in all rights to payment and in all other respects, to all of our senior debt. Senior debt includes, without limitation, all of our bank debt and our secured affiliate loans and any we obtain in the future. This means that if we are unable to pay our debts when due, all of the senior debt would be paid first, before any payment would be made on the Notes. |

| Events of Default | Under the indenture, an event of default is generally defined as (1) a default in the payment of principal or interest on the Notes that is not cured for 30 days, (2) bankruptcy or insolvency, or (3) our failure to comply with provisions of the Notes or the indenture if such failure is not cured or waived within 60 days after the receipt of a specific notice. |

| Transfer Restrictions | Transfer of a Note is effective only upon the receipt of valid transfer instructions from the Note holder of record. |

| Trustee | TBD |

| Plan of Distribution | This offering is being conducted directly by us, without any underwriter or placement agent. |

| Charitable Match Program | We offer a charitable match program for interest payments that you elect to give to a qualifying charity. If you choose to participate in the program and donate all or a portion of your interest payments to charity, when we calculate your interest we will deduct the percentage of interest you selected and keep track of that amount separate from your information. After interest is calculated for all Note holders at the beginning of December of each year, all of the money for each charity will be totaled up and sent in one check to each charity. Each check will have the name and address of each contributor, and the amount each contributed. Our matching portion will be included in the total check. We will match your interest payment donation up to 10% of your interest. |

| Risk Factors | See “Risk Factors” beginning on page 15 and other information included in this prospectus and any prospectus supplement for a discussion of factors you should carefully consider before investing in the Notes. |

| 11 |

Summary of Consolidated Financial Data

(All dollar [$] amounts shown in thousands.)

The following table summarizes selected consolidated financial data from our business. You should read this summary together with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our audited consolidated financial statements and related notes thereto included in this prospectus.

The summary consolidated financial data as of and for the fiscal years ended December 31, 2014, and 2013 is derived from our audited consolidated financial statements included elsewhere in this document. The summary consolidated financial data as of and for the fiscal years ended December 31, 2012, 2011 and 2010 is derived from our audited consolidated financial statements not included in this document.

As of, and for, the years ended December 31,

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (Audited) | (Audited) | (Audited) | (Audited) | (Audited) | ||||||||||||||||

| Operations Data | ||||||||||||||||||||

| Interest income | $ | 1,138 | $ | 596 | $ | 581 | $ | 5 | $ | – | ||||||||||

| Interest expense | 433 | 157 | 115 | – | – | |||||||||||||||

| Provision for loan losses | 22 | – | – | – | – | |||||||||||||||

| Net interest income after loan loss provision | 683 | 439 | 466 | 5 | – | |||||||||||||||

| Selling, general and administrative expenses | 390 | 415 | 344 | 5 | – | |||||||||||||||

| Income from continuing operations | 293 | 24 | 122 | – | – | |||||||||||||||

| Income from discontinued operations | – | – | – | 309 | 578 | |||||||||||||||

| Net income | $ | 293 | $ | 24 | $ | 122 | $ | 309 | $ | 578 | ||||||||||

| Balance Sheet Data | ||||||||||||||||||||

| Cash and cash equivalents | $ | 558 | $ | 722 | $ | 646 | $ | 50 | $ | – | ||||||||||

| Accrued interest on loans | 78 | 27 | 26 | 2 | – | |||||||||||||||

| Deferred financing costs, net | 630 | 649 | 596 | – | – | |||||||||||||||

| Other assets | 13 | 14 | 10 | 26 | – | |||||||||||||||

| Loans receivable, net | 8,097 | 4,045 | 3,604 | 4,580 | – | |||||||||||||||

| Assets of discontinued operations | – | – | – | – | 10,339 | |||||||||||||||

| Total assets | 9,376 | 5,457 | 4,882 | 4,658 | 10,339 | |||||||||||||||

| Customer interest escrow | 318 | 255 | 329 | 450 | – | |||||||||||||||

| Accounts payable and accrued expenses | 199 | 59 | 41 | – | – | |||||||||||||||

| Notes payable unsecured | 5,802 | 3,239 | 1,502 | 1,500 | – | |||||||||||||||

| Notes payable related parties | – | – | 1,108 | 878 | – | |||||||||||||||

| Liabilities of discontinued operations | – | – | – | – | 7,863 | |||||||||||||||

| Total liabilities | 6,319 | 3,553 | 2,980 | 2,828 | 7,863 | |||||||||||||||

| Members’ capital | 3,057 | 1,904 | 1,902 | 1,830 | 2,476 | |||||||||||||||

| Members’ contributions | 1,000 | – | – | – | – | |||||||||||||||

| Members’ distributions (1) | $ | (140 | ) | $ | (22 | ) | $ | (50 | ) | $ | (955 | ) | $ | (177 | ) | |||||

__________

(1) Fiscal 2011 includes in this amount ($250) for the redemption of the ownership interests of two of our former members; ($383) was a return of capital to certain of the remaining members; and ($322) was earnings distributed to the members.

| 12 |

RISK FACTORS

Our operations and your investment in the Notes are subject to a number of risks. You should carefully read and consider these risks, together with all other information in this prospectus, before you decide to buy the Notes. If any of these risks occur in the future, our business, consolidated financial condition, operating results, and cash flows and our ability to repay the Notes could be materially adversely affected.

Risks Related to Our Offering and Structure

Our Notes are not insured or guaranteed by the FDIC or any third party, so repayment of your Note depends upon our equity (which may be limited at times), our experience, the collateral securing our loans, and our ability to manage our business and generate adequate cash flows.

Our Notes are not certificates of deposit or similar obligations or guaranteed by any depository institution and are not insured by the FDIC or any governmental or private insurance fund, or any other entity. Therefore, you are dependent upon our ability to manage our business and generate adequate cash flows. If we are unable to generate sufficient cash flow to repay our debts, you could lose your entire investment.

The Notes are risky speculative investments. Therefore, you should not invest in the Notes unless you are able to afford the loss of your entire investment.

The Notes may not be a suitable investment for you, and we advise you to consult with your investment, tax, and other professional financial advisors prior to deciding whether to invest in the Notes. The characteristics of the Notes, including the maturity and interest rate, may not satisfy your investment objectives. The Notes may not be a suitable investment for you based on your ability to withstand a loss of interest or principal or other aspects of your financial situation, including your income, net worth, financial needs, investment risk profile, return objectives, investment experience, and other factors. Before deciding whether to purchase Notes, you should consider your investment allocation with respect to the amount of your contemplated investment in the Notes in relation to your other investments and the diversity of those holdings. If you cannot afford to lose all of your investment, you should not invest in these Notes.

There will not be any market for the Notes, so you should only purchase them if you do not have any need for your money prior to the maturity of the Note.

The Notes are not listed on a national securities exchange or authorized for quotation on the NASDAQ Stock Market, or any securities exchange. The Notes do not have a CUSIP identification number; there is no trading market for the Notes; and it is unlikely that the Notes will be able to be used as collateral for a loan. Except as described elsewhere in this prospectus, you have no right to require redemption of the Notes. You should only purchase these Notes if you do not have the need for your money prior to the maturity of the Note.

You will not have the benefit of an independent review of the terms of the Notes, the prospectus, or our Company as is customarily performed in underwritten offerings.

The Notes are being offered by our executive officer without an underwriter or placement agent. Therefore, you will not have the benefit of an independent review of the terms of the Notes, the prospectus, or our Company. Accordingly, you should consult your investment, tax, and other professional financial advisors prior to deciding whether to invest in the Notes.

Payment on the Notes is subordinate to the payment of our outstanding present and future senior debt, if any. Since there is no limit on the amount of senior debt we may incur, our present and future senior debt may make it difficult to repay the Notes.

As of December 31, 2014, we had $0 of senior debt outstanding, with availability on our senior debt lines of credit of $1,500,000. Our purchase and sale agreement with a third party functions as senior debt as well. The balance on that was $0 on December 31, 2014, but is expected to grow in the future. The Notes are subordinate and junior in priority to any and all of our senior debt and equal to any and all non-senior debt, including other Notes. There are no restrictions in the indenture regarding the amount of senior debt or other indebtedness that we may incur. Upon the maturity of our senior debt, by lapse of time, acceleration or otherwise, the holders of our senior debt have first right to receive payment, in full, prior to any payments being made to you as a Note holder or to other non-senior debt. Therefore, upon such maturity of our senior debt you would only be repaid in full if the senior debt is satisfied first and, following satisfaction of the senior debt, if there is an amount sufficient to fully satisfy all amounts owed under the Notes and any other non-senior debt.

| 13 |

The indenture and terms of our Notes do not restrict our use of leverage. A relatively small loss can cause over leveraged companies a material adverse change in their financial position. If this happened to us, it may make it difficult to repay the Notes.

Financial institutions which are federally insured typically have 8-12% of their total assets in equity. A reduction in their loan assets due to losses of 2% reduces their equity by roughly 20%. Our assets increased in 2014 by 78%. Our company had 33% and 35% of our total assets in equity as of December 31, 2014 and 2013, respectively, as we increased our equity in 2014 as well. If we allow our assets to increase without increasing our equity, we could have a much lower equity as a percentage of assets than we have today, which would increase our risk of nonpayment on the Notes. You have no structural mechanism to protect you from this action, and rely solely on us to keep equity at a satisfactory ratio.

If we are unable to raise substantial funds, we will be limited in our ability to diversify the loans we make, and our ability to repay the Notes that have been sold will be dependent on the performance of the specific loans we make.

We are conducting this offering of Notes ourselves without any underwriter or placement agent. We have limited experience in conducting a notes offering or any other securities offering. There is no minimum amount of proceeds that must be received from the sale of the Notes in order to accept proceeds from Notes actually sold. As a result, the amount of proceeds we raise in this offering may be substantially less than the amount we would need to achieve a broadly diversified portfolio of loans. If we are unable to raise a substantial amount of funds, we will make fewer loans, resulting in less diversification in terms of the number of loans we make, the borrowers on such loans, and the geographic regions in which our collateral is located. In such event, the likelihood of our profitability being affected by the performance of any one of our loans will increase. Our ability to repay the Notes will be subject to greater risk to the extent that we lack a diversified portfolio of loans.