Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - UNITED MORTGAGE TRUST | Financial_Report.xls |

| EX-31 - EXHIBIT 31 - UNITED MORTGAGE TRUST | v404852_ex31.htm |

| EX-32 - EXHIBIT 32 - UNITED MORTGAGE TRUST | v404852_ex32.htm |

| EX-3.3 - EXHIBIT 3.3 - UNITED MORTGAGE TRUST | v404852_ex3-3.htm |

| EX-23.1 - EXHIBIT 23.1 - UNITED MORTGAGE TRUST | v404852_ex23-1.htm |

| EX-23.3 - EXHIBIT 23.3 - UNITED MORTGAGE TRUST | v404852_ex23-3.htm |

| EX-99.1 - EXHIBIT 99.1 - UNITED MORTGAGE TRUST | v404852_ex99-1.htm |

| EX-23.2 - EXHIBIT 23.2 - UNITED MORTGAGE TRUST | v404852_ex23-2.htm |

| EX-99.2 - EXHIBIT 99.2 - UNITED MORTGAGE TRUST | v404852_ex99-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Fiscal Year Ended

December 31, 2014.

¨ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Transition Period from _______________ to _______________.

Commission File Number 000-32409

UNITED MORTGAGE TRUST

(Exact name of registrant as specified in its charter)

| MARYLAND | 75-6493585 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification Number) |

1301 Municipal Way, Grapevine TX 76051

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number: (214) 237-9305

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Shares of Beneficial interest, par value $0.01 per share

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (Section 229.405) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated Filer ¨ Accelerated Filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant computed with reference to the price at which the common equity as last sold, or the average of the bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter.

There is currently no established public market on which the Registrant’s common shares are traded. The aggregate market value of the Registrant’s shares of beneficial interest held by non-related parties of the Registrant at June 30, 2014 computed by reference to the price at which the common equity was last sold was $93,432,739

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date.

As of March 31, 2015 6,429,438 of the Registrant's Shares of beneficial interest were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference to the Registrant’s definitive proxy statement for the 2014 annual meeting of shareholders.

| 2 |

This annual report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not statements of fact and can be identified by words such as “anticipate,” “expect,” “estimate,” “intend,” “seek,” “plan,” “will,” “should,” “may” and similar terms, including their negative forms, and also by references to strategies, plans or intentions. Such statements involve known and unknown risks, uncertainties, and other factors which may cause our actual results, performance, or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the availability of and our ability to find suitable mortgage investments; economic trends affecting the real estate industry generally and the current conditions in the housing and mortgage industries including the impact thereof on the homebuilding industry, current high unemployment rates and changes in economic and credit market conditions, federal and state legislative action and actions of regulatory agencies, changes in interest rates, our ability to adapt to changing circumstances, the concentration of our credit risks particularly with related parties, the continued financial viability of related parties to whom we have extended loans, the ability of counterparties to perform their obligations to us, and the requirement to maintain qualification as a real estate investment trust. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore we cannot give assurance that such statements included in this Annual Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or by any other person that the results or conditions described in such statements or in our objectives and plans will be realized. Readers should carefully review our financial statements and the notes thereto, as well as the risk factors described in Item 1A of this Annual Report and in our other filings with the Securities and Exchange Commission (“SEC”). Although we may elect to update forward-looking statements in the future, we specifically disclaim any obligation to do so, even if our estimates change, and readers should not rely on those forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report.

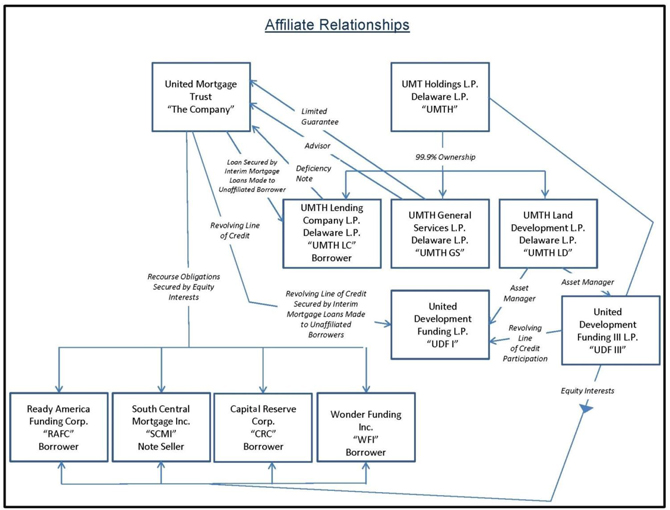

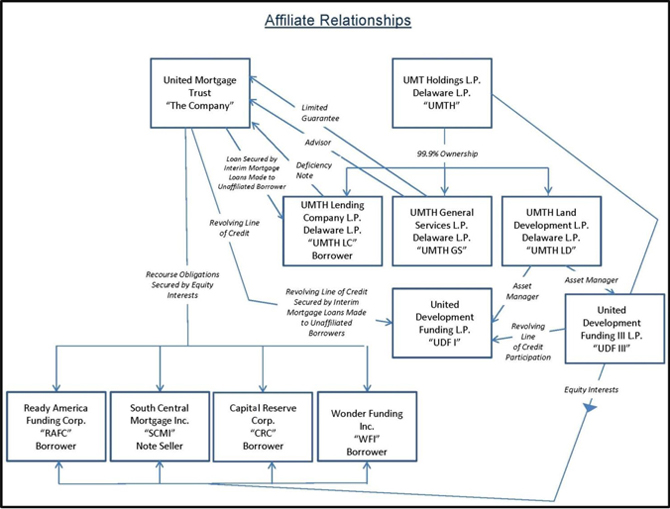

GENERAL

United Mortgage Trust (which we refer to in this report as “we,”, “us”, “our”, “UMT”, the “Trust” and the “Company”) is a Maryland real estate investment trust formed on July 12, 1996. We acquire mortgage investments from several sources, including from related parties of our Advisor, UMTH General Services, L.P., a Delaware limited partnership (“Advisor” or “UMTHGS”). The amount of mortgage investments acquired from such sources depends upon the mortgage investments that are available from them or from other sources at the time we have funds to invest. We believe that all mortgage investments purchased from related parties of the Advisor are at prices consistent with those that would be paid to non-related third parties for mortgages with comparable terms, rates, credit risks and seasoning. For a more detailed description of these and other related parties and our transactions with them, please see Part III, Item 13 “Certain Relationships and Related Transactions and Director Independence” in this Annual Report.

In the past, we have invested in first lien secured interim mortgage loans with initial terms of 12 months or less for the acquisition and renovation of single-family homes, which we refer to as “Interim Loans” and first lien secured mortgage loans with terms of 12 to 360 months for the acquisition of single-family homes, referred to as “Residential Mortgages, some of which are still outstanding. Currently, our principal investment objectives are to invest proceeds from our financing proceeds, proceeds from the repayment of our loans, capital transaction proceeds and retained earnings in the following types of investments: (i) lines of credit and secured loans for the acquisition and development of single-family home lots, referred to as “Land Development Loans”; (ii) lines of credit and loans secured by developed single-family lots, referred to as “Finished Lot Loans”; (iii) lines of credit and loans secured by completed model homes, referred to as “Model Home Loans”; (iv) lines of credit and loans, with terms of 18 months or less, secured by single family lots and homes constructed thereon, referred to as “Construction Loans”;)”; (v) to provide credit enhancements to real estate developers, homebuilders, land bankers and other real estate investors who acquire real property, subdivide real property into single-family residential lots, acquire finished lots and/or build homes on such lots referred to as “Credit Enhancements”; (vi) discounted cash flows secured by assessments levied on real property; and (vii) senior or subordinate securities backed by finished lot loans and/or development loans referred to as “Securitizations”. We collectively refer to the above listed loans as “Mortgage Investments”. Additionally, our portfolio includes obligations of related parties of our Advisor, which we refer to as “Recourse Obligations” and “Deficiency Notes.”

Land Development Loans are expected to have terms from 12 to 48 months. Our loans to United Development Funding, L.P., a Nevada Limited Partnership, (“UDF”), are secured by the pledge of all of UDF’s Land Development Loans and equity participations, and are subordinated to its senior debt. Finished Lot Loans, Construction Loans and builder Model Home Loans are expected to have terms of 9 to 48 months.

| 3 |

We seek to produce net interest income from our mortgage investments while maintaining strict cost controls in order to generate cash flow for monthly distribution to our shareholders. We intend to continue to operate in a manner that will permit us to qualify as a Real Estate Investment Trust (“REIT”) for federal income tax purposes. As a result of that REIT status, we are permitted to deduct dividend distributions to shareholders, thereby effectively eliminating the "double taxation" that generally results when a corporation earns income (upon which the corporation is taxed) and distributes that income to shareholders in the form of dividends (upon which the shareholders are taxed).

The overall management of our business is vested in our Board of Trustees (the “Board”). UMTHGS has been retained as Advisor to manage our day-to-day operations and to use its best efforts to seek out and present, whether through its own efforts or those of third parties retained by it, investment opportunities that are consistent with our investment policies and objectives and consistent with the investment programs the members of the Board (the “Trustees”) may adopt from time to time in conformity with our Second Amended and Restated Declaration of Trust (“Declaration of Trust”).

In addition to this Annual Report, we file quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). All documents that we file with the SEC are available free of charge on our website, which is www.unitedmorgagetrust.com. You may also read and copy any document that we file at the public reference facilities of the SEC at 450 Fifth Street NW, Washington DC 20549. Please call the SEC at (800) SEC-0330 for further information about the public reference facilities. These documents also may be accessed through the SEC’s electronic data gathering, analysis and retrieval system (“EDGAR”) via electronic means, including the SEC’s home page on the internet (http://www.sec.gov).

Our principal executive offices are located at 1301 Municipal Way, Grapevine TX 76051, telephone (214) 237-9305 or (800) 955-7917, facsimile (214) 237-9304.

INVESTMENT OBJECTIVES AND POLICIES OF UNITED MORTGAGE TRUST

PRINCIPAL INVESTMENT OBJECTIVES

Our principal investment objectives are to invest proceeds from our financing proceeds, proceeds from the repayment of our loans, capital transaction proceeds and retained earnings in the following types of investments:

| (i) | lines of credit and secured loans for the acquisition and development of single-family home lots, referred to as “Land Development Loans;” |

| (ii) | lines of credit and loans secured by developed single-family lots, referred to as “Finished Lot Loans;” |

| (iii) | lines of credit and loans secured by completed model homes, referred to as “Model Home Loans;” |

| (iv) | lines of credit and loans, with terms of 18 months or less, secured by single family lots and homes constructed thereon, referred to as “Construction Loans;” |

| (v) | to provide credit enhancements to real estate developers, homebuilders, land bankers and other real estate investors who acquire real property, subdivide real property into single-family residential lots, acquire finished lots and/or build homes on such lots referred to as “Credit Enhancements;” |

| (vi) | discounted cash flows secured by assessments levied on real property; and |

| (vii) | senior or subordinate securities backed by finished lot loans and/or development loans referred to as “Securitizations.” |

We collectively refer the above listed loans as “Mortgage Investments”.

Mortgage Investments and Credit Enhancements are expected to:

| (1) | produce net interest income and fees; |

| (2) | provide monthly distributions from, among other things, interest on Mortgage Investments and fees from Credit Enhancements; and |

| (3) | permit reinvestment of payments of principal and proceeds of prepayments, sales and insurance net of expenses. |

There is no assurance that these objectives will be attained.

| 4 |

INVESTMENT POLICY

Most of our Mortgage Investments to date are geographically concentrated in the Texas market. We anticipate that this concentration will continue in the near future, but it is our intention to expand our geographic presence through the purchase of Mortgage Investments in other geographic areas of the United States. In making the decision to invest in other areas, we consider the market conditions prevailing at the time we invest.

As of December 31, 2014, our portfolio was comprised of:

| Mortgage Loan Category: | Percentage of Mortgage Portfolio: | |||

| First lien secured interim mortgages 12 months or less and residential mortgages | 14 | % | ||

| Secured Line of Credit to UMTH Lending Company, L.P. (“UMTHLC”) | 6 | % | ||

| Land development loans | 67 | % | ||

| Finished lot loans | 7 | % | ||

| Construction loans | 6 | % | ||

We no longer invest in Interim Loans or Residential Mortgages. We plan to continue to invest in Land Development Loans, Finished Lot Loans, Construction Loans and Model Home Loans because, 1) Land Development Loans and Finished Lot Loans have provided us with suitable collateral positions, well capitalized borrowers and attractive yields; and, 2) Model Home Loans and Construction Loans are expected to provide us with suitable collateral positions, well capitalized borrowers and attractive yields. Model Home and Construction Loans are expected to produce higher yields commensurate with Land Development Loans, Finished Lot. As we phased out of Interim Loans we increased the percentage of our portfolio invested in Land Development Loans, Finished Lot Loans, Model Home Loans, and Construction Loans.

UNDERWRITING CRITERIA

We will not originate residential mortgage loans, except to facilitate the resale of a foreclosed property. Funds awaiting investment in Mortgage Investments will be invested in government securities, money market accounts or other assets that are permitted investments for REITs. See “Temporary Investments” below.

The underwriting criteria for Mortgage Investments are as follows:

| (1) | Priority of Lien |

| · | Land Development Loans and Finished Lot Loans must be secured by a first lien, second lien or a pledge of partnership interest that is insured by a title company. Second liens are subject to the Loan-to-Value (“LTV”) limitations set forth below. |

| · | Model Home Loans and Construction Loans will be secured by a first lien or a second lien that is insured by a title insurance company. Second liens are subject to the Loan-to-Value (“LTV”) limitations set forth below. |

| · | Credit Enhancements must be secured by first or second liens or pledges of partnership interests. |

| (2) | Rate and Fees |

| · | Our Advisor seeks to acquire Mortgage Investments that will provide us with a satisfactory net yield. Net yield is determined by the yield realized after payment of note servicing fees, if any, and administrative costs (ranging from 1% to 2% of our average invested assets). Rates will be either adjustable or fixed. No loans will be purchased at a premium above the outstanding principal balance. Our investment policy allows for acquisition of loans at various interest rates. Fees charged for Credit Enhancements will be determined by the degree of risk as determined and recommended by our Advisor. Credit Enhancement fees are expected to range between 0.5% and 3% per annum. |

| (3) | Term and Amortization |

| · | There is no minimum term for the loans we acquire. |

| · | Land Development Loans, Finished Lot Loans and Model Home Loans will generally have terms from 24 to 48 months. |

| · | Construction Loans will generally have terms of 12 to 18 months. |

| · | Generally, Land Development Loans, Finished Lot Loans, Model Home Loans and Construction Loans do not amortize. They are interest only loans with the principal paid in full when the loans mature. |

| · | Credit Enhancements will generally range from 12 to 48 months. |

| 5 |

| (4) | Loan-to-Value (“LTV”), Investment-to-Value Ratio (“ITV”), Combined LTV Ratio (“CLTV”) |

| · | Land Development Loans, Finished Lot Loans and Construction Loans: Except as set forth below, loans purchased may not exceed an 85% ITV. Except as set forth below, Land Development Loans, Finished Lot Loans and Construction Loans will not exceed 85% of the value of the collateral securing the indebtedness (the LTV of the loan). The purchase of, or investment in, subordinate liens, secured loans or partnership interests securing loans will not exceed a CLTV of 85%, (subject to the exceptions listed below) and may not exceed 85% LTV for first liens and 100% CLTV for second lien loans. CLTV shall mean the sum of all indebtedness senior to us plus the sum of our investment or loan. |

| · | Model Home Loans: LTV may not exceed 93% of each first lien loan, and will be a part of a pool of model home collateral and will also be cross-collateralized. CLTV may not exceed 100% of second lien loans. All expenses associated with the model home are borne by the home builder. |

| (5) | Seasoning |

| · | None of the types of loans we currently purchase, or intend to purchase, are subject to seasoning requirements. |

| (6) | Borrower, Loan and Property Information |

| · | Land Development Loans, Finished Lot Loans, Model Homes Loans, Construction Loans, and Credit Enhancements: Borrower, loan and property information will be in accordance with guidelines set forth by the originating entities, UDF and UMTH Land Development, L. P. (“UMTHLD”), including economic feasibility studies, engineering due diligence reports, exit strategy analysis, and construction oversight requirements. Our Advisor, will periodically monitor compliance and changes to underwriting guidelines. |

| · | Our Advisor will employ the services of outside consultants, when and if necessary, to effectively evaluate each opportunity. |

| (7) | Appraisals |

| · | Land Development Loans, Finished Lot Loans, Construction Loans and Model Home Loans: Appraisal must demonstrate that the LTV, ITV or CLTV is in compliance with the above-referenced LTV, ITV and CLTV standards. Loans exceeding LTV, ITV and CLTV guidelines must note the criteria on which the exception was based. |

| · | The appraisals must be performed by appraisers approved by our Advisor. |

| (8) | Credit |

| · | Land Development Loans, Finished Lot Loans, Model Home Loans, Construction Loans and Credit Enhancements: Extensions of credit to borrowers will be determined in accordance with net worth and down payment requirements prescribed by the originating companies (currently UDF and UMTHLD). Our Advisor shall periodically monitor compliance and changes to underwriting guidelines. |

| (9) | Hazard Insurance |

| · | Loans that are secured by a residence must have an effective, prepaid hazard insurance policy with a mortgagee's endorsement for our benefit in an amount not less than the outstanding principal balance on the loan. We reserve the right to review the credit rating of the insurance issuer and, if deemed unsatisfactory, request replacement of the policy by an acceptable issuer. |

| (10) | Geographical Boundaries |

| · | We may purchase Mortgage Investments and provide Credit Enhancements for real estate projects in any of the 48 contiguous United States. |

| 6 |

| (11) | Mortgagees' Title Insurance |

| · | Each Mortgage Investment purchased must have a valid mortgagees' title insurance policy insuring our lien position in an amount not less than the outstanding principal balance of the loan. Such title policy shall be issued by a title company with an “S – Substantial” rating or higher, as rated by Demotech, Inc., an independent financial analysis firm, or other similar standard determined by our Board of Trustees. |

| (12) | Guarantees, Recourse Agreements, and Mortgage Insurance |

| · | Land Development Loans, Finished Lot Loans, Model Home Loans, Construction Loans and Credit Enhancements shall have guarantees and collateral arrangements as determined by the originating companies (UDF and UMTHLD). Our Advisor shall review guarantees and recourse obligations. |

| (13) | Pricing |

| · | Mortgage Investments will be purchased at no minimum percentage of the principal balance, but in no event in excess of the outstanding principal balance. |

| · | Yields on our loan portfolio and fees charged for Credit Enhancements will vary with perceived risk, interest rate, credit, LTV ratios, down payments, guarantees or recourse agreements among other factors. Our objectives will be accomplished through the purchase of high rate loans, reinvestment of principal payments and other short-term investment of cash reserves and leverage of capital to purchase additional Mortgages Investments. |

The principal amounts of Mortgage Investments and the number of Mortgage Investments in which we invest will be affected by market availability and also depend upon the amount of capital available to us from proceeds of our retained earnings, repayment of our loans and borrowings. There is no way to predict the future composition of our portfolio since it will depend in part on the loans available at the time of investment.

TEMPORARY INVESTMENTS

We intend to use proceeds from our retained earnings, proceeds from the repayment of our loans and bank borrowings to acquire Mortgage Investments. There can be no assurance as to when we will be able to invest the full amount of capital available to us in Mortgage Investments, although we will use our best efforts to invest or commit for investment all capital within 60 days of receipt. We will temporarily invest any excess cash balances not immediately invested in Mortgage Investments or for the other purposes described above, in certain short-term investments appropriate for a trust account or investments which yield "qualified temporary investment income" within the meaning of Section 856(c)(6)(D) of the Internal Revenue Code of 1986, as amended (the “Code”), other investments which invest directly or indirectly in any of the foregoing (such as repurchase agreements collateralized by any of the foregoing types of securities), investments necessary for us to maintain our REIT qualification, short-term highly liquid investments such as in investments with banks having assets of at least $220,000,000, savings accounts, bank money market accounts, certificates of deposit, bankers' acceptances or commercial paper rated A-1 or better by Moody's Investors Service, Inc., securities issued, insured or guaranteed by the United States government or government agencies, or in money market funds having assets in excess of $220,000,000 which invest directly or indirectly in any of the foregoing.

OTHER POLICIES

We will not: (a) issue senior securities; (b) invest in the securities of other issuers for the purpose of exercising control; (c) invest in securities of other issuers, other than in temporary investments as described under " Temporary Investments;” (d) underwrite the securities of other issuers; or (e) offer securities in exchange for property.

We may borrow funds to make distributions to our shareholders or to acquire additional Mortgage Investments. Our ability to borrow funds is subject to certain limitations set forth in the Declaration of Trust, specifically, we may not incur indebtedness in excess of 50% of the Net Asset Value of the Trust

Other than in connection with the purchase of Mortgage Investments or issuance of Credit Enhancements, which may be deemed to be a loan from us to the borrower, we do not intend to loan funds to any person or entity. Our ability to lend funds to the Advisor, a Trustee or related parties thereof is subject to certain restrictions as described in "Summary of Declaration of Trust - Restrictions on Transactions with related parties.”

We will not sell property to our Advisor, a Trustee or Related Parties thereof at terms less favorable than could be obtained from a non-related party.

| 7 |

Although we do not intend to invest in real property, to the extent we do, a majority of the Trustees shall determine the consideration paid for such real property, based on the fair market value of the property. If a majority of the Independent Trustees so determine, or if the real property is acquired from the Advisor, as Trustee or related parties thereof, a qualified independent real estate appraiser selected by the independent Trustees shall determine such fair market value.

We will use our best efforts to conduct our operations so as not to be required to register as an investment company under the Investment Company Act of 1940 and so as not to be deemed a "dealer" in mortgages for federal income tax purposes. See "Risks Related to Federal Income Taxation and Our Status as a REIT.”

We will not engage in any transaction which would result in the receipt by the Advisor or its related parties of any undisclosed "rebate" or "give-up" or in any reciprocal business arrangement which results in the circumvention of the restrictions contained in the Declaration of Trust and in applicable state securities laws and regulations upon dealings between us and the Advisor and its related parties.

The Advisor and its related parties, including companies, other partnerships and entities controlled or managed by such related parties, may engage in transactions described in our prospectus, including acting as Advisor, receiving distributions and compensation from us and others, the purchasing, warehousing, servicing and reselling of mortgage notes, property and investments and engaging in other businesses or ventures that may be in competition with us.

CHANGES IN INVESTMENT OBJECTIVES AND POLICIES

The investment restrictions contained in the Declaration of Trust may only be changed by amending the Declaration of Trust with the approval of our shareholders. However, subject to those investment restrictions, the methods for implementing our investment policies may vary as new investment techniques are developed. The Board of Trustees shall periodically, no less than annually review our investment policies and objectives and publish them in a public filing and direct mail communication to our shareholders.

COMPETITION

We believe that our principal competition in the business of acquiring and holding mortgage investments is from financial institutions such as banks, saving and loan associations, life insurance companies, institutional investors such as mutual funds and pension funds, and certain other mortgage REITs. While most of these entities have significantly greater resources than we do, we believe that we are able to compete effectively and to generate relatively attractive rates of return for shareholders due to our relationships with related party loan origination companies, our relatively low level of operating costs, our relationships with our sources of mortgage investments and the tax advantages of our REIT status.

EMPLOYEES

The Company has no direct employees. However, our Advisor is staffed with employees who possess expertise in all areas required to fulfill its obligation as manager of our day-to-day management. UMT Holdings, L.P. (“UMTH”) owns 99.9% of our Advisor. The services of our President and Chief Financial Officer, Mr. Ducote, are retained through a consulting agreement.

The following are certain risk factors that could affect our business, financial condition, operating results and cash flows. These risk factors should be considered in connection with the forward-looking statements contained in this Annual Report on Form 10-K because these risk factors could cause our actual results to differ materially from those expressed in any forward-looking statement. The risks highlighted below are not the only ones we face. If any of these events actually occur, our business, financial condition, operating results or cash flows could be negatively affected. We caution readers to keep these risk factors in mind and to refrain from attributing undue certainty to any forward-looking statements, which speak only as of the date of this report.

Risks Related to the Real Estate Industry

Our operations and results are subject to the risks associated with the real estate industry.

| 8 |

Our operating results and the value of our mortgage investments, and consequently the value of your shares, are subject to the risk that if our mortgage investments do not generate revenues sufficient to meet our operating expenses, including debt service and capital expenditures, our cash flow and ability to pay distributions to you will be adversely affected. The following factors, among others, may adversely affect our results:

| - | downturns in the national, regional and local economic climate; |

| - | competition from other real estate lenders; |

| - | local real estate market conditions, such as oversupply or reduction in demand for properties; |

| - | trends and developments in the homebuilding industry; |

| - | conditions in financial markets, including changes in interest rates, the availability and cost of financing, the fiscal and monetary policies of the United States government and the Board of Governors of the Federal Reserve System and international financial conditions; |

| - | unemployment rates; |

| - | increased operating costs, including, but not limited to, insurance expense, utilities, real estate taxes and state and local taxes; |

| - | civil disturbances, natural disasters, terrorist acts or acts of war which may result in uninsured or underinsured losses; and |

| - | declines in the financial condition of our borrowers and our ability to collect from our borrowers. |

Continued distressed conditions in the real estate and mortgage markets have had and may continue to have adverse effects on our results.

During 2014 the mortgage lending industry continued to experience some instability due to, among other things, defaults and foreclosures on sub-prime and prime loans and a resulting decline in the market value of such loans. These developments were initially referred to as the “sub-prime crisis” but it became evident in 2008 that the crisis had progressed beyond “sub-prime” mortgages as the default rate on prime mortgages also increased. The sub-prime crisis had become a credit crisis and part of an overall negative economic environment. In response to these negative market conditions, lenders, investors, regulators and other third parties questioned the adequacy of lending standards and other credit requirements for several loan programs made available to borrowers in recent years. This has led generally to less investor demand for mortgage loans and mortgage-backed securities, tightened credit requirements, reduced liquidity and increased credit risk premiums.

The deterioration in the housing market has had an adverse impact on our portfolio of Mortgage Investments because our Interim Loan borrowers rely on prospective home buyers who do not satisfy all of the income ratios, credit record criteria, loan-to-value ratios, seasoning, employment history and liquidity requirements of conventional mortgage financing. These factors place the loans in the “non-conforming” category, meaning that they are not insured or guaranteed by a federally owned or guaranteed mortgage agency. Accordingly, the risk of default by the borrower in those "non-conforming loans" is higher than the risk of default in loans made to persons who qualify for conventional mortgage financing.

We believe that the impact of these factors on our operations has been significant. We have adopted active strategies to monitor and manage our credit risk and our portfolio of mortgage investments, such as eliminating our investments in new Interim Loans secured by conventionally built homes, with the objective of limiting the extent to which possible adverse financial effects from the credit crisis. However, we have two loans in California, which is one of the states that suffered most from the sub-prime crisis and conditions could change in Texas and in our other markets. Therefore, we can give no assurances that there will not be a marked increase in defaults under our Interim Loans accompanied by a rapid decline in real estate values that could have further material adverse effect upon our financial condition and operating results.

Real estate properties are illiquid and are difficult to sell in a poor market environment.

Real estate investments are relatively illiquid, which limits our ability to react quickly to adverse changes in economic or market conditions. Our ability to dispose of those of our assets which constitute real property depends on prevailing economic and market conditions. We may be unable to sell our properties to repay debt, to raise capital we need to fund our planned development and construction program, or to fund distributions to investors.

| 9 |

Fluctuations in interest rates may affect our return on investment.

Mortgage interest rates may be subject to abrupt and substantial fluctuations. Changes in interest rates may impact both demand for our real estate finance products and the rate of interest on the loans we make. If prevailing interest rates rise above the average interest rate being earned by our mortgage investments, we may be unable to quickly liquidate our existing investments in order to take advantage of higher returns available from other investments. Furthermore, interest rate fluctuations may have a particularly adverse effect on the return we realize on our mortgage investments if we use money borrowed at variable rates to fund fixed rate mortgage investments. A portion of the loans we finance for UDF are junior in the right of repayment to senior lenders, who will provide loans representing 70% to 80% of total project costs. As senior lender interest rates available to our borrowers increase, demand for our mortgage loans may decrease, and vice versa.

Bankruptcy of borrowers may delay or prevent recovery on our loans.

The recovery of money owed to us may be delayed or impaired by the operation of the federal bankruptcy laws. Any borrower has the ability to delay a foreclosure sale for a period ranging from a few months to several months or more by filing a petition in bankruptcy, which automatically stays any actions to enforce the terms of the loan. The length of this delay and the associated costs would generally have an adverse impact on the return we realize on our investments.

Risks Related to Our Business

We may not be successful in managing credit risk, particularly as such risk is impacted by the economic conditions, which could adversely affect our results and our ability to pay distributions to our shareholders.

Despite our efforts to manage credit risk, there are many aspects of credit risk that we cannot control. In addition, the negative economic environment has created new circumstances that increase the difficulty of predicting the credit risks to which we will be exposed and limiting future delinquencies, defaults, and losses. Our borrowers may default and we may experience delinquencies at a higher rate than we anticipate. Our underwriting reviews may not be effective. Our loan loss reserves may prove to be inadequate. The value of the homes collateralizing our mortgage investments may decline. We may have difficulty selling any homes that are repossessed which could delay or prevent us from recovering our investment. Changes in lending trends, consumer behavior, bankruptcy laws, tax laws, regulations impacting the mortgage industry, and other laws may exacerbate loan losses. Other changes or actions by judges or legislators regarding mortgage loans and contracts including the voiding of certain portions of these agreements may reduce our earnings, impair our ability to mitigate losses, or increase the probability and severity of losses. Our loss mitigation efforts will impact our operating costs and may not be effective in reducing our future credit losses.

We have previously invested in non-conforming loans which are subject to a higher risk of default than conventional mortgage loans.

Most of our mortgage investments are “non-conforming” in that they are not insured by a federally owned or guaranteed mortgage agency. Also, a portion of our loans involve, directly or indirectly, borrowers who do not satisfy all of the income ratios, credit record criteria, loan-to-value ratios, employment histories and liquidity requirements of conventional mortgage financing. Accordingly, the risk of default by the borrowers of those "non-conforming loans" is higher than the risk of default in loans made to persons who qualify for conventional mortgage financing. The three year average default rate for our residential mortgages and contracts for deed was approximately 0.54% and for our Interim Loans was approximately 0.0%.

We are exposed to concentrated credit risk with respect to a number of our loan transactions with related parties which could result in adverse results in the event of delinquencies or defaults.

A significant portion of our Mortgage Investments are comprised of loans we have made to related entities. Although we regularly conduct collectability analyses of these related entities, including UDF, the obligors under the recourse notes, UMTH and UMTHGS, because the security we hold for payment of a number of these obligations consists in significant part of receivables of these related parties from other related parties as well as from non-related parties and because our ultimate ability to collect on these obligations is dependent to a large extent upon the continued financial performance of those related parties we are exposed to a concentrated credit risk. In the event of a failure by those related parties to perform financially as they have regularly done in the past, our ability to collect on those obligations could be severely impaired or precluded. In such case, our earnings could be negatively impacted which in turn may limit distributions that we are able to pay to our shareholders.

| 10 |

We have a dependence upon the UDF line of credit which exposes us to concentrated credit risk and could result in adverse results with respect to delinquencies or defaults.

The balance of our line of credit to UDF is approximately $82 million at December 31, 2014. A significant amount of our total earnings are provided through that lending arrangement: however we have sold a participation in the UDF loan to UDF III, L.P, effectively reducing our exposure to less than 10% of the outstanding loan balance at December 31, 2014. Effective December 31, 2010, the line of credit was increased from $60 million to $75 million and extended for one year, and effective December 31, 2012 the line of credit was increased from $75 million to $82 million. Effective September 30, 2014, the line of credit was increased from $82,000,000 to $84,674,672 and effective December 31, 2014, the line of credit was extended and matures on December 31, 2015. The large amount that we have committed to the UDF line of credit means that we face a concentrated credit risk with UDF so that, in the event of delinquencies or defaults by UDF, a significant portion of our total portfolio of mortgage investments could be adversely affected. In addition, if we are unable to renew the line of credit when it expires or to find an alternative lending arrangement either with UDF or other borrowers that will allow us to use an equivalent amount of our lending resources and that will generate an equivalent or better return to us, our earnings will be negatively impacted which may result in an adverse impact on our ability to make distributions to our shareholders.

Our loans to UDF are junior to other lenders and expose us to the risks of the homebuilding industry that could result in losses on our mortgage investments.

Our loans to UDF are secured by UDF’s interest in mortgages and equity participations that it has obtained to secure its loans to real estate developers. Some of those mortgages are junior mortgages. The developers obtain the money to repay the development loans by reselling the residential home lots to home builders or individuals who build single-family residences on the lots. A developer’s ability to repay its loans is based primarily on the amount of money generated by the developer’s sale of its inventory of single-family residential lots. As a result, we are exposed to the risks of the homebuilding industry, which has undergone a significant downturn due in large part to the negative economic environment. Accordingly, continued or further deterioration of home building conditions or in the broader economic conditions of the homebuilding market could cause the number of homebuyers to decrease, which would increase the likelihood of defaults on the development loans and, consequently, increase the likelihood of a default on the UDF line of credit loan. If this were to occur, we may face the inability to recover the outstanding loan balance on foreclosure of collateral securing our loans because our rights to this collateral will be junior to the rights of senior lenders and because of the potentially reduced value of the underlying properties.

We may change our investment strategy, operating policies and/or asset allocations without shareholder consent which could result in losses.

We may change our investment strategy, operating policies and/or asset allocation with respect to investments, acquisitions, leverage, growth, operations, indebtedness, capitalization and distributions at any time without the consent of our shareholders. A change in our investment strategy may increase our exposure to interest rate and/or credit risk, default risk and real estate market fluctuations. Furthermore, a change in our asset allocation could result in our making investments in asset categories different from our historical investments. These changes could adversely affect our financial condition, results of operations, the Net Asset Value (“NAV”) of our shares or our ability to pay dividends or make distributions.

We purchase most of our mortgage investments from related parties of our Advisor, which may present a conflict of interest for our Advisor.

We acquire most of our mortgage investments from related parties of the Advisor. Due to the affiliation between the Advisor and those entities and the fact that those entities may earn fees on the origination of mortgage investments sold to us, the Advisor has a conflict of interest in determining if mortgage investments should be purchased from related or non-related third parties. These arrangements could affect our Advisor’s judgment and advice with respect to acquisitions of investments, originations of loans, sales of properties and other dealings between us and our Advisor.

We are dependent upon our Advisor for sourcing and management of our investments and management of our operations, and any adverse changes in the financial condition of our Advisor or its related parties or our relationship with them could hinder our operating performance and the return on our investments.

We rely heavily on our Advisor, and its related parties for the sourcing and management of our investments and for management of our operations. A significant portion of our investment activities are with related parties of our Advisor and therefore adverse changes in the financial condition of our Advisor or our relationship with our Advisor could hinder its ability to successfully manage our operations and our portfolio of investments and could limit our sources of investments. Because our Advisor and its related parties engage in other business activities, conflicts of interest may arise in operating more than one entity with respect to allocating time between those entities. This may cause our operations and our shareholders’ investment to suffer.

We have a high geographic concentration of mortgage investments in Texas and adverse changes in economic or market conditions in Texas could negatively affect our financial performance and condition.

A large percentage of the properties securing our mortgage investments are located in Texas, with approximately 38% in the Dallas/Fort Worth area. As a result, we have a greater susceptibility to the effects of an economic downturn in that area or from slowdowns in certain business segments that represent a significant part of that area’s overall economic activity such as energy, construction, financial services and tourism.

| 11 |

We face the risk of loss on non-insured, non-guaranteed mortgage loans.

We generally do not obtain credit enhancements for our mortgage investments, because the majority of those mortgage loans are "non-conforming" in that they do not meet all of the underwriting criteria required for the sale of the mortgage loan to a federally owned or guaranteed mortgage agency. Accordingly, during the time we hold mortgage investments for which third party insurance is not obtained, we are subject to the general risks of borrower defaults and bankruptcies and special hazard losses that are not covered by standard hazard insurance (such as those occurring from earthquakes or floods). In the event of a default on any mortgage investment held by us, including, without limitation, defaults resulting from declining property values and worsening economic conditions, we would bear the risk of loss of principal to the extent of any deficiency between the value of the related mortgage property and the amount owing on the mortgage loan. Defaulted mortgage loans would also cease to be eligible collateral for borrowings and would have to be held or financed by us out of other funds until those loans are ultimately liquidated, which could cause increased financing costs and reduced net income or a net loss.

We face risks under the representations, warranties and guarantees that we gave in connection with our securitization activities.

We have engaged in two securitizations of our mortgage investments as a means of providing funding. In these transactions, we receive the proceeds from third party investors for securities issued from our securitization vehicles which are collateralized by transferred mortgage investments from our portfolio. As part of those securitizations we made certain representations and warranties concerning the portfolio of mortgage investments conveyed and we also guaranteed certain obligations. If, because of irregularities in the underlying loans, our representations and warranties are inaccurate, we may be obligated to repurchase the loans from the purchasing entities at principal value, which may exceed market value.

Potential environmental liabilities could increase our costs and limit our ability to make distributions.

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous real property owner or operator may be liable for the cost of removing or remediating hazardous or toxic substances on, under or in such property. In the event that we are forced to foreclose on a defaulted mortgage investment to recover our investment, we may be subject to environmental liabilities in connection with that real property which may cause its value to be diminished. Hazardous substances or wastes, contaminants, pollutants or sources thereof (as defined by state and federal laws and regulations) may be discovered on a property during our ownership or after a sale of that property to a third party. If those hazardous substances are discovered on a property, we may be required to remove those substances or sources and clean up the property. We could incur full recourse liability for the entire cost of any removal and clean up and the cost of such removal and clean up could exceed the value of the property or any amount that we could recover from any third party. We may also be liable to tenants and other users of neighboring properties for environmental liabilities. In addition, we may find it difficult or impossible to sell the property prior to or following any such clean up. The costs of defending against claims of environmental liability, of complying with environmental regulatory requirements, of remediating any contaminated property, or paying personal injury claims could reduce amounts available for distribution to our shareholders.

We obtain lines of credit and other borrowings, which increases our risk of loss due to potential foreclosure.

We finance our investment activities through the use of borrowed money from lines of credit and other borrowings. These borrowings may be secured by liens on our mortgage investments. Accordingly, we could lose our mortgage investments if we default on the indebtedness. Our debt service payments reduce our cash flow available for distributions. If we were unable to meet our debt service obligations, we risk the loss of some or all of our assets to foreclosure or sale to satisfy our debt obligations.

We employ leverage in connection with our investments, which increases the risk of loss in those investments.

We are allowed to borrow an aggregate amount not to exceed 50% of our net assets to acquire Mortgage Investments. In addition, we have engaged in securitizations in order to finance our loan purchases. Although the use of leverage can enhance returns and increase the number of investments that we can make, a further effect of leveraging is to increase the risk of loss. The higher the rate of interest on the financing, the more difficult it would be for us to meet our obligations and the greater the chance of default. We can offer no assurance that leveraged financing will be available to us on favorable terms or that, among other factors, the terms of such financing will parallel the maturities of the underlying assets acquired. If alternative financing is not available, we may have to liquidate assets at unfavorable prices to pay off such financing. The return on our investments and cash available for distribution to our shareholders may be reduced to the extent that changes in market conditions cause the cost of our financing to increase relative to the income that we can derive from the assets we acquire.

| 12 |

We rely on appraisals that may not be accurate or may be affected by subsequent events.

Because our investment decisions are based in major part upon the value of the real estate underlying our mortgage investments and less upon the creditworthiness of the borrowers, we rely primarily on the real property securing the mortgage investments to protect our investment. We rely on appraisals and on Broker Price Opinions ("BPO's"), both of which are paid for and most of which are provided by the loan originator, to determine the fair market value of real property used to secure the mortgage investments we purchase. BPO’s are determinations of the value of a property based on a study of the comparable values of similar properties prepared by a licensed real estate broker. We cannot be sure that those appraisals or BPO's are accurate. Moreover, since an appraisal or BPO is given with respect to the value of real property at a given point in time, subsequent events could adversely affect the value of real property used to secure a loan. Such subsequent events may include changes in general or local economic conditions, neighborhood values, interest rates and new construction. Moreover, subsequent changes in applicable governmental laws and regulations may have the effect of severely limiting the permitted uses of the property, thereby drastically reducing its value. Accordingly, if an appraisal is inaccurate or subsequent events adversely affect the value of the property, the mortgage investment would not be as secure as anticipated, and, in the event of foreclosure, we may not be able to recover our entire investment.

Our mortgages may be considered usurious in which case we may incur penalties and those loans may be unenforceable and result in losses to us.

Usury laws impose limits on the maximum interest that may be charged on loans and impose penalties for violations that may include restitution of the usurious interest received, damages for up to three times the amount of interest paid and rendering the loan unenforceable. Most, if not all, of the mortgage investments we purchase are subject to state usury laws and therefore we face the risk that the interest rate for our loans could be held usurious in states with restrictive usury laws.

We face risks in complying with Section 404 of the Sarbanes-Oxley Act of 2002.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we could be subject to regulatory action or other litigation, and our operating results could be harmed. Beginning with 2007, we were required to document and test our internal control procedures to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires our management to assess annually the effectiveness of our internal control over financial reporting.

During the course of our testing, we may identify deficiencies that we may not be able to remediate in a timely manner. In addition, if we fail to maintain the adequacy of our internal accounting controls, as those standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Failure to achieve and maintain an effective internal control environment could cause us to face regulatory action and also cause investors to lose confidence in our reported financial information, either of which could have an adverse impact on our operations and our shares.

We face the risk of financial loss, litigation and regulatory action arising from the fraud, misconduct or inadvertent errors made by employees and contractors of our Advisor.

We are dependent upon our Advisor and the employees and contractors of our Advisor with respect to virtually all aspects of our operations and financial affairs. Fraud, misconduct or inadvertent errors by those employees or contractors could cause financial harm to us or expose us to litigation or regulatory action and injure our reputation. These types of conduct could include, among other types, activities such as unauthorized expenditures, defalcations, incorrect reporting of our transactions or errors or misstatements in required filings. Our ability to protect against and detect fraud, misconduct or inadvertent errors is limited and we may not be successful in detecting and remedying these actions in which case we may suffer financial and other harm that would have a negative impact on the value of our shares.

Risks Related to Federal Income Taxation and Our Status as a REIT

We face the risk of an inability to maintain our qualification as a REIT.

We are organized and conduct our operations in a manner that we believe enables us to be taxed as a REIT under the Code. To qualify as a REIT and avoid the imposition of federal income tax on any income we distribute to our shareholders, we must continually satisfy two income tests, two asset tests and one distribution test.

If, in any taxable year, we fail to distribute at least 90% of our taxable income, we will be taxed as a corporation and distributions to our shareholders will not be deductible in computing our taxable income for federal income tax purposes. Because of the possible receipt of income without corresponding cash receipts due to timing differences that may arise between the realization of taxable income and net cash flow (e.g., by reason of the original issue discount rules) or our payment of amounts that do not give rise to a current deduction (e.g., as principal payments on indebtedness), it is possible that we may not have sufficient cash or liquid assets at a particular time to distribute 90% of our taxable income. In that event, we could declare a consent dividend or we could be required to borrow funds or liquidate a portion of our investments in order to pay our expenses, make the required distributions to shareholders, or satisfy our tax liabilities, including the possible imposition of a four percent excise tax. We may not have access to funds to the extent, and at the time, required to make such payments.

| 13 |

If we were taxed as a corporation, our payment of tax would substantially reduce the funds available for distribution to shareholders or for reinvestment and, to the extent that distributions had been made in anticipation of our qualification as a REIT, we might be required to borrow additional funds or to liquidate certain of our investments in order to pay the applicable tax. Moreover, should our election to be taxed as a REIT terminate or be voluntarily revoked, we may not be able to elect to be treated as a REIT for the following four-year period.

Complying with REIT requirements may cause us to forego otherwise attractive opportunities.

In order to qualify as a REIT for federal income tax purposes, we must continually satisfy tests concerning, among other things, our sources of income, the nature and diversification of our mortgage investments, the amounts we distribute to our shareholders and the ownership of our shares. We may also be required to make distributions to shareholders at disadvantageous times or when we do not have funds readily available for distribution. Thus, compliance with REIT requirements may hinder our ability to operate solely on the basis of maximizing profits.

Complying with REIT requirements may force us to liquidate otherwise attractive investments or to make investments inconsistent with our business plan.

In order to qualify as a REIT, we must also determine that at the end of each calendar quarter, at least 75% of the value of our assets consists of cash, cash items, government securities and qualified REIT real estate assets. The remainder of our investment in securities generally cannot include more than 10% of the outstanding voting securities of any one issuer or more than 10% of the total value of the outstanding securities of any one issuer. In addition, in general, no more than 5% of the value of our assets can consist of the securities of any one issuer. No more than 25% of the total value of our assets can be stock in taxable REIT subsidiaries. If we fail to comply with these requirements, we must dispose of a portion of our assets within 30 days after the end of the calendar quarter in order to avoid losing our REIT status and suffering adverse tax consequences. The need to comply with these gross income and asset tests may cause us to acquire other assets that are qualifying real estate assets for purposes of the REIT requirements, but that are not part of our overall business strategy and might not otherwise be the best investment alternatives for us.

We may be subject to adverse legislative or regulatory tax changes.

Federal income tax laws or regulations governing REITs or the administrative interpretations of those laws or regulations are subject to amendment at any time. We cannot predict when or if any new federal income tax law, regulation or administrative interpretation, or any amendment to any existing federal income tax law, regulation or administrative interpretation, will be adopted, promulgated or become effective and any such law, regulation or interpretation may take effect retroactively. We and our stockholders could be adversely affected by any such change in, or any new, federal income tax law, regulation or administrative interpretation.

Risks Related to Ownership of Our Shares

Our dividend can fluctuate because it is based on earnings.

The dividend rate is fixed quarterly by our trustees, based, in part, on earnings projections. As such, the dividend rate may fluctuate up or down. Earnings are affected by various factors including use of leverage, cash on hand, current yield on investments, loan losses, general and administrative operating expenses and amount of non-income producing assets. We made distributions in excess of earnings between 1999 and 2005 and between 2008 and 2014. The amount of the excess constituted a return of capital.

We have not established a minimum dividend payment level for our shareholders and there are no assurances of our ability to pay dividends in the future.

We intend to pay monthly dividends and to pay dividends to our shareholders in amounts such that all or substantially all of our taxable income in each year, subject to certain adjustments, is distributed. Payment of such dividends, together with compliance with other factors, should enable us to qualify for the tax benefits accorded to a REIT under the Internal Revenue Code of 1986, as amended, or Internal Revenue Code. We have not established a minimum dividend payment level for our shareholders and our ability to pay dividends may be harmed by the risk factors described herein. We have reduced our level of dividend payments in recent years in reflection of the decline in interest rates and the yield on our investments. Future dividend payments to our shareholders will be made at the discretion of our Board of Trustees and will depend on our earnings, our financial condition, maintenance of our REIT status and such other factors as our Board of Trustees may deem relevant from time to time. There are no assurances of our ability to pay dividends in the future.

| 14 |

Shareholders may have current tax liability on distributions they elect to reinvest in our common stock.

If our shareholders participate in our dividend reinvestment plan, they will be deemed to have received, and for income tax purposes will be taxed on, the amount reinvested in shares of our common stock to the extent the amount reinvested was not a tax-free return of capital. In addition, our shareholders will be treated for tax purposes as having received an additional distribution to the extent the shares are purchased at a discount to fair market value, if any. As a result, unless our shareholders are tax-exempt entities, they may have to use funds from other sources to pay their tax liability on the value of the shares of common stock received. Effective April 15, 2015, pursuant to the terms of the DRP, the Board of Trustees will suspend the DRP until further notice. Please refer to our Report on Form 8-K filed on March 3, 2015 for further information about the modification to the DRP.

No active trading market for our shares currently exists and one may not develop in the future.

Our shares are not listed on any exchange nor to our knowledge are there any bona fide quotes for the shares on any inter-dealer quotation system or electronic communication network. We have no current plans to cause our shares to be listed on any exchange. As a result, an investor in our shares may be unable to sell those shares at a price equal to or greater than that which the investor paid, if at all.

Our shareholders may not be able to sell their shares under our share redemption program and, if our shareholders are able to sell their shares under the program, they will likely encounter a lengthy delay in receiving payment for their shares and may not be able to recover the amount of their investment in our shares.

Our Share Redemption Plan (“SRP”) contains numerous restrictions that limit our shareholders’ ability to sell their shares. Shareholders must hold their shares for at least one year in order to participate in the SRP, except for hardship redemptions (as defined in the plan). In addition, the SRP limits us to purchasing, in any consecutive 12 month period, more than 5% of the outstanding shares at the beginning of the 12 month period and repurchases are further subject to cash availability. Shares are repurchased at their NAV”. In recent years we have had a large number of requests from shareholders to purchase their shares and have been required to place shareholders in a queue and to make repurchases on a “first come, first served” basis in order for us to comply with the restrictions of our SRP. As a result, shareholders have experienced significant delays in receiving payment for their shares that they have submitted for purchase under the SRP. Since the repurchase price is equal to the NAV, a shareholder may receive less than the amount of their remaining investment in the shares. Moreover, our Trustees have the discretion to suspend or terminate the SRP upon 30 days’ notice. As a result of these restrictions and circumstances, the ability of our shareholders to sell their shares should they require liquidity, and to recover the value they invested, is significantly restricted. Currently our share redemptions are limited to death and medical hardship requests as approved by our trustees on a case-by-case basis.

Provisions of Maryland law and our governing documents may have an anti-takeover effect; investors may be prevented from receiving a “control premium” for their shares.

Provisions contained in our Declaration of Trust and bylaws, as well as Maryland corporate law may have anti-takeover effects that delay, defer or prevent a takeover attempt, which may prevent shareholders from receiving a “control premium” for their shares. For example, these provisions may defer or prevent tender offers for our shares or purchases of large blocks of our shares, thereby limiting the opportunities for our shareholders to receive a premium for their shares over then-prevailing market prices. These provisions include the following:

| · | Ownership limit. Our Declaration of Trust limits related investors who acquire over 9.8% of our shares (“Excess Shares”) from voting those shares, and we have the right to repurchase any Excess Shares held by any investor. |

| · | Maryland business combination statute. Maryland law restricts the ability of holders of more than 10% of the voting power of our shares to engage in a business combination with us. |

| · | Maryland control share acquisition statute. Maryland law limits the voting rights of large shareholders who acquire “control shares” in a “control share acquisition.” |

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

We do not maintain any physical properties.

We are unaware of any threatened or pending legal action or litigation that individually or in the aggregate could have a material effect on us.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 15 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET INFORMATION

There is currently no established public trading market for our shares. As an alternative means of providing limited liquidity for our shareholders, we maintain a Share Redemption Plan (“SRP”).

REGISTRANT PURCHASES OF EQUITY SECURITIES

SHARE REDEMPTION PLAN

Our Trustees have the discretion to modify or terminate the SRP upon 30 days’ notice. Under the terms of our plan as last modified and effective on May 1, 2009 (see below for a further description of the plan modifications), shareholders who have held their shares for at least one year are eligible to request that we repurchase their shares. In any consecutive 12 month period we may not repurchase more than 5% of the outstanding shares at the beginning of the 12 month period. The repurchase price is based on the net asset value (“NAV”) as of the end of the quarter prior to the month in which the redemption is made. The NAV will be established by our Board of Trustees no less frequently than each calendar quarter. For reference, at December 31, 2014 and 2013 the NAV was $14.81 and $14.66 per share, respectively. Under the prior SRP terms, the redemption price was $20.00 per share. The Company will waive the one-year holding period ordinarily required for eligibility for redemption and will redeem shares for hardship requests. A “hardship” redemption is (i) upon the request of the estate, heir or beneficiary of a deceased shareholder made within two years of the death of the shareholder; (ii) upon the disability of a shareholder or such shareholder’s need for long-term care, providing that the condition causing such disability or need for long-term care was not pre-existing at the time the shareholder purchased the shares and that the request is made within 270 days after the onset of disability or the need for long-term care; and (iii) in the discretion of the Board of Trustees, due to other involuntary exigent circumstances of the shareholder, such as bankruptcy, provided that the request is made within 270 days after of the event giving rise to such exigent circumstances. Previously, there was no hardship exemption. Shares will be redeemed quarterly in the order that requests are presented. Any shares not redeemed in any quarter will be carried forward to the subsequent quarter unless the redemption request is withdrawn by the shareholder. Previously, shares were redeemed monthly. Repurchases are subject to cash availability and Trustee discretion. Previously, the SRP provided that repurchases were subject to the availability of cash from the DRP or the Company’s credit line. Currently our share redemptions are limited to death and medical hardship requests as approved by our trustees on a case-by-case basis. The Board received redemption requests for 32,039 shares and 19,708 shares were approved and redeemed during the year ended December 31, 2014. The Board received redemption requests for 72,297 shares and 17,847 shares were approved and redeemed during the year ended December 31, 2013.

Share repurchases have been at prices of $14.51 to $20.00 through our SRP. Shares repurchased for less than $20.00 per share were 1) shares held by shareholders for less than 12 months 2) shares purchased outside of our Share Redemption Program prior to the May 1, 2009 modifications to our SRP or 3) shares purchased under our SRP subsequent to the May 1, 2009 modifications to our SRP.

Prior to May 1, 2009 the redemption price was $20 based on the determination of our Board of Trustees regarding the value of the shares with reference to our book value, our operations to date and general market and economic conditions Subsequent to May 1, 2009, the redemption price was equal to the NAV as of the end of the quarter prior to the month in which the redemption was made.

The Company complies with Distinguishing Liabilities from Equity topic of FASB Accounting Standards Codification, which requires, among other things, that financial instruments that represent a mandatory obligation of the Company to repurchase shares be classified as liabilities and reported at settlement value. We believe that shares tendered for redemption by a shareholder under the SRP do not represent a mandatory obligation until such redemptions are approved at the discretion of our Board of Trustees. At such time, we will reclassify such obligations from equity to an accrued liability based upon their respective settlement values. At December 31, 2014 and 2013, all approved redemption requests had been paid.

| 16 |

The following table summarizes the share repurchases made by us in 2014:

| Month | Total number of shares repurchased | Average Purchase Price | Total number of shares purchased as part of a publicly announced plan | Total number of shares purchased outside of plan | ||||||||||||

| January | 1,795 | $ | 14.76 | 1,795 | - | |||||||||||

| February | 2,188 | $ | 14.76 | 2,188 | - | |||||||||||

| March | 627 | $ | 14.76 | 627 | - | |||||||||||

| April | 1,603 | $ | 14.66 | 1,603 | - | |||||||||||

| May | 2,324 | $ | 14.66 | 2,324 | ||||||||||||

| June | 1,039 | $ | 14.53 | 1,039 | - | |||||||||||

| July | 1,828 | $ | 14.53 | 1,828 | - | |||||||||||

| August | 2,216 | $ | 14.54 | 2,216 | - | |||||||||||

| September | 1,134 | $ | 14.56 | 1,134 | - | |||||||||||

| October | 2,644 | $ | 14.56 | 2,644 | - | |||||||||||

| November | 1,759 | $ | 14.56 | 1,759 | - | |||||||||||

| December | 551 | $ | 14.51 | 551 | - | |||||||||||

| Totals | 19,708 | $ | 14.62 | 19,708 | - | |||||||||||

SHAREHOLDERS

On December 31, 2014, we had 6,431,960 shares of beneficial interest outstanding compared to 6,436,768 and 6,439,531 shares of beneficial interest outstanding at December 31, 2013 and 2012, respectively. The decrease in outstanding shares from 2012 to 2014 is due to the increase in repurchases under our SRP and the decrease of shares issued under our Dividend Reinvestment Plan (“DRP”). The shares were held by 2,502, 2,515, and 2,486 beneficial owners in 2014, 2013, and 2012, respectively. No single shareholder owned 5% or more of our outstanding shares at December 31, 2014, 2013 or 2012.

The redemption price is equal to the “Net Asset Value” (NAV) as of the end of the month prior to the month in which the redemption is made. The NAV is established by our Board of Trustees no less frequently than each calendar quarter. For reference, at December 31, 2014 and 2013 the NAV was $14.81 and $14.66 per share, respectively. The Company will waive the one-year holding period ordinarily required for eligibility for redemption and will redeem shares for hardship requests. A “hardship” redemption is (i) upon the request of the estate, heir or beneficiary of a deceased shareholder made within two years of the death of the shareholder; (ii) upon the disability of a shareholder or such shareholder’s need for long-term care, providing that the condition causing such disability or need for long-term care was not pre-existing at the time the shareholder purchased the shares and that the request is made within 270 days after the onset of disability or the need for long-term care; and (iii) in the discretion of the Board of Trustees, due to other involuntary exigent circumstances of the shareholder, such as bankruptcy, provided that that the request is made within 270 days after of the event giving rise to such exigent circumstances. Previously, there was no hardship exemption. Shares will be redeemed quarterly in the order that they are presented. Any shares not redeemed in any quarter will be carried forward to the subsequent quarter unless the redemption request is withdrawn by the shareholder. Previously, shares were redeemed monthly. Repurchases are subject to cash availability and Trustee discretion. Previously, the SRP provided that repurchases were subject to the availability of cash from the DRP or the Company’s credit line. Currently our share redemptions are limited to death and medical hardship requests as approved by our trustees on a case-by-case basis.

Effective April 15, 2015, pursuant to the terms of the DRP, the Board of Trustees will suspend the DRP until further notice. Please refer to our Report on Form 8-K filed on March 3, 2015 for further information about the modification to the DRP.

DIVIDEND POLICY