Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - UNITED MORTGAGE TRUST | v319007_ex31-1.htm |

| EX-31.2 - CERTIFICATION - UNITED MORTGAGE TRUST | v319007_ex31-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - UNITED MORTGAGE TRUST | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2012

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file number: 000-32409

UNITED MORTGAGE TRUST

(Exact name of registrant as specified in its charter)

| Maryland | 75-6493585 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1301 Municipal Way, Suite 220

Grapevine, Texas 76051

(Address of principal executive offices)(Zip Code)

(214) 237-9305

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ (Do not check if a smaller reporting company)

x Smaller Reporting Company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

The number of shares outstanding of the Registrant’s shares of beneficial interest, par value $0.01 per share, as of the close of business on August 14, 2012 was 6,438,398.

UNITED MORTGAGE TRUST

INDEX

PART I - FINANCIAL INFORMATION

| Page | ||

| ITEM 1. | Financial Statements | |

| Consolidated Balance Sheets as of June 30, 2012 (unaudited) and December 31, 2011 | 3 | |

| Consolidated Statements of Income for the three months and six months ended June 30, 2012 and June 30, 2011 (unaudited) | 4 | |

| Consolidated Statements of Cash Flows for the six months ended June 30, 2012 and June 30, 2011 (unaudited) | 5 | |

| Notes to Consolidated Financial Statements (unaudited) | 7 | |

| ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| ITEM 3. | Quantitative and Qualitative Disclosures about Market Risk | 34 |

| ITEM 4T. | Controls and Procedures | 34 |

| PART II - OTHER INFORMATION | ||

| ITEM 1. | Legal Proceedings | 35 |

| ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 35 |

| ITEM 3. | Defaults Upon Senior Securities | 36 |

| ITEM 4. | Mine Safety Disclosures | 36 |

| ITEM 5. | Other Information | 36 |

| ITEM 6. | Exhibits | 36 |

| Signatures | 38 | |

| 2 |

UNITED MORTGAGE TRUST

CONSOLIDATED BALANCE SHEETS

| June 30, 2012 | December 31, 2011 | |||||||

| (unaudited) | ||||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 485,665 | $ | 363,561 | ||||

| Mortgage investments: | ||||||||

| Investment in trust receivable | 962,995 | 1,098,797 | ||||||

| Investment in residential mortgages | 4,858,080 | 4,904,537 | ||||||

| Interim mortgages, affiliates | 16,292,877 | 17,319,590 | ||||||

| Interim mortgages | 35,886 | 35,886 | ||||||

| Allowance for loan losses | (339,901 | ) | (340,487 | ) | ||||

| Total mortgage investments | 21,809,937 | 23,018,323 | ||||||

| Line of credit receivable, affiliates | 78,676,051 | 78,356,781 | ||||||

| Line of credit receivable | 5,049,006 | 4,132,639 | ||||||

| Accrued interest receivable | 1,459,961 | 1,433,610 | ||||||

| Accrued interest receivable, affiliates | 14,742,896 | 9,032,145 | ||||||

| Reserves – accrued interest receivable | (2,722,006 | ) | (2,418,413 | ) | ||||

| Recourse obligations, affiliates | 18,480,608 | 18,361,710 | ||||||

| Real estate owned, net | 9,536,458 | 11,090,796 | ||||||

| Deficiency notes | 8,620,001 | 8,063,129 | ||||||

| Deficiency note, affiliate | 30,101,737 | 29,507,820 | ||||||

| Allowance for loan losses – deficiency notes | (4,997,746 | ) | (4,757,746 | ) | ||||

| Other assets | 322,583 | 445,584 | ||||||

| Total assets | $ | 181,565,151 | $ | 176,629,939 | ||||

| Liabilities and Shareholders’ Equity | ||||||||

| Liabilities: | ||||||||

| Dividend payable | $ | 310,000 | $ | 310,000 | ||||

| Lines of credit payable | 7,738,152 | 6,680,333 | ||||||

| Accounts payable and accrued liabilities | 689,593 | 936,279 | ||||||

| Accounts payable and accrued liabilities, affiliates | 7,033,510 | 2,522,158 | ||||||

| Participation payable, affiliate | 65,503,661 | 65,503,661 | ||||||

| Notes payable | 2,245,919 | 1,574,521 | ||||||

| Total liabilities | 83,520,835 | 77,526,952 | ||||||

| Commitments and contingencies | ||||||||

| Shareholders' equity: | ||||||||

| Shares of beneficial interest; $0.01 par value; 100,000,000 shares authorized; 8,336,340 and 8,324,756 shares issued in 2012 and 2011, respectively; and 6,439,778 and 6,437,420 outstanding in 2012 and 2011, respectively | 83,347 | 83,227 | ||||||

| Additional paid-in capital | 147,386,578 | 147,151,952 | ||||||

| Cumulative distributions in excess of earnings | (12,744,851 | ) | (11,620,748 | ) | ||||

| 134,725,074 | 135,614,431 | |||||||

| Less treasury stock of 1,896,562 and 1,887,336 shares in 2012 and 2011, respectively, at cost | (36,680,758 | ) | (36,511,444 | ) | ||||

| Total shareholders' equity | 98,044,316 | 99,102,987 | ||||||

| Total liabilities and shareholders' equity | $ | 181,565,151 | $ | 176,629,939 | ||||

See accompanying notes to consolidated financial statements.

| 3 |

UNITED MORTGAGE TRUST

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Revenues: | ||||||||||||||||

| Interest income –related party | $ | 1,286,281 | $ | 993,320 | $ | 2,187,828 | $ | 1,998,862 | ||||||||

| Interest income | 242,815 | 340,863 | 516,539 | 692,133 | ||||||||||||

| 1,529,096 | 1,334,183 | 2,704,367 | 2,690,995 | |||||||||||||

| Expenses: | ||||||||||||||||

| Trust administration fee – related party | 250,000 | 249,999 | 499,999 | 499,998 | ||||||||||||

| Loan servicing fee – related party | 5,068 | 5,365 | 10,718 | 11,998 | ||||||||||||

| General and administrative – related party | 19,494 | 19,771 | 38,498 | 43,107 | ||||||||||||

| General and administrative | 317,220 | 424,638 | 598,731 | 628,327 | ||||||||||||

| Provision for loan losses | 240,000 | 180,000 | 420,000 | 360,000 | ||||||||||||

| Interest expense – related parties | 29,925 | 17,861 | 58,854 | 34,528 | ||||||||||||

| Interest expense | 176,117 | 121,416 | 335,682 | 222,905 | ||||||||||||

| 1,037,824 | 1,019,050 | 1,962,482 | 1,800,863 | |||||||||||||

| Net income | $ | 491,272 | $ | 315,133 | $ | 741,885 | $ | 890,132 | ||||||||

| Net income per share of beneficial interest | $ | 0.08 | $ | 0.05 | $ | 0.12 | $ | 0.14 | ||||||||

| Weighted average shares outstanding | 6,439,559 | 6,431,577 | 6,439,080 | 6,430,452 | ||||||||||||

| Distributions per weighted share outstanding | $ | 0.14 | $ | 0.14 | $ | 0.29 | $ | 0.29 | ||||||||

See accompanying notes to consolidated financial statements.

| 4 |

UNITED MORTGAGE TRUST

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| Six Months Ended June 30, | ||||||||

| 2012 | 2011 | |||||||

| Operating Activities | ||||||||

| Net income | $ | 741,885 | $ | 890,132 | ||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | ||||||||

| Provision for loan losses | 420,000 | 360,000 | ||||||

| Depreciation and amortization | 6,883 | 3,189 | ||||||

| Changes in assets and liabilities: | ||||||||

| Accrued interest receivable, net | 94,078 | (488,569 | ) | |||||

| Accrued interest receivable, affiliates, net | (1,114,722 | ) | (964,026 | ) | ||||

| Other assets | 116,118 | 10,248 | ||||||

| Accounts payable and accrued liabilities | (246,686 | ) | (60,723 | ) | ||||

| Accounts payable and accrued liabilities, affiliates | (61,341 | ) | 362,541 | |||||

| Net cash provided by (used in) operating activities | (43,785 | ) | 112,792 | |||||

| Investing Activities | ||||||||

| Principal receipts on trust receivables | 135,802 | 58,583 | ||||||

| Investments in residential mortgages | - | (124,000 | ) | |||||

| Principal receipts on residential mortgages | 46,457 | 202,210 | ||||||

| Investment in interim mortgages and deficiency notes | - | (41,575 | ) | |||||

| Principal receipts on interim mortgages and deficiency notes | - | 311,773 | ||||||

| Investments in interim mortgages and deficiency note, affiliate | - | (2,129,184 | ) | |||||

| Principal receipts on interim mortgages and deficiency note, affiliate | 702,080 | 610,554 | ||||||

| Investments in recourse obligations, affiliates | - | (6,635 | ) | |||||

| Principal receipts from recourse obligations, affiliates | 6,315 | 2,500 | ||||||

| Principal investments in lines of credit receivable, affiliates, net | (319,270 | ) | (482,763 | ) | ||||

| Principal receipts from (investments in) lines of credit receivable, net | (916,367 | ) | 985,712 | |||||

| Investments in real estate owned | (111,062 | ) | (694,353 | ) | ||||

| Principal receipts from real estate owned | 693,273 | 2,971,712 | ||||||

| Net cash provided by investing activities | 237,228 | 1,664,534 | ||||||

| Financing Activities | ||||||||

| Proceeds from issuance of shares of beneficial interest | 234,746 | 200,068 | ||||||

| Net borrowings on line of credit payable | 1,057,819 | 1,603,900 | ||||||

| Proceeds from notes payable | 1,372,000 | 345,000 | ||||||

| Principal payments on notes payable | (700,602 | ) | (531 | ) | ||||

| Purchase of treasury stock | (169,314 | ) | (94,242 | ) | ||||

| Dividends | (1,865,988 | ) | (1,863,350 | ) | ||||

| Net cash provided by (used in) financing activities | (71,339 | ) | 190,845 | |||||

| Net increase in cash and cash equivalents | 122,104 | 1,968,171 | ||||||

| Cash and cash equivalents at beginning of period | 363,561 | 7,325 | ||||||

| Cash and cash equivalents at end of period | $ | 485,665 | $ | 1,975,496 | ||||

See accompanying notes to consolidated financial statements.

| 5 |

UNITED MORTGAGE TRUST

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(unaudited)

| Six Months Ended June 30, | ||||||||

| 2012 | 2011 | |||||||

| Supplemental Disclosure of Cash Flow Information | ||||||||

| Cash paid for interest | $ | 265,474 | $ | 194,813 | ||||

| Non-Cash Financing and Investing Activity | ||||||||

| Transfers of affiliate and non-affiliate loans to foreclosed properties or recourse obligations | $ | 110,476 | $ | 110,457 | ||||

| (Increase) decrease participation accrued interest receivable , affiliates | $ | (4,572,693 | ) | $ | (3,965,018 | ) | ||

| Increase (decrease) participation accrued interest payable, affiliates | $ | 4,572,693 | $ | 3,965,018 | ||||

| (Increase) decrease participation receivable , affiliates | $ | - | $ | (109,242 | ) | |||

| Increase (decrease) participation payable, affiliates | $ | - | $ | 109,242 | ||||

| (Increase) decrease accrued interest receivable, affiliates | $ | 159,828 | $ | 6,937,187 | ||||

| (Increase) decrease interim mortgages & deficiency notes, affiliates | $ | (159,828 | ) | $ | (6,937,187 | ) | ||

| (Increase) decrease interim mortgages & deficiency notes, affiliates | $ | 996,162 | $ | 4,630,041 | ||||

| (Increase) decrease interim mortgages & deficiency notes, affiliates | $ | (996,162 | ) | $ | (4,630,041 | ) | ||

| (Increase) decrease interim mortgages & deficiency notes, affiliates | $ | (234,669 | ) | $ | - | |||

| Receipts from real estate owned | $ | 234,669 | $ | - | ||||

| (Increase) decrease interim mortgages & deficiency notes | $ | (556,872 | ) | $ | - | |||

| Receipts from real estate owned | $ | 556,872 | $ | - | ||||

| (Increase) decrease recourse note, affiliates | $ | 125,213 | $ | - | ||||

| Receipts from real estate owned | $ | (125,213 | ) | $ | - | |||

See accompanying notes to consolidated financial statements.

| 6 |

UNITED MORTGAGE TRUST

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Nature of Business

United Mortgage Trust (the “Company”) is a Maryland real estate investment trust that qualifies as a real estate investment trust (a “REIT”) under federal income tax laws. The Company’s principal investment objectives are to invest proceeds from our dividend reinvestment plan, financing proceeds, proceeds from the repayment of our loans, capital transaction proceeds and retained earnings in the following types of investments: (i) lines of credit and secured loans for the acquisition and development of single-family home lots, referred to as “Land Development Loans”; (ii) lines of credit and loans secured by developed single-family lots, referred to as “Finished Lot Loans”; (iii) lines of credit and loans secured by completed model homes, referred to as “Model Home Loans”; (iv) loans provided to entities that have recently filed for bankruptcy protection under Chapter 11 of the U.S. bankruptcy code, secured by a priority lien over pre-bankruptcy secured creditors, referred to as “Debtor in Possession Loans”, (v) lines of credit and loans, with terms of 18 months or less, secured by single family lots and homes constructed thereon, referred to as “Construction Loans”; (vi) to provide credit enhancements to real estate developers, homebuilders, land bankers and other real estate investors who acquire real property, subdivide real property into single-family residential lots, acquire finished lots and/or build on such lots; and (vii) discounted cash flows secured by assessments levied on real property. We collectively refer to the above listed loans as “Mortgage Investments”. Additionally, our portfolio includes obligations of affiliates of our Advisor, which we refer to as “recourse loans” and “deficiency notes.”

The Company has no employees. The Company pays a monthly trust administration fee to UMTH General Services, L.P. (“UMTHGS” or “Advisor”), a subsidiary of UMT Holdings, L.P. (“UMTH”), a Delaware real estate finance company and affiliate, for its services as our advisor. The Company’s offices are located in Grapevine, Texas.

2. Basis of Presentation

The consolidated financial statements include the accounts of the Company and wholly-owned subsidiaries and all significant intercompany accounts and transactions have been eliminated. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and with the instructions for Form 10-Q and Article 10 of Regulation S-X adopted by the Securities and Exchange Commission. Accordingly, the financial statements do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with our consolidated financial statements, and notes thereto, for the year ended December 31, 2011, included in our Annual Report on Form 10-K filed with the SEC on March 30, 2012. Operating results for the six months ended June 30, 2012, are not necessarily indicative of the results that may be expected for the year ended December 31, 2012. Certain prior period amounts have been reclassified to conform to current period presentation.

3. Deficiency Notes – Affiliate and Non-Affiliate

The Company has made loans in the normal course of business to affiliates and non-affiliates, the proceeds from which have been used to originate underlying loans that are pledged to the Company as security for such obligations. When principal and interest on an underlying loan is due in full, at maturity or otherwise, the corresponding obligation owed by the originating company to the Company is also due in full. If the borrower or the Company foreclosed on property securing an underlying loan, or if the Company foreclosed on property securing a purchased loan, and the proceeds from the sale were insufficient to pay the loan in full, the originating company had the option of (1) repaying the outstanding balance owed to the Company associated with the underlying loan or purchased loan, as the case may be, or (2) delivering to the Company an unsecured deficiency note in the amount of the deficiency.

| 7 |

As of June 30, 2012, the Company had two deficiency notes with non-affiliates in the total amount of approximately $8,620,000. One note in the amount of approximately $1,725,000 bears interest at a rate of 14% per annum. The second note in the amount of approximately $6,895,000. The Company does not accrue interest on this note as the underlying collateral value approximates the note balance, net of reserves of approximately $4,998,000.

As of December 31, 2011, the Company had two deficiency notes with non-affiliates in the amount of approximately $8,063,000. One note in the amount of approximately $1,725,000 bears interest at a rate of 14% per annum. The second note in the amount of approximately $6,338,000. The Company does not accrue interest on this note as the underlying collateral value approximates the note balance, net of reserves of approximately $4,758,000.

As of December 31, 2007, UMTH Lending Company, L.P. (“UMTHLC’) issued to the Company a variable amount promissory note in the amount of $5,100,000 to evidence its deficiency obligations to the Company. The initial principal amount of the note was approximately $1,848,000. The principal balance will fluctuate from time to time based on the underlying loan activity and the amount of deficiencies realized by the affiliate. The note is secured by a limited guaranty by UMTHGS, the Advisor, equal to a monthly amount not to exceed 33% of the advisory fee received by UMTHGS under the terms of its advisory agreement with the Company. The note requires monthly principal and interest payments based on a ten-year amortization for the outstanding principal balance. Effective January 2011, the deficiency note was modified and the interest rate was reduced from 10% to 6%. The principal balance as of June 30, 2012 and December 31, 2011, was approximately $30,102,000 and $29,508,000, respectively, resulting primarily from deficiencies associated with the sale of foreclosed properties securing interim loans.

4. Related Party Transactions

1) UMTH is a Delaware limited partnership which is in the real estate finance business. UMTH holds a 99.9% limited partnership interest in UMTHLC, which originates interim loans that the Company is assigned, UMTH Land Development, L.P., (“UMTH LD”), a Texas limited partnership which holds a 50% profit interest in United Development Funding, L.P., (“UDF”) a Nevada limited partnership that is affiliated with the Company’s Advisor, UMTHGS and acts as UDF's asset manager, and Prospect Service Corp. (“PSC”), which services the Company’s residential mortgages and contracts for deed and manages the Company’s real estate owned (“REO”). In addition, UMTH has a limited guarantee of the obligations of Capital Reserve Group (“CRG”), Ready America Funding Corp (“RAFC”), and South Central Mortgage, Incorporated (“SCMI”), a Texas corporation that sold mortgage investments to the Company, under the Secured Notes. United Development Funding III, L.P., a Delaware limited partnership, (“UDF III”) which is managed by UMTH Land Development, L.P., has previously provided a limited guarantee of the line of credit extended by the Company to UDF and has purchased an economic participation in a revolving credit facility we have provided to UDF.

See Note 7 below for a discussion of credit arrangements with UDF.

2) UMTHLC is a Delaware limited partnership, and subsidiary of UMTH. The Company has loaned money to UMTHLC so it can make loans to its borrowers. The loans are collaterally assigned to the Company, as security for the promissory note between UMTHLC and the Company. The unpaid principal balance of the loans at June 30, 2012 and December 31, 2011 was approximately $7,309,000 and $7,861,000 respectively.

On March 26, 2009, the Company executed a secured line of credit promissory note with UMTHLC in the amount of $8,000,000. The note bears interest at 12.50% per annum, had an original maturity date of March 26, 2012 and is secured by first lien mortgage interests in single family residential properties. Effective March 2012, the promissory note’s maturity date was extended to September 26, 2012. The outstanding balance on this line of credit at June 30, 2012 and December 31, 2011 was approximately $7,309,000 and $6,990,000, respectively, and is included in the balances noted in the paragraph above.

See Note 3 above for discussion of additional related party transactions with UMTHLC.

3) CRG is a Texas corporation that is 50% owned by Todd Etter and William Lowe, partners of UMTH, which owns the Advisor. CRG was in the business of financing home purchases and renovations by real estate investors. The Company loaned money to CRG to make loans to other borrowers. During 2006 the Company took direct assignment of the remaining loans from CRG with full recourse.

| 8 |

4) RAFC is a Texas corporation that is 50% owned by SCMI, which is owned by Todd Etter. RAFC is in the business of financing interim loans for the purchase of land and the construction of modular and manufactured single-family homes placed on the land by real estate investors. The Company continues to directly fund obligations under one existing RAFC loan, which was collaterally assigned to the Company, but does not fund new originations. The unpaid principal balance of the loans at June 30, 2012 and December 31, 2011 was approximately $16,293,000 and $16,449,000 respectively.

5) Wonder Funding, LP (“Wonder”) is a Delaware limited partnership that is owned by RMC. RMC is beneficially owned by Craig Pettit, a partner of UMTH and the sole proprietor of two companies that own 50% of RAFC. Wonder is in the business of financing interim loans for the purchase of land and the construction of single family homes and the purchase and renovation of single family homes. The Company has ceased funding any new originations. As of June 30, 2012 and December 31, 2011, respectively, all remaining obligations owed by Wonder to the Company are included in the recourse obligations discussed below.

6) Recourse Obligations. The Company has made recourse loans to (a) CRG, which is a Texas corporation that is 50% owned by Todd Etter and William Lowe, partners of UMTH, which owns the Advisor, (b) RAFC, which is owned by SCMI and two companies owned by Craig Pettit, Eastern Intercorp, Inc. and RMC, and (c) SCMI, which is owned by Todd Etter, (these companies are referred to as the "originating companies"). In addition to the originating companies discussed above, the Company made loans with recourse to Wonder. Each of these entities used the proceeds from such loans to originate loans, that are referred to as "underlying loans," that are pledged to the Company as security for such originating company's obligations to the Company. When principal and interest on an underlying loan are due in full, at maturity or otherwise, the corresponding obligation owed by the originating company to the Company is also due in full.

In addition, some of the originating companies have sold loans to the Company, referred to as the "purchased loans," and entered into recourse agreements under which the originating company agreed to repay certain losses the Company incurred with respect to purchased loans.

If the originating company forecloses on property securing an underlying loan, or the Company forecloses on property securing a purchased loan, and the proceeds from the sale are insufficient to pay the loan in full, the originating company has the option of (1) repaying the outstanding balance owed to the Company associated with the underlying loan or purchased loan, as the case may be, or (2) delivering an unsecured deficiency note in the amount of the deficiency to the Company.

On March 30, 2006, but effective December 31, 2005, the Company and each originating company agreed to consolidate (1) all outstanding amounts owed by such originating company to the Company under the loans made by the Company to the originating company and under the deficiency notes described above and (2) the estimated maximum future liability to the Company under the recourse arrangements described above, into secured promissory notes. Each originating company issued to the Company a secured variable amount promissory note dated December 31, 2005 (the “Secured Notes”) in the principal amounts shown below, which amounts represent all principal and accrued interest owed as of such date. The initial principal amounts are subject to increase if the Company incurs losses upon the foreclosure of loans covered by recourse arrangements with the originating company. The Secured Notes (including related guaranties discussed below) are secured by an assignment of the distributions on the Class C units, Class D units and Class EIA units of limited partnership interest of UMTH held by each originating company.

| 9 |

| Name | Initial

principal amount |

Balance

at June 30, 2012 |

Promissory

Note principal amount (2) |

Units

pledged as security |

Units

remaining |

Estimated

Collateral Value (3) | ||||||

| CRG | $2,725,442 | $4,529,625 | $4,300,000 | 4,984 Class C and 2,710 Class D | 2,625 Class C and 2,710 Class D | $5,674,000 | ||||||

| RAFC | $3,243,369 | $8,511,554 | $7,100,000 | 11,228 Class C and 6,659 Class D | 9,473 Class C and 6,659 Class D | $13,802,000 | ||||||

| SCMI | $3,295,422 | $3,480,792 | $3,488,643 | 4,545 Class and 3,000 Class D | 1,073 Class C and 3,000 Class D | $4,285,000 | ||||||

| RAF / Wonder(1) | $1,348,464 | $1,958,637 | $1,400,000 | 1,657 Class C | 1,615 Class C | $1,615,000 | ||||||

Wonder Indemnification (1) |

n/a | n/a | n/a | $1,134,000 | n/a | $822,000 | ||||||

| Totals | $10,612,697 | $18,480,608 | $16,288,643 | $26,198,000 |

| (1) | Wonder is collateralized by an indemnification agreement from UMTH in the amount of $1,134,000, and is secured by the pledge of 3,870 C Units from RMC. 2,213 of the pledged C Units also cross-collateralize the RAFC obligation. |

| (2) | The CRG, RAFC and Wonder balances at June 30, 2012, exceeded the stated principal amount per their variable Secured Notes by approximately $230,000, $1,412,000 and $559,000, respectively. Per the terms of the Secured Notes, the unpaid principal balance may be greater or less than the initial principal amount of the note and is not considered an event of default. The rapid rate of liquidation of the remaining portfolio of properties caused a more rapid increase in the Unpaid Principal Balance (“UPB”) than originally anticipated and outpaced the minimum principal reductions scheduled for the loans. |

| (3) | Estimated collateral value reflects pledge of C, D and EIA units of limited partnership interest of UMTH held by WLL, Ltd., RAFC and KLA, Ltd. UMTH D units represent equity interests in UMT Holdings, LP. Pledge of the UMTH D units entitles the beneficiary to a pro-rata share of UMTH partnership D unit cash distributions. |

Through September 2007, the Secured Notes incurred interest at a rate of 10% per annum. The CRG, RAFC, and RAFC/Wonder Secured Notes amortize over 15 years. The SCMI Secured Note amortizes over approximately 22 years, which was the initial amortization of the deficiency notes from SCMI that were consolidated. The Secured Notes required the originating company to make monthly payments equal to the greater of (1) principal and interest amortized over 180 months and 264 months, respectively, or (2) the amount of any distributions paid to the originating company with respect to the pledged Class C and EIA units. Effective, October, 2007, the recourse loans were modified to accommodate the anticipated increases in principal balances throughout the remaining liquidation periods of the underlying assets, suspended the principal component of the amortized loans for the period of July 2007 through June 2009, and reduced the interest rate from 10% to 6%. The above modifications have been extended through December 31, 2012. Management has not recognized any reserves on these loans as the underlying collateral value exceeds the outstanding loan amounts.

| 10 |

The Secured Notes have also been guaranteed by the following entities under the arrangements described below, all of which are dated effective December 31, 2005:

| - | UMT Holdings. This guaranty is limited to a maximum of $10,582,336 of all amounts due under the Secured Notes. Application of payments received through June 30, 2012 have reduced the amount outstanding under the guaranty to approximately $30,102,000 |

| - | WLL, Ltd., an affiliate of CRG. This guaranty is of all amounts due under Secured Note from CRG, is non-recourse and is secured by an assignment of 2,492 Class C Units and 1,355 Class D units of limited partnership interest of UMT Holdings held by WLL, Ltd. |

| - | RMC. This guaranty is non-recourse, is limited to 50% of all amounts due under the Secured Note from RAFC and is secured by an assignment of 3,870 Class C units of limited partnership interest of UMT Holdings. |

| - | Wonder. Wonder Funding obligations are evidenced by a note from RAFC (RAFC/Wonder Note) and are secured by a pledge of a certain Indemnification Agreement given by UMTH to RAFC and assigned to UMT in the amount of $1,134,000, which amount is included in the UMTH limited guarantee referenced above. |

| - | SCMC. This guaranty is limited to a maximum of $2,213,000 due under the Secured Note from RAFC and is secured by an assignment of 2,213 Class C units of limited partnership interest of UMT Holdings. |

| - | KLA, Ltd. KLA has given the following guaranties: (1) Guaranty of obligations of SCMI under the First Amended and Restated Secured Variable Amount Promissory Note to the Company dated as of October 1, 2007 with a then current principal balance of $3,472,073 and is secured by an assignment of 3,000 of Guarantor’s Class D units of partnership interest in UMT Holdings, L.P. (2) Guaranty of obligations of CRG under the First Amended and Restated Secured Variable Amount Promissory Note dated as of October 1, 2007 with a then current principal balance of $4,053,800 and is secured by a pledge of 1,355 of Guarantor’s Class D units of partnership interest in UMT Holdings, L.P. |

In addition, WLL, Ltd. has obligations to UMT Holdings under an indemnification agreement between UMT Holdings, WLL, Ltd. and William Lowe, under which UMT Holdings is indemnified for certain losses on loans and advances made to William Lowe by UMT Holdings. That indemnification agreement allows UMT Holdings to offset any amounts subject to indemnification against distributions made to WLL, Ltd., with respect to the Class C and Class D units of limited partnership interest held by WLL, Ltd. Because WLL, Ltd. has pledged these Class C and Class D units to the Company to secure its guaranty of Capital Reserve Corp.'s obligations under its Secured Note, UMT Holdings and the Company entered into an Intercreditor and Subordination Agreement under which UMT Holdings has agreed to subordinate its rights to offset amounts owed to it by WLL, Ltd. to the Company’s lien on such units.

These loans were reviewed by management and no reserves are deemed necessary at June 30, 2012.

7) On June 20, 2006, the Company entered into a Second Amended and Restated Secured Line of Credit Promissory Note as modified by an amendment effective September 1, 2006 - (the "Amendment") with UDF, a Nevada limited partnership that is affiliated with the Company's Advisor, UMTHGS. The Amendment increased an existing revolving line of credit facility ("Loan") to $45 million. The purpose of the Loan is to finance UDF's loans and investments in real estate development projects. On July 29, 2009, our trustees approved an amendment to increase the revolving line of credit facility to an amount not to exceed $60,000,000. Effective December 31, 2010, the loan was extended for a period of one year and the loan amount was increased from $60,000,000 to $75,000,000. Effective December 31, 2011, the loan was extended for a period of one year and matures on December 31, 2012.

The Loan is secured by the pledge of all of UDF's land development loans and equity investments pursuant to the First Amended and Restated Security Agreement dated as of September 30, 2004, executed by UDF in favor of UMT (the “Security Agreement”). Those UDF loans may be first lien loans or subordinate loans.

The Loan interest rate is the lower of 15% or the highest rate allowed by law, further adjusted with the addition of a credit enhancement to a minimum of 14%.

UDF may use the Loan proceeds to finance indebtedness associated with the acquisition of any assets to seek income that qualifies under the Real Estate Investment Trust provisions of the Internal Revenue Code to the extent such indebtedness, including indebtedness financed by funds advanced under the Loan and indebtedness financed by funds advanced from any other source, including Senior Debt, is no more than 85% of 80% (68%) of the appraised value of all subordinate loans and equity interests for land development and/or land acquisition owned by UDF and 75% for first lien secured loans for land development and/or acquisitions owned by UDF.

| 11 |

On September 19, 2008, UMT entered into an Economic Interest Participation Agreement with UDF III pursuant to which UDF III purchased (i) an economic interest in the $45,000,000 revolving credit facility (“Loan”) from UMT to UDF I and (ii) a purchase option to acquire a full ownership participation interest in the Loan (the “Option”). On July 29, 2009, our trustees approved an amendment to increase the revolving line of credit facility to an amount not to exceed $60,000,000. Effective December 31, 2010, the loan was extended for a period of one year and the loan amount was increased from $60,000,000 to $75,000,000. Effective December 31, 2011, the loan was extended for a period of one year and matures on December 31, 2012.

Pursuant to the Economic Interest Agreement, each time UDF requests an advance of principal under the UMT Loan, UDF III will fund the required amount to UMT and UDF III’s economic interest in the UMT Loan increases proportionately. Because these advances are funded by UDF III and UMT recognizes an offsetting participation payable amount to UDF III, the Company does not earn any net interest income on the advances made under the Economic Interest Participation Agreement. UDF III’s economic interest in the UMT Loan gives UDF III the right to receive payment from UMT of principal and accrued interest relating to amounts funded by UDF III to UMT which are applied towards UMT’s funding obligations to UDF under the UMT Loan. UDF III may abate its funding obligations under the Economic Participation Agreement at any time for a period of up to twelve months by giving UMT notice of the abatement.

The Option gives UDF III the right to convert its economic interest into a full ownership participation interest in the UMT Loan at any time by giving written notice to UMT and paying an exercise price of $100. The participation interest includes all rights incidental to ownership of the UMT Loan and the Security Agreement, including participation in the management and control of the UMT Loan. UMT will continue to manage and control the UMT Loan while UDF III owns an economic interest in the UMT Loan. If UDF III exercises its Option and acquires a participation interest in the UMT Loan, UMT will serve as the loan administrator but both UDF III and UMT will participate in the control and management of the UMT Loan. At both June 30, 2012 and December 31, 2011, UDF III had funded approximately $71,367,000 to UDF under this agreement of which approximately $65,504,000 was outstanding under the Economic Interest Participation Agreement at both June 30, 2012 and December 31, 2011. UMT had funded approximately $5,863,000 to UDF under this agreement at both June 30, 2012 and December 31, 2011.

On June 21, 2010, UDF entered into a new promissory note agreement with a private investor, the proceeds from which were used to pay off an existing credit facility that UDF had with Textron Financial Corporation in full. Pursuant with this transaction, the Company entered into a second amendment to our subordination and intercreditor agreement which subordinates the UMT loan to the new loan from the private investor, reducing the amount subject to subordination from $30,000,000 to $15,000,000

8) Loans made to affiliates of the Advisor. Below is a table of the aggregate principal amount of mortgages funded during the quarters ended June 30, 2012 and 2011, respectively, to the companies affiliated with the Advisor, and named in the table and aggregate amount of draws made by UDF under the line of credit, during the two quarters indicated:

| Affiliated Company | 2012 | 2011 |

| UMTHLC | $332,000 | $621,000 |

9) As of August 1, 2006, (now subject to an Advisory Agreement effective January 1, 2009) the Company entered into an Advisory Agreement with UMTHGS. Under the terms of the agreement, UMTHGS is paid a monthly trust administration fee. The fee is calculated monthly depending on the Company’s annual distribution rate, ranging from 1/12th of 1% up to 1/12th of 2% of the amount of average invested assets per month. During the six months ended June 30, 2012 and June 30, 2011, the expenses for the Company’s Advisor were $500,000, and $500,000, respectively, and actual payments made were approximately, $421,000 and $156,000, respectively. The Advisor and its affiliates are also entitled to reimbursement of costs of goods, materials and services obtained from unaffiliated third parties for the Company’s benefit, except for note servicing and for travel and expenses incurred in connection with efforts to acquire investments for the Company or to dispose of any of its investments. The Company paid the Advisor $19,000 and $38,000, as reimbursement for costs of $38,000, associated with providing shareholder relations activities during the six months ending June 30, 2012 and June 30, 2011, respectively.

| 12 |

The agreement also provides for a subordinated incentive fee equal to 25% of the amount by which the Company’s net income for a year exceeds a 10% per annum non-compounded cumulative return on its adjusted contributions. No incentive fee was paid during 2012 or 2011. In addition, for each year in which it receives a subordinated incentive fee, the Advisor will receive a 5-year option to purchase 10,000 Shares at a price of $20.00 per share (not to exceed 50,000 shares). As of June 30, 2012, the Advisor has not received options to purchase shares under this arrangement.

The Advisory Agreement provides for the Advisor to pay all of the Company’s expenses and for the Company to reimburse the Advisor for any third-party expenses that should have been paid by the Company but which were instead paid by the Advisor. However, the Advisor remains obligated to pay: (1) the employment expenses of its employees, (2) its rent, utilities and other office expenses and (3) the cost of other items that are part of the Advisor's overhead that is directly related to the performance of services for which it otherwise receives fees from the Company.

The Advisory Agreement also provides for the Company to pay to the Advisor, or an Affiliate of the Advisor, a debt placement fee. The Company may engage the Advisor, or an Affiliate of the Advisor, to negotiate lines of credit on behalf of the Company. UMT shall pay a negotiated fee, not to exceed 1% of the amount of the line of credit secured, upon successful placement of the line of credit. During six months ending June 30, 2012, and June 30, 2011, the Company paid debt placement fees of approximately $0, and $43,000 to an affiliate of the Advisor, while expensing approximately $15,000, and $10,000, respectively. These fees are amortized monthly, as an adjustment to interest expense, over the term of the credit facility agreements described in Note 6.

10) The Company pays loan servicing fees to PSC, a subsidiary of UMTH, under the terms of a Mortgage Servicing Agreement. The Company paid loan servicing fees of approximately $11,000, and $12,000, during the six months ending June 30, 2012 and June 30, 2011, respectively.

11) The Company pays “guarantee” credit enhancement fees to UDF III, affiliate of PSC and UDF, as specified under the terms of the UDF Guarantee agreement. In three months ending June 30, 2012 and June 30, 2011, the Company made payments in the amounts of $17,000 and $13,000, respectively. In the six months ending June 30, 2012 and June 30, 2011, the related credit enhancement expenses were approximately $43,000 and $25,000, respectively.

12) Affiliates UDF LOF, UDF IV and UDF X, are reimbursed for their degree of invested “participatory” interest in the Company’s construction loans, the degree of invested interest is not to exceed $2,000,000. The Company made payments of such participation interest, as a net amount against the construction loan interest, in six months ending June 30, 2012 and June 30, 2011, in the amounts of approximately $723,000 and $331,000, respectively.

13) The Company pays UMTH LD, administrative and origination fees, for the construction loans in which UDF affiliates take an invested interest in. The fees are withheld from construction draws funded to the borrower, and are in turn paid directly to UMTH LD. In the six months ending June 30, 2012 and June 30, 2011, payments were made for the above administrative and origination fees in the amounts of approximately $110,000 and $77,000, respectively.

| 13 |

The table below summarizes the approximate payments associated with related parties for the three months ended June 30, 2012 and 2011:

| Related Party Payments: | |||||||||

| For Three Months Ended | |||||||||

| Payee | Purpose | June 30, 2012 | June 30, 2011 | ||||||

| UMTHGS | Trust administration fees | $ 47,000 | 71% | $ 74,000 | 80% | ||||

| UMTHGS | General & administrative - Shareholder Relations | 19,000 | 29% | 19,000 | 20% | ||||

| UMTHGS | General & administrative –Misc. | - | 0% | - | 0% | ||||

| $ 66,000 | 100% | $ 93,000 | 100% | ||||||

| PSC | Loan Servicing Fee | $ 5,000 | 100% | $ 5,000 | 100% | ||||

| PSC | General & Administrative – Misc. | - | 0% | - | 0% | ||||

| $ 5,000 | 100% | $ 5,000 | 100% | ||||||

| UMTH | Debt Placement Fees | - | - | 43,000 | 100% | ||||

| UDF III | Credit Enhancement Fees | 16,000 | 100% | 13,000 | 100% | ||||

| UDF LOF | Participation Interest Paid | - | - | 79,000 | 100% | ||||

| UDF IV | Participation Interest Paid | 270,000 | 100% | 78,000 | 100% | ||||

| UDF X | Participation Interest Paid | 13,000 | 100% | 13,000 | 100% | ||||

| UMTH LD | Admin and Origination Fees Paid | 4,000 | 100% | 52,000 | 100% | ||||

The table below summarizes the approximate expenses associated with related parties for the three months ended June 30, 2012 and 2011:

|

Related Party Expenses: | |||||||||

| For Three Months Ended | |||||||||

| Payee | Purpose | June 30, 2012 | June 30, 2011 | ||||||

| UMTHGS | Trust administration fees | $ 250,000 | 93% | $ 250,000 | 93% | ||||

| UMTHGS | General & administrative - Shareholder Relations | 19,000 | 7% | 19,000 | 7% | ||||

| UMTHGS | General & administrative –Misc. | 1,000 | 0% | - | 0% | ||||

| $ 270,000 | 100% | $ 269,000 | 100% | ||||||

| PSC | Loan Servicing Fee | $ 5,000 | 100% | $ 5,000 | 100% | ||||

| PSC | General & Administrative – Misc. | - | 0% | - | 0% | ||||

| $ 5,000 | 100% | $ 5,000 | 100% | ||||||

| UMTH | Debt Placement Fees | 8,000 | 100% | 5,000 | 100% | ||||

| UDF III | Credit Enhancement Fees | 22,000 | 100% | 13,000 | 100% | ||||

| 14 |

The table below summarizes the approximate payments associated with related parties for the six months ended June 30, 2012 and 2011:

| Related Party Payments: | |||||||||

| For Six Months Ended | |||||||||

| Payee | Purpose | June 30, 2012 | June 30, 2011 | ||||||

| UMTHGS | Trust administration fees | $ 421,000 | 96% | $ 156,000 | 80% | ||||

| UMTHGS | General & administrative - Shareholder Relations | 19,000 | 4% | 38,000 | 19% | ||||

| UMTHGS | General & administrative –Misc. | - | 0% | 2,000 | 1% | ||||

| $ 440,000 | 100% | $ 196,000 | 100% | ||||||

| PSC | Loan Servicing Fee | $ 11,000 | 100% | $ 12,000 | 92% | ||||

| PSC | General & Administrative – Misc. | - | 0% | 1,000 | 8% | ||||

| $ 11,000 | 100% | $ 13,000 | 100% | ||||||

| UMTH | Debt Placement Fees | - | - | 43,000 | 100% | ||||

| UDF III | Credit Enhancement Fees | 17,000 | 100% | 13,000 | 100% | ||||

| UDF LOF | Participation Interest Paid | - | - | 186,000 | 100% | ||||

| UDF IV | Participation Interest Paid | 700,000 | 100% | 120,000 | 100% | ||||

| UDF X | Participation Interest Paid | 23,000 | 100% | 25,000 | 100% | ||||

| UMTH LD | Admin and Origination Fees Paid | 110,000 | 100% | 77,000 | 100% | ||||

The table below summarizes the approximate expenses associated with related parties for the six months ended June 30, 2012 and 2011:

| Related Party Expenses: | |||||||||

| For Six Months Ended | |||||||||

| Payee | Purpose | June 30, 2012 | June 30, 2011 | ||||||

| UMTHGS | Trust administration fees | $ 500,000 | 93% | $ 500,000 | 93% | ||||

| UMTHGS | General & administrative - Shareholder Relations | 38,000 | 7% | 38,000 | 7% | ||||

| UMTHGS | General & administrative –Misc. | 1,000 | 0% | 1,000 | 0% | ||||

| $ 539,000 | 100% | $ 539,000 | 100% | ||||||

| PSC | Loan Servicing Fee | $ 11,000 | 100% | $ 12,000 | 75% | ||||

| PSC | General & Administrative – Misc. | - | 0% | 4,000 | 25% | ||||

| $ 11,000 | 100% | $ 16,000 | 100% | ||||||

| UMTH | Debt Placement Fees | 15,000 | 100% | 10,000 | 100% | ||||

| UDF III | Credit Enhancement Fees | 43,000 | 100% | 25,000 | 100% | ||||

5. Fair Value of Financial Instruments

In accordance with the reporting requirements of Accounting Standards Codification (“ASC”) 825, Disclosures About Fair Value of Financial Instruments, the Company calculates the fair value of its assets and liabilities that qualify as financial instruments under this statement and includes additional information in notes to the Company’s consolidated financial statements when the fair value is different than the carrying value of those financial instruments. The estimated fair value of accrued interest receivable, accrued interest receivable affiliates and accounts payable and accrued liabilities (including affiliates) approximate the carrying value due to the relatively short maturity of these instruments. The carrying value of investments in residential mortgages, interim mortgages (including affiliates), lines of credit (including affiliates), recourse obligations from affiliates, notes payable, deficiency notes (including affiliates) and the Company’s line of credit payable also approximate fair value since these instruments bear market rates of interest. None of these instruments are held for trading purposes.

| 15 |

6. Lines of Credit Payable

During August 2009, the Company entered into a term line of credit facility with a bank for $5,000,000. The line of credit bears interest at prime plus one percent, with a floor of 5.50% and requires monthly interest payments. Principal and all unpaid interest will be due at maturity, which is August 29, 2012. The line is collateralized by a first lien security interest in the underlying real estate financed by the line of credit. The outstanding balance on this line of credit was approximately $3,618,000 and $4,143,000 at June 30, 2012 and December 31, 2011, respectively.

On May 27, 2011, the Company entered into a term line of credit facility with a bank for $4,300,000. The loan bears interest at prime plus one percent, with a floor of 5.0%, and requires monthly interest payments. Principal and all unpaid interest will be due at maturity which is May 27, 2014. The loan is collateralized by a first lien security interest in the underlying real estate financed by the loan. The outstanding balance on this loan at June 30, 2012 and December 31, 2011 was approximately $4,012,000, and $2,253,000, respectively.

On August 1, 2011, the Company entered into a term line of credit facility with a bank for $250,000. The loan bears interest at prime plus one percent, with a floor of 4.75%, and requires monthly interest payments. Principal and all unpaid interest will be due at maturity which is August 1, 2012. This loan was collateralized by a first lien security interest in the underlying real estate financed by the loan. This line of credit was paid in full in May 2012, and the outstanding balance on this loan at June 30, 2012 and December 31, 2011, was approximately $0, and $104,000, respectively.

On October 26, 2011, the Company entered into a term line of credit facility with a bank for $5,000,000. The loan bears interest at prime plus one percent, with a floor of 5.0%, and requires monthly interest payments. Principal and all unpaid interest will be due at maturity which is October 26, 2014. The loan is collateralized by a first lien security interest in the underlying real estate financed by the loan. The outstanding balance on this loan at June 30, 2012 and December 31, 2011, was approximately $108,000, and $181,000, respectively.

The Company was in compliance with all of its debt covenants as of June 30, 2012.

7. Notes Payable

In March, 2010, the Company sold two residential mortgage loans, with full recourse, to unaffiliated investors for approximately $169,000. These sales were accounted for as recourse borrowings. The notes require monthly principal and interest payments at a rate of 9.5% amortized over 30 years with all unpaid principal and interest due at maturity. One loan had a balance of approximately $69,000 at June 30, 2012 and approximately $70,000 at December 31, 2011, and matures on May 1, 2015. The other loan had a balance of approximately $97,000 on June 30, 2012 and December 31, 2011, and matures on November 23, 2013. The total outstanding balance on these notes was approximately $166,000 and $167,000, at June 30, 2012 and December 31, 2011, respectively.

On April 21, 2010, the Company entered into a term loan credit facility with a bank for $1,600,000. The loan bears interest at prime plus one percent, with a floor of 7.0%, and requires monthly interest payments. Principal and all unpaid interest was due at maturity which was October 21, 2011. In December 2011, the term loan credit facility was extended through December 19, 2012, and the interest rate was reduced from 7.0% to 5.5%. The loan is collateralized by a first lien security interest in the underlying real estate financed by the loan. The outstanding balance on this loan at June 30, 2012 and December 31, 2011, was approximately $1,107,000.

On January 27, 2011, United Mortgage Trust initiated a private offering of Secured Subordinated Notes (“Notes,” to accredited investors “Note Holders”). The Notes are being offered through a wholly owned and consolidated subsidiary, UMT Home Finance II, L.P. (“HF II”). HF II is a Delaware limited partnership that was formed on November 29, 2010 as a Special Purpose Entity, for the purpose of originating and holding loans made to fund the acquisition of finished lots and the construction of single-family homes on the subject lots (“Loans”). HF II will issue up to $5 million in 7.5% Notes. The Notes will be secured by an undivided security interest on the pool of loans owned by HF II. The offering of the Notes is not registered under the Securities Act, in reliance upon the exemption from registration for non-public offerings provided by Rule 506 of Regulation D promulgated under the Securities Act of 1933. As of June 30, 2012, approximately $972,000 was outstanding, and as of December 31, 2011, approximately $300,000 was outstanding. Approximately $100,000, $150,000, $50,000, $500,000, $75,000, and $97,000 matures on, March 1, 2016, April 1, 2016, April 1, 2017, August 1, 2017, September 1, 2017, and March 1, 2018, respectively.

| 16 |

8. Share Redemption Program

There is currently no established public trading market for our shares. As an alternative means of providing limited liquidity for our shareholders, we maintain a Share Redemption Plan, (“SRP”). Our trustees have the discretion to modify or terminate the SRP upon 30 days’ notice. Under the terms of our plan as modified and effective on May 1, 2009 (see below for a further description of the plan modifications), shareholders who have held their shares for at least one year are eligible to request that we repurchase their shares. In any consecutive 12 month period we may not repurchase more than 5% of the outstanding shares at the beginning of the 12 month period. The repurchase price is based on the “Net Asset Value” (NAV) as of the end of the month prior to the month in which the redemption is made. The NAV will be established by our Board of Trustees no less frequently than each calendar quarter. For reference, at June 30, 2012 and December 31, 2011, the NAV was $15.22 and $15.39 per share, respectively. Under the prior SRP terms, the redemption price was $20.00 per share. The Company will waive the one-year holding period ordinarily required for eligibility for redemption and will redeem shares for hardship requests. A “hardship” redemption is (i) upon the request of the estate, heir or beneficiary of a deceased shareholder made within two years of the death of the shareholder; (ii) upon the disability of a shareholder or such shareholder’s need for long-term care, providing that the condition causing such disability or need for long term care was not pre-existing at the time the shareholder purchased the shares and that the request is made within 270 days after the onset of disability or the need for long term care; and (iii) in the discretion of the Board of Trustees, due to other involuntary exigent circumstances of the shareholder, such as bankruptcy, provided that the request is made within 270 days after of the event giving rise to such exigent circumstances. Previously, there was no hardship exemption. Shares will be redeemed quarterly in the order that they are presented. Any shares not redeemed in any quarter will be carried forward to the subsequent quarter unless the redemption request is withdrawn by the shareholder. Previously, shares were redeemed monthly. Repurchases are subject to cash availability and Trustee discretion. Previously, the SRP provided that repurchases were subject to the availability of cash from the DRIP or the Company’s credit line. We have also purchased a limited number of shares outside of our SRP from shareholders with special hardship considerations.

Share repurchases have been at prices between $15.25 and $20 per share. Shares repurchased at the lower price were 1) shares held by shareholders for less than 12 months or 2) shares purchased outside of our SRP. Our stated NAV at June 30, 2012 and December 31, 2011, was $15.22 and $15.39 per share, respectively.

The Company complies with Distinguishing Liabilities from Equity topic of FASB Accounting Standards Codification, which requires, among other things, that financial instruments that represent a mandatory obligation of the Company to repurchase shares be classified as liabilities and reported at settlement value. We believe that shares tendered for redemption by the shareholder under the Company’s share redemption program do not represent a mandatory obligation until such redemptions are approved at the discretion of our board of trustees. At such time, we will reclassify such obligations from equity to an accrued liability based upon their respective settlement values. As of June 30, 2012, we had approximately $27,000 of approved redemption requests included in our liabilities. These shares were redeemed in July 2012.

The following table sets forth information relating to shares of beneficial interest repurchased into treasury during the period covered by this report.

| Month | Total number of shares repurchased | Average Purchase Price | Total number of shares purchased as part of a publicly announced plan | Total number of shares purchased outside of plan | ||||||||||||||

| January | 302 | $ | 15.50 | 302 | - | |||||||||||||

| February | 2,298 | $ | 15.50 | 2,298 | - | |||||||||||||

| March | 1,332 | $ | 15.50 | 1,332 | - | |||||||||||||

| April | 1,849 | $ | 15.39 | 1,849 | - | |||||||||||||

| May | 2,233 | $ | 15.37 | 2,233 | - | |||||||||||||

| June | 1,212 | $ | 15.29 | 1,212 | - | |||||||||||||

| Totals | 9,226 | $ | 15.41 | 9,226 | - | |||||||||||||

| 17 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

This Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements involve known and unknown risks, uncertainties, and other factors which may cause our actual results, performance, or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the availability of and our ability to find suitable mortgage investments; the difficulties of the real estate industry generally in response to the “sub-prime crisis,” the “credit crisis,” the current difficulties in the housing and mortgage financing markets including the impact thereof on the homebuilding industry, the current U.S. and global economic environment and changes in economic and credit market conditions in response to credit and monetary issues in Europe, the impact of tax law changes, changes in interest rates, our ability to adapt to changing circumstances, the continued financial viability of affiliates to whom we have extended loans, the level of reinvestment of dividends by our shareholders in our dividend reinvestment plan and the requirement to maintain qualification as a real estate investment trust. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore we cannot give assurance that such statements included in this Form 10-Q will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or by any other person that the results or conditions described in such statements or in our objectives and plans will be realized. Readers should carefully review our financial statements and the notes thereto contained in our Annual Report on Form 10-K for the year ended December 31, 2011, as well as those statements contained in this report, and in our other filings with the Securities and Exchange Commission.

In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Form 10-Q may not occur. We undertake no obligation to update or revise our forward-looking statements, whether as a result of new information, future events or otherwise.

General Investment Information

United Mortgage Trust (the “Company”) is a Maryland real estate investment trust that qualifies as a real estate investment trust (a “REIT”) under federal income tax laws. Our principal investment objectives are to invest proceeds from our dividend reinvestment plan, financing proceeds, capital transaction proceeds and retained earnings in following types of investments:

| (i) | lines of credit and secured loans for the acquisition and development of single-family home lots, referred to as “Land Development Loans”; |

| (ii) | lines of credit and loans secured by developed single-family lots, referred to as “Finished Lot Loans”; |

| (iii) | lines of credit and loans secured by completed model homes, referred to as “Model Home Loans”; |

| (iv) | loans provided to entities that have recently filed for bankruptcy protection under Chapter 11 of the US bankruptcy code, secured by a priority lien over pre-bankruptcy secured creditors, referred to as “Debtor in Possession Loans”; |

| (v) | lines of credit and loans, with terms of 18 months or less, secured by single family lots and homes constructed thereon, referred to as “Construction Loans”; |

| (vi) | to provide credit enhancements to real estate developers, homebuilders, land bankers and other real estate investors who acquire real property, subdivide real property into single-family residential lots, acquire finished lots and/or build homes on such lots; and |

| (vii) | discounted cash flows secured by assessments levied on real property. |

| 18 |

We collectively refer to the above listed loans as “Mortgage Investments”. Additionally, our portfolio includes obligations of affiliates of our Advisor, which we refer to as “recourse loans” and deficiency notes. Loans are originated by others to the Company’s specifications or to specifications approved by the Company. Most, if not all, of such loans are not insured or guaranteed by a federally owned or guaranteed mortgage agency.

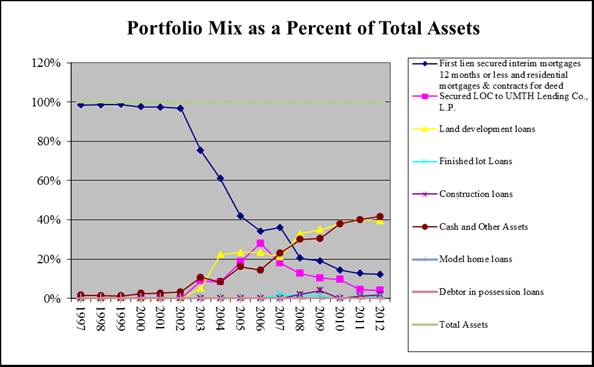

The following table illustrates the percentage of our mortgage portfolio dedicated to each mortgage loan category as of June 30, 2012 and December 31, 2011:

| Mortgage Category: | June 30, 2012 | December 31, 2011 | ||||||

| First lien secured interim mortgages 12 months or less and residential mortgages and contracts for deed | 21 | % | 21 | % | ||||

| Secured interim mortgages and line of credit to UMTHLC | 7 | % | 7 | % | ||||

| Land development loans | 67 | % | 68 | % | ||||

| Finished lot loans | 2 | % | 2 | % | ||||

| Construction loans | 3 | % | 2 | % | ||||

| 19 |

The following table summarizes mortgage loans by type and original loan amount held by United Mortgage Trust at June 30, 2012.

| Description | No. of Loans | Interest Rate | Final Maturity Date | Periodic Payment Terms | Prior Liens | Face amount of Mortgage (1) | Carrying amount of Mortgage (2) | Past Due

Amounts (3) | ||||||||

| Single family residential 1st mortgages and interim loans (5): | ||||||||||||||||

| Original balance > $100,000 | 6 | 10% - 11% | 11/24/11– 5/1/38 | n/a | n/a | $898,119 | $845,998 | $2,609 | ||||||||

| Original balance $50,000 - $99,999 | 179 | 8.5% - 12.75% | 5/8/13 – 3/1/39 | n/a | n/a | 3,348,364 | 3,154,046 | 31,026 | ||||||||

| Original balance $20,000 - $49,999 | 116 | 9% - 14.5% | 12/1/10 – 5/19/36 | n/a | n/a | 1,563,345 | 1,472,618 | 19,960 | ||||||||

| Original balance under $20,000 | 8 | 9% - 14.5% | 12/1/11-9/1/31 | n/a | n/a | 47,133 | 44,398 | 412 | ||||||||

| First Lien secured interim mortgages | ||||||||||||||||

| Ready America Funding (4) | 10 | 14% | n/a | n/a | n/a | 16,292,877 | 16,292,877 | - | ||||||||

| Secured, LOC to UMTH Lending Co., L.P. (4), (5) | 1 | 12.5% - 13.5% | n/a | n/a | n/a | 7,309,365 | 7,309,365 | - | ||||||||

| Land Development Loans | ||||||||||||||||

| UDF III Economic Interest Participation | 2 | 14% | 12/31/10 | n/a | n/a | 71,366,686 | 71,366,686 | - | ||||||||

| Construction Loans | 5 | 13% | 10/28/10-6/10/2014 | n/a | n/a | 5,049,006 | 5,049,006 | - | ||||||||

| Totals | 327 | $105,874,895 | $105,534,994 | $54,007 |

| (1) | Current book value of loans. |

| (2) | Net of allowance for loan losses on mortgage loans of $339,901 at June 30, 2012. |

| (3) | Principal amounts greater than thirty (30) days past due. |

| (4) | Lines of credit with Ready America Funding and UMTH Lending Co., L.P. are collateralized by 10 and 1 loans, respectively. Principal amounts due upon disposition of assets. |

| (5) | The Company has a first lien collateral position in these loans funded by the originator. The advances to the originator do not have specific maturity dates. |

Below is a reconciliation and walk forward of mortgage loans, net of allowance for loan losses, for the three months ended June 30, 2012.

| Balance at beginning of period | $ | 105,507,743 | ||

| Additions during period: | ||||

| Deductions during period: | ||||

| Collections of principal, net | 963,679 | |||

| Other decreases, net | (826,538 | ) | ||

| Foreclosures | (110,476 | ) | ||

| Other (net change in allowance for loan loss) | 586 | |||

| Balance at close of period | $ | 105,534,994 |

| 20 |

Material Trends Affecting Our Business

We are a real estate investment trust and derive a substantial portion of our income from loans secured by single-family homes (both finished homes and homes under construction), single-family home lots, and entitled land under development into single-family home lots. We continue to concentrate our investment activities in the southwest sections of the United States, particularly in Texas. We believe these areas continue to experience demand for new construction of single-family homes, however the U.S. housing market suffered declines over the past four years, particularly in geographic areas that had experienced rapid growth, steep increases in property values and speculation. However, we expect to see continued healthy demand for our products as the supply of new homes, finished lots and land is once again aligned with our market demand.

We believe that the housing market reached a bottom and continues to recover. This recovery will continue to be regional in its early stages, led by those housing markets with balanced supply, affordable and stable home prices, lower levels of foreclosures, strong economies, and strong demand fundamentals. Nationally, we expect the housing recovery will continue to slowly strengthen as excess inventories of new and existing homes get absorbed and household balance sheets are restored in each market. The Federal Reserve has indicated that it intends to keep reserve interest rates at historic lows through the end of 2014. This easing policy coupled with extensive price correction over the past several years has restored housing affordability across the country. We believe that continued strengthening of the recovery depends on the continued recovery of consumer health and confidence. The national consumer confidence index, which fell to record lows during the economic downturn, has recovered somewhat, but remains closer to levels historically associated with recession than to normalized conditions. We believe consumers continue to remain cautious due to uncertainty present in many economic sectors, particularly with regards to the European debt crisis and the anticipated federal fiscal tightening scheduled for January 2013, and we expect the markets that participated most heavily in the housing bubble will continue to lag the overall recovery, as consumers in those markets have generally suffered greater losses of household wealth from the declines in home prices and equity and continue experience higher levels of unemployment relative to the nation as a whole.

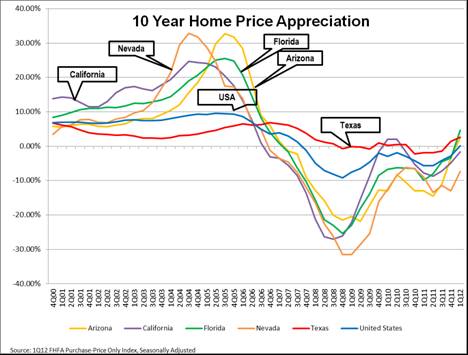

Unemployment remains elevated and access to conventional real estate and commercial financing remains challenging in many parts of the country. These factors continue pose obstacles to a robust recovery on a national scale, which, we believe, is contingent upon the reengagement of the consumer and the return of final demand. However, as inventory levels continue to decline and housing prices stabilize, we expect the recovery to gain strength. We continue to believe the recovery will be stronger in markets such as Texas, where consumer confidence averaged more than 22 points higher than the national index from June 2011 to June 2012; where the job growth rate over the past 12 months was approximately 80 basis points higher than the national rate; and where approximately 15.7% of all single-family homebuilding permits in the country were issued in 2011. Further, according to the Bureau of Labor Statistics, nearly 20% of the total net new jobs created in the United States since the official end of the national recession were created in Texas (from June 2009 to June 2012). Currently, the majority of our portfolio relates to property located in the state of Texas, and we intend to invest in markets that demonstrate similarly sound economic and demand fundamentals – fundamentals that we believe will be the drivers of the recovery – and balanced supplies of homes and finished lots. We believe the fact that new single-family home permits, starts, and sales have all risen from their respective lows reflects a continued return of real demand for new homes. However, we anticipate the former bubble market states – principally California, Arizona, Nevada and Florida – will be slower to recover, as those markets have seen overbuilding and extensive price correction and are experiencing weakened economies and continued foreclosures. These conditions have caused significant weakness among consumers in these markets, and losses of property tax revenue, sales and use tax revenue, and budget imbalances have, in many cases, led to significant fiscal difficulties at the state and municipal levels associated with these former bubble markets.

From a national perspective, ongoing credit constriction, a less robust economic recovery, continued high unemployment, and housing price instability have made potential new home purchasers and real estate lenders cautious. As a result of these factors, the national housing market experienced a protracted decline, and the time necessary to correct the market likely means a corresponding slower recovery for the housing industry relative to historical trends. However, improving fundamentals such as price stability, high home affordability, and continued inventory absorption housing recovery indicates to us that the recovery will continue to gain strength in the coming quarters.

| 21 |

Nationally, capital constraints at the heart of the credit crisis have reduced the number of real estate lenders able or willing to finance development, construction or the purchase of homes and have increased the number of undercapitalized or failed builders and developers. In correlation, the number of new homes and finished lots developed has decreased and remains near historic lows, which may result in a shortage of new homes and developed lots in select real estate markets in 2012. We believe this shortage will be most prominent in markets that did not participate in the housing bubble, avoiding overbuilding and maintaining balanced supplies and affordable and stable home prices. With lenders imposing stricter underwriting standards, mortgages to purchase homes have become more difficult to obtain in some markets. To support the secondary residential mortgage market and prevent further deterioration of mortgage lending, the Federal Reserve began an unprecedented program to purchase approximately $1.25 trillion of residential mortgage backed securities between January 5, 2009 and March 31, 2010. This program ended on March 31, 2010, as scheduled by the Federal Reserve. On September 21, 2011, the Federal Reserve announced that it would begin reinvesting the principal payments from its mortgage-backed securities holdings into additional purchases of agency mortgage-backed securities to help further support conditions in mortgage markets. Any limitations or restrictions on the availability of financing or on the liquidity provided in the secondary residential mortgage market by Government Sponsored Enterprises such as Fannie Mae and Freddie Mac could adversely affect interest rates and mortgage availability, which could cause the number of homebuyers to decrease, which could increase the likelihood of borrowers defaulting on our loans and, consequently, reduce our ability to pay distributions to our shareholders.

Nationally, new home sales rose slightly during the second quarter of 2012 from the pace of sales in the first quarter of 2012, though levels remain near historical lows. National fundamentals that drive home sales continue to improve in most markets and home affordability remains near record-highs, so we expect the pace of home sales will continue to increase over 2012. The U.S. Census Bureau reports that the sales of new single-family residential homes in June 2012 were at a seasonally adjusted annual rate of 350,000 units. While this number is down approximately 0.57% from the revised March 2012 figure of 352,000, it is up approximately 15.1% year-over-year from the June 2011 estimate of 304,000.

Nationally, new single-family home inventory continued to improve in the second quarter of 2012 as it has done consistently since the second quarter of 2007. Through much of the downturn, homebuilders reduced their starts and focused on selling their existing new home inventory. The number of new homes for sale fell by approximately 22,000 units from June 2011 to June 2012 and by 1,000 units in the second quarter of 2012. We believe that, with such reductions, the new home market has been restored to equilibrium in most markets, even at lower levels of demand; and the new home market is experiencing shortages in certain markets that did not participate in the housing bubble. The seasonally adjusted estimate of new homes for sale at the end of June 2012 was 144,000 -- a generally short supply of 4.9 months at the June 2012 sales rate and the second lowest number of homes available for sale since the U.S. Census Bureau began keeping records of this statistic in 1963, up from the record-low of 143,000 new homes for sale reported in May 2012. We believe that what is necessary now to regain prosperity in housing markets is the return of healthy levels of demand.

According to the U.S. Census Bureau, new single-family residential home permits and starts fell nationally from 2006 through early 2009, as a result and in anticipation of an elevated supply of and decreased demand for new single-family residential homes in that period. Since bottoming in early 2009, however, single-family permits and starts have improved significantly. Single-family homes authorized by building permits in June 2012 were at a seasonally adjusted annual rate of 493,000 units. This was an increase year-over-year of approximately 19.7% from the rate of 412,000 in June 2011, and is approximately 46.3% higher than the low of 337,000 set in January 2009. Single-family home starts for June 2012 stood at a seasonally adjusted annual rate of 539,000 units. This pace is up approximately 21.7% from the June 2011 estimate of 443,000 units. Further, the June 2012 pace of home starts is 52.7% higher than the low of 353,000 set in March 2009. Such increases suggest to us that new home inventories are generally in balance and the homebuilding industry now anticipates greater demand for new homes in coming months relative to the demand evident at the bottom of the new homebuilding cycle.

| 22 |