Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANDEAVOR | tso8kearningsreleaseq42014.htm |

| EX-99.1 - EARNINGS RELEASE - ANDEAVOR | exhibit991earningsreleaseq.htm |

4th Quarter Earnings Slides February 11, 2015 Exhibit 99.2

This Presentation includes and references “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things, expectations regarding refining margins, revenues, cash flows, capital expenditures, turnaround expenses and other financial items. These statements also relate to our business strategy, goals and expectations concerning our market position, future operations, margins and profitability. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “would” and similar terms and phrases to identify forward-looking statements in this Presentation, which speak only as of the date the statements were made. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. Forward Looking Statements 2

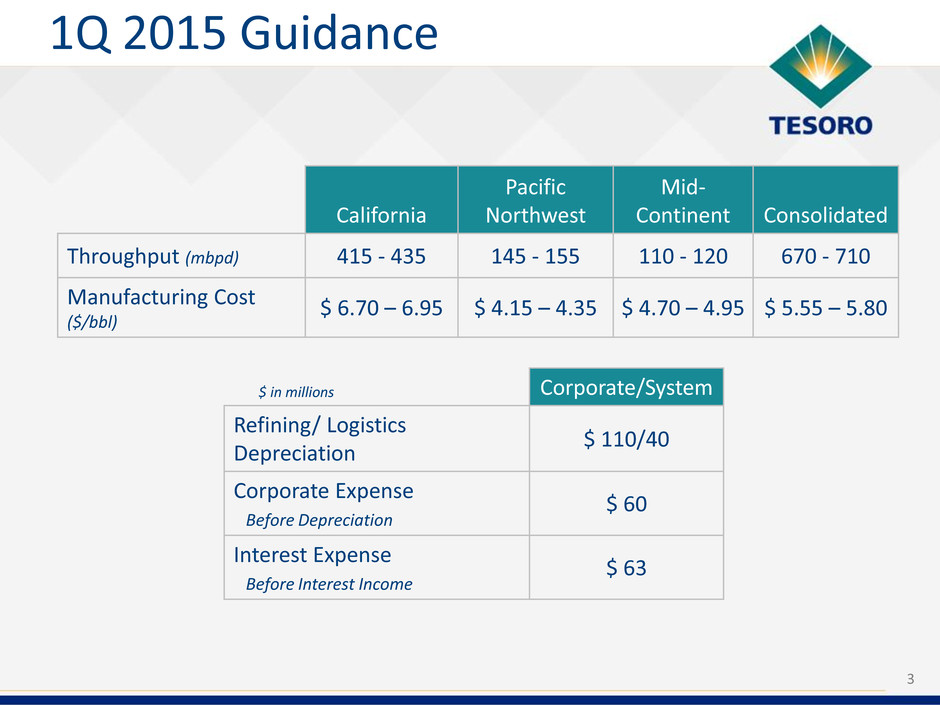

1Q 2015 Guidance 3 California Pacific Northwest Mid- Continent Consolidated Throughput (mbpd) 415 - 435 145 - 155 110 - 120 670 - 710 Manufacturing Cost ($/bbl) $ 6.70 – 6.95 $ 4.15 – 4.35 $ 4.70 – 4.95 $ 5.55 – 5.80 $ in millions Corporate/System Refining/ Logistics Depreciation $ 110/40 Corporate Expense Before Depreciation $ 60 Interest Expense Before Interest Income $ 63

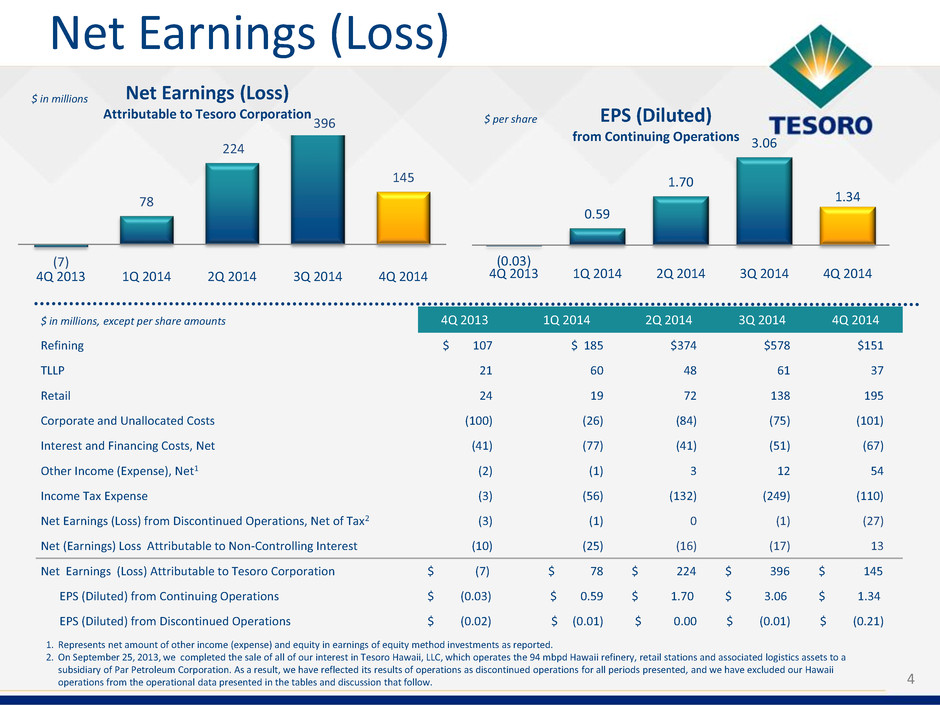

Net Earnings (Loss) 4 (0.03) 0.59 1.70 3.06 1.34 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 EPS (Diluted) from Continuing Operations $ per share $ in millions, except per share amounts 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Refining $ 107 $ 185 $374 $578 $151 TLLP 21 60 48 61 37 Retail 24 19 72 138 195 Corporate and Unallocated Costs (100) (26) (84) (75) (101) Interest and Financing Costs, Net (41) (77) (41) (51) (67) Other Income (Expense), Net1 (2) (1) 3 12 54 Income Tax Expense (3) (56) (132) (249) (110) Net Earnings (Loss) from Discontinued Operations, Net of Tax2 (3) (1) 0 (1) (27) Net (Earnings) Loss Attributable to Non-Controlling Interest (10) (25) (16) (17) 13 Net Earnings (Loss) Attributable to Tesoro Corporation $ (7) $ 78 $ 224 $ 396 $ 145 EPS (Diluted) from Continuing Operations $ (0.03) $ 0.59 $ 1.70 $ 3.06 $ 1.34 EPS (Diluted) from Discontinued Operations $ (0.02) $ (0.01) $ 0.00 $ (0.01) $ (0.21) 1. Represents net amount of other income (expense) and equity in earnings of equity method investments as reported. 2. On September 25, 2013, we completed the sale of all of our interest in Tesoro Hawaii, LLC, which operates the 94 mbpd Hawaii refinery, retail stations and associated logistics assets to a subsidiary of Par Petroleum Corporation. As a result, we have reflected its results of operations as discontinued operations for all periods presented, and we have excluded our Hawaii operations from the operational data presented in the tables and discussion that follow. (7) 78 224 145 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 Net Earnings (Loss) Attributable to Tesoro Corporation $ in millions 396

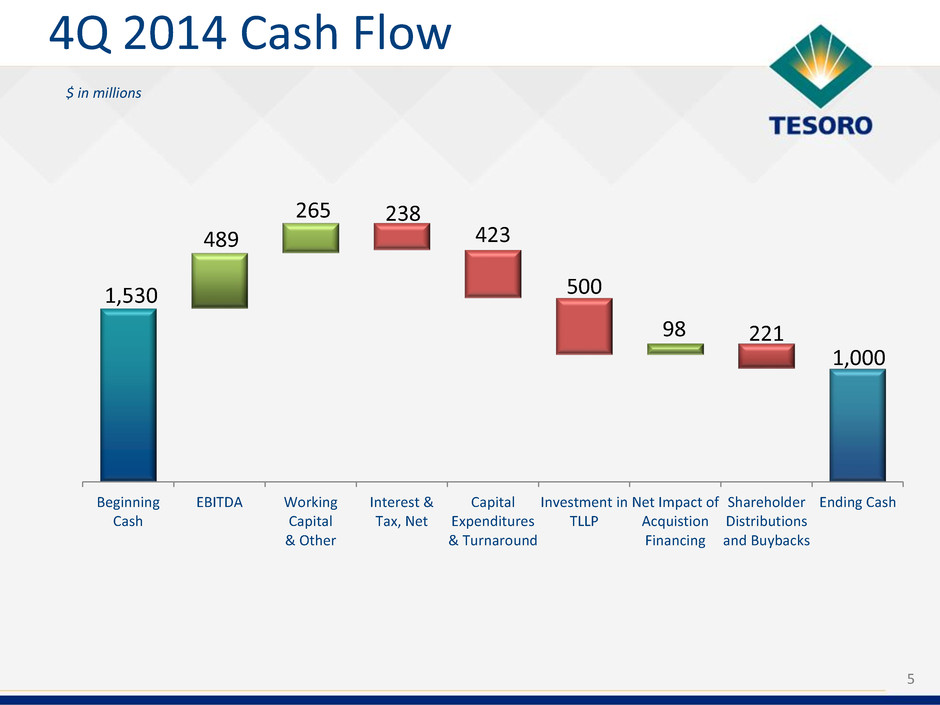

1,530 489 265 238 423 500 98 221 1,000 Beginning Cash EBITDA Working Capital & Other Interest & Tax, Net Capital Expenditures & Turnaround Investment in TLLP Net Impact of Acquistion Financing Shareholder Distributions and Buybacks Ending Cash 4Q 2014 Cash Flow 5 $ in millions

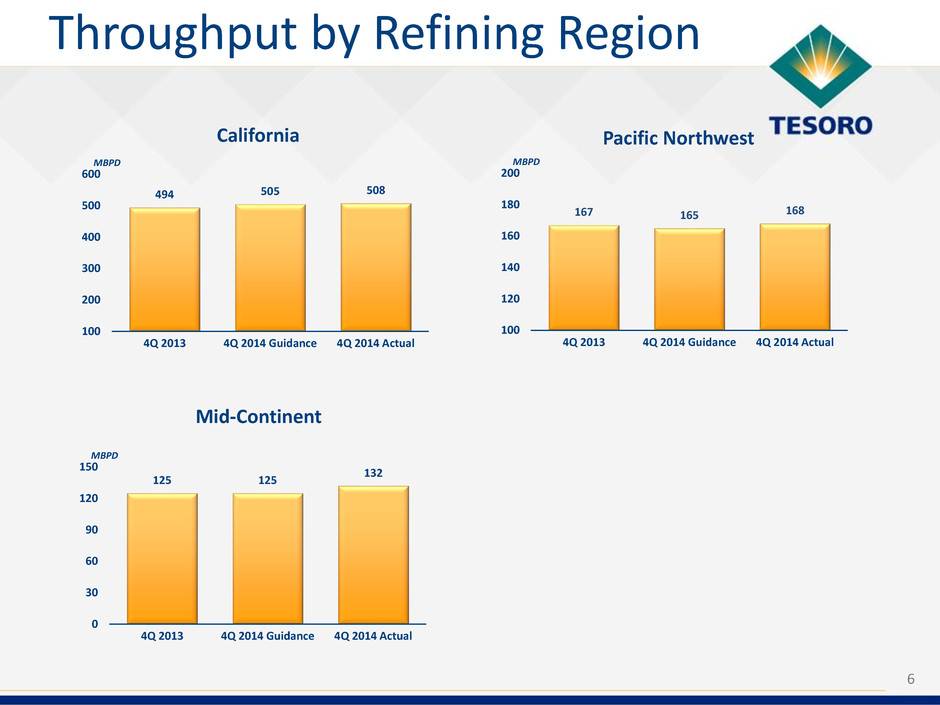

Throughput by Refining Region 6 167 165 168 100 120 140 160 180 200 4Q 2013 4Q 2014 Guidance 4Q 2014 Actual MBPD Pacific Northwest 125 125 132 0 30 60 90 120 150 4Q 2013 4Q 2014 Guidance 4Q 2014 Actual MBPD Mid-Continent 494 505 508 100 200 300 400 500 600 4Q 2013 4Q 2014 Guidance 4Q 2014 Actual MBPD California

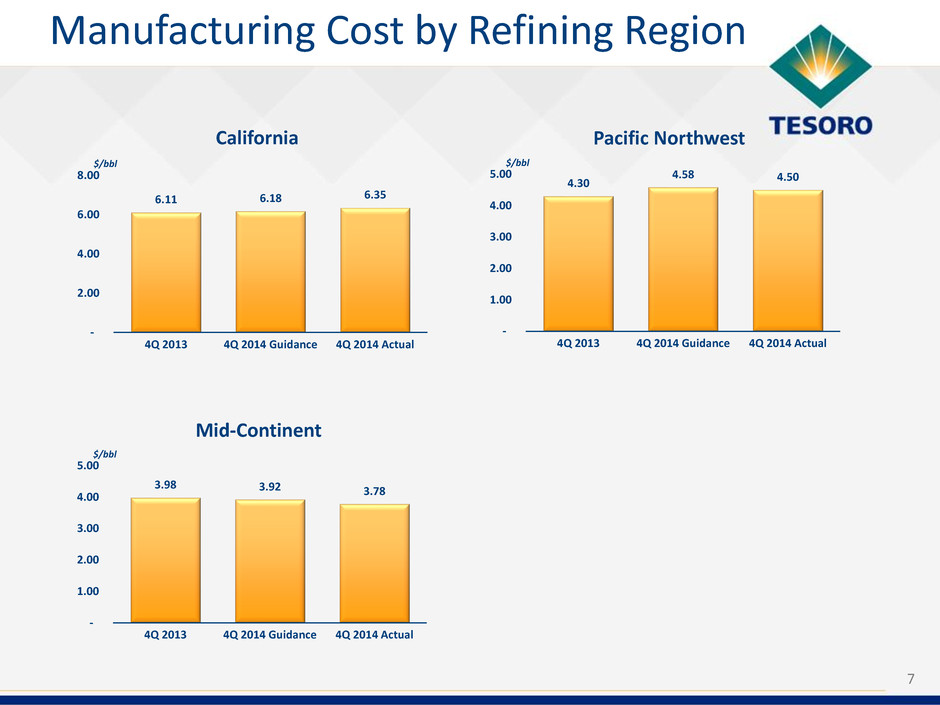

Manufacturing Cost by Refining Region 4.30 4.58 4.50 - 1.00 2.00 3.00 4.00 5.00 4Q 2013 4Q 2014 Guidance 4Q 2014 Actual $/bbl Pacific Northwest 3.98 3.92 3.78 - 1.00 2.00 3.00 4.00 5.00 4Q 2013 4Q 2014 Guidance 4Q 2014 Actual $/bbl Mid-Continent 6.11 6.18 6.35 - 2.00 4.00 6.00 8.00 4Q 2013 4Q 2014 Guidance 4Q 2014 Actual $/bbl California 7

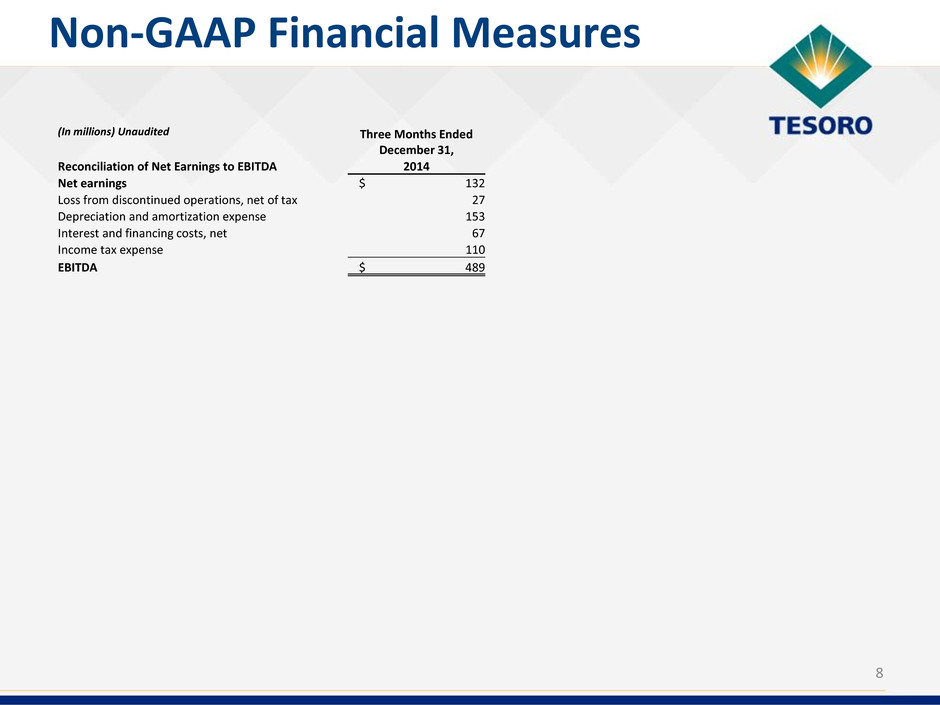

8 Non-GAAP Financial Measures (In millions) Unaudited Three Months Ended December 31, Reconciliation of Net Earnings to EBITDA 2014 Net earnings $ 132 Loss from discontinued operations, net of tax 27 Depreciation and amortization expense 153 Interest and financing costs, net 67 Income tax expense 110 EBITDA $ 489