Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 906 - ANDEAVOR | andv2q201810-qex322.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 906 - ANDEAVOR | andv2q201810-qex321.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 302 - ANDEAVOR | andv2q201810-qex312.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 - ANDEAVOR | andv2q201810-qex311.htm |

| EX-10.4 - AMENDMENT NO. 1 TO ALASKA TERMINALLING SERVICES AGREEMENT - ANDEAVOR | andv2q201810-qex104xalaska.htm |

| EX-10.3 - AMENDMENT NO. 1 TO MARTINEZ STORAGE SERVICES AGREEMENT - ANDEAVOR | andv2q201810-qex103xmartin.htm |

| EX-10.2 - AMENDMENT NO. 1 TO AVON MARINE TERMINAL USE AND THROUGHPUT AGREEMENT - ANDEAVOR | andv2q201810-qex102xavonmt.htm |

| EX-10.1 - AMENDMENT NO. 1 TO KENAI STORAGE SERVICES AGREEMENT - ANDEAVOR | andv2q201810-qex101xkenais.htm |

| EX-2.6 - AMENDMENT TO AGREEMENT AND PLAN OF MERGER - ANDEAVOR | andv2q201810-qex26xamendme.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________________to__________

Commission File Number 1‑3473

ANDEAVOR

(Exact name of registrant as specified in its charter)

Delaware |  | 95‑0862768 |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

19100 Ridgewood Pkwy, San Antonio, Texas 78259-1828 | ||

(Address of principal executive offices) (Zip Code) | ||

210-626-6000 | ||

(Registrant’s telephone number, including area code) | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | þ | Accelerated filer | o | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Emerging growth company | o | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

There were 151,125,987 shares of the registrant’s Common Stock outstanding at August 2, 2018.

Table of Contents | ||

Andeavor

Quarterly Report on Form 10-Q

For the Quarterly Period Ended June 30, 2018

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2.

2 | |  | |

Financial Statements | ||

Part I - Financial Statements

Item 1. Financial Statements

Andeavor

Condensed Statements of Consolidated Operations

(Unaudited)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(In millions, except per share amounts) | |||||||||||||||

Revenues (a) | $ | 12,472 | $ | 7,849 | $ | 22,772 | $ | 14,487 | |||||||

Costs and Expenses | |||||||||||||||

Cost of materials and other (excluding items shown separately below) (a) | 10,235 | 6,217 | 18,844 | 11,643 | |||||||||||

Lower of cost or market inventory valuation adjustment | — | 209 | — | 209 | |||||||||||

Operating expenses (excluding depreciation and amortization) | 918 | 740 | 1,784 | 1,395 | |||||||||||

Depreciation and amortization expenses | 292 | 240 | 574 | 466 | |||||||||||

General and administrative expenses | 179 | 247 | 352 | 382 | |||||||||||

(Gain) loss on asset disposals and impairments | 1 | (22 | ) | 1 | (21 | ) | |||||||||

Operating Income | 847 | 218 | 1,217 | 413 | |||||||||||

Interest and financing costs, net | (109 | ) | (96 | ) | (211 | ) | (194 | ) | |||||||

Equity in earnings of equity method investments | 11 | 3 | 21 | 3 | |||||||||||

Other income, net | — | 18 | 10 | 29 | |||||||||||

Earnings Before Income Taxes | 749 | 143 | 1,037 | 251 | |||||||||||

Income tax expense | 167 | 56 | 226 | 77 | |||||||||||

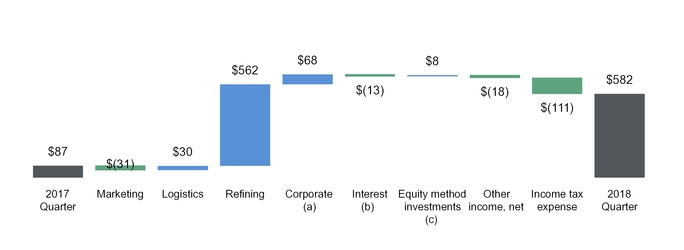

Net Earnings from Continuing Operations | 582 | 87 | 811 | 174 | |||||||||||

Earnings from discontinued operations, net of tax | — | — | 8 | — | |||||||||||

Net Earnings | 582 | 87 | 819 | 174 | |||||||||||

Less: Net earnings from continuing operations attributable to noncontrolling interest | 67 | 47 | 132 | 84 | |||||||||||

Net Earnings Attributable to Andeavor | $ | 515 | $ | 40 | $ | 687 | $ | 90 | |||||||

Net Earnings Attributable to Andeavor | |||||||||||||||

Continuing operations | $ | 515 | $ | 40 | $ | 679 | $ | 90 | |||||||

Discontinued operations | — | — | 8 | — | |||||||||||

Total | $ | 515 | $ | 40 | $ | 687 | $ | 90 | |||||||

Net Earnings per Share - Basic | |||||||||||||||

Continuing operations | $ | 3.41 | $ | 0.31 | $ | 4.47 | $ | 0.73 | |||||||

Discontinued operations | — | — | 0.05 | — | |||||||||||

Total | $ | 3.41 | $ | 0.31 | $ | 4.52 | $ | 0.73 | |||||||

Weighted average common shares outstanding - Basic | 151.1 | 130.8 | 152.0 | 124.0 | |||||||||||

Net Earnings per Share - Diluted | |||||||||||||||

Continuing operations | $ | 3.38 | $ | 0.31 | $ | 4.43 | $ | 0.72 | |||||||

Discontinued operations | — | — | 0.05 | — | |||||||||||

Total | $ | 3.38 | $ | 0.31 | $ | 4.48 | $ | 0.72 | |||||||

Weighted average common shares outstanding - Diluted | 152.6 | 131.7 | 153.5 | 125.0 | |||||||||||

Dividends per Share | $ | 0.59 | $ | 0.55 | $ | 1.18 | $ | 1.10 | |||||||

Supplemental Information | |||||||||||||||

(a) Excise taxes collected by our Marketing segment included in revenues. Refer to Note 12 in the accompanying notes for adoption of revenue recognition standards. | $ | — | $ | 153 | $ | — | $ | 287 | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

June 30, 2018 | 3 | ||

Financial Statements | ||

Andeavor

Condensed Consolidated Balance Sheets

(Unaudited)

June 30, 2018 | December 31, 2017 | ||||||

(In millions, except share data) | |||||||

Assets | |||||||

Current Assets | |||||||

Cash and cash equivalents (Andeavor Logistics: $44 and $75, respectively) | $ | 388 | $ | 543 | |||

Receivables, net of allowance for doubtful accounts (Andeavor Logistics: $200 and $219, respectively) | 2,623 | 1,961 | |||||

Inventories | 3,653 | 3,630 | |||||

Prepayments and other current assets | 496 | 749 | |||||

Total Current Assets | 7,160 | 6,883 | |||||

Property, Plant and Equipment, Net | |||||||

Property, plant and equipment, at cost | 19,834 | 18,823 | |||||

Accumulated depreciation and amortization | (4,389 | ) | (4,081 | ) | |||

Property, Plant and Equipment, Net (Andeavor Logistics: $5,625 and $5,413, respectively) | 15,445 | 14,742 | |||||

Goodwill (Andeavor Logistics: $712 and $692, respectively) | 3,288 | 3,234 | |||||

Acquired Intangibles, Net (Andeavor Logistics: $1,128 and $1,153, respectively) | 1,709 | 1,645 | |||||

Other Noncurrent Assets, Net (Andeavor Logistics: $404 and $406, respectively) | 2,472 | 2,069 | |||||

Total Assets | $ | 30,074 | $ | 28,573 | |||

Liabilities and Equity | |||||||

Current Liabilities | |||||||

Accounts payable | $ | 3,799 | $ | 3,330 | |||

Current maturities of debt | 28 | 17 | |||||

Other current liabilities | 1,227 | 1,654 | |||||

Total Current Liabilities | 5,054 | 5,001 | |||||

Deferred Income Taxes | 1,777 | 1,591 | |||||

Debt, Net of Unamortized Issuance Costs (Andeavor Logistics: $4,372 and $4,127, respectively) | 8,698 | 7,668 | |||||

Other Noncurrent Liabilities | 978 | 898 | |||||

Total Liabilities | 16,507 | 15,158 | |||||

Commitments and Contingencies (Note 9) | |||||||

Equity | |||||||

Andeavor Stockholders’ Equity | |||||||

Common stock, par value $0.162/3; authorized 300,000,000 shares; 200,797,146 shares issued (200,095,819 in 2017) | 33 | 33 | |||||

Additional paid-in capital | 5,269 | 5,224 | |||||

Retained earnings | 8,141 | 7,651 | |||||

Treasury stock, 49,675,841 common shares (46,810,338 in 2017), at cost | (3,123 | ) | (2,841 | ) | |||

Accumulated other comprehensive loss, net of tax | (252 | ) | (252 | ) | |||

Total Andeavor Stockholders’ Equity | 10,068 | 9,815 | |||||

Noncontrolling Interest | 3,499 | 3,600 | |||||

Total Equity | 13,567 | 13,415 | |||||

Total Liabilities and Equity | $ | 30,074 | $ | 28,573 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4 | |  | |

Financial Statements | ||

Andeavor

Condensed Statements of Consolidated Cash Flows

(Unaudited)

Six Months Ended June 30, | |||||||

2018 | 2017 | ||||||

(In millions) | |||||||

Cash Flows From (Used In) Operating Activities | |||||||

Net earnings | $ | 819 | $ | 174 | |||

Adjustments to reconcile net earnings to net cash from operating activities: | |||||||

Depreciation and amortization expenses | 574 | 466 | |||||

Lower of cost or market inventory valuation adjustment | — | 209 | |||||

Amortization of debt issuance costs and discounts | 10 | 10 | |||||

(Gain) loss on asset disposals and impairments | 1 | (21 | ) | ||||

Gain related to Hawaii Business | (10 | ) | — | ||||

Stock-based compensation expense | 26 | 34 | |||||

Deferred income taxes | 171 | 50 | |||||

Turnaround expenditures | (237 | ) | (274 | ) | |||

Marketing branding costs | (24 | ) | (37 | ) | |||

Equity in earnings of equity method investments, net of distributions | 6 | 13 | |||||

Other operating activities, net | 9 | (6 | ) | ||||

Changes in current assets and current liabilities | (282 | ) | (4 | ) | |||

Changes in noncurrent assets and noncurrent liabilities | 34 | 156 | |||||

Net cash from operating activities | 1,097 | 770 | |||||

Cash Flows From (Used In) Investing Activities | |||||||

Capital expenditures | (852 | ) | (539 | ) | |||

Acquisitions, net of cash | (631 | ) | (938 | ) | |||

Proceeds from asset sales | 7 | 44 | |||||

Investments in equity method investments and joint ventures | (37 | ) | — | ||||

Other investing activities, net | 1 | (15 | ) | ||||

Net cash used in investing activities | (1,512 | ) | (1,448 | ) | |||

Cash Flows From (Used In) Financing Activities | |||||||

Borrowings under revolving credit agreements | 2,940 | 764 | |||||

Repayments on revolving credit agreements | (1,898 | ) | (514 | ) | |||

Repayments of debt | (11 | ) | (1,636 | ) | |||

Proceeds from inventory financing arrangements | 330 | — | |||||

Repayments of inventory financing arrangements | (446 | ) | — | ||||

Dividend payments | (181 | ) | (130 | ) | |||

Net proceeds from issuance of Andeavor Logistics LP common units | — | 281 | |||||

Distributions to noncontrolling interest | (189 | ) | (133 | ) | |||

Purchases of common stock | (258 | ) | (148 | ) | |||

Taxes paid related to net share settlement of equity awards | (23 | ) | (31 | ) | |||

Other financing activities, net | (4 | ) | (9 | ) | |||

Net cash from (used in) financing activities | 260 | (1,556 | ) | ||||

Decrease in Cash and Cash Equivalents | (155 | ) | (2,234 | ) | |||

Cash and Cash Equivalents, Beginning of Period | 543 | 3,295 | |||||

Cash and Cash Equivalents, End of Period | $ | 388 | $ | 1,061 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

June 30, 2018 | 5 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

Note 1 - Organization and Basis of Presentation

Organization

As used in this report, the terms “Andeavor,” the “Company,” “we,” “us” or “our” may refer to Andeavor, one or more of its consolidated subsidiaries or all of them taken as a whole. The words “we,” “us” or “our” generally include Andeavor Logistics LP (“Andeavor Logistics”), a publicly-traded limited partnership, and its subsidiaries as consolidated subsidiaries of Andeavor with certain exceptions where there are transactions or obligations between Andeavor Logistics and Andeavor or its other subsidiaries.

Marathon Petroleum Corporation Merger

Andeavor and Marathon Petroleum Corporation (“MPC”) entered into an Agreement and Plan of Merger, dated as of April 29, 2018 (the “MPC Merger Agreement”), under which MPC will acquire all of our outstanding shares (the “MPC Merger”). Our shareholders will have the option to receive in exchange for their shares of Andeavor common stock shares of MPC stock, cash, or a combination of both, subject to a proration mechanism that will result in 15 percent of the shares of our common stock being exchanged for cash, and the remaining shares being exchanged for MPC stock. The transaction was unanimously approved by the boards of directors of both companies and subject to regulatory and other customary closing conditions, including approvals from the shareholders of each company.

On July 3, 2018, we were notified that the waiting period with respect to the notification and report forms filed under the

U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976 expired. In addition, we have received the necessary regulatory clearance in Canada. These matters satisfy certain conditions to the closing of the MPC Merger, but others remain.

Andeavor stockholders as of the close of business on August 1, 2018 (the “Record Date”) were invited to attend a special meeting on September 24, 2018 to consider and vote upon a proposal to adopt the MPC Merger Agreement and other matters related to the MPC Merger. MPC stockholders as of the close of business on the Record Date were invited to attend a special meeting on September 24, 2018 to consider and vote upon a proposal to approve the issuance of MPC common stock in connection with the MPC Merger and other matters related to the MPC Merger.

Western Refining

On June 1, 2017, pursuant to the Agreement and Plan of Merger, dated as of November 16, 2016, by and among Western Refining, Inc. (“Western Refining”), the Company, and our wholly-owned subsidiaries, a wholly-owned subsidiary was merged with and into Western Refining, with Western Refining surviving such merger as a wholly-owned subsidiary of the Company (the “Merger” or the “Western Refining Acquisition”). Refer to Note 2 for more information on the Merger.

Principles of Consolidation and Basis of Presentation

Principles of Consolidation

These interim condensed consolidated financial statements and notes hereto of Andeavor and its subsidiaries have been prepared by management without audit according to the rules and regulations of the Securities and Exchange Commission (“SEC”) and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of results for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed. We prepare our condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). However, certain information and notes normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to the SEC’s rules and regulations. The consolidated balance sheet at December 31, 2017 has been condensed from the audited consolidated financial statements at that date. Management believes that the disclosures presented herein are adequate to present the information fairly. The accompanying condensed consolidated financial statements and notes should be read in conjunction with the Andeavor Annual Report on Form 10-K for the year ended December 31, 2017.

Basis of Presentation

We are required under U.S. GAAP to make estimates and assumptions that affect the reported amounts and disclosures of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the periods presented. We review our estimates on an ongoing basis. Changes in facts and circumstances may result in revised estimates and actual results could differ from those estimates. The results of operations for any interim period are not necessarily indicative of results for the full year. Certain prior year balances have been aggregated or disaggregated to conform to the current year presentation, including the adoption of recent accounting standards discussed further below.

The consolidated statements of comprehensive income for the six months ended June 30, 2018 and 2017 have been omitted, as there was no material change to accumulated other comprehensive income in either period.

Cost Classifications

Cost of materials and other includes the purchase cost of commodities sold within our Refining and Logistics segments along with the cost of inbound transportation and outbound distribution costs incurred to transport product to our customers, gains and

6 | |  | |

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

losses related to our commodity hedging activities and the cost of merchandise sold through our Marketing segment. Additionally, lower of cost or market valuation adjustments impact our cost of materials and other but are separately presented in our statements of consolidated operations.

Operating expenses are comprised of direct and indirect operating costs. Direct operating expenses reflect costs incurred for direct labor, repairs and maintenance, outside services, chemicals and catalysts, utility costs, including the purchase of electricity and natural gas used by our facilities, property taxes, environmental compliance costs related to current period operations, rent expense and other direct operating expenses incurred in the production of refined products sold through our Marketing or Refining segments or towards the provision of services in our Logistics segment. Indirect operating expenses represent allocated labor and other administrative costs for centralized personnel that influence our underlying operations, environmental remediation costs unrelated to current period operations, and other costs that are related, but not directly, to our segment operations.

Operating Expenses (in millions)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Direct operating expenses | $ | 836 | $ | 708 | $ | 1,664 | $ | 1,333 | |||||||

Indirect operating expenses | 82 | 32 | 120 | 62 | |||||||||||

Operating expenses (excluding depreciation and amortization) | $ | 918 | $ | 740 | $ | 1,784 | $ | 1,395 | |||||||

Depreciation and amortization expenses consist of the depreciation and amortization of property, plant and equipment, deferred turnaround expenditures, marketing branding costs and intangible assets related to our operating segments along with our corporate operations. General and administrative expenses represent costs that are not directly or indirectly related to or otherwise are not allocated to our marketing, logistics or refining operations. Cost of materials and other, any lower of cost or market valuation adjustments, direct operating expenses incurred across our operating segments, and depreciation and amortization expenses recognized by our Marketing, Logistics and Refining segments (refer to amounts disclosed in Note 13) constitute costs of revenue as defined by U.S. GAAP.

Variable Interest Entities

Our condensed consolidated financial statements include a variable interest entity, Andeavor Logistics, which is part of our Marketing and Logistics segments. Andeavor Logistics is a publicly traded limited partnership that we formed to own, operate, develop and acquire logistics assets. Its assets are integral to the success of Andeavor’s refining and marketing operations and are used to gather crude oil, natural gas, and water, process natural gas and distribute, transport and store crude oil and refined products. Andeavor Logistics provides us with various pipeline transportation, trucking, terminal distribution, gathering and processing, storage and petroleum-coke handling services under long-term, fee-based commercial agreements. Each of these agreements, apart from the storage and transportation services agreement, contain minimum volume commitments. We do not provide financial or equity support through any liquidity arrangements or financial guarantees to Andeavor Logistics.

Tesoro Logistics GP, LLC (“TLGP”), our wholly-owned subsidiary, serves as the general partner of Andeavor Logistics. As the general partner of Andeavor Logistics, we have the sole ability to direct the activities of Andeavor Logistics that most significantly impact its economic performance. We are considered to be the primary beneficiary for accounting purposes and are Andeavor Logistics’ primary customer. We held an approximate 59% interest in Andeavor Logistics at both June 30, 2018 and December 31, 2017. In the event Andeavor Logistics incurs a loss, our operating results will reflect Andeavor Logistics’ loss, net of intercompany eliminations. Andeavor Logistics’ transactions with us under our various long-term, fee-based commercial agreements accounted for 68% and 64% of Andeavor Logistics’ total revenues for the three and six months ended June 30, 2018, respectively, and 45% and 46% of Andeavor Logistics’ total revenues for the three and six months ended June 30, 2017, respectively.

In January 2018, Andeavor acquired Rangeland Energy II, LLC, (“Rangeland”), which included the acquisition of Rangeland’s 67% interest in Rangeland RIO Pipeline, LLC (“RIO”), a variable interest entity that owns assets in the Delaware and Midland Basins. Andeavor’s interests in RIO include its initial equity investment of $159 million, which is subject to adjustment during the one-year measurement period, and a service agreement through one of its wholly-owned subsidiaries to operate, maintain and repair the assets. Andeavor is not the primary beneficiary of RIO, under the partnership agreement, because Andeavor and the other minor shareholder jointly direct the activities of RIO that most significantly impact its economic performance. In addition, Andeavor Logistics has a 78% interest in Rendezvous Gas Services, L.L.C (“RGS”).

In April 2018, Andeavor announced participation in two new joint ventures under development, Gray Oak Pipeline, LLC (“Gray Oak Pipeline”) and South Texas Terminal LLC (“South Texas Gateway Terminal”). The Gray Oak Pipeline will support the transportation of crude oil from the Permian Basin to Corpus Christi, Texas. We own a 25% interest in the pipeline that is expected to be placed in service by the end of the fourth quarter of 2019 and is backed by long-term third-party, take-or-pay commitments with primarily investment grade customers. We own a 25% participation in the South Texas Gateway Terminal, a

June 30, 2018 | 7 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

planned deep-water, open access marine terminal in Ingleside, Texas. RIO, RGS, Gray Oak Pipeline and the South Texas Gateway Terminal are unconsolidated variable interest entities and we use the equity method of accounting with respect to our investments in each entity.

Discontinued Operations

On September 25, 2013, we completed the sale of all of our interest in Tesoro Hawaii, LLC, which operated a 94 thousand barrels per day Hawaii refinery, retail sites and associated logistics assets (the “Hawaii Business”). The sale of the Hawaii Business was subject to an earn-out provision based on the annual gross margin (as defined in sale agreement) in the three annual periods beginning with the year ended December 31, 2014 and ending with the year ended December 31, 2016. Additionally, we retained liability for certain regulatory improvements required at the Hawaii refinery and tank replacement efforts at certain retail sites. The results of operations for this business have been presented as discontinued operations in the condensed statements of consolidated operations. There were no revenues for the three or six months ended June 30, 2018 and 2017. We recorded $10 million in pre-tax earnings ($8 million after-tax) during the six months ended June 30, 2018 primarily related to final adjustments to previous earn-out periods. No additional earn-outs related to the sale of the Hawaii Business remain to be paid to Andeavor. There were no earnings or loss recorded for the three months ended June 30, 2018 or 2017 and the six months ended June 30, 2017. Cash flows from discontinued operations were $8 million for the six months ended June 30, 2018 and cash flows used in discontinued operations were $6 million for the six months ended June 30, 2017. Unless otherwise noted, the information in the notes to the condensed consolidated financial statements relates to our continuing operations.

New Accounting Standards and Disclosures

Revenue Recognition

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Updated (“ASU”) 2014-09, “Revenue from Contracts with Customers” to replace existing revenue recognition rules with a single comprehensive model to use in accounting for revenue arising from contracts with customers. Under this ASU and the associated subsequent amendments (collectively, “ASC 606”), revenue is recognized when a customer obtains control of promised goods or services for an amount that reflects the consideration the entity expects to receive in exchange for those goods or services. In addition, ASC 606 requires expanded disclosure of the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

We adopted ASC 606 on January 1, 2018 utilizing the modified retrospective method. We recognized a $16 million reduction to retained earnings and a $9 million reduction to noncontrolling interest on January 1, 2018 for the cumulative effect adjustment related to contracts in process but not substantially complete as of that date. We reflected the aggregate impact of all modifications executed and effective as of January 1, 2018 in applying the new standard to these contracts. The cumulative effect adjustment is primarily related to the period over which revenue is recognized on contracts within our Logistics segment for which our customers pay minimum throughput volume commitments and clawback provisions apply. We also made immaterial adjustments associated with our gift card program and franchise fees. Additionally, upon the adoption of ASC 606, the gross versus net presentation of certain contractual arrangements and taxes has changed as further described in Note 12. The current period results and balances are presented in accordance with ASC 606, while comparative periods continue to be presented in accordance with the accounting standards in effect for those periods.

For the three and six months ended June 30, 2018, we recorded lower revenues of $315 million and $566 million, respectively, and correspondingly $315 million and $566 million lower cost of materials and other, respectively, for presentation impacts of applying ASC 606. These presentation impacts were primarily associated with netting excise and other related taxes in our Marketing segment as described in Note 12. We recorded an additional $3 million and $5 million in revenues during the three and six months ended June 30, 2018, respectively, primarily related to the minimum throughput volume commitments in our Logistics segment discussed above as a result of applying the new standard. There were no material impacts during the period to the condensed consolidated balance sheet or condensed statement of consolidated cash flows, as a result of the adoption.

Leases

In February 2016, the FASB issued ASU 2016-02, “Leases” (“ASU 2016-02”), which amends existing accounting standards for lease accounting and adds additional disclosures about leasing arrangements. Under the new guidance, lessees are required to recognize right-of-use assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either a financing lease or operating lease, with classification affecting the pattern of expense recognition in the income statement and presentation of cash flows in the statement of cash flows. The new standard also requires additional disclosures to help financial statement users better understand the amount, timing, and uncertainty of cash flows arising from leases. ASU 2016-02 is effective for annual reporting periods beginning after December 15, 2018, and interim reporting periods within those annual reporting periods. Early adoption is permitted and in the original guidance the modified retrospective application was required, however, in July 2018 the FASB issued ASU 2018-11 which permits entities with another transition method in which the effective date would be the date of initial application of transition. Under this optional transition method, we would recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. We expect to elect the optional transition method.

8 | |  | |

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

We are progressing through our implementation plan, which includes the following activities; designing and implementing a new lease accounting system, designing new business processes and related internal controls, extracting the required accounting and reporting data from our lease agreements as well as the continued assessment and documentation of the accounting impacts related to the new standard. In addition, we continue to work with the industry group on certain areas and assess the impacts as consensus continues to be formed. While we are still working through our implementation plan, we do expect that the recognition of right-of-use assets and lease liabilities, which are not currently reflected on our condensed consolidated balance sheets, will have a material impact on total assets and liabilities. However, we do not expect the adoption of the standard to have a material impact on our condensed statements of consolidated operations or liquidity. At this time, we are unable to estimate the full impact of the standard until we progress further through our plan and the industry reaches a consensus on certain industry specific issues.

Credit Losses

In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which amends guidance on the impairment of financial instruments. The ASU requires the estimation of credit losses based on expected losses and provides for a simplified accounting model for purchased financial assets with credit deterioration. ASU 2016-13 is effective for annual reporting periods beginning after December 15, 2019, and interim reporting periods within those annual reporting periods. Early adoption is permitted for annual reporting periods beginning after December 15, 2018. While we are still evaluating the impact of ASU 2016-13, we do not expect the adoption of this standard to have a material impact on our financial statements.

Pension and Postretirement Costs

In March 2017, the FASB issued ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost” (“ASU 2017-07”), which requires the current service-cost component of net benefit costs to be presented similarly with other current compensation costs for related employees on the statements of consolidated operations, and stipulates that only the service cost component of net benefit costs is eligible for capitalization. The Company will present other components of net benefit costs elsewhere on the statements of consolidated operations as discussed further in Note 8. The amendments to the presentation of the statements of consolidated operations in this update should be applied retrospectively while the change in capitalized benefit cost is to be applied prospectively. We adopted ASU 2017-07 as of January 1, 2018. Adoption of the standard resulted in an increase to operating expenses of $1 million and $2 million respectively, and interest and financing costs of $9 million and $18 million respectively, with a corresponding decrease to general and administrative expenses of $1 million and $2 million, respectively, and an increase to other income of $9 million and $18 million, respectively, for the three and six months ended June 30, 2017. There was no impact to net earnings and ASU 2017-07 does not impact the consolidated balance sheets or statements of consolidated cash flows.

Stock-based Compensation

In May 2017, the FASB issued ASU 2017-09, “Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting” (“ASU 2017-09”), which provides guidance about which changes to the terms or conditions of a share-based payment awarded require an entity to apply modification accounting. The amendments in ASU 2017-09 are to be applied prospectively to an award modified on or after the adoption date. As such, the impact of ASU 2017-09 is dependent on whether we modify any share-based payment awards and the nature of such modifications. We adopted ASU 2017-09 as of January 1, 2018 with no impact on our financial statements.

Derivatives and Hedging

In August 2017, the FASB issued ASU 2017-12, “Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities” (“ASU 2017-12”), which amends and simplifies existing guidance to more accurately present the economic effects of risk management activities in the financial statements. ASU 2017-12 is effective for interim and annual reporting periods beginning after December 15, 2018. Early adoption is permitted. While we are still evaluating the impact of ASU 2017-12, we do not expect the adoption of this standard to have a material impact on our financial statements.

Comprehensive Income

In February 2018, the FASB issued ASU 2018-02, “Income Statement-Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income” (“ASU 2018-02”), which allows a reclassification of recorded amounts from accumulated other comprehensive income to retained earnings for the adjustment of deferred taxes due to the reduction of the historical corporate income tax rate to the newly enacted corporate income tax rate resulting from the U.S. tax law changes enacted in December 2017. It also requires certain disclosures about these reclassifications. ASU 2018-02 is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years, with early adoption permitted. The new guidance must be applied either on a prospective basis in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the U.S. tax law changes are recognized. While we are still evaluating the impact of ASU 2018-02, we do not expect the adoption of this standard to have a material impact on our financial statements.

June 30, 2018 | 9 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

Note 2 - Acquisitions

Western Refining Acquisition

On June 1, 2017, we completed the Western Refining Acquisition. Based on our $83.25 per share closing stock price on June 1, 2017, the aggregate value of consideration paid to Western Refining shareholders was $4.0 billion, including approximately $3.6 billion of our stock and approximately $424 million of cash, including cash payable upon accelerated vesting of Western Refining equity awards. The cash portion of the purchase price, along with the settlement of $1.6 billion of certain Western Refining debt and other transaction related costs, was funded using cash on hand and $575 million of funds drawn on the Andeavor Revolving Credit Facility.

We accounted for the Western Refining Acquisition using the acquisition method of accounting, which requires, among other things, that assets acquired at their fair values and liabilities assumed be recognized on the balance sheet as of the acquisition date. The purchase price allocation for the Western Refining Acquisition is complete and has been allocated based on the fair values of the assets acquired and liabilities assumed at the acquisition date. During the six months ended June 30, 2018, we recorded adjustments to our allocation to increase other noncurrent liabilities by $32 million, property, plant and equipment by $22 million and deferred income taxes by $3 million offset by decreases in accounts payable of $13 million and accrued liabilities of $3 million.

Acquisition Date Purchase Price Allocation (in millions)

Cash | $ | 159 | |

Receivables | 510 | ||

Inventories | 805 | ||

Prepayments and Other Current Assets | 212 | ||

Property, Plant and Equipment (a) | 3,486 | ||

Goodwill | 2,948 | ||

Acquired Intangibles | 315 | ||

Other Noncurrent Assets | 162 | ||

Accounts Payable | (688 | ) | |

Accrued Liabilities | (267 | ) | |

Current Portion of Long-term Debt | (12 | ) | |

Deferred Income Taxes | (721 | ) | |

Debt | (2,092 | ) | |

Other Noncurrent Liabilities | (118 | ) | |

Noncontrolling Interest | (719 | ) | |

Total purchase price | $ | 3,980 | |

(a) | Estimated useful lives ranging from 3 to 28 years have been assumed based on the valuation. |

Goodwill

Andeavor evaluated several factors that contributed to the amount of goodwill presented above. These factors include the acquisition of an existing integrated refining, marketing and logistics business located in areas with access to cost-advantaged feedstocks with an assembled workforce that cannot be duplicated at the same costs by a new entrant. Further, the Western Refining Acquisition provides a platform for future growth through operating efficiencies Andeavor expects to gain from the application of best practices across the combined company and an ability to realize synergies from the geographic diversification of Andeavor’s business and rationalization of general and administrative costs. The amount of goodwill by reportable segment is as follows: Marketing $282 million, Logistics $707 million and Refining $1.96 billion. Approximately $1.98 billion of the $2.95 billion in goodwill resulting from the tax-free merger with Western Refining is non-deductible for tax purposes. As a result of prior acquisitions, Western Refining has tax-deductible goodwill, in which we received carryover basis, providing tax deductibility for approximately $970 million of the $2.95 billion in goodwill that otherwise would not be deductible.

10 | |  | |

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

Property, Plant and Equipment

The fair value of property, plant and equipment is $3.5 billion. This fair value is based on the valuation using a combination of the income, cost and market approaches. The useful lives of acquired assets have been aligned to similar assets at Andeavor.

Acquired Intangible Assets

The fair value of the acquired identifiable intangible assets is $315 million. This fair value is based on the valuation completed for the business enterprise, along with the related tangible assets, using a combination of the income method, cost method and comparable market transactions. We recognized intangible assets associated with customer relationships, franchise rights and favorable leases, all of which will be amortized over a definite-life. We also recognized an intangible asset of $38 million related to liquor licenses and $113 million related to trade names, both of which have indefinite lives. We considered the assets' historical accounting by Western Refining, our plans for the continued use and marketing of the assets, and how a market participant would use the assets in determining whether the intangible assets have an indefinite or definite life. We amortize acquired intangibles with finite lives on a straight-line basis over a weighted average useful life of 13 years, and we include the amortization in depreciation and amortization expenses on our condensed statement of consolidated operations. The gross carrying value of our finite life intangibles acquired from the Western Refining Acquisition was $164 million and the accumulated amortization was $14 million as of June 30, 2018. Amortization expense is expected to be $13 million per year for the next five years related to the Western Refining acquired intangible assets.

Contingencies

We assumed environmental, legal and asset retirement obligation liabilities of $49 million in the Western Refining Acquisition. This represents an increase of $30 million during the six months ended June 30, 2018.

Interests in Western Refining Logistics and Minnesota Pipe Line Company

With the Western Refining Acquisition, we acquired a controlling interest in Western Refining Logistics, LP (“WNRL”). The fair value of the non-controlling interest in WNRL is based on the unit price, units outstanding and the percent of public unitholders of WNRL on June 1, 2017. The October 30, 2017 merger between Andeavor Logistics and WNRL in which all WNRL outstanding common units were exchanged for common units in Andeavor Logistics did not impact the fair value of non-controlling interest. Additionally, we acquired a 17% common equity interest in Minnesota Pipe Line Company, LLC (“MPL”). We are accounting for our investment in MPL under the equity method of accounting given our ability to exercise significant influence over MPL.

Acquisition Costs

There were no material acquisition, severance or retention costs incurred in the three and six and months ended June 30, 2018 related to the Western Refining Acquisition. As it relates to severance and retention costs, we had $13 million recognized in accrued liabilities remaining to be paid at June 30, 2018.

Western Refining Revenues and Earnings Before Income Taxes

For the period from January 1, 2018 through June 30, 2018, we recognized $6.8 billion in revenues and $343 million of earnings before income taxes related to the business acquired. The earnings before income taxes for the period include related acquisition and severance costs along with interest expense incurred related to the acquisition.

Pro Forma Financial Information

The following unaudited pro forma information combines the historical operations of Andeavor and Western Refining, giving effect to the Merger and related transactions as if they had been consummated on January 1, 2017, the beginning of the earliest period presented.

Pro Forma Consolidated Revenues and Consolidated Net Earnings (in millions)

Three Months Ended | Six Months Ended | ||||||

June 30, 2017 | June 30, 2017 | ||||||

Revenues | $ | 9,591 | $ | 18,581 | |||

Net earnings | 215 | 326 | |||||

June 30, 2018 | 11 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

Rangeland Energy

On January 19, 2018, Andeavor completed its announced acquisition of 100% of the equity of Rangeland. Rangeland, which includes a 67% interest in RIO, owns and operates assets in the Delaware and Midland Basins in New Mexico and Texas, including the recently constructed RIO crude oil pipeline, three crude oil storage terminals, a frac sand storage and truck loading facility. Andeavor funded the acquisition using the Andeavor Revolving Credit Facility. This acquisition is not material to our consolidated financial statements and its operating results are recognized in our Logistics segment.

SLC Core Pipeline System

On May 1, 2018, Andeavor Logistics completed its acquisition of the SLC Core Pipeline System (formerly referred to as the Wamsutter Pipeline System) from Plains All American Pipeline, L.P. The system consists of pipelines that transport crude oil to another third-party pipeline system that supplies the Salt Lake City area refineries, including our Salt Lake City refinery. Andeavor Logistics financed the acquisition using the Andeavor Logistics Revolving Credit Facility. This acquisition is not material to our consolidated financial statements and its operating results are recognized in our Logistics segment.

West Coast Asphalt Terminals

On May 21, 2018, Andeavor acquired the West Coast asphalt terminals of Delek US Holdings, Inc. The assets acquired include four wholly-owned asphalt terminals in California and Arizona as well as a terminal in Nevada that is held in a 50% joint venture. Andeavor financed the acquisition using the Andeavor Revolving Credit Facility. This acquisition is not material to our consolidated financial statements and its operating results are recognized in our Refining segment.

Note 3 - Inventories

Components of Inventories (in millions)

June 30, 2018 | December 31, 2017 | ||||||

Domestic crude oil and refined products | $ | 3,219 | $ | 3,203 | |||

Materials and supplies | 218 | 229 | |||||

Oxygenates and by-products | 72 | 85 | |||||

Merchandise | 60 | 50 | |||||

Foreign subsidiary crude oil and refined products | 84 | 63 | |||||

Total Inventories | $ | 3,653 | $ | 3,630 | |||

At June 30, 2018 and December 31, 2017, the replacement cost of our crude oil and refined product inventories exceeded carrying value, both in the aggregate, by approximately $1.2 billion and $703 million, respectively.

Note 4 - Investments - Equity Method and Joint Ventures

We have the ability to exercise significant influence over each of the following investments through our participation in the management committees, which have the ability to make decisions that are significant to the entities. However, since we have equal or proportionate influence over each committee as a joint interest partner, we have determined that these entities should not be consolidated and apply the equity method of accounting with respect to our investments in each entity.

We own a 51% interest in Watson Cogeneration Company (“Watson”), which produces steam and electricity at a facility located at our Los Angeles refinery. We also own a 17% interest in MPL, which owns and operates a crude oil pipeline in Minnesota. Following the acquisition of Rangeland in early 2018, we own a 67% interest in RIO, a recently constructed crude oil pipeline located in the Delaware and Midland basins in west Texas. On May 21, 2018, we acquired the West Coast asphalt terminals, which included a 50% interest in the Paramount Nevada Asphalt Company (“PNAC”) joint venture.

Andeavor Logistics has a 78% interest in RGS, which owns and operates the infrastructure that transports gas from certain fields to several re-delivery points in southwestern Wyoming, including natural gas processing facilities that are owned by Andeavor Logistics or a third party. Andeavor Logistics also owns a 50% interest in Three Rivers Gathering, LLC (“TRG”), which operates natural gas gathering assets in the southeastern Uinta Basin, as well as a 38% interest in Uintah Basin Field Services, L.L.C. (“UBFS”), which owns and operates the natural gas gathering infrastructure located in the southeastern Uinta Basin and is operated by Andeavor Logistics.

12 | |  | |

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

On April 24, 2018, we announced a 25% participation in the Gray Oak Pipeline joint venture. The Gray Oak Pipeline will provide crude oil transportation from West Texas to destinations in the Corpus Christi, Sweeny and Freeport areas. In addition, we announced a 25% participation in the South Texas Gateway Terminal with Buckeye Partners, LP to develop a deep-water, open access marine terminal in Ingleside, Texas. The South Texas Gateway Terminal includes crude oil storage capacity and will serve as an outlet for crude oil and condensate volumes delivered from the Gray Oak Pipeline.

Equity Method Investments (in millions)

Balance at December 31, 2017 (a) | Fair value of acquired interest | Investments in joint ventures | Equity in earnings | Cumulative effect of accounting standard adoption | Distributions received | Balance at June 30, 2018 (a) | |||||||||||||||||||||

Watson | $ | 78 | $ | — | $ | — | $ | 2 | $ | — | $ | (3 | ) | $ | 77 | ||||||||||||

Gray Oak Pipeline | — | — | 23 | — | — | — | 23 | ||||||||||||||||||||

South Texas Gateway Terminal | — | — | 14 | — | — | — | 14 | ||||||||||||||||||||

RIO | — | 159 | — | 4 | — | — | 163 | ||||||||||||||||||||

PNAC | — | 27 | — | — | — | — | 27 | ||||||||||||||||||||

MPL | 120 | — | — | 10 | — | (10 | ) | 120 | |||||||||||||||||||

RGS | 268 | — | — | 3 | — | (10 | ) | 261 | |||||||||||||||||||

TRG | 37 | — | — | 1 | (3 | ) | (3 | ) | 32 | ||||||||||||||||||

UBFS | 15 | — | — | 1 | — | (1 | ) | 15 | |||||||||||||||||||

Total | $ | 518 | $ | 186 | $ | 37 | $ | 21 | $ | (3 | ) | $ | (27 | ) | $ | 732 | |||||||||||

(a) | The carrying amount of our investments in Watson, RIO, PNAC, MPL, RGS, TRG and UBFS exceeded the underlying equity in net assets by $61 million, $75 million, $18 million, $34 million, $128 million, $15 million and $6 million, respectively, at June 30, 2018. There was no difference between the carrying amount of our investments and the underlying equity in net assets for the Gray Oak Pipeline and the South Texas Gateway Terminal joint ventures at June 30, 2018. The carrying amount of our investments in Watson, MPL, RGS, TRG and UBFS exceeded the underlying equity in net assets by $62 million, $35 million $130 million, $15 million and $6 million, respectively, at December 31, 2017. The carrying amounts of our investments allocated to tangible assets that exceed the underlying equity in net assets are amortized over the useful life of the underlying fixed assets and included in equity in earnings. |

Note 5 - Derivative Instruments

In the ordinary course of business, our profit margins, earnings and cash flows are impacted by the timing, direction and overall change in pricing for commodities used throughout our operations. We use non-trading derivative instruments to manage our exposure to the following:

• | price risks associated with the purchase or sale of feedstocks, refined products and energy supplies related to our refineries, terminals, marketing fuel inventory and customers; |

• | price risks associated with inventories above or below our target levels; |

• | future emission credit requirements; and |

• | exchange rate fluctuations on our purchases of Canadian crude oil. |

Our accounting for derivative instruments depends on whether the underlying commodity will be used or sold in the normal course of business. For contracts where the crude oil or refined products are expected to be used or sold in the normal course of business, we apply the normal purchase normal sale exception and follow the accrual method of accounting. All other derivative instruments are recorded at fair value using mark-to-market accounting. We did not designate any of our derivatives for hedge accounting during the six months ended June 30, 2018 and 2017.

Our derivative instruments can include Forward Contracts, Futures Contracts, Over-the-Counter swaps, including Swap Contracts, Options, and OTC Option Contracts. Forward Contracts are agreements to buy or sell the commodity at a predetermined price at a specified future date. Futures Contracts are standardized agreements, traded on a futures exchange, to buy or sell the commodity at a predetermined price at a specified future date. Options provide the right, but not the obligation to buy or sell the commodity at a specified price in the future. Swap Contracts and OTC Option Contracts require cash settlement for the commodity based on the difference between a contracted fixed or floating price and the market price on the settlement date. Certain of these contracts require cash collateral to be received or paid if our asset or liability position, respectively, exceeds specified thresholds. We believe that we have minimal credit risk with respect to our counterparties.

June 30, 2018 | 13 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

The following table presents the fair value of our derivative instruments as of June 30, 2018 and December 31, 2017. The fair value amounts below are presented on a gross basis and do not reflect the netting of asset and liability positions permitted under the terms of our master netting arrangements including cash collateral on deposit with, or received from, brokers. We offset the recognized fair value amounts for multiple derivative instruments executed with the same counterparty in our financial statements when a legal right of offset exists. As a result, the asset and liability amounts below will not agree with the amounts presented in our consolidated balance sheets.

Derivative Assets and Liabilities (in millions)

Derivative Assets | Derivative Liabilities | |||||||||||||||

Balance Sheet Location | June 30, 2018 | December 31, 2017 | June 30, 2018 | December 31, 2017 | ||||||||||||

Commodity Futures Contracts | Prepayments and other current assets | $ | 1,025 | $ | 780 | $ | 1,012 | $ | 807 | |||||||

Commodity Swap Contracts | Prepayments and other current assets | 120 | 48 | 103 | 63 | |||||||||||

Commodity Swap Contracts | Receivables | 3 | 15 | — | — | |||||||||||

Commodity Swap Contracts | Accounts payable | — | — | 20 | 24 | |||||||||||

Commodity Options Contracts | Prepayments and other current assets | — | — | 5 | 2 | |||||||||||

Commodity Forward Contracts | Receivables | 1 | 2 | — | — | |||||||||||

Commodity Forward Contracts | Accounts payable | — | — | 1 | — | |||||||||||

Total Gross Mark-to-Market Derivatives | 1,149 | 845 | 1,141 | 896 | ||||||||||||

Less: Counterparty Netting | (1,102 | ) | (813 | ) | (1,102 | ) | (813 | ) | ||||||||

Add back: Cash Collateral | 7 | 67 | — | — | ||||||||||||

Total Net Fair Value of Derivatives | $ | 54 | $ | 99 | $ | 39 | $ | 83 | ||||||||

Net Gains on Mark-to-Market Derivatives (in millions)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Commodity Contracts | $ | 15 | $ | 92 | $ | 28 | $ | 120 | |||||||

Foreign Currency Forward Contracts | (2 | ) | — | (1 | ) | — | |||||||||

Total Net Gain on Mark-to-Market Derivatives | $ | 13 | $ | 92 | $ | 27 | $ | 120 | |||||||

Income Statement Location of Net Gains on Mark-to-Market Derivatives (in millions)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenues | $ | 1 | $ | 1 | $ | 2 | $ | 9 | |||||||

Cost of materials and other | 14 | 91 | 26 | 111 | |||||||||||

Other income, net | (2 | ) | — | (1 | ) | — | |||||||||

Total Net Gain on Mark-to-Market Derivatives | $ | 13 | $ | 92 | $ | 27 | $ | 120 | |||||||

14 | |  | |

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

Open Long (Short) Positions

Outstanding Commodity and other Contracts (units in thousands)

Contract Volumes by Year of Maturity | Unit of Measure | ||||||

Mark-to-Market Derivative Instrument | 2018 | 2019 | 2020 | ||||

Crude oil, refined products and blending products: | |||||||

Futures Contracts - long | 2,636 | 259 | 20 | Barrels | |||

Swap Contracts - long | 1,218 | 610 | — | Barrels | |||

Swap Contracts - short | (1,525) | (620) | — | Barrels | |||

Forwards - short | (574) | — | — | Barrels | |||

Corn: | |||||||

Futures Contracts - short | (310) | — | — | Bushels | |||

Soybean oil: | |||||||

Futures Contracts - short | (5,700) | — | — | Pounds | |||

Note 6 - Fair Value Measurements

We classify financial assets and liabilities according to the fair value hierarchy. Financial assets and liabilities classified as level 1 instruments are valued based on quoted prices in active markets for identical assets and liabilities. Level 2 instruments are valued based on quoted prices for similar assets and liabilities in active markets, and inputs other than quoted prices, such as liquidity, that are observable for the asset or liability. Our level 2 instruments include derivatives valued using market quotations from independent price reporting agencies, third-party brokers and commodity exchange price curves that are corroborated with market data. Level 3 instruments are valued using significant unobservable inputs that are not supported by sufficient market activity. We do not have any financial assets or liabilities classified as level 3 at June 30, 2018 or December 31, 2017.

Our financial assets and liabilities measured at fair value on a recurring basis include derivative instruments. Additionally, our financial liabilities include obligations for Renewable Identification Numbers (“RINs”) and cap and trade emission credits for the state of California (together with RINs, our “Environmental Credit Obligations”). See Note 5 for further information on our derivative instruments. Amounts presented below for Environmental Credit Obligations represent the estimated fair value amount at each balance sheet date for which we do not have sufficient RINs and California cap and trade credits to satisfy our obligations to the U.S. Environmental Protection Agency (“EPA") and the state of California, respectively.

Financial Assets and Liabilities at Fair Value (in millions)

June 30, 2018 | |||||||||||||||||||

Level 1 | Level 2 | Level 3 | Netting and Collateral (a) | Total | |||||||||||||||

Assets: | |||||||||||||||||||

Commodity Futures Contracts | $ | 1,025 | $ | — | $ | — | $ | (996 | ) | $ | 29 | ||||||||

Commodity Swap Contracts | — | 123 | — | (99 | ) | 24 | |||||||||||||

Commodity Options Contracts | — | — | — | — | — | ||||||||||||||

Commodity Forward Contracts | — | 1 | — | — | 1 | ||||||||||||||

Total Assets | $ | 1,025 | $ | 124 | $ | — | $ | (1,095 | ) | $ | 54 | ||||||||

Liabilities: | |||||||||||||||||||

Commodity Futures Contracts | $ | 1,012 | $ | — | $ | — | $ | (1,003 | ) | $ | 9 | ||||||||

Commodity Swap Contracts | — | 123 | — | (99 | ) | 24 | |||||||||||||

Commodity Options Contracts | — | 5 | — | — | 5 | ||||||||||||||

Commodity Forward Contracts | — | 1 | — | — | 1 | ||||||||||||||

Environmental Credit Obligations | — | 204 | — | — | 204 | ||||||||||||||

Total Liabilities | $ | 1,012 | $ | 333 | $ | — | $ | (1,102 | ) | $ | 243 | ||||||||

June 30, 2018 | 15 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

December 31, 2017 | |||||||||||||||||||

Level 1 | Level 2 | Level 3 | Netting and Collateral (a) | Total | |||||||||||||||

Assets: | |||||||||||||||||||

Commodity Futures Contracts | $ | 780 | $ | — | $ | — | $ | (707 | ) | $ | 73 | ||||||||

Commodity Swap Contracts | — | 63 | — | (39 | ) | 24 | |||||||||||||

Commodity Forward Contracts | — | 2 | — | — | 2 | ||||||||||||||

Total Assets | $ | 780 | $ | 65 | $ | — | $ | (746 | ) | $ | 99 | ||||||||

Liabilities: | |||||||||||||||||||

Commodity Futures Contracts | $ | 807 | $ | — | $ | — | $ | (774 | ) | $ | 33 | ||||||||

Commodity Swap Contracts | — | 87 | — | (39 | ) | 48 | |||||||||||||

Commodity Options Contracts | — | 2 | — | — | 2 | ||||||||||||||

Environmental Credit Obligations | — | 43 | — | — | 43 | ||||||||||||||

Total Liabilities | $ | 807 | $ | 132 | $ | — | $ | (813 | ) | $ | 126 | ||||||||

(a) | Certain of our derivative contracts, under master netting arrangements, include both asset and liability positions. We offset both the fair value amounts and any related cash collateral amounts recognized for multiple derivative instruments executed with the same counterparty when there is a legally enforceable right and an intention to settle net or simultaneously. As of June 30, 2018 and December 31, 2017, we had provided cash collateral amounts of $7 million and $67 million, respectively, related to our unrealized derivative positions. Cash collateral amounts are netted with mark-to-market derivative assets. |

We believe the carrying value of our other financial instruments, including cash and cash equivalents, receivables, accounts payable and certain accrued liabilities approximate fair value. Our fair value assessment incorporates a variety of considerations, including the short-term duration of the instruments and the expected future insignificance of bad debt expense, which includes an evaluation of counterparty credit risk. The borrowings under the Revolving Credit Facility, the Andeavor Logistics Revolving Credit Facility and our Term Loan Credit Facility, which include variable interest rates, approximate fair value. The fair value of our fixed rate debt is based on prices from recent trade activity and is categorized in level 2 of the fair value hierarchy. The carrying value and fair value of our debt were $8.8 billion and $8.9 billion as of June 30, 2018, respectively, and $7.8 billion and $8.1 billion at December 31, 2017, respectively. These carrying and fair values of our debt do not consider the unamortized issuance costs, which are netted against our total debt.

Note 7 - Debt

Debt Balance, Net of Current Maturities and Unamortized Issuance Costs (in millions)

June 30, 2018 | December 31, 2017 | ||||||

Total debt (a) | $ | 8,832 | $ | 7,799 | |||

Unamortized issuance costs and premiums | (106 | ) | (114 | ) | |||

Current maturities | (28 | ) | (17 | ) | |||

Debt, Net of Current Maturities and Unamortized Issuance Costs | $ | 8,698 | $ | 7,668 | |||

(a) | Total debt related to Andeavor Logistics, which is non-recourse to Andeavor, except for TLGP, was $4.4 billion and $4.2 billion at June 30, 2018 and December 31, 2017, respectively. |

Available Capacity Under Credit Facilities (in millions)

Total Capacity | Amount Borrowed as of June 30, 2018 | Outstanding Letters of Credit | Available Capacity as of June 30, 2018 | Weighted Average Interest Rate | Expiration | |||||||||||||||

Andeavor Revolving Credit Facility | $ | 3,000 | $ | 855 | $ | 17 | $ | 2,128 | 3.88 | % | September 30, 2020 | |||||||||

Andeavor Logistics Revolving Credit Facility | 1,100 | 665 | — | 435 | 3.83 | % | January 29, 2021 | |||||||||||||

Andeavor Logistics Dropdown Credit Facility | 1,000 | — | — | 1,000 | — | % | January 29, 2021 | |||||||||||||

Letter of Credit Facilities | 975 | — | 123 | 852 | ||||||||||||||||

Total Credit Facilities | $ | 6,075 | $ | 1,520 | $ | 140 | $ | 4,415 | ||||||||||||

16 | |  | |

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

Andeavor Logistics Revolving Credit Facility

On January 5, 2018, Andeavor Logistics amended the existing Andeavor Logistics Revolving Credit Facility and Andeavor Logistics Dropdown Credit Facility to increase the aggregate commitments under the Andeavor Logistics Revolving Credit Agreement from $600 million to $1.1 billion, add certain financial institutions as additional lenders under the Andeavor Logistics Revolving Credit Agreement and make certain changes to both the Andeavor Logistics Revolving Credit Facility and the Andeavor Logistics Dropdown Credit Facility to permit the incurrence of an additional $500 million of incremental loans (in the aggregate) under such facility agreements subject to the satisfaction of certain conditions.

Inventory Financing Arrangement

During the six months ended June 30, 2018, we entered into a $330 million financing arrangement with a third party that was secured by our crude oil inventory (“Inventory Financing Arrangement”). The Inventory Financing Arrangement was repaid in early April and had an effective interest rate of 6.7%. The Inventory Financing Arrangement is included within our financing activities on the condensed statements of consolidated cash flows for the six months ended June 30, 2018.

MPC Merger Agreement

Among other things, the MPC Merger Agreement prohibits the Company from incurring any additional indebtedness outside the ordinary course of business.

Note 8 - Benefit Plans

Components of Pension and Other Postretirement Benefit Expense (Income) (in millions)

Pension Benefits | |||||||||||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Service cost | $ | 17 | $ | 13 | $ | 34 | $ | 26 | |||||||

Interest cost | 8 | 8 | 17 | 16 | |||||||||||

Expected return on plan assets | (7 | ) | (7 | ) | (15 | ) | (14 | ) | |||||||

Recognized net actuarial loss | 7 | 6 | 15 | 11 | |||||||||||

Net Periodic Benefit Expense (a) | $ | 25 | $ | 20 | $ | 51 | $ | 39 | |||||||

Other Postretirement Benefits | |||||||||||||||

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Service cost | $ | — | $ | — | $ | 1 | $ | 1 | |||||||

Interest cost | — | 1 | 1 | 1 | |||||||||||

Amortization of prior service credit | (7 | ) | (9 | ) | (15 | ) | (17 | ) | |||||||

Recognized net actuarial loss | 1 | 1 | 2 | 2 | |||||||||||

Net Periodic Benefit Income (a) | $ | (6 | ) | $ | (7 | ) | $ | (11 | ) | $ | (13 | ) | |||

(a) | Service cost is included in operating and general and administrative expenses and interest cost is included in interest and financing costs on the condensed statement of consolidated operations. The remaining components of net periodic benefit expense are included in other income. |

Western Refining Benefit Plans

We assumed all of Western Refining’s existing defined contribution and benefit plans as a result of the Merger. Effective January 1, 2018, Western Refining employees began participating in the Andeavor 401(k) and pension plans. Defined contribution assets from Western Refining plans have been moved to respective Andeavor defined contribution plans as of June 30, 2018. Andeavor has also received IRS approval to move forward with termination of the Northern Tier Energy Retirement Plan. The impact of the Western Refining benefit plans is immaterial to our financial statements.

Note 9 - Commitments and Contingencies

Litigation Matters

In the ordinary course of business, we may become party to lawsuits, administrative proceedings and governmental investigations, including environmental, regulatory and other matters. The outcome of these matters cannot always be predicted accurately, but we accrue liabilities for these matters if we have determined that it is probable a loss has been incurred and the

June 30, 2018 | 17 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

loss can be reasonably estimated. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, we believe there would be no material impact on our consolidated financial statements.

Environmental Matters

We are incurring and expect to continue to incur expenses for environmental remediation liabilities at a number of currently and previously owned or operated refining, pipeline, terminal and retail properties. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, we believe there would be no material impact on our consolidated financial statements.

On July 18, 2016, the U.S. Department of Justice (“DOJ”) lodged a complaint on behalf of the EPA and a Consent Decree with the Western District Court of Texas. Among other things, the Consent Decree required our Martinez refinery meet certain annual emission limits for NOx by July 1, 2018. In February 2018, we informed the EPA that we will need additional time to satisfy requirements of the Consent Decree. We are currently negotiating a resolution of this matter with the DOJ and the EPA, including the required timing to complete the project. These expenditures associated with the Consent Decree will not have a material impact on our liquidity, financial position or results of operations.

Tax Matters

We are subject to federal, state and foreign tax laws and regulations. Newly enacted tax laws and regulations, and changes in existing tax laws and regulations, could result in increased or decreased expenditures in the future. We are also subject to audits by federal, state and foreign taxing authorities in the normal course of business. It is possible that tax audits could result in claims against us in excess of recorded liabilities. However, we believe that resolution of any such claim(s) would not have a material impact on our consolidated financial statements.

As of June 30, 2018, we have not completed our accounting for the tax effects of enactment of the tax reform legislation (the “Tax Act”) enacted on December 22, 2017 (the “Enactment Date”); however, we have made a reasonable estimate of the effects on our existing deferred tax balances. The SEC issued Staff Accounting Bulletin No. 118 (“SAB 118”) in December 2017 to address the application of U.S. GAAP in situations when a registrant does not have the necessary information available, prepared or analyzed in reasonable detail to complete the accounting for certain income tax effects of the Tax Act. Among other things, SAB 118 provides for a period of up to twelve months from the Enactment Date to record the effects of the Tax Act. During the six months ended June 30, 2018, adjustments to the provisional income tax benefit recorded in December 2017 from the enactment of the Tax Act were not material. We may make adjustments to the provisional amount during the SAB 118 measurement period, which could result from future changes in interpretation of the Tax Act, changes to estimates made by us and/or issuance of additional regulatory guidance.

Note 10 - Stockholders’ Equity and Earnings Per Share

Changes to Equity (in millions)

Andeavor Stockholders’ Equity | Noncontrolling Interest | Total Equity | |||||||||

Balance at December 31, 2017 (a) | $ | 9,815 | $ | 3,600 | $ | 13,415 | |||||

Net earnings | 687 | 132 | 819 | ||||||||

Purchases of common stock | (258 | ) | — | (258 | ) | ||||||

Dividend payments | (181 | ) | — | (181 | ) | ||||||

Net effect of amounts related to equity-based compensation | 23 | 3 | 26 | ||||||||

Taxes paid related to net share settlement of equity awards | (23 | ) | — | (23 | ) | ||||||

Distributions to noncontrolling interest | — | (189 | ) | (189 | ) | ||||||

Transfers to (from) Andeavor paid-in capital related to: | |||||||||||

Andeavor Logistics’ issuance of common units | 21 | (35 | ) | (14 | ) | ||||||

Cumulative effect of accounting standard adoption | (16 | ) | (9 | ) | (25 | ) | |||||

Other | — | (3 | ) | (3 | ) | ||||||

Balance at June 30, 2018 (a) | $ | 10,068 | $ | 3,499 | $ | 13,567 | |||||

(a) | We have 5.0 million shares of preferred stock authorized with no par value per share. No shares of preferred stock were outstanding as of June 30, 2018 and December 31, 2017. |

18 | |  | |

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

Earnings per share

We compute basic earnings per share by dividing net earnings attributable to Andeavor stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings per share include the effects of potentially dilutive shares outstanding during the period.

Share Calculations (in millions)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||

Weighted average common shares outstanding | 151.1 | 130.8 | 152.0 | 124.0 | |||||||

Common stock equivalents | 1.5 | 0.9 | 1.5 | 1.0 | |||||||

Total Diluted Shares | 152.6 | 131.7 | 153.5 | 125.0 | |||||||

Potentially dilutive common stock equivalents are excluded from the calculation of diluted earnings per share if the effect of including such securities in the calculation would have been anti-dilutive. Anti-dilutive securities were 0.4 million and 0.3 million for the three and six months ended June 30, 2017, respectively. There were no material anti-dilutive securities for the three and six months ended June 30, 2018.

Share Repurchases

We are authorized by our Board of Directors (the “Board”) to purchase shares of our common stock in open market transactions at our discretion. The Board’s authorization has no time limit and may be suspended or discontinued at any time. Purchases of our common stock can also be made to offset the dilutive effect of stock-based compensation awards and to meet our obligations under employee benefit and compensation plans, including the exercise of stock options and vesting of restricted stock units and to fulfill other stock compensation requirements. During the six months ended June 30, 2018 and 2017, we repurchased approximately 2.6 million and 1.6 million shares of our common stock for approximately $258 million and $148 million, respectively. Among other things, the MPC Merger Agreement restricts the Company from issuing shares and purchasing any of our capital stock.

Cash Dividends

We paid cash dividends totaling $89 million and $181 million for the three and six months ended June 30, 2018, respectively, based on a $0.59 per share quarterly cash dividend on common stock. We paid cash dividends totaling $65 million and $130 million for the three and six months ended June 30, 2017, respectively, based on a $0.55 per share quarterly cash dividend on common stock. On August 3, 2018, our Board declared a cash dividend of $0.59 per share payable on September 14, 2018 to shareholders of record on August 31, 2018. Among other things, the MPC Merger Agreement allows the Company to continue paying a regular dividend up to $0.59 per share.

Note 11 - Stock-Based Compensation

Stock-Based Compensation Expense (Benefit) (in millions)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Market stock units (a) | $ | 7 | $ | 7 | $ | 14 | $ | 14 | |||||||

Performance share awards (b) | 3 | 3 | 5 | 8 | |||||||||||

Other stock-based awards (c) | 4 | 20 | 7 | 22 | |||||||||||

Total Stock-Based Compensation Expense | $ | 14 | $ | 30 | $ | 26 | $ | 44 | |||||||

(a) | We granted 0.5 million market stock units at a weighted average grant date fair value of $103.07 per unit under the amended and restated 2011 Long-Term Incentive Plan (“2011 Plan”) during the six months ended June 30, 2018. |

(b) | We granted 0.2 million market condition performance share awards at a weighted average grant date fair value of $107.51 per share under the 2011 Plan during the six months ended June 30, 2018. |

(c) | We have aggregated expense for certain award types as they are not considered significant, including awards issued by Andeavor Logistics. |

The income tax effect recognized in the income statement for stock-based compensation was a benefit of $4 million and $13 million for the three months ended June 30, 2018 and 2017, respectively, and $11 million and $33 million for the six months

June 30, 2018 | 19 | ||

Notes to Condensed Consolidated Financial Statements (Unaudited) | ||

ended June 30, 2018 and 2017, respectively. Included in the tax benefits were $1 million and $3 million of excess tax benefits from exercises and vestings for the three months ended June 30, 2018 and 2017, respectively, and $5 million and $17 million for the six months ended June 30, 2018 and 2017, respectively. The reduction in current taxes payable recognized from tax deductions resulting from exercises and vestings under all of our stock-based compensation arrangements totaled $1 million and $7 million for the three months ended June 30, 2018 and 2017, respectively, and $20 million and $32 million for the six months ended June 30, 2018 and 2017, respectively.

All outstanding equity awards from Western Refining and Northern Tier Energy LP (“NTI”) stock-based compensation plans were converted to Andeavor shares but remain under their respective Western Refining and NTI plans.

Note 12 - Revenues