Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Lustros Inc. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3201.htm |

| EX-32.2 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3202.htm |

| EX-31.2 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3102.htm |

| EX-21 - LIST OF SUBSIDIARIES - Lustros Inc. | lustros_10k-ex2101.htm |

| EX-31.1 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-K

_________________

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ________________.

Commission File Number: 000-30215

LUSTROS, INC.

(Exact name of Registrant as Specified in its Charter)

| Utah | 45-5313260 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

9025 Carlton Hills Blvd. Santee, CA 92071 | |

| (Address of principal Executive Offices, including ZIP code) | |

|

619-449-4800 Registrant’s telephone number, including area code | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of Each Class | Name of each exchange on which registered |

| None | None |

| Securities registered pursuant to Section 12(g) of the Act: | |

| Common stock, $0.001 par value | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. o Yes x No

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding twelve months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o | |

|

Non-accelerated Filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

The aggregate market value of the Issuer's voting and non-voting common equity held by non-affiliates of the registrant, as of June 30, 2014, computed by reference to the closing price of such common equity on the OTC Market Inc.’s Pink Sheets , the end of the Registrant’s most recently completed fiscal year of December 31, 2013 was $18,630,952.

On December 5, 2014, the Registrant had 121,160,193 outstanding shares of common stock (“Common Stock”), $.001 par value.

LUSTROS, INC.

TABLE OF CONTENTS

| Item 1 | BUSINESS | 4 |

| Item 1A | RISK FACTORS | 15 |

| Item 1B | UNRESOLVED STAFF COMMENTS | 15 |

| Item 2 | PROPERTIES | 15 |

| Item 3 | LEGAL PROCEEDINGS | 16 |

| Item 4 | MINE SAFETY DISCLOSURES | 17 |

| Item 5 | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 18 |

| Item 6 | SELECTED FINANCIAL DATA | 21 |

| Item 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 21 |

| Item 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 27 |

| Item 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 33 |

| Item 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 33 |

| Item 9A | CONTROLS AND PROCEDURES | 35 |

| Item 9B | OTHER INFORMATION | 36 |

| Item 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 36 |

| Item 11 | EXECUTIVE COMPENSATION | 42 |

| Item 12 | SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 44 |

| Item 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 46 |

| Item 14 | PRINCIPAL ACCOUNTING FEES AND SERVICES | 49 |

| Item 15 | EXHIBITS, FINANCIAL STATEMENTS, AND SCHEDULES | 50 |

| 2 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| · | The availability and adequacy of our cash flow to meet our requirements; | |

| · | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| · | Changes or developments in laws, regulations or taxes in our industry; | |

| · | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| · | Competition in our industry; | |

| · | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| · | Changes in our business strategy, capital improvements or development plans; | |

| · | The availability of additional capital to support capital improvements and development; and | |

| · | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context, references in this report to “Company”, “we”, “us”, “our” and “LSTS” are references to Lustros, Inc., a Utah corporation, formerly known as Power-Save Energy Company, (“Lustros”), and, unless the context indicates otherwise, also includes our subsidiary, Lustros Chile SpA (“Lustros Chile”), and their majority-owned subsidiaries as described in greater detail below under the caption “Business.” All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

| 3 |

Item 1 BUSINESS

Formation and History

Lustros, Inc. ("Lustros", and together with its consolidated subsidiaries, the "Company"), formerly Power-Save Energy Company, is a Utah corporation. Power-Save Energy Company was the successor corporation of Mag Enterprises, Inc., incorporated on July 30, 1980. On September 10, 1993, an Amendment to the Articles of Incorporation was filed to change the name from Mag Enterprises, Inc. to Safari Associates, Inc. On September 12, 2006, an Amendment to the Articles of Incorporation was filed to change the name from Safari Associates, Inc. to Power-Save Energy Company (the “Company”). On April 9, 2012, the Company announced its name change from Power-Save Energy Company to Lustros, Inc.

On March 9, 2012, the Company acquired all of the outstanding capital stock and rights to acquire capital stock of Bluestone, S.A., a Chilean corporation (“Bluestone”), in exchange for 60,000,000 shares of its common stock (the "Bluestone Acquisition"). Bluestone's principal asset was a 60% equity interest in Sulfatos Chile, S.A. ("Sulfatos"), which it acquired in February 2012.

For accounting purposes, the Company treated the Bluestone Acquisition as a reverse acquisition with Bluestone as the acquiring entity and Lustros as the acquired entity. As a result, the Company's financial statements reflect the financial information of Bluestone prior to March 9, 2012 and the combined entity on and after March 9, 2012.

On March 25, 2012, the Company sold the assets and liabilities (including the "Power-Save" name) of its renewable energy and energy savings product business in which it had engaged prior to the Bluestone Acquisition, to the former management of the Company (the "Power Save Sale").

On June 25, 2012, the Company created a new subsidiary, Mineraltus S.A. (“Mineraltus”), a Chilean corporation, to extract copper from the tailings (waste products) of expired copper mines to secure the raw materials to manufacture copper sulfate. The Company owns 80% of Mineraltus.

On August 22, 2012, the Company formed Lustros Chile SPA as a wholly owned subsidiary of Lustros, for the purpose of acting as a Chilean entity holding company for the Company’s Chilean subsidiaries Sulfatos (60%), Mineraltus (80%), and Bluestone.

Business Description

The Company markets and sells industrial grade copper sulfate obtained by processing raw copper ore materials at Company-owned processing facilities in Chile. The Company has incurred losses since inception, just commenced pilot production of copper sulfate in December of 2013 and commercial production of copper sulfate in April 2014. As of the date of this filing the plant is currently shut down pending the resolution of the arbitration with Nueva Pudhuel regarding the Congo project (See Item 3- Legal Proceedings). Currently an injunction order is in effect and the following assets are and will remain seized: Lustros Chile SpA’s shares in Sulfatos (600,000 shares); 24,000 shares in Bluestone SpA; bank account ending in 0748 at Itaú Bank; all credit that Lustros Chile SpA has against Sulfatos Chile S.A.; and all credit related to the current account between Lustros Chile SpA and Sulfatos Chile S.A. These measures will remain in place until Lustros Chile SpA pays Nueva Pudahuel the full claimed amount, offers assets as guarantee, or arrives at a settlement. Lustros Chile SpA continues to vigorously defend against the actions taken and is working through its Chilean attorneys to resolve these matters as soon as reasonably possible. The arbitration and the trial are in their final stages, the parties having presented their main arguments and means of proof however no decision has been made as of the time of this filing.

None of the Company’s properties has been established as having any material proven or probable mineral reserves and the Company has no plans to conduct feasibility studies. The Company will require additional financing to carry out its growth and operations, however, it has no current plans to raise such capital. The Company’s auditors have issued a qualification as to the Company’s ability to continue as a going concern. The Company’s accumulated deficit through December 31, 2013 was $10,739,296.

| 4 |

During the next twelve months, the Company plans to satisfy its cash requirements through revenues from operations and additional equity financings.

Copper Sulfate Uses and Market

Copper.org states, copper sulphate, blue stone, blue vitriol are all common names for pentahydrated cupric sulphate, CuS04 - 5H20, which is the best known and the most widely used of the copper salts. Indeed it is often the starting raw material for the production of many of the other copper salts.

Copper sulphate is a very versatile chemical with as extensive a range of uses in industry as it has in agriculture. Its principal employment is in agriculture. Copper sulphate has many agricultural uses (see Table “A” at http://www.copper.org/resources/properties/compounds/table_a.html for an in depth list) but the following are the more important ones ((http://www.copper.org/resources/properties/compounds/copper_sulfate01.html)):

| · | Preparation of Bordeaux and Burgundy mixtures on the farm |

| · | Control of fungus diseases |

| · | Correction of copper deficiency in soils |

| · | Correction of copper deficiency in animals |

| · | Stimulation of growth for fattening pigs and broiler chickens |

| · | A molluscicide for the destruction of slugs and snails, particularly the snail host of the liver fluke |

Copper has a wide spectrum of effectiveness against the many biological agents of timber and fabric decay. It renders them unpalatable to insects and protects them from fungus attack. Copper sulphate is the base for many proprietary wood preservatives.

Many algae are highly susceptible to copper, which led to the use of copper salts by water engineers to prevent the development of algae in potable water reservoirs. They are also employed to control green slime and similar algal scums in farm ponds, rice fields, irrigation and drainage canals, rivers, lakes and swimming pools.

Another well-known use for copper compounds is as a molluscicide for the control of slugs and snails. Less than one part of copper per million parts of water can control disease-transmitting aquatic snails, which are responsible for schistosomiasis or bilharzia in humans in tropical countries and fascioliasis or liver fluke of animals in both tropical and temperate climates. (http://www.copper.org/resources/properties/compounds/general.html)

Copper compounds have their most extensive employment in agriculture. Copper fungicides have been indispensable as a cure for seed borne diseases such as bunt and for treatment in downy mildew disease on vines. Many thousands of tons are used annually all over the world to prevent these and other plant diseases.

As a generalization, soils would be considered copper deficient if they contain less than two parts per million available copper in the context of plant health. However, where the soil contains less than five parts per million available copper, symptoms of copper deficiency may be expected in animals. The increasing use of chemical fertilizers which contain little or no copper are denuding soils of readily available copper and creating a deficiency of the element in plants and through them in animals. Copper compounds are now being added to the ever increasing copper deficient soils either direct or in combination with commercial fertilizers. This is particularly the case where the fertilizers are rich in nitrogen and phosphorus. Animals grazing on copper deficient pastures or obtaining an inadequate amount of copper through their normal diet will benefit from mineral supplements containing copper.

Copper sulphate, because of its fungicidal and bactericidal properties, has been employed as a disinfectant on farms against storage rots and for the control and prevention of certain animal diseases, such as foot rot of sheep and cattle. (http://www.copper.org/resources/properties/compounds/agricultural.html)

In industrial applications copper sulfate is used as a mordant for dyeing and for electroplating as well as in many other industrial processes. The synthetic fiber industry has found an application for it in the production of their raw material. The metal industry uses large quantities of copper sulphate as an electrolyte in copper refining, for copper coating steel wire prior to wire drawing and in various copper plating processes. The mining industry employs it as an activator in the concentration by froth flotation of lead, zinc, cobalt and gold ores. The printing trade takes it as an electrolyte in the production of electrotype and as an etching agent for process engraving. The paint industry uses it in anti-fouling paints and it plays a part in the coloring of glass. Indeed, today there is hardly an industry which does not have some small use for copper sulphate. In Table A at http://www.copper.org/resources/properties/compounds/table_a.html some of the many uses of copper sulphate are listed. (http://www.copper.org/resources/properties/compounds/copper_sulfate01.html)

| 5 |

Copper.org states that today in the world there are more than 100 manufacturers and the world's consumption is around 200,000 tons per annum of which it is estimated that approximately three-quarters is used in agriculture, principally as a fungicide.

A 2014 research report by International Market Analysis Research & Consulting found that the worldwide demand for copper sulfate was higher at approximately 350,000 tons, which equates to $756M at an average price of $2,160 per ton, in 2013. Currently Asian Pacific countries are the biggest consumers of copper sulfate accounting for approximately 38% of the world’s consumption followed by North and South America at 32%, and Europe at 28%. As the population increases so does the demand for food and the need for copper sulfate in agriculture. Worldwide demand for copper sulfate is expected to grow to 392,000 tons and $1.1B by 2019. The global average current price of pentahydrate copper sulfate is around $2,320 per ton. (International Market Analysis Research & Consulting (IMARC), 2014)

Lustros produces Copper Sulfate directly from mineral-rich copper ore, making it an ideal Copper Sulfate to be used for agricultural purposes. The Company sells its copper sulfate in bulk to wholesale customers. Each sale is negotiated individually based on the specific laboratory results of the concentration of copper and other properties of samples sent to each customer in advance of each product shipment.

Sulfatos Chile – Processing Plant Subsidiary

Sulfatos Chile

On September 15, 2010, Santa Teresa Minerals and Minera Anica Ltda. formed the Chilean corporation, “Sulfatos Chile, S.A.” Santa Teresa Minerals sold its 60% interest in Sulfatos Chile S.A. to our subsidiary, Bluestone, in February 2012. Bluestone now owns 60% of Sulfatos Chile S.A., which owns the Anica Copper Mine and mining claims to Anico 1/5, and owns and operates a copper sulfate production facility on the same property as the Anica Copper Mine. Copper sulfate is a byproduct of copper mining that is used in industrial processes, livestock feed, and aerospace industries.

| 6 |

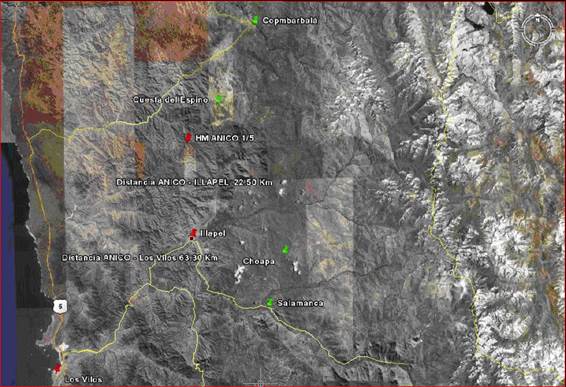

Map Showing Location of the Sulfatos Chile Property

The Sulfatos Chile property is located in the la Cuarta region, close to the township of Canela and less than 20 Km from the Ruta 5 highway, 22 kilometers northeast of the community of Illapel in the fourth region of the Choapa Province. Illapel is located on a plain along the side of the Illapel River, approximately 57 km northeast from Los Vilos and approximately 144 km south from Ovalle. The Sulfatos Chile property is located at latitude North 31 degrees, 25 minutes, 6953 seconds, longitude East, 71 degrees, 10 minutes, 588 seconds, with UTM coordinates of 6.521.208 meters North, 293.319 meters East. The Sulfatos Chile property is approximately 22 km by conventional roadways, from Illapel, on the road leading to Combarbalá, past the Auco sector, following the road that leads to Cocou, then to Culen Creek, where the Sulfatos Chile property is located.

On February 21, 2011, a lease offer with purchase option agreement was formalized between Sulfatos Chile and the property owners of the plant site. The lease with option to purchase has a term of 10 years and includes the water rights of 2 liters per second. This agreement has been superseded by a purchase agreement executed on March 31, 2011. The total purchase price for 835 hectares in Fundo Puerto Oscuro, Comuna de Canela, Province of Choapa, Los Vilos, Chile is 280 million Chilean Pesos (currently $585,040 US) payable over 2 years. 100 million Chilean Pesos (currently $217,276 USD) was paid upon signing and 90 million Chilean Pesos ($183,882 USD) was due one year after signing and 90 million Chilean Pesos (currently $183,882 USD) is due two years after signing. On June 12, 2014, Sulfatos Chile SA and the Landowners signed a Loan Refinance Agreement (the “Loan Refinance Agreement”) whereby the parties agreed that Sulfatos Chile SA will pay the Debt in thirty-seven installments, which will accrue interest at a rate of 3% per year, payable at the end of the last installment. The parties agree that the total amount of the interest accrued will be CLP$7,822,942, or approximately $14,004 US dollars. The first installment for CLP$10,000,000, or approximately $17,901 US dollars, was paid at the signing of the agreement. The following 35 installments of CLP$5,000,000 each, or approximately $8,951 US dollars, will be paid monthly within the first five days of each month, beginning in August of 2014. The final installment, number 37, for the remaining unpaid principal and all accrued interest, will be made in one payment for a total of CLP$12,227,995, or approximately $21,890 US dollars.

| 7 |

Property History

Registered in 1999 as Anico 1/5, the property consists of 25 hectares, which was contributed to Sulfatos Chile S.A. by Minera Anica Ltda.

The last geological study on the mine was made in April 2008. The property is currently without known material reserves. The mine is not currently being exploited as it is more cost effective for the Company to purchase raw materials from other sources than to mine it ourselves. No reserve or feasibility studies have been completed by the Company nor are any currently planned by the Company.

Current Activity

The Company has determined that it is more cost effective to purchase copper ore than it is to mine it and none of the Company’s properties has been established as having any material proven or probable mineral reserves. We fully impaired the book value of our mine at December 31, 2013. However, the Company shut down the copper sulfate processing plant in December 2014 pending resolution of legal matters (See Item 3 - Legal Proceedings).

Through Sulfatos Chile, we have constructed a copper sulfate production facility that extracts copper sulfate from copper ore. The facility was in pilot production in December of 2013 and began commercial production in April of 2014.

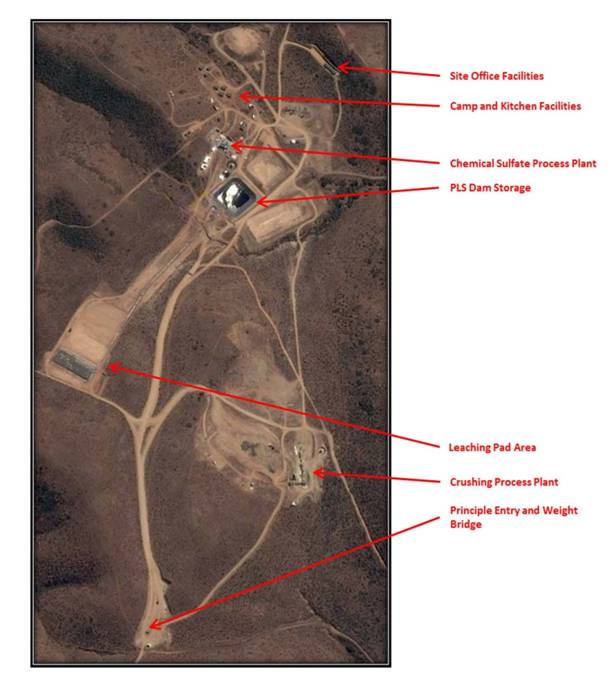

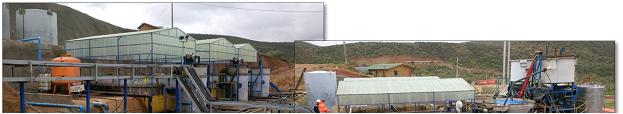

Copper Sulfate Processing Plant

Our copper sulfate facility began crushing and processing approximately 5,000 tons of copper with an average soluble Cu % grade of approximately 1.74% per month in the second fiscal quarter of 2014. Production is not yet operational on a constant basis as the Company does not have consistent demand for its supply. Once demand and production are consistent, the Company expects to produce 440 metric tons of copper sulfate per month with 5,000 tons of copper ore processed as currently permitted.

At the copper sulfate plant, copper ore is crushed in to 0.25 inch pellets at our crushing facility and transported to the leaching pads, where it is irrigated with a mixture of sulfuric acid and water to create a solution with a heavy concentration of copper, PLS. The PLS accumulates in large pools where it concentrates for a short period before it is pumped into the company’s crystallization plant and converted into copper sulfate pentahydrate. The plant utilizes solvent by extraction technology to separate the copper from the liquid solution before it is purified and crystallized.

The industrial operations located at the plant consist of five areas, differentiated by processes. They include: reception and mineral collection, where the copper-bearing raw material is delivered; crushing and agglomeration plant, heap leaching area, chemical plant and Solvent Extraction and Crystallization (SX - CR - RCR), which prepares the final product. Additionally there are offices for administration, chemical laboratories and worker lodging. The infrastructure is spread out over the Sulfatos Chile site.

| 8 |

| 9 |

RAW MATERIAL RECEIVING

This part of the plant has a checkpoint, truck weighing area, receiving system and holding area for the raw material where it waits to be crushed.

CRUSHING PLANT

This is the dry area of the plant where the raw material is crushed to the size necessary for the next stage.

| 10 |

AGGLOMERATION AREA

In this operation, the crushed material is prepared for the first addition sulfuric acid.

HEAP LEACHING PITS

This area has a platform of 28,000 square meters of level surface conditioned with HDPE liner folders, stacking capacity of 600,000 tons.

| 11 |

CHEMICAL PLANT

The Solvent Extraction and Crystallization (SX - CR - RCR) plant utilizes solvent by extraction technology to separate the copper from the liquid solution before it is purified and crystallized into the final product.

CHEMICAL LABORATORY

The laboratory consists of a samples preparation area and a chemical analysis area, along with quality assurance and quality control.

Mining Interests

| Claims/Mining Properties | Location | Entity | Ownership Interest |

| Anica Copper Mines | Anico Project, Illapel | Sociedad Sulfatos Chile, S.A. | 60.00% |

Sulfatos Chile SA owns the Anica Copper Mine, however, the Company has determined that it is more cost effective to purchase copper ore than it is to mine it and is not currently utilizing the Anica mine and has no plans to do so in the future. The Anica mine has not been established as having any material proven or probable mineral reserves. Because the useful life of this mine to Sulfatos is currently unknown, the Company elected to impair $4,146,764, the full book value of the Anica Mine plus other mine costs as of December 31, 2013.

| 12 |

Raw Material Sources

Local family miners represent a large opportunity for potential supply of quality ore at discounted prices as do larger local mining companies.

For example, in 2014 the Company signed a supply agreement with Minera Illapel to purchase ore with an estimated 1% soluble copper grade as well as Pregnant Leaching Solution (PLS), the material required for crystallization in the manufacturing of Copper Sulfate.

The purchased copper ore is crushed to 0.25 inch pellets at our Sulfatos Chile crushing facility and transported to the leaching pads, where it is irrigated with a mixture of sulfuric acid and water to create a solution with a heavy concentration of copper, PLS. The PLS accumulates in large pools where it will concentrate for a short period before it is pumped into the company’s state-of-the-art crystallization plant and converted into Copper Sulfate Pentahydrate. The plant utilizes solvent by extraction technology to separate the copper from the liquid solution before it is purified and crystallized to very strict specifications.

Additionally, Lustros can purchase PLS directly from Minera Illapel which will allow the company to significantly increase output at the plant by bypassing the crushing and leaching portions of the process for a portion of our Copper Sulfate production. This supply agreement will allow the company to crush and process the maximum amount of ore currently permitted and, in addition, process the PLS purchased from Minera Illapel which will significantly enhance the output of copper sulfate.

Mineraltus – Tailings Treatment Subsidiary

Mineraltus SA was created as a subsidiary to clean up tailings from closed mining operations, charging the government and private mine owners for the clean-up and potentially taking mineral rights on the abandoned tailings. Mineraltus has entered into one agreement, the Congo Project, and is not currently exploring any other opportunities.

Congo Project

Mineraltus previously agreed to remove the tailings and restore the value of the property so that it could be used for development projects. The Company’s purchase price was $7 million payable as follows:

| · | $360,000 was paid on November 26, 2012 for the right to use all assets and facilities; |

| · | $436,828 payable upon completion of the copper sulfate processing plant on site no later than November 13, 2014 as the final payment for the assets; |

| · | $6,203,172 payable in equal monthly installments of $77,540 beginning on July 1, 2013 for the lease of the Lo Aguirre main pit. SMP may request that the final 12 lease payments not be made by the Company in exchange for the return of 60.2 hectares of land at their option on or before date the 69th lease payment is made. Lease payments had not yet begun and were in default as of the time of this filing. |

The required lease payments for the Congo Project have not been made to date and production of the copper sulfate processing plant on the property has not begun. The Company is currently in negotiations to amend the original agreement through arbitration but no agreement has been finalized. On October 16, 2014, we were informed that an injunction order was granted against Lustros Chile SPAs assets in the arbitration until a resolution is reached. These assets include bank accounts and Lustros’ shares on Sulfatos Chile S.A. Because the Company was in default under the original terms of this agreement and the resolution of said default is currently unknown, the Company elected to fully reserve for the $360,000 paid for the right to use as of December 31, 2013. $465,239 in lease payments were accrued as of December 31, 2013. There is approximately $3,017,191 claimed against the Company in arbitration in this matter. Should the arbitrator decide against the Company, it may be forced to liquidate some or all of its assets to satisfy the judgment. The Company currently has no plans to move forward with this project and is considering its options.

Employees

As of the date of this filing, we currently have four management level employees who work for Lustros, Inc. (two are employed full time and two are employed on a part-time basis and are not compensated) and one full time office staff member. Sulfatos Chile employs 39 full-time employees.

We may require additional employees in the future as we expand our operations. There is intense competition for capable, experienced personnel and there is no assurance we will be able to obtain new qualified employees when required.

| 13 |

Competition

We compete with other mineral resource processing, exploration and development companies for financing and for the acquisition of raw material. Many of the mineral resource processing, exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of ore. This competition could have an adverse impact on our ability to acquire the raw materials needed to produce our product or to achieve the financing necessary for us to fund operations and develop other projects.

Government Regulations and Permits

Our mineral exploration and processing activities are subject to extensive foreign laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Mineral exploration and processing is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations may impose substantial costs on us and will subject us to significant potential liabilities. Changes in these regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations.

Various permits from government bodies are required for mining and processing operations to be conducted; no assurance can be given that such permits will be received. Permits for exploration and development are administered by the Chilean National Geological and Mining Service (SERNAGEOMIN). Environmental compliance is assured via the offices of the National Environmental Committee (CONAMA). Claim titles are recorded at the local Mining Conservator in Copiapo.

We believe that we are in compliance in all material respects with applicable Chilean mining, health, safety and environmental statutes and the regulations passed thereunder. There are no current orders or directions relating to us with respect to the foreign laws and regulations.

We have obtained or have pending applications for those licenses, permits or other authorizations currently required in conducting our exploration and other programs, but may from time to time need to apply for new, or renew our current, licenses, permits or other authorizations to continue our business or expand our operations.

Environmental Regulation

In connection with mining, production and exploration activities, we are subject to extensive Chilean laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species. Potential areas of environmental consideration for mining companies, including ours include but are not limited to, acid rock drainage, cyanide containment and handling, contamination of water courses, dust and noise. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Specifically, we may be subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. These laws are continually changing and, in general, are becoming more restrictive. Additionally, we may be subject to liability for pollution or other environmental damages that we may elect not to insure against due to prohibitive premium costs and other reasons.

| 14 |

Chile’s environmental law (Law No 19.300), which regulates all environmental activities in the country, was first published in March 1994. An exploration project or field activity cannot be initiated until its potential impact to the environment is carefully evaluated. This is documented in Article 8 of the environmental law and is referred to as the Sistema de Evaluación de Impacto Ambiental (SEIA).

The SEIA is administered and coordinated on both regional and national levels by the Comisión Regional del Medio Ambiente (COREMA) and the Comisión Nacional del Medio Ambiente (CONAMA), respectively. The initial application is generally made to COREMA, in the corresponding region where the property is located, however in cases where the property might affect various regions the application is made directly to the CONAMA. Various other Chilean government organizations are also involved with the review process, however, most documentation is ultimately forwarded to CONAMA, which is the final authority on the environment and is the organization that issues the final environmental permits.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site, www.sec.gov.

Item 1A RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 1B UNRESOLVED STAFF COMMENTS

We received a comment letter from the Commission on January 23, 2014 with regard to our Registration Statement on Form S-1, which was filed on December 27, 2013. We have not yet responded to this letter as we needed to first update our periodic reports. We have included disclosure in this Form 10-K which we believe is consistent with the Commission’s comments and plan on revising our Form S-1 and formally responding to the Commission upon completion of this Form 10-K and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2014 and June 30, 2014 and September 30, 2014, respectively.

Item 2 PROPERTIES

Our corporate office is located at 9025 Carlton Hills Blvd., Santee, California 92071. This facility is a 1,530 square foot administrative office space, which we have leased through September 30, 2015 with extensions available through September 30, 2017 at a monthly rent of $2,029. Our telephone number at this facility is 619-449-4800. It is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our operations. We do not foresee any significant difficulties in obtaining any required additional facilities. We do not presently own any real property in the United States.

Sulfatos Chile has offices in Santiago, Chile located at Avenida Nuevade Lyon 96 Officina 202, Providencia, Santiago, Chile that are leased at a cost of 1,745,585 CLP or approximately $2,910 per month. It is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our operations in Chile. We do not foresee any significant difficulties in obtaining any required additional facilities. Additionally, through Sulfatos Chile we hold interests in the Anico Copper Mine mining property described below, and we own the property on which the processing plant is located, 835 hectares in Fundo Puerto Oscuro, Comuna de Canela, Province of Choapa, Los Vilos, Chile.

| 15 |

The Sulfatos Chile property is located in the la Cuarta region, close to the township of Canela and less than 20 Km from the Ruta 5 highway, 22 kilometers northeast of the community of Illapel in the fourth region of the Choapa Province. Illapel is located on a plain along the side of the Illapel River, approximately 57 km northeast from Los Vilos and approximately 144 km south from Ovalle. The Sulfatos Chile property is located at latitude North 31 degrees, 25 minutes, 6953 seconds, longitude East, 71 degrees, 10 minutes, 588 seconds, with UTM coordinates of 6.521.208 meters North, 293.319 meters East. The Sulfatos Chile property is approximately 22 km by conventional roadways, from Illapel, on the road leading to Combarbalá, past the Auco sector, following the road that leads to Cocou, then to Culen Creek, where the Sulfatos Chile property is located.

On February 21, 2011, a lease offer with purchase option agreement was formalized between Sulfatos Chile and the property owners of the plant site. The lease with option to purchase has a term of 10 years and includes the water rights of 2 liters per second. This agreement has been superseded by a purchase agreement executed on March 31, 2011. The total purchase price for 835 hectares in Fundo Puerto Oscuro, Comuna de Canela, Province of Choapa, Los Vilos, Chile is 280 million Chilean Pesos (currently $585,040 US) payable over 2 years. 100 million Chilean Pesos (currently $217,276 USD) was paid upon signing and 90 million Chilean Pesos ($183,882 USD) was due one year after signing and 90 million Chilean Pesos (currently $183,882 USD) is due two years after signing. On June 12, 2014, Sulfatos Chile SA and the Landowners signed a Loan Refinance Agreement (the “Loan Refinance Agreement”) whereby the parties agreed that Sulfatos Chile SA will pay the Debt in thirty-seven installments, which will accrue interest at a rate of 3% per year, payable at the end of the last installment. The parties agree that the total amount of the interest accrued will be CLP$7,822,942, or approximately $14,004 US dollars. The first installment for CLP$10,000,000, or approximately $17,901 US dollars, was paid at the signing of the agreement. The following 35 installments of CLP$5,000,000 each, or approximately $8,951 US dollars, will be paid monthly within the first five days of each month, beginning in August of 2014. The final installment, number 37, for the remaining unpaid principal and all accrued interest, will be made in one payment for a total of CLP$12,227,995, or approximately $21,890 US dollars.

Item 3 LEGAL PROCEEDINGS

The Company was named in a action filed by Unirac, Inc. in New Mexico State Court on June 22, 2011 (Unirac, Inc. v. Power Save Energy Corporation et al., Case No. D-202-CV-2011-06295). Also named as defendants in this lawsuit were, among others, SLO 3 Holdings, Inc., Michael Forster, and Zirk Engelbrecht (“Other Defendants”). A settlement agreement was entered into on July 1, 2013, whereby the Other Defendants agreed to be responsible for paying Unirac, Inc.’s claim; however, pursuant to that settlement agreement, Unirac, Inc. retained the right to pursue the Company for payment of its claim if the Other Defendants did not honor their commitment to do so. A Stipulated Judgment (“Judgment”) was entered into in the New Mexico State Court action based upon this settlement agreement on July 19, 2013. The Plantiff has recently taken action to enforce this Judgment by filing an Application for Entry of Judgment on Sister State Judgment in San Luis Obispo County, California. Assuming that Michael Forster, Zirk Engelbrecht (aka Zirk de Maison) and/or SLO 3 Holdings, Inc. have the financial capacity to pay the Judgment, interests and any associated costs, and do not dispute the validity or enforceability of the Judgment, the Company should have no financial exposure in connection with this lawsuit. However, the Company has done no investigation to determine the financial ability of the Other Defendants to pay the funds now due pursuant to the Judgment. The Company does have information, however, that one of the defendants, Mr. Engelbrecht/de Maison, is incarcerated and his assets have been frozen. Also, the Company does not know if any of the Other Defendants are, for any reason, disputing the validity or enforceability of the Judgment.

The Company was engaged in litigation in the Supreme Court in the County of Westchester, New York, Index No. 11139/2009, in the matter Steeneck v. Power-Save and Engelbrecht. The claim was brought before the Court on or about May 8, 2009, although the defendants were never notified of the action until September 2012. Putting aside pleading in the alternative (duplicative claims under different legal theories for the same acts/omissions to act) the claim appears to be for approximately $200,000. As reported on Form 8-K filed with the Commission on January 18, 2013, the Company was informed that on January 10, 2013 the Court filed and entered a Decision & Order stating that the statute of limitations of the action had expired and that the plaintiff is not entitled to the relief that was sought. The plaintiff’s motion was denied and the case is now marked as disposed by the court.

The Company’s subsidiary, Sulfatos Chile, is engaged in arbitration in Chile, Docket Number 1639-2012 before Mr. Andres Molina del Rio, whereby Franciso Javier Morales Rivera E.I.R.L and Nunez Ojeda y da Silva LLC asked for the termination of the Engineering and Construction contract of the Anica Plant and sought damages of $1,989,300 for breach of contract. This matter was settled on May 6, 2014 by way of a public deed with the claimants and respondents both dismissing their claims and counterclaims respectively.

| 16 |

The Company’s subsidiary, Sulfatos Chile, is engaged in arbitration in Chile, Docket Number 5765-2013 before Mr. Mauricio Izquierdo, whereby in May of 2013 Minera Anica S.A. asked for the dissolution of Sulfatos Chile S.A. as a consequence of a breach of the stockholders’ agreement by Santa Teresa Minerals and seeking a to be determined amount of damages to be discussed in a different stage of the trial. Bluestone SpA (a wholly owned subsidiary of Lustros Chile S.A.), Santa Teresa and Lustros Chile SpA. filed their responses to the claim, asking the Court to dismiss it. Also, Bluestone SpA filed a counter claim against Minera Anica S.A. Minera Anica alleging, among other things, a breach of the articles of incorporation of Sulfatos Chile S.A. The probatory stage of this case is still pending.

The Company’s subsidiary, Lustros Chile SpA, is engaged in arbitration in Chile, Docket Number 1933-2013, before Mr. Juan Carlos Varela M. whereby Nueva Pudahuel filed a request for arbitration before the Center for Arbitration and Mediation of the Santiago Center of Commerce in December of 2013 against Lustros Chile, SpA, a wholly owned subsidiary of the Company, asking for the termination of the tails contract referred to the “Congo” project. It is also asking for the restitution of some properties, the payment of due rent, and damages in the amount of $3,017,191, (i) USD 775,396.5 for unpaid rents 2013-2014; (ii) USD 77,539.65 for each month of delay; (iii) UF 50.000.- under penalty clause. Lustros is asking for the termination of the contract, plus damages of UF 50.000 in a counterclaim under the penalty clause. On July 31, 2014 we filed our rejoinder to their claim and our rebuttal to our counter claim. On September 16, 2014 and September 29, 2014, the parties attended conciliatory hearings before the arbitrator. The arbitrator conceded an extension for the parties to continue conversations about the possibility to settle. That extension ended on October 6, 2014. In addition, Lustros Chile SpA has filed a civil law action, objection to an arbitrator Docket Number 111-2014 before the 23rd Civil Trial Court in Santiago. We are asking the Civil Trial Court to declare that Mr. Varela, as an arbitrator for the case Docket Nº 1933-2013 cannot continue the arbitration because of his objection in the process. This action was brought since the arbitrator filed a preliminary decision on the matter before he was allowed to do so. Therefore, we believe that he lacks impartiality for the final ruling. On October 16, 2014, we were informed that an injunction order was granted by Mr. Varela and executed on Lustros Chile SpA’s assets in the arbitration. As a consequence, the following assets are and will remain seized: Lustros Chile SpA’s shares in Sulfatos (600,000 shares though it is alleged that Lustros Chile SPA does not own any property or shares in Sulfatos Chile S.A.); 24,000 shares in Bluestone SpA; bank account ending in 0748 at Itaú Bank; all credit that Lustros Chile SpA has against Sulfatos Chile S.A.; and all credit related to the current account between Lustros Chile SpA and Sulfatos Chile S.A. On October 16, 2014 the Company’s bank account at Itau Bank was levied for 29,019,497 CLP or approximately $49,636 US Dollars. These measures will remain in place until Lustros Chile SpA pays Nueva Pudahuel the full claimed amount, offers assets as guarantee, or arrives at a settlement. Lustros Chile SpA continues to vigorously defend against the actions taken and is working through its Chilean attorneys to resolve these matters as soon as reasonably possible. The arbitration and the trial are in their final stages, the parties having presented their main arguments and means of proof however no decision has been made as of the time of this filing. Our copper sulfate processing plant is currently shut down pending resolution of this matter.

The company’s subsidiary, Sulfatos Chile S.A., in engaged in litigation before the 8th Civil Trial court of Santiago, Docket Nº 18242-2013, in the matter Nueva Pudahuel S.A. v. Sulfatos Chile S.A. The claim was brought before the court on or about November 2013. Nueva Pudahuel S.A. is claiming for the payment of invoices for a total amount of $58,386.61. The company has filed a formal opposition to such claim, under articles 464 et seq of the Chilean Civil Procedural Code., which is currently in the probatory stage.

The Company’s subsidiary, Sulfatos Chile S.A. is involved in various labor lawsuits with former employees that are likely to have an unfavorable outcome. We have accrued approximately $345,000 as of the date of this filing to handle these claims.

The Company’s subsidiary, Sulfatos Chile S.A. is engaged in litigation before the 4th Civil Trial Court of Santiago, Docket No. 25496-2014, in the matter of Oryxeio Ingenieria Limitada v. Sulfatos Chile S.A. On December 22, 2014 Sulfatos Chile S.A. was declared bankrupt by the court. The Board of Directors of Sulfatos Chile S.A. decided not to oppose the bankruptcy process. The Company will provide more information on these proceedings via a Current Report on Form 8-K as it becomes available.

Other than the foregoing, we know of no material, existing or pending legal proceedings against the Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

Item 4 MINE SAFETY DISCLOSURES

As of December 31, 2013, we were an exploration stage company in pilot production at our copper sulfate production plant and had not engaged in any actual mining activities that would result in mining violations.

| 17 |

PART II

Item 5 MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock is currently traded on the OTC Pink Sheets under the symbol “LSTS.” Our symbol was previously “LSLD” from March 9, 2012 until January 10, 2013 when our symbol was changed to our current symbol “LSTS.” Prior to the Bluestone Acquisition, our symbol was “PWSV”. The market represented by the OTC Markets, Inc. Pink Sheets is limited and the price for our Common Stock quoted on the OTC Markets, Inc. Pink Sheets is not necessarily a reliable indication of the value of our Common Stock. Our stock is a “penny stock” as defined in the penny stock rules which are under Exchange Act Section 15(h) and Exchange Act Rules 3a51-1 and 15g-1 through 15g-100, all as amended.

The following table sets forth the high and low bid prices for shares of our Common Stock for the period from January 1, 2012 to December 4, 2014, as reported on the OTCQB and OTC Markets, Inc. Pink Sheets (as of April 16, 2014). Quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Common Stock | |||||

| High | Low | ||||

| 2014 | |||||

| Fourth Quarter (through December 4, 2014) | $ | 0.095 | $ | 0.015 | |

| Third Quarter | $ | 0.15 | $ | 0.05 | |

| Second Quarter | $ | 0.18 | $ | 0.07 | |

| First Quarter | $ | 0.32 | $ | 0.08 | |

| High | Low | ||||

| 2013 | |||||

| Fourth Quarter | $ | 0.48 | $ | 0.14 | |

| Third Quarter | $ | 0.44 | $ | 0.14 | |

| Second Quarter | $ | 0.63 | $ | 0.30 | |

| First Quarter | $ | 1.06 | $ | 0.32 | |

| High | Low | ||||

| 2012 | |||||

| Fourth Quarter | $ | 1.50 | $ | 0.66 | |

| Third Quarter | $ | 1.72 | $ | 1.06 | |

| Second Quarter | $ | 2.48 | $ | 0.60 | |

| First Quarter (March 9-March 31) | $ | 1.53 | $ | 0.41 | |

| First Quarter (January 1-March 8)* | $ | 1.01 | $ | 0.11 | |

*The share prices from January 1, 2012 through March 8, 2012 share prices for the Common Stock of the Company reflect pre-Bluestone Acquisition reverse merger share prices.

| 18 |

Description of Securities

On December 3, 2013 the Company filed a Definitive Schedule 14C Information Form with the SEC informing them that the holders of more than a majority of the outstanding Common Stock of the Company had approved to amend the Company’s Certificate of Incorporation to increase the number of authorized shares of Common Stock from 100,000,000 to 250,000,000 which had been approved by a vote of the shareholders of the Company on November 20, 2013.

Holders

As of December 5, 2014, an aggregate of 121,160,193 shares of Common Stock were issued and outstanding and were held by approximately 503 holders of record, based on information provided by our transfer agent. This total excludes 202,794 shares of Preferred Stock which are convertible in to 20,279,400 shares of Common Stock.

Recent Sales of Unregistered Securities

2013 Issuances

The authorized capital stock of Lustros consists of 250,000,000 shares of Common Stock, $0.001 par value per share, and 10,000,000 shares of Preferred Stock, par value of $0.001 per share, designated “Series A Preferred Stock.” Each share of Series A Preferred Stock is convertible at the option of the holder into 100 shares of Common Stock, and is entitled to 100 votes per share on all matters submitted to the shareholders of Lustros. On December 31, 2013, there were 97,169,346 shares of Common Stock and 441,416 shares of Series A Preferred Stock outstanding.

From January 2013 through December 2013, Magna converted $527,378 of their loans and $1,338 in accrued interest valued at $977,733 with the debt discount into 2,424,728 shares of Common Stock.

On March 1, 2013, the Company and Global Investments I, LLC (“Global”) entered into a Stock Purchase Agreement, whereby Global agreed to purchase 818,182 shares of Common Stock at a purchase price of $0.55 per share or net proceeds of $450,000. More information regarding this agreement can be found in the Company’s Form 8-K filed with the Commission on March 7, 2013.

On March 1, 2013, the Company and Angelique de Maison (“de Maison”) entered into a Stock Purchase Agreement, whereby de Maison agreed to purchase 181,818 shares of Common Stock at a purchase price of $0.55 per share or net proceeds of $100,000. More information regarding this agreement can be found in the Company’s Form 8-K filed with the Commission on March 7, 2013.

On April 22, 2013 the Board of Directors of the Company approved the sale of up to 100,000 Preferred Series “A” Shares of the Company (Series “A” Shares) at a purchase price of $10.00 per share. Each Series “A” Share is convertible into 100 shares of Company Common Stock upon the satisfaction of certain terms and conditions. On June 25, 2013 the Board of Directors of the Company approved increasing the number of Preferred Series “A’ Shares available for sale to 142,200. The Series A Shares were offered to small group of accredited investors already familiar with the Company in a private placement transaction exempt from registration under Section 4(2) of the Securities Act of 1933. The termination date of the offering was September 30, 2013, and a total of 142,200 Series “A” Shares for a total of $1,422,000 have been subscribed for to date, $700,000 were received in cash proceeds and $722,000 were settled against related party notes. The offering is only available to this small group of accredited investors and this disclosure does not constitute an offer to sell securities to any persons whatsoever.

On June 25, 2013 the Board of Directors of the Company approved the sale of up to an additional 50,000 Preferred Series “A” Shares of the Company (Series “A” Shares) at a purchase price of $17.00 per share. Each Series “A” Share is convertible into 100 shares of Company Common Stock upon the satisfaction of certain terms and conditions. The Series “A” Shares were offered to small group of accredited investors already familiar with the Company in a private placement transaction exempt from registration under Section 4(2) of the Securities Act of 1933. The termination date of the offering is September 30, 2013. The offering is only available to this small group of accredited investors and this disclosure does not constitute an offer to sell securities to any persons whatsoever. In addition, the Board of Directors of the Company approved the sale of Convertible Notes bearing interest at the rate of 10% per annum redeemable in 18 months or convertible after six months into shares of the Company’s Common Stock at a price equal to 60% of the average of the variable weighted average price for the 10 trading days prior to the date of conversion. As of September 30, 2013, 19,176 subscriptions had been sold for $326,000 in cash proceeds and $69,000 in Convertible Notes had been issued.

| 19 |

On August 8, 2013 the Board of Directors of the Company approved the sale of up to an additional 130,000 Preferred Series “A” Shares of the Company (Series “A” Shares) at a purchase price of $5.00 per share. Each Series “A” Share is convertible into 100 shares of Company Common Stock upon the satisfaction of certain terms and conditions. The Series “A” Shares were offered to small group of accredited investors already familiar with the Company in a private placement transaction exempt from registration under Section 4(2) of the Securities Act of 1933. The termination date of the offering is September 30, 2013. The offering is only available to this small group of accredited investors and this disclosure does not constitute an offer to sell securities to any persons whatsoever. As of September 30, 2013, 130,000 subscriptions had been sold for $650,000 in cash proceeds.

In October 2013 the Board of Directors of the Company approved the sale of up to an additional 50,000 Preferred Series “A” Shares of the Company (Series “A” Shares) at a purchase price of $5.00 per share. Each Series “A” Share is convertible into 100 shares of Company Common Stock upon the satisfaction of certain terms and conditions. The Series “A” Shares were offered to small group of accredited investors already familiar with the Company in a private placement transaction exempt from registration under Section 4(2) of the Securities Act of 1933. The termination date of the offering was October 31, 2013. The offering was only available to this small group of accredited investors and this disclosure does not constitute an offer to sell securities to any persons whatsoever. As of October 31, 2013, 50,000 subscriptions had been sold for $250,000, $210,000 in debt conversion and $40,000 in cash proceeds.

On November 13, 2013 Angelique de Maison agreed to convert 4,500,000 shares of Common Stock into 45,000 shares of Preferred Series “A” Shares of the Company. These Preferred Series “A” Shares are convertible back to Common Stock at the holder’s option at the rate of 100 shares of Common Stock for each Preferred Series “A” share.

On November 13, 2013 the Board of Directors of the Company approved that as a condition to closing a financing transaction, all related party debt would be converted into stock of the Company. A total of $880,640 in debt was converted into 55,040 shares of Preferred Series A Stock at $16 per share. Each Series “A” Share is convertible into 100 shares of Company Common Stock upon the satisfaction of certain terms and conditions. The Series “A” Shares were offered to small group of accredited investors already familiar with the Company in a private placement transaction exempt from registration under Section 4(2) of the Securities Act of 1933. The termination date of the offering was October 31, 2013. The offering was only available to this small group of accredited investors and this disclosure does not constitute an offer to sell securities to any persons whatsoever.

On November 15, 2013, the Company entered into a Unit Purchase Agreement (the “Unit Purchase Agreement”) with several accredited investors pursuant to which an initial closing has occurred with respect to which certain accredited investors purchased a total of 1,975,000 units at a purchase price of $.80 per unit, for a total purchase price of $1,580,000. Each unit (“Unit”) consists of five shares of Common Stock of the Company and one warrant to purchase a share of common stock of the Company (“Warrant”). The Unit Purchase Agreement, as amended, allows for sales of up to $1,650,000 aggregate purchase price for the Units, and the Company may have one or more subsequent closings until it reaches the $1,650,000 limit. The shares purchased in conjunction with the Units will be registered on a resale registration statement to be filed by the Company in conjunction with a registration rights agreement which was executed in connection with the Unit Purchase Agreement. As of December 31, 2013 a total of 9,875,000 common shares had been sold under these Unit Purchase Agreements for $1,580,000 in cash proceeds less fees. This registration statement is required to be filed within 30 days of the closing date as contemplated by the Unit Purchase Agreement. Each Warrant issued in connection with the units bears a $0.25 per share exercise price and expires on the third anniversary of the date of issuance. If at any time the volume weighted average price as reported on Bloomberg, LP on the OTCQB or other principal market for the Company’s common stock for one share of the Company’s common stock is more than $.50 (as adjusted for stock splits and reverse splits) for a period of thirty (30) consecutive calendar days, the Company, may, upon twenty (20) business days prior written notice, repurchase this Warrant in whole or in part, whether or not the actual Warrant is tendered to the Company, at a purchase price of $.001 per share represented by the portion of the Warrant being repurchased, which payment must be made by the Company to the Warrantholder no later than 5 PM Pacific standard time on the 15th business day following the date of tender of written notice by the Company to the Warrantholder to repurchase such Warrant. All issuances of the Company’s securities pursuant to the above have been made, or will be made, in reliance on the exemption from registration contained in Section 4(2) of the Securities Act of 1933, as amended and Regulation D, as amended, as promulgated under the Securities Act of 1933, and all investors in the above referenced transaction are accredited investors as such term is defined in Regulation D. No general solicitation or advertising was used in connection with the sale of such securities, and the Company has imposed appropriate limitations on resales.

Axiom Capital Management, Inc. acted as sole placement agent in connection with the financing and received a 9% commission and is entitled to warrants to purchase shares of the Company’s Common Stock equal to 10% of the aggregate purchase price paid by each purchaser of the Units at the same terms as the Warrants issued to said purchasers.

| 20 |

2014 Issuances

On January 16, 2014, a holder of a Convertible Note (see Note 7 – Debt) in the amount of $20,000 elected to convert their Convertible Note into Common Stock of the Company. $20,000 of principal plus $802.19 in accrued interest was converted into 128,647 shares of Common Stock at the rate of $0.1617 (60% of the 10 day average on 1/16/2014) which is a discount of $0.1078 per share.

On March 5, 2014, Suprafin, Ltd. converted 39,540 shares of Series A Preferred Stock into 3,954,000 shares of Common Stock of the Company.

On June 16, 2014, Angelique de Maison converted 178,200 shares of Series A Preferred Stock into 17,820,000 shares of Common Stock of the Company and a company controlled by Ms. de Maison converted 2,941 shares of Series A Preferred Stock into 294,100 shares of Common Stock of the Company.

On August 14, 2014, a shareholder converted 17,941 shares of Series A Preferred Stock into 1,794,100 shares of Common Stock of the Company.

Dividends

Our Board of Directors has not declared a dividend on our Common Stock since inception and presently anticipate that all earnings, if any, will be retained for development of our business and that no dividends on our common stock will be declared in the foreseeable future. Any future dividends will be subject to the discretion of our Board of Directors and will depend upon, among other things, future earnings, operating and financial condition, capital requirements, general business conditions and other pertinent facts. Therefore material, there can be no assurance that any dividends on our common stock will be paid in the future.

Item 6 SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. You should read this report completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

| 21 |

References in this Annual Report to the “Company”, “we”, “us” or “our” refer to Lustros, Inc., a Utah corporation (“Lustros”), and its consolidated subsidiaries including, Bluestone, S.A, (“Bluestone”), Lustros Chile SpA (“Lustros Chile”), Mineraltus SA (“Mineraltus”) and Sulfatos Chile, S.A., (“Sulfatos Chile”). The following discussion of our financial condition and results of operations should be read in conjunction with the financial statements and related notes to the financial statements included elsewhere in this filing.

We market and sell copper sulfate obtained by processing copper ore raw materials purchased from third parties at a Company-owned processing facility in Chile.

On March 9, 2012, Lustros acquired all of the outstanding capital stock and rights to acquire capital stock of Bluestone, S.A. a Chilean corporation, in exchange for 60,000,000 shares of its common stock (the "Bluestone Acquisition"). As of the closing, these shares represented 96.7% of Lustros' outstanding common stock. For financial reporting purposes, the Company has treated the Bluestone Acquisition as a reverse acquisition with Bluestone the acquiring entity and Lustros as the acquired entity. As a result, the Company's financial statements reflect the financial information of Bluestone prior to March 9, 2012 and the combined entity on and after March 9, 2012. Because Bluestone commenced operations in January 2012, there are no results of operations for Bluestone prior to that date.

On February 15, 2012, Bluestone purchased a 60% equity interest in Sulfatos Chile, S.A. from Santa Teresa Minerals S.A., a Chilean corporation ("Santa Teresa Minerals"). The purchase price for the equity interest was: (a) a 20% interest in Bluestone; (b) $2.2 million, with $1.1 million paid by assumption of a demand loan payable by Santa Teresa Minerals to Angelique de Maison, and the balance of $1.1 million to be paid in monthly installments from time to time upon demand by Santa Teresa Minerals. As of December 31, 2013, the entire purchase price has been paid. On October 16, 2012 Angelique de Maison entered into an agreement with Santa Teresa Minerals pursuant to which Santa Teresa Minerals waived and released any claim to any Equity Interests in Bluestone or Lustros and their affiliated companies, with Bluestone and Lustros Inc. express third party beneficiaries of that waiver and release. As such, Santa Teresa Minerals' 20% interest in Bluestone has been cancelled, and Bluestone is a wholly owned subsidiary of Lustros. This acquisition has been treated as an "asset purchase" for financial reporting purposes. Because the acquisition was between related parties, the purchase price has been allocated to additional paid-in capital and the assets and liabilities were carried over at historical costs. Results of operations for Sulfatos have been reflected in the Company's financial statements from the closing date.

On March 25, 2012, the Company sold the assets (including the "Power-Save" name) of its renewable energy and energy savings product business in which it had engaged prior to the Bluestone Acquisition, to the former management of the Company. The purchase price for the assets was the cancellation of obligations for unpaid salaries and other monies owed to prior management and the assumption by the buyer of certain liabilities of the Company related to the Power-Save business.

We process raw copper ore material at our copper sulfate processing plant in Puerto Oscuro, Chile. We obtain the copper ore by purchase from local corporate and artisanal miners. Our copper sulfate facility began crushing and processing 5,000 tons of raw material per month in the second quarter of 2014. However, the Company shut down the copper sulfate processing plant in December 2014 pending resolution of legal matters (See Item 3 - Legal Proceedings).

Our consolidated financial statements contain our accounts and those of our consolidated subsidiaries, all of which are wholly-owned at December 31, 2013 except for Sulfatos and Mineraltus, which we control. Due to the structure of our ownership interests in Sulfatos and Mineraltus, in accordance with generally accepted accounting principles, we consolidate the financial statements of Sulfatos and Mineraltus into our financial statements rather than present our ownership interests as equity investments. As such, the non-controlling interests in Sulfatos and Mineraltus are reflected as income attributable to non-controlling interests in our consolidated statements of operations and as a component of stockholders’ equity on our consolidated balance sheet. Throughout this section, when we refer to “our” consolidated financial statements, we are referring to the consolidated results for us, our wholly-owned subsidiaries and the consolidated results of Sulfatos and Mineraltus, adjusted for non-controlling interests in Sulfatos and Mineraltus. All significant intercompany transactions and balances have been eliminated in the consolidation of our financial statements.

| 22 |

RESULTS OF OPERATIONS

The following discusses results of operations from Inception (January 1, 2012) to December 31, 2013.

Revenue for the year ended December 31, 2013 was $204,239 as opposed to $54,902 for the year ended December 31, 2012, most of which was earned from sales of the first pilot run of copper sulfate in December 2013. Gross loss for the year ended December 31, 2013 was $107,122 as opposed to a gross profit of $54,902 for the year ended December 31, 2012. We incurred a gross loss at December 31, 2013 due to the high costs of the small pilot production run produced to validate the operation of the copper sulfate processing plant. We expect revenues to increase significantly after the full scale launch of our copper sulfate production facility which began in the second quarter of 2014.

Operating expenses for the year ended December 31, 2013 were $10,571,612 as opposed to $4,583,352 for the year ended December 31, 2012. Operating expenses were primarily associated with the operations of Sulfatos in the ordinary course of business as well as legal and accounting expenses required by a public company.

Due to the losses during the period the Company has not recorded a provision for income taxes. The Company will carry back any net operating loss to recover taxes paid in prior periods.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES.

Liquidity and Capital Resources

Our primary source of liquidity has historically been cash generated from issuances of our equity securities. From inception through December 31, 2013, we have not generated revenue from operations that was significant enough to produce an operating profit.

Subsequent sources of outside funding will be required to fund the Company’s future growth and will also be required for working capital, capital expenditures and corporate operations if the Company does not reach cash positive cash flow in the near future. No assurances can be given that the Company will be successful in arranging the further funding needed to continue the execution of its business plan including the development and commercialization of new products, or if successful, on what terms. Failure to obtain such funding will require management to substantially curtail, if not cease operations, which will result in a material adverse effect on the financial position and results of operations of the Company.

Cash, Cash Equivalents, and Working Capital

At year end December 31, 2013 we had cash and cash equivalents of $615,469. At year ended December 31, 2012 we had $277,565 of cash and cash equivalents. At December 31, 2013 we had a working capital deficit of $1,959,851 compared to a working capital deficit of $2,497,941 at December 31, 2012. Cash equivalents consist of short-term liquid investments with original maturities of no more than six months and are readily convertible into cash.

The amount of cash and cash equivalents and short-term investments which we hold outside the U.S. was $128,063 as of December 31, 2013 and $277,236 as of December 31, 2012. These were not needed for our domestic operations, but if they were, we would be required to accrue and pay federal taxes to repatriate these funds. We intend to permanently invest these foreign amounts outside of the U.S. and our current plans do not demonstrate the need to repatriate the foreign amounts to fund our domestic operations.

| 23 |

Cash Flows from Operating Activities

In 2013, $3,454,059 was used for operating activities. Of the net cash used in 2013, $5,206,090 was used to fund the operations of the business while $1,752,031 was generated from changes in operating assets and liabilities. Of the net cash used of $3,670,487 in 2012, $4,448,527 was used to fund the operations of the business while $778,040 was generated from changes in operating assets and liabilities

Cash Flows from Investing Activities

Net cash used by investing activities for year ended December 31, 2013 was $393,007 compared to net cash provided by investing activities of $292,383 for the same period in 2012. Investing activities were primarily for the acquisition of Sulfatos Chile by Bluestone and for purchases of property and equipment.

Cash Flows from Financing Activities

Net cash provided by financing activities for the year ended December 31, 2013 was $3,753,214 compared to net cash provided by financing activities of $3,680,108 for the same period in 2012. Financing activities were primarily sales of the Company’s Common and Preferred Stock. Cash from financing activities is used to fund ongoing operational requirements, research & development, administrative and capital needs.

Significant Financing Arrangements

From March 5, 2014 through December 3, 2014 Bass Energy and LV Ventures, Inc. provided the Company with $2,663,596 in cash through two year convertible notes which bear interest at 5% per annum. These notes are convertible into shares of the Company’s Common Stock at the rate of $0.16 per share with 25% warrant coverage at $0.25 per share which is identical to the financing round closed by the Company in December of 2013.

As of December 31, 2013, our current liabilities exceeded our current assets by $1,959,851. At December 31, 2013, we had cash in the amount of $615,469.

Subsequent sources of outside funding will be required to fund the Company’s working capital, capital expenditures and corporate operations if the Company does not reach cash flow positive. No such financing arrangements currently exist and no assurances can be given that the Company will be successful in arranging the further funding needed to continue the execution of its business plan including the development and commercialization of new products, or if successful, on what terms. Failure to obtain such funding will require management to substantially curtail, if not cease operations, which will result in a material adverse effect on the financial position and results of operations of the Company.

Cash Requirements

During the next twelve months, the Company plans to satisfy its cash requirements by income from operations, loans and the sale of debt and equity securities. There can be no assurance that the Company will be successful in raising the capital it requires through loans or the sale of securities. While directors, officers, and principal shareholders have provided funding to the Company since inception, they have no commitment to provide additional funding. Currently our bank accounts in Chile are frozen pending resolution of the arbitration in the Congo Project as is our interest in Sulfatos Chile which could substantially impact our ability to raise capital.

Sulfatos Chile