Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - KEY TRONIC CORP | Financial_Report.xls |

| EX-21 - SUBSIDIARIES OF REGISTRANT - KEY TRONIC CORP | q42014exhibit21.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - KEY TRONIC CORP | q42014exhibit321.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - KEY TRONIC CORP | q42014exhibit312.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - KEY TRONIC CORP | q42014exhibit311.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - KEY TRONIC CORP | q42014exhibit231.htm |

| EX-32.2 - SECTION 906 CFO CERTIFICATION - KEY TRONIC CORP | q42014exhibit322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 10-K

____________________________________________________________

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JUNE 28, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE PERIOD FROM TO

Commission File Number 0-11559

____________________________________________________________

KEY TRONIC CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________________________

Washington | 91-0849125 | |

(State or other jurisdiction of Incorporation or organization) | (I.R.S. Employer Identification No.) | |

N. 4424 Sullivan Road, Spokane Valley, Washington | 99216 | |

(Address of principal executive offices) | (Zip Code) | |

(509) 928-8000

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

____________________________________________________________

Securities Registered Pursuant to Section 12(b) of the Act: None

Title of each class | Name of each exchange on which registered | |

Common stock, no par value | The NASDAQ Stock Market LLC | |

Securities Registered Pursuant to Section 12(g) of the Act: None

____________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of December 28, 2013, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $110.6 million based on the closing price as reported on the NASDAQ.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 10,551,680 shares of common stock were outstanding as of September 3, 2014.

____________________________________________________________

Documents Incorporated by Reference:

The following documents are incorporated by reference to the extent specified herein:

Document Description | Part of Form 10-K | |

Proxy Statement dated September 19, 2014 | Part III | |

KEY TRONIC CORPORATION

2014 FORM 10-K

TABLE OF CONTENTS

Page No. | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | 29-50 | |

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

3

FORWARD-LOOKING STATEMENTS

References in this report to “the Company”, “Key Tronic”, “KeyTronicEMS”, “we”, “our”, or “us” mean Key Tronic Corporation together with its subsidiaries, except where the context otherwise requires.

This Annual Report on Form 10-K contains forward-looking statements in addition to historical information. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Risks and uncertainties that might cause such differences include, but are not limited to those outlined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Risks and Uncertainties that May Affect Future Results.” Readers are cautioned not to place undue reliance on forward-looking statements, which reflect management’s opinions only as of the date hereof. The Company undertakes no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof and disclaims any obligation to do so. Readers should carefully review the risk factors described in periodic reports the Company files from time to time with the Securities and Exchange Commission, including Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

PART I

Item 1. | BUSINESS |

Background

Key Tronic Corporation (dba: KeyTronicEMS Co.), was organized in 1969 as a Washington corporation that locally manufactured computer keyboards. The ability to design, build and deliver a quality product led us to become a leading independent manufacturer of keyboards for computers in the United States. Our fully integrated design, tooling, and automated manufacturing capabilities enabled us to rapidly respond to customers’ needs for keyboards in production quantities worldwide. We supported our sales growth through the development and purchase of international manufacturing facilities. As the computer keyboard market matured with increasing competition from other international providers, we determined that our business could no longer solely rely on keyboard sales.

After assessing market conditions and our strengths and capabilities, we shifted focus from keyboard manufacturing to contract manufacturing for a wide range of products. Our unique strategic attributes are based on our core strengths of innovative design and engineering expertise in electronics, mechanical engineering, sheet metal fabrication and stamping, and precision plastics combined with high-quality, low cost production, and assembly on an international basis while providing exceptional customer service. These strengths have made our company a strong competitor in the electronic manufacturing services (EMS) market.

Our Industry and Strategy

The expansion of the EMS industry has allowed us to continue to expand our customer base and the industries that we serve. The challenging global macroeconomic environment had a negative impact on previously held customer programs during the past fiscal year, as we saw a significant decrease in revenue generated from two of our largest customer programs. However, we are successfully confronting the challenging global macroeconomic environment by controlling our costs and winning new customer programs, which allowed us to maintain our profitability and a strong balance sheet. The increase in new programs represents a growing portion of our revenue and a promising foundation for our future. In keeping with our long-term strategic objectives, we have been successfully building a more diversified customer portfolio, spanning a wider range of industries. We currently offer our customers the following services: integrated electronic and mechanical engineering, precision plastic molding, sheet metal fabrication, assembly, component selection, sourcing and procurement, worldwide logistics, and new product testing and production all at competitive pricing due to our global footprint.

We believe that we are well positioned in the EMS industry to continue the expansion of our customer base and achieve long term growth. Our unique blend of multinational facilities, centralized management, and core strengths continue to support our growth and our customers’ needs. We continue to focus on controlling operating expenses and leveraging the synergistic capabilities of our world-class facilities in the United States, Mexico, and China. This international production capability provides our customers with the benefits of improved supply-chain management, reduced inventory, lower labor costs, lower transportation costs, and reduced product fulfillment time. Given our competitive advantages and the growing pressure for new potential customers to move forward with their outsourcing strategies, we are strongly positioned to win new business in coming periods and grow our revenue and profits.

4

The EMS industry is intensely competitive. Although our customer base is growing we still have less than 1% of the potential global market and our revenue can fluctuate significantly due to reliance on a concentrated base of customers. We are planning for new customer growth in the coming quarters by securing new programs with new and existing customers, increasing our worldwide manufacturing capacity, and continuing to improve our manufacturing and procurement processes. Ongoing challenges that we face include the following: Continuing to win programs from new and existing customers, balancing production capacity and key personnel in support of new customer programs, improving operating efficiencies, controlling costs while developing competitive pricing strategies, and successfully transitioning new program wins to full production during a time of macroeconomic uncertainty.

Customers and Marketing

We provide a mix of manufacturing services for outsourced Original Equipment Manufacturing (OEM) products. We provide the following EMS services: Product design, surface mount technologies (SMT) and pin through hole capability for printed circuit board assembly, tool making, precision plastic molding, sheet metal fabrication, liquid injection molding, complex assembly, automated tape winding, prototype design and full product assembly.

Sales of the majority of our products have not historically been seasonal in nature, but may be seasonal in the future if there are changes in the types of products manufactured. Sales can, however, fluctuate significantly between quarters from changes in customers and customer demand due to the concentration of sales generated by our largest customers.

For the fiscal years 2014, 2013 and 2012, the five largest customers in each year accounted for 62%, 71% and 73% of combined total net sales, respectively. At the end of fiscal year 2014, we were generating revenue from 196 separate programs and 59 distinct customers as compared to 183 programs and 56 customers at the end of fiscal year 2013. As these new customers’ sales ramp up and new programs are won our concentration of revenue should continue to decrease in the future.

The following table represents all customers that represented 10% or more of total net sales during the last three fiscal years:

Percentage of Net Sales by Fiscal Year | ||||||

2014 | 2013 | 2012 | ||||

Customer A | 20% | 19% | 16% | |||

Customer B | 15% | 23% | 29% | |||

Customer C | 15% | 21% | 17% | |||

Although keyboard manufacturing is still included in our product offerings, we do not expect annual keyboard sales to be a material component of our business. We realized revenues of approximately $2.3 million, $2.4 million and $2.8 million in fiscal years 2014, 2013 and 2012, respectively, from the sale of keyboards. In order to accommodate the demand for standard keyboard layouts, we maintain a purchase-from-stock program. The more popular standard layouts are built and stocked for immediate availability.

We market our products and services primarily through our direct sales department aided by strategically located field sales people and distributors. Although we maintain relationships with several independent sales organizations to assist in marketing our EMS product lines, commissions earned and paid are not material to the consolidated financial statements.

Manufacturing

We have continually made investments in developing and expanding a capital equipment base to achieve vertical integration and efficiencies in our manufacturing processes. We have invested significant capital into SMT for volume manufacturing of complex printed circuit board assemblies and in our metal shop providing precision metal stamping, fabricating, and finishing. We also design and develop tooling for injection molding and manufacture the majority of plastic parts used in the products we manufacture. Additionally, we have equipment to maintain a controlled clean environment for manufacturing processes that require a high level of precise control.

We use a variety of manual and automated assembly processes in our facilities, depending upon product complexity and degree of customization. Some examples of automated processes include component insertion, SMT, selective soldering, flexible robotic assembly, automated storage tape winding, computerized vision system quality inspection, laser turrets, automated switch and key top installation, and automated functional testing.

Our engineering expertise and automated manufacturing processes enable us to work closely with our customers during the design and prototype stages of production and to jointly increase productivity and reduce response time to the marketplace. We use computer-aided design techniques and software to assist in preparation of the tool design layout and component placement, to reduce tooling and production costs, improve component and product quality, and enhance turnaround time during product development.

5

We purchase materials and components for our products from many different suppliers, including both domestic and international sources. We develop close working relationships with our suppliers, many of whom have been supplying products to us for several years.

Research, Development, and Engineering

As part of our long-term strategy, we are committed to supporting our customers by providing research, development, and engineering services. These services allow us to facilitate in optimizing new product designs, and the production processes of our customers programs.

Research, development, and engineering (RD&E) expenses consist principally of employee related costs, third party development costs, program materials costs, depreciation, and allocated information technology and facilities costs.

Competition

The market for the products and services we provide is highly competitive. There are numerous competitors in the EMS industry, many of which have substantially more resources and are more geographically diverse than we are. Some of our competitors have similar international production capabilities, large financial resources and some have substantially greater manufacturing, research and development, and marketing resources. There is also competition from the manufacturing operations of our current and potential customers, who are continually evaluating the merits of manufacturing their products internally versus the advantages of outsourcing. We believe that we can currently compete favorably in these areas primarily on the basis of our international footprint, responsiveness, creativity, vertical production capability, quality, and cost.

Trademarks and Patents

Our name and logo are federally registered trademarks, and we believe they are valuable assets of our business. We operate under the trade name “KeyTronicEMS” to better identify our primary business concentration in contract manufacturing in the EMS industry. We also own several keyboard patents; however, since our focus is EMS, management believes that these patents will not have a significant impact on future revenues.

Employees

We consider our employees to be our primary strength and we make considerable efforts to maintain a well-qualified workforce. Our employee benefits include bonus programs involving periodic payments to all employees based on meeting quarterly or fiscal year performance targets. We regularly provide transportation, medical services, and meals to all of our employees in foreign locations. We maintain a 401(k) plan for U.S. employees, which provides a discretionary matching company contribution of up to 4% of an employee’s salary. We provide group health, life, and disability insurance plans. We also maintain stock option plans and other long term incentive plans for certain employees and outside directors.

As of June 28, 2014 we had 3,343 employees compared to 2,584 on June 29, 2013, and 2,700 on June 30, 2012. Since we can have significant fluctuations in product demand, we seek to maintain flexibility in our workforce by utilizing skilled temporary and short-term contract labor in our manufacturing facilities in addition to full-time employees.

Backlog

On July 26, 2014 our order backlog was valued at approximately $103.1 million, compared to approximately $60.0 million on July 27, 2013. Even though our order backlog is comprised of firm purchase orders, the amount of backlog is not necessarily indicative of future sales but can be indicative of trends in expected future sales revenue. Due to the relationships with our customers, we will occasionally allow orders to be canceled or rescheduled and as a result it is not a meaningful indicator of future financial results. If there are canceled or rescheduled orders, we typically negotiate fees to cover the costs we have incurred. Order backlog consists of purchase orders received for products expected to be shipped approximately within the next twelve months, although shipment dates are subject to change due to design modifications, customer forecast changes, or other customer requirements.

Foreign Markets

Information concerning net sales and long-lived assets (property, plant, and equipment) by geographic areas is set forth in Note 12, “Enterprise-Wide Disclosures” of the consolidated financial statements of this Annual Report on Form 10-K and that information is incorporated herein.

6

Executive Officers of the Registrant

The table below sets forth the name, current age and current position of our executive officers and other significant employees:

Name | Age | Positions Held |

Executive Officers | ||

Craig D. Gates | 55 | President and Chief Executive Officer |

Ronald F. Klawitter | 62 | Executive Vice President of Administration, Chief Financial Officer and Treasurer |

Douglas G. Burkhardt | 56 | Executive Vice President of Worldwide Operations |

Philip S. Hochberg | 52 | Executive Vice President of Business Development |

Lawrence J. Bostwick | 62 | Vice President of Engineering and Quality |

Brett R. Larsen | 41 | Vice President of Finance and Controller |

Frank Crispigna III | 53 | Vice President of Materials |

Duane D. Mackleit | 46 | Vice President of Program Management |

Executive Officers

CRAIG D. GATES – President and Chief Executive Officer

Mr. Gates, age 55, has been President and Chief Executive officer of the Company since April 2009. Previously he was Executive Vice President and General Manager from August 2002 to April 2009. He served as Executive Vice President of Marketing, Engineering and Sales from July 1997 to August 2002 and served as Vice President and General Manager of New Business Development from October 1995 to July 1997. He joined the Company as Vice President of Engineering in October of 1994. From 1982 to 1991 he held various engineering and management positions within the Microswitch Division of Honeywell, Inc., in Freeport, Illinois, and from 1991 to October 1994 he served as Director of Operations, Electronics for Microswitch. Mr. Gates has a Bachelor of Science Degree in Mechanical Engineering and a Masters in Business Administration from the University of Illinois, Urbana.

RONALD F. KLAWITTER – Executive Vice President of Administration, Chief Financial Officer, and Treasurer

Mr. Klawitter, age 62, has been Executive Vice President of Administration, CFO, and Treasurer since July 1997. Previously he was Vice President of Finance, Secretary, and Treasurer of the Company from October 1995 to July 1997. He was Acting Secretary from November 1994 to October 1995 and Vice President of Finance and Treasurer from 1992 to October 1995. From 1987 to 1992, Mr. Klawitter was Vice President of Finance at Baker Hughes Tubular Service, a subsidiary of Baker Hughes, Inc. Mr. Klawitter has a BA degree from Wittenberg University and is a Certified Public Accountant.

DOUGLAS G. BURKHARDT – Executive Vice President of Worldwide Operations

Mr. Burkhardt, age 56, has been Executive Vice President of Worldwide Operations of the Company since July 2010. Previously Mr. Burkhardt was Vice President of Worldwide Operations from July 2008 to July 2010 and Director of China Operations and Program Management from January 2006 to July 2008. Mr. Burkhardt also served as Director of Northwest and China Operations from November of 1998 to January of 2006. Mr. Burkhardt also served as Director of Customer Satisfaction from March 1997 to November 1998 and Director of Molding from September of 1995 to March of 1997. Prior to this, Mr. Burkhardt served in other various senior management positions within the Company. Mr. Burkhardt has been with the Company since May of 1989. Prior to joining Key Tronic, Mr. Burkhardt worked for House of Aluminum and Glass for 12 years where he was the plant manager.

PHILIP S. HOCHBERG – Executive Vice President of Business Development

Mr. Hochberg, age 52, has been Executive Vice President of Business Development since July 2012. Prior this, Mr. Hochberg served as Vice President of Business Development from October 2009 through June 2012. He was Director of Business Development and Program Management from July 2008 to October 2009. Mr. Hochberg served as Director of Business Development from October 2004 to July 2008 and as Director of EMS Sales and Marketing from July 2000 to October 2004. Prior to joining Key Tronic, Mr. Hochberg worked for Quinton Instrument Company as their Director of Marketing and Product Management from 1992 to 2000. From 1988 to 1992, he was employed by SpaceLabs Medical as their Business Development Marketing Manager. Mr. Hochberg has an MBA from the University of British Columbia, a BA Psychology, with a minor in Business from Washington University in St. Louis.

7

LAWRENCE J. BOSTWICK – Vice President of Engineering and Quality

Mr. Bostwick, age 62, has been Vice President of Engineering and Quality since July 2008. Previously he was Director of Engineering and Quality from February 2007 to July 2008 and served as Corporate Director of Quality from February 2006 to February 2007. From 2003 to 2006 he was Director of Supply Chain Management and Quality for the Lancer Corporation and from 1998 to 2003 he was Vice President of Operations for Thermacore International. He is a graduate of the Westinghouse and General Electric – Engineering and Manufacturing Professional Development Programs. He is certified in both Quality and Industrial Engineering and is a Lean – Six Sigma Master Black Belt. Mr. Bostwick has a combined B.S. degree in Production and Operation and Industrial Engineering from Bowling Green State University and a Masters degree in Industrial Engineering and Business Administration from Syracuse University.

BRETT R. LARSEN – Vice President of Finance, and Controller

Mr. Larsen, age 41, has served as Vice President of Finance and Controller since February 2010. He was Chief Financial Officer of FLSmidth Spokane, Inc. from December 2008 to February 2010. From October 2005 through November 2008, Mr. Larsen served as Controller of Key Tronic Corporation. From May 2004 to October 2005, Mr. Larsen served as Manager of Financial Reporting of Key Tronic Corporation. From 2002 to May 2004, Mr. Larsen was an audit manager for the public accounting firm BDO Seidman, LLP. He also held various auditing and supervisory positions with Grant Thornton LLP from 1997 to 2002. Mr. Larsen has a Bachelor of Science degree in Accounting and a Masters degree in Accounting from Brigham Young University and is a Certified Public Accountant.

FRANK CRISPIGNA III – Vice President of Materials

Mr. Crispigna, age 53, has been Vice President of Materials of the company since October 2011. Prior to this, Mr. Crispigna held a variety of Materials and Supply Chain positions at Plexus Corporation since 1997, most recently serving as the Director – Supply Chain Solutions from 2005 - 2011. He has a Masters degree in Business Administration, and a Bachelor of Business Administration Degree in Marketing from the University of Wisconsin – Oshkosh. Mr. Crispigna also is a C.P.M., and received his certification in Supply Chain Leadership from the University of Wisconsin.

DUANE D. MACKLEIT – Vice President of Program Management

Mr. Mackleit, age 46, has been Vice President of Program Management of the company since July 2012. He served as Director of Program Management from July 2008 through June 2012. From May 2006 to July 2008 he served as Principal Program Manager. Prior to that, he served as Program Manager from March 2002 to May 2006 and Associate Program Manager from August 2000 to March 2002. Mr. Mackleit has also held several other positions with Key Tronic Corporation. Mr. Mackleit has an AA in Business from Spokane Falls Community College and a BA in Business/Marketing from Eastern Washington University. He also holds a MBA from Gonzaga University.

Available Information

Our principal executive offices are located at N. 4424 Sullivan Road, Spokane Valley, Washington 99216, and our telephone number is (509) 928-8000. Our website is located at http://www.keytronicems.com where filings of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q or current reports on Form 8-K are available after they have been filed with the Securities and Exchange Commission. The information presented on our website currently and in the future is not considered to be part of this document or any document incorporated by reference in this document.

Item 1A. | RISK FACTORS |

There are risks and uncertainties that could affect our business. These risks and uncertainties include but are not limited to, the risk factors described below, in Item 7A: “Quantitative and Qualitative Disclosures about Market Risk” and elsewhere in this Form 10-K.

RISKS AND UNCERTAINTIES THAT MAY AFFECT FUTURE RESULTS

The following risks and uncertainties could affect our actual results and could cause results to differ materially from past results or those contemplated by our forward-looking statements. When used herein, the words “expects,” “believes,” “anticipates” and other similar expressions are intended to identify forward-looking statements.

8

We may experience fluctuations in quarterly results of operations.

Our quarterly operating results have varied in the past and may vary in the future due to a variety of factors, including adverse changes in the U.S. and global macroeconomic environment, volatility in overall demand for our customers' products, success of customers' programs, timing of new programs, new product introductions or technological advances by us, our customers and our competitors, and changes in pricing policies by us, our customers, our suppliers, and our competitors. Our customer base is diverse in the markets they serve, however, decreases in demand, particularly from customers that supply the education, consumer products, and gambling industries, could affect future quarterly results. Additionally, our customers could be impacted by the illiquidity of the credit markets which could directly impact our operating results.

Component procurement, production schedules, personnel and other resource requirements are based on estimates of customer requirements. Occasionally, our customers may request accelerated production that can stress resources and reduce operating margins. In addition, because many of our operating expenses are relatively fixed, a reduction in customer demand can harm our gross profit and operating results. The products which we manufacture for our customers have relatively short product lifecycles. Therefore, our business, operating results and financial condition are dependent in a significant way on our ability to obtain orders from new customers and new product programs from existing customers.

Operating results can also fluctuate if changes are made to significant estimates and assumptions. Significant estimates and assumptions include the allowance for doubtful receivables, provision for obsolete and non-saleable inventory, stock-based compensation, the valuation allowance on deferred tax assets, valuation of goodwill, impairment of long-lived assets, long-term incentive compensation accrual, the provision for warranty costs, and the impact of hedging activities.

We are exposed to general economic conditions, which could have a material adverse impact on our business, operating results and financial condition.

Recently there have been adverse conditions and uncertainty in the global economy as the result of unstable global financial and credit markets, inflation, and recession. These unfavorable economic conditions and the weakness of the credit market could affect the demand for our customers' products. The current global macroeconomic environment may affect some of our customers that could reduce orders and change forecasts which could adversely affect our sales in future periods. Additionally, the financial strength of our customers and suppliers and their ability to obtain and rely on credit financing may affect their ability to fulfill their obligations to us and have an adverse effect on our financial results.

The majority of our sales come from a small number of customers and a decline in sales to any of these customers could adversely affect our business.

At present, our customer base is concentrated and could become more or less concentrated. There can be no assurance that our principal customers will continue to purchase products from us at current levels. Moreover, we typically do not enter into long-term volume purchase contracts with our customers, and our customers have certain rights to extend or delay the shipment of their orders. We, however, typically require that our customers contractually agree to buy back inventory purchased within specified lead times to build their products if not used.

The loss of one or more of our major customers, or the reduction, delay or cancellation of orders from such customers, due to economic conditions or other forces, could materially and adversely affect our business, operating results and financial condition. Specifically, some of our major customers provide products to the banking and gambling industries which have been adversely affected by the unfavorable economic environment. The contraction in demand from our customers in these industries could continue to impact our customer orders and continue to have a negative impact on our operations over the foreseeable future. Additionally, if one or more of our customers were to become insolvent or otherwise unable to pay for the manufacturing services provided by us, our operating results and financial condition would be adversely affected.

We depend on a limited number of suppliers for certain components that are critical to our manufacturing processes. A shortage of these components or an increase in their price could interrupt our operations and result in a significant change in our results of operations.

We are dependent on many suppliers, including sole source suppliers, to provide key components and raw materials used in manufacturing customers' products. We have seen supply shortages in certain electronic components. This can result in longer lead times and the inability to meet our customers request for flexible production and extended shipment dates. If demand for components outpaces supply, capacity delays could affect future operations. Delays in deliveries from suppliers or the inability to obtain sufficient quantities of components and raw materials could cause delays or reductions in shipment of products to our customers which could adversely affect our operating results and damage customer relationships.

9

We operate in a highly competitive industry; if we are not able to compete effectively in the EMS industry, our business could be adversely affected.

Competitors may offer customers lower prices on certain high volume programs. This could result in price reductions, reduced margins and loss of market share, all of which would materially and adversely affect our business, operating results, and financial condition. If we were unable to provide comparable or better manufacturing services at a lower cost than our competitors, it could cause sales to decline. In addition, competitors can copy our non-proprietary designs and processes after we have invested in development of products for customers, thereby enabling such competitors to offer lower prices on such products due to savings in development costs.

Cash and cash equivalents are exposed to concentrations of credit risk.

We place our cash with high credit quality institutions. At times, such balances may be in excess of the federal depository insurance limit or may be on deposit at institutions which are not covered by insurance. If such institutions were to become insolvent during which time it held our cash and cash equivalents in excess of the insurance limit, it could be necessary to obtain other credit financing to operate our facilities.

Our ability to secure and maintain sufficient credit arrangements is key to its continued operations.

There is no assurance that we will be able to retain or renew our credit agreements in the future. In the event the business grows rapidly or the uncertain macroeconomic climate continues, additional financing resources could be necessary in the current or future fiscal years. There is no assurance that we will be able to obtain equity or debt financing at acceptable terms, or at all in the future. For a summary of our banking arrangements, see Note 4 Long-Term Debt of the “Notes to Consolidated Financial Statements.”

Our international operations may be subject to certain risks.

Most of the products we manufacture are in facilities located in Mexico and China. These international operations may be subject to a number of risks, including:

• | difficulties in staffing and managing foreign operations; |

• | political and economic instability (including acts of terrorism, pandemics, civil unrest, forms of violence and outbreaks of war), which could impact our ability to ship, manufacture, and/or receive product; |

• | unexpected changes in regulatory requirements and laws; |

• | longer customer payment cycles and difficulty collecting accounts receivable; |

• | export duties, import controls and trade barriers (including quotas); |

• | governmental restrictions on the transfer of funds; |

• | burdens of complying with a wide variety of foreign laws and labor practices; |

• | fluctuations in currency exchange rates, which could affect component costs, local payroll, utility and other expenses; |

• | our foreign locations may be impacted by hurricanes, earthquakes, water shortages, tsunamis, floods, typhoons, fires, extreme weather conditions and other natural or man-made disasters. |

Our operations in certain foreign locations receive favorable income tax treatment in the form of tax credits or other incentives. In the event that such tax incentives are not extended, are repealed, or we no longer qualify for such programs, our taxes may increase, which would reduce our net income.

A significant portion of our operations are in foreign locations. As a result, transactions occur in currencies other than the U.S. dollar. Exchange rate fluctuations among other currencies used by us could directly or indirectly affect our financial results. Future currency fluctuations are dependent upon a number of factors and cannot be easily predicted. We currently use Mexican peso forward contracts to hedge foreign currency fluctuations for a portion of our Mexican peso denominated expenses. However, unexpected losses could occur from future fluctuations in exchange rates.

Additionally, certain foreign jurisdictions restrict the amount of cash that can be transferred to the U.S or impose taxes and penalties on such transfers of cash. To the extent we have excess cash in foreign locations that could be used in, or is needed by, our operations in the United States, we may incur significant penalties and/or taxes to repatriate these funds.

10

Our success will continue to depend to a significant extent on our key personnel.

Our future success depends in large part on the continued service of our key technical, marketing and management personnel and on our ability to continue to attract and retain qualified employees. There can be no assurance that we will be successful in attracting and retaining such personnel. The loss of key employees could have a material adverse effect on our business, operating results and financial condition.

If we are unable to maintain our technological and manufacturing process expertise, our business could be adversely affected.

The markets for our customers' products is characterized by rapidly changing technology, evolving industry standards, frequent new product introductions and short product life cycles. The introduction of products embodying new technologies or the emergence of new industry standards can render existing products obsolete or unmarketable. Our success will depend upon our customers' ability to enhance existing products and to develop and introduce, on a timely and cost-effective basis, new products that keep pace with technological developments and emerging industry standards and address evolving and increasingly sophisticated customer requirements. Failure of our customers to do so could substantially harm our customers' competitive positions. There can be no assurance that our customers will be successful in identifying, developing and marketing products that respond to technological change, emerging industry standards or evolving customer requirements.

Start-up costs and inefficiencies related to new or transferred programs can adversely affect our operating results and such costs may not be recoverable if such new programs or transferred programs are canceled.

Start-up costs, the management of labor and equipment resources in connection with the establishment of new programs and new customer relationships, and the need to obtain required resources in advance can adversely affect our gross margins and operating results. These factors are particularly evident in the ramping stages of new programs. These factors also affect our ability to efficiently use labor and equipment. We are currently managing a number of new programs. Consequently, our exposure to these factors has increased. In addition, if any of these new programs or new customer relationships were terminated, our operating results could be harmed, particularly in the short term. We may not be able to recoup these start-up costs or replace anticipated new program revenues.

An adverse change in the interest rates for our borrowings could adversely affect our financial condition.

We are exposed to interest rate risk under our revolving line of credit with interest rates based on various levels of margin added to published prime rate and LIBOR rates depending on the calculation of a certain financial covenant. We have not historically hedged the interest rate on our credit facility; therefore, unless we do so significant changes in interest rates could adversely affect our results of operations.

Compliance or the failure to comply with current and future environmental laws or regulations could cause us significant expense.

We are subject to a variety of domestic and foreign environmental regulations relating to the use, storage, and disposal of materials used in our manufacturing processes. If we fail to comply with any present or future regulations, we could be subject to future liabilities or the suspension of current manufacturing operations. In addition, such regulations could restrict our ability to expand our operations or could require us to acquire costly equipment, substitute materials, or incur other significant expenses to comply with government regulations.

Our stock price is volatile.

Holders of the common stock will suffer immediate dilution to the extent outstanding equity awards are exercised to purchase common stock. Our stock price may be subject to wide fluctuations and possible rapid increases or declines over a short time period. These fluctuations may be due to factors specific to us such as variations in quarterly operating results or changes in earnings estimates, or to factors relating to the EMS industry or to the securities markets in general, which, in recent years, have experienced significant price fluctuations. These fluctuations often have been unrelated to the operating performance of the specific companies whose stocks are traded.

Due to inherent limitations, there can be no assurance that our system of disclosure and internal controls and procedures will be successful in preventing all errors, theft and fraud, or in informing management of all material information in a timely manner.

Management does not expect that our disclosure controls and internal controls and procedures will prevent all errors or fraud. A control system is designed to give reasonable, but not absolute, assurance that the objectives of the control system are met. In addition, any control system reflects resource constraints and the benefits of controls must be considered relative to their costs. Inherent limitations of a control system may include: judgments in decision making may be faulty, breakdowns can occur simply because of error or mistake and controls can be circumvented by collusion or management override. Due to the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

11

If we do not manage our growth effectively, our profitability could decline.

Our business is experiencing rapid growth which can place considerable additional demands upon our management team and our operational, financial and management information systems. Our ability to manage growth effectively requires us to continue to implement and improve these systems; avoid cost overruns; maintain customer, supplier and other favorable business relationships during possible transition periods; continue to develop the management skills of our managers and supervisors; and continue to train, motivate and manage our employees. Our failure to effectively manage growth could have a material adverse effect on our results of operations.

If our manufacturing processes and services do not comply with applicable statutory and regulatory requirements, or if we manufacture products containing design or manufacturing defects, demand for our services may decline and we may be subject to liability claims.

We manufacture and design products to our customers' specifications, and, in some cases, our manufacturing processes and facilities may need to comply with applicable statutory and regulatory requirements. For example, medical devices that we manufacture or design, as well as the facilities and manufacturing processes that we use to produce them, are regulated by the Food and Drug Administration and non-U.S. counterparts of this agency. In addition, our customers' products and the manufacturing processes that we use to produce them often are highly complex. As a result, products that we manufacture may at times contain manufacturing or design defects, and our manufacturing processes may be subject to errors or not be in compliance with applicable statutory and regulatory requirements. Defects in the products we manufacture or design, whether caused by a design, manufacturing or component failure or error, or deficiencies in our manufacturing processes, may result in delayed shipments to customers or reduced or canceled customer orders. If these defects or deficiencies are significant, our business reputation may also be damaged. The failure of the products that we manufacture or our manufacturing processes and facilities to comply with applicable statutory and regulatory requirements may subject us to legal fines or penalties and, in some cases, require us to shut down or incur considerable expense to correct a manufacturing process or facility. Our customers are required to indemnify us against liability associated with designing products to meet their specifications. However, if our customers are responsible for the defects, they may not, or may not have resources to, assume responsibility for any costs or liabilities arising from these defects, which could expose us to additional liability claims.

Energy price increases may negatively impact our results of operations.

Certain components that we use in our manufacturing process are petroleum-based. In addition, we, along with our suppliers and customers, rely on various energy sources in our transportation activities. While significant uncertainty currently exists about the future levels of energy prices, a significant increase is possible. Increased energy prices could cause an increase to our raw material costs and transportation costs. In addition, increased transportation costs of certain of our suppliers and customers could be passed along to us. We may not be able to increase our product prices enough to offset these increased costs. In addition, any increase in our product prices may reduce our future customer orders and profitability.

Disruptions to our information systems, including security breaches, losses of data or outages, could adversely affect our operations.

We rely on information technology networks and systems to process, transmit and store electronic information. In particular, we depend on our information technology infrastructure for a variety of functions, including worldwide financial reporting, inventory management, procurement, invoicing and email communications. Any of these systems may be susceptible to outages due to fire, floods, power loss, telecommunications failures, terrorist attacks and similar events. Despite the implementation of network security measures, our systems and those of third parties on which we rely may also be vulnerable to computer viruses, break-ins and similar disruptions. If we or our vendors are unable to prevent such outages and breaches, our operations could be disrupted.

We are involved in various legal proceedings.

In the past, we have been notified of claims relating to various matters including contractual matters, intellectual property rights or other issues arising in the ordinary course of business. In the event of such a claim, we may be required to spend a significant amount of money to defend or otherwise address the claim. Any litigation, even where a claim is without merit, could result in substantial costs and diversion of resources. Accordingly, the resolution or adjudication of such disputes, even those encountered in the ordinary course of business, could have a material adverse effect on our business, consolidated financial conditions and results of operations.

12

Increases in our own market capitalization and changes in securities laws and regulations will increase our costs and risk of noncompliance.

As a result of our increased market capitalization as of the end of our second quarter of fiscal year 2013, we are required to file as an accelerated filer. As such, we are subject to additional requirements contained in the Sarbanes-Oxley Act of 2002 (the Sarbanes-Oxley Act) and more recently the Dodd-Frank Act. The Sarbanes-Oxley and Dodd-Frank Acts required or will require changes in some of our corporate governance, securities disclosure and compliance practices. In response to the requirements of the Sarbanes-Oxley and Dodd-Frank Acts, the SEC and NASDAQ promulgated new rules and additional rulemaking is expected in the future. Compliance with these new rules and future rules has increased and may increase further our legal, financial and accounting costs as well as a potential risk of noncompliance. Absent significant changes in related rules, which we cannot assure, we anticipate some level of increased costs related to these new regulations to continue indefinitely. We also expect these developments to make it more difficult and more expensive to obtain director and officer liability insurance, and we may be forced to accept reduced coverage or incur substantially higher costs to obtain coverage. Likewise, these developments may make it more difficult for us to attract and retain qualified members of our Board of Directors or qualified management personnel. Further, the costs associated with the compliance with and implementation of procedures under these and future laws and related rules could have a material impact on our results of operations. In addition, the costs associated with noncompliance with additional securities laws and regulations could also impact our business.

We may encounter complications with acquisitions, which could potentially harm our business.

Any current or future acquisitions may require additional equity financing, which could be dilutive to our existing shareholders, or additional debt financing, which could potentially affect our credit ratings. Any downgrades in our credit ratings associated with an acquisition could adversely affect our ability to borrow by resulting in more restrictive borrowing terms. To integrate acquired businesses, we must implement our management information systems, operating systems and internal controls, and assimilate and manage the personnel of the acquired operations. The integration of acquired businesses may be further complicated by difficulties managing operations in geographically dispersed locations. The integration of acquired businesses may not be successful and could result in disruption by diverting management's attention from the core business. In addition, the integration of acquired businesses may require that we incur significant restructuring charges or other increases in our expenses and working capital requirements, which reduce our return on invested capital.

Acquisitions may involve numerous other risks and challenges including but not limited to: potential loss of key employees and customers of the acquired companies; the potential for deficiencies in internal controls at acquired companies; lack of experience operating in the geographic market or industry sector of the acquired business; constraints on available liquidity, and exposure to unanticipated liabilities of acquired companies. These and other factors could harm our ability to achieve anticipated levels of profitability at acquired operations or realize other anticipated benefits of an acquisition, and could adversely affect our consolidated business and operating results.

Our goodwill and identifiable intangible assets could become impaired, which could reduce the value of our assets and reduce net income in the year in which the write-off occurs.

Goodwill represents the excess of the cost of an acquisition over the fair value of the net assets acquired. The Company also ascribes value to certain identifiable intangible assets, which consists of customer relationships and non-compete agreements, as a result of the acquisition of Sabre. The Company may incur impairment charges on goodwill or identifiable intangible assets if it determines that the fair values of goodwill or identifiable intangible assets are less than their current carrying values. The Company evaluates, on a regular basis, whether events or circumstances have occurred that indicate all, or a portion, of the carrying amount of goodwill may no longer be recoverable, in which case an impairment charge to earnings would become necessary.

Refer to Notes 1 and 15 to the consolidated financial statements and 'critical accounting policies' in management's discussion and analysis of financial condition and results of operations for further discussion regarding the impairment testing of goodwill and identifiable intangible assets.

A decline in general economic conditions or global equity valuations could impact the judgments and assumptions about the fair value of the Company's businesses and the Company could be required to record impairment charges on its goodwill or other identifiable intangible assets in the future, which could impact the Company's consolidated balance sheet, as well as the Company's consolidated statement of operations. If the Company was required to recognize an impairment charge in the future, the charge would not impact the Company's consolidated cash flows, current liquidity, capital resources, and covenants under its existing credit facilities.

Item 1B. | UNRESOLVED STAFF COMMENTS |

None

13

Item 2. | PROPERTIES |

We have manufacturing and sales operations located in the United States, Mexico, and China. The table below lists the locations and square footage of our operating facilities:

Location | Approx. Sq. Ft. | Type of Interest (Leased/Owned) | Description of Use | ||||

Spokane Valley, Washington (1) | 95,000 | Leased | Sales, research, administration and manufacturing | ||||

Spokane Valley, Washington | 36,000 | Leased | Manufacturing | ||||

El Paso, Texas | 80,000 | Leased | Shipping and warehouse | ||||

Total USA | 211,000 | ||||||

Juarez, Mexico | 174,000 | Owned | Manufacturing | ||||

Juarez, Mexico | 60,000 | Owned | Manufacturing and warehouse | ||||

Juarez, Mexico | 66,000 | Owned | Manufacturing and warehouse | ||||

Juarez, Mexico | 115,000 | Owned | Manufacturing and warehouse | ||||

Juarez, Mexico (2) | 103,000 | Owned | Manufacturing and warehouse | ||||

Juarez, Mexico (3) | 193,000 | Leased | Warehouse | ||||

Juarez, Mexico (4) | 66,000 | Leased | Manufacturing | ||||

Total Mexico | 777,000 | ||||||

Shanghai, China (5) | 115,000 | Leased | Manufacturing and warehouse | ||||

Shanghai, China | 36,000 | Leased | Manufacturing | ||||

Total China | 151,000 | ||||||

Grand Total | 1,139,000 | ||||||

(1) | During fiscal year 2014, we amended the lease agreement whereby increasing our leased space to 95,000 square feet. |

(2) | During fiscal year 2012, we purchased an additional 103,000 square feet of manufacturing and warehouse space. |

(3) | During fiscal year 2014, we amended the lease agreement whereby increasing our leased space to 193,000 square feet to accommodate additional warehouse space. |

(4) | During fiscal year 2014, we completed our acquisition of Sabre Manufacturing resulting in an additional 66,000 square feet of leased manufacturing space. |

(5) | During fiscal year 2014, we amended the lease of our China facility whereby increasing our leased space to 115,000 square feet to accommodate additional manufacturing and warehouse space. |

On September 3, 2014, the Company acquired CDR Manufacturing resulting in an increase in our manufacturing and warehouse space; however, the amount is yet to be determined.

The geographic diversity of these locations allows us to offer services near certain of our customers and major electronics markets with the additional benefit of reduced labor costs. We consider the productive capacity of our current facilities sufficient to carry on our current business. In addition, in Juarez, Mexico one of our buildings includes adjacent vacant land that could be developed into additional manufacturing and warehouse space.

All of our facilities are ISO certified to ISO 9001:2008 standards, ISO-14001 environmental standards, ISO-13485:2003 medical devices standards, AS9100C aviation, space and defense standards, ISO/TS 16949 automotive standards, ANSI/ESD S20.20-2007 Electrostatic Discharge Control Program and to Customs Trade Partnership against Terrorism (CTPAT). The Spokane, Washington facilities are additionally registered ISO/IEC 80079-34 explosive atmospheres and by the US State Department for International Traffic in Arms Regulations (ITAR).

Item 3. | LEGAL PROCEEDINGS |

We are a party to certain lawsuits or claims in the ordinary course of business. We do not believe that these proceedings, individually or in the aggregate, will have a material adverse effect on our financial position, results of operations or cash flow.

14

Item 4. | MINE SAFETY DISCLOSURES |

Not Applicable

PART II

Item 5: | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is traded on the NASDAQ Global Market, formerly the NASDAQ National Market System under the symbol “KTCC”. Quarterly high and low sales prices for our common stock for fiscal years 2014 and 2013 were as follows:

2014 | 2013 | |||||||||||||||

High | Low | High | Low | |||||||||||||

First Quarter | $ | 12.19 | $ | 9.60 | $ | 11.35 | $ | 7.15 | ||||||||

Second Quarter | 11.36 | 9.83 | 11.62 | 8.69 | ||||||||||||

Third Quarter | 11.44 | 9.81 | 12.28 | 9.36 | ||||||||||||

Fourth Quarter | 10.99 | 10.00 | 12.12 | 10.16 | ||||||||||||

High and low stock prices are based on the daily sales prices reported by the NASDAQ Stock Market. These quotations represent prices between dealers without adjustment for markups, markdowns, and commissions, and may not represent actual transactions.

Holders and Dividends

As of June 28, 2014, we had 721 shareholders of common stock on record. As a result of our credit agreement with Wells Fargo Bank, N.A. we are restricted from declaring or paying dividends in cash or stock without the Bank's prior written consent. We have not paid a cash dividend and do not anticipate payment of dividends in the foreseeable future.

15

Equity Compensation Plan Information

Information concerning securities authorized for issuance under our equity compensation plans is set forth in Part III, Item 12 of this Annual Report, under the caption “Securities Authorized for Issuance under Equity Compensation Plans”, and that information is incorporated herein by reference.

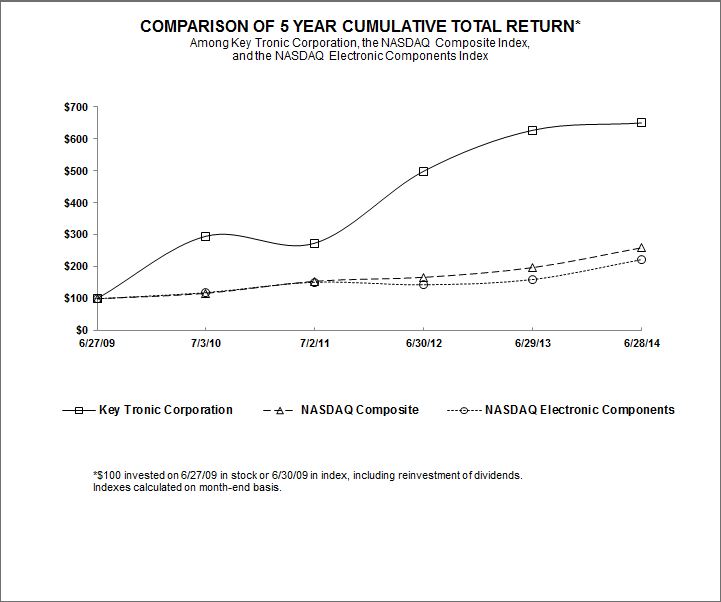

Performance Graph

Set forth below is a line graph comparing the cumulative total shareholder return on our common stock with the cumulative total return of the NASDAQ Stock Market (U.S. & Foreign) Index and the NASDAQ Electronic Components Index in fiscal 2014.

6/27/2009 | 7/3/2010 | 7/2/2011 | 6/30/2012 | 6/29/2013 | 6/28/2014 | |||||||||||||

Key Tronic Corporation | 100.00 | 295.76 | 273.94 | 499.39 | 627.27 | 650.30 | ||||||||||||

NASDAQ Composite | 100.00 | 117.06 | 154.79 | 167.05 | 197.48 | 259.41 | ||||||||||||

NASDAQ Electronic Components | 100.00 | 119.12 | 151.74 | 143.59 | 160.15 | 222.48 | ||||||||||||

16

Item 6: | SELECTED FINANCIAL DATA |

The following selected data is derived from our audited consolidated financial statements and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the consolidated financial statements and related notes, and other information included in this report.

Financial Highlights

(In thousands, except for Supplemental Data and Per Share Amounts)

Fiscal Year Ended | ||||||||||||||||||||

June 28, 2014 | June 29, 2013 | June 30, 2012 | July 2, 2011 | July 3, 2010 | ||||||||||||||||

Consolidated Statements of Operations Data: | ||||||||||||||||||||

Net sales | $ | 305,394 | $ | 361,033 | $ | 346,475 | $ | 253,846 | $ | 199,620 | ||||||||||

Gross profit | 26,854 | 34,512 | 29,836 | 20,648 | 19,250 | |||||||||||||||

Gross margin percentage | 8.8 | % | 9.6 | % | 8.6 | % | 8.1 | % | 9.6 | % | ||||||||||

Operating income | 9,304 | 18,126 | 14,351 | 6,939 | 7,388 | |||||||||||||||

Operating margin percentage | 3.0 | % | 5.0 | % | 4.1 | % | 2.7 | % | 3.7 | % | ||||||||||

Net income | 7,613 | 12,583 | 11,626 | 5,736 | 8,690 | |||||||||||||||

Earnings per share – diluted | 0.67 | 1.12 | 1.07 | 0.55 | 0.85 | |||||||||||||||

Consolidated Cash Flow Data: | ||||||||||||||||||||

Cash flows provided by (used in) operations | 1,458 | 29,282 | (5,066 | ) | (2,569 | ) | 3,534 | |||||||||||||

Capital expenditures | 7,763 | 3,470 | 4,654 | 3,818 | 3,378 | |||||||||||||||

Consolidated Balance Sheet Data: | ||||||||||||||||||||

Net working capital (1) | 71,049 | 73,827 | 76,236 | 58,307 | 44,708 | |||||||||||||||

Total assets | 156,660 | 135,130 | 150,912 | 112,364 | 101,642 | |||||||||||||||

Long-term liabilities | 848 | 3,030 | 19,050 | 11,063 | 4,236 | |||||||||||||||

Shareholders’ equity | 103,645 | 94,160 | 78,608 | 68,023 | 59,417 | |||||||||||||||

Book value per share (2) | $ | 9.83 | $ | 8.97 | $ | 7.50 | $ | 6.54 | $ | 5.79 | ||||||||||

Supplemental Data: | ||||||||||||||||||||

Number of shares outstanding at year-end | 10,546,750 | 10,502,188 | 10,481,356 | 10,399,187 | 10,264,390 | |||||||||||||||

Number of employees at year-end | 3,343 | 2,584 | 2,700 | 1,997 | 2,036 | |||||||||||||||

Approximate square footage of operational facilities | 1,139,000 | 1,011,000 | 945,000 | 796,000 | 987,000 | |||||||||||||||

(1) | Net working capital is defined as total current assets less total current liabilities. Net working capital measures the portion of current assets that are financed by long term funds and is an indicator of short term financial management. |

(2) | Book value per share is defined as total shareholders’ equity divided by the number of shares outstanding at the end of the fiscal year. |

17

Item 7: | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

KeyTronicEMS is a leader in electronic manufacturing services and solutions to original equipment manufacturers of a broad range of products. We provide engineering services, worldwide procurement and distribution, materials management, world-class manufacturing and assembly services, in-house testing, and unparalleled customer service. Our international production capability provides our customers with benefits of improved supply-chain management, reduced inventories, lower transportation costs, and reduced product fulfillment time. We continue to make investments in all of our operating facilities to give us the production capacity, capabilities and logistical advantages to continue to win new business. The following information should be read in conjunction with the consolidated financial statements included herein and with Item 1A, Risk Factors included as part of this filing.

Our mission is to provide our customers with superior manufacturing and engineering services at the lowest total cost for the highest quality products, and create long-term mutually beneficial business relationships by employing our “Trust, Commitment, Results” philosophy.

Executive Summary

While fiscal year 2014 was a challenging year with respect to our total revenue, we continued to make significant progress in ramping up our new programs, expanding our customer base and extending our capabilities. Throughout the year, our revenue was impacted by slowdowns and delays from certain longstanding customers. At the same time, we saw the continued ramp up of our new programs, while maintaining operating efficiencies and a strong balance sheet.

Net sales of $305.4 million for fiscal year 2014 decreased by 15.4 percent as compared to net sales of $361.0 million in fiscal year 2013. The decrease in net sales was primarily driven by the overall decrease in demand related to current customer programs. At the end of fiscal year 2014, we were generating revenue from 196 separate programs and 59 distinct customers as compared to 183 programs and 56 customers at the end of fiscal year 2013. These new customers have programs that represent small annual sales while others have multi-million-dollar potential. Moving into the first quarter of fiscal 2015, our new customer programs continue to steadily ramp up and we expect to see renewed sequential growth. Furthermore, our acquisition of CDR Manufacturing on September 3, 2014, represents a major step forward for Key Tronic, significantly growing our revenue and extending capabilities and customer base worldwide. Excluding the potential impact of the acquisition of CDR manufacturing in fiscal year 2015, the Company expects to report revenue in the range of $76 million to $82 million for the first quarter of fiscal year 2015. Future results will depend on actual levels of customers’ orders, the timing of the start-up of production of new product programs and the potential impact of the macroeconomic uncertainty. We believe that we are well positioned in the EMS industry to continue expansion of our customer base and continue long-term growth.

The concentration of our largest customers decreased during fiscal year 2014 with the top five customers’ sales decreasing to 62 percent of total sales in 2014 from 71 percent in 2013, and 73 percent in 2012. Our current customer relationships involve a variety of products, including consumer electronics, electronic storage devices, plastics, household products, gaming devices, specialty printers, telecommunications, industrial equipment, military supplies, computer accessories, electronic whiteboards, medical, educational, irrigation, automotive, transportation management, robotics, RFID, power supply, off-road vehicle equipment, fitness equipment, HVAC controls, and consumer products.

Gross profit as a percent of sales was 8.8 percent in fiscal year 2014 compared to 9.6 percent for the prior fiscal year. This 0.8 percentage point decrease in gross profit as a percentage of net sales during fiscal year 2014 as compared to fiscal year 2013 is primarily related to a 5.1 percentage point increase in certain overhead costs as we brought on additional headcount and equipment to support new customer programs, partially offset by a 4.3 percentage point improvement in material costs. The level of gross margin is impacted by product mix, timing of the startup of new programs, facility utilization, pricing within the electronics industry and material costs, which can fluctuate significantly from quarter to quarter and year to year.

Operating income as a percentage of sales for fiscal year 2014 was 3.0 percent compared to 5.0 percent for fiscal year 2013. The decrease in operating income as a percentage of net sales was primarily due to a decrease in gross margin and a slight increase in headcount in program management and engineering to support new program wins and anticipated future growth.

Net income for fiscal year 2014 was $7.6 million or $0.67 per diluted share, as compared to net income of $12.6 million or $1.12 per diluted share for fiscal year 2013. The decrease in net income for fiscal year 2014 as compared to fiscal year 2013 was primarily due to a decrease in demand from some of our large, longstanding customers as well as an increase in certain overhead costs as a percentage of net sales, partially offset by a decrease in material-related costs as a percentage of net sales.

18

We maintain a strong balance sheet with a current ratio of 2.4 and currently have no bank debt apart from $7.9 million outstanding under a factoring agreement described in Note 5. Total cash provided by operating activities as defined on our cash flow statement was $1.5 million during fiscal year 2014. We maintain sufficient liquidity for our expected future operations. We did not have an outstanding balance on our revolving line of credit with Wells Fargo Bank, N.A. as of June 28, 2014. As a result, $30.0 million remained available to borrow as of June 28, 2014. We believe cash flow from operations, our borrowing capacity, our accounts receivable sale program, and equipment lease financing should provide adequate capital for planned growth over the long term.

RESULTS OF OPERATIONS

Comparison of the Fiscal Year Ended June 28, 2014 with the Fiscal Year Ended June 29, 2013

The following table sets forth for the periods indicated certain items of the consolidated statements of income expressed as a percentage of net sales. The financial information and discussion below should be read in conjunction with the consolidated financial statements and notes contained in this Annual Report.

Fiscal Year Ended | ||||||||||||||||||

June 28, 2014 | % of net sales | June 29, 2013 | % of net sales | $ change | % point change | |||||||||||||

Net sales | $ | 305,394 | 100.0% | $ | 361,033 | 100.0% | $ | (55,639 | ) | — | ||||||||

Cost of sales | 278,540 | 91.2 | 326,521 | 90.4 | (47,981 | ) | 0.8 | |||||||||||

Gross profit | 26,854 | 8.8 | 34,512 | 9.6 | (7,658 | ) | (0.8) | |||||||||||

Operating expenses: | ||||||||||||||||||

Research, development and engineering | 5,586 | 1.8 | 5,156 | 1.4 | 430 | 0.4 | ||||||||||||

Selling, general and administrative | 11,964 | 3.9 | 11,230 | 3.1 | 734 | 0.8 | ||||||||||||

Total operating expenses | 17,550 | 5.7 | 16,386 | 4.5 | 1,164 | 1.2 | ||||||||||||

Operating income | 9,304 | 3.0 | 18,126 | 5.0 | (8,822 | ) | (2.0) | |||||||||||

Interest expense, net | 81 | — | 271 | 0.1 | (190 | ) | (0.1) | |||||||||||

Income before income taxes | 9,223 | 3.0 | 17,855 | 4.9 | (8,632 | ) | (1.9) | |||||||||||

Income tax provision | 1,610 | 0.5 | 5,272 | 1.5 | (3,662 | ) | (1.0) | |||||||||||

Net income | $ | 7,613 | 2.5% | $ | 12,583 | 3.5% | $ | (4,970 | ) | (1.0) | ||||||||

Effective income tax rate | 17.5 | % | 29.5 | % | ||||||||||||||

Net Sales

The decrease in net sales from prior year was primarily driven by an approximate $67.4 million decrease in revenues related to decreased demand from current customer programs, an approximate $5.2 million decrease in revenues related to program losses, partially offset by a $17.0 million increase in revenues related to new program wins and the revenue generated from the acquisition of Sabre.

The following table shows the revenue by industry sectors as a percentage of revenue for fiscal years 2014 and 2013:

Fiscal Year Ended | ||||

June 28, 2014 | June 29, 2013 | |||

Consumer | 30% | 24% | ||

Communication | 23 | 29 | ||

Industrial and Commercial Printer | 17 | 8 | ||

Gaming | 15 | 22 | ||

Transaction Printer | 11 | 11 | ||

Computer and Peripheral | 4 | 6 | ||

Total | 100% | 100% | ||

We provide services to customers in a number of industries and produce a variety of products for our customers in each industry. As we continue to diversify our customer base and win new customers we will continue to see a change in the industry concentrations of our revenue.

Sales to foreign locations outside the United States represented 35.3 percent, and 31.8 percent of our total net sales in fiscal years 2014, and 2013, respectively.

19

Cost of Sales

Total cost of sales as a percentage of net sales was 91.2 percent and 90.4 percent in fiscal years 2014, and 2013, respectively.

Total cost of materials as a percentage of net sales was approximately 64.5 percent and 68.5 percent in fiscal years 2014 and 2013, respectively. The change from year-to-year is primarily the result of a change in product mix and to a lesser degree improved pricing of certain raw materials.

Production and support costs as a percentage of net sales were 26.7 percent and 21.9 percent in fiscal years 2014 and 2013, respectively. The increase in fiscal year 2014 is primarily related to adding headcount and manufacturing capacity to support new programs.

We provide a reserve for obsolete and non-saleable inventories based on specific identification of inventory against current demand and recent usage. The amounts charged to expense for these inventories were approximately $0.3 million, and $0.5 million in fiscal years 2014 and 2013, respectively.

We provide warranties on certain products we sell and estimate warranty costs based on historical experience and anticipated product returns. Warranty expense is related to workmanship claims on keyboards and EMS products. The amounts charged to expense are determined based on an estimate of warranty exposure. The net warranty expense was approximately $35,000 and $26,000 in fiscal years 2014 and 2013, respectively.

Gross Profit

Gross profit as a percentage of net sales was 8.8 percent and 9.6 percent in fiscal years 2014, and 2013, respectively. The 0.8 percentage point decrease in gross profit as a percentage of net sales during fiscal year 2014 as compared to fiscal year 2013 is primarily related to a 5.1 percentage point increase in certain overhead costs, partially offset by a 4.3 percentage point improvement in material costs.

Changes in gross profit margins reflect the impact of a number of factors that can vary from period to period, including product mix, start-up costs and efficiencies associated with new programs, product life cycles, sales volumes, capacity utilization of our resources, management of inventories, component pricing and shortages, end market demand for customers’ products, fluctuations in and timing of customer orders, and competition within the EMS industry. These and other factors can cause variations in operating results. There can be no assurance that gross margins will not decrease in future periods.

We took early pay discounts to suppliers that totaled approximately $1.1 million and $0.9 million in fiscal years 2014 and 2013, respectively. Early pay discounts will fluctuate based on our liquidity and changes in the discounts and terms offered by our suppliers.

Research, Development and Engineering

Research, development and engineering expenses (RD&E) consists principally of employee related costs, third party development costs, program materials, depreciation and allocated information technology and facilities costs. Total RD&E expense was $5.6 million and $5.2 million in fiscal years 2014 and 2013, respectively. This $0.4 million increase is primarily the result of an increase in payroll related expenses as additional headcount was necessary to support new program wins and anticipated future growth.

Total RD&E expenses as a percent of net sales were 1.8 percent and 1.4 percent in fiscal years 2014 and 2013, respectively. This 0.4 percentage point increase in RD&E is primarily related to a slight increase in headcount in program management and engineering to support new program wins and anticipated future growth coupled with the decline in revenue.

Selling, General and Administrative

Selling, general and administrative expenses (SG&A) consist principally of salaries and benefits, advertising and marketing programs, sales commissions, travel expenses, provision for doubtful accounts, facilities costs, and professional services. Total SG&A expenses were $12.0 million and $11.2 million in fiscal years 2014 and 2013, respectively. This $0.7 million increase is primarily related to an increase in payroll related expenses due to increased headcount. In addition, SG&A expenses for fiscal year 2013, included a positive impact of a non-recurring adjustment of approximately $0.5 million related to the reversal of a deferred compensation liability.

Total SG&A expenses as a percent of net sales were 3.9 percent and 3.1 percent in fiscal years 2014 and 2013, respectively. This 0.8 percent percentage point increase in SG&A is primarily related to an increase in labor related expenses and the decrease in net sales.

20

Interest Expense

We had net interest expense of $0.1 million and $0.3 million in fiscal years 2014 and 2013, respectively. This decrease in interest expense is primarily related to a decrease in the average balance outstanding on our line of credit and to a lesser extent paying down existing capital leases.

Income Tax Provision