Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERITAGE FINANCIAL CORP /WA/ | d767582d8k.htm |

Keefe, Bruyette

& Woods Community Bank Investor Conference

July 29

th

& 30

th

, 2014

NASDAQ: HFWA

Brian Vance, Chief Executive Officer

Jeff Deuel, President and Chief Operating Officer

Don Hinson, Executive Vice President and Chief Financial Officer

Bryan McDonald, Executive Vice President and Chief Lending Officer

Exhibit 99.1 |

Forward-Looking Statements

2

This presentation contains forward-looking statements that are subject to risks and

uncertainties, including, but not limited to: The expected revenues, cost savings,

synergies and other benefits from the Washington Banking merger and our other merger

and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties

relating to integration matters, including but not limited to, customer and employee retention

might be greater than expected;

The credit and concentration risks of lending activities;

Changes in general economic conditions, either nationally or in our market areas;

Competitive market pricing factors and interest rate risks;

Market interest rate volatility;

Balance sheet (for example, loans) concentrations;

Fluctuations in demand for loans and other financial services in our market areas;

Changes in legislative or regulatory requirements or the results of regulatory

examinations; The ability to recruit and retain key management and staff;

Risks associated with our ability to implement our expansion strategy and merger

integration; Stability of funding sources and continued availability of

borrowings; Adverse changes in the securities markets;

The inability of key third-party providers to perform their obligations to us;

Changes in accounting policies and practices and the use of estimates in determining fair

value of certain of our assets, which estimates may prove to be incorrect and result in

significant declines in valuation; and These and other risks as may be detailed from

time to time in our filings with the Securities and Exchange Commission. The Company

cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these

statements as speaking only as of the date they are made and based only on information then

actually known to the Company. The Company does not undertake and specifically

disclaims any obligation to revise any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances after the date of such

statements. These risks could cause our actual results for 2014 and beyond to differ

materially from those expressed in any forward-looking statements by, or on behalf of,

us, and could negatively affect the Company’s operating and stock price

performance. |

Overview

3

Company Overview

WBCO Merger

Financial Review

Strategic Initiatives |

Our

Company 4

Overview

NASDAQ Symbol

HFWA

Market Capitalization

$486 million

Total Assets

$3.4 billion

Headquarters

Olympia, WA

Branches

67

Data as of June 30, 2014 |

Major

Initiatives & Activities 5

2013

Q1

Merger and Conversion with Northwest Commercial Bank $65 million

Q2

Central Valley Bank Subsidiary Consolidation

Q3

Merger with Valley Community Bancshares, Inc. (Valley Bank) $237 million

Q4

Core System Conversion

Valley Bank Conversion

Closed 3 Heritage Bank Branches

Consolidated 4 of 8 Valley Bank Branches

Announced WBCO Merger

2014

Q1

Continued Integration of 2013 Acquired Banks

Q2

Merger with Washington Banking Company (Whidbey Island Bank)

Q4

System Conversion for Legacy Whidbey systems |

Washington

State Economy 6

Major U.S. Industries Located in Washington

Microsoft, Amazon, Boeing, Starbucks, Costco, Nordstrom, Expeditors International,

Weyerhaeuser, PACCAR, T-Mobile, Nintendo, Russell Investments

Unemployment:

Washington State at a 6 year low of 5.8% in June compared to national average of 6.1%

Seattle-Bellevue-Everett unemployment rate of 4.8%

Housing:

Seattle area home prices up 24% from lows in November 2011 |

7

Company Overview

WBCO Merger

Financial Review

Strategic Initiatives |

Merger

Summary 8

Heritage Financial Corporation / Heritage Bank

Will do business as “Whidbey Island Bank”

on Whidbey Island

Olympia, Washington

HFWA:

Brian Vance (CEO), Jeff Deuel (COO), Don Hinson (CFO) and Dave Spurling (CCO)

WBCO:

Bryan McDonald (CLO), Ed Eng (CAO) and Lynn Garrison (HR)

8 directors from HFWA / 7 directors from WBCO (including Chairman)

May 1, 2014

54% HFWA / 46% WBCO

Shares outstanding of 30.2 million

Fixed exchange ratio of 0.8900x HFWA shares and $2.75 in cash per WBCO share

Transaction value of $17.13 per share

Name

Headquarters

Management

Closed

Ownership

Consideration

Board Composition

Shares Outstanding |

Financial Impact

& Key Assumptions at Announcement 9

Financially

Compelling

EPS

accretion

of

approximately

13%

in

2014

and

approximately

24%

in

2015

(1)(2)

Tangible

book

value

per

share

dilution

of

approximately

12.8%

at

closing

Payback

period

of

approximately

2.0

years

based

on

incremental

earnings

method

(3)

Payback

period

of

approximately

4.9

years

based

on

traditional

EPS

method

(4)

IRR of ~18.0%

Pro

forma

ROAA

above

1.00%

and

ROATCE

above

10.0%

(2)

Strong

pro

forma

capital

position

–

TCE

ratio

and

leverage

ratio

above

9.0%

and

10.0%

respectively

Source: SNL Financial, financial data as of 9/30/2013

Note: All information as of 10/23/2013 announcement

(1) Mean EPS estimate for 2014 per SNL FactSet research. EPS estimate in 2015 based on 7.50%

long-term growth rate (2) EPS accretion in 2014 and 2015 excludes non-recurring

merger related costs (3) Payback period based on the number of years its takes to

eliminate the tangible book value per share dilution with the estimated incremental

after-tax earnings per share provided by WBCO divided by pro forma fully diluted HFWA shares

outstanding

(4) Payback period based on the number of years its takes to eliminate the tangible book value

per share dilution with the estimated pro forma HFWA EPS accretion

(5) Excludes additional core deposit intangible asset amortization expense and changes in FDIC

clawback liability Key

Assumptions

Gross credit mark write-down of approximately $26.7 million, or 3.04% of originated

loans Cost savings of approximately 10% of combined company non-interest expense,

or 20% of standalone

(5)

Cost

savings

is

50%

phased-in

by

2014,

100%

phased-in

by

2015

(5)

After-tax one-time merger cost of $11.9 million

Several areas of opportunity for revenue synergies, but none included in the modeling

No expected branch consolidation |

10

As of and for the Quarter Ending

June 30, 2013

Dec 31, 2013

June 30, 2014

YOY %

Change

Total Assets

$1,425,635

$1,659,038

$3,391,579

138%

Total Deposits

$1,196,531

$1,399,189

$2,866,542

140%

Number of Branches

34

35

67

97%

Deposits per Branch

$35,192

$39,977

$42,784

22%

Number of FTE

361

373

809

124%

Tang. Common Equity to

Tang. Assets

13.2%

11.3%

9.8%

N/A

Resulting Company

Dollars in thousands |

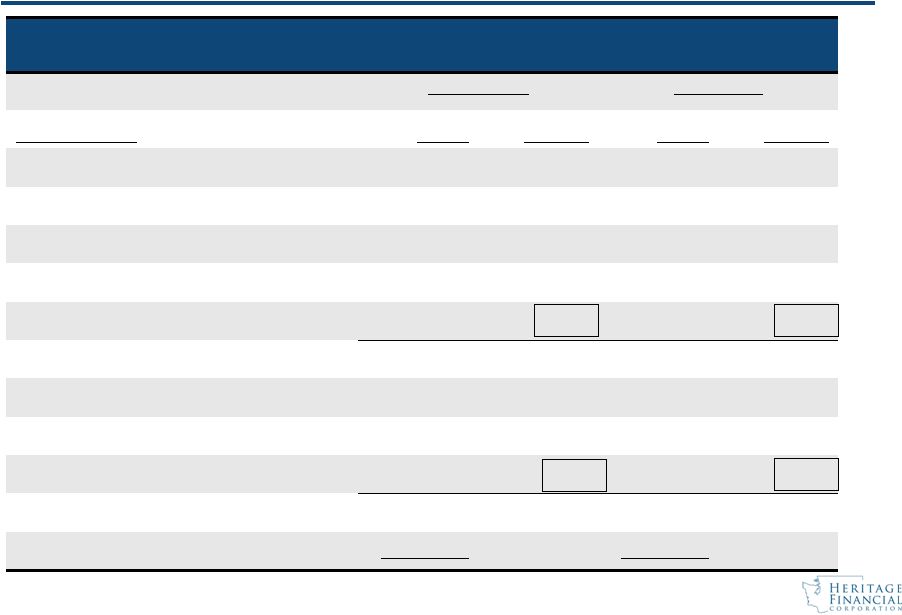

11

Adjusted Metrics

Three Months Ended

Mar 31, 2014

Adjusted*

Mar 31, 2014

June 30, 2014

Adjusted*

June 30, 2014

Diluted EPS

$ 0.16

$ 0.21

$ 0.16

$ 0.31

Efficiency ratio

77.6%

73.4%

80.9%

64.9%

Overhead Ratio**

3.58%

3.38%

3.84%

3.08%

Return on Assets

0.62%

0.82%

0.59%

1.13%

Return on Equity

4.74%

6.22%

4.49%

8.54%

* Adjusted amounts exclude effects of expenses related to implementing 2013/2014

strategic initiatives, including the merger with Washington Banking Company. These

expenses are identifiable costs paid to third-party providers as well as any

retention bonuses or severance payments made in conjunction with these initiatives.

**

Overhead

ratio

is

the

ratio

of

noninterest

expense

to

average

total

assets. |

Overview

12

Company Overview

WBCO Merger

Financial Review

Strategic Initiatives |

13

Financial Statistics

Three Months Ended

Earnings:

June 30, 2013

Sept 30, 2013

Dec 31, 2013

Mar 31, 2014

June 30, 2014

Net interest Income

$ 15,940

$ 17,581

$ 17,646

$ 16,741

$ 28,596

Provision for (reversal of)

loan losses on noncovered

loans

209

875

200

(21)

370

Provision for loan losses on

covered loans

1,099

203

228

479

321

Noninterest income

2,357

2,582

2,429

2,307

4,780

Noninterest expense

13,007

14,285

18,505

14,779

26,995

Net income

2,690

3,290

710

2,543

4,147

Diluted EPS

0.18

0.20

0.04

0.16

0.16

Financial Ratios:

Return on average assets

0.75%

0.80%

0.17%

0.62%

0.38%

Return on average equity

5.33%

6.05%

1.30%

4.74%

2.92%

Efficiency ratio

71.1%

70.9%

92.2%

77.6%

80.9%

Net interest margin

4.82%

4.67%

4.58%

4.48%

4.54%

Dollars in thousands except per share amounts |

14

Financial Statistics

As of Period End

Balance Sheet:

June 30, 2013

Sept 30, 2013

Dec 31, 2013

Mar 31, 2014

June 30, 2014

Total assets

$ 1,425,635

$ 1,674,714

$ 1,659,038

$ 1

,662,473

$ 3,391,579

Loans, including covered loans

1,086,453

1,208,082

1,203,096

1,207,650

2,200,711

Investment securities

156,233

202,339

199,288

178,002

691,245

Deposits

1,196,531

1,425,985

1,399,189

1,404,214

2,866,542

Total equity

200,525

216,595

215,762

216,417

449,829

Financial Measures:

Tang. book value per common share

$ 12.26

$

11.44

$ 11.40

$ 11.45

$ 10.57

Tang. common equity to tang. assets

13.2%

11.3%

11.3%

11.5%

9.8%

Net loans to deposits

90.8%

84.7%

86.0%

86.0%

77.0%

Deposits per branch

$ 35,192

$ 33,952

$ 39,977

$ 39,006

$ 42,784

Assets per FTE

3,949

4,035

4,448

4,644

4,192

Credit Quality Metrics:

ALLL on noncovered loans to total

noncovered loans

2.19%

1.95%

1.94%

1.94%

1.08%

Nonperforming noncovered loans to

total noncovered loans

1.21%

1.01%

0.66%

0.98%

0.66%

Nonperforming noncovered assets to

total noncovered assets

1.19%

0.90%

0.76%

0.97%

0.58%

Dollars in thousands except per share amounts |

15

Loan Composition

As of Period End

March 31, 2014

June 30, 2014

Loan Composition:

Balance

% of Total

Balance

% of Total

Noncovered Loans:

Commercial business:

Commercial and industrial

$ 333,216

28.3%

$ 534,458

25.8%

Owner-occupied commercial real estate

277,652

23.6%

473,603

22.9%

Non-owner occupied commercial real estate

405,848

34.4%

637,067

30.7%

Total commercial business

1,016,716

86.3%

1,645,128

79.4%

One-to-four family residential

43,613

3.7%

86,422

4.2%

Total real estate construction and land dev

74,763

6.3%

130,029

6.3%

Consumer

43,093

3.7%

210,230

10.1%

Gross noncovered loans

1,178,185

100%

2,071,809

100%

Total loans, net of deferred fees

$ 1,237,037

$ 2,229,194

Dollars in thousands |

16

Deposit Composition

As of Period End

March 31, 2014

June 30, 2014

Deposit Composition:

Balance

% of Total

Balance

% of Total

Noninterest demand deposits

$ 353,043

25.1%

$ 669,017

23.3%

NOW accounts

350,182

24.9%

723,889

25.3%

Money market accounts

235,541

16.8%

510,374

17.8%

Savings accounts

167,988

12.0%

342,605

11.9%

Total non-maturity deposits

1,106,754

78.8%

2,245,885

78.3%

Certificates of deposit

297,460

21.2%

620,657

21.7%

Total deposits

$ 1,404,214

100.0%

$ 2,866,542

100.0%

Dollars in thousands |

Total Risk

Based Capital Tangible Common

Equity/Tangible Assets

17

Capital Measures |

18

Cash Dividends

2012

2013

2014

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Regular

Dividend

$.06

$.08

$.08

$.08

$.08

$.08

$.08

$.08

$.16*

-

$.09

Special

Dividend

-

$.20

-

$.30

-

$.10

-

-

-

-

-

* The dividends for Q1 2014 consist of a regular quarterly dividend declared on January 29 and

another dividend declared on March 27. The March 27 dividend is the dividend regularly

declared in April for Q2, but was declared one month in advance as a result of the

anticipated merger with Washington Banking Company. |

Overview

19

Company Overview

WBCO Merger

Financial Review

Strategic Initiatives |

2014/2015

Strategic Initiatives 20

•

Drive growth synergies as a result of the HFWA/WBCO combination

•

Loan growth and “up-market”

relationships

•

Seattle/Bellevue

•

Mortgage Origination

•

SBA Lending

•

Consumer Lending

•

Wealth Management

•

Continue Efficiency Improvements

•

Assets per Employee

•

Efficiency Ratio

•

Non-Interest Expense/Average Assets |

2014/2015

Strategic Initiatives 21

•

Successful Conversion of WBCO Customers

•

Achieve announced cost saves and EPS accretion for 2015

•

Capital

•

Dividend payout may exceed 35-40% payout ratio until capital

is normalized.

•

Will consider opportunistic stock buybacks

•

Merger/Acquisitions

•

Priority is integration and conversion of WBCO

•

Continue to have a disciplined M&A strategy |

Investment

Value 22

Heritage offers:

•

A company of scale that will drive greater organic growth and

efficiency improvements

•

An experienced management team

•

A balance sheet poised for growth in the heart of a vibrant

economic region

•

9.8% TCE

•

77% Loan to deposit ratio

•

High quality funding base

•

Operating in a strong growth market footprint |

23

Questions and Answers |