Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Unilife Corp | d723828d8k.htm |

| EX-99.1 - EX-99.1 - Unilife Corp | d723828dex991.htm |

Fiscal

Year

2014

3

rd

Quarter

Earnings

Call

May

12,

2014

Exhibit 99.2 |

2

This

presentation

contains

forward

looking

statements

under

the

safe

harbor

provisions

of

the

US

securities

laws.

These

forward-looking

statements

are

based

on

management’s

beliefs

and

assumptions

and

on

information

currently

available

to

our

management.

Our

management

believes

that

these

forward-looking

statements

are

reasonable

as

and

when

made.

However

you

should

not

place

undue

reliance

on

any

such

forward

looking

statements

as

these

are

subject

to

risks

and

uncertainties.

Please

refer

to

our

press

releases

and

our

SEC

filings

for

more

information

regarding

the

use

of

forward

looking

statements.

Cautionary

Note

Regarding

Forward-Looking

Statements |

Opening Comments

3

$22.6MM in cash receipts from customers during the first nine

months of FY 2014, with $10.9MM during Current Quarter

$60MM debt financing with OrbiMed

Generating cash receipts from ten ongoing customer programs,

including several wearable injector programs

Clear pathway to profitability via existing supply agreements

secured to-date

Scale-up of manufacturing in preparation for commercial sales

One of the products from the Unifill platform commencing commercial sales

in the first quarter of FY 2015 (Quarter ending September 30, 2014)

Two other products from the Unifill platform commencing commercial sales

in the second quarter of FY 2015 (Quarter ending December 31, 2014)

|

4

Participating in Large, Growing Markets

* Based on internal estimates and independent market research data

Market Segment

Market Size*

Market Trends / Unmet Needs

Position of Unilife

Prefilled Syringes

(ready-to-fill syringes)

•

$2B market

•

13.5% CAGR

•

$5B market by 2024

•

Needlestick safety compliance.

•

High-performance biologics

•

Modular design, multiple application

•

Differentiation from competitors

•

Broad, customizable platform for all

prefilled drugs, biologics and vaccines

•

Long-term contracts signed to-date

include Sanofi and Hikma

Wearable Injectors

(Wearable, disposable

systems)

•

New, emerging market

•

20-40% CAGR

•

$8.8B market by 2024

•

Self-injection of viscous biologics

•

Customizable, platform-based systems

for large drug portfolios

•

Easy and ready to use for patients

•

Establishing

leadership

position

for

large,

rapid-growth

market

sector

•

Several customer programs underway

including MedImmune

Drug Reconstitution

Delivery Systems

(dual-chamber syringes)

•

New, emerging market

•

20% CAGR or more

•

$500MM-$1B by 2024

•

Reconstitute or mixing liquid or dry

drug combination products

•

Ventless, orientation-free mixing

•

More intuitive steps of use

•

Extensive, customizable platform inc.

EZMix, EZMix Prodigy & AutoMix

•

Emerging leader. Low competition

•

Lifecycle management opportunities

Auto-Injectors

(Disposable / smart

reusable systems)

•

$200MM market

•

20-30% CAGR

•

$1B market by 2024

•

Biologics for patient self-injection

•

True end-of-dose indicators

•

Compact, convenient, user-centric

•

Shift to smart reusable systems

•

Only company with both disposable and

smart reusable auto-injectors

•

Customizable. True end-of-dose

Ocular Delivery

(Accurate, precise drug

delivery to the eye)

•

New, emerging market

•

20-30% CAGR

•

$250MM market 2024

•

Localized or targeted drug delivery

•

Small doses measured in uL

•

Proliferation of drug depots

•

Trend from surgery to clinic

•

Establishing leadership position

•

Technology enables quantum shift in

dose accuracy and precision

Novel Delivery

(ie. novel devices for

target organ delivery)

•

New, emerging market

•

20-30% CAGR

•

$250MM market 2024

•

Enable

novel

drug

commercialization

•

New routes of administration

•

Long-term contracts with high ASP

•

Leader for novel delivery devices

•

Novartis

contract

now

in

2

stage with

long-term commercial potential

nd |

Unilife is Much Like an Annuity Business Model

5

Differentiated devices become part of the regulatory drug label

Long-term supply contracts that ensure continuity of supply

Each supply contract provides recurring annual revenue with

intrinsic growth year over year

New customers increase revenue and rate of revenue growth

B2B model enables minimal selling costs and encourages

attractive operating margins

Strong, growing IP portfolio creates a barrier for new competition

|

Scaling up for Existing and New Programs

6

Ten ongoing customer programs as of March 31, 2014

Expanding operational infrastructure and cleanrooms

Unifill

®

platform of prefilled syringes

Capacity for existing line largely sold or reserved for customers

Additional lines on order for other Unifill products

Q1 2015 –

Commence commercial sales of one of our Unifill products

Q2 2015 –

Commence commercial sales of two other Unifill products

Commercial sales to accelerate through FY 2015 and FY 2016

Manufacturing scale-up occurring across other platforms

|

OrbiMed Debt Financing

7

$60MM debt financing with OrbiMed, the world’s largest

dedicated healthcare investor

$40MM received by Unilife to-date

Unilife has the option to receive two extra tranches of $10MM

each in December 2014 and June 2015*

Interest only payments of approximately $1MM per quarter

Cash flow savings of $400,000 per quarter compared to previous debt

service payments

Option to repay loan prior to Maturity Date in 2020

Provides capital to drive growth as several large contracts with

existing customers proceed to commercial rollout

Provided the Company is in compliance with the terms of the agreement

|

Cash

Receipts from Customers 8 |

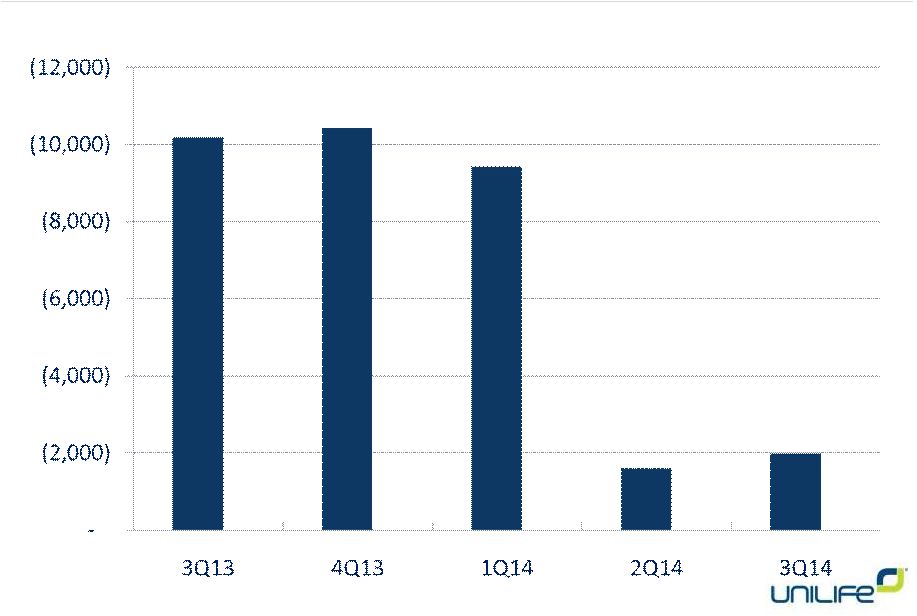

Net

Operating Cash Flow Loss 9 |

Financial Results for Third Quarter of Fiscal 2014

10

Revenue of $1.4MM*

Deferred revenue increased by $8.3MM to $18.4MM

$39.7MM of total cash and cash equivalents including restricted

cash as of March 31, 2014

Three Months Ended

March 31,

Nine Months Ended

March 31,

2014

2013

2014

2013

Revenues

$1.4MM

$0.7MM

$8.1MM

$2.1MM

Research & development

$8.0MM

$5.5MM

$22.2MM

$15.2MM

Selling, general & administrative

$6.6MM

$7.3MM

$19.9MM

$22.2MM

Net loss

$15.1MM

$14.1MM

$42.6MM

$41.2MM

Net loss per share –

diluted

$0.15

$0.17

$0.44

$0.52

Adjusted net loss**

$11.7MM

$9.4MM

$27.1MM

$28.2MM

Adjusted net loss per share -

diluted

$0.12

$0.12

$0.28

$0.36

* Revenue of $2.7 million anticipated to be recognized during the Q3 has instead already been

recognized in Q4 of Fiscal Year 2014 based on the timing of the receipt of certain

documentation. This will be incremental to revenue from additional sources . ** Adjusted

net loss excludes non-cash share-based compensation expense, depreciation and amortization and interest expense. |

Fiscal Year 2014 Full Year Guidance

11

Expected recognized revenue for FY 2014 to be in range of

$12MM -

$15MM

Commercial sales to begin comprising larger share of revenue

from FY 2015 onwards |

Closing Statements

12

Increasing cash position via cash receipts and OrbiMed deal

Increasing base of pharmaceutical and biotech customers

Increasing number of customer programs with ten now

ongoing and activity underway across all product platforms

Increasing revenue with $12 -

$15MM target for FY 2014

while continuing to narrow cash losses and invest in R&D

Increasing manufacturing capacities and ordering new lines in

preparation for commercial sales in FY 2015 |

Questions

|