Attached files

| file | filename |

|---|---|

| EX-99.2 - TIAA REAL ESTATE ACCOUNT | c77326_ex99-2.htm |

| 8-K - TIAA REAL ESTATE ACCOUNT | c77326_8k.htm |

Exhibit 99.1

|

TIAA Retirement Annuity Accounts

TIAA Real Estate Account

|

| Real Estate | As of 3/31/2014 |

| Account Net Assets | Inception Date | Estimated Annual Expenses1 2 |

| $17.5 Billion | 10/02/1995 | 0.90% |

Portfolio Strategies

This variable annuity account seeks favorable long-term returns primarily through rental income and appreciation of real estate and real estate-related investments owned by the Account. The Account will also invest in non-real estate-related publicly traded securities and short-term higher quality liquid investments that are easily converted to cash to enable the Account to meet participant redemption requests, purchase or improve properties or cover other expenses. The Account intends to have between 75% and 85% of its net assets invested directly in real estate or real estate-related assets with the goal of producing favorable long-term returns. The Account’s principal strategy is to purchase direct ownership interests in income-producing real estate, primarily office, industrial, retail and multi-family residential properties. The Account may also make foreign real estate investments. Under the Account’s investment guidelines, investments in direct foreign real estate, together with foreign real estate-related securities and foreign non-real estate-related liquid investments may not comprise more than 25% of the Account’s net assets. The Account will invest the remaining portion of its assets (targeted between 15% and 25% of net assets) in publicly traded, liquid investments.

Learn More

For more information please contact:

800 842-2252

Weekdays 8 a.m. to 10 p.m. ET,

Saturdays 9 a.m. to 6 p.m. ET,

or visit tiaa-cref.org

| Performance | |||||||

| Total Return | Average Annual Total Return | ||||||

| 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | |

| TIAA Real Estate Account | 2.33% | 2.33% | 10.14% | 10.50% | 4.54% | 4.84% | 6.16% |

The returns quoted represent past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your mutual fund shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org, or call 800 842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

| 1 | Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. |

| 2 | The Account’s total annual expense deduction appears in the Account’s prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. |

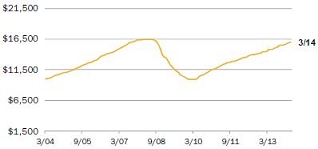

| Hypothetical Growth of $10,000 | |||

| The chart illustrates the performance of a hypothetical $10,000 investment on March 31, 2004 and redeemed on March 31, 2014. |  | ||

| — TIAA Real Estate Account | $16,038 | ||

The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs.

| Properties by Type | (As of 3/31/2014) | Properties by Region | (As of 3/31/2014) | |

| % of Real Estate Investments3 4 | % of Real Estate Investments3 5 | |||

| Office | 42.8 | East | 37.3 | |

| Apartment | 22.4 | West | 35.8 | |

| Retail | 17.3 | South | 23.8 | |

| Industrial | 13.3 | Foreign | 1.6 | |

| Other | 4.2 | Midwest | 1.5 | |

| 3 | Wholly-owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. |

| 4 | Other properties represents interest in Storage Portfolio investment, a fee interest encumbered by a ground lease real estate investment and a land development. |

| 5 | Foreign property represents real estate investment in France. |

Please refer to the next page for important disclosure information.

|

TIAA Retirement Annuity Accounts TIAA Real Estate Account

|

| Real Estate | As of 3/31/2014 |

| Portfolio Composition | (As of 3/31/14) |

| Investments by Type | % of Net Assets |

| Real Estate Properties | 54.6% |

| Short Term Investments | 18.5% |

| Real Estate Joint Venture And Limited Partnerships | 16.8% |

| Marketable Securities Real Estate Related | 9.6% |

| Other (Net Receivable/Liability) | 0.5% |

| Top 10 Holdings6 | (As of 3/31/14) |

| % of Total Investments7 | |

| 1001 Pennsylvania Avenue | 3.7% |

| 50 Fremont Street | 2.7% |

| The Florida Mall | 2.6% |

| 99 High Street | 2.3% |

| Fourth and Madison | 2.2% |

| DDR | 2.1% |

| 425 Park Avenue | 2.0% |

| 501 Boylston Street | 1.9% |

| 780 Third Avenue | 1.9% |

| Ontario Industrial Portfolio | 1.7% |

Market Recap

Despite challenging weather conditions, real estate market conditions remain solid

An unusually harsh winter somewhat slowed U.S. hiring during the first quarter of 2014, particularly in January. Despite the challenging weather conditions, 533,000 new jobs were added in the quarter according to the Bureau of Labor Statistics, compared to 595,000 in the fourth quarter of 2013. During the first quarter, 177,000 new jobs were added on average per month. Employment growth of this magnitude is considered adequate to provide jobs for new workers entering the workforce. Consequently, the unemployment rate ended the first quarter where it started, at 6.7%.

Employment trends in financial and professional and business services serve as a primary driver of office space demand. Job growth accelerated slightly across both sectors in the first quarter. The financial services sector added 9,000, compared with 5,000 in the fourth quarter. Meanwhile, the professional and business services sector continued to expand as well, adding 187,000 new jobs versus 142,000 in the previous quarter. According to preliminary data from CB Richard Ellis Econometric Advisors (CBRE-EA), a frequently cited source for real estate market data, the national office vacancy rate ticked down slightly to 14.8% in the first quarter, compared with 14.9% at year-end 2013. Vacancy rates declined in 34 of the 63 markets tracked by CBRE-EA.

Industrial market conditions also continued to display modest improvements in the first quarter. Based on data from CBRE-EA, the national availability rate declined to 11.1% compared with 11.3% at the end of 2013. This marked the smallest quarterly rate decline in more than a year and suggests a maturing recovery in the industrial space. Further, higher levels of new supply are being delivered in many markets for the first time since the start of the recession. Nonetheless, availability rates declined in 41 of the 61 industrial markets tracked by CBRE-EA.

The apartment market cycle also showed increasing signs of maturity in the first quarter. The national vacancy rate declined to 4.9% in the first quarter, versus 5.1% in the year-ago period. (A year-over-year comparison is necessary to take into account the effects of seasonal leasing patterns in the apartment sector.) Effective rent growth remained steady at 2.5%-3.0% across most markets. Rents continued to climb in many tech-based areas while rents in smaller markets and Washington, DC struggled to gain traction.

Exceptionally harsh winter weather had an impact on retail sales. Retail sales (excluding motor vehicles and parts) increased 0.2% in the first quarter compared with year-end 2013. Weaker winter sales contributed to a smaller-than-anticipated decline in the national retail availability rate to 11.9% during the quarter, versus 12.0% previously. Nonetheless, this marked the first time the availability rate fell below 12.0% since 2009.

Important Information

| 6 | The top 10 holdings are subject to change and may not be representative of the account’s current or future investments. The holdings listed only include the account’s long-term investments. Money market instruments and/or futures contracts, if applicable, are excluded. The holdings do not include the account’s entire investment portfolio and should not be considered a recommendation to buy or sell a particular security. |

| 7 | Value as reported in the March 31, 2014 Statement of Investments. Investments owned 100% by the Account are reported based on fair value. Investments in joint ventures are reported at fair value and are presented at the Account’s ownership interest. |

| This property, 1001 Pennsylvania Avenue, is presented gross of debt. The value of the Account’s interest less the fair value of leverage is $410.0 million. | |

| This property, 50 Fremont Street, is presented gross of debt. The value of the Account’s interest less the fair value of leverage is $332.2 million. | |

| This property, The Florida Mall, is a 50% / 50% joint venture with Simon Property Group, L.P. and is presented net of debt. As of March 31, 2014 this debt had a fair value of $191.0 million. | |

| This property, 99 High Street, is presented gross of debt. The value of the Account’s interest less the fair value of leverage is $268.0 million. | |

| This property, Fourth and Madison, is presented gross of debt. The value of the Account’s interest less the fair value of leverage is $247.6 million. | |

| This property is held in a 85% / 15% joint venture with Developers Diversified Realty Corporation (“DDR”), and consists of 27 retail properties located in 12 states and is presented net of debt. As of March 31, 2014 this debt had a fair value of $687.1 million. | |

| This property, 780 Third Avenue, is presented gross of debt. The value of the Account’s interest less the fair value of leverage is $209.2 million. | |

| Real estate investment portfolio turnover rate was 2.10% for the year ended 12/31/2013. Real estate investment portfolio turnover rate is calculated by dividing the lesser of purchases or sales of real estate property investments (including contributions to, or return of capital distributions received from, existing joint venture and limited partnership investments) by the average value of the portfolio of real estate investments held during the period. | |

| Marketable securities portfolio turnover rate was 8.36% for the year ended 12/31/2013. Marketable securities portfolio turnover rate is calculated by dividing the lesser of purchases or sales of securities, excluding securities having maturity dates at acquisition of one year or less, by the average value of the portfolio securities held during the period. |

| Teachers Insurance and Annuity Association of America (TIAA), New York, NY, issues annuity contracts and certificates. |

Continued on next page…

|

TIAA Retirement Annuity Accounts TIAA Real Estate Account

|

| Real Estate | As of 3/31/2014 |

Investment, insurance and annuity products: are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value.

TIAA-CREF Individual & Institutional Services, LLC and Teachers Personal investors Services, Inc., members FINRA, distribute securities products.

THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS FOR THE TIAA REAL ESTATE ACCOUNT. PLEASE CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES, AND EXPENSES BEFORE INVESTING AND CAREFULLY READ THE PROSPECTUS. ADDITIONAL COPIES OF THE PROSPECTUS CAN BE OBTAINED BY CALLING 877-518-9161.

A Note About Risks

In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests.

The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including among other things fluctuations in property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus.

©2014 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017 C16103