Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERITAGE FINANCIAL CORP /WA/ | d671796d8k.htm |

Q4

2013 Investor Presentation February 6, 2014

Heritage Financial Corporation

Brian L. Vance, CEO of HFWA and Heritage Bank

Jeffrey J. Deuel, President and COO of Heritage Bank

Donald

J.

Hinson,

Executive

Vice

President

and

CFO

of

HFWA

Exhibit 99.1 |

2

This presentation contains forward-looking statements that are subject to risks and

uncertainties, including, but not limited to: The expected revenues, cost

savings, synergies and other benefits from the pending Washington Banking merger and our other merger

and acquisition activities might not be realized within the anticipated time frames or

at all, and costs or difficulties relating to integration matters, including

but not limited to, customer and employee retention might be greater than expected;

The possibility that the requisite shareholder approvals for the pending Washington

Banking merger may not be obtained; The credit and concentration risks of

lending activities; Changes in general economic conditions, either nationally or

in our market areas; Competitive market pricing factors and interest rate

risks; Market interest rate volatility;

Balance sheet (for example, loans) concentrations;

Fluctuations in demand for loans and other financial services in our market

areas; Changes in legislative or regulatory requirements or the results of

regulatory examinations; The ability to recruit and retain key management and

staff; Risks associated with our ability to implement our expansion strategy and

merger integration; Stability of funding sources and continued availability of

borrowings; Adverse changes in the securities markets;

The inability of key third-party providers to perform their obligations to

us; The

Company

cautions

readers

not

to

place

undue

reliance

on

any

forward-looking

statements.

Moreover,

you

should

treat

these

statements

as

speaking

only

as

of

the

date

they

are

made

and

based

only

on

information

then

actually

known

to

the

Company.

The

Company

does

not

undertake

and

specifically

disclaims

any

obligation

to

revise

any

forward-looking

statements

to

reflect

the

occurrence

of

anticipated

or

unanticipated

events

or

circumstances

after

the

date

of

such

statements.

These

risks

could

cause

our

actual

results

for

2014

and

beyond

to

differ

materially

from

those

expressed

in

any

forward-looking

statements

by,

or

on

behalf

of,

us,

and

could

negatively

affect

the

Company’s

operating

and

stock

price

performance.

Forward

Looking

Statement

Changes in accounting policies and practices and the use of estimates in determining

fair value of certain of our assets, which estimates may prove to be incorrect

and result in significant declines in valuation; and These and other risks as

may be detailed from time to time in our filings with the Securities and Exchange Commission. |

3

ADDITIONAL INFORMATION

In

connection

with

the

proposed

merger

between

Heritage

Financial

Corporation

(“Heritage”)

and

Washington

Banking

Company

(“Washington

Banking”),

Heritage

has

filed

a

registration

statement

on

Form

S-4

with

the

Securities

and

Exchange

Commission

(“SEC”).

The

registration

statement

includes

a

preliminary

joint

proxy

statement

of

Heritage

and

Washington

Banking

that

also

constitutes

a

preliminary

prospectus

of

Heritage,

which,

when

finalized,

will

be

sent

to

the

shareholders

of

Heritage

and

Washington

Banking.

Shareholders

are

advised

to

read

the

preliminary

joint

proxy

statement/prospectus

regarding

the

proposed

merger,

the

definitive

joint

proxy

statement/prospectus

(when

it

becomes

available),

and

any

other

relevant

documents

filed

with

the

SEC,

as

well

as

any

amendments

or

supplements

to

those

documents,

because

they

contain,

or

will

contain,

as

the

case

may

be,

important

information

about

Heritage,

Washington

Banking

and

the

proposed

transaction.

Copies

of

all

documents

relating

to

the

merger

filed

by

Heritage

and

Washington

Banking

can

be

obtained

free

of

charge

from

the

SEC’s

website

at

www.sec.gov

.

These

documents

also

can

be

obtained

free

of

charge

by

accessing

Heritage’s

website

at

http://www.hf-wa.com/docs.aspx?iid=1024198

or

by

accessing

Washington

Banking’s

website

at

http://investor.washingtonbanking.info/docs.aspx?iid=1025104

.

Alternatively,

these

documents,

can

be

obtained

free

of

charge

from

Heritage

upon

written

request

to

Heritage

Financial

Corporation,

Secretary,

201

Fifth

Avenue

S.W.,

Olympia,

WA

98501

or

by

calling

(360)

943-1500,

or

from

Washington

Banking,

upon

written

request

to

Washington

Banking

Company,

Secretary,

450

SW

Bayshore

Drive,

Oak

Harbor,

Washington

98277

or

by

calling

(360)

240-6458.

Heritage,

Washington

Banking

and

certain

of

their

respective

directors

and

executive

officers

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

shareholders

in

connection

with

the

proposed

transaction

under

the

rules

of

the

SEC.

Information

about

these

participants

may

be

found

in

the

definitive

proxy

statement

of

Heritage

relating

to

its

2013

Annual

Meeting

of

Shareholders

filed

with

the

SEC

by

Heritage

on

March

19,

2013

and

the

definitive

proxy

statement

of

Washington

Banking

relating

to

its

2013

Annual

Meeting

of

Shareholders

filed

with

the

SEC

on

March

26,

2013.

These

definitive

proxy

statements

can

be

obtained

free

of

charge

from

the

sources

indicated

above.

Additional

information

regarding

the

interests

of

these

participants

will

also

be

included

in

the

joint

proxy

statement/prospectus

regarding

the

proposed

transaction

when

it

becomes

available.

Forward

Looking

Statement |

•

Company Information

•

Financial Performance

•

Strategic Initiatives

4

Overview |

Company Information

5 |

6

Financial data as of December 31, 2013

•

East Vancouver Branch opened January 13, 2014

Overview

NASDAQ Symbol

HFWA

Market Capitalization

$277 million

Headquarters

Olympia, WA

Branches

35

Number of FTE

373

Our

Company |

7

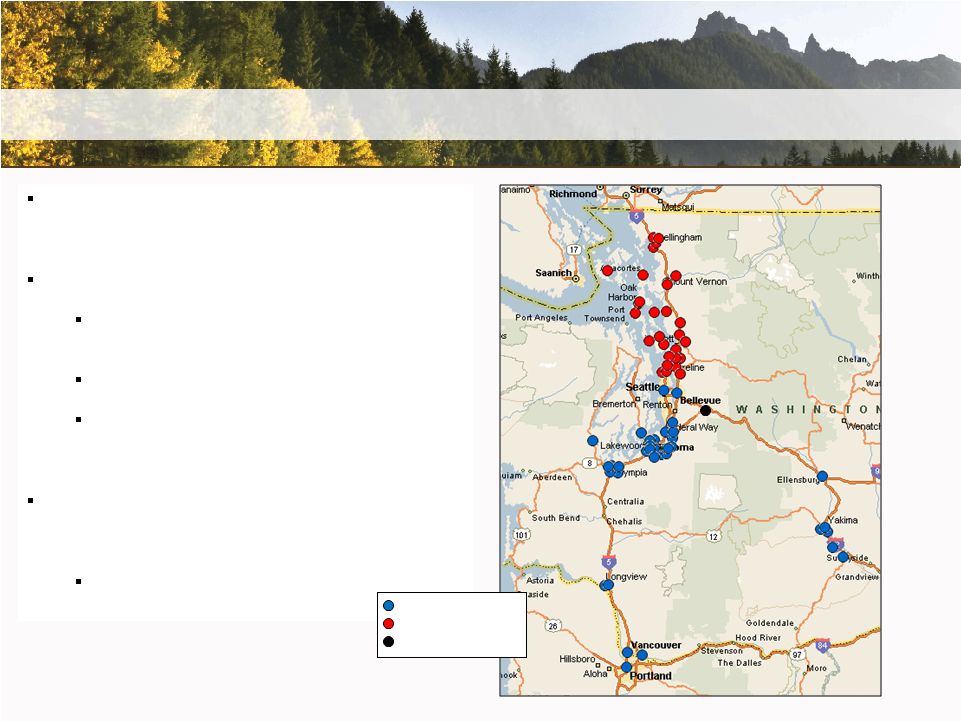

Combination creates $3.3 billion asset franchise with 67

branch locations

(1)

across Washington and Oregon from

Bellingham, WA to Portland, OR

Logical geographic fit

Strength from the North (WBCO) joining strength

from the South (HFWA)

Doubles the branch footprint along the I-5 corridor

#3 deposit market share within combined market

area among banks and thrifts headquartered in

the state of Washington

(2)

Strength of both franchises will provide momentum for

accelerated growth initiatives in King County (Greater

Seattle / Bellevue)

Larger scale, deeper resources, creates new

opportunities

WBCO

(30

Branches)

HFWA

(36

Branches)

WBCO

Proposed

(1

Branch)

WBCO

Announced

Merger

Source: SNL Financial and FDIC deposit reports, as of 6/30/2013

(1) 36 HFWA branches as of 2/3/2014

(2) Combined footprint of all counties in Washington with either

a HFWA branch or WBCO

branch. Includes all institutions with corporate headquarters in

the state of Washington |

8

Financial data as of and for the year ending December 31, 2013

Total Assets

$1.66 billion

Net Loans

$1.20 billion

Total Deposits

$1.40 billion

Tangible Common Equity

$184.8 million

Loan/Deposit Ratio

86.0%

Return on Average Assets

0.62%

Net Interest Margin

4.80%

Financial

Highlights |

Financial Performance

9 |

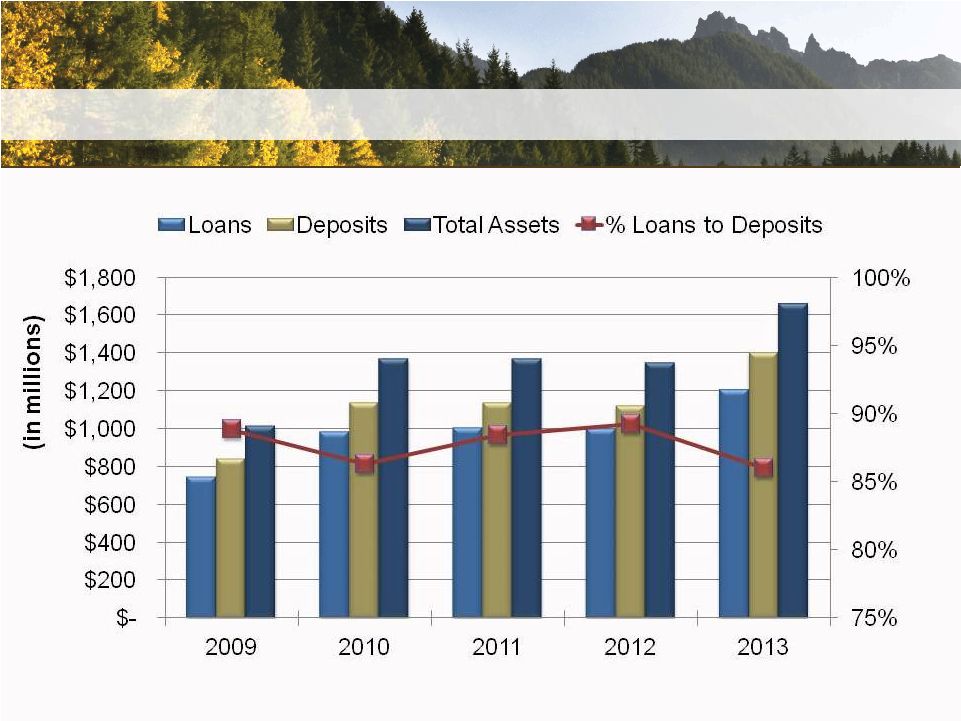

10

Balance

Sheet |

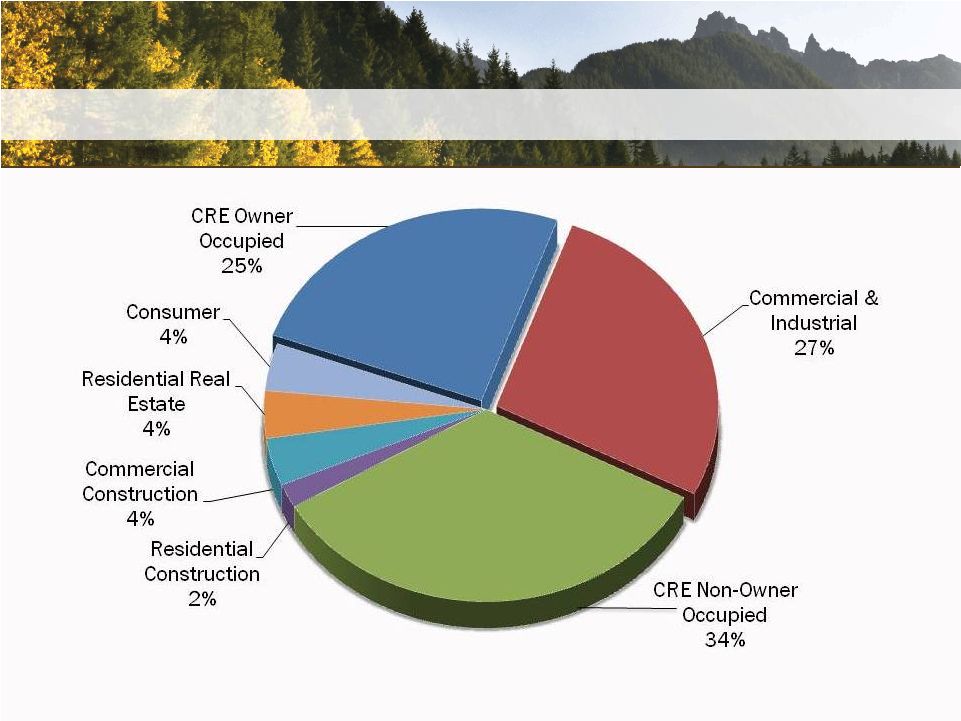

11

Financial

data

as

of

December

31,

2013

Total

Loan

Portfolio |

12

2009

2010

2011

2012

2013

CAGR

Originated

Loans

$746.1

$720.0

$815.6

$855.4

$960.1

6.51%

Purchased

Covered

Loans

-

$128.7

$105.4

$84.0

$57.6

n/a

Purchased

Non-

Covered

Loans

-

$131.0

$83.5

$59.0

$185.4

n/a

Total

$746.1

$979.8

$1,004.5

$998.4

$1,203.1

12.69%

Dollars in millions

Net Loan Trends |

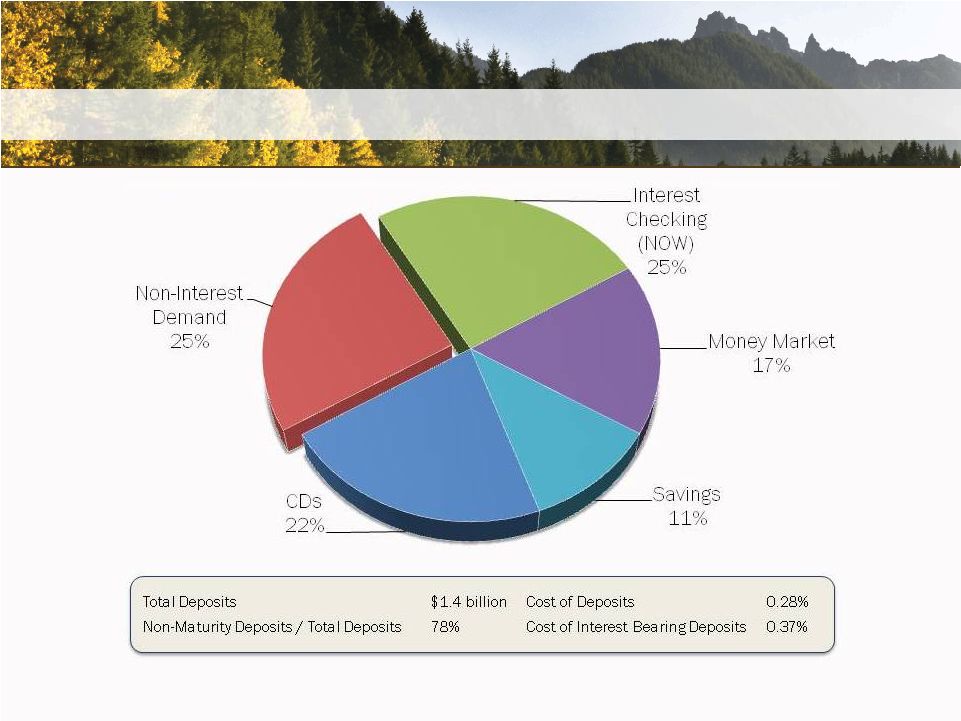

13

Financial data as of and for the year ending December 31, 2013

Deposit Base |

Annual Earnings (Loss) Per Share

Quarterly Earnings Per Share

14

* Includes $0.69 earnings per share related to the after-tax gain on

FDIC-assisted acquisitions. ** For the year and quarter ended December 31,

2013, earnings include $0.22 per share and $0.15 per share, respectively, of

expenses (after-tax) related to 2013 company initiatives.

Diluted Earnings Per Share |

15

Strategic Initiatives

15 |

•

Acquisitions

•

Enhance Pacific Northwest footprint

•

Organic Growth

•

Projected originated loan growth of 3-5% with actual growth of 11.8%

•

Maintain loan to deposit ratio 85-90% with year-end at 86%

•

Efficiency Improvements

•

Assets per Employee (ApE)

•

Deposits per Branch (DpB)

16

2013 Strategic Initiatives |

17

2013

Key Accomplishments

Q1

Merger and Conversion with Northwest Commercial Bank

Q2

Central Valley Bank Subsidiary Consolidation

Q3

Merger with Valley Community Bancshares, Inc. (Valley Bank)

Q4

Core System Conversion

Valley Bank Conversion

Closed 3 Heritage Bank Branches

Consolidated 4 of 8 Valley Bank Branches

Announced WBCO Merger |

18

As of Period End

Dec 31, 2012

Sept 30, 2013

Dec 31, 2013

YOY %

Change

Total Assets

$1,345,540

$1,674,417

$1,659,038

23%

Total Deposits

$1,117,971

$1,425,985

$1,399,189

25%

Number of Branches

33

42

35

6%

Avg. Deposits per Branch

$33,878

$33,952

$39,977

18%

Number of FTE

363

415

373

2%

Avg. Assets per Employee

$3,707

$4,035

$4,448

20%

Dollars in thousands

Resulting Performance Metrics |

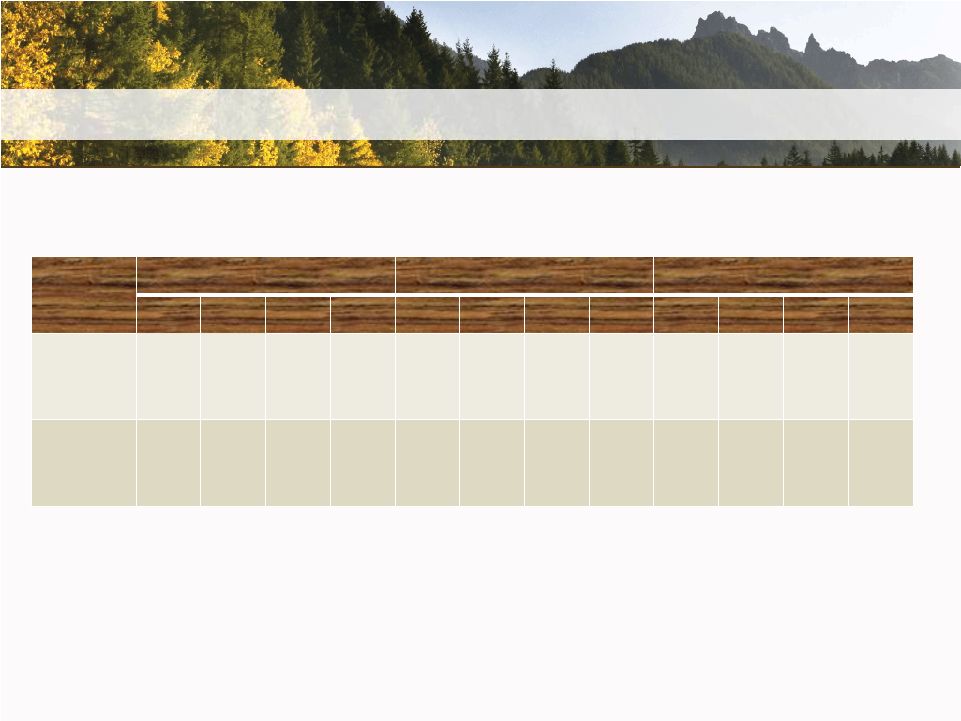

Long term cash dividend strategy is 35% to 40% payout range.

19

2011

2012

2013

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Quarterly

Dividend

-

$.03

$.05

$.05

$.06

$.08

$.08

$.08

$.08

$.08

$.08

$.08

Special

Dividend

-

-

-

$.25

-

$.20

-

$.30

-

$.10

-

-

Cash Dividends |

20

Conclusion

20 |

•

Strong financial foundation

•

Positioned to take advantage of the right

opportunities

•

Continued focus on building long-term

franchise value

•

Disciplined approach to acquisitions

21

Investment Value |

Thank You

Questions? |