Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Affinia Group Intermediate Holdings Inc. | d662947d8k.htm |

Affinia Group

Inc. Affinia Group Inc.

Lender Presentation

Lender Presentation

Amendment to Senior Secured Credit Facility

Amendment to Senior Secured Credit Facility

January 27

, 2014

th

Exhibit 99.1 |

Pg.

2 This presentation may contain forward-looking statements reflecting

management's beliefs and assumptions regarding

future

events

based

on

the

best

available

information.

Readers

are

cautioned

not

to

put

undue

reliance

on forward-looking statements as they are not a guarantee of future

performance and remain subject to a number of uncertainties and other

factors that could cause actual results to differ materially from forecasts. A more detailed

description of these uncertainties and risk factors is provided in Affinia’s

regular filings with the SEC on Forms 10-Q and 10-K.

Disclosure

Disclosure |

Pg. 3

Presenters

Presenters

Affinia Group Inc.

Steve Klueg

Senior Vice President and Chief Financial Officer

J.P. Morgan

Stathis Karanikolaidis

Managing Director |

Pg. 4

Transaction Overview

Stathis Karanikolaidis

J.P. Morgan

–

Managing Director |

Pg. 5

Affinia announced on January 22, 2014 the sale of its Global Chassis division to

Federal Mogul Global Chassis is a leading manufacturer of aftermarket

chassis components under the brand names Raybestos®

and McQuay-Norris®

Affinia will receive $150 million cash proceeds at close

Closing expected to occur shortly after satisfaction of closing conditions,

including HSR clearance

Global Chassis represented 12% of revenues and 11% of adjusted EBITDA in the last

twelve months ended 9/30/13

Affinia will continue to focus on growing its core business and eliminating

corporate costs through consolidation in 2014

Sale of Chassis Division –

Sale of Chassis Division –

Overview and

Overview and

Strategic Rationale

Strategic Rationale |

Pg. 6

Summary of Proposed Amendments

Summary of Proposed Amendments

Affinia Group Inc. (the “Company”) is seeking certain amendments to its

Term Loan and ABL Permit the sale of

the Chassis business for $150 million In connection with the amendments, the

Company will Make a $75 million prepayment of the Term Loans (TLB-1 and

TLB-2 tranches on a pro rata basis); no Break Funding Payments will be

payable Repay outstanding amounts under the Dana Seller Note

Add a basket for Restricted Payments and a basket for Investments to permit

dividends, loans or advances to Affinia Group Holdings Inc. for the purpose

of repaying outstanding amounts under the Dana Seller Note

Aggregate amount of dividends, loans or advances is not to exceed $85

million Extend

the

period

during

which

the

Company

may

use

proceeds

from

the

sale

of

its

South

America

business to make loans and advances and to pay dividends from October 25th, 2014

to April 25th, 2015

Permit deferral of first Excess Cash Flow sweep payment, which will be based on

the LTM period ending June 30, 2014, for six months from the current due

date credit agreements |

Pg. 7

Proposed Amendments –

Proposed Amendments –

Voting and Fees

Voting and Fees

Voting

Approval

of

the

proposed

amendments

is

subject

to

a

vote

by

Term

Loan

lenders

and

ABL

lenders

Approval

requires

a

majority

of

Term

Loan

lenders

and

a

majority

of

ABL

lenders

to consent

Fees

15 bps to consenting Term Loan lenders

7.5 bps to consenting ABL lenders |

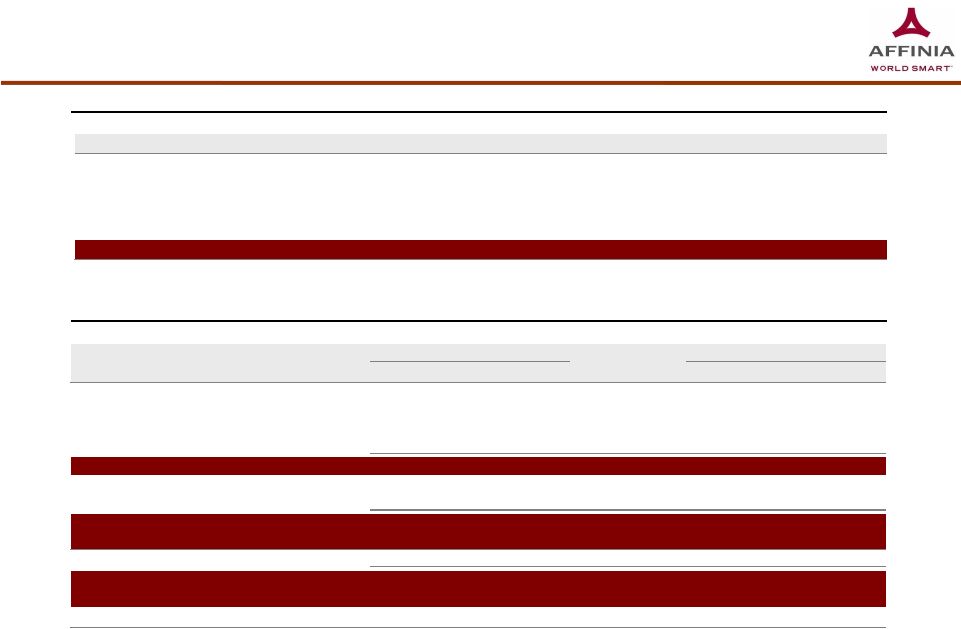

Sources

($mm)

Uses

($mm)

Proceeds from Chassis sale

$150

Repay existing Term Loan B tranches

$75

Cash on balance sheet

86

Repay Dana seller note

50

Cash remaining on balance sheet

108

Estimated fees and expenses

3

Total sources

$236

Total uses

$236

Sources, Uses and Pro Forma Capitalization

Sources, Uses and Pro Forma Capitalization

Sources and Uses

Pro Forma Capitalization Table

($ in millions)

($ in millions)

1

Based

on

LTM

9/30/13

Adj.

EBITDA

of

$185

million,

including

the

Chassis

business

2

Based on Pro Forma LTM 9/30/13 Adj. EBITDA of $164 million, excluding the Chassis

business 3

Debt of Affinia Group Holdings, Inc.; a subordinated 12.5% payment in kind note which matures

on November 30, 2019. Actual amount of Dana Seller Note paydown could differ based on capacity

for Restricted Payments as of 12/31/13 in the 7.75% senior notes

Existing

Pro forma

Capitalization

9/30/2013

x EBITDA¹

Adjustments

9/30/2013

xEBITDA²

Cash

$86

$22

$108

$175mm ABL R/C

0

0

Term loan B-1

200

(22)

177

Term loan B-2

469

(53)

416

Total senior secured debt

$668

3.6x

$593

3.6x

7.75% senior notes

250

250

Other

22

22

Total debt through the OpCo

$941

5.1x

$866

5.3x

Total net debt through the OpCo

$855

4.6x

$758

4.6x

Dana seller note³

77

(50)

27

Total debt through the HoldCo

$1,018

5.5x

$893

5.4x

Total net debt through the HoldCo

$932

5.0x

$785

4.8x

Cash interest coverage

3.6x

3.4x

1

Actual

amount

of

Dana

Seller

Note

paydown

could

differ

based

on

capacity

for

Restricted

Payments

as

of

12/31/13

in

the

7.75%

senior

notes

Pg. 8

1 |

Pg. 9

Key Date

Amendment Timeline

Amendment Timeline

S

M

T

W

T

F

S

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

January 2014

S

M

T

W

T

F

S

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

February 2014

Key Events

Date

Lender Conference Call

January 27

Lender consents due

February 3

th

rd |

Pg. 10

Business update

Steve Klueg

Senior Vice President and Chief Financial Officer

|

Global low-cost manufacturing and distribution footprint

Key Investment Highlights

Key Investment Highlights

Leading market positions and highly regarded aftermarket brands

Long-standing customer relationships

Strong operating efficiency and cash flow generation:

Exposure to favorable aftermarket trends

12.4% LTM Adj. EBITDA margin

$141 million LTM Adj. EBITDA less CapEx

Pg. 11 |

Affinia Group

- Affinia Group -

Business Update

Business Update

Global Filtration Update

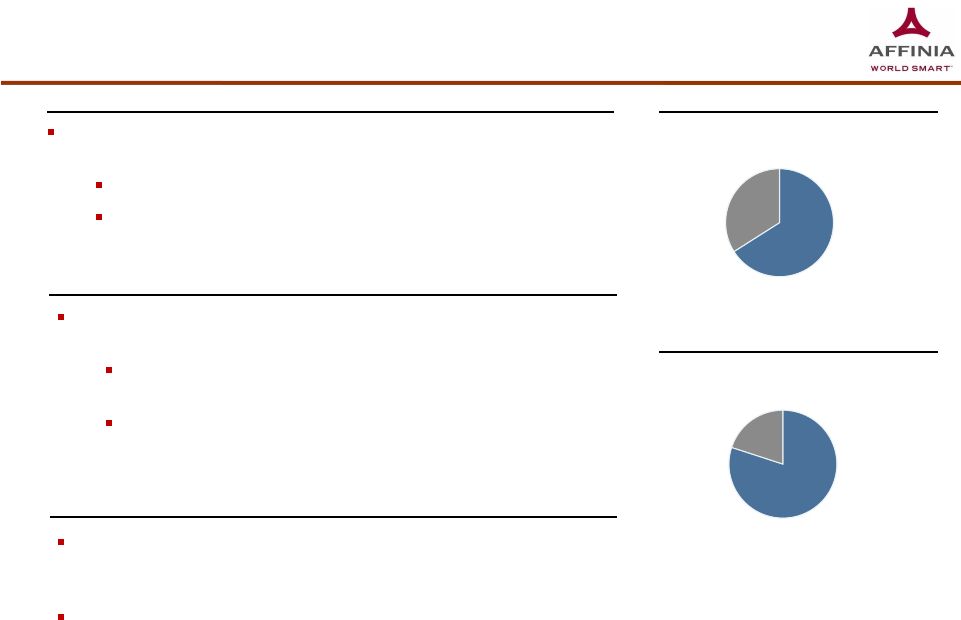

9/30/13 Pro Forma LTM Revenue by Division

9/30/13 Pro Forma LTM Adj. EBITDA by Division

Filtration

66%

South

America

34%

Affinia South America (“ASA”) Update

Affinia announced in October 2013 plans to relocate its Ann Arbor, MI

corporate headquarters to Gastonia, NC, where its Global Filtration Group is

headquartered

Transition to occur in phases during 2014

Company Headquarters

Total: $1.3 billion

Global

Filtration

sales

grew

6.6%

to

$877

million

in

the

LTM

period

ending

9/30/2013 in comparison to the corresponding period in 2012

Increased sales from European operations

Increased sales in Venezuela

ASA sales grew 2.5% to $447 million

in the LTM period ending 9/30/2013 in

comparison to the corresponding period in 2012

Driven

by

Pellegrino,

the

Brazilian

distribution

arm,

which

grew

at

5.1%

in the LTM period ending 9/30/2013

Pellegrino has grown 132% since 2005 and holds the #2 market

position in Brazilian aftermarket parts distribution

Filtration

80%

South

America

20%

Total: $164 million

Note: % of total excludes unallocated corporate expenses

Pg. 12 |

Pg. 13

Financial Overview

Steve Klueg

Senior Vice President and Chief Financial Officer

|

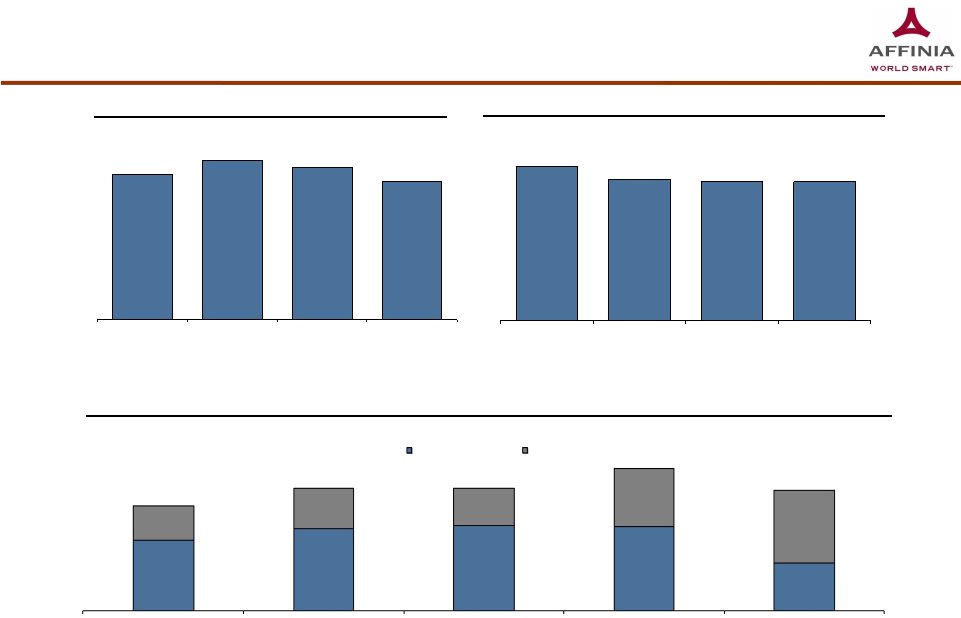

Pg. 14

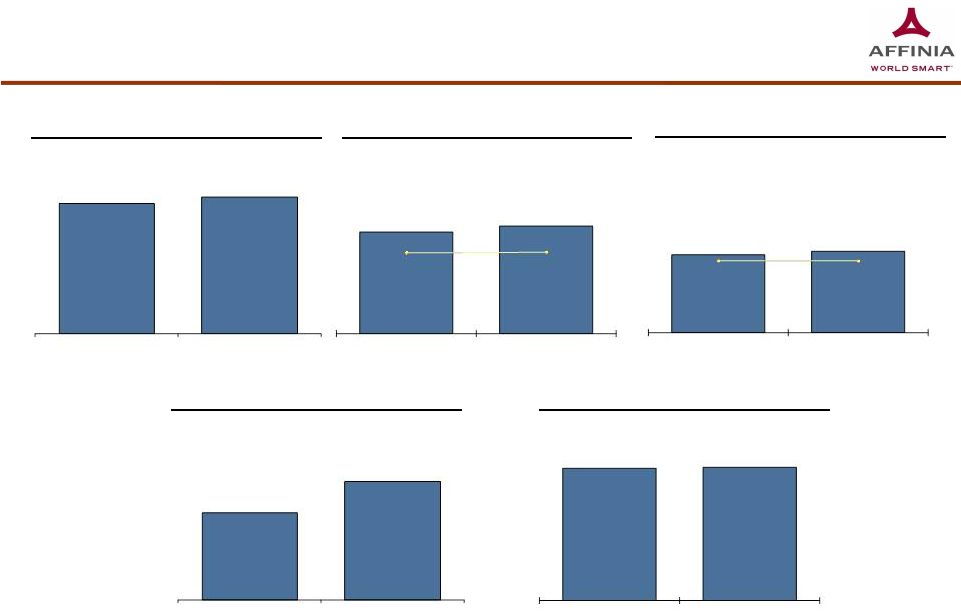

Pro Forma Financial Performance

Pro Forma Financial Performance

NET SALES

GROSS PROFIT & MARGIN

ADJUSTED EBITDA & MARGIN

($ in millions)

($ in millions)

($ in millions)

$1,259

$1,323

2012A

LTM 9/30/13

$157

$164

12.4%

12.4%

2012A

LTM 9/30/13

$292

$310

23.2%

23.4%

2012A

LTM 9/30/13

CAPITAL EXPENDITURES

ADJUSTED EBITDA LESS CAPEX

($ in millions)

($ in millions)

$17

$23

2012A

LTM 9/30/13

$140

$141

2012A

LTM 9/30/13

Note: All figures exclude results from Chassis segment

|

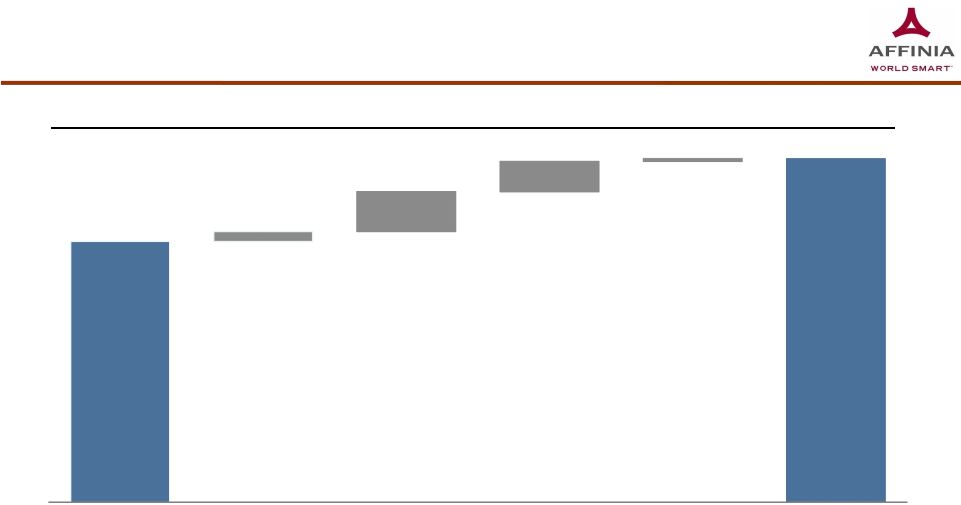

Pro Forma LTM

EBITDA Bridge Pro Forma LTM EBITDA Bridge

LTM Adjusted EBITDA Bridge

($ in millions)

Note: All figures exclude results from Chassis segment

$124.5

$4.7

$19.0

$14.5

$164.0

$1.3

LTM 9/30/13 Reported

EBITDA

Venezuela Devaluation

Non-Recurring Costs

Call Premium

Restructuring

LTM 9/30/13 Adj.EBITDA

Pg. 15

Venezuela

Devaluation:

This

comprises

the

devaluation

impact

of

adopting

hyper-inflationary

accounting

principles

by

the

Company’s

Venezuelan

subsidiary in 2012, followed by the devaluation of the currency in 2013

Non-Recurring Costs:

Transaction costs, strategic consulting costs, executive compensation costs

related to transition, environmental costs and establishment of legal

reserves Call Premium:

Call premium paid to retire bonds in the April 2013 recapitalization

transaction Restructuring:

Business restructuring expenses, excluding charges related to Global Chassis

|

Credit

Metrics and Liquidity Profile Credit Metrics and Liquidity Profile

INTEREST COVERAGE (LTM ADJ. EBITDA / CASH INTEREST)

($ in millions)

($ in millions)

OPCO NET LEVERAGE (TOTAL OPCO NET DEBT / LTM ADJ. EBITDA)

Note: LTM EBITDA divided by annualized cash interest on ending debt

balance. Cash interest excludes amortization of OID and financing fees

Pro Forma for April 2013 recapitalization transaction

Pro

Forma

for

sale

of

Global

Chassis

division

and

proposed

debt

paydown

Note:

Ending

debt

balance

divided

by

LTM

EBITDA. Net

leverage

is

net

of

all

cash and cash equivalents

Pro Forma for April 2013 recapitalization transaction

Pro

Forma

for

sale

of

Global

Chassis

division

and

proposed

debt

paydown

($ in millions)

LTM Liquidity

$103

$121

$125

$124

$70

$51

$60

$55

$86

$108

Dec-2012

Mar-2013

Jun-2013

Sep-2013

Sep-2013PF

$181

$180

$210

ABL R/C

Outstanding:

$0

$0

$0

$0

$154

$0

$178

Note: All figures exclude results from Chassis segment; ABL availability is based on

Inventory and Accounts Receivable levels 5.0x

4.7x

4.6x

4.6x

3.5x

3.7x

3.6x

3.4x

6/30/2013

9/30/2013

3/31/13 PF¹

6/30/2013

9/30/2013

2

Pg. 16

9/30/13 PF

2

9/30/13 PF

3/31/13 PF¹

ABL availability

Cash

1

2

1

2 |

Pg. 17

Questions & Answers |

Pg. 18

Appendix |

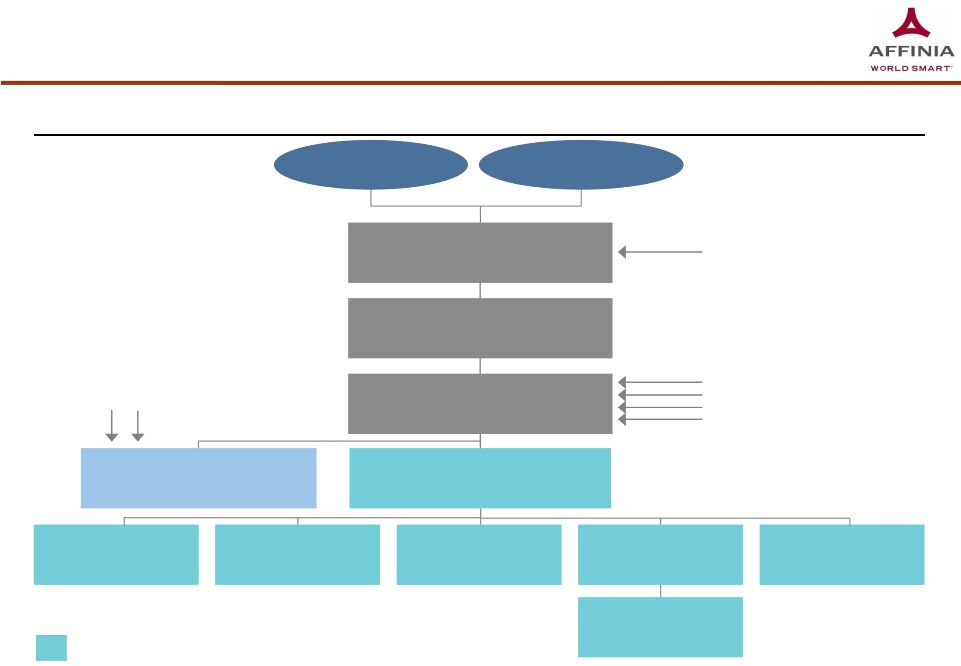

Organizational Structure

Organizational Structure

Note: Debt balances reflect amounts outstanding as of 9/30/2013

OMERS Administration Corporation (“OMERS”), formerly known as Ontario Municipal

Employees Retirement Board 2

Affinia Group Organizational Structure

Cypress

OMERS

,

Co-investors

&

Management/

Directors²

Affinia Group Holdings Inc.

(Non-guarantor)

Affinia Group

Intermediate Holdings Inc.

(Guarantor)

Affinia Group Inc.

(Borrower)

$175 million ABL Revolver

$200 million Term Loan B-1

$469 million Term Loan B-2

$250 million Unsecured Notes

60.9%

39.1%

Guarantor subsidiary

Various Foreign Subsidiaries

(Non-guarantors)

US Wholly-Owned Subsidiaries

(Guarantors)

Affinia Canada GP Corp

Affinia Products Corp LLC

Wix Filtration Corp LLC

$20 million Revolver in Poland

$2 million China Operations

Affinia International Inc.

Automotive Brake Company

Inc.

Affinia International Holdings

Corp.

$77 Dana Seller Note

Includes current and former management and directors

Pg. 19

1

1 |