Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

Commission No. 333-128166-10

Affinia Group Intermediate Holdings Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

I.R.S. Employer Identification Number: 34-2022081

1 Wix Way

Gastonia, North Carolina 28054

(704) 869-3300

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

(Note: As a voluntary filer not subject to the filing requirements of Section 13 or 15(d) of the Exchange Act, the registrant has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant would have been required to file such reports) as if it were subject to such filing requirements).

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated Filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There were 1,000 shares outstanding of the registrant’s common stock as of March 17, 2015 (all of which are privately owned and not traded on a public market).

Table of Contents

i

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

This report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements include statements concerning the Company’s plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends and other information that is not historical information. When used in this report, the words “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” or future or conditional verbs, such as “could” “may,” “should,” or “will,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, management’s examination of historical operating trends and data are based upon The Company’s current expectations and various assumptions. The Company’s expectations, beliefs and projections are expressed in good faith and the Company believes there is a reasonable basis for them. However, there is no assurance that these expectations, beliefs and projections will be achieved. With respect to all forward-looking statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

There are a number of risks and uncertainties that could cause the Company’s actual results to differ materially from the forward-looking statements contained in this report. Such risks, uncertainties and other important factors include, among others, domestic and global economic conditions and the resulting impact on the availability and cost of credit; financial viability of key customers and key suppliers; the Company’s dependence on its largest customers; increased crude oil and gasoline prices and resulting reductions in global demand for the use of automobiles; the shift in demand from premium to economy products; pricing and pressures from imports; increasing costs for manufactured components, raw materials and energy; the expansion of return policies or the extension of payment terms; risks associated with the Company’s non-U.S. operations; risks related to the Company’s receivables factoring arrangements; product liability and warranty and recall claims brought against the Company; reduced inventory levels by the Company’s distributors resulting from consolidation and increased efficiency; environmental and automotive safety regulations; the availability of raw materials, manufactured components or equipment from the Company’s suppliers; challenges to the Company’s intellectual property portfolio; the Company’s ability to develop improved products; the introduction of improved products and services that extend replacement cycles or otherwise reduce demand for the Company’s products; the Company’s ability to achieve cost savings from its restructuring plans; the Company’s ability to successfully effect dispositions of existing lines of business; the Company’s ability to successfully combine its operations with any businesses it has acquired or may acquire; risk of impairment charges to the Company’s long-lived assets, intangibles and goodwill; the risk of business disruptions related to a variety of events or conditions including natural and man-made disasters; risks associated with foreign exchange rate fluctuations; risks associated with the Company’s expansion into new markets; the impact on the Company’s tax rate resulting from the mix of the its profits and losses in various jurisdictions; reductions in the value of the Company’s deferred tax assets; difficulties in developing, maintaining or upgrading information technology systems; risks associated with doing business in corrupting environments; and the Company’s leverage and limitations on flexibility in operating its business contained in the debt agreements. Additionally, there may be other factors that could cause the Company’s actual results to differ materially from the forward-looking statements. The Company’s forward-looking statements apply only as of the date of this report or as of the date they were made. The Company undertakes no obligation to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

ii

Table of Contents

PART I.

History and Ownership

The registrant, Affinia Group Intermediate Holdings Inc. (the “registrant’ or “Intermediate Holdings”), is a Delaware corporation formed on October 18, 2004 and is a wholly-owned subsidiary of Affinia Group Holdings Inc. (“Holdings”). Holdings is controlled by affiliates of The Cypress Group L.L.C. (“Cypress”). The registrant’s direct wholly-owned subsidiary Affinia Group Inc., a Delaware corporation formed on June 28, 2004, entered into a stock and asset purchase agreement, as amended (the “Purchase Agreement”), with Dana Corporation (“Dana”) on July 8, 2004. The Purchase Agreement provided for the acquisition by Affinia Group Inc. of substantially all of Dana’s aftermarket business operations (the “Acquisition”). The Acquisition was completed on November 30, 2004.

All references in this report to “Affinia,” and the “Company,” mean, unless the context indicates otherwise, Intermediate Holdings and its subsidiaries on a consolidated basis.

As a result of the Acquisition, investment funds controlled by Cypress hold approximately 61% of the common stock of Holdings, which directly owns 100% of the common stock of the registrant, and therefore Cypress controls the registrant. The other principal investors in Holdings are the following: OMERS Administration Corporation (formerly known as Ontario Municipal Employees Retirement Board), California State Teachers Retirement System, The Northwestern Mutual Life Insurance Company and Stockwell Capital.

Since 2010, the Company has strategically divested three businesses. On February 2, 2010, the Company sold its Commercial Distribution Europe business unit, also known as Quinton Hazell, which was a diverse aftermarket manufacturer and distributor of automotive components throughout Europe. On November 30, 2012, the Company distributed its Brake North America and Asia group to the shareholders of Holdings, and it was subsequently sold on March 25, 2013 to a new investor. On May 1, 2014, the Company completed the sale of its global chassis business (the “Chassis group”).

The Company

Affinia is an innovative global leader in the design, manufacture, distribution and marketing of industrial grade global filtration products, as well as services and replacement products in South America. The Company has two operating segments, both of which are considered reportable segments under generally accepted accounting principles (“GAAP”) in the United States (“U.S.”). See Note 3 to the Consolidated Financial Statements, “Segment Information,” for a further discussion on the Company’s business segments. The Filtration segment (“Filtration”), which is the Company’s largest operating segment, manufactures and distributes filtration products for medium and heavy-duty trucks, light vehicles, equipment in the off-highway market (i.e. residential and non-residential construction, agriculture, mining, and forestry vehicles), and equipment for industrial, and marine applications. The Affinia South America (“ASA”) segment manufactures and distributes replacement products for on-road and off-road vehicles, principally in Brazil. See “Filtration Segment” and “Affinia South America Segment” sections below for further information on each operating segment.

Affinia’s net sales from continuing operations for 2014 were $1,396 million, of which $967 million were generated by Filtration and $430 million were generated by ASA. The following table provides Affinia’s net sales from continuing operations by geography for the fiscal year ended December 31, 2014.

| Region |

% of Sales | |||

| United Sates |

45 | % | ||

| Brazil |

28 | % | ||

| Poland |

12 | % | ||

| Venezuela |

5 | % | ||

| Canada |

3 | % | ||

| Other(a) |

7 | % | ||

|

|

|

|||

| Total |

100 | % | ||

| (a) | Other includes sales in Argentina, Russia, Ukraine, Mexico, China and Uruguay |

Since 2010, Filtration has continued to expand and enter new markets, primarily in Europe and Asia, as well as successfully grow existing market share in North America, South America and Europe. Significant expansion within Filtration since 2010 was as follows:

| • | 2010 – initiated filter product distribution capabilities in Russia |

3

Table of Contents

| • | 2011 – completed new facility in Poland to handle increased production volumes in Poland and other European countries in which the Company distributes product |

| • | 2011 – completed construction of a manufacturing facility in China |

| • | 2013 – acquired a distributor in the United Kingdom (“U.K.”) |

In addition to the global expansion discussed above, Filtration has been able to successfully grow market share through product innovation, continued introduction of new stock keeping units (“SKUs”), with over 40,000 SKUs currently available to the aftermarket, and a unique comprehensive value proposition to serve as a one-stop-shop in both heavy-duty and light-duty aftermarkets. Also contributing to Filtration’s growth is the Company’s long-standing relationships with leading commercial vehicle and automotive parts retailers and wholesale distributors. Filtration has supplied the automotive aftermarket industry for over 75 years, including its largest customer, NAPA, for nearly 50 years.

ASA has also experienced significant growth since 2010 as follows:

| • | 2011 – Pellegrino opened a new distribution branch in Brazil |

| • | 2011 – Affinia Automotiva (“Automotiva”) opened a new warehouse in Brazil that more than tripled distribution capacity |

| • | 2012 – Pellegrino opened a new distribution branch in Brazil |

| • | 2014 – Pellegrino opened two new distribution branches in Brazil |

While expanding and enhancing distribution capabilities and channels throughout Brazil has resulted in increased market penetration, ASA’s growth has also been driven by introduction of new product lines, as well as entering new product categories. For example, since 2010, ASA has launched C.V. joints, wheel bearing and brake shoes product lines under its Nakata® brand, which is one of the most highly recognizable brands in South America, and entered high growth markets including motorcycle parts, accessories and electronics.

The Company’s Industry

Statements regarding industry outlook, the Company’s expectations regarding the performance of its business and other non-historical statements are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described under “Forward-Looking Statements” and “Risk Factors.” The Company’s actual results may differ materially from those contained in or implied by any forward-looking statements. You should read the following discussion together with “Forward-Looking Statements,” “Item 6. Selected Consolidated and Combined Financial Data” and “Item 8. Financial Statements and Supplementary Data.”

Substantially all of the Company’s 2014 net sales were derived from the on and off-highway replacement products and services industry, which is also referred to as the aftermarket. According to the Auto Care Association (formerly the AAIA), there were approximately one billion light, medium and heavy-duty vehicles registered worldwide in 2014, typically referred to as car parc. While the size of the domestic aftermarket continues to increase, original equipment manufacturers (“OEM”), who manufacture new vehicles, are increasingly focused on emerging markets for growth opportunities. It is believed that this focus on developing regions, including Asia and South America, will ultimately drive the need for replacement aftermarket parts for these vehicles, leading to longer-term growth opportunities for the Company outside the U.S.

One of the main drivers of the anticipated growth in the aftermarket is the increase in the average age of light vehicles and the increase in miles driven. Vehicle usage, typically measured in number of miles driven, has historically increased year-over-year in most global markets. That increase in usage causes vehicle parts to wear out faster, thus requiring more frequent replacement.

To facilitate efficient inventory management and timely vehicle owner customer service, many of the Company’s customers and professional installers rely on larger suppliers like the Company to have full line product offerings, consistent value-added services and timely delivery. There are important advantages to having meaningful size and scale in the aftermarket, including the ability to support significant distribution operations, offer sophisticated supply chain management capabilities and provide a broad line of quality products.

In general, aftermarket industry participants may be categorized into three major groups: (i) manufacturers of parts, (ii) distributors of replacement parts (without manufacturing capabilities) and (iii) installers, both professional and do-it-yourself (“DIY”) customers. Distributors purchase products from manufacturers and sell them to wholesale or retail operations, which in turn sell them to installers.

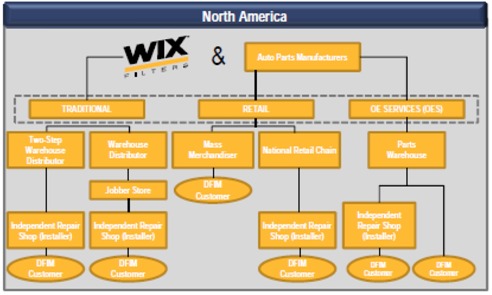

The distribution business is comprised of the (i) traditional, (ii) retail and (iii) original equipment supply (“OES”) channels as illustrated by the chart below.

4

Table of Contents

Typically, professional installers purchase their products through the traditional channel, and DIY customers purchase products through the retail channel. The traditional channel includes such well-known distributors as NAPA, the Alliance and Uni-Select. Through a network of distribution centers, these distributors sell primarily to owned or affiliated stores, which in turn supply professional installers. The retail channel includes merchants such as AutoZone, O’Reilly Auto Parts and Canadian Tire. The OES channel consists primarily of vehicle manufacturers’ service departments at new vehicle dealerships. ASA mainly serves the traditional and retail channels.

The aftermarket industry is impacted by a number of factors, including but not limited to, economic conditions, fuel price volatility, weather and legislation associated with limitations of emissions into the environment. Economic conditions, fuel price volatility and weather can favorably or unfavorably impact consumer behavior. Introduction of new environmental regulations could potentially have an adverse impact on suppliers to the aftermarket depending on how stringent new regulations may be and the costs associated with meeting new emission level requirements. In addition, consolidation within the aftermarket industry continues to impact the aftermarket. As independent aftermarket customers continue to consolidate, these customers have gained purchasing power through economies of scale, thus resulting in requests for extended payment terms and pricing concessions. Also, there has been some recent industry consolidation by direct competitors that could potentially impact selling prices and gross margins as the Company aims to remain price competitive in the marketplace for certain products.

Filtration Segment

Overview

Filtration is a global leader in designing, manufacturing, marketing, and distributing of a broad range of filtration replacement products. Filtration manufactures and distributes a wide range of aftermarket filters, covering 99% of addressable applications for both heavy-duty and light-duty vehicles. Products sold by Filtration are used in on-road and off-road vehicles, in addition to various industrial, locomotive, and marine applications. The Company’s filtration business includes manufacturing and/or distribution operations in the U.S., Mexico, Europe, South America and China. It benefits from industry-leading brands, long-standing customer relationships and a global low-cost manufacturing and distribution footprint, along with the all-makes/all-models product line of oil, air, fuel, cabin air, coolant, hydraulic and other filters. The numerous strengths of Filtration have led to a #1 market position in the North America filtration aftermarket and a the #1 market position in the Central and Eastern Europe filtration aftermarket. See Note 3 to the Consolidated Financial Statements, “Segment Information,” for a further discussion on the Company’s business segments.

The Company markets Filtration’s products under a variety of well-known brands, including WIX®, Filtron™ and ecoLAST®. Additionally, the Company provides private label products to large aftermarket distributors, including NAPA® and ACDelco®. The Company believes that Filtration’s business has achieved its leading market positions due to the quality and reputation of its brands and products among professional installers, who are the primary decision makers for the purchase of the products that the Company supplies to the aftermarket. The Company’s reputation for reliability has helped the Company penetrate retailers whose customers have become increasingly sophisticated about the quality of the products they install in their vehicles.

The global heavy-duty and light-duty aftermarket, which is the subsection of the automotive aftermarket that Filtration serves, is an approximate $13 billion market. By major geographic region, North America and Europe each represent approximately 30% of the

5

Table of Contents

sector, Asia represents approximately 25% of the sector, South America represents 10% of the sector and the rest of the world collectively represents approximately 5% of the sector.

Filtration Products

Filtration’s product lines include oil, air, fuel, hydraulic and other filters for light, medium and heavy duty on and off-highway vehicle, industrial and marine applications.

The following summarizes a few of Filtration’s key filter products:

Oil Filters: An oil filter traps particles and dirt that might otherwise damage the bearings and rings of a vehicle’s engine. A build-up of particles inside an oil filter can also slow oil flow to the bearings, camshaft and upper valve train components and allow unfiltered oil, possibly containing contaminants, to enter the oil stream and cause accelerated wear on the engine.

Air Filters: An air filter traps particles that could otherwise reduce engine performance. A clogged air filter may restrict air flow into the engine, resulting to a shift away from the optimum air to fuel ratio for combustion, and thus reducing gas mileage.

Fuel Filters: A vehicle’s fuel filter prevents sediment and rust particles sized three microns or larger from entering and blocking the fuel injector. A clogged fuel filter may restrict fuel flow to the engine, resulting in a loss of fuel pressure and horsepower.

Filtration products can be grouped into two distinct categories: heavy-duty and light-duty. Light-duty offerings are further grouped into premium and value products. The following is a description of these categories:

Heavy-Duty: Comprised of filters for heavy-duty and on-and-off-highway applications, including on-highway trucks, residential and non-residential construction equipment, agricultural, energy, mining, forestry and industrial equipment, severe service vehicles, medium-duty vehicles and marine applications. Filtration’s heavy-duty filters are designed to withstand harsh elements and provide for optimal filtration and engine protection in less-than-optimal work environments.

Filtration’s full line of heavy-duty products is a key differentiator versus its light-duty filtration competitors. In contrast to most light-duty competitors, the Company is able to provide customers with a full suite of filtration options. Customers, particularly distributors, derive value from having a one-stop-shop supplier that is capable of providing products for a diverse range of end markets. Furthermore, heavy-duty filtration products are generally more technologically advanced and have higher selling prices than similar light-duty products.

Light-Duty: Filtration’s light-duty offering includes a full line of premium and value line product for light commercial, passenger vehicle, sport utility vehicle motorcycle and all-terrain vehicle (“ATV”) applications. Filtration’s automotive and light truck products are at the forefront of filter technology and performance and are designed to exceed performance demands for the applications in the Company’s product offering.

Premium light-duty products are designed to provide maximum protection for vehicles that are driven under severe or harsh driving conditions, use conventional or synthetic oil and/or change their oil at the Original Equipment (“OE”) recommended mileage. Due to their enhanced design and technology, premium light-duty products carry higher selling prices than value or opening price point (“OPP”) products. Value or OPP light-duty filters are designed for normal driving and oil change intervals of 5,000 miles or less.

Approximately half of Filtration’s sales are in heavy-duty products, while approximately 85% of sales are comprised of premium product, which includes all heavy-duty offerings as well as premium light-duty offerings.

Filtration Sales Channels and Customers

Filtration’s extensive filter product offering fits nearly every car, truck, off-highway and agricultural make and model on the road, allowing Filtration to serve as a full line supplier to the Company’s customers for the Company’s product categories. These customers primarily comprise large aftermarket distributors and retailers selling to professional technicians or installers. Filtration’s customer base also includes OES participants such as ACDelco. Many of Filtration’s customers are leading aftermarket participants, including NAPA, Aftermarket Auto Parts Alliance (the “Alliance”), Uni-Select Inc. and O’Reilly Auto Parts. As an active participant in the aftermarket for more than 60 years, the Company has been successful in maintaining long-standing relationships with many of the Company’s customers.

For the year ended December 31, 2014, approximately 23% of consolidated net sales from continuing operations was derived from the Company’s largest customer, NAPA. See Item 1A. “Risk Factors” for additional information regarding concentration of credit risk with significant customers.

For years the Company has sold to CQ Sourcing, Inc. (“CQ Sourcing”) various CARQUEST branded filters. CQ Sourcing is a subsidiary of General Parts International, Inc. (“General Parts”) that owns and operates stores under the CARQUEST brand and

6

Table of Contents

provides services to independently owned stores that operate under the CARQUEST brand. CQ Sourcing was the Company’s third largest customer in terms of annual net sales for the year ended December 31, 2014, representing approximately 5% of consolidated net sales and 8% of Filtration segment net sales. On January 2, 2014, Advance Auto Parts, Inc. (“Advance Auto”) acquired General Parts. Following that acquisition, on August 29, 2014, the Company and CQ Sourcing agreed to end their business relationship effective as of December 31, 2014. The Company’s sales to CQ Sourcing will continue into early 2015 as remaining inventory is relieved, but will not go beyond the first quarter of 2015. As the relationship with CQ Sourcing is winding down, management is implementing plans to replace a portion of the lost business through other distribution channels. While there is no guaranty that these lost sales can be replaced through current or new distribution channels, management has taken actions it believes are appropriate in an effort to lessen the impact of the termination of the CQ Sourcing relationship. Given the nature of distribution channels in the automotive aftermarket and the Company’s brand recognition and broad customer base, management does not believe the termination of this relationship will have a material adverse impact on the Company’s results of operations, financial position or cash flows.

The following table provides a description of the primary sales channels to which the Company supplies Filtration’s products:

| Primary Sales Channels |

Description |

Customers | ||

| Traditional |

Warehouses and distribution centers that supply local distribution outlets, which sell to professional installers. | NAPA, the Alliance and Uni-Select | ||

| Retail |

Retail stores, including national chains that sell replacement parts directly to consumers (the DIY market) and to some professional installers. | O’Reilly Auto Parts and AutoZone | ||

| OES |

Vehicle manufacturers and service departments at vehicle dealerships. | ACDelco, Robert Bosch, TRW Automotive and Chrysler | ||

The traditional channel is the primary source of products for professional installers. The Company believes that the quality and reputation of Filtration’s brands for form, fit, and function promotes significant demand for the Company’s products from these installers and throughout the aftermarket supply chain. The Company has many long-standing relationships with leading distributors in the traditional channel such as NAPA, for whom the Company has manufactured products for nearly 50 years.

As retailers become increasingly focused on consolidating their supplier base, the Company believes that the Company’s broad product offering, product quality, sales and marketing support and customer service capabilities make the Company more valuable to these customers.

Filtration Geographic Regions

The operations of Filtration are comprised of the following geographic regions: North America, which includes the United States, Canada and Mexico, and Europe, South America and Asia.

In North America, there are manufacturing and distribution operations in the U.S. and Mexico and distribution operations in Canada. The majority of products in North America are sold either under the WIX® brand, under private label brands to large aftermarket distributors or OE/OES brands. The product portfolio in North America consists of heavy-duty and light-duty filtration products, which include oil filters, air filters, cabin air filters and fuel filters. During the year ended December 31, 2014, sales of premium products, which include all heavy-duty products as well as premium light-duty products, represent approximately 88% of North America’s net sales. Premium products typically carry higher selling prices and margins than value line products. The North American operations sell products into a broad range of end-markets in the heavy-duty and light-duty categories. Heavy-duty end markets include, but are not limited to, on-highway trucks, construction, industrial, agriculture, marine and energy. Light-duty end markets include passenger cars, small engine and motorcycles. Overall, the broad range of product offerings in North America has resulted in the Company holding the #1 market position in heavy-duty and light-duty aftermarket filtration products.

In Europe, there are manufacturing and distribution operations in Poland and Ukraine, as well as distribution operations in the U.K. and Russia. The products in Europe are sold branded under either the Filtron™ or WIX® brand, under private label brands to aftermarket distributors or OE/OES brands. The product portfolio in Europe consists of premium light-duty and heavy-duty products,

7

Table of Contents

including oil filters, air filters, cabin air filters and fuel filters. These products are sold primarily throughout Central and Eastern Europe, with a growing presence in Western Europe. The diverse product offering in Europe has resulted in the Company holding the #1 market position in aftermarket filtration in Central and Eastern Europe.

In South America, there are manufacturing and distribution operations in Venezuela and Brazil. The product portfolio in South America consists primarily of heavy-duty oil filters, cabin air filters and air filters and premium light-duty oil filters, air filters and fuel filters. The majority of filtration products sold in South America are under the WIX® brand.

In Asia, there are manufacturing and distribution operations in China. The product portfolio in Asia consists primarily of branded heavy-duty oil filters, fuel filters and air filters and premium light-duty oil filters, air filters, cabin air filters and fuel filters. The manufacturing facility in China was opened in 2011 and currently manufactures a significant amount of product shipped to the U.S. and Europe. Management is currently focused on improving market presence through identifying potential distributors who are looking to carry a premium brand.

Affinia South America Segment

ASA is a market leader in the distribution and manufacturing of replacement products throughout South America. The segment focuses on distributing and manufacturing products through its operations in Brazil, Argentina and Uruguay. Prior to shutting down operations in the second quarter of 2014, ASA also had operations in Venezuela. ASA consists primarily of Pellegrino and Automotiva, which are the two primary operating units in Brazil and comprise approximately 90% of the total net sales for the segment. The two units are strategically aligned and, while they are operated independently, share the same top level management. See Note 3 to the Consolidated Financial Statements, “Segment Information,” for a further discussion on the Company’s business segments.

ASA operates three manufacturing facilities and 25 warehouses in Brazil, Argentina and Uruguay.

Pellegrino, which represents approximately 60% of ASA’s net sales, is a warehouse distributor that sources products from 60 suppliers of premium products and brands, including, among others, Automotiva, TRW, Bosch, Philips, Mahle. Pellegrino is the second largest warehouse distributor in Brazil, carrying more than 26,000 products across 180 different product categories, including leading brands for light and heavy-duty vehicles, motorcycle parts and accessories. Pellegrino uses its 22 warehouse locations with over 400,000 square feet of warehouse space to service customers in the Northern, Northeastern, Midwestern, and Southern regions of Brazil. To support the continued growth of the business, during 2014, Pellegrino opened up two new warehouse distribution facilities, with plans to open up additional facilities in 2015.

Pellegrino’s core business is within three different segments of the aftermarket: Autoparts, Motorcycle Parts and Accessories. Autoparts, which includes, among other things, engine, suspension, chassis and brake parts, comprises the majority of Pellegrino’s net sales and includes both light duty and heavy-duty product offerings. Additionally, Pellegrino has recently expanded its light duty and heavy-duty product offering to include motorcycle and automotive electronics (e.g. GPS systems, speakers), which are high growth markets that are anticipated to continue to flourish.

Pellegrino has a very fragmented customer base with more than 27,000 customers across 2,500 cities, which represents approximately 95% of the potential market. These customers are primarily comprised of jobber stores, independent repair shops and fleets. With approximately 75% of its customer base consisting of jobber stores, which in turn sell products to thousands of unique installers and end users, Pellegrino’s ultimate sources of sales are highly diversified. As a result, Pellegrino’s top 10 customers only represent approximately 2% of its net sales.

Automotiva, which represents approximately 30% of ASA’s net sales, manufactures shock absorbers in Brazil, and sells outsourced product in Brazil under the Nakata® and Spicer® brands. In addition to direct manufacturing, Automotiva is a leader in the supply of chassis components and driveshaft products, assembling, packaging and branding various components from third-party manufacturers. Automotiva’s manufactured and outsourced products are shipped to warehouse distributors both in Brazil and internationally. Pellegrino is Automotiva’s largest customer. In addition, Automotiva exports to Argentina and to 28 other countries around the world. It has a market leading position in a number of products including Chassis Parts, CV Joints, rear axle sets, universal joint kits, shock absorbers, fuel pumps, and oil pumps.

The remainder of ASA’s business is comprised of manufacturing and distribution operations in Argentina and Uruguay, which represents approximately 10% of ASA’s net sales. The primary product lines manufactured and/or distributed in these regions are brake fluids, brake pads, linings and blocks, antifreeze, shock absorbers, chassis parts and coolants.

ASA products

ASA manufactures and/or distributes products in Brazil, Argentina and Uruguay. ASA has one of the most complete product offerings for under car, transmission, engine management and hard parts for heavy-duty and light-duty vehicles. In addition, ASA offers an extensive line of motorcycle parts and accessories.

8

Table of Contents

ASA Sales Channel and Customers

Pellegrino, a warehouse distributor, sells the majority of its products to retailers and jobber stores, with the balance sold to parties such as auto centers, diesel injection centers, motorcycle retailers, heavy-duty fleets and engine rebuilders. Automotiva’s products are sold to warehouse distributors, which includes Pellegrino, within Brazil and Argentina, and internationally through Brazil’s master distribution centers.

Corporate and Other

While not considered a segment, Corporate and other primarily includes corporate costs not allocated to the segments, interest expense on outstanding senior notes and term loans, stock-based compensation expense associated with outstanding restricted stock units, other costs and intercompany eliminations. Additionally, the results of Affinia Global Sales (“AGS”), which is a sales office located in Miami, Florida, are included in Corporate and other. AGS primarily supports Filtration’s efforts to expand into markets where the Company does not currently have dedicated sales personnel.

Sales by Region

Affinia’s broad range of filtration and other products are primarily sold in North America, Europe, South America and Asia. The Company is also focusing on expanding manufacturing capabilities globally to position the Company to take advantage of global growth opportunities. For information about the Company’s segments and the Company’s sales by geographic region, see Note 3 to the Consolidated Financial Statements, “Segment Information.”

Customer Support

The Company believes that its emphasis on customer support has been a key factor in maintaining its leading market positions. The Company continuously seeks to improve service, order turnaround time, product coverage and order accuracy. In order to maintain the competitiveness of the Company’s existing customers and maximize new sales opportunities, it has extensive product coverage. In turn, this has allowed the Company’s customers to develop a reputation for carrying the parts their customers need, especially for newer vehicles for which warranties may not have expired and aftermarket parts are not generally available.

In addition, as the aftermarket becomes more electronically integrated, customers often prefer to receive their application information electronically as well as in print form. The Company provides both printed and electronic catalog media. The Company also provides products which are problem solvers for professional installers, such as alignment products that allow installers to properly align a vehicle, even though the vehicle was not equipped with adjustment features. The Company provides many other support features, such as technical support hot lines and training and electronic systems which interface with customers and conform to aftermarket industry standards.

Intellectual Property

The Company strategically manages its portfolio of patents, trade secrets, copyrights, trademarks and other intellectual property.

As of December 31, 2014, the Company maintains and has pending approximately 180 patents and patent applications on a worldwide basis. These patents expire over various periods up to the year 2034. The Company does not materially rely on any single patent or group of patents. In addition, it believes that the expiration of any single patent or group of patents will not materially affect its business. The Company has proprietary trade secrets, technology, know-how, processes and other intellectual property rights that are not registered.

Trademarks are important to the Company’s business activities. The Company has a robust worldwide program of trademark registration and enforcement to maintain and strengthen the value of the trademarks and prevent the unauthorized use of the Company’s trademarks. The WIX® trade name is highly recognizable to the public and is a valuable asset. Additionally, the Company uses numerous other trademarks which are registered worldwide or for which it claims common law rights. As of December 31, 2014, the Company has approximately 600 active trademark registrations and applications worldwide.

Raw Materials and Manufactured Components

The Company uses a broad range of raw materials in its products, including steel, steel-related components, filtration media, aluminum, brass, iron, rubber, resins, plastics, paper and packaging materials. In addition, the Company purchases parts manufactured by other manufacturers for sale in the aftermarket. The Company has not experienced any significant shortages of raw materials, components or finished parts and normally does not carry inventories of raw materials or finished parts in excess of those reasonably required to meet its production and shipping schedules. In 2014, no outside supplier of the Company provided products that accounted for more than 10% of the Company’s annual purchases.

Seasonality

The Company’s business is moderately seasonal and the aftermarket may experience fluctuations in sales due to demands caused by weather and driving patterns. In a typical year, the Company builds inventory during the first and second quarters to

9

Table of Contents

accommodate the Company’s peak sales during the second and third quarters. The Company’s working capital requirements therefore tend to be highest from March through August. In periods of weak sales, inventory can increase beyond typical levels, as the Company’s product delivery lead times are less than two days while certain components it purchases from overseas require lead times of approximately 90 days.

Backlog

Substantially all of the orders on hand at December 31, 2014 are expected to be filled during 2015. Management does not view the backlog as being insufficient, excessive or problematic, or a significant indication of 2015 sales.

Research and Development Activities

Information regarding research and development activities are discussed in Note 2 to the Consolidated Financial Statements, “Summary of Significant Accounting Policies.”

Competition

The light duty filter aftermarket is comprised of several large U.S. manufacturers that compete with the Company, including United Components, Inc. under the brand name Champ, FRAM Group, LLC under the brand name FRAM and Purolator Filters NA LLC under the brand name Purolator, along with several international light duty filter suppliers such as Mahle Filtersysteme Gmbh and The Mann+Hummel Group. The heavy-duty filter aftermarket is comprised of several manufacturers that compete with the Company, including Cummins, Inc. under the brand name Fleetguard, CLARCOR Inc. under the brand name Baldwin and Donaldson Company Inc. under the brand name Donaldson and Champion Laboratories under the brand name Luber-finer. ASA competitors include Dpk Distribuidora de Pecas, Ltda, Pacaembu Autopeças, Polipeças Comercial e Importadora Ltda and Comdip Comercial Distribuidora de Peças Ltda. The Company competes on, among other things, quality, price, service, brand reputation, delivery, technology and product offerings.

Employees

As of December 31, 2014, the Company had 5,543 employees, of whom 2,135 were employed in North America, 1,747 were employed in South America, 1,441 were employed in Europe and 220 were employed in Asia. Approximately 38% of employees are salaried and approximately 62% of employees are hourly.

Environmental Matters

The Company is subject to a variety of federal, state, local and foreign environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the emission of noise and odors, the management and disposal of hazardous substances or wastes, the clean-up of contaminated sites and human health and safety. Some of the Company’s operations require environmental permits and controls to prevent or reduce air and water pollution, and these permits are subject to modification, renewal and revocation by issuing authorities. Contamination has been discovered at certain of the Company’s owned properties, which is currently being monitored and/or remediated. The Company is not aware of any contaminated sites which the Company believes will result in material liabilities; however, the discovery of additional remedial obligations at these or other sites could result in significant liabilities. ASC Topic 410, “Asset Retirement and Environmental Obligations,” requires that a liability for the fair value of an Asset Retirement Obligation (“ARO”) be recognized in the period in which it is incurred if it can be reasonably estimated, with the offsetting associated asset retirement costs capitalized as part of the carrying amount of the long-lived asset.

In addition, many of the Company’s current and former facilities are located on properties with long histories of industrial or commercial operations. Because some environmental laws can impose liability for the entire cost of clean-up upon any of the current or former owners or operators, regardless of fault, the Company could become liable for investigating or remediating contamination at these properties if contamination requiring such activities is discovered in the future. The Company has incurred environmental remediation costs associated with the comprehensive restructuring and the acquisition restructuring.

The Company is also subject to the U.S. Occupational Safety and Health Act and similar state and foreign laws regarding worker safety. The Company believes that the Company is in substantial compliance with all applicable environmental, health and safety laws and regulations. Historically, the Company’s costs of achieving and maintaining compliance with environmental and health and safety requirements have not been material to the Company’s operations.

Internet Availability

Available free of charge through the Company’s internet website, www.affiniagroup.com, under the investor relations tab are the Company’s recent filings of forms 10-K, 10-Q, 8-K and amendments to those reports filed with the Securities and Exchange Commission. These reports can be found on the Company’s internet website as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The information contained on or connected to the Company’s website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report filed with the SEC.

10

Table of Contents

| Item 1A. | Risk Factors |

If any of the following events discussed in the following risks were to occur, the Company’s results of operations, financial conditions, and/or cash flows could be materially affected. Additional risks and uncertainties not presently known by the Company may also constrain its business operations.

Risks Relating to the Company’s Industry and The Company’s Business

Domestic and global economic conditions, including conditions in the global capital and credit markets, have affected and may continue to materially and adversely affect the Company’s business, financial condition and/or results of operations, as well as the Company’s ability to access credit and have affected and may continue to materially and adversely affect the financial soundness of the Company’s customers and suppliers.

The Company’s business and operating results have been, and in the future may be affected by domestic and global economic conditions, including conditions in the global capital and credit markets. Domestic and global economies, including in South America where the Company has significant sales, continue to experience periods of significant uncertainty, characterized by very weak or negative economic growth, high unemployment, reduced spending by consumers and businesses, bankruptcy, collapse or sale of various financial institutions and a considerable level of intervention from the United States federal government and various foreign governments. Downgrades of long-term sovereign debt issued by the United States and various European countries by Standard & Poor’s, Moody’s and other rating agencies could also affect global and domestic financial markets and economic conditions. Recessionary conditions, if experienced in the future, could materially and adversely affect the demand for the Company’s products and services and, therefore, reduce purchases by customers, and negatively affect revenue growth and cause a decrease in the Company’s profitability.

Although many vehicle maintenance and repair expenses are non-discretionary, difficult economic conditions may reduce miles driven and thereby increase periods between maintenance and repairs. In addition, interest rate fluctuations, financial market volatility or credit market disruptions may limit the Company’s access to capital, and may also negatively affect the Company’s customers’ and suppliers’ ability to obtain credit to finance their businesses on acceptable terms. As a result, the Company’s customers’ need for and ability to purchase its products or services may decrease, and its suppliers may increase their prices, reduce their output or change their terms of sale. If the Company’s customers’ or suppliers’ operating and financial performance deteriorates, or if they are unable to make scheduled payments or obtain credit, its customers may not be able to pay, or may delay payment of, accounts receivable owed to the Company, and its suppliers may restrict credit or impose different payment terms. Any inability of customers to pay for the Company’s products and services, or any demands by suppliers for different payment terms, may materially and adversely affect the its earnings and cash flow.

If economic conditions deteriorate, the Company’s results of operations or financial condition could limit its ability to take actions pursuant to certain covenants in the Company’s debt agreements that are tied to ratios based on the Company’s financial performance. Such covenants include the Company’s ability to incur additional indebtedness, make investments or pay dividends.

The Company’s business could be materially and adversely affected if the Company lost any of its larger customers.

For the year ended December 31, 2014, approximately 23% of the Company’s net sales from continuing operations were to NAPA. To compete effectively, the Company must continue to satisfy this and other customers’ pricing, service, technology and increasingly stringent quality and reliability requirements. Additionally, the Company’s revenues may be affected by decreases in NAPA’s business or market share. Consolidation among the Company’s customers may also negatively impact the business. For example, CQ Sourcing, a subsidiary of General Parts, represented the Company’s third largest customer for the year ended December 31, 2014. Following Advance Auto’s acquisition of General Parts on January 2, 2014, the Company and CQ Sourcing agreed to end their business relationship effective December 31, 2014. While the Company intends to continue to focus on retaining and winning all of its other customers’ business, the Company may not succeed in doing so. The Company cannot provide any assurance as to the amount of future business with any customers. Although business with any given customer is typically split among numerous contracts, the loss of, or significant reduction in, purchases by one of those major customers could materially and adversely affect the Company’s business, financial condition and results of operations.

Increases in crude oil and gasoline prices could reduce global demand for and use of automobiles and increase the Company’s costs, which could have a material and adverse effect on the Company’s business, financial condition and results of operations.

Significant increases in the price of crude oil have historically been a contributing factor to the periodic reduction in the global demand for and use of automobiles. The price of crude oil experienced a significant decrease in 2014. An increase in the price of crude oil in the future could reduce global demand for and use of automobiles and continue to shift customer demand away from larger cars and light trucks (including sport utility vehicles (“SUVs”), which the Company believes has more frequent replacement intervals for its products, which could have a material and adverse effect on its business, financial condition and results of operations. In the past, demand for traditional SUVs and vans declined when gasoline prices increased. If gasoline prices increased, or if total

11

Table of Contents

miles driven were to decrease for a number of years, it could have a material and adverse effect on the Company’s business, financial condition and/or results of operations. Further, as higher gasoline prices result in a reduction in discretionary spending for auto repair by the end users of the Company’s products, its results of operations have been, in the past and could in the future be impacted. Additionally, higher gasoline prices could have a material adverse impact on the Company’s freight expenses, which could lower the its profit margin.

The shift in demand from premium to economy brands may require the Company to produce value products at the expense of premium products, resulting in lower prices, thereby reducing the Company’s margins and decreasing the Company’s net sales.

The Company estimates that a majority of its net sales are currently derived from products it considers to be premium products. Shifts in demand from premium products, on which the Company can generally command premium pricing and generate enhanced margins, to value products could have a material adverse impact on its financial position, results of operations and cash flows. If such a shift occurs, the Company could be forced to expand its production and/or purchases of value products at competitive prices. In addition, the Company could be forced to further reduce its prices to remain competitive, in which case its margins will decrease unless it makes corresponding reductions in its cost structure.

The Company is subject to increasing pricing pressure from imports, particularly from lower labor cost countries.

Price competition from other aftermarket manufacturers particularly those based in lower labor cost countries, such as China, have historically played a role and may play an increasing role in the aftermarket sectors in which the Company competes. While aftermarket manufacturers in these locations have historically competed primarily in markets for less technologically advanced products and manufactured a limited number of products, many are expanding their manufacturing capabilities to produce a broad range of lower labor cost, higher quality products and provide an expanded product offering. In the future, competitors in Asia or other lower labor cost sources may be able to effectively compete in the Company’s premium markets and produce a wider range of products which may force the Company to move additional manufacturing capacity offshore and/or lower its prices, reducing margins and/or decreasing the Company’s net sales.

Increasing costs for manufactured components, raw materials and energy prices may materially and adversely affect the Company’s business, financial condition and results of operations.

The Company uses a broad range of manufactured components and raw materials in its products, including raw steel, steel-related components, filtration media, aluminum, brass, iron, rubber, resins, plastics, paper and packaging materials. Materials comprise the largest component of the Company’s manufactured goods cost structure. Increases in the price of these items could materially increase the Company’s operating costs and materially and adversely affect profit margins. In addition, in connection with passing through steel and other raw material price increases to the Company’s customers, there has typically been a delay of up to several months in the Company’s ability to increase prices, which has temporarily impacted profitability. In the future, it may be difficult to pass further price increases on to the Company’s customers, especially if the Company experiences additional cost increases soon after implementing price increases. In addition, the Company has experienced longer than typical lead times in sourcing some of its steel-related components and certain finished products, which has caused it to buy from non-preferred vendors at higher costs.

If the Company’s customers seek more expansive return policies or practices, such as extended payment terms, the Company’s cash flows and results of operations could be materially and adversely affected.

The Company is subject to product returns from customers, some of which manage their excess inventory by returning product to the Company. The Company’s agreements with its customers typically include provisions that permit its customers to return specified levels of their purchases. Returns on a continuing operations basis have historically represented less than 1% of the Company’s sales. If returns from the Company’s customers significantly increase, the business, financial condition and results of operations may be materially and adversely affected. In addition, some customers in the aftermarket are pursuing ways to shift their costs of working capital, including extending payment terms. To the extent customers extend payment terms, the Company’s cash flows and results of operations may be materially and adversely affected.

12

Table of Contents

The Company is subject to other risks associated with its non-U.S. operations.

The Company has significant manufacturing operations outside the United States. In 2014, approximately 55% of the Company’s net sales from continuing operations originated outside the United States. In addition, many of its manufacturing operations, suppliers and employees are located outside the United States. Since the Company’s growth strategy depends in part on its ability to further penetrate markets outside the United States and increase the localization of its products and services, the Company expects to continue to increase its sales and presence outside the United States, particularly in high-growth markets. The Company’s international business (and particularly its business in high-growth markets) is subject to risks that are customarily encountered in non-U.S. operations, including:

| • | multiple regulatory requirements that are subject to change and that could restrict the Company’s ability to manufacture, market or sell its products; |

| • | differences in terms of sale, including payment terms; |

| • | limitations on ownership and on repatriation of earnings and cash; |

| • | the potential for nationalization of enterprises; |

| • | inflation, recession, fluctuations in foreign currency exchange and interest rates and discriminatory fiscal policies; |

| • | trade protection measures, including increased duties and taxes, and import or export licensing requirements; |

| • | price controls; |

| • | exposure to possible expropriation or other government actions; |

| • | differing local product preferences and product requirements; |

| • | difficulty in establishing, staffing and managing operations; |

| • | differing labor regulations; |

| • | changes in medical reimbursement policies and programs; |

| • | difficulties in implementing restructuring actions on a timely or comprehensive basis; |

| • | potentially negative consequences from changes in or interpretations of tax laws; |

| • | political and economic instability and possible terrorist attacks against American interests; |

| • | enforcement of remedies in various jurisdictions; and |

| • | diminished protection of intellectual property in some countries. |

These and other factors may have a material and adverse effect on the Company’s international operations or on its business, financial condition and results of operations. In addition, the Company may experience net foreign exchange losses due to currency fluctuations.

The Company is exposed to risks related to its receivables factoring arrangements.

The Company has entered into agreements with third-party financial institutions to factor on a non-recourse basis certain receivables. The terms of the factoring arrangements provide for the factoring of certain U.S. Dollar-denominated or Canadian Dollar-denominated receivables, which are purchased at the face amount of the receivable discounted at the annual rate of LIBOR plus a bank-determined spread on the purchase date. The amount factored is not contractually defined by the factoring arrangements and the Company’s use will vary each month based on the amount of underlying receivables and its cash flow needs. For the years ended December 31, 2014 and 2013, the Company factored $467 million and $541 million of receivables, respectively, and incurred costs on factoring of $4 million for each of the years ended December 31, 2014 and 2013. Results for 2013 included the Company’s Chassis group for periods prior to its sale. Accounts receivable factored by the Company are accounted for as a sale and removed from the balance sheet at the time of factoring. If any of the financial institutions with which the Company has factoring arrangements experience financial difficulties or are otherwise unable or unwilling to honor the terms of, or otherwise terminate, its factoring arrangements, the Company may experience material and adverse economic losses due to the impact of such failure on its liquidity, which could have a material and adverse effect upon its financial condition, results of operations and cash flows.

The Company may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against the Company.

The Company may be exposed to product liability and warranty claims in the event that its products actually or allegedly fail to perform as expected or the use of the Company’s products results, or is alleged to result, in bodily injury and/or property damage.

13

Table of Contents

Accordingly, the Company could experience material warranty or product liability losses in the future and incur significant costs to defend these claims.

In addition, if any of the Company’s products are, or are alleged to be, defective, it may be required to participate in a recall of that product if the defect or the alleged defect relates to vehicle safety. The Company’s costs associated with any product recall or with providing product warranties could be material. Product liability, warranty and recall costs may have a material and adverse effect on the Company’s business, financial condition and results of operations. The Company’s insurance may not be sufficient to cover such costs.

As a result of the consolidation driven by improved logistics and data management, distributors have reduced their inventory levels, which have reduced and could continue to reduce the Company’s sales.

Warehouse distributors have consolidated through acquisition and rationalized inventories, while streamlining their distribution systems through more timely deliveries and better data management. The corresponding reduction in purchases by distributors has negatively impacted the Company’s sales. Further consolidation or improvements in distribution systems could have a similar material and adverse impact on the Company’s sales.

The Company is subject to costly regulation, particularly in relation to environmental, health and safety matters, which could materially and adversely affect the Company’s business, financial condition and results of operations.

The Company is subject to a substantial number of costly regulations. In particular, the Company is required to comply with frequently changing and increasingly stringent requirements of federal, state and local environmental and occupational safety and health laws and regulations in the United States and other countries, including those governing emissions to air, discharges to air and water, and the creation and emission of noise and odor; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties and occupational health and safety. The Company could incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, third-party property damage or personal injury claims, or costs to upgrade or replace existing equipment, as a result of violations of or liabilities under environmental, health and safety laws or non-compliance with environmental permits required at its facilities. In addition, many of the Company’s current and former facilities are located on properties with long histories of industrial or commercial operations. Because some environmental laws may impose joint and several liabilities for the entire cost of cleanup upon any of the current or former owners or operators, regardless of fault, the Company could become liable for investigating and/or remediating contamination at these properties if contamination requiring such activities is discovered in the future. The Company cannot assure that it has been, or will at all times be, in complete compliance with all environmental requirements, or that it will not incur material costs or liabilities in connection with these requirements in excess of amounts the Company has reserved. In addition, environmental requirements are complex, change frequently and have tended to become more stringent over time. These requirements may change in the future in a manner that could have a material and adverse effect on the Company’s business, financial condition and results of operations. The Company has made and will continue to make expenditures to comply with environmental requirements. These requirements, responsibilities and associated expenses and expenditures, if they continue to increase, could have a material and adverse effect on the Company’s business and results of operations. While the Company’s costs to defend and settle claims arising under environmental laws in the past have not been material, the Company cannot assure you that this will remain the case in the future. For more information about the Company’s environmental compliance and potential environmental liabilities, see “Item 1. Business—Environmental Matters” and “Item 3. Legal Proceedings.”

The Company’s operations would be materially and adversely affected if it is unable to purchase raw materials, manufactured components or equipment from its suppliers.

Because the Company purchases from suppliers various types of raw materials, finished goods, equipment and component parts, the Company may be materially and adversely affected by the failure of those suppliers to perform as expected. This non-performance may consist of delivery delays or failures caused by production issues or delivery of non-conforming products. The risk of non-performance may also result from the insolvency or bankruptcy of one or more of the Company’s suppliers. The Company’s suppliers’ ability to supply products to the Company is also subject to a number of risks, including availability of raw materials, such as steel, destruction of their facilities or work stoppages. In addition, the Company’s failure to promptly pay, or order sufficient quantities of inventory from, the Company’s suppliers may increase the cost of products it purchases or may lead to suppliers refusing to sell products to the Company at all. The Company’s efforts to protect against and to minimize these risks may not always be effective.

The Company’s intellectual property portfolio could be subject to legal challenges and it may be subject to certain intellectual property claims.

The Company has developed and is continuing to develop a considerable amount of proprietary technology in the replacement products industry and rely on intellectual property laws of the United States and other countries to protect such technology. In doing so, the Company incurs ongoing costs to enforce and defend its intellectual property. The Company has from time to time been involved in litigation regarding patents and other intellectual property. The Company may be subject to material intellectual property

14

Table of Contents

claims in the future or it may incur significant costs or losses related to such claims, including payments for licenses that may not be available on reasonable terms, if at all. The Company’s proprietary rights may be challenged, invalidated or circumvented. Moreover, third parties may independently develop technology or other intellectual property that is comparable with or similar to the Company’s own technology and it may not be able to prevent the use of it.

The Company’s success depends in part on its development of improved products, and its efforts may fail to meet the needs of customers on a timely or cost-effective basis.

The Company’s continued success depends on its ability to maintain advanced technological capabilities, machinery and knowledge necessary to adapt to changing market demands as well as to develop and commercialize innovative products. The Company cannot assure that it will be able to develop new products as successfully as in the past or that it will be able to keep pace with technological developments by its competitors and the industry generally. In addition, the Company may develop specific technologies and capabilities in anticipation of customers’ demands for new innovations and technologies. If such demand does not materialize, the Company may be unable to recover the costs incurred in such programs. If the Company is unable to recover these costs or if any such programs do not progress as expected, its business, financial condition or results of operations could be materially and adversely affected.

The introduction of new and improved products and services may reduce the Company’s future sales.

Improvements in technology and product quality may extend the longevity of vehicle component parts and delay aftermarket sales. In particular, in the Company’s oil filter business the introduction of oil change indicators and the use of synthetic motor oils may further extend oil filter replacement cycles. The continued development and sale of electric, fuel cell and hybrid automobiles may pose a long-term risk to the Company’s business because these vehicles may alter demand for its primary product lines. In addition, the introduction by OEMs of increased warranty and maintenance service initiatives, which are gaining popularity, have the potential to decrease the demand for the Company’s products in the traditional and retail sales channels.

Any dispositions the Company makes could disrupt the Company’s business and materially and adversely affect the Company’s business, financial condition and results of operations.

The Company may, from time to time, consider dispositions of existing lines of business. For example, the Company distributed its Brake North America and Asia group to the shareholders of Holdings in 2012 and the Company completed the sale of its Chassis group on May 1, 2014. Dispositions involve numerous risks, including the diversion of the Company’s management’s attention from other business concerns and potential adverse effects on existing business relationships with current customers and suppliers. Any of these factors could result in a material adverse effect on the Company’s business, financial condition and results of operations.

Any acquisitions the Company makes could disrupt the Company’s business and materially and adversely affect the Company’s business, financial condition and results of operations.

The Company may, from time to time, consider acquisitions of complementary companies, products or technologies. Acquisitions involve numerous risks, including the diversion of management’s attention from other business concerns and potential adverse effects on existing business relationships with current customers and suppliers. Any acquisitions could present difficulties in the assimilation of the acquired business and involve the incurrence of substantial additional indebtedness. The Company cannot assure that it will be able to successfully integrate any acquisitions that it pursues or that such acquisitions will perform as planned or prove to be beneficial to the Company’s operations and cash flow. Any of these factors could result in a material adverse effect on the Company’s business, financial condition and results of operations.

Cypress controls the Company and may have conflicts of interest with the Company or the holders of the Company’s notes in the future.

Cypress beneficially owns 61% of the outstanding shares of the Company’s common stock. As a result, Cypress has control over the Company’s decisions to enter into any corporate transaction and has the ability to prevent any transaction that requires the approval of stockholders regardless of whether or not other stockholders or note holders believe that any such transactions are in their own best interests. Additionally, Cypress is in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with the Company. Cypress may also pursue, for its own account, acquisition opportunities that may be complementary to the Company’s business, and, as a result those acquisition opportunities may not be available to the Company. So long as Cypress continues to own a significant number of the outstanding shares of the Company’s common stock, even if such number is less than 50%, it will continue to be able to strongly influence or effectively control the Company’s decisions, including director and officer appointments, potential mergers and acquisitions, asset sales and other significant corporate transactions.

The Company’s ability to maintain its ongoing operations could be impaired.

To be successful and achieve the Company’s objectives under its strategic plan, the Company must retain qualified personnel, including its senior management, and hire new talent necessary to maintain the Company’s ongoing operations. An inability to retain key employees could have a material adverse effect on the Company’s business. Accordingly, the Company may fail to maintain its ongoing operations, or execute its strategic plan if the Company is unable to manage such changes effectively.

15

Table of Contents

The Company may be required to recognize impairment charges for its long-lived assets, which include fixed assets, intangible assets, and goodwill.

At December 31, 2014, the net carrying value of long-lived assets (property, plant and equipment) totaled $123 million. In accordance with GAAP, long-lived assets shall be tested for recoverability whenever events or changes in circumstances, such as, significant negative industry or economic trends, disruptions to the Company’s business, unexpected significant changes or planned changes in use of the assets, divestitures and market capitalization declines indicate that its carrying amount may not be recoverable and may result in charges to long-lived asset impairments. Future impairment charges could significantly affect the Company’s results of operations in the periods recognized. Impairment charges would also reduce the Company’s consolidated net worth and increase its debt to total capitalization ratio, which could negatively impact the Company’s access to the public debt and equity markets.

The Company has $56 million of recorded intangible assets and goodwill on its consolidated balance sheet as of December 31, 2014. These assets may become impaired with the loss of significant customers or a decline of profitability. In assessing the recoverability of goodwill, projections regarding estimated future cash flows and other factors are made to determine the fair value of the respective reporting unit. If these estimates or related projections change in the future, the Company may be required to record impairment charges for goodwill at that time. If the Company’s trade names carrying values exceed fair value, the Company will be required to record an impairment charge.

While the Company’s intangibles with definite lives may not be impaired, the useful lives are subject to continual assessment, taking into account historical and expected losses of relationships that were in the base at time of acquisition. This assessment may result in a reduction of the remaining useful life of these assets, resulting in potentially significant increases to non-cash amortization expense that is charged to the Company’s consolidated statement of operations. An intangible asset or goodwill impairment charge, or a reduction of amortization lives, could have a material adverse effect on the Company’s results of operations.

Business disruptions could materially and adversely affect the Company’s future sales and financial condition or increase the Company’s costs and expenses.

The Company’s business may be disrupted by a variety of events or conditions, including, but not limited to, threats to physical security, acts of terrorism, labor stoppages or disruptions, raw material shortages, natural and man-made disasters, information technology failures and public health crises. Any of these disruptions could affect the Company’s internal operations or services provided to customers, and could impact its sales, increase expenses or materially and adversely affect the Company’s reputation.

Foreign exchange rate fluctuations could cause a decline in the Company’s financial condition, results of operations and cash flows.