Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

Affinia Group Intermediate Holdings Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

I.R.S. Employer Identification Number: 34-2022081

1101 Technology Drive

Ann Arbor, MI 48108

(734) 827-5400

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

(Note: As a voluntary filer not subject to the filing requirements of Section 13 or 15(d) of the Exchange Act, the registrant has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant would have been required to file such reports) as if it were subject to such filing requirements).

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated Filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There were 1,000 shares outstanding of the registrant’s common stock as of March 16, 2010 (all of which are privately owned and not traded on a public market).

Table of Contents

| Page | ||||

| PART I. | ||||

| Item 1. |

1 | |||

| 1 | ||||

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| Item 1A. |

11 | |||

| Item 1B. |

16 | |||

| Item 2. |

16 | |||

| Item 3. |

16 | |||

| Item 4. |

16 | |||

| PART II. | ||||

| Item 5. |

17 | |||

| Item 6. |

17 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 | ||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 30 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| Item 7A. |

35 | |||

i

Table of Contents

| Page | ||||

| Item 8. |

Financial Statements and Supplementary Data | 37 | ||

| Item 9. |

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | 78 | ||

| Item 9A(T). |

Controls and Procedures | 78 | ||

| Item 9B. |

Other Information | 79 | ||

| PART III. | ||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 80 | ||

| Item 11. |

Executive Compensation | 84 | ||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 98 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence | 101 | ||

| Item 14. |

Independent Registered Public Accounting Firm Fees | 102 | ||

| PART IV. | ||||

| Item 15. |

Exhibits, Financial Statement Schedules | 103 | ||

ii

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

This report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends and other information that is not historical information. When used in this report, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or future or conditional verbs, such as “will,” “should,” “could” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, management’s examination of historical operating trends and data are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there is no assurance that these expectations, beliefs and projections will be achieved. With respect to all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this report. Such risks, uncertainties and other important factors include, among others: the impact of the recent turmoil in the financial markets on the availability and cost of credit; financial viability of key customers and key suppliers; our substantial leverage; limitations on flexibility in operating our business contained in our debt agreements; pricing and import pressures; the shift in demand from premium to economy products; our dependence on our largest customers; changing distribution channels; increasing costs for manufactured components, raw materials, crude oil and energy; our ability to achieve cost savings from our restructuring; increased costs in imported products from low cost sources; the consolidation of distributors; risks associated with our non-U.S. operations; product liability and customer warranty and recall claims; changes to environmental and automotive safety regulations; risk of impairment to intangibles and goodwill; non-performance by, or insolvency of, our suppliers or our customers; work stoppages or similar difficulties that could significantly disrupt our operations, and other labor disputes; challenges to our intellectual property portfolio; changes in accounting standards that impact our financial statements; difficulties in developing, maintaining or upgrading information technology systems; the adequacy of our capital resources for future acquisitions; our ability to successfully combine our operations with any businesses we have acquired or may acquire; effective tax rates and timing and amounts of tax payments; and our exposure to a recession. Additionally, there may be other factors that could cause our actual results to differ materially from the forward-looking statements.

iii

Table of Contents

PART I.

| Item 1. | Business |

Affinia is a global leader in the on and off-highway replacement products and services industry, which is also referred to as the aftermarket. Our extensive aftermarket product offering, which consists principally of brake, chassis and filtration products, fits nearly every car, truck, off-highway and agricultural make and model, allowing us to serve as a full line supplier in our product categories to our customers. We believe the growth of the aftermarket, from which we derive approximately 98% of our sales, is predominantly driven by the size, age, and by the population of vehicles in operation. We believe we hold the No. 1 market position in North America in aftermarket brake and filtration products and the No. 2 market position in North America in aftermarket chassis products.

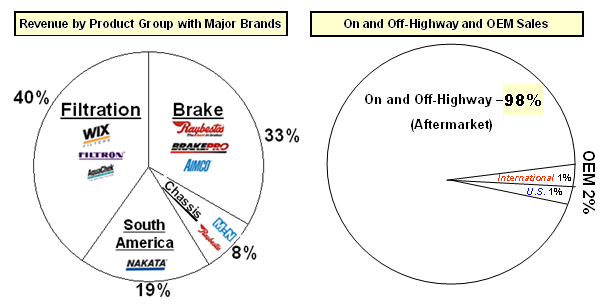

The following charts illustrate the aggregation of net sales by product grouping together with a representative brand and the concentration of On and Off-Highway replacement product sales and automotive original equipment manufacturers (“OEM”) sales. Excluded from the charts is our Commercial Distribution Europe division which is classified as a discontinued operation and was sold on February 2, 2010 (refer to Note 2 Discontinued Operation, which is included in Item 8 of this report).

Our brands include WIX®, Raybestos®, McQuay-Norris®, Nakata®, Filtron® and Brake Pro®. Additionally, we provide private label offerings for NAPA®, CARQUEST®, ACDelco® and other customers and co-branded offerings for Federated Auto Parts (“Federated”) and Automotive Distribution Network (“ADN”). For the year ended December 31, 2009, our net sales from continuing operations were approximately $1.8 billion.

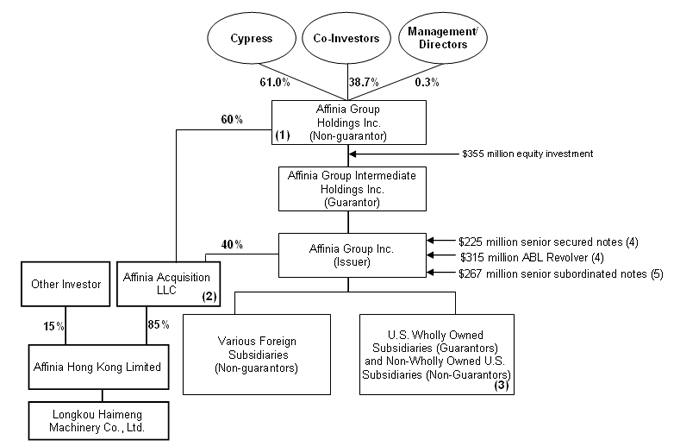

Affinia Group Inc., a Delaware corporation formed on June 28, 2004 and controlled by affiliates of The Cypress Group L.L.C. (“Cypress”), entered into a stock and asset purchase agreement, as amended (the “Purchase Agreement”), with Dana Corporation (“Dana”). Affinia Group Inc. is a wholly-owned subsidiary of Affinia Group Intermediate Holdings Inc. a Delaware corporation formed on October 18, 2004. The Purchase Agreement provided for the acquisition by Affinia Group Inc. of substantially all of Dana’s aftermarket business operations (the “Acquisition”). The Acquisition was completed on November 30, 2004, for a purchase price of $1.0 billion.

All references in this report to “Affinia,” “Company,” “we,” “our,” and “us” mean, unless the context indicates otherwise, Affinia Group Intermediate Holdings Inc. and its subsidiaries on a consolidated basis.

As a result of the Acquisition, investment funds controlled by Cypress hold approximately 61% of the common stock of Affinia Group Holdings Inc. (“Affinia Group”), which directly owns 100% of our common stock, and therefore Cypress controls us. The other Affinia Group Holdings Inc. initial investors are the following: OMERS Administration Corporation (formerly known as Ontario Municipal Employees Retirement Board), California State Teachers Retirement System, The Northwestern Mutual Life Insurance Company and Stockwell Capital.

1

Table of Contents

On December 15, 2005, Affinia Group, our parent company, entered into stockholder and other agreements with certain officers, directors and key employees (collectively, the “Executives”) of the Company, pursuant to which those Executives purchased an aggregate of 9,520 shares (the “Shares”) of Affinia Group’s common stock for $100 per Share in cash. Affinia Group received aggregate proceeds of $952,000 as a result of the offering, which was made pursuant to the Affinia Group’s 2005 Stock Incentive Plan. Affinia Group purchased from key Executives 250 shares in 2007, 1,600 shares in 2008 and 370 shares in 2009. Therefore, as of December 31, 2009 the Executives owned 7,300 shares (excluding shares issued pursuant to our non-qualified deferred compensation plan).

On October 30, 2008, Affinia Group authorized 9.5% Class A Convertible preferred stock, with an initial issuance price of $1,000 per share, consisting of 150,000 shares. There were 51,475 shares issued on October 31, 2008 to our investors and certain Management and Directors. The proceeds from the issuance of preferred shares were contributed to Affinia Acquisition LLC and were utilized to purchase HBM Investment Limited (“HBM”), which subsequently changed its name to Affinia Hong Kong Limited.

2

Table of Contents

Ownership Structure

| (1) | Affinia Group Holdings Inc. received $51 million in return for preferred stock from Cypress, Co-investors and management. Affinia Group Holdings Inc. contributed $50 million of the $51 million to Affinia Acquisition LLC to purchase 85% of the equity interests in HBM which is now known as Affinia Hong Kong Limited. |

| (2) | On June 30, 2008, Affinia entered into a Shares Transfer Agreement with Mr. Zhang Haibo for the purchase by Affinia of 85% of the equity interests (the “Acquired Shares”) in HBM. HBM is the sole owner of Longkou Haimeng Machinery Company Limited (“Haimeng”), a drum and rotor manufacturing company located in Longkou City, China. Affinia Acquisition LLC, an affiliate, completed the purchase of the Acquired Shares on November 6, 2008, with an effective date of October 31, 2008. HBM subsequently changed its name to Affinia Hong Kong Limited. Affinia Group Holdings Inc. owned 95% of Affinia Acquisition LLC and Affinia Group Inc. owned the remaining 5% interest. Based on the criteria for consolidation of a variable interest entity (“VIE”), we determined that Affinia Group Inc. is deemed the primary beneficiary of Affinia Acquisition LLC. Therefore, the consolidated financial statements within this report include Affinia Acquisition LLC and its subsidiaries. Effective June 1, 2009, Affinia Group Inc. acquired an additional 35% ownership interest for a purchase price of $25 million, increasing its ownership to 40%. |

| (3) | The guarantors of the outstanding senior subordinated notes guarantee our senior credit facilities on a senior secured basis. |

| (4) | On August 13, 2009, we refinanced our former term loan facility, revolving credit facility and accounts receivable facility. The refinancing consisted of a new four-year $315 million asset-based revolving credit facility (the “ABL Revolver”) and $225 million of new 10.75% senior secured notes (“Secured Notes”), the proceeds of which were used to repay outstanding borrowings under our former term loan facility, revolving credit facility and accounts receivable facility, as well as to settle interest rate derivatives and to pay fees and expenses related to the refinancing. The ABL Revolver and the Secured Notes replaced our revolving credit facility, which would have otherwise matured on November 30, 2010, our former term loan facility, which would have otherwise matured on November 30, 2011, and our accounts receivables facility, which would have otherwise matured on November 30, 2009. The ABL Revolver was entered into by Affinia Group Inc. and Affinia Group Intermediate Holdings Inc. |

| (5) | As of December 31, 2008, $300 million principal amount of the Issuer’s senior subordinated notes was outstanding. During the second quarter of 2009, Affinia Group Holdings Inc. purchased approximately $33 million principal amount of the senior subordinated notes in the open market and thereafter contributed such notes to Affinia Group Intermediate Holdings Inc., which contributed such notes to Affinia Group Inc. Affinia Group Inc. promptly surrendered such purchased notes for cancellation, such that as of December 31, 2009, approximately $267 million principal amount of the senior subordinated notes was outstanding. The cancellation of the notes resulted in an $8 million pre-tax gain. |

3

Table of Contents

Our extensive product offering fits nearly every car, truck, off-highway and agricultural make and model on the road, allowing us to serve as a full line supplier to our customers for our product categories. These customers primarily comprise large aftermarket distributors and retailers selling to professional technicians or installers. Our customer base also includes original equipment service (“OES”) participants such as ACDelco. Many of our customers are leading aftermarket companies, including NAPA, CARQUEST, Aftermarket Auto Parts Alliance (“the Alliance”), Uni-Select Inc., O’Reilly Auto Parts, and Federated Auto Parts. As an active participant in the aftermarket for more than 60 years, we have many long-standing customer relationships.

We derived approximately 98% of our 2009 net sales from the on and off-highway replacement products and services industry, which is also referred to as the aftermarket. We believe that the aftermarket will continue to grow as a result of the increase in the light vehicle population and the average age of light vehicles. According to the Automotive Aftermarket Industry Association (“AAIA”), the U.S. aftermarket grew by 0.2% during 2008. In 2009, the industry was forecasted to decrease by 1.3% and rebound in 2010 with 4.5% growth.

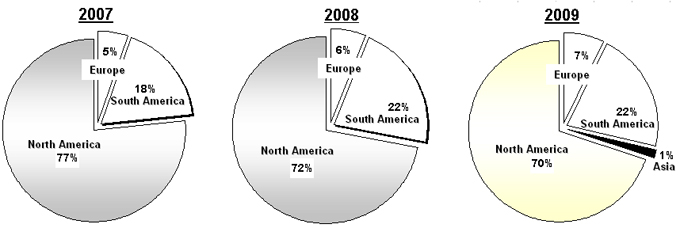

Our broad range of brake, chassis and filtration products are primarily sold in North America, Europe and South America. We are also focusing on expanding manufacturing capabilities globally to position Affinia to take advantage of global growth opportunities. With Affinia Acquisition LLC purchasing Affinia Hong Kong Limited we believe we are well positioned in Asia. In the future we plan to sell our broad product offering in China and other Asian markets. The percentage of sales by geographic region for the last three years is outlined in the chart below (For information about our segments refer to Note 18 Segment Information, which is included in Item 8 of this report). Excluded from the charts is our Commercial Distribution Europe segment which is classified as a discontinued operation and was sold on February 2, 2010 (refer to Note 2 Discontinued Operation, which is included in Item 8 of this report).

North America

We believe we hold the #1 market position in North America in brake and filtration components and the #2 market position in chassis components in the aftermarket. We believe we have achieved our #1 and #2 market positions due to the quality and reputation of our brands and products among professional technicians, who are the primary installers of the types of components we supply to the aftermarket. These professionals prefer to order reliable, well known brands because it is industry practice to replace, free of any labor or service charge, malfunctioning parts. We believe that the quality and reputation of our brands for form, fit, and functional quality creates and maintains significant demand for our products from these technicians and throughout the aftermarket supply chain.

Over the last several years, domestic production has been diminishing due to price sensitivity in the market. To meet our customers’ needs and continue to be a leader in the aftermarket we initiated restructuring plans in 2005 to consolidate domestic production and shift a significant portion of our manufacturing base to lower cost countries. We have opened new facilities in China, Ukraine, Mexico, and India over the last couple of years. In addition, we manufacture and distribute our products in 18 countries, which include the 7 countries of the Commercial Distribution Europe segment, and we also export to many other countries covering four continents. Not only do we plan to increase our manufacturing capabilities globally, but we also intend to grow our business in those new markets. To continue to be a full product line leader in our industry we will continue to research and develop, design, and manufacture products globally.

4

Table of Contents

South America

We have manufacturing and distribution operations in Brazil, Argentina, Uruguay and Venezuela. We manufacture and/or distribute filters, brakes, pumps and other aftermarket components in South America. Our South American operations manufacture and distribute product mostly in their domestic markets. We believe we hold the # 3 position as a distributor of aftermarket parts in Brazil.

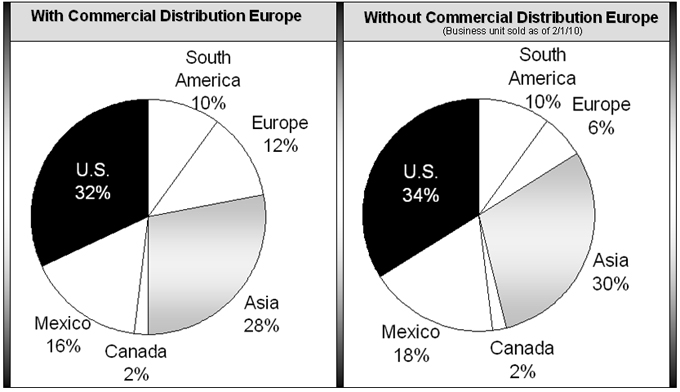

Europe

In Europe, we have one significant operation classified in continuing operations: Filtron, which manufactures filters in Poland and Ukraine. We believe Filtron holds the #1 position in filters in Poland. Approximately 61% of Filtron products are exported outside of Poland. As part of our strategic plan we committed to a plan to sell our Commercial Distribution Europe business unit during the fourth quarter of 2009. Our Commercial Distribution Europe business unit, also known as Quinton Hazell, is a diverse aftermarket manufacturer and distributor of automotive components throughout Europe. On February 2, 2010, we sold our Commercial Distribution Europe operations and it is classified as a discontinued operation in our consolidated financial statements.

Asia

Haimeng, which is located in China, significantly expands Affinia’s worldwide manufacturing capacity for high-quality brake components. Haimeng operates drum and rotor manufacturing facilities comprising over one million square feet. This acquisition also provides Affinia with a strategic opportunity for continued market expansion through Haimeng’s current aftermarket customer base in Asia and Europe. We also have a joint venture in India with MAT Holdings Inc., to manufacture brake friction products. The testing and manufacturing of brake friction products began during the fourth quarter of 2008, and initial shipments began in the first quarter of 2009.

Restructuring

In 2005, we announced two restructuring plans: (i) a restructuring plan that we announced at the beginning of 2005 as part of the Acquisition, referred to as the acquisition restructuring and (ii) a restructuring plan that we announced at the end of 2005, referred to as the comprehensive restructuring. During the last four years we have rationalized and consolidated many of our facilities and have shifted some production to low cost sources. We have closed 46 facilities over the last four years in connection with the restructuring plans. We completed the acquisition restructuring plan in 2005 and we anticipate finishing the comprehensive restructuring plan by the end of 2010. As of the end of 2009, we have incurred restructuring costs of $154 million in connection with the comprehensive restructuring, and forecast that we will incur another $7 million until completion, for a total of $161 million ($9 million higher than the original plan of $152 million). The major cost components of the plan are employee severance costs, asset impairment charges related to fixed assets, and other costs such as environmental remediation, site clearance and repair costs, each of which should represent approximately 45%, 19% and 36%, respectively, of the total $161 million restructuring expense.

Statements regarding industry outlook, our expectations regarding the performance of our business and other non-historical statements are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described under “Forward-Looking Statements.” Our actual results may differ materially from those contained in or implied by any forward-looking statements. You should read the following discussion together with “Forward-Looking Statements,” “Item 6. Selected Consolidated and Combined Financial Data” and “Item 8. Financial Statements and Supplementary Data.”

Aftermarket products can be classified into three primary groups: routine service parts, wear parts and components that commonly fail. We primarily compete in the routine service parts and wear parts product categories.

We believe the overall U.S. motor vehicle aftermarket, excluding tires, was approximately $247 billion in sales in 2009. We are one of the largest participants, offering a full line of quality products within our product categories. To facilitate efficient inventory management, many of our customers rely on larger suppliers like us to have full line product offerings, consistent value-added services and timely delivery. There are important advantages to having meaningful size and scale in the aftermarket, including the ability to support significant distribution operations, offer sophisticated supply chain management capabilities and provide broad product line offerings.

In general, aftermarket industry participants can be categorized into three major groups: (1) manufacturers of parts, (2) distributors of replacement parts (without manufacturing capabilities) and (3) installers, both professional and Do-It-Yourself (“DIY”). Distributors purchase products from manufacturers and sell them to wholesale or retail operations, which in turn sell them to installers.

5

Table of Contents

The distribution business is comprised of the (1) traditional, (2) retail and (3) OES channels. Typically, professional installers purchase their products through the traditional channel, and DIY mechanics purchase products through both traditional and retail stores. The traditional channel includes such well-known distributors as NAPA, CARQUEST, Federated, the Alliance, Uni-Select and ADN. Through a network of distribution centers, these distributors sell primarily to owned or affiliated stores, which in turn supply professional installers. The retail sector includes merchants such as O’Reilly Auto Parts, AutoZone, Advance Auto Parts and Canadian Tire. OES channels consist primarily of new vehicle manufacturers’ service departments at new vehicle dealerships.

We believe that future growth in aftermarket product sales will be driven by the following key factors:

Increase in light vehicle population. The light vehicle population in the United States has been increasing in recent years, driven principally by growth in the number of licensed drivers and an increase in the average vehicles in service per licensed driver. As of 2008, there were over 242 million light vehicles in operation in the U.S. Although this figure represents only a 0.5% increase over 2007, the U.S. light vehicle population has risen in each of the past ten years; increasing by a total of 23% from 197 million vehicles in 1998. From 1998 to 2008, the U.S. light vehicle population experienced a compound annual growth rate of 2.1%.

The vehicle population has also been increasing in South America and Europe. As of 2006, there were 37 million vehicles in operation in South America and 311 million vehicles in Europe. Those vehicle populations have increased to 42 million and 319 million in 2008, respectively; representing a growth of 13.5% in South America and 2.6% in Europe.

The vehicle population has also been increasing in China in both vehicle production and sales. As of 2008, there were 47 million vehicles in operation. According to industry sources the vehicle population is expected to grow by 18% in each of the next three years in China. We are working to establish distribution channels in China to capitalize on the growth of the vehicle population.

Increase in average age of light vehicles. As of 2008, the average light vehicle age in the United States was 10.0 years, compared to an average of 8.7 years in 1998. As the average light vehicle age continues to rise, the use of aftermarket products generally increases as well.

Increase in total miles driven. In the United States, the total miles driven rose from 2.6 trillion in 1998 to 2.9 trillion in 2008, an increase of 12%. However, the total miles driven decreased by 3.6% in 2008 relative to 2007 due to a number of factors including a 16% increase in average retail gasoline prices, the unstable economy, and the growth in unemployment. From 1998 to 2008, the annual miles driven in the U.S. has experienced a compound annual growth rate of 1.1%.

Increase in the number of light trucks and cross-over vehicles in service. The AAIA estimates that the number of light trucks and cross-over vehicles in operation in the United States has increased by 36 million, or 50% from 1998 to 2008. This group of larger and heavier vehicles which place more wear on brake systems and chassis components is expected to result in a corresponding growth in the sale of aftermarket brake and chassis components. Also, the percentage of these vehicles in operation that use disc brakes, rather than drum brakes, continues to grow. Smaller and lighter weight disc brake systems have shorter operational lives than drum brakes, and therefore require more frequent replacement. From 1998 to 2008, the U.S. light truck population experienced a compound annual growth rate of 4.1%.

The medium and heavy duty truck population has also experienced significant growth. As of 2008, there were 8.7 million medium and heavy duty trucks in operation in the U.S. versus 6.7 million in 1999; an increase of 29%. From 1999 to 2008, the U.S. medium and heavy duty truck population experienced a compound annual growth rate of 2.9%.

6

Table of Contents

Our principal product areas are described below:

| Product |

2009 Net Sales (Dollars in Millions) |

Percent of 2009 Net Sales |

Representative Brands | Product Description | |||||||

| Filtration products |

$ | 713 | 40 | % | WIX, FILTRON, NAPA and CARQUEST |

Oil, fuel, air, hydraulic and other filters for light-, medium- and heavy-duty on and off-highway vehicle applications | |||||

| Brake products North America & Asia South America |

|

593 22 |

|

33 1 |

% % |

Raybestos, NAPA, CARQUEST, AIMCO and ACDelco |

Drums, rotors, calipers, pads and shoes and hydraulic components | ||||

| Total Brake products |

615 | 34 | % | ||||||||

| Commercial Distribution South America products |

333 | 19 | % | Nakata, Urba, WIX | Steering, suspension, driveline components, brakes, fuel and water pumps and other aftermarket products | ||||||

| Chassis products |

153 | 8 | % | Raybestos Chassis, NAPA Chassis, McQuay-Norris, ACDelco and Nakata |

Steering, suspension and driveline components | ||||||

| Eliminations and other |

(17 | ) | (1 | )% | |||||||

| Net sales of continuing operations |

1,797 | ||||||||||

| Discontinued Operations |

|||||||||||

| Commercial Distribution European products(1) |

237 | Quinton Hazell and other |

Cooling, transmission, steering and suspension, brake, shock absorber, electrical and filter products | ||||||||

| Net sales |

$ | 2,034 | |||||||||

| (1) | We committed to a plan to sell the Commercial Distribution European products business in the fourth quarter of 2009 and sold it on February 2, 2010. |

Filtration Products. We are a leading designer, manufacturer, marketer and distributor of a broad range of filtration products for the aftermarket. Based on 2009 net sales, we believe we hold the #1 market position in North America. In addition, we also manufacture filtration products in Europe and South America. We are one of the few aftermarket suppliers of both heavy-duty and light-duty filters. Our filtration product lines include oil, fuel, air and other filters for automobiles, trucks and off-road equipment. We sell our filtration products into the three primary distribution channels—traditional, retail and OES.

Under our well-known WIX brand, we offer automotive, diesel, agricultural, industrial and specialty filter applications. WIX is the #1 filter for cars on the NASCAR circuit and an exclusive NASCAR Performance Product. We also provide a comprehensive private label product offering to our two largest customers, NAPA and CARQUEST. We also sell our filters under the Filtron brand in Europe.

The heavy-duty filtration market is expected to continue to grow at a stable rate. Demand for heavy-duty oil filters is expected to increase due to newer diesel engines with exhaust gas recirculation technology, which generates more soot particulates compared to older engine designs, thereby increasing engine filtration demands. In other heavy-duty filter categories, demand is expected to experience stable growth, as there are more filters per engine in newer vehicles. Proprietary filtration designs and increasingly complicated filtration systems are also expected to create additional demand.

Brake Products. We are a leading designer, manufacturer, marketer and distributor of a broad range of brake products for the aftermarket. Based on 2009 net sales, we believe we hold the #1 market position in North America for brake components. Our products include master cylinders, wheel cylinders, hardware and hydraulics, drums, shoes, linings, bonded/riveted segments, rotors, brake pads, calipers and castings. We sell our brake products into the three primary distribution channels—traditional, retail and OES.

We have an extensive offering of high quality, premium brake products. These brake products are sold under our leading premium brand name, Raybestos. In addition to our own brands, we also provide private label offerings for NAPA, CARQUEST, ACDelco and other customers and co-branded offerings for Federated Auto Parts (“Federated”) and Automotive Distribution Network (“ADN”).

7

Table of Contents

Aftermarket customers rely on our expertise for product design and engineering. These customers are highly focused on delivery time for their unpredictable and changing volume requirements, as they prefer to carry lower inventory levels while demanding full product coverage of different makes and models.

This product category has and is expected to continue to have one of the highest growth rates in the aftermarket due to the high level of SUVs, cross-over vehicles and other heavy vehicles in the overall fleet mix which tend to generate greater wear of brake system products.

Commercial Distribution South America Products. We manufacture and/or distribute products in Brazil and Argentina, including: pumps, universal joint kits, axle sets, shocks, steering, filtration products and suspension parts. We believe we hold the #3 position as a distributor of aftermarket parts in Brazil and the #1 position in several product lines.

Chassis Products. We are a leading designer, manufacturer, marketer and distributor of a broad range of chassis products for the aftermarket. Based on 2009 net sales, we believe we hold the #2 market position in North America for chassis products. Our chassis parts include steering, suspension and driveline products such as ball joints, tie rods, Pitman arms, idler arms, drag links, control arms, center links, stabilizers and other related parts. In addition to our own brands, including Nakata, Raybestos and McQuay-Norris, we provide private label products for NAPA and other customers. We sell our chassis products into the three primary distribution channels—traditional, retail and OES.

Chassis products by their nature wear out and need to be replaced periodically. Frequency of replacement depends on the use of the vehicle. As a result, fleet, construction and off-road vehicles typically need to have chassis parts replaced more frequently than other types of vehicles. We believe growth in the replacement of chassis products will be driven by an increase in the proliferation of replaceable chassis products and in the average age of vehicles.

Eliminations and Other. This category consists of inter company sales eliminations between product grouping.

Discontinued Operations - Commercial Distribution European Products. As noted above, on February 2, 2010, the Company sold its Commercial Distribution European division, which sells primarily under the Quinton Hazell® brand name. As a result of the sale, the Commercial Distribution Europe segment is now classified as discontinued operations in the Company’s Consolidated Financial Statements and the accompanying notes for all periods presented.

Further information relating to the Company’s reportable operating segments, for the three most recent fiscal years, appears in Note 18 of the Notes to the Consolidated Financial Statements contained in Item 8, “Financial Statements and Supplementary Data.”

We distribute our products across several sales channels, including traditional, retail and OES channels. Approximately 29% and 8% of our 2009 net sales from continuing operations were derived from our two largest customers, NAPA and CARQUEST, respectively (See “Risk Factors—Our Business would be materially and adversely affected if we lost any of our larger customers”). During 2009, we derived 60% of our net sales from the United States and 40% of our net sales from other countries.

We have maintained long-standing relationships with many of our top customers. Some of our most significant customers include NAPA, CARQUEST, ADN, ACDelco, Federated, Parts Plus, Uni-Select, Les Schwab, the Alliance, and O’Reilly Auto Parts, each of which is a key player in the aftermarket.

8

Table of Contents

The following table provides a description of the primary sales channels to which we supply our products:

| Primary Sales Channels |

Description |

Customers | ||

| Traditional |

Warehouses and distribution centers that supply local distribution outlets, which sell to professional installers. | NAPA, CARQUEST, Federated, ADN, the Alliance and Uni-Select | ||

| Retail and Mass Merchant |

Retail stores, including national chains that sell replacement parts directly to consumers (the DIY market) and to some professional installers. | O’Reilly Auto Parts | ||

| OES |

Vehicle manufacturers and service departments at vehicle dealerships. | ACDelco, Robert Bosch, TRW Automotive and Chrysler | ||

The traditional channel is important to us because it is the primary source of products for professional installers. We believe that the quality and reputation of our brands for form, fit, and function promotes significant demand for our products from these installers and throughout the aftermarket supply chain. We have many long-standing relationships with leading distributors in the traditional channel such as NAPA and CARQUEST, for whom we have manufactured products for 42 and 20 years, respectively.

As retailers become increasingly focused on consolidating their supplier base, we believe that our broad product offering, product quality, sales and marketing support and customer service capabilities make us more valuable to these customers.

Recently, automobile dealerships have begun providing “all-makes” service whereby dealers will service a vehicle even if they do not sell the make or model being serviced. These dealerships can choose to purchase competitive components from aftermarket suppliers. We believe the volumes generated by OES customers, especially in brakes, may provide an opportunity for sales growth.

We believe that our emphasis on customer support has been a key factor in maintaining our leading market positions. We continuously seek to improve service, order turnaround time, product coverage and order accuracy. Our ability to replenish inventory quickly is extremely important to customers as it enables them to maximize their sales while carrying reduced inventory levels. For these reasons, we ship the majority of orders within 24 to 48 hours of receipt.

In order to maintain the competitiveness of our existing customers and maximize new sales opportunities, we have extensive product coverage. In turn, this has allowed our customers to develop a reputation for carrying the parts their customers need, especially for newer vehicles for which warranties may not have expired and aftermarket parts are not generally available.

In addition, as the aftermarket becomes more electronically integrated, customers often prefer to receive their application information electronically as well as in print form. We provide both printed and electronic catalog media. We also provide products which are problem solvers for professional installers, such as alignment products that allow installers to properly align a vehicle, even though the vehicle was not equipped with adjustment features. We provide many other support features, such as technical support hot lines and training and electronic systems which interface with customers and conform to aftermarket industry standards.

The Company strategically manages its portfolio of patents, trade secrets, copyrights, trademarks and other intellectual property.

We maintain and have pending in excess of 300 patents and patent applications on a worldwide basis. These patents expire over various periods up to the year 2028. The Company does not materially rely on any single patent, nor will the expiration of any single patent materially affect the Company’s business. The Company has proprietary trade secrets, technology, know-how, processes, and other intellectual property rights that are not registered.

Trademarks are important to the Company’s business activities. The Company has a robust worldwide program of trademark registration and enforcement to maintain and strengthen the value of the trademarks and prevent the unauthorized use of the trademarks. The RAYBESTOS and WIX trade names are highly recognizable to the public and are valuable assets. Additionally, the Company uses numerous other trademarks which are registered worldwide. We maintain more than 1,150 active trademark registrations and applications worldwide.

Raw Materials and Manufactured Components

We use a broad range of manufactured components and raw materials in our products, including steel, steel-related components, filtration media, aluminum, brass, iron, rubber, resins, plastics, paper and packaging materials. We purchase raw materials from a wide variety of domestic and international suppliers, and we have not, in recent years, experienced any significant shortages of these items and normally do not carry inventories of these items in excess of those reasonably required to meet our production and shipping schedule. Raw materials comprise the largest component of our manufactured goods cost structure.

9

Table of Contents

With our commitment to globalization, we are subject to increases in freight costs due to increased oil prices. During 2009 oil prices decreased in comparison to the prior year. The decrease in oil prices during 2009 had a positive affect on products such as filtration media and oil based products. Steel prices decreased in 2009 in comparison to the prior year which had a positive affect on certain products. The U.S. dollar strengthened during 2009 and it had a positive impact on the purchasing of raw materials and finished goods from our international sources. We will continue to review our purchasing and sourcing strategies for opportunities to reduce costs.

In a typical year, we build inventory during the first and second quarters to accommodate our peak sales during the second and third quarters. Our working capital requirements therefore tend to be highest from March through August. In periods of weak sales, inventory can increase beyond typical levels, as our product delivery lead times are less than two days while certain components we purchase from overseas require lead times of approximately 90 days.

Substantially all of the orders on hand at December 31, 2009 are expected to be filled during 2010. The Company does not view its backlog as being insufficient, excessive or problematic, or a significant indication of 2010 sales.

Research and Development Activities

We provide information regarding our research and development activities in Note 4 to our consolidated financial statements, which is included in Item 8 of this report.

The brake aftermarket is comprised of several large manufacturers: our Company, Federal Mogul Corp. under the brand name Wagner, Honeywell International Inc. under the brand name Bendix, and Cardone Industries, Inc. under the brand name A1 Cardone. The light-duty filter aftermarket is comprised of several large U.S. manufacturers: our Company, United Components, Inc. under the brand name Champ, Honeywell International Inc. under the FRAM brand and Purolator Filters NA LLC under the Purolator brand, along with several international light-duty filter suppliers. The heavy-duty filter aftermarket is comprised of several manufacturers: our Company, Cummins, Inc. under the brand name Fleetguard, CLARCOR Inc. under the brand name Baldwin, and Donaldson Company Inc. under the brand name Donaldson. The chassis aftermarket is comprised primarily of two large U.S. manufacturers: our Company and Federal Mogul Corp. under the brand name Moog, along with some international chassis suppliers. We compete on, among other things, quality, price, service, brand reputation, delivery, technology and product offerings.

As of December 31, 2009, we had 11,572 employees (including Commercial Distribution Europe), of whom 5,682 were employed in North America, 2,331 were employed in Asia, 1,873 were employed in Europe, and 1,686 were employed in South America. The Commercial Distribution Europe segment had 793 employees. Approximately 23% of our employees are salaried and the remaining 77% of our employees are hourly. As of December 31, 2009, approximately 3% of our 3,978 U.S. employees and approximately 17% of our 342 Canadian employees were represented by unions. We consider our relations with our employees to be good.

We are subject to a variety of federal, state, local and foreign environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the emission of noise and odors, the management and disposal of hazardous substances or wastes, the clean-up of contaminated sites and human health and safety. Some of our operations require environmental permits and controls to prevent or reduce air and water pollution, and these permits are subject to modification, renewal and revocation by issuing authorities. Contamination has been discovered at certain of our owned properties, which is currently being monitored and/or remediated. We are not aware of any contaminated sites which we believe will result in material liabilities; however, the discovery of additional remedial obligations at these or other sites could result in significant liabilities. Accounting Standards Codification (“ASC”) Topic 410 Asset Retirement and Environmental Obligations, requires that a liability for the fair value of an Asset Retirement Obligation (“ARO”) be recognized in the period in which it is incurred if it can be reasonably estimated, with the offsetting associated asset retirement costs capitalized as part of the carrying amount of the long-lived asset.

In addition, many of our current and former facilities are located on properties with long histories of industrial or commercial operations. Because some environmental laws can impose liability for the entire cost of clean-up upon any of the current or former owners or operators, regardless of fault, we could become liable for investigating or remediating contamination at these properties if contamination requiring such activities is discovered in the future. We have incurred environmental remediation costs associated with the comprehensive restructuring and the acquisition restructuring.

10

Table of Contents

We are also subject to the U.S. Occupational Safety and Health Act and similar state and foreign laws regarding worker safety. We believe that we are in substantial compliance with all applicable environmental, health and safety laws and regulations. Historically, our costs of achieving and maintaining compliance with environmental and health and safety requirements have not been material to our operations.

Available free of charge through our internet website, www.affiniagroup.com, under the investor relations tab are our recent filings of forms 10-K, 10-Q, 8-K and amendments to those reports filed with the Securities and Exchange Commission. These reports can be found on our internet website as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. The information contained on or connected to our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report filed with the Securities and Exchange Commission (SEC).

| Item 1A. | Risk Factors |

If any of the following events discussed in the following risks were to occur, our results of operations, financial conditions, or cash flows could be materially affected. Additional risks and uncertainties not presently known by us may also constrain our business operations.

Continued volatility and disruption to the global capital and credit markets and the economy more broadly has and may continue to adversely affect our results of operations and financial condition, as well as our ability to access credit and has and may continue to adversely affect the financial soundness of our customers and suppliers.

Recently, the global capital and credit markets have been experiencing a period of significant uncertainty, characterized by the bankruptcy, failure, collapse or sale of various financial institutions and a considerable level of intervention from the United States federal government. These conditions have adversely affected the demand for our products and services and, therefore, reduced purchases by our customers, which has negatively affected our revenue growth and caused a decrease in our profitability. In addition, interest rate fluctuations, financial market volatility or credit market disruptions may limit our access to capital, and may also negatively affect our customers’ and our suppliers’ ability to obtain credit to finance their businesses on acceptable terms. As a result, our customers’ need for and ability to purchase our products or services may decrease, and our suppliers may increase their prices, reduce their output or change their terms of sale. If our customers’ or suppliers’ operating and financial performance deteriorates, or if they are unable to make scheduled payments or obtain credit, our customers may not be able to pay, or may delay payment of, accounts receivable owed to us, and our suppliers may restrict credit or impose different payment terms. Any inability of customers to pay us for our products and services, or any demands by suppliers for different payment terms, may adversely affect our earnings and cash flow.

As the contraction of the global capital and credit markets has spread throughout the broader economy, the United States and other major markets around the world have experienced very weak or negative economic growth. These recessionary conditions have and will continue to impact demand for our products by consumers. Although many vehicle maintenance and repair expenses are non-discretionary, difficult economic conditions may reduce miles driven and thereby increase periods between maintenance and repairs.

Our substantial leverage could harm our business by limiting our available cash and our access to additional capital and, to the extent of our variable rate indebtedness, exposing us to interest rate risk.

As a result of the Acquisition in 2004 and refinancing in 2009, we are highly leveraged. This leverage may limit our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions, restructuring and general corporate or other purposes, limit our ability to adjust to changing market conditions and place us at a competitive disadvantage compared to our less leveraged competitors. Further volatility in the credit markets could adversely impact our ability to obtain favorable terms on financing in the future. In addition, a substantial portion of our cash flows from operations must be dedicated to the payment of principal and interest on our indebtedness and is not available for other purposes, including our operations, capital expenditures and future business opportunities. We may be more vulnerable than a less leveraged company to a downturn in the general economic conditions or in our business, or we may be unable to carry out capital spending that is important to our growth. We may be vulnerable to interest rate increases, as certain of our borrowings, including those under our ABL Revolver, are at variable rates. We can give no assurance that our business will generate sufficient cash flow from operations, that revenue growth or operating improvements will be realized, or that future borrowings will be available under our ABL Revolver in an amount sufficient to enable it to service its indebtedness or to fund other liquidity needs.

11

Table of Contents

Our business would be materially and adversely affected if we lost any of our larger customers.

For the year ended December 31, 2009, approximately 29% and 8% of our net sales from continuing operations were to NAPA and CARQUEST, respectively. To compete effectively, we must continue to satisfy these and other customers’ pricing, service, technology and increasingly stringent quality and reliability requirements. Additionally, our revenues may be affected by decreases in NAPA’s or CARQUEST’s business or market share. Consolidation among our customers may also negatively impact our business. We cannot provide any assurance as to the amount of future business with these or any other customers. While we intend to continue to focus on retaining and winning these and other customers’ business, we may not succeed in doing so. Although business with any given customer is typically split among numerous contracts, the loss of, or significant reduction in purchases by, one of those major customers could materially and adversely affect our business, results of operations and financial condition.

The shift in demand from premium to economy brands may require us to produce value products at the expense of premium products, resulting in lower prices, thereby reducing our margins and decreasing our net sales.

We estimate that a majority of our net sales are currently derived from products we consider to be premium products; however, this number has been declining. There has been, and may continue to be, a shift in demand from premium products, on which we can generally command premium pricing and generate enhanced margins, to value products. If such a trend continues, we may be forced to expand our production and/or purchases of value products at competitive prices. In addition, we could be forced to further reduce our prices to remain competitive, in which case our margins will decrease unless we make corresponding reductions in our cost structure.

Increasing costs for manufactured components, raw materials, and energy prices may adversely affect our profitability.

We use a broad range of manufactured components and raw materials in our products, including raw steel, steel-related components, filtration media, aluminum, brass, iron, rubber, resins, plastics, paper and packaging materials. Materials comprise the largest component of our manufactured goods cost structure. Further increases in the price of these items could further materially increase our operating costs and materially adversely affect our profit margins. In addition, in connection with passing through steel and other raw material price increases to our customers, there has typically been a delay of up to several months in our ability to increase prices, which has temporarily impacted profitability. In the future, it may be difficult to pass further price increases on to our customers, especially if we experience additional cost increases soon after implementing price increases. In addition, we have experienced longer than typical lead times in sourcing some of our steel-related components and certain finished products, which caused us to buy from non-preferred vendors at higher costs.

We are subject to other risks associated with our non-U.S. operations.

We have significant manufacturing operations outside the United States, including joint ventures and other alliances. In 2009, approximately 40% of our net sales originated outside the United States. Risks inherent in international operations include:

| • | Exchange controls and currency restrictions; |

| • | Currency fluctuations and devaluations; |

| • | Changes in local economic conditions; |

| • | Changes in laws and regulations; |

| • | Exposure to possible expropriation or other government actions; and |

| • | Unsettled political conditions and possible terrorist attacks against American interests. |

These and other factors may have a material adverse effect on our international operations or on our business, results of operations and financial condition. In addition, we may experience net foreign exchange losses due to currency fluctuations.

As a result of the consolidation driven by improved logistics and data management, distributors have reduced their inventory levels, which have reduced and could continue to reduce our sales.

Warehouse distributors have consolidated through acquisition and rationalized inventories, while streamlining their own distribution systems through more timely deliveries and better data management. The corresponding reduction in purchases by distributors negatively impacted our sales. Further consolidation could have a similar adverse impact on our sales.

Increases in crude oil and energy prices could reduce global demand for and use of automobiles and increase our costs, which could have an adverse effect on our profitability.

Material increases in the price of crude oil have, historically, been a contributing factor to the periodic reduction in the global demand for and use of automobiles. An increase in the price of crude oil could reduce global demand for and use of automobiles and continue to shift customer demand away from larger cars and light trucks (including SUVs), which we believe have more frequent replacement intervals for our products, which could have an adverse effect on our profitability. Further, as higher gasoline prices result in a reduction in discretionary spending for auto repair by the end users of our products, our results of operations have been, and could continue to be, impacted. Additionally, higher gasoline prices also have an adverse impact on our freight expenses.

12

Table of Contents

Our operations would be adversely affected if we are unable to purchase raw materials, manufactured components or equipment from our suppliers.

Because we purchase from suppliers various types of raw materials, finished goods, equipment and component parts, we may be materially and adversely affected by the failure of those suppliers to perform as expected. This non-performance may consist of delivery delays or failures caused by production issues or delivery of non-conforming products. The risk of non-performance may also result from the insolvency or bankruptcy of one or more of our suppliers. Our suppliers’ ability to supply products to us is also subject to a number of risks, including availability of raw materials, such as steel, destruction of their facilities or work stoppages. In addition, our failure to promptly pay, or order sufficient quantities of inventory from, our suppliers may increase the cost of products we purchase or may lead to suppliers refusing to sell products to us at all. Our efforts to protect against and to minimize these risks may not always be effective.

We are subject to costly regulation, particularly in relation to environmental, health and safety matters, which could adversely affect our business and results of operations.

We are subject to a substantial number of costly regulations. In particular, we are required to comply with frequently changing and increasingly stringent requirements of federal, state and local environmental and occupational safety and health laws and regulations in the United States and other countries, including those governing emissions to air, discharges to air and water, and the creation and emission of noise and odor; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties and occupational health and safety. We could incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims, or costs to upgrade or replace existing equipment, as a result of violations of or liabilities under environmental, health and safety laws or non-compliance with environmental permits required at our facilities. In addition, many of our current and former facilities are located on properties with long histories of industrial or commercial operations. Because some environmental laws can impose joint and several liability for the entire cost of cleanup upon any of the current or former owners or operators, regardless of fault, we could become liable for investigating and/or remediating contamination at these properties if contamination requiring such activities is discovered in the future. We cannot assure that we have been, or will at all times be, in complete compliance with all environmental requirements, or that we will not incur material costs or liabilities in connection with these requirements in excess of amounts we have reserved. In addition, environmental requirements are complex, change frequently and have tended to become more stringent over time. These requirements may change in the future in a manner that could have a material adverse effect on our business, results of operations and financial condition. We have made and will continue to make expenditures to comply with environmental requirements. These requirements, responsibilities and associated expenses and expenditures, if they continue to increase, could have a material adverse effect on our business and results of operations. While our costs to defend and settle claims arising under environmental laws in the past have not been material, we cannot assure you that this will remain the case in the future. For more information about our environmental compliance and potential environmental liabilities, see “Item 1. Business—Environmental Matters” and “Item 3. Legal Proceedings.”

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us.

We may be exposed to product liability and warranty claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury and/or property damage. Accordingly, we could experience material warranty or product liability losses in the future and incur significant costs to defend these claims.

In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall of that product if the defect or the alleged defect relates to automotive safety. Our costs associated with providing product warranties could be material. Product liability, warranty and recall costs may have a material adverse effect on our business, results of operations and financial condition. Our insurance may not be sufficient to cover such costs.

We are subject to increasing pricing pressure from imports, particularly from low cost sources.

Price competition from other aftermarket manufacturers particularly those based in lower cost countries have historically played a role and may play an increasing role in the aftermarket sectors in which we compete. Pricing pressures have historically been more prevalent with respect to our brake products than our other products. While aftermarket manufacturers in these locations have historically competed primarily in markets for less technologically advanced products and manufactured a limited number of products, many are expanding their manufacturing capabilities to produce a broad range of lower cost, higher quality products and provide an expanded product offering. The pressure from these low cost sources was partially alleviated in our drum and rotor products due to the acquisition of Haimeng. In the future, competitors in Asia or other low cost sources may be able to effectively compete in our premium markets and produce a wider range of products which may force us to move additional manufacturing capacity offshore and/or lower our prices, reducing our margins and/or decreasing our net sales.

13

Table of Contents

We must successfully maintain and/or upgrade our information technology systems.

We rely on various information technology systems to manage our operations. We are currently implementing modifications and upgrades to our systems, including making changes to legacy systems, replacing legacy systems with successor systems with new functionality and acquiring new systems with new functionality. These types of activities subject us to inherent costs and risks associated with replacing and changing these systems, including impairment of our ability to fulfill customer orders, potential disruption of our internal control structure, substantial capital expenditures, additional administration and operating expenses, retention of sufficiently skilled personnel to implement and operate the new systems, demands on management time, and other risks and costs of delays or difficulties in transitioning to new systems or of integrating new systems into our current systems. Our system implementations may not result in productivity improvements at a level that outweighs the costs of implementation, or at all. In addition, the implementation of new technology systems may cause disruptions in our business operations and have an adverse effect on our business and operations, if not anticipated and appropriately mitigated.

The introduction of new and improved products and services may reduce our future sales.

Improvements in technology and product quality may extend the longevity of automotive parts and delay aftermarket sales. In particular, in our oil filter business the introduction of oil change indicators and the use of synthetic motor oils may further extend oil filter replacement cycles. The introduction of electric, fuel cell and hybrid automobiles may pose a long-term risk to our business because these vehicles may alter demand for our primary product lines. In addition, the introduction by OEMs of increased warranty and maintenance service initiatives, which are gaining popularity, have the potential to decrease the demand for our products in the traditional and retail sales channels.

Our success depends in part on our development of improved products, and our efforts may fail to meet the needs of customers on a timely or cost-effective basis.

Our continued success depends on our ability to maintain advanced technological capabilities, machinery and knowledge necessary to adapt to changing market demands as well as to develop and commercialize innovative products. We cannot assure that we will be able to develop new products as successfully as in the past or that we will be able to keep pace with technological developments by our competitors and the industry generally. In addition, we may develop specific technologies and capabilities in anticipation of customers’ demands for new innovations and technologies. If such demand does not materialize, we may be unable to recover the costs incurred in such programs. If we are unable to recover these costs or if any such programs do not progress as expected, our business, financial condition or results of operations could be adversely affected.

We may not be able to achieve the cost savings that we expect from the restructuring of our operations.

Although we expect to realize cost savings as a result of restructuring, we may not be able to achieve the level of benefits that we expect to realize or we may not be able to realize these benefits within the timeframes we currently expect. We have rationalized many domestic manufacturing operations in order to alleviate redundant capacity and reduce our cost structure. This restructuring has involved the movement of some U.S. and Canadian production to Mexico, South America and Asia. Our ability to achieve cost savings could be affected by a number of factors. Since our restructuring efforts focus on increasing our international presence, they will exacerbate the risks described above relating to our non-U.S. operations. Changes in the amount, timing and character of charges related to the restructuring, failure to complete or a substantial delay in completing the restructuring and planned divestitures or the receipt of lower proceeds from such divestitures than currently is anticipated could have a material adverse effect on us. Our cost savings is also predicated upon maintaining our sales levels.

Our intellectual property portfolio is subject to legal challenges.

We have developed and actively pursue developing a considerable amount of proprietary technology in the automotive industry and rely on intellectual property laws and a number of patents to protect such technology. In doing so, we incur ongoing costs to enforce and defend our intellectual property. We also face increasing exposure to the claims of others for infringement of intellectual property rights. We cannot assure that we will not incur material intellectual property claims in the future or that we will not incur significant costs or losses related to such claims. We also cannot assure that our proprietary rights will not be invalidated or circumvented.

Work stoppages or similar difficulties could significantly disrupt our operations.

As of December 31, 2009, 116 U.S. employees and 57 of our Canadian employees were represented by unions. It is possible that our workforce will become more unionized in the future. We may be subject to work stoppages and may be affected by other labor disputes. A work stoppage at one or more of our plants may have a material adverse effect on our business. Unionization activities could also increase our costs, which could have an adverse effect on our profitability.

Additionally, a work stoppage at one of our suppliers could adversely affect our operations if an alternative source of supply were not readily available. Stoppages by employees of our customers also could result in reduced demand for our products.

14

Table of Contents

Any acquisitions we make could disrupt our business and seriously harm our financial condition.

We may, from time to time, consider acquisitions of complementary companies such as Affinia Hong Kong Limited, products or technologies. Acquisitions involve numerous risks, including difficulties in the assimilation of the acquired businesses, the diversion of our management’s attention from other business concerns and potential adverse effects on existing business relationships with current customers and suppliers. In addition, any acquisitions could involve the incurrence of substantial additional indebtedness. We cannot assure that we will be able to successfully integrate any acquisitions that we pursue or that such acquisitions will perform as planned or prove to be beneficial to our operations and cash flow. Any such failure could seriously harm our business, financial condition and results of operations.

Cypress controls us and may have conflicts of interest with us or the holders of our notes in the future.

Cypress beneficially owns 61% of the outstanding shares of our common stock. As a result, Cypress has control over our decisions to enter into any corporate transaction and has the ability to prevent any transaction that requires the approval of stockholders regardless of whether or not other stockholders or note holders believe that any such transactions are in their own best interests. Additionally, Cypress is in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. So long as Cypress continues to own a significant amount of the outstanding shares of our common stock, even if such amount is less than 50%, it will continue to be able to strongly influence or effectively control our decisions.

We are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act. Failure to comply with the requirements of Section 404 or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the credit ratings and trading price of our debt securities.

We are not currently an “accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended. As required by Section 404 of the Sarbanes-Oxley Act of 2002, we have provided an internal control report with this Annual Report, which includes management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the year. Beginning with our Annual Report for the year ending December 31, 2010, our independent registered public accounting firm will also be required to issue a report on their evaluation of the effectiveness of our internal control over financial reporting. Our assessment requires us to make subjective judgments and our independent registered public accounting firm may not agree with our assessment. If we or our independent registered public accounting firm were unable to conclude that our internal control over financial reporting was effective as of the relevant period, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our debt securities, negatively affect our credit rating, and affect our ability to borrow funds on favorable terms.

We may be required to recognize impairment charges for our long-lived assets.

At December 31, 2009, the net carrying value of long-lived assets (property, plant and equipment) totaled approximately $199 million. We recorded an impairment charge in 2009 related to the discontinued operation of Commercial Distribution Europe due to a reduction in market value of its operations. In accordance with generally accepted accounting principles, we periodically assess our long-lived assets to determine if they are impaired. Significant negative industry or economic trends, disruptions to our business, unexpected significant changes or planned changes in use of the assets, divestitures and market capitalization declines may result in charges to long-lived asset impairments. Future impairment charges could significantly affect our results of operations in the periods recognized. Impairment charges would also reduce our consolidated net worth and increase our debt to total capitalization ratio, which could negatively impact our access to the public debt and equity markets.

We could be required to record a material non-cash charge to income if our recorded intangible assets or goodwill is impaired, or if we shorten intangible asset useful lives.

We have $192 million of recorded intangible assets and goodwill on our consolidated balance sheet as of December 31, 2009. These assets may become impaired with the loss of significant customers or a decline of profitability. In assessing the recoverability of goodwill, projections regarding estimated future cash flows and other factors are made to determine the fair value of the respective reporting unit. If these estimates or related projections change in the future, we may be required to record impairment charges for goodwill at that time. If our trade names carrying values exceed fair value we will be required to record an impairment charge.

While our intangibles with definite lives may not be impaired, the useful lives are subject to continual assessment, taking into account historical and expected losses of relationships that were in the base at time of acquisition. This assessment may result in a reduction of the remaining useful life of these assets, resulting in potentially significant increases to non-cash amortization expense that is charged to our consolidated statement of operations. An intangible asset or goodwill impairment charge, or a reduction of amortization lives, could have an adverse effect on our results of operations.

15

Table of Contents

Business disruptions could seriously affect our future sales and financial condition or increase our costs and expenses.

Our business may be impacted by disruptions including, but not limited to, threats to physical security, information technology, or public health crises. Any of these disruptions could affect our internal operations or services provided to customers, and could impact our sales, increase our expenses or adversely affect our reputation.

| Item 1B. | Unresolved Staff Comments. |

None.

| Item 2. | Properties |

Our principal executive offices are located in Ann Arbor, Michigan; our operations include numerous manufacturing, research and development, and warehousing facilities as well as offices. The table below summarizes the number of facilities by geographical region for our manufacturing, distribution and warehouse, and other facilities.

| Manufacturing facilities |

Distribution & Warehouse facilities |

Other facilities | ||||

| United States |

9 | 12 | 8 | |||

| Canada |

1 | 2 | 1 | |||

| Mexico |

5 | 1 | 2 | |||

| Europe |

6 | 17 | 2 | |||

| South America |

5 | 23 | 1 | |||

| Asia |

3 | — | 1 | |||

| Total |

29 | 55 | 15 | |||