Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Wright Medical Group N.V. | d655452dex991.htm |

| 8-K - FORM 8-K - Wright Medical Group N.V. | d655452d8k.htm |

Investor Presentation

2

0

1

4

Exhibit 99.2 |

FORWARD LOOKING STATEMENTS

Statements

contained

in

this

presentation

that

relate

to

future,

not

past,

events

are

forward-looking

statements

under

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

are

based

on

current

expectations

of

future

events

and

often

can

be

identified

by

words

such

as

“expect,”

“anticipate,”

“project,”

“intend,”

“will,”

“may,”

“believe,”

“could,”

“continue,”

“estimate,”

“outlook,”

“plan,”

“guidance,”

“tomorrow”,

“desired

state,”

other

words

of

similar

meaning

or

the

use

of

future

dates.

Forward-looking

statements

by

their

nature

address

matters

that

are,

to

different

degrees,

uncertain.

Uncertainties

and

risks

may

cause

Tornier’s

actual

results

to

be

materially

different

than

those

expressed

in

or

implied

by

Tornier’s

forward-looking

statements.

For

Tornier,

such

uncertainties

and

risks

include,

among

others,

Tornier’s

future

operating

results

and

financial

performance;

the

success

of

and

possible

disruption

from

Tornier’s

recently

completed

transition

to

dedicated

upper

and

lower

extremities

sales

forces;

fluctuations

in

foreign

currency

exchange

rates;

the

effect

of

global

economic

conditions;

the

timing

of

regulatory

approvals

and

introduction

of

new

products;

physician

acceptance,

endorsement,

and

use

of

new

products;

and

the

effect

of

regulatory

actions,

changes

in

and

adoption

of

reimbursement

rates,

product

recalls

and

competitor

activities.

More

detailed

information

on

these

and

other

factors

that

could

affect

Tornier’s

actual

results

are

described

in

Tornier’s

filings

with

the

U.S.

Securities

and

Exchange

Commission,

including

its

most

recent

quarterly

report

on

Form

10-Q.

Tornier

undertakes

no

obligation

to

update

its

forward-looking

statements. |

NON

GAAP FINANCIAL MEASURES Tornier

uses

certain

non-GAAP

financial

measures

in

this

presentation,

such

as

adjusted

EBITDA,

adjusted

gross

margin

and

constant

currency.

Tornier

uses

non-GAAP

financial

measures

as

supplemental

measures

of

performance

and

believes

these

measures

provide

useful

information

to

investors

in

evaluating

Tornier’s

operations,

period

over

period.

However,

non-GAAP

financial

measures

have

limitations

as

analytical

tools,

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

Tornier’s

financial

results

prepared

in

accordance

with

GAAP.

In

addition,

investors

should

note

that

any

non-GAAP

financial

measure

Tornier

uses

may

not

be

the

same

non-GAAP

financial

measure,

and

may

not

be

calculated

in

the

same

manner,

as

that

of

other

companies.

A

reconciliation

of

the

non-GAAP

financial

measures

used

in

the

presentation

to

the

most

directly

comparable

GAAP

financial

measures

can

be

found

on

Tornier’s

website

www.tornier.com

under

the

“Non-GAAP

Measure

Reconciliation

Tables”

section

of

the

“Investor

Relations”

page |

TORNIER IS…

Global Medical Device Company,

focusing on providing superior solutions to surgeons

treating extremities injuries & disorders |

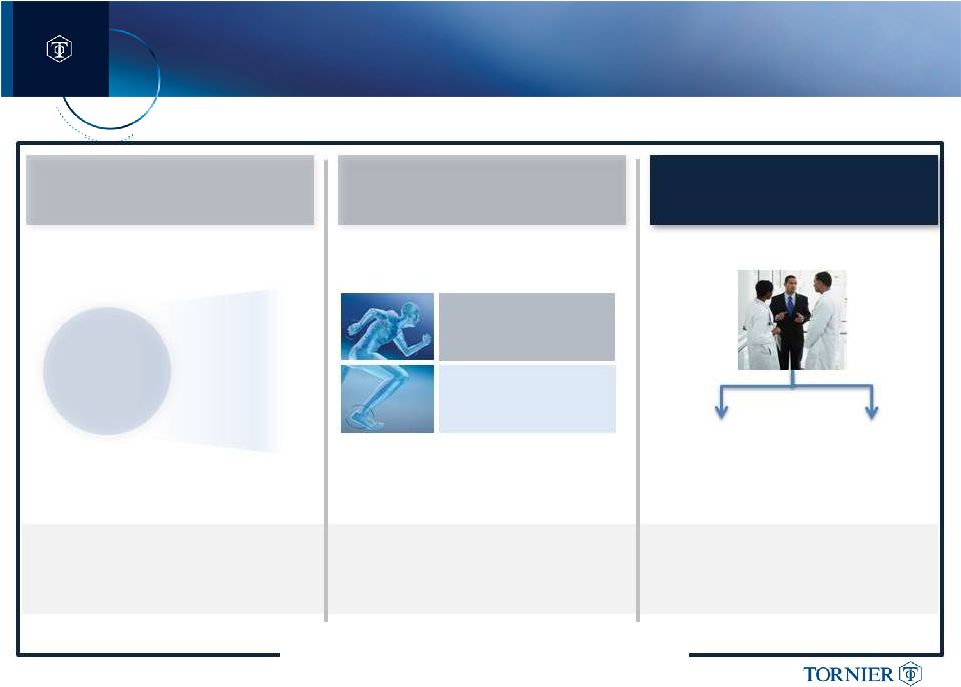

TORNIER IS WELL-POSITIONED FOR LONG-TERM GROWTH

HIGH

GROWTH MARKET

Robust Drivers

Enable Sustained Growth

Extremities

Extremities

$6.5B

8-9%

CAGR

(’14 –

’18)

Based upon management estimates

COMPREHENSIVE

PRODUCT PORTFOLIO

Leader in Innovation,

Science & Education

FOCUSED FOR

EFFICIENT SALES

Aligned to

the

Extremity Call Point

FOCUSED ON EXECUTION

UPPER

EXTREMITIES

LOWER

EXTREMITIES

Upper Extremities

Orthopedic Surgeon

Lower Extremities

Orthopedic Surgeon

&

Surgical Podiatrist |

TORNIER IS WELL-POSITIONED FOR LONG-TERM GROWTH

Robust Drivers

Enable Sustained Growth

$6.5B

8-9%

CAGR

(’14 –

’18)

Based upon management estimates

Leader in Innovation,

Science & Education

Aligned to

the

Extremity Call Point

FOCUSED ON EXECUTION

Upper Extremities

Orthopedic Surgeon

Lower Extremities

Orthopedic Surgeon

&

Surgical Podiatrist

HIGH

GROWTH MARKET

UPPER

EXTREMITIES

LOWER

EXTREMITIES

FOCUSED FOR

EFFICIENT SALES

COMPREHENSIVE

PRODUCT PORTFOLIO

Extremities |

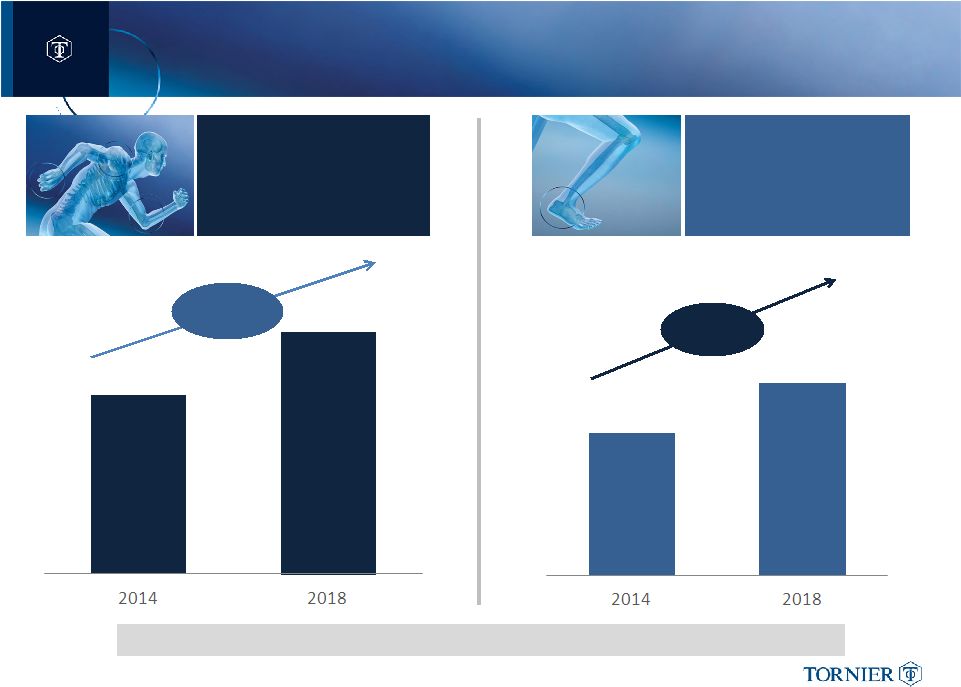

Tornier’s Available Market is $6.5B with

a 8-9% CAGR

$1.7B

$2.8B

9-10%

CAGR

LOWER

EXTREMITIES

TORNIER IS FOCUSED ON ROBUST, HIGH-GROWTH MARKETS

$2.7B

$3.7B

UPPER

EXTREMITIES

8-9%

CAGR |

EXTREMITY MARKET DRIVERS PROVIDE OPPORTUNITY

FOR SUSTAINED GROWTH

•

Aging population

•

Growing awareness (globally)

•

“Quality of life”

expectations

•

Extremities specific design

•

Unmet need for early intervention

•

Growing need for revision

TECHNOLOGY

PATIENTS

OUTCOMES

•

Improving clinical outcomes

•

Evidence driven decisions |

TORNIER IS WELL-POSITIONED FOR LONG-TERM GROWTH

Based upon management estimates

Leader in Innovation,

Science & Education

Robust Drivers

Enable Sustained Growth

$6.5B

8-9%

CAGR

(’14 –

’18)

FOCUSED ON EXECUTION

Aligned to

the

Extremity Call Point

Upper Extremities

Orthopedic Surgeon

Lower Extremities

Orthopedic Surgeon

&

Surgical Podiatrist

Extremities

HIGH

GROWTH MARKET

COMPREHENSIVE

PRODUCT PORTFOLIO

FOCUSED FOR

EFFICIENT SALES

UPPER

EXTREMITIES

LOWER

EXTREMITIES |

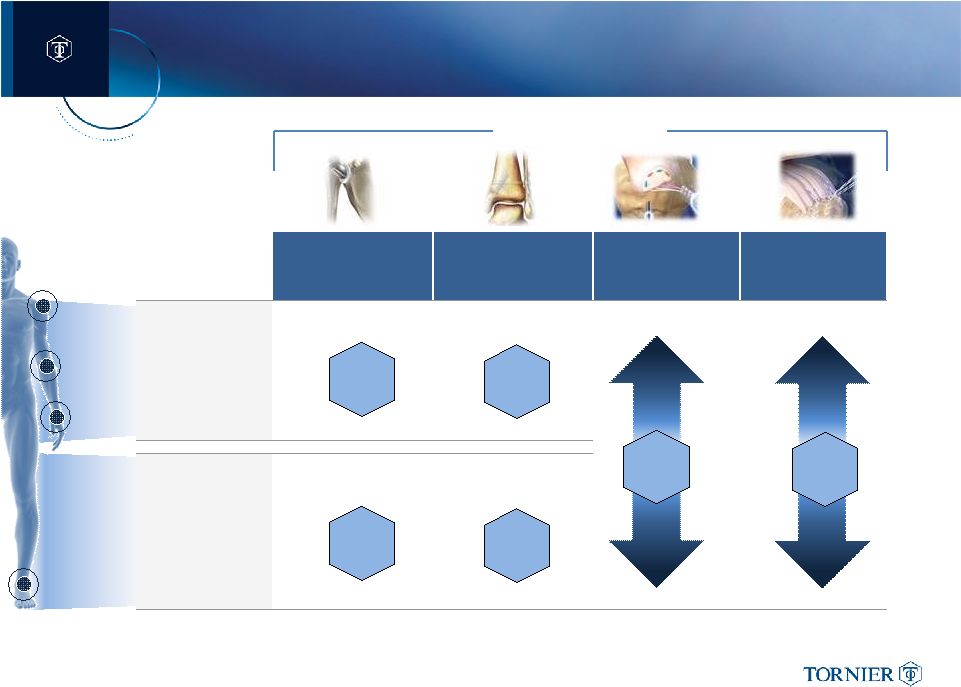

COMPREHENSIVE

PORTFOLIO PROVIDES FULL-LINE SUPPORT TO THE EXTREMITY SURGEON

96 Distinct Extremities Products

Number of

Extremities

Products:

JOINT

REPLACEMENTS

BONE

REPAIR

BIOLOGICS

SOFT TISSUE

REPAIR

UPPER

Shoulder,

Elbow, Hand &

Wrist

LOWER

Foot & Ankle

10

34

33

3

3

13

PROCEDURES |

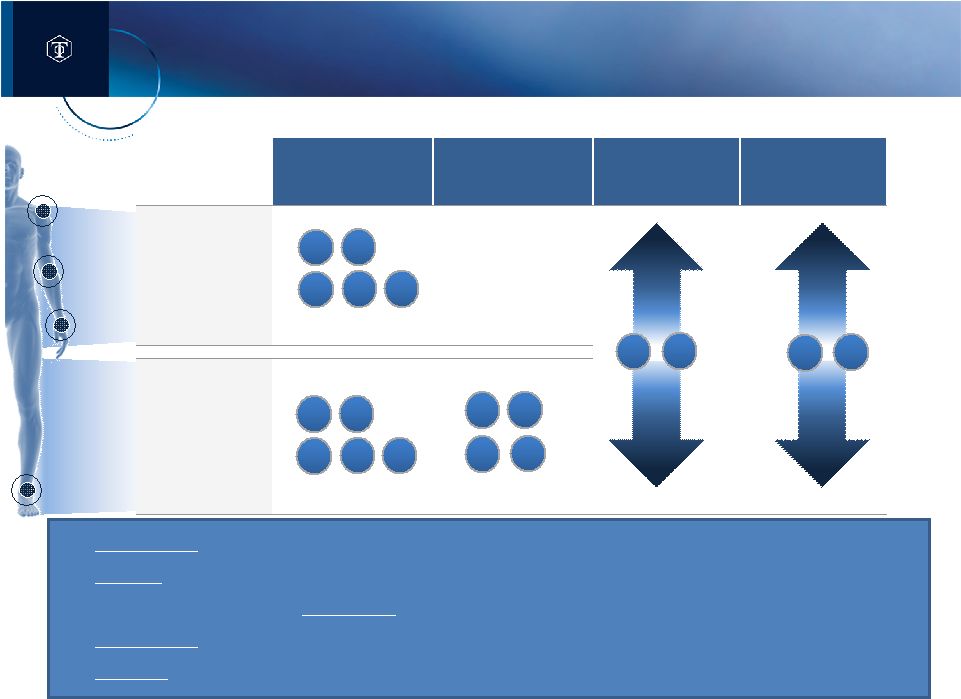

PORTFOLIO STRATEGY LEVERAGES STRENGTHS TO

TAKE SHARE WHILE EXPANDING EXTREMITY MARKETS

JOINT

REPLACEMENTS

BONE

REPAIR

BIOLOGICS

SOFT TISSUE

REPAIR

UPPER

Shoulder,

Elbow, Hand &

Wrist

LOWER

Foot & Ankle

1.

Take Share

through introduction of best-in-class extremity specific solutions

2.

Expand

arthroplasty markets with early intervention products

3.

Create solutions for an Expanding

extremity revision segment

4.

Take Share

with differentiated value products, (“Value”

= outcome per healthcare dollar spent)

5.

Expand customer base through ease-of-use products, instrumentation &

surgical procedures 1

2

3

4

5

1

2

3

4

5

1

2

4

5

4

5

4

5 |

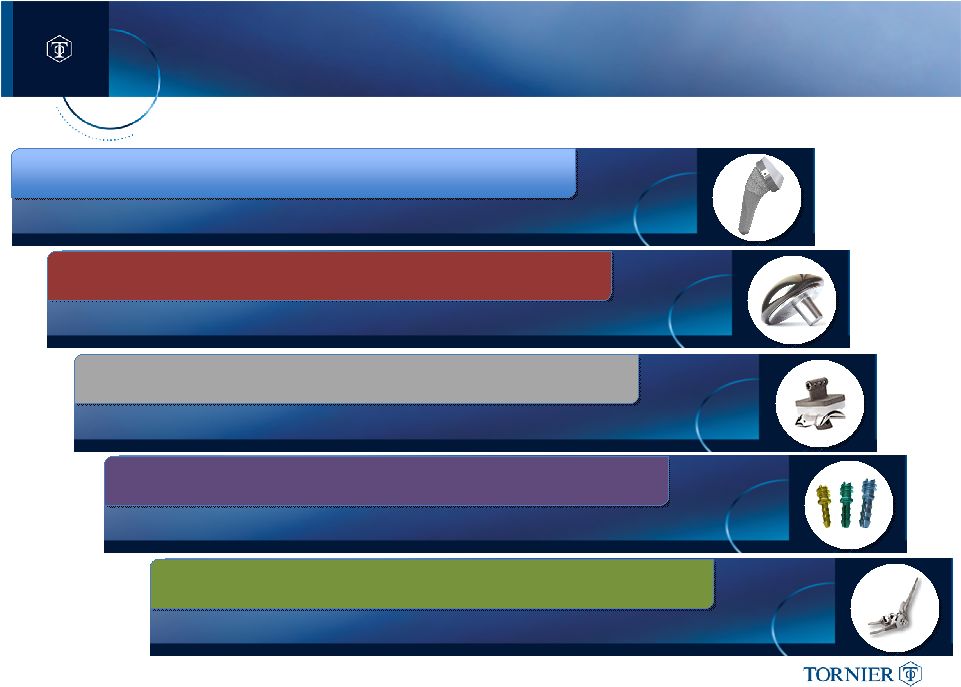

RECENT INTRODUCTIONS REFLECT OUR FOCUSED

PORTFOLIO STRATEGY

ASCEND FLEX

TM

Best in Class Arthroplasty

PYC HUMERAL HEAD

Earlier Intervention / Less Invasive

SALTO TALARIS

TM

XT

Revision Options

CANNULINK IFS

Differentiated Value

LATITUDE

TM

EV

Ease-of-use / Expanded Customer Base |

TORNIER IS THE “GO-TO”

EXTREMITIES COMPANY WITH

INDUSTRY LEADING SCIENCE & EDUCATION PROGRAMS

RESPECTED FOR

SCIENTIFIC RIGOR

SUPPORTING ACTIVE FUNDAMENTAL RESEARCH

•

Pyrolytic carbon

•

Advanced kinematic & biomechanical testing capability

•

Computer aided surgery / 3D operative planning

COMMITTED TO “EVIDENCE-BASED”

MEDICINE

•

Aequalis shoulder registry -

20+ years of data

•

Simpliciti trial –

1st US IDE shoulder arthroplasty study

•

Salto-Talaris –

total ankle replacement survivorship data

INVESTED IN PROFESSIONAL EDUCATION & TRAINING

•

Unique shoulder and ankle master courses

•

Orthopedic fellowship courses

•

Cadence of product-specific cadaveric training labs

|

TORNIER IS WELL-POSITIONED FOR LONG-TERM GROWTH

Robust Drivers

Enable Sustained Growth

$6.5B

7-9%

CAGR

(’14 –

’18)

Aligned to

the

Extremity Call Point

FOCUSED ON EXECUTION

Based upon management estimates

Leader in Innovation,

Science & Education

Upper Extremities

Orthopedic Surgeon

Lower Extremities

Orthopedic Surgeon

&

Surgical Podiatrist

LOWER

EXTREMITIES

UPPER

EXTREMITIES

HIGH

GROWTH MARKET

Extremities

FOCUSED FOR

EFFICIENT SALES

COMPREHENSIVE

PRODUCT PORTFOLIO |

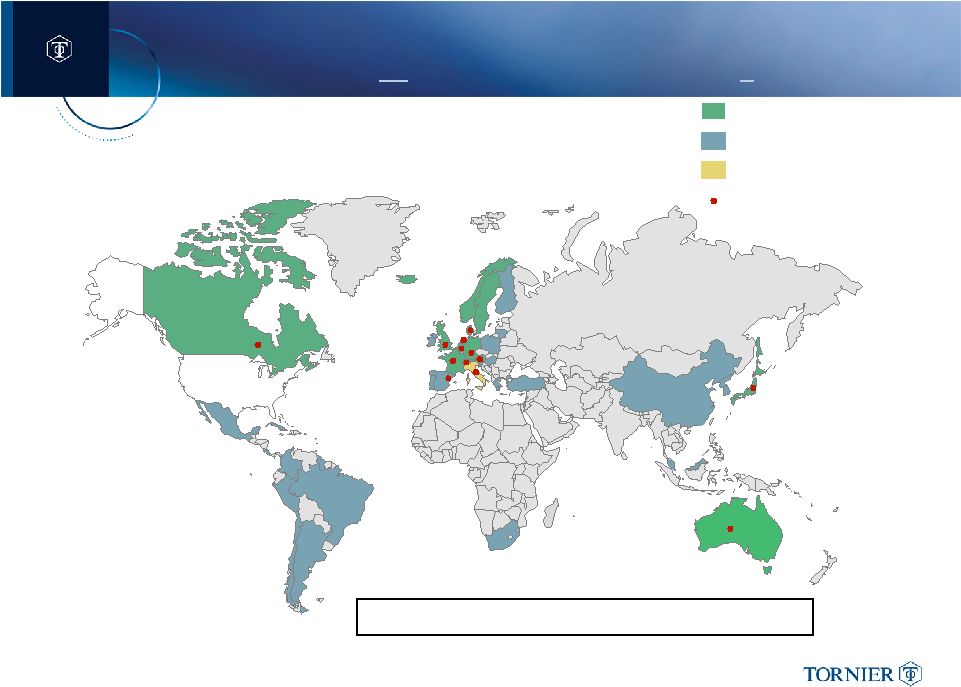

TORNIER CONDUCTS INTERNATIONAL SALES OPERATIONS

IN 45

DISTINCT COUNTRIES ON 6

CONTINENTS

Primarily direct sales

Primarily distributor

Mixed Model

Country Office

International revenue $93.3 MM (41% of Total)*

* Q3 2013 year to date revenue results |

THREE STRATEGIC INITIATIVES TO STRENGTHEN OUR

INTERNATIONAL BUSINESS

STRENGTHEN BRAND IN EMERGING MARKETS

3

ACCELERATE REVENUE GROWTH

2

•

Aggressively launch new platform products globally

(ex. Ascend Flex)

•

Broaden product offering in direct & distributor markets

DRIVE ADOPTION IN DEVELOPED GEOGRAPHIES

•

Strengthen and further focus our sales forces

•

Invest in strategic market development activities

1

•

Select investments to accelerate presence in Brazil & China

•

Evaluate targeted expansion plans in other emerging markets

(ex. India) |

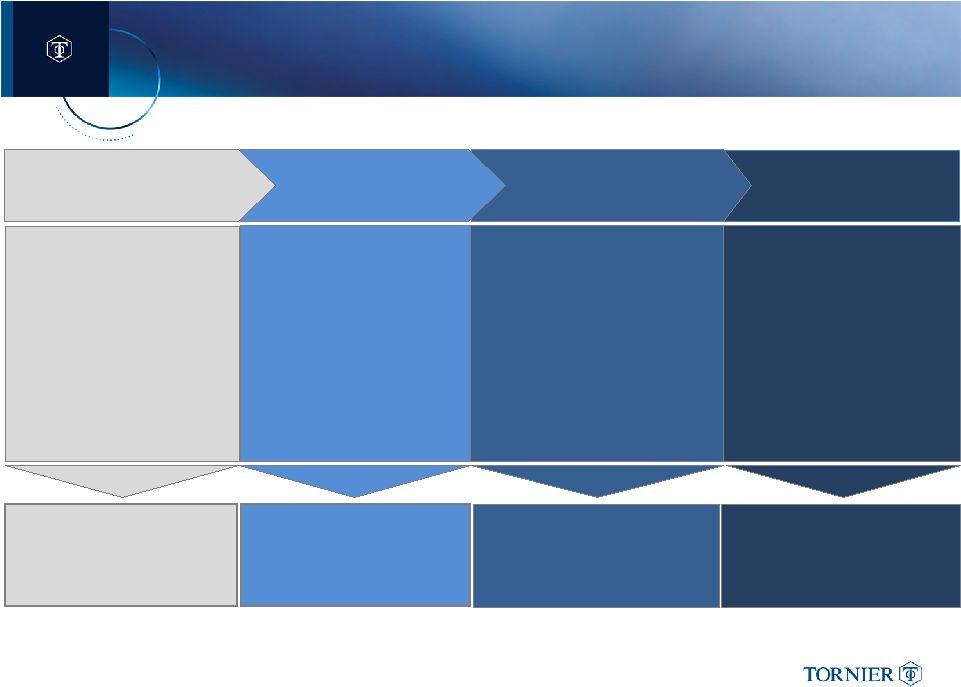

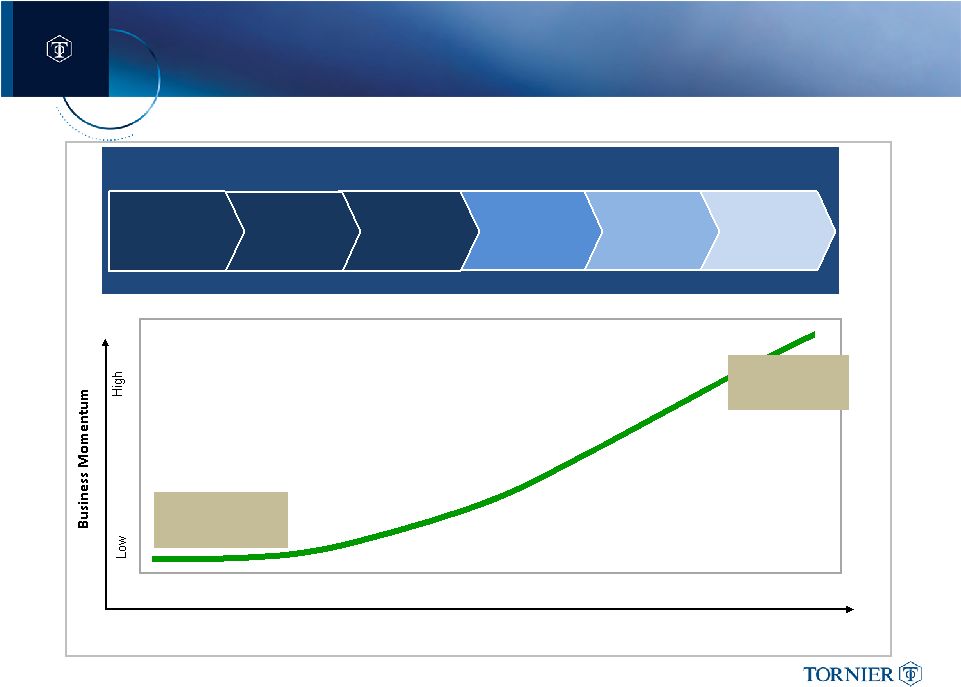

CONTINUE TO INVEST TO BUILD A SUPERIOR

U.S. SALES FORCE

Competitively Superior

•

Exclusive channel

•

Expanded portfolio

•

Narrow rep territories

•

Reps provide “value-add”

DESIRED STATE

Proficient & Productive

•

Reps aligned to Upper /

Lower

•

Continue to fill territories

•

Certify rep training

•

Track & manage reps

Aligned & Committed

•

Agreements for

dedicated Upper / Lower

•

Hire and fill Territories

•

Clearly defined coverage

•

Initial rep training

2013 –

PHASE I

•

Limited access to reps

•

Rep covered any/all cases

•

Limited formal training

•

Inconsistent distributor

contracts

Limited

Standardization

and Commitment to

Tornier

TORNIER 2012

4

4

2014/2015 –

PHASE II |

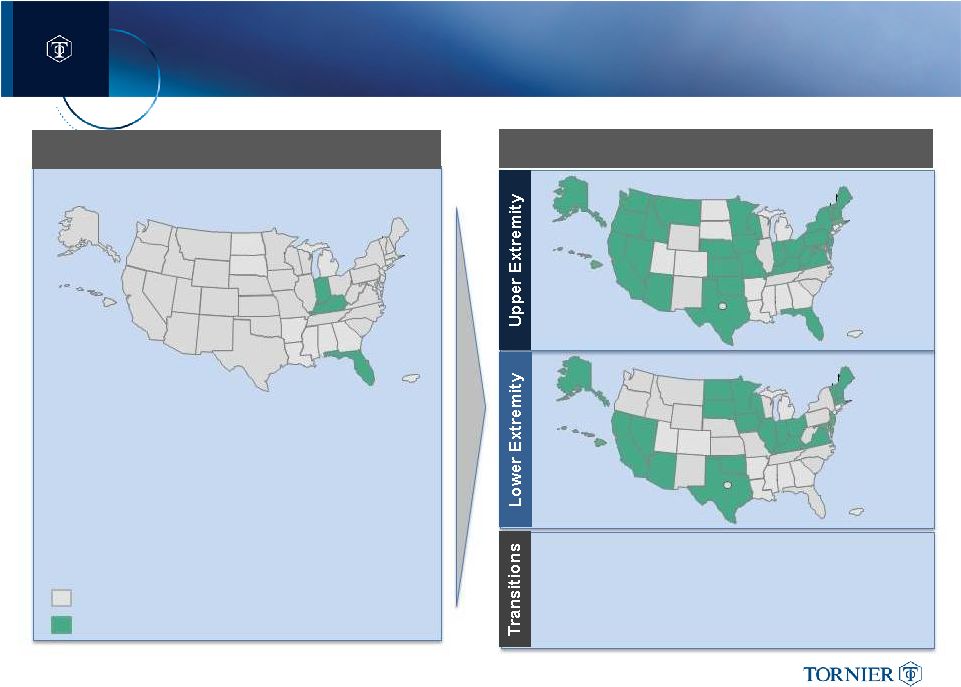

COMPLETED SIGNIFICANT TRANSITIONS WITHIN

U.S. SALES CHANNEL IN 2013

EXITING 2012

Distributor

Direct

US Sales Network

•

18 Legacy Tornier distributors selling both UE & LE

•

3 Direct Tornier territories

•

50 OrthoHelix LE agents in Oct-12

ENTERING 2014

US Sales Network

•

U.S. revenue $134.2 MM (59% of Total)*

•

> 85% US revenues –

dedicated sales reps UE or LE

•

> 50% US revenues managed by direct sales reps

* Q3 2013 year to date revenue results |

WORK REMAINS TO BUILD

A “BEST-IN-CLASS” U.S. SALES FORCE

Timing

2012

Desired State

Agreements

& Alignment

Rep Training &

Education

Performance &

Productivity

Distributor

Negotiation

High Uncertainty

Strong & Reliable

Performance

US Sales Channel Transition

Territory

Staffing

Sales Mgmt. &

Training Org.

4

4

4 |

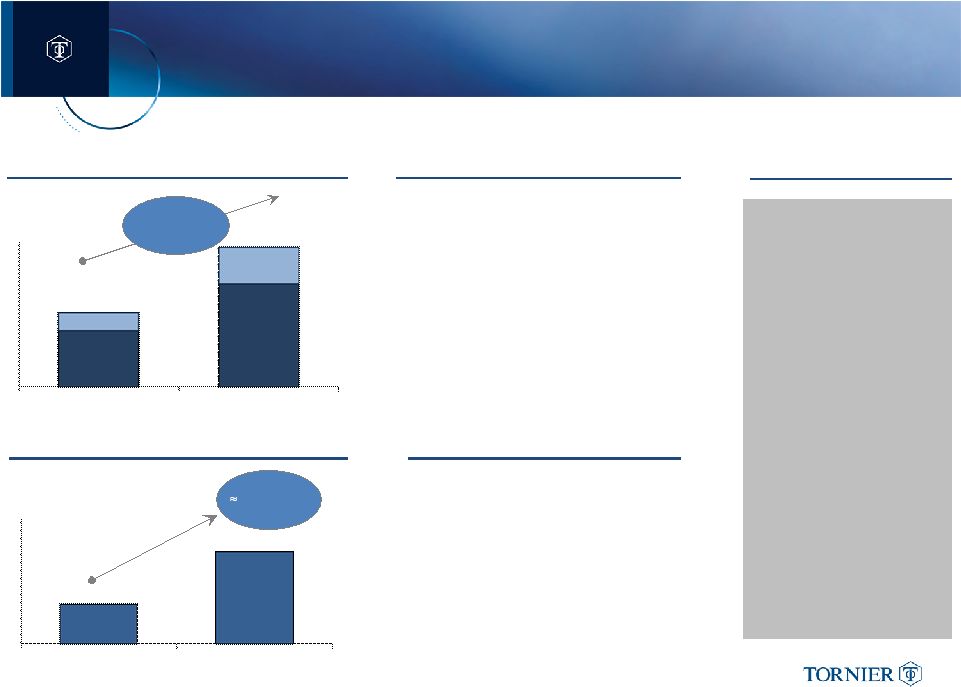

EBITDA Leverage

Above Market

CAGR

2018

2013

2013

2018

Upper Extrm.

Lower Extrm.

20% of Rev

Projected Extremities Revenues

•

Driving above-market growth

in upper and lower extremity

segments

•

Revenue geographically

balanced

Revenue Takeaways

•

Runway to EBITDA >20% of Rev.

•

GM contributions expand:

•

Continued insourcing

(OrthoHelix)

•

On-going manufacturing

efficiencies

•

SG&A leverage comes with

revenue

•

Market Cap: ~$925M

•

FY13 Results:

Rev:

$310.5

-

$311.5M

•

Q3 ‘13 YTD Results:

Revenue:

$227.6M

Adj.

GM:

73.9%

*

Adj.

EBITDA:

$21.3M*

•

Cash (Q3 ‘13): $62.6M

Financial Profile

PLANS TO DELIVER CONSISTENT ABOVE-MARKET GROWTH

AND STRONG FINANCIAL PERFORMANCE

EBITDA Takeaways

*Represents non-GAAP financial

measure. Reconciliation to the closest

GAAP measure can be found on

Tornier’s website. |

TORNIER IS WELL-POSITIONED FOR LONG-TERM GROWTH

FOCUSED ON EXECUTION

Based upon management estimates |

THANK YOU |