Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KBS Real Estate Investment Trust, Inc. | kbsri8k.htm |

Exhibit 99.1 1

KBS REIT I Valuation & Portfolio Update December 20, 2013 2

Forward-Looking Statements The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust’s (“KBS REIT I”) Annual Report on Form 10-K for the year ended December 31, 2012, filed with the Securities and Commission Exchange (the “SEC”) on March 13, 2013 and in KBS REIT I’s Quarterly Report on Form 10-Q for the period ended September 30, 2013, filed with the SEC on November 8, 2013, including the “Risk Factors” contained in such filings. For a full description of the limitations, methodologies and assumptions used to value KBS REIT I’s assets and liabilities in connection with the calculation of KBS REIT I’s estimated value per share, see KBS REIT I’s Current Report on Form 8-K, filed with the SEC on December 19, 2013. Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. KBS REIT I intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of KBS REIT I and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Further, forward-looking statements speak only as of the date they are made, and KBS REIT I undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Actual results may differ materially from those contemplated by such forward-looking statements. The valuation methodology for KBS REIT I’s real estate investments assumes the properties realize the projected cash flows and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the valuation estimates used in calculating the estimated value per share are Duff & Phelps’ or KBS REIT I’s and the Advisor’s best estimates as of December 18, 2013, KBS REIT I can give no assurance in this regard. These statements also depend on factors such as: future economic, competitive and market conditions; KBS REIT I’s ability to maintain occupancy levels and lease rates at its real estate properties; the borrowers under KBS REIT I’s loan investments continuing to make required payments under the loan documents; KBS REIT I’s ability to sell real estate properties at the times and at the prices it expects; the ability of certain borrowers to maintain occupancy levels and lease rates at the properties securing KBS REIT I’s real estate-related investments; KBS REIT I’s ability to successfully negotiate modifications, extensions or refinancings of its debt obligations; the ability of KBS REIT I to make strategic asset sales to make required amortization payments and principal payments on its debt obligations and to fund its short and long-term liquidity needs; KBS REIT I’s ability to successfully operate and sell the GKK properties given current economic conditions and the concentration of the GKK properties in the financial services sector; the significant debt obligations KBS REIT I has assumed with respect to the GKK properties; the Advisor’s limited experience operating and selling bank branch properties; and other risks identified in Part I, Item IA of KBS REIT I’s Annual Report on Form 10-K for the year ended December 31, 2012 and in Part II, Item IA of KBS REIT I’s Quarterly Report on Form 10-Q for the period ended September 30, 2013, each as filed with the SEC. Actual events may cause the value and returns on KBS REIT I’s investments to be less than that used for purposes of KBS REIT I’s estimated value per share. 3

Overview Valuation History – Offering Price $10.00 – November 20091 $7.17 – December 20102 $7.32 – March 20123 $5.16 – December 20124 $5.18 – December 20135 $4.45 after $0.395/share distribution paid 12/5/13 Distribution History (Record Dates) – 7/18/06 – 6/30/09 (36 Payments): $0.70/share on an annualized basis – 7/1/09 – 2/28/12 (32 Payments): $0.525/share on an annualized basis – 11/8/13 (1 Payment): $0.395/share as a one-time distribution paid 12/5/13, which will constitute a return of capital. 4 1Data as of 9/30/09. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on November 23, 2009. 2Data as of 9/30/10. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on December 10, 2010. 3Data as of 12/31/11. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on March 26, 2012. 4Data as of 9/30/12. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on December 19, 2012. 5Data as of 9/30/13, with the exception of real estate appraised as of November 30, 2013. See KBS REIT I’s Current Report on Form 8-K filed with the SEC on December 19, 2013.

• Consistent with IPA Valuation Guidelines, KBS REIT I has utilized independent third-party appraisals of its real estate properties this year1. • Both historical assets and GKK properties were appraised by Duff & Phelps, and KBS REIT I used these appraised values in calculating its estimated value per share.2 • The estimated value per share as of December 18, 2013 is based on the estimated value of the REIT’s assets less the estimated value of the REIT’s liabilities divided by the number of shares outstanding, as of September 30, 2013 with the exception of the REIT’s real estate properties, which were appraised as of November 30, 2013. • Duff & Phelps used a 10-year discounted cash flow valuation method for historical properties, and DCF, direct capitalization and present value of cash flow valuation methods for the GKK properties. • KBS REIT I currently expects to update the estimated value per share in December 2014, in accordance with the recommended IPA Valuation Guidelines, but is not required to update the estimated value per share more frequently than every 18 months. It expects to utilize an independent valuation firm or the Advisor for such valuation. Valuation Information 5 Third Party Valuation 1Real estate properties that were under contract to sell as of December 18, 2013 or were sold subsequent to September 30, 2013 were not appraised. Rather, contractual sales prices less actual or estimated closing costs were used. 2The appraisals were performed in accordance with the Code of Ethics and the Uniform Standards of Professional Appraisal Practice, or USPAP, as well as the requirements of the state where each real estate property is located. Each appraisal was reviewed, approved and signed by an individual with the professional designation of MAI.

KBS REIT I Portfolio Overview Estimated Value of Portfolio As of 12/18/131 As of 12/18/122 Assets: $1.977 Billion3 $2.989 Billion GKK Properties $769 Million (39%) $1.706 Billion (57%) 417 Assets 788 Assets Historical Real Estate4 $836.7 Million (42%) $912.7 Million (31%) 23 Assets 24 Assets Historical Real Estate-Related $25.5 Million (1%) $25.2 Million (1%) Investments 4 Assets 4 Assets Real Estate Securities $19.3 Million (1%) None Other Assets5 $326.4 Million (17%) $344.5 Million (11%) Liabilities: $1.056 Billion $1.998 Billion Mortgage and other debt: $982 Million $1.897 Billion Other Liabilities6: $74.0 Million $100.5 Million Net Equity at Estimated Value: $921.2 Million $990.9 Million Distributions Paid December 5, 2013 ($75.0 Million) Net Equity at Estimated Value After Distribution $846.2 Million 6 1Based on data as of September 30, 2013, with the exception of real estate appraised as of November 30, 2013. 2 Based on data as of September 30, 2012. 3Includes assets held for sale and non-sale disposition as of September 30, 2013, some of which were sold or transferred prior to December 18, 2013. 4Includes unconsolidated joint venture participation and Tribeca. 5Includes cash and cash equivalents, restricted cash, defeasance securities, rents and other receivables, deposits and prepaid expenses as applicable. 6Includes accounts payable, accrued liabilities, security deposits, contingent liabilities and prepaid rent.

December 18, 2012 estimated value per share Real estate investments (including historical and GKK properties) $ $ [1] Capital expenditures on real estate (including historical and GKK properties) Mortgage debt [2] Real estate securities [3] Undistributed operating cash flows [4] Other changes, net [5] $ $ [6] Estimated value per share before December 5, 2013 distribution payment Distributions paid on December 5, 2013 December 18, 2013 estimated value per share $ $ (63,557) (0.33) (138,573) 4.45 10,263 13,439 (5,551) 0.07 (0.02) (75,016) (33,791) (25,333) Change in Estimated Value per Share (6) 5.18 4.85 (0.40) (0.18) (0.13) (0.12) 0.05 (22,584) Change in Estimated Value (in thousands) On December 18, 2013, the Board approved an estimated value per share of $4.45. The change in the estimated value per share from the December 2012 valuation of $5.18 was due to the following:* Valuation Information 7 * The changes are not equal to the change in values of each asset and liability group due to asset sales, loan payments, and other factors, which caused the value of certain asset or liability groups to change with no impact to KBS REIT I’s fair value of equity or the overall estimated value per share. [1] Includes all real estate investments as of September 30, 2013, which includes one historical real estate property that was sold subsequent to September 30, 2013 and 11 GKK properties that were under contract to sell as of December 18, 2013 or were sold subsequent to September 30, 2013. The estimated values for the properties sold or under contract to sell were based on contractual sales price less actual or estimated closing costs. Additional details about significant changes in specific real estate properties are included on Slide 7. [2] The change in the value of the notes payable is due to the notes being one year closer to maturity (based on the fair value methodology, the value of the notes payable accrete towards their face value as they get closer to maturity) and due to changes in market interest rates assumed in valuing the notes payable as compared to prior year. Additional details are provided on Slide 10. [3] The change in value of the real estate securities is based on the gain on sale of 1,294,102 shares of common stock of Gramercy Property Trust, Inc. (“Gramercy”), the unrealized gain on the outstanding 2,705,898 shares of Gramercy common stock held by KBS REIT I as of September 30, 2013 and the unrealized gain on two million shares of Class B-2 non-voting common stock of Gramercy (which were converted to two million shares of common stock of Gramercy on December 6, 2013) adjusted for lack of marketability as of September 30, 2013. [4] Amount includes operating cash flows from real estate properties that were under contract to sell as of December 18, 2013 or were sold subsequent to September 30, 2013, which may not provide future operating cash flows. [5] “Other changes, net” consists of various unrelated insignificant items. [6] The reconciliation of total change in estimated value does not reflect $6.2 million used to fulfill redemption requests in accordance with KBS REIT I’s share redemption program, as such redemptions resulted in no change to the estimated value per share because, while the gross net asset value was reduced by the $6.2 million of redemptions, the redemptions also resulted in a corresponding decrease in the number of shares outstanding. For more information, see the Current Report on Form 8-K filed with the SEC on December 19, 2013.

Significant Real Estate Changes 8 [1] Tysons Dulles Plaza: The asset was previously impaired in Q2 2013. See Slide 8 for additional details related to the decline in value of this property. [2] Woodfield Preserve: See Slide 9 for additional details related to the decline in value in this property. [3] City Gate Plaza: Decrease is mostly due to the pending vacancy of a large tenant. [4] Crescent Green: KBS REIT I is moving forward with the sale of this asset at an offer price that approximates the value shown above. The decrease from the 2012 estimated value is mainly due to uncertainty related to a large tenant, which occupies 154,000 SF or 62% of the asset. [5] Bridgeway Tech Center: The property is located in a difficult leasing market on the east side of the San Francisco bay directly across the Dumbarton bridge from Palo Alto. KBS REIT I has been unsuccessful in leasing up the building and the underlying loan matured in August 2013. The lender has commenced foreclosure proceedings on the property. [6] Reflects net sales proceeds of properties sold since September 30, 2012, and also reflects the value of any debt relieved, plus any consideration received, related to properties transferred to the lender since the 2012 valuation. 2013 2012 2013 Estimated Estimated vs. 2012 Property City State Value Value Change ($) Office Properties: RT1336ysons Dulles Plaza McLean VA 130,600,000$ 153,248,454$ (22,648,454)$ [1] RT1256Woodfield Preserve Schaumberg IL 107,900,000 115,998,898 (8,098,898) [2] RT1438City Gate Plaza Sacramento CA 14,500,000 21,673,072 (7,173,072) [3] RT1145Crescent Green Cary NC 38,100,000 43,221,479 (5,121,479) [4] RT1180Bridgeway Tech Center Newark CA 26,600,000 31,658,311 (5,058,311) [5] GKK Properties 769,013,782 755,334,606 13,679,176 Other Properties 518,995,879 518,180,791 815,088 September 2013 remaining real estate properties 1,605,709,661$ 1,639,315,611$ (33,605,950)$ Value realized on properties disposed of subsequent to 9/30/2012 979,358,710$ [6] 979,543,762$ (185,052)$ Real estate value (Including properties disposed of subsequent to 9/30/2012) 2,585,068,371$ 2,618,859,373$ (33,791,002)$ ($) ($) Schaumburg

Tysons Dulles Plaza • 487,775 SF Office Park in McLean, VA • Acquired June 2008 for $152.8 million – 5% of estimated value of all of KBS REIT I’s assets as of 12/18/12. • Challenge 1: Continuing diminished occupancy stemming from significant government budget issues and sequestration, which have created considerable uncertainty for government contractor tenants and resulted in consolidation of space. – 75% leased as of 9/30/13 • Challenge 2: Significantly higher projected capital costs to increase asset's quality and competitiveness. These include replacement of the entire plaza surface and waterproofing membrane to repair leakage into the underground parking structure as well as the addition of a conference room, exercise facility, and other systems and amenity improvements. • Challenge 3: Higher projected leasing costs in the form of concessions and tenant improvement allowances. • These challenges, including the investment costs that will be incurred to address such challenges and increase occupancy, have resulted in a decreased estimated value of the property. • Change in estimated value1: -$22.6 million, -$0.12/share 9 1Based on change in estimated value from data as of September 30, 2012 to data as of November 30, 2013.

Woodfield Preserve • 647,216 SF Office Park in Schaumburg, IL • Acquired November 2007 for $135.8 million – 4% of estimated value of all of KBS REIT I’s assets as of 12/18/12. • Challenge 1: Over time, the Schaumburg real estate market has experienced significant pressure from increasing vacancy rates. A significant amount of financial and mortgage related tenants no longer occupy office space in the market and many other employers have moved closer to CBD Chicago, where the younger workforce resides. • Challenge 2: Significant leasing concessions and other high costs associated with retaining tenants due to unionized labor. • These challenges have resulted in lower expected lease rates and cash flows, higher projected capital costs and a decreased estimated value of the property. • Change in estimated value1: -$8.1 million, -$0.04/share 10 1Based on change in estimated value from data as of September 30, 2012 to data as of November 30, 2013.

Fair Value of Debt Changes The estimated value reflected a negative valuation change related to the estimated value of notes payable this year. • The estimated values of KBS REIT I’s notes payable are equal to the GAAP fair values as disclosed in KBS REIT I’s quarterly report on Form 10-Q for the nine months ended September 30, 2013. The values were determined using a discounted cash flow analysis consistent with the prior year. • The -$22.6 million change (-$0.12/share) in the valuation was a result of an increase in the estimated value of the notes payable versus the 2012 valuation. In both periods, the notes payable were valued at a discount to the face value, or principal balance of the loan. However, the estimated values of the notes payable increased (the discount decreased) for several reasons: 1. Generally, the notes payable are one year closer to maturity, resulting in a decline in the discount rate and an increase in the estimated value of the notes payable. 2. There have been changes in the discount rates assumed related to changes in the interest rate environment that occurred since last year. 3. Several notes payable were repaid in full during 2013, resulting in the elimination of any prior premium or discount and in one instance, KBS REIT I’s determination to refinance a loan resulted in the estimated value of the note increasing to the full face value. • The remaining fair value discount reflected in notes payable is approximately $8 million as of September 30, 2013. 11

GKK Overview As of September 30, 2013, KBS REIT I had sold, transferred, or otherwise disposed of 450 properties1 from the GKK portfolio for a gain in estimated net asset value of $15.9 million since the entry into the GKK settlement agreement on September 1, 2011. • As of November 30, 2013 the estimated value of the remaining 417 unsold GKK properties and related mortgage debt resulted in an increase in estimated net asset value of $1.4 million since the initial settlement date of September 1, 2011. • Since the transfer of the portfolio in 2011, the GKK portfolio has generated $38.9 million of net operating income less interest and G&A expense. • Additionally, KBS REIT I has recognized a total of $10.3 million of realized and unrealized gains from the increase in market value of Gramercy stock (NYSE:GPT) as of September 30, 2013. • The estimated value per share increased $0.02 due to the change in value of GKK properties (net of CapEx) in the December 18, 2013 valuation. • The estimated value per share increased by $0.05 due to the change in value of Gramercy stock in the December 18, 2013 valuation. 12 1Includes eight leasehold interests which have expired or been terminated.

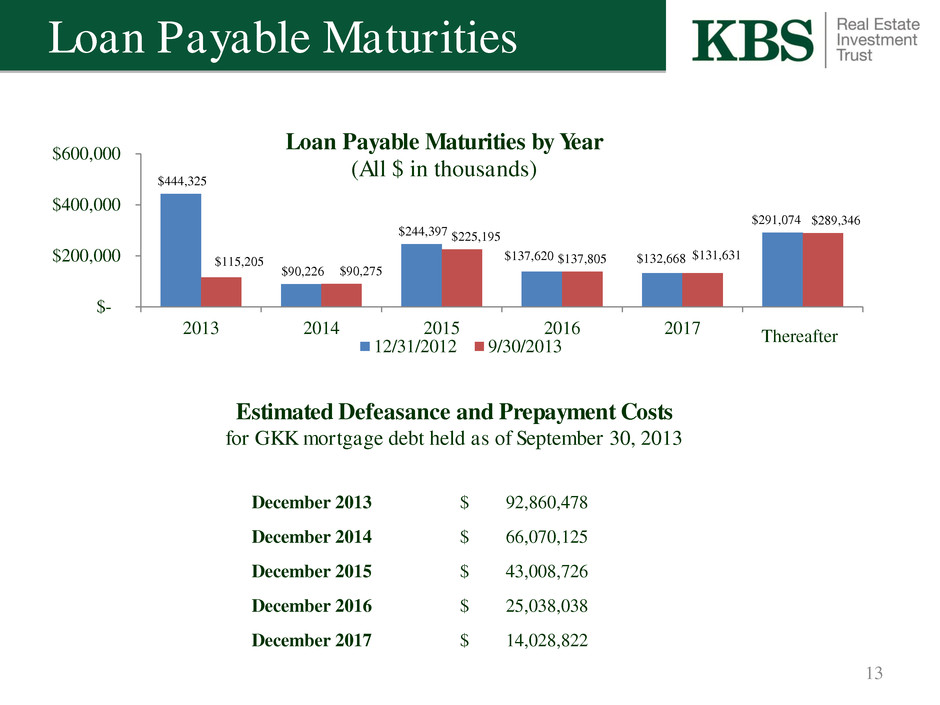

13 Loan Payable Maturities $444,325 $90,226 $244,397 $137,620 $132,668 $291,074 $115,205 $90,275 $225,195 $137,805 $131,631 $289,346 $- $200,000 $400,000 $600,000 2013 2014 2015 2016 2017 Loan Payable Maturities by Year (All $ in thousands) 12/31/2012 9/30/2013 Thereafter December 2013 $ 92,860,478 December 2014 $ 66,070,125 December 2015 $ 43,008,726 December 2016 $ 25,038,038 December 2017 $ 14,028,822 Estimated Defeasance and Prepayment Costs for GKK mortgage debt held as of September 30, 2013

2014 Focus & Objectives 1) Strategically selling assets 2) Refinancing upcoming maturities and paying down debt 3) Exploring value-add opportunities for existing assets, primarily in the GKK portfolio 4) Distributing available cash to stockholders 14

Examples of Challenges and Risks • Lower net operating income and cash flow from operations • Appropriately deploying capital to maintain and/or increase the value of the assets in the portfolio • Successful execution of strategic dispositions at times that maximize value returned to investors • Successful continued operations of the GKK properties given current economic conditions • Management of leasing activity throughout the entire portfolio in a challenging leasing environment • Attracting tenants to vacant space in suburban markets at acceptable capital costs • Ability of tenants and borrowers to make future payments to the REIT • Susceptibility to disruptions in the banking industry due to a significant portion of GKK properties being leased to financial institutions 15

Stockholder Performance 16 $4.45 $3.865 $8.315 Hypothetical Performance of Early and Late Investors Assumes all distributions have been taken in cash and stockholder has held shares since the dates below1 Estimated Value Per Share As of December 18, 20132 Cumulative Cash Distributions Received Sum of Estimated Value Per Share as of December 18, 2013 and Cumulative Cash Distributions Received Late Investor: Invested at Close of Public Offering (May 31, 2008) Early Investor: Invested at Escrow Break (July 5, 2006) $4.45 $2.555 $7.005 1Does not reflect the hypothetical performance of investments by stockholders that participated in the dividend reinvestment plan. The hypothetical performance of investments by stockholders that participated in the dividend reinvestment plan would be lower per share than that shown above. 2KBS REIT I is providing this estimated value per share to assist broker dealers that participated in its initial public offering in meeting their customer account statement reporting obligations. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share. KBS REIT I can give no assurance that: • a stockholder would be able to resell his or her shares at this estimated value; • a stockholder would ultimately realize distributions per share equal to KBS REIT I’s estimated value per share upon liquidation of KBS REIT I’s assets and settlement of its liabilities or a sale of KBS REIT I; • KBS REIT I’s shares of common stock would trade at the estimated value per share on a national securities exchange; • an independent third-party appraiser or other third-party valuation firm would agree with KBS REIT I’s estimated value per share; or • the methodology used to estimate KBS REIT I’s value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. Further, the estimated value per share as of December 18, 2013 is based on the estimated value of KBS REIT I’s assets less the estimated value of KBS REIT I’s liabilities divided by the number of shares outstanding, all as of September 30, 2013, with the exception of real estate appraised as of November 30, 2013. The value of KBS REIT I’s shares will fluctuate over time in response to developments related to individual assets in the portfolio and the management of those assets and in response to the real estate and finance markets. KBS REIT I currently expects to update the estimated value per share in December 2014, in accordance with the recommended IPA Valuation Guidelines, but is not required to update the estimated value per share more frequently than every 18 months. It expects to utilize an independent valuation firm or the Advisor for such valuation.

Thank You. Q&A 17